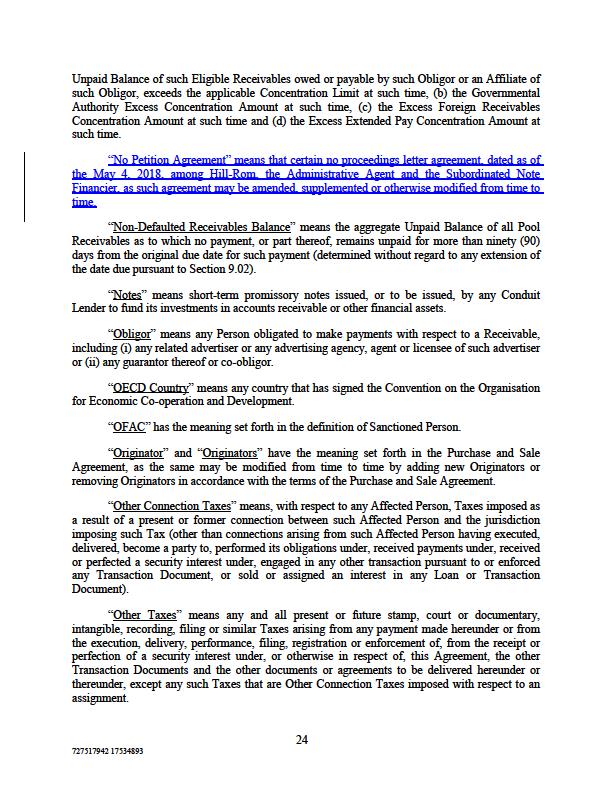

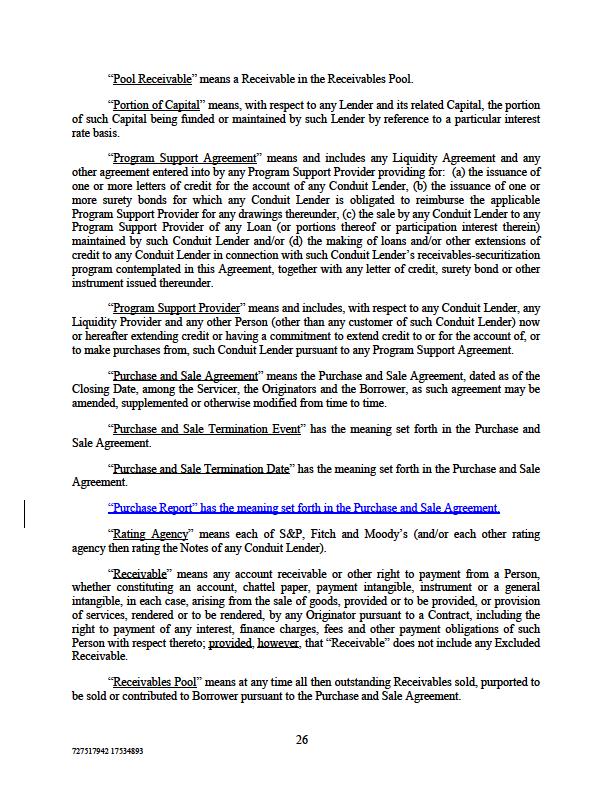

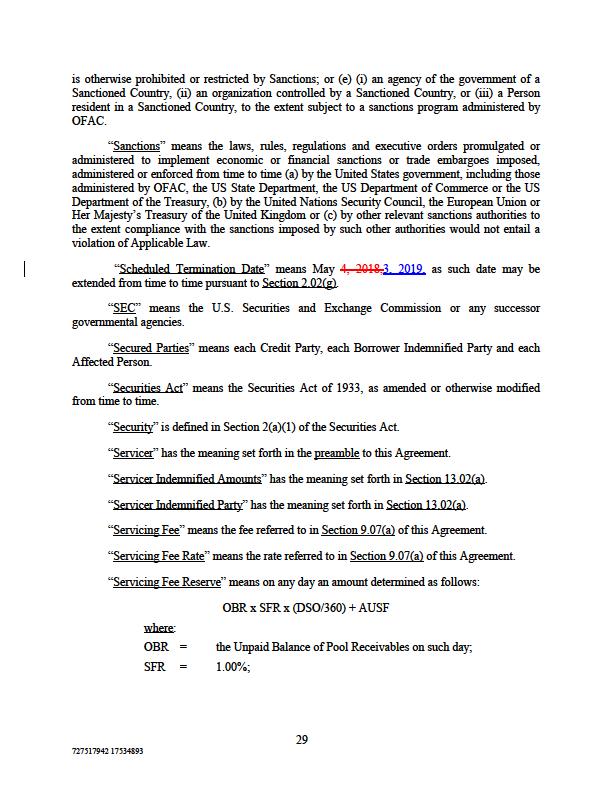

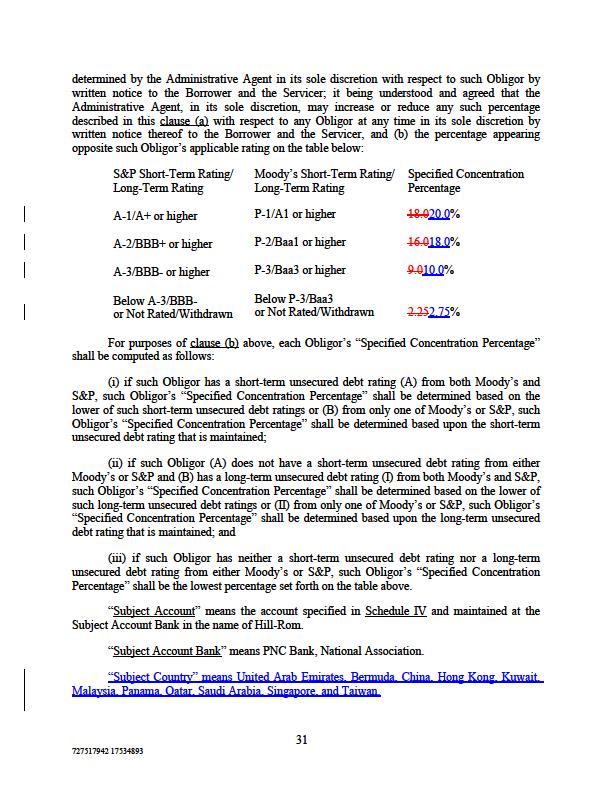

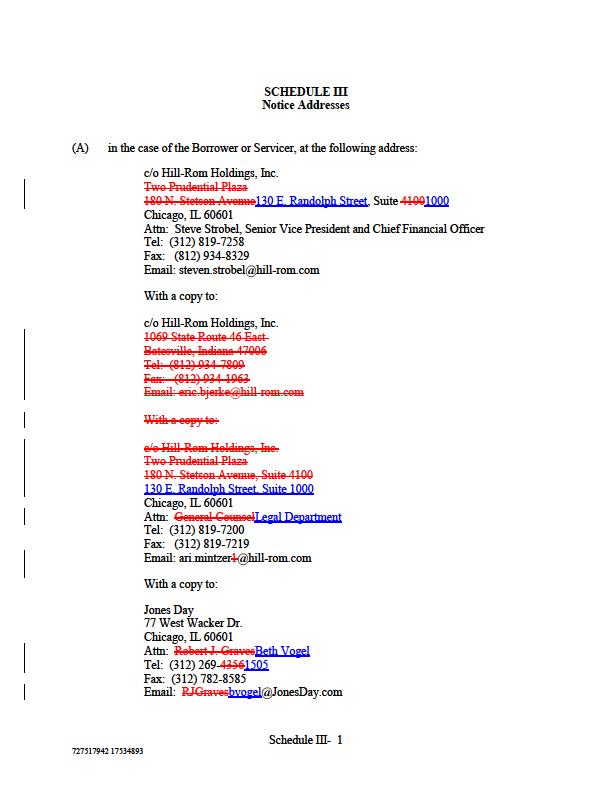

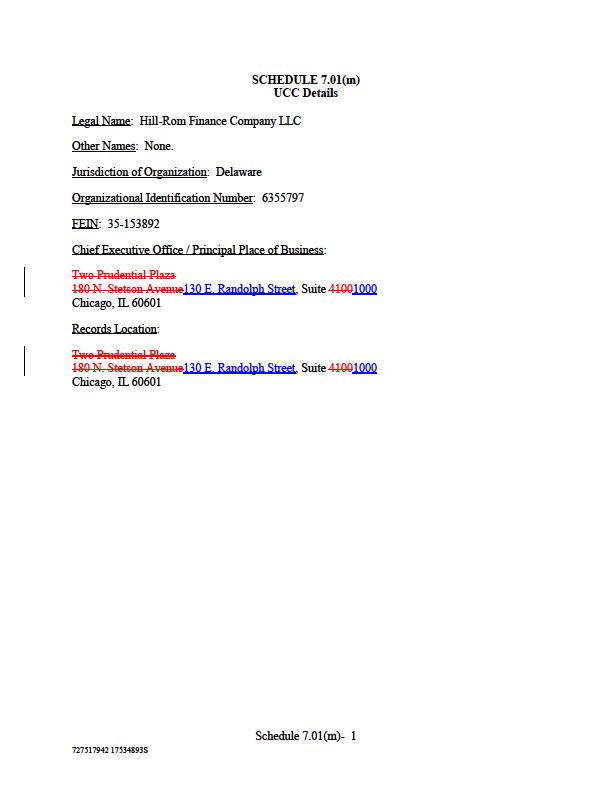

EXHIBIT A to Amendment No. 1, dated May 4, 2018 EXECUTION COPY LOAN AND SECURITY AGREEMENT Dated as of May 5, 2017 by and among HILL-ROM FINANCE COMPANY LLC, as Borrower, THE PERSONS FROM TIME TO TIME PARTY HERETO, as Lenders and as Group Agents, MUFG BANK, LTD. (F/K/A THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH), as Administrative Agent, and HILL-ROM COMPANY, INC., as initial Servicer 72751794217534893 This LOAN AND SECURITY AGREEMENT (as amended, restated, supplemented or otherwise modified from time to time, this “Agreement”) is entered into as of May 5, 2017 by and among the following parties: HILL-ROM FINANCE COMPANY LLC, a Delaware limited liability company, as Borrower (together with its successors and assigns, the “Borrower”); the Persons from time to time party hereto as Lenders and as Group Agents; MUFG BANK, LTD. (F/K/A THE BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH) (“BTMUMUFG”), as Administrative Agent; and HILL-ROM COMPANY, INC., an Indiana Corporation (“Hill-Rom”) and as initial Servicer (in such capacity, together with its successors and assigns in such capacity, the “Servicer”). PRELIMINARY STATEMENTS The Borrower has acquired, and will acquire from time to time, Receivables from the Originators pursuant to the Purchase and Sale Agreement. The Borrower has requested that the Lenders make Loans from time to time to the Borrower, on the terms, and subject to the conditions set forth herein, secured by, among other things, the Receivables. In consideration of the mutual agreements, provisions and covenants contained herein, the sufficiency of which is hereby acknowledged, the parties hereto agree as follows: ARTICLE I DEFINITIONS SECTION 1.01. Certain Defined Terms. As used in this Agreement, the following terms shall have the following meanings (such meanings to be equally applicable to both the singular and plural forms of the terms defined): “Adjusted LIBOR” means with respect to any Tranche Period, the interest rate per annum determined by the applicable Group Agent by dividing (the resulting quotient rounded upwards, if necessary, to the nearest 1/100th of 1% per annum) (i) the Intercontinental Exchange Benchmark Administration Ltd. (or the successor thereto if it is no longer making such rates available) LIBOR Rate (“ICE LIBOR”), as published by Reuters (currently Reuters LIBOR01 page) (or any other commercially available source providing quotations of ICE LIBOR as designated by the Administrative Agent from time to time) at approximately 11:00 a.m. (London, England time) for deposits in U.S. Dollars with a duration comparable to such Tranche Period on the second Business Day preceding the first day of such Tranche Period (or if a rate cannot be determined under the foregoing, an interest rate per annum equal to the average (rounded upwards, if necessary, to the nearest 1/100th of 1% per annum) of the interest rates per annum at which deposits in U.S. Dollars with a duration comparable to such Tranche Period in a principal amount substantially equal to the Portion of Capital to be funded at Adjusted LIBOR during such Tranche Period are offered to the principal London office of the applicable Group Agent (or its related Committed Lender) by three London banks, selected by the applicable Group Agent in good faith, at approximately 11:00 a.m. (London, England time) on the second Business Day preceding the first day of such Tranche Period), by (ii) a number equal to 1.00 minus the Euro-Rate Reserve Percentage. The calculation of Adjusted LIBOR may also be expressed by the following formula: ICE LIBOR or appropriate successor Adjusted LIBOR = (Missing Graphic Reference) 1.00 - Euro-Rate Reserve Percentage Adjusted LIBOR shall be adjusted on the effective date of any change in the Euro-Rate Reserve Percentage as of such effective date. The applicable Group Agent shall give prompt notice to the Borrower of Adjusted LIBOR as determined or adjusted in accordance herewith (which determination shall be conclusive absent manifest error). Notwithstanding the foregoing, if Adjusted LIBOR as determined herein would be less than zero (0.00), such rate shall be deemed to be zero percent (0.00%) for purposes of this Agreement. “Administrative Agent” means BTMUMUFG, in its capacity as contractual representative for the Credit Parties, and any successor thereto in such capacity appointed pursuant to Section 11.09 or Section 14.03(g). “Advanced Respiratory Division” means the Advanced Respiratory Division of Hill-Rom. “Adverse Claim” means any claim of ownership or any Lien; it being understood that any such claim or Lien in favor of, or assigned to, the Administrative Agent (for the benefit of the Secured Parties) under the Transaction Documents shall not constitute an Adverse Claim. “Advisors” has the meaning set forth in Section 14.06(c). “Affected Person” means each Credit Party, each Program Support Provider, each Liquidity Agent and each of their respective Affiliates. “Affiliate” means, with respect to a specified Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified. “Affiliate Receivable” means any Pool Receivable any Obligor of which (a) is an Affiliate of any Hill-Rom Party; (b) is a Person 10% or more of the Voting Stock of which is controlled, directly or indirectly, by any Hill Rom Party or any Affiliate of any Hill Rom Party; or (c) is a Person which, together with any Affiliates of such Person, controls, directly or indirectly, 10% of the Voting Stock of any Hill Rom Party. “Aggregate Capital” means, at any time of determination, the aggregate outstanding Capital of all Lenders at such time. 2 “Borrowing Base Deficit” means, at any time of determination, the amount, if any, by which (a) the Aggregate Capital at such time, exceeds (b) the Borrowing Base at such time. “Breakage Fee” means (i) for any Interest Period for which Interest is computed by reference to the CP Rate or the Adjusted LIBOR and a reduction of Capital is made for any reason on any day other than a Settlement Date or solely with respect to a LIBOR Loan, the Monthly Settlement Date that corresponds to the end of the related Tranche Period or (ii) to the extent that the Borrower shall for any reason, fail to borrow on the date specified by the Borrower in connection with any request for funding pursuant to Article II of this Agreement, the amount, if any, by which (A) the additional Interest (calculated without taking into account any Breakage Fee or any shortened duration of such Interest Period pursuant to the definition thereof) which would have accrued during such Interest Period (or, in the case of clause (i) above, until the maturity of the underlying Note or end of the related Tranche Period, as applicable) on the reductions of Capital relating to such Interest Period had such reductions not been made (or, in the case of clause (ii) above, the amounts so failed to be borrowed or accepted in connection with any such request for funding by the Borrower), exceeds (B) the amount of interest which would accrue on such principal amount for such period at the interest rate that such Lender would bid were it to bid, at the commencement of such period, for deposits in the relevant currency or a comparable amount and period from other banks in the eurocurrency market. A certificate as to the amount of any Breakage Fee (including the computation of such amount) shall be submitted by the affected Lender (or applicable Group Agent on its behalf) to the Borrower and shall be conclusive and binding for all purposes, absent manifest error. “BTMU” has the meaning set forth in the preamble to this Agreement. “Business Day” means any day (other than a Saturday or Sunday) on which: (a) banks are not authorized or required to close in New York City, New York and (b) if this definition of “Business Day” is utilized in connection with Adjusted LIBOR, dealings are carried out in the London interbank market. “Capital” means, with respect to any Lender, the aggregate amounts paid to, or on behalf of, the Borrower in connection with all Loans made by such Lender pursuant to Article II, as reduced from time to time by Collections distributed and applied on account of such Capital pursuant to Section 4.01; provided, that if such Capital shall have been reduced by any distribution and thereafter all or a portion of such distribution is rescinded or must otherwise be returned for any reason, such Capital shall be increased by the amount of such rescinded or returned distribution as though it had not been made. “Capital Stock” means, with respect to any Person, any and all common shares, preferred shares, interests, participations, rights in or other equivalents (however designated) of such Person’s capital stock, partnership interests, limited liability company interests, membership interests or other equivalent interests and any rights (other than debt securities convertible into or exchangeable for capital stock), warrants or options exchangeable for or convertible into such capital stock or other equity interests. “Change in Control” means the occurrence of any of the following: with respect to the Parent, an event or series events by which any “person” or “group” (as such terms are used in Sections 13(d) and 14(d) of the Exchange Act, but excluding the Parent and its subsidiaries, any employee benefit plan of the Parent or its subsidiaries, and any person or entity acting in its capacity as trustee, agent or other fiduciary or administrator of any such plan) other than any member or members of the Hillenbrand Family Group or the Allyn Family Group becomes the “beneficial owner” (as defined in Rules 13d-3 and 13d-5 under the Exchange Act, except that a person or group shall be deemed to have “beneficial ownership” of all securities that such person or group has the right to acquire (such right, an “option right”), whether such right is exercisable immediately or only after the passage of time), directly or indirectly, of 35% or more of the equity securities of the Parent entitled to vote for members of the board of directors or equivalent governing body of the Parent on a fully-diluted basis (and taking into account all such securities that such person or group has the right to acquire pursuant to any option right); with respect to the Parent, an event or series events by which during any period of 12 consecutive months, a majority of the members of the board of directors or other equivalent governing body of the Parent cease (other than by reason of death or disability) to be composed of individuals (i) who were members of that board or equivalent governing body on the first day of such period, (ii) whose election or nomination to that board or equivalent governing body was approved by individuals referred to in clause (i) above constituting at the time of such election or nomination at least a majority of that board or equivalent governing body or (iii) whose election or nomination to that board or other equivalent governing body was approved by individuals referred to in clauses (i) and (ii) above constituting at the time of such election or nomination at least a majority of that board or equivalent governing body; Hill-Rom ceases to own, directly, 100% of the issued and outstanding Capital Stock and all other equity interests of the Borrower free and clear of all Adverse Claims; Parent ceases to own, directly or indirectly, 100% of the issued and outstanding Capital Stock of Hill-Rom, any Originator, Servicer or Borrower; any Subordinated Note shall at any time cease to be owned by an Originator, free and clear of all Adverse Claims; provided, however, that any Adverse Claim of the Subordinated Note Financier in any Subordinated Note that occurs pursuant to any Subordinated Note Financing Document shall not be a “Change in Control” pursuant to this clause (e), so long as the Subordinated Note Financier is then party to the No Petition Agreement; or a “change of control” (or similar event) shall occur under the Credit Agreement. “Change in Law” means the occurrence, after the Closing Date, of any of the following: (a) the adoption or taking effect of any law, rule, regulation or treaty, (b) any change in any law, rule, regulation or treaty or in the administration, interpretation, implementation or application thereof by any Governmental Authority or (c) the making or issuance of any request, rule, guideline, requirement or directive (whether or not having the force of law) by any Governmental Authority; provided that notwithstanding anything herein to the contrary, (w) the final rule titled Risk-Based Capital Guidelines; Capital Adequacy Guidelines; Capital Maintenance: Regulatory Capital; Impact of Modifications to Generally Accepted Accounting Principles; Consolidation of Asset-Backed Commercial Paper Programs; and Other Related Issues, adopted by the United States bank regulatory agencies on December 15, 2009, (x) the Dodd-Frank Wall Street Reform and Consumer Protection Act and all requests, rules, guidelines or directives thereunder or issued in connection therewith and (y) all reports, notes, requests, rules, guidelines or directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities, in each case pursuant to the agreements reached by the Basel Committee on Banking Supervision in “Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems” (as amended, supplemented or otherwise modified or replaced from time to time), shall in each case be deemed to be a “Change in Law”, regardless of the date enacted, adopted, issued or implemented. “Closing Date” means May 5, 2017. “Code” means the Internal Revenue Code of 1986, as amended or otherwise modified from time to time. “Collateral” has the meaning set forth in Section 5.05(a). “Collections” means, with respect to any Pool Receivable: (a) all funds that are received by any Originator, the Borrower, the Servicer or any other Person on their behalf in payment of any amounts owed or payable in respect of such Pool Receivable (including purchase price, finance charges, interest and all other charges), or applied to amounts owed or payable in respect of such Pool Receivable (including insurance payments and net proceeds of the sale or other disposition of repossessed goods or other collateral or property of any related Obligor or any other Person directly or indirectly liable for the payment of such Pool Receivable and available to be applied thereon), (b) all Deemed Collections, (c) all proceeds of all Related Security with respect to such Pool Receivable and (d) all other proceeds of such Pool Receivable. “Commitment” means, with respect to any Committed Lender (including a Related Committed Lender), the maximum aggregate amount which such Person is obligated to lend or pay hereunder on account of all Loans, on a combined basis, as set forth on Schedule I or in the Assumption Agreement or other agreement pursuant to which it became a Lender, as such amount may be modified in connection with any subsequent assignment pursuant to Section 14.03 or in connection with a reduction in the Facility Limit pursuant to Section 2.02(e). If the context so requires, “Commitment” also refers to a Committed Lender’s obligation to make Loans hereunder in accordance with this Agreement. “Committed Lenders” means BTMUMUFG and each other Person that is or becomes a party to this Agreement in the capacity of a “Committed Lender”. SF x LR x LHR where: SF = 2.0; LR = the highest average Loss Ratio for any three (3) consecutive Settlement Periods observed over the preceding 12 Settlement Periods; and LHR = Loss Horizon Ratio on such day. “EEA Financial Institution” means (a) any credit institution or investment firm established in any EEA Member Country which is subject to the supervision of an EEA Resolution Authority, (b) any entity established in an EEA Member Country which is a parent of an institution described in clause (a) of this definition, or (c) any financial institution established in an EEA Member Country which is a subsidiary of an institution described in clauses (a) or (b) of this definition and is subject to consolidated supervision with its parent. “EEA Member Country” means any of the member states of the European Union, Iceland, Liechtenstein, and Norway. “EEA Resolution Authority” means any public administrative authority or any person entrusted with public administrative authority of any EEA Member Country (including any delegee) having responsibility for the resolution of any EEA Financial Institution. “Eligible Assignee” means (i) any Committed Lender or any of its Affiliates, (ii) any Person managed by a Committed Lender or any of its Affiliates and (iii) any other financial or other institution that is not a Disqualified Institution. “Eligible Contract” means a Contract governed by the law of the United States of America or of any State thereof that contains an obligation to pay a specified sum of money on or before a date certain and that has been duly authorized by each party thereto and which (i) does not require any Obligor thereunder to consent to any transfer, sale or assignment thereof or of the related Receivable or any proceeds of any of the foregoing, (ii) is not subject to a confidentiality provision, covenant of non-disclosure or similar restrictions that would restrict the ability of the Administrative Agent or any Credit Party to fully exercise or enforce its rights under the Transaction Documents (including any rights thereunder assigned or originated to them hereunder) with respect to the related Receivable, (iii) is not “chattel paper” as defined in the UCC of any jurisdiction governing the perfection or assignment of the related Receivable, (iv) the payment terms of which have not been modified, extended or rewritten in any manner (except for extensions and modifications expressly permitted hereunder) and (v) remains in full force and effect. “Eligible Foreign Country” means, at any time, any country or territory that that satisfies each of the following: (i) is not a Sanctioned Country, (ii) is not the United States of America, (iii) is either an OECD Country or a Highly Rated Country and (iv) the Servicer is able to service, administer, collect and enforce the Receivables owing by Obligors of such country or 12 territory to the same extent as Receivables owing from Obligors located in the United States of America. “Eligible Foreign Obligor” means an Obligor that is organized in and that has a head office (domicile), registered office and chief executive office that is located in an Eligible Foreign Country. “Eligible Receivable” means, as of any date of determination, a Receivable: (i) which represents all or part of the sales price of goods or services, sold by an Originator and billed to the related Obligor in the ordinary course of such Originator’s business and sold or contributed to Borrower pursuant to the Purchase and Sale Agreement, (ii) for which all obligations of the Originator in connection with which have been fully performed, (iii) no portion of which is in respect of any amount as to which any related Obligor is permitted to withhold payment until the occurrence of a specified event or condition (including “guaranteed” or “conditional” sales or any performance by an Originator), (iv) which is not owed to any Originator or Borrower, in whole or in part, as a bailee or consignee for another Person, (v) which is not issued under cash-in-advance or cash-on-account terms or (vi) which (A) has payment terms of not more than 90 days from the original billing date or (B) is an Extended Pay Receivable; provided that, for the avoidance of doubt, no portion of any Receivable billed to any Obligor for which the related goods or services have not been delivered or performed by an Originator shall constitute an “Eligible Receivable” (including for purposes of calculating the Net Pool Balance); for which the related Originator has recognized all of the related revenue on its financial books and records in accordance with GAAP; which (i) constitutes an “account” or a “payment intangible”, (ii) is not evidenced by “instruments” or “chattel paper” and (iii) does not constitute, or arise from the sale of, “as-extracted collateral”, in each case, as defined in the UCC; each Obligor of which is a commercial Obligor; no Obligor of which (i) is a Sanctioned Person, (ii) is a natural Person acting in its individual capacity or (iii) is subject to an Event of Bankruptcy that has occurred and is continuing; each Obligor of which either (i) is a U.S. Obligor or (ii) is an Eligible Foreign Obligor; no Obligor of which has an aggregate Unpaid Balance of Defaulted Receivables included in the Receivables Pool that is more than 35% of the aggregate Unpaid Balance of all Pool Receivables owed by such Obligor; which (i) is not a Defaulted Receivable and (ii) has not been cancelled; with regard to which the warranties of Borrower in Section 7.01(k) are true and correct; 13 “Excess Foreign Receivables Concentration Amount” means, at any time, the amount (if any) by which (a) the aggregate Unpaid Balance of all Eligible Receivables, the Obligors of which are Eligible Foreign Obligors at such time, exceeds (b) 9.010.0% of the aggregate Unpaid Balance of all Eligible Receivables at such time. “Excluded Receivable” means any Receivable (without giving effect to the exclusion of “Excluded Receivable” from the definition thereof), that satisfies each of the following criteria: (i) such Receivable was generated by the Advanced Respiratory Division in connection with the sale of goods to individuals, (ii) such Receivable is payable in thirteen installments by either an individual or by Medicare or Medicaid and (iii) such Receivable is payable either to the Subject Account or any other account that does not constitute a Lock-Box Account. “Excluded Taxes” means any of the following Taxes imposed on or with respect to an Affected Person or required to be withheld or deducted from a payment to an Affected Person: (a) Taxes imposed on or measured by net income (however denominated), franchise Taxes and branch profits Taxes, in each case, (i) imposed as a result of such Affected Person being organized under the laws of, or having its principal office or, in the case of any Lender, its applicable lending office located in, the jurisdiction imposing such Tax (or any political subdivision thereof) or (ii) that are Other Connection Taxes, (b) in the case of a Lender, U.S. federal withholding Taxes imposed on amounts payable to or for the account of such Lender with respect to an applicable interest in the Loans or Commitment pursuant to a law in effect on the date on which (i) such Lender makes a Loan or its Commitment or (ii) such Lender changes its lending office, except in each case to the extent that, pursuant to Section 5.03, amounts with respect to such Taxes were payable either to such Lender’s assignor immediately before such Lender became a party hereto or to such Lender immediately before it changed its lending office, (c) Taxes attributable to such Affected Person’s failure to comply with Section 5.03(f) and (g), and (d) any Taxes imposed pursuant to FATCA. “Executive Order” means Executive Order No. 13224 on Terrorist Financings: Blocking Property and Prohibiting Transactions With Persons Who Commit, Threaten To Commit, or Support Terrorism issued on September 23, 2001. “Exiting Group” has the meaning set forth in Section 2.02(g). “Extended Pay Receivable” means any Receivable, with payment terms of more than 90 days but less than 120 days from its original billing date. “Facility Limit” means $110,000,000 as reduced from time to time pursuant to Section 2.02(e). References to the unused portion of the Facility Limit shall mean, at any time of determination, an amount equal to (x) the Facility Limit at such time, minus (y) the Aggregate Capital. “FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreement entered into pursuant to Section 1471(b)(1) of the Code, any intergovernmental agreements entered into in connection with the implementation of the 17 executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government or any court, tribunal, grand jury or arbitrator, or any accounting board or authority (whether or not part of a government) which is responsible for the establishment or interpretation of national or international accounting principles, in each case whether foreign or domestic (including any supra-national bodies such as the European Union or the European Central Bank). “Governmental Authority Excess Concentration Amount” means, at any time, the amount (if any) by which (a) the aggregate Unpaid Balance of all Eligible Receivable, any Obligor of which is a Governmental Authority, exceeds (b) 9.0% of the aggregate Unpaid Balance of all Eligible Receivables at such time. “Group” means, (i) for any Conduit Lender, such Conduit Lender, together with such Conduit Lender’s Related Committed Lenders and related Group Agent and (ii) for any other Lender that does not have a Related Conduit Lender, such Lender, together with such Lender’s related Group Agent and each other Lender for which such Group Agent acts as a Group Agent hereunder. “Group Agent” means each Person acting as agent on behalf of a Group and designated as the Group Agent for such Group on the signature pages to this Agreement or any other Person who becomes a party to this Agreement as a Group Agent for any Group pursuant to an Assumption Agreement, an Assignment and Acceptance Agreement or otherwise in accordance with this Agreement. “Group Agent’s Account” means, with respect to any Group, the account(s) from time to time designated in writing by the applicable Group Agent to the Borrower and the Servicer for purposes of receiving payments to or for the account of the members of such Group hereunder. “Group Commitment” means, with respect to any Group, at any time of determination, the aggregate Commitments of all Committed Lenders within such Group. “Highly Rated Country” means, at any time, any Subject Country that satisfies at least two of the following ratings thresholds: (i) it has a transfer and convertibility assessment of at least A by S&P, (ii) it has a foreign currency deposit ceiling of at least A2 by Moody’s and (iii) it has a country ceiling of at least A by Fitch. “Hill-Rom” has the meaning set forth in the preamble to this Agreement. “Hill-Rom Parties” means Hill-Rom, the Servicer, the Borrower, the Parent, each Originator and the Performance Guarantor. “Hillenbrand Family Group” means the descendants of John A. Hillenbrand and members of such descendants’ families and trusts for the benefit of such Persons. “Indemnified Taxes” means (a) Taxes, other than Excluded Taxes, imposed on or with respect to any payment made by or on account of any obligation of the Borrower or any of its Affiliates under any Transaction Document and (b) to the extent not otherwise described in clause (a) above, Other Taxes. 19 “Lock-Box Agreement” means a valid and enforceable agreement in form and substance reasonably satisfactory to the Administrative Agent, among the Borrower, the Servicer, the Administrative Agent and any Lock-Box Bank, whereupon the Borrower, as sole owner of the related Lock-Box Account(s) and the customer of the related Lock-Box Bank in respect of such Lock-Box Account(s), shall transfer to the Administrative Agent exclusive dominion and control over and otherwise perfect a first-priority security interest in, such Lock-Box Account(s) and the cash, instruments or other property on deposit or held therein. “Lock-Box Bank” means any bank at which the Borrower maintains one or more Lock-Box Accounts. “Loss Horizon Ratio” means, as of any date of determination, a fraction (expressed as a percentage), (a) the numerator of which is the aggregate initial Unpaid Balance of all Receivables originated by each Originator during the five most recently ended Settlement Periods and (b) the denominator of which is the Non-Defaulted Receivables Balance as of the Cut-Off Date of the most recently ended Settlement Period. “Loss Ratio” means, as of any date of determination, a fraction (expressed as a percentage), (a) the numerator of which is the sum of (i) the aggregate Unpaid Balance of all Receivables as to which any payment, or part thereof, remains unpaid for more than 150 but less than 180 days from the original due date for such payment as of the Cut-Off Date of the most recently ended Settlement Period, plus (without duplication) (ii) any Losses (net of recoveries) incurred in such Settlement Period, and (b) the denominator of which is the aggregate initial Unpaid Balance of all Receivables originated by the Originators during the six (6) Settlement Periods most recently ended prior to the current Settlement Period. “Loss Ratio Test” has the meaning set forth in Section 10.01. “Loss Reserve Floor Percentage” means 18.020.0%. “Losses” means the Unpaid Balance of any Pool Receivables that either (i) have been, or should have been, written-off as uncollectible by Servicer in accordance with the Credit and Collection Policies or (ii) are owed by an Obligor of which is subject to an Event of Bankruptcy that has occurred and is continuing. “Majority Group Agents” means one or more Group Agents which in its Group, or their combined Groups, as the case may be, have Committed Lenders representing more than 50% of the aggregate Commitments of all Committed Lenders in all Groups (or, if the Commitments have been terminated, have Lenders representing more than 50% of the aggregate outstanding Capital held by all the Lenders in all Groups); provided, however, that in no event shall the Majority Group Agents include fewer than two (2) Group Agents at any time when there are two (2) or more Groups. “Material Action” is defined in the Borrower’s limited liability company agreement. “Material Adverse Effect” means, with respect to any event or circumstance, a material adverse effect on: (i) if a particular Person is specified, the ability of such Person to perform its obligations under this Agreement or any other Transaction Document or (ii) if a particular Person is not specified, the ability of any Hill-Rom Party to perform its obligations under this Agreement or any other Transaction Document; (i) the validity or enforceability against any Hill-Rom Party of any Transaction Document or (ii) the value, validity, enforceability or collectibility of the Pool Receivables, the Related Security with respect thereto or, in each case, any material portion thereof, including if such event or circumstance would materially increase the days to pay or Dilution with respect to the Pool Receivables or any material portion thereof; the status, existence, perfection, priority, enforceability or other rights and remedies of any Credit Party under the Transaction Documents or associated with its respective interest in the Collateral; or (i) if a particular Person is specified, the business, assets, liabilities, property, operations or financial condition of such Person or (ii) if a particular Person is not specified, the business, assets, liabilities, property, operations or financial condition of any Hill-Rom Party. “Medicaid” means the medical assistance program established by Title XIX of the Social Security Act (42 U.S.C. Secs. 1396 et seq.) and any statutes succeeding thereto. “Medicare” means the health insurance program for the aged and disabled established by Title XVIII of the Social Security Act (42 U.S.C. Secs. 1395 et seq.) and any statutes succeeding thereto. “Medicare/Medicaid Receivable” means any Receivable that arises under Medicare, TRICARE, or a Medicaid program. “Monthly Settlement Date” means the 15th day of each calendar month (or if such day is not a Business Day, the next occurring Business Day); provided, however, that the initial Monthly Settlement Date shall be May 31, 2017. “Moody’s” means Moody’s Investors Service, Inc. and any successor thereto that is a nationally recognized statistical rating organization. “MUFG” has the meaning set forth in the preamble to this Agreement. “Multiemployer Plan” means a multiemployer plan as defined in Section 4001(a)(3) of ERISA to which any Hill-Rom Party or any of their respective ERISA Affiliates is making or accruing an obligation to make contributions, or has within any of the preceding five plan years made or accrued an obligation to make contributions. “Net Pool Balance” means, at any time, an amount equal to the aggregate Unpaid Balance of all Pool Receivables that are Eligible Receivables determined at such time, minus (without duplication) the sum of (a) with respect to each Obligor, the amount by which the aggregate Unpaid Balance of such Eligible Receivables owed or payable by such Obligor or an Affiliate of such Obligor, exceeds the applicable Concentration Limit at such time, (b) the Governmental Authority Excess Concentration Amount at such time, (c) the Excess Foreign Receivables Concentration Amount at such time and (d) the Excess Extended Pay Concentration Amount at such time. “No Petition Agreement” means that certain no proceedings letter agreement, dated as of the May 4, 2018, among Hill-Rom, the Administrative Agent and the Subordinated Note Financier, as such agreement may be amended, supplemented or otherwise modified from time to time. “Non-Defaulted Receivables Balance” means the aggregate Unpaid Balance of all Pool Receivables as to which no payment, or part thereof, remains unpaid for more than ninety (90) days from the original due date for such payment (determined without regard to any extension of the date due pursuant to Section 9.02). “Notes” means short-term promissory notes issued, or to be issued, by any Conduit Lender to fund its investments in accounts receivable or other financial assets. “Obligor” means any Person obligated to make payments with respect to a Receivable, including (i) any related advertiser or any advertising agency, agent or licensee of such advertiser or (ii) any guarantor thereof or co-obligor. “OECD Country” means any country that has signed the Convention on the Organisation for Economic Co-operation and Development. “OFAC” has the meaning set forth in the definition of Sanctioned Person. “Originator” and “Originators” have the meaning set forth in the Purchase and Sale Agreement, as the same may be modified from time to time by adding new Originators or removing Originators in accordance with the terms of the Purchase and Sale Agreement. “Other Connection Taxes” means, with respect to any Affected Person, Taxes imposed as a result of a present or former connection between such Affected Person and the jurisdiction imposing such Tax (other than connections arising from such Affected Person having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security interest under, engaged in any other transaction pursuant to or enforced any Transaction Document, or sold or assigned an interest in any Loan or Transaction Document). “Other Taxes” means any and all present or future stamp, court or documentary, intangible, recording, filing or similar Taxes arising from any payment made hereunder or from the execution, delivery, performance, filing, registration or enforcement of, from the receipt or perfection of a security interest under, or otherwise in respect of, this Agreement, the other Transaction Documents and the other documents or agreements to be delivered hereunder or thereunder, except any such Taxes that are Other Connection Taxes imposed with respect to an assignment. “Pool Receivable” means a Receivable in the Receivables Pool. “Portion of Capital” means, with respect to any Lender and its related Capital, the portion of such Capital being funded or maintained by such Lender by reference to a particular interest rate basis. “Program Support Agreement” means and includes any Liquidity Agreement and any other agreement entered into by any Program Support Provider providing for: (a) the issuance of one or more letters of credit for the account of any Conduit Lender, (b) the issuance of one or more surety bonds for which any Conduit Lender is obligated to reimburse the applicable Program Support Provider for any drawings thereunder, (c) the sale by any Conduit Lender to any Program Support Provider of any Loan (or portions thereof or participation interest therein) maintained by such Conduit Lender and/or (d) the making of loans and/or other extensions of credit to any Conduit Lender in connection with such Conduit Lender’s receivables-securitization program contemplated in this Agreement, together with any letter of credit, surety bond or other instrument issued thereunder. “Program Support Provider” means and includes, with respect to any Conduit Lender, any Liquidity Provider and any other Person (other than any customer of such Conduit Lender) now or hereafter extending credit or having a commitment to extend credit to or for the account of, or to make purchases from, such Conduit Lender pursuant to any Program Support Agreement. “Purchase and Sale Agreement” means the Purchase and Sale Agreement, dated as of the Closing Date, among the Servicer, the Originators and the Borrower, as such agreement may be amended, supplemented or otherwise modified from time to time. “Purchase and Sale Termination Event” has the meaning set forth in the Purchase and Sale Agreement. “Purchase and Sale Termination Date” has the meaning set forth in the Purchase and Sale Agreement. “Purchase Report” has the meaning set forth in the Purchase and Sale Agreement. “Rating Agency” means each of S&P, Fitch and Moody’s (and/or each other rating agency then rating the Notes of any Conduit Lender). “Receivable” means any account receivable or other right to payment from a Person, whether constituting an account, chattel paper, payment intangible, instrument or a general intangible, in each case, arising from the sale of goods, provided or to be provided, or provision of services, rendered or to be rendered, by any Originator pursuant to a Contract, including the right to payment of any interest, finance charges, fees and other payment obligations of such Person with respect thereto; provided, however, that “Receivable” does not include any Excluded Receivable. “Receivables Pool” means at any time all then outstanding Receivables sold, purported to be sold or contributed to Borrower pursuant to the Purchase and Sale Agreement. 26 is otherwise prohibited or restricted by Sanctions; or (e) (i) an agency of the government of a Sanctioned Country, (ii) an organization controlled by a Sanctioned Country, or (iii) a Person resident in a Sanctioned Country, to the extent subject to a sanctions program administered by OFAC. “Sanctions” means the laws, rules, regulations and executive orders promulgated or administered to implement economic or financial sanctions or trade embargoes imposed, administered or enforced from time to time (a) by the United States government, including those administered by OFAC, the US State Department, the US Department of Commerce or the US Department of the Treasury, (b) by the United Nations Security Council, the European Union or Her Majesty’s Treasury of the United Kingdom or (c) by other relevant sanctions authorities to the extent compliance with the sanctions imposed by such other authorities would not entail a violation of Applicable Law. “Scheduled Termination Date” means May 4, 2018,3, 2019, as such date may be extended from time to time pursuant to Section 2.02(g). “SEC” means the U.S. Securities and Exchange Commission or any successor governmental agencies. “Secured Parties” means each Credit Party, each Borrower Indemnified Party and each Affected Person. “Securities Act” means the Securities Act of 1933, as amended or otherwise modified from time to time. “Security” is defined in Section 2(a)(1) of the Securities Act. “Servicer” has the meaning set forth in the preamble to this Agreement. “Servicer Indemnified Amounts” has the meaning set forth in Section 13.02(a). “Servicer Indemnified Party” has the meaning set forth in Section 13.02(a). “Servicing Fee” means the fee referred to in Section 9.07(a) of this Agreement. “Servicing Fee Rate” means the rate referred to in Section 9.07(a) of this Agreement. “Servicing Fee Reserve” means on any day an amount determined as follows: OBR x SFR x (DSO/360) + AUSF where: OBR = the Unpaid Balance of Pool Receivables on such day; SFR = 1.00%; 29 determined by the Administrative Agent in its sole discretion with respect to such Obligor by written notice to the Borrower and the Servicer; it being understood and agreed that the Administrative Agent, in its sole discretion, may increase or reduce any such percentage described in this clause (a) with respect to any Obligor at any time in its sole discretion by written notice thereof to the Borrower and the Servicer, and (b) the percentage appearing opposite such Obligor’s applicable rating on the table below: S&P Short-Term Rating/ Long-Term Rating Moody’s Short-Term Rating/ Long-Term Rating Specified Concentration Percentage A-1/A+ or higher P-1/A1 or higher 18.020.0% A-2/BBB+ or higher P-2/Baa1 or higher 16.018.0% A-3/BBB- or higher P-3/Baa3 or higher 9.010.0% Below A-3/BBBor Not Rated/Withdrawn Below P-3/Baa3 or Not Rated/Withdrawn 2.252.75% For purposes of clause (b) above, each Obligor’s “Specified Concentration Percentage” shall be computed as follows: if such Obligor has a short-term unsecured debt rating (A) from both Moody’s andS&P, such Obligor’s “Specified Concentration Percentage” shall be determined based on the lower of such short-term unsecured debt ratings or (B) from only one of Moody’s or S&P, such Obligor’s “Specified Concentration Percentage” shall be determined based upon the short-term unsecured debt rating that is maintained; if such Obligor (A) does not have a short-term unsecured debt rating from eitherMoody’s or S&P and (B) has a long-term unsecured debt rating (I) from both Moody’s and S&P, such Obligor’s “Specified Concentration Percentage” shall be determined based on the lower of such long-term unsecured debt ratings or (II) from only one of Moody’s or S&P, such Obligor’s “Specified Concentration Percentage” shall be determined based upon the long-term unsecured debt rating that is maintained; and if such Obligor has neither a short-term unsecured debt rating nor a long-termunsecured debt rating from either Moody’s or S&P, such Obligor’s “Specified Concentration Percentage” shall be the lowest percentage set forth on the table above. “Subject Account” means the account specified in Schedule IV and maintained at the Subject Account Bank in the name of Hill-Rom. “Subject Account Bank” means PNC Bank, National Association. “Subject Country” means United Arab Emirates, Bermuda, China, Hong Kong, Kuwait, Malaysia, Panama, Qatar, Saudi Arabia, Singapore, and Taiwan. “Subject Medicare/Medicaid Date” has the meaning set forth in the definition of “Eligible Receivable”. “Subordinated Note” has the meaning set forth in the Purchase and Sale Agreement. “Subordinated Note Financier” means MUFG Bank, Ltd. or any Affiliate thereof that is a party to any Subordinated Note Financing Document. “Subordinated Note Financing” means any transaction or series of transactions that may be entered into by one or more Originators and the Subordinated Note Financier pursuant to which one or more Originators may (a) sell, transfer, assign or convey one or more Subordinated Notes to the Subordinated Note Financier and/or (b) grant a security interest in one or more Subordinated Notes to the Subordinated Note Financier. “Subordinated Note Financing Document” means each purchase agreement, sale agreement, credit agreement, loan agreement, repurchase agreement, security agreement and/or other financing agreement entered into from time to time between the Subordinated Note Financier and one or more Originators in connection with a Subordinated Note Financing, in each case, as amended, restated, supplemented or otherwise modified from time to time. “Sub-Servicer” has the meaning set forth in Section 9.01(d). “Subsidiary” means a corporation or other entity of which Hill-Rom owns, or its other direct or indirect Subsidiaries own, directly or indirectly, such number of outstanding shares or other ownership or control interest as have more than 50% of the ordinary voting power for the election of directors or managers, as the case may be. “Supplier Receivable” means any Pool Receivable owed by any Obligor that is a material supplier (or an Affiliate thereof) to any Originator or any of its Affiliates. “Taxes” means any and all present or future taxes, levies, imposts, duties, deductions, assessments, fees, charges or withholdings (including backup withholding) imposed by any Governmental Authority and all interest, penalties, additions to tax and any similar liabilities with respect thereto. “Termination Date” means the earliest to occur of (a) the Scheduled Termination Date, (b) the date on which the “Termination Date” is declared or deemed to have occurred under Section 10.01 and (c) the date selected by the Borrower on which all Commitments have been reduced to zero pursuant to Section 2.02(e). “Tranche Period” means, with respect to any LIBOR Loan and subject to the provisoprovisos below, a period of one, two or three months selected by the Borrower pursuant to Section 2.05. Each Tranche Period shall commence on a Monthly Settlement Date and end on (but not including) the Monthly Settlement Date occurring one, two or three calendar months thereafter, as selected by the Borrower pursuant to Section 2.05; provided, however, that if the date any LIBOR Loan made pursuant to Section 2.01 is not a Monthly Settlement Date, the initial Tranche Period for such LIBOR Loan shall commence on the date such LIBOR Loan is made pursuant to Section 2.01 and end on (a) solely with respect to the initial LIBOR Loan under the Agreement, May 31, 2017 and (b) with respect to each other LIBOR Loan, the next Monthly Settlement Date; provided, further, that with respect to (a) each LIBOR Loan outstanding on April 16, 2018, the following Tranche Period for such LIBOR Loans shall commence on such date and end on May 4, 2018 and (b) each LIBOR Loan outstanding on May 4, 2018, the following Tranche Period for such LIBOR Loans shall commence on such date and end on the next Monthly Settlement Date; provided, further, however, that if any Tranche Period would end after the Termination Date, such Tranche Period (including a period of one day) shall end on the Termination Date. “Transaction Documents” means this Agreement, the Purchase and Sale Agreement, the Lock-Box Agreements, the Fee Letter, each Subordinated Note, the Performance Guaranty, the No Petition Agreement and all other certificates, instruments, UCC financing statements, and agreements executed or delivered under or in connection with this Agreement, in each case as the same may be amended, supplemented or otherwise modified from time to time in accordance with this Agreement. “TRICARE” means the Civilian Health and Medical Program of the Uniformed Services formerly known as CHAMPUS, a program of medical benefits covering former and active members of the uniformed services and certain of their dependents, financed and administered by the United States Departments of Defense, Health and Human Services and Transportation and established pursuant to 10 U.S.C. §§ 1071-1106, and all regulations promulgated thereunder including without limitation (a) all federal statutes (whether set forth in 10 U.S.C. §§ 1071-1106 or elsewhere) affecting CHAMPUS or TRICARE and (b) all rules, regulations (including 32 CFR 199), manuals, orders and administrative, reimbursement and other guidelines of all Governmental Entities (including, without limitation, the Department of Health and Human Services, the Department of Defense, the Department of Transportation, the Assistant Secretary of Defense (Health Affairs) and the Office of Military Medical Support, or any Person or entity succeeding to the functions of any of the foregoing) promulgated pursuant to or in connection with any of the foregoing (whether or not having the force of law) in each case, as amended, supplemented or otherwise modified from time to time. “UCC” means the Uniform Commercial Code as from time to time in effect in the applicable jurisdiction. “Unmatured Event of Default” means any event which, with the giving of notice or lapse of time, or both, would become an Event of Default. “Unpaid Balance” means, at any time of determination, with respect to any Receivable, the then outstanding principal balance thereof. “U.S. Dollars” means dollars in lawful money of the United States of America. “U.S. Obligor” means an Obligor that is a corporation or other business organization and is organized under the laws of the United States of America (or of a United States of America territory, district, state, commonwealth, or possession, including, without limitation, Puerto Rico and the U.S. Virgin Islands) or any political subdivision thereof. “U.S. Tax Compliance Certificate” has the meaning set forth in Section 5.03(f)(ii)(B)(3). memorandum attached as Exhibit I hereto, in each case, in form and substance reasonably acceptable to the Administrative Agent and (b) all fees and expenses payable by the Borrower on the Closing Date to the Credit Parties have been paid in full in accordance with the terms of the Transaction Documents. SECTION 6.02. Conditions Precedent to All Credit Extensions. Each Credit Extension hereunder on or after the Closing Date shall be subject to the conditions precedent that: the Borrower shall have delivered to the Administrative Agent and each Group Agent a Loan Request for such Loan, in accordance with Section 2.02(a); the Servicer shall have delivered to the Administrative Agent and each Group Agent all Information Packages and Purchase Reports required to be delivered hereunder and under the Purchase and Sale Agreement; the restrictions with respect to such Credit Extension specified in Section 2.01(i) through (iv) shall not be violated; on the date of such Credit Extension the following statements shall be true and correct (and upon the occurrence of such Credit Extension, the Borrower and the Servicer shall be deemed to have represented and warranted that such statements are then true and correct): the representations and warranties of the Borrower and the Servicer contained in Sections 7.01 and 7.02 are true and correct in all material respects on and as of the date of such Credit Extension as though made on and as of such date unless such representations and warranties by their terms refer to an earlier date, in which case they shall be true and correct in all material respects on and as of such earlier date; no Event of Default or Unmatured Event of Default has occurred and is continuing, and no Event of Default or Unmatured Event of Default would result from such Credit Extension; no Borrowing Base Deficit exists or would exist after giving effect to such Credit Extension; the Aggregate Capital does not exceed the Facility Limit; no Performance Test is then being breached; and (vi) the Termination Date has not occurred. SECTION 6.03. Conditions Precedent to All Releases. Each Release hereunder on or after the Closing Date shall be subject to the conditions precedent that: (a) after giving effect to such Release, the Servicer shall be holding in trust for the benefit of the Secured Parties an amount of Collections sufficient to pay the sum of (x) all accrued and unpaid Servicing Fees, Interest, Fees and Breakage Fees, in each case, through the 50 delivery and performance by it of this Agreement or any other Transaction Document to which it is a party, except for (i) the filing of the UCC financing statements referred to in Article VI, all of which, at the time required in Article VI, shall have been duly filed and shall be in full force and effect, (ii) those that have been made or obtained and are in full force and effect, or (iii) those that are not currently required. Litigation. No injunction, decree or other decision has been issued or made by any Governmental Authority against the Borrower or its properties, and no threat by any Person has been made to attempt to obtain any such decision against it or its properties. Use of Proceeds. The use of all funds obtained by the Borrower under this Agreement will not conflict with or contravene any of Regulations T, U and X promulgated by the Federal Reserve Board. Quality of Title. The Borrower has acquired, for fair consideration and reasonably equivalent value, all of the right, title and interest of the applicable Originator in each Pool Receivable and the Related Security. Each Pool Receivable and the Related Security is owned by Borrower free and clear of any Adverse Claim other than Permitted Liens; the Administrative Agent shall have acquired and shall at all times thereafter continuously maintain a valid and perfected first priority perfected security interest in each Pool Receivable and Collections and proceeds of any of the foregoing, free and clear of any Adverse Claim other than Permitted Liens; and no financing statement or other instrument similar in effect covering any Pool Receivable and any interest therein is on file in any recording office except such as may be filed (i) in favor of the Borrower in accordance with any Transaction Document (and assigned to the Administrative Agent), or (ii) in favor of the Administrative Agent in accordance with this Agreement or any Transaction Document. Accurate Reports. No Information Package, Purchase Report or any other information, exhibit, financial statement, document, book, record or report furnished or to be furnished by or on behalf of any Hill-Rom Party or any of their respective Affiliates to Administrative Agent, any Group Agent, any Liquidity Provider or any other Secured Party in connection with the Collateral, this Agreement or the other Transaction Documents: (i) was or will be untrue or inaccurate in any material respect as of the date it was or will be dated or as of the date so furnished; or (ii) contained or will contain when furnished any material misstatement of fact or omitted or will omit to state a material fact or any fact necessary to make the statements contained therein not misleading; provided, however, that with respect to projected financial information and information of a general economic or industry specific nature, the Borrower represents only that such information has been prepared in good faith based on assumptions believed by the Borrower to be reasonable at the time such information was delivered. UCC Details. The Borrower’s true legal name as registered in the sole jurisdiction in which it is organized, the jurisdiction of such organization, its organizational identification number, if any, as designated by the jurisdiction of its organization, its federal employer identification number, if any, and the location of its chief executive office and principal place of business are specified in Schedule 7.01(m) and the offices where the Borrower keeps all its Records are located at the addresses specified in Schedule 7.01(m) (or at such other locations, notified to the Administrative Agent in accordance with Section 8.01(f)), in jurisdictions where 53 Financial Condition. The Servicer has furnished to the Administrative Agent the consolidated balance sheet and statements of income, stockholders equity and cash flows of the Parent as of and for the fiscal year ended December 31, 2016, reported on by PricewaterhouseCoopers LLP, independent public accountants. All financial statements of the Parent and its consolidated Subsidiaries referenced above or delivered to the Administrative Agent pursuant to Section 8.05(a) were prepared in accordance with GAAP in effect on the date such statements were prepared and fairly present in all material respects the consolidated financial condition, business, and operations of the Parent and its consolidated Subsidiaries as of the date and for the period presented or provided (other than in the case of annual financial statements, subject to the absence of footnotes and year-end audit adjustments). Since December 31, 2016, there has been no change in the business, property, operation or condition of the Parent and its Subsidiaries, taken as a whole, which could reasonably be expected to have a Material Adverse Effect. Litigation. No injunction, decree or other decision has been issued or made by any Governmental Authority against it or its properties that prevents, and no threat by any Person has been made to attempt to obtain any such decision against it or its properties, and there are no actions, suits, litigation or proceedings pending or threatened against it or its properties in or before any Governmental Authority that has had or could reasonably be expected to have a Material Adverse Effect. Accurate Reports. No Information Package, Purchase Report or any other information, exhibit, financial statement, document, book, record or report furnished by any Hill-Rom Party or any of their respective Affiliates to Administrative Agent, any Group Agent, any Liquidity Provider or any other Secured Party in connection with the Collateral, this Agreement or the other Transaction Documents: (i) was or will be untrue or inaccurate in any material respect as of the date it was or will be dated or as of the date so furnished or (ii) contained or will contain when furnished any material misstatement of fact or omitted or will omit to state a material fact or any fact necessary to make the statements contained therein not misleading; provided, however, that with respect to projected financial information and information of a general economic or industry specific nature, the Servicer represents only that such information has been prepared in good faith based on assumptions believed by the Servicer to be reasonable at the time such information was delivered. Lock-Box Accounts. The names and addresses of all of the Lock-Box Banks, together with the account numbers of the Lock-Box Accounts at such Lock-Box Banks, are specified in Schedule II (or have been notified to and approved by the Administrative Agent in accordance with Section 8.03(d)). Servicing Programs. No license or approval is required for the Administrative Agent’s use of any software or other computer program used by Servicer, any Originator or any Sub-Servicer in the servicing of the Receivables, other than those which have been obtained and are in full force and effect. Eligible Receivables. Each Receivable included in the Net Pool Balance as an Eligible Receivable on the date of any Credit Extension or on the date of any Information Package constitutes an Eligible Receivable on such date. 59 becomes due and payable (whether by scheduled maturity, required prepayment, acceleration, demand or otherwise), and such failure shall continue after the applicable grace period, if any, specified in the applicable agreement relating to such Debt (whether or not such failure shall have been waived under the related agreement); (ii) the default by any such Person in the performance of any term, provision or condition contained in any agreement under which any such Debt was created or is governed, or any other event shall occur or condition exist, and such failure shall continue after the applicable grace period, if any, specified in the applicable agreement relating to such Debt, the effect of which is to cause, such Debt to become due prior to its stated maturity or to permit such holders to terminate any undrawn committed thereunder; (iii) any such Debt of any Hill-Rom Party or any Subsidiary thereof shall be declared to be due and payable or required to be prepaid (other than by a regularly scheduled payment), redeemed, defeased, accelerated or repurchased, or the commitment of any lender thereunder to be terminated, in each case, prior to the stated maturity thereof; or (iv) any “event of default” (or similar event) shall occur under the Credit Agreement; or (v) any “event of default” (or similar event) shall occur under any Subordinated Note Financing Document; an Event of Bankruptcy shall have occurred with respect to any Hill-Rom Party; the average of the Default Ratios for the consecutive three preceding Settlement Periods shall at any time exceed 17.00% (such test, the “Default Ratio Test”), and the Aggregate Capital shall not have been reduced to zero within one (1) Business Day; the average of the Dilution Ratios for the consecutive three preceding Settlement Periods shall at any time exceed 9.75% (such test, the “Dilution Ratio Test”), and the Aggregate Capital shall not have been reduced to zero within one (1) Business Day; the average of the Loss Ratios for the consecutive three preceding Settlement Periods shall at any time exceed 5.25% (such test, the “Loss Ratio Test”), and the Aggregate Capital shall not have been reduced to zero within one (1) Business Day; the average Days Sales Outstanding for the consecutive three preceding Settlement Periods shall at any time be more than 90 days (such test, the “Days Sales Outstanding Test”), and the Aggregate Capital shall not have been reduced to zero within one (1) Business Day; a Borrowing Base Deficit shall occur, and shall not have been cured within two (2) Business Days; a Change of Control shall occur; any Hill-Rom Party shall make any change in any of the Credit and Collection Policies that could reasonably be expected to have a Material Adverse Effect without the prior written consent of the Administrative Agent; the Administrative Agent, for the benefit of the Secured Parties, fails at any time to have a valid and perfected first priority ownership interest or first priority perfected security interest in all the Collateral or any Lock-Box Account (other than such Lock-Box Bank’s 87 resignation hereunder, the provisions of this Article XII and Article XIII shall inure to its benefit as to any actions taken or omitted to be taken by it while it was a Group Agent. SECTION 12.09. Reliance on Group Agent. Unless otherwise advised in writing by a Group Agent or by any Credit Party in such Group Agent’s Group, each party to this Agreement may assume that (i) such Group Agent is acting for the benefit and on behalf of each of the Credit Parties in its Group, as well as for the benefit of each assignee or other transferee from any such Person and (ii) each action taken by such Group Agent has been duly authorized and approved by all necessary action on the part of the Credit Parties in its Group. ARTICLE XIII INDEMNIFICATION SECTION 13.01. Indemnities by the Borrower. (a) Without limiting any other rights that the Administrative Agent, the Credit Parties, the Affected Persons and their respective assigns, officers, directors, agents and employees (each, a “Borrower Indemnified Party”) may have hereunder or under Applicable Law, the Borrower hereby agrees to indemnify each Borrower Indemnified Party from and against any and all claims, losses and liabilities (including Attorney Costs) (all of the foregoing being collectively referred to as “Borrower Indemnified Amounts”) arising out of or resulting from this Agreement or any other Transaction Document or the use of proceeds of the Credit Extensions or the security interest in respect of any Pool Receivable or any other Collateral; excluding, however, (a) Borrower Indemnified Amounts (x) resulted solely from the gross negligence or willful misconduct by the Borrower Indemnified Party seeking indemnification, as determined by a final non-appealable judgment of a court of competent jurisdiction, (y) resulting from a material breach of any Transaction Document on the part of such Borrower Indemnified Party, as determined by a final non-appealable judgment of a court of competent jurisdiction, or (z) that constitute recourse with respect to a Pool Receivable by reason of an Event of Bankruptcy or insolvency, or the financial or credit condition or financial default, of the related Obligor, and (b) Taxes (other than any Taxes that represent losses, claims, damages, etc. arising from any non-Tax Claim). Without limiting or being limited by the foregoing, the Borrower shall pay on demand (it being understood that if any portion of such payment obligation is made from Collections, such payment will be made at the time and in the order of priority set forth in Section 4.01), to each Borrower Indemnified Party any and all amounts necessary to indemnify such Borrower Indemnified Party from and against any and all Borrower Indemnified Amounts relating to or resulting from any of the following (but excluding Borrower Indemnified Amounts and Taxes described in clauses (a) and (b) above): any Pool Receivable which the Borrower or the Servicer includes as an Eligible Receivable as part of the Net Pool Balance but which is not an Eligible Receivable at such time; any representation, warranty or statement made or deemed made by the Borrower (or any of its officers) under or in connection with this Agreement, any of the other Transaction Documents, any Information Package, any Purchase Report or any 95 against any loss, liability, expense, damage or injury suffered or sustained by reason of any acts, omissions or alleged acts or omissions arising out of activities of the Servicer pursuant to this Agreement or any other Transaction Document, including any judgment, award, settlement, Attorney Costs and other reasonable and documented out-of-pocket costs or expenses incurred in connection with the defense of any actual or threatened action, proceeding or claim (all of the foregoing being collectively referred to as, “Servicer Indemnified Amounts”); excluding (i) Servicer Indemnified Amounts (x) resulted solely from the gross negligence or willful misconduct by the Servicer Indemnified Party seeking indemnification, as determined by a final non-appealable judgment of a court of competent jurisdiction holds that such Servicer Indemnified Amounts, (y) resulting from a material breach of any Transaction Document on the part of such Servicer Indemnified Party, as determined by a final non-appealable judgment of a court of competent jurisdiction, or (z) that constitute recourse with respect to a Pool Receivable by reason of an Event of Bankruptcy or insolvency, or the financial or credit condition or financial default, of the related Obligor, (ii) Taxes (other than any Taxes that represent losses, claims, damages, etc. arising from any non-Tax Claim), and (iii) Servicer Indemnified Amounts to the extent the same includes losses in respect of Pool Receivables that are uncollectible solely on account of the insolvency, bankruptcy, lack of creditworthiness or other financial inability to pay of the related Obligor. Without limiting or being limited by the foregoing, the Servicer shall pay on demand, to each Servicer Indemnified Party any and all amounts necessary to indemnify such Servicer Indemnified Party from and against any and all Servicer Indemnified Amounts relating to or resulting from any of the following (but excluding Servicer Indemnified Amounts described in clauses (i), (ii) and (iii) above): any Pool Receivable which the Servicer includes as an Eligible Receivable as part of the Net Pool Balance but which is not an Eligible Receivable at such time; any representation, warranty or statement made or deemed made by the Servicer (or any of its respective officers) under or in connection with this Agreement, any of the other Transaction Documents, any Information Package, any Purchase Report or any other information or report delivered by or on behalf of the Servicer pursuant hereto which shall have been untrue or incorrect when made or deemed made; the failure by the Servicer to comply with any Applicable Law with respect to any Pool Receivable or the related Contract; or the failure of any Pool Receivable or the related Contract to conform to any such Applicable Law; any failure of the Servicer to perform any of its duties or obligations under any Contract related to any Receivable; the commingling of Collections of Pool Receivables at any time with other funds; or any failure of the Servicer to comply with its covenants, obligations and agreements contained in this Agreement or any other Transaction Document. 98 THEMUFG BANK OF TOKYO-MITSUBISHI UFJ, LTD.,(Missing Graphic Reference) NEW YORK BRANCH, as Administrative Agent By:(Missing Graphic Reference) Name: Title: THEMUFG BANK OF TOKYO-MITSUBISHI UFJ, LTD.,(Missing Graphic Reference) NEW YORK BRANCH, as Group Agent for the BTMUMUFG Group By:(Missing Graphic Reference) Name: Title: THEMUFG BANK OF TOKYO-MITSUBISHI UFJ, LTD., NEW YORK BRANCH, as a Committed Lender By:(Missing Graphic Reference) Name: Title: S- 2 Loan and Security Agreement EXHIBIT A Form of Loan Request [Letterhead of Borrower] [Date] [Administrative Agent] [Group Agents] Re: Loan Request Ladies and Gentlemen: Reference is hereby made to that certain Loan and Security Agreement, dated as of May 5, 2017 among Hill-Rom Finance Company LLC (the “Borrower”), Hill-Rom Company, Inc., as Servicer (the “Servicer”), the Lenders party thereto, the Group Agents party thereto and MUFG Bank, Ltd. (f/k/a The Bank of Tokyo-Mitsubishi UFJ, LTD., New York BranchLtd.), as Administrative Agent (in such capacity, the “Administrative Agent”) (as amended, supplemented or otherwise modified from time to time, the “Agreement”). Capitalized terms used in this Loan Request and not otherwise defined herein shall have the meanings assigned thereto in the Agreement. This letter constitutes a Loan Request pursuant to Section 2.02(a) of the Agreement. The Borrower hereby request a Loan in the amount of [$_______] to be made on [_____, 20__] and for a Tranche Period of [one] [two] [three] [month[s]]. The proceeds of such Loan should be deposited to [Account number], at [Name, Address and ABA Number of Bank]. After giving effect to such Loan, the Aggregate Capital will be [$_______]. The Borrower hereby represents and warrants as of the date hereof, and after giving effect to such Credit Extension, as follows: the representations and warranties of the Borrower and the Servicer contained in Sections 7.01 and 7.02 of the Agreement are true and correct in all material respects on and as of the date of such Credit Extension as though made on and as of such date unless such representations and warranties by their terms refer to an earlier date, in which case they shall be true and correct in all material respects on and as of such earlier date; no Event of Default or Unmatured Event of Default has occurred and is continuing, and no Event of Default or Unmatured Event of Default would result from such Credit Extension; no Borrowing Base Deficit exists or would exist after giving effect to such Credit Extension; the Aggregate Capital will not exceed the Facility Limit; Exhibit A- 1 EXHIBIT B Form of Reduction Notice [LETTERHEADOF BORROWER] [Date] [Administrative Agent] [Group Agents] Re: Reduction Notice Ladies and Gentlemen: Reference is hereby made to that certain Loan and Security Agreement, dated as of May 5, 2017 among Hill-Rom Finance Company LLC, as borrower (the “Borrower”), Hill-Rom Company, Inc., as Servicer (the “Servicer”), the Lenders party thereto, and MUFG Bank, Ltd. (f/k/a The Bank of Tokyo-Mitsubishi UFJ, LTD., New York BranchLtd.), as Administrative Agent (in such capacity, the “Administrative Agent”) (as amended, supplemented or otherwise modified from time to time, the “Agreement”). Capitalized terms used in this Reduction Notice and not otherwise defined herein shall have the meanings assigned thereto in the Agreement. This letter constitutes a Reduction Notice pursuant to Section 2.02(d) of the Agreement. The Borrower hereby notifies the Administrative Agent and the Lenders that it shall prepay the outstanding Capital of the Lenders in the amount of [$_______] to be made on [_____, 201_]. After giving effect to such prepayment, the Aggregate Capital will be [$_______]. The Borrower hereby represents and warrants as of the date hereof, and after giving effect to such reduction, as follows: the representations and warranties of the Borrower and the Servicer contained in Sections 7.01 and 7.02 of the Agreement are true and correct in all material respects on and as of the date of such prepayment as though made on and as of such date unless such representations and warranties by their terms refer to an earlier date, in which case they shall be true and correct in all material respects on and as of such earlier date; no Event of Default or Unmatured Event of Default has occurred and is continuing, and no Event of Default or Unmatured Event of Default would result from such prepayment; no Borrowing Base Deficit exists or would exist after giving effect to such prepayment; the Aggregate Capital will not exceed the Facility Limit; no Performance Test is then being breached; and Exhibit B- 1 EXHIBIT C [Form of Assignment and Acceptance Agreement] Dated as of ___________, 20__ Section 1. Commitment assigned: $[_____] Assignor’s remaining Commitment: $[_____] Capital allocable to Commitment assigned: $[_____] Assignor’s remaining Capital: $[_____] Interest (if any) allocable to Capital assigned: $[_____] Interest (if any) allocable to Assignor’s remaining Capital: $[_____] Section 2. Effective Date of this Assignment and Acceptance Agreement: [__________] Upon execution and delivery of this Assignment and Acceptance Agreement by the assignee and the assignor and the satisfaction of the other conditions to assignment specified in Section 14.03(b) of the Agreement (as defined below), from and after the effective date specified above, the assignee shall become a party to, and, to the extent of the rights and obligations thereunder being assigned to it pursuant to this Assignment and Acceptance Agreement, shall have the rights and obligations of a Committed Lender under that certain Loan and Security Agreement, dated as of May 5, 2017 among Hill-Rom Finance Company LLC, Hill-Rom Company, Inc., as Servicer, the Lenders party thereto, the Group Agents party thereto and MUFG Bank, Ltd. (f/k/a The Bank of Tokyo-Mitsubishi UFJ, LTD., New York BranchLtd.), as Administrative Agent (as amended, supplemented or otherwise modified from time to time, the “Agreement”). (Signature Pages Follow) Exhibit C- 1 ASSIGNOR: [_________] By: Name: Title ASSIGNEE: [_________] By:(Missing Graphic Reference) Name: Title: [Address] Accepted as of date first above written: THE BANK OF TOKYO-MITSUBISHI UFJ, MUFG BANK, LTD., NEW YORK BRANCH, as Administrative Agent By:(Missing Graphic Reference) Name: Title: HILL-ROM FINANCE COMPANY LLC By:(Missing Graphic Reference) Name: Title:] Exhibit C- 2 EXHIBIT D [Form of Assumption Agreement] THIS ASSUMPTION AGREEMENT (this “Agreement”), dated as of [______ __, ____], is among ____________________ (the “Borrower”), [________], as conduit lender (the “[_____] Conduit Lender”), [________], as the Related Committed Lender (the “[______] Committed Lender” and together with the Conduit Lender, the “[_____] Lenders”), and [________], as group agent for the [_____] Lenders (the “[______] Group Agent” and together with the [_____] Lenders, the “[_______] Group”). BACKGROUND The Borrower and various others are parties to a certain Loan and Security Agreement, dated as of May 5, 2017 among Hill-Rom Finance Company LLC, Hill-Rom Company, Inc., as Servicer, the Lenders party thereto, the Group Agents party thereto and MUFG Bank, Ltd. (f/k/a The Bank of Tokyo-Mitsubishi UFJ, LTD., New York BranchLtd.), as Administrative Agent (as amended, supplemented or otherwise modified from time to time, the “Loan and Security Agreement”). Capitalized terms used and not otherwise defined herein have the respective meaning assigned to such terms in the Agreement. NOW, THEREFORE, the parties hereto hereby agree as follows: SECTION 1. This letter constitutes an Assumption Agreement pursuant to Section 14.03(i) of the Loan and Security Agreement. The Borrower desires [the [_____] Lenders] [the [______] Committed Lender] to [become a Group] [increase its existing Commitment] under the Loan and Security Agreement, and upon the terms and subject to the conditions set forth in the Loan and Security Agreement, the [[________] Lenders] [[__________] Committed Lender] agree[s] to [become Lenders within a Group thereunder] [increase its Commitment to the amount set forth as its “Commitment” under the signature of such [______] Committed Lender hereto]. The Borrower hereby represents and warrants to the [________] Lenders and the [_________] Group Agent as of the date hereof, as follows: the representations and warranties of the Borrower contained in Section 7.01 of the Agreement are true and correct in all material respects on and as of such date as though made on and as of such date unless such representations and warranties by their terms refer to an earlier date, in which case they shall be true and correct in all material respects on and as of such earlier date; no Event of Default or Unmatured Event of Default has occurred and is continuing or would result from the assumption contemplated hereby; and (iii) the Termination Date has not occurred. SECTION 2. Upon execution and delivery of this Agreement by the Borrower and each member of the [______] Group, satisfaction of the other conditions with respect to the addition of a Group specified in Section 14.03(i) of the Loan and Security Agreement (including the Exhibit D- 1 EXHIBIT H Form of Compliance Certificate To: MUFG Bank, Ltd. (f/k/a The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch), as Administrative Agent This Compliance Certificate is furnished pursuant to that certain Loan and Security Agreement, dated as of May 5, 2017 among Hill-Rom Finance Company LLC (the “Borrower”), Hill-Rom Company, Inc., as Servicer (the “Servicer”), the Lenders party thereto, the Group Agents party thereto and MUFG Bank, Ltd. (f/k/a The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch), as Administrative Agent (in such capacity, the “Administrative Agent”) (as amended, supplemented or otherwise modified from time to time, the “Agreement”). Capitalized terms used herein and not otherwise defined herein shall have the meanings assigned to them in the Agreement. THE UNDERSIGNED HEREBY CERTIFIES THAT: I am the duly elected ________________of the Hill-Rom Holdings, Inc. (the “Parent”). I have reviewed the terms of the Agreement and each of the other Transaction Documents and I have made, or have caused to be made under my supervision, a detailed review of the transactions and condition of the Borrower during the accounting period covered by the attached financial statements. The examinations described in paragraph 2 above did not disclose, and I have no knowledge of, the existence of any condition or event which constitutes an Event of Default or an Unmatured Event of Default, as each such term is defined under the Agreement, during or at the end of the accounting period covered by the attached financial statements or as of the date of this Certificate[, except as set forth in paragraph 5 below]. Schedule I attached hereto sets forth financial statements of the Parent and its Subsidiaries for the period referenced on such Schedule I. [5. Described below are the exceptions, if any, to paragraph 3 above by listing, in detail, the nature of the condition or event, the period during which it has existed and the action which Borrower has taken, is taking, or proposes to take with respect to each such condition or event:] Exhibit H- 1 EXHIBIT J Special Concentration Obligor Percentages Obligor Special Concentration Obligor Percentage HOSPITAL CORPORATION OF AMERICA 11.2511.75% Exhibit I SCHEDULE I Commitments Party Capacity Commitment BTMUMUFG Committed Lender $110,000,000 Schedule I SCHEDULE III Notice Addresses (A) in the case of the Borrower or Servicer, at the following address: c/o Hill-Rom Holdings, Inc. Two Prudential Plaza 180 N. Stetson Avenue130 E. Randolph Street, Suite 41001000 Chicago, IL 60601 Attn: Steve Strobel, Senior Vice President and Chief Financial Officer Tel: (312) 819-7258 Fax: (812) 934-8329 Email: steven.strobel@hill-rom.com With a copy to: c/o Hill-Rom Holdings, Inc. 1069 State Route 46 East Batesville, Indiana 47006 Tel: (812) 934-7809 Fax: (812) 934-1963 Email: eric.bjerke@hill-rom.com With a copy to: c/o Hill-Rom Holdings, Inc. Two Prudential Plaza 180 N. Stetson Avenue, Suite 4100 130 E. Randolph Street, Suite 1000 Chicago, IL 60601 Attn: General CounselLegal Department Tel: (312) 819-7200 Fax: (312) 819-7219 Email: ari.mintzer1@hill-rom.com With a copy to: Jones Day 77 West Wacker Dr. Chicago, IL 60601 Attn: Robert J. GravesBeth Vogel Tel: (312) 269-43561505 Fax: (312) 782-8585 Email: RJGravesbvogel@JonesDay.com Schedule III- 1 in the case of the Administrative Agent, at the following address: MUFG Bank, Ltd. (f/k/a The Bank of Tokyo-Mitsubishi UFJ, Ltd., New York Branch) 1221 Avenue of the Americas New York, NY 10020 Attention: Securitization Group Email: securitization_reporting@us.mufg.jp in the case of any other Person, at the address for such Person specified in the other Transaction Documents; in each case, or at such other address as shall be designated by such Person in a written notice to the other parties to this Agreement. Schedule III- 2 SCHEDULE 7.01(m) UCC Details Legal Name: Hill-Rom Finance Company LLC Other Names: None. Jurisdiction of Organization: Delaware Organizational Identification Number: 6355797 FEIN: 35-153892 Chief Executive Office / Principal Place of Business: Two Prudential Plaza 180 N. Stetson Avenue130 E. Randolph Street, Suite 41001000 Chicago, IL 60601 Records Location: Two Prudential Plaza 180 N. Stetson Avenue130 E. Randolph Street, Suite 41001000 Chicago, IL 60601 Schedule 7.01(m)- 1 72751794217534893s SCHEDULE 8.04(f) Location of Records Chief Executive Office / Principal Place of Business: Two Prudential Plaza 180 N. Stetson Avenue130 E. Randolph Street, Suite 41001000 Chicago, IL 60601 Records Location: Two Prudential Plaza 180 N. Stetson Avenue130 E. Randolph Street, Suite 41001000 Chicago, IL 60601 Schedule 8.04(f)- 1 72751794217534893