Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

HERCULES INCORPORATED |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

2008

Proxy Statement

Invitation to 2008

Annual Meeting

of Shareholders

Hercules Incorporated, Hercules Plaza, 1313 North Market Street

Wilmington, Delaware 19894-0001 (302) 594-5000

| | | Hercules Incorporated

Hercules Plaza

1313 North Market Street

Wilmington, DE 19894-0001 |

|

|

John K. Wulff

Chairman of the Board |

|

|

Craig A. Rogerson

President and

Chief Executive Officer |

|

|

March 20, 2008 |

Dear Shareholder:

We are pleased to invite you to attend the 2008 Annual Meeting of Shareholders of Hercules Incorporated, scheduled for Thursday, April 17, 2008, at 11:00 A.M., local time, at Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001. Directions to Hercules Plaza are on the following pages.

The items to be considered and voted on at the Annual Meeting are described in the Notice and the Proxy Statement accompanying this letter. Please carefully read these materials and our Annual Report which is enclosed with the Proxy Statement.

It is important that your shares be represented and voted at the Annual Meeting. Accordingly, we encourage you to vote as soon as possible and prior to the Annual Meeting. This will help ensure that your shares will be duly represented whether or not you plan to attend the Annual Meeting.

To vote your shares, you may either (i) complete, sign, date and return the Proxy Card (a postage-prepaid envelope is enclosed), (ii) vote by telephone or (iii) vote by Internet. Procedures for voting by mail, telephone or Internet are on page 3 of the Proxy Statement.

We appreciate your continued interest in and support of Hercules.

| | Sincerely, |

|

|

| | John K. Wulff

Chairman of the Board |

|

|

| | Craig A. Rogerson

President and Chief Executive Officer |

DIRECTIONS TO HERCULES PLAZA

(1313 North Market Street, Wilmington, Delaware 19894-0001)

From Philadelphia, New Jersey and Areas North of Wilmington:

- •

- Take Interstate 95 South to Wilmington (do not take I-495 — follow I-95 signs for Wilmington).

- •

- Take Exit 7B, which is marked Delaware Avenue/Route 52.

- •

- Stay to the left as you come up grade to traffic light. Turn left onto Delaware Avenue and take center lane. There is a sign marked "Business District 52 South."

- •

- You will pass seven streets — Adams, Jefferson, Washington, West, Tatnall, Orange and Shipley. After passing Orange Street, the Hotel DuPont will be on your right. Get into the left lane.

- •

- The next street is Market Street. Turn left.

- •

- Proceed on Market Street crossing over 12th and 13th Streets (traffic lights at each corner). Hercules Plaza is located at 13th Street and will be on your left. Hercules Plaza is a twelve-story granite/glass building with green tinted windows.

If traveling from New Jersey over the Delaware Memorial Bridge:

- •

- Stay to the far left lane as you exit the Delaware Memorial Bridge. Stay left heading toward sign marked Wilmington Delaware Turnpike — Baltimore — 295 - 95 - 495.

- •

- Bear to the right heading for Interstate 95 North.

- •

- Take the center lane as it will narrow to two lanes past Exit 6 (Martin Luther King Boulevard).

- •

- Take Exit 7, Delaware Avenue. Stay to the right as you come up grade to traffic light. You will be on Adams Street — continue straight ahead to a dead end (about 3 blocks) to Delaware Avenue. Turn right onto Delaware Avenue and take the center lane. You will pass under sign marked "Business District 52 South." Pass five streets — Jefferson, Washington, West, Tatnall and Orange.

- •

- After passing Orange Street, the Hotel DuPont will be on your right. Get into the left lane.

- •

- Turn left onto Market Street. Pass 12th and 13th Streets (traffic lights at each). Hercules Plaza is located at 13th Street and will be on your left. Hercules Plaza is a twelve-story granite/glass building with green tinted windows.

From Pennsylvania on I-476 (the Blue Route):

- •

- Take the Blue Route to Interstate 95 South to Wilmington.

- •

- Follow the above directions for traveling from Philadelphia.

From Baltimore, Washington and Areas South of Wilmington:

- •

- Take Interstate 95 North to Wilmington. Take Exit 7, which is marked Delaware Avenue/Route 52.

- •

- Stay to the right as you come up grade to traffic light. You will be on Adams Street — continue straight ahead to a dead end (about 3 blocks) to Delaware Avenue. Turn right on to Delaware Avenue and take the center lane. You will pass under sign marked "Business District 52 South." Pass five streets — Jefferson, Washington, West, Tatnall and Orange.

- •

- After passing Orange Street, the Hotel DuPont will be on your right. Get into the left lane.

- •

- Turn left onto Market Street. Pass 12th and 13th Streets (traffic lights at each). Hercules Plaza is located at 13th Street and will be on your left. Hercules Plaza is a twelve-story granite/glass building with green tinted windows.

From the Wilmington Train (Amtrak) Station:

- •

- The Wilmington Train Station is located between King and French Streets on Front Street.

- •

- Hercules Plaza is located at Market and 13th Streets, 12 blocks north of the Train Station. Cabs are usually available at the Train Station.

- •

- Hercules Plaza is located on the NW corner of Market and 13th Streets. Hercules Plaza is a twelve-story granite/glass building with green tinted windows.

- •

- After you enter the Hercules Plaza building, follow the posted signs to the meeting room located in the Lower Atrium.

Hotel Accommodations

Wilmington has hotels and motels in both the downtown and surrounding areas. For a listing you may want to refer to the Wilmington area website athttp://www.wilmcvb.net/lodging.

Parking Near Hercules Plaza Building

There is a limited number of public parking spaces under the Hercules Plaza building. However, there are public parking garages located across the street from Hercules Plaza between Orange and 12th Streets and on the side of Hercules Plaza between Market and 14th Streets.

Important Note

Please bring photograph identification (e.g., driver's license, passport or other) with you in order to gain admission to the Annual Meeting. If your shares are held in the name of a bank, broker or other nominee and you plan to attend the Annual Meeting, please bring evidence of your ownership of Hercules shares, such as a copy of your broker statement or a copy of the Proxy Card mailed to you by your bank or broker. Cameras, cell phones, pagers, recording equipment and other electronic devices will not be permitted at the Annual Meeting.

* * * * * * * * * * *

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR OUR 2008 ANNUAL MEETING:

Hercules Proxy Statement for the 2008 Annual Meeting of Shareholders and the Annual Report on Form 10-K for the year ended December 31, 2007, are available via the Internet athttp://bnymellon.mobular.net/bnymellon/hpc.

| | | Hercules Incorporated

Hercules Plaza

1313 North Market Street

Wilmington, DE 19894-0001 |

March 20, 2008

| To: | | Shareholders of Hercules Incorporated |

Subject: |

|

Notice of 2008 Annual Meeting of Shareholders |

The 2008 Annual Meeting of Shareholders (the "Annual Meeting") is scheduled for Thursday, April 17, 2008, at 11:00 A.M., local time, at Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001 (telephone: 800-441-9274) to consider and take action on the following proposals:

- 1.

- Election or re-election of each of the following four (4) director nominees: Allan H. Cohen, Burton M. Joyce, Jeffrey M. Lipton and John K. Wulff, each for a new one-year term expiring at the 2009 Annual Meeting of Shareholders (Proposal No. 1);

- 2.

- Approval of the provisions of the Amended and Restated Hercules Incorporated Annual Management Incentive Compensation Plan (Proposal No. 2); and

- 3.

- Ratification of the appointment of BDO Seidman, LLP as Hercules' independent registered public accountants for 2008 (Proposal No. 3).

Shareholders of record as of the close of business on March 3, 2008, will be entitled to vote at the Annual Meeting. We encourage you, whether or not you plan to attend the Annual Meeting, to vote by Proxy Card, telephone or Internet in advance of the Annual Meeting. You may attend the Annual Meeting and change your vote at that time if you wish to do so.

| | | By order of the Board of Directors |

|

|

|

|

|

Israel J. Floyd

Corporate Secretary

and General Counsel |

TABLE OF CONTENTS

-i-

-ii-

PROXY STATEMENT

Hercules Incorporated

Hercules Plaza

1313 North Market Street

Wilmington, DE 19894-0001

THE 2008 ANNUAL MEETING OF SHAREHOLDERS

The accompanying proxy is being solicited on behalf of the Board of Directors of Hercules Incorporated (the "Board") for use at the 2008 Annual Meeting of Shareholders to be held at Hercules Plaza on Thursday, April 17, 2008 at 11:00 A.M., local time, and at any adjournment, postponement, continuation or rescheduling of the Annual Meeting.

This Proxy Statement and the accompanying Proxy Card are being distributed on or about March 20, 2008. A copy of the Hercules 2007 Annual Report is enclosed with this Proxy Statement.

Who is Entitled to Vote

Shareholders of record as of the close of business on March 3, 2008, which is the Record Date, will be entitled to one vote for each share of Hercules common stock registered in the shareholder's name. Shareholders of record will retain their voting rights even if they sell their Hercules shares after the Record Date. As of the Record Date, there were 113,854,449 shares of Hercules common stock outstanding.

How You May Vote

You may vote by completing and mailing the enclosed Proxy Card or you may vote by telephone or by Internet.

- •

- To vote your proxy by mail, mark your selections on the enclosed Proxy Card, date and sign your name exactly as it appears on your Proxy Card, and return your Proxy Card in the enclosed envelope.

- •

- To vote by telephone, please dial 1-866-540-5760, have your Proxy Card in hand when you call and follow the voice prompts.

- •

- To vote by Internet, please log on to the Internet athttp://www.proxyvoting.com/hpc and have your Proxy Card in hand when you access the website.

If your Hercules shares are held in the name of a bank, broker or nominee (e.g. custodians, fiduciaries or trustees), then only your bank, broker or nominee can sign a Proxy Card with respect to your shares and only upon specific instructions from you. Therefore, if your bank, broker or nominee has not sent you a Proxy Card and requested your instructions, then please contact your bank, broker or nominee. You should provide instructions to your bank, broker or nominee for a Proxy Card to be signed representing your shares.

1

Annual Meeting Admission Procedures

Please vote prior to the Annual Meeting, whether or not you plan to attend the Annual Meeting. However, if you are a shareholder of record and plan to attend the Annual Meeting, please bring with you valid government-issued photographic identification (such as a driver's license or passport) in order to gain admission to the Annual Meeting. If your shares are held in the name of a bank, broker or nominee, you will have to bring evidence of your ownership of Hercules shares as of the Record Date, in addition to valid government-issued photographic identification, if you wish to attend the Annual Meeting. Examples of proof of ownership include the following:

- •

- a letter from your bank, broker or nominee stating that you owned your shares as of the Record Date;

- •

- an account statement from your bank, broker or nominee indicating that you owned your shares as of the Record Date; or

- •

- a copy of the voting instruction card provided by your bank, broker or nominee indicating that you owned your shares as of the Record Date.

If you are a proxy holder for a Hercules shareholder, to gain entry to the Annual Meeting you must bring:

- •

- a validly executed proxy naming you as the proxy holder, signed by a Hercules shareholder who owned Hercules shares as of the Record Date;

- •

- valid government-issued photographic identification (such as a driver's license or passport); and

- •

- if the shareholder whose proxy you hold was not a record holder of Hercules shares as of the Record Date, proof of the shareholder's ownership of Hercules shares as of the Record Date, in the form of a letter or statement from a bank, broker or nominee or the voting instruction card provided by the bank, broker or nominee in each case, indicating that the shareholder owned those shares as of the Record Date.

If you sign your Proxy Card and do not indicate your vote on any one or more of the proposals, you will give authority to each of Craig A. Rogerson, our President and Chief Executive Officer, Allen A. Spizzo, our Vice President and Chief Financial Officer, and Israel J. Floyd, our Corporate Secretary and General Counsel, to vote on such proposal(s) and any other matter that may arise at the Annual Meeting. Messrs. Rogerson, Spizzo and Floyd each intend to use that authority to vote as follows:

- •

- FOR the election of each of the four director nominees (Proposal No. 1);

- •

- FOR the approval of the Amended and Restated Hercules Incorporated Annual Management Incentive Compensation Plan (the "MICP") (Proposal No. 2); and

2

- •

- FOR the ratification of the appointment of BDO Seidman, LLP as Hercules' independent registered public accountants for 2008 (Proposal No. 3).

Vote Required and Voting Procedures

Under Hercules' Revised and Amended By-Laws (the "By-Laws"), the holders of record of a majority of the total number of shares of Hercules common stock outstanding and entitled to vote must be present, in person or represented by proxy, in order for there to be a quorum at the Annual Meeting. Votes will be counted by our transfer agent. Pursuant to applicable rules of the Securities and Exchange Commission (the "SEC"), boxes and a designated blank space are provided on the Proxy Card for you to mark if you wish:

- •

- to vote "FOR" or "WITHHOLD" your vote from one or more of the director nominees (see Proposal No. 1);

- •

- to vote "FOR" or "AGAINST," or to "ABSTAIN" from voting on the approval of the MICP (see Proposal No. 2); or

- •

- to vote "FOR" or "AGAINST" or to "ABSTAIN" from voting on the ratification of the appointment of BDO Seidman, LLP as Hercules' independent registered public accountants for 2008 (see Proposal No. 3).

If you vote by telephone, please dial 1-866-540-5760, enter the control number indicated on your Proxy Card and follow the voice prompts. If you vote by Internet, please log on tohttp://www.proxyvoting.com/hpc and have your Proxy Card in hand when you access the website.

Pursuant to Hercules' By-Laws, if a quorum is present:

- •

- the election of directors (Proposal No. 1) by shareholders requires the affirmative vote of the holders of a majority of the total number of issued and outstanding shares of Hercules common stock and entitled to vote;

- •

- approval of the MICP (Proposal No. 2) requires the affirmative vote of the holders of a majority of the total number of issued and outstanding shares of Hercules common stock present, in person or by proxy, and entitled to vote; and

- •

- ratification by shareholders of the appointment of BDO Seidman, LLP as Hercules' independent registered public accountants for 2008 (Proposal No. 3) requires the affirmative vote of the holders of a majority of the total number of issued and outstanding shares of Hercules common stock present, in person or by proxy, and entitled to vote.

Abstentions, votes withheld in connection with the election of one or more nominees for director and broker non-votes, which occur when brokers that hold shares in street name do not receive instructions from the beneficial owners of those shares, will be counted in determining whether a quorum is present at the Annual Meeting but will not be counted as votes for or against any of the proposals. Therefore, such votes will have the same effect as

3

votes against each of the proposals and will make it more difficult to obtain the required approval on each proposal.

Revocation of Proxy

A shareholder giving a proxy has the power to revoke such proxy at any time before the voting at the Annual Meeting by submitting a written revocation or a duly executed proxy bearing a later date. A written revocation must be received by Hercules Incorporated, Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001, Attention: Corporate Secretary by mail or by facsimile at (302) 594-7315, no later than the beginning of voting at the Annual Meeting. In addition, any shareholder who attends the Annual Meeting in person may vote by ballot at the Annual Meeting, thereby canceling any proxy previously given, or may give notice of revocation to the inspector of election. However, merely attending the Annual Meeting without voting will not revoke any previously executed proxy.

Hercules Incorporated Savings and Investment Plan

If you are a participant in the Hercules Incorporated Savings and Investment Plan ("SIP"), you will receive a separate packet of information about how to provide voting instructions to the SIP trustee. The SIP trustee will vote the Hercules shares that are allocable to your account under the SIP in accordance with your instructions unless the SIP trustee determines that it is legally obligated to do otherwise. If you do not provide the SIP trustee with instructions, the SIP trustee will vote your Hercules shares in proportion to the manner in which it votes the shares allocable to other SIP participants who provided instructions unless the SIP trustee determines that it is legally obligated to do otherwise.

Annual Report

Our 2007 Annual Report is enclosed with this Proxy Statement. Shareholders of record who did not receive the Annual Report may request a copy free of charge by contacting Helen Calhoun, Hercules Incorporated, Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001, facsimile (302) 594-6909, telephone (302) 594-5129 or e-mail at hcalhoun@herc.com. The Annual Report can also be found on websiteswww.herc.com andhttp://bnymellon.mobular.net/bnymellon/hpc.

Shareholder Proposals

To be included in our 2009 Proxy Statement, shareholder proposals must be submitted in writing and received by Israel J. Floyd, Corporate Secretary and General Counsel, Hercules Incorporated, Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001, no later than November 19, 2008 (or, if the date of the 2009 Annual Meeting is changed by more than 30 days from the date of the 2008 Annual Meeting, a reasonable time before Hercules begins to print and mail its proxy materials). Upon receipt of a shareholder proposal, we will determine whether or not to include such proposal in our 2009 Proxy Statement in accordance with applicable law.

Shareholder proposals submitted after November 19, 2008 will not be included in our 2009 Proxy Statement but may be presented at the 2009 Annual Meeting. However, if any

4

shareholder wishes to present a proposal for the 2009 Annual Meeting that is not included in our 2009 Proxy Statement and fails to submit that proposal on or before February 2, 2009, then the persons named as proxies in the Proxy Card accompanying our 2009 Proxy Statement will be allowed to use their discretionary voting authority when the proposal is raised at the 2009 Annual Meeting, without any discussion of the matter in our 2009 Proxy Statement.

Nomination of Directors

Until our 2010 Annual Meeting, a class of directors is elected to the Board each year at the annual meeting. The Board is responsible for filling vacancies on the Board that may occur at any time during the year, and for nominating director nominees to stand for election at the annual meeting. The Corporate Governance, Nominating and Ethics Committee of the Board of Directors ("Governance Committee") reviews potential director candidates and recommends potential director candidates to the full Board. Director candidates may be identified by current directors and officers of Hercules, as well as by shareholders. The Governance Committee is comprised entirely of independent directors, as defined in the New York Stock Exchange Listing Standards. Depending upon the then existing circumstances, the Governance Committee may utilize the services of director search firms and/or recruiting consultants to assist in identifying and screening potential candidates. The Governance Committee has an extensive diligence process for reviewing potential candidates, including an assessment of each candidate's education, experience, independence and other relevant factors, as described under "The Board — Director Qualifications" in Hercules' Corporate Governance Guidelines (which can be found on our website atwww.herc.com). The Board reviews and has final approval of all potential director candidates being recommended to the shareholders for election.

The Governance Committee seeks nominees who have the highest personal and professional integrity, who have demonstrated exceptional ability and judgment and who would be most effective, in conjunction with the other nominees and members of the Board, in collectively serving the long-term interests of the shareholders and Hercules. The Governance Committee considers potential director candidates recommended by Hercules' shareholders. Nominations from shareholders for the election of directors, which are in compliance with all applicable laws and regulations and which are properly submitted in writing, will be referred to the Governance Committee for consideration.

Shareholder Nomination of Directors

A shareholder may recommend any person as a nominee for director of Hercules for consideration by the Governance Committee by submitting the name and supporting information for each person in writing to the Governance Committee of the Board of Directors, Hercules Incorporated, Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001. Recommendations must be in writing and received by November 19, 2008 for our 2009 Annual Meeting, and should be accompanied by:

- •

- the name, residence and business address of the nominating shareholder;

- •

- a representation that the shareholder is a record holder of Hercules stock or holds Hercules stock through a bank, broker or other nominee and the number of shares held;

5

- •

- information regarding each nominee which would be required to be included in a proxy statement;

- •

- a description of any arrangements or understandings between and among the shareholder and each and every nominee; and

- •

- the written consent of each nominee to serve as a director, if elected.

No nominations were received from shareholders for the 2008 Annual Meeting.

Shareholder and Interested Party Communication with the Board of Directors

The Board provides a process for shareholders and interested parties to send communications to the Board. Shareholders and interested parties may communicate with any of Hercules' directors, any Board Committee chairperson, the non-management directors as a group or the full Board by writing to them in care of Hercules Incorporated, Attention: Corporate Secretary, Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001. Communications received by the Corporate Secretary for any Hercules director are forwarded directly to the director. If the communication is addressed to the Board and no particular director is named, the communication will be forwarded, depending on the subject matter, to the Chairman, the appropriate Board Committee chairperson, all non-management directors, or all directors.

Hercules' Website

Access to information on our website (www.herc.com) is free of charge (except for any Internet provider or telephone charges). We provide access through our website to all SEC filings submitted by Hercules, as well as to information relating to corporate governance. Copies of the documents found on our website include the following: the Audit Committee Charter; the Human Resources Committee Charter; the Governance Committee Charter; the Directors Code of Business Conduct and Ethics; the Corporate Governance Guidelines; the Business Practices Policy; the Code of Ethics for Senior Financial Executives; the Certificate of Incorporation; and the By-Laws. Paper copies of such documents may be obtained free of charge by contacting Hercules Incorporated, Hercules Plaza, 1313 North Market Street, Wilmington, Delaware 19894-0001, Attention: Corporate Secretary, telephone (800) 441-9274. Hercules will post on its website any waivers to the Directors Code of Business Conduct and Ethics and to the Code of Ethics for Senior Financial Executives, that are required to be disclosed by applicable law and the New York Stock Exchange Listing Standards. Information contained on Hercules' website is not part of this Proxy Statement.

Method and Cost of Proxy Solicitation

Proxies may be solicited, without additional compensation, by directors, officers or employees of Hercules by mail, telephone, telegram, Internet, in person or otherwise. Hercules will bear the costs of the solicitation of proxies, which may include the cost of preparing, printing and mailing the proxy materials. In addition, Hercules will request banks, brokers and nominees (e.g. custodians, fiduciaries or trustees) to forward proxy materials to the beneficial owners of common stock and obtain their voting instructions. Hercules will

6

reimburse those firms for their expenses in accordance with the rules of the SEC and the New York Stock Exchange.

Householding of Proxy Materials

Certain shareholders who share the same address may receive only one copy of the Proxy Statement and the Company's 2007 Annual Report to Shareholders in accordance with a notice delivered from such shareholders' bank, broker or other holder of record, unless the applicable bank, broker or other holder of record received contrary instructions. This practice, known as "householding," is designed to reduce printing and postage costs. Shareholders owning their shares through a bank, broker or other holder of record who wish to either discontinue or commence householding may request or discontinue householding, or may request a separate copy of this Proxy Statement or the 2007 Annual Report, either by contacting their bank, broker or other holder of record at the telephone number or address provided in the above referenced notice, or contacting the Company by telephone at (800) 441-9274 or in writing at Hercules Plaza, 1313 North Market Street, Wilmington, DE 19894-0001, Attention: Corporate Secretary. Shareholders who are requesting to commence or discontinue householding should provide their name, the name of their broker, bank or other record holder and their account information.

Declassification of Our Board

From 1986 until 2007, our governing documents provided that our Board was classified into three classes, with each class being elected to a three-year term. In 2007, the Shareholders approved amendments to the Certificate of Incorporation and the By-Laws including a three-year process to declassify the Board. Starting with the election of directors at this 2008 Annual Meeting, the nominees for director positions will be nominated to serve one-year terms and until their successors are duly elected and qualified. Accordingly, at this meeting, the nominees, including directors whose prior three-year terms are expiring at this Annual Meeting, will be elected for a one-year term. At the 2009 Annual Meeting, all director nominees, including those whose prior three-year term will expire at the 2009 Annual Meeting, plus the directors elected at this 2008 Annual Meeting, will have their terms expire and will be subject to re-election, if nominated, for an additional one-year term. At the 2010 Annual Meeting, the entire slate of the Board nominees will be nominated to be elected for a one-year term.

PROPOSAL NO. 1 — Election of Hercules Directors

Our Certificate of Incorporation and By-Laws provide that each director shall serve for a one-year term and until his successor is elected and qualified or until his earlier death, resignation or removal; provided, however, that each director elected for a term scheduled to expire in 2008, 2009 or 2010 shall complete such elected term unless such director resigns from or otherwise leaves the Board of Directors prior to completion of such elected term. With the exception of Mr. Cohen, who was elected to the Board in February 2008, directors elected prior to the 2008 Annual Meeting were elected to serve for three-year terms. Pursuant to the authority granted to the Board in our Certificate of Incorporation, the Board has fixed the number of directors at ten (10), of which four (4) directors have a term that expires in

7

2008 (i.e., Allan H. Cohen, Burton M. Joyce, Jeffrey M. Lipton and John K. Wulff), three (3) directors have a term that expires in 2009 (i.e., Anna C. Catalano, Thomas P. Gerrity and Joe B. Wyatt), and three (3) directors have a term that expires in 2010 (i.e., John C. Hunter, III, Robert D. Kennedy and Craig A. Rogerson).

At the Annual Meeting, four directors are to be elected, and if elected, their respective terms will expire at the 2009 Annual Meeting. The Board has nominated for election at the Annual Meeting Messrs. Cohen, Joyce, Lipton and Wulff, each of whom has agreed to serve as a director and has consented to being named in this Proxy Statement.

It is intended that the shares represented by the accompanying proxy will be voted for the election of Messrs. Cohen, Joyce, Lipton and Wulff. If for any reason any nominee should be unavailable to serve as a director at the time of the Annual Meeting, a contingency which we do not expect as of the date of this Proxy Statement, the shares represented by the accompanying proxy may be voted for the election of such other person as may be determined by the holders of the proxy, unless the proxy withholds authority to vote for all director nominees. Pursuant to our By-Laws, a majority vote of the total number of shares of Hercules common stock issued and outstanding is required to elect each director.

Hercules Board of Directors

Nominees for Directors for Terms Ending in 2008

Allan H. Cohen — Director since 2008

Allan H. Cohen — Director since 2008

Dr. Cohen was first elected to our Board of Directors on February 21, 2008. He was elected by the Board of Directors. Dr. Cohen, age 61, was, until August 2007, a Managing Director with First Analysis Corporation, a research driven investment organization, where he was employed for fifteen years. He continues as a co-manager of the general partner of The First Analysis Private Equity Fund IV, L.P. and on the Boards of Directors of two First Analysis private equity portfolio companies, MCubed Technologies, Inc. and Kelatron Corporation. Since August 2007, he has joined the Boards of Directors of Intertape Polymer Group, Inc., Doe and Ingalls Management LLC, and IGI Holding Corporation. Prior to his entry into the financial services industry in 1988, he held executive and senior management positions at The Valspar Corporation and The Enterprise Companies (a unit of Insilco), and planning and chemical research management positions with The Sherwin-Williams Company and Champion International Corp. Dr. Cohen holds a Ph.D. in Chemistry from Northwestern University and an M.B.A. from The University of Chicago.

8

Burton M. Joyce — Director since 2005

Burton M. Joyce — Director since 2005

Mr. Joyce, age 66, is the retired Chairman of the Board of Directors of IPSCO Inc., a leading steel producer. He held this position from 2000 until 2007 and was a member of the Board of Directors from 1993 to 2007. Previously, Mr. Joyce was with Terra Industries, Inc., where he served as Vice Chairman (2001-2003), President and Chief Executive Officer (1991-2001), Chief Operating Officer (1987-1991) and Chief Finance Officer (1986-1987). Mr. Joyce also serves on the Board of Directors of Norfolk Southern Corporation.

Jeffrey M. Lipton —Director since 2001

Jeffrey M. Lipton —Director since 2001

Mr. Lipton, age 65, is the President and Chief Executive Officer and a Director of NOVA Chemicals Corporation. He joined NOVA in 1993 after a 29-year career with the DuPont Company, where he held a number of management and executive positions. He is a member of the United States Steel Corporation Board of Directors and Chair of its Audit Committee. He is currently a member of the Board of Directors of the Canadian Council of Chief Executives and the American Chemistry Council. He is a past Chairman of the Board of Directors of the American Chemistry Council and the American Section of the Society of Chemical Industries.

John K. Wulff —Director since 2003

John K. Wulff —Director since 2003

Mr. Wulff, age 59, is the non-executive Chairman of the Board, a position he has held since December 2003. He was first elected as a director in July 2003 and served as Interim Chairman from October 2003 to December 2003. He served as a member of the Financial Accounting Standards Board from July 2001 until June 2003. From January 1996 to March 2001, he was the Chief Financial Officer of Union Carbide Corporation. He is a member of the Board of Directors of Sunoco, Inc., Moody's Corporation, Federal National Mortgage Association ("Fannie Mae") and Celanese Corporation.

9

Hercules Board of Directors

Directors Continuing in Office until 2009

Anna C. Catalano — Director since 2005

Anna C. Catalano — Director since 2005

Ms. Catalano, age 48, is the former Group Vice President Marketing for BP plc. Ms. Catalano held a number of executive and senior management positions during her 23 years with Amoco (which merged with BP plc in 1998), particularly in the areas of global sales and marketing. Ms. Catalano serves on the Board of Directors of SSL International Plc where she serves on the Remuneration and Audit Committees, and is a member of the Board of Directors of Willis Group Holdings where she serves on the Corporate Governance and Nominating Committee. She is also a member of the Board of Gulf Coast Chapter for Juvenile Diabetes Research Fund where she serves as strategic champion.

Thomas P. Gerrity —Director since 2003

Thomas P. Gerrity —Director since 2003

Dr. Gerrity, age 66, is the Joseph Aresty Professor of Management and Dean Emeritus at the Wharton School of the University of Pennsylvania. He served as the 11th Dean of the Wharton School from 1990 to 1999. Prior to Wharton, he was the founder and Chief Executive Officer for 20 years of the Index Group, a leading consulting firm in business reengineering and information technology strategy. Dr. Gerrity currently serves on the Board of Directors of PharMerica Corporation, Sunoco, and Internet Capital Group. He also serves as a member of the MIT Corporation, which is the Board of Trustees of the Massachusetts Institute of Technology. He is a Trustee of the Baldwin School. Until December 31, 2007, Dr. Gerrity was a Member of the Board of Directors of Fannie Mae and served as the Chair of Fannie Mae's Audit Committee from January 1999 until May 2006, when he stepped down from the Committee. Fannie Mae restated its audited financial statements for certain periods during which Dr. Gerrity was Chair of the Audit Committee. For additional information, see Fannie Mae's reports filed with the SEC.

10

Joe B. Wyatt —Director since 2001

Joe B. Wyatt —Director since 2001

Mr. Wyatt, age 72, is Chancellor Emeritus of Vanderbilt University in Nashville, Tennessee. He served as Vanderbilt's sixth Chancellor and Chief Executive Officer for 18 years, beginning in 1982. From 1972 to 1982, he was a member of the faculty and administration at Harvard University. He is Chairman of the Board of Directors of the Universities Research Association Inc. of Washington, D.C., and a director of the EAA Aviation Foundation, Ingram Micro, Inc. (where he is Chairman of the Audit Committee) and El Paso Corporation (where he is Chairman of the Compensation Committee), and he is a Principal of the Washington Advisory Group, LLC in Washington, D.C.

Hercules Board of Directors

Directors Continuing in Office until 2010

Craig A. Rogerson — Director since 2003

Craig A. Rogerson — Director since 2003

Mr. Rogerson, age 51, is President and Chief Executive Officer of Hercules. He joined Hercules in 1979 in the firm's Water Management Chemicals Division and progressed in Hercules to Vice President and General Manager of the Fibers Division in 1996. In April 1997, Mr. Rogerson joined Wacker Silicones Corporation, where he served as President and Chief Executive Officer. In May 2000, Mr. Rogerson rejoined Hercules as Vice President, Business Operations, BetzDearborn Division. In August 2000, Mr. Rogerson was promoted to Vice President and General Manager, BetzDearborn Division. In April 2002, he was promoted to President, FiberVisions; President, Pinova; and Vice President, Global Procurement. In October 2003, Mr. Rogerson was named Acting President and Chief Operating Officer of Hercules. He assumed his current position in December 2003. He is on the Board of Directors of PPL Corporation, the Delaware Business Roundtable, First State Innovation and the American Chemistry Council.

11

John C. Hunter, III —Director since 2002

John C. Hunter, III —Director since 2002

Mr. Hunter, age 61, is the former Chairman, President and Chief Executive Officer of Solutia Inc., a specialty chemicals company created in 1997 as a spin-off from the Monsanto Company. Mr. Hunter joined Monsanto in 1969 and held a number of executive and senior management positions until his retirement in 2004. He is a member of the Board of Directors of the Penford Corporation and Energizer Holdings, Inc.

Robert D. Kennedy —Director since 2001

Robert D. Kennedy —Director since 2001

Mr. Kennedy, age 75, held a number of executive and senior management positions with Union Carbide Corporation, including Chairman, Chief Executive Officer and President. He retired as Chairman from Union Carbide in 1995 after a career that spanned 40 years. He retired as a director of Sunoco Inc. and International Paper in 2005. He is a director of Blount International and on the Advisory Board of RFE Investment Associates.

The Board currently consists of ten directors. Ms. Catalano and Messrs. Cohen, Gerrity, Hunter, Joyce, Kennedy, Lipton, Wulff and Wyatt have been determined by the Board to be independent under the New York Stock Exchange Listing Standards and the standards set forth in the Board's Corporate Governance Guidelines. Any changes to the Board's standards will be reflected in such Corporate Governance Guidelines as posted on Hercules' website (www.herc.com).

Board's Standards for Determining Director Independence

Below is a general description of the Board's standards for determining director independence. The full text of such standards is set forth in the Board's Corporate Governance Guidelines on Hercules' website atwww.herc.com.

All members of the Board shall be independent, except that up to two (2) directors may be members of management, including the Chief Executive Officer. A director is considered "independent" only when the Board has affirmatively determined that the director has no material relationship with the Company or any entity owned or controlled by the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company or any entity owned or controlled by the Company), following a review of all relevant information and factors the Board deems appropriate, and a recommendation by the Governance Committee. Among others, the Board recognizes that material relationships can include commercial, industrial, banking, consulting, legal,

12

accounting, charitable and familial relationships. However, as the key concern is independence from management, the ownership of a significant amount of stock, by itself, shall not be considered a bar to an independence finding (except as discussed below in connection with the Audit Committee).

The Governance Committee is responsible for reviewing the independence of the members of the Board and Board Committees on a periodic basis (but at least annually), as well as any relationships directors may have with the Company and/or its subsidiaries or affiliates or otherwise that may reasonably create the appearance of non-independence. The Company shall disclose each determination of an "independent director" in its annual proxy statement.

Without limiting the information and factors that the Board may review and consider, a director shall meet the criteria for independence established in applicable laws, rules and regulations concerning independence, including those of the SEC and of the New York Stock Exchange. However, a director shall not be considered to be independent in the following cases:

- •

- the director is, or within the last three (3) years has been, an employee* of the Company;

- *

- The New York Stock Exchange provides that employment as an interim executive officer does not, in and of itself, disqualify a director from being considered independent following such employment.

- •

- an immediate family member of the director is, or has been within the last three (3) years, an executive officer† of the Company;

- †

- "Executive Officer" has the meaning ascribed to such term in Section 16a-1(f) of the Securities Exchange Act of 1934.

- •

- the director is a current partner or employee of a firm that is the Company's internal or external auditor;

- •

- an immediate family member of the director is a current partner of a firm that is the Company's internal or external auditor;

- •

- an immediate family member of the director is a current employee of the Company's internal or external auditor and participates in the firm's audit, assurance or tax compliance (but not tax planning) practice;

- •

- the director or an immediate family member was within the last three years a partner or employee of a firm that is the Company's internal or external auditor and personally worked on the Company's audit within that time;

- •

- the director or an immediately family member of the director is, or has been within the last three (3) years, an executive officer of another company where any of the Company's present executive officers at the same time serves or served on that other company's compensation committee;

13

- •

- the director is a current employee, or an immediate family member of the director is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company's consolidated gross revenues; and

- •

- the director or an immediate family member of the director has received during any twelve-month period within the last three years more than $100,000 in direct compensation from the Company (other than in director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service) and compensation received by an immediate family member for service as a non-executive employee and compensation received by a director for former service as an interim executive officer of the Company).

An "immediate family member" includes a person's spouse, parents, children, siblings, mothers and fathers-in-law, sons and daughters-in-law, brothers and sisters-in-law, and anyone (other than domestic employees) who shares such person's home.

For the purposes of service on the Audit Committee, a director will not be considered "independent," unless, in addition to meeting the above criteria and such other qualifications as may be required by the Board, he or she (A) does not receive, directly or indirectly, any consulting, advisory, or other compensatory fee from the Company or any of its subsidiaries, and (B) is not an affiliate of the Company or any of its subsidiaries. The foregoing shall be interpreted in accordance with, and shall be subject to the exceptions provided under, Rule 10A(m) promulgated under the Securities Exchange Act of 1934, as amended.

Board Committees

A general description of the functions of the Board Committees is set forth below. The respective charters of the Audit Committee, the Human Resources Committee and the Governance Committee are available on our website atwww.herc.com.

Audit Committee. Monitors the integrity of the financial statements, financial reporting process and systems of internal accounting and financial controls of Hercules, engages Hercules' independent registered public accountants and monitors their qualifications, independence and performance. Also, the Audit Committee has oversight responsibility for the performance of Hercules' internal audit function and compliance with legal and regulatory requirements, including Hercules' disclosure controls and procedures. All members of the Audit Committee are independent as defined under relevant SEC rules and the New York Stock Exchange Listing Standards. The report of the Audit Committee is included in this Proxy Statement. In addition, the Audit Committee meets in regularly scheduled separate private sessions (without the Chief Executive Officer or other Hercules personnel) with management (including the Chief Financial Officer), the independent registered public accountant and the head of the internal audit function.

14

Governance Committee. Takes a leadership role in shaping Hercules' corporate governance policies and practices, including recommending Corporate Governance Guidelines to the Board and monitoring Hercules' compliance with these policies and the Guidelines. Also, the Governance Committee is responsible for identifying individuals qualified to be Board members and recommending to the Board the director nominees for the next annual meeting of shareholders. In addition, the Governance Committee leads the Board in its annual review of the performance of the Board and its committees, has oversight of management's succession planning and recommends to the Board director candidates for each Board committee. It also has oversight responsibility for legal and regulatory compliance matters (other than those matters relating to accounting, auditing, financial reporting and/or internal controls). All members of the Governance Committee are independent as defined under relevant SEC rules and the New York Stock Exchange Listing Standards.

Human Resources Committee. Responsible for determining the compensation of the Chief Executive Officer and all of the executive officers, approving and evaluating all compensation plans, policies and programs as they affect the Chief Executive Officer and executive officers as well as all other programs for all employees. The policies and plans developed by the Human Resources Committee are approved by the Board. All members of this committee are independent directors as defined under relevant SEC rules and the New York Stock Exchange Listing Standards. The report of the Human Resources Committee on the inclusion of Compensation Discussion and Analysis in this Proxy Statement is included in this Proxy Statement.

Emergency Committee. Has limited powers to act on behalf of the Board whenever the Board is not in session, and meets only as needed and acts only by unanimous vote. If any non-employee director wants a matter to be addressed by the Board rather than the Emergency Committee, then the matter is submitted to the Board. All members of the Board attending a meeting of the Emergency Committee are members of the Emergency Committee for the purposes of such meeting.

Finance Committee. Reviews Hercules' financial affairs. The Finance Committee has full and final authority on certain financial matters. It also serves as a named fiduciary for all of Hercules' employee benefit plans.

Responsible Care Committee. Reviews Hercules' policies, programs and practices on Safety, Health, Environment and Regulatory Affairs programs, plant and facility security issues, community affairs and university relations.

15

The following chart shows the respective membership and number of meetings held in 2007 for each of our standing Board Committees.

Director

| | Audit

Committee

| | Human

Resources

Committee

| | Emergency

Committee

| | Finance

Committee

| | Governance

Committee

| | Respon-

sible Care

Committee

|

|---|

| Anna C. Catalano | | | | X | | X | | X | | | | |

| Thomas P. Gerrity | | | | X | | X | | X | | | | |

| John C. Hunter, III | | X | | | | X | | C | | X | | |

| Burton M. Joyce | | C | | | | X | | | | | | X |

| Robert D. Kennedy | | X | | | | X | | | | X | | C |

| Jeffrey M. Lipton | | | | C | | X | | | | X | | X |

| Craig A. Rogerson | | | | | | C | | | | | | |

| John K. Wulff | | | | X | | X | | X | | | | X |

| Joe B. Wyatt | | | | X | | X | | | | C | | X |

| Number of Meetings in 2007 | | 13 | | 3 | | 0 | | 4 | | 6 | | 4 |

C = Chairperson

The Board held nine meetings in 2007. During 2007, the directors attended at least 96% of the aggregate number of meetings of the Board and 95% of the aggregate number of meetings of committees of the Board on which they served during the time for which they served. In 2007, eight out of nine directors attended the Annual Meeting. Directors are expected to attend the Annual Meeting, as well as regular Board and committee meetings, and to spend the time needed and meet as frequently as necessary to properly fulfill their responsibilities.

Executive and Independent Directors Sessions

As the Board deems appropriate, Board meetings include an executive session of all directors and the Chief Executive Officer. In addition, the Board meets in regularly scheduled independent directors' sessions without the Chief Executive Officer or other Hercules personnel. The Chairman of the Board, currently Mr. Wulff, presides over the executive sessions and the independent directors' sessions but may delegate authority to any Board Committee Chair with respect to matters within the responsibility of a particular Board Committee.

Compensation of Directors

Please see the disclosure below, under the heading "Director Compensation" for a description of the compensation we pay to our directors.

Certain Relationships and Related Person Transactions

We have relationships with many businesses, including the entities referred to below with which some of our directors are involved. Our relationships with these entities existed before the related director joined our Board. We believe that all of the transactions described below were entered into on commercially reasonable terms and are in the best interest of Hercules. In addition, our Board has determined that all of our directors, other than our Chief Executive Officer, are independent as defined in our Corporate Governance Guidelines

16

and the New York Stock Exchange Listing Standards. Our Board has concluded that all transactions were entered into in the normal course of business, that none of the relationships interferes with the exercise of independent judgment by any of our independent directors, that the transactions relate to commercial matters in which the independent directors are not involved and that none of the relationships require any additional disclosure.

Messrs. Wulff and Gerrity are on the Board of Directors of Sunoco, Inc. In 2007, Hercules purchased products from Sunoco or subsidiaries or affiliates of Sunoco in the ordinary course of business, for which it paid Sunoco approximately $1.3 million.

Mr. Wulff is on the Board of Celanese Corporation. In 2007, Hercules purchased products from Celanese or subsidiaries or affiliates of Celanese in the ordinary course of business, for which it paid Celanese approximately $900,000.

Mr. Joyce is on the Board of Directors of Norfolk Southern Corporation. In 2007, Norfolk Southern or subsidiaries or affiliates of Norfolk Southern provided services to Hercules in the ordinary course of business, for which Hercules paid Norfolk Southern approximately $363,000.

General Description of Our Written Policy and Procedures with Respect to Related Persons Transactions

The Board through its Audit Committee has formally adopted a written policy titled "Policy and Procedures with Respect to Related Persons Transactions". The policy provides that the Audit Committee shall evaluate the material facts of each Related Person Transaction and either approve, disapprove or ratify the Related Person Transaction. The Audit Committee in good faith shall only approve and/or ratify those Related Person Transactions that are in, or are not inconsistent with, the best interest of the Company and its shareholders. The following is a general description of the material terms of the policy.

- •

- A Related Person includes (i) any person since the beginning of our last fiscal year who was a Director, Executive Officer or nominee to become a Director and certain of their respective immediate family members, or (ii) any person who is known to be a beneficial owner of more than five percent (5%) of any class of our voting securities.

- •

- A Related Person Transaction is a transaction, arrangement or relationship (or any series of similar transactions, arrangements or relationships) in which the Company (including any of its subsidiaries or controlled affiliates) was, is or will be a participant and the amount involved exceeds One Hundred Twenty Thousand Dollars ($120,000), or the equivalent thereof in other relevant currencies, and in which any Related Person had, has or will have a direct or indirect interest ("Transaction").

- •

- No Director or Audit Committee member shall participate in any discussion, evaluation, approval, disapproval or ratification of a proposed Transaction with respect to which he or she or his or her immediate family member is a Related Person, except that the Director shall provide all material information concerning the

17

18

- •

- All Transactions that are required to be disclosed in the Company's SEC filings, as required by the Securities Act of 1933 or the Securities Exchange Act of 1934 and related rules and regulations, or the rules and regulations of the New York Stock Exchange, shall be so disclosed in accordance with such laws, rules and regulations.

The Board of Directors recommends a vote FOR each of the four Hercules director nominees: Messrs. Cohen, Joyce, Lipton and Wulff.

19

PROPOSAL NO. 2 — Approval of the Company's Amended and Restated Annual Management Incentive Compensation Plan

Since 1990, Hercules has used awards under annual Management Incentive Compensation Plans as an integral part of its executive compensation program in order to provide competitive variable incentive opportunities to executives who can significantly influence Hercules' performance and improve Hercules' ability to attract and motivate its management team.

In February 2008, the Board of Directors approved the Amended and Restated Hercules Incorporated Annual Management Incentive Compensation Plan (the "MICP") which is being submitted to the shareholders for approval at this 2008 Annual Shareholders Meeting. The approval of the MICP is being sought for approval of the plan in its entirety, including for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code").

The Human Resources Committee has primary responsibility for the administration of the MICP.

All employees of the Company or any participating subsidiary, including the CEO and other executive officers of the Company, are eligible to be designated as participants in the plan. Generally, Section 162(m) of the Internal Revenue Code does not permit publicly held companies like Hercules to deduct compensation paid to the CEO and the three most highly compensated executive officers other than the CEO to the extent such compensation exceeds one million dollars per officer in any year. However, a performance-based compensation plan that is approved by shareholders at least once every five years will not be subject to this deduction limit. In order to satisfy this requirement, Hercules is submitting the MICP for shareholder approval. If shareholder approval is obtained, and Hercules complies with the other requirements set forth in Section 162(m) of the Code, then all amounts paid to executive officers under the MICP will be "performance-based compensation" under Section 162(m) and will qualify for a federal tax deduction by Hercules. If shareholder approval is not obtained, the Company will continue to use the annual Management Incentive Compensation Plan currently in place.

Participants eligible to receive incentive awards under the MICP are determined annually from the eligible employees of Hercules and its subsidiaries. The Human Resources Committee has the exclusive power to designate the CEO and other Section 16 reporting persons as participants in the MICP and to determine the performance goals and targets for all such participants, including for all awards that are designed to qualify as performance-based compensation under Section 162(m). The CEO has the power to designate non-reporting persons as participants in the MICP and to determine the performance goals and targets for all such participants. Each of the Human Resources Committee and the CEO is the "grantor" for purposes of awards made to such eligible participants.

Awards granted under the MICP are earned based on the attainment of performance goals, which must generally be established no later than the end of the first quarter of the calendar year to which they relate. Performance goals for awards that are intended to qualify

20

as performance-based compensation under Section 162(m) must be established in writing by the Human Resources Committee no later than 90 days after the start of the plan year and must state, in the form of an objective formula or standard, the maximum amount of the award payable based on actual performance as compared to the performance goals.

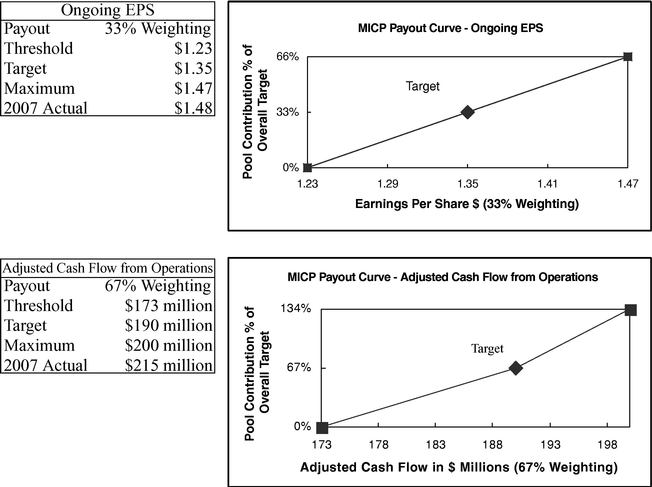

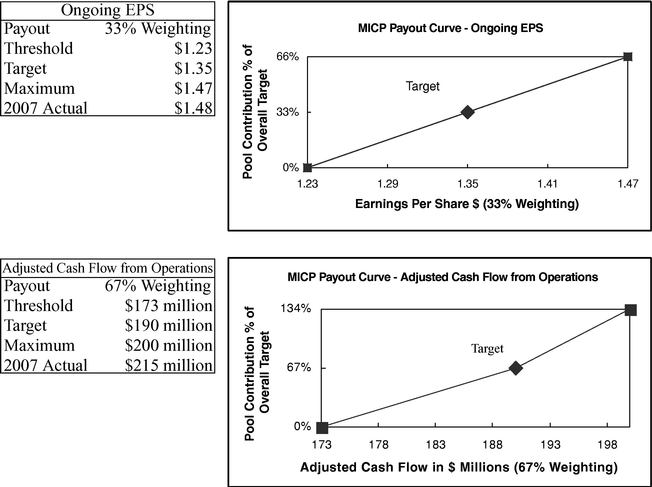

The performance goals for each award may include corporate performance goals and/or group performance goals. In addition, individual performance goals may apply to awards that are not designed to qualify as performance-based compensation under Section 162(m). The corporate performance goals, including threshold, target and maximum levels of achievement, are determined each year by the Human Resources Committee. The group performance goals, including threshold, target and maximum levels of achievement, are established by the CEO in consultation with the applicable heads of the operating or corporate staff departments of Hercules or a participating subsidiary. However, for awards that are intended to qualify as performance-based compensation under Section 162(m), the group performance goals are established by the Human Resources Committee.

The performance goals established by the Human Resources Committee for awards that are intended to qualify as performance-based compensation under Section 162(m) must be based on one or more of the following business criteria with respect to the Company (for corporate performance goals) or one of the participating subsidiaries, operating groups or corporate staff departments of the Company or a subsidiary (for group performance goals): revenue; earnings per share; earnings per share before or after funding for some or all of the Company's incentive programs; operating profit; operating profit less a charge on one or more of the following items: working capital, inventory or receivables; net income; return on equity; return on equity less a capital charge; cash flow return on investment; return on invested capital or assets; return on invested capital or assets less a capital charge; stock value; return on capital employed; return on capital employed less a capital charge; total shareholder return; earnings before interest and taxes; earnings before interest, taxes and amortization; earnings before interest, taxes, depreciation and amortization; operating income before interest, taxes, depreciation and amortization; cash generation; unit volume; market share; sales; asset quality; return on assets; return on operating assets; cost-saving levels; operating income; marketing-spending efficiency; core non-interest income; change in working capital; gross margins; and achievement of objectively determinable strategic initiatives. The corporate performance goals and group performance goals established by the Human Resources Committee or the CEO for awards that are not intended to qualify as performance-based compensation under Section 162(m) may include any of the business criteria above and/or other goals or standards.

Individual performance goals are established for reporting persons by the Human Resources Committee after consultation with the CEO and the reporting person; and for non-reporting person participants, by the group head, after consultation with the participant.

The Human Resources Committee establishes the payout curve for the corporate performance goal component for all MICP incentive awards, and the group performance goal component for awards intended to qualify as performance-based compensation under Section 162(m). The CEO establishes a payout curve for the group performance goal component of all other MICP incentive awards. These curves establish threshold (or

21

minimum), target, maximum and intermediate performance and payment levels for amounts to be distributed pursuant to MICP awards. The maximum award payable to any participant will be based on a percentage of the participant's base salary or the benchmark for the participant's position, or a flat dollar amount, as determined by the grantor. The maximum amount of any incentive award that may be payable to any one participant under the MICP for any plan year is five million dollars ($5,000,000).

As soon as practicable after the end of each plan year, the Human Resources Committee or the CEO, as applicable, determines whether and to what extent the various performance goals were attained and calculates the actual award values, based on the level of goal attainment. For any award intended to qualify as performance-based compensation under Section 162(m), the Committee must also determine and certify in writing that the applicable performance goals and any other material award terms were satisfied. Awards are paid promptly after the award values are determined, but in no event later than March 15 immediately following the end of the applicable plan year. Awards are generally payable in cash, but, as determined by the Human Resources Committee, may be paid through the award of restricted shares under the Hercules' Long-Term Incentive Compensation Plan, as amended. There are no separate authorizations of shares of Hercules' common stock for awards under the MICP; any such restricted stock awards must be made under the terms of, and subject to the Long-Term Incentive Compensation Plan.

Awards made in any plan year, and the various threshold, target and maximum goals, can be adjusted by the grantor during a plan year if material and extraordinary changes affecting Hercules occur, except that no such adjustments are permitted for MICP awards that are intended to qualify as performance based compensation under Section 162(m). Individual participants may also receive pro-rated awards for situations such as initiation of employment during the plan year, transfers from one group to another, intra-year position changes or death, disability, retirement or a reduction in force. However, the payment of a pro-rata portion of any award that is intended to qualify as performance-based compensation under Section 162(m) in the event of death, disability, retirement or a reduction in force is contingent upon attainment of the applicable performance goals. If a participant receives a substandard performance review, he or she will not receive an award for such plan year, subject only to compliance with the change in control provisions described below.

In the event of a change in control (as defined in the MICP), each participant shall receive a pro-rated award at target level multiplied by a fraction based upon the number of days in the plan year that elapsed prior to the change in control. In the case of officers with employment or change in control agreements, payments under the MICP may be enhanced under such agreements, provided, that there will be no duplication of payments.

The MICP was first adopted by the Hercules' Board in 1990 and was last amended and restated in February 2008. The MICP has no established term, but does require approval by shareholders every five years for purposes of Section 162(m) of the Code.

The MICP does not have separate deferred compensation features, but a participant that is eligible to participate in an existing deferred compensation plan of Hercules may defer any cash-based awards in compliance with such deferred compensation plan.

22

The MICP is an unfunded plan.

The Board proposes that you approve the continuation of the MICP, so that if established goals and targets are met, certain payments that would be made under the MICP to Hercules' most highly compensated executive officers may be deducted by Hercules as provided in Section 162(m) of the Code.

The MICP is attached to this Proxy Statement asAppendix A. You are encouraged to read the MICP in its entirety.

The Board of Directors believes that approval of this proposal is in the best interests of Hercules and its shareholders and recommends that you vote FOR the approval of Proposal No. 2 to approve the MICP, including for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended.

23

PROPOSAL NO. 3 — Ratification of the Appointment of BDO Seidman, LLP as Independent Registered Public Accountants for 2008

Our Audit Committee has appointed BDO Seidman, LLP ("BDO") as our independent registered public accountants for 2008. Partners and employees of BDO are periodically changed, providing Hercules with new expertise and experience. Representatives of BDO have direct access to our Audit Committee and regularly attend Audit Committee meetings.

Please see the discussion below under the headings "Audit Committee" and "Principal Accountant Fees and Services" for a description of the fees paid to BDO during 2007, and the practices and policies of our Audit Committee with respect to the approval and use of BDO to provide audit and non-audit services to Hercules.

Representatives of BDO will attend the Annual Meeting to answer appropriate questions and make a statement if they choose to do so. The affirmative vote of the majority of Hercules shares present in person or by proxy and entitled to vote at the Annual Meeting is required to approve this proposal. If the appointment is not ratified, the adverse vote will be considered as an indication to the Board that it should consider other independent registered public accounting firms for the following fiscal year.

The appointment of independent registered public accountants is approved annually by our Audit Committee and subsequently submitted by the Board to the shareholders for ratification. The decision of the Audit Committee is based on its review and approval of the audit scope, the types of non-audit services and the estimated fees for the coming year. The Audit Committee also reviews and approves non-audit services to ensure that they will not impair the independence of the accountants. Before requesting that the Board submit the approval of BDO to the shareholders for ratification, the Audit Committee carefully considered that firm's qualifications as independent registered public accountants for Hercules. This included a review of their service proposal as well as their integrity and competence in the fields of accounting and auditing. The Audit Committee has expressed its satisfaction with BDO in all of these respects. For more information, see the "Audit Committee Report".

The Board of Directors recommends a vote FOR ratification of the appointment of BDO Seidman, LLP as independent registered public accountants for 2008.

24

OTHER MATTERS

The Board is not aware of any matters, other than those described above, that will be presented for consideration at the Annual Meeting. If other matters properly come before the Annual Meeting, it is the intention of the persons named on the enclosed Proxy Card to vote thereon in accordance with their respective best judgment. Moreover, the Board reserves the right to adjourn, postpone, continue or reschedule the Annual Meeting, depending on circumstances and the Board's belief that such adjournments, postponements, continuations or reschedulings would be in the best interests of all Hercules shareholders.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and holders of more than ten percent of our common stock to file with the SEC and the New York Stock Exchange reports of beneficial ownership and changes in beneficial ownership of the common stock and other equity securities of Hercules. Such directors, executive officers and holders of more than ten percent of our common stock are required to file all Section 16(a) reports electronically and to provide Hercules with notice of each filing.

Based solely on a review of the Section 16(a) reports filed electronically and the representations made by such persons to Hercules, we believe that, during 2007, our directors, executive officers and holders of more than ten percent of our common stock complied with all applicable Section 16(a) filing requirements.

25

AUDIT COMMITTEE

The Board has charged the Audit Committee with a number of responsibilities, including review of the adequacy of Hercules' financial reporting and internal control over financial reporting. The Audit Committee is directly responsible for the appointment, compensation and oversight of the work of Hercules' independent registered public accountant and Hercules' Director, Internal Audit. Private sessions are held at least quarterly with the independent registered public accountant, the Director, Internal Audit, and Hercules' Chief Financial Officer. In accordance with Section 301 of the Sarbanes-Oxley Act of 2002 (the "Act"), the Audit Committee is composed entirely of independent directors as defined by the Hercules Corporate Governance Guidelines and the listing standards of the New York Stock Exchange. The Board has adopted and reviews at least annually a written Audit Committee charter, a copy of which is posted on Hercules' website atwww.herc.com.

Audit Committee Financial Expert

In accordance with Section 407 of the Act, effective March 2003 the SEC issued rules requiring public companies to disclose whether they have an audit committee financial expert. These rules were initially effective for Hercules for the year ending December 31, 2003. The Board of Directors has decided that, among its directors determined to be qualified to be the Audit Committee Financial Expert, Mr. Burton M. Joyce will serve in such capacity.

Fees of Independent Registered Public Accountants

The Audit Committee appointed BDO as the Company's independent registered public accountant on April 18, 2005. BDO commenced providing services for the quarterly period ended June 30, 2005.

The aggregate fees for professional services rendered for the Company by BDO for the years ended December 31, 2007 and 2006, respectively, were:

| | (Dollars in millions)

| |

|

|---|

| | 2007

| | 2006

| |

|

|---|

| Audit | | $ | 3.1 | | $ | 3.0 | | |

| Audit Related | | | — | | | — | | |

| Tax | | | 0.2 | | | 0.1 | | |

| All Other | | | — | | | — | | |

| | |

| |

| | |

| | | $ | 3.3 | | $ | 3.1 | | |

| | |

| |

| | |

Audit Fees

Fees billed by our independent registered public accountants for professional services rendered to us in connection with the audit of the Company's financial statements for the years ended December 31, 2007 and 2006, reviews of the financial statements included in the quarterly reports on Form 10-Q that we were required to file during 2007 and 2006, audits of the Company's internal control over financial reporting as of December 31, 2007 and 2006, and statutory audits performed during both years were approximately $3.1 million and $3.0 million for the years ended December 31, 2007 and 2006, respectively, of which aggregate amounts of $2.8 million and $2.0 million had been billed through December 31, 2007 and 2006, respectively.

26

AUDIT COMMITTEE REPORT

The Audit Committee has received from the independent registered public accountants written disclosures and a letter concerning the independent registered public accountants' independence from Hercules, as required by Independence Standards Board Standard No. 1, "Independence Discussions with Audit Committees." These disclosures have been reviewed by the Audit Committee and discussed with the independent registered public accountants. The Audit Committee has also considered whether the provision of other services by the independent registered public accountants is compatible with maintaining the principal accountant's independence.

In the discharge of its responsibilities, the Audit Committee has reviewed and discussed with management and the independent registered public accountants the audited consolidated financial statements for Hercules fiscal year ended December 31, 2007. In addition, the Audit Committee has discussed with the independent registered public accountants matters such as the quality in addition to acceptability, clarity, consistency and completeness of Hercules' financial reporting, as required by Statement on Auditing Standards No. 61, "Communication with Audit Committees."

Based on these reviews and discussions, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the Hercules 2007 Annual Report on Form 10-K and filed with the SEC.

| | | Audit Committee |

|

|

B. M. Joyce (Chair) |

| | | J. C. Hunter, III |

| | | R. D. Kennedy |

27

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The Audit Committee has adopted a policy for the approval of audit and non-audit services. Under this policy, services are segregated into three categories:

- •

- Legally Prohibited/Restricted Services — Those services which our auditor may not provide by statute.

- •

- Additional Prohibited Services — Those services which our auditor may legally provide, but which we will not obtain from our auditor.

- •

- Permitted Services — Those services which our auditor may provide if pre-approved by the Audit Committee.

Legally Prohibited/Restricted Services

The auditor is prohibited from providing the following non-audit services:

- 1.