Filed by Helix Technology Corporation

pursuant to Rule 425

under the Securities Act of 1933

and deemed filed pursuant to

Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: Helix Technology Corporation

(Commission File No.: 0-6866)

This filing relates to a planned business combination between Helix Technology Corporation (“Helix”) and Brooks Automation, Inc. (“Brooks”) pursuant to the terms of an Agreement and Plan of Merger, dated as of July 11, 2005 (the “Merger Agreement”), among Helix, Brooks and Mt. Hood Corporation. The Merger Agreement has been filed with the Securities and Exchange Commission as an exhibit to the Report on Form 8-K filed by Helix on July 11, 2005.

On July 12, 2005, Helix made the following presentation available to investors:

Searchable text section of graphics shown above

[GRAPHIC]

Investor Presentation

July 2005

Creating Manufacturing Efficiency

[LOGO] | Forward-Looking Statements/Risk Factors | [LOGO] |

Cautionary Statement Concerning Forward-Looking Statements. Statements in this presentation regarding the proposed transaction and the expected timetable for completing the transaction, constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These include statements concerning the benefits of the proposed transaction, the combined company’s status as a premier provider of integrated subsystems solutions primarily for the semiconductor capital equipment market; trends in the semiconductor manufacturing industry, including the trend among semiconductor capital equipment manufacturers to outsource production of certain of their systems and growth trends within the market segments in which the combined company will compete; the strength, profitability and capabilities of the combined company; the ability of the combined company to achieve efficiencies, profitability and growth; the capabilities and market acceptance of the combined company’s products going forward; the impact of the acquisition and merger in mitigating the volatility of financial performance; and the importance of size and scale as a factor in competing in the market segments in which the combined company will operate. Such statements are based upon the current beliefs and expectations of Brooks’ and Helix’s management and are subject to significant risks and uncertainties. Actual results may differ from those set forth in the forward-looking statements. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,” “estimates” and similar expressions) should also be considered to be forward-looking statements. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including: the ability to obtain governmental approvals of the transaction on the proposed terms and schedule; the failure of Brooks and Helix stockholders to approve the transaction; the ability of Brooks to successfully integrate Helix’s operations and employees; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption from the transaction making it more difficult to maintain relationships with customers and employees; and competition and its effect on pricing, spending, third-party relationships and revenues. Additional factors that may affect future results are contained in Brooks’ and Helix’s filings with the SEC, including Brooks’ Annual Report on Form 10-K for the year ended September 30, 2004 and Helix’s Annual Report on Form 10-K for the year ended December 31, 2004, which are available at the SEC’s Internet site (http://www.sec.gov). The information set forth herein speaks only as of the date hereof, and Brooks and Helix disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this presentation.

2

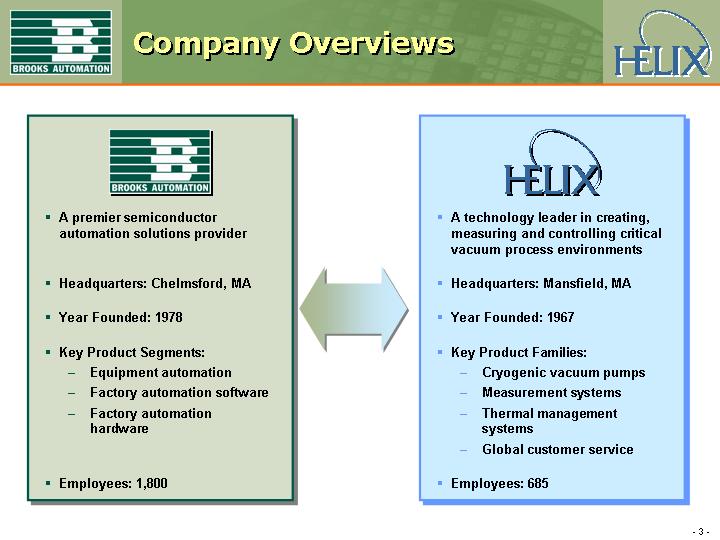

[LOGO]

• A premier semiconductor automation solutions provider

• Headquarters: Chelmsford, MA

• Year Founded: 1978

• Key Product Segments:

• Equipment automation

• Factory automation software

• Factory automation hardware

• Employees: 1,800

[LOGO]

• A technology leader in creating, measuring and controlling critical vacuum process environments

• Headquarters: Mansfield, MA

• Year Founded: 1967

• Key Product Families:

• Cryogenic vacuum pumps

• Measurement systems

• Thermal management systems

• Global customer service

• Employees: 685

3

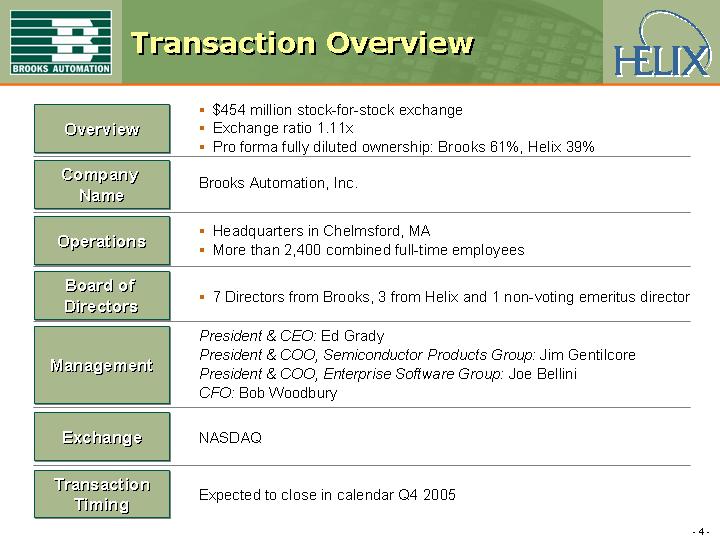

Overview

• $454 million stock-for-stock exchange

• Exchange ratio 1.11x

• Pro forma fully diluted ownership: Brooks 61%, Helix 39%

Company Name

Brooks Automation, Inc.

Operations

• Headquarters in Chelmsford, MA

• More than 2,400 combined full-time employees

Board of Directors

• 7 Directors from Brooks, 3 from Helix and 1 non-voting emeritus director

Management

President & CEO: Ed Grady

President & COO, Semiconductor Products Group: Jim Gentilcore

President & COO, Enterprise Software Group: Joe Bellini

CFO: Bob Woodbury

Exchange

NASDAQ

Transaction Timing

Expected to close in calendar Q4 2005

4

• Combination increases integrated content of vacuum automation systems, which is the fastest-growing segment in automation

• Positions Company to be a leading provider of vacuum automation and process vacuum outsourcing to Tier 1 OEMs

• Extends combined company’s world-class service organization and deepens relationships with semiconductor manufacturers to drive selection of integrated platform solutions with tool OEMs

• Combined manufacturing expertise will drive operational improvement and efficiency throughout combined entity

• Expands Brooks’ footprint beyond the automation system, increasing available market by $1.0 billion

• Positions Company for accelerated earnings growth while reducing revenue cyclicality and enhancing profitability through downturns

5

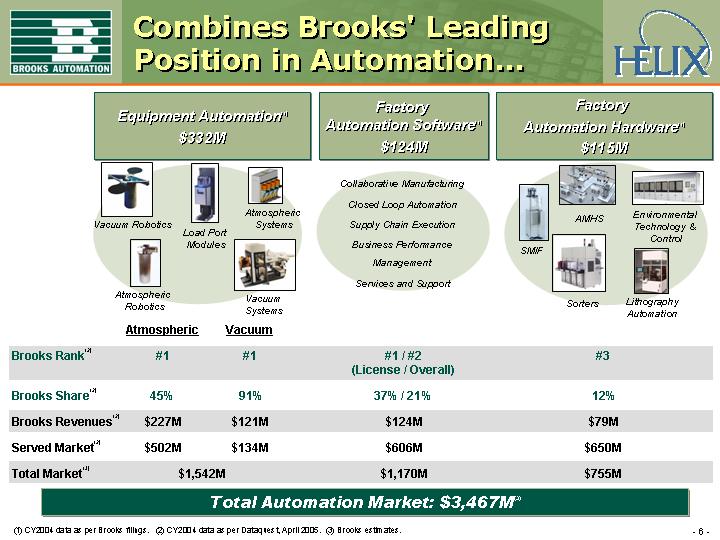

| Combines Brooks’ Leading Position in Automation... | |

Equipment Automation(1)

$332M

[GRAPHIC]

Factory

Automation Software(1)

$124M

Collaborative Manufacturing

Closed Loop Automation

Supply Chain Execution

Business Performance

Management

Services and Support

Factory

Automation Hardware(1)

$115M

[GRAPHIC]

| | Atmospheric | | Vacuum | | | | | |

| | | | | | | | | |

Brooks Rank(2) | | #1 | | #1 | | #1 / #2

(License / Overall) | | #3 | |

Brooks Share(2) | | 45% | | 91% | | 37% / 21% | | 12% | |

Brooks Revenues(2) | | $227M | | $121M | | $124M | | $79M | |

Served Market(2) | | $502M | | $134M | | $606M | | $650M | |

Total Market(3) | | $1,542M | | $1,170M | | $755M | |

Total Automation Market: $3,467M(3)

(1) CY2004 data as per Brooks filings.

(2) CY2004 data as per Dataquest, April 2005.

(3) Brooks estimates.

6

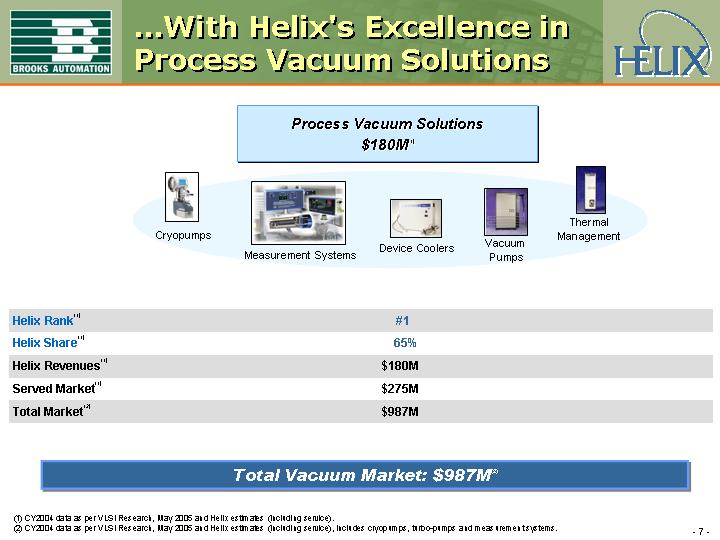

| ...With Helix’s Excellence in Process Vacuum Solutions | |

Process Vacuum Solutions

$180M(1)

[GRAPHIC]

Helix Rank(1) | | #1 | |

Helix Share(1) | | 65% | |

Helix Revenues(1) | | $180M | |

Served Market(1) | | $275M | |

Total Market(2) | | $987M | |

Total Vacuum Market: $987M(2)

(1) CY2004 data as per VLSI Research, May 2005 and Helix estimates (including service).

(2) CY2004 data as per VLSI Research, May 2005 and Helix estimates (including service), includes cryopumps, turbo-pumps and measurement systems.

7

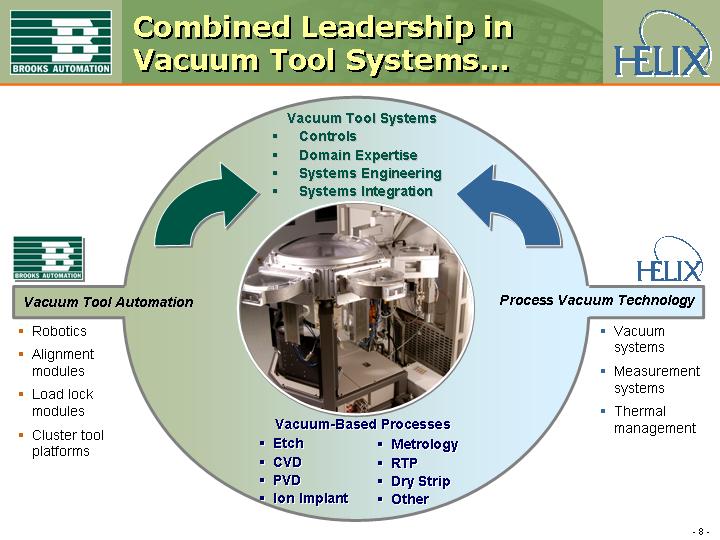

| Combined Leadership in Vacuum Tool Systems… | |

[GRAPHIC]

[LOGO]

Vacuum Tool Automation

• Robotics

• Alignment modules

• Load lock modules

• Cluster tool platforms

Vacuum Tool Systems

• Controls

• Domain Expertise

• Systems Engineering

• Systems Integration

[LOGO]

Process Vacuum Technology

• Vacuum systems

• Measurement systems

• Thermal management

Vacuum-Based Processes

• Etch

• CVD

• PVD

• Ion Implant

• Metrology

• RTP

• Dry Strip

• Other

8

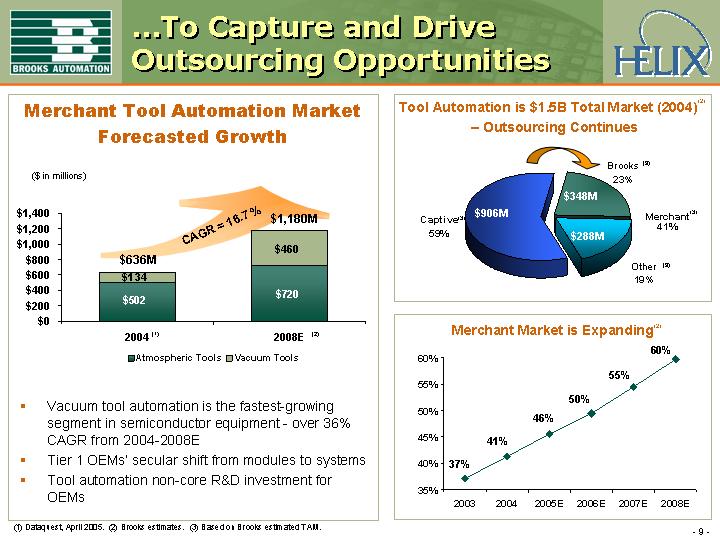

| …To Capture and Drive Outsourcing Opportunities | |

Merchant Tool Automation Market

Forecasted Growth

[CHART]

• Vacuum tool automation is the fastest-growing segment in semiconductor equipment - over 36% CAGR from 2004-2008E

• Tier 1 OEMs’ secular shift from modules to systems

• Tool automation non-core R&D investment for OEMs

Tool Automation is $1.5B Total Market (2004)(2)

– Outsourcing Continues

[CHART]

Merchant Market is Expanding(2)

[CHART]

(1) Dataquest, April 2005.

(2) Brooks estimates.

(3) Based on Brooks estimated TAM.

9

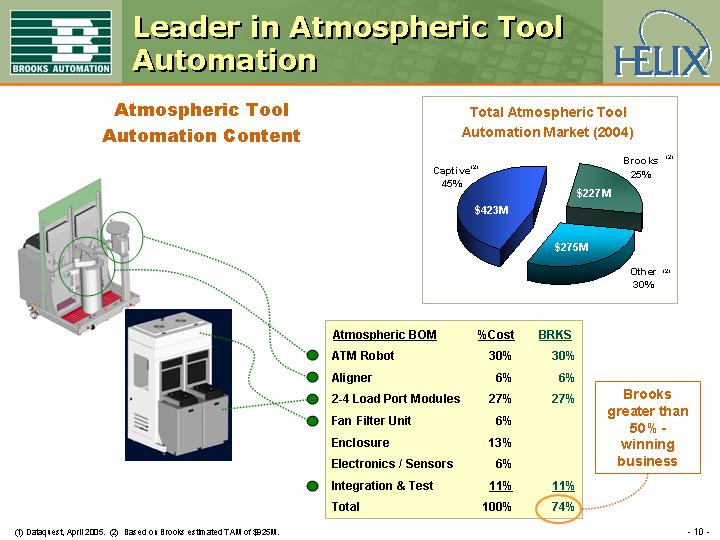

| Leader in Atmospheric Tool Automation | |

Atmospheric Tool

Automation Content

[GRAPHIC]

Atmospheric BOM | | % Cost | | BRKS | |

ATM Robot | | 30 | % | 30 | % |

Aligner | | 6 | % | 6 | % |

2-4 Load Port Modules | | 27 | % | 27 | % |

Fan Filter Unit | | 6 | % | | |

Enclosure | | 13 | % | | |

Electronics / Sensors | | 6 | % | | |

Integration & Test | | 11 | % | 11 | % |

Total | | 100 | % | 74 | % |

Brooks greater than 50% - winning business

Total Atmospheric Tool

Automation Market (2004)

[CHART]

(1) Dataquest, April 2005.

(2) Based on Brooks estimated TAM of $925M.

10

| Increasing Value in Vacuum Tool Systems | |

Vacuum Tool Opportunity Increases

• Ion Implant

• Metrology

• PVD (shown below)

[GRAPHIC]

PVD Vacuum BOM | | %Cost | | BRKS | | HELX | | Combined | |

1-Vacuum Robots | | 18 | % | 18 | % | | | 18 | % |

2-Chambers / Frame | | 28 | % | | | | | | |

3-Valves | | 19 | % | 3 | % | 1 | % | 4 | % |

4-Dry Pumps | | 7 | % | | | | | | |

5-Cryo / Turbo Pumps | | 20 | % | | | 20 | % | 20 | % |

6-Measurement | | 2 | % | | | 2 | % | 2 | % |

7-Electronics / Sensors | | 3 | % | | | | | | |

8-Integration & Test | | 7 | % | 7 | % | | | 7 | % |

Total | | 100 | % | 28 | % | 23 | % | 51 | % |

PVD Vacuum Process BOM | | | | | | 37 | % | | |

Combination positions Company to win greater share in wafer transport

Total Vacuum Tool

Automation Market (2004)

[CHART]

(1) Dataquest, April 2005.

(2) Based on Brooks estimated TAM of $616M.

11

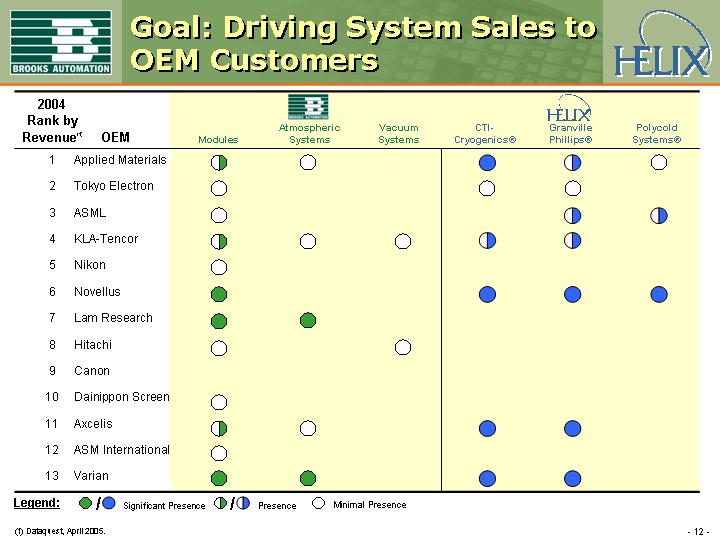

| Goal: Driving System Sales to OEM Customers | |

2004

Rank by

Revenue(1) | | OEM | | Modules | | [LOGO]

Atmospheric

Systems | | Vacuum

Systems | | CTI-

Cryogenics® | | [LOGO]

Granville

Phillips® | | Polycold Systems® | |

1 | | Applied Materials | | Y | | Z | | | | X | | Y | | Z | |

2 | | Tokyo Electron | | Z | | | | | | Z | | Z | | | |

3 | | ASML | | Z | | | | | | | | Y | | Y | |

4 | | KLA-Tencor | | Y | | Z | | Z | | Y | | Y | | | |

5 | | Nikon | | Z | | | | | | | | | | | |

6 | | Novellus | | X | | | | | | X | | X | | X | |

7 | | Lam Research | | X | | X | | | | | | | | | |

8 | | Hitachi | | Z | | | | Z | | | | | | | |

9 | | Canon | | | | | | | | | | | | | |

10 | | Dainippon Screen | | Z | | | | | | | | | | | |

11 | | Axcelis | | Y | | Z | | | | X | | X | | | |

12 | | ASM International | | Z | | | | | | | | | | | |

13 | | Varian | | X | | X | | | | X | | X | | | |

Legend: X Significant Presence | Y Presence | Z Minimal Presence |

(1) Dataquest, April 2005.

12

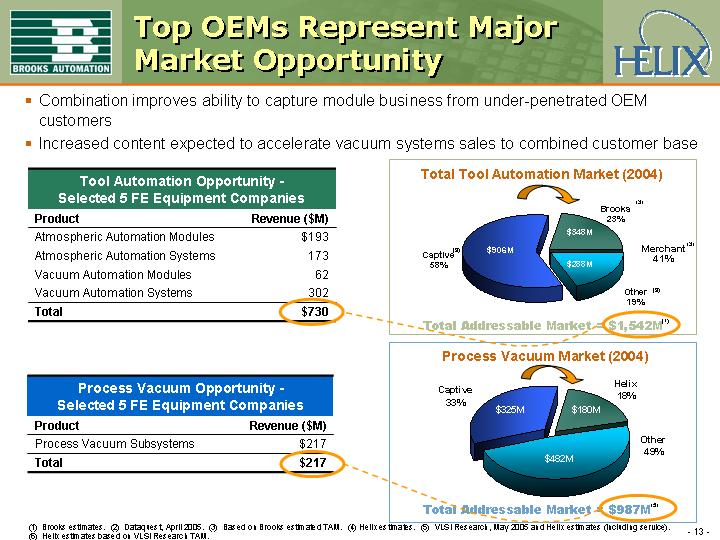

| Top OEMs Represent Major Market Opportunity | |

• Combination improves ability to capture module business from under-penetrated OEM customers

• Increased content expected to accelerate vacuum systems sales to combined customer base

Tool Automation Opportunity -

Selected 5 FE Equipment Companies

Product | | Revenue ($M) | |

Atmospheric Automation Modules | | $ | 193 | |

Atmospheric Automation Systems | | 173 | |

Vacuum Automation Modules | | 62 | |

Vacuum Automation Systems | | 302 | |

Total | | $ | 730 | |

Total Tool Automation Market (2004)

[CHART]

Process Vacuum Opportunity -

Selected 5 FE Equipment Companies

Product | | Revenue ($M) | |

Process Vacuum Subsystems | | $ | 217 | |

Total | | $ | 217 | |

Process Vacuum Market (2004)

[CHART]

(1) Brooks estimates.

(2) Dataquest, April 2005.

(3) Based on Brooks estimated TAM.

(4) Helix estimates.

(5) VLSI Research, May 2005 and Helix estimates (including service).

(6) Helix estimates based on VLSI Research TAM.

13

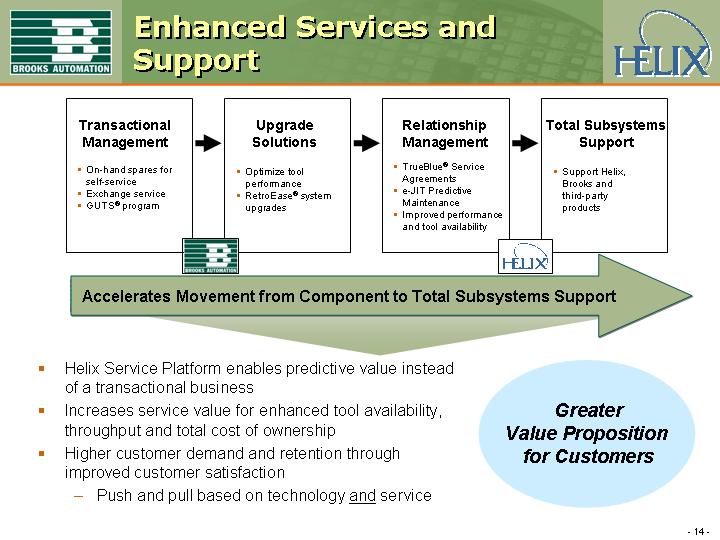

| Enhanced Services and Support | |

Transactional

Management |

|

• On-hand spares for self-service |

• Exchange service |

• GUTS® program |

[LOGO]

Upgrade

Solutions |

|

• Optimize tool performance |

• RetroEase® system upgrades |

Relationship

Management |

|

• TrueBlue® Service Agreements |

• e-JIT Predictive Maintenance |

• Improved performance and tool availability |

[LOGO]

Total Subsystems

Support |

|

• Support Helix, Brooks and third-party products |

Accelerates Movement from Component to Total Subsystems Support

• Helix Service Platform enables predictive value instead of a transactional business

• Increases service value for enhanced tool availability, throughput and total cost of ownership

• Higher customer demand and retention through improved customer satisfaction

• Push and pull based on technology and service

Greater

Value Proposition

for Customers

14

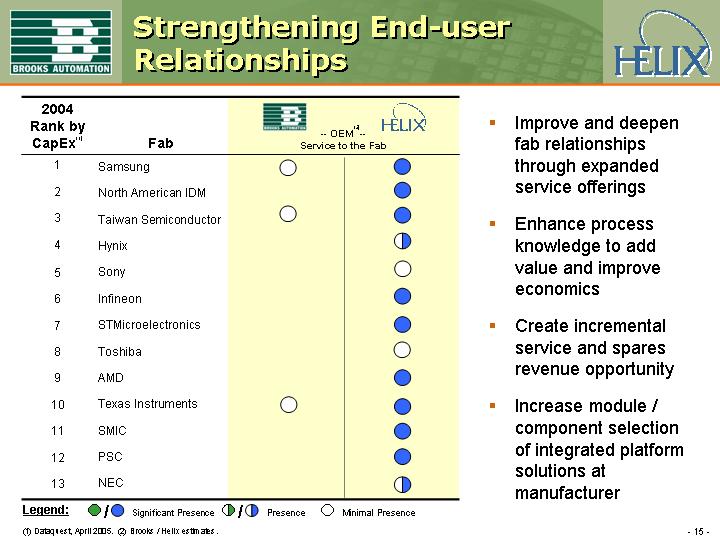

| Strengthening End-user Relationships | |

2004

Rank by

CapEx(1) | | | | [LOGO] | | [LOGO] | |

| | | — OEM(2) —

Service to the Fab | |

| Fab | | |

1 | | Samsung | | Z | | X | |

2 | | North American IDM | | | | X | |

3 | | Taiwan Semiconductor | | Z | | X | |

4 | | Hynix | | | | Y | |

5 | | Sony | | | | Z | |

6 | | Infineon | | | | X | |

7 | | STMicroelectronics | | | | X | |

8 | | Toshiba | | | | Z | |

9 | | AMD | | | | X | |

10 | | Texas Instruments | | Z | | X | |

11 | | SMIC | | | | X | |

12 | | PSC | | | | X | |

13 | | NEC | | | | Y | |

Legend: X Significant Presence | Y Presence | Z Minimal Presence |

(1) Dataquest, April 2005.

(2) Brooks / Helix estimates.

• Improve and deepen fab relationships through expanded service offerings

• Enhance process knowledge to add value and improve economics

• Create incremental service and spares revenue opportunity

• Increase module / component selection of integrated platform solutions at manufacturer

15

| Transaction Creates a Leading Subsystems Supplier | |

Tool Automation and Component Suppliers

LTM Revenue

($ in millions)

[CHART]

(1) Pro forma for the announced merger of Brooks and Helix.

(2) Pro forma for the announced merger of Entegris and Mykrolis.

(3) Helix pro forma as if acquisition of Polycold had occurred on 3/31/04.

16

| Manufacturing Excellence Leveraging Global Resources | |

[GRAPHIC]

Key Goals

• Achieve economies of scale, particularly in materials procurement

• Greater vertical integration, specifically machining capability in Mexico

• Higher content to reduce stacked margins for systems

17

• Stabilization of revenue streams – reduced volatility

• Potential to accelerate top-line growth

• Higher margins throughout business cycle

• Improved cash flow generation and profitability

• $10 million in identifiable, achievable cost synergies in Year 1; incremental synergies thereafter

• Significant near-term tax synergies on P&L and ongoing cash flow

• Accretive to earnings in FY2006

18

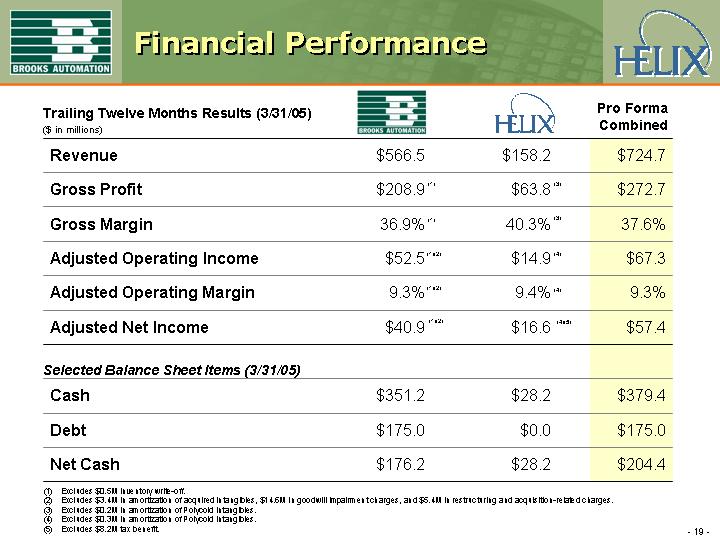

Trailing Twelve Months Results (3/31/05)

($ in millions) | | [LOGO] | | [LOGO] | | Pro Forma

Combined | |

Revenue | | $ | 566.5 | | $ | 158.2 | | $ | 724.7 | |

Gross Profit | | $ | 208.9 | (1) | $ | 63.8 | (3) | $ | 272.7 | |

Gross Margin | | 36.9 | %(1) | 40.3 | %(3) | 37.6 | % |

Adjusted Operating Income | | $ | 52.5 | (1)(2) | $ | 14.9 | (4) | $ | 67.3 | |

Adjusted Operating Margin | | 9.3 | %(1)(2) | 9.4 | %(4) | 9.3 | % |

Adjusted Net Income | | $ | 40.9 | (1)(2) | $ | 16.6 | (4)(5) | $ | 57.4 | |

| | | | | | | | | | |

Selected Balance Sheet Items (3/31/05) | | | | | | | |

Cash | | $ | 351.2 | | $ | 28.2 | | $ | 379.4 | |

Debt | | $ | 175.0 | | $ | 0.0 | | $ | 175.0 | |

Net Cash | | $ | 176.2 | | $ | 28.2 | | $ | 204.4 | |

(1) Excludes $0.5M inventory write-off.

(2) Excludes $3.4M in amortization of acquired intangibles, $14.6M in goodwill impairment charges, and $5.4M in restructuring and acquisition-related charges.

(3) Excludes $0.2M in amortization of Polycold intangibles.

(4) Excludes $0.3M in amortization of Polycold intangibles.

(5) Excludes $8.2M tax benefit.

19

Integration plan in place

• Shared vision for execution

• Minimal anticipated disruption

• No product rationalization and limited required design fit

• Leverage Helix service infrastructure

Key Integration Goals

• Realize cost synergies

• Minimize disruption to existing customers and business operations

• Maintain employee motivation

• Adopt best practices enterprise-wide

• Enhance customer value proposition

• Pursue revenue synergies

20

Important Additional Information to be Filed with the SEC

In connection with the proposed transaction, Brooks plans to file a Registration Statement on Form S-4 containing a Joint Proxy Statement/Prospectus with the Securities and Exchange Commission (“SEC”). Security holders of each company and other investors are urged to read the Registration Statement and any other relevant documents filed with the SEC, including the Joint Proxy Statement/Prospectus that will be part of the Registration Statement, when they become available because they will contain important information about Brooks, Helix, the proposed transaction and related matters. The final Joint Proxy Statement/Prospectus will be mailed to stockholders of Brooks and Helix. Security holders and investors of Brooks and Helix will be able to obtain free copies of the Registration Statement and the Joint Proxy Statement/Prospectus, when they become available, as well as other filings with the SEC that will be incorporated by reference into such documents, containing information about Brooks and Helix, without charge, at the SEC’s Internet site (http://www.sec.gov). These documents can also be obtained, without charge, by directing a request to Brooks Automation, 15 Elizabeth Drive, Chelmsford, MA 01824, Attention: Investor Relations Dept., telephone: 978-262-2602, or at mark.chung@brooks.com; or to Helix Technology Corporation, Nine Hampshire Street, Mansfield, MA 02048, Attention: Investor Relations Dept., telephone: (508) 337-5111, or at investors@helixtechnology.com. In addition, investors and security holders may access copies of the documents filed with the SEC by Brooks or Helix on their respective Web sites at www.brooks.com or www.helixtechnology.com.

Participants in Solicitation

Brooks, Helix and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Brooks and Helix stockholders in respect of the proposed transaction. Information regarding Brooks’ participants is available in Brooks’ Annual Report on Form 10-K for the year ended September 30, 2004, and the proxy statement, dated January 10, 2005, for its 2005 annual meeting of stockholders, which are filed with the SEC. Information regarding Helix’s participants is available in Helix’s Annual Report on Form 10-K for the year ended December 31, 2004, and the proxy statement, dated May 2, 2005, for its 2005 annual meeting of stockholders, which are filed with the SEC. Additional information regarding interests of such participants will be included in the Registration Statement containing the Joint Proxy Statement/Prospectus to be filed with the SEC.

21