Bank of Hawai‘i Corporation operational overview March 15, 2023 Exhibit 99.1

operational highlights 2 unique and competitively advantageous deposit market exceptional deposit base substantial liquidity back up high quality assets

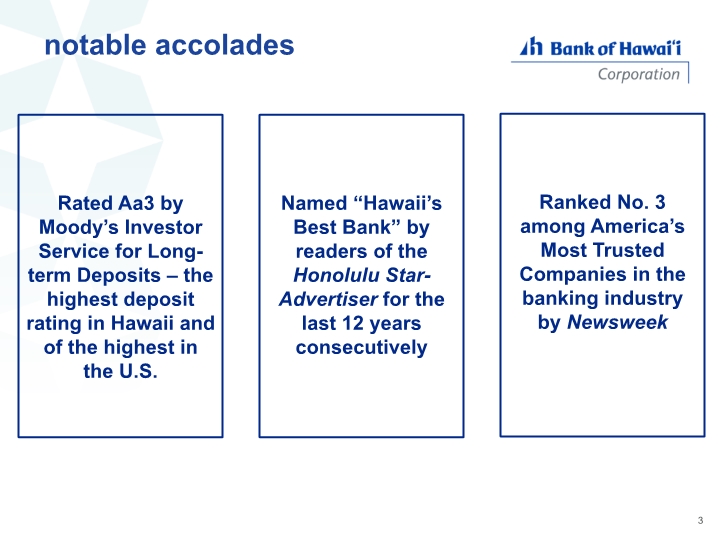

notable accolades 3 Rated Aa3 by Moody’s Investor Service for Long-term Deposits – the highest deposit rating in Hawaii and of the highest in the U.S. Named “Hawaii’s Best Bank” by readers of the Honolulu Star- Advertiser for the last 12 years consecutively Ranked No. 3 among America’s Most Trusted Companies in the banking industry by Newsweek

our deposits 4 Over our 125 year history in the islands, Bank of Hawaii has developed an exceptionally seasoned deposit base, built one relationship at a time, over many years, and in neighborhoods and communities we know

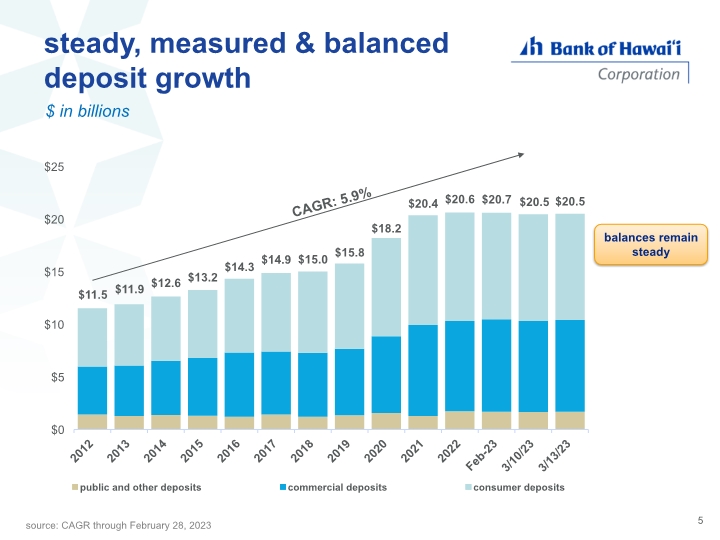

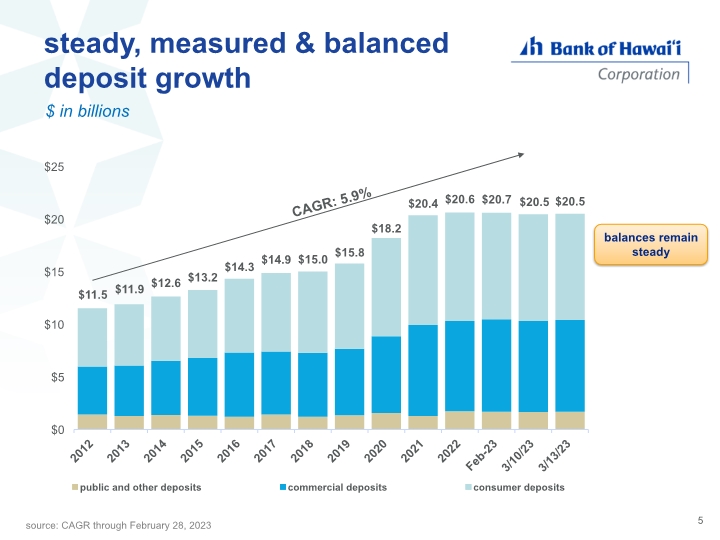

steady, measured & balanced deposit growth $ in billions 5 source: CAGR through February 28, 2023 balances remain steady

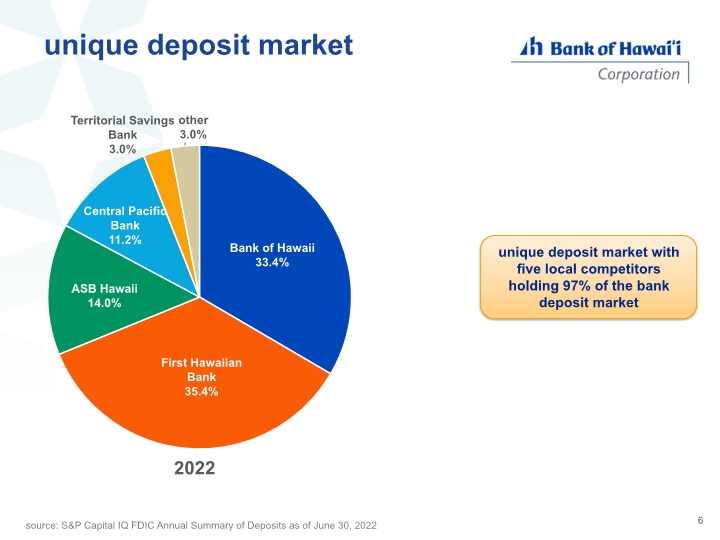

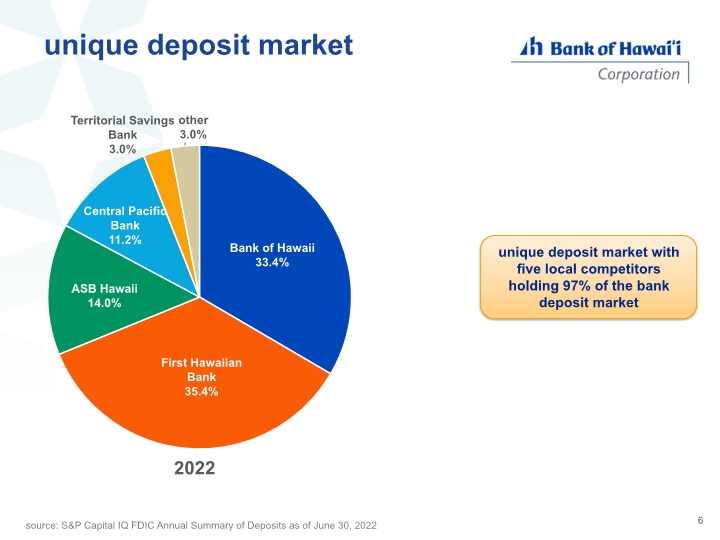

unique deposit market 6 source: S&P Capital IQ FDIC Annual Summary of Deposits as of June 30, 2022 unique deposit market with five local competitors holding 97% of the bank deposit market

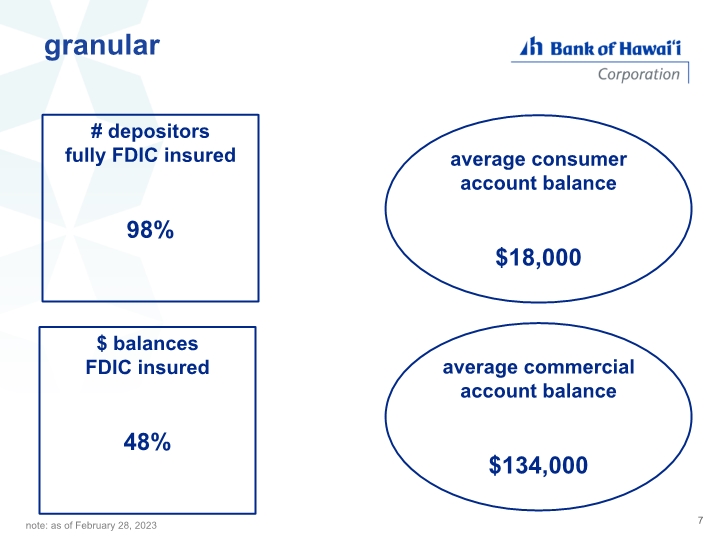

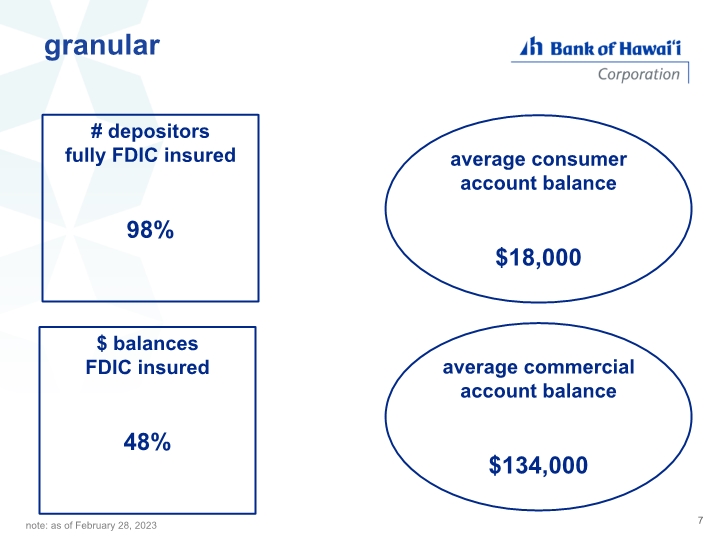

granular 7 note: as of February 28, 2023 # depositors fully FDIC insured 98% $ balances FDIC insured 48% average consumer account balance $18,000 average commercial account balance $134,000

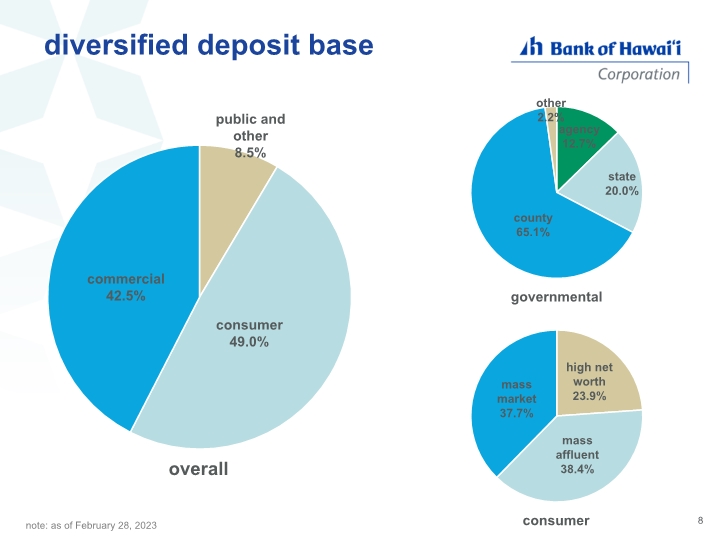

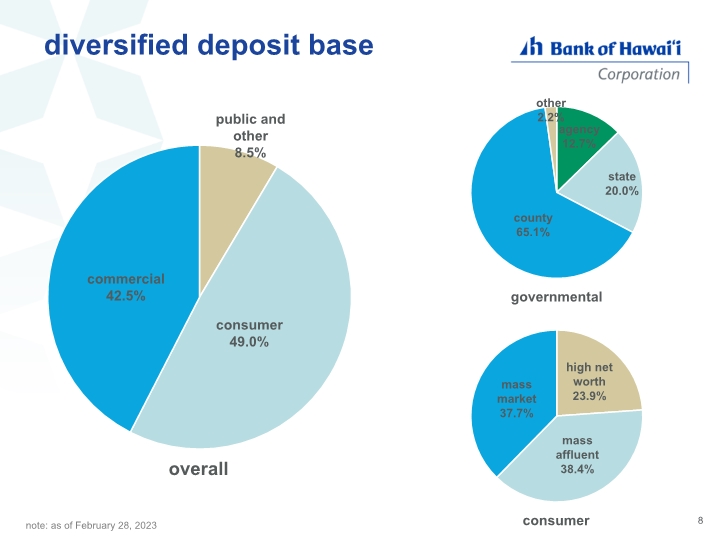

diversified deposit base 8 note: as of February 28, 2023

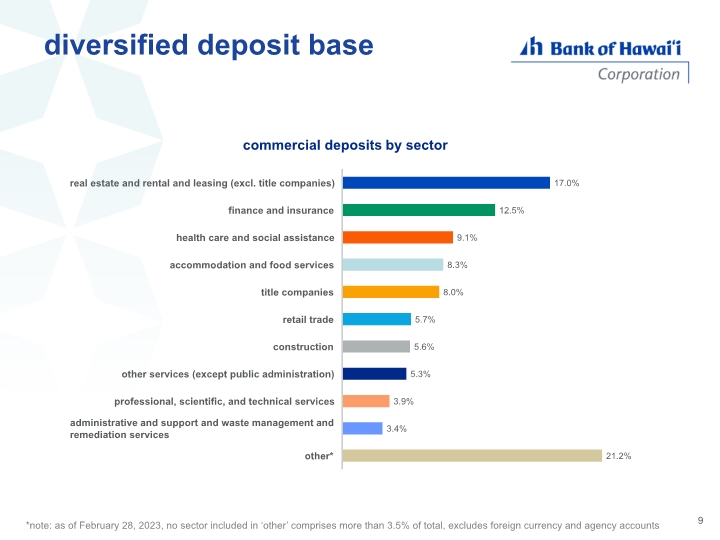

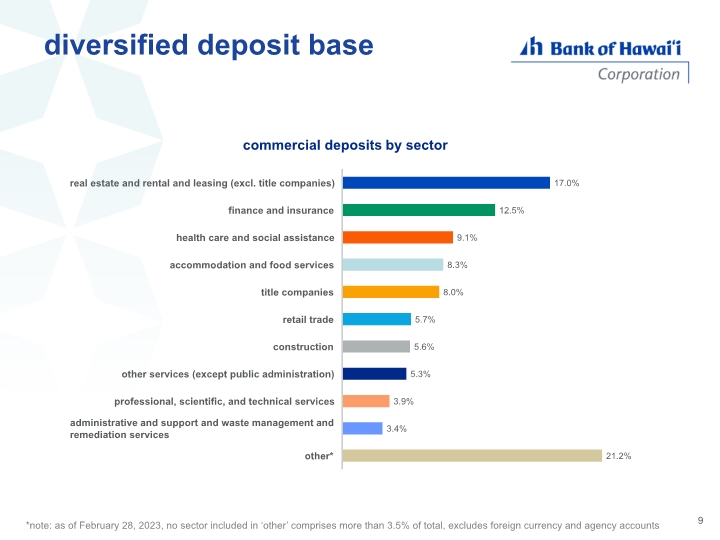

diversified deposit base 9 *note: as of February 28, 2023, no sector included in ‘other’ comprises more than 3.5% of total, excludes foreign currency and agency accounts

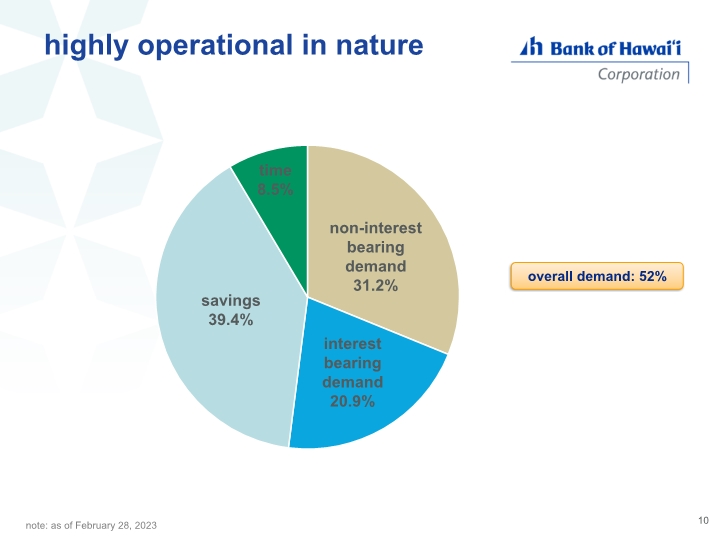

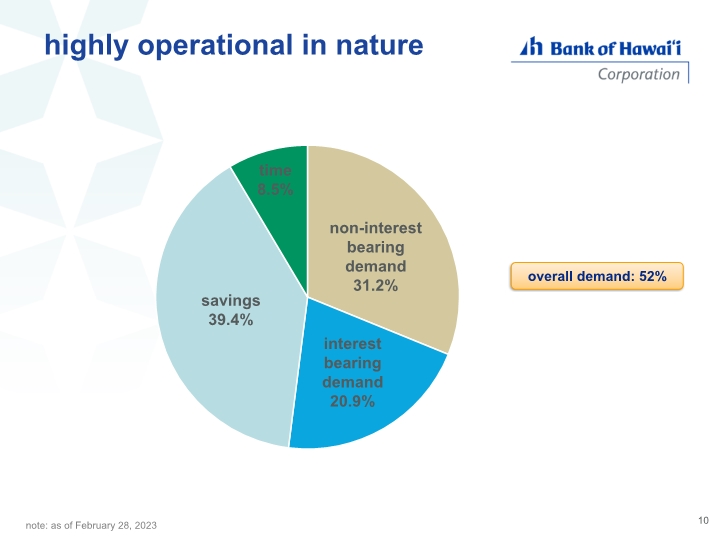

highly operational in nature 10 note: as of February 28, 2023 overall demand: 52%

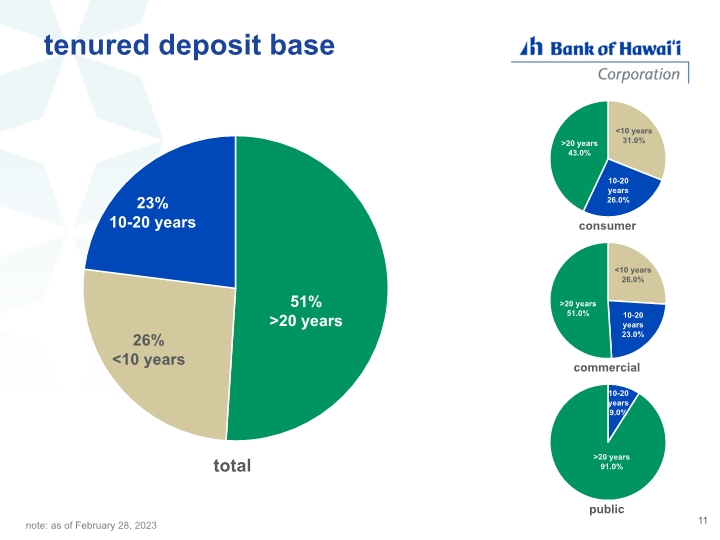

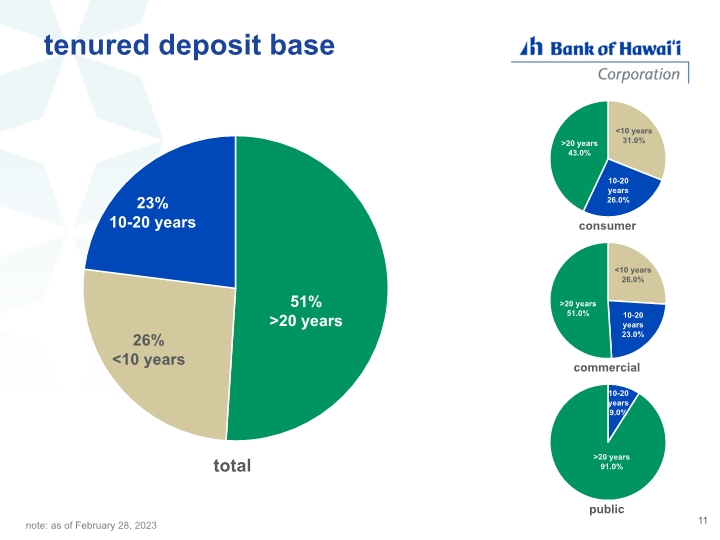

tenured deposit base 11 note: as of February 28, 2023

liquidity lines 12 Bank of Hawaii carries substantial liquidity lines and equivalents for both day-to-day operational purposes as well as for liquidity back stop purposes. The high quality of our asset base provides us with ample access.

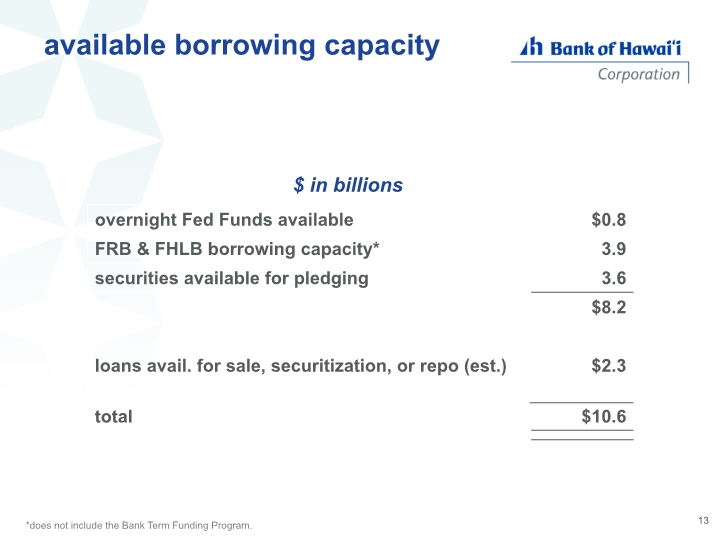

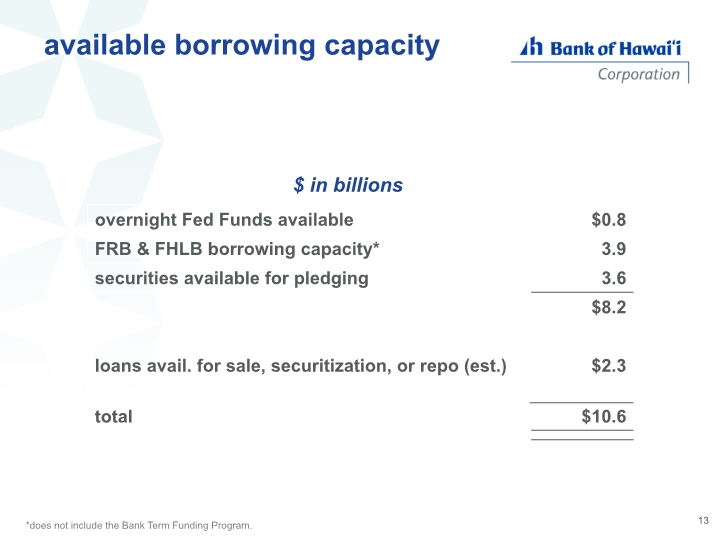

available borrowing capacity 13 $ in billions *does not include the Bank Term Funding Program.

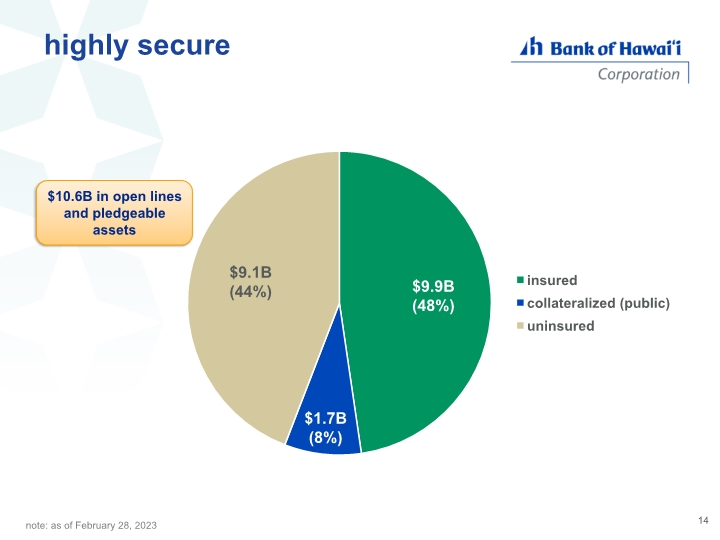

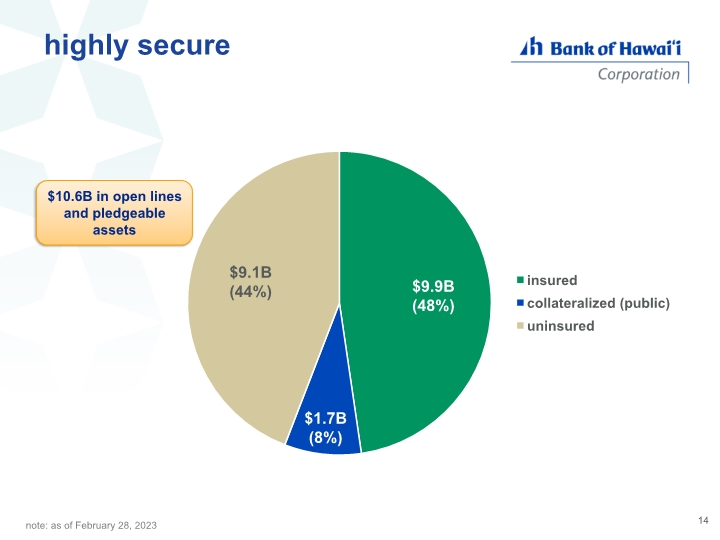

highly secure 14 note: as of February 28, 2023 $10.6B in open lines and pledgeable assets

our assets 15 Serving an island based community for over 125 years has steered us to embrace values like stewardship and sustainability. It is with these values that we manage the assets of the organization.

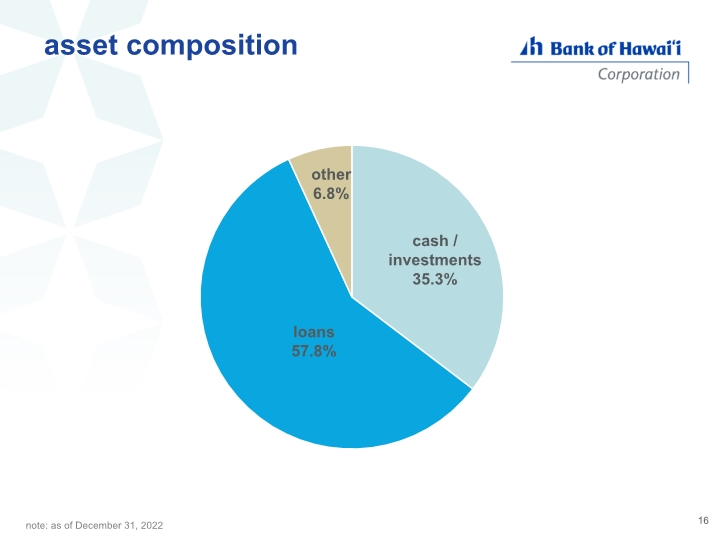

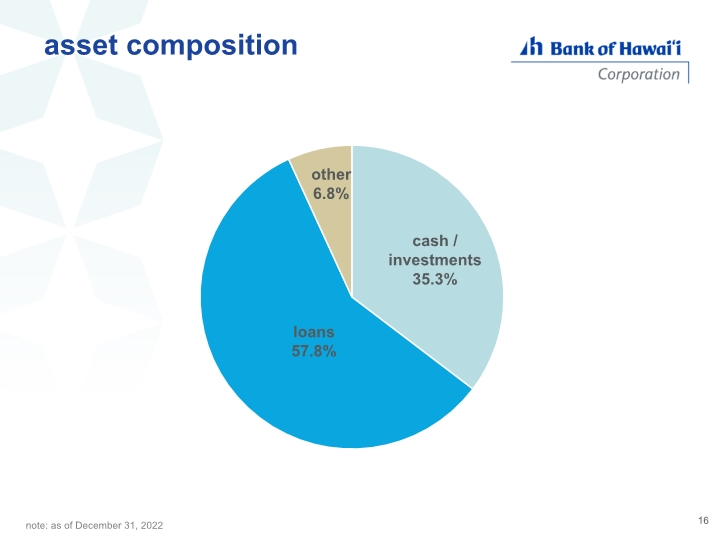

asset composition 16 note: as of December 31, 2022

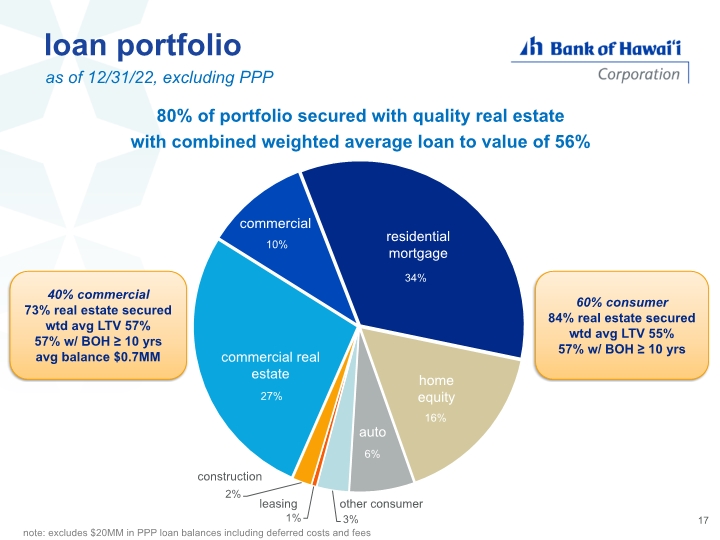

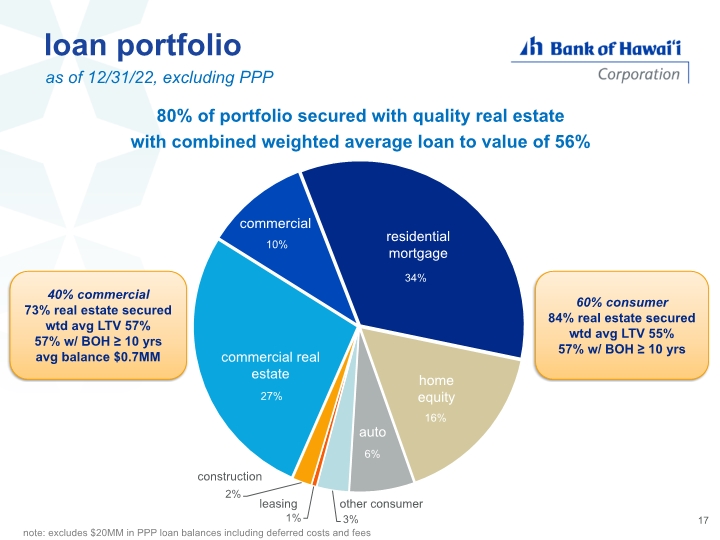

loan portfolio as of 12/31/22, excluding PPP 17 40% commercial 73% real estate secured wtd avg LTV 57% 57% w/ BOH ≥ 10 yrs avg balance $0.7MM commercial real estate commercial residential mortgage home equity auto leasing other consumer construction 60% consumer 84% real estate secured wtd avg LTV 55% 57% w/ BOH ≥ 10 yrs 80% of portfolio secured with quality real estate with combined weighted average loan to value of 56% note: excludes $20MM in PPP loan balances including deferred costs and fees

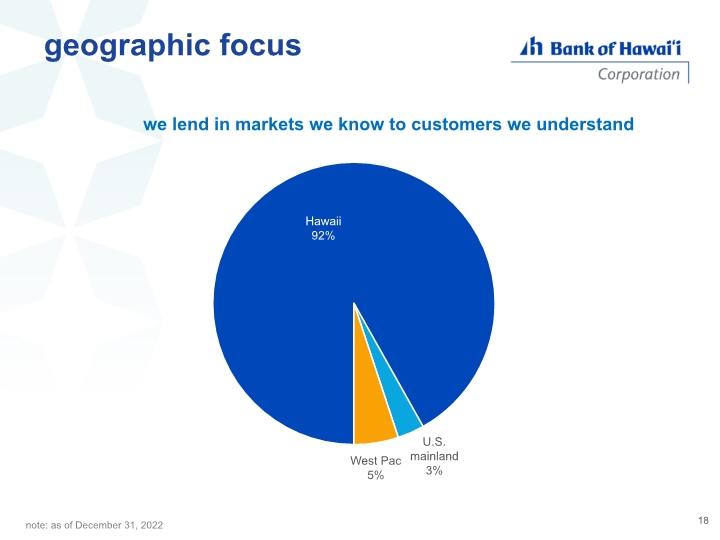

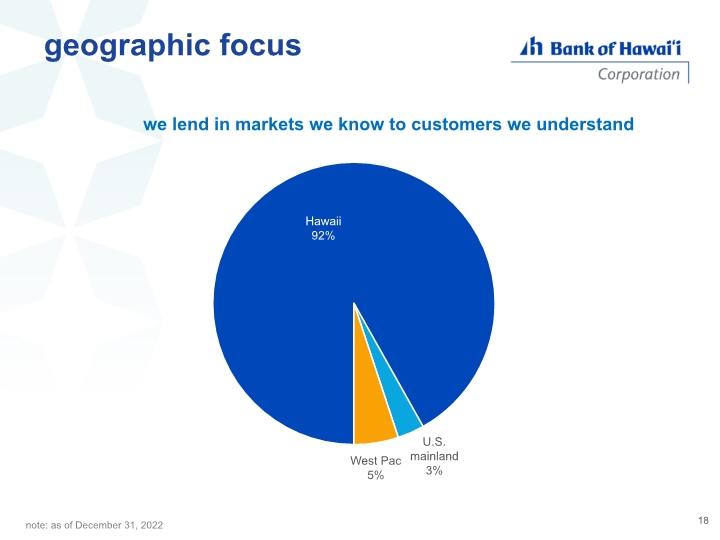

geographic focus 18 note: as of December 31, 2022 we lend in markets we know to customers we understand

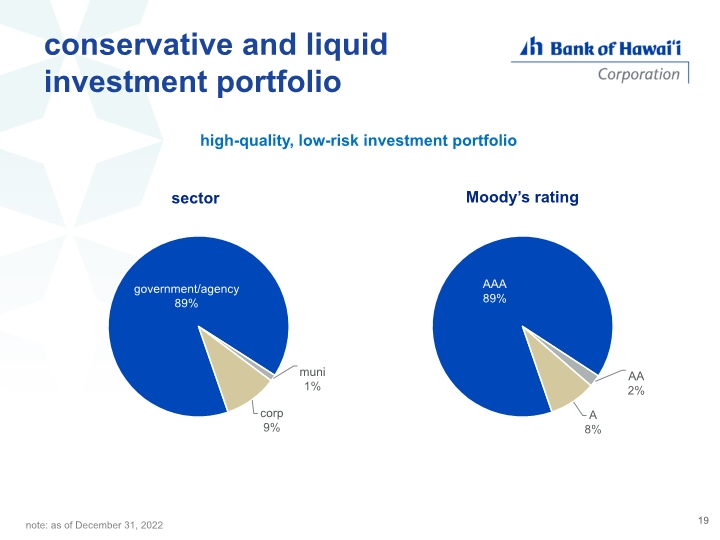

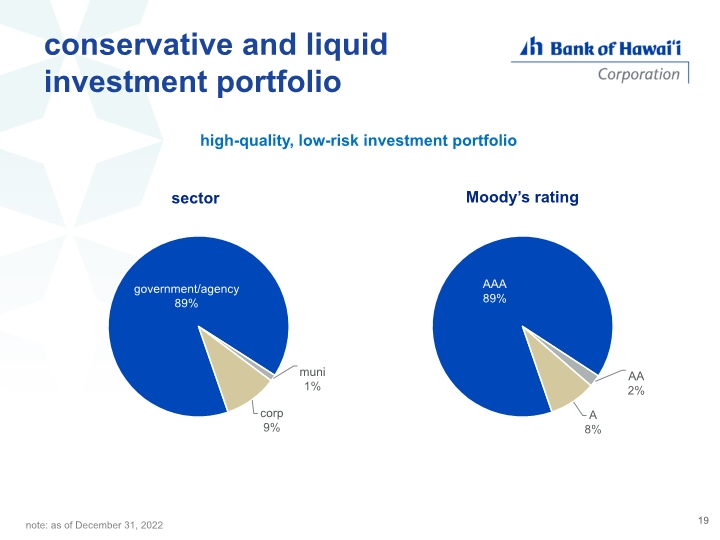

conservative and liquid investment portfolio 19 high-quality, low-risk investment portfolio note: as of December 31, 2022

operational take aways 20 unique and competitively advantageous deposit market exceptional deposit base substantial liquidity back up high quality assets