Exhibit 99.3

Humana Inc. Fourth Quarter 2024 Prepared Management Remarks 2/11/2025

Please view these remarks in conjunction with our 4Q 2024 earnings release that can be found on our website at www.humana.com under the Investors section, or via the following link: https://humana.gcs-web.com/financial-information/quarterly-results.

We also invite you to listen to our live question and answer webcast with our President and Chief Executive Officer, Jim Rechtin, Chief Financial Officer, Celeste Mellet, and President of Insurance, George Renaudin, which will begin today at 9:00 a.m. Eastern Time and will be available at via the following link: https://humana.gcs-web.com/events-and-presentations/upcoming-events. For those unable to listen to the live event, the archive will be available in the Historical Webcasts and Presentations section of the Investor Relations page via the following link: https://humana.gcs-web.com/events-and-presentations.

Cautionary Statement

Certain of the matters discussed in these prepared remarks are forward-looking and are subject to a number of risks, uncertainties and assumptions. Actual results could differ materially.

Investors are advised to read the detailed risk factors discussed in our latest Form 10-K, our other filings with the Securities and Exchange Commission, and our 4Q 2024 earnings release as they relate to forward-looking statements along with other risks discussed in our SEC filings. We undertake no obligation to publicly address or update any forward-looking statements in future filings or communications regarding our business or results.

Today’s release, our historical financial news releases and our filings with the SEC are all also available on our Investor Relations site.

These remarks include financial measures that are not in accordance with generally accepted accounting principles, or GAAP.

Management's explanation for the use of these non-GAAP measures and reconciliations of GAAP to non-GAAP financial measures are included in today’s release which can be found via the following link: https://humana.gcs-web.com/financial-information/quarterly-results.

Finally, any references to earnings per share or EPS made within these remarks refer to diluted earnings per common share.

Exhibit 99.3

Humana Inc. Fourth Quarter 2024 Prepared Management Remarks 2/11/2025

Key Messages

•Achieved 2024 Adjusted EPS of $16.21, in line with our guidance, and reaffirmed 2025 outlook of ‘at least in line with 2024 results’

o2025 Adjusted EPS guidance of ‘approximately $16.25’, inclusive of incremental investments to support operational excellence as we prioritize sustainable, long-term value creation

•Solid finish to 2024, reporting 4Q Adjusted net loss per share of $2.16, in line with expectations and inclusive of incremental investments in Stars

o4Q Insurance segment Adjusted benefit ratio of 91.9%, which includes a 20-basis point increase related to incremental Stars investments, was consistent with expectations

oGrew individual Medicare Advantage (MA) membership over 250,000 or approximately 5% in 2024, while taking incremental pricing action to mitigate reimbursement pressure

•Committed to achieving individual MA pretax margin of ‘at least 3%’ over time

oIntend to improve underlying margins annually through operational improvements and pricing strategies, including targeted Stars mitigation actions

oAcknowledge risk in achieving ‘at least 3%’ by 2027 driven by uncertainty in pace of Stars recovery

•2025 represents a critical step on our margin expansion journey, with a focus on:

oResetting MA pricing and membership to improve underlying margins

Remain confident in our expectation that MA pricing will drive the intended underlying margin improvement

Anticipate full year Individual MA membership losses of approximately 550,000, inclusive of impact of exiting certain unprofitable plans and counties

Remain confident in our pricing strategy as we prioritize membership that is expected to drive sustainable, long-term value creation

oContinue efforts to strengthen our Stars program with initiatives expected to impact across key measures as we focus on a return to an industry leading position

Acknowledge that risk remains regarding our overall 2026 Star results (payment year 2027) given the limited timeframe to impact results post receipt of the 2025 Star results (payment year 2026)

oInvesting to improve member and patient outcomes and support operational excellence, positioning the company for long-term success

oContinue to advance Medicaid and CenterWell strategies, which are expected to drive increased earnings contribution over the mid and longer term as they mature through their respective J curves

Expanded Medicaid footprint, which now spans 13 states, including the recent intents to award in Georgia and Texas (subject to clearing state protest process); executed a Virginia contract with implementation expected in 2025

Medicaid progress is important for our long-term strategy given linkage of Medicare and Medicaid programs for dually eligible populations (D-SNP), and is emerging as a strong, scaled business with meaningful earnings potential

Solid growth expected in CenterWell Primary Care through center adds and expansion of our Independent Physician Association (IPA) model, adding 20 to 30 clinics and 30,000 to 50,000 patients

•We have conviction that the strong core fundamentals and growth outlook for MA and value-based care remain intact

oBelieve that Humana’s platform, unique focus on MA, and expanding CenterWell and Medicaid capabilities will allow us to compete effectively, drive better outcomes for members and patients, and deliver compelling shareholder value over the long-term

Exhibit 99.3

Humana Inc. Fourth Quarter 2024 Prepared Management Remarks 2/11/2025

Fourth Quarter and Full Year 2024 Results

Today, Humana reported fourth quarter Adjusted net loss per share of $2.16, consistent with expectations. Our results were underpinned by solid performance across the Insurance and CenterWell segments and are inclusive of additional investments in Stars to support long term value creation, as previously disclosed. The fourth quarter Insurance segment Adjusted benefit ratio of 91.9%, which includes a 20-basis point increase from incremental Stars investments, was consistent with expectations.

We are pleased to deliver full year 2024 Adjusted EPS and Insurance segment benefit ratio results in line with our initial guidance while also making incremental investments to position the company for long term success. In addition, we grew our individual MA membership over 250,000, or approximately 5%, while taking incremental pricing action to mitigate reimbursement pressure, and further expanded our Medicaid footprint which now covers 13 states. Finally, we advanced our integrated health strategy during 2024 with further expansion of our CenterWell platform, including the addition of 48 centers and nearly 100,000 patients in our Primary Care business representing growth of approximately 16% and 33%, respectively.

2025 Outlook

2025 represents a critical step on our margin expansion journey. Our 2025 MA pricing strategy was focused on resetting pricing and membership to more accurately reflect the funding and medical cost trend environment, improving underlying margins. We assessed the needs and benefit preferences of various consumer segments, the current and expected profitability of our offerings and greatest opportunities for attractive membership growth, making targeted plan and county exits if we did not see a path to sustainable profitability over a reasonable timeframe. Importantly, we remain confident in our expectation that our 2025 MA pricing will drive the intended underlying margin improvement contemplated in bids. From a membership perspective, we now anticipate full year Individual MA membership losses of approximately 550,000, inclusive of plan and county exits. See additional discussion of our 2025 MA membership expectations below.

The path to achieving compelling margins in individual MA is a multi-year process. We are investing in the near term to improve member outcomes and support operational excellence which, when combined with disciplined pricing, is expected to lead to high quality membership growth that will drive compelling returns for our shareholders over the long term. As previously discussed, we are planning to invest in 2025 to further strengthen our operating performance in areas including Stars, supporting clinical excellence and operating efficiencies, among others. These investments, while limiting margin expansion and earnings growth in the near term, position us for structural operational improvement, profitable growth and long-term value creation. Currently, we anticipate incremental investments of ‘a few hundred million’ dollars in these key drivers of the business in 2025. We will be disciplined and data driven in our investment decisions. As a result, the actual level of and timing of investments will be informed by early returns achieved and therefore may be adjusted throughout the year.

Exhibit 99.3

Humana Inc. Fourth Quarter 2024 Prepared Management Remarks 2/11/2025

Accordingly, today we provided Adjusted EPS guidance for 2025 of ‘approximately $16.25’, inclusive of the investments described above, which is consistent with our previous commentary of ‘at least in line with 2024 results’. Our guidance assumes consolidated revenue in a range of $126 to $128 billion, reflecting approximately 8% year over year growth at the midpoint. Expected 2025 consolidated revenue growth is impacted by anticipated high single digit premium yield in our individual MA business, driven in large part by an increased direct subsidy due to the IRA, along with growth in Medicaid, Stand-Alone Part D (PDP), and agnostic activity in our CenterWell segment. These increases are partially offset by the expected reduction in individual MA membership, reimbursement headwinds in our Primary Care business, and a reduction in investment income.

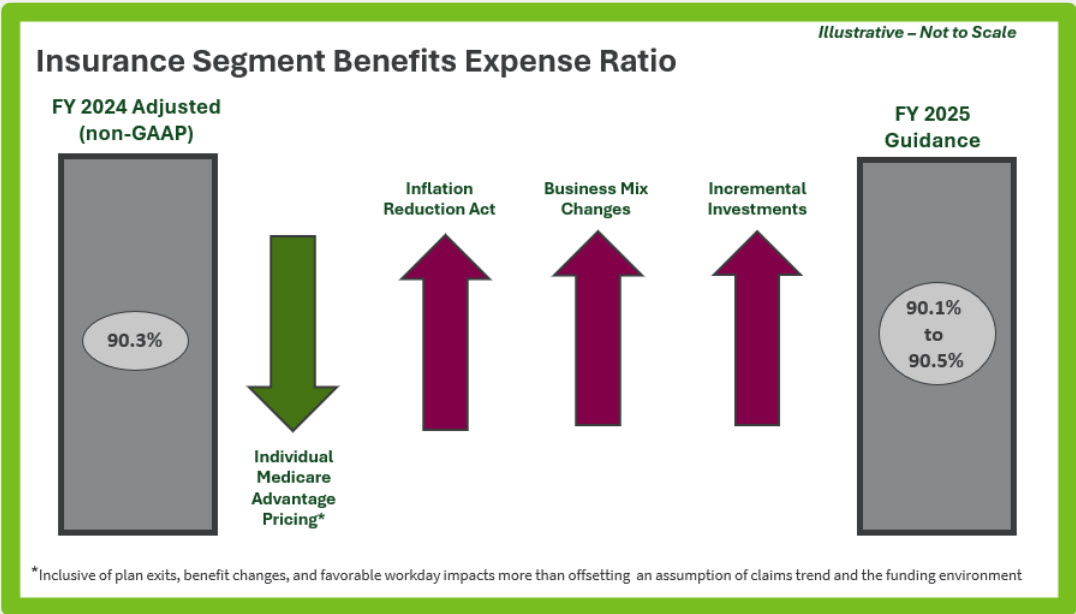

With respect to medical costs, we anticipate a full year 2025 Insurance Segment benefit ratio in a range of 90.1% to 90.5% compared to the 2024 Adjusted ratio of 90.3%. Individual MA is expected to see an improving benefit ratio year over year, with plan exits, benefit changes, and favorable workday impacts more than offsetting the impact of IRA, our assumption of claims trend, the funding environment and incremental investments. In PDP, we expect the benefit ratio to increase several hundred basis points year over year driven by IRA changes. In addition, business mix puts upward pressure on the Insurance segment benefit ratio due to reductions in individual MA membership and growth in PDP and Medicaid. (see Appendix A) Finally, we anticipate our consolidated benefit ratio will be in line with the Insurance benefit ratio for the full year.

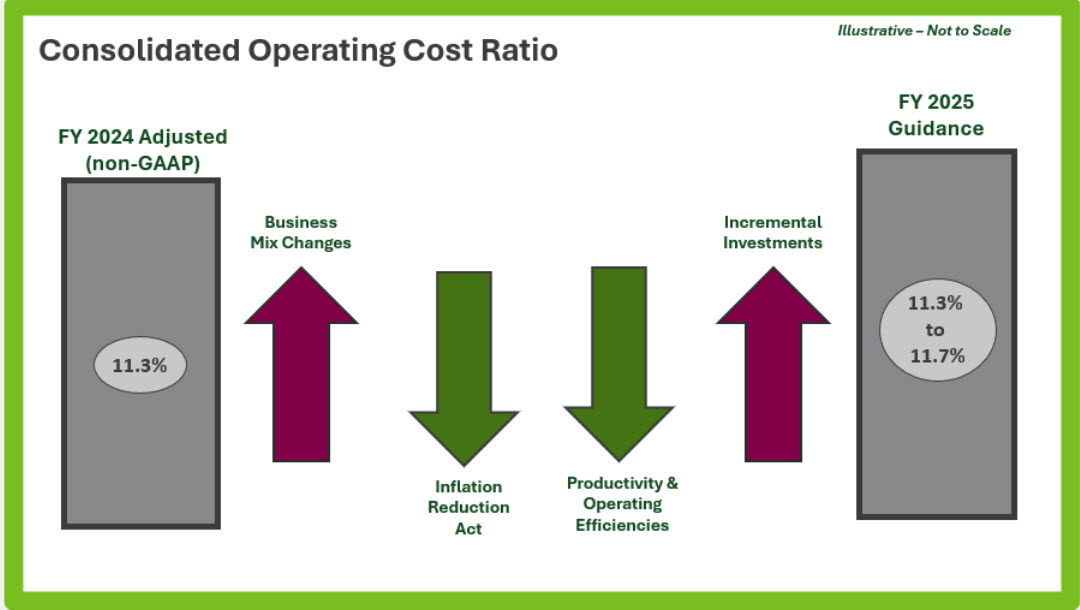

We anticipate the consolidated operating cost ratio to be in a range of 11.3% to 11.7% for 2025, an increase of 20 basis points at the mid-point from the Adjusted operating cost ratio of 11.3% in 2024. This increase is primarily driven by business mix changes, including within our CenterWell segment which runs a significantly higher operating cost ratio than our Insurance segment, along with the incremental investments described above, a portion of which is expected to impact operating expenses. These increases are partially offset by the impact of the IRA, as well as our ongoing focus on driving sustainable value creation from productivity and operating efficiencies. (see Appendix A)

Turning to earnings seasonality. As discussed above, the actual level of and timing of incremental investments will be informed by early returns achieved and therefore may be adjusted throughout the year. At this time, we expect first quarter earnings to be approximately 60% to 65% of expected full year 2025 Adjusted earnings and anticipate that the first quarter Insurance segment benefit ratio will be approximately 87.5%. The higher than historical earnings contribution expected in the first quarter is primarily driven by the impacts of the IRA, benefit changes (including the addition of deductibles), and favorable year over year workday seasonality.

Individual MA Membership

Turning to MA membership growth. We expect full-year individual MA membership losses of approximately 550,000 in 2025, compared to our previous commentary of ‘down a few hundred thousand members’. Membership losses are driven in part by our decision to exit certain unprofitable plans and counties, which impacted approximately 560,000 members. The greater than previously anticipated full year membership loss is expected to be largely driven by a slightly lower recapture rate for members affected by plan exits, along with higher than expected D-SNP attrition. Given the

Exhibit 99.3

Humana Inc. Fourth Quarter 2024 Prepared Management Remarks 2/11/2025

change in special election period (SEP) rules for D-SNP members in 2025, there is more uncertainty in the rest of year membership activity than is typical. We believe we have been prudent in the assumptions utilized in our full year membership outlook and will monitor actual experience closely.

As we focus our efforts on driving high quality membership growth, we have been pleased to see strong year to date performance in markets with a concentration of our best performing value-based partners including Florida, Illinois and Texas (excluding plan exits). Further, we are seeing a higher than historical percentage of our non-DSNP sales coming from individuals switching from peer MA plans. This activity reflects the strength of Humana’s value proposition, which goes beyond benefit value and includes our best-in-class customer service and integrated health strategy oriented to driving better health outcomes.

Importantly, we remain confident in our pricing strategy as we prioritize serving membership which will drive sustainable, long-term value creation.

Group MA

We expect group MA membership to be relatively flat year over year as we maintain pricing discipline in a competitive market. Given the group MA pricing cycles, we anticipate continued margin pressure in 2025. We remain focused on improving Group MA margins through renewal cycles to reflect the current reimbursement levels and cost trends, with the opportunity to significantly improve performance through pricing action in 2026 and beyond.

Stand Alone Part D (PDP)

We were disciplined in the pricing and design of our PDP products for 2025 recognizing increased plan liability due to the IRA changes. Further, we are participating in the PDP Premium Stabilization Demonstration which limits the maximum amount of member premium increase, while narrowing the risk corridors and increasing the direct subsidy paid to plan sponsors.

We now expect net PDP membership growth of approximately 200,000 versus our previous expectation of largely flat membership. The improved expectations are largely driven by shifting competitive dynamics.

Turning to our PDP margin outlook, while we priced for positive margins in 2025, we are taking a conservative approach to guidance given the magnitude of IRA changes implemented this year. We will closely monitor PDP performance over the course of the year and adjust expectations as appropriate based on performance.

Finally, we are enhancing enterprise value from our PDP plans by driving increased mail order pharmacy usage and conversions to MA.

Medicaid

In our Medicaid business, we are successfully expanding our footprint organically, including our recent “intent to award” wins in Georgia and Texas (subject to clearing state protest process), which brought our total awarded footprint to 13 states. We look forward to begin serving members in Virginia later this year, bringing our total Medicaid active

Exhibit 99.3

Humana Inc. Fourth Quarter 2024 Prepared Management Remarks 2/11/2025

footprint to 10 states, with the Michigan Fully Integrated Dual Eligible (FIDE) contract on track to be implemented in January of 2026 driving our total to 11 active states. While the Texas and Georgia awards remain under protest, we are optimistic that these programs will move forward in 2026. Further, we have a bid outstanding in Illinois and are investing in our business development capabilities. We are pursuing priority states and advancing our Medicaid capabilities and growth prospects – leaning into enterprise innovation, existing community presence, and best practices. For context, our recent organic growth is unprecedented within the Medicaid industry, where incumbent MCOs have historically had a strong advantage over new entrants. In the last two years, Humana has launched or been awarded Medicaid plans in eight new states.

From a membership perspective, we currently anticipate growth of 175,000 to 250,000 members in 2025, representing an increase of approximately 16% at the midpoint, largely driven by the expected implementation of the Virginia contract and an additional membership allocation in Kentucky.

While we are excited about our historical and prospective growth opportunities, we are also focused on ensuring both operational and financial discipline. Notably, six of our ten active states have been operating less than 3 years with this cohort comprising approximately 45% of our 2025 Medicaid revenue; typically, it takes a newly added state a few years to reach break-even and eventually industry-standard margins. Florida is our most mature contract and has margins consistent with industry standards. We expect margin progression to align with industry levels as our business mix matures. In addition, we are working closely with our state and industry partners to ensure 1) rates reflect the acuity level of members maintaining coverage, and 2) rates in newly implemented states are updated to reflect recent trend experience. States have been generally receptive and collaborative. All in, we anticipate modest improvement in our Medicaid margin in 2025.

Tricare

Humana Military successfully transitioned to the new T-5 contract, which went live on January 1st, 2025. We are meeting or exceeding contract expectations in critical areas such as access to care, beneficiary service, enrollment, billing, and referrals. We are pleased with our ongoing collaborative partnership with the Defense Health Agency and honored to be able to serve approximately 4.6 million active-duty military, families, and retirees in the TRICARE East Region in 2025.

CenterWell

Primary Care

Our multi payer Primary Care platform is key to our integrated value-based care strategy, creating value for our members and patients, and is expected to meaningfully contribute to enterprise earnings over time. We intend to continue to scale our platform through a combination of new center adds, patient growth and expansion of our IPA business, as we look to strategically grow our IPA affiliate footprint in additional states where we already operate centers.

Exhibit 99.3

Humana Inc. Fourth Quarter 2024 Prepared Management Remarks 2/11/2025

Our IPA business allows the Primary Care Organization (PCO) to support affiliate practices through a multi payer portfolio of senior value-based contracts, enabling these practices to succeed in value-based care by leveraging our data and analytics infrastructure, clinical programs, and engagement model. Further, the current regulatory and funding environment has created opportunities as certain smaller provider groups have challenges adapting to the dynamic environment. We have been opportunistic, focusing on high value transactions in 2024, as evidenced by our lease agreement with Walmart to take over certain Walmart Health locations, as well as the addition of 41 centers in the fourth quarter through multiple highly attractive acquisitions. We anticipate exploring similar opportunities in 2025. All in, we expect to add approximately 20 to 30 centers in 2025, with a focus on scaling our Primary Care portfolio in key geographies.

From a patient panel perspective, we expect 2025 net patient growth of 30,000 to 50,000, reflecting approximately 10% growth at the midpoint, driven by organic growth, M&A, and additional growth with Original Medicare as a part of our ACO Reach program. We are excited about the recent launch of a new patient onboarding experience where new PCO patients that are also Humana health plan members have a more simplified onboarding experience – both prior to and during their visit to a center, eliminating paperwork and friction for both the patient and the provider. This is one example of our broader efforts to create a simpler experience through our integrated health strategy, contributing to 120 basis point improvement in voluntary termination rate (VTR) for Humana health plan members who are seen by the PCO across all markets.

Year-over-year we anticipate largely flat margins in our PCO business. The headwinds created by the continued phase in of v28 and addition of centers at various stages of maturation are expected to be offset by (1) advancement of our ongoing v28 mitigation activities, and (2) further maturation of our centers which are progressing through the J curve. We still anticipate we will largely mitigate the ultimate impact of the risk model changes over the three-year phase in through a multi-pronged plan including numerous operational efficiencies such as centralizing and streamlining administrative functions, standardizing the clinic operating model, and improving clinician productivity to increase capacity.

Home

In the Home, we expect further expansion of our value-based home care models. During 2025, OneHome will continue to pursue novel value-based home health care with the expectation of growing members in some form of value-based home health model by greater than 15% through innovative payment models and additional expansion of our CenterWell partnerships. These arrangements align incentives between the health plan and the home health provider, driving better coordination, lower cost, and a better experience and health outcomes for the patient. As an example, through OneHome’s collaborative value-based model with CenterWell Primary Care in Florida and Texas in 2024, CenterWell Home Health successfully drove a relative reduction in length of stay of greater than 15% and an absolute decrease in recertification rates by greater than 10% versus baseline while maintaining consistent clinical outcomes performance, such as 60-day admission rates.

Exhibit 99.3

Humana Inc. Fourth Quarter 2024 Prepared Management Remarks 2/11/2025

Within our CenterWell Home Health fee for service business, we anticipate a ‘mid to high’ single digit increase in home health admissions year over year. Further, we continue our comprehensive initiative to drive productivity and efficiency within our home operating model to offset reimbursement pressure. Our efforts are aimed at reducing overhead both through simplifying our home health organizational structure and centralizing and streamlining key functions. Examples of this important work include consolidating branch locations to reduce operating expense while maintaining broad geographic coverage, introducing technology to simplify the referral process, and the launching of AI solutions to improve clinical documentation and reduce administrative tasks for our clinicians.

Pharmacy

Our CenterWell Pharmacy business expects to sustain industry leading mail order penetration for Humana health plan members in 2025. In addition, we are focused on expanding our agnostic client base and anticipate strong growth in our agnostic volume this year driven by new and existing client growth.

Within Humana Pharmacy Solutions, our Pharmacy Benefit Manager (PBM) business, we remain focused on providing convenient and affordable access to medications for Humana health plan members. As a reminder, our PBM fees are not linked to drug prices. Further, our PBM activity is intercompany and is reported and eliminated within our Insurance segment.

Net Investment Income

In 2025, we anticipate a high single digit percentage reduction in investment income driven by the cumulative impact of rate cuts in 2024 and further rate reductions expected throughout this year. In addition, we expect interest expense to be largely consistent year over year. Collectively, net investment income is expected to be down approximately $100 million year over year.

Capital Deployment

We will remain prudent in our near-term capital deployment approach as we fully assess our Stars mitigation plans and until we have better visibility into the final 2026 MA funding environment and our MA pricing strategy. As a result, our current 2025 outlook does not contemplate share repurchase activity. We will re-evaluate our capital deployment plans throughout the year, taking a balanced approach to evaluating capital investments and returns.

Further, we are evaluating optimal timing to execute on the call option for the first cohort of 18 clinics built in 2020 as part of the WCAS joint venture. The call period begins June 30, 2025, and continues for one year.

Finally, we intend to maintain our dividend flat year over year on a per share basis throughout 2025.

Stars Program

As previously shared, we are focused on returning to an industry leading Stars position as quickly as possible and have initiatives underway to improve performance for measures that have not kept pace with the industry. Areas of

Exhibit 99.3

Humana Inc. Fourth Quarter 2024 Prepared Management Remarks 2/11/2025

focus include enhancing member and provider engagement strategies and incentive programs, improving customer experience, optimizing vendor relationships, and strengthening technology integrations to support operational excellence.

2026 Stars (payment year 2027) results will be released by CMS in October 2025, with calendar year 2024 as the measurement period for most measures. As you know, our overall 2026 Star ratings will be determined by (1) our performance and (2) peer performance and the resulting industry cut points. With respect to our performance, given the higher than anticipated industry cut points for 2025 Stars (payment year 2026), we invested in the final months of 2024 to accelerate our performance on impactable 2026 Star measures through year end and were pleased to see our efforts yield positive results. However, the industry cut points remain unknown and we had a limited timeframe to impact results post receipt of the 2025 Star results. As a result, risk remains regarding our overall 2026 Star results.

Looking ahead to 2027 Stars (payment year 2028), the measurement period is calendar year 2025 for most measures. We set our targets with the goal of having an appropriate buffer between our performance and the expected industry cut points to provide increased confidence in our ability to recover to an industry leading position. We are working to ensure we achieve the performance targets set for all 2027 Stars measures, and we have enhanced our internal governance and performance reporting to increase visibility across the enterprise.

Closing

We had a solid finish to 2024 in a dynamic environment and were pleased to provide initial 2025 Adjusted EPS guidance consistent with our previous commentary. Looking forward, we remain committed to returning to industry leading Stars performance and achieving individual MA pretax margin of ‘at least 3%’. 2025 represents a critical step on this margin expansion journey. We reset our MA pricing and membership to improve underlying margins and are investing to improve member outcomes and support operational excellence, positioning the company for long-term success. In addition, we are advancing our Medicaid and CenterWell strategies which are expected to drive increased earnings contribution over the mid and longer term as they mature through their respective J curves.

We have conviction that the strong core fundamentals and growth outlook for MA and value-based care remain intact and that Humana’s platform, unique focus on MA, and expanding CenterWell and Medicaid capabilities will allow us to compete effective, drive better outcomes for our members and patients, and deliver compelling shareholder value over the long term.

We appreciate your ongoing support and look forward to providing further updates in the coming months.

Jim Rechtin, President and Chief Executive Officer

Celeste Mellet, Chief Financial Officer

Exhibit 99.3

Humana Inc. Fourth Quarter 2024 Prepared Management Remarks 2/11/2025

Appendix A

Exhibit 99.3

Humana Inc. Fourth Quarter 2024 Prepared Management Remarks 2/11/2025