I would know like to turn your presentation over to Mr. Eric Boni, Director of Investor Relations for Ashland. Please proceed.

Our speakers here today are Jim O'Brien, Ashland's Chairman and Chief Executive Officer; Lamar Chambers, Senior Vice President and CFO; and Sam Mitchell, President of Ashland Consumer Markets.

On slide 2 we provide our cautionary language regarding forward-looking statements. Statements made during the course of this presentation that constitute forward-looking statements, as that term is defined in relevant securities law. Ashland believes its expectations regarding it's operating performance and the Hercules transaction are based on reasonable assumptions, but cannot assure those expectations will be achieved. Therefore, any forward-looking statements may prove to be inaccurate. You will also see the mandatory additional information we must provide in connection with the proposed acquisition of Hercules.

Please turn to slide 3. Before we get started, I will give you an outline of the call. First we will review Ashland's overall results and then get into the specifics of our businesses including a more in depth review of Valvoline by Sam Mitchell. We will then discuss our progress on cost structure initiatives and conclude our prepared remarks with an update on the Hercules transaction. After that we will take your questions.

Let's go to our third quarter highlights on slide 4. Ashland's overall results for our 2008 third fiscal quarter were solid, with operating income increasing 19% on an apples to apples basis, versus the June 2007 quarter which included certain key items I'll talk about shortly. In aggregate, Ashland's volume was down several percentage points and we experienced approximately $80 million of raw material cost increases during the quarter. We will discuss our plans to recover these costs later in the presentation.

In light of the difficult economic environment, we are encouraged by our performance in the quarter. Ashland Performance Materials was most affected by these macro-economic factors and reported a 44% decline in operating income. Valvoline's results were also affected by rapidly rising raw material costs which outpaced price increases leading to a 6% decline in operating income versus the year ago quarter. On a sequential basis, Valvoline's operating income did improve over March quarter earnings, benefiting from the traditionally strong summer driving season. Ashland Water Technologies improved its results for the June quarter, although they were enhanced by certain items that are unlikely to repeat going forward. We are encouraged by Ashland Distribution's performance in the quarter as its continued focus on margin improvement led to a 70% increase in operating income versus the June 2007 quarter.

Quarter just ended also marked the third consecutive quarter in which distribution increased its income sequentially. It is particularly worth noting that we increased our EBITDA by 3%, versus a year ago quarter, to $121 million. Also, our focus on working capital continues to show results. We achieved an additional 46 basis point reduction sequentially in our operating segment trade working capital as a percentage of sales, excluding the effective acquisitions.

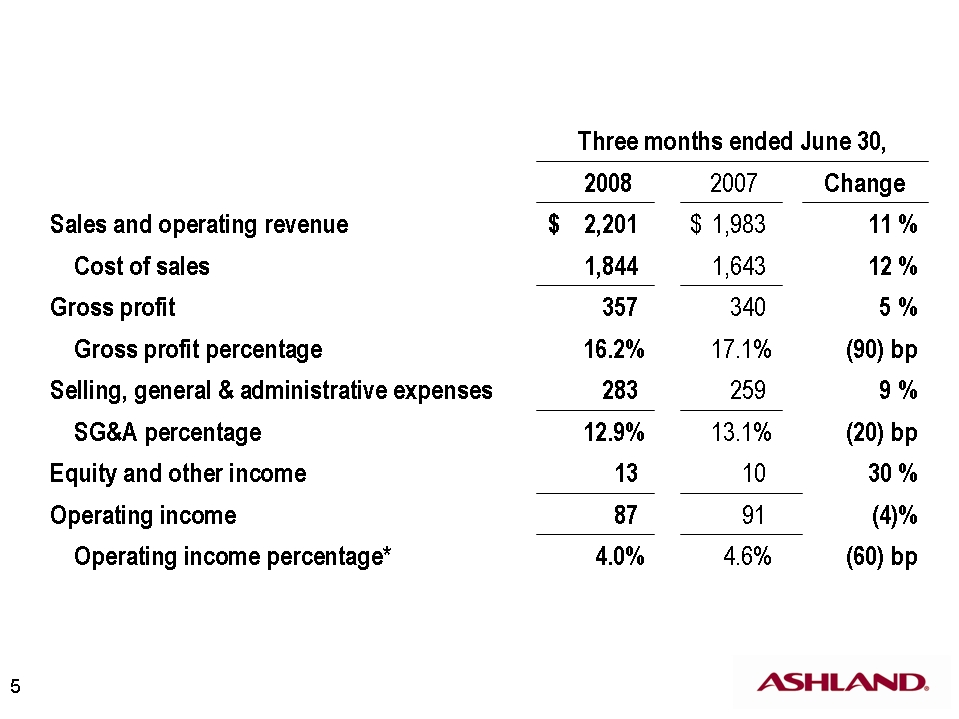

Now let's turn to the financial results on slide 5. Revenues increased 11% to $2.2 billion in the third quarter of 2008 driven by significant price increases versus the year ago quarter. Four percentage points of the increase were attributable to currency translation. Cost of sales increased at a slightly faster pace, going up 12%. Gross profit dollars increased by $17 million, or 5%, although our gross profit percentage was down 90 basis points. Selling, general and administrative expenses grew 9%, versus the 11% increase in sales, resulting in a 20 basis point reduction in SG&A as a percentage of sales. Approximately five percentage points of this increase were due to currency translation. We will discuss the increase in SG&A in more depth shortly.

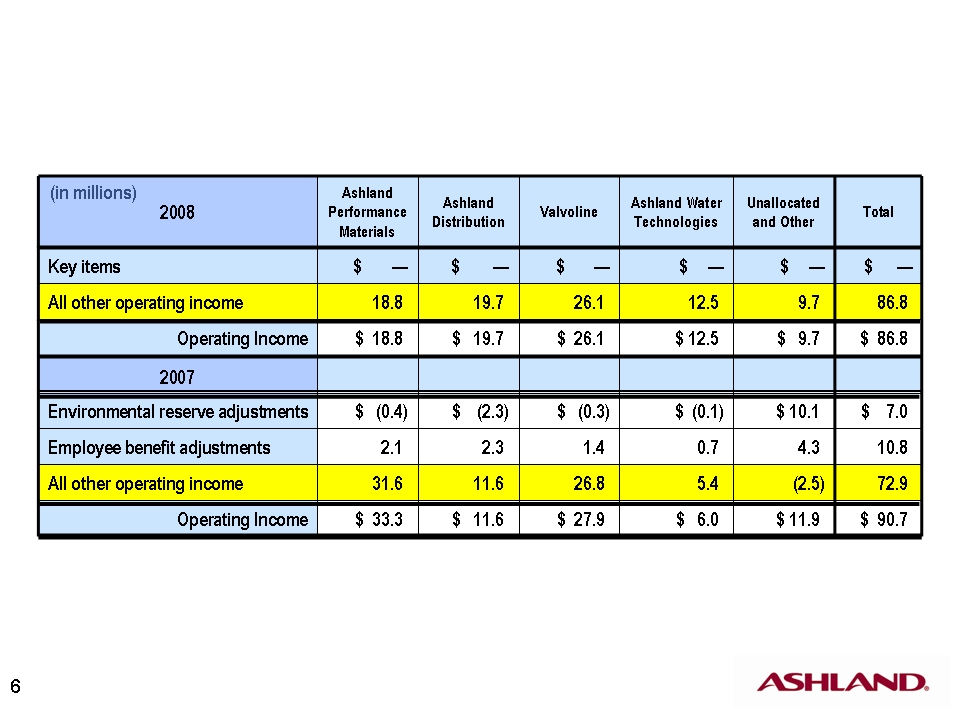

Our reported operating income declined 4% versus year ago quarter, but as I mentioned earlier, when key items in the June 2007 quarter are excluded, operating income increased 19%. Please turn to slide 6 to see the key items affecting our operating income. This chart summarizes our operating income by segment, versus the same quarter last year, and shows the impact of key items on operating income. In 2007, each of our businesses was impacted to some degree by unusually large environmental reserve and employee benefit income adjustments. The yellow "all other operating income" line for 2007, therefore, represents our underlying performance. While we also had these types of items in 2008, they were at historical levels and do not warrant specific adjustment and thus the "all other operating income" and "operating income" lines are identical. On a comparable basis, "all other operating income" increased by $13.9 million, or 19%, versus the year ago June quarter, with a combined $15.2 million improvement in Distribution and Water Technologies as well as a $12.2 million improvement in our "unallocated and other" line, more than offsetting the $12.8 million decline in Performance Materials. We will discuss the operating income performance of each of our businesses in detail later.

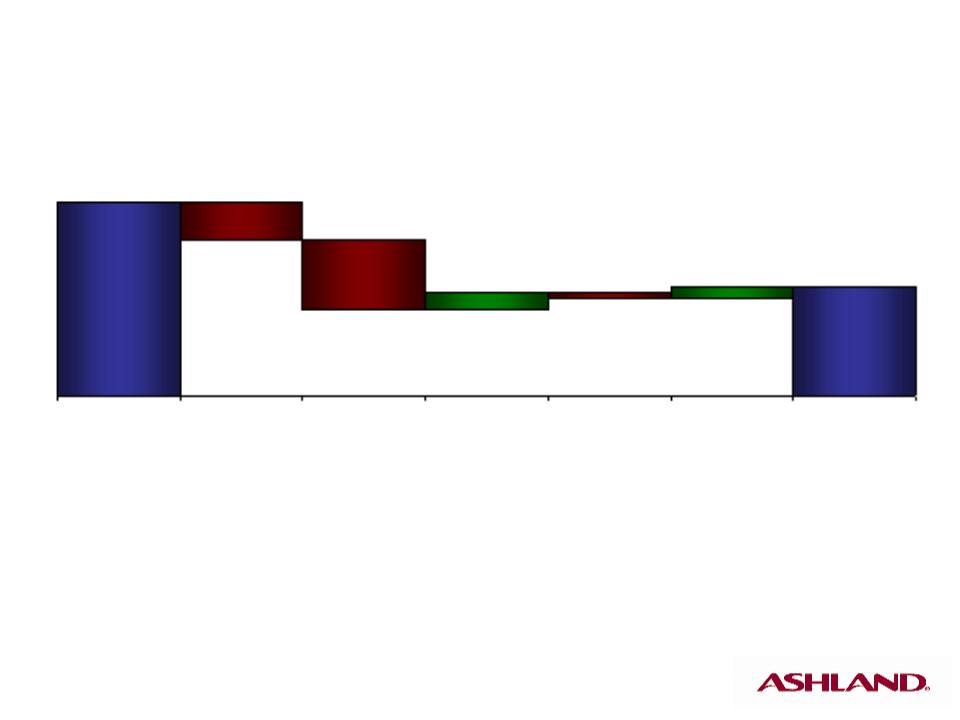

Let's move to slide 7 to look at Ashland's income bridge. Operating income declined by nearly $4 million to $86.8 million in the June 2008 quarter, as compared with the year ago quarter. Currency translation contributed positively to the quarter by $5.6 million. Volume had a $1.1 million positive impact to earnings as increases in Water and Valvoline businesses offset volume declines in Performance Materials and Distribution. Similarly, significant margin increases in Distribution were offset by margin declines in our other businesses. SG&A increased by $10.4 million, excluding currency impacts.

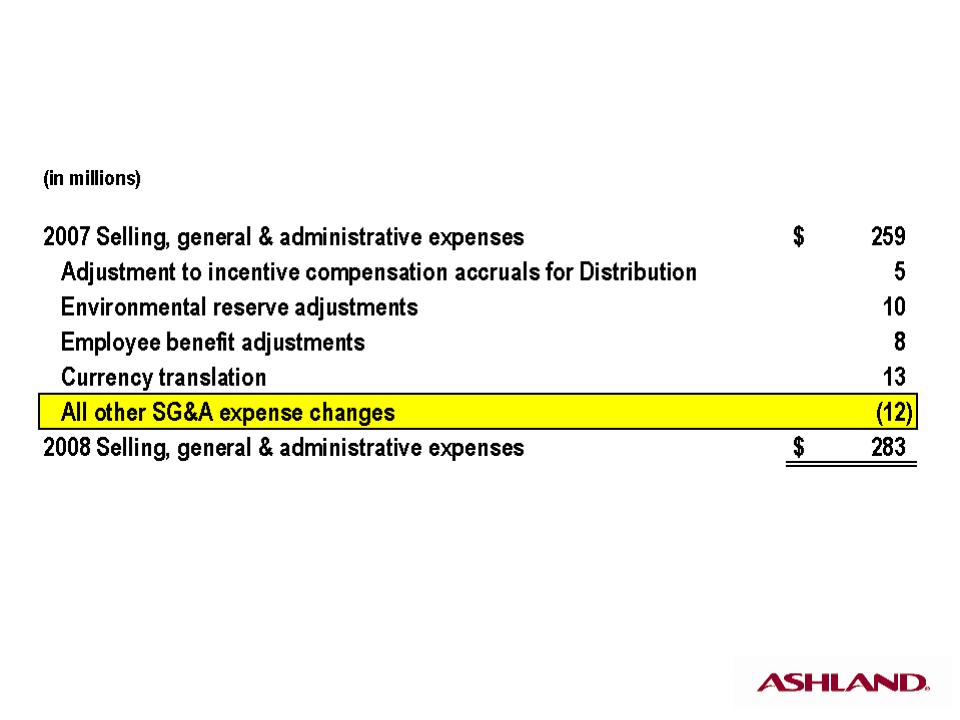

Let's turn to slide 8 for more detail on the SG&A. Reported 2008 third quarter SG&A increased by $24 million, versus the same prior year quarter on an as reported basis. $5 million of this increase was attributable to adjustments to incentive accruals in the Ashland Distribution business. Additionally, certain portions of the environmental reserve and employee benefit adjustments noted on slide 6 were included in the SG&A line and total $18 million. When taken into account with the $13 million in currency translation, all other SG&A expenses declined by $12 million, or about 5%, versus the year ago quarter.

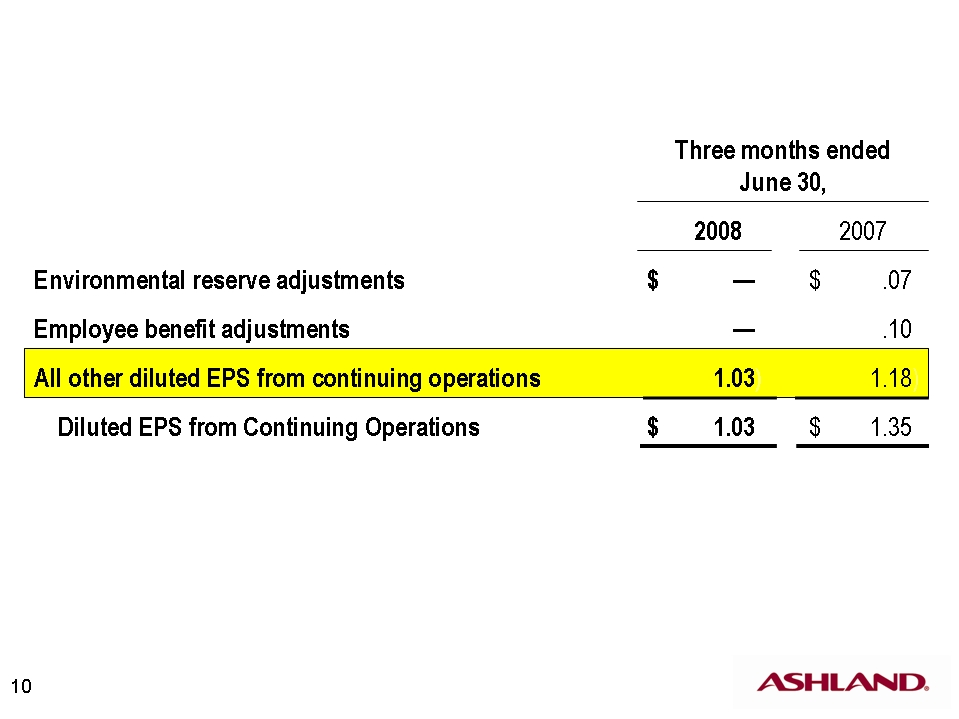

Now please turn to slide 9 for a review of our preliminary earnings per share chart. Looking at this chart, you will see that net interest and other financing income for the third quarter declined by $4 million. This primarily reflects lower interest rate on Ashland cash and securities. Income taxes increased by $12 million, giving us an effective tax rate of 29.4% in the June 2008 quarter, versus 15% in the 2007 quarter. The tax rate for both periods included the net favorable effect of adjustments to the estimated annual tax expense. In the unusually low 15% effective tax rate in the year ago quarter also reflected favorable developments with respect to settlements of certain tax matters. Discontinued operations in both periods include net favorable adjustments to asbestos reserves, primarily to related insurance receivables, of $6 million in 2008 and $16 million in 2007, as well as other smaller items. On a reported basis, our earnings per share from continuing operations amounted to $1.03 as compared with $1.35 in the year earlier quarter.

Let's go to slide 10 to see our EPS on an adjusted basis. When the previously mentioned key items are excluded from the prior period, our diluted earnings per share from continuing operations for the June 2008 quarter were $1.03 as compared with $1.18 in the June 2007 quarter.

Let's turn to slide 11 for a review of our cash flows. Ashland generated positive operating cash flows after capital expenditures of $75 million in the June 2008 quarter, an increase of $20 million, or 36%, versus the prior year quarter. This brings total year-to-date cash generated to $216 million, versus a use of cash of $94 million through nine months last year. This dramatic increase of more than $300 million is a direct result of our increased focus on working capital management throughout the company. EBITDA for the June 2008 quarter increased by $4 million, or 3%, over the year ago quarter.

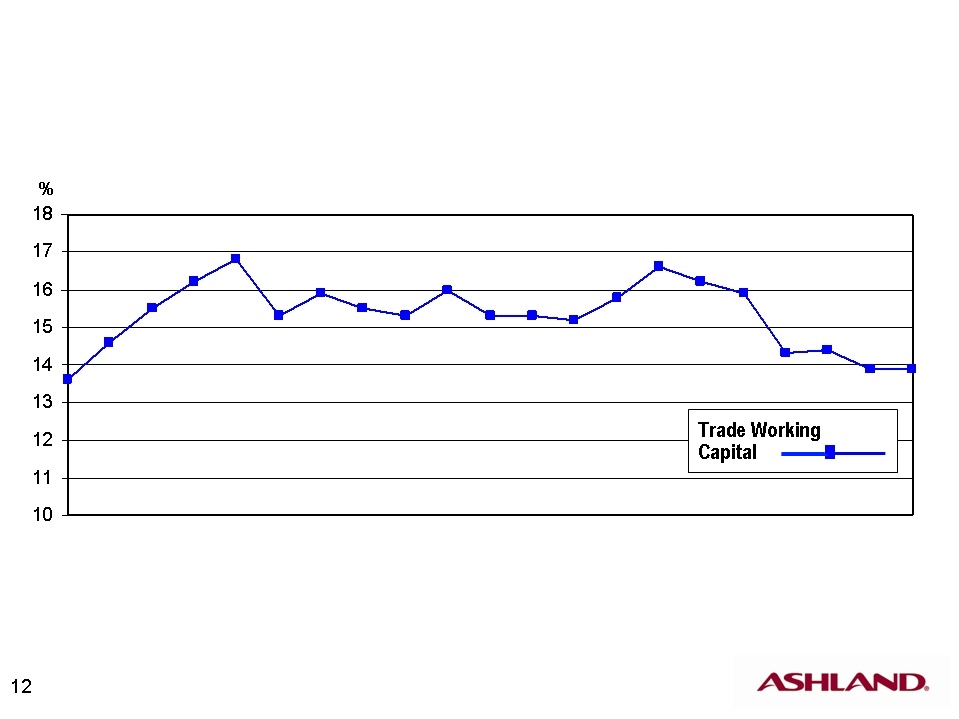

Please turn to slide 12 for a more in-depth look at our trade working capital. Our internal benchmark of operating segment trade working capital to sales decreased sequentially by nearly one half of 1% of annualized sales in the June quarter, excluding the impact of working capital added through acquisitions. We continue to make progress on managing inventories, reducing them by an additional 61 basis points, versus the end of the March quarter. All of our businesses contributed to this improvement with Water Technologies' especially note-worthy reduction of more than 350 basis points in one quarter. We are starting to realize a reduction in our account receivable as a percentage of sales in all of our businesses, most notably in the Valvoline organization. However, we have not achieved the hoped for progress in increasing our payables as a percentage of sales. We are continuing to focus on ways to improve this metric.

Overall, we are pleased with our progress and look forward to achieving further reductions in the working capital requirements of our businesses.

Now I'd like to turn the presentation over to Lamar Chambers to discuss the performances of our businesses. Lamar.

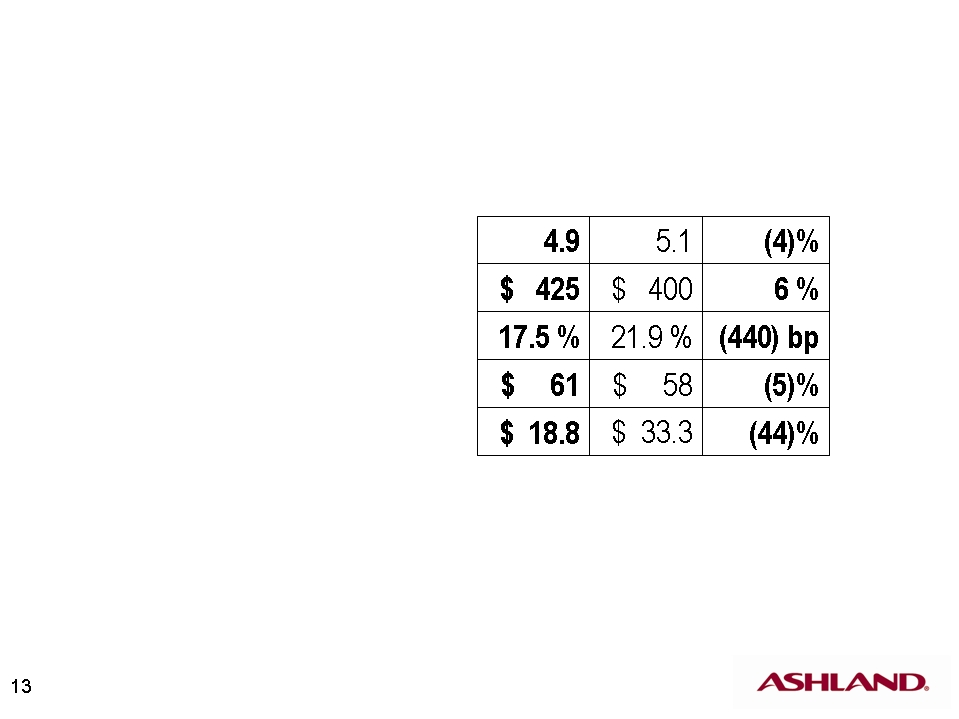

Lamar Chambers - Ashland - SVP and CFO - Thank you, Eric, and good morning, everyone. Let's turn to slide 13 to look at the results of our Ashland Performance Materials business. Volume per day declined 4% as compared with the year ago quarter, including a greater than 10% reduction in volume in the Americas, primarily in our Composite Polymers business. As you're well aware, the US residential construction and transportation markets continue to struggle, impacting volumes in our larger market. Sales of larger vehicles, such as SUVs and pickup trucks, disproportionately affect Performance Materials, particularly the Composite Polymers unit. The precipitous drop-off in large vehicle sales has had a real impact on our recent performance.

That said, we continue to experience significant growth in Asia, with a nearly 30% increase in volume versus the prior year. Asia now represents nearly 9% of total volume. We also continue to achieve some volume growth in Europe, albeit at reduced levels, primarily the result of strong growth in our Casting Solutions unit.

Additionally, our premium business, such as our [Duricane] and Hetron Resins, which are sold into markets such as infrastructure and energy, continues to generate strong margins and provides some underlying stability for our profitability.

Sales and operating revenues increased by 6% to $425 million, as currency translation and price increases helped offset reduced volume. The lag in achieving price increases is the primary cause of our reduction in gross profit percentage. We've also been targeting lower-margin business to help recover some of the volume lost, due to our customers' reduced production, which is also contributing to the gross profit percentage reduction.

Selling, general and administrative increased 5%, versus the year ago quarter, but when adjusted for foreign currency translation, SG&A increased by only approximately 1%, a direct result of severance charges related to our cost structure efficiency initiatives. Overall, operating income fell by 44%, primarily result of reduced margins. Increases in Casting Solutions income were offset by significant reductions in our Composite Polymers unit.

Now, let's go to slide 14 to review the components of our change in operating income for Performance Materials. Volume reductions accounted for roughly $6 million of the operating income decline in the quarter. Margin pressures in the quarter were more pronounced and accounted for $12 million of the decline and operating income, as compared with the June 2007 quarter. As raw material costs have increased, we have only been able to recover approximately 80% of the increases, thus far. However, we have announced price increases for July and August, but do not expect to fully recover the raw material increases until about the end of the September quarter. As a result of these factors and the normal seasonality of the business, we expect Performance Materials' operating income to be down significantly, versus the June 2008 quarter. We do, however, expect some upside earnings potential from the significant cost structure improvements underway, which we will discuss further in a few minutes.

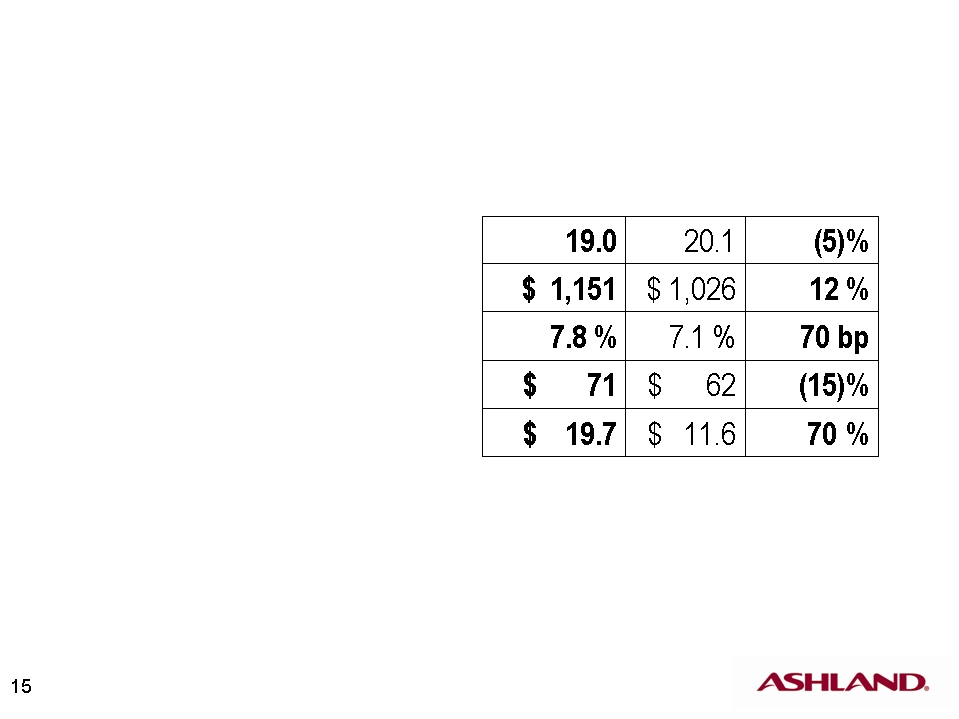

Let's turn to slide 15 for a look at our Distribution business. Distribution's volume per day declined 5%, versus the year ago quarter. Note that this is the first quarter that we do not have an impact on the quarter over quarter comparisons from the terminated DOW Plastics contract in North America. Meanwhile, sales increased by 12% to nearly $1.2 billion. Gross profit is significantly improved, both on percentage basis and in absolute dollars, and was a primary contributor to the 70% improvement in operating income. While SG&A increased by 15% over the 2007 quarter, as we noted previously, the prior year was unusually low due to adjustments to incentive accruals. Excluding those adjustments and the effect of currency translations, SG&A increased only 3%.

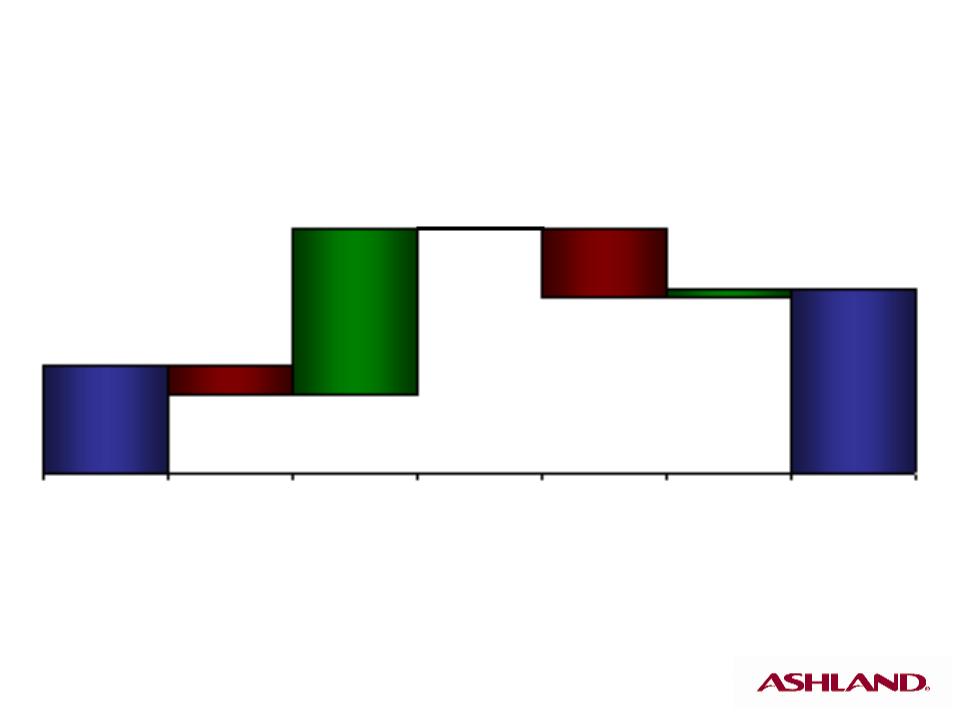

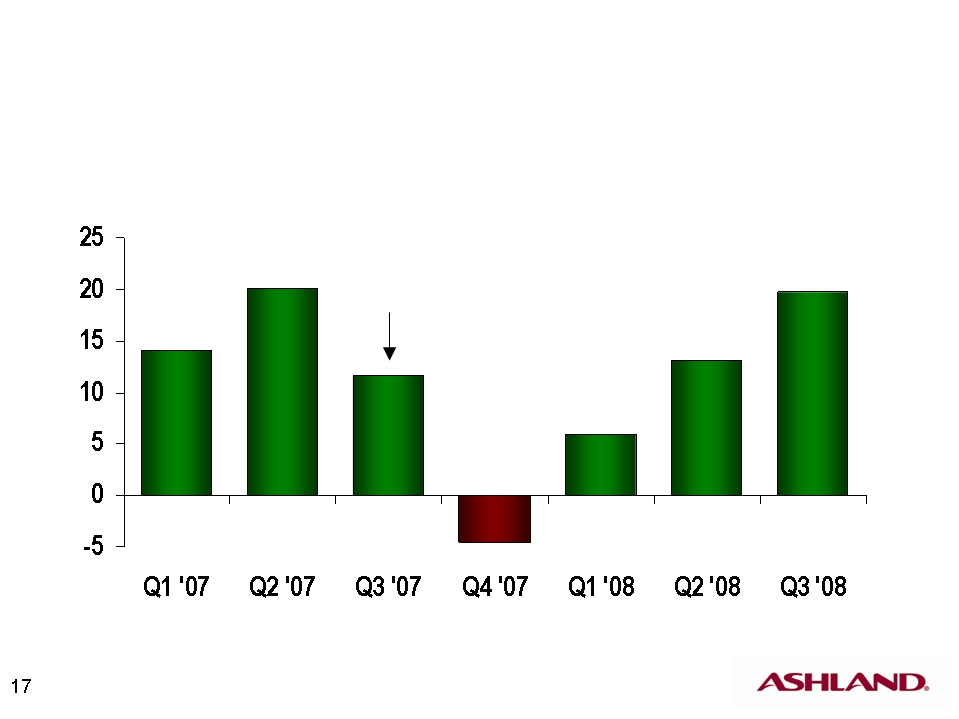

Let's turn to Distribution's income on slide 16. The margin improvement that you see here was broad-based with all of our US business units and Distribution contributing to the increase. Let's take a look at the trends. In Distribution's recent operating income performance, as you can see on slide 17, the June quarter represents the third consecutive quarter of operating income improvement and we have fully recovered from the impact of the terminated North American plastic supply contract. The business has demonstrated its ability to quickly recover product cost increases. Our new pricing process, which focuses on a more disciplined, centralized price-book approach to cost recovery, is helping to drive these improvements. We are counting on further improvements in this area to help us achieve our targeted 3% operating income margins for Distribution.

While we are reasonably pleased with Distribution's results for the June quarter, considering the difficult market conditions, we recognize that there is more to do, and continue to focus on improving this business's margins, and reducing working capital requirements. Distribution's fourth quarter performance will continue to be affected by weakness in North American industrial output. That said, we expect to significantly improve our results, verses the weak fourth quarter last year, although it is unlikely that we will achieve another sequential quarterly increase due primarily to seasonality.

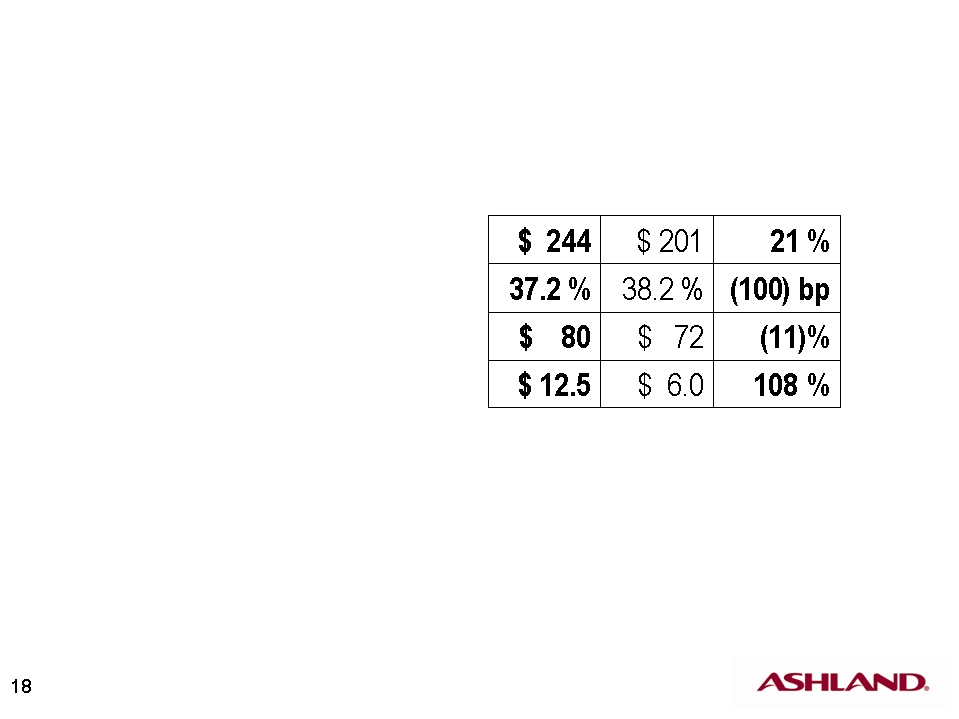

With that, let's turn to slide 18 and our Water Technologies business. Sales and operating revenues increased by 21%, or approximately 9%, excluding the impact of foreign currency translation and a transfer of certain sales from Performance Materials to Water Technologies. Water Technologies more than doubled operating income to $12.5 million in the June 2008 quarter, which benefited by $5 million from the completion of certain large sales contracts and from favorable adjustments estimated liabilities. These items are not expected to repeat going forward. While SG&A was unfavorable by $8 million to the previous year quarter, when adjusted for comparability, SG&A increased by only one half of 1%.

Please turn to slide 19 to look at the factors impacting Water Technologies' operating income. Continued strong organic revenue growth drove the operating income increase in the quarter. We were also starting to realize benefits of our cost structures initiatives, as SG&A had only $1.5 million negative impact on the operating income comparison. As you may recall in the second quarter, SG&A expenses were a negative $9.4 million on the comparable income bridge.

The business continues to feel raw material cost pressure, particularly on its hydrocarbon-based inputs. Our price increases announced in June should fully offset raw material cost increases announced for the fourth quarter, and we should be able to start increasing gross profit percentage closer to historical levels.

Please turn to slide 20 for an update on the action items to improve profitability that we talked about in our March quarter conference call. As you will recall, we discussed five specific action items to improve the profitability of Water Technologies. We have made good progress in the quarter. The first item was to fix certain operating issues concerning invoice accuracy and the sales of products manufactured in Germany and sold to customers and affiliates outside the European Union. We experienced an improvement in invoice accuracy during the quarter, with a $600,000 expense reduction, compared with the March quarter. We have also begun selling and sourcing products in local geographies, where financially viable, to reduce the impact profitability of currency swings.

We have experienced some improvement in our pricing process and are currently implementing our June increases of 10% to 30%, depending on the product line. We reduced our cost structure by $8 million on annualized run rate-basis. This includes the termination of consulting arrangements related to our business redesign work, reductions in travel and entertainment, and the elimination of 11 sales positions in the Americas through attrition. These positions will not be replaced. All of these cost structure reductions produced $1 million in additional income in the June quarter. We were able to renegotiate several raw material contracts during the quarter as well, which should produce an annualized run-rate savings of approximately $3.5 million.

Finally, we have restructured the incentive plans for Water Technologies' leadership to aline with those of our other businesses. We continue to press forward with these action items and our commitment to making these improvements is not altered by the pending Hercules transaction.

With that, I'll turn the proceedings over to Sam Mitchell, President of our Valvoline business. Sam.

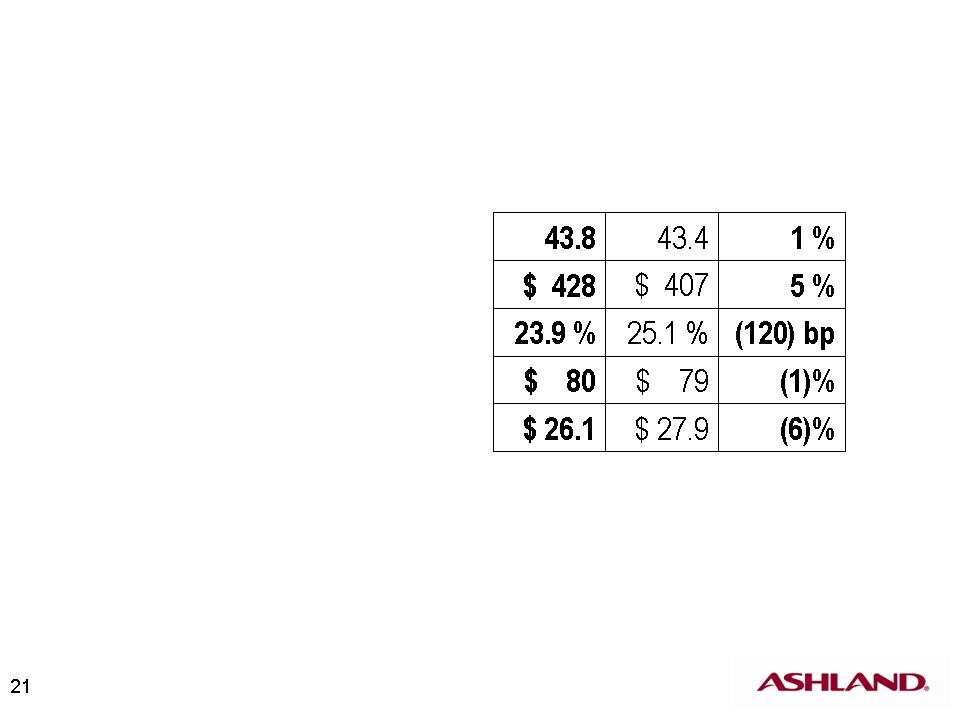

Sam Mitchell - Ashland - VP and President, Ashland Consumer Markets - Thank you Lamar. I appreciate the opportunity to update everyone on the Valvoline business. Looking at slide 21, we increased lubricant volume by 1% over the prior year quarter. We believe the overall market declined more than 4% during the same period. Our comparatively strong performance is a result of growth in our large national account business, in our Do-It-For-Me -- or DIFM -- channel and strong marketing plan execution in our DIY channel.

Sales and operating revenues have increased 5%, primarily from price increases. Gross profit as a percent of sales declined by 120 basis points, the result of both higher selling price and lower unit margin, as raw material cost climb rapidly throughout the quarter. Business in both our DIY and DIFM installer channels experienced margin declines due to the lag effect of pricing increase implementation, following the impact of cost increases. The other channel within our DIFM market is our Valvoline Instant Oil Change unit which grew operating income by 3%. (inaudible) our businesses posted solid results in a challenging environment, generating $26 million of operating income in the quarter, a 6% decline versus the prior year quarter.

Let's look at slide 22. The operating income decline in the quarter was a result of margin decreases given by the time-lag between our receipt of raw material cost increases and the full implementation of price increases into the marketplace. Meanwhile, our international business continues to be a solid contributor to results, with operating income up 31% for the quarter and 113% for the first nine months.

Please turn to slide 23 for some insight into current market conditions. Valvoline continues to be greatly impacted by the volatile crude oil markets. The announced base oil cost increases between May and July have totaled approximately 36%, on a product that sold for about $4 a gallon at the beginning of the period. Additives, likewise, have increased significantly, and the market has announced two increases totaling 28% to take effect during the fourth quarter. Meanwhile, supplies of base oil remain fairly tight, despite increases in global group two production as group one capacity closures have shifted demand to group two supplies. Against these cost issues, we are also experiencing lower demand on a short-term basis versus our long-term expectation of flat to slightly declining lubricant demand. Demand will likely remain weak in the calendar year 2009.

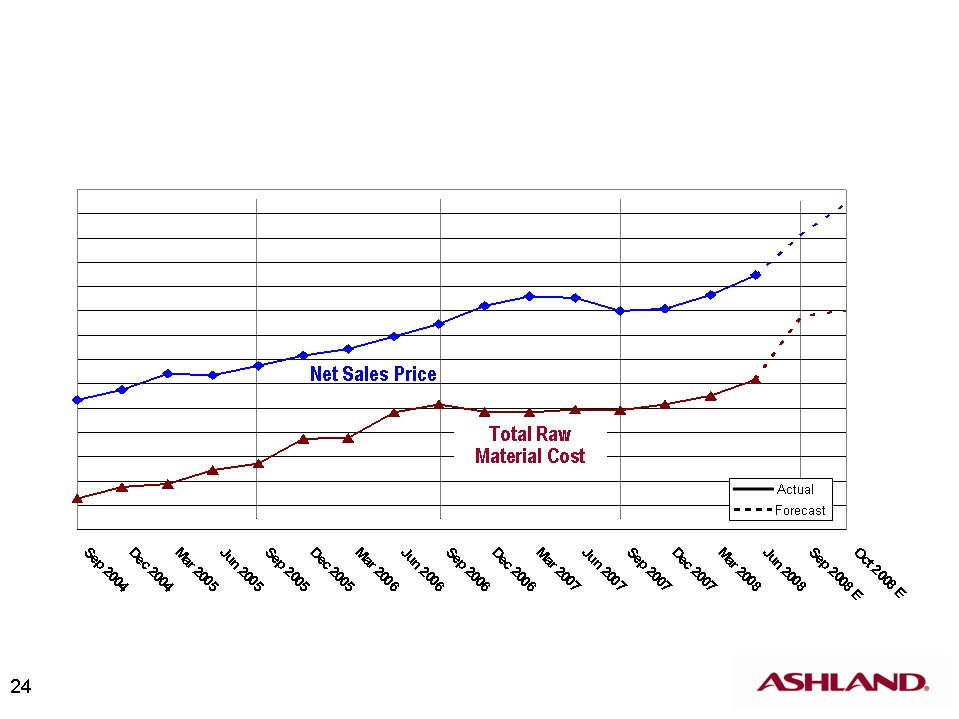

Please turn to slide 24. This chart shows the change in Valvoline's total US branded raw material cost through June 2008 as shown on the bottom solid red line. The top solid blue line is a change in net sales price. The gap between these two lines essentially represents our unit gross profit margin. The vast portion of these lines represents our estimates for the next few months. The narrowing and widening of the gap between the two lines shows the impact on margins of raw material costs.

During fiscal 2006, rapid run ups in cost squeezed margins, while in fiscal 2007 our costs stabilized, enabling our price increases to catch up with cost and leading to a record year. It is important to note that while the impact of raw material cost increases can be felt within weeks, it can take two to three months to fully implement price increases in some markets, due to competitive pressures and promotional commitments. Similar to 2006, we are experiencing the negative effects of this timing-lag in the implementation of price increases in fiscal 2008. This will particularly effect our fourth quarter where you can see the sharp rising cost is not fully recovered by pricing during the quarter. Specifically, we have announced price increases for the US market in June and July that will be effective with customers in August and September. We expect these increases should enable us to offset the cost increases, allowing margins to return to more normalized levels during the early part of fiscal 2009.

All that said, despite the negative impact we are projecting in the fourth quarter and the challenging market conditions, we have a strong brand and we are confident in our plans to deliver earnings growth in 2009.

I'll now turn the call over to Jim O'Brien who will provide an update on cost structure initiatives.

Jim O'Brien - Ashland - Chairman and CEO - Thanks, Sam. You will note on slide 25 that, as we discussed this spring, we are focused on achieving cost structure efficiency throughout Ashland. Our target was to reduce cost by $14 million by the end of fiscal 2008 on an annualized run rate basis, and by $40 million by year end fiscal 2009, also on run rate basis. In addition, we announced that we are targeting another $25 million of year-end 2009 run rate savings through changes in our business models in Performance Materials and Water Technologies. We are significantly ahead of plan in achieving our run rate annualized cost savings of $40 million. Through the June quarter, we have achieved run rate savings of $22 million, primarily in our Water Technologies and Performance Material business, and we expect to have run rate savings well in excess of $40 million by the beginning of the December quarter.

I've asked Lamar to provide more detail on the proposed Hercules acquisition before we take your questions. So Lamar.

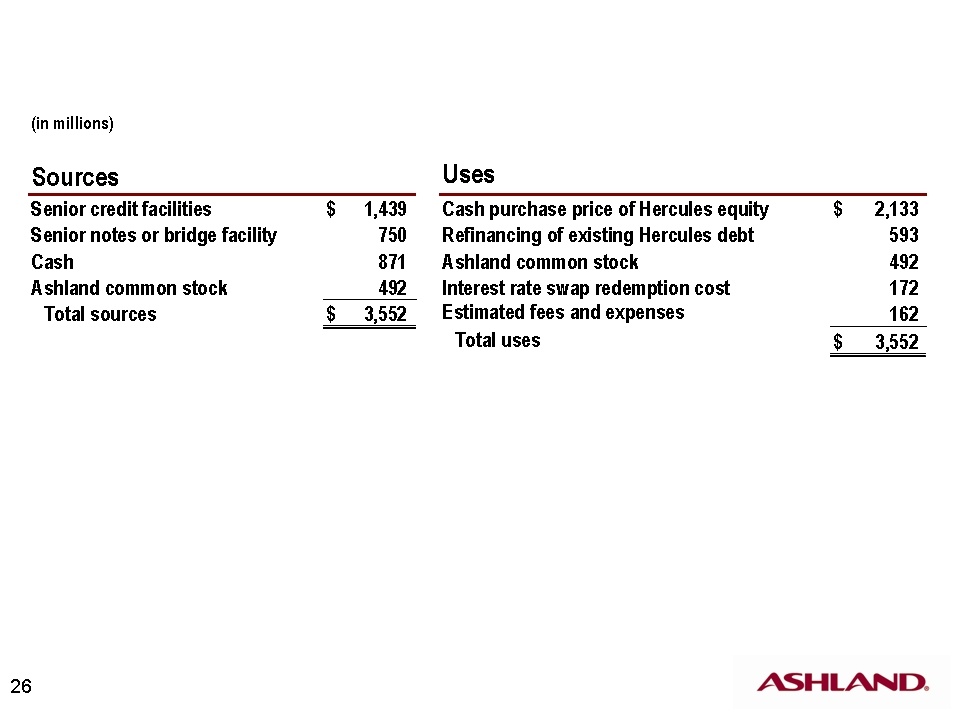

Lamar Chambers - Ashland - SVP and CFO - Thank you, Jim. As we have been out talking about the Hercules transaction, we have heard a number of recurring questions. I hope to provide you with some of the answers in the next few slides. The chart on slide 26 provides the estimated sources and uses of funds for the Hercules transaction. The plan to utilize about $1.4 billion of senior credit facilities, $750 million of notes, $900 million of cash on hand, and $500 million of new Ashland stock to fund the transaction. The sources table presumes we will continue to hold our $275 million of student loan option rate securities. To the extent we are able to liquidate these securities, our need for debt financing will, of course, be reduced.

That said, when the transaction is complete, we expect to have $2.4 to $2.5 billion of debt, including $2.2 billion of new debt and $215 million assumed debt from Hercules, along with some or all of Hercules's relatively small amount of foreign debt. The $215 million represents 6.5% junior subordinated deferable interest divestures, due 2029. Hercules's other debt is expected to be retired at closing. We expect the debt to trailing EBITDA ratio to be 3.2 to 3.3 times, immediately upon close.

You will note on the usage side of the table that $172 million will be set aside to retire a cross currency swap arrangement that Hercules has maintained. We plan to pursue our options with these swaps and will consider maintaining some or all of them post closing, but for purposes of conservatism we have assumed that we will use funds to close these instruments out at the time of closing.

The current expected blended interest rate is 7.25% to 7.5%. Of course the credit markets continue to move and rates will not be locked in until the syndication of the credit facilities is complete. For your modeling purposes, you may want to consider a range of 7.25% up to 8% or 8.25%.

Now let's take a look at additional details of the transaction economics on slide 27. The Hercules acquisition is expected to generate significant shareholder value based upon our estimated internal rate of return. When the final book evaluation for each asset acquired -- while the final book valuation for each asset acquired often requires up to a year after closing to determine, our preliminary analysis of the amount of the increase annualized amortization and depreciation, due to purchase accounting, is approximately $120 million for the first several years after the transaction. Of course DNA will scale down after the useful life of each asset is surpassed. We are anticipating an asset write up of amortizable and tangible assets and property plant and equipment of approximately $1.6 to $2.0 billion. Further details on the transaction are covered on slide 28.

Based upon the debt levels that we showed on slide 26 and, assuming weighted average interest rate of 7.25% to 8% or so, initial total gross interest expense is forecast to be $175 to $200 million. Ashland's interest income will be, of course,substantially reduced since we will be using the large majority of existing Ashland and Hercules cash for the acquisition.

As a part of the transaction, we will issue approximately 10.5 million new shares of Ashland common stock. Thus increasing Ashland's shares outstanding to approximately 75 million.

Regarding an expected tax rate, due to Hercules foreign tax credit carryover, Ashland should benefit from a lower effective tax cash rate during the first five years or so following the acquisition. Specifically, it should be less than the low 30s that we have provided as long term guidance for Ashland's tax rate.

Now let's turn to slide 29 to discuss expected synergies and integration cost associated with the acquisition. We announced in our July 11th call regarding the Hercules acquisition that we expect $50 million of synergies to result from the transaction. In discussing synergies, we're choosing to focus on those we have direct visibility into at this time. Approximately 75% of the estimated $50 million of synergies that we have initially identified are in the area of general and administrative expenses. We included no potential revenue synergies in our figure. We expect to achieve at least 60% of the synergies on a run rate basis by the end of the first year after closing of the transaction.

We expect the integration team to uncover additional opportunities, both on the revenue and savings sides, as well as to identify opportunities to accelerate the realization of synergies. In total, the integration team is targeting an additional $30 million to $70 million of synergies beyond our initial estimate. Likely areas for these additional synergies would include efficiency opportunities within the commercial organization of the combined Hercules Paper and Ashland Water businesses and additional supply chain savings. Revenue synergies are likely to be identified in several areas, most notably selling the Ashland Water products, such as retention aids, to paper companies with which Hercules already has a strong relationship. All of these savings are in addition to the $65 million of cost structure efficiencies from our existing businesses that Jim mentioned previously. So taken altogether, we're targeting combined savings of synergies of $145 million to $185 million from Ashland and Hercules as compared with their recent individual performances.

Please turn to slide 30 for a discussion of the Merger Agreement and Financing Commitments. The Merger Agreement was signed July 10 and the Merger Agreement and Financing Commitment documents were filed with the SEC on July 14th. We have had a lot of questions about the financing-out for Ashland. First, let me just emphasize that both Ashland and Hercules look forward to closing the transaction. However, with regard to financing, the basic principle is if Ashland cannot obtain the funds, we cannot be required to close.

We're very happy to be working with Bank of America and Scotia Bank, two of our long-term relationship banks, in obtaining the debt financing for the transaction. The debt commitments are in place until December 31st. If closing were to occur after December 31st, we would attempt to obtain financing on comparable terms, first with these banks or, if unavailable, from other sources. If we don't obtain financing, we don't have to close, but we would have to pay a $77.5 million reverse breakup fee and the agreement would terminate. Ashland would have no other obligations or payments other than the reverse breakup.

There are several standard conditions precedent to closing which are shown on the slide. The SEC will need to declare effective before (inaudible) that Ashland will be filing. While we don't anticipate any issues, we will closely monitor the progress and timing of this process. With respect to antitrust approvals, we do not believe we should have any issues. The portions of the business that, even in the broadest sense, could be considered overlap are very small and the reality is that Ashland and Hercules are not competitors in the marketplace. The transaction does require a two thirds approval from the Hercules shareholders. As is standard, there are material adverse change clauses in affect, but there is not a general market-out.

Let's turn to slide 31 to review the anticipated timing of the transaction. We will make our HSR filing within the next few days and plan to make the EU filing in mid-August. We will also have a Canadian filing and are investigating several other jurisdictions where a filing may be required. We plan to file the S-4 with the SEC in early August, anticipate that the SEC will complete its review by late September. We also are in anticipating antitrust reviews to be completed in a similar timeframe. We currently anticipate that the Hercules special shareholder meeting to vote on the transaction would occur in late October or early November, with closing occurring five days following shareholder approval.

Jim?

Jim O'Brien - Ashland - Chairman and CEO - Thanks, Lamar. I appreciate you going through the details of the Hercules transaction. I know that it's a fair amount of technicalities, but I also know that many of our investors and analysts are interested in these items. So all that said, let me be clear - we plan and we want to close this transaction. We look forward to the combination of Ashland and Hercules and the new opportunities that it presents.

With that, let's go to the next slide and we will take your questions on our third quarter performance or the transaction.