QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Hercules Incorporated |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

| | |  |

|

|

|

| | | 2005 |

| | | |

| | | Proxy Statement |

|

|

|

| | | Invitation to the 2005 |

|

|

Annual Meeting |

|

|

of Shareholders |

|

|

|

Hercules Incorporated, Hercules Plaza, 1313 North Market Street

Wilmington, Delaware 19894-0001 (302) 594-5000

|

| | |

| | | Hercules Incorporated

Hercules Plaza

1313 North Market Street

Wilmington, DE 19894-0001 |

|

|

John K. Wulff

Chairman of the Board |

|

|

Craig A. Rogerson

President and

Chief Executive Officer |

|

|

April 29, 2005 |

Dear Shareholder:

We are pleased to invite you to attend the 2005 Annual Meeting of Shareholders of Hercules Incorporated, which is scheduled to be held on Thursday, June 16, 2005, at 11 a.m., local time, at Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001. Directions to Hercules Plaza are on the following pages.

The items to be considered and voted on at the Annual Meeting are described in the notice of the 2005 Annual Meeting of Shareholders and the Proxy Statement accompanying this letter. We encourage you to read carefully all of these materials, as well as the copy of our Annual Report which is enclosed with this Proxy Statement.

It is important that your shares be represented at the Annual Meeting even if you cannot attend the meeting and vote your shares in person. Please complete, sign and date the proxy card and return it in the enclosed, postage-prepaid envelope as soon as possible to ensure that your shares will be duly represented and voted at the Annual Meeting. If you choose to do so, you may vote by telephone or by Internet instead of voting by proxy card. Please vote even if you plan to attend the Annual Meeting.

We appreciate your continued interest in and support of Hercules.

| | | Sincerely, |

|

|

|

| | | John K. Wulff

Chairman of the Board |

|

|

|

| | | Craig A. Rogerson

President and Chief Executive Officer

|

DIRECTIONS TO HERCULES PLAZA

(1313 North Market Street, Wilmington, Delaware 19894-0001)

From Philadelphia/New Jersey:

- •

- Take Interstate 95 South to Wilmington (do not take I-495—follow I-95 signs for Wilmington).

- •

- Take Exit 7B, which is Delaware Avenue/Route 52.

- •

- Stay to the left as you come up grade to traffic light. Turn left onto Delaware Avenue and take center lane. There is a sign marked "Business District 52 South."

- •

- You will pass six streets—Adams, Jefferson, Washington, West, Tatnall and Orange. After crossing over Orange Street, the Hotel DuPont will be on your right. Get into the left lane.

- •

- The next street is Market Street. Turn left.

- •

- Proceed down Market Street crossing over 12th and 13th Streets (traffic lights at each corner). Hercules Plaza is at 13th Street and will be on your left. Hercules Plaza is a twelve-story granite/glass building with green tinted windows.

If traveling over the Delaware Memorial Bridge:

- •

- Stay to the far left lane as you exit the Delaware Memorial Bridge. Stay left heading toward sign stating Wilmington Delaware Turnpike - Baltimore - 295 - 95 - 495.

- •

- Bear to the right heading for Interstate 95 North.

- •

- Take the center lane as it will narrow to two lanes past Exit 6 (Martin Luther King Boulevard).

- •

- Take Exit 7, Delaware Avenue. Stay to the right as you come up grade to traffic light. You are on Adams Street—continue straight ahead to dead end (about 3 blocks) to Delaware Avenue. Turn right onto Delaware Avenue and take center lane. You will pass under sign "Business District 52 South." Pass five streets—Jefferson, Washington, West, Tatnall and Orange.

- •

- After crossing over Orange Street, the Hotel DuPont will be on your right. Get into the left lane.

- •

- Turn left onto Market Street. Pass 12th and 13th Streets (traffic lights at each). Hercules Plaza is at 13th Street and will be on your left. Hercules Plaza is a twelve-story granite/glass building with green tinted windows.

From I-476 (the Blue Route):

- •

- Take the Blue Route to Interstate 95 South to Wilmington.

- •

- Follow the above directions for traveling from Philadelphia.

From Baltimore/Washington:

- •

- Take Interstate 95 North to Wilmington. Take Exit 7, which is Delaware Avenue/Route 52.

- •

- Stay to the right as you come up grade to traffic light. You are on Adams Street—continue straight ahead to dead end (about 3 blocks) to Delaware Avenue. Turn right on to Delaware Avenue and take center lane. You will pass under sign "Business District 52 South." Pass five streets—Jefferson, Washington, West, Tatnall and Orange.

- •

- After crossing over Orange Street, the Hotel DuPont will be on your right. Get into the left lane.

- •

- Turn left onto Market Street. Pass 12th and 13th Streets (traffic lights at each). Hercules Plaza is at 13th Street and will be on your left. Hercules Plaza is a twelve-story granite/glass building with green tinted windows.

From the Wilmington Train (Amtrak) Station:

- •

- The Wilmington Train Station is located between King and French Streets on Front Street.

- •

- Hercules Plaza is at Market and 13th Streets, 12 blocks north of the station. Cabs are usually available at the station.

- •

- Hercules Plaza is on the NW corner of Market and 13th Streets. Hercules Plaza is a twelve-story granite/glass building with green tinted windows.

- •

- After you enter the building, follow the posted signs to the meeting room located in the Lower Atrium.

Hotel Accommodations

Wilmington has numerous hotels and motels in both the downtown and surrounding areas. For a listing you may want to refer to the Wilmington area website athttp://www.wilmcvb.org/accomm.html.

Parking Near Hercules Plaza

There is limited parking under the Hercules Plaza building. However, in addition to the parking available under the building, there are parking garages located across the street from Hercules Plaza between Orange and 12th Streets and on the side of Hercules Plaza between 14th and North Market Streets.

Important Note

Please be sure to bring photograph identification with you in order to gain admission to the Annual Meeting. If your shares are held in the name of a bank, broker or other nominee and you plan to attend the Annual Meeting, please be sure to bring evidence of your ownership of Hercules shares, such as a copy of your broker statement or a copy of the proxy card mailed to you by your bank or broker. Cameras, cell phones, pagers, recording equipment and other electronic devices will not be permitted at the Annual Meeting.

| | |

| | | Hercules Incorporated

Hercules Plaza

1313 North Market Street

Wilmington, DE 19894-0001

|

April 29, 2005

| To: | | Shareholders of Hercules Incorporated |

Subject: |

|

Notice of 2005 Annual Meeting of Shareholders |

The 2005 Annual Meeting of Shareholders is scheduled to be held on Thursday, June 16, 2005, at 11 a.m., local time, at Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001, (telephone 302-594-5128) to consider and take action on the following proposals:

- 1.

- Election of each of the following four director nominees: Anna Cheng Catalano, Burton M. Joyce, Jeffrey M. Lipton (incumbent director) and John K. Wulff (incumbent director), each for a three-year term expiring at the 2008 Annual Meeting of Shareholders; and

- 2.

- Ratification of the appointment of BDO Seidman, LLP as Hercules' independent registered public accountants for 2005.

Shareholders of record as of the close of business on April 18, 2005, will be entitled to vote at the Annual Meeting. We encourage you, whether or not you plan to attend the Annual Meeting, to vote by proxy card, telephone or Internet in advance of the Annual Meeting. You may attend the Annual Meeting and change your vote at that time if you wish to do so.

|

|

By order of the Board of Directors |

|

|

|

|

|

Israel J. Floyd

Corporate Secretary

and General Counsel

|

TABLE OF CONTENTS

| | Page

|

|---|

| THE 2005 ANNUAL MEETING OF SHAREHOLDERS | | 1 |

| |

Who is Entitled to Vote |

|

1 |

| |

How You May Vote |

|

1 |

| |

Annual Meeting Admission Procedures |

|

1 |

| |

Vote Required and Voting Procedures |

|

2 |

| |

Revocation of Proxy |

|

3 |

| |

Hercules Incorporated Savings and Investment Plan |

|

3 |

| |

Annual Report |

|

3 |

| |

Shareholder Proposals |

|

3 |

| |

Nomination of Directors |

|

4 |

| |

Shareholder Nomination of Directors |

|

4 |

| |

Shareholder and Interested Party Communication with the Board of Directors |

|

4 |

| |

Hercules' Website:www.herc.com |

|

5 |

PROPOSAL NO. 1—Election of Hercules Directors |

|

5 |

| |

Hercules Nominees for Directors |

|

6 |

| |

Directors Continuing in Office |

|

6 |

| |

Board of Directors and its Committees |

|

7 |

| |

Compensation of Employee Directors |

|

9 |

| |

Compensation of Non-Employee Directors |

|

9 |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE |

|

11 |

PROPOSAL NO. 2—Ratification of the Appointment of BDO Seidman, LLP as Hercules' Independent Registered Public Accountants for 2005 |

|

11 |

OTHER MATTERS |

|

14 |

Fees of Independent Registered Public Accountants |

|

15 |

| |

Legally Prohibited/Restricted Services |

|

16 |

| |

Additional Prohibited Services |

|

16 |

| |

Permitted Services |

|

17 |

HUMAN RESOURCES COMMITTEE REPORT |

|

18 |

HUMAN RESOURCES COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION |

|

21 |

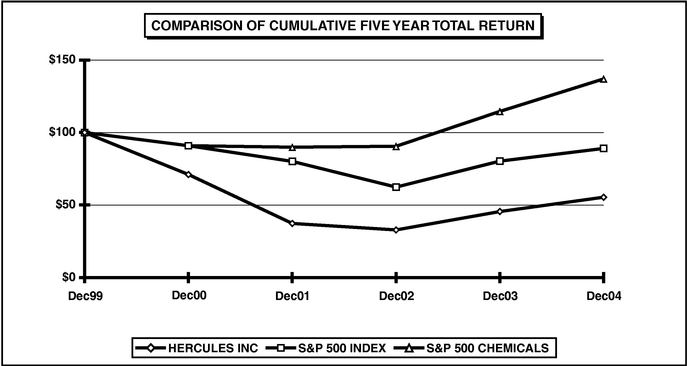

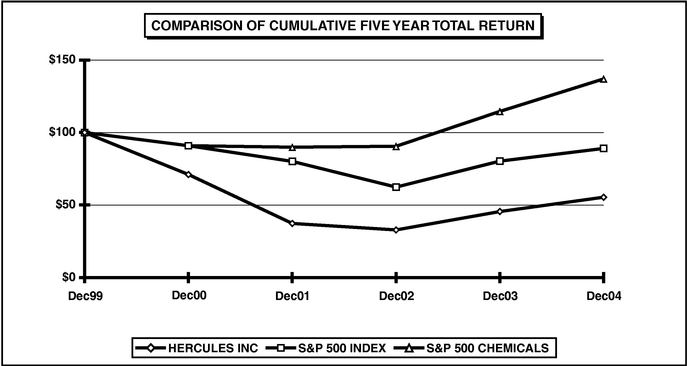

FIVE-YEAR PERFORMANCE COMPARISON |

|

22 |

BENEFICIAL OWNERSHIP OF COMMON STOCK |

|

23 |

COMPENSATION OF EXECUTIVE OFFICERS |

|

25 |

| | | |

i

| |

Equity Compensation Plan Information |

|

26 |

| |

Option Grants in Last Fiscal Year |

|

27 |

| |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values |

|

27 |

| |

Long-Term Incentive Plan (LTICP) Awards in Last Fiscal Year |

|

27 |

| |

Pension Plans |

|

28 |

| |

Trust Arrangements |

|

29 |

| |

Severance Pay Plan |

|

29 |

| |

Employment Contracts |

|

30 |

| |

Change in Control Agreements |

|

30 |

METHOD AND COST OF PROXY SOLICITATION |

|

31 |

ii

PROXY STATEMENT

Hercules Incorporated

Hercules Plaza

1313 North Market Street

Wilmington, DE 19894-0001

April 29, 2005

THE 2005 ANNUAL MEETING OF SHAREHOLDERS

The accompanying proxy is solicited on behalf of the Board of Directors of Hercules Incorporated for use at the 2005 Annual Meeting of Shareholders to be held on Thursday, June 16, 2005, and at any adjournment, postponement, continuation or rescheduling of the Annual Meeting.

This Proxy Statement and the accompanying proxy card are being distributed on or about April 29, 2005. A copy of Hercules' 2004 Annual Report is enclosed with this Proxy Statement.

Who is Entitled to Vote

Shareholders of record as of the close of business on April 18, 2005, which is the Record Date, will be entitled to one vote for each share of Hercules common stock registered in the shareholder's name. Shareholders of record will retain their voting rights even if they sell their Hercules shares after the Record Date. As of the Record Date, there were 112,436,971 shares of Hercules common stock outstanding.

How You May Vote

You may vote by completing and mailing the enclosed proxy card or you may vote by telephone or Internet.

- •

- To vote your proxy by mail, mark your selections on the enclosed proxy card, date and sign your name exactly as it appears on your proxy card, and return your proxy card in the enclosed envelope.

- •

- To vote by telephone, dial 1-866-540-5760, have your proxy card in hand when you call and follow the voice prompts.

- •

- To vote by Internet, log on tohttp://www.proxyvoting.com/herc and have your proxy card in hand when you access the website.

Please remember that if your Hercules shares are held in the name of a bank, broker or other nominee, then only such record holder can sign a proxy card with respect to your shares and only upon specific instructions from you. Therefore, please contact the person responsible for your account and give instructions to such person for a proxy card to be signed representing your shares.

Annual Meeting Admission Procedures

We encourage you to vote by proxy, whether or not you plan to attend the Annual Meeting. If, however, you are a shareholder of record and plan to attend the Annual Meeting, please be sure to bring with you valid government-issued personal identification with a picture (such as a driver's license or passport) in order to gain admission to the Annual Meeting. If your shares are held in the name of a bank, broker or other nominee, you will have to bring evidence of your ownership of Hercules shares as of the Record Date, in addition to valid government-issued personal identification, if you wish to attend the Annual Meeting. Examples of proof of ownership include the following:

- •

- a letter from your bank or broker stating that you owned your shares as of the Record Date;

1

- •

- a brokerage account statement indicating that you owned your shares as of the Record Date; or

- •

- a copy of the voting instruction card provided by your broker indicating that you owned your shares as of the Record Date.

If you are a proxy holder for a Hercules shareholder, to gain entry to the Annual Meeting you must bring:

- •

- a validly executed proxy naming you as the proxy holder, signed by a Hercules shareholder who owned Hercules shares as of the Record Date;

- •

- valid government-issued personal identification with a picture (such as a driver's license or passport); and

- •

- if the shareholder whose proxy you hold was not a record holder of Hercules shares as of the Record Date, proof of the shareholder's ownership of Hercules shares as of the Record Date, in the form of a letter or statement from a bank, broker, or other nominee or the voting instruction card provided by the broker, in each case, indicating that the shareholder owned those shares as of the Record Date.

If you sign your proxy card and do not indicate your vote on any one or more of the proposals, you will give authority to each of Craig A. Rogerson, our President and Chief Executive Officer, Allen A. Spizzo, our Vice President and Chief Financial Officer, and Israel J. Floyd, our Corporate Secretary and General Counsel, to vote on such proposal(s) and any other matter that may arise at the Annual Meeting. Messrs. Rogerson, Spizzo and Floyd each intend to use that authority to vote as follows:

- •

- FOR the election of each of the four director nominees (Proposal No. 1); and

- •

- FOR the ratification of the appointment of BDO Seidman, LLP as Hercules' independent registered public accountants for 2005 (Proposal No. 2).

Vote Required and Voting Procedures

Under our By-laws, a majority of the total number of shares of Hercules common stock entitled to vote, present in person or represented by proxy, constitutes a quorum. Votes will be counted by our transfer agent. Pursuant to rules of the Securities and Exchange Commission, or the SEC, boxes and a designated blank space are provided on the proxy card for you to mark if you wish:

- •

- to vote "for" or "withhold" authority for one or more of the director nominees (see Proposal No. 1); or

- •

- to vote "for" or "against," or to "abstain" from voting on, the proposal concerning the ratification of the appointment of BDO Seidman, LLP as Hercules' independent registered public accountants for 2005 (see Proposal No. 2).

If you are voting by telephone, dial 1-866-540-5760, enter the control number indicated on your proxy card and follow the voice prompts. If you are voting by the Internet, log on tohttp://www.proxyvoting.com/herc and have your proxy card in hand when you access the website.

Pursuant to Hercules' By-laws, election of directors (Proposal No. 1) requires the affirmative vote of the holders of a majority of the total number of issued and outstanding shares of Hercules common stock. Ratification of the appointment of BDO Seidman, LLP as Hercules' independent registered public accountants for 2005 (Proposal No. 2) requires the affirmative vote of the holders of a majority of the total number of issued and outstanding shares of Hercules common stock present in person or by proxy and entitled to vote at the Annual Meeting.

Abstentions, votes withheld in connection with the election of one or more nominees for director and broker non-votes, which occur when brokers that hold shares in street name do not receive

2

instructions from the beneficial owners of those shares, will be counted in determining whether a quorum is present at the Annual Meeting but will not be counted as votes for or against any of the proposals. Therefore, such votes will have the same effect as votes against each of the proposals and will make it more difficult to obtain the required approval on each proposal.

Revocation of Proxy

A person giving any proxy has the power to revoke such proxy at any time before the voting, by submitting a written revocation or a duly executed proxy bearing a later date. A written revocation must be received by Hercules Incorporated, Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001, Attention: Corporate Secretary, no later than the beginning of voting at the Annual Meeting. In addition, any shareholder who attends the Annual Meeting in person may vote by ballot at the Annual Meeting, thereby canceling any proxy previously given, or may give notice of revocation to the inspector of election. Merely attending the Annual Meeting without voting, however, will not revoke any previously executed proxy.

Hercules Incorporated Savings and Investment Plan

If you are a participant in the Hercules Incorporated Savings and Investment Plan, you will receive a separate packet of information about how to provide voting instructions to the plan trustee. The plan trustee will vote the Hercules shares that are allocable to your account under the plan in accordance with your instructions unless the plan trustee determines that it is legally obligated to do otherwise. If you do not provide the plan trustee with instructions, the plan trustee will vote your Hercules shares in proportion to the manner in which it votes the shares allocable to other plan participants who provided instructions unless the plan trustee determines that it is legally obligated to do otherwise.

Annual Report

Hercules' 2004 Annual Report is enclosed with this Proxy Statement. Shareholders of record who did not receive the Annual Report may request a copy free of charge by contacting Helen Calhoun, Hercules Incorporated, 1313 North Market Street, Wilmington, Delaware 19894-0001, facsimile (302) 594-6909, telephone (302) 594-5129 or e-mail at hcalhoun@herc.com. The Annual Report can also be found on our website atwww.herc.com.

Shareholder Proposals

To be included in Hercules' 2006 proxy statement, shareholder proposals must be submitted in writing and received by Israel J. Floyd, Esquire, Corporate Secretary and General Counsel, Hercules Incorporated, Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001, no later than December 30, 2005 (or, if the date of the 2006 Annual Meeting is changed by more than 30 days from the date of the 2005 Annual Meeting, a reasonable time before Hercules begins to print and mail its proxy materials). Upon receipt of a shareholder proposal, Hercules will determine whether or not to include such proposal in Hercules' 2006 Proxy Statement in accordance with applicable law.

Shareholder proposals submitted after December 30, 2005 will not be included in Hercules' 2006 proxy statement but may be raised at the 2006 Annual Meeting. However, if any shareholder wishes to present a proposal for the 2006 Annual Meeting that is not included in Hercules' Proxy Statement for that meeting and fails to submit that proposal on or before March 15, 2006, then the persons named as proxies in Hercules' proxy card accompanying Hercules' 2006 proxy statement will be allowed to use their discretionary voting authority when the proposal is raised at the 2006 Annual Meeting, without any discussion of the matter in Hercules' 2006 proxy statement.

3

Nomination of Directors

A class of Hercules' directors is elected each year at the annual meeting. The Board of Directors is responsible for filling vacancies on the Board that may occur at any time during the year, and for nominating director nominees to stand for election at the annual meeting. The Corporate Governance, Nominating and Ethics Committee of the Board of Directors, or Governance Committee, reviews potential director candidates, and recommends potential director candidates to the full Board. Director candidates may be identified by current directors and officers of Hercules, as well as by shareholders. The Governance Committee is comprised entirely of independent directors, as defined in the New York Stock Exchange, or NYSE, Listing Standards. Depending upon the then existing circumstances, the Governance Committee may utilize the services of director search firms and/or recruiting consultants to assist in identifying and screening potential candidates. The Governance Committee has an extensive diligence process for reviewing potential candidates, including an assessment of each candidate's education, experience, independence and other relevant factors, as described under "The Board—Director Qualifications" in Hercules' Corporate Governance Guidelines. The Board reviews and has final approval on all potential director nominees being recommended to the shareholders for election.

The Governance Committee seeks nominees who have the highest personal and professional integrity, who have demonstrated exceptional ability and judgment, and who would be most effective, in conjunction with the other nominees and members of the Board, in collectively serving the long-term interests of the shareholders and Hercules. The Governance Committee considers potential director candidates recommended by Hercules' shareholders. Nominations from shareholders for the election of directors, which are in compliance with all applicable laws and regulations and which are properly submitted in writing to Hercules' Corporate Secretary, will be referred to this committee for consideration.

Shareholder Nomination of Directors

As a shareholder, you may recommend any person as a nominee for director of Hercules for consideration by the Governance Committee by submitting name(s) and respective supporting information for each named person in writing to the Governance Committee of the Board of Directors, Hercules Incorporated, Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001. Recommendations should be received by December 31, 2005 for the 2006 Annual Meeting, and should be accompanied by:

- •

- the name, residence and business address of the nominating shareholder;

- •

- a representation that the shareholder is a record holder of Hercules stock or holds Hercules stock through a bank, broker or other nominee and the number of shares held;

- •

- information regarding each nominee which would be required to be included in a proxy statement;

- •

- a description of any arrangements or understandings between and among the shareholder and each and every nominee; and

- •

- the written consent of each nominee to serve as a director, if elected.

No nominations were received from shareholders for the 2005 Annual Meeting.

Shareholder and Interested Party Communication with the Board of Directors

Hercules' Board of Directors provides a process for shareholders and interested parties to send communications to the Board. Shareholders and interested parties may communicate with any of Hercules' directors, any committee chairperson, the non-management directors as a group or the entire Board of Directors by writing to the director, committee chairperson or the Board in care of Hercules

4

Incorporated, Attention: Corporate Secretary, Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001. Communications received by the Corporate Secretary for any Hercules director are forwarded directly to the director. If the communication is addressed to the Board and no particular director is named, the communication will be forwarded, depending on the subject matter, to the Chairman, the appropriate Committee chairperson, all non-management directors, or all directors.

Hercules' Website:www.herc.com

Hercules' website address iswww.herc.com, and access to information on the website is free of charge (except for any Internet provider or telephone charges). We provide access through our website to all SEC filings submitted by Hercules, as well as to information relating to corporate governance. Copies of our Audit Committee, Human Resources Committee and Corporate Governance, Nominating and Ethics Committee charters, our Directors Code of Business Conduct and Ethics, our Corporate Governance Guidelines, our Business Practices Policy, our Code of Ethics for Senior Financial Executives, our Restated Certificate of Incorporation, our By-laws and other matters impacting our corporate governance program are found on our website. Copies of these documents may also be obtained free of charge by contacting Hercules Incorporated, Hercules Plaza, 1313 North Market Street, Wilmington, Delaware, Attention: Corporate Secretary, telephone (302) 594-5000, facsimile (302) 594-7315. Hercules will post on its website any waivers to our Directors Code of Business Conduct and Ethics and our Code of Ethics for Senior Financial Executives, which are required to be disclosed by applicable law and the NYSE Listing Standards. Information contained on Hercules' website is not part of this Proxy Statement.

PROPOSAL NO. 1—Election of Hercules Directors

Our Restated Certificate of Incorporation and By-laws provide for three classes of directors, with the term of one class expiring at each annual meeting of shareholders. Pursuant to the authority granted to the Board of Directors in our Restated Certificate of Incorporation, the Board has fixed the number of directors at eight. Of the current eight directors, two directors (i.e. Messrs. Lipton and Wulff) are in the class with a term that expires in 2005. The Board has approved increasing the Board size from eight to ten members if all four director nominees are elected. Assuming that all four director nominees are elected, the Board will then be classified as follows: three directors in the class whose term expires in 2006, i.e. Messrs. Duff, Gerrity and Wyatt, three directors in the class with a term that expires in 2007, i.e. Messrs. Hunter, Kennedy and Rogerson, and four directors in the class with a term that expires in 2008, i.e. Ms. Catalano and Messrs. Joyce, Lipton and Wulff.

At the Annual Meeting, four directors are to be elected, all of whom, if elected, will constitute the class with a term that expires in 2008. The Board has nominated for election at the Annual Meeting: Anna Cheng Catalano, Burton M. Joyce, Jeffrey M. Lipton (incumbent director) and John K. Wulff (incumbent director) each of whom has agreed to serve as a director and has consented to being named in this Proxy Statement.

It is intended that the shares represented by the accompanying proxy will be voted for the election of Ms. Catalano and Messrs. Joyce, Lipton and Wulff. If for any reason any nominee should be unavailable to serve as a director at the time of the Annual Meeting, a contingency which we do not expect as of the date of this Proxy Statement, the shares represented by the accompanying proxy may be voted for the election of such other person as may be determined by the holders of the proxy, unless the proxy withholds authority to vote for all director nominees. Pursuant to our By-laws, a majority vote of the total number of shares of Hercules common stock issued and outstanding is required to elect each director.

5

Hercules Nominees for Directors

Anna Cheng Catalano—New Director Nominee

Ms. Catalano, age 45, is the former Group Vice President Marketing for BP plc. Ms. Catalano held a number of executive and senior management positions during her 20 years with Amoco (which merged with BP plc in 1998), particularly in the areas of global sales and marketing. Ms. Catalano also serves on the Board of Directors of SSL International Plc where she serves on the Remuneration and Audit Committees.

Burton M. Joyce—New Director Nominee

Mr. Joyce, age 63, is the Chairman of the Board of Directors of IPSCO Inc., a leading steel producer. He has held this position since 2000 and has been a member of the Board of Directors since 1993. Previously, Mr. Joyce was with Terra Industries, Inc. where he served as Vice Chairman (2001 - 2003), President and Chief Executive Officer (1991-2001), Chief Operating Officer (1987-1991) and Chief Finance Officer (1986-1987). Mr. Joyce also serves on the Board of Directors of Norfolk Southern Corporation and Terra Nitrogen Company LP.

Jeffrey M. Lipton—Director since 2001

Mr. Lipton, age 62, is the President and Chief Executive Officer and a Director of NOVA Chemicals Corporation. He joined NOVA in 1993 after a 28-year career with the DuPont Company, where he held a number of management and executive positions. He is Chairman of the Board of Trimeris, Inc., a member of the Board of Directors and Chairman of the Executive Committee of the American Chemistry Council, a member of the Board of Directors of the Canadian Council of Chief Executives—Canada, and Chairman of the Board of the American Section of the Society of Chemical Industries.

John K. Wulff—Director since 2003

Mr. Wulff, age 56, is the Non-Executive Chairman of the Board, a position he has held since December 2003. Mr. Wulff was first elected as a director in July 2003 and served as Interim Chairman from October 2003 to December 2003. Mr. Wulff served as a member of the Financial Accounting Standards Board ("FASB") from July 2001 to June 2003. From January 1996 to March 2001, he was the Chief Financial Officer of Union Carbide Corporation. He has held leadership positions in the Financial Executives Institute, has served as Chairman of its Committee on Corporate Reporting, and has been a Steering Committee member of the FASB Business Reporting Research Project. He is a member of the Board of Directors of Sunoco Inc., Moody's Corporation and Fannie Mae.

Directors Continuing in Office

Terms expiring in 2006

Patrick Duff—Director since 2003

Mr. Duff, age 47, is a private investor. Mr. Duff was Senior Managing Director and a member of the Management Committee of Tiger Management, one of the largest U.S. investment funds, until December 1993, when he joined the faculty of the Columbia Graduate School of Business. Mr. Duff taught Security Analysis at Columbia until 1999. Mr. Duff is a member of the Board of Directors of the Gerson Lehrman Group and the New Community Corporation. Mr. Duff is licensed as a Certified Public Accountant and is a Chartered Financial Analyst.

Thomas P. Gerrity—Director since 2003

Dr. Gerrity, age 63, is the Joseph Aresty Professor of Management at the Wharton School of the University of Pennsylvania. He served as the 11th Dean of the Wharton School from 1990 to 1999.

6

Prior to Wharton, he was the founder and Chief Executive Officer for 20 years of the Index Group, a leading consulting firm in business reengineering and information technology strategy. Dr. Gerrity currently serves on the Board of Directors of CVS Corporation, Fannie Mae (where he is Chairman of the Audit Committee), Sunoco (where he is Chairman of the Audit Committee), Internet Capital Group, and Knight Ridder. He also serves as a member of the MIT Corporation, which is the Board of Trustees of the Massachusetts Institute of Technology.

Joe B. Wyatt—Director since 2001

Mr. Wyatt, age 69, is Chancellor Emeritus of Vanderbilt University in Nashville, Tennessee. He served as Vanderbilt's sixth Chancellor and Chief Executive Officer for 18 years, beginning in 1982. From 1972 to 1982, he was a member of the faculty and administration at Harvard University. He is Chairman of the Board of Directors of the Universities Research Association Inc. of Washington, D.C., the EAA Aviation Foundation, Ingram Micro, Inc. (where he is Chairman of the Audit Committee), El Paso Corporation (where he is Chairman of the Compensation Committee), and he is a Principal of the Washington Advisory Group, LLC in Washington, D.C.

Terms expiring in 2007:

Craig A. Rogerson—Director since 2003

Mr. Rogerson, age 48, is President and Chief Executive Officer of Hercules. He joined Hercules in 1979 in the firm's Water Management Chemicals Division and progressed in Hercules to Vice President and General Manager of the Fibers Division in 1996. In April 1997, Mr. Rogerson joined Wacker Silicones Corporation, where he served as President and Chief Executive Officer. In May 2000, Mr. Rogerson rejoined Hercules as Vice President, Business Operations, BetzDearborn Division. In August 2000, Mr. Rogerson was promoted to Vice President and General Manager, BetzDearborn Division. In April 2002, he was promoted to President, FiberVisions; President, Pinova; and Vice President, Global Procurement. In October 2003, Mr. Rogerson was named Acting President and Chief Operating Officer of Hercules. He assumed his current position in December 2003.

John C. Hunter, III—Director since 2002

Mr. Hunter, age 56, is the former Chairman, President and Chief Executive Officer of Solutia Inc., a specialty chemicals company created in 1997 as a spin-off from the Monsanto Company. Mr. Hunter joined Monsanto in 1969 and held a number of executive and senior management positions until his retirement in 2004. He is a member of the Board of Directors of Solutia Inc., Missouri Baptist Medical Center, the Penford Corporation and Energizer Holdings, Inc. In December 2003, Solutia Inc. filed a petition under the federal bankruptcy laws and remains as a debtor-in-possession.

Robert D. Kennedy—Director since 2001

Mr. Kennedy, age 72, held a number of executive and senior management positions with Union Carbide Corporation, including Chairman, Chief Executive Officer and President. He retired as Chairman from Union Carbide in 1995 after a career that spanned 40 years. He is a member of the Boards of Directors of Sunoco Inc. and Blount International Inc. He is on the advisory board of RFE Associates.

Information regarding Hercules' executive officers is incorporated herein by reference to the 2004 Annual Report on Form 10-K enclosed with this Proxy Statement.

Board of Directors and its Committees

The Board of Directors currently consists of eight directors, seven of whom have been determined by the Board to be independent under the NYSE Listing Standards and the standards set by the Board. The Board's Corporate Governance Guidelines, including its policies for determining director

7

independence, are posted on Hercules' website. Any changes in these Corporate Governance Guidelines, or other governance documents, will be reflected in the corporate governance section of our website atwww.herc.com.

A general description of the functions of the Board Committees is set forth below. The Audit Committee, Human Resources Committee and Corporate Governance, Nominating and Ethics Committee charters are all available on our website.

Audit Committee. Monitors the integrity of the financial statements, financial reporting process and systems of internal accounting and financial controls of Hercules, engages Hercules' independent registered public accountants, and monitors their qualifications, independence and performance. Has oversight responsibility for the performance of Hercules' internal audit function and compliance with legal and regulatory requirements, including Hercules' disclosure controls and procedures. All members of this committee are independent as defined under relevant SEC rules and the NYSE Listing Standards. The report of our Audit Committee is included in this Proxy Statement.

Corporate Governance, Nominating and Ethics Committee. Takes a leadership role in shaping Hercules' corporate governance policies and practices, including recommending Corporate Governance Guidelines to the Board and monitoring Hercules' compliance with these policies and the Guidelines. Is responsible for identifying individuals qualified to be Board members and recommending to the Board the director nominees for the next annual meeting of shareholders. Leads the Board in its annual review of the performance of the Board and its committees, has oversight of management's succession planning and recommends to the Board director candidates for each Board committee. All members of this committee are independent as defined under relevant SEC rules and the NYSE Listing Standards.

Human Resources Committee (formerly named the Compensation Committee). Responsible for determining the compensation of the chief executive officer and approving the compensation structure, compensation and equity grants for senior management, including members of the business planning groups, the most senior managers of corporate staff and other highly paid professionals. Produces an annual report on executive compensation that is included in Hercules' Proxy Statement. Responsible for administering Hercules' stock incentive plans and approves broad-based and special compensation plans for Hercules directors and employees. Additionally, the Committee is responsible for executive officer succession planning and implementation of development plans applicable to the management ranks of the Company. The policies and plans developed by the Human Resources Committee are approved by the Board of Directors. All members of this committee are independent directors as defined under relevant SEC rules and the NYSE Listing Standards. The report of our Human Resources Committee is included in this Proxy Statement.

Emergency Committee. Has limited powers to act on behalf of the Board whenever the Board is not in session. Meets only as needed and acts only by unanimous vote. If any non-employee director wants a matter to be addressed by the Board rather than the Emergency Committee, then the matter is submitted to the Board. All members of the Board attending a meeting of the Emergency Committee are members of the Emergency Committee for the purposes of such meeting.

Finance Committee. Reviews Hercules' financial affairs. Has full and final authority on certain financial matters. Serves as a named fiduciary for all of Hercules' employee benefit plans.

Responsible Care Committee. Reviews Hercules' policies, programs and practices on Safety, Health, Environment and Regulatory Affairs programs, plant and facility security issues, equal employment opportunity, community affairs and university relations. Charged with monitoring Hercules' performance relating to employee diversity.

8

The following chart shows, for each of our standing committees, current membership and number of meetings held in 2004.

Director

| | Audit

Committee

| | *Human

Resources

Committee

| | Emergency

Committee

| | Finance

Committee

| | Corporate

Governance,

Nominating

and Ethics

Committee

| | Hercules

Respon-

sible Care

Committee

|

|---|

| Patrick Duff | | C | | | | X | | X | | X | | |

| Thomas P. Gerrity | | | | X | | X | | X | | | | |

| John C. Hunter, III | | X | | | | X | | C | | X | | X |

| Robert D. Kennedy | | X | | | | X | | | | X | | C |

| Jeffrey M. Lipton | | | | C | | X | | | | X | | X |

| Craig A. Rogerson | | | | | | C | | | | | | |

| John K. Wulff | | | | X | | X | | X | | | | X |

| Joe B. Wyatt | | | | X | | X | | | | C | | X |

| Number of Meetings in 2004 | | 17 | | 3 | | 0 | | 8 | | 4 | | 3 |

C = Chairperson

* In 2004, the Compensation Committee changed its name to the Human Resources Committee.

The Board held eight meetings during 2004. During 2004, the directors attended at least 94% of the aggregate number of meetings of the Board and 95% of the aggregate number of meetings of committees of the Board on which they served during the time for which they served. In 2004, seven directors attended the Annual Meeting. Directors are expected to attend the annual meeting, as well as regular Board and committee meetings and to spend the time needed and meet as frequently as necessary to properly fulfill their responsibilities.

Executive and Independent Directors Sessions

As the Board deems appropriate, Board meetings include an executive session of all directors and the Chief Executive Officer. In addition, the Board meets in regularly scheduled independent directors' sessions without the Chief Executive Officer or other Hercules personnel. The Chairman of the Board, currently Mr. Wulff, presides over the executive sessions and the independent directors' sessions but may delegate authority to any Board Committee Chair with respect to matters within the responsibility of a particular Board Committee.

Compensation of Employee Directors

Employee directors receive no additional compensation other than their normal employee compensation.

Compensation of Non-Employee Directors

Based on the results of a non-employee director compensation survey conducted in 2004 by a leading compensation consultant, the Company increased non-employee director annual retainer compensation to $40,000 in cash. Additionally, per meeting fees were increased from $1,000 to $1,200 and annual chair fees were increased from $3,000 to $5,000 for the Emergency Committee, Finance Committee, Corporate Governance, Nominating and Ethics Committee and Hercules Responsible Care Committee, and $7,500 for the Audit Committee and Human Resources Committee. Equity compensation (long term incentives) remained a $59,000 value. With these changes, total non-employee director cash compensation is at the 50th percentile of the Chemical Industry group measured by the aforementioned compensation consultant. These changes were approved by the Board and became effective July 1, 2004.

9

In February 2005, the Board approved continuing the position of Non-Executive Chairman of the Board currently held by Mr. Wulff. In light of the personal commitment required as Non-Executive Chairman, the Board approved additional annual compensation of $50,000 payable in cash or in equivalent restricted stock units ("RSUs") to Mr. Wulff as long as he remains Non-Executive Chairman.

Non-Employee Director Compensation Plans

Non-Employee Director Stock Accumulation Plan. In 2004, as in past years, non-employee directors had the right to elect to receive restricted stock in lieu of part or all of their fees under Hercules' Non-Employee Director Stock Accumulation Plan, or NEDSAP. Restricted stock issued pursuant to the NEDSAP is restricted until the director's retirement from the Board and is valued, for exchange purposes, at 85% of the fair market value of Hercules' common stock on the date of grant.

Hercules Incorporated Omnibus Equity Compensation Plan for Non-Employee Directors. Under the Hercules Incorporated Omnibus Equity Compensation Plan for Non-Employee Directors (the "Omnibus Plan"), non-employee directors receive nonqualified stock options to purchase 3,000 shares of common stock each year. The options have an exercise price equal to the fair market value of Hercules' common stock on the date of grant and vest one year from the grant date. Each director also receives an additional grant of a number of RSUs that is equal to the difference between $59,000 and the value of the 3,000 stock options granted under the Omnibus Plan (determined using the Black Scholes valuation methodology). The initial RSU grants will be settled in cash. Subsequent RSU grants will be settled in stock. The RSUs are placed in an unfunded account and accrue dividend equivalents, to the extent any dividends are paid on Hercules' common stock. Each RSU represents the right to receive one Hercules common stock at retirement or the equivalent in cash. RSUs do not carry any voting rights.

Equity Award. Each director has a one-time opportunity to purchase 750 shares of Hercules common stock at fair market value during a window period beginning the third business day after release of earnings for the most recent fiscal period. If a director purchases these shares, Hercules awards the director an additional 1,500 shares of Hercules common stock that cannot be transferred until retirement or resignation from the Board.

Retirement Restricted Stock Units. Upon initially being elected to the Board, each director receives a one-time grant of 1,100 RSUs. The RSUs are placed in an unfunded account and accrue dividend equivalents, to the extent any dividends are paid on Hercules' common stock. Each RSU represents the right to receive one Hercules common share at retirement or the equivalent in cash. RSUs do not carry any voting rights. Of the 1,100 RSUs, 200 vest immediately. Thereafter, for every year served on the Board, 100 additional RSUs vest. Upon retirement from the Board, all vested RSUs are paid in shares of Hercules common stock distributed in a lump sum or distributed over a period not to exceed ten years, at the option of the director.

Trust Arrangements. Hercules has a "rabbi trust" to provide for the funding of accrued benefits under the Hercules Incorporated Deferred Compensation Plan for Non-employee Directors and other plans that are currently not funded. Under the terms of the rabbi trust, the funding is triggered by an "Unsolicited Change in Control Event" as defined in the trust documents.

Certain Relationships and Related Transactions

We have relationships with many businesses, including the entities referred to below with which our directors are involved. Our relationships with these entities existed before the related director joined our Board. We believe that all of the transactions described below were entered into on commercially reasonable terms and are in the best interest of Hercules. In addition, all of our directors, other than our Chief Executive Officer, are independent as defined in our Corporate Governance

10

Guidelines and the NYSE Listing Standards. Our Board has carefully reviewed each of these relationships and transactions and has concluded that all transactions were entered into in the normal course of business, that none of the relationships interferes with the exercise of independent judgment by any of our independent directors, that the transactions relate to commercial matters in which the independent directors are not involved and that none of the relationships requires any additional disclosure.

Mr. Hunter is the former Chairman, President and Chief Executive Officer of Solutia Inc. ("Solutia"). In 2004, Hercules purchased products from Solutia or subsidiaries or affiliates of Solutia in the ordinary course of business, for which it paid Solutia approximately $13.7 million.

Mr. Lipton is President, Chief Executive Officer and a director of NOVA Chemicals Corporation ("NOVA"). In 2004, Hercules purchased products from NOVA or subsidiaries or affiliates of NOVA in the ordinary course of business, for which it paid NOVA approximately $4,200.

Messrs. Wulff, Kennedy and Gerrity are on the Board of Directors of Sunoco Inc. In 2004, Hercules purchased products from Sunoco or subsidiaries or affiliates of Sunoco in the ordinary course of business, for which it paid Sunoco approximately $27.8 million. In 2004, Hercules sold products to Sunoco or subsidiaries or affiliates of Sunoco in the ordinary course of business, for which it received payments from Sunoco totaling approximately $22,600.

Mr. Joyce is on the Board of Directors of Norfolk Southern Corporation ("Norfolk"). In 2004, Norfolk or subsidiaries or affiliates of Norfolk provided services to Hercules in the ordinary course of business, for which it paid Norfolk approximately $304,000.

Mr. Wulff is on the Board of Directors of Moody's Corporation. In 2004, Moody's provided services to Hercules in the ordinary course of business, including ratings of securities issued by Hercules and its subsidiaries, for which Hercules paid Moody's approximately $258,000.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and holders of more than ten percent of our common stock to file with the SEC and the NYSE reports of beneficial ownership and changes in beneficial ownership of the common stock and other equity securities of Hercules within two days of the changes. These persons are required by SEC rules to furnish Hercules with copies of all Section 16(a) forms they file.

Based solely on a review of the copies of those reports furnished to Hercules, we believe that, during 2004, our directors, executive officers and holders of more than ten percent of our common stock complied with all applicable Section 16(a) filing requirements.

The Board of Directors recommends a vote FOR the election of each of the four Hercules director nominees, Ms. Catalano and Messrs. Joyce, Lipton and Wulff.

PROPOSAL NO. 2—Ratification of the Appointment of BDO Seidman, LLP as Hercules' Independent Registered Public Accountants for 2005

As disclosed in our 2003 Proxy Statement and as is embodied in our Corporate Governance Guidelines, the Company has a policy of periodic rotation of our independent registered public accounting firm. In furtherance of such policy, our Audit Committee initiated and led a process to evaluate several qualified international accounting firms as candidates to be our independent registered public accounting firm for 2005. PricewaterhouseCoopers LLP ("PwC") was among the participating candidates. The process resulted in the engagement of BDO Seidman, LLP ("BDO") as Hercules' independent registered public accounting firm for 2005. Representatives of PwC are not expected to attend the Annual Meeting; however, representatives of BDO will attend. Below is additional

11

information on this process, which information was included in a Form 8-K filed by the Company on April 22, 2005.

On April 18, 2005, the Audit Committee dismissed PwC as our independent registered public accounting firm effective upon completion of services related to the review of the Company's financial statements for the first quarter ended March 31, 2005.

PwC's reports on the Company's financial statements for the past two fiscal years did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principle. During the two most recent fiscal years and through April 18, 2005, there have been no disagreements with PwC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of PwC, would have caused PwC to make reference to the subject matter of the disagreement in connection with its reports on the financial statements for such years.

During the two most recent fiscal years and through April 18, 2005, there have been no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K, except that:

- •

- The Company included a disclosure in Item 4. Controls and Procedures, of its Form 10-Q for the quarter ended September 30, 2004 as filed on November 15, 2004 and as amended in a Form 10-Q/A filed on January 7, 2005, that the Company's disclosure controls and procedures were not effective as of September 30, 2004 solely as a result of a material weakness in internal control over financial reporting relating to the calculation of available foreign tax credits and over the tax settlement process. In connection with a restatement of previously issued financial statements, the Company made improvements to its disclosure controls and procedures that effectively remediated the underlying material weakness such that the Company's President and Chief Executive Officer and the Company's Vice President and Chief Financial Officer believed that the Company's disclosure controls and procedures implemented over the tax process, including the collection and analysis of information used to calculate foreign tax credits and the tax settlement process were effective. Accordingly, the material weakness in the tax process was remediated permitting management to conclude that, as of December 31, 2004, the Company's internal control over financial reporting was effective. As reflected in their Report of Independent Registered Public Accounting Firm dated as of March 16, 2005 included in the Company's Annual Report on Form 10-K for the year ended December 31, 2004, PwC stated, in their opinion, management's assessment, included in Management's Report on Internal Control Over Financial Reporting, that the Company maintained effective internal control over financial reporting as of December 31, 2004 based on criteria established inInternal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO"), is fairly stated, in all material respects, based on those criteria. Furthermore, in PwC's opinion, the Company maintained, in all material respects, effective internal control over financial reporting as of December 31, 2004, based on criteria established inInternal Control—Integrated Framework issued by the COSO.

- •

- The Company included a disclosure in Item 9A. Controls and Procedures, of its Form 10-K for the year ended December 31, 2003 as filed on March 15, 2004 and as amended in a Form 10-K/A filed on March 25, 2004, with respect to the accounting for a special pension benefit granted in the quarter ended September 30, 2003. In connection with a restatement of previously issued financial statements, the Company made improvements to its disclosure controls and procedures that effectively remediated the underlying material weakness such that the Company's President and Chief Executive Officer and the Company's Vice President and Controller (Principal Accounting Officer) concluded that the Company's disclosure controls and procedures were effective as of December 31, 2003.

12

- •

- In the second quarter of 2003, the Company implemented the provisions of Statement of Financial Accounting Standards No. 148 ("SFAS No. 148") "Accounting for Stock-Based Compensation—Transition and Disclosure, an amendment of SFAS No. 123." The Company adopted SFAS No. 148 on a prospective basis. During the year-end audit procedures of the Company's stock compensation plans it was noted that the Company continued to account for its employee stock purchase plan under APB 25, "Accounting for Stock Issued to Employees" resulting in an immaterial ($130,000) understatement of its compensation expense during the first three quarters of 2003. The error was corrected in the fourth quarter of 2003.

Hercules provided PwC with a copy of the Form 8-K and requested that Pwc furnish it with a letter addressed to the Securities and Exchange Commission stating whether it agrees with the statements made by the Company in the Form 8-K and, if not, stating the respects in which it does not agree. A letter from PwC, dated as of April 22, 2005, regarding its concurrence with these statements was included as an exhibit to the Form 8-K as filed.

On April 18, 2005, the Audit Committee unanimously voted to engage BDO as Hercules' independent registered public accountant to audit the Company's financial statements and internal control over financial reporting for the year ending December 31, 2005.

Hercules has not consulted with BDO during the two most recent fiscal years and through April 18, 2005 regarding either the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on the financial statements of the Company as well as any matters or reportable events described in Items 304(a)(2)(i) or (ii) of Regulation S-K.

BDO is the fifth largest accounting and consulting organization in the world serving multinational clients through a network comprised of more than 600 member firm offices with over 25,000 employees in 105 countries.

Representatives of BDO will attend the Annual Meeting to answer appropriate questions and make a statement if they choose to do so. The affirmative vote of the majority of Hercules shares present in person or by proxy and entitled to vote at the Annual Meeting is required to approve this proposal. If the appointment is not ratified, the adverse vote will be considered as an indication to the Board that it should consider other independent registered public accounting firms for the following fiscal year.

The appointment of independent registered public accountants is approved annually by our Audit Committee and subsequently submitted by the Board to the shareholders for ratification. The decision of the Audit Committee is based on its review and approval of the audit scope, the types of non-audit services and the estimated fees for the coming year. The Audit Committee also reviews and approves non-audit services to ensure that they will not impair the independence of the accountants. Before requesting that the Board submit the approval of BDO to the shareholders for ratification, the Audit Committee carefully considered that firm's qualifications as independent registered public accountants for Hercules. This included a review of their service proposal as well as their integrity and competence in the fields of accounting and auditing. The Audit Committee has expressed its satisfaction with BDO in all of these respects. For more information, see the "Audit Committee Report."

The Board of Directors recommends a vote FOR ratification of the appointment of BDO Seidman, LLP as Hercules' independent registered public accountants for 2005.

13

OTHER MATTERS

The Board of Directors is not aware of any matters, other than those described above, that will be presented for consideration at the Annual Meeting. If other matters properly come before the Annual Meeting, it is the intention of the persons named on the enclosed proxy card to vote thereon in accordance with their respective best judgment. Moreover, the Board reserves the right to adjourn, postpone, continue or reschedule the Annual Meeting, depending on circumstances and the Board's belief that such adjournments, postponements, continuations or reschedulings would be in the best interests of all Hercules shareholders.

AUDIT COMMITTEE REPORT

The Board of Directors has charged the Audit Committee with a number of responsibilities, including review of the adequacy of Hercules' financial reporting and internal controls over financial reporting. The Audit Committee is directly responsible for the appointment, compensation and oversight of the work of Hercules' independent registered public accountants and has a direct line of communication with the Director, Internal Audit. In accordance with Section 301 of the Sarbanes-Oxley Act of 2002 (the "Act"), the Audit Committee is composed entirely of independent directors as defined by the Hercules Corporate Governance Guidelines and the listing standards of the New York Stock Exchange. The Board of Directors has adopted and reviews at least annually a written Audit Committee charter, a copy of which is posted on Hercules' public website located atwww.herc.com.

The Audit Committee has received from its independent registered public accountants written disclosures and a letter concerning the independent registered public accountants' independence from Hercules, as required by Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees." These disclosures have been reviewed by the Audit Committee and discussed with the independent registered public accountants. The Audit Committee has also considered whether the provision of other services by the independent registered public accountants is compatible with maintaining such accountant's independence.

In the discharge of its responsibilities, the Audit Committee has reviewed and discussed with management and the independent registered public accountants the audited consolidated financial statements for Hercules fiscal year ended December 31, 2004. In addition, the Audit Committee has discussed with the independent registered public accountants matters such as the quality (in addition to acceptability), clarity, consistency and completeness of Hercules' financial reporting, as required by Statement on Auditing Standards No. 61, "Communication with Audit Committees."

Based on these reviews and discussions, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the Hercules 2004 Annual Report on Form 10-K and filed with the SEC.

Audit Committee Financial Expert

In accordance with Section 407 of the Act, the Securities and Exchange Commission issued rules requiring public companies to disclose the identity of their audit committee financial expert. Mr. Duff has been designated by the Board of Directors as the Audit Committee Financial Expert.

14

Fees of Independent Registered Public Accountants

The aggregate fees for professional services rendered for the Company by PricewaterhouseCoopers LLP as of and for the years ended December 31, 2004 and 2003, were:

| | 2004

| | 2003

|

|---|

| | (Dollars in millions)

|

|---|

| Audit | | $ | 7.9 | | $ | 3.8 |

| Audit-related | | | 0.4 | | | 0.4 |

| Tax | | | 0.4 | | | 0.9 |

| All Other | | | 0.0 | | | 0.1 |

| | |

| |

|

| | | $ | 8.7 | | $ | 5.2 |

| | |

| |

|

Audit Fees

Fees billed by our independent registered public accountants for professional services rendered to us in connection with the audit of the Company's financial statements for the years ended December 31, 2004 and 2003, reviews of the financial statements included in the quarterly reports on Form 10-Q that we were required to file during 2004 and 2003 and audits of the Company's internal control over financial reporting as of December 31, 2004 were approximately $7.9 million and $3.8 million, respectively, of which aggregate amounts of $5.4 million and $3.5 million had been billed through December 31, 2004 and 2003, respectively. The increase in audit fees is primarily related to internal control audits performed pursuant to Section 404 of the Sarbanes-Oxley Act of 2002. The Audit Committee approved 100% of the fees for services rendered in 2004 and 2003.

Audit-related Fees

Audit-related fees billed by our independent registered public accountants in 2004 and 2003 were approximately $0.4 million and $0.4 million, respectively. Audit-related fees in 2004 included pre-implementation internal control reviews. Audit-related fees in 2003 related to the acquisition of Quantum Hi-Tech Company Limited and other services. The Audit Committee approved 100% of the fees for services rendered in 2004 and 2003.

Tax Fees

Fees billed by our independent registered public accountants for professional services rendered to us in connection with the preparation and review of U.S. federal, state, local and foreign jurisdiction tax returns and tax audits were approximately $0.4 million and $0.9 million during fiscal years 2004 and 2003, respectively. The Audit Committee approved 100% of the fees for tax services rendered in 2004 and 2003.

All Other Fees

The aggregate fees billed by our independent registered public accountants for professional services rendered to us during 2003, other than the audit, audit-related and tax fees referred to above, were approximately $0.1 million. The Audit Committee approved 100% of the fees for all other services rendered in 2003.

The foregoing report of the Audit Committee does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other of our filings under the Securities Act

15

of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent we specifically incorporate this report by reference therein.

| | | Audit Committee |

|

|

P. Duff (Chair)

J. C. Hunter, III

R. D. Kennedy |

FEES AND SERVICES

The Audit Committee has adopted a policy for the approval of audit and non-audit services. Under this policy, services are segregated into three categories:

- •

- Legally Prohibited/Restricted Services—Those services which our independent registered public accountant may not provide by statute.

- •

- Additional Prohibited Services—Those services which our independent registered public accountant may legally provide, but which we will not obtain from our independent registered public accountant.

- •

- Permitted Services—Those services which our independent registered public accountant may provide if pre-approved by the Audit Committee.

Legally Prohibited/Restricted Services

The independent registered public accountant is prohibited from providing the following non-audit services:

- •

- Bookkeeping or other services related to the accounting records or financial statements of the audit client

- •

- Financial information systems design and implementation

- •

- Appraisal or valuation services, fairness opinions or contribution-in-kind reports

- •

- Actuarial services

- •

- Internal audit outsourcing activities

- •

- Management functions or human resources

- •

- Broker or dealer, investment adviser or investment banking services

- •

- Legal services and expert services unrelated to the audit

- •

- Any other service that the Public Company Accounting Oversight Board determines by regulation is impermissible

Additional Prohibited Services

In addition to the Legally Prohibited/Restricted Services, the Company has decided it will not engage its independent registered public accountant to provide the following services.

- •

- Large-scale Information System Design and Implementation Services

We will prohibit our independent registered public accountant from providing any information system design or implementation services.

- •

- Tax Shelters

Our independent registered public accountant will not be engaged to render tax advice on any "tax shelter" (as currently defined on an ongoing basis by the Internal Revenue Code and Regulations thereunder).

16

Permitted Services

Rule 2-01 of Regulations S-X requires all services (audit and non-audit) that are provided by an audit firm to be pre-approved by the Audit Committee, but the Audit Committee may delegate to one or more members of the Committee the authority to grant pre-approvals.

We believe that, for certain non-audit services, there may be benefits to engaging our independent registered public accountant, as our independent registered public accountant may be best positioned to provide services more efficiently and effectively. Also, due to confidentiality concerns, we may decide engaging our independent registered public accountant firm is preferable to engaging another firm.

The Company has adopted the following policy for audit and non-audit services not prohibited elsewhere in this policy.

Audit and Audit-Related Services

This category comprises those audit and audit-related services that we have traditionally purchased from our external independent registered public accountant. The Company believes that the audit-related services described below are consistent with the independent registered public accountant's role and are either: (i) directly or inherently related to evaluating the Company's underlying internal control structure or financial information affecting the consolidated financial statements; or (ii) directly involved in performing audit or attestation services:

- •

- Services related to SEC filings

- •

- Accounting and financial reporting consultations

- •

- Carve-out audits

- •

- Statutory audits

- •

- Agreed-upon audit procedures performed to comply with a contract between the Company and a third party

- •

- Acquisition and divestiture-related due diligence and transaction services

- •

- Fraud and forensic investigations

- •

- Dispute resolution and litigation support

- •

- Benefit plan audits

The Audit Committee has pre-approved the purchase of this category of services. Individual projects with fees in excess of $100,000 and $500,000 in the aggregate are discussed with and approved by the Committee in advance of the project.

Internal Control-Related Consulting

Given the independent registered public accountant's understanding of the Company and its internal control environment, the Company may engage our independent registered public accountant to assess and recommend improvements as to its internal control structure, procedures or policies. The Company believes its independent registered public accountant often is best positioned to provide these services. However, the Company has specifically precluded its independent registered public accountant from implementing internal controls, policies or procedures.

The Audit Committee has pre-approved the purchase of this category of services. Individual projects with fees in excess of $100,000 are discussed with and approved by the Committee in advance of the project.

Tax-Related Services

It is important to the Company that it be able to engage its independent registered public accountant to provide tax services, with the exception that the independent registered public accountant will not be used to provide advice on any structure that would be classified as a "tax shelter," as discussed above.

17

Tax Services are included in the category of "Permitted Services," which our independent registered public accountant may provide if pre-approved by the Audit Committee. This category of permitted services includes:

- •

- Tax return preparation, review, consultation and assistance

- •

- Tax audit support

- •

- Tax planning on acquisition/divestiture structuring, dividend planning, etc.

- •

- Tax consulting

- •

- Expatriate tax services

- •

- Transfer pricing tax services

The Audit Committee has pre-approved the purchase of a specific set of this category of services. In addition, individual projects with fees in excess of $100,000 and $300,000 in the aggregate are discussed with and approved by the Audit Committee in advance of the project.

These permitted tax services, if required, are reported to the Audit Committee at the regularly scheduled Audit Committee meetings following the decision to purchase the services.

HUMAN RESOURCES COMMITTEE REPORT

The Human Resources Committee (formerly named the Compensation Committee) of the Board of Directors reviews compensation objectives and policies for all employees and sets compensation for Hercules' executive officers, including the individuals named in the table set forth below under "Compensation of Executive Officers." Additionally, the Human Resources Committee is responsible for executive officer succession planning and implementation of development plans applicable to the management ranks of the Company. The policies and plans developed by the Human Resources Committee are approved by the Board of Directors. Administration of the plans is the responsibility of the Human Resources Committee. None of the members of the Human Resources Committee is an officer, employee or former officer or employee of Hercules or its subsidiaries, and each member is independent, as such term is defined in the NYSE Listing Standards. Compensation matters relating to the Chief Executive Officer and executive officers, including the named executive officers, are referred to the Board of Directors for separate approval.

The Hercules Executive Compensation Policy, as established by the Human Resources Committee, is designed to provide a base salary measured at the 50th percentile of chemical companies with revenue approximately the same as that of Hercules or regressed to Hercules' revenue size, adjusted for individual performance. Additionally, the Human Resources Committee and the Board have approved an annual variable compensation plan (the Management Incentive Compensation Plan ("MICP")) targeted to pay at the 50th percentile of these peer group companies when pre-established goals are achieved. Finally, the Long Term Incentive Compensation Plan ("LTICP"), also targeted at the 50th percentile, rewards participants for achieving long term goals through grants of restricted stock. Stock price performance below targeted levels results in a delay of the vesting of the award. Stock price performance above the targeted level results in acceleration of vesting, but not sooner than three years from the date of grant. The total potential value of these three components is then benchmarked against competitive norms for Hercules' industry group with similar revenue at the 50th percentile. Additionally, it is the policy of the Human Resources Committee to recognize extraordinary achievements through special periodic stock-based awards. In arriving at its MICP award decisions for 2004, the Human Resources Committee considered the financial performance (Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA"), Cash Flow and Earnings per Share) of Hercules during the year.

Hercules' compensation components—base salary paid in the form of cash, LTICP and MICP awards—apply to all executive officers. The percentage of each component of the total varies by

18

position with the Chief Executive Officer having the highest equity component percentage and lowest annual base salary component percentage. All salaries are reviewed against pay levels of comparable positions in comparable companies and reviewed for internal consistency. Individual performance, measured in part against pre-established goals, heavily influences base salary. Business or functional unit performance and corporate achievement impacts annual MICP awards, which are modified up or down based on individual performance. Finally, the value of LTICP grants is impacted by market price and Hercules relative stock price performance compared to peer stock price performance over the performance period.