Investor Presentation M a r c h 2 0 1 6

Hol lyF ront ie r Corpora t ion D isc losure S ta tement 2 Statements made during the course of this presentation that are not historical facts are “forward looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are inherently uncertain and necessarily involve risks that may affect the business prospects and performance of HollyFrontier Corporation and/or Holly Energy Partners, L.P., and actual results may differ materially from those discussed during the presentation. Such risks and uncertainties include but are not limited to risks and uncertainties with respect to the actions of actual or potential competitive suppliers and transporters of refined petroleum products in HollyFrontier’s and Holly Energy Partners’ markets, the demand for and supply of crude oil and refined products, the spread between market prices for refined products and market prices for crude oil, the possibility of constraints on the transportation of refined products, the possibility of inefficiencies or shutdowns in refinery operations or pipelines, effects of governmental regulations and policies, the availability and cost of financing to HollyFrontier and Holly Energy Partners, the effectiveness of HollyFrontier’s and Holly Energy Partners’ capital investments and marketing strategies, HollyFrontier's and Holly Energy Partners’ efficiency in carrying out construction projects, HollyFrontier's ability to acquire refined product operations or pipeline and terminal operations on acceptable terms and to integrate any existing or future acquired operations, the possibility of terrorist attacks and the consequences of any such attacks, and general economic conditions. Additional information on risks and uncertainties that could affect the business prospects and performance of HollyFrontier and Holly Energy Partners is provided in the most recent reports of HollyFrontier and Holly Energy Partners filed with the Securities and Exchange Commission. All forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. The forward-looking statements speak only as of the date hereof and, other than as required by law, HollyFrontier and Holly Energy Partners undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

OUR MISSION OUR MISSION IS to be the premier U.S. petroleum refining, pipeline and terminal company as measured by superior financial performance and sustainable, profitable growth. WE SEEK TO ACCOMPLISH THIS BY: • Operating in a safe, reliable and environmentally responsible manner, • Efficiently operating our existing assets, • Offering our customers superior products and services, and • Growing both organically and through strategic acquisitions. We strive to outperform our competition through the quality and development of our employees and assets. We endeavor to maintain an inclusive and stimulating work environment that enables each employee to fully contribute to and participate in our Company’s success. OUR VALUES HEALTH & SAFETY WE PUT HEALTH AND SAFETY FIRST. We conduct our business with primary emphasis on the health and safety of our employees, contractors and neighboring communities. We continuously strive to raise the bar, guided by our health and safety performance standards. ENVIRONMENTAL STEWARDSHIP WE CARE ABOUT THE ENVIRONMENT. We are committed to minimizing environmental impacts by reducing wastes, emissions and other releases. We understand that it is a privilege to conduct our business in the communities where we operate. CORPORATE CITIZENSHIP WE OBEY THE LAW. We are committed to promoting sustainable social and economic benefits wherever we operate. HONESTY & RESPECT WE TELL THE TRUTH & RESPECT OTHERS. We uphold high standards of business ethics and integrity, enforce strict principles of corporate governance and support transparency in our operations. One of our greatest assets is our reputation for behaving ethically in the interests of employees, shareholders, customers, business partners and the communities in which we operate and serve. CONTINUOUS IMPROVEMENT WE CONTINUALLY IMPROVE. Innovation and high-performance are our way of life. Our culture creates a fulfilling environment which enables employees to reach their potential. We believe in creating our own destiny and that a constructive attitude toward change is essential. 3

FOOTPR INT OF HOLLYFRONTIER AND HOLLY ENERGY PARTNERS Pure play inland refining company with 443,000 barrels per day of crude capacity Proximity to North American crude production and attractive niche product markets Collaboration with HEP provides strategic growth opportunities in logistics and marketing operations 4 About the HollyFrontier Companies • 443,000 BPD Refining Capacity • 12.2 Nelson Complexity • Approximately 3,400 Pipeline miles • 75% UNEV ownership • 50% Frontier Pipeline ownership • 50% Osage Pipeline ownership • 25% SLC Pipeline ownership • 14 million barrels of crude & product storage • 7 Loading Racks and 10 Terminals * The El Paso terminal was transferred from HEP to HFC as part of an asset swap on February 22, 2016

ACHIEVEMENTS AND OB JECTIVES ACHIEVEMENTS • Geographically advantaged inland refining system created with 2011 HollyFrontier merger • Enhanced operating procedures and practices implemented across refining system • Among the first independent refiners to launch an MLP in 2004 • Leader in returning cash to shareholders • Investment grade rating by S&P and Moody’s OBJECTIVES • Continuous operational improvement • Continued system integration • Large and small capital project execution • Improve balance sheet efficiency • Unlock MLP value • Shareholder-oriented capital allocation strategy 5

HOLLYFRONTIER INVESTMENT H IGHL IGHTS Safe and reliable operations Continued system integration to drive profitability OPERATIONS 6 Internal investment to drive growth and enhance returns Liquid yield improvement and de-bottlenecking opportunities CAPITAL PROJECTS Maintain investment grade rating Target optimal balance sheet structure CAPITAL STRUCTURE Strong track record of returning excess cash to shareholders Execute $1 billion share repurchase authorization Competitive dividend and total cash yield CAPITAL ALLOCATION Industry leading returns on capital employed Best in class Net Income per barrel crude capacity FINANCIAL PERFORMANCE UNLOCK MLP VALUE 39% HEP ownership, including 2% GP interest and 37% of LP Units Evaluate dropdown potential of planned HFC capital projects Full Year 2015 HEP cash distributions to HFC of more than $90 million* *Q4 2014 through Q3 2015 quarterly LP and GP distributions announced and paid in 2015

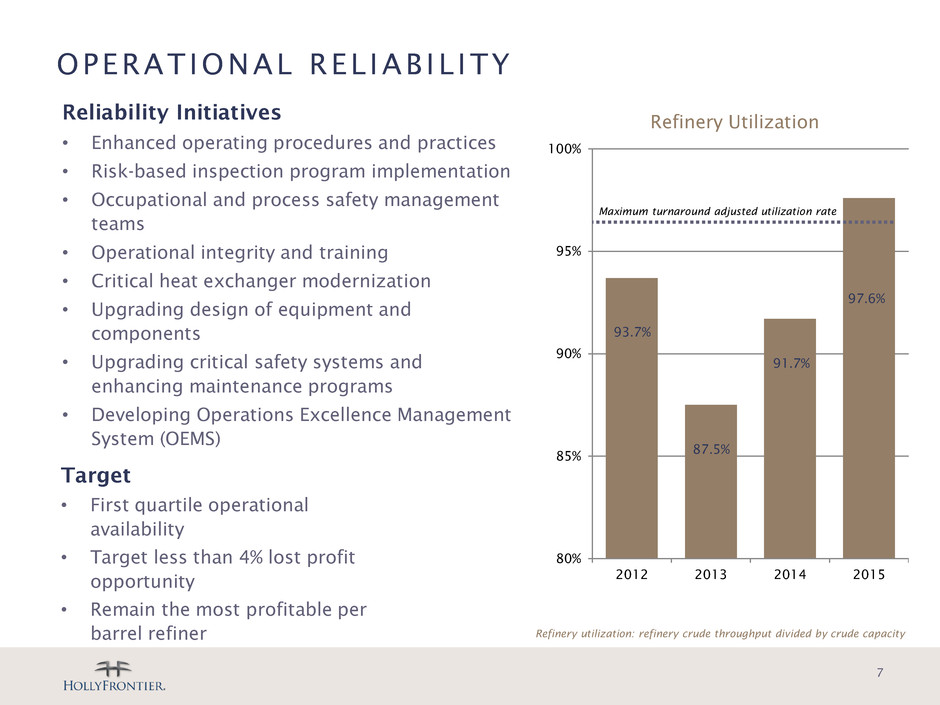

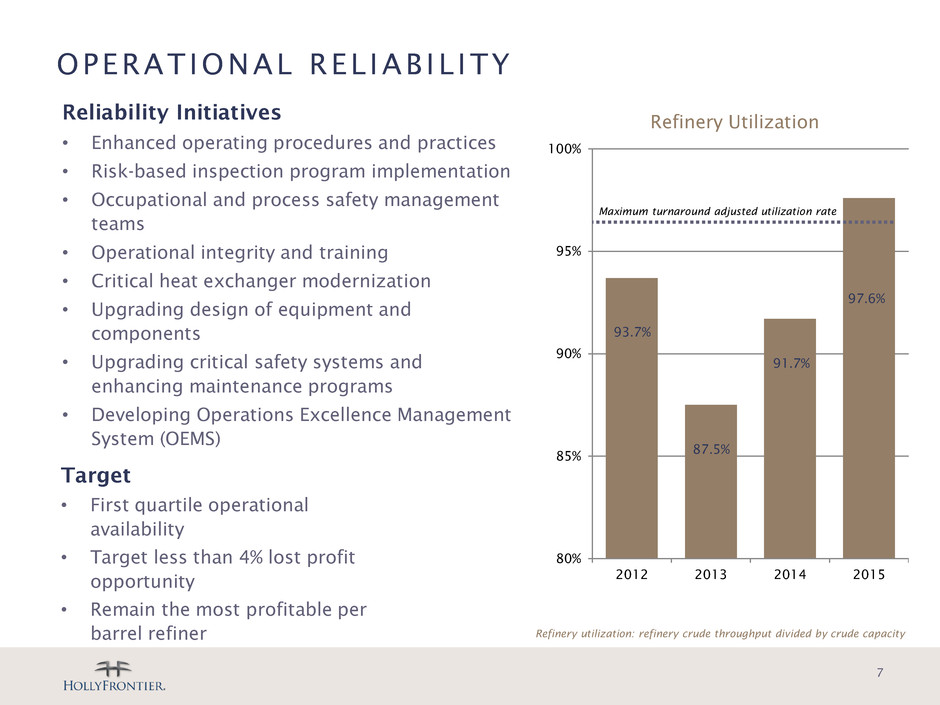

OPERATIONAL REL IAB IL ITY Reliability Initiatives • Enhanced operating procedures and practices • Risk-based inspection program implementation • Occupational and process safety management teams • Operational integrity and training • Critical heat exchanger modernization • Upgrading design of equipment and components • Upgrading critical safety systems and enhancing maintenance programs • Developing Operations Excellence Management System (OEMS) 7 Refinery utilization: refinery crude throughput divided by crude capacity Maximum turnaround adjusted utilization rate 93.7% 87.5% 91.7% 97.6% 80% 85% 90% 95% 100% 2012 2013 2014 2015 Refinery Utilization Target • First quartile operational availability • Target less than 4% lost profit opportunity • Remain the most profitable per barrel refiner

• Refinery location and configuration enables a fleet-wide crude slate discounted to WTI • Highly flexible refining system allows feedstock optionality • Discounted feeds drive higher gross margins / barrel and ultimately, EBITDA PROXIMITY TO NORTH AMERICAN CRUDE PRODUCTION 8 *Data from quarterly earnings calls Increased access to discounted crude Improved crude quality Further feedstock optimization Drives higher GM/BBL and ultimately EBITDA -$8 -$6 -$4 -$2 $0 $2 4Q15 3Q15 2Q15 1Q15 $ /b b l di s co u n t to W T I Feedstock Advantaged Refining* Rockies MidCon Southwest Consolidated

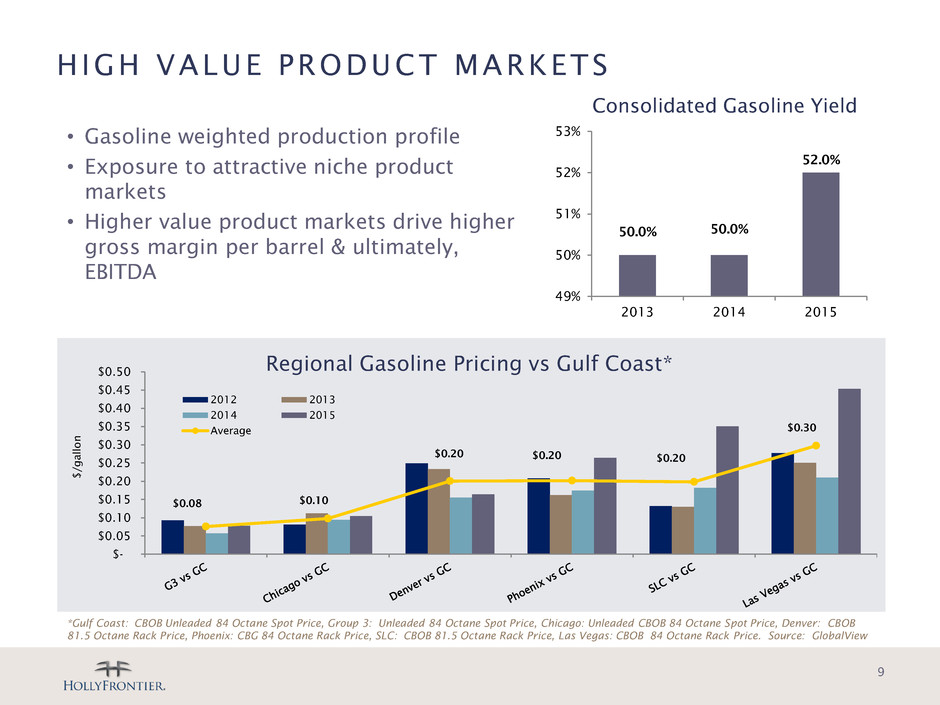

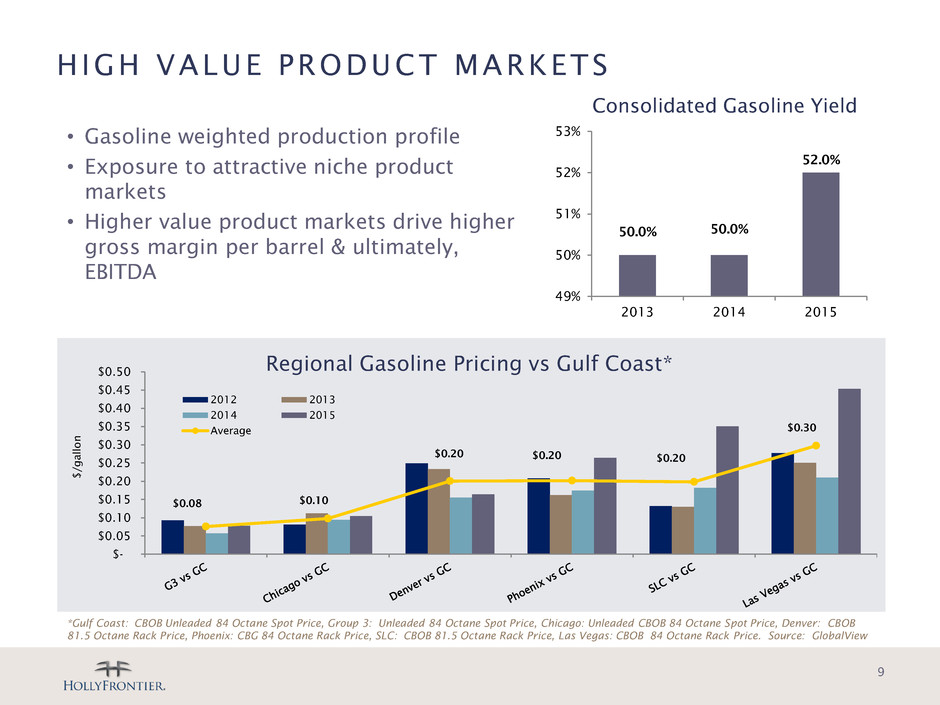

• Gasoline weighted production profile • Exposure to attractive niche product markets • Higher value product markets drive higher gross margin per barrel & ultimately, EBITDA HIGH VALUE PRODUCT MARKETS *Gulf Coast: CBOB Unleaded 84 Octane Spot Price, Group 3: Unleaded 84 Octane Spot Price, Chicago: Unleaded CBOB 84 Octane Spot Price, Denver: CBOB 81.5 Octane Rack Price, Phoenix: CBG 84 Octane Rack Price, SLC: CBOB 81.5 Octane Rack Price, Las Vegas: CBOB 84 Octane Rack Price. Source: GlobalView $0.08 $0.10 $0.20 $0.20 $0.20 $0.30 $- $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 $0.45 $0.50 $ /g a ll o n Regional Gasoline Pricing vs Gulf Coast* 2012 2013 2014 2015 Average 50.0% 50.0% 52.0% 49% 50% 51% 52% 53% 2013 2014 2015 Consolidated Gasoline Yield 9

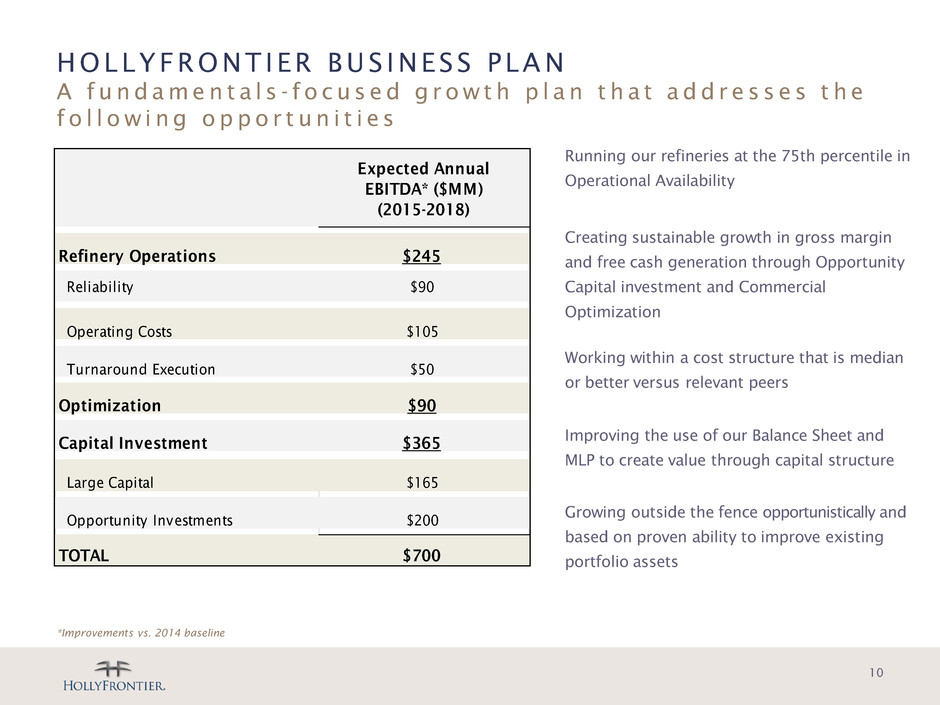

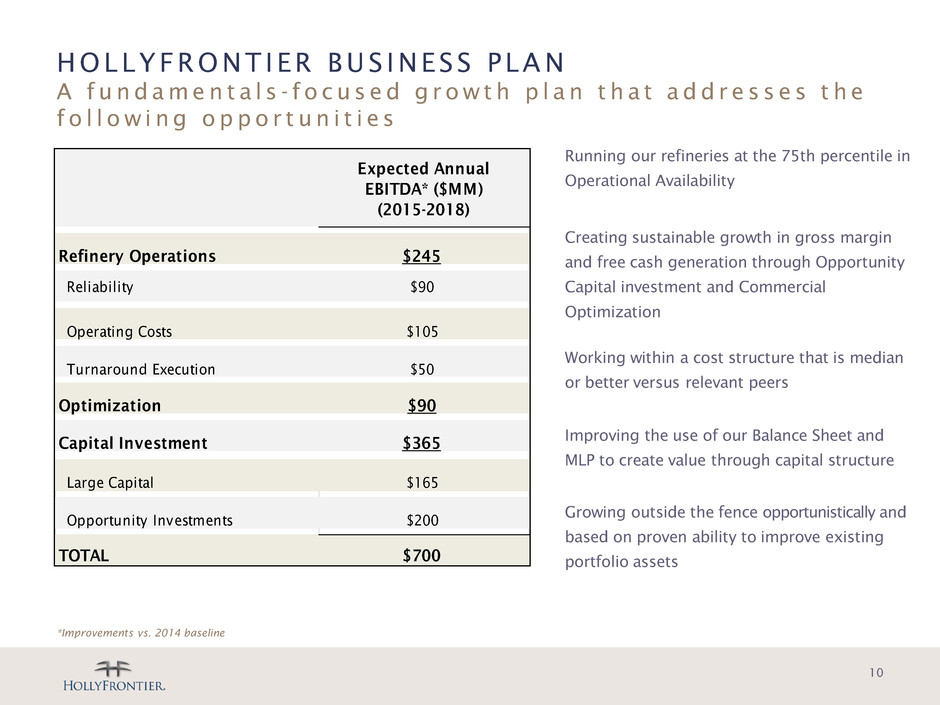

HOLLYFRONTIER BUS INESS PLAN A f u n d a me n t a l s - f o c u s e d g r o w t h p l a n t h a t a d d r e s s e s t h e f o l l o w i n g o p p o r t u n i t i e s 10 Expected Annual EBITDA* ($MM) (2015-2018) Refinery Operations $245 Reliability $90 Operating Costs $105 Turnaround Execution $50 Optimization $90 Capital nvestment $365 Large Capital $165 Opportunity Investments $200 TOTAL $700 Running our refineries at the 75th percentile in Operational Availability Creating sustainable growth in gross margin and free cash generation through Opportunity Capital investment and Commercial Optimization Working within a cost structure that is median or better versus relevant peers Improving the use of our Balance Sheet and MLP to create value through capital structure Growing outside the fence opportunistically and based on proven ability to improve existing portfolio assets *Improvements vs. 2014 baseline

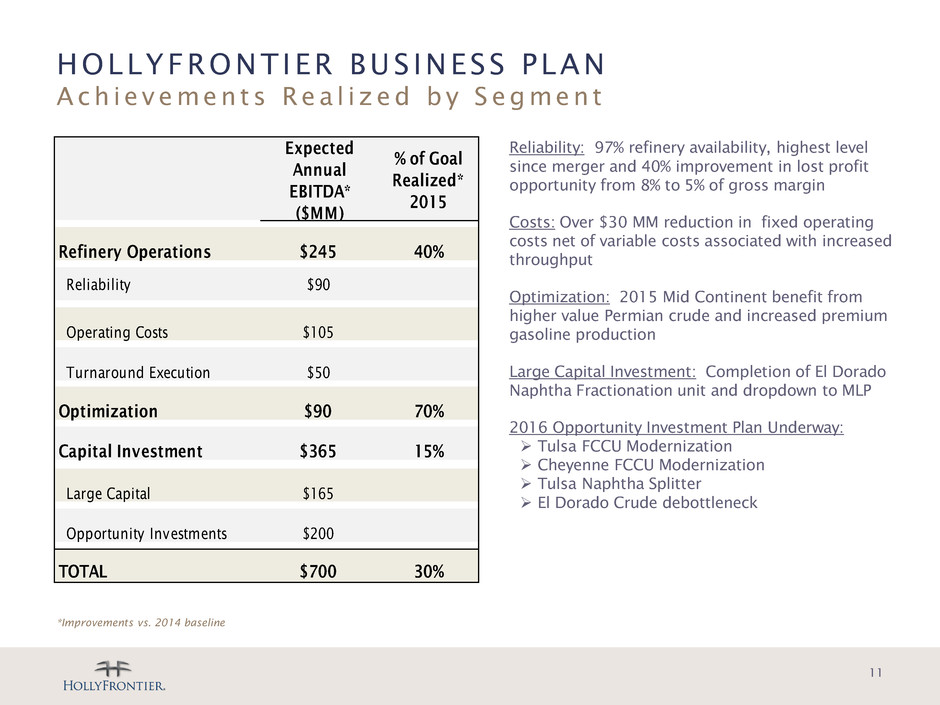

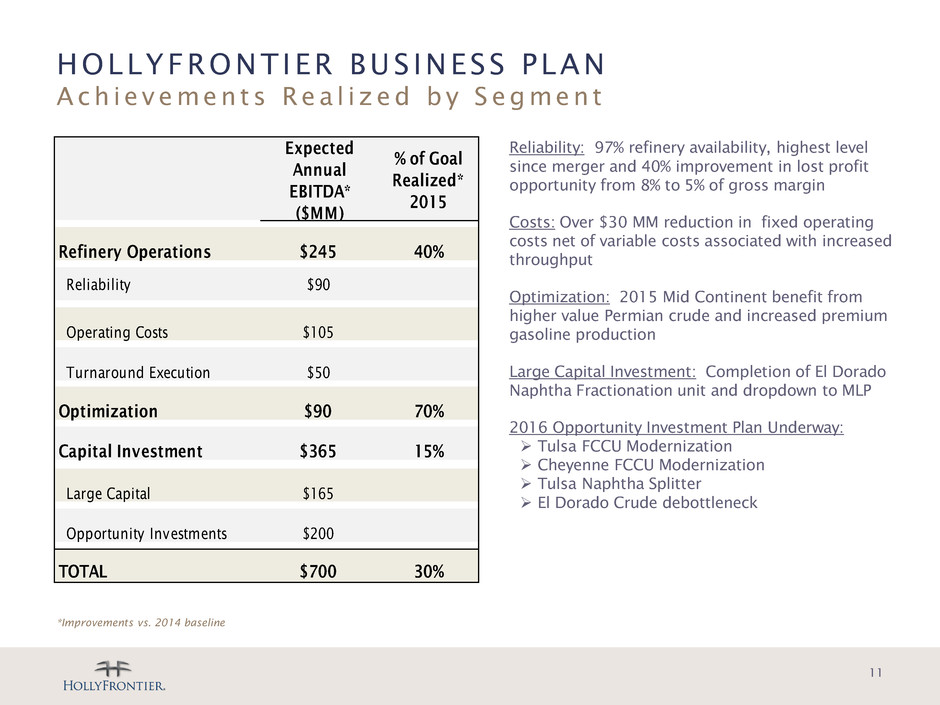

HOLLYFRONTIER BUS INESS PLAN A ch ie ve me n t s Re a l i ze d by S e g me n t 11 Expected Annual EBITDA* ($MM) % of Goal Realized* 2015 Refinery Operations $245 40% Reliability $90 Operating Costs $105 Turnaround Execution $50 Optimization $90 70% Capital Investment $365 15% Large Capital $165 Opportunity Investments $200 TOTAL $700 30% Reliability: 97% refinery availability, highest level since merger and 40% improvement in lost profit opportunity from 8% to 5% of gross margin Costs: Over $30 MM reduction in fixed operating costs net of variable costs associated with increased throughput Optimization: 2015 Mid Continent benefit from higher value Permian crude and increased premium gasoline production Large Capital Investment: Completion of El Dorado Naphtha Fractionation unit and dropdown to MLP 2016 Opportunity Investment Plan Underway: Tulsa FCCU Modernization Cheyenne FCCU Modernization Tulsa Naphtha Splitter El Dorado Crude debottleneck *Improvements vs. 2014 baseline

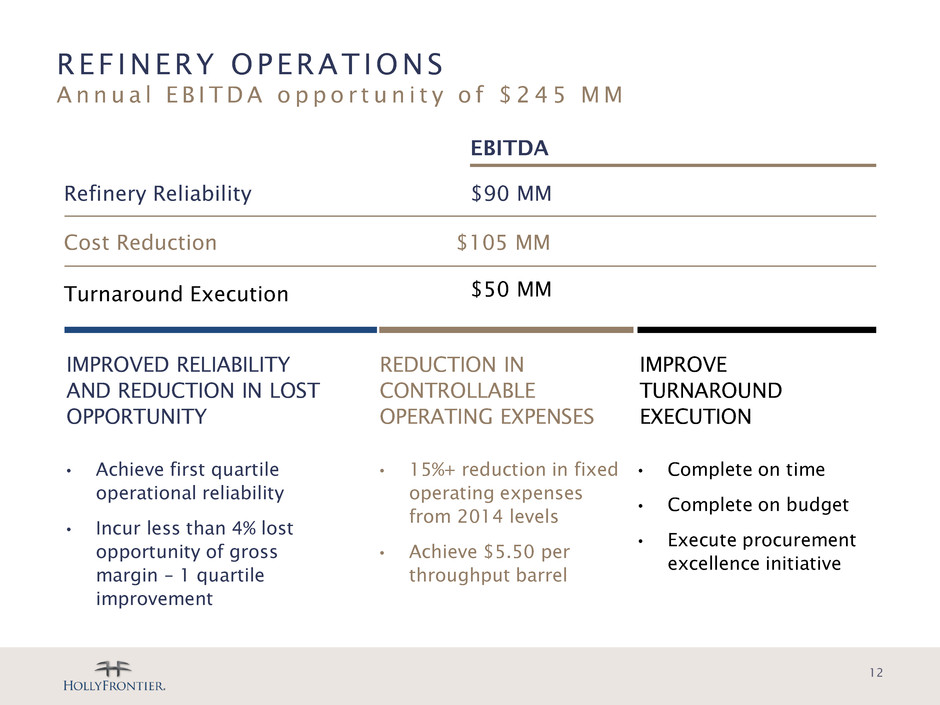

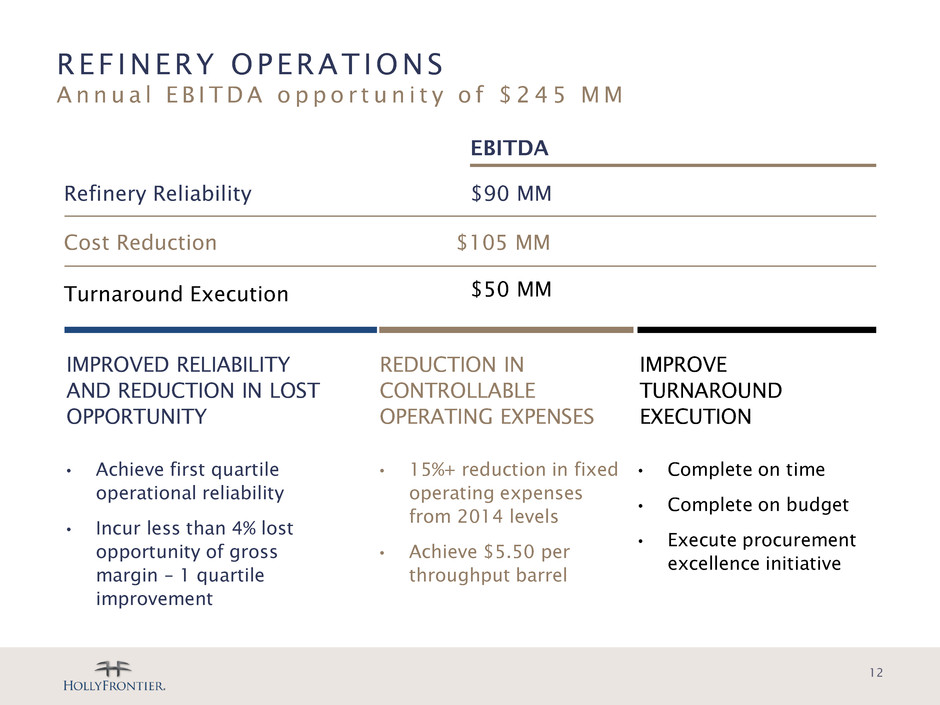

REF INERY OPERATIONS A n n u a l E B I T D A o p p o r t u n i t y o f $ 2 4 5 M M Refinery Reliability $90 MM Cost Reduction Turnaround Execution $105 MM $50 MM EBITDA 12 IMPROVED RELIABILITY AND REDUCTION IN LOST OPPORTUNITY • Achieve first quartile operational reliability • Incur less than 4% lost opportunity of gross margin – 1 quartile improvement REDUCTION IN CONTROLLABLE OPERATING EXPENSES • 15%+ reduction in fixed operating expenses from 2014 levels • Achieve $5.50 per throughput barrel IMPROVE TURNAROUND EXECUTION • Complete on time • Complete on budget • Execute procurement excellence initiative

OPTIMIZATION A n n u a l E B I T D A o p p o r t u n i t y o f $ 9 0 M M 13 PUTTING THE RIGHT MOLECULE IN THE RIGHT REFINERY OR MARKET AT THE RIGHT TIME • Little or no capital investment required • Driven by commercial and planning groups recognizing market opportunities Crude Supply • Pipeline reversal between Navajo and Cushing increases optionality • HEP system allows us to preserve quality of Permian Crude Transportation Fuels • Increased market access out of Tulsa allows for increased refinery utilization and increased production in premium products Specialty Lubricants: • Unique portfolio and production flexibility contribute to relatively stable margins • Increase heavier viscosity and Bright Stock production where margins are more than double alternative lighter grades Heavy Products: • Upgrading to higher value and specialty products like Pitch and Roofing Flux • Blending capability at both Port of Catoosa and Holly Asphalt Terminals allows access to new higher value markets and access to retail markets Planning: • Optimize refineries focusing on inter-refinery opportunities to maximize value

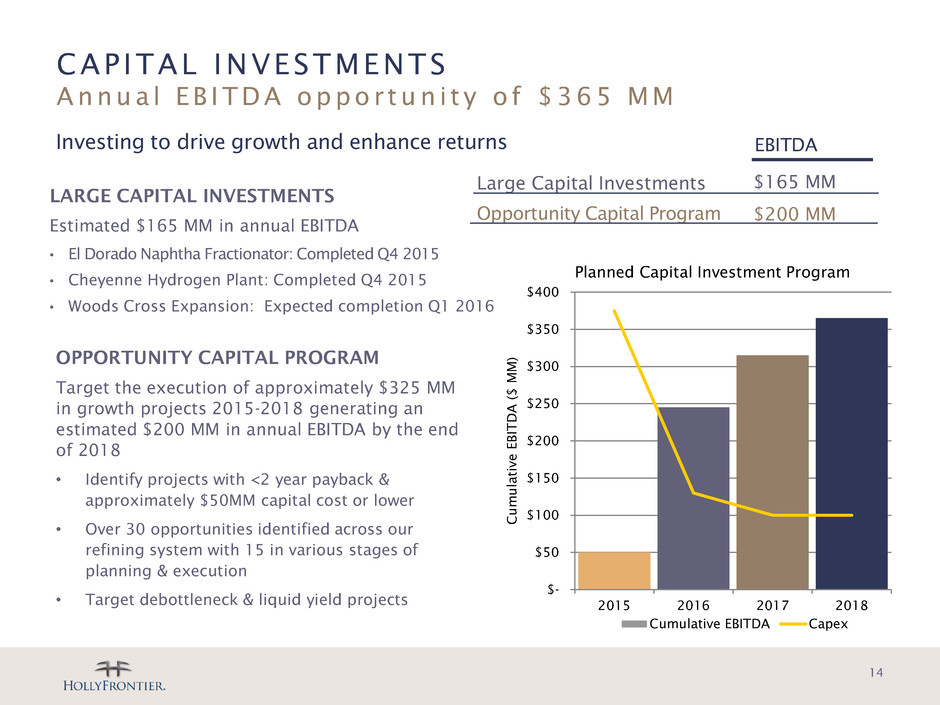

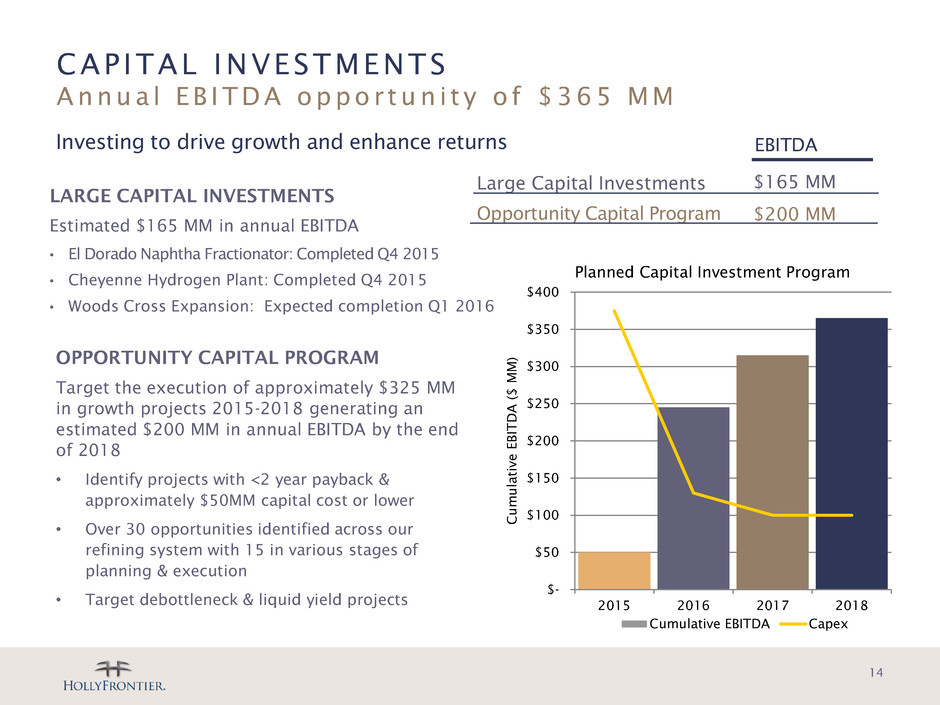

14 CAPITAL INVESTMENTS A nnu a l E B I TDA oppo r t u n i t y o f $ 3 6 5 MM LARGE CAPITAL INVESTMENTS Estimated $165 MM in annual EBITDA • El Dorado Naphtha Fractionator: Completed Q4 2015 • Cheyenne Hydrogen Plant: Completed Q4 2015 • Woods Cross Expansion: Expected completion Q1 2016 Large Capital Investments $165 MM Opportunity Capital Program $200 MM EBITDA OPPORTUNITY CAPITAL PROGRAM Target the execution of approximately $325 MM in growth projects 2015-2018 generating an estimated $200 MM in annual EBITDA by the end of 2018 • Identify projects with <2 year payback & approximately $50MM capital cost or lower • Over 30 opportunities identified across our refining system with 15 in various stages of planning & execution • Target debottleneck & liquid yield projects Investing to drive growth and enhance returns $- $50 $100 $150 $200 $250 $300 $350 $400 2015 2016 2017 2018 C u m u la tive E B IT D A ( $ M M ) Planned Capital Investment Program Cumulative EBITDA Capex

15 Woods Cross Expansion Expand crude capacity from 31,000 to 45,000 barrels per day • Includes relocation/revamp of FCC and polymerization units from Bloomfield, NM refinery • Crude slate to include up to 25,000 BPD local Uinta Basin Black Wax or other regional crudes. 20,000 BPD 10-year crude supply agreement with Newfield • Expected yields: 60% gasoline and 40% diesel • Incremental production to ship on the UNEV Pipeline to the Las Vegas market Crude supply will be available • 10,000 BPD excess Express Pipeline • Ability to optimize between the Cheyenne and Woods Cross Refineries • New Bakken and Guernsey alternatives being developed • HEP owns 25% of SLC Pipeline and 50% of Frontier Pipeline $20-$30 MM investment to increase crude flexibility • Crude farm flexibility – piping to allow delivery of more crude • Crude tower flexibility – piping to allow more naphtha and distillate production • Gas oil hydrocracker allows additional distillates to be hydrotreated and increases distillate production capacity INVEST ING TO DRIVE GROWTH AND ENHANCE RETURNS PROJECT Woods Cross Expansion ESTIMATED CAPEX (including new design flexibility) $420 - $430 million PROJECTED EBITDA GENERATION* $100 million EXPECTED MECHANICAL COMPLETION 1Q 2016 EXPECTED ADDITIONAL SCOPE COMPLETION 1Q 2016 *Woods Cross expected EBITDA generation range based on conservatively estimated crack spread environment and two cases of partial and full supply of black wax crude.

16 Tulsa Refinery Modernization: FCC Revamp • FCC modernization underway: Upgrade existing FCC with improved feed nozzles, high efficiency catalyst stripper and riser termination device • Expected increase in FCC capacity up to 4,000 BPD • Expected 1% improvement in conversion rates and yield • Yield shift value is attributed to the shift from Decant Oil and Light Cycle Oil to Gasoline PROJECT Tulsa FCC Modernization ESTIMATED CAPEX $36 million PROJECTED EBITDA GENERATION* $19 million EXPECTED COMPLETION 1Q 2016 * Tulsa & Cheyenne FCC Revamps expected EBITDA generation based on improvement in liquid yield and increased FCC capacity resulting the conversion of previous gasoil sales to gasoline Cheyenne Refinery Modernization: FCC Revamp • FCC modernization plan: Upgrade existing FCC with new, single vertical riser, improved feed nozzles, and spent catalyst distributor • The spent catalyst distributor is expected to improve charge rate by 500 BPD and will allow for some avoided maintenance cost benefits • Expected 1% improvement in conversion rates and yield • Modifications and improvements expected to be installed during the Spring 2016 turnaround PROJECT Cheyenne FCC Modernization ESTIMATED CAPEX $9 million PROJECTED EBITDA GENERATION* $8 million EXPECTED COMPLETION 2Q 2016

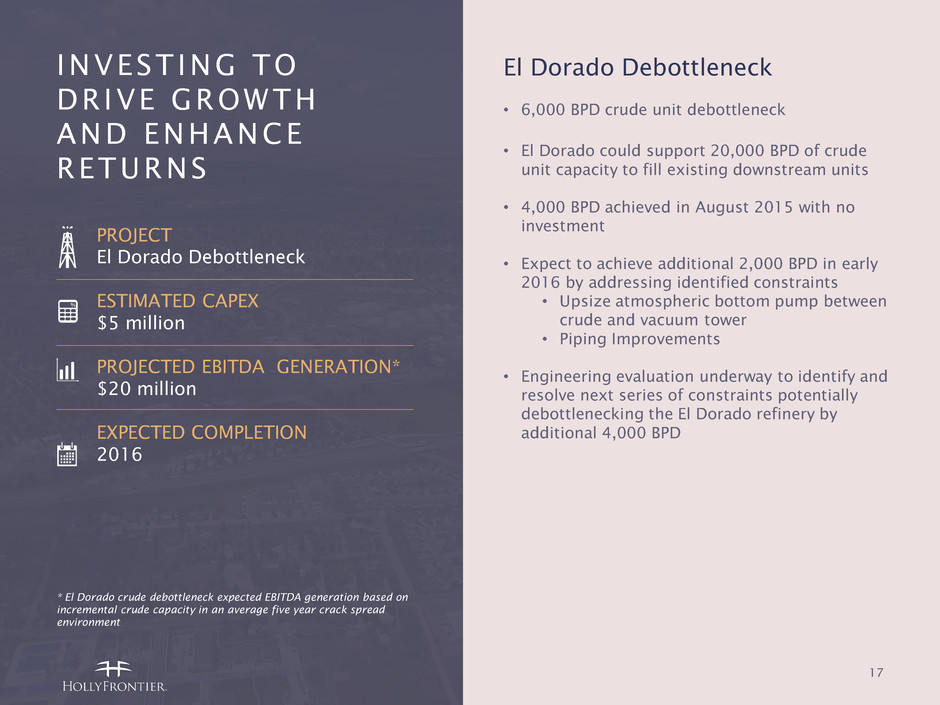

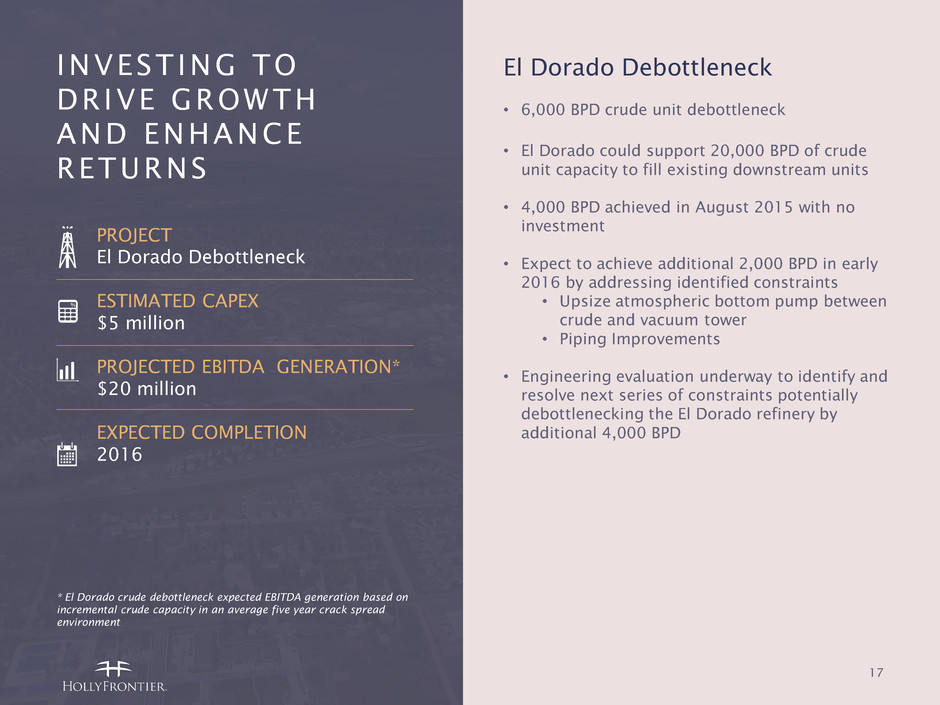

17 El Dorado Debottleneck • 6,000 BPD crude unit debottleneck • El Dorado could support 20,000 BPD of crude unit capacity to fill existing downstream units • 4,000 BPD achieved in August 2015 with no investment • Expect to achieve additional 2,000 BPD in early 2016 by addressing identified constraints • Upsize atmospheric bottom pump between crude and vacuum tower • Piping Improvements • Engineering evaluation underway to identify and resolve next series of constraints potentially debottlenecking the El Dorado refinery by additional 4,000 BPD INVEST ING TO DRIVE GROWTH AND ENHANCE RETURNS PROJECT El Dorado Debottleneck ESTIMATED CAPEX $5 million PROJECTED EBITDA GENERATION* $20 million EXPECTED COMPLETION 2016 * El Dorado crude debottleneck expected EBITDA generation based on incremental crude capacity in an average five year crack spread environment

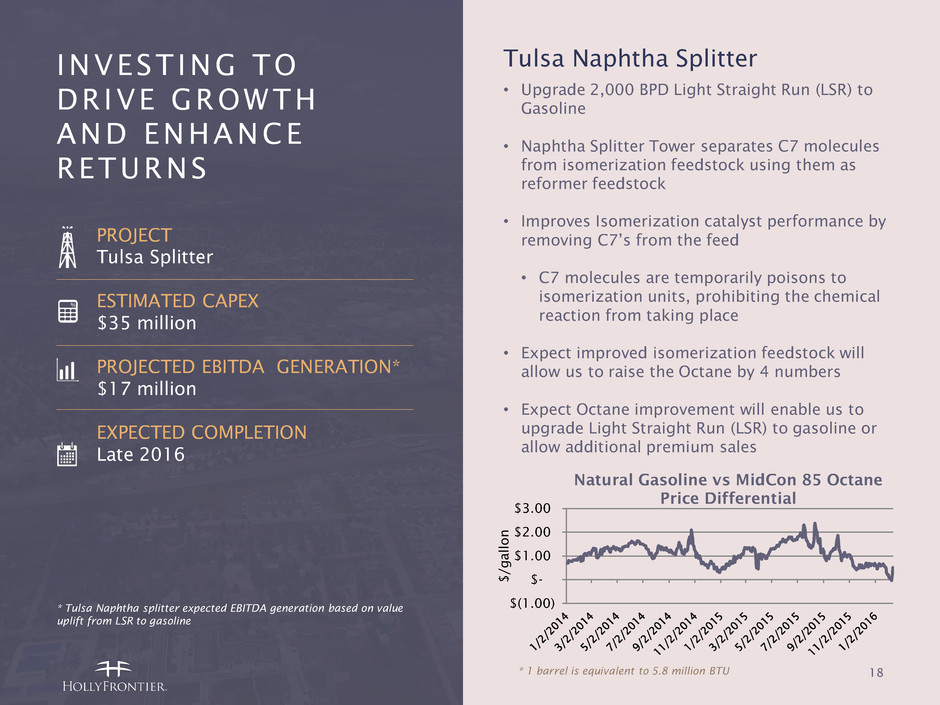

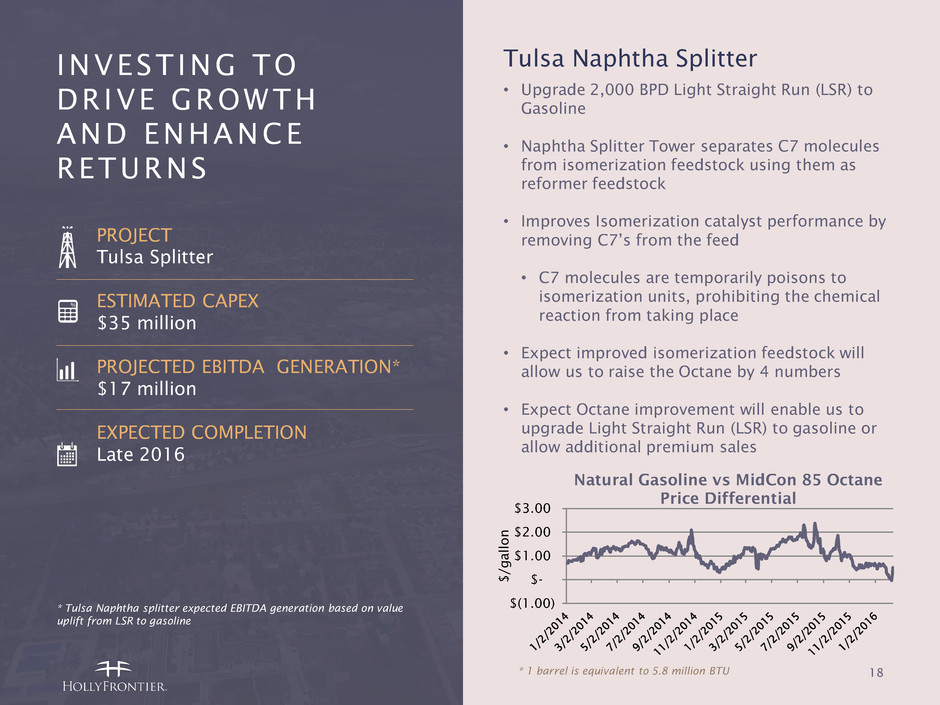

18 Tulsa Naphtha Splitter • Upgrade 2,000 BPD Light Straight Run (LSR) to Gasoline • Naphtha Splitter Tower separates C7 molecules from isomerization feedstock using them as reformer feedstock • Improves Isomerization catalyst performance by removing C7’s from the feed • C7 molecules are temporarily poisons to isomerization units, prohibiting the chemical reaction from taking place • Expect improved isomerization feedstock will allow us to raise the Octane by 4 numbers • Expect Octane improvement will enable us to upgrade Light Straight Run (LSR) to gasoline or allow additional premium sales INVEST ING TO DRIVE GROWTH AND ENHANCE RETURNS PROJECT Tulsa Splitter ESTIMATED CAPEX $35 million PROJECTED EBITDA GENERATION* $17 million EXPECTED COMPLETION Late 2016 * 1 barrel is equivalent to 5.8 million BTU * Tulsa Naphtha splitter expected EBITDA generation based on value uplift from LSR to gasoline $(1.00) $- $1.00 $2.00 $3.00 $ /g a ll o n Natural Gasoline vs MidCon 85 Octane Price Differential

DISC IPL INED APPROACH TO CAPITAL ALLOCATION RETURN EXCESS CASH TO SHAREHOLDERS: SUSTAINING CAPITAL: GROWTH CAPITAL: 19 • Committed to maintaining best in class total cash yield relative to our peer group • $1 billion May 2015 repurchase authorization execution • Maintenance capex: $125 million in annual sustaining maintenance • Compliance capex: environmental compliance spending focused on Tier 3 gasoline and MSAT 2 standards • Turnaround spending: $125 million annual turnaround budget • Focus on quick hit opportunities, those with a maximum approximate capital cost of $50 million and less than a 2 year payback period on average • Expect to execute approximately $100 million in internal investments annually • M&A: buy the right assets at the right price

BALANCE SHEET • Investment Grade Rating • Moody’s Baa3 • S&P BBB- • $211 million cash as of 12/31/15 • $31 million outstanding debt as of 12/31/15 • excludes non-recourse HEP debt • $250 million 5.875% senior notes due 2026 priced on 3/15/16, expected to close on 3/22/16 • Total debt to capital ratio .5% (including $250 million senior notes) • Target 1x net debt/EBITDA (ex HEP) 20 * Total Debt to Capital calculated by taking total debt (excluding MLP debt) divided by and total debt (excluding MLP debt) plus total equity (excluding non- controlling interest) as of 12/31/15. Net Debt deducts cash from total debt. Data is taken from public filings. HFC includes $250 million senior notes due 2026 priced on 3/15/16, expected to close on 3/22/16. 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% HFC TSO PSX VLO ALJ MPC DK PBF WNR Debt/Cap Net Debt/Cap Total Debt to Capital*

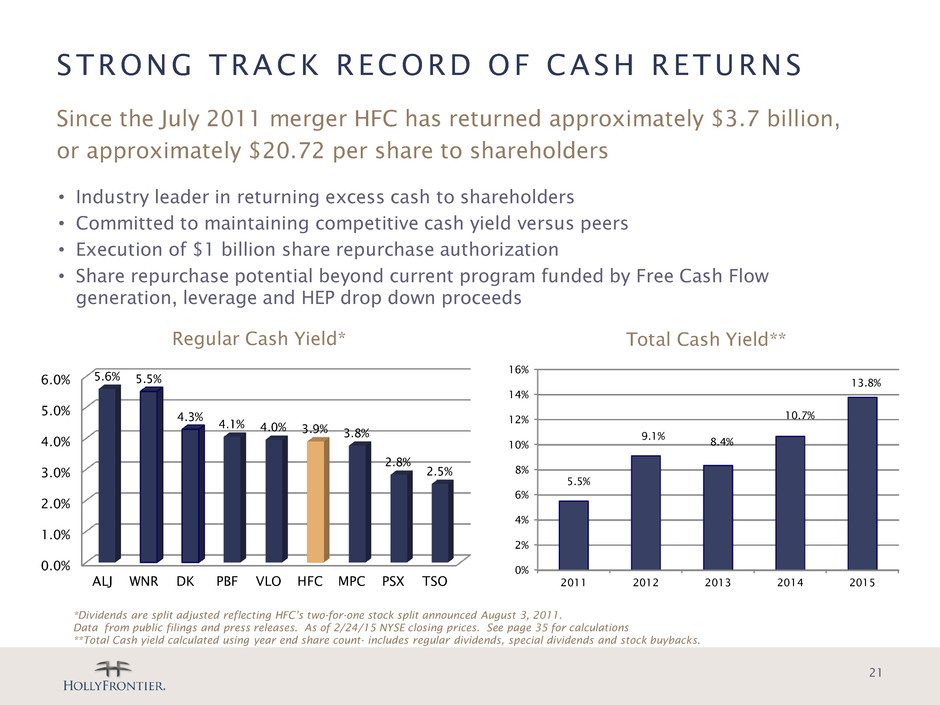

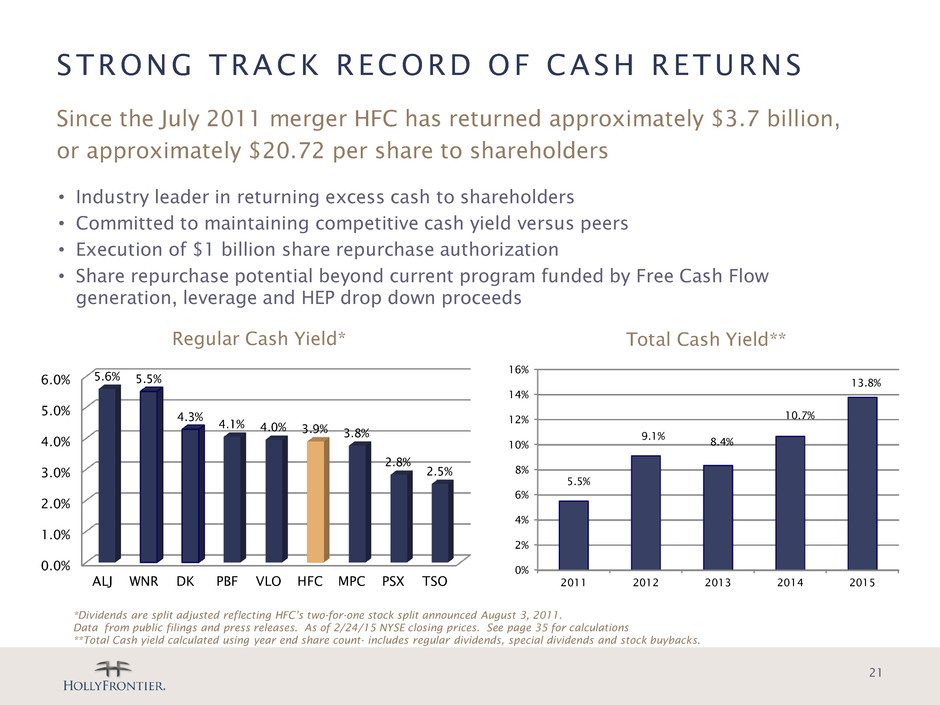

STRONG TRACK RECORD OF CASH RETURNS Since the July 2011 merger HFC has returned approximately $3.7 billion, or approximately $20.72 per share to shareholders 21 • Industry leader in returning excess cash to shareholders • Committed to maintaining competitive cash yield versus peers • Execution of $1 billion share repurchase authorization • Share repurchase potential beyond current program funded by Free Cash Flow generation, leverage and HEP drop down proceeds *Dividends are split adjusted reflecting HFC’s two-for-one stock split announced August 3, 2011. Data from public filings and press releases. As of 2/24/15 NYSE closing prices. See page 35 for calculations **Total Cash yield calculated using year end share count- includes regular dividends, special dividends and stock buybacks. 0% 2% 4% 6% 8% 10% 12% 14% 16% 2011 2012 2013 2014 2015 5.5% 9.1% 8.4% 10.7% 13.8% Total Cash Yield** 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% ALJ WNR DK PBF VLO HFC MPC PSX TSO 5.6% 5.5% 4.3% 4.1% 4.0% 3.9% 3.8% 2.8% 2.5% Regular Cash Yield*

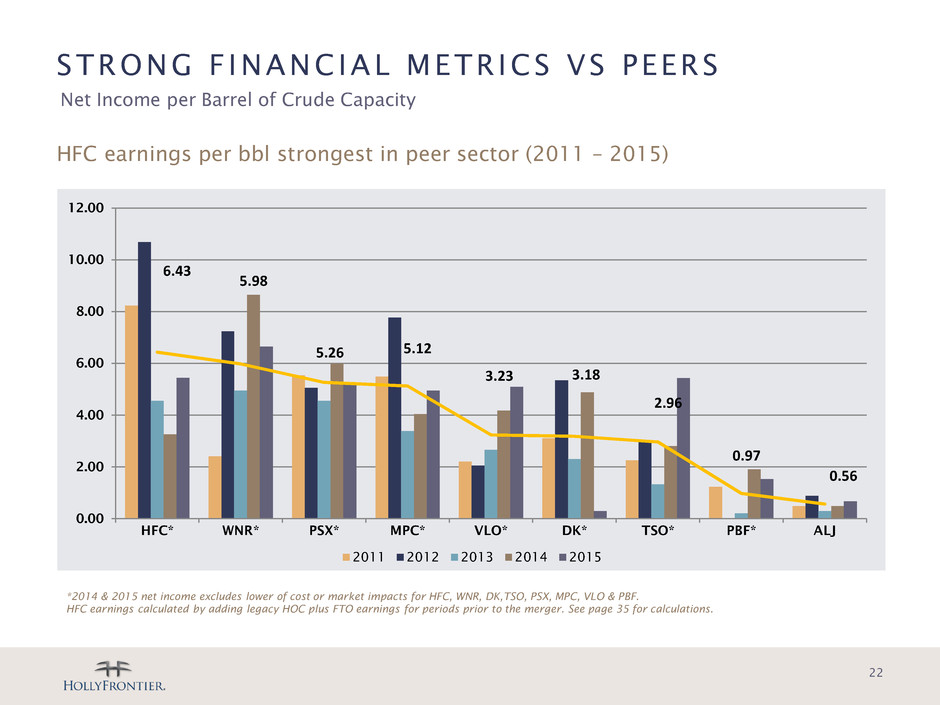

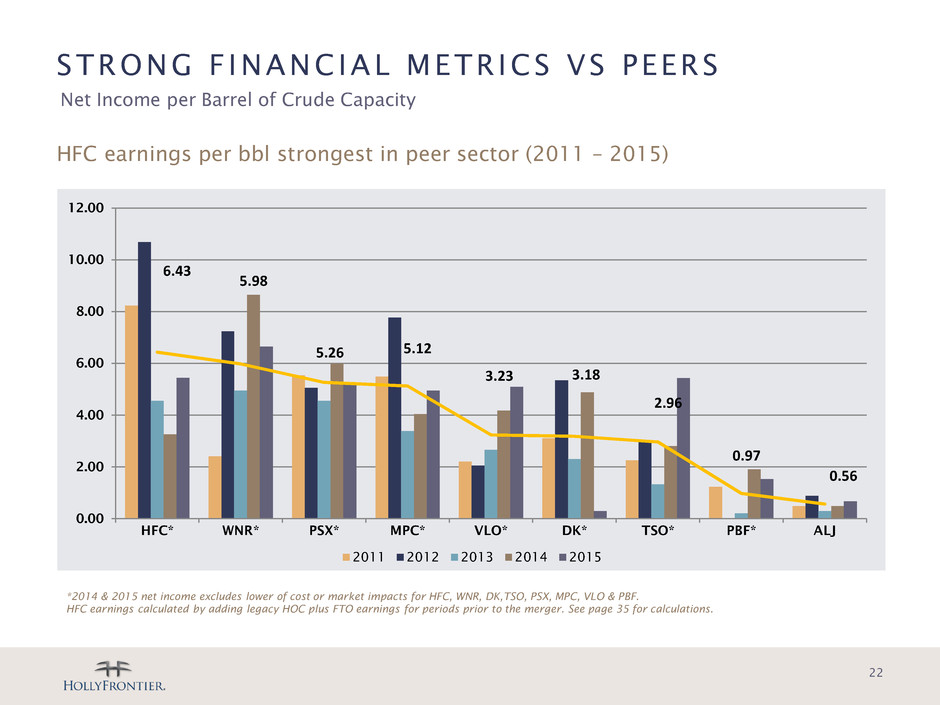

STRONG F INANCIAL METR ICS VS PEERS HFC earnings per bbl strongest in peer sector (2011 – 2015) 22 Net Income per Barrel of Crude Capacity *2014 & 2015 net income excludes lower of cost or market impacts for HFC, WNR, DK,TSO, PSX, MPC, VLO & PBF. HFC earnings calculated by adding legacy HOC plus FTO earnings for periods prior to the merger. See page 35 for calculations. 6.43 5.98 5.26 5.12 3.23 3.18 2.96 0.97 0.56 0.00 2.00 4.00 6.00 8.00 10.00 12.00 HFC* WNR* PSX* MPC* VLO* DK* TSO* PBF* ALJ 2011 2012 2013 2014 2015

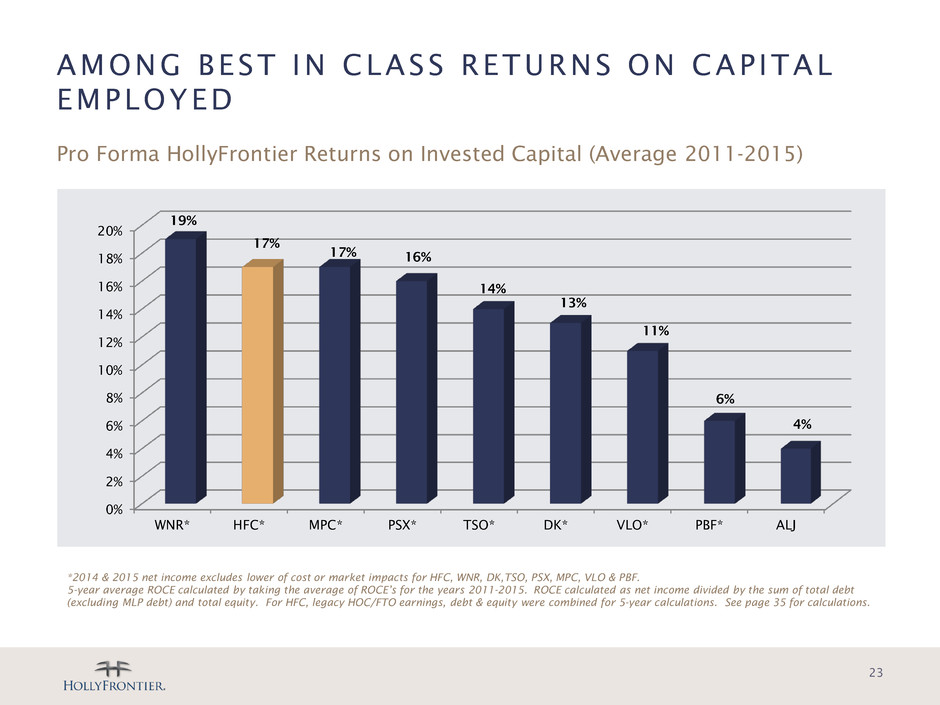

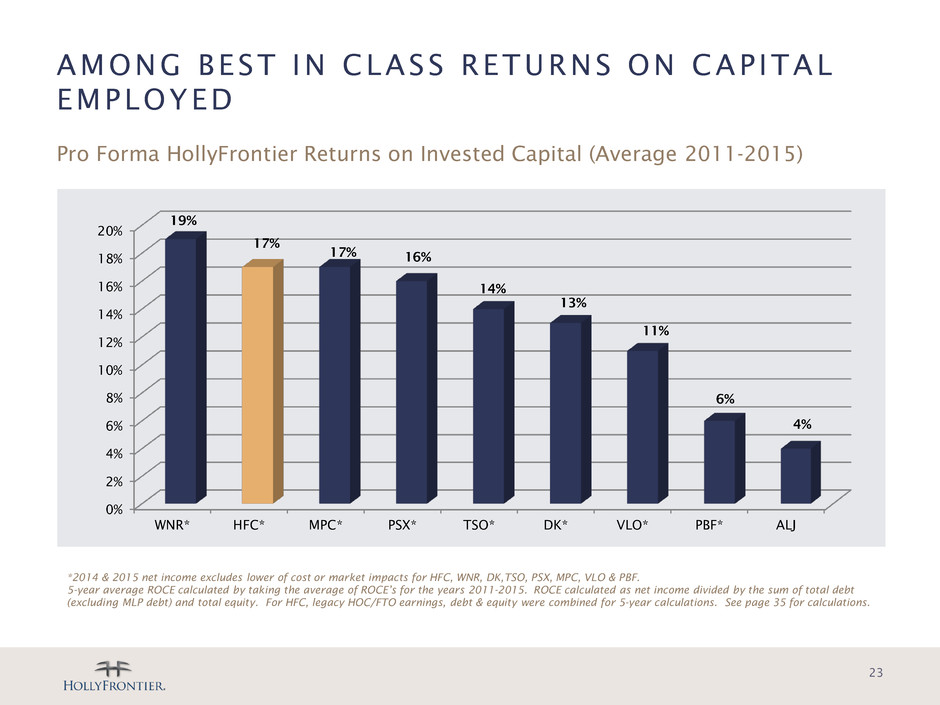

AMONG BEST IN CLASS RETURNS ON CAPITAL EMPLOYED Pro Forma HollyFrontier Returns on Invested Capital (Average 2011-2015) 23 *2014 & 2015 net income excludes lower of cost or market impacts for HFC, WNR, DK,TSO, PSX, MPC, VLO & PBF. 5-year average ROCE calculated by taking the average of ROCE’s for the years 2011-2015. ROCE calculated as net income divided by the sum of total debt (excluding MLP debt) and total equity. For HFC, legacy HOC/FTO earnings, debt & equity were combined for 5-year calculations. See page 35 for calculations. 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% WNR* HFC* MPC* PSX* TSO* DK* VLO* PBF* ALJ 19% 17% 17% 16% 14% 13% 11% 6% 4%

24 HOLLY ENERGY PARTNERS HollyFrontier Corporation (HFC) General Partner (GP) “Holly Logistic Services LLC” Holly Energy Partners (HEP) Public 22.4mm HEP units, 37% LP Interest 2% GP Interest + IDRs* 100% Interest 36.3mm HEP units, 61% LP Interest * IDR: incentive distribution rights

25 HOLLY ENERGY PARTNERS Operate a system of petroleum product and crude pipelines, storage tanks, distribution terminals and loading rack facilities located near HFC’s refining assets in high growth markets • Revenues are 100% fee-based with limited commodity risk • Major refiner customers have entered into long-term contracts • Contracts require minimum payment obligations for volume and/or revenue commitments • Over 80% of revenues tied to long term contracts and minimum commitments • Earliest contract up for renewal in 2019 (approx. 17% of total commitments) • 45 consecutive quarterly distribution increases since IPO in 2004 *Distribution Per Unit $0 $20 $40 $60 $80 $100 $120 $140 $160 $0.00 $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 Q 4 2 0 0 4 Q 2 2 0 0 5 Q 4 2 0 0 5 Q 2 2 0 0 6 Q 4 2 0 0 6 Q 2 2 0 0 7 Q 4 2 0 0 7 Q 2 2 0 0 8 Q 4 2 0 0 8 Q 2 2 0 0 9 Q 4 2 0 0 9 Q 2 2 0 1 0 Q 4 2 0 1 0 Q 2 2 0 1 1 Q 4 2 0 1 1 Q 2 2 0 1 2 Q 4 2 0 1 2 Q 2 2 0 1 3 Q 4 2 0 1 3 Q 2 2 0 1 4 Q 4 2 0 1 4 Q 2 2 0 1 5 Q 4 2 0 1 5 W T I Pri ce Di s trib u ti o n Consistent Distribution Growth Despite Crude Price Volatility DPU* WTI 1Distributions are split adjusted reflecting HEP’s January 2013 two-for-one unit split.

26 HOLLY ENERGY PARTNERS G R O W T H D R I V E R S Dropdown Context • HEP generally has right of first refusal on all logistics assets HFC builds or acquires • As HFC grows, HEP is positioned to benefit by partnering with HFC to build and/or acquire new assets • Target high tax basis assets with durable cash flow characteristics that also add to HFC EBITDA Acquisition Approach • Pursue logistic assets HFC is currently utilizing to create acquisition opportunities for HEP • Leverage HFC refining footprint and commercial commitments plus HEP logistic capabilities Organic • Southeastern New Mexico Gathering • UNEV • Internal Initiatives • Contractual PPI/FERC Increases Dropdowns From HFC • El Dorado Naphtha Fractionation Unit • WX Expansion Assets Acquisitions • El Dorado Crude Tanks • Frontier Crude Pipeline Interest

• HEP recently purchased the newly constructed naphtha fractionation and hydrogen generation units at HFC’s El Dorado refinery for a total cash consideration of approximately $62.0 MM • Naphtha fractionation unit has the capacity to process up to 50 kb/d of naphtha into intermediates and blending components • Hydrogen generation unit has the capacity to produce up to 17 mmscf/d of hydrogen E l DORADO NAPHTHA FRACTIONATION DROPDOWN 27 • HEP and HFC entered into 15-year tolling agreements for each respective unit • 2016 EBITDA from these tolling agreements expected to be at least $6.9 MM* • Both tolling agreements feature minimum volume commitments • HFC will own all commodity inputs and outputs; HEP will take no commodity risk * For historical reconciliation, please see the Holly Energy Partners 201510-K

28 FRONTIER P I PEL INE INTEREST ACQUIS IT ION Asset Description • 289 mile, 72K bpd capacity crude pipeline from Casper, WY to Frontier Station, UT • At Frontier Station, connects to SLC Pipeline (PAA/HEP JV) • Sources to Frontier: Express, Big Horn, local crude gathering • Ultimate customers: SLC refiners Deal Highlights • 50% non-operating Ownership Interest Purchase from Enbridge • Estimate $6-7 mm EBITDA to HEP • Effective August 31, 2015

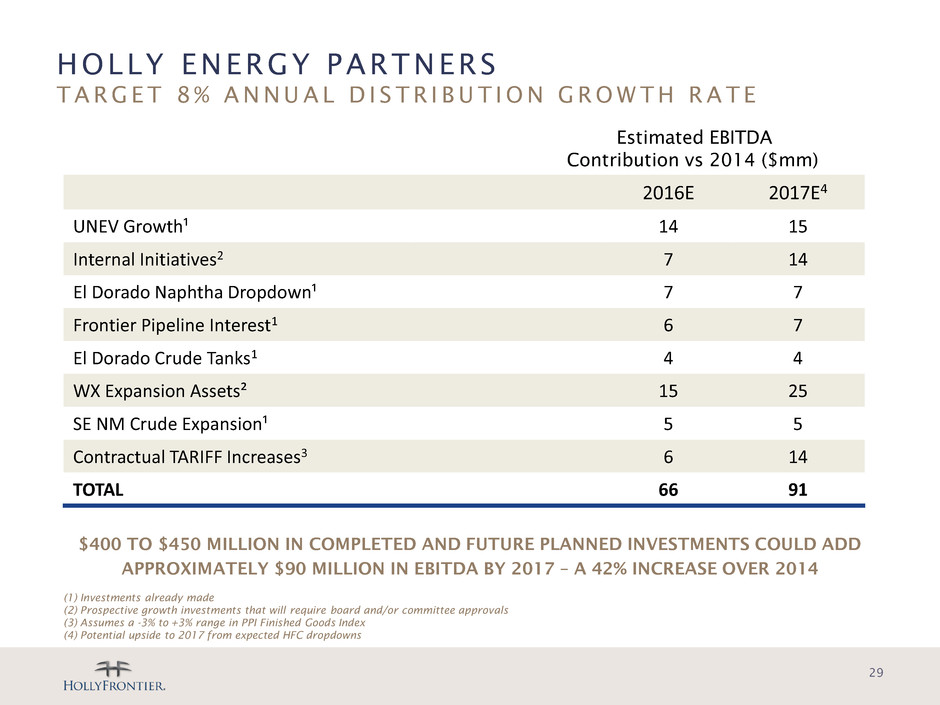

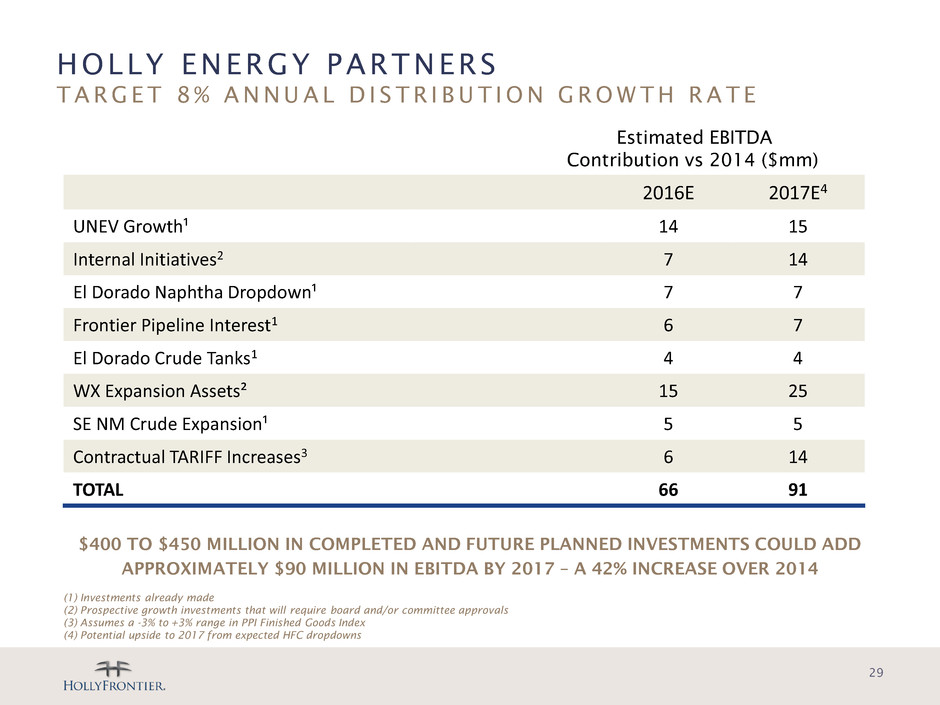

HOLLY ENERGY PARTNERS T A R G E T 8 % A N N U A L D I S T R I B U T I O N G R O W T H R A T E 29 (1) Investments already made (2) Prospective growth investments that will require board and/or committee approvals (3) Assumes a -3% to +3% range in PPI Finished Goods Index (4) Potential upside to 2017 from expected HFC dropdowns $400 TO $450 MILLION IN COMPLETED AND FUTURE PLANNED INVESTMENTS COULD ADD APPROXIMATELY $90 MILLION IN EBITDA BY 2017 – A 42% INCREASE OVER 2014 Estimated EBITDA Contribution vs 2014 ($mm) 2016E 2017E4 UNEV Growth¹ 14 15 Internal Initiatives2 7 14 El Dorado Naphtha Dropdown¹ 7 7 Frontier Pipeline Interest1 6 7 El Dorado Crude Tanks1 4 4 WX Expansion Assets² 15 25 SE NM Crude Expansion¹ 5 5 Contractual TARIFF Increases3 6 14 TOTAL 66 91

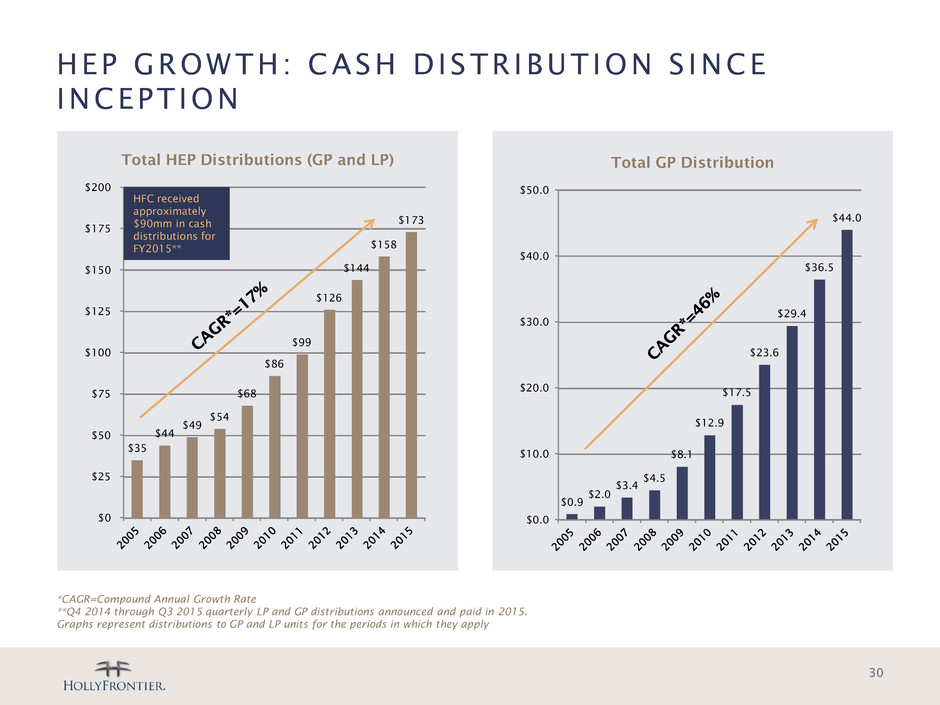

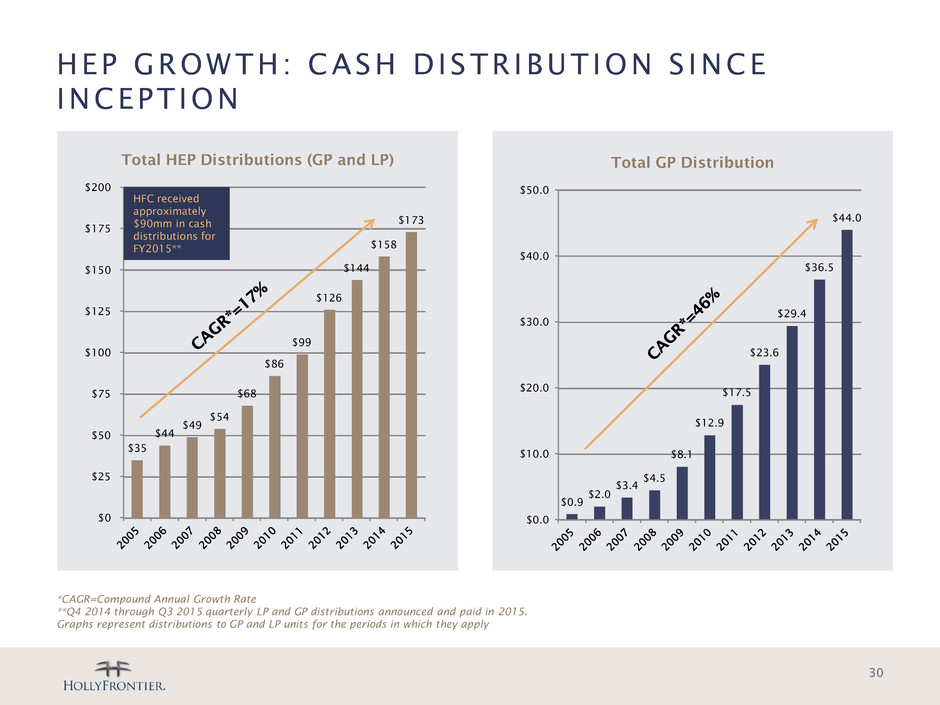

HEP GROWTH: CASH DISTR IBUTION S INCE INCEPTION 30 *CAGR=Compound Annual Growth Rate **Q4 2014 through Q3 2015 quarterly LP and GP distributions announced and paid in 2015. Graphs represent distributions to GP and LP units for the periods in which they apply $0 $25 $50 $75 $100 $125 $150 $175 $200 $35 $44 $49 $54 $68 $86 $99 $126 $144 $158 $173 Total HEP Distributions (GP and LP) HFC received approximately $90mm in cash distributions for FY2015** $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $0.9 $2.0 $3.4 $4.5 $8.1 $12.9 $17.5 $23.6 $29.4 $36.5 $44.0 Total GP Distribution

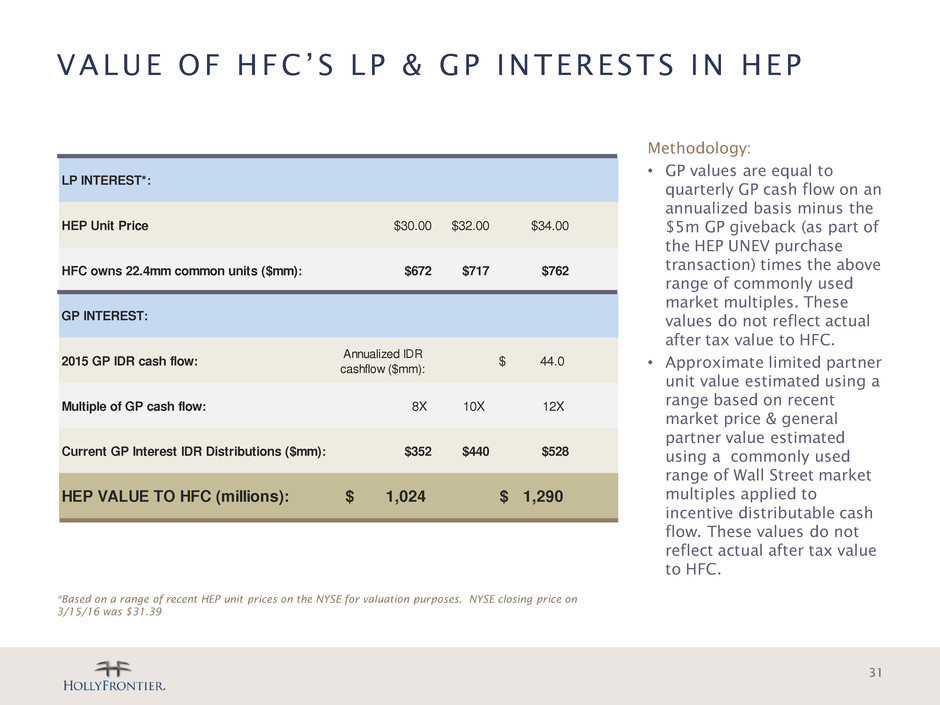

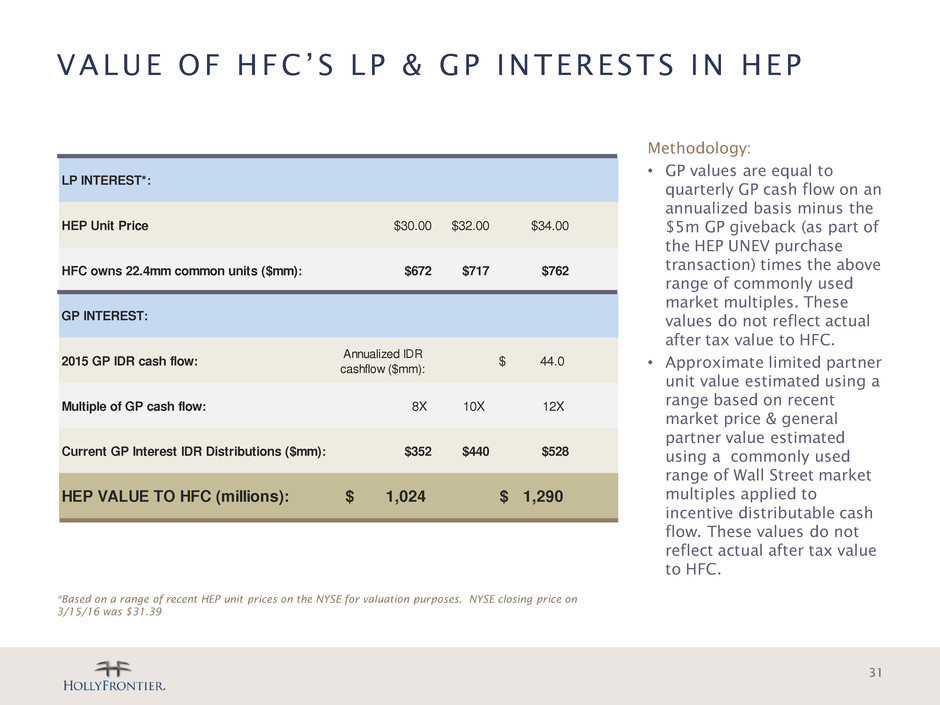

VALUE OF HFC’S LP & GP INTERESTS IN HEP 31 Methodology: • GP values are equal to quarterly GP cash flow on an annualized basis minus the $5m GP giveback (as part of the HEP UNEV purchase transaction) times the above range of commonly used market multiples. These values do not reflect actual after tax value to HFC. • Approximate limited partner unit value estimated using a range based on recent market price & general partner value estimated using a commonly used range of Wall Street market multiples applied to incentive distributable cash flow. These values do not reflect actual after tax value to HFC. LP INTEREST*: HEP Unit Price $30.00 $32.00 $34.00 HFC owns 22.4mm common units ($mm): $672 $717 $762 GP INTEREST: 2015 GP IDR cash flow: Annualized IDR cashflow ($mm): 44.0$ Multiple of GP cash flow: 8X 10X 12X Current GP Interest IDR Distributions ($mm): $352 $440 $528 HEP VALUE TO HFC (millions): 1,024$ 1,290$ *Based on a range of recent HEP unit prices on the NYSE for valuation purposes. NYSE closing price on 3/15/16 was $31.39

HollyFrontier Corporation (NYSE: HFC) 2828 N. Harwood, Suite 1300 Dallas, Texas 75201 (214) 954-6510 www.hollyfrontier.com 32 Julia Heidenreich, VP, Investor Relations Craig Biery, Investor Relations investors@hollyfrontier.com 214-954-6510

APPENDIX 33

HOLLYFRONTIER INDEX 34 Please see p. 37 for disclaimer and www.HollyFrontier.com/investor-relations for most current version.

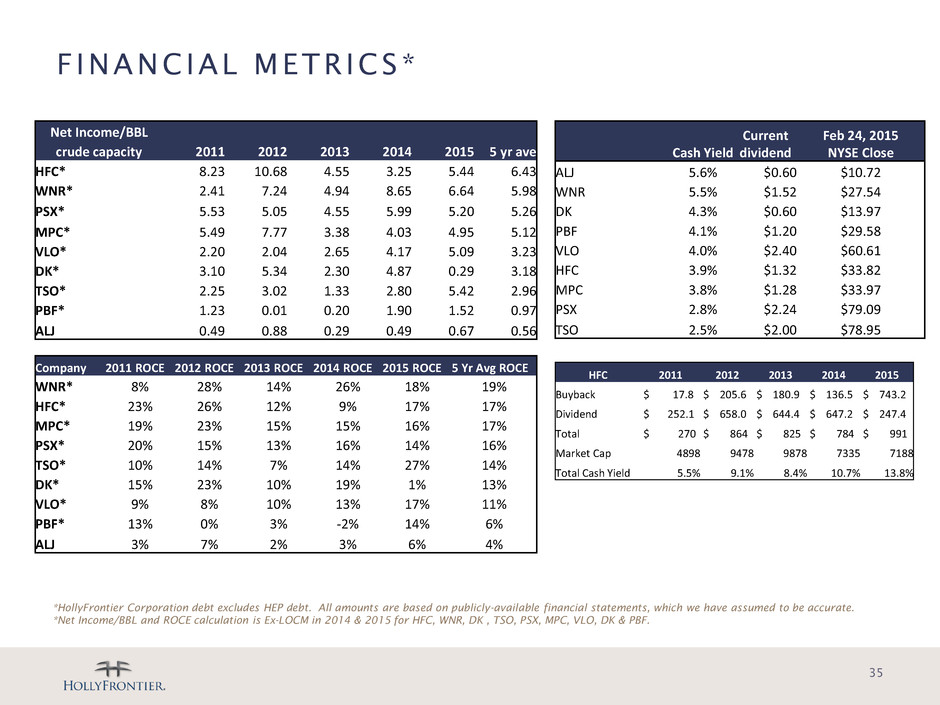

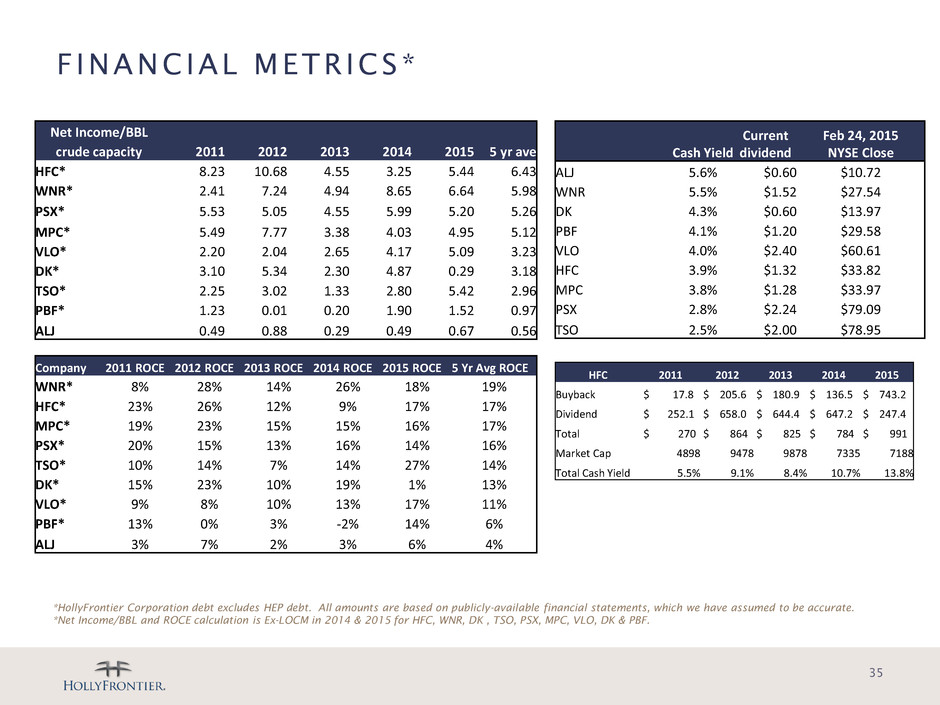

F INANCIAL METR ICS* 35 *HollyFrontier Corporation debt excludes HEP debt. All amounts are based on publicly-available financial statements, which we have assumed to be accurate. *Net Income/BBL and ROCE calculation is Ex-LOCM in 2014 & 2015 for HFC, WNR, DK , TSO, PSX, MPC, VLO, DK & PBF. HFC 2011 2012 2013 2014 2015 Buyback $ 17.8 $ 205.6 $ 180.9 $ 136.5 $ 743.2 Dividend $ 252.1 $ 658.0 $ 644.4 $ 647.2 $ 247.4 Total $ 270 $ 864 $ 825 $ 784 $ 991 Market Cap 4898 9478 9878 7335 7188 Total Cash Yield 5.5% 9.1% 8.4% 10.7% 13.8% Cash Yield Current dividend Feb 24, 2015 NYSE Close ALJ 5.6% $0.60 $10.72 WNR 5.5% $1.52 $27.54 DK 4.3% $0.60 $13.97 PBF 4.1% $1.20 $29.58 VLO 4.0% $2.40 $60.61 HFC 3.9% $1.32 $33.82 MPC 3.8% $1.28 $33.97 PSX 2.8% $2.24 $79.09 TSO 2.5% $2.00 $78.95 Net Income/BBL crude capacity 2011 2012 2013 2014 2015 5 yr ave HFC* 8.23 10.68 4.55 3.25 5.44 6.43 WNR* 2.41 7.24 4.94 8.65 6.64 5.98 PSX* 5.53 5.05 4.55 5.99 5.20 5.26 MPC* 5.49 7.77 3.38 4.03 4.95 5.12 VLO* 2.20 2.04 2.65 4.17 5.09 3.23 DK* 3.10 5.34 2.30 4.87 0.29 3.18 TSO* 2.25 3.02 1.33 2.80 5.42 2.96 PBF* 1.23 0.01 0.20 1.90 1.52 0.97 ALJ 0.49 0.88 0.29 0.49 0.67 0.56 Company 2011 ROCE 2012 ROCE 2013 ROCE 2014 ROCE 2015 ROCE 5 Yr Avg ROCE WNR* 8% 28% 14% 26% 18% 19% HFC* 23% 26% 12% 9% 17% 17% MPC* 19% 23% 15% 15% 16% 17% PSX* 20% 15% 13% 16% 14% 16% TSO* 10% 14% 7% 14% 27% 14% DK* 15% 23% 10% 19% 1% 13% VLO* 9% 8% 10% 13% 17% 11% PBF* 13% 0% 3% -2% 14% 6% ALJ 3% 7% 2% 3% 6% 4%

DEF IN IT IONS Non GAAP measurements: We report certain financial measures that are not prescribed or authorized by U. S. generally accepted accounting principles ("GAAP"). We discuss management's reasons for reporting these non-GAAP measures below. Although management evaluates and presents these non-GAAP measures for the reasons described below, please be aware that these non-GAAP measures are not alternatives to revenue, operating income, income from continuing operations, net income, or any other comparable operating measure prescribed by GAAP. In addition, these non-GAAP financial measures may be calculated and/or presented differently than measures with the same or similar names that are reported by other companies, and as a result, the non-GAAP measures we report may not be comparable to those reported by others. Refining gross margin or refinery gross margin: the difference between average net sales price and average product costs per produced barrel of refined products sold. Refining gross margin or refinery gross margin is a non-GAAP performance measure that is used by our management and others to compare our refining performance to that of other companies in our industry. This margin does not include the effect of depreciation, depletion and amortization. Other companies in our industry may not calculate this performance measure in the same manner. Our historical refining gross margin or refinery gross margin is reconciled to net income under the section entitled “Reconciliation to Amounts Reported Under Generally Accepted Accounting Principles” in HollyFrontier Corporation’s 2015 10-K filed February 24, 2016. Net Operating Margin: the difference between refinery gross margin and refinery operating expense per barrel of produced refined products. Net operating margin is a non-GAAP performance measure that is used by our management and others to compare our refining performance to that of other companies in our industry. This margin does not include the effect of depreciation, depletion and amortization. Other companies in our industry may not calculate this performance measure in the same manner. Our historical net operating margin is reconciled to net income under the section entitled “Reconciliation to Amounts Reported Under Generally Accepted Accounting Principles” in HollyFrontier Corporation’s 2015 10-K filed February 24, 2016. EBITDA: Earnings before interest, taxes, depreciation and amortization, which we refer to as EBITDA, is calculated as net income plus (i) interest expense net of interest income, (ii) income tax provision, and (iii) depreciation, depletion and amortization. EBITDA is not a calculation provided for under GAAP; however, the amounts included in the EBITDA calculation are derived from amounts included in our consolidated financial statements. EBITDA should not be considered as an alternative to net income or operating income as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. EBITDA is not necessarily comparable to similarly titled measures of other companies. EBITDA is presented here because it is a widely used financial indicator used by investors and analysts to measure performance. EBITDA is also used by our management for internal analysis and as a basis for financial covenants. Our historical EBITDA is reconciled to net income under the section entitled “Reconciliation to Amounts Reported Under Generally Accepted Accounting Principles” in HollyFrontier Corporation’s 2015 10-K filed February 24, 2016. Enterprise Value: calculated as market capitalization plus minority interest, plus preferred shares, plus net-debt, less MLP debt Free Cash Flow: Calculated by taking operating income and subtracting capital expenditures CAGR: The compound annual growth rate is calculated by dividing the ending value by the beginning value, raise the result to the power of one divided by the period length, and subtract one from the subsequent result. CAGR is the mean annual growth rate of an investment over a specified period of time longer than one year Debt-To-Capital: A measurement of a company's financial leverage, calculated as the company's long term debt divided by its total capital. Debt includes all long-term obligations. Total capital includes the company's debt and shareholders' equity. Return on Capital Employed / Return on Invested Capital: A measurement which for our purposes is calculated using Net Income divided by the sum of Total Equity and Long Term Debt. We consider ROCE to be a meaningful indicator of our financial performance, and we evaluate this metric because it measures how effectively we use the money invested in our operations. IDR: Incentive Distribution Rights BPD: the number of barrels per calendar day of crude oil or petroleum products. BPSD: the number of barrels per stream day (barrels of capacity in a 24 hour period) of crude oil or petroleum products. MMSCFD: million standard cubic feet per day. Solvent deasphalter / residuum oil supercritical extraction (“ROSE”): a refinery unit that uses a light hydrocarbon like propane or butane to extract non-asphaltene heavy oils from asphalt or atmospheric reduced crude. These deasphalted oils are then further converted to gasoline and diesel. The remaining asphaltenes are either sold, blended to fuel oil or blended with other asphalt as a hardener. Distributable Cash Flow: Distributable cash flow (DCF) is not a calculation based upon GAAP. However, the amounts included in the calculation are derived from amounts separately presented in HEP’s consolidated financial statements, with the exception of excess cash flows over earnings of SLC Pipeline, maintenance capital expenditures and distributable cash flow from discontinued operations. Distributable cash flow should not be considered in isolation or as an alternative to net income or operating income as an indication of HEP’s operating performance or as an alternative to operating cash flow as a measure of liquidity. Distributable cash flow is not necessarily comparable to similarly titled measures of other companies. Distributable cash flow is presented here because it is a widely accepted financial indicator used by investors to compare partnership performance. We believe that this measure provides investors an enhanced perspective of the operating performance of HEP’s assets and the cash HEP is generating. HEP’s historical net income is reconciled to distributable cash flow in "Item 6. Selected Financial Data" of HEP's 2015-10-K. 36

HFC INDEX D ISCLOSURE The data on p. 34 is for informational purposes only and is not reflective or intended to be an indicator of HollyFrontier's past or future financial results. This data is general industry information and does not reflect prices paid or received by HFC. The data was compiled from publicly available information, various industry publications, other published industry sources, including OPIS, and our own internal data and estimates. Although this data is believed to be reliable, HFC has not had this information verified by independent sources. HFC does not make any representation as to the accuracy of the data and does not undertake any obligation to update, revise or continue to provide the data. HFC's actual pricing and margins may differ from benchmark indicators due to many factors. For example: - Crude Slate differences – HFC runs a wide variety of crude oils across its refining system and crude slate may vary quarter to quarter. - Product Yield differences – HFC’s product yield differs from indicator and can vary quarter to quarter as a result of changes in economics, crude slate, and operational downtime. - Other differences including but not limited to secondary costs such as product and feedstock transportation costs, purchases of environmental credits, quality differences, location of purchase or sale, and hedging gains/losses. Moreover, the presented indicators are generally based on spot sales, which may differ from realized contract prices. Market prices are available from a variety of sources, each of which may vary slightly. Please note that this data may differ from other sources due to adjustments made by data providers and due to differing data definitions. Below are indicator definitions used for purposes of this data. MidCon Indicator: (100% Group 3: Sub octane and ULSD) – WTI Rockies Indicator: 63% Cheyenne: ((100% Denver Regular Gasoline; 100% Denver ULSD) – WTI) 37% Woods Cross: ((60% Salt Lake City Regular Gasoline, 40% Las Vegas Regular Gasoline; 80% Salt Lake City ULSD, 20% Las Vegas ULSD) – WTI) 2013 Southwest Indicator: (50% El Paso Subgrade Gasoline, 50% Phoenix CBG; 50% El Paso ULSD, 50% Phoenix ULSD) – WTI 2011 - 2012 Southwest Indicator: (50% El Paso Regular Gasoline, 50% Phoenix CBG; 50% El Paso ULSD, 50% Phoenix ULSD) – WTI 37