UNITED STATESSECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under Rule 14a-12 |

| HILL-ROM HOLDINGS, INC. |

(Name of Registrant as Specified In Its Charter)

|

|

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| (4) | Date Filed: |

[The following talking points were made available for use by executives of Hill-Rom Holdings, Inc. on September 2, 2021.]

ELT, SLT and All-Employee Meetings

Baxter Acquisition of Hillrom

September 2, 2021 - FINAL

About Hillrom’s combination with Baxter

| • | Hillrom has agreed to be acquired by Baxter for $156 per share in cash, for a purchase price of $10.5 billion. |

| • | The purchase price represents a 26% premium to Hillrom’s closing stock price on July 27, 2021, the last trading day prior to media reports speculating about a potential transaction. |

| • | This is an extraordinary testament to the entire Hillrom team, in every business unit, every region and every function, everywhere around the world. The work you have done to bring our vision of Advancing Connected Care™ to life has helped us consistently achieve our mission of enhancing outcomes for patients and their caregivers. |

| • | What’s more, the deal demonstrates the value of our connected care strategy, our potential for rapid growth, and the long-term viability of our business. We have a bright future. |

| • | By joining Baxter, a 50,000-person, $12 billion revenue company headquartered just outside Chicago, we will add complementary businesses to its industry-leading portfolio of critical care, nutrition, renal, hospital and surgical products. |

| • | The combined company will be able to provide a broader array of medical products and services to patients and clinicians across the care continuum and around the world, facilitating the delivery of healthcare that is patient- and customer-centered, and focused on improving clinical outcomes. |

| • | We also will be combining organizations with similar values, a shared focus on creating cultures of diversity, inclusion, equity and belonging, and commitments to accountability and social responsibility. |

| • | This is truly a win-win for all our stakeholders – employees will benefit from being part of a larger, stronger company with accelerated growth opportunities, patients and their caregivers will benefit from our ability to pursue our vision of Advancing Connected Care™ as part of Baxter, and our shareholders will receive a significant premium for their investment. |

| • | The companies expect to close the deal by early 2022, subject to approval of Hillrom shareholders and the satisfaction of customary closing conditions (including regulatory approvals), and in that time we’ll all have an opportunity to learn more about Baxter and how Hillrom will fit in to their connected care growth strategy, one that is very much in line with ours. |

| • | While we know that this news is a lot to digest, over the course of Hillrom’s recent history we have made a number of major strategic decisions that have brought significant change to our company – and it’s through this openness to change that we’ve become so successful. A few examples: |

| o | Hillrom’s spin-off from our former parent Hillenbrand and emergence as a stand-alone public company; |

| o | The acquisitions of Trumpf Medical and Welch Allyn, which added very large businesses to our portfolio, as well as our more-recent moves to add key innovations and capabilities in the connected care space; and |

| o | The divestiture of Aspen and the closure or sale of other businesses and assets. |

| • | In other words, we understand the strategic potential of significant M&A. |

| • | Baxter’s goal of “advancing the next generation of transformative healthcare innovations” is truly our sweet spot. They are looking to achieve scale in the connected care space, and we are poised to continue our growth and success as part of Baxter – a much larger company with significant global scale and resources, especially internationally, where we’ll have substantially more resources to support and sustain our businesses around the world. |

| • | We know there are many questions, organizational and personal; we have the answers to some of those questions today. But most others will come over time, and we’ll share what we know when we can provide additional information to our team members. |

| • | We will hold an all-employee town hall meeting Thursday at 11 a.m. CT and for APAC employees Thursday at 8 p.m. CT – Friday morning in that part of the world – to share more about the combination of Hillrom and Baxter. |

| • | In addition, various members of our leadership team will be visiting a number of Hillrom sites in the coming days. |

What Employees Can Expect Before Deal Close

| • | The proposed acquisition of Hillrom by Baxter is subject to standard closing conditions, including the approval of Hillrom’s shareholders and the satisfaction of customary closing conditions, including regulatory approvals. Until closing, Hillrom and Baxter will continue to operate business as usual. |

| • | There is also a great deal of planning work internally to be done within both companies prior to close. We have identified a small team of senior leaders, headed by Mark Nicholson, who will be working with partners at Baxter in the coming months across a wide range of functions to prepare for this transition, and they will communicate when there is meaningful information to be shared. |

| • | We know this is a time of uncertainty, and we’ll do our best to bring as much clarity as we can, when we can. We will soon launch a Leading Through Transition dedicated page on Connect where you can access the latest information about Hillrom’s planned combination with Baxter, and you can send questions to Integration.Questions@hillrom.com. |

| • | Much of the acquisition-related planning work will happen in the background, and there are at least several months before this combination is finalized, expected by early 2022. Our responsibility, to customers, patients and caregivers, to our shareholders and to one another, is to continue to strengthen our vision of Advancing Connected Care™ and deliver to Baxter a healthy, successful, growing company. |

| • | I am so grateful to each of you – as individuals, as team members – for your outstanding performance in fiscal 2021. Let’s keep up the great work and finish 2021 Hillrom Strong! |

Messages Specifically for Leaders – ELT and SLT

| • | For those of you leading teams, this is important: Hillrom’s ELT and SLT and all of our Hillrom employees are responsible for our business, including making decisions for the benefit of patients and their caregivers, employees, and shareholders. So, it’s business as usual for Hillrom. We must continue to run our business with the same focus and determination that has led us to today. |

| • | In short: we will continue to run our business with the same focus and commitment to values that have led to our success in our 100-plus year history. How we act, how we display our values, vision and mission, will help define the Hillrom legacy. |

| • | Your teams will have questions. |

| o | We won’t have answers to many of the most pressing questions right away, and we appreciate everyone’s patience while we work through the details. |

| o | Please do not guess or speculate – turn to the resources we will make available for the official word on various aspects of any planned integration into Baxter. |

| o | Please instruct your teams to visit the new site on Connect – coming soon – and to send their questions to Integration.Questions@hillrom.com. We’ll plan to answer general questions publicly, and personal questions privately. |

| • | In addition, it is critically important that only authorized executives speak to investors, members of the media or government officials. Please forward any investor inquiries you might receive to Mary Kay Ladone and Lorna Williams, any reporter/media inquiries to Howard Karesh, and any governmental inquiries to the Deb Rasin and Tom Jeffers. |

| • | Now, I’d like to turn it over to Cheryl, who will walk through the leadership toolkit you will be receiving at the conclusion of today’s meeting. |

Cheryl / Leadership Toolkit

| • | We have assembled a number of resources to assist you in meeting with your teams – as a group or in one-on-ones, and we recommend you do both – in the coming days. |

| • | First, let me share with you some leadership principles that will help orient you to our task as leaders. |

| • | We also will send detailed talking points, including much of what you are hearing today. |

| • | Finally, we’d like to take you through a detailed schedule so you have a feel for how the communications will be flowing, and what you can expect. |

| • | This week we will launch a dedicated intranet site, where we’ll house all of our communications, including frequently asked questions, which we’ll update as we go through this process. |

| • | As John already mentioned, please reinforce to your teams that we have an email box already set up to accept employees’ questions: XXX.XXXX@hillrom.com. We’ll answer general questions publicly through our FAQs, and privately when necessary. |

| • | We’ll be sending the Leadership Kit shortly after the conclusion of this call. |

| • | Now, back to John to address how we’ll support our customers during this transition period. |

Supporting Customers Between Deal Sign and Close

| • | While we plan for the combination, we remain separate companies until we formally come together, and must continue to operate and serve customers business as usual. |

| • | While there will be limited teams involved in a formal integration planning process, it is otherwise business as usual, and nothing more. |

| • | For example, Hillrom and Baxter may not, until closing, partner on customer opportunities, nor sell each other’s products. We must continue to operate as distinct organizations. |

| o | Many of us have friends and former colleagues at Baxter; some of us even worked there previously. |

| o | We ask that, to protect the integrity of our planning process, you limit your interactions with those individuals to strictly personal ones until the transaction closes. |

| o | Please send any deal-related questions or matters that arise to Mark Nicholson so they are handled properly and through the appropriate channels. |

| • | Hillrom continues to be led by our current leadership team, who remain responsible for our business globally. |

| • | We have created our success through our commitment to patients and their caregivers, and we will continue to innovate and bring our full capabilities to our customers – business as usual – during this interim period. |

Additional Information About the Merger and Where to Find It

This communication relates to the proposed transaction involving Hillrom. This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. In connection with the proposed transaction, Hillrom will file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including Hillrom’s proxy statement on Schedule 14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document that Hillrom may file with the SEC or send to its shareholders in connection with the proposed transaction. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF HILLROM ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s website, www.sec.gov, or by visiting Hillrom’s investor relations website, https://ir.hill-rom.com/ir-home/default.aspx.

Participants in the Solicitation

Hillrom and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Hillrom’s common stock in respect of the proposed transaction. Information about the directors and executive officers of Hillrom and their ownership of Hillrom’s common stock is set forth in the definitive proxy statement for Hillrom’s 2021 Annual Meeting of Stockholders, which was filed with the SEC on January 19, 2021, or its Annual Report on Form 10-K for the year ended September 30, 2020, and in other documents filed by Hillrom with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Statements concerning general economic conditions, our financial condition, results of operations, cash flows and business and our expectations or beliefs concerning future events, including the demand for our products, the ability to operate our manufacturing sites at full capacity, future supplies of raw materials for our operations, product launches, share repurchases, international market conditions, expectations regarding our liquidity, our capital spending, plans for future acquisitions and divestitures, and our operating plans; and any statements using phases such as we or our management “expects,” “anticipates,” “believes,” “estimates,” “intends,” “plans to,” “ought,” “could,” “will,” “should,” “likely,” “appears,” “projects,” “forecasts,” “outlook” or other similar words or phrases are forward-looking statements that involve certain factors, risks and uncertainties that could cause Hillrom’s actual results to differ materially from those anticipated. Such factors, risks and uncertainties include: (1) the future impact of the COVID-19 pandemic on Hillrom’s business, including but not limited to, the impact on its workforce, operations, supply chain, demand for products and services, and Hillrom’s financial results and condition; (2) Hillrom’s ability to successfully manage the challenges associated with the COVID-19 pandemic; (3) increasing regulatory focus on privacy and data security issues; (4) breaches or failures of Hillrom’s information technology systems or products, including by cyberattack, unauthorized access or theft; (5) failures with respect to compliance programs; (6) Hillrom’s ability to achieve expected synergies from acquisitions; (7) risks associated with integrating recent acquisitions; (8) global economic conditions; (9) demand for and delays in delivery of Hillrom’s products; (10) Hillrom’s ability to develop, commercialize and deploy new products; (11) changes in regulatory environments; (12) the effect of adverse publicity; (13) the impact of competitive products and pricing; (14) Hillrom’s ability to maintain or increase margins; (15) the potential loss of key distributors or key personnel; (16) the impact of the Affordable Health Care for America Act (including excise taxes on medical devices) and any applicable healthcare reforms (including changes to Medicare and Medicaid), and/or changes in third-party reimbursement levels; (17) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement between the parties to the proposed transaction; (18) the failure to obtain the approval of Hillrom’s shareholders, (19) the failure to obtain certain required regulatory approvals or the failure to satisfy any of the other closing conditions to the completion of the proposed transaction within the expected timeframes or at all; (20) risks related to disruption of management’s attention from Hillrom’s ongoing business operations due to the transaction; (21) the effect of the announcement of the transaction on the ability of Hillrom to retain and hire key personnel and maintain relationships with its customers, suppliers and others with whom it does business, or on its operating results and business generally; (22) the ability to meet expectations regarding the timing and completion of the transaction; (23) uncertainty regarding actual or potential legal proceedings; and (24) the other risks listed from time to time in Hillrom’s filings with the SEC. For additional information concerning factors that could cause actual results and events to differ materially from those projected herein, please refer to Hillrom’s Annual Report on Form 10-K for the year ended September 30, 2020 and in other documents filed by Hillrom with the SEC, including subsequent Current Reports on Form 8-K and Quarterly Reports on Form 10-Q. Hillrom is providing the information in this communication as of this date and assumes no obligation to update or revise the forward-looking statements in this communication because of new information, future events, or otherwise.

[The following “frequently asked questions” document was shared with employees of Hill-Rom Holdings, Inc. on September 2, 2021.]

Frequently Asked Questions

Baxter Acquisition of Hillrom

September 2, 2021 - FINAL

| 1. | Why is Hillrom combining with Baxter? |

Baxter is a global healthcare company with a vision, mission and culture that align well with our vision of Advancing Connected Care™ and Our Hillrom Commitment. Hillrom joining Baxter is expected to transform the global healthcare landscape by bringing complementary capabilities together, enabling the acceleration of the companies’ expansion into digital and connected care solutions that are increasingly enabling patients to access hospital-level care at home or in other care settings.

This is truly a win-win for all our stakeholders – employees will benefit from being part of a larger, stronger company with accelerated growth, patients and their caregivers will benefit from our ability to Advance Connected Care™ as part of Baxter, and our shareholders will receive a significant and immediate premium for their investment.

| 2. | Is $156 per share a fair price for our company? |

Our Board of Directors strongly believes in the power of this combination and in the immediate, high return for our shareholders to be realized at closing. The purchase price, $156 per share in cash, or $10.5 billion, represents a 26% premium to Hillrom’s closing stock price on July 27, 2021, the last trading day prior to media reports regarding a potential transaction. This is an extraordinary testament to the entire Hillrom team, in every business unit, every region and every function, everywhere around the world.

| 3. | Does this transaction require the approval of Hillrom and/or Baxter shareholders? If so, whenwould that vote take place? |

Yes, for Hillrom, no for Baxter. Hillrom’s shareholder vote will take place at a date yet to be determined.

| 4. | How do Baxter’s and Hillrom’s businesses compare today? |

Our companies’ portfolios are complementary. That fact alone makes this combination an attractive one. By combining forces, we will be a stronger company able to advance connected healthcare innovations better and faster – and at a far larger scale – than we could separately.

| 5. | How long will it take for the deal to be completed, and what should we be doing between nowand then? |

The transaction is subject to Hillrom shareholder approval and customary closing conditions for transactions of this size, including receipt of certain regulatory approvals. We anticipate closing the deal by early calendar year 2022. Until closing, it is business as usual.

| 6. | Are we expecting layoffs once the companies come together? |

Baxter’s motivation for joining forces with Hillrom starts with our highly skilled team and unique capabilities. They have been clear that they aim to preserve the value that Hillrom brings, and that includes our talent. While there are always some changes resulting from a transaction like this, our combination with Baxter is about growth and accelerating our shared vision. As we move forward, we will be open and transparent about the integration, our plans to bring the companies together, and any impacts from organization-design plans.

| 7. | What will happen to my job, supervisor and pay when the companies come together? |

Our integration planning teams from Baxter and Hillrom are just now getting to work, thinking through what the combined organization will look like once we formally come together. What I can tell you is that we will be open and transparent about the integration, our plans to bring the companies together, and any impacts on our team.

| 8. | What are Hillrom’s and Baxter’s severance policies for those whose jobs are eliminated? Whichone will we follow? |

As part of our agreement with Baxter, any U.S. Hillrom employees whose positions are eliminated within 18 months of the closing as a result of the combination of our companies will receive transition benefits in accordance with Hillrom’s U.S. severance plan. After 18 months from closing, Baxter’s severance policies would apply. The U.S. severance plan is also being amended in connection with the transaction to enhance certain benefits. More information will be provided on this in the coming weeks.

| 9. | If I participate in the Hillrom Employee Stock Purchase Plan, what happens to my shares? |

Any shares you have already purchased through the program are fully owned by you. For each Hillrom share in your ESPP account, you will receive cash according to the per-share acquisition price ($156) when the deal closes, less any applicable taxes. In addition, please be aware that your participation in the ESPP will continue until September 30, 2021, at which time shares of Hillrom will be purchased on your behalf. The program will then be terminated in preparation for Hillrom’s proposed acquisition by Baxter, and payroll deductions for the Hillrom ESPP will cease.

| 10. | If I participate in the Hillrom Long-Term Incentive Program, what happens to my grants andvestedshares? |

There is a distinction between grants made prior to the signing of the deal between Baxter and Hillrom, and those to be granted in November 2021 according to Hillrom’s regular schedule:

| • | Grants made prior to the signing: Any outstanding grants made prior to the definitive acquisition agreement between Baxter and Hillrom will vest immediately upon transaction close, and will be converted to cash according to the per-share acquisition price of $156 per share, less any applicable taxes. |

| • | Grants made after the signing: Any restricted stock units (RSU) grants made after the signing of the definitive agreement between Baxter and Hillrom will be valued according to the acquisition price of $156 per share and converted to restricted stock units (RSUs) of Baxter shares, subject to the terms and conditions of Hillrom’s current RSU program. |

| 11. | What if I am offered a job in the combined company but I don’t want it? Do I have to take it, orcan I elect to receive severance? |

The combined integration planning team is working on the specifics of questions like this. We will have more information as we get closer to the completion of the proposed transaction.

| 12. | Does this change anything with our recent acquisition(s), like BardyDx? |

No. Until the acquisition of Hillrom by Baxter closes, we remain an independent company, responsible for pursuing our vision of Advancing Connected Care™ on behalf of patients and their caregivers as well as our team around the world. That means we will continue to integrate BardyDx into our Front Line Care business.

| 13. | Will Hillrom be keeping all of its current plants, offices and field service centers? Can we expectsome combination of Hillrom and Baxter locations? What about our headquarters? |

This is an important area that our companies’ integration planning team will look at carefully to make the best decision for the combined company. For the time being, there are no changes to work locations.

| 14. | Is our leadership team staying in place? |

Until the merger close, yes. Leadership positions in the combined organization won’t be determined until much closer to the completion of the transaction.

| 15. | How will Hillrom fit in to Baxter structurally – will we operate as a stand-alone business or beintegrated in pieces to various parts of Baxter? |

The details regarding organization structure will be worked out by the companies’ integration planning team. More information will follow on this key question as decisions are made.

| 16. | Who makes decisions about Hillrom’s business between now and close? |

This is important: Hillrom leadership and all of our Hillrom employees are responsible for our business, including making decisions for the benefit of patients and their caregivers, employees, and shareholders. It’s business as usual until we close the transaction.

| 17. | So, I should continue to do my job today as I did yesterday? |

Yes! We have a business to run, customers and patients to serve, a vision of Advancing Connected Care™ to bring to life, and responsibilities to one another as colleagues and employees of Hillrom. Let’s do our best to stay focused on our individual and team responsibilities – business as usual.

| 18. | What happens to Everest? |

We will continue to pursue investments in Everest, while evaluating, during the integration planning process, whether any changes may be needed.

| 19. | How are we prioritizing employee retention and keeping them focused? |

One of the most important strategic aspects of this transaction is that it is a growth-oriented combination focused on our connected care strategy and the talent required to bring that strategy to life. We fully expect to continue investing in innovation, acquisitions and talent to realize our vision of Advancing Connected Care™ as part of Baxter. That is an extraordinary opportunity for Hillrom moving forward and we’re excited about the growth and development potential for our employees.

| 20. | Are we going to continue to fill open positions? What can we tell candidates about Hillrom’sacquisition by Baxter? |

We will continue our normal process of reviewing all open roles before backfilling them. This is an existing and consistent approach for Hillrom that will be continued. We have a business to run, and the only way to do so successfully is having the right talent on board. Candidates need to know that one of the most important strategic aspects of the combination with Baxter is that it is focused on our connected care strategy. We fully expect to continue investing in innovation and talent to realize our vision of Advancing Connected Care™ as part of Baxter.

| 21. | What will happen to the Hillrom brand? |

This is an important area that our companies’ integration planning team will look at carefully to make the best decision for the combined company.

| 22. | How should we cooperate during the integration work? |

An integration team with representatives from both companies has been established. This team will help to ensure the smooth integration following the close of the transaction. The integration planning process, which we are just beginning, and the resulting organizational structure will be guided by a set of core principles that will be focused on people, patients and products that advance our collective mission of saving and sustaining lives, and improving healthcare outcomes for patients and caregivers.

If you are asked by an assigned member of the integration team to provide support for the efforts, please honor those requests. However, until the transaction closes, each company should continue to operate as an independent organization. Except for assigned members of the integration team, employees should not reach out to or interact with employees from Baxter. This is critically important from a legal and regulatory perspective.

Additional Information About the Merger and Where to Find It

This communication relates to the proposed transaction involving Hillrom. This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. In connection with the proposed transaction, Hillrom will file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including Hillrom’s proxy statement on Schedule 14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document that Hillrom may file with the SEC or send to its shareholders in connection with the proposed transaction. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF HILLROM ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s website, www.sec.gov, or by visiting Hillrom’s investor relations website, https://ir.hill-rom.com/ir-home/default.aspx.

Participants in the Solicitation

Hillrom and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Hillrom’s common stock in respect of the proposed transaction. Information about the directors and executive officers of Hillrom and their ownership of Hillrom’s common stock is set forth in the definitive proxy statement for Hillrom’s 2021 Annual Meeting of Stockholders, which was filed with the SEC on January 19, 2021, or its Annual Report on Form 10-K for the year ended September 30, 2020, and in other documents filed by Hillrom with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Statements concerning general economic conditions, our financial condition, results of operations, cash flows and business and our expectations or beliefs concerning future events, including the demand for our products, the ability to operate our manufacturing sites at full capacity, future supplies of raw materials for our operations, product launches, share repurchases, international market conditions, expectations regarding our liquidity, our capital spending, plans for future acquisitions and divestitures, and our operating plans; and any statements using phases such as we or our management “expects,” “anticipates,” “believes,” “estimates,” “intends,” “plans to,” “ought,” “could,” “will,” “should,” “likely,” “appears,” “projects,” “forecasts,” “outlook” or other similar words or phrases are forward-looking statements that involve certain factors, risks and uncertainties that could cause Hillrom’s actual results to differ materially from those anticipated. Such factors, risks and uncertainties include: (1) the future impact of the COVID-19 pandemic on Hillrom’s business, including but not limited to, the impact on its workforce, operations, supply chain, demand for products and services, and Hillrom’s financial results and condition; (2) Hillrom’s ability to successfully manage the challenges associated with the COVID-19 pandemic; (3) increasing regulatory focus on privacy and data security issues; (4) breaches or failures of Hillrom’s information technology systems or products, including by cyberattack, unauthorized access or theft; (5) failures with respect to compliance programs; (6) Hillrom’s ability to achieve expected synergies from acquisitions; (7) risks associated with integrating recent acquisitions; (8) global economic conditions; (9) demand for and delays in delivery of Hillrom’s products; (10) Hillrom’s ability to develop, commercialize and deploy new products; (11) changes in regulatory environments; (12) the effect of adverse publicity; (13) the impact of competitive products and pricing; (14) Hillrom’s ability to maintain or increase margins; (15) the potential loss of key distributors or key personnel; (16) the impact of the Affordable Health Care for America Act (including excise taxes on medical devices) and any applicable healthcare reforms (including changes to Medicare and Medicaid), and/or changes in third-party reimbursement levels; (17) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement between the parties to the proposed transaction; (18) the failure to obtain the approval of Hillrom’s shareholders, (19) the failure to obtain certain required regulatory approvals or the failure to satisfy any of the other closing conditions to the completion of the proposed transaction within the expected timeframes or at all; (20) risks related to disruption of management’s attention from Hillrom’s ongoing business operations due to the transaction; (21) the effect of the announcement of the transaction on the ability of Hillrom to retain and hire key personnel and maintain relationships with its customers, suppliers and others with whom it does business, or on its operating results and business generally; (22) the ability to meet expectations regarding the timing and completion of the transaction; (23) uncertainty regarding actual or potential legal proceedings; and (24) the other risks listed from time to time in Hillrom’s filings with the SEC. For additional information concerning factors that could cause actual results and events to differ materially from those projected herein, please refer to Hillrom’s Annual Report on Form 10-K for the year ended September 30, 2020 and in other documents filed by Hillrom with the SEC, including subsequent Current Reports on Form 8-K and Quarterly Reports on Form 10-Q. Hillrom is providing the information in this communication as of this date and assumes no obligation to update or revise the forward-looking statements in this communication because of new information, future events, or otherwise.

[The following presentation was shared with employees of Hill-Rom Holdings, Inc. on September 2, 2021.]

Schedule regular team meetings and 1:1 discussionsAvoid sharing your personal thoughts or previous experiencesRegularly review published FAQsEncourage employees to send questions to the Integration Questions mailbox Model the right behaviors…Guide and inspire your teamContinue to focus on the business and manage performanceLook for opportunities to assign projects to keep employees engaged Actively listen and acknowledge people’s situations and emotionsShow your human sideBe flexiblePay special attention to those who seem to struggle the most Check-in regularly for levels of engagementConduct re-recruitment conversations, i.e., focus on development and career growthInvolve ELT/HR in retention risks Leading Through Change TALK TO YOUR TEAM BE THE CHAMPION FOR THE COMPANY PRACTICE COMPASSIONATE LEADERSHIP TAKE TEAM’S TEMPERATURE REGULARLY VISION Everyday, around the world, we enhance outcomes for patients and their caregivers MISSION Business as usual to enhance outcomes for patients and their caregivers.

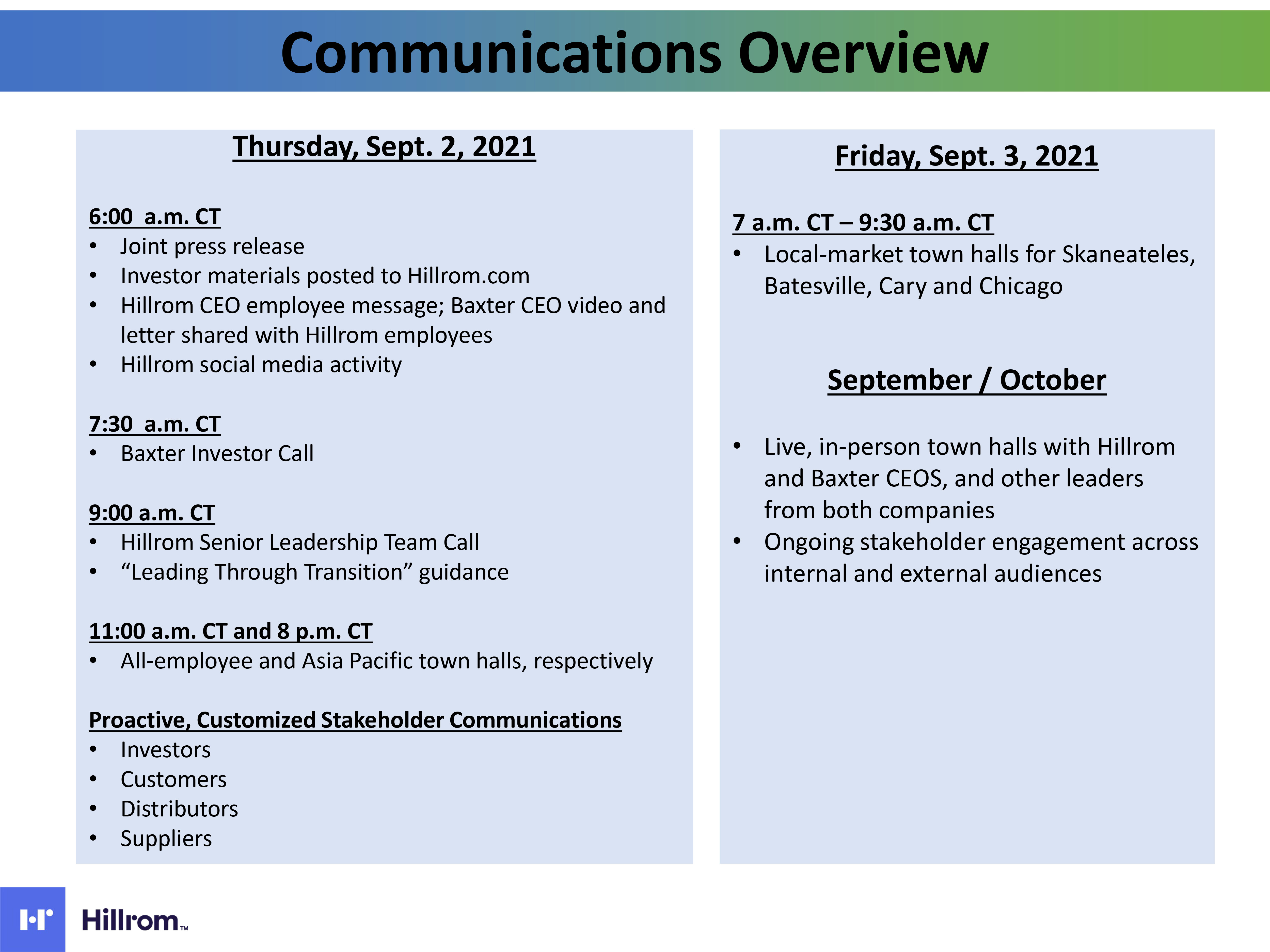

Thursday, Sept. 2, 20216:00 a.m. CTJoint press releaseInvestor materials posted to Hillrom.comHillrom CEO employee message; Baxter CEO video and letter shared with Hillrom employeesHillrom social media activity7:30 a.m. CT Baxter Investor Call 9:00 a.m. CT Hillrom Senior Leadership Team Call“Leading Through Transition” guidance11:00 a.m. CT and 8 p.m. CTAll-employee and Asia Pacific town halls, respectivelyProactive, Customized Stakeholder CommunicationsInvestors CustomersDistributorsSuppliers Friday, Sept. 3, 20217 a.m. CT – 9:30 a.m. CTLocal-market town halls for Skaneateles, Batesville, Cary and ChicagoSeptember / OctoberLive, in-person town halls with Hillrom and Baxter CEOS, and other leaders from both companiesOngoing stakeholder engagement across internal and external audiences Communications Overview

Additional Information About the Merger and Where to Find It This communication relates to the proposed transaction involving Hillrom. This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. In connection with the proposed transaction, Hillrom will file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including Hillrom’s proxy statement on Schedule 14A (the “Proxy Statement”). This communication is not a substitute for the Proxy Statement or any other document that Hillrom may file with the SEC or send to its shareholders in connection with the proposed transaction. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF HILLROM ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain the documents (when available) free of charge at the SEC’s website, www.sec.gov, or by visiting Hillrom’s investor relations website, https://ir.hill-rom.com/ir-home/default.aspx. Participants in the SolicitationHillrom and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the holders of Hillrom’s common stock in respect of the proposed transaction. Information about the directors and executive officers of Hillrom and their ownership of Hillrom’s common stock is set forth in the definitive proxy statement for Hillrom’s 2021 Annual Meeting of Stockholders, which was filed with the SEC on January 19, 2021, or its Annual Report on Form 10-K for the year ended September 30, 2020, and in other documents filed by Hillrom with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement and other relevant materials to be filed with the SEC in respect of the proposed transaction when they become available.

Forward-Looking StatementsThis communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Statements concerning general economic conditions, our financial condition, results of operations, cash flows and business and our expectations or beliefs concerning future events, including the demand for our products, the ability to operate our manufacturing sites at full capacity, future supplies of raw materials for our operations, product launches, share repurchases, international market conditions, expectations regarding our liquidity, our capital spending, plans for future acquisitions and divestitures, and our operating plans; and any statements using phases such as we or our management “expects,” “anticipates,” “believes,” “estimates,” “intends,” “plans to,” “ought,” “could,” “will,” “should,” “likely,” “appears,” “projects,” “forecasts,” “outlook” or other similar words or phrases are forward-looking statements that involve certain factors, risks and uncertainties that could cause Hillrom’s actual results to differ materially from those anticipated. Such factors, risks and uncertainties include: (1) the future impact of the COVID-19 pandemic on Hillrom’s business, including but not limited to, the impact on its workforce, operations, supply chain, demand for products and services, and Hillrom’s financial results and condition; (2) Hillrom’s ability to successfully manage the challenges associated with the COVID-19 pandemic; (3) increasing regulatory focus on privacy and data security issues; (4) breaches or failures of Hillrom’s information technology systems or products, including by cyberattack, unauthorized access or theft; (5) failures with respect to compliance programs; (6) Hillrom’s ability to achieve expected synergies from acquisitions; (7) risks associated with integrating recent acquisitions; (8) global economic conditions; (9) demand for and delays in delivery of Hillrom’s products; (10) Hillrom’s ability to develop, commercialize and deploy new products; (11) changes in regulatory environments; (12) the effect of adverse publicity; (13) the impact of competitive products and pricing; (14) Hillrom’s ability to maintain or increase margins; (15) the potential loss of key distributors or key personnel; (16) the impact of the Affordable Health Care for America Act (including excise taxes on medical devices) and any applicable healthcare reforms (including changes to Medicare and Medicaid), and/or changes in third-party reimbursement levels; (17) the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement between the parties to the proposed transaction; (18) the failure to obtain the approval of Hillrom’s shareholders, (19) the failure to obtain certain required regulatory approvals or the failure to satisfy any of the other closing conditions to the completion of the proposed transaction within the expected timeframes or at all; (20) risks related to disruption of management’s attention from Hillrom’s ongoing business operations due to the transaction; (21) the effect of the announcement of the transaction on the ability of Hillrom to retain and hire key personnel and maintain relationships with its customers, suppliers and others with whom it does business, or on its operating results and business generally; (22) the ability to meet expectations regarding the timing and completion of the transaction; (23) uncertainty regarding actual or potential legal proceedings; and (24) the other risks listed from time to time in Hillrom’s filings with the SEC. For additional information concerning factors that could cause actual results and events to differ materially from those projected herein, please refer to Hillrom’s Annual Report on Form 10-K for the year ended September 30, 2020 and in other documents filed by Hillrom with the SEC, including subsequent Current Reports on Form 8-K and Quarterly Reports on Form 10-Q. Hillrom is providing the information in this communication as of this date and assumes no obligation to update or revise the forward-looking statements in this communication because of new information, future events, or otherwise.