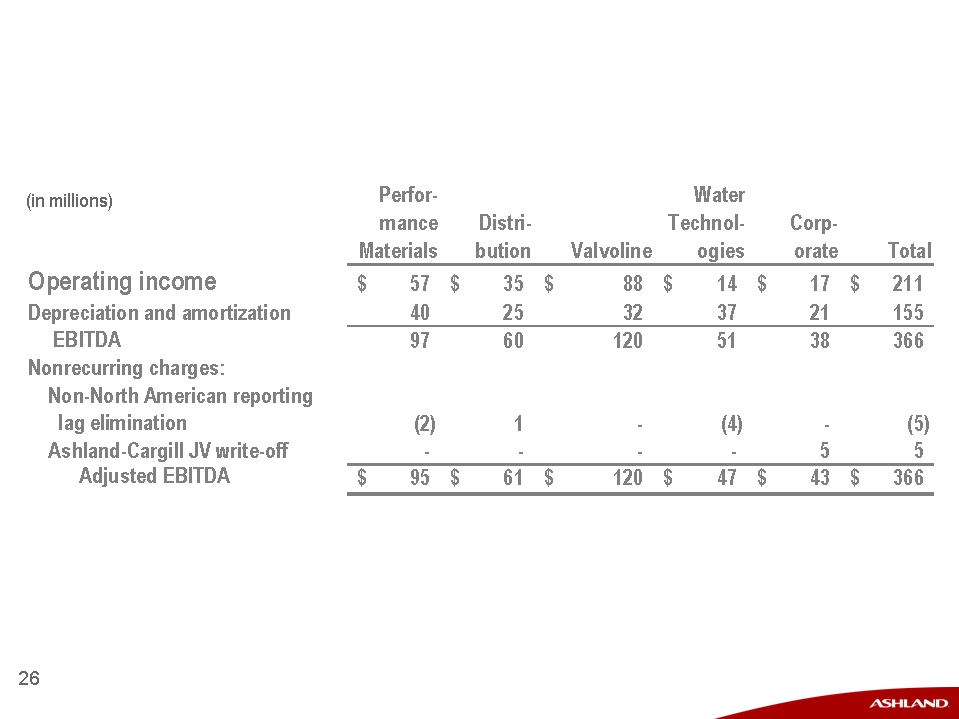

• Creates a major, global specialty chemicals company

– ~75 percent of estimated pro forma adjusted EBITDA* derived from specialty

chemicals

– More than $10 billion in pro forma revenue

– Boosts pro forma revenue from outside North America to approximately

$3.5 billion

• Significantly enhances focus and expands scale

in three specialty chemical businesses

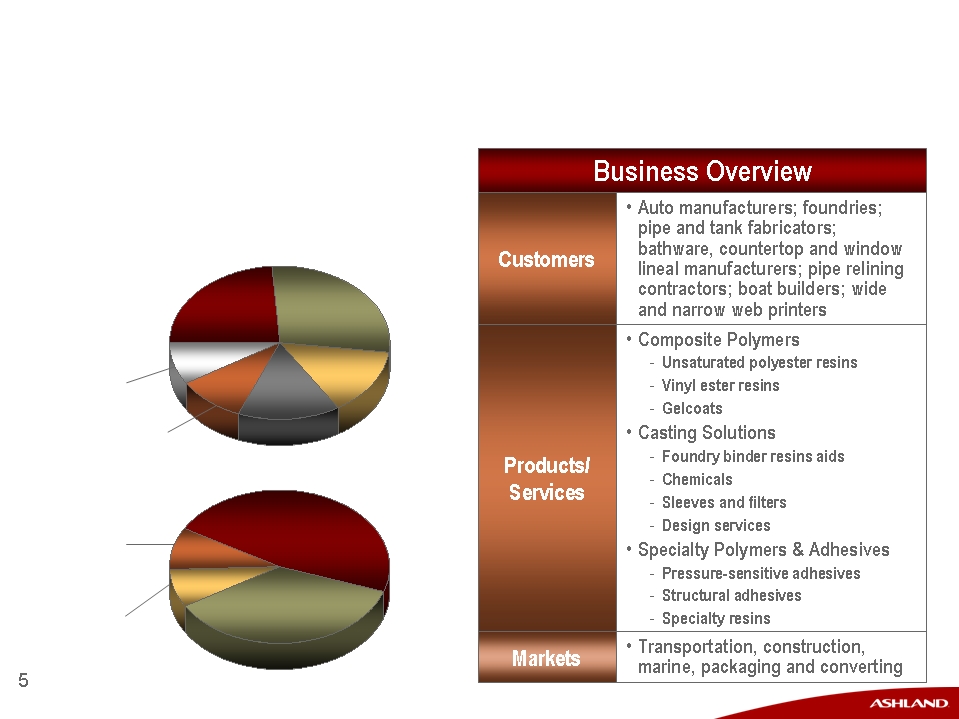

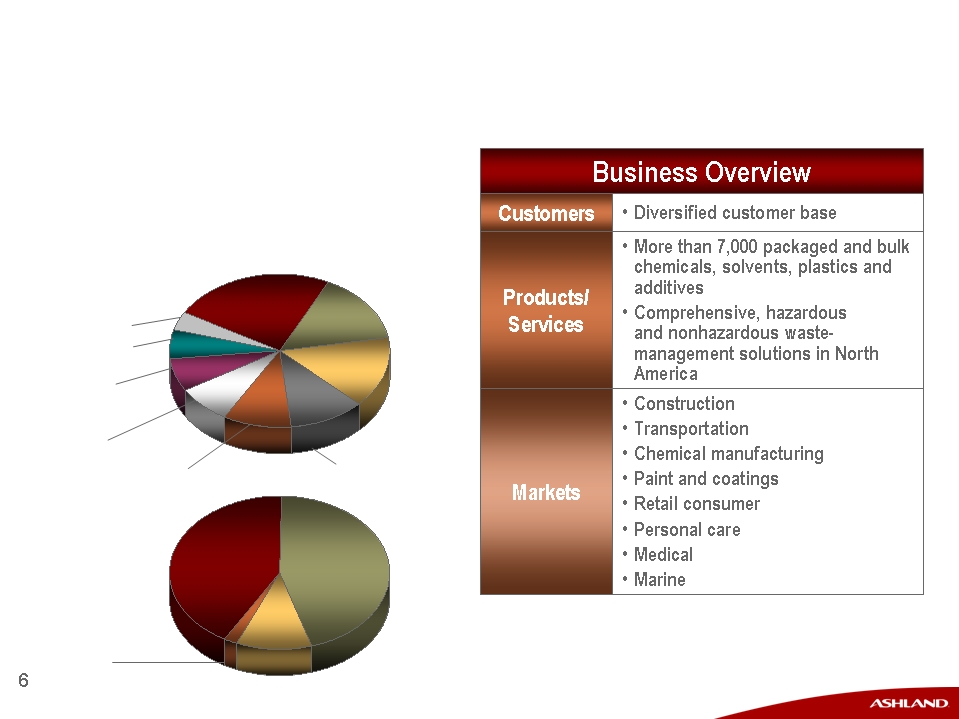

– Specialty additives and ingredients, paper and water technologies,

and specialty resins

• Creates leadership position in attractive and growing

renewable/sustainable chemistries

– Derives approximately one-third of estimated pro forma EBITDA

from bio-based chemistries

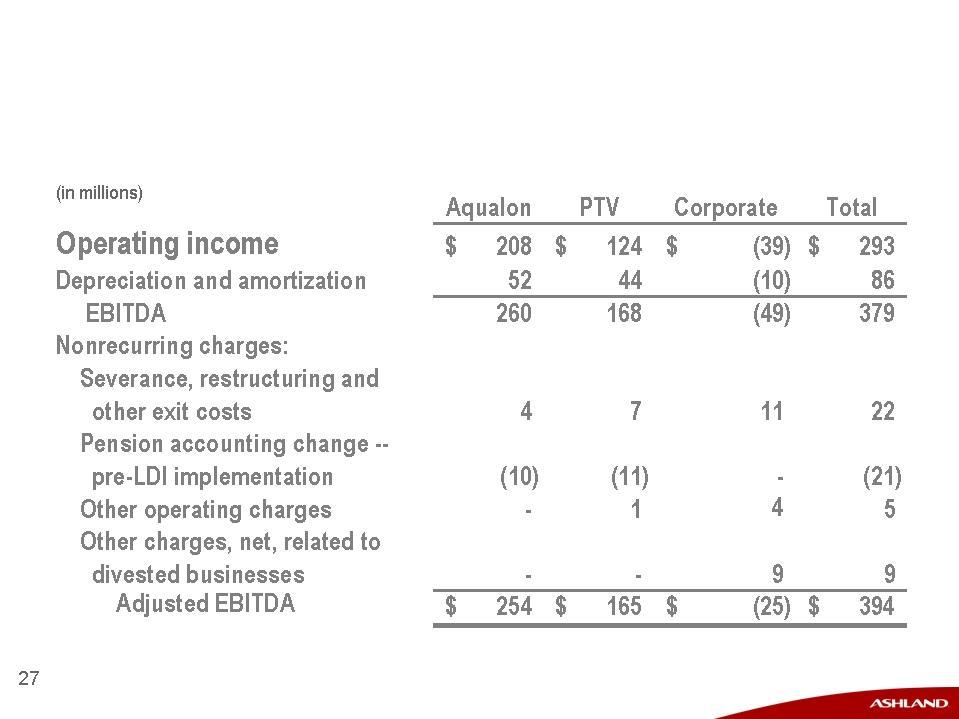

* For the 12 months ended June 30, 2008. Sales & Operating Revenue includes intersegment sales.

EBITDA excludes Ashland Unallocated and Other and Hercules Corporate Items.

Drives stronger, more profitable

and less cyclical earnings

Hercules Acquisition

Strategic Benefits