UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement. |

| ☐ | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| ☐ | Definitive Proxy Statement. |

| ☐ | Definitive Additional Materials. |

| ☐ | Soliciting Material Pursuant to § 240.14a-12. |

BRUCE FUND, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) Title of each class of securities to which transaction applies: |

| | (2) Aggregate number of securities to which transaction applies: |

| | (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) Proposed maximum aggregate value of transaction: |

| | (5) Total fee paid: |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) Amount Previously Paid: |

| | (2) Form, Schedule or Registration Statement No.: |

| | (3) Filing Party: |

| | (4) Date Filed: |

October __, 2023

Bruce Fund, Inc.

20 North Wacker Drive, Suite 2414

Chicago, Illinois 60606

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD November 15, 2023

Dear Shareholder.

Please take a moment to read this letter and the enclosed proxy statement about some important matters pertaining to your investments. We need your help with the upcoming special meeting of shareholders (the “Meeting”) of Bruce Fund (the “Fund,”) to vote on three proposals affecting the Fund. The Meeting will be held at 2:00 p.m., CDT, on November 15, 2023, at 20 North Wacker Drive, 24th Floor, Chicago, Illinois 60606. The purpose of the Meeting is:

(1) Approve a new investment advisory agreement (“New Advisory Agreement”) between the Fund and Bruce & Co., Inc., the Fund’s current investment adviser (“Bruce” or “Adviser”) because a recent change in control of the Adviser occurred on June 23, 2023, when Robert B. Bruce, unfortunately passed away. Robert Bruce was the Advisor’s founder, President, and one of two managing partners, and one of two co-portfolio managers of the Fund, President and Treasurer of the Fund, and Chairman of the Fund’s Board. Upon Robert Bruce’s death, management of the Adviser transferred exclusively to the other manager and majority controlling shareholder of the Adviser who is also the other co-portfolio manager of the Fund, R. Jeffrey Bruce (“Jeffrey Bruce”), who is Robert Bruce’s son.

Under relevant provisions of the Investment Company Act of 1940, the change in control of the Adviser that occurred upon Robert Bruce’s death was deemed to be an assignment of the Fund’s current investment advisory agreement with the Fund (“Old Agreement”) that resulted in its immediate termination under the terms of the Old Agreement and the requirements of the Investment Company Act of 1940. As a result, a shareholder vote is required to approve a new advisory agreement between Bruce and the Fund (“New Advisory Agreement”)(as described in the materials provided).

(2) to elect Directors to the Fund, including two current Independent Directors: Robert DeBartolo and W. Martin Johnson, and Interested Director nominee R. Jeffrey Bruce, who was nominated to serve on the Board by the Fund’s Independent Directors at the Fund’s Board meeting on July 13, 2023, (as also described in the materials provided),

(3) to ratify or reject the selection of Grant Thornton LLP as independent certified public accountant for the Fund; and

(4) to transact such other business as may properly come before the Meeting or any adjournments or postponements thereof.

The question-and-answer section that follows discusses these four proposals. The proxy statement itself provides greater detail about the proposals. The Board of Directors recommend that you read the enclosed materials carefully and vote in favor of each proposal.

You may choose one of the following options to authorize a proxy to vote your shares (which is commonly known as proxy voting) or to vote in person at the Meeting:

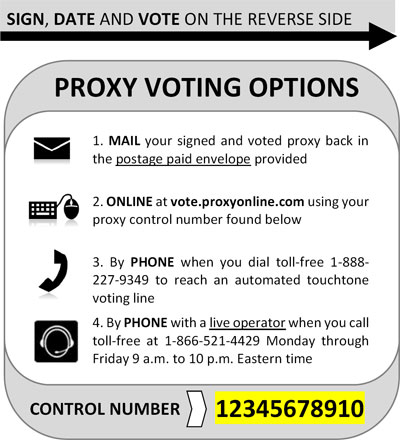

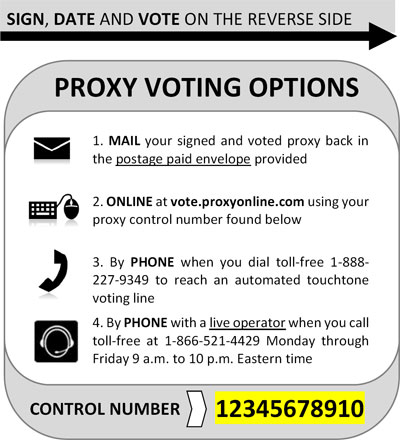

• Mail: Complete and return the enclosed proxy card.

• Internet: Access the website shown on your proxy card and follow the online instructions.

• Telephone (automated service): Call the toll-free number shown on your proxy card and follow the recorded instructions.

• In person: Attend the special shareholder meeting on November 15, 2023.

Thank you for your response and for your continued investment in the Fund.

Sincerely,

/s/ R. Jeffrey Bruce

R. Jeffrey Bruce

President and Treasurer of Bruce Fund, Inc.

The question-and-answer section that follows discusses each proposal, with the proxy statement itself providing additional details. The Board of Directors requests that you read the enclosed materials carefully and unanimously recommends that you vote in favor of each proposal.

You may choose one of the following options to authorize a proxy to vote your shares (which is commonly known as proxy voting) or to vote in person at the Meeting:

| · | Mail: Complete and return the enclosed proxy card. |

| · | Internet: Access the website shown on your proxy card and follow the online instructions. |

| · | Telephone (automated service): Call the toll-free number shown on your proxy card and follow the recorded instructions. |

| · | In person: Attend the special shareholder meeting on November 15, 2023 at 2:00 p.m. |

If you grant a proxy but wish to revoke it prior to its exercise, you may do so by mailing notice of such revocation to the Fund (addressed to the Secretary at the principal executive office of the Fund shown at the beginning of this proxy statement), or in person at the Special Meeting by executing a superseding proxy or by submitting a notice of revocation to the Fund. In addition, although mere attendance at the Special Meeting will not revoke a proxy, if you are present at the Special Meeting, you may withdraw a previously submitted proxy and vote in person. Thank you for your response and for your continued investment in the Fund.

Sincerely,

/s/ R. Jeffrey Bruce

R. Jeffrey Bruce

President and Treasurer of Bruce Fund, Inc.

Questions and Answers

While we encourage you to read the full text of the enclosed proxy statement, for your convenience, we have provided a brief overview of the proposals that require a shareholder vote.

| Q. | Why am I receiving this proxy statement? |

| A. | You are receiving these proxy materials —including the proxy statement and your proxy card — because you have the right to vote on the proposals concerning the Bruce Fund (the “Fund”). Shareholders of the Fund are being asked to vote on three proposals: (1) the approval of a new investment advisory agreement (the “New Advisory Agreement”) between the Fund and Bruce & Co., Inc. (“Bruce or the “Adviser”), the investment adviser of the Fund; (2) the election of Directors to the Fund, including two current Directors and one new Director nominee; and (3) the ratification of the selection of Grant Thornton LLP as independent certified public accountant for the Fund. At a meeting of the Fund’s Board of Directors (the “Board”) held on June 29, 2023, the Board approved an Interim Advisory Agreement between the Fund and Bruce, with identical terms to the Old Advisory Agreement except that the Interim Advisory Agreement had a maximum duration of 150 days from the date of Robert Bruce’s death occurred, June 23, 2023. At a meeting held on July 13, 2013, the Board nominated the slate of Directors. At a meeting held on August 31, 2023 the Board approved the selection of Grant Thornton. At a special meeting held September 29, 2023, the Board approved the New Advisory Agreement. All of the foregoing are subject to shareholder approval. |

| Q. | Why am I being asked to approve the New Advisory Agreement? |

| A. | Pursuant to the Old Advisory Agreement with the Fund, Bruce served as the investment adviser to the Fund. As required by section 15(a)(4) of the Investment Company Act of 1940 (the “1940 Act”), the Old Advisory Agreement between the Fund and Bruce automatically terminated if Bruce experienced a direct or indirect change in control, which would constitute an assignment of the Old Agreement. Unfortunately, on June 23, 2023, Robert B. Bruce, Bruce’s founder and President, and one of two managing partners of Bruce, as well as one of two co-portfolio managers of the Fund, a Chairman of the Board of Directors, President and Treasurer of the Fund, passed away. Upon Robert Bruce’s death, management of the Adviser transferred exclusively to the other managing partner and majority-controlling shareholder of the Adviser, and other co-portfolio manager of the Fund, R, Jeffrey Bruce (“Jeffrey Bruce”), who was Robert Bruce’s son. |

Under relevant provisions of the Investment Company Act of 1940, including Sections 2(a)(4), 2(a)(9), and 15(a)(4), the change in control of the Adviser that occurred upon Robert Bruce’s death was deemed to be an assignment of the Fund’s current investment advisory agreement with the Fund (“Old Agreement”) that resulted in its immediate termination under the terms of the Old Agreement and the requirements of the Investment Company Act of 1940. As a result, a shareholder vote is required to approve a new advisory agreement between Bruce and the Fund (“New Advisory Agreement” )(as described in the materials provided). In effect, these provisions require the Fund’s shareholders to vote on a new Advisory Agreement because of the change of control of the Fund’s Adviser. The provision is designed to ensure that shareholders have a say in determining the company or persons that manage their fund.

To ensure continuation of the advisory services Bruce has provided to the Fund, shareholders of the Fund are being asked to approve the New Advisory Agreement. Both the New Advisory Agreement and the Prior Advisory Agreement contain identical fee structures. Both agreements

provide that Bruce shall receive the same Advisory fee from the Fund. There are also no material differences between the New Advisory Agreement and the Prior Advisory Agreement in terms of the services that Bruce is required to provide.

| Q. | Who is serving as investment adviser to the Fund in the interim? |

| A. | At a meeting of the Board held on June 29, 2023, the Board, consisting of the two Independent Directors who are not “interested persons” (as defined in the 1940 Act) of the Fund, took the actions described below to ensure that investment advisory services would continue to be provided to the Fund and its shareholders despite the change of control. The Board considered and unanimously approved an interim advisory agreement (“Interim Advisory Agreement”) between Bruce and the Fund that has no material differences from the Prior Advisory Agreement or the New Advisory Agreement. The Interim Advisory Agreement became effective as of June 23, 2023, with a maximum duration of 150 days from that date. |

The Interim Advisory Agreement is scheduled to expire on the earlier of the following dates: (1) the date that shareholders approve the New Advisory Agreement, and such results are certified; or (2) on November 20, 2023, which is 150 days after the death of Robert Bruce. If shareholders do not approve the New Advisory Agreement before November 20, 2023, the Fund will not have an effective advisory agreement in place as of November 20, 2023, and Bruce would not be authorized to continue to provide such services to the Fund. If this were to occur, the Board would need to consider further actions including but not limited to potentially merging the Fund with another mutual fund or liquidating and deregistering the Fund.

Your vote to approve the New Advisory Agreement is consequently extremely important.

| Q. | How will my approval of the New Advisory Agreement affect the management and operation of the Fund? |

| A. | The Fund’s investment management, investment strategies or investment operations will not change as a result of the New Advisory Agreement. There will be no change to the Fund’s portfolio management, investment objectives, principal investment strategies or principal risks. |

| Q. | How will the Transactions affect the fees and expenses I pay as a shareholder of the Fund? |

| A. | The fees and expenses that you pay as a shareholder of the Fund will not increase as a result of the Transactions. The approval of the New Advisory Agreement will not result in an increase in the Fund’s advisory fee and the Fund will not bear any portion of the costs or expenses associated with this proxy. |

| Q. | Are there any material differences between the Fund’s Prior Advisory Agreement, the Interim Advisory Agreement or the New Advisory Agreement? |

| A. | No. There are no material differences between the Fund’s Prior Advisory Agreement with Bruce, the Interim Advisory Agreement, and the Fund’s New Advisory Agreement, other than their effective dates and signatories. The Prior Advisory Agreement, Interim Advisory Agreement and New Advisory Agreement contain identical fee structures and service requirements. A form of the New Advisory Agreement as approved by the Board of Directors is attached as Exhibit A to the Proxy. |

| Q. | How will these events affect my account with the Fund? |

| A. | The implementation of the New Advisory Agreement will not affect your account. You will still own the same number of shares in the Fund and the value of your investment did not, nor will it, change as a result of the change of control at Bruce. In addition, R. Jeffrey Bruce, who served as co-portfolio manager of the Fund with his father until his father’s death, will continue managing the Fund without interruption as the sole portfolio manager. Except for the effective dates and the signatories, there are no material differences between the Prior Advisory Agreement and New Advisory Agreement. |

| Q. | What will happen if shareholders do not approve the New Advisory Agreement before the Interim Advisory Agreement expires? |

| A. | At its meeting on June 29, 2023, the Board of Directors discussed the course of action it might take if the New Advisory Agreement is not approved within 150 days of the death of Robert Bruce. Both the Board of Directors and Bruce are fully aware that if the New Advisory Agreement is not approved by November 20, 2023, there will not be an advisory agreement in place that would permit Bruce to continue to provide advisory serves to the Fund after that date. |

To address these concerns, the Fund, with the Board of Director’s approval, will take the following measures. As a first step, if the requisite approval is not obtained at the Meeting, the Fund will seek to adjourn the Meeting by the requisite vote of shareholders present at the Meeting in person or by proxy until a later date or dates, and continue to solicit the necessary votes for approval of the Proposal. If shareholders have not approved the New Advisory Agreement by November 20, 2023, the Fund will advise the staff of the Securities and Exchange Commission of that fact and apprise the staff whether it intends to seek no-action relief, in a manner that is consistent with no-action relief that the staff has granted in similar circumstances, to allow Bruce to continue to provide advisory services to the Fund after the expiration of the 150-day term of the Interim Advisory Agreement while also continuing to solicit votes on the proposal to approve the New Advisory Agreement. There is no assurance such relief will be granted. If sufficient shareholder votes to approve the New Advisory Agreement are not obtained during the additional period of no-action relief, or if the staff does not issue the requested relief, the Fund’s Board will consider and determine what further actions it might take in the best interests of Fund shareholders, including potentially merging the Fund with another mutual fund, or liquidating and deregistering the Fund.

| Q. | Why am I being asked to elect current and new Directors? |

| A. | You are being asked to use the enclosed proxy to vote in favor of the election of each of the following nominees as a Director to hold office until the next meeting of Shareholders at which Directors are elected and until his or her successor is elected and qualified. Two of three nominees, Independent Directors, Robert DeBartolo and W. Martin Johnson, are currently Directors of the Fund. The third nominee, Interested Director, R. Jeffrey Bruce, was nominated by the Board of Directors on July 13, 2013, by the current Directors subject to approval by shareholders. Each nominee has consented to be named in the Proxy Statement and to serve if elected. It is not expected that any of the nominees will decline or become unavailable for election, but in case this should happen, the discretionary power given in the proxy may be used to vote for a substitute nominee or nominees. |

| Q. | Why am I being asked to ratify the appointment of Grant Thornton, LLP as independent accountant for the Fund’s fiscal year ended June 30, 2024? |

| A. | Grant Thornton has been selected by the Board of Directors to examine the Fund’s financial statements for the fiscal year ending June 30, 2024. Section 32(a)(2) of the 1940 Act requires the Board’s selection of the independent auditors to be ratified by shareholders at its next succeeding annual meeting. |

| Q. | How does the Fund’s Board of Directors recommend that I vote? |

| A. | After careful consideration, the Board unanimously recommended that shareholders vote to APPROVE the New Advisory Agreement in Proposal 1, APPROVE the proposal to elect each Director in Proposal 2, and APPROVE the proposal to ratify the election of Grant Thornton as the Fund’s independent accountant. |

| Q. | Who is eligible to vote? |

| A. | Any person who owns shares of the Fund on the “record date,” which is October __, 2023, (even if that person subsequently redeems those shares), is eligible to vote on the Proposals. |

| Q. | Who is paying for this proxy mailing and for the other expenses and solicitation costs associated with this Special Meeting? |

| A. | The expenses incurred in connection with preparing the proxy statement and its enclosures and all related legal and solicitation expenses will be paid by the Advisor Bruce. Bruce will not seek reimbursement for the any costs associated with the proxy. |

| Q. | What vote is required to approve the Proposals? |

| A. | The proposal to approve the New Advisory Agreement requires the vote of the “majority of the outstanding voting securities” of the Fund. Under the 1940 Act, a “majority of the outstanding voting securities” is defined as the lesser of: (1) 67% or more of the voting securities of the Fund entitled to vote present in person or by proxy at the Meeting, if the holders of more than 50% of the outstanding voting securities entitled to vote thereon are present in person or represented by proxy; or (2) more than 50% of the outstanding voting securities of the Fund entitled to vote thereon. |

The proposal to elect Directors requires, under the Fund’s Articles of Incorporation, a quorum of a majority of the Fund’s Shares that are outstanding and entitled to vote at the Meeting. Once that quorum is present, either in person or by proxy, a plurality of the of the shares voted (i.e., more FOR than AGAINST) will elect a Director.

The proposal to ratify the appointment the appointment of Grant Thornton, LLP as independent accountant for the Fund’s fiscal year ended June 30, 2024, requires approval by a majority of the shares voted.

A majority of the votes cast at the Meeting, either in person or by proxy, is required to approve any adjournment(s) of the Meeting, even if the number of votes cast is fewer than the number required for a quorum.

| Q. | Who is eligible to vote? |

| A. | Any person who owns shares of the Fund on the “record date,” which is October __, 2023, (even if that person subsequently redeems those shares), is eligible to vote on the Proposals. |

| Q. | How can I cast my vote? |

| A. | You may vote in any of four ways: |

| · | By telephone, with a toll-free call to the phone number indicated on the proxy card. |

| · | By internet, by accessing the website shown on your proxy card and following the online instructions. |

| · | By mailing in your proxy card. |

| · | In person at the Meeting in Chicago, IL on November 15, 2023. |

We encourage you to vote via telephone or over the internet using the control number on your proxy card and following the simple instructions because these methods result in the most efficient means of transmitting your vote and reduces the need for the Fund to conduct telephone solicitations and/or follow up mailings. If you would like to change your previous vote, you may vote again using any of the methods described above.

IMPORTANT INFORMATION FOR SHAREHOLDERS

Bruce Fund, Inc.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held November 15, 2023

Notice is hereby given that Bruce Fund, Inc. (the “Fund”) will hold a special meeting of shareholders (the “Meeting”) of the Bruce Fund, Inc. (the “Fund”) on November 15, 2023, at the offices of the Fund’s investment adviser, Bruce & Co., 20 North Wacker Drive, Suite 2414, Chicago, Illinois 60606 at 2:00 P.M. Central Time.

The purpose of the Meeting is to consider and act upon the following proposals and to transact such other business as may properly come before the Meeting or any adjournments thereof:

| Proposal | Description |

| 1 | To approve a New Advisory Agreement between Bruce & Co. (“Bruce”) and the Fund. |

| 2 | To elect Directors of the Fund, including the two Directors (Independent Directors Robert DeBartolo and W. Martin Johnson), and Interested Director nominee R. Jeffrey Bruce. |

| 3 | To approve the ratification of Grant Thornton, LLP as the Fund’s independent accountants for the fiscal year ended June 30, 2024. |

| 4 | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

The Board of Director of the Fund unanimously recommends that you APPROVE each Proposal.

Shareholders of record of the Fund at the close of business on the record date, October __, 2023, are entitled to notice of and to vote at the Meeting and any adjournment(s) or postponements thereof. The Notice of Special Meeting of Shareholders, proxy statement and proxy card are being mailed on or about October __, 2023, to such shareholders of record.

By Order of the Board of Directors,

/s/ R. Jeffrey Bruce

R. Jeffrey Bruce

President of Bruce Fund, Inc.

Chicago, Illinois

October __, 2023

IMPORTANT – WE NEED YOUR PROXY VOTE IMMEDIATELY

Shareholders are invited to attend the Special Meeting in person. Any shareholder who does not expect to attend the Special Meeting is urged to vote using the touch-tone telephone voting and

internet voting instructions found on the enclosed proxy card. Alternatively, you may cast your votes on the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. To avoid unnecessary expense, we ask your cooperation in responding promptly, no matter how large or small your holdings may be.

Bruce Fund, Inc.

PROXY STATEMENT

c/o Bruce & Co.

20 North Wacker Drive, Suite 2414

Chicago, Illinois 60606

SPECIAL MEETING OF SHAREHOLDERS

November 15, 2023

Introduction

This proxy statement is being provided to you on behalf of the Board of Directors (the “Board”) of Bruce Fund, Inc. (the “Fund”) in connection with the solicitation of proxies to be used at the special meeting of shareholders of the Bruce Fund, Inc. (the “Fund”) to be held on November 15, 2023 (the “Meeting”). The purpose of the Meeting is (1) to seek shareholder approval of a new investment advisory agreement (“New Advisory Agreement”) between the Fund and Bruce & Co. (“Bruce” or the “Adviser”); (2) elect the two current Directors (Independent Directors: Robert DeBartolo and W. Martin Johnson) and one new Director nominee (Interested Director R. Jeffrey Bruce) as directors of the Fund; (3) to ratify or reject the selection of Grant Thornton LLP as independent certified public accountant for the Fund; and (4) transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

Shareholders of record at the close of business on the record date, established as October __, 2023 (the “Record Date”), are entitled to notice of, and to vote at, the Special Meeting. We anticipate that the Notice of Special Meeting of Shareholders, this proxy statement and the proxy card (collectively, the “proxy materials”) will be mailed to shareholders beginning on or about October __, 2023.

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on November 15, 2023:

The Notice of Meeting, Proxy Statement and Proxy Card

are available at http://vote.proxyonline.com/brucefund/docs/proxy2023.pdf

Please read the proxy statement before voting on the proposals. If you need additional copies of this proxy statement or proxy card, please contact EQ Fund Solutions at 1-866-521-4429. Representatives are available to answer your call Monday through Friday, 9:00 a.m. to 10:00 p.m., Eastern Time. Additional copies of this proxy statement will be delivered to you promptly upon request.

For a free copy of the Fund’s annual report for the fiscal year ended June 30, 2023, please contact the Fund at 1-800-872-7823 or write to the Fund, c/o Ultimus Asset Services, 225 Pictoria Dr., Suite 450, Cincinnati, OH 45246.

DESCRIPTION OF PROPOSAL 1

APPROVAL OF NEW ADVISORY AGREEMENT

Background

The approval of a new investment advisory agreement (“New Advisory Agreement”) between the Fund and Bruce & Co. Inc., the Fund’s current investment adviser (“Bruce” or “Adviser”), is necessary because a recent change in control of the Adviser resulted in an assignment of the Old Advisory Contact between Bruce and the Fund that immediately terminated it, the change in control occurred because of the unfortunate death of Robert B. Bruce on June 23, 2023. Robert Bruce founded Bruce, and at the time of his death, he was President of the Adviser, one of two managing partners of the Adviser, Chairman of the Board of Directors, President and Treasurer of the Fund, and one of two co-portfolio managers of the Fund. Upon Robert Bruce’s death, control of the Adviser transferred to the other managing partner who also is the majority controlling shareholder of the Adviser, and other co-portfolio manager of the Fund, R, Jeffrey Bruce (“Jeffrey Bruce”). Jeffrey Bruce is Robert Bruce’s son.

Under relevant provisions of the Investment Company Act of 1940, including Sections 2(a)(4), 2(a)(9), and 15(a)(4), the change in control of the Adviser that occurred upon Robert Bruce’s death was deemed to be an assignment of the Fund’s current investment advisory agreement with the Fund (“Old Agreement”) that resulted in its immediate termination under the terms of the Old Agreement and the requirements of the Investment Company Act of 1940. As a result, a shareholder vote is required to approve a new advisory agreement between Bruce and the Fund (“New Advisory Agreement”) (as described in the materials provided). In effect, these provisions require the Fund’s shareholders to vote on a new Advisory Agreement because of the change of control of the Fund’s Adviser. The provision is designed to ensure that shareholders have a say in determining the company or persons that manage their fund.

To ensure continuation of the advisory services Bruce has provided to the Fund, shareholders of the Fund are being asked to approve the New Advisory Agreement. Both the New Advisory Agreement and the Prior Advisory Agreement contain identical fee structures. Both agreements provide that Bruce shall receive the same Advisory fee from the Fund. There are also no material differences between the New Advisory Agreement and the Prior Advisory Agreement in terms of the services that Bruce is required to provide.

If the Proposal is approved by shareholders of the Fund, Bruce will serve as the investment Adviser to the Fund, from the effective date of the New Advisory Agreement, and remain in effect until modified by agreement of the parties, provided the terms of this Agreement and any renewal thereof shall have been approved by a vote of a majority of directors who are not interested persons of the Adviser at a meeting called for the purpose of voting on such approval, as provided in Sec. 15(c) of the Investment Company Act. The change of control of Bruce is not expected to have any material impact on Bruce’s business or operations or the day-to-day portfolio management of the Fund.

Information About the Fund

The Fund is an open-end investment management company incorporated as a Maryland corporation. Bruce & Co., Inc., 20 North Wacker Drive, Suite 2414, Chicago, Illinois 60606, is the Fund’s investment adviser. Ultimus Fund Distributors, LLC (“Ultimus”) is the distributor of the Fund’s shares. Ultimus is located at 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. The Fund’s administrator, transfer agent, and fund accountant is Ultimus Fund Solutions, LLC, also located at the same address as Ultimus.

Information About Bruce

Bruce is an investment adviser registered with the Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940. As of June 30, 2023, Bruce had assets under management of approximately $523 million. Bruce provides investment advisory and advisory services to the Fund, high net worth individuals, pension and profit-sharing plans and charitable organizations. Bruce is controlled by Jeffrey Bruce, who also is the President and Chief Compliance Officer of the Adviser. There are no other principal officers of Bruce.

Bruce does not serve as an investment adviser to any other investment company.

Impact on the Prior Investment Advisory Agreement of Robert Bruce’s Death

Shareholders of the Fund are being asked to approve the New Advisory Agreement. Under the 1940 Act, Robert Bruce’s death resulted in an “assignment” (as defined in the 1940 Act) under terms of the Old Advisory Agreement. As required under the 1940 Act, the Old Advisory Agreement provided for its automatic termination in the event of its assignment, and a shareholder vote is required to approve a New Advisory Agreement.

If the shareholders of the Fund do not approve the New Advisory Agreement, the Board of Directors will take action as it deems necessary in the best interests of shareholders of the Fund. At its meeting on June 29, 2023, and at subsequent meetings, the Board discussed the course of action it might take in the unlikely scenario that the New Advisory Agreement is not approved within 150 days of the death of Robert Bruce on June 23, 2023. Both the Board and Bruce are fully aware that if the New Advisory Agreement is not approved by November 20, 2023, there will not be an advisory agreement in place that would permit Bruce to continue to provide advisory serves to the Fund after that date.

To address these concerns, the Adviser, with the Board’s approval, will take the following measures. As a first step, if the requisite approval is not obtained at the shareholder meeting on November 15, 2023, the Fund will seek to adjourn the Shareholder Meeting by the requisite vote of shareholders present at the Meeting in person or by proxy until a later date or dates, and continue to solicit the necessary votes for passage of the Proposal. If shareholders have not approved the New Advisory Agreement by November 20, 2023, the Registrant will advise Commission staff of that fact and apprise the staff whether it intends to seek no-action relief, in a manner that is consistent with no-action relief that the staff has granted in similar circumstances, to allow Bruce to continue to provide advisory services to the Fund after the expiration of the 150-day term of the Interim Advisory Agreement while also continuing to solicit votes on the proposal to approve the New Advisory Agreement. There is no guarantee the staff will grant such relief.

If sufficient shareholder votes to approve the New Advisory Agreement are not obtained during the period of no-action relief, or if the staff does not issue the requested relief, the Fund’s Board will consider and determine what further actions it might take in the best interests of Fund shareholders, including potentially merging the Fund with another mutual fund, or liquidating and deregistering the Fund.

Terms of the New Advisory Agreement, Interim Advisory Agreement and Prior Advisory Agreement

A form of the New Advisory Agreement is attached as Exhibit A. The following description is a summary that discusses all relevant and material terms of that agreement. However, you should refer to Exhibit A for the full text of the New Advisory Agreement. There are no differences between the terms of the New Advisory Agreement, the Interim Advisory Agreement, and the Prior Advisory Agreement with respect to services provided by Bruce, and the three Agreements are identical with respect to the Advisory fees paid to Bruce.

The Fund’s Prior Advisory Agreement with Bruce with respect to the Fund was originally approved by Fund shareholders in 1996, and annually reviewed and approved by the Independent Directors of the Board. For the fiscal year ended June 30, 2023, Bruce received $2,769,797 in advisory fees from the Fund.

Services Rendered by the Adviser to the Fund. Each of the New Advisory Agreement, the Interim Advisory Agreement, and the Prior Advisory Agreement require Bruce to provide identical services to the Fund. In particular, Bruce is required to (i) furnish continuously an investment program for the Fund and to make investment decisions on behalf of the Fund and place all orders for the purchase and sale of portfolio securities and (ii) manage, supervise and conduct all of the affairs and business of the Fund, furnish office space and equipment, and pay all salaries, fees and expenses of officers and directors of the Fund who are affiliated with the Adviser.

Advisory Fee. The New Advisory Agreement, the Interim Advisory Agreement, and the Prior Advisory Agreement contain identical fee structures. All three agreements provide that Bruce shall receive an advisory fee from the Fund The advisory fee payable by the Fund to Bruce and Co. is a percentage applied to the average net assets of the Fund as follows:

| Annual Percentage Fee | Applied to Average Net Assets of Fund |

| | |

| 1.0% | Up to $20,000,000; plus |

| | |

| 0.6% | $20,000,000 through $100,000,000; plus |

| | |

| 0.5% | over $100,000,000 |

Duration and Termination. Subject to requisite Board and/or shareholder approvals required by the 1940 Act, both the New Advisory Agreement and the Prior Advisory Agreement provide that they will become effective upon their execution. Both agreements provide that they shall remain in effect for the Fund for one year from the effective date and thereafter for successive periods of one year, subject to annual Board approval as required by the 1940 Act. Both the New Advisory Agreement and the Prior Advisory Agreement provide for the termination of the agreement by either party at any time by written notice of at least 60 days to the other party. Action by the Fund to terminate the Agreement may be taken either (i) by vote of a majority of its Directors, or (ii) by the affirmative vote of a majority of the outstanding shares of the Fund. Under both the New Advisory Agreement and the Prior Advisory Agreement, termination of the Agreement by either party pursuant to these contractual provisions is not subject to the payment of any penalty.

The Interim Advisory Agreement became effective on June 23, 2023, the date Robert Bruce passed away and the effective date of the change of control of Bruce, thereby terminating the Prior Advisory Agreement. The Interim Advisory Agreement is scheduled to expire on the earlier of the following dates: (1) the date that shareholders approve the New Advisory Agreement, and such results are certified; or (2) on November 20, 2023, which is 150 days from the date of Robert Bruce passed away. If shareholders do not approve the New Advisory Agreement before November 20, 2023, the Fund will not have an effective advisory agreement in place as of November 20, 2023, and Bruce would not be authorized to continue to provide such services to the Fund.

Payment of Expenses. Under each of the New Advisory Agreement, the Interim Advisory Agreement and the Prior Advisory Agreement, Bruce is responsible at its own expense for (i) furnishing continuously an investment program for the Fund, making investment decisions on behalf of the Fund and placing all orders

for the purchase and sale of portfolio securities and (ii) managing, supervising and conducting all of the affairs and business of the Fund, furnishing office space and equipment, and paying all salaries, fees and expenses of officers and directors of the Fund who are affiliated with the Adviser. Under each of the New Advisory Agreement, the Interim Advisory Agreement and the Prior Advisory Agreement, the Adviser is not obligated to pay any expenses of or for the Fund that not expressly assumed by the Adviser under the Advisory Agreement. The Fund will be responsible for the same expenses under the New Advisory Agreement as it is under Interim Advisory Agreement and was under the Prior Advisory Agreement.

Limitation on Liability and Indemnification. The New Advisory Agreement, like the Interim Advisory Agreement and the Prior Advisory Agreement provide that, in the absence of willful misfeasance, bad faith, or gross negligence or reckless disregard of the duties and obligation imposed on the Adviser by such Agreements, Bruce shall not be subject to any liability to the Fund, or to any shareholder of the Fund, for any act or omission in the course of, or connected with, rendering services under the Advisory Agreement or for any losses that may be sustained in the purchase, holding or sale of any security.

Board Approval and Recommendation

The Board approved the New Advisory Agreement at a meeting called specifically for that purpose held on September 29, 2023 (the “September Meeting”). The Board received and considered information from Bruce and the Fund’s administrator designed to provide the Board with the information necessary to evaluate the approval of the New Advisory Agreement. In determining whether to approve the New Advisory Agreement, the Directors considered all factors they believed relevant, including the following with respect to the Fund: (1) the nature, extent, and quality of the services to be provided by Bruce with respect to the Fund; (2) the Fund’s historical performance as managed by Bruce under the Current Advisory Agreement; (3) the costs of the services to be provided by Bruce and the profits to be realized by Bruce from services rendered to the Fund; (4) comparative fee and expense data for the Fund and other investment companies with similar investment objectives; (5) the extent to which economies of scale may be realized as the Fund grows, and whether the advisory fee for the Fund reflects such economies of scale for the Fund’s benefit; and (6) other benefits to Bruce resulting from its relationship with the Fund. In their deliberations, the Directors weighed to varying degrees the importance of the information provided to them and did not identify any particular information that was all-important or controlling. The Board did comment on the long-term success of the Fund’s performance, and steady and consistent approach of the Advisor in the face of uncertain markets.

The Board unanimously approved the New Advisory Agreement as in the best interests of the Fund and its shareholders. The Board considered the following factors and made the following conclusions with respect to the Fund:

Nature, Extent and Quality of Services. With respect to the nature, extent and quality of services that the Adviser renders, the Directors considered the scope of services provided under the Agreement, which includes, but are not limited to, the following: (1) providing a continuous investment program for the Fund, adhering to the Fund’s investment restrictions, complying with the Fund’s policies and procedures, and voting proxies on behalf of the Fund. The Directors considered the qualifications and experience of the Fund’s portfolio manager who is responsible for the day-to-day management of the Fund’s portfolio, as well as the qualifications and experience of other resources utilized by Bruce to provide services to the Fund. The Directors concluded that they were satisfied with the nature, extent, and quality of investment management services provided by Bruce to the Fund and that the fees for the services provided seem reasonable and appropriate for the services especially in comparison to what other funds pay. The Directors also considered the long-term investment philosophy and the significant industry experience of the Adviser’s portfolio manager in servicing the Fund, noting his high quality. In addition,

The Directors concluded that they were satisfied with the nature, extent and quality of services provided by the Adviser pursuant to the Agreement.

Performance of the Fund. The Board also reviewed the Fund’s performance and observed that the Fund had outperformed its peers in its Morningstar category of Hybrid Funds for the long-term categories (15 and 20 year). The Directors noted that the Fund has performed better in difficult market conditions and that longer-term assessment is appropriate. Based upon the foregoing, the Directors concluded the Fund’s performance is acceptable.

Cost of Advisory Services and Profitability. The Directors considered and discussed with the Adviser the profitability to the Adviser. The Directors also considered a profitability analysis presented by Bruce, which showed that Bruce is earning a profit. The Directors noted Bruce’s representation that it does not enter into soft-dollar transactions on behalf of the Fund. The Directors also considered that the Adviser bears a substantial portion of operational costs. They noted that the Adviser has been diligent to ensure that the Fund has provided no undue compensation or benefits to the Adviser or anyone else.

Economies of Scale. In determining the reasonableness of the management fee, the Directors also considered the extent to which Bruce will realize economies of scale as the Fund grows. The Directors noted that the management fee is currently subject to breakpoints and that such breakpoints are reasonable.

Comparative Fee and Expense Data; Economies of Scale. The Directors discussed the Fund’s Fee Rate and Profitability. The Directors reviewed a fee and expense comparison for the Fund. The Directors noted that the advisory fee of the Fund is below the average and median of the Fund’s Morningstar category and the Fund’s peer group. The Directors also noted that the expense ratio of the Fund is below the average and median of the Fund’s Morningstar category and the Fund’s peer group.

Other Benefits. The Directors noted that the Adviser has been diligent to ensure that the Fund has provided no undue compensation or benefits to the Adviser or anyone else.

Based upon the Adviser’s presentation at the meeting and the information contained in Adviser’s Section 15(c) Response, as well as other information gleaned from the Fund’s quarterly Board meetings throughout the year and past information, the Board concluded that the overall arrangements between the Fund and the Adviser as set forth in the New Agreement are fair and reasonable in light of the services performed, fees paid and such other matters as the Directors considered relevant in the exercise of their reasonable judgment. In their deliberations, the Directors did not identify any particular factor that was all-important or controlling.

Based on all of the information presented to and considered by the Board and the conclusions that it reached, the Board (consisting of Independent Directors) voting unanimously to approve the New Advisory Agreement for the Fund on the basis that its terms and conditions are fair and reasonable and in the best interests of the Fund and its shareholders.

THE BOARD RECCOMENDS THAT SHAREHOLDERS VOTE IN FAVOR OF PROPOSAL 1 TO APPROVE THE NEW ADVISORY AGREEMENT WITH BRUCE

PROPOSAL 2 – TO ELECT DIRECTORS OF THE FUND

The shareholders of the Fund are being asked to vote for the election of the following three nominees at the Special Meeting: two nominees who are were previously serving as directors: W. Martin Johnson and

Robert DeBartolo, and one new nominee, R. Jeffrey Bruce. Following Robert Bruce’s death on June 23, 2023, the Board was comprised of only the two members; the two current director nominees W. Martin Johnson and Robert DeBartolo, who have served continuously on the Board for more than 15 years. The Board met on July 13, 2023, and nominated Jeffrey Bruce for election to the Board by shareholders.

Jeffrey Bruce will be an “interested person” (as that term is defined in the 1940 Act) of the Fund by virtue of his position as the principal owner and officer of the Adviser. W. Martin Johnson and Robert DeBartolo are non-interested persons, which means that they are not “interested persons” of the Adviser, or distributor of the Fund (sometimes referred to herein as the “Independent Nominees”).

If elected, the nominees will comprise the entire Board of the Fund, and each will hold office until the appointment and/or election and qualification of his successor, if any, or until he sooner dies, resigns, retires or is removed. Any Director may be removed at a meeting of shareholders by a vote that meets the requirements of the Fund’s organizational documents. All of the Nominees have consented to serve as Directors. However, if any Nominee is not available for election at the time of the Special Meeting, the proxies may be voted for such other person(s) as shall be determined by the persons acting under the proxies in their discretion.

Each Nominee was nominated to serve on the Board of Directors based on his particular experiences, qualifications, attributes and skills. Generally, the Board believes that each nominee is competent to serve because of his individual overall merits, including: (i) experience; (ii) qualifications; (iii) attributes; and (iv) skills. The Board does not believe any one factor is determinative in assessing a nominee’s qualifications.

The following table provides information regarding the three nominees:

INDEPENDENT NOMINEES

Name, Address*, (Age), Position with

Fund**, Term of Position with Fund | Principal Occupation and

Other Directorships During Past 5 Years |

W. Martin Johnson (86)

Independent Director, December 1985 to present | 2022 to present retired; 2002 to 2021 - Real Estate Sales, Landings Co.; 2000 - 2002 – President, Savannah Capital |

Robert DeBartolo (63)

Independent Director, March 2007 to present | 2013 to present – Independent consultant to the life sciences sector; 2011 to 2012 – Director, Global Franchise Marketing, Novartis/Alcon |

INTERESTED NOMINEE

| Name, Address*, (Age), Position with Fund**, Term of Position with Fund | Principal Occupation and

Other Directorships During Past 5 Years |

R. Jeffrey Bruce*** (63) Secretary, 1983 to present, Chief Compliance Officer since 2022 and, AML Officer since 2022. President and Treasurer, July 2023 to present. Vice President 1983 to July 2023. | Secretary, 1983 to present, Chief Compliance Officer since 2022 and, AML Officer since 2022. Vice President 1983 to July 2023 2022 to present – Chief Compliance Officer of Bruce & Co, Inc. (investment adviser); 1983 to present – analyst/manager, Bruce & Co., Inc.; 1993 to June 2019 – Director, Professional Life & Casualty Company (life insurance issuer). |

* The address for each director nominee is 20 North Wacker Drive, Suite 2414, Chicago, Illinois 60606.

** The Fund consists of one series. The Fund is not part of a Fund Complex.

*** Mr. Jeffrey Bruce is an “interested” person because he is an officer and is compensated by the Adviser.

Board Structure and Process

Currently, the Board is comprised solely of two Independent Directors. The Board is responsible for the management and supervision of the Fund. The Board oversees the Fund and certain aspects of the services

of the Adviser and the Fund’s other service providers. The Board has only one standing committees of directors, which is the Audit Committee.

The Board does not have a designated lead independent director nor does it have a chairman at this time. The responsibility of the Board is to ensure that the Fund is being run for the benefit of the shareholders and in compliance with its investment mandates and objectives. The Board has determined that this structure is appropriate due to the facts that the Fund is a no-load fund, does no marketing, promotion or advertising, has low portfolio turnover, and has a concentrated management structure.

The Board reviews the performance of the Fund and its portfolio make-up on a regular basis to ensure compliance with the Fund’s strategies and objectives. It also annually reviews the advisory contract, determining the appropriateness of fees, expenses and performance. The Directors also on a regular basis review and discuss some or all of the following compliance and risk management reports or topics related to the Fund:

1. Portfolio Management Process, Portfolio Review

2. Review of Commissions, Best Execution

3. Trading Activities, Affiliated Persons Security Transactions

4. Disclosure Requirements, Fund Compliance Tests

5. Anti-Money Laundering, Customer Identification Policy Review

6. Proxy Voting Policy

7. Code of Ethics, Chief Compliance Officer Reports

8. Pricing of Portfolio Securities, Fair Value Pricing Policy

9. Privacy Policy

10. Continuity Planning and Business Recovery

11. Processing of Fund Shares

12. Protection of Non-Public Information

13. Fund Governance, Advisory Contract Review

14. Market Timing, Late Trading Issues

15. Compliance Issues

16. Federal Registration, Filings and Audit Review

17. Portfolio Liquidity

Nominee Ownership of Fund Shares. The following table provides information regarding shares of the Fund owned by each Director (and Nominee) as of June 30, 2023.

| Director | Dollar Range of Fund Shares |

| W. Martin Johnson | $1 - $10,000 |

| Robert DeBartolo | $10,001 - $50,000 |

| R. Jeffrey Bruce (Nominee) | $ Over $100,000 |

Compensation. Directors and officers of the Fund who are interested persons of the Fund or the Adviser do not receive any salary or fees from the Fund. Other Directors receive an annual fee of $8,000 per year. The Fund will also reimburse each Director and officer for his travel and other expenses relating to Board meeting attendance.

Independent Director and Nominees’ Ownership of Interests in, or other Business Relationships with, the Fund’s Adviser or the Fund’s Principal Underwriter

As of October __, 2023, other than Mr. Bruce’s ownership interest in Bruce & Co., no current Independent Director or Nominee for Director, nor any of his immediate family members, had any ownership position in Bruce & Co., the Fund’s Adviser, the Fund’s Manager, or Ultimus Fund Distributors, LLC, the Fund’s

distributor and principal underwriter (“Distributor”), or any person (other than a regulated investment company) directly or indirectly controlling, controlled by, or under common control with the Adviser or the Distributor.

No Nominee for Independent Director purchased or sold securities of the Adviser or its affiliates or the Distributor or its affiliates since the beginning of the Fund’s most recently completed fiscal year.

Fund Ownership

Each of the Director nominees currently owns shares of the Fund. As of June 30, 2023, R. Jeffrey Bruce is the beneficial owner of 31,518 Fund shares, Robert DeBartolo is the beneficial owner of 32 Fund shares, and W. Martin Johnson is the beneficial owner of 6 Fund shares. As of the same date, the Director nominees and executive officers of the Fund, as a group, owned less than 4% of the Fund.

As of the Record Date, there are no shareholders who own 5% or more of the outstanding shares of the Fund.

As defined under the 1940 Act, shareholders owning more than 25% of the shares of the Fund are considered to “control” the Fund. Persons controlling the Fund can determine the outcome of any proposal submitted to the shareholders for approval. As of the Record Date, there are no shareholders who are “control” persons.

Information Regarding Directors’ Attendance at Board Meetings

During the Fund’s fiscal year ended June 30, 2023, the Board held five regularly scheduled meetings and did not have any special meetings. Each of the two current Director nominees attended all of the meetings.

Communications with the Board of Directors

Shareholders who wish to communicate with the Board with respect to matters relating to the Fund may address their written correspondence to the Board as a whole or to individual Board members c/o Bruce Fund, c/o Ultimus Asset Services, LLC, 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

Director Attendance at Annual Meetings of Shareholders

Pursuant to the Fund’s by-laws, the Fund is not required to hold an annual meeting of shareholders. Because annual meetings are very infrequent, the Fund has not adopted a policy regarding director attendance at any Special Meeting of shareholders. The Directors do not intend to attend the Meeting.

Each nominee has consented to be named in the Proxy Statement and to serve if elected. It is not expected that any of the nominees will decline or become unavailable for election, but in case this should happen, the discretionary power given in the proxy may be used to vote for a substitute nominee or nominees.

SHAREHOLDERS ARE RECOMMENDED TO ELECT EACH OF THE NOMINEES.

PROPOSAL 3—RATIFICATION OF SELECTION OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANT

Registration of the Fund shares under the Securities Act of 1933 requires the Fund to make at least annual filings with the Securities and Exchange Commission, which filings include financial statements which must be signed or certified by an independent public accountant. The Board of Directors has unanimously selected the firm of Grant Thornton LLP, 171 N. Clark St., Chicago,

Illinois 60601 to serve as such independent public accountant for the fiscal year ending in 2024 and will submit this selection for ratification or rejection by the shareholders. The Fund’s Annual Report for fiscal year ended 2023 was mailed to shareholders on August 29, 2023. The Fund does not plan to request a representative of Grant Thornton LLP (which certified the financial statements dated June 30, 2023) to be present at the special meeting.

Audit Fees.

Information relating to fees billed for professional audit services rendered by Grant Thornton for the audit of the Fund’s annual financial statements for the past two fiscal years and for fees billed for other services rendered by Grant Thornton to the Fund follows:

Audit Fees.

FY 2023 $53,550

FY 2022 $53,575

Audit-Related Fees. There were no aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit or review of the registrant's financial statements and are not reported immediately above.

Tax Fees. The following aggregate fees were billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The fees were for the preparation of the 1120 RIC tax form:

FY 2023 $9,700

FY 2022 $9,540

All Other Fees. There were no aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported immediately above.

SHAREHOLDERS ARE RECOMMENDED TO APPROVE GRANT THORNTON

PROPOSAL 4 - TO TRANSACT SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENTS OR POSTPONEMENTS THEREOF

The purpose of this Proposal 4 is to authorize the holder of proxies solicited under this proxy statement to vote the shares represented by the proxies in favor of the adjournment of the Meeting from time to time in order to allow more time to solicit additional proxies, as necessary, if there are insufficient votes at the time of the Meeting to constitute a quorum or to approve any Proposal.

One or more adjournments may be made without notice other than an announcement at the Meeting, to the extent permitted by applicable law and the Fund’s governing documents. Any adjournment of the Meeting for the purpose of soliciting additional proxies will allow the Fund’s shareholders who have already sent in their proxies to revoke them at any time before their use at the Meeting, as adjourned.

The proxy holders have no current intention to bring any matter before the Meeting other than those specifically referred to above or matters in connection with or for the purpose of effecting such matters. Neither the proxy holders nor the Board of Director are aware of any matters which may be presented by others. If any business shall properly come before the Meeting, the proxy holders intend to vote thereon in accordance with their best business judgment.

INFORMATION ABOUT OWNERSHIP OF SHARES OF THE FUND

Outstanding Shares

Only shareholders of record at the close of business on October __, 2023, the record date (the “Record Date”), will be entitled to notice of, and to vote at, the Special Meeting. On the Record Date, the Fund had ________ shares outstanding.

Security Ownership of Advisory, Director Officer, Affiliated Person and Principal Shareholders

As of the Record Date, to the best of the knowledge of the Fund, directors, officers, and affiliated persons of the Fund, as a group, owned less than 4% of the outstanding shares of the Fund. As of the Record Date, no shareholder owned more than 25% of the Fund and therefore no shareholder may be deemed to control the Fund. The Board is aware of no arrangements, the operation of which at a subsequent date may result in a change in control of the Fund. As of the Record Date, the Independent Directors, and their respective immediate family members, did not own any securities beneficially or of record in Bruce or Ultimus. As of the Record Date, there were no shareholders who owned more than 5% of the outstanding shares of the Fund:

VOTING INFORMATION

Who is Eligible to Vote?

Shareholders of record of the Fund as of the close of business on the Record Date, October __, 2023, are entitled to vote on the proposal at the Special Meeting and any adjournments thereof. Each whole share is entitled to one vote on each matter on which it is entitled to vote, and each fractional share is entitled to a proportionate fractional vote.

Quorum

In order for a vote on each Proposal to occur at the Special Meeting, there must exist a quorum of shareholders of the Fund to which the Proposal relates. With respect to the Fund, the presence at the Special Meeting, in person or by proxy, of shareholders representing a majority of the Fund’s shares outstanding and entitled to vote as of the Record Date constitutes a quorum for the Special Meeting.

It is the Fund’s understanding that because Proposal 1 presented for approval at the Special Meeting is a “non-routine” matter, broker-dealers and other intermediaries will not have discretionary authority to vote on that proposal in the absence of specific authorization from their customers. Consequently, there are unlikely to be any “broker non-votes” at the Special Meeting with respect to Proposal 1. “Broker non-votes” would otherwise have the same effect as abstentions (that is, they could be counted as present for purposes of determining the presence of a quorum and would be treated as if they were votes against the proposal).

In the event the necessary quorum to transact business or the vote required to approve Proposal 1 is not obtained at the Special Meeting, the persons named as proxies may propose one or more adjournments of the Special Meeting with respect to the Proposal in accordance with applicable law to permit further solicitation of proxies. Any adjournment of the Special Meeting will require the affirmative vote of the

holders of a simple majority of the Fund’s shares cast at the Special Meeting. The persons named as proxies will vote for or against any adjournment in their discretion.

Vote Required to Pass the Proposal 1 (Approval of New Investment Advisory Agreement)

As required by the 1940 Act, approval of Proposal 1 related to the New Advisory Agreement will require the vote of a majority of the outstanding voting securities of the Fund. In accordance with the 1940 Act, a “majority of the outstanding voting securities” of the Fund means the lesser of (a) 67% or more of the shares of the Fund present at a shareholder meeting if the owners of more than 50% of the shares of the Fund then outstanding are present in person or by proxy, or (b) more than 50% of the outstanding shares of the Fund entitled to vote at the meeting. Abstentions and broker “non-votes”, if any, will have the effect of a “no” vote for purposes of obtaining the requisite approval of the proposal.

Vote Required to Pass Proposal 2 (Elect Directors)

The proposal to elect Directors requires, under the Fund’s Articles of Incorporation, a quorum of a majority of the Fund’s Shares that are outstanding and entitled to vote at the Meeting. Once that quorum is present, either in person or by proxy, a plurality of the of the shares voted (i.e., more FOR than AGAINST) will elect a Director.

Vote Required to Pass Proposal 3 (Ratify Independent Accountant)

The proposal to ratify the appointment the appointment of Grant Thornton, LLP as independent accountant for the Fund’s fiscal year ended June 30, 2024, requires approval by a majority of the shares voted.

Proxies and Voting at the Special Meeting

Shareholders may use the proxy card provided if they are unable to attend the meeting in person or wish to have their shares voted by a proxy even if they do attend the meeting. Any shareholder of the Fund giving a proxy has the power to revoke it prior to its exercise by mail (addressed to the Secretary at the principal executive office of the Fund shown at the beginning of this proxy statement), or in person at the meeting, by executing a superseding proxy or by submitting a notice of revocation to the Fund. In addition, although mere attendance at the Special Meeting will not revoke a proxy, a shareholder present at the Special Meeting may withdraw a previously submitted proxy and vote in person. To obtain directions on how to attend the Special Meeting and vote in person, please call 1- 800-347-8607.

All properly executed proxies received in time for the Special Meeting will be voted as specified in the proxy or, if no specification is made, FOR the Proposal referred to in the proxy statement and in the discretion of the persons named as proxies on such procedural matters that may properly come before the Special Meeting. If any other business comes before the Special Meeting, your shares will be voted at the discretion of the persons named as proxies.

Telephonic Voting. Shareholders may call the toll-free phone number indicated on their proxy card to vote their shares. Shareholders will need to enter the control number set forth on their proxy card and then will be prompted to answer a series of simple questions. The telephonic procedures are designed to authenticate a shareholder’s identity, to allow shareholders to vote their shares and to confirm that their instructions have been properly recorded.

Method of Solicitation and Expenses

EQ Funds Solutions has been retained as proxy solicitor and tabulator. Bruce will assist in the solicitation of proxies. The solicitation of proxies may occur principally by mail, but proxies may also be solicited by telephone, e-mail or other electronic means, facsimile or personal interview. If instructions are recorded by telephone, the person soliciting the proxies will use procedures designed to authenticate shareholders’ identities to allow shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that a shareholder’s instructions have been properly recorded.

The cost of preparing, printing and mailing the enclosed proxy card and this proxy statement, and all other costs incurred in connection with the solicitation of proxies, including any additional solicitation made by letter, telephone, facsimile or telegraph is estimated to be $70,000. The cost of solicitation will be borne by the Adviser, and not the Fund. Bruce will not seek reimbursement from the Fund for any costs associated with the proxy.

Shareholder Proposals for Subsequent Meetings

The Fund does not hold annual shareholder meetings except to the extent that such meetings may be required under the 1940 Act or state law. Shareholders who wish to submit proposals for inclusion in the proxy statement for a subsequent shareholder meeting should send their written proposals to the Fund’s Secretary at its principal office within a reasonable time before such meeting. The timely submission of a proposal does not guarantee its inclusion.

Householding

If possible, depending on shareholder registration and address information, and unless you have otherwise opted out, only one copy of this Proxy Statement will be sent to shareholders at the same address. However, each shareholder will receive separate proxy cards. If you would like to receive a separate copy of the Proxy Statement, please call --1-800-872-7823. If you currently receive multiple copies of Proxy Statements or shareholder reports and would like to request to receive a single copy of documents in the future, please call 1-800-872-7823 or write to the Fund at Ultimus Asset Services, 225 Pictoria Dr., Suite 450, Cincinnati, OH 45246.

Other Matters to Come Before the Meeting

No business other than the matters described above is expected to come before the Special Meeting but should any other matter requiring a vote of shareholders arise the persons named as proxies will vote thereon in their discretion according to their best judgment in the interests of the Fund and its shareholders.

EXHIBIT A

FORM OF NEW INVESTMENT ADVISORY AGREEMENT

THE BRUCE FUND

INVESTMENT ADVISORY AGREEMENT

Agreement made this __ day of October, 2023, by and between BRUCE FUND, INC., a Maryland corporation (the "Fund") and BRUCE AND CO., an Illinois corporation, located in Chicago, Illinois (the "Adviser").

WITNESSETH

In consideration of the mutual covenants hereinafter contained, IT IS HEREBY AGREED by and between the parties hereto as follows:

1. The Fund hereby employs the Adviser to act as its investment adviser and to manage the investment and reinvestment of the assets of the Fund and otherwise to administer the Fund's affairs to the extent requested by the Board of Directors of the Fund, all subject to the supervision of the Board of Directors of the Fund and the applicable provisions of the Certificate of Incorporation and By-Laws of the Fund for the period and on the terms herein set forth. The Adviser hereby accepts such employment and agrees during such period to render the services and to assume the obligations herein set forth for the compensation herein provided. The Adviser shall in acting hereunder be an independent contractor and, unless otherwise expressly provided or authorized hereunder or by the Board of Directors of the Fund, shall have no authority to act for or represent the Fund in any way or otherwise be deemed an agent of the Fund.

2. The Adviser shall, at its own expense, furnish to the Fund suitable office space in its own offices or in such other place as may be agreed upon from time to time and all necessary office facilities and equipment for managing the assets of the Fund and shall arrange, if desired by the Fund, for members of the Adviser's organization to serve without salaries from the Fund as directors, officers or agents of the Fund, if duly elected or appointed to such positions by the shareholders or by the Board of Directors of the Fund, subject to their individual consent and to any limitations imposed by law. The Fund will not charge any sales load or commission in connection with the sale of Fund shares and the Adviser shall bear all sales and promotional expenses of the Fund, other than expenses incurred in complying with laws regulating the issue or sale of securities.

3. The Adviser shall be responsible. only for those expenses expressly stated in paragraph 2 thereof The Fund shall bear all other expenses, including as illustrative and without limitation, fees and salaries of the officers and directors who are not interested persons of the Adviser, fees and charges of any custodian (including charges as custodian and for keeping books and records and similar services to the Fund), costs of personnel to perform clerical, accounting and other office services for the Fund, fees and expenses of independent auditors, legal counsel, transfer agents, dividend disbursing agents, and registrars; costs of and incident to issuance, redemption and transfer of its shares and distributions to shareholders (including dividend payments and reinvestment of dividends), brokers' commissions, interest charges; taxes, corporate fees and registration fees payable to any government or governmental body or agency (including those incurred on account of the registration or qualification under federal or state laws of securities issued by the Fund); dues and other expenses incident to the Fund's membership in the

Investment Company Institute and other like associations; costs of stock certificates, stockholder meetings, corporate reports, reports and notices to shareholders; and costs of printing, stationery and bookkeeping forms. The Adviser shall be reimbursed by the Fund on or before the 15th day of each calendar month for all expenses paid or incurred during the preceding calendar month by the Adviser for or on behalf or at the request or direction of the Fund, which are not the responsibility of the Adviser hereunder.

4. Services of the Adviser herein provided are not to be deemed exclusive and the Adviser shall be free to render similar services or other services to others, so long as its services hereunder shall not be impaired thereby. In the absence of willful misfeasance, bad faith or gross negligence or reckless disregard of the obligations or duties hereunder on the part of the Adviser, the Adviser shall not be subject to liability to the Fund or to any shareholder of the Fund for any act or omission in the course of or connected with rendering services hereunder or for any losses that may be sustained in the purchase, holding or sale of any security.

5. The Fund shall pay to the Adviser a monthly management fee of one-twelfth (1/12) of the annual percentage fee calculated as follows:

| Annual Percentage Fee | Applied to Net Assets of Fund |

| 1.0% | Up to $20,000,000; plus |

| 0.6% | $20,000,000 through $100,000,000; plus |

| 0.5% | over $100,000,000 |

The fee for each calendar month shall be computed on the basis of the average of the daily closing net asset values for each business day of the calendar month for which the fee is paid. During any period where the determination of net asset value is suspended, as provided in the Fund's Certificate of Incorporation, the net asset value as last determined and effective shall be deemed the daily closing net asset value on each business day until a new net asset value is again determined and made effective. Each monthly fee shall be paid on or before the 15th day of the month next succeeding the month for which the fee is paid. This Agreement shall be effective October __, 2023, and remain in effect until modified by agreement of the parties, provided the terms of this Agreement and any renewal thereof shall have been approved by a vote of a majority of directors who are not interested persons of the Adviser at a meeting called for the purpose of voting on such approval, as provided in Sec. 15(c) of the Investment Company Act.

6. It is understood that the officers, directors, agents and shareholders of the Fund are or may be interested in the Adviser as officers, directors, shareholders or otherwise and that the Adviser and its officers, directors, shareholders and agents may be interested in the Fund as shareholders or otherwise. The Adviser agrees that neither it nor its officers or directors will take a long or short position in the shares issued by the Fund except in accordance with the applicable provisions of the By-Laws of the Fund.

7. This Agreement shall continue in force so long as such continuance is specifically approved annually: (i) by the vote of a majority of the directors of the Fund who are not interested persons of the Adviser of the Fund (except solely as a director of the Fund) at a meeting called for the purpose of voting on such approval, and (ii) by a majority of the directors or by vote of a majority of the outstanding voting securities of the Fund. This Agreement shall immediately terminate in the event of its assignment. Either party hereto may at any time, on sixty (60) days' written notice to the other, terminate this Agreement without payment of any penalty, termination on the part of the Fund to be by the Board of Directors of the Fund or by a vote of a majority of the outstanding voting securities of the Fund.

8. This Agreement may be modified by mutual consent, such consent on the part of the Fund only to be authorized by a vote of a majority of the outstanding voting securities of the Fund.

9. The terms "assignment", "affiliated persons", "interested persons", and "a vote of a majority of the outstanding voting securities" when used herein shall have the respective meanings specified in the Investment Company Act of 1940, as now in effect and as from time to time amended.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed and effective on the day and year first above written.

BRUCE FUND, INC.

By:_______________________

Ward M. Johnson, Director

By: _______________________

Robert DeBartolo, Director

BRUCE AND CO., a Corporation

| By:_________________________ |

| | R. Jeffrey Bruce, President |

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN. PLEASE CAST YOUR PROXY VOTE TODAY!

FORM OF PROXY CARD

BRUCE FUND

PROXY FOR A SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON NOVEMBER 15, 2023

The undersigned, revoking prior proxies, hereby appoints (names of the undersigned), and each of them, as attorneys-in-fact and proxies of the undersigned, granted in connection with the voting of the shares subject hereto with full power of substitution, to vote shares held in the name of the undersigned on the record date at the Joint Special Meeting of Shareholders of Bruce Fund (the “Fund”) to be held at 20 North Wacker Drive, 24th Floor, Chicago, Illinois 60606 on November 15, 2023, at 2:00 p.m. Central time, or at any adjournment thereof, upon the Proposals described in the Notice of Meeting and accompanying Proxy Statement, which have been received by the undersigned.

Do you have questions?If you have any questions about how to vote your proxy or about the meeting in general, please call toll-free 1-866-521-4429. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

Important Notice Regarding the Availability of Proxy Materials for this Joint Special Meeting of Shareholders to Be Held on November 15, 2023. The proxy statement for this meeting is available at:

https://vote.proxyonline.com/brucefund/docs/proxy2023.pdf

| | | |

| [PROXY ID NUMBER HERE] | [BAR CODE HERE] | [CUSIP HERE] |

| |

| |

| BRUCE FUND |

| |

| YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED. The signer(s) acknowledges receipt with this Proxy Statement of the Board of Trustees. Your signature(s) on this should be exactly as your name(s) appear on this Proxy (reverse side). If the shares are held jointly, each holder should sign this Proxy. Attorneys-in-fact, executors, administrators, trustees or guardians should indicate the full title and capacity in which they are signing. |

| FORM OF PROXY CARD |

| | |

| | |

| | |

| | |

| SIGNATURE (AND TITLE IF APPLICABLE) | DATE |

| | |

| | |

| | |

| SIGNATURE (IF HELD JOINTLY) | DATE |

| | |