Exhibit 99.2

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Link to searchable text of slide shown above

Searchable text section of graphics shown above

Hilton Hotels Corporation to

Acquire Hilton International

December 29, 2005

[LOGO]

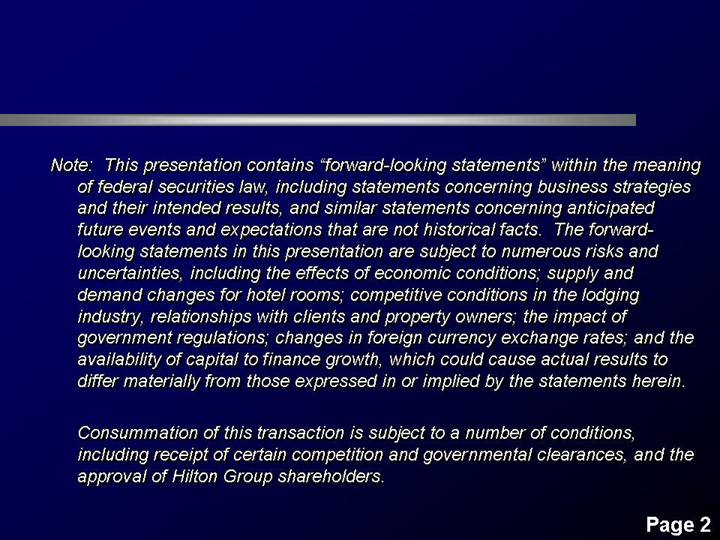

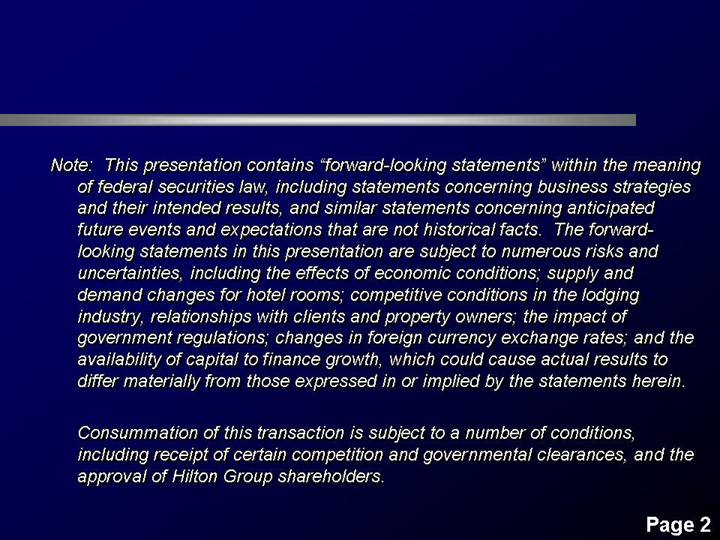

Note: This presentation contains “forward-looking statements” within the meaning of federal securities law, including statements concerning business strategies and their intended results, and similar statements concerning anticipated future events and expectations that are not historical facts. The forward-looking statements in this presentation are subject to numerous risks and uncertainties, including the effects of economic conditions; supply and demand changes for hotel rooms; competitive conditions in the lodging industry, relationships with clients and property owners; the impact of government regulations; changes in foreign currency exchange rates; and the availability of capital to finance growth, which could cause actual results to differ materially from those expressed in or implied by the statements herein.

Consummation of this transaction is subject to a number of conditions, including receipt of certain competition and governmental clearances, and the approval of Hilton Group shareholders.

2

“This transaction represents the final and logical step in a process that began in 1997 with the signing of a strategic alliance between HHC and HI and once again makes HHC a global lodging leader for the first time in 40 years.”

| Stephen F. Bollenbach |

| Co-Chairman & C.E.O. |

| Hilton Hotels Corporation |

3

STRATEGIC RATIONALE

4

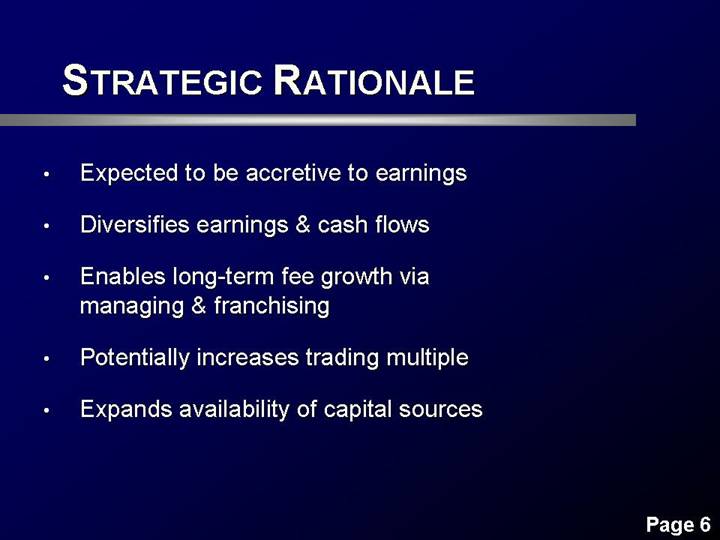

STRATEGIC RATIONALE

• Makes us a true global hotel competitor for first time in 40+ years

• Gives us full control of Hilton & Conrad brands worldwide

• Opens global expansion opportunities for all brands

• Opportunity to implement OnQ internationally

• Enhances our portfolio (resorts, urban hotels)

[GRAPHIC]

Hilton Hua Hin Resort & Spa

5

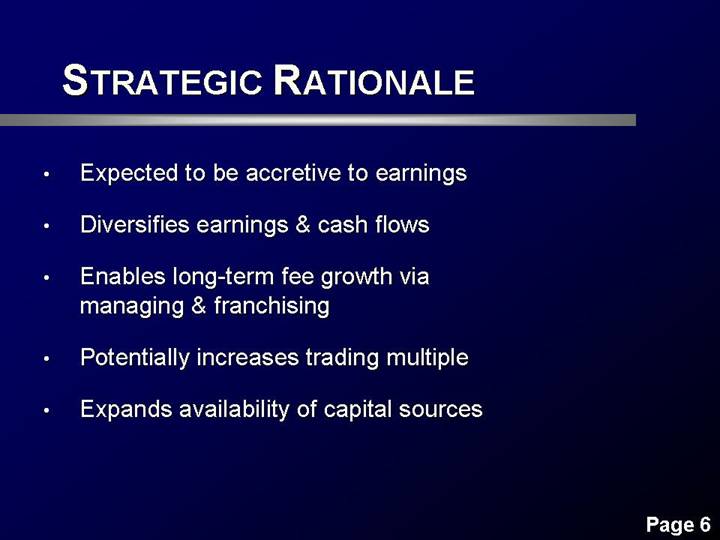

• Expected to be accretive to earnings

• Diversifies earnings & cash flows

• Enables long-term fee growth via managing & franchising

• Potentially increases trading multiple

• Expands availability of capital sources

6

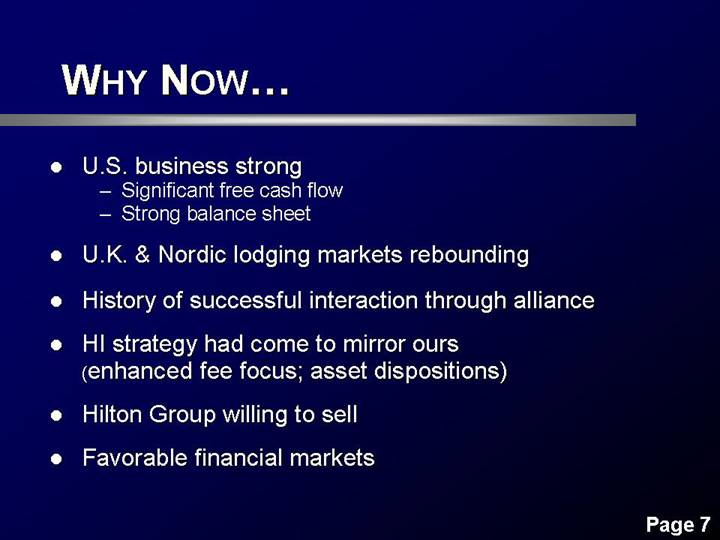

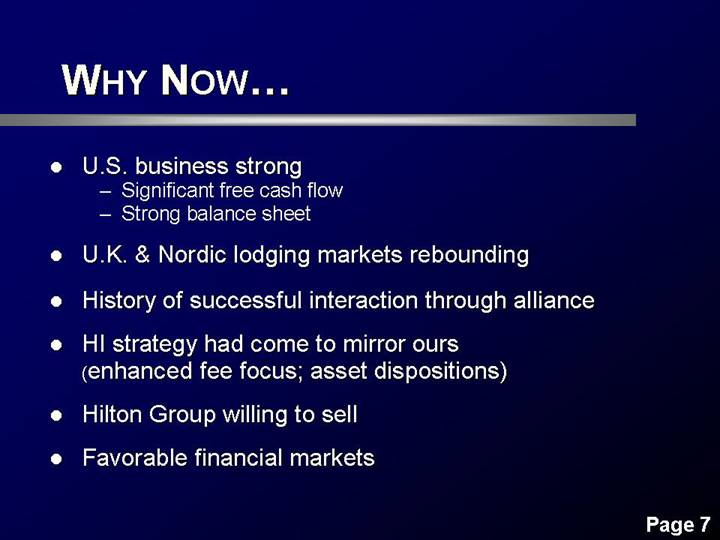

WHY NOW…

• U.S. business strong

• Significant free cash flow

• Strong balance sheet

• U.K. & Nordic lodging markets rebounding

• History of successful interaction through alliance

• HI strategy had come to mirror ours (enhanced fee focus; asset dispositions)

• Hilton Group willing to sell

• Favorable financial markets

7

WHAT WE WILL BE …

8

WHAT WE WILL BE…

Premier global lodging company with…

• World-class properties appealing to broad customer base (business, group, leisure)

• High-growth potential through brand development

• Market leadership across segments (mid-scale to luxury)

• International management expertise

• Strength in gateway cities & resort areas

[GRAPHIC]

Hilton Maldives Resort & Spa Rangali Island

9

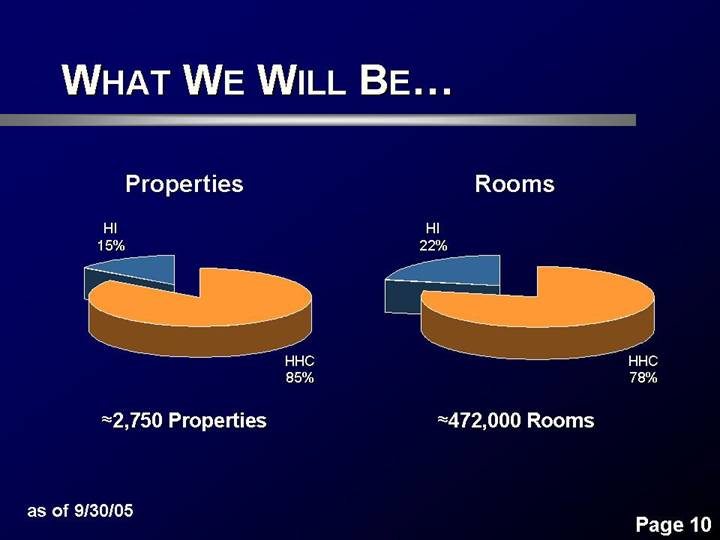

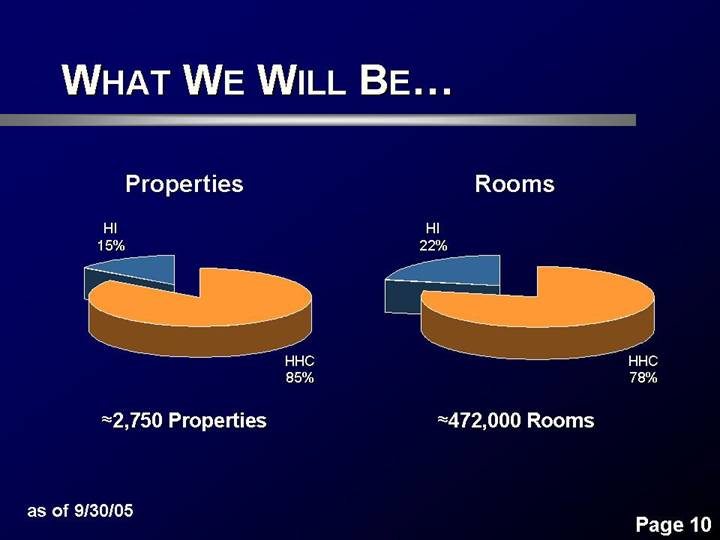

Properties | Rooms |

| |

[CHART] | [CHART] |

| |

»2,750 Properties | »472,000 Rooms |

as of 9/30/05

10

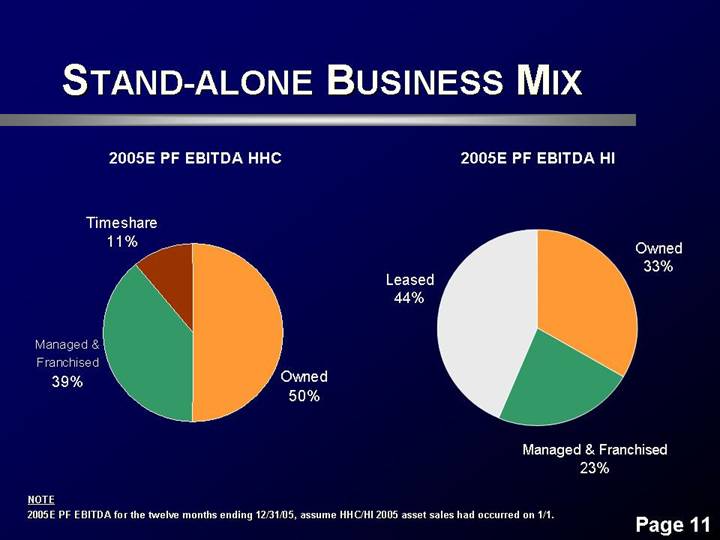

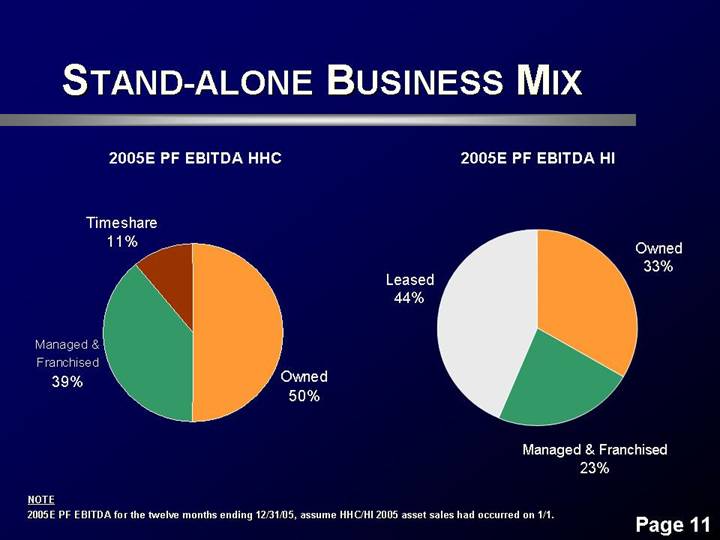

STAND-ALONE BUSINESS MIX

2005E PF EBITDA HHC | 2005E PF EBITDA HI |

| |

[CHART] | [CHART] |

NOTE

2005E PF EBITDA for the twelve months ending 12/31/05, assume HHC/HI 2005 asset sales had occurred on 1/1.

11

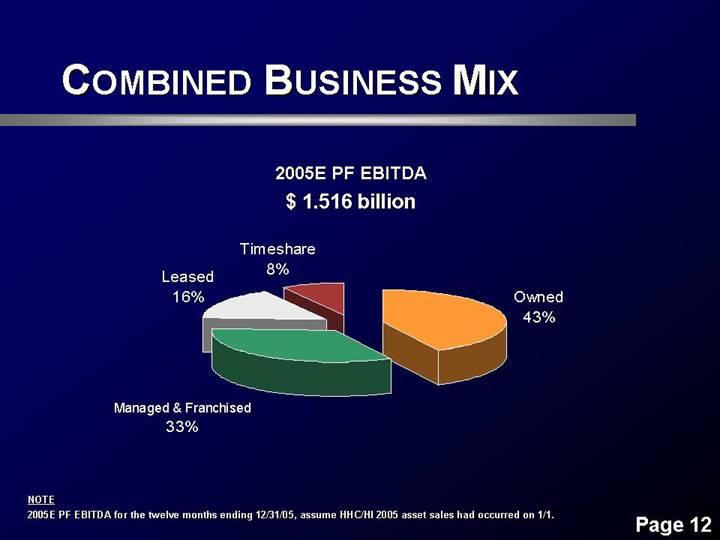

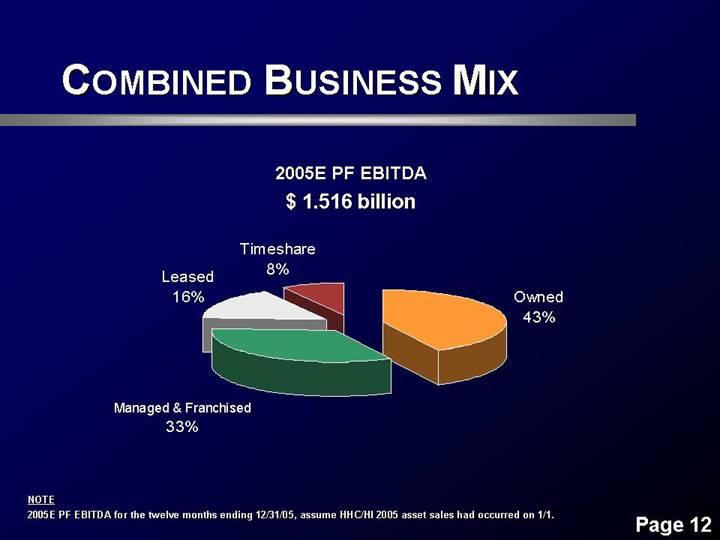

COMBINED BUSINESS MIX

2005E PF EBITDA

$ 1.516 billion

[CHART]

NOTE

2005E PF EBITDA for the twelve months ending 12/31/05, assume HHC/HI 2005 asset sales had occurred on 1/1.

12

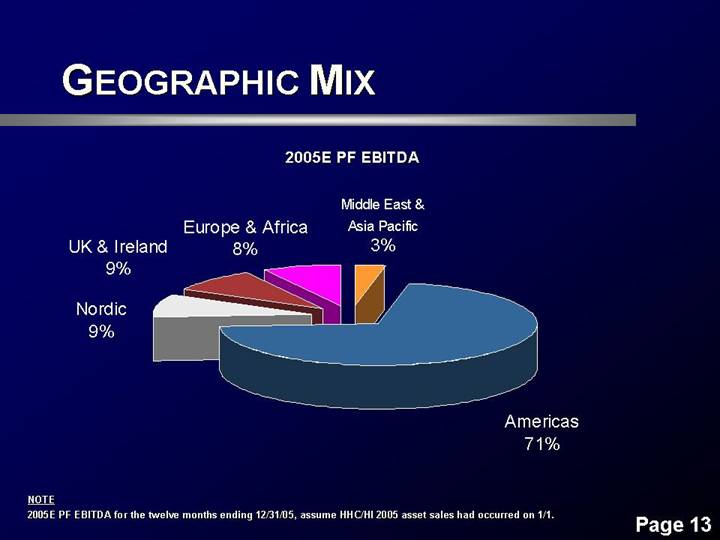

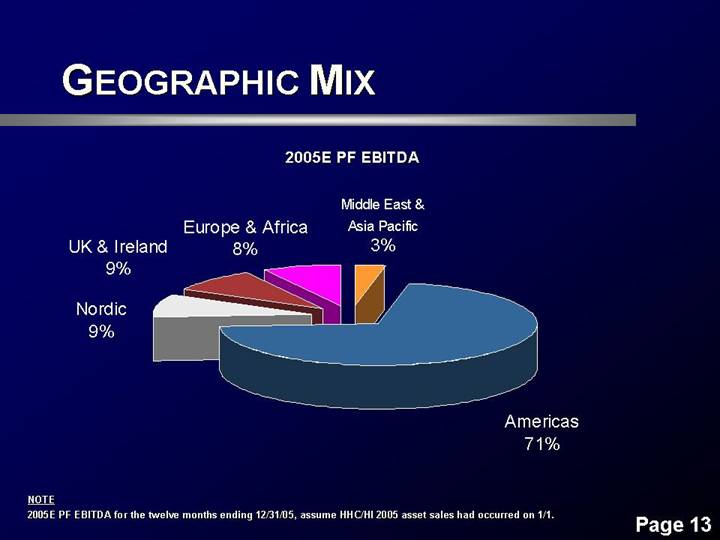

GEOGRAPHIC MIX

2005E PF EBITDA

[CHART]

NOTE

2005E PF EBITDA for the twelve months ending 12/31/05, assume HHC/HI 2005 asset sales had occurred on 1/1.

13

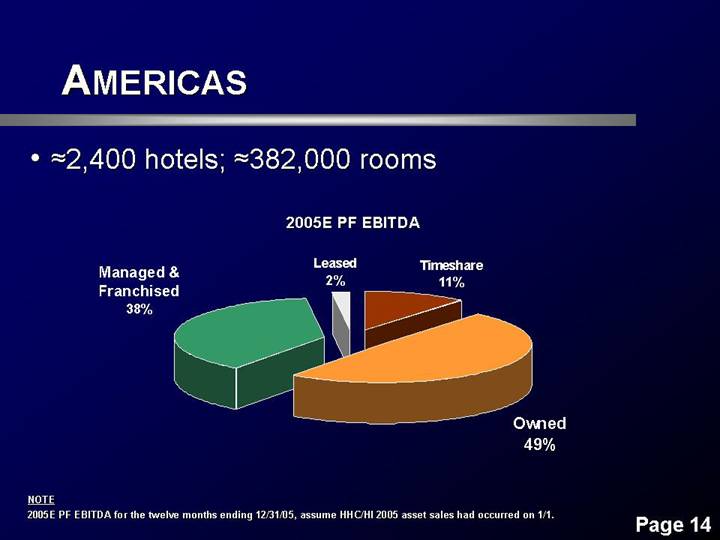

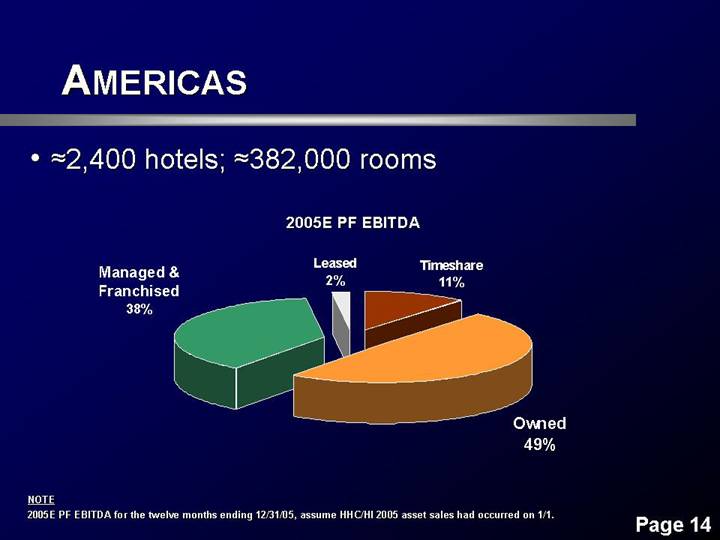

AMERICAS

• »2,400 hotels; »382,000 rooms

2005E PF EBITDA

[CHART]

NOTE

2005E PF EBITDA for the twelve months ending 12/31/05, assume HHC/HI 2005 asset sales had occurred on 1/1.

14

UNITED KINGDOM & IRELAND

• »70 hotels; »15,000 rooms

2005E PF EBITDA

[CHART]

NOTE

2005E PF EBITDA for the twelve months ending 12/31/05, assume HHC/HI 2005 asset sales had occurred on 1/1.

15

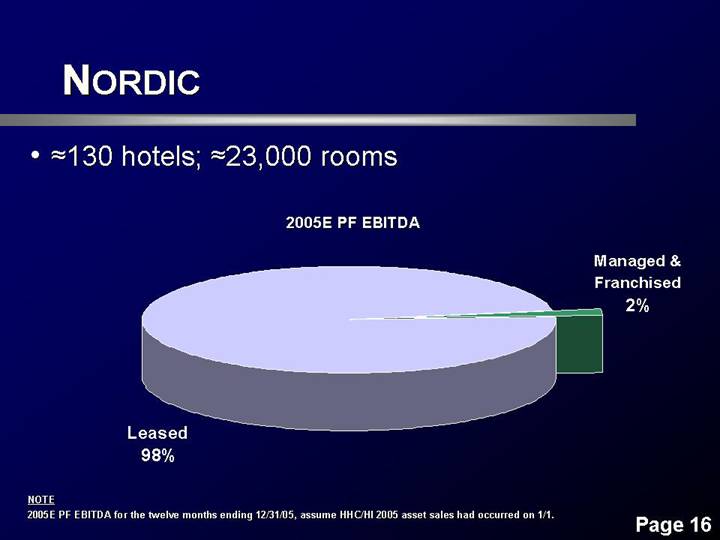

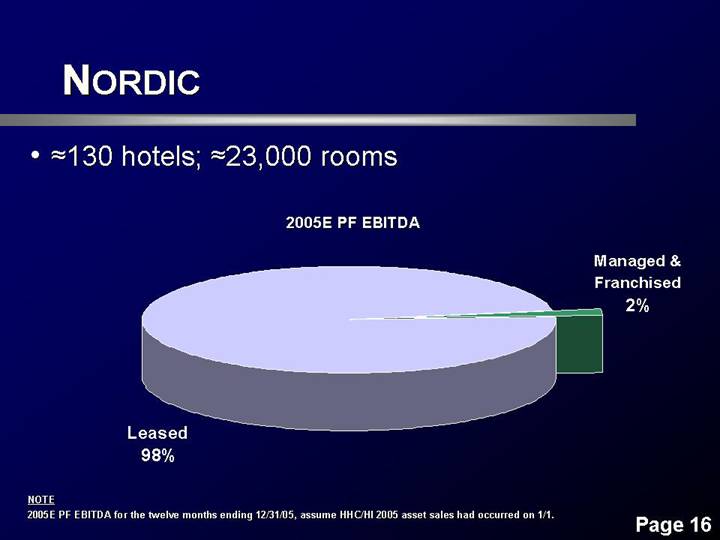

NORDIC

• »130 hotels; »23,000 rooms

2005E PF EBITDA

[CHART]

NOTE

2005E PF EBITDA for the twelve months ending 12/31/05, assume HHC/HI 2005 asset sales had occurred on 1/1.

16

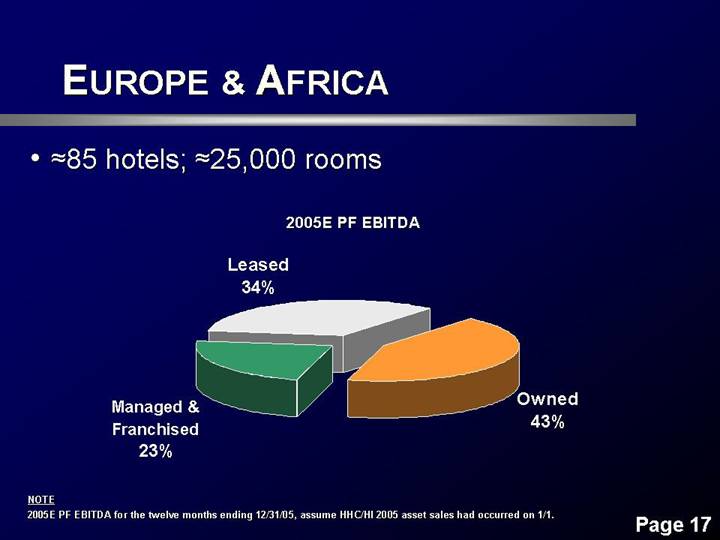

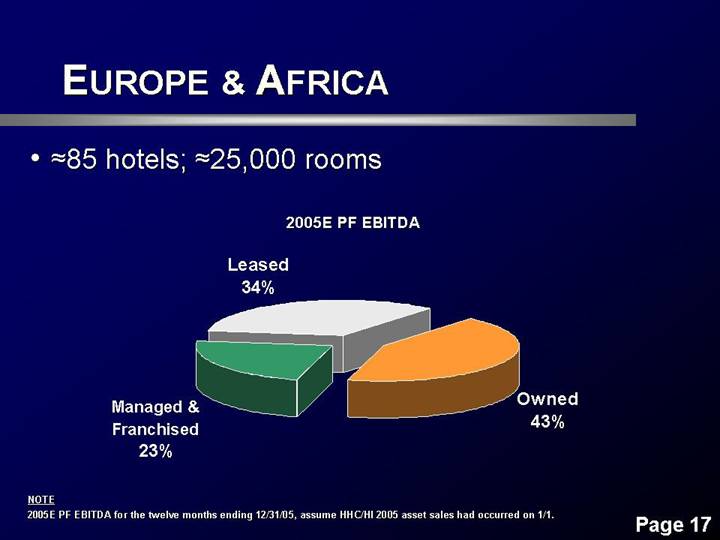

EUROPE & AFRICA

• »85 hotels; »25,000 rooms

2005E PF EBITDA

[CHART]

NOTE

2005E PF EBITDA for the twelve months ending 12/31/05, assume HHC/HI 2005 asset sales had occurred on 1/1.

17

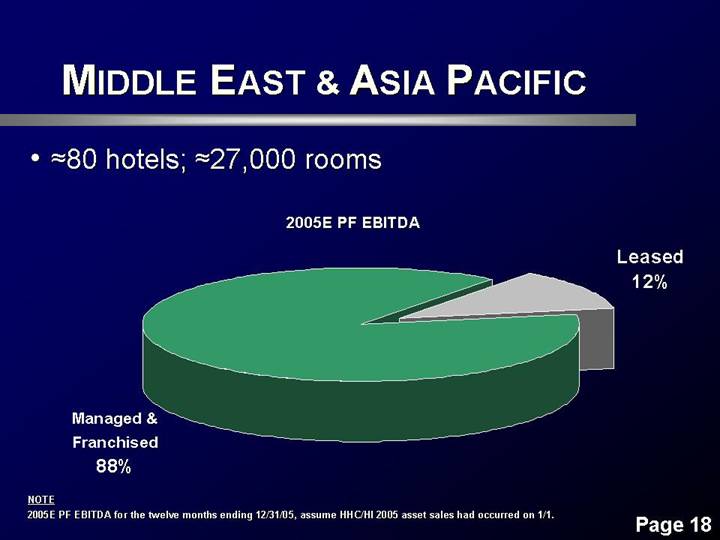

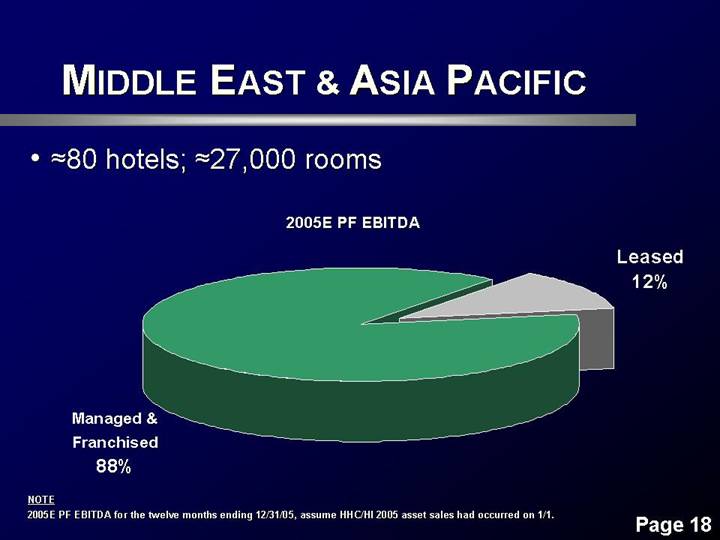

MIDDLE EAST & ASIA PACIFIC

• »80 hotels; »27,000 rooms

2005E PF EBITDA

[CHART]

NOTE

2005E PF EBITDA for the twelve months ending 12/31/05, assume HHC/HI 2005 asset sales had occurred on 1/1.

18

TOP MARKETS

1. | | New York | | 8-9% | | Waldorf=Astoria, Hilton New York |

| | | | | | |

2. | | Hawaii | | 7-8% | | Hilton Hawaiian Village, Hilton Waikoloa Village |

| | | | | | |

3. | | London | | 3-4% | | Hilton London Metropole, Hilton Park Lane (L), Hilton Heathrow A/P (L) |

| | | | | | |

4. | | Chicago | | 2-3% | | Hilton Chicago, Hilton O’Hare, The Drake (L) |

| | | | | | |

5. | | Washington D.C. area | | 2-3% | | Hilton Washington, Hilton McLean |

| | | | | | |

6. | | New Orleans | | 2-3% | | Hilton New Orleans, Hilton New Orleans Airport |

| | | | | | |

7. | | San Francisco area | | 1-2% | | Hilton San Francisco, Doubletree San Jose, Hilton Oakland A/P |

| | | | | | |

8. | | Birmingham, U.K. | | 1-2% | | Hilton Birmingham |

| | | | | | |

9. | | Sydney | | <1% | | Hilton Sydney |

| | | | | | |

10. | | Puerto Rico | | <1% | | Hilton Caribe Resort |

Top 10 Markets = approx. 30% of total co. EBITDA

NOTE

• Ranked by 2005E PF EBITDA as a percentage of total company 2005E PF EBITDA, as if all asset sales had occurred on 1/1/2005, with adjustments for New Orleans (hurricane) and Sydney (renovation)

• Includes owned/leased hotels (leased noted : L;) excludes managed or franchised hotels

19

MARKET POSITION & TRENDS

20

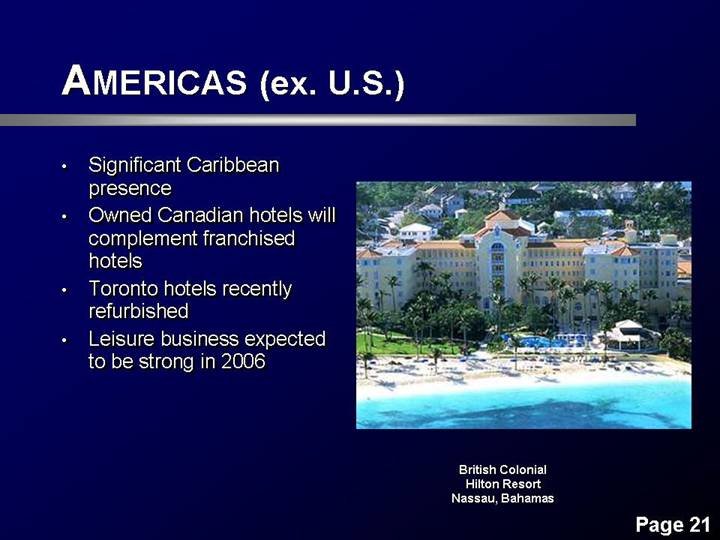

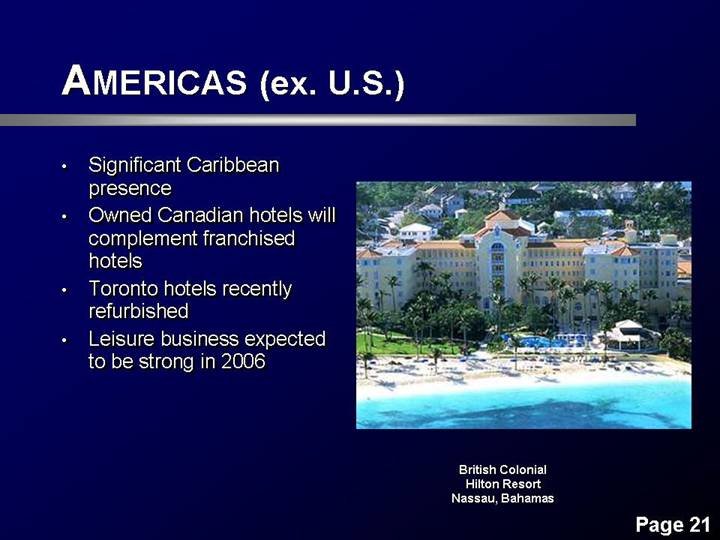

AMERICAS (ex. U.S.)

• Significant Caribbean presence

• Owned Canadian hotels will complement franchised hotels

• Toronto hotels recently refurbished

• Leisure business expected to be strong in 2006

[GRAPHIC]

British Colonial

Hilton Resort

Nassau, Bahamas

21

HILTON TORONTO

[GRAPHIC]

22

HILTON PRINCESS SAN SALVADOR (EL SALVADOR)

[GRAPHIC]

23

U.K. & IRELAND

• Almost 50% of regional EBITDA from London

• Leadership position – U.K.’s most preferred lodging brand

• LivingWell: strong presence in region

• RevPAR continues to improve

Caledonian Hilton | | [GRAPHIC] |

Edinburgh, Scotland | | |

| | |

| | Hilton London Metropole |

[GRAPHIC] | | London, England |

24

HILTON LONDON GATWICK AIRPORT

[GRAPHIC]

25

HILTON LONDON PARK LANE

[GRAPHIC]

26

HILTON LONDON METROPOLE

[GRAPHIC]

27

HILTON NEWCASTLE GATESHEAD

[GRAPHIC]

28

THE WALDORF HILTON LONDON

[GRAPHIC]

29

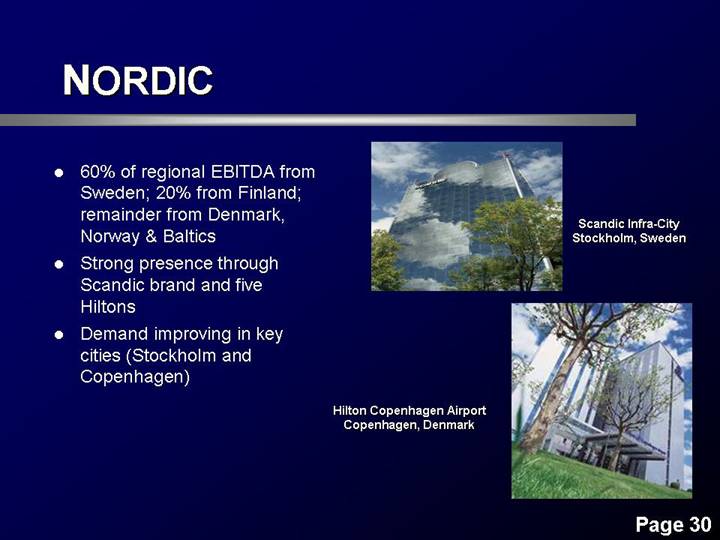

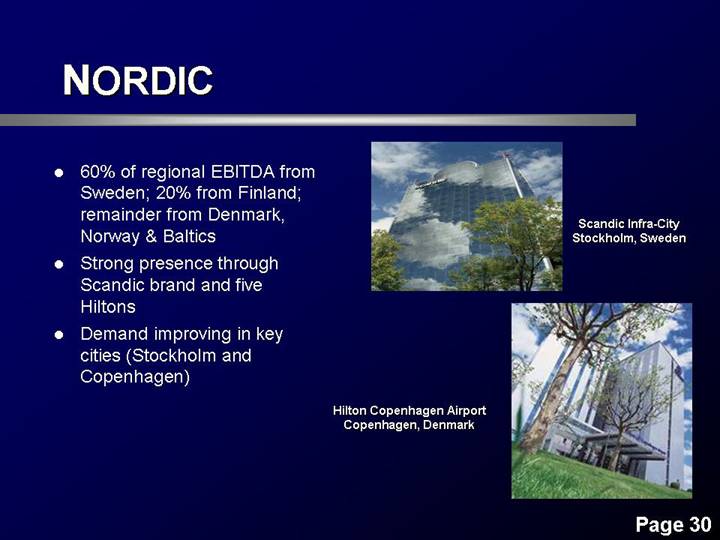

NORDIC

• 60% of regional EBITDA from Sweden; 20% from Finland; remainder from Denmark, Norway & Baltics

• Strong presence through Scandic brand and five Hiltons

• Demand improving in key cities (Stockholm and Copenhagen)

[GRAPHIC] | | Scandic Infra-City Stockholm, Sweden |

| | |

Hilton Copenhagen Airport Copenhagen, Denmark | | [GRAPHIC] |

30

EUROPE & AFRICA

• 35% of regional EBITDA from Germany & Switzerland; 20% from Mediterranean

• Europe:

• Highest presence in terms of # of hotels versus competitors

• High brand awareness

• EU extending

• Africa

• Predominantly management contracts

• No dominant lodging cos.

[GRAPHIC]

Athenee Palace Hilton

Bucharest, Romania

31

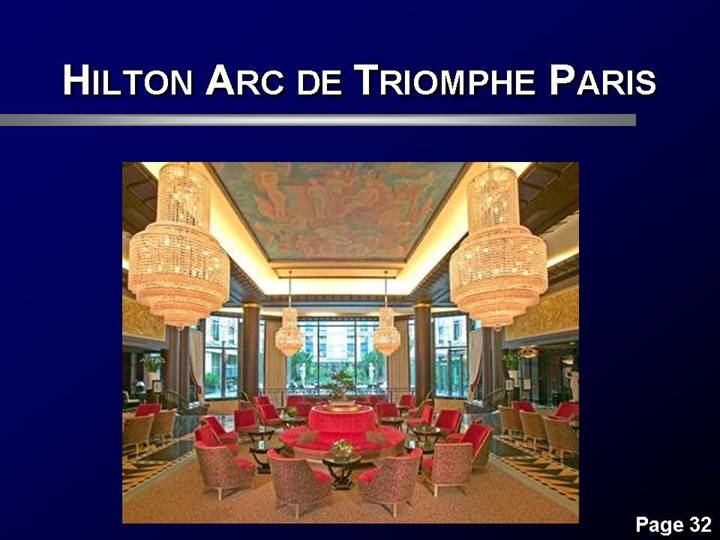

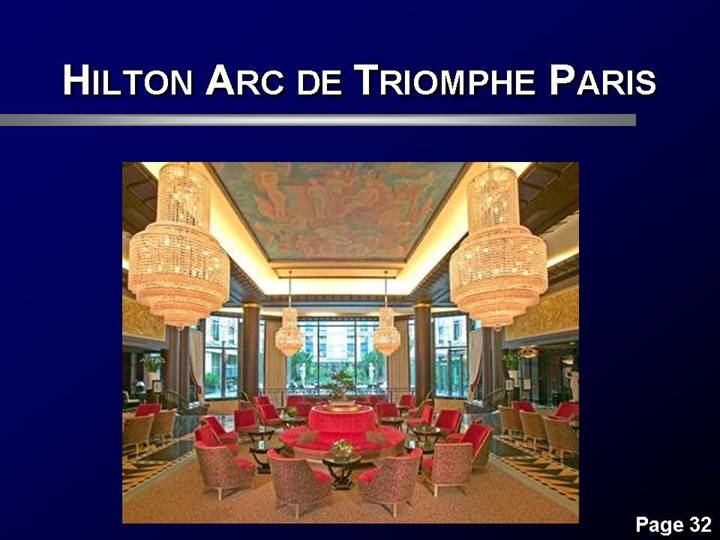

HILTON ARC DE TRIOMPHE PARIS

[GRAPHIC]

32

HILTON DIAGONAL MAR BARCELONA

[GRAPHIC]

33

HILTON SANDTON (SOUTH AFRICA)

[GRAPHIC]

34

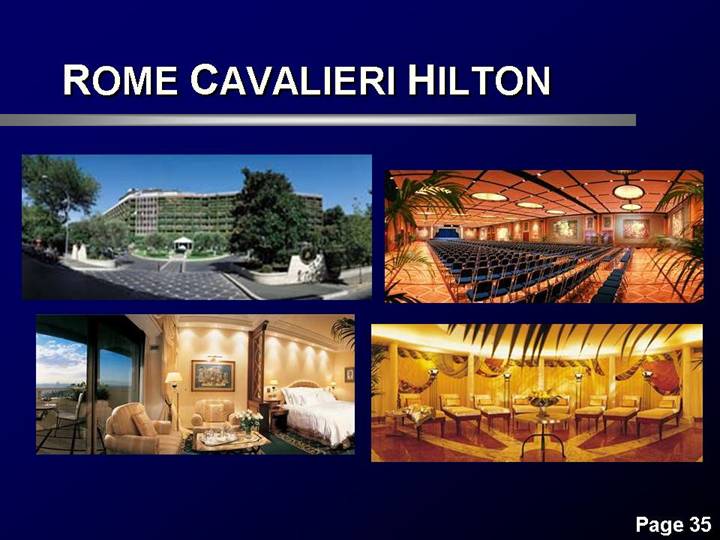

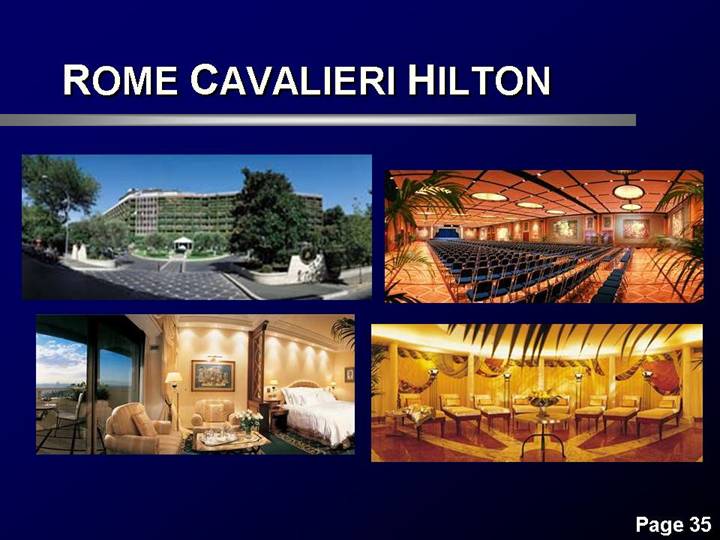

ROME CAVALIERI HILTON

[GRAPHIC]

35

HILTON DURBAN (SOUTH AFRICA)

[GRAPHIC]

36

HILTON MAURITIUS RESORT

[GRAPHIC]

37

MIDDLE EAST

• Large # of properties; good presence vs. competitors

• Dubai and other markets exhibiting strong growth

• High GDP growth

[GRAPHIC]

Hilton Jeddah

Saudi Arabia

38

HILTON DUBAI JUMERIAH

[GRAPHIC]

39

HILTON HURGHADA LONG BEACH RESORT (EGYPT)

[GRAPHIC]

40

ASIA PACIFIC

• Strong recent portfolio growth

• Sydney - - largest conference hotel in Australia

• High GDP growth and growing middle class in some markets

• Japan market starting to recover

[GRAPHIC]

Hilton Beijing

41

HILTON AUCKLAND

[GRAPHIC]

42

GRAND HILTON SEOUL

[GRAPHIC]

43

HILTON SYDNEY

[GRAPHIC]

44

[GRAPHIC]

45

HILTON TOKYO BAY

[GRAPHIC]

46

TRIDENT HILTON JAIPUR (INDIA)

[GRAPHIC]

47

HILTON MELBOURNE AIRPORT

[GRAPHIC]

48

NEW BRANDS

IN NEW MARKETS

GROWTH OPPORTUNITIES

49

DEVELOPMENT STRATEGY

• Manage or franchise; limited capital from us

• Use the Hilton name (e.g. “….by Hilton”) on brands to improve recognition

• Use different contract structures as needed

• Direct effort at key markets & best owners within regions

• Focus [LOGO] or [LOGO]

• Maintain control and quality; critical mass

• Continue full-service development of: [LOGO]

50

AMERICAS (ex. U.S.)

[GRAPHIC]

• Development factors:

• Existing presence in Caribbean & South American gateway cities

• Proximity to U.S. means our brands more popular/recognized

• Brands:

[LOGO]

• Locations:

• Central America: primary & secondary cities

• South America: Argentina & Brazil

51

U.K. & IRELAND

[GRAPHIC]

• Development factors:

• Mature markets

• More conversions than new builds

• Brands:

[LOGO]

52

EUROPE & AFRICA

[GRAPHIC]

• Development factors:

• Only 20% branded in Europe

• Low supply growth in Europe

• More conversions than new builds

• Brands:

[LOGO]

[GRAPHIC]

• Locations:

• Central/Eastern Europe (Croatia, Slovakia) & Russia

• South Africa

53

MIDDLE EAST

[GRAPHIC]

• Development factors:

• Economies diversifying from oil

• New infrastructure (airports, etc.)

• Brands:

[LOGO]

• Locations:

• Egypt, Bahrain, Dubai

54

ASIA PACIFIC

[GRAPHIC]

• Development factors:

• Increasing demand (fast-growing markets, expanding middle class)

• Relaxed visa requirements

• U.S. brands successful in Asia

• Brands:

• Locations:

• India & China – primary and secondary cities

• Thailand, Australia

55

ROOM GROWTH

• 2006:

• North America

• Approx. 175-200 hotels; 23,000-27,000 rooms

• International

• Approx. 15-20 hotels; 4,000-5,000 rooms

• Includes Bangkok, Valencia, Warsaw

• 2007 & Beyond:

• Approx. 7% growth worldwide

56

TRANSACTION OVERVIEW

57

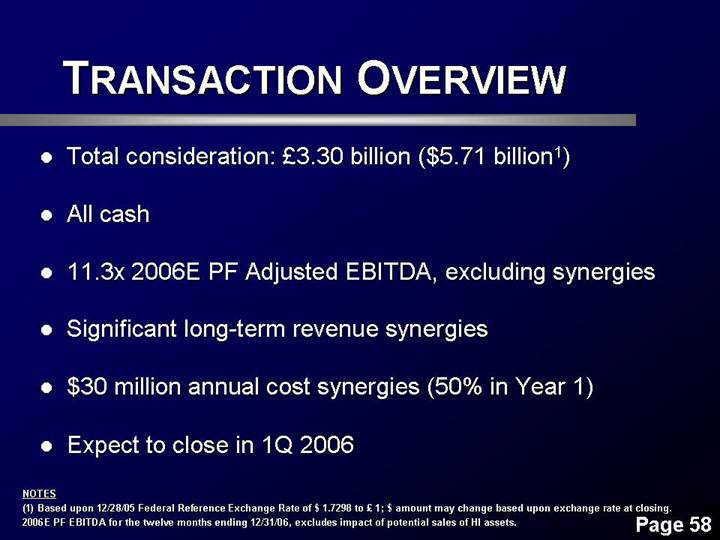

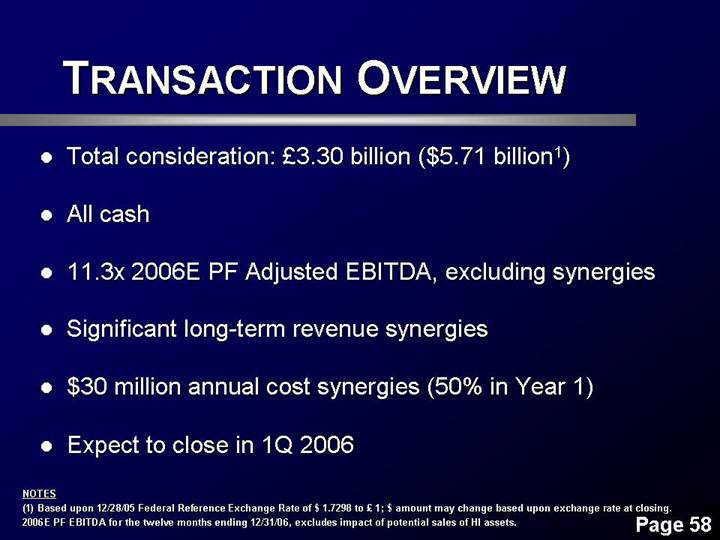

TRANSACTION OVERVIEW

• Total consideration: £3.30 billion ($5.71 billion(1))

• All cash

• 11.3x 2006E PF Adjusted EBITDA, excluding synergies

• Significant long-term revenue synergies

• $30 million annual cost synergies (50% in Year 1)

• Expect to close in 1Q 2006

NOTES

(1) Based upon 12/28/05 Federal Reference Exchange Rate of $ 1.7298 to £ 1; $ amount may change based upon exchange rate at closing.

2006E PF EBITDA for the twelve months ending 12/31/06, excludes impact of potential sales of HI assets.

58

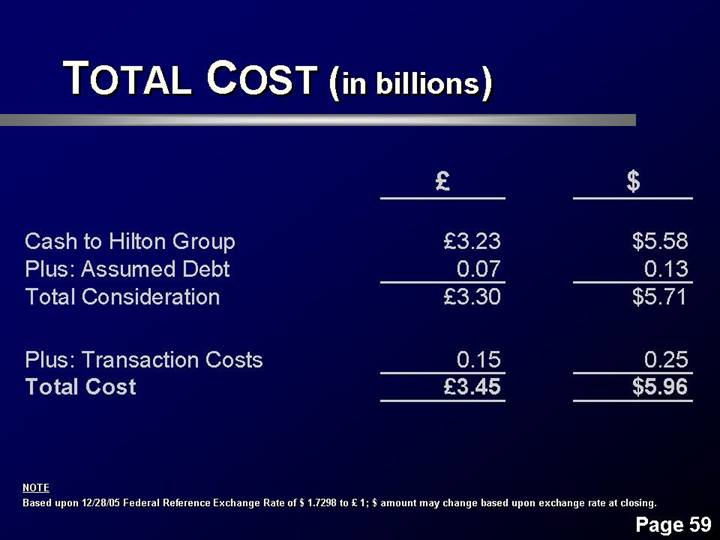

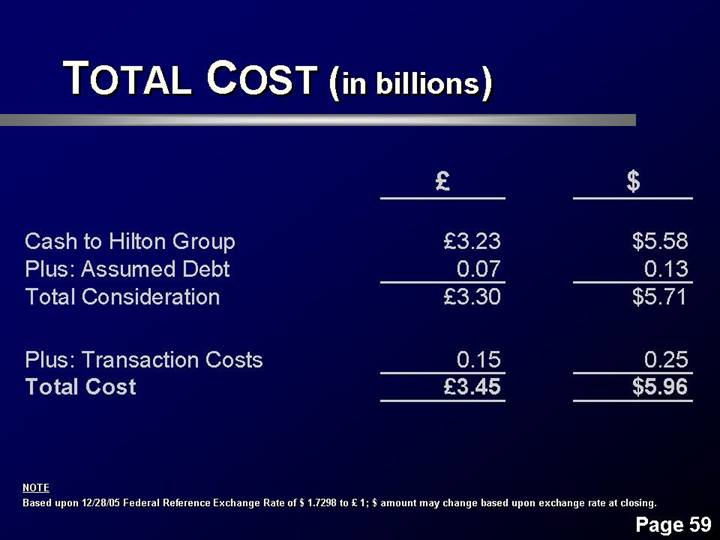

TOTAL COST (in billions)

| | £ | | $ | |

| | | | | |

Cash to Hilton Group | | £ | 3.23 | | $ | 5.58 | |

Plus: Assumed Debt | | 0.07 | | 0.13 | |

Total Consideration | | £ | 3.30 | | $ | 5.71 | |

| | | | | |

Plus: Transaction Costs | | 0.15 | | 0.25 | |

Total Cost | | £ | 3.45 | | $ | 5.96 | |

NOTE

Based upon 12/28/05 Federal Reference Exchange Rate of $ 1.7298 to £ 1; $ amount may change based upon exchange rate at closing.

59

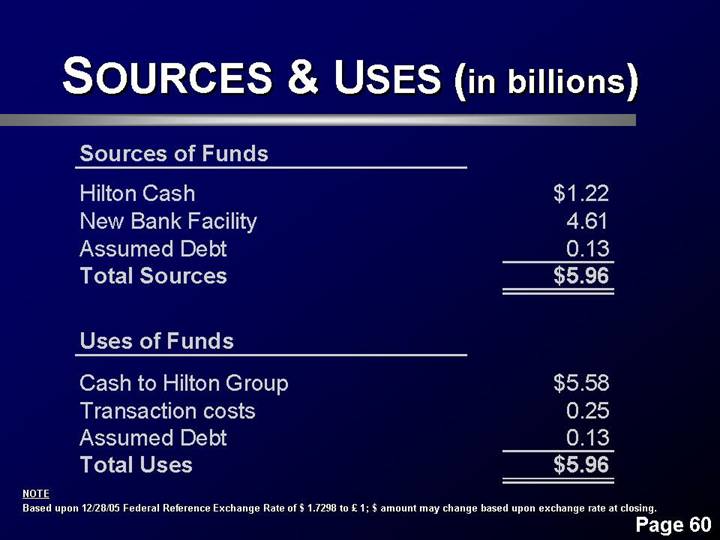

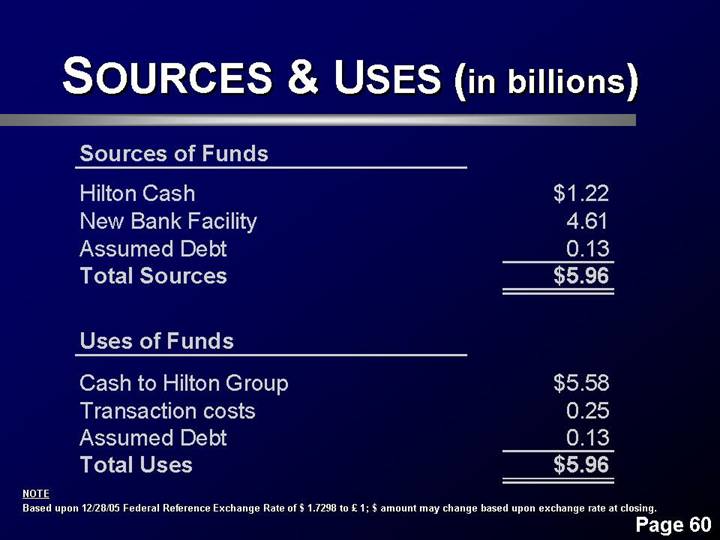

SOURCES & USES (in billions)

Sources of Funds | | | |

| | | |

Hilton Cash | | $ | 1.22 | |

New Bank Facility | | 4.61 | |

Assumed Debt | | 0.13 | |

Total Sources | | $ | 5.96 | |

Uses of Funds | | | |

| | | |

Cash to Hilton Group | | $ | 5.58 | |

Transaction costs | | 0.25 | |

Assumed Debt | | 0.13 | |

Total Uses | | $ | 5.96 | |

NOTE

Based upon 12/28/05 Federal Reference Exchange Rate of $ 1.7298 to £ 1; $ amount may change based upon exchange rate at closing.

60

H.I. OWNED HOTELS

• »40 hotels; »13,000 rooms

• 70% in UK, Ireland, or Europe

• 2005 RevPAR » $95

• 2005 EBITDA margin » 25%

61

H.I. LEASES

• »200 hotels; »43,000 rooms

• 20% fixed; 80% contingent

• Mostly mature hotels, stable cash flows

• Payment & terms vary, overall coverage approx. 1.5x

• Concentration in Nordic region with leading brand: Scandic

• Renewal flexibility

62

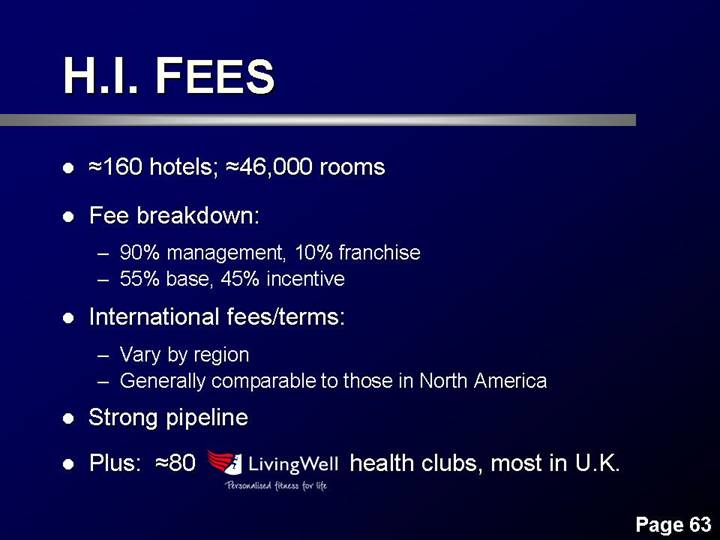

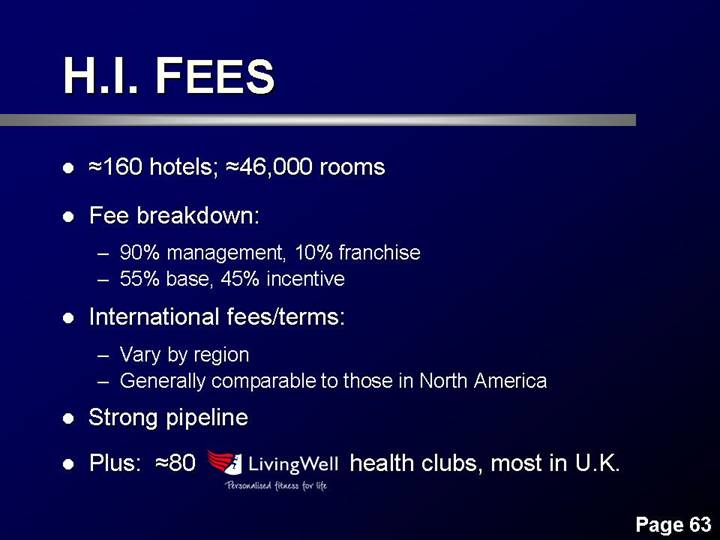

H.I. FEES

• »160 hotels; »46,000 rooms

• Fee breakdown:

• 90% management, 10% franchise

• 55% base, 45% incentive

• International fees/terms:

• Vary by region

• Generally comparable to those in North America

• Strong pipeline

• Plus: »80 [LOGO] health clubs, most in U.K.

63

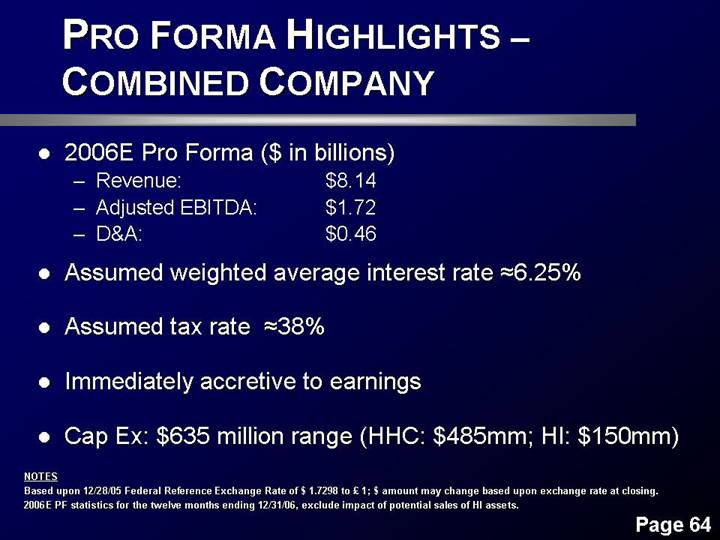

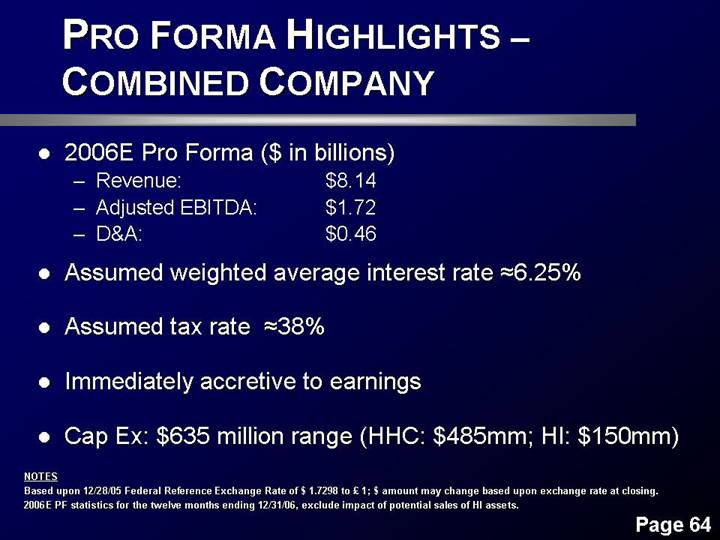

PRO FORMA HIGHLIGHTS – COMBINED COMPANY

• 2006E Pro Forma ($ in billions)

• | | Revenue: | | $ | 8.14 | |

• | | Adjusted EBITDA: | | $ | 1.72 | |

• | | D&A: | | $ | 0.46 | |

• Assumed weighted average interest rate »6.25%

• Assumed tax rate »38%

• Immediately accretive to earnings

• Cap Ex: $635 million range (HHC: $485mm; HI: $150mm)

NOTES

Based upon 12/28/05 Federal Reference Exchange Rate of $ 1.7298 to £ 1; $ amount may change based upon exchange rate at closing.

2006E PF statistics for the twelve months ending 12/31/06, exclude impact of potential sales of HI assets.

64

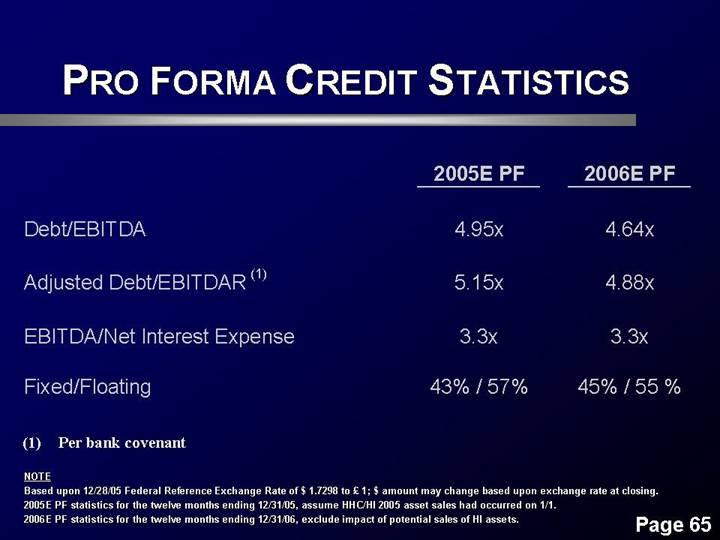

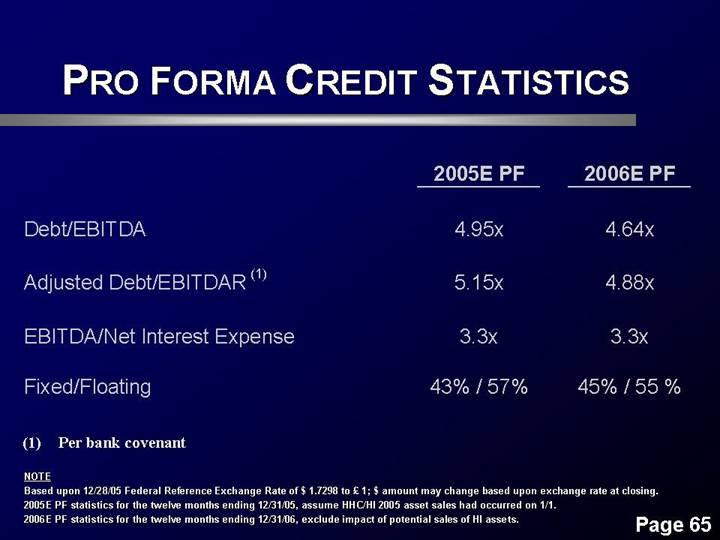

PRO FORMA CREDIT STATISTICS

| | 2005E PF | | 2006E PF | |

| | | | | |

Debt/EBITDA | | 4.95x | | 4.64x | |

| | | | | |

Adjusted Debt/EBITDAR (1) | | 5.15x | | 4.88x | |

| | | | | |

EBITDA/Net Interest Expense | | 3.3x | | 3.3x | |

| | | | | |

Fixed/Floating | | 43% / 57% | | 45% / 55% | |

(1) Per bank covenant

NOTE

Based upon 12/28/05 Federal Reference Exchange Rate of $ 1.7298 to £ 1; $ amount may change based upon exchange rate at closing.

2005E PF statistics for the twelve months ending 12/31/05, assume HHC/HI 2005 asset sales had occurred on 1/1.

2006E PF statistics for the twelve months ending 12/31/06, exclude impact of potential sales of HI assets.

65

DISPOSITIONS

• U.S. sales mostly complete

• U.K. & Europe pricing currently strong

• International sales anticipated in 2006 & 2007

• Keep management or franchise

66

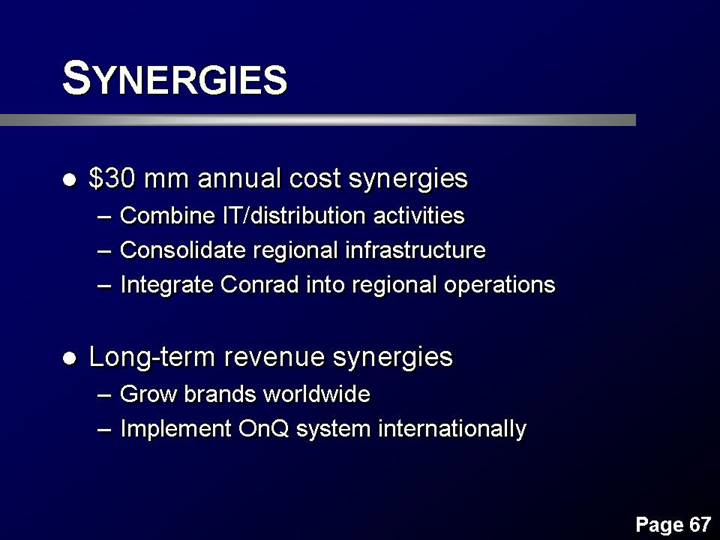

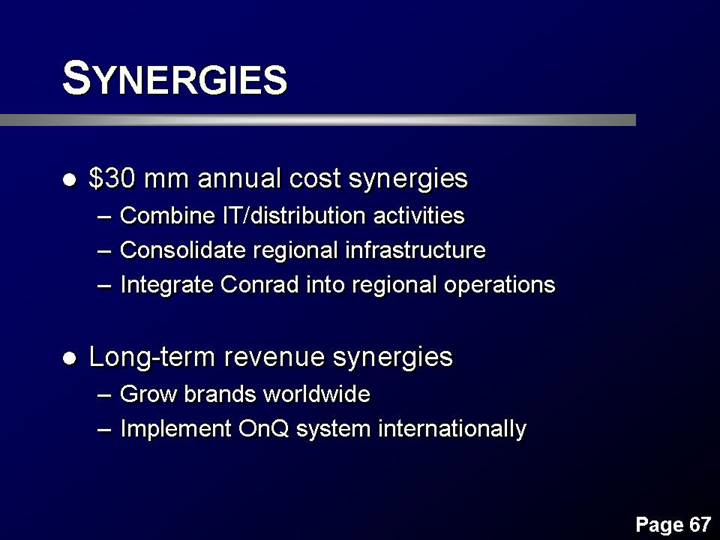

SYNERGIES

• $30 mm annual cost synergies

• Combine IT/distribution activities

• Consolidate regional infrastructure

• Integrate Conrad into regional operations

• Long-term revenue synergies

• Grow brands worldwide

• Implement OnQ system internationally

67

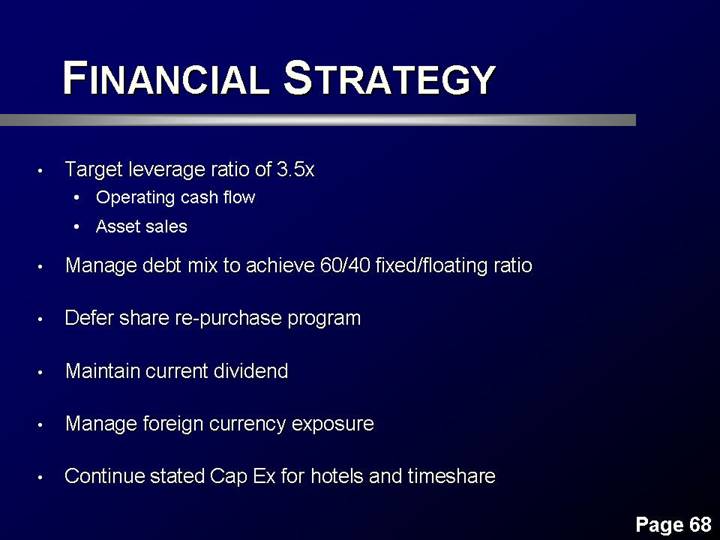

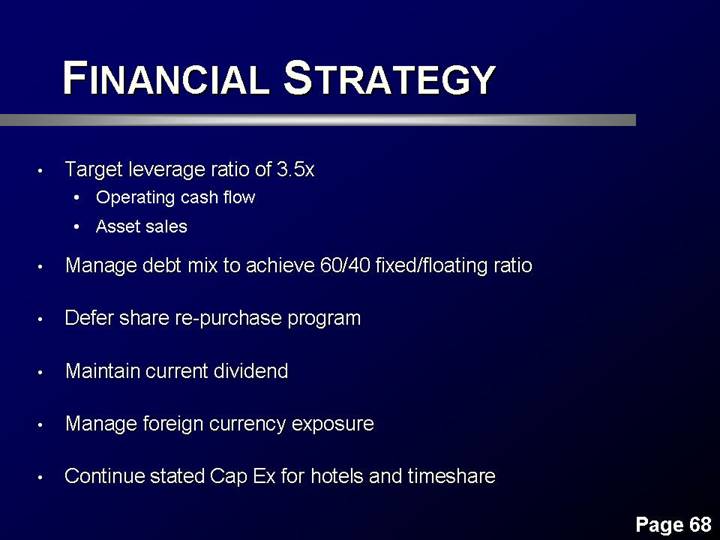

FINANCIAL STRATEGY

• Target leverage ratio of 3.5x

• Operating cash flow

• Asset sales

• Manage debt mix to achieve 60/40 fixed/floating ratio

• Defer share re-purchase program

• Maintain current dividend

• Manage foreign currency exposure

• Continue stated Cap Ex for hotels and timeshare

68

SUMMARY

• Companies reunited

• HHC a global leader

• Excellent brand/unit growth prospects

• Experienced worldwide management team

69

[LOGO]

70