UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF | |

| | THE SECURITIES EXCHANGE ACT OF 1934 | |

| | | |

| | For the fiscal year ended October 31, 2009 or | |

| | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF | |

| | THE SECURITIES EXCHANGE ACT OF 1934 | |

| | | |

| | For the transition period from ___________________to__________________ | |

Commission file number 1-4604

HEICO CORPORATION

(Exact name of registrant as specified in its charter)

| Florida | 65-0341002 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

| 3000 Taft Street, Hollywood, Florida | 33021 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (954) 987-4000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

| Common Stock, $.01 par value per share | | New York Stock Exchange |

| Class A Common Stock, $.01 par value per share | | |

Securities registered pursuant to Section 12(g) of the Act:

Rights to Purchase Series B Junior Participating Preferred Stock

Rights to Purchase Series C Junior Participating Preferred Stock

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer o Non−accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by nonaffiliates of the registrant was $639,454,000 based on the closing price of HEICO Common Stock and Class A Common Stock as of April 30, 2009 as reported by the New York Stock Exchange.

The number of shares outstanding of each of the registrant's classes of common stock as of December 17, 2009:

| Common Stock, $.01 par value | | 10,421,225 shares |

| Class A Common Stock, $.01 par value | | 15,732,299 shares |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the 2010 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

INDEX TO ANNUAL REPORT ON FORM 10-K

| | Page |

| |

| | | 1 |

| | | 11 |

| | | 15 |

| | | 16 |

| | | 16 |

| | | 16 |

| | | | |

| |

| | | 17 |

| | | 21 |

| | | 22 |

| | | 38 |

| | | 39 |

| | | 77 |

| | | 77 |

| | | 78 |

| | | | |

| |

| | | 79 |

| | | 79 |

| | | 79 |

| | | 79 |

| | | 79 |

| | | | |

| |

| | | 80 |

| | |

| 85 |

The Company

HEICO Corporation through its subsidiaries (collectively, “HEICO,” “we,” “us,” “our” or the “Company”) believes it is the world’s largest manufacturer of Federal Aviation Administration (“FAA”)-approved jet engine and aircraft component replacement parts, other than the original equipment manufacturers (“OEMs”) and their subcontractors. HEICO also believes it is a leading manufacturer of various types of electronic equipment for the aviation, defense, space, medical, telecommunication and electronic industries.

The Company was organized in 1993 creating a new holding corporation known as HEICO Corporation and renaming the former holding company (formerly known as HEICO Corporation, organized in 1957) as HEICO Aerospace Corporation. The reorganization, which was completed in 1993, did not result in any change in the business of the Company, its consolidated assets or liabilities or the relative interests of its shareholders.

Our business is comprised of two operating segments:

The Flight Support Group. Our Flight Support Group (“FSG”), consisting of HEICO Aerospace Holdings Corp. (“HEICO Aerospace”) and its subsidiaries, accounted for 73%, 75% and 76% of our net sales in fiscal 2009, 2008 and 2007, respectively. The Flight Support Group uses proprietary technology to design and manufacture jet engine and aircraft component replacement parts for sale at lower prices than those manufactured by OEMs. These parts are approved by the FAA and are the functional equivalent of parts sold by OEMs. In addition, the Flight Support Group repairs and distributes jet engine and aircraft components, avionics and instruments for domestic and foreign commercial air carriers and aircraft repair companies as well as military and business aircraft operators; and manufactures thermal insulation products and other component parts primarily for aerospace, defense and commercial applications.

The Flight Support Group competes with the leading industry OEMs and, to a lesser extent, with a number of smaller, independent parts distributors. Historically, the three principal jet engine OEMs, General Electric (including CFM International), Pratt & Whitney and Rolls Royce, have been the sole source of substantially all jet engine replacement parts for their jet engines. Other OEMs have been the sole source of replacement parts for their aircraft component parts. While we believe that we currently supply less than 2% of the market for jet engine and aircraft component replacement parts, we have in recent years been adding new products to our line at a rate of 400 to 500 per year of Parts Manufacturer Approvals (“PMA” or “PMAs”). We currently offer to our customers over 5,000 parts for which PMAs have been received from the FAA.

We believe that, based on our competitive pricing, reputation for high quality, short lead time requirements, strong relationships with domestic and foreign commercial air carriers and repair stations (companies that overhaul aircraft engines and/or components), strategic relationships with Lufthansa and other major airlines and successful track record of receiving PMAs from the FAA, we are uniquely positioned to continue to increase our product lines and gain market share.

The Electronic Technologies Group. Our Electronic Technologies Group (“ETG”), consisting of HEICO Electronic Technologies Corp. and its subsidiaries, accounted for 27%, 25% and 24% of our net

sales in fiscal 2009, 2008 and 2007, respectively. Through our Electronic Technologies Group, which derived approximately 46% of its sales in fiscal 2009 from the sale of products and services to U.S. and foreign military agencies, we design, manufacture and sell various types of electronic, microwave and electro-optical products, including infrared simulation and test equipment, laser rangefinder receivers, electrical power supplies, back-up power supplies, power conversion products, underwater locator beacons, electromagnetic interference and radio frequency interference shielding, high power capacitor charging power supplies, amplifiers, photodetectors, amplifier modules, flash lamp drivers, laser diode drivers, arc lamp power supplies, custom power supply designs, cable assemblies, high voltage interconnection devices and wire, high voltage energy generators, high frequency power delivery systems and high-speed interface products that link devices such as telemetry receivers, digital cameras, high resolution scanners, simulation systems and test systems to almost any computer.

In October 1997, we entered into a strategic alliance with Lufthansa. Lufthansa is the world’s largest independent provider of engineering and maintenance services for commercial aircraft components and jet engines and supports over 200 airlines, governments and other customers. As part of this strategic alliance, Lufthansa has invested over $60 million in our Company to acquire and maintain a 20% minority interest in HEICO Aerospace. This strategic alliance has enabled us to expand domestically and internationally by enhancing our ability to (i) identify key jet engine and aircraft component replacement parts with significant profit potential by utilizing Lufthansa’s extensive operating data on engine and component parts; (ii) introduce those parts throughout the world in an efficient manner due to Lufthansa’s testing and diagnostic resources; and (iii) broaden our customer base by capitalizing on Lufthansa’s established relationships and alliances within the airline industry.

In March 2001, we entered into a joint venture with American Airlines, one of the world’s largest airlines, to develop, design and sell FAA-approved jet engine and aircraft component replacement parts through HEICO Aerospace. The joint venture is partly owned by American Airlines. American Airlines and HEICO Aerospace have agreed to cooperate regarding technical services and marketing support on a worldwide basis. We have also entered into several strategic relationships with other leading airlines, such as United Airlines (May 2002), Delta Air Lines (February 2003), Japan Airlines (March 2004) and British Airways (May 2007). These relationships accelerate HEICO’s efforts in developing a broad range of jet engine and aircraft component replacement parts for FAA approval. Each of the aforementioned airlines purchase these newly developed parts, and many of HEICO Aerospace’s current FAA-approved parts product line, on an exclusive basis from HEICO Aerospace.

HEICO has continuously operated in the aerospace industry for more than 50 years. Since assuming control in 1990, our current management has achieved significant sales and profit growth through a broadened line of product offerings, an expanded customer base, increased research and development expenditures and the completion of a number of acquisitions. As a result of internal growth and acquisitions, our net sales from continuing operations have grown from $26.2 million in fiscal 1990 to $538.3 million in fiscal 2009, a compound annual growth rate of approximately 17%. During the same period, we improved our net income from $2.0 million to $44.6 million, representing a compound annual growth rate of approximately 18%.

Flight Support Group

The Flight Support Group, headquartered in Hollywood, Florida, serves a broad spectrum of the aviation industry, including (i) commercial airlines and air cargo carriers; (ii) repair and overhaul facilities; (iii) OEMs; and (iv) U.S. and foreign governments.

Jet engine and aircraft component replacement parts can be categorized by their ongoing ability to be repaired and returned to service. The general categories in which we participate are as follows: (i)

rotable; (ii) repairable; and (iii) expendable. A rotable is a part which is removed periodically as dictated by an operator’s maintenance procedures or on an as needed basis and is typically repaired or overhauled and re-used an indefinite number of times. An important subset of rotables is “life limited” parts. A life limited rotable has a designated number of allowable flight hours and/or cycles (one take-off and landing generally constitutes one cycle) after which it is rendered unusable. A repairable is similar to a rotable except that it can only be repaired a limited number of times before it must be discarded. An expendable is generally a part which is used and not thereafter repaired for further use.

Jet engine and aircraft component replacement parts are classified within the industry as (i) factory-new; (ii) new surplus; (iii) overhauled; (iv) repairable; and (v) as removed. A factory-new or new surplus part is one that has never been installed or used. Factory-new parts are purchased from FAA-approved manufacturers (such as HEICO or OEMs) or their authorized distributors. New surplus parts are purchased from excess stock of airlines, repair facilities or other redistributors. An overhauled part is one that has been completely repaired and inspected by a licensed repair facility such as ours. An aircraft spare part is classified as “repairable” if it can be repaired by a licensed repair facility under applicable regulations. A part may also be classified as “repairable” if it can be removed by the operator from an aircraft or jet engine while operating under an approved maintenance program and is airworthy and meets any manufacturer or time and cycle restrictions applicable to the part. A “factory-new,” “new surplus” or “overhauled” part designation indicates that the part can be immediately utilized on an aircraft. A part in “as removed” or “repairable” condition requires inspection and possibly functional testing, repair or overhaul by a licensed facility prior to being returned to service in an aircraft.

Factory-New Jet Engine and Aircraft Component Replacement Parts. The Flight Support Group engages in the research and development, design, manufacture and sale of FAA-approved replacement parts that are sold to domestic and foreign commercial air carriers and aircraft repair and overhaul companies. Our principal competitors are Pratt & Whitney, a division of United Technologies Corporation, and General Electric Company, including its CFM International joint venture. The Flight Support Group’s factory-new replacement parts include various jet engine and aircraft component replacement parts. A key element of our growth strategy is the continued design and development of an increasing number of PMA replacement parts in order to further penetrate our existing customer base and obtain new customers. We select the jet engine and aircraft component replacement parts to design and manufacture through a selection process which analyzes industry information to determine which replacement parts are suitable candidates. As part of Lufthansa’s investment in the Flight Support Group, Lufthansa has the right to select 50% of the parts for which we will seek PMAs, provided that such parts are technologically and economically feasible and substantially comparable with the profitability of our other PMA parts.

Repair and Overhaul Services. The Flight Support Group provides repair and overhaul services on selected jet engine and aircraft component parts, as well as on avionics, instruments, composites and flight surfaces of commercial aircraft operated by domestic and foreign commercial airlines. The Flight Support Group also provides repair and overhaul services including avionics and navigation systems as well as subcomponents and other instruments utilized on military aircraft operated by the United States government and foreign military agencies and for aircraft repair and overhaul companies. Our repair and overhaul operations require a high level of expertise, advanced technology and sophisticated equipment. Services include the repair, refurbishment and overhaul of numerous accessories and parts mounted on gas turbine engines and airframes. Components overhauled include fuel pumps, generators, fuel controls, pneumatic valves, starters and actuators, turbo compressors and constant speed drives, hydraulic pumps, valves and actuators, composite flight controls, electro-mechanical equipment and auxiliary power unit accessories. The Flight Support Group also provides commercial airlines, regional operators, asset management companies and Maintenance, Repair and Overhaul (“MRO”) providers with high quality and cost effective niche accessory component exchange services as an alternative to OEMs’ spares services.

Distribution. The Flight Support Group distributes FAA-approved parts including hydraulic, pneumatic, mechanical and electro-mechanical components for the commercial, regional and general aviation markets.

Manufacture of Specialty Aircraft/Defense Related Parts and Subcontracting for OEMs. The Flight Support Group manufactures thermal insulation blankets primarily for aerospace, defense and commercial applications. The Flight Support Group also manufactures specialty components for sale as a subcontractor for aerospace and industrial original equipment manufacturers and the United States government.

FAA Approvals and Product Design. Non-OEM manufacturers of jet engine replacement parts must receive a PMA from the FAA to sell the replacement part. The PMA approval process includes the submission of sample parts, drawings and testing data to one of the FAA’s Aircraft Certification Offices where the submitted data are analyzed. We believe that an applicant’s ability to successfully complete the PMA process is limited by several factors, including (i) the agency’s confidence level in the applicant; (ii) the complexity of the part; (iii) the volume of PMAs being filed; and (iv) the resources available to the FAA. We also believe that companies such as HEICO that have demonstrated their manufacturing capabilities and established favorable track records with the FAA generally receive a faster turnaround time in the processing of PMA applications. Finally, we believe that the PMA process creates a significant barrier to entry in this market niche through both its technical demands and its limits on the rate at which competitors can bring products to market.

As part of our growth strategy, we have continued to increase our research and development activities. Research and development expenditures by the Flight Support Group, which were approximately $300,000 in fiscal 1991, increased to approximately $11.5 million in fiscal 2009, $11.1 million in fiscal 2008 and $10.7 million in 2007. We believe that our Flight Support Group’s research and development capabilities are a significant component of our historical success and an integral part of our growth strategy. In recent years, the FAA granted us PMAs for approximately 400 to 500 new parts per year (excluding acquired PMAs); however, no assurance can be given that the FAA will continue to grant PMAs or that we will achieve acceptable levels of net sales and gross profits on such parts in the future.

We benefit from our proprietary rights relating to certain design, engineering and manufacturing processes and repair and overhaul procedures. Customers often rely on us to provide initial and additional components, as well as to redesign, re-engineer, replace or repair and provide overhaul services on such aircraft components at every stage of their useful lives. In addition, for some products, our unique manufacturing capabilities are required by the customer’s specifications or designs, thereby necessitating reliance on us for production of such designed products.

We have no material patents for the proprietary techniques, including software and manufacturing expertise, we have developed to manufacture jet engine and aircraft component replacement parts and instead, we primarily rely on trade secret protection. Although our proprietary techniques and software and manufacturing expertise are subject to misappropriation or obsolescence, we believe that we take appropriate measures to prevent misappropriation or obsolescence from occurring by developing new techniques and improving existing methods and processes, which we will continue on an ongoing basis as dictated by the technological needs of our business.

Electronic Technologies Group

Our Electronic Technologies Group’s strategy is to design and produce mission-critical subcomponents for smaller, niche markets, but which are utilized in larger systems – systems like

targeting, tracking, identification, simulation, testing, communications, lighting, surgical, x-ray, telecom and computer systems. These systems are, in turn, often located on another platform, such as aircraft, satellites, ships, vehicles, handheld devices and other platforms.

Electro-Optical Infrared Simulation and Test Equipment. The Electronic Technologies Group believes it is a leading international designer and manufacturer of niche state-of-the-art simulation, testing and calibration equipment used in the development of missile seeking technology, airborne targeting and reconnaissance systems, shipboard targeting and reconnaissance systems, space-based sensors as well as ground vehicle-based systems. These products include infrared scene projector equipment, such as our MIRAGE IR Scene Simulator, high precision blackbody sources, software and integrated calibration systems.

Simulation equipment allows the U.S. government and allied foreign military to save money on missile testing as it allows infrared-based missiles to be tested on a multi-axis, rotating table instead of requiring the launch of a complete missile. In addition, several large military prime contractors have elected to purchase such equipment from us instead of maintaining internal staff to do so because we can offer a more cost-effective solution. Our customers include major U.S. Department of Defense weapons laboratories and defense prime contractors, such as Lockheed Martin, Northrop Grumman and Boeing.

Electro-Optical Laser Products. The Electronic Technologies Group believes it is a leading designer and maker of Laser Rangefinder Receivers and other photodetectors used in airborne, vehicular and handheld targeting systems manufactured by major prime military contractors, such as Northrop Grumman and Lockheed Martin. Most of our Rangefinder Receiver product offering consists of complex and patented products which detect reflected light from laser targeting systems and allow the systems to confirm target accuracy and calculate target distances prior to discharging a weapon system. These products are also used in laser eye surgery systems for tracking ocular movement.

Electro-Optical, Microwave and Other Power Equipment. The Electronic Technologies Group produces power supplies, amplifiers and flash lamp drivers used in laser systems for military, medical and other applications that are sometimes utilized with our Rangefinder Receivers. We also produce emergency back-up power supplies and batteries used on commercial aircraft and business jets for services such as emergency exit lighting, emergency fuel shut-off, power door assists, cockpit voice recorders and flight computers. We offer custom or standard designs that solve challenging OEM requirements and meet stringent agency safety and emissions requirements. Our power electronics products include capacitor charger power supplies, laser diode drivers, arc lamp power supplies and custom power supply designs.

Our microwave products are used in satellites and electronic warfare systems. These products, which include isolators, bias tees, circulators, latching ferrite switches and waveguide adapters, are used in satellites to control or direct energy according to operator needs. As satellites are frequently used as sensors for stand-off warfare, we believe this product line further supports our goal of increasing our activity in the stand-off market. We believe we are a leading supplier of the niche products which we design and manufacture for this market, a market that includes commercial satellites. Our customers for these products include satellite manufacturers, such as Space Systems/Loral, Boeing and Raytheon.

Electromagnetic and Radio Interference Shielding. The Electronic Technologies Group designs and manufactures shielding used to prevent electromagnetic energy and radio frequencies from interfering with computers, telecommunication devices, avionics, weapons systems and other electronic equipment. Our products include a patented line of shielding applied directly to circuit boards and a line of gasket-type shielding applied to computers and other electronic equipment. Our customers consist essentially of medical, electronic, telecommunication and defense equipment producers.

High-Speed Interface Products. The Electronic Technologies Group designs and manufactures advanced high-technology, high-speed interface products utilized in homeland security, defense, medical research, astronomical and other applications across numerous industries.

High Voltage Interconnection Devices. The Electronic Technologies Group designs and manufactures high and very high voltage interconnection devices, cable assemblies and wire for the medical equipment, defense and other industrial markets. Among others, our products are utilized in aircraft missile defense, fighter pilot helmet displays, avionic systems, medical applications, wireless communications, and industrial applications including high voltage test equipment and underwater monitoring systems.

High Voltage Advanced Power Electronics. The Electronic Technologies Group designs and manufactures a patented line of high voltage energy generators for medical, baggage inspection and industrial imaging systems, and also offers a patented line of high frequency power delivery systems for the commercial sign industry.

Power Conversion Products. The Electronic Technologies Group designs and provides innovative power conversion products principally serving the high-reliability military, space and commercial avionics end-markets. These high density, low profile and lightweight DC-to-DC converters and electromagnetic interference filters, which include thick film hermetically sealed hybrids, military commercial-off-the-shelf and custom designed and assembled products, have become the primary specified components of their kind on a generation of complex military, space and avionics equipment.

Underwater Locator Beacons. The Electronic Technologies Group designs and manufactures Underwater Locator Beacons (“ULBs”) used to locate aircraft Cockpit Voice Recorders and Flight Data Recorders, marine ship Voyage Recorders and various other devices which have been submerged under water. ULBs are required equipment on all U.S. FAA and European Aviation Safety Agency (“EASA”) approved Flight Data and Cockpit Voice Recorders used in aircraft and on similar systems utilized on large marine shipping vessels.

As part of our growth strategy, we have continued to increase our research and development activities. Research and development expenditures by the Electronic Technologies Group were $8.2 million in fiscal 2009, $7.3 million in fiscal 2008 and $5.8 million in fiscal 2007. We believe that our Electronic Technologies Group’s research and development capabilities are a significant component of our historical success and an integral part of our growth strategy.

Financial Information About Operating Segments and Geographic Areas

See Note 14, Operating Segments, of the Notes to Consolidated Financial Statements for financial information by operating segment and by geographic areas.

Distribution, Sales, Marketing and Customers

Each of our operating segments independently conducts distribution, sales and marketing efforts directed at their respective customers and industries and, in some cases, collaborates with other operating divisions and subsidiaries within its group for cross-marketing efforts. Sales and marketing efforts are conducted primarily by in-house personnel and, to a lesser extent, by independent manufacturers’ representatives. Generally, the in-house sales personnel receive a base salary plus commission and manufacturers’ representatives receive a commission on sales.

We believe that direct relationships are crucial to establishing and maintaining a strong customer base and, accordingly, our senior management is actively involved in our marketing activities, particularly with established customers. We are also a member of various trade and business organizations related to the commercial aviation industry, such as the Aerospace Industries Association, which we refer to as AIA, the leading trade association representing the nation’s manufacturers of commercial, military and business aircraft, aircraft engines and related components and equipment. Due in large part to our established industry presence, we enjoy strong customer relations, name recognition and repeat business.

We sell our products to a broad customer base consisting of domestic and foreign commercial and cargo airlines, repair and overhaul facilities, other aftermarket suppliers of aircraft engine and airframe materials, OEMs, domestic and foreign military units, electronic manufacturing services companies, manufacturers for the defense industry as well as medical, telecommunication, scientific, and industrial companies. No one customer accounted for sales of 10% or more of total consolidated sales from continuing operations during any of the last three fiscal years. Net sales to our five largest customers accounted for approximately 20% of total net sales during the year ended October 31, 2009.

Competition

The aerospace product and service industry is characterized by intense competition and some of our competitors have substantially greater name recognition, inventories, complementary product and service offerings, financial, marketing and other resources than we do. As a result, such competitors may be able to respond more quickly to customer requirements than we can. Moreover, smaller competitors may be in a position to offer more attractive pricing as a result of lower labor costs and other factors.

Our jet engine and aircraft component replacement parts business competes primarily with Pratt & Whitney, General Electric, and other OEMs. The competition is principally based on price and service to the extent that our parts are interchangeable. With respect to other aerospace products and services sold by the Flight Support Group, we compete with both the leading jet engine OEMs and a large number of machining, fabrication and repair companies, some of which have greater financial and other resources than we do. Competition is based mainly on price, product performance, service and technical capability.

Competition for the repair and overhaul of jet engine and aircraft components comes from three principal sources: OEMs, major commercial airlines and other independent service companies. Some of these competitors have greater financial and other resources than we do. Some major commercial airlines own and operate their own service centers and sell repair and overhaul services to other aircraft operators. Foreign airlines that provide repair and overhaul services typically provide these services for their own aircraft components and for third parties. OEMs also maintain service centers that provide repair and overhaul services for the components they manufacture. Other independent service organizations also compete for the repair and overhaul business of other users of aircraft components. We believe that the principal competitive factors in the repair and overhaul market are quality, turnaround time, overall customer service and price.

Our Electronic Technologies Group competes with several large and small domestic and foreign competitors, some of which have greater financial and other resources than we do. The markets for our electronic products are niche markets with several competitors with competition based mainly on design, technology, quality, price, and customer satisfaction.

Raw Materials

We purchase a variety of raw materials, primarily consisting of high temperature alloy sheet metal and castings, forgings, pre-plated metals and electrical components from various vendors. The

materials used by our operations are generally available from a number of sources and in sufficient quantities to meet current requirements subject to normal lead times.

Backlog

Our total backlog of unshipped orders was $104.5 million as of October 31, 2009 compared to $107.1 million as of October 31, 2008. The Flight Support Group’s backlog of unshipped orders was $32.9 million as of October 31, 2009 as compared to $49.0 million as of October 31, 2008. This backlog excludes forecasted shipments for certain contracts of the Flight Support Group pursuant to which customers provide only estimated annual usage and not firm purchase orders. Our backlogs within the Flight Support Group are typically short-lead in nature with many product orders being received within the month of shipment. The decrease in the Flight Support Group’s backlog reflects a reduction in demand for our aftermarket replacement parts and repair and overhaul services resulting from worldwide airline capacity cuts and efforts to reduce spending and conserve cash by the airline industry. The Electronic Technologies Group’s backlog of unshipped orders was $71.6 million as of October 31, 2009 as compared to $58.1 million as of October 31, 2008. The increase in the Electronic Technologies Group’s backlog is primarily related to backlogs of businesses acquired during fiscal 2009 and some increased orders associated with our defense related businesses, including homeland security products. Substantially the entire backlog of orders as of October 31, 2009 is expected to be delivered during fiscal 2010.

Government Regulation

The FAA regulates the manufacture, repair and operation of all aircraft and aircraft parts operated in the United States. Its regulations are designed to ensure that all aircraft and aviation equipment are continuously maintained in proper condition to ensure safe operation of the aircraft. Similar rules apply in other countries. All aircraft must be maintained under a continuous condition monitoring program and must periodically undergo thorough inspection and maintenance. The inspection, maintenance and repair procedures for the various types of aircraft and equipment are prescribed by regulatory authorities and can be performed only by certified repair facilities utilizing certified technicians. Certification and conformance is required prior to installation of a part on an aircraft. Aircraft operators must maintain logs concerning the utilization and condition of aircraft engines, life-limited engine parts and airframes. In addition, the FAA requires that various maintenance routines be performed on aircraft engines, some engine parts, and airframes at regular intervals based on cycles or flight time. Engine maintenance must also be performed upon the occurrence of certain events, such as foreign object damage in an aircraft engine or the replacement of life-limited engine parts. Such maintenance usually requires that an aircraft engine be taken out of service. Our operations may in the future be subject to new and more stringent regulatory requirements. In that regard, we closely monitor the FAA and industry trade groups in an attempt to understand how possible future regulations might impact us.

There has been no material adverse effect to our consolidated financial statements as a result of these government regulations.

Environmental Regulation

Our operations are subject to extensive, and frequently changing, federal, state and local environmental laws and substantial related regulation by government agencies, including the Environmental Protection Agency. Among other matters, these regulatory authorities impose requirements that regulate the operation, handling, transportation and disposal of hazardous materials; protect the health and safety of workers; and require us to obtain and maintain licenses and permits in connection with our operations. This extensive regulatory framework imposes significant compliance

burdens and risks on us. Notwithstanding these burdens, we believe that we are in material compliance with all federal, state and local laws and regulations governing our operations.

Other Regulation

We are also subject to a variety of other regulations including work-related and community safety laws. The Occupational Safety and Health Act of 1970 mandates general requirements for safe workplaces for all employees and established the Occupational Safety and Health Administration (“OSHA”) in the Department of Labor. In particular, OSHA provides special procedures and measures for the handling of some hazardous and toxic substances. In addition, specific safety standards have been promulgated for workplaces engaged in the treatment, disposal or storage of hazardous waste. Requirements under state law, in some circumstances, may mandate additional measures for facilities handling materials specified as extremely dangerous. We believe that our operations are in material compliance with OSHA’s health and safety requirements.

Insurance

We are a named insured under policies which include the following coverage: (i) product liability, including grounding; (ii) personal property, inventory and business income at our facilities; (iii) general liability coverage; (iv) employee benefit liability; (v) international liability and automobile liability; (vi) umbrella liability coverage; and (vii) various other activities or items subject to certain limits and deductibles. We believe that our insurance coverage is adequate to insure against the various liability risks of our business.

Employees

As of October 31, 2009, we had approximately 2,100 full-time and part-time employees including approximately 1,400 in the Flight Support Group and approximately 700 in the Electronic Technologies Group. None of our employees are represented by a union. Our management believes that we have good relations with our employees.

Available Information

Our Internet web site address is http://www.heico.com. We make available free of charge through our web site our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission (“SEC”). These materials are also available free of charge on the SEC’s website at http://www.sec.gov. The information on or obtainable through our web site is not incorporated into this annual report on Form 10-K.

We have adopted a code of ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller and other persons performing similar functions. Our Code of Ethics for Senior Financial Officers and Other Officers is part of our Code of Business Conduct, which is located on our web site at http://www.heico.com. Any amendments to or waivers from a provision of this code of ethics will be posted on the web site. Also located on the web site are our Corporate Governance Guidelines, Finance/Audit Committee Charter, Nominating & Corporate Governance Committee Charter, and Compensation Committee Charter.

Copies of the above referenced materials will be made available, free of charge, upon written request to the Corporate Secretary at the Company’s headquarters.

Executive Officers of the Registrant

Our executive officers are elected by the Board of Directors at the first meeting following the annual meeting of shareholders and serve at the discretion of the Board. The following table sets forth the names, ages of, and positions and offices held by our executive officers as of December 17, 2009:

| Name | | Age | | Position(s) | | Director Since |

| | | | | | | |

| Laurans A. Mendelson | | 71 | | Chairman of the Board and Chief Executive Officer | | 1989 |

| | | | | | | |

| Eric A. Mendelson | | 44 | | Co-President and Director; President and Chief Executive Officer of HEICO Aerospace Holdings Corp. | | 1992 |

| | | | | | | |

| Victor H. Mendelson | | 42 | | Co-President and Director; President and Chief Executive Officer of HEICO Electronic Technologies Corp. | | 1996 |

| | | | | | | |

| Thomas S. Irwin | | 63 | | Executive Vice President and Chief Financial Officer | | ─ |

| | | | | | | |

| William S. Harlow | | 61 | | Vice President of Corporate Development | | ─ |

Laurans A. Mendelson has served as our Chairman of the Board since December 1990. He has also served as our Chief Executive Officer since February 1990 and served as our President from September 1991 through September 2009. HEICO Corporation is a member of the Aerospace Industries Association (“AIA”) in Washington D.C., and Mr. Mendelson serves on the Board of Governors of AIA. He is also former Chairman of the Board of Trustees, former Chairman of the Executive Committee and a current member of the Society of Mt. Sinai Founders of Mt. Sinai Medical Center in Miami Beach, Florida. In addition, Mr. Mendelson served as a Trustee of Columbia University in The City of New York from 1995 to 2001, as well as Chairman of the Trustees’ Audit Committee. Mr. Mendelson currently serves as Trustee Emeritus of Columbia University. Mr. Mendelson is a Certified Public Accountant. Laurans Mendelson is the father of Eric Mendelson and Victor Mendelson.

Eric A. Mendelson has served as our Co-President since October 2009 and served as our Executive Vice President from 2001 through September 2009. He also serves as President and Chief Executive Officer of HEICO Aerospace Holdings Corp., a subsidiary of ours, since its formation in 1997; and President of HEICO Aerospace Corporation since 1993. He also served as our Vice President from 1992 to 2001; President of HEICO’s Jet Avion Corporation, a wholly owned subsidiary of HEICO Aerospace, from 1993 to 1996; and Jet Avion’s Executive Vice President and Chief Operating Officer from 1991 to 1993. From 1990 to 1991, Mr. Mendelson was our Director of Planning and Operations. Mr. Mendelson is a co-founder, and, since 1987, has been Managing Director of Mendelson International Corporation, a private investment company and a shareholder of HEICO. In addition, Mr. Mendelson is a member of the Advisory Board of Trustees of Mt. Sinai Medical Center in Miami Beach, Florida and a member of the Board of Trustees of Ransom – Everglades School in Coconut Grove, Florida, as well as a member of the Executive Committee of the Columbia College Alumni Association. Eric Mendelson is the son of Laurans Mendelson and the brother of Victor Mendelson.

Victor H. Mendelson has served as our Co-President since October 2009 and served as our Executive Vice President from 2001 through September 2009. He also serves as President and Chief

Executive Officer of HEICO Electronic Technologies Corp., a subsidiary of ours, since September 1996. He served as our General Counsel from 1993 to September 2008 and our Vice President from 1996 to 2001. In addition, Mr. Mendelson was the Executive Vice President of our former MediTek Health Corporation subsidiary from 1994 and MediTek Health’s Chief Operating Officer from 1995 until its sale in July 1996. He was our Associate General Counsel from 1992 until 1993. From 1990 until 1992, he worked on a consulting basis with us, developing and analyzing various strategic opportunities. Mr. Mendelson is a co-founder, and, since 1987, has been President of Mendelson International Corporation, a private investment company and a shareholder of HEICO. He is a member of the Board of Visitors of Columbia College in New York City, a Trustee of St. Thomas University in Miami Gardens, Florida and President and a Director of the Florida Grand Opera. Victor Mendelson is the son of Laurans Mendelson and the brother of Eric Mendelson.

Thomas S. Irwin has served as our Executive Vice President and Chief Financial Officer since September 1991; our Senior Vice President from 1986 to 1991; and our Vice President and Treasurer from 1982 to 1986. Mr. Irwin is a Certified Public Accountant. He is a Trustee of the Greater Hollywood Chamber of Commerce and a Director of the Broward Alliance.

William S. Harlow has served as our Vice President of Corporate Development since 2001 and served as Director of Corporate Development from 1995 to 2001.

Our business, financial condition, operating results and cash flows can be impacted by a number of factors, many of which are beyond our control, including those set forth below and elsewhere in this Annual Report on Form 10-K, any one of which may cause our actual results to differ materially from anticipated results:

Our success is highly dependent on the performance of the aviation industry, which could be impacted by lower demand for commercial air travel or airline fleet changes causing lower demand for our goods and services.

Economic factors and passenger security concerns that affect the aviation industry also affect our business. The aviation industry has historically been subject to downward cycles from time to time which reduce the overall demand for jet engine and aircraft component replacement parts and repair and overhaul services, and such downward cycles result in lower prices and greater credit risk. These economic factors and passenger security concerns may have a material adverse effect on our business, financial condition and results of operations.

We are subject to governmental regulation and our failure to comply with these regulations could cause the government to withdraw or revoke our authorizations and approvals to do business and could subject us to penalties and sanctions that could harm our business.

Governmental agencies throughout the world, including the FAA, highly regulate the manufacture, repair and overhaul of aircraft parts and accessories. We include, with the replacement parts that we sell to our customers, documentation certifying that each part complies with applicable regulatory requirements and meets applicable standards of airworthiness established by the FAA or the equivalent regulatory agencies in other countries. In addition, our repair and overhaul operations are subject to certification pursuant to regulations established by the FAA. Specific regulations vary from country to country, although compliance with FAA requirements generally satisfies regulatory requirements in other countries. The revocation or suspension of any of our material authorizations or approvals would have an

adverse effect on our business, financial condition and results of operations. New and more stringent government regulations, if adopted and enacted, could have an adverse effect on our business, financial condition and results of operations. In addition, some sales to foreign countries of the equipment manufactured by our Electronic Technologies Group require approval or licensing from the U.S. government. Denial of export licenses could reduce our sales to those countries and could have a material adverse effect on our business.

The retirement of commercial aircraft could reduce our revenues.

Our Flight Support Group designs, engineers, manufactures and distributes jet engine and aircraft component replacement parts and also repairs, refurbishes and overhauls jet engine and aircraft components. If aircraft or engines for which we have replacement parts or supply repair and overhaul services are retired and there are fewer aircraft that require these parts or services, our revenues may decline.

Reductions in defense, space or homeland security spending by U.S. and/or foreign customers could reduce our revenues.

In fiscal 2009, approximately 46% of the sales of our Electronic Technologies Group were derived from the sale of defense products and services to U.S. and foreign military agencies and their suppliers. A decline in defense, space or homeland security budgets or additional restrictions imposed by the U.S. government on sales of products or services to foreign military agencies could lower sales of our products and services.

Intense competition from existing and new competitors may harm our business.

We face significant competition in each of our businesses.

Flight Support Group

| | · | For jet engine replacement parts, we compete with the industry’s leading jet engine OEMs, particularly Pratt & Whitney and General Electric. |

| | · | For the overhaul and repair of jet engine and airframe components as well as avionics and navigation systems, we compete with: |

| | - | major commercial airlines, many of which operate their own maintenance and overhaul units; |

| | - | OEMs, which manufacture, repair and overhaul their own parts; and |

| | - | other independent service companies. |

Electronic Technologies Group

| | · | For the design and manufacture of various types of electronic and electro-optical equipment as well as high voltage interconnection devices and high speed interface products, we compete in a fragmented marketplace with a number of companies, some of which are well capitalized. |

The aviation aftermarket supply industry is highly fragmented, has several highly visible leading companies, and is characterized by intense competition. Some of our OEM competitors have greater name recognition than HEICO, as well as complementary lines of business and financial, marketing and other

resources that HEICO does not have. In addition, OEMs, aircraft maintenance providers, leasing companies and FAA-certificated repair facilities may attempt to bundle their services and product offerings in the supply industry, thereby significantly increasing industry competition. Moreover, our smaller competitors may be able to offer more attractive pricing of parts as a result of lower labor costs or other factors. A variety of potential actions by any of our competitors, including a reduction of product prices or the establishment by competitors of long-term relationships with new or existing customers, could have a material adverse effect on our business, financial condition and results of operations. Competition typically intensifies during cyclical downturns in the aviation industry, when supply may exceed demand. We may not be able to continue to compete effectively against present or future competitors, and competitive pressures may have a material and adverse effect on our business, financial condition and results of operations.

Our success is dependent on the development and manufacture of new products, equipment and services. Our inability to develop, manufacture and introduce new products and services at profitable pricing levels could reduce our sales or sales growth.

The aviation, defense, space, medical, telecommunication and electronic industries are constantly undergoing development and change and, accordingly, new products, equipment and methods of repair and overhaul service are likely to be introduced in the future. In addition to manufacturing electronic and electro-optical equipment and selected aerospace and defense components for OEMs and the U.S. government and repairing jet engine and aircraft components, we re-design sophisticated aircraft replacement parts originally developed by OEMs so that we can offer the replacement parts for sale at substantially lower prices than those manufactured by the OEMs. Consequently, we devote substantial resources to research and product development. Technological development poses a number of challenges and risks, including the following:

| | · | We may not be able to successfully protect the proprietary interests we have in various aircraft parts, electronic and electro-optical equipment and our repair processes; |

| | · | As OEMs continue to develop and improve jet engines and aircraft components, we may not be able to re-design and manufacture replacement parts that perform as well as those offered by OEMs or we may not be able to profitably sell our replacement parts at lower prices than the OEMs; |

| | · | We may need to expend significant capital to: |

- purchase new equipment and machines,

- train employees in new methods of production and service, and

- fund the research and development of new products; and

| | · | Development by our competitors of patents or methodologies that preclude us from the design and manufacture of aircraft replacement parts or electrical and electro-optical equipment could adversely affect our business, financial condition and results of operations. |

In addition, we may not be able to successfully develop new products, equipment or methods of repair and overhaul service, and the failure to do so could have a material adverse effect on our business, financial condition and results of operations.

Product specification costs and requirements could cause an increase to our costs to complete contracts.

The costs to meet customer specifications and requirements could result in us having to spend more to design or manufacture products and this could reduce our profit margins on current contracts or those we obtain in the future.

We may incur product liability claims that are not fully insured.

Our jet engine and aircraft component replacement parts and repair and overhaul services expose our business to potential liabilities for personal injury or death as a result of the failure of an aircraft component that we have designed, manufactured or serviced. The commercial aviation industry occasionally has catastrophic losses that may exceed policy limits. An uninsured or partially insured claim, or a claim for which third-party indemnification is not available, could have a material adverse effect on our business, financial condition and results of operations. Additionally, insurance coverage costs may become even more expensive in the future. Our customers typically require us to maintain substantial insurance coverage and our inability to obtain insurance coverage at commercially reasonable rates could have a material adverse effect on our business.

We may not have the administrative, operational or financial resources to continue to grow the company.

We have experienced rapid growth in recent periods and intend to continue to pursue an aggressive growth strategy, both through acquisitions and internal expansion of products and services. Our growth to date has placed, and could continue to place, significant demands on our administrative, operational and financial resources. We may not be able to grow effectively or manage our growth successfully, and the failure to do so could have a material adverse effect on our business, financial condition and results of operations.

We may not be able to execute our acquisition strategy, which could slow our growth.

A key element of our strategy is growth through the acquisition of additional companies. Our acquisition strategy is affected by and poses a number of challenges and risks, including the following:

| | · | Availability of suitable acquisition candidates; |

| | · | Availability of capital; |

| | · | Diversion of management’s attention; |

| | · | Integration of the operations and personnel of acquired companies; |

| | · | Potential write downs of acquired intangible assets; |

| | · | Potential loss of key employees of acquired companies; |

| | · | Use of a significant portion of our available cash; |

| | · | Significant dilution to our shareholders for acquisitions made utilizing our securities; and |

| | · | Consummation of acquisitions on satisfactory terms. |

We may not be able to successfully execute our acquisition strategy, and the failure to do so could have a material adverse effect on our business, financial condition and results of operations.

We may incur environmental liabilities and these liabilities may not be covered by insurance.

Our operations and facilities are subject to a number of federal, state and local environmental laws and regulations, which govern, among other things, the discharge of hazardous materials into the air and water as well as the handling, storage and disposal of hazardous materials. Pursuant to various environmental laws, a current or previous owner or operator of real property may be liable for the costs of removal or remediation of hazardous materials. Environmental laws typically impose liability whether or not the owner or operator knew of, or was responsible for, the presence of hazardous materials. Although management believes that our operations and facilities are in material compliance with environmental laws and regulations, future changes in them or interpretations thereof or the nature of our operations may require us to make significant additional capital expenditures to ensure compliance in the future.

We do not maintain specific environmental liability insurance and the expenses related to these environmental liabilities, if we are required to pay them, could have a material adverse effect on our business, financial condition and results of operations.

We are dependent on key personnel and the loss of these key personnel could have a material adverse effect on our success.

Our success substantially depends on the performance, contributions and expertise of our senior management team led by Laurans A. Mendelson, our Chairman and Chief Executive Officer, Eric A. Mendelson, our Co-President, and Victor H. Mendelson, our Co-President. Technical employees are also critical to our research and product development, as well as our ability to continue to re-design sophisticated products of OEMs in order to sell competing replacement parts at substantially lower prices than those manufactured by the OEMs. The loss of the services of any of our executive officers or other key employees or our inability to continue to attract or retain the necessary personnel could have a material adverse effect on our business, financial condition and results of operations.

Our executive officers and directors have significant influence over our management and direction.

As of December 17, 2009, collectively our executive officers and entities controlled by them, our 401(k) Plan and members of the Board of Directors beneficially owned approximately 26% of our outstanding Common Stock and approximately 7% of our outstanding Class A Common Stock. Accordingly, they will be able to substantially influence the election of the Board of Directors and control our business, policies and affairs, including our position with respect to proposed business combinations and attempted takeovers.

| UNRESOLVED STAFF COMMENTS |

None.

We own or lease a number of facilities, which are utilized by our Flight Support Group (“FSG”), Electronic Technologies Group (“ETG”) and Corporate office. All of the facilities listed below are in good operating condition, well maintained and in regular use. We believe that our existing facilities are sufficient to meet our operational needs for the foreseeable future. Summary information on the facilities utilized within the FSG and the ETG to support their principal operating activities is as follows:

Flight Support Group

| | | Square Footage | | |

Location | | Leased | | | Owned | | Description |

| United States facilities (8 states) | | | 294,000 | | | | 173,000 | | Manufacturing, engineering and distribution |

| | | | | | | | | | facilities, and corporate headquarters |

| United States facilities (6 states) | | | 134,000 | | | | 127,000 | | Repair and overhaul facilities |

International facilities (3 countries) - India, Singapore and United Kingdom | | | 10,000 | | | | — | | Manufacturing, engineering and distribution facilities |

Electronic Technologies Group

| | | Square Footage | | |

| Location | | Leased | | | Owned | | Description |

| United States facilities (9 states) | | | 185,000 | | | | 76,000 | | Manufacturing and engineering facilities |

| International facilities (2 countries) | | | 52,000 | | | | 12,000 | | Manufacturing and engineering facilities |

| - Canada and United Kingdom | | | | | | | | | |

Corporate

| | | Square Footage | | |

| Location | | Leased | | | Owned (1) | | Description |

| United States facilities (1 state) | | | — | | | | 4,000 | | Administrative offices |

| (1) | Represents the square footage of corporate offices in Miami, Florida. The square footage of our corporate headquarters in Hollywood, FL is included within the square footage under the caption “United States facilities (8 states)” under Flight Support Group. |

We are involved in various legal actions arising in the normal course of business. Based upon the company’s and our legal counsel’s evaluations of any claims or assessments, management is of the opinion that the outcome of these matters will not have a material adverse effect on our results of operations, financial position or cash flows.

| SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

There were no matters submitted to a vote of security holders during the fourth quarter of fiscal 2009.

| MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our Class A Common Stock and Common Stock are listed and traded on the New York Stock Exchange (“NYSE”) under the symbols “HEI.A” and “HEI”, respectively. The following tables set forth, for the periods indicated, the high and low share prices for our Class A Common Stock and our Common Stock as reported on the NYSE, as well as the amount of cash dividends paid per share during such periods.

Class A Common Stock

| | | High | | | Low | | | Cash Dividends Per Share | |

| Fiscal 2008: | | | | | | | | | |

| First Quarter | | $ | 44.63 | | | $ | 32.05 | | | $ | .05 | |

| Second Quarter | | | 42.24 | | | | 32.80 | | | | ― | |

| Third Quarter | | | 41.68 | | | | 24.87 | | | | .05 | |

| Fourth Quarter | | | 36.19 | | | | 19.82 | | | | ― | |

| | | | | | | | | | | | | |

| Fiscal 2009: | | | | | | | | | | | | |

| First Quarter | | $ | 31.36 | | | $ | 18.27 | | | $ | .06 | |

| Second Quarter | | | 30.63 | | | | 17.34 | | | | ― | |

| Third Quarter | | | 32.76 | | | | 23.26 | | | | .06 | |

| Fourth Quarter | | | 35.00 | | | | 26.01 | | | | ― | |

As of December 17, 2009, there were 569 holders of record of our Class A Common Stock.

Common Stock

| | | High | | | Low | | | Cash Dividends Per Share | |

| Fiscal 2008: | | | | | | | | | |

| First Quarter | | $ | 56.92 | | | $ | 42.00 | | | $ | .05 | |

| Second Quarter | | | 52.78 | | | | 41.80 | | | | ― | |

| Third Quarter | | | 54.35 | | | | 30.16 | | | | .05 | |

| Fourth Quarter | | | 48.27 | | | | 26.49 | | | | ― | |

| | | | | | | | | | | | | |

| Fiscal 2009: | | | | | | | | | | | | |

| First Quarter | | $ | 42.78 | | | $ | 24.30 | | | $ | .06 | |

| Second Quarter | | | 41.64 | | | | 21.40 | | | | ― | |

| Third Quarter | | | 40.50 | | | | 26.32 | | | | .06 | |

| Fourth Quarter | | | 44.02 | | | | 35.00 | | | | ― | |

As of December 17, 2009, there were 584 holders of record of our Common Stock.

Performance Graphs

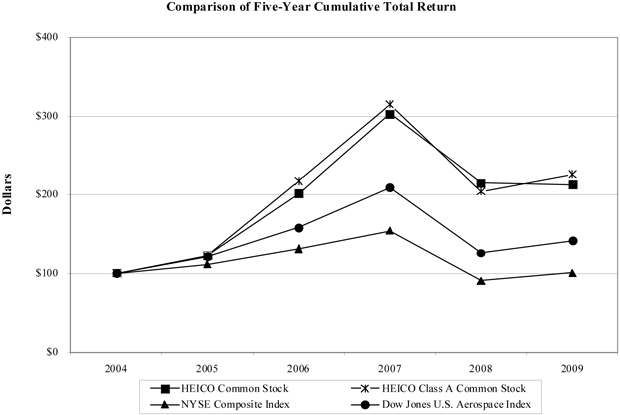

The following graph and table compare the total return on $100 invested in HEICO Common Stock and HEICO Class A Common Stock with the total return of $100 invested in the New York Stock Exchange (NYSE) Composite Index and the Dow Jones U.S. Aerospace Index for the five-year period from October 31, 2004 through October 31, 2009. The NYSE Composite Index measures all common stock listed on the NYSE. The Dow Jones U.S. Aerospace Index is comprised of large companies which make aircraft, major weapons, radar and other defense equipment and systems as well as providers of satellites used for defense purposes. The total returns include the reinvestment of cash dividends.

| | | Cumulative Total Return as of October 31, | | | | |

| | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| HEICO Common Stock | | $ | 100.00 | | | $ | 122.76 | | | $ | 201.48 | | | $ | 302.93 | | | $ | 214.60 | | | $ | 212.80 | |

| HEICO Class A Common Stock | | | 100.00 | | | | 122.23 | | | | 217.16 | | | | 314.51 | | | | 204.39 | | | | 225.62 | |

| NYSE Composite Index | | | 100.00 | | | | 111.06 | | | | 131.11 | | | | 154.07 | | | | 90.56 | | | | 100.70 | |

| Dow Jones U.S. Aerospace Index | | | 100.00 | | | | 121.17 | | | | 158.41 | | | | 209.17 | | | | 125.95 | | | | 141.69 | |

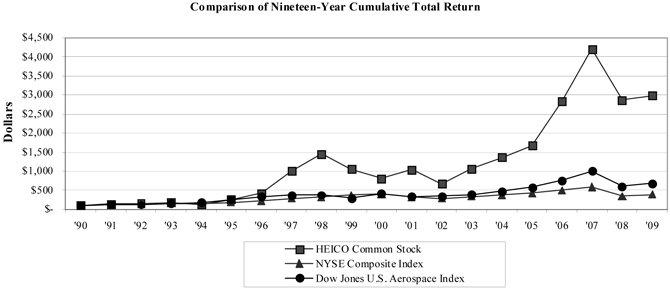

The following graph and table compare the total return on $100 invested in HEICO Common Stock since October 31, 1990 using the same indices shown on the five-year performance graph on the previous page. October 31, 1990 was the end of the first fiscal year following the date the current executive management team assumed leadership of the Company. No Class A Common Stock was outstanding as of October 31, 1990. As with the five-year performance graph, the total returns include the reinvestment of cash dividends.

| | | Cumulative Total Return as of October 31, | |

| | | 1990 | | | 1991 | | | 1992 | | | 1993 | | | 1994 | | | 1995 | | | 1996 | |

HEICO Common Stock (1) | | $ | 100.00 | | | $ | 141.49 | | | $ | 158.35 | | | $ | 173.88 | | | $ | 123.41 | | | $ | 263.25 | | | $ | 430.02 | |

| NYSE Composite Index | | | 100.00 | | | | 130.31 | | | | 138.76 | | | | 156.09 | | | | 155.68 | | | | 186.32 | | | | 225.37 | |

| Dow Jones U.S. Aerospace Index | | | 100.00 | | | | 130.67 | | | | 122.00 | | | | 158.36 | | | | 176.11 | | | | 252.00 | | | | 341.65 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1997 | | | 1998 | | | 1999 | | | 2000 | | | 2001 | | | 2002 | | | 2003 | |

HEICO Common Stock (1) | | $ | 1,008.31 | | | $ | 1,448.99 | | | $ | 1,051.61 | | | $ | 809.50 | | | $ | 1,045.86 | | | $ | 670.39 | | | $ | 1,067.42 | |

| NYSE Composite Index | | | 289.55 | | | | 326.98 | | | | 376.40 | | | | 400.81 | | | | 328.78 | | | | 284.59 | | | | 339.15 | |

| Dow Jones U.S. Aerospace Index | | | 376.36 | | | | 378.66 | | | | 295.99 | | | | 418.32 | | | | 333.32 | | | | 343.88 | | | | 393.19 | |

| | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

HEICO Common Stock (1) | | $ | 1,366.57 | | | $ | 1,674.40 | | | $ | 2,846.48 | | | $ | 4,208.54 | | | $ | 2,872.01 | | | $ | 2,984.13 | |

| NYSE Composite Index | | | 380.91 | | | | 423.05 | | | | 499.42 | | | | 586.87 | | | | 344.96 | | | | 383.57 | |

| Dow Jones U.S. Aerospace Index | | | 478.49 | | | | 579.77 | | | | 757.97 | | | | 1,000.84 | | | | 602.66 | | | | 678.00 | |

| (1) | Information has been adjusted retroactively to give effect to all stock dividends paid during the nineteen-year period. |

Dividend Policy

We have historically paid semi-annual cash dividends on both our Class A Common Stock and Common Stock. In July 2009, we paid our 62nd consecutive semi-annual cash dividend since 1979. Our Board of Directors presently intends to continue the payment of regular semi-annual cash dividends on both classes of our common stock. In December 2009, the board of directors declared a regular semi-annual cash dividend of $.06 per share payable in January 2010. The current annual cash dividend of $.12 per share represents a 20% increase over the prior annual per share amount. Our ability to pay dividends could be affected by future business performance, liquidity, capital needs, alternative investment opportunities and loan covenants under our revolving credit facility.

Equity Compensation Plan Information

The following table summarizes information about our equity compensation plans as of October 31, 2009.

| | | | | | | | | Number of Securities | |

| | | | | | | | | Remaining Available for | |

| | | Number of Securities | | | | | | Future Issuance Under | |

| | | to be Issued Upon | | | Weighted-Average | | | Equity Compensation | |

| | | Exercise of | | | Exercise Price of | | | Plans (Excluding | |

| | | Outstanding Options, | | | Outstanding Options, | | | Securities Reflected in | |

| | | Warrants and Rights | | | Warrants and Rights | | | Column (a)) | |

Plan Category | | (a) | | | (b) | | | (c) | |

Equity compensation plans approved by security holders (1) | | | 1,703,062 | | | $ | 15.19 | | | | 1,326,064 | |

| | | | | | | | | | | | | |

Equity compensation plans not approved by security holders (2) | | | 160,000 | | | $ | 7.36 | | | | ― | |

| | | | | | | | | | | | | |

| Total | | | 1,863,062 | | | $ | 14.52 | | | | 1,326,064 | |

| (1) | Represents aggregated information pertaining to our three equity compensation plans: the 1993 Stock Option Plan, the Non-Qualified Stock Option Plan and the 2002 Stock Option Plan. See Note 9, Stock Options, of the Notes to Consolidated Financial Statements for further information regarding these plans. |

| (2) | Represents stock options granted in fiscal 2002 to a former shareholder of a business acquired in fiscal 1999. Such stock options were fully vested and transferable as of the grant date and expire ten years from the date of grant. The exercise price of such options was the fair market value as of the date of grant. |

Issuer Purchases of Equity Securities

During March 2009, we repurchased 193,736 shares of our Class A Common Stock at an average price of $20.08 per share and 184,500 shares of our Common Stock at an average price of $22.81 per share under a pre-existing share repurchase authorization that was announced by our Board of Directors in October 2002. We did not repurchase any shares of our Class A Common Stock and/or Common Stock during fiscal 2008 or 2007.

In March 2009, our Board of Directors approved an increase in our share repurchase program by an aggregate 1,000,000 shares of either or both Class A Common Stock and Common Stock, bringing the total authorized for future purchase to 1,024,742 shares. The remaining shares authorized for repurchase can be executed, at management’s discretion, in the open market or via private transactions and are

subject to certain restrictions included in our revolving credit agreement. The repurchase program does not have a fixed termination date.

Recent Sales of Unregistered Securities

There were no unregistered sales of our equity securities during fiscal 2009.

| | | For the year ended October 31, (1) | |

| | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | |

| | | (in thousands, except per share data) | |

| Operating Data: | | | | | | | | | | | | | | | |

| Net sales | | $ | 269,647 | | | $ | 392,190 | | | $ | 507,924 | | | $ | 582,347 | | | $ | 538,296 | |

| Gross profit | | | 100,996 | | | | 142,513 | | | | 177,458 | | | | 210,495 | | | | 181,011 | |

| Selling, general and administrative expenses | | | 56,347 | | | | 75,646 | | | | 91,444 | | | | 104,707 | | | | 92,756 | |

| Operating income | | | 44,649 | | | | 66,867 | | | | 86,014 | | | | 105,788 | (4) | | | 88,255 | |

| Interest expense | | | 1,136 | | | | 3,523 | | | | 3,293 | | | | 2,314 | | | | 615 | |

| Other income (expense) | | | 528 | | | | 639 | | | | 95 | | | | (637 | ) | | | 205 | |

| Net income | | | 22,812 | | | | 31,888 | (2) | | | 39,005 | (3) | | | 48,511 | (4) | | | 44,626 | (5) |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of common shares outstanding: | | | | | | | | | | | | | | | | | | | | |

| Basic | | | 24,460 | | | | 25,085 | | | | 25,716 | | | | 26,309 | | | | 26,205 | |

| Diluted | | | 26,323 | | | | 26,598 | | | | 26,931 | | | | 27,243 | | | | 27,024 | |

| | | | | | | | | | | | | | | | | | | | | |

| Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Net income: | | | | | | | | | | | | | | | | | | | | |

| Basic | | $ | 0.93 | | | $ | 1.27 | (2) | | $ | 1.52 | (3) | | $ | 1.84 | (4) | | $ | 1.70 | (5) |

| Diluted | | | 0.87 | | | | 1.20 | (2) | | | 1.45 | (3) | | | 1.78 | (4) | | | 1.65 | (5) |

| Cash dividends | | | .05 | | | | .08 | | | | .08 | | | | .10 | | | | .12 | |

| | | | | | | | | | | | | | | | | | | | | |

| Balance Sheet Data (as of October 31): | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 5,330 | | | $ | 4,999 | | | $ | 4,947 | | | $ | 12,562 | | | $ | 7,167 | |

| Total assets | | | 435,624 | | | | 534,815 | | | | 631,302 | | | | 676,542 | | | | 732,910 | |

| Total debt (including current portion) | | | 34,124 | | | | 55,061 | | | | 55,952 | | | | 37,601 | | | | 55,431 | |

| Minority interests in consolidated subsidiaries | | | 49,035 | | | | 63,301 | | | | 72,938 | | | | 83,978 | | | | 89,742 | |

| Shareholders’ equity | | | 273,503 | | | | 317,258 | | | | 371,601 | | | | 417,760 | | | | 457,853 | |

| (1) | Results include the results of acquisitions from each respective effective date. |

| (2) | Includes the benefit of a tax credit (net of related expenses) for qualified research and development activities claimed for certain prior years, which increased net income by $1,002, or $.04 per basic and diluted share. |

| (3) | Includes the benefit of a tax credit (net of related expenses) for qualified research and development activities recognized for the full fiscal 2006 year pursuant to the retroactive extension in December 2006 of Section 41, “Credit for Increasing Research Activities,” of the Internal Revenue Code, which increased net income by $535, or $.02 per basic and diluted share. |

| (4) | Operating income was reduced by an aggregate of $1,835 in impairment losses related to the write-down of certain intangible assets within the Electronic Technologies Group to their estimated fair values. The impairment losses were recorded as a component of selling, general and administrative expenses and decreased net income by $1,140, or $.04 per basic and diluted share. |

| (5) | Includes a benefit related to a settlement with the Internal Revenue Service concerning the income tax audit claimed by the Company on its U.S. federal filings for qualified research and development activities incurred during fiscal years 2002 through 2005 as well as an aggregate reduction to the related reserve for fiscal years 2006 through 2008, which increased net income by $1,225, or $.05 per basic and diluted share. |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview

Our business is comprised of two operating segments, the Flight Support Group (“FSG”) and the Electronic Technologies Group (“ETG”).

The Flight Support Group consists of HEICO Aerospace Holdings Corp. (“HEICO Aerospace”) and its subsidiaries, which primarily:

| | · | Designs, Manufactures, Repairs and Distributes Jet Engine and Aircraft Component Replacement Parts. The Flight Support Group designs, manufactures, repairs and distributes jet engine and aircraft component replacement parts. The parts and services are approved by the Federal Aviation Administration (“FAA”). The Flight Support Group also manufactures and sells specialty parts as a subcontractor for aerospace and industrial original equipment manufacturers and the United States government. |

The Electronic Technologies Group consists of HEICO Electronic Technologies Corp. (“HEICO Electronic”) and its subsidiaries, which primarily:

| | · | Designs and Manufactures Electronic, Microwave and Electro-Optical Equipment, High-Speed Interface Products, High Voltage Interconnection Devices and High Voltage Advanced Power Electronics. The Electronic Technologies Group designs, manufactures and sells various types of electronic, microwave and electro-optical equipment and components, including power supplies, laser rangefinder receivers, infrared simulation, calibration and testing equipment; power conversion products serving the high-reliability military, space and commercial avionics end-markets; underwater locator beacons used to locate data and voice recorders utilized on aircraft and marine vessels; electromagnetic interference shielding for commercial and military aircraft operators, electronics companies and telecommunication equipment suppliers; advanced high-technology interface products that link devices such as telemetry receivers, digital cameras, high resolution scanners, simulation systems and test systems to computers; high voltage energy generators interconnection devices, cable assemblies and wire for the medical equipment, defense and other industrial markets; and high frequency power delivery systems for the commercial sign industry. |

Our results of operations during each of the past three fiscal years have been affected by a number of transactions. This discussion of our financial condition and results of operations should be read in conjunction with the Consolidated Financial Statements and Notes thereto included herein. For further information regarding the acquisitions discussed below, see Note 2, Acquisitions, of the Notes to Consolidated Financial Statements. The acquisitions have been accounted for using the purchase method of accounting and are included in our results of operations from the effective dates of acquisition.

In April and September 2007, we acquired, through HEICO Electronic, all of the stock of a U.S. company engaged in the design and manufacture of Radio Frequency Interference and Electromagnetic Frequency Interference Suppressors for a variety of markets and a Canadian company that designs and manufactures high voltage energy generators for medical, baggage inspection and industrial imaging manufacturers and high frequency power delivery systems for the commercial sign industry, respectively. In August 2007, we acquired, through HEICO Aerospace, substantially all of the assets of a U.S. company that designs and manufactures FAA-approved aircraft and engine parts.