5

Fiscal Fourth Quarter 2008

Highlights

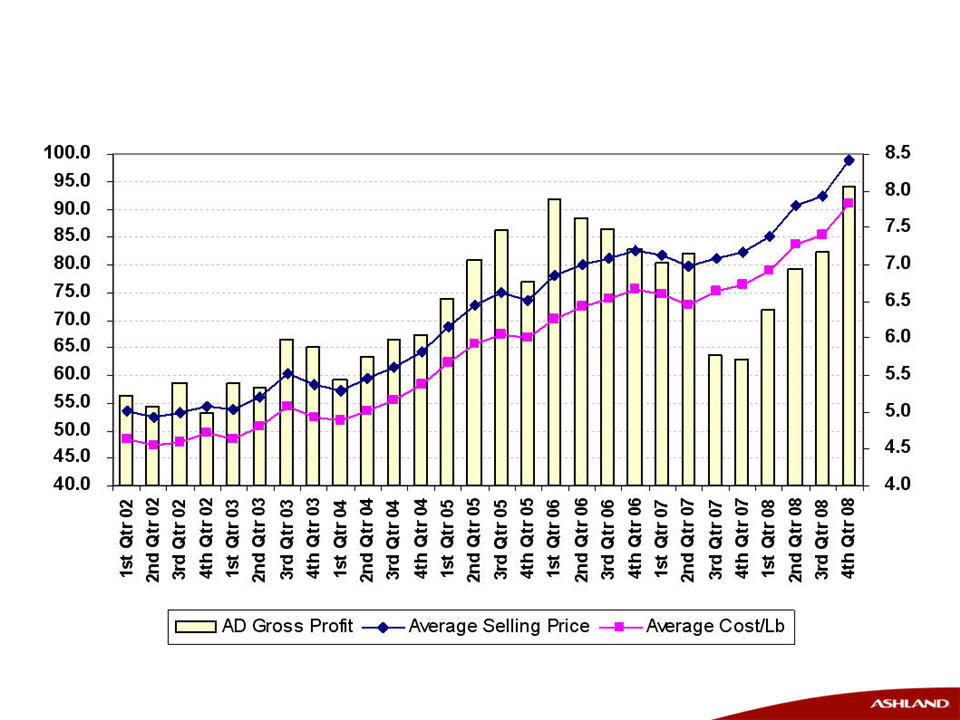

· Continued volatile raw materials cost environment and

declining demand

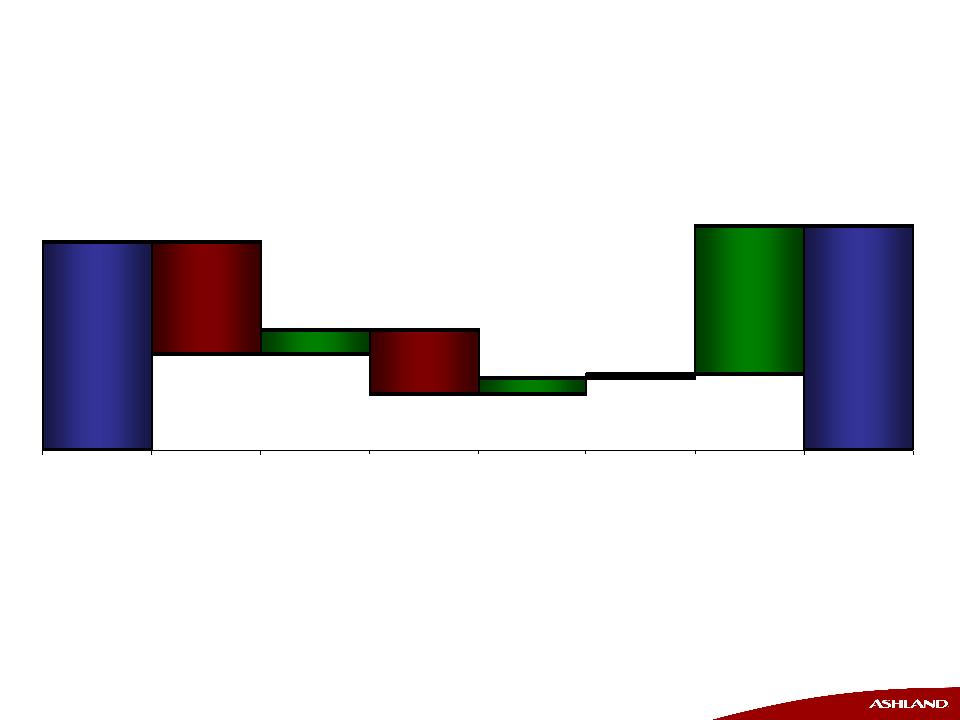

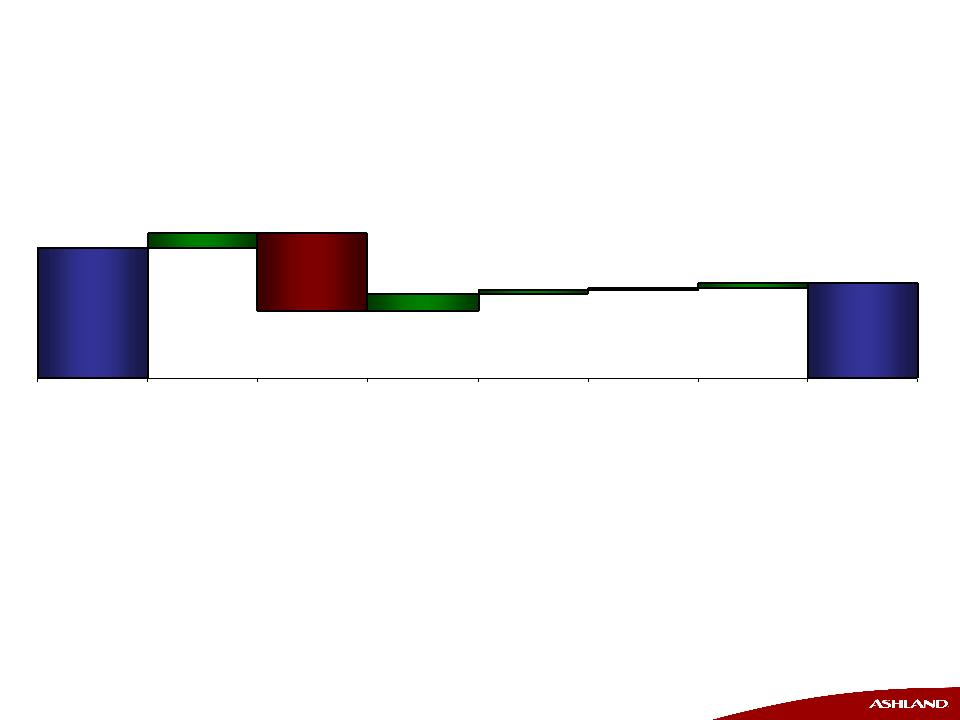

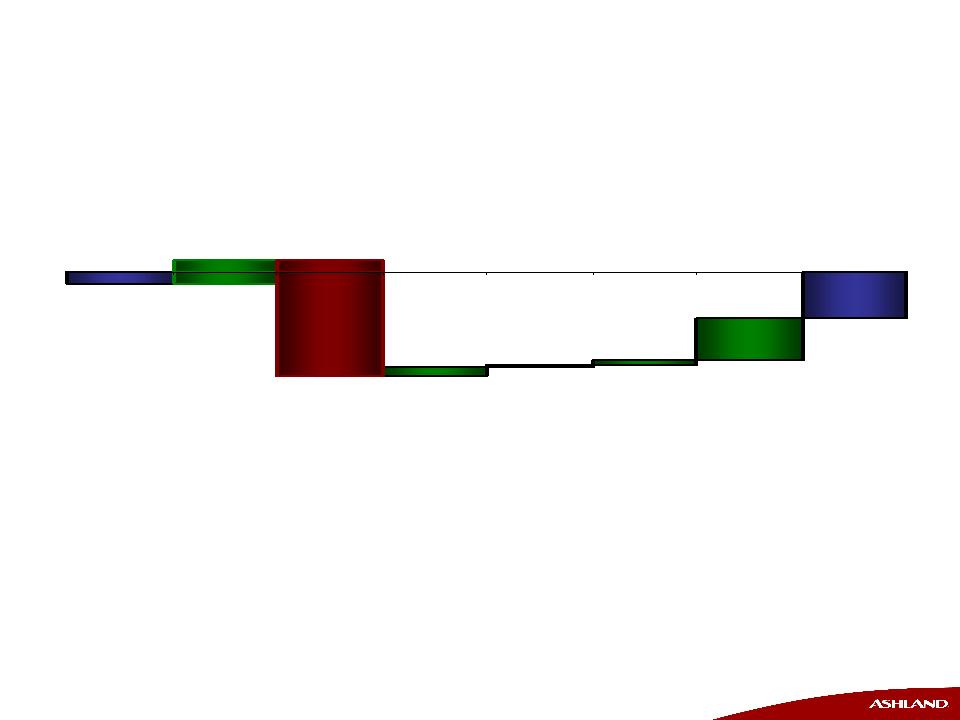

· Operating income versus September 2007

- Increased 6 percent to $27.8 million, as reported

- Declined 41 percent to $23.8 million, excluding key items1

§ Declines in Ashland Performance Materials, Ashland Water

Technologies and Valvoline

§ Significant improvement of $10.6 million at Ashland Distribution

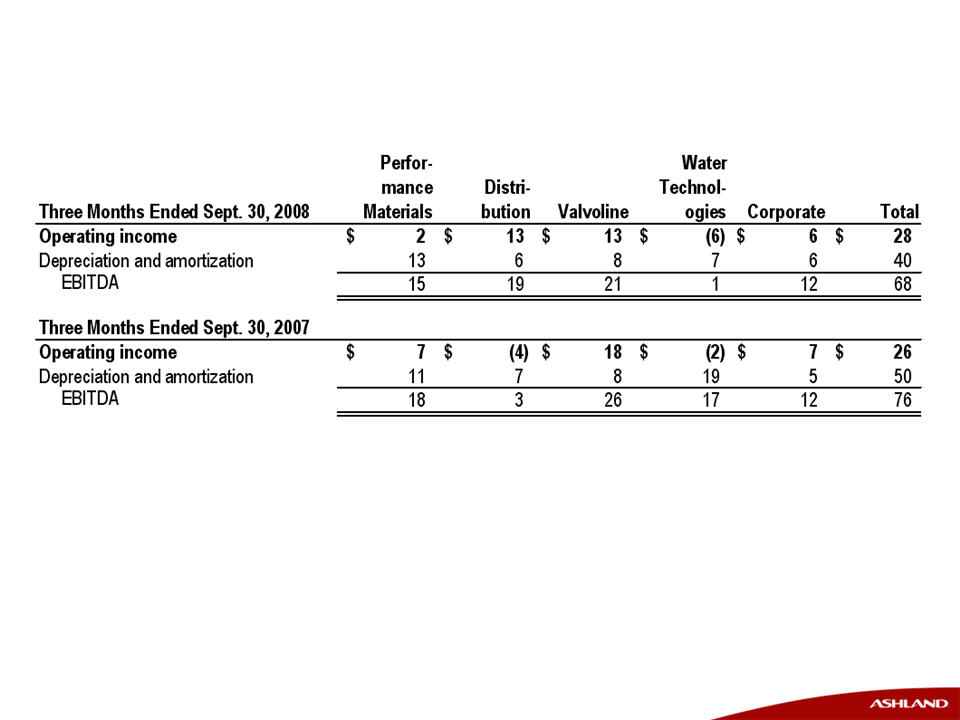

· EBITDA2 decreased 11 percent to $68 million

· Tax provision adjustments unfavorably impacted

EPS by approximately 30 cents per share

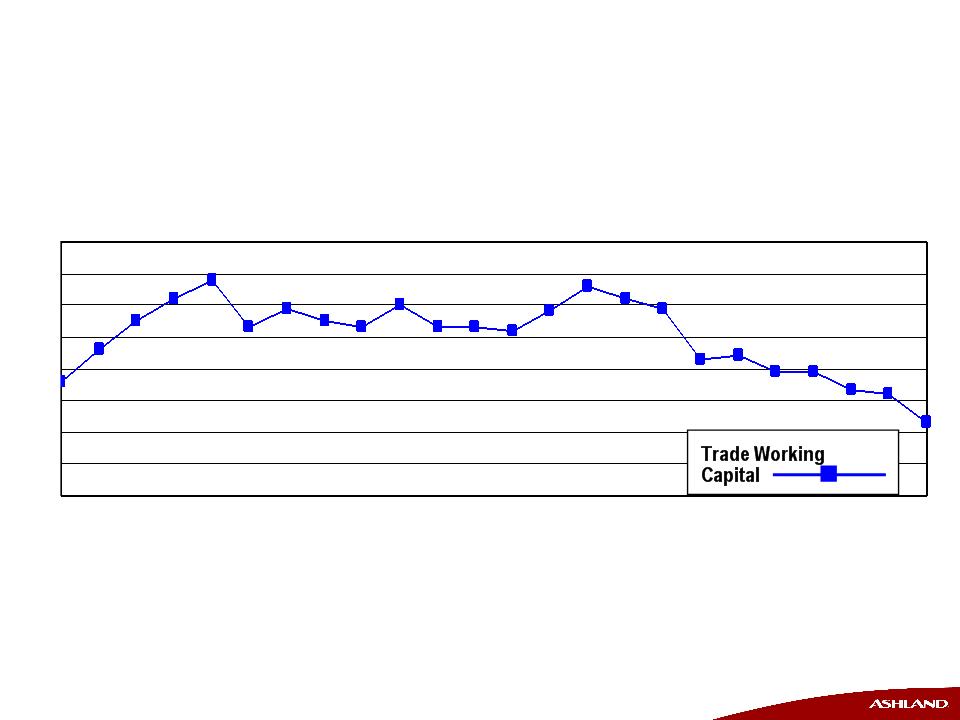

· Continued reductions in operating-segment trade

working capital as a percent of sales to 12.3 percent

1 When adjusted for key items in both periods as noted on Slide 7 of this presentation.

2 Operating income, plus depreciation and amortization.