UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report: February 26, 2007

Exact Name of Registrant as Specified in Its Charter | Commission File Number | I.R.S. Employer Identification No. | ||

| Hawaiian Electric Industries, Inc. | 1-8503 | 99-0208097 | ||

| Hawaiian Electric Company, Inc. | 1-4955 | 99-0040500 |

State of Hawaii

(State or other jurisdiction of incorporation)

900 Richards Street, Honolulu, Hawaii 96813

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code:

(808) 543-5662 - Hawaiian Electric Industries, Inc. (HEI)

(808) 543-7771 - Hawaiian Electric Company, Inc. (HECO)

None

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events.

On February 26, 2007, HEI will hold a webcast and teleconference using the following slides and notes:

Hawaiian Electric Industries, Inc.

2006 Year-end Webcast

February 26, 2007

Thanks Suzy. Aloha and good afternoon.

Hopefully, most of you had a chance to read through our year-end and fourth quarter earnings that we released last Friday. For those of you that didn’t, let me briefly summarize those results.

1

2006 Net Income and EPS From Continuing Operations

2005 2006

120

100

80

60

40

20

0

-20

-40

73

75

65

56

127

108

(10) |

|

(23) |

|

Utility

Bank

Hold. Co. &

Other

Consol.

2006 EPS—$1.33

2005 EPS—$1.58

$ in millions

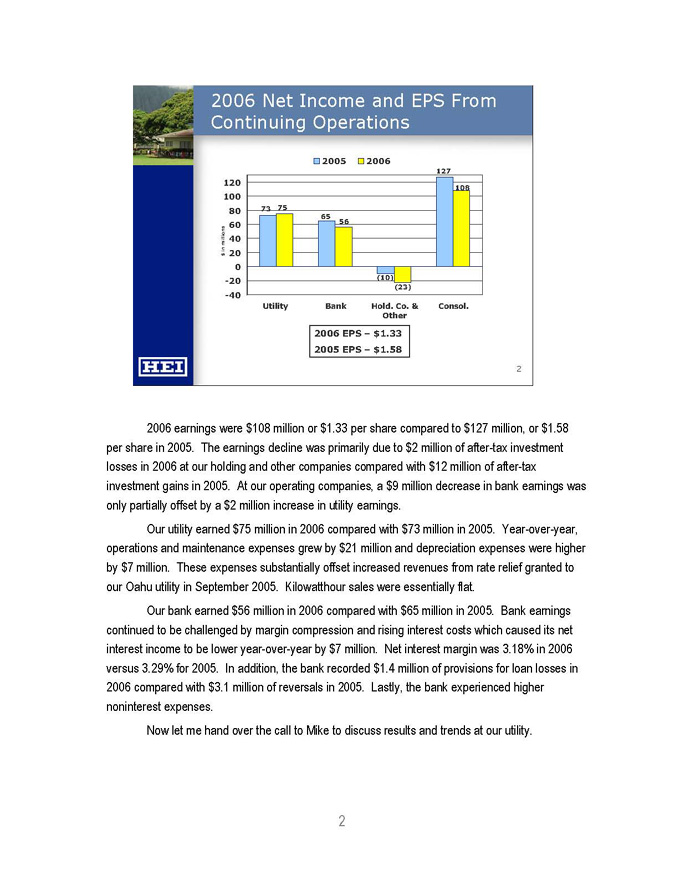

2006 earnings were $108 million or $1.33 per share compared to $127 million, or $1.58 per share in 2005. The earnings decline was primarily due to $2 million of after-tax investment losses in 2006 at our holding and other companies compared with $12 million of after-tax investment gains in 2005. At our operating companies, a $9 million decrease in bank earnings was only partially offset by a $2 million increase in utility earnings.

Our utility earned $75 million in 2006 compared with $73 million in 2005. Year-over-year, operations and maintenance expenses grew by $21 million and depreciation expenses were higher by $7 million. These expenses substantially offset increased revenues from rate relief granted to our Oahu utility in September 2005. Kilowatthour sales were essentially flat.

Our bank earned $56 million in 2006 compared with $65 million in 2005. Bank earnings continued to be challenged by margin compression and rising interest costs which caused its net interest income to be lower year-over-year by $7 million. Net interest margin was 3.18% in 2006 versus 3.29% for 2005. In addition, the bank recorded $1.4 million of provisions for loan losses in 2006 compared with $3.1 million of reversals in 2005. Lastly, the bank experienced higher noninterest expenses.

Now let me hand over the call to Mike to discuss results and trends at our utility.

2 |

|

Kilowatthour Sales and Forecast

11,000

9,500

8,000

6,500

5,000

‘01

‘02

‘03

‘04

‘05

‘06

‘07

‘08

Kilowatthours (in millions)

Growth(%)

1.1

1.9

2.4

2.9

0.3

0.3

0.6

1.6

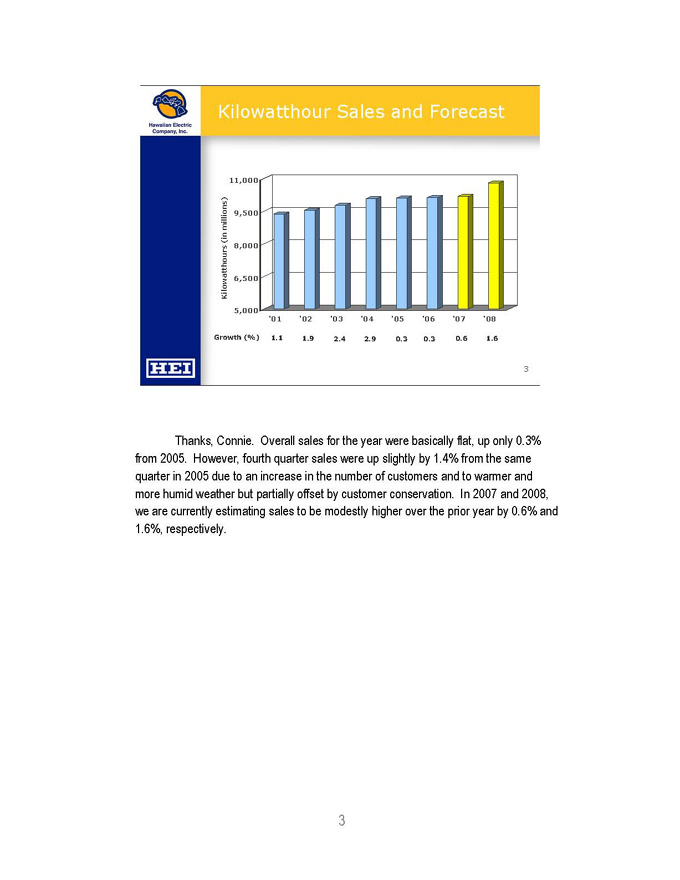

Thanks, Connie. Overall sales for the year were basically flat, up only 0.3% from 2005. However, fourth quarter sales were up slightly by 1.4% from the same quarter in 2005 due to an increase in the number of customers and to warmer and more humid weather but partially offset by customer conservation. In 2007 and 2008, we are currently estimating sales to be modestly higher over the prior year by 0.6% and 1.6%, respectively.

3 |

|

Rising Operations and Maintenance Expenses

$ in millions

300

200

100

187

199

220

235

255

277

‘01

‘02

‘03

‘04

‘05

‘06

• |

| More frequent and extensive maintenance and repairs |

• |

| Increased retirement benefits expenses |

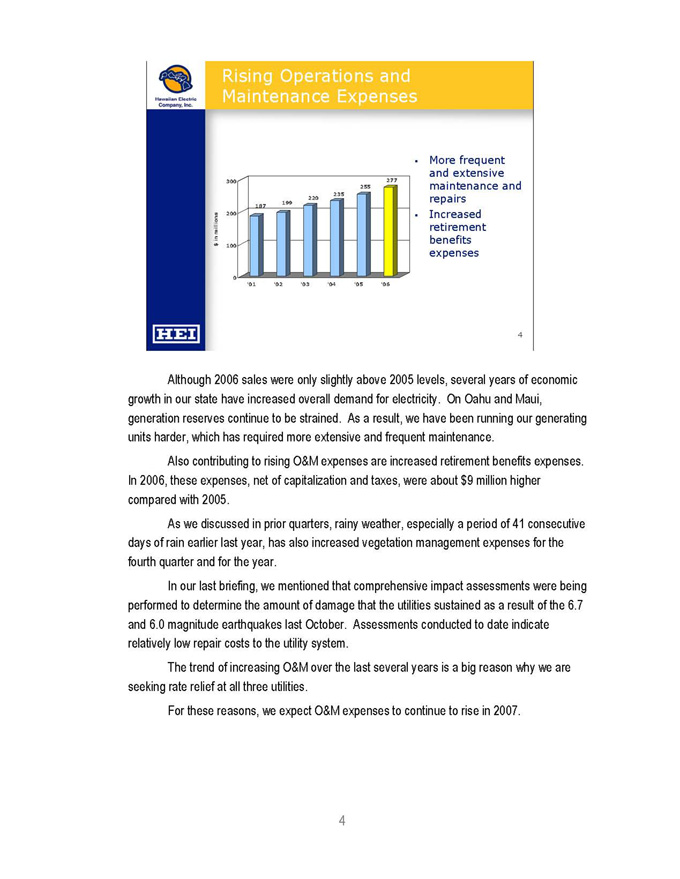

Although 2006 sales were only slightly above 2005 levels, several years of economic growth in our state have increased overall demand for electricity. On Oahu and Maui, generation reserves continue to be strained. As a result, we have been running our generating units harder, which has required more extensive and frequent maintenance.

Also contributing to rising O&M expenses are increased retirement benefits expenses. In 2006, these expenses, net of capitalization and taxes, were about $9 million higher compared with 2005.

As we discussed in prior quarters, rainy weather, especially a period of 41 consecutive days of rain earlier last year, has also increased vegetation management expenses for the fourth quarter and for the year.

In our last briefing, we mentioned that comprehensive impact assessments were being performed to determine the amount of damage that the utilities sustained as a result of the 6.7 and 6.0 magnitude earthquakes last October. Assessments conducted to date indicate relatively low repair costs to the utility system.

The trend of increasing O&M over the last several years is a big reason why we are seeking rate relief at all three utilities.

For these reasons, we expect O&M expenses to continue to rise in 2007.

4

Capital Expenditures

$ in millions

350

300

250

200

150

100

50

0

Gross $1,153M

Net $ 986M

25

77

130

26

139

137

11

105

117

12

75

98

18

76

107

‘07

‘08

‘09

‘10

‘11

T&D

Generation

Other

% Internally financed

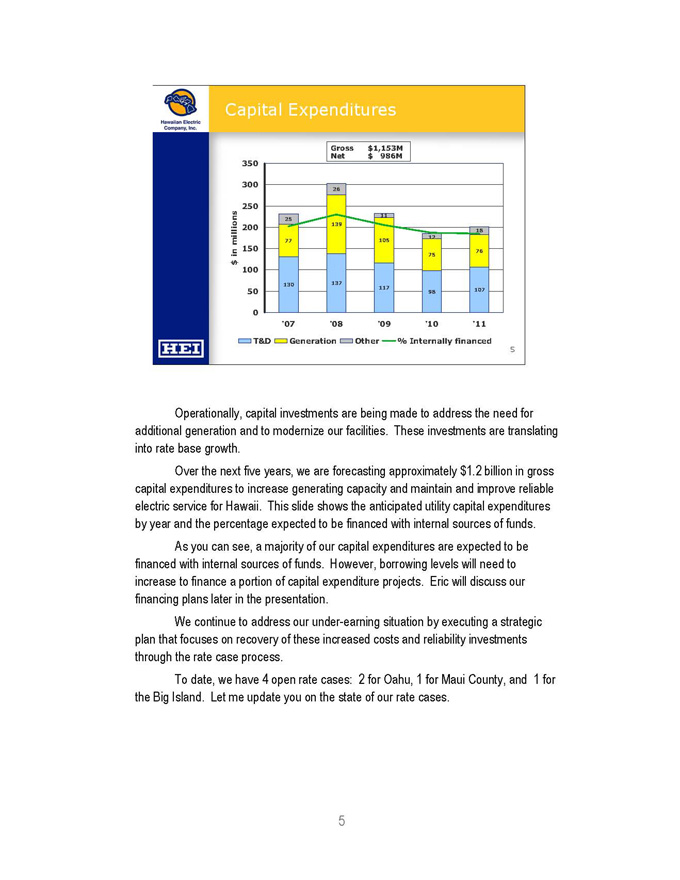

Operationally, capital investments are being made to address the need for additional generation and to modernize our facilities. These investments are translating into rate base growth.

Over the next five years, we are forecasting approximately $1.2 billion in gross capital expenditures to increase generating capacity and maintain and improve reliable electric service for Hawaii. This slide shows the anticipated utility capital expenditures by year and the percentage expected to be financed with internal sources of funds.

As you can see, a majority of our capital expenditures are expected to be financed with internal sources of funds. However, borrowing levels will need to increase to finance a portion of capital expenditure projects. Eric will discuss our financing plans later in the presentation.

We continue to address our under-earning situation by executing a strategic plan that focuses on recovery of these increased costs and reliability investments through the rate case process.

To date, we have 4 open rate cases: 2 for Oahu, 1 for Maui County, and 1 for the Big Island. Let me update you on the state of our rate cases.

5 |

|

Oahu Rate Case–2005

• |

| 2005 test year |

• |

| Interim decision received September 2005 |

• |

| $41M* (3.3%) interim increase |

• |

| Interim increases are subject to refund with interest based on a final decision and order |

• |

| 10.7% return on common equity |

• |

| 8.66% return on rate base |

• |

| $1,109M average rate base |

• |

| Final decision and order pending |

• |

| Additional base revenues net of $12M already collected via a surcharge |

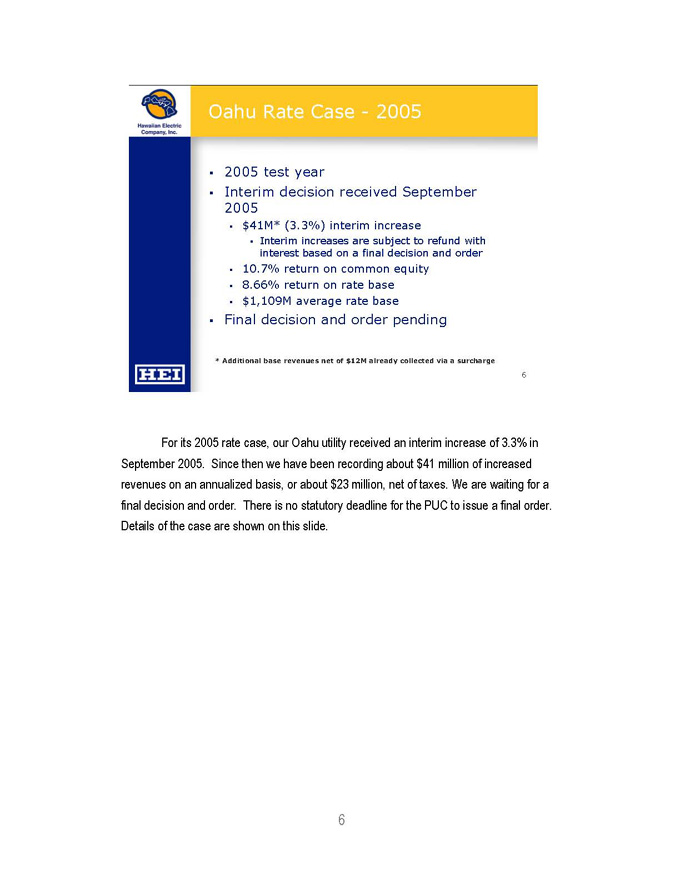

For its 2005 rate case, our Oahu utility received an interim increase of 3.3% in September 2005. Since then we have been recording about $41 million of increased revenues on an annualized basis, or about $23 million, net of taxes. We are waiting for a final decision and order. There is no statutory deadline for the PUC to issue a final order. Details of the case are shown on this slide.

6

Energy Efficiency Docket D&O

• |

| Final D&O – February 2007 |

• |

| All proposed DSM programs approved |

• |

| Allows program cost recovery and performance-based incentives |

• |

| Load management programs remain with utility |

• |

| All other DSM programs transition to a third-party administrator in January 2009 |

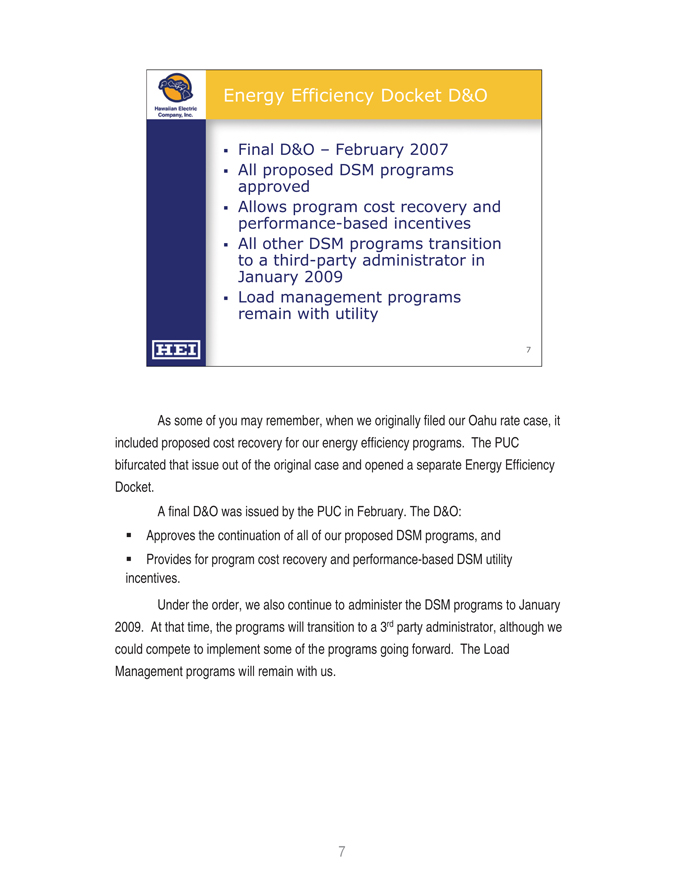

As some of you may remember, when we originally filed our Oahu rate case, it included proposed cost recovery for our energy efficiency programs. The PUC bifurcated that issue out of the original case and opened a separate Energy Efficiency Docket.

A final D&O was issued by the PUC in February. The D&O:

Approves the continuation of all of our proposed DSM programs, and

Provides for program cost recovery and performance-based DSM utility incentives.

Under the order, we also continue to administer the DSM programs to January 2009. At that time, the programs will transition to a 3rd party administrator, although we could compete to implement some of the programs going forward. The Load Management programs will remain with us.

7

Oahu Rate Case—2007

Filed in December 2006

2007 test year

Requesting 7.1% or $99.6M increase in revenues

11.25% return on common equity

8.92% return on rate base

$1,214M average rate base

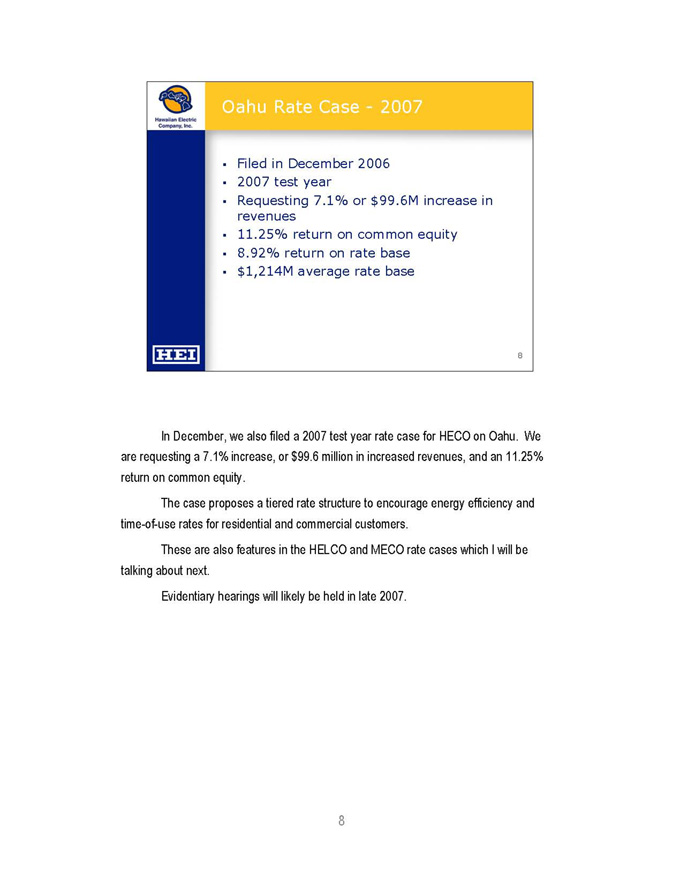

In December, we also filed a 2007 test year rate case for HECO on Oahu. We are requesting a 7.1% increase, or $99.6 million in increased revenues, and an 11.25% return on common equity.

The case proposes a tiered rate structure to encourage energy efficiency and time-of-use rates for residential and commercial customers.

These are also features in the HELCO and MECO rate cases which I will be talking about next.

Evidentiary hearings will likely be held in late 2007.

8

Maui County Rate Case—2007

Filed February 23, 2007

2007 test year

Requesting 5.3% or $18.9M increase in revenues

11.25% return on common equity

8.98% return on rate base

$386M average rate base

Last week, on February 23rd, we filed a rate case for our Maui county subsidiary, MECO, with a 2007 test year.

We are requesting $19.0 million, or a 5.3% increase in revenues and an 11.25% return on common equity.

9

Hawaii Island Rate Case—2006

Filed May 2006

2006 test year

Requesting 9.2% or $30M increase in revenues

11.25% return on common equity

8.65% return on rate base

$369M average rate base

Evidentiary hearings scheduled for May 2007

Also back in May of last year, we filed a rate case for our Hawaii island subsidiary, HELCO, with a 2006 test year.

We are requesting $30 million, or a 9.2% increase in revenues, as well as an 11.25% return on common equity.

Evidentiary hearings are scheduled for May 2007.

10

Possible Interim Decision Timing

HELCO 2006 test year: mid-2007

HECO 2007 test year: end 2007

MECO 2007 test year: early 2008

For all three rate cases, State law requires that our PUC issue an interim decision within 10 months after the rate case application is filed, if an evidentiary hearing is held. However, the PUC may postpone an interim D&O by up to 30 days if hearings have not been completed.

This would mean possible interim decisions in the period ranging from mid-2007 to early 2008.

11

HECO Retirement Benefits

$127M AOCI charge for 2006

$2.6M change in net expense 2007 vs. 2006

Assumptions (%): 2006 Expense 2006 AOCI and 2007 Expense

Discount rate 5.75 6.0

Long-term rate of return 9.0 8.5

As you know, in September 2006, the Financial Accounting Standards Board issued its Statement No. 158. This changes the measurement of our retirement benefit plan obligations and requires recognition of the funded status as of year-end.

Our utility recorded a non-cash charge to accumulated other comprehensive income of $127 million (net of taxes). This charge to equity assumes a discount rate of 6% and an expected return on plan assets of 8.5%.

We filed an application with the Hawaii PUC seeking regulatory asset treatment for this charge for financial reporting purposes.

On January 26, 2007, the PUC issued a D&O in the AOCI docket, which denied the electric utilities’ request to record a regulatory asset for financial reporting purposes.

There is no immediate impact to our net income as a result of the D&O.

We will continue to seek a return on the pension assets through inclusion in the rate base for each of our rate cases.

On the expense side, retirement benefits expenses, net of taxes and capitalization at the utility are estimated to be $2.6 million higher in 2007 compared with 2006.

12

Utility Summary

Reduced reserve margins

Increase capital investments to maintain and improve reliability

O&M expected to increase in 2007

Improve returns through rate cases

To sum up…a growing Hawaii economy has impacted our utility’s reserve margins, and from a financial perspective, our earnings. To address this situation, we are increasing our capital expenditure program to increase generating capacity and maintain and improve reliable electric service for Hawaii.

We expect this earnings pressure from increasing O&M to continue in 2007 due to the items I discussed earlier.

We are focused on improving our earned rates of return to get closer to our allowed returns.

I want to emphasize that our plan will take several years and involve all three of our utilities. Over time, we will improve our earnings.

Now, I’d like to turn the call back to Connie to discuss the bank.

13

2006 Bank Highlights

Solid growth in loans

Deposit balances essentially flat

Ongoing margin compression pressure

Continued upward pressure on deposit and borrowing costs

Shift in mix toward higher cost CDs

Continued strong credit quality

Higher noninterest expenses

Thanks Mike.

At the bank, operating conditions remained challenging due to the interest rate environment. The area that was most directly impacted was our effort to retain and grow deposits. While we produced good growth in our loan portfolio and credit quality remained strong, deposit balances were flat for the year and high short-term interest rates continued to put upward pressure on our funding costs.

Our lending businesses posted another solid year, growing by 6%. The continued diversification of our business mix enabled us to overcome the slowdown in the residential real estate market. About 60% of the loan growth was in our commercial banking, commercial real estate and consumer portfolios.

As we discussed throughout the year, high short-term interest rates and the inverted yield curve made it a challenge to retain deposits and control our funding costs. We experienced net deposit outflows in the middle of the year, and responded with a combination of tactical repricings of deposits, promotions and the introduction of new products and services. We closed with a strong fourth quarter and ended the year with deposits essentially flat compared to the prior year-end. But, deposit retention and growth will remain a challenge in the current environment.

Overall funding costs increased due to the combination of deposit repricing, the continued shift in mix from lower-costing deposits to higher-costing time deposits and higher rates on our wholesale borrowings.

Noninterest expense was $7.6 million higher in 2006 than 2005, primarily due to increased legal and litigation related expenses and occupancy expenses.

14

2007 Bank Outlook

Continued challenging operating environment

Flat/inverted yield curve

Ongoing competition for deposits

Slower rate of local economic growth

Focus on

Growing low/no-cost deposits

Loan portfolio growth

Maintaining excellent asset quality

Controlling expenses

At American Savings Bank, we are expecting the difficult interest rate environment to persist through 2007. The market now appears to be expecting the Federal Reserve to remain on hold for most of the year, and the yield curve to remain flat or inverted. This will continue to pressure our net interest margin.

An ongoing challenge in this environment is to grow deposits while managing deposit costs. To support this, we will continue to develop new products and services, and also focus on growing the less interest rate sensitive types of accounts, such as consumer checking accounts.

On the lending side, we expect moderate growth in loan balances in 2007. Continued growth in commercial loans may be partially offset by a slight decline in the commercial real estate portfolio. The scheduled repayment of some large construction loans and the shift in emphasis back towards income property lending is expected to result in a slight decline in the size of the commercial real estate portfolio. The slowing residential real estate market is expected to result in modest growth in residential loan balances.

We expect overall credit quality to remain strong. However, factors such as growth in the loan portfolio, situations with specific borrowers or changes in outlook for the economy may cause credit costs to increase. The outlook for the residential real estate market remains good. Although transaction volumes have fallen off, prices have remained stable and we have not experienced the declines in value seen in many mainland markets. Given the outlook for the continued health of the economy, we also expect businesses to continue to do well. In addition, the commercial real estate market, while coming off of its peaks, is expected to remain strong.

We are also working to offset net interest margin pressure by focusing on growing noninterest income and managing expenses. Initiatives such as our combined rewards program for personal and business checking and credit cards, which we rolled out in 2006, provide us with opportunities to deepen our relationship with our customers and have the potential for increasing noninterest income by encouraging card use. The initial response to the introduction of this program far exceeded our expectations, and we hope to leverage off of that momentum and continue to grow the program in 2007.

Now, let me ask Eric to cover the holding and other companies’ results and discuss our financing plans for 2007.

15

2006 Holding and Other Company Results

Exiting non-strategic investments in 2005

and 2006 affected comparability of year-

over-year results:

Sale of leveraged lease investment

$9 million gain on sale, net of taxes, recorded in the fourth quarter of 2005

No similar sales in 2006

Hoku Scientific stock

$3 million after-tax unrealized investment gains in 2005 versus $2 million after-tax realized and unrealized investment losses in 2006

Sold entire remaining interest in 2007 for an after-tax gain of just under $1 million

Thanks Connie and good afternoon.

The holding and other companies net loss for 2006 was $23 million compared to $10 million in 2005. The comparability of year-over-year results was primarily affected by the sale of a non-strategic asset and sales and mark-to-market adjustments related to our investment in Hoku Scientific.

As an update, in January 2007, we sold our entire remaining interest in Hoku Scientific for an after-tax gain of just under $1 million.

16

Planned 2007 Financing Activities

$160 million of revenue bonds in the first quarter of 2007

No expected increases in long-term debt at the holding company

Begin issuing shares in early March 2007 to satisfy the requirements of the Dividend Reinvestment and 401k plans

Now let me turn to our financing plans.

As Mike indicated, the utility’s borrowing levels will increase in 2007 to support their capital expenditure program. To that end, they contemplate issuing up to $160 million of revenue bonds in the first quarter of this year.

There are no plans to increase long-term debt at the holding company.

However, beginning in early March 2007, HEI will start issuing shares of common stock to satisfy the requirements of our dividend reinvestment and 401K plans. In 2006, HEI purchased 1.5 million shares on the open market to satisfy the requirements of these plans.

Additionally, at the end of March, we plan to register 3.75 million of additional shares for the dividend reinvestment plan.

Now let me turn the presentation back to Connie for some closing remarks.

17

Dividend

Attractive 4.6% yield, based on a closing price of $27.02 on February 23rd

Next dividend payable March 13th to holders of record on February 26th

Thanks Eric.

As you know, we pay an attractive dividend yield of 4.6%. You may have seen our dividend release dated February 15, 2007, announcing the board’s approval of a 31 cents per share dividend on our common stock. The dividend is payable on March 13th to shareholders of record on February 26th.

A few of you have asked about the timing of the year-end earnings release and dividend declaration. You may have noticed over the last couple of quarters that we have been moving toward issuing our earnings and filing our 10-Q on the same date so that investors have a more complete picture of what has happened at the company in the previous quarter. Because we moved our earnings release date to February 23 to be closer to our 10-K filing date, the dividend declaration was delayed.

18

Summary

Several factors will continue affecting core businesses in 2007

Trend of rising O&M

Rate case cycle

Inverted yield curve and higher funding cost

No significant sales of non-strategic assets

2007 will continue to be challenging

Long-term prospects for core operating companies are good

In summary, several key factors will continue to affect our core businesses in 2007.

We expect the trend of rising utility O&M to continue due to factors that Mike covered in detail. And as Mike pointed out, it will take a while for all three utilities to be able to earn closer to their allowed rates of return.

At the bank, the inverted yield curve and higher funding costs will continue to put pressure on net interest margins. The bank’s focus remains on gathering low-cost deposits, growing the loan portfolio, maintaining credit quality, growing noninterest income and controlling expenses.

At the holding company, we don’t expect significant sales of non-strategic assets.

In summary, 2007 will continue to be another challenging year for HEI. Challenges aside, our core operating companies remain sound and their long-term prospects are good.

19

This concludes our formal comments. We’ll be happy to answer any questions you may have.

20

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned thereunto duly authorized. The signature of the undersigned companies shall be deemed to relate only to matters having reference to such companies and any subsidiaries thereof.

HAWAIIAN ELECTRIC INDUSTRIES, INC. | HAWAIIAN ELECTRIC COMPANY, INC. | |||

| (Registrant) | (Registrant) | |||

/s/ Eric K. Yeaman | /s/ Tayne S. Y. Sekimura | |||

Eric K. Yeaman | Tayne S. Y. Sekimura | |||

Financial Vice President, Treasurer | Financial Vice President | |||

and Chief Financial Officer | (Principal Financial Officer of HECO) | |||

(Principal Financial Officer of HEI) | Date: February 26, 2007 | |||

Date: February 26, 2007 | ||||

21