2009

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 40-F

| ¨ | Registration Statement pursuant to section 12 of the Securities Exchange Act of 1934 |

| x | Annual report pursuant to section 13(a) or 15(d) of the Securities Exchange Act of 1934 |

| | |

| For the fiscal year ended December 31, 2009 | | Commission File Number: 001-04307 |

Husky Energy Inc.

(Exact name of Registrant as specified in its charter)

| | | | |

Alberta, Canada | | 1311 | | Not Applicable |

| (Province or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Numbers (if applicable)) | | (I.R.S. Employer Identification Number (if applicable)) |

707-8th Avenue S.W., P.O. Box 6525 Station D, Calgary, Alberta, Canada T2P 3G7

(403) 298-6111

(Address and telephone number of Registrant’s principal executive office)

CT Corporation System, 111 Eighth Avenue, New York, New York 10011

(212) 894-8400

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Class: None

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Title of Class: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Title of Class: Debt Securities

The Registrant is a “voluntary filer” and files annual reports on Form 40-F, amendments to such reports and furnishes information on Form 6-K to the Securities and Exchange Commission, pursuant to its obligations under its Indentures dated June 14, 2002 and September 11, 2007 relating to its debt securities issued thereunder.

For annual reports, indicate by check mark the information filed with this Form:

| | |

| x Annual information form | | x Audited annual financial statements |

Number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 849,860,935

Common Shares outstanding as of December 31, 2009

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (s.232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

The Annual Report on Form 40-F shall be incorporated by reference into or as an exhibit to, as applicable, the Registrant’s Registration Statement under the Securities Act of 1933: Form F-9 File No. 333-157389.

Principal Documents

The following documents have been filed as part of this Annual Report on Form 40-F:

| A. | Annual Information Form |

The Annual Information Form of Husky Energy Inc. (“Husky” or “the Company”) for the year ended December 31, 2009 is included as Document A of this Annual Report on Form 40-F.

| B. | Audited Annual Financial Statements |

Husky’s audited consolidated financial statements for the year ended December 31, 2009 and 2008, including the auditor’s report with respect thereto, is included as Document B of this Annual Report on Form 40-F. The reconciliation of Husky’s audited consolidated financial statements to accounting principles generally accepted in the United States is included as Document C of this Annual Report on Form 40-F. In addition, see the “Disclosure about Oil and Gas Producing Activities — Accounting Standards Codification 932, “Extractive Activities — Oil and Gas” in the Annual Information Form included as Document A of this Annual Report on Form 40-F.

| C. | Reconciliation to Accounting Principles Generally Accepted in the United States |

The reconciliation of Husky’s audited consolidated financial statements to accounting principles generally accepted in the United States is included as Document C of this Annual Report on Form 40-F. In addition, see the “Disclosure about Oil and Gas Producing Activities — Accounting Standards Codification 932, “Extractive Activities — Oil and Gas” in the Annual Information Form included as Document A of the Annual Report on Form 40-F.

| D. | Management’s Discussion and Analysis |

Husky’s Management’s Discussion and Analysis for the year ended December 31, 2009 is included as Document D of this Annual Report on Form 40-F.

Certifications

See Exhibits 23.1, 23.2, 31.1, 31.2, 32.1 and 32.2, which are included as Exhibits to this Annual Report on Form 40-F.

Controls and Procedures

See the section “Controls and Procedures” in Husky’s Management’s Discussion and Analysis for the year ended December 31, 2009 which is included as Document D to this Annual Report on Form 40-F.

Management’s Annual Report on Internal Control Over Financial Reporting

The required disclosure is included in “Management’s Report” that accompanies Husky’s consolidated financial statements for the year ended December 31, 2009, which is included as Document B to this Annual Report on Form 40-F.

Attestation Report of the Registered Public Accounting Firm

The required disclosure is included in “Auditors’ Report to the Shareholders” that accompanies Husky’s consolidated financial statements for the year ended December 31, 2009, which is included as Document B to this Annual Report on Form 40-F.

Page ii

Changes in Internal Control Over Financial Reporting

The required disclosure is included in the section “Controls and Procedures” in Husky’s Management’s Discussion and Analysis for the year ended December 31, 2009, which is included as Document D to this Annual Report on Form 40-F.

Notice Pursuant to Regulation BTR

Not Applicable.

Audit Committee Financial Expert

The Board of Directors of Husky has determined that R. Donald Fullerton is an “audit committee financial expert” (as defined in paragraph 8(b) of General Instruction B to Form 40-F) serving on its Audit Committee. Pursuant to paragraph 8(a)(2) of General Instruction B to Form 40-F, the Board has applied the definition of independence applicable to the audit committee members of New York Stock Exchange listed companies. Mr. Fullerton is a corporate director and is independent under the New York Stock Exchange standard. For a description of Mr. Fullerton’s relevant experience in financial matters, see Mr. Fullerton’s five year history in the section “Directors and Officers” and in the section “Audit Committee” in Husky’s Annual Information Form for the year ended December 31, 2009, which is included as Document A of this Annual Report on Form 40-F.

Code of Business Conduct and Ethics

Husky’s Code of Ethics is disclosed in its Code of Business Conduct, which is applicable to its principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions and all its other employees, and is posted on its website atwww.huskyenergy.com. In the fiscal year ended December 31, 2009, there have been no amendments to Husky’s Code of Ethics, nor has Husky granted a waiver including an implicit waiver from a provision of its Code of Ethics. In the event that, during Husky’s ensuing fiscal year, Husky:

| | i. | amends any provision of its Code of Business Conduct that applies to its principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions that relates to any element of the code of ethics definition enumerated in paragraph (9)(b) of General Instruction B to Form 40-F, or |

| | ii. | grants a waiver, including an implicit waiver, from a provision of its Code of Business Conduct to any of its principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions that relates to one or more of the items set forth in paragraph (9)(b) of General Instruction B to Form 40-F. |

Husky will promptly disclose such occurrences on its website following the date of such amendment or waiver and will specifically describe the nature of any amendment or waiver, and in the case of a waiver, name the person to whom the waiver was granted and the date of the waiver.

Principal Accountant Fees and Services

See the section “Audit Committee” in the Annual Information Form for the year ended December 31, 2009, which is included as Document A to this Annual Report on Form 40-F.

Off-Balance Sheet Arrangements

See the section “Off-Balance Sheet Arrangements” in Husky’s Management’s Discussion and Analysis for the year ended December 31, 2009, which is included as Document D to this Annual Report on Form 40-F.

Page iii

Disclosure of Contractual Obligations

See the section “Contractual Obligations and Other Commercial Commitments” in Husky’s Management’s Discussion and Analysis for the year ended December 31, 2009, which is included as Document D to this Annual Report on Form 40-F.

Identification of the Audit Committee

Husky has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The members of the audit committee are: R.D. Fullerton, M.J.G. Glynn, C. S. Russel and W. Shurniak.

Page iv

Undertaking and Consent to Service of Process

Undertaking

Husky undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

Consent to Service of Process

A Form F-X signed by Husky and its agent for service of process has been filed with the Commission together with Forms F-9 (333 - 137211), (333 - 157389) and (333 - 89714) in connection with its debt securities registered on such forms.

Any change to the name or address of the agent for service of process of Husky shall be communicated promptly to the Commission by an amendment to the Form F-X referencing the file number of Husky.

Signatures

Pursuant to the requirements of the Exchange Act, Husky Energy Inc. certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereto duly authorized.

Dated this 24th day of February, 2010

| | |

| Husky Energy Inc. |

| |

By: | | /s/ JOHN C.S. LAU |

| Name: | | John C.S. Lau |

| Title: | | President & Chief Executive Officer |

| |

By: | | /s/ JAMES D. GIRGULIS |

| Name: | | James D. Girgulis |

| Title: | | Vice President, Legal & Corporate Secretary |

Page v

Document A

Form 40-F

Annual Information Form

For the Year Ended December 31, 2009

Husky Energy Inc.

Annual Information Form

For the Year Ended December 31, 2009

February 24, 2010

TABLE OF CONTENTS

In this Annual Information Form the term “Husky,” “we,” “our,” “us,” and “the Company,” means Husky Energy Inc. and its subsidiaries and partnership interests on a consolidated basis including information with respect to predecessor corporations.

Unless otherwise indicated, all financial information is in accordance with accounting principles generally accepted in Canada. Unless otherwise indicated, gross reserves or gross production are reserves or production attributable to Husky’s interest prior to deduction of royalties; net reserves or net production are reserves or production net of such royalties. Gross or net production reported refers to sales volume, unless otherwise indicated. Natural gas volumes are converted to a barrels of oil equivalent (“boe”) basis using the ratio of six thousand cubic feet (“mcf”) of natural gas to one barrel (“bbl”) of oil and natural gas liquids. Unless otherwise indicated, oil and gas commodity prices are quoted after the effect of hedging gains and losses. Natural gas volumes are stated at the official temperature and pressure basis of the area in which the reserves are located. The calculation of boe and thousands of cubic feet equivalent (“mcfge”) are based on a conversion rate of six mcf to one bbl.

Page 3

The Company has disclosed discovered petroleum initially-in-place in this Annual Information Form. Discovered petroleum initially-in-place is that quantity of petroleum that is estimated, as of a given date, to be contained in known accumulations prior to production. The recoverable portion of discovered petroleum initially-in-place includes production, reserves and contingent resources; the remainder is unrecoverable. A recovery project cannot be defined for these volumes of discovered petroleum initially-in-place at this time. There is no certainty that it will be commercially viable to produce any portion of the resources.

Cautionary Note to U.S. Investors

The United States Securities and Exchange Commission (“SEC”) permits U.S. oil and gas companies, in their filings with the SEC, to separately disclose proved, probable and possible reserves that have been determined in accordance with SEC rules. Husky uses certain terms in this document, such as “discovered petroleum initially-in-place” that the SEC’s guidelines strictly prohibit in filings with the SEC by U.S. oil and gas companies.

Boe or mcfge may be misleading, particularly if used in isolation. A boe conversion ratio of six mcf to one bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

This Annual Information Form contains “forward-looking information and statements” within the meaning of applicable securities laws. For a full discussion of the forward-looking information and statements and the risks to which they are subject, see the “Special Note Regarding Forward-Looking Statements” in this Annual Information Form.

EXCHANGE RATE INFORMATION

Except where otherwise indicated, all dollar amounts stated in this Annual Information Form (“AIF”) are Canadian dollars. The following table discloses various indicators of the Canadian/United States rate of exchange or the cost of a U.S. dollar in Canadian currency for the three years indicated.

| | | | | | |

| | | Year ended December 31 |

| | | 2009 | | 2008 | | 2007 |

Year end | | 1.047 | | 1.224 | | 0.988 |

Low | | 1.029 | | 0.972 | | 0.917 |

High | | 1.300 | | 1.297 | | 1.185 |

Average | | 1.136 | | 1.066 | | 1.074 |

Notes:

| (1) | The exchange rates were as quoted by the Federal Reserve Bank of New York for the noon buying rate. |

| (2) | The high, low and average rates were either quoted or calculated as of the last day of the relevant month. |

DISCLOSURE OF EXEMPTION UNDER NATIONAL INSTRUMENT 51-101

Husky believes that comparability of its disclosures with those required in its major capital market, the United States, is important to many of the investors and prospective investors in its securities. Accordingly, the Company applied for and was granted an exemption by the Canadian securities regulators under the provisions of National Instrument 51-101 “Standards of Disclosures for Oil and Gas Activities” (“NI 51-101”). The exemption permits Husky to disclose, according to the rules of the SEC and the Financial Accounting Standards Board in the United States (“FASB”) in place of much of the disclosure required by NI 51-101. In accordance with the

Page 4

exemption, proved and probable oil and gas reserves data and certain other disclosures with respect to Husky’s oil and gas activities in this Annual Information Form are presented in accordance with the following requirements:

| | • | | FASB Accounting Standards Codification 932, “Extractive Activities — Oil and Gas”; |

| | • | | FASB Current Text Section Oi5, “Oil and Gas Producing Activities” paragraphs .103, .106, .107, .108, .112, 160 through .167, .174 through ..184 and .401 through .408; |

| | • | | Regulation S-K (17 CFR 229.302(b)) Items 102, 302(b) and 1200 through 1208; and |

| | • | | The definitions and disclosures required by SEC Regulation S-X (CFR 210.4-10). |

Proved and probable oil and gas reserves information and other disclosures about oil and gas activities in this Annual Information Form are in accordance with SEC requirements and definitions and, accordingly, may differ from corresponding information otherwise required by NI 51-101.

NI 51-101 specifies that proved, probable and possible reserves be determined in accordance with the Canadian Oil and Gas Evaluation Handbook (“COGEH”) definitions. There were no material differences between the oil and gas reserves determined using the SEC definitions and the COGEH definitions.

Modernization of Oil and Gas Reporting

In December 2008, the SEC issued its final rule, Modernization of Oil and Gas Reporting (Release Nos. 33-8995; 34-59192; FR-78). The disclosure requirements under the final rule are effective for registration statements filed on or after January 1, 2010 and for annual reports for fiscal years ending on or after December 31, 2009. The final rule changes a number of oil and gas estimation and disclosure requirements, as well as definitions, under SEC regulations S-K and S-X.

Among the principal changes in the final rule are the requirements to use a price based on a 12-month average for reserves estimation and disclosure instead of a single period end price (NI 51-101 requires the evaluation of oil and gas reserves to be based on a forecast of economic conditions); allowing the optional disclosure of probable and possible reserves; expanding the definition of oil and gas activities to include certain non-traditional resources such as bitumen extracted from oil sands, oil and gas extracted from oil shales; modifying the definition of geographic area for disclosure of reserve estimates and production; amending the disclosures of proved reserve quantities to include separate disclosures of synthetic oil and gas; expanding proved undeveloped reserves disclosures (PUDs), including discussion of PUDs five years old or more; permitting the use of new reliable technologies to establish reasonable certainty of proved reserves; and disclosure of the chief technical person who oversees the Company’s overall reserves estimation process.

Husky believes that its reserves evaluators are qualified and that it has a well established reserves evaluation process that is at least as rigorous as would be the case were Husky to rely upon independent reserves evaluators. Husky has adopted written evaluation practices and procedures using the COGEH modified to the extent necessary to reflect the definitions and standards under SEC disclosure requirements. In addition, Husky engaged a firm of independent qualified reserves evaluators to conduct an audit of the reserves estimates and respective present worth value of the reserves as at December 31, 2009. They conducted their audit in accordance with the standards described in the COGEH and the auditing standards generally accepted in the United States.

The Audit Committee of the Board of Directors has reviewed the Company’s procedures for providing information to the internal and external qualified oil and gas reserves evaluators; met with the internal and external qualified oil and gas reserves evaluators to determine whether any restrictions placed by management affect the ability of the qualified oil and gas reserves evaluators to report without reservation; and reviewed the reserves data with management and the internal qualified reserves evaluator. An external consultant was engaged by the Audit Committee to provide an assessment and recommendation in respect of the oil and gas reserves evaluation and reporting process.

Page 5

NI 51-101 prescribes a relatively comprehensive set of disclosures in respect of oil and gas reserves and other disclosures about oil and gas activities. The SEC also prescribes an extensive set of disclosures but instructs reporting companies to remain flexible in their disclosure, where appropriate, in order to provide meaningful disclosure in the circumstances.

In either jurisdiction, information to further an investor’s understanding is specifically encouraged to be included in the Company’s Management’s Discussion and Analysis (“MD&A”). The MD&A is intended to be a narrative explanation describing the Company, both its history and prospects, as perceived by management. The readers of the AIF are encouraged to also read the Company’s MD&A, which is filed, in accordance with the requirements of the Canadian Securities Administrators, on the System for Electronic Data Analysis and Retrieval (“SEDAR”). Documents filed on SEDAR may be accessed online atwww.sedar.com. This AIF together with the MD&A and the Company’s Audited Consolidated Financial Statements are included in Husky’s Form 40-F which is filed with SEC’s Electronic Data Gathering Analysis and Retrieval (“EDGAR”) system, which may be accessed online atwww.sec.gov.

CORPORATE STRUCTURE

Husky Energy Inc.

Husky Energy Inc. was incorporated under theBusiness Corporations Act(Alberta) on June 21, 2000.

Husky Energy Inc. has its registered office and its head and principal office at 707 — 8th Avenue S.W., P.O. Box 6525, Station D, Calgary, Alberta, T2P 3G7.

Intercorporate Relationships

The principal subsidiaries of Husky and place of incorporation, continuance or place of organization, as the case may be, are as follows.(1) All of the following companies and partnerships, except as otherwise indicated, are 100% beneficially owned or controlled or directed, directly or indirectly.

| | |

Name | | Jurisdiction |

Subsidiaries of Husky Energy Inc. | | |

Husky Oil Operations Limited (“HOOL”) | | Nova Scotia |

| |

Subsidiaries of Husky Oil Operations Limited | | |

Husky Oil Limited Partnership | | Alberta |

Husky Terra Nova Partnership | | Alberta |

Husky Downstream General Partnership | | Alberta |

Husky Energy Marketing Partnership | | Alberta |

Sunrise Oil Sands Partnership (50%) | | Alberta |

BP Husky Refining LLC (50%) | | Delaware |

Lima Refining Company | | Delaware |

Husky Marketing and Supply Company | | Delaware |

Notes:

| (1) | Principal operating subsidiaries exclusive of intercorporate relationships due to financing related receivables and investments. |

Page 6

GENERAL DEVELOPMENT OF HUSKY

Three Year History of Husky

2007

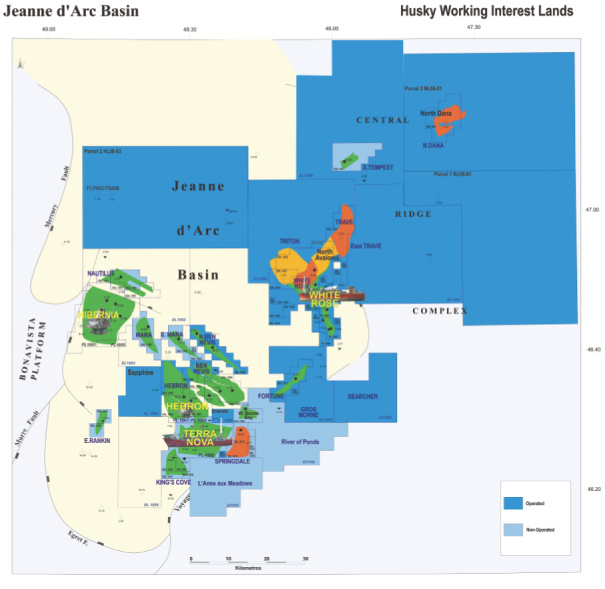

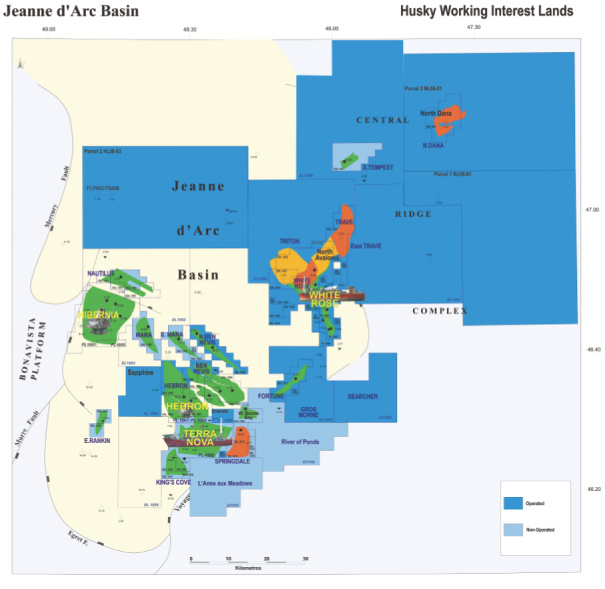

On January 15, 2007, Husky acquired an interest in three Exploration Licences (“EL”) in the Jeanne d’Arc Basin offshore Newfoundland and Labrador. Husky acquired a 100% interest in EL 1099 covering 61,376 acres, a 50% interest in EL 1100 covering 75,545 acres and a 50% interest in EL 1101 covering 51,914 acres. Husky has committed to spend $23.5 million on these EL areas during the five year period commencing in 2007.

In January 2007, Husky signed a three-year contract with Seadrill Offshore AS for the deep water semi-submersible drilling rig,West Hercules. The rig, which was constructed in Korea, was delivered to Husky’s offshore properties in the South China Sea in late 2008. The rig commenced drilling operations in November 2008 and is scheduled to drill several delineation wells at the Liwan natural gas discovery and a number of stratigraphic test wells on Husky’s exploration blocks.

On June 19, 2007, Husky announced it had been awarded two exploration and exploitation licences by the governments of Greenland and Denmark. The licences are for Block 5 with an area of 10,138 sq km and Block 7 with an area of 10,929 sq km. These blocks are located in an offshore area west of Disko Island in West Greenland. Husky holds an 87.5% interest. Both of these licences expire on May 31, 2017.

Effective July 1, 2007, Husky acquired all of the issued and outstanding shares of the Lima Refining Company from The Premcor Refinery Group Inc., a wholly owned subsidiary of Valero Energy Corporation. The purchase price was U.S. $1.9 billion plus U.S. $540 million for feedstock and product inventory. The 160 mbbls/day refinery is located at Lima, Ohio.

On September 6, 2007, Husky announced the issuance of U.S. $300 million of 6.20% 10 year notes due September 15, 2017 and U.S. $450 million of 6.80% 30 year notes due September 15, 2037. These notes rank equally with Husky’s other unsecured debt. The net proceeds from the notes were used to partially repay a U.S. $1.5 billion short-term bridge financing arranged to acquire the Lima Refinery.

On October 11, 2007, Husky was awarded an additional exploration and exploitation licence by the governments of Greenland and Denmark. The licence is for Block 6 with an area of 13,213 sq km. Block 6 is located in an offshore area west of Disko Island in West Greenland. Husky holds a 43.75% interest. This licence will expire on May 31, 2017.

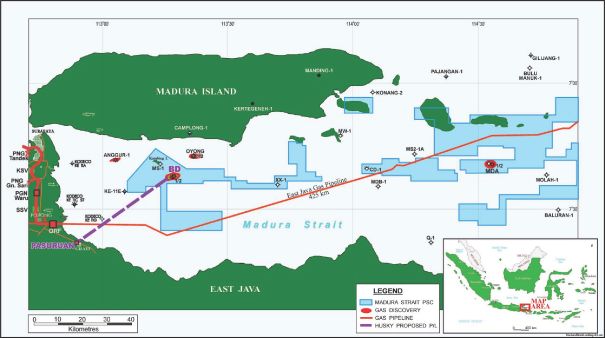

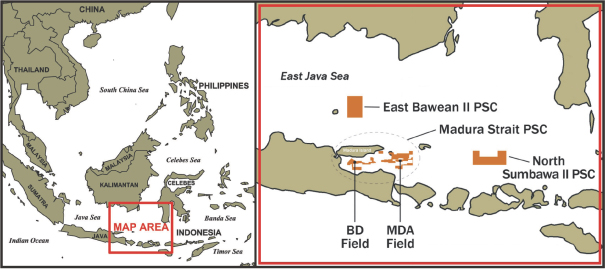

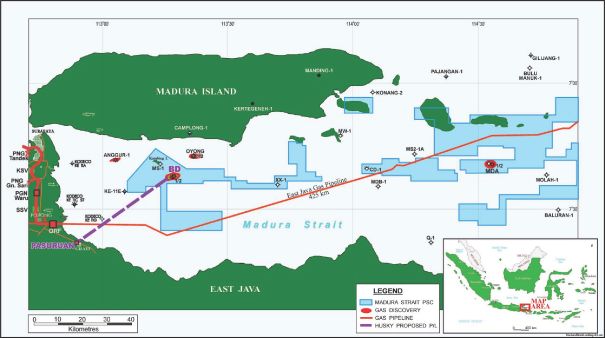

On October 30, 2007, Husky completed Gas Sales Agreements between Husky Oil (Madura) Ltd. and PT Inti Parna Raya, PT Inti Alasindo Energy and PT Perusahaan Gas Negara (Persero) Tbk (“PNG”) for the sale of natural gas from the Madura BD natural gas and natural gas liquids field offshore Java, Indonesia. The BD field is expected to be developed after receipt of an extension to the production sharing contract (“PSC”).

On December 4, 2007, Husky completed construction of the Minnedosa ethanol plant. The plant is located at Minnedosa, Manitoba and has the capacity to produce 130 million litres of ethanol for blending with gasoline.

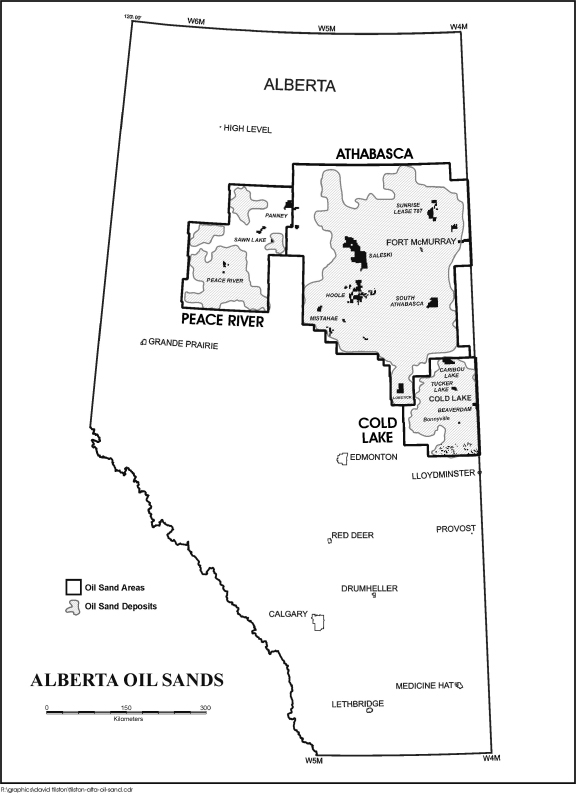

On December 5, 2007, Husky announced an agreement with BP Canada Energy Company (“BP”) to create an integrated North American oil sands business. The business consists of a 50/50 partnership to develop the Sunrise oil sands project contributed and operated by Husky and a 50/50 limited liability company for the Toledo Refinery contributed and operated by BP. The transaction closed at the end of the first quarter of 2008 with an effective date of January 1, 2008.

On December 17, 2007, a framework agreement between the Province of Newfoundland and Labrador and Husky and its partner was signed for the development of North Amethyst, West White Rose and the South White Rose Extension. Under the terms of the agreement, a crown corporation of Newfoundland and Labrador acquired a 5% equity interest in the White Rose expansion oil fields in January 2009.

Page 7

2008

On January 18, 2008, Husky announced that it had secured the Transocean owned semi-submersible drilling rig,GSF Grand Banks, for continuing operations in the White Rose area and for continued delineation drilling offshore Newfoundland and Labrador. The three year agreement also includes an option for two additional one year extensions.

On March 11, 2008, Husky announced an agreement with Suncor (formerly Petro-Canada) and StatoilHydro to secure the semi-submersible drilling rig,Henry Goodrich, for a period of 24 to 30 months. Husky will use the rig on its operated properties offshore Newfoundland and Labrador for 17 months.

On March 31, 2008, Husky announced that all necessary government and regulatory approvals had been received and the arrangements for the formation of an integrated oil sands/refining joint venture with BP had been completed. The effective date of the transaction was January 1, 2008.

On April 2, 2008, Husky announced that it had received approval from the federal and provincial governments and regulators to proceed with the development of the North Amethyst oil field, a satellite of the South Avalon White Rose producing oil field.

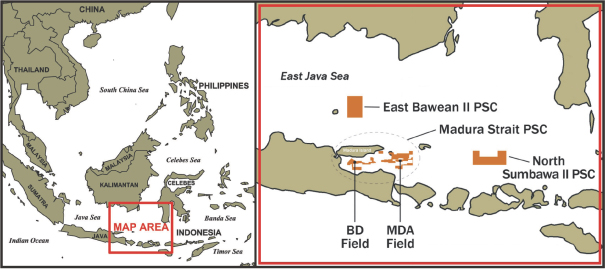

On April 17, 2008, Husky announced that it had reached an agreement with China National Offshore Oil Corporation (“CNOOC”) to jointly develop the Madura BD natural gas and natural gas liquids field offshore the East Java Sea, Indonesia. The agreement covers the development and further exploration of the Madura Strait Production Sharing Contract. CNOOC paid U.S. $125 million to acquire a 50% equity interest in Husky Oil (Madura) Ltd., which holds the Madura Strait Production Sharing Contract.

On June 5, 2008, Husky repaid the remaining U.S. $750 million short-term bridge facility arranged in 2007 to acquire the Lima Refinery.

On June 12, 2008, Husky announced a cash tender offer to purchase any and all of its outstanding 8.90% Capital Securities. The offer was for payment of U.S. $1,010 per U.S. $1,000 principal amount plus accrued and unpaid interest. On July 11, 2008, 95% of the 8.90% Capital Securities had been validly tendered and accepted for payment. The Company subsequently redeemed all remaining 8.90% Capital Securities.

On June 25, 2008, Husky announced that it had signed a contract with CNOOC for an exploration block in the South China Sea. The 63/05 block covers approximately 1,777 sq km and is located in the Qiongdongnan Basin approximately 100 km south of Hainan Island, in less than 120m of water.

On August 29, 2008, Husky redeemed the 6.95% medium-term notes Series E at a redemption price of $208 million including accrued interest.

On September 11, 2008, Husky announced that it had acquired two parcels (Block 1 and 3) offshore Labrador, on the Labrador Shelf. Parcel NL07-2-1, Block 1, covers approximately 2,370 sq km and Parcel NL07-2-3, Block 3, covers approximately 2,337 sq km.

During 2008, Husky repurchased a total of U.S. $63 million of the outstanding U.S. $450 million 6.80% notes due September 2037.

2009

In 2009, theWest Hercules drilling rig completed drilling and testing of three appraisal wells at the Liwan 3-1 field on Block 29/26, in the South China Sea.

Page 8

In 2009, an application was made in the East Bawean II PSC to relinquish the block. The application was based on the drilling of two exploration wells, the Adiyasa 1 and Kukura 1, which were abandoned without testing in the third quarter.

Husky filed a debt shelf prospectus with the Alberta Securities Commission on February 26, 2009 and the SEC on February 27, 2009. The shelf prospectus enables Husky to offer up to U.S. $3.0 billion of debt securities in the U.S. until March 26, 2011.

On May 11, 2009, Husky issued U.S. $750 million of 5.90% notes due June 15, 2014 and U.S. $750 million of 7.25% notes due December 15, 2019 under the debt shelf prospectus filed in February 2009.

In August 2009, Husky completed theSeaRose FPSOmaintenance at the White Rose oil field and work on the satellite development is proceeding on schedule.

On October 29, 2009, Husky announced it has completed and tested two exploratory wells to evaluate the shale gas potential in the Montney and Doig formations in Northeast British Columbia, Canada.

On November 23, 2009, Husky announced the discovery of additional oil resources in the White Rose area. Analysis of results from the North Amethyst E-17 exploration well that was drilled in 2008 to the deeper Hibernia formation revealed 55 m of net oil-bearing reservoir.

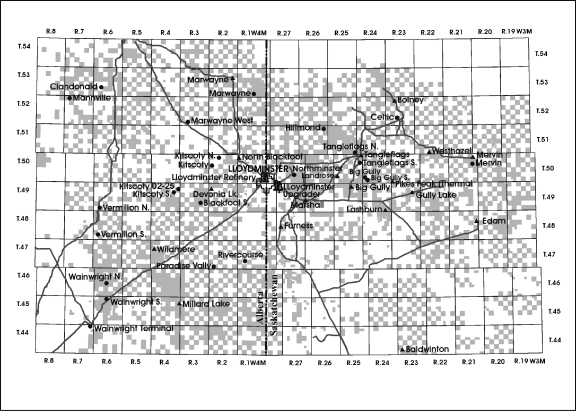

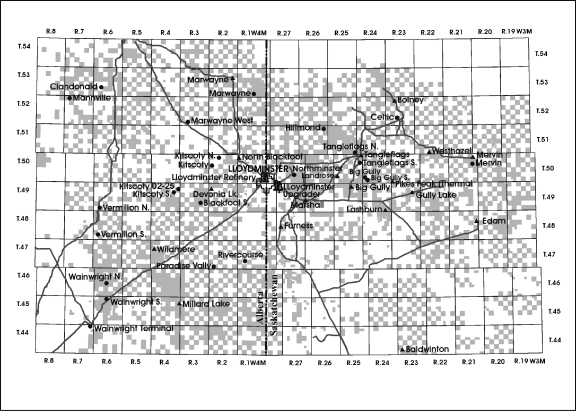

On November 30, 2009, Husky announced an agreement to purchase Penn West Energy Trust heavy oil properties contained within Husky’s Lloydminister area of operations in Alberta and Saskatchewan. The asset acquisition provides Husky more than 6,000 barrels of oil production per day.

On December 8, 2009, Husky announced that theWest Herculesdrilling rig drilled a significant new natural gas discovery at Liuhau 34-2-1 on Block 29/26 in the South China Sea. The well tested natural gas with high liquids content at an equipment restricted rate of 55 mmcf/day, with indications that future well deliveries could exceed 140 mmcf/day.

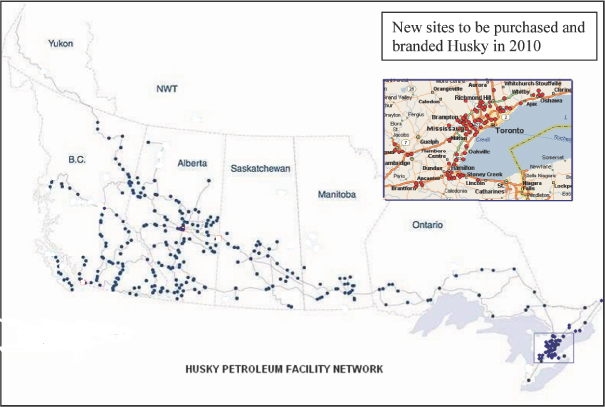

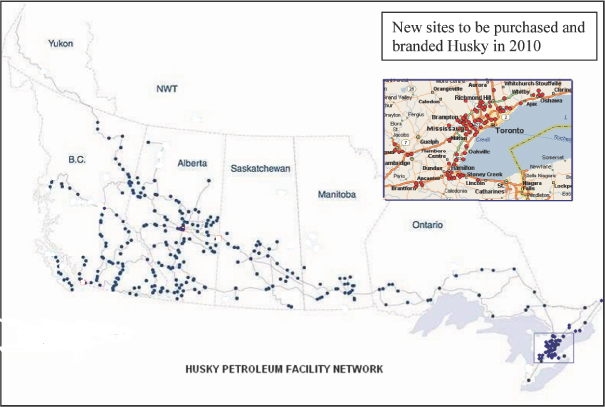

On December 10, 2009, Husky announced that it has entered into an agreement with Suncor Energy Inc. and Suncor Energy Products Inc. to purchase 98 retail outlets in the Ontario market. The first site will be transferred to Husky in March 2010, with the remaining sites transferred between April and November 2010.

On December 21, 2009, Husky filed a debt shelf prospectus that enables Husky to offer up to $1.0 billion of medium term notes in Canada until January 21, 2012.

Page 9

Business Environment Trends

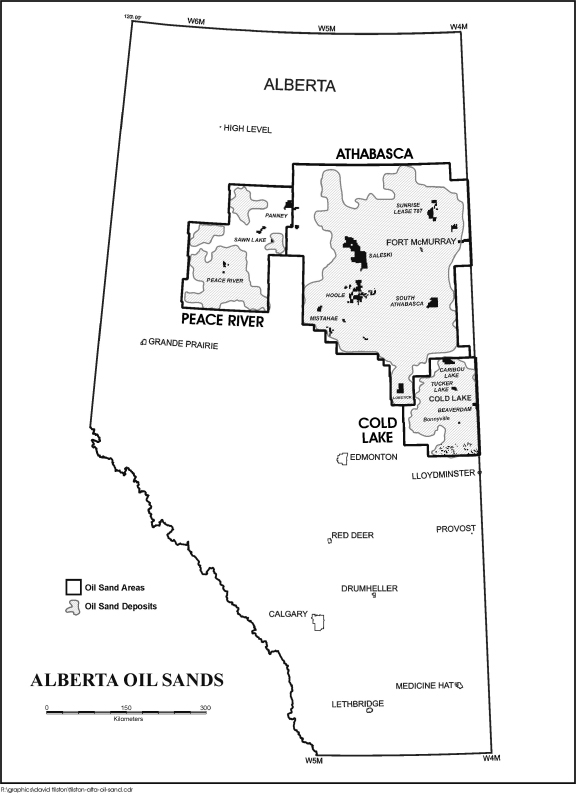

There are a number of trends that are developing, which may have both long and short-term effects on the oil and gas industry in Canada. Conventional production of crude oil in the Western Canada Sedimentary Basin (“WCSB”) has been in decline since 2000 and will, according to industry forecasts(1), continue to decline. Since 2000, increased crude oil production from the WCSB has come from mining and in-situ production of bitumen and heavy crude oil. An increase in overall crude oil production from the WCSB beyond current production levels is forecast(1) to be non-conventional production. Natural gas exploration efforts are focused on the traditionally less accessible areas in the overthrust belt along the eastern slope of the Rocky Mountains, in the Northwest Territories, offshore the East Coast of Canada and smaller shallow gas deposits and coal bed methane in the WCSB.

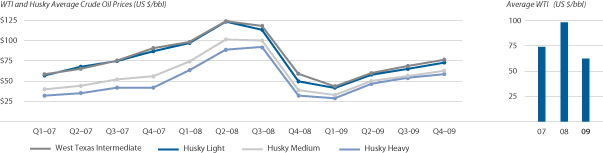

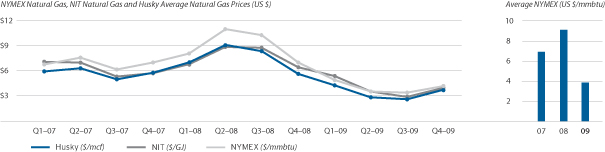

The trend of volatile commodity prices is expected to continue. Natural gas prices are sensitive to regional supply/demand imbalances, regional industrial activity levels, weather patterns and access to cheaper sources of energy. As a result of numerous supply disruptions and increased demand from emerging economies oil prices reached historic highs in 2008. Notwithstanding supply disruptions or major policy changes in respect of greenhouse gas emissions, recent forecasts(2) by the Energy Information Administration (“EIA”) in the United States indicates the possibility of crude oil production capacity increasing significantly over the next two decades, particularly conventional production from Brazil, Russia, Kazakhstan and with higher prices supporting economic viability, Canada’s oil sands could reach 4.5 mmbbls/day in 2035. Although crude oil prices declined significantly in the fourth quarter of 2008 in response to the economic downturn, prices improved during 2009 and the EIA’s reference case forecast prices continue to increase gradually as the world economy rebounds and global demand out paces supplies from non-OPEC producers.

The EIA short-term energy outlook(3) was published on February 10, 2010 and provides the following insights to the near-term energy environment. World energy demand is expected to continue to increase in 2010 and 2011, particularly in Asia. Although global oil inventories and spare production capacity are high, the EIA expects the Organization of Petroleum Exporting Countries (“OPEC”) to increase production in line with recovering global demand. Most of the OPEC’s spare capacity is concentrated in Saudi Arabia, who is not expected to over produce provided markets are stable and prices remain within its U.S. $70/bbl to U.S. $80/bbl target range.

DESCRIPTION OF HUSKY’S BUSINESS

General

Husky is a publicly held integrated international energy and energy related company headquartered in Calgary, Alberta, Canada.

Husky’s business is conducted predominantly in three major business sectors—upstream, midstream and downstream.

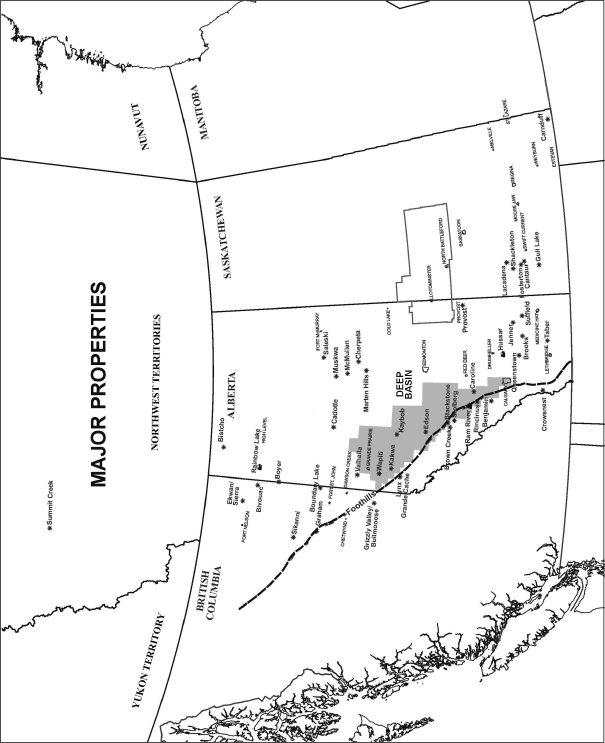

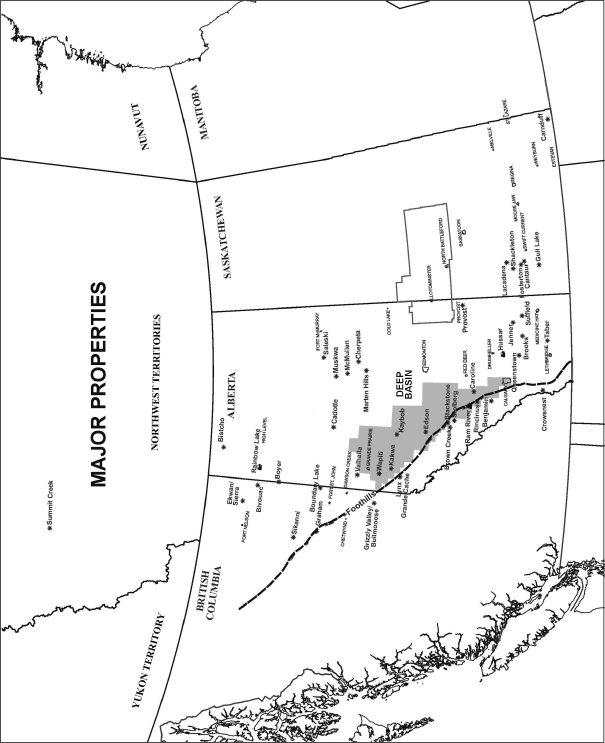

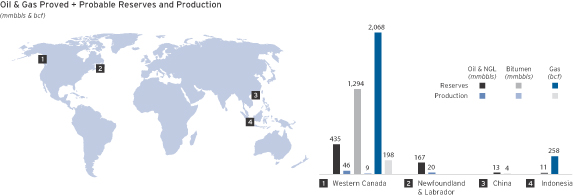

Upstream includes exploration for, development and production of crude oil, natural gas and natural gas liquids. The Company’s upstream operations and key prospects are located in Western Canada, offshore Eastern Canada, offshore Greenland, United States, offshore China, and offshore Indonesia (upstream business segment).

Notes:

| (1) | “Canadian Crude Oil Production and Supply forecast,” May 2006, Canadian Association of Petroleum Producers “Oil Sands Technology Roadmap,” January 30, 2004, Alberta Chamber of Resources. |

| (2) | Annual Energy Outlook 2010 Early Release Overview, December 2009, Energy Information Administration U.S. Department of Energy. |

| (3) | “Short-Term Energy Outlook,” February 10, 2010, Energy Information Administration U.S. Department of Energy. |

Page 10

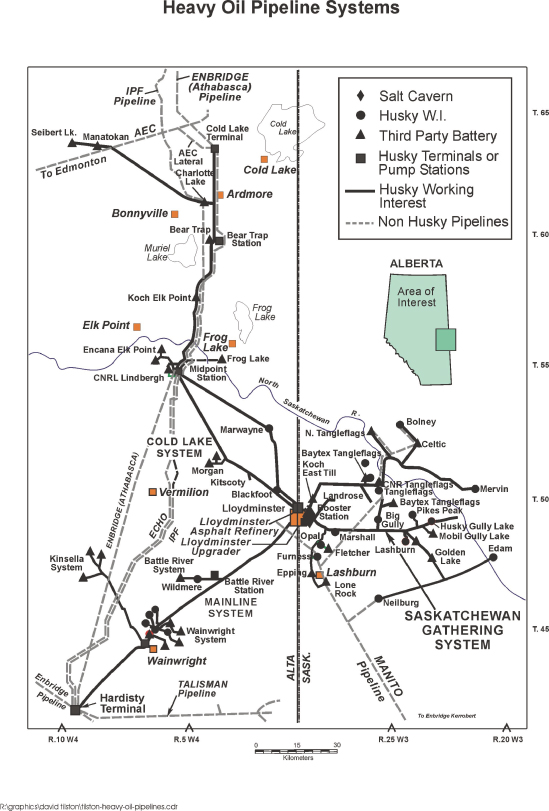

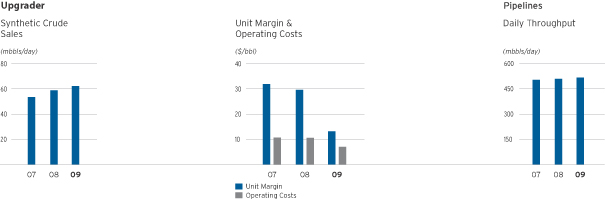

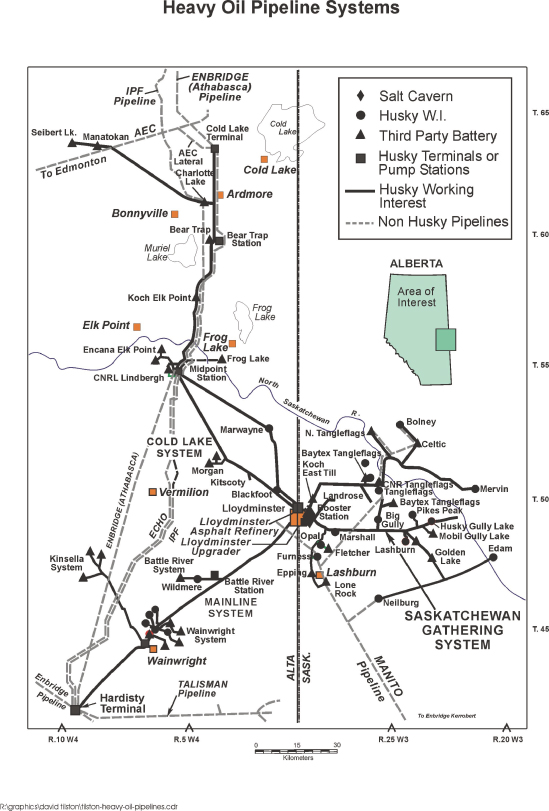

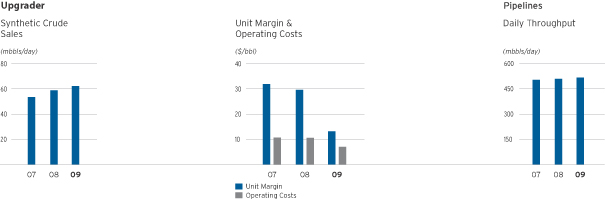

Midstream includes upgrading of heavy crude oil feedstock into synthetic crude oil (upgrading); marketing of the Company’s and other producers’ crude oil, natural gas, natural gas liquids, sulphur and petroleum coke; pipeline transportation, processing of heavy crude oil, storage of crude oil, diluent and natural gas, and cogeneration of electrical and thermal energy (infrastructure and marketing).

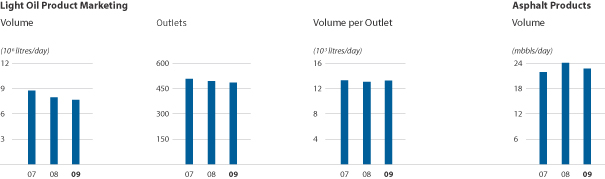

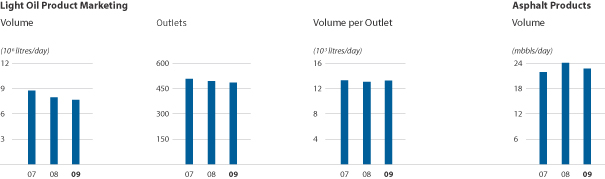

Downstream includes refining of light and heavy crude oil, production of ethanol, and marketing of refined petroleum products including gasoline, diesel, jet fuel, blending stocks, ethanol blended fuels, asphalt and the marketing of a wide variety of merchandise through convenience stores at Husky’s retail outlet locations. The downstream sector includes the Canadian refined products business segment and the U.S. refining and marketing business segment.

Social and Environmental Policy

Husky approaches social responsibility and sustainable development by seeking a balance among economic, operational reliability, health, safety, environmental and social issues while maintaining growth. Husky strives to find solutions to these issues that do not compromise the needs of future generations. In 2008, Husky implemented the Husky Operational Integrity Management System (HOIMS) which is followed by all Husky businesses, with particular emphasis on projects and operations, and manages operational integrity through the life cycle of the assets. HOIMS includes 14 fundamental elements; each element contains well defined aims and expectations that guide Husky to continuously improve operational integrity performance. The aims outline the overall intent behind each element and expectations outline the individual activities that are undertaken to support the aims. HOIMS guides Husky employees in effectively managing the risks associated with Husky’s business and creating a safe and secure place to work. Resources are applied and dedicated to the continued implementation and execution of HOIMS, and progress will be monitored at all levels of the Company. Periodic reviews and audits are conducted to ensure that HOIMS is effectively integrated into daily operations and to continuously improve performance.

Aims:

| | 1. | Ensure all levels of management demonstrate leadership and commitment to operational integrity. Define and ensure appropriate accountability for HOIMS throughout the organization. |

| | 2. | Prevent incidents by identifying and minimizing workplace and personal health risks. Promote and reinforce all safe behaviours. |

| | 3. | Manage risks by performing comprehensive risk assessments to provide essential decision-making information. Develop and implement plans to manage significant risks and impacts to as low as reasonably practical levels. |

| | 4. | Be prepared for an emergency or security threat, identify all necessary actions to be taken to protect people, the environment, the organization’s assets and reputation in the event of an emergency or security threat. |

| | 5. | Maintain operations reliability and integrity by use of clearly defined and documented operational, maintenance, inspection and corrosion programs. Seek improvements in process and equipment dependability by systematically eliminating defects and sources of loss. |

| | 6. | Provide assurance that personnel possess the necessary competencies, knowledge, abilities and demonstrate behaviours to perform their tasks and designated responsibilities effectively, efficiently and safely. |

| | 7. | Report and investigate all incidents. Learn from incidents and use the information to take corrective action and prevent recurrence. |

| | 8. | Operate responsibly to minimize the environmental impact of how we conduct our business. Leave a positive legacy behind us when operations cease. |

Page 11

| | 9. | Ensure that risks and exposures from proposed changes are identified, evaluated and managed to remain at an acceptable level. |

| | 10. | Identify, maintain and safeguard important information. Ensure personnel can readily access and retrieve information. Promote and encourage constructive dialogue within the organization to share industry recommended practices and acquired knowledge. |

| | 11. | Ensure conformance with corporate policies and compliance with all relevant government regulations. Work constructively to influence proposed laws and regulations, and debate. |

| | 12. | Design, construct, commission, operate and decommission all assets in a healthy, safe, secure, environmentally sound, reliable and efficient manner. |

| | 13. | Ensure contractors and suppliers perform in a manner that is consistent and compatible with Husky’s policies and business performance standards. Ensure contracted services and procured materials meet the requirements and expectations of Husky’s standards. |

| | 14. | Confirm that HOIMS processes are implemented and assess whether they are working effectively. Measure progress and continually improve towards meeting HOIMS objectives, targets, and key performance indicators. |

The Health, Safety and Environment Committee of the Board of Directors is responsible for reviewing and recommending for approval by the Board of Directors updates to the health, safety and environment policy, the development with management and achievement of specific environmental objectives and targets, and for monitoring compliance with the Company’s environmental policies and regulatory requirements. The mandate of the Health, Safety and Environment Committee is available on the Husky website atwww.huskyenergy.com.

Environmental Protection

Husky’s operations are subject to various environmental requirements under federal, provincial, state and local laws and regulations, as well as international conventions. These laws and regulations cover matters such as air emissions, wastewater discharge, freshwater use, land disturbances and handling and disposal of waste materials. These laws and regulations have proliferated and become more complex over time, governing an increasingly broad aspect of the industry’s mode of operating and product characteristics. Husky continues to monitor emerging environmental laws and regulations and proactively implements programs as required for compliance. According to the American Petroleum Institute, between 1990 and 2007, reported environmental expenditures by the oil and gas industry in the United States increased by 85%.(1)

Husky is required by the Government of Canada to report facilities that emit greater than 50,000 tonnes of CO2E. The Lloydminster upgrader, Lloydminster refinery, Prince George refinery,SeaRose FPSO, Ram River gas plant, Rainbow Lake gas plant, Tucker thermal oil plant, Bolney steam assisted gravity drainage (“SAGD”) thermal plant and Pikes Peak CSS thermal plant, Lloydminster ethanol plant, Minnedosa ethanol plant are in this category. Husky has implemented an Environmental Performance Reporting System (“EPRS”) that will gather, consolidate, calculate, report and identify trends including greenhouse gas emissions. To ensure the integrity of the EPRS data, Husky will have an independent third party audit performed at Ram River gas plant and Tucker thermal oil plant. Husky is also a member of the Integrated CO2 Network, which is working to reduce greenhouse gas emissions. The group continues to study technologies in respect of capture, transportation and storage of CO2. A project is underway at Husky to review the engineering to capture, compress and liquefy CO2from the Lloydminster ethanol plant for injection into heavy oil fields for Enhanced Oil Recovery. At Lloydminster and Rainbow Lake, Husky utilizes cogeneration to produce both electricity and thermal energy for use at its

Note:

| (1) | “Environmental Expenditures by the U.S. Oil and Natural Gas Industry,” 2009, American Petroleum Institute. |

Page 12

processing facilities. This configuration has less adverse effects on the environment and is cost effective. Electrical energy in excess of Husky’s requirements is sold into the grid. Fugitive emissions are a contributor to greenhouse gas, a potential hazard and a waste of money. In 2009, Husky implemented a program to detect and repair leaks. At Husky’s Tucker SAGD project vapour recovery systems are in use on all tanks and process vessels.

Husky has undertaken programs to minimize water consumption, particularly freshwater, and minimize risk to water resources. At the Tucker project, 90% of water is recycled and very saline (i.e. non-potable) water is used for make-up water. Husky is implementing various technologies to reduce water usage. Husky’s alkaline surfactant polymer floods which increases the efficiency of water and the use of CO2 instead of water to mobilize heavy oil in the reservoir are being evaluated in pilots to reduce overall water consumption.

A large proportion of environmental costs are embedded in general capital costs, particularly when compliance is achieved by upgrading or expanding facilities. Husky continually implements a variety of initiatives that have cost efficiency, environmental protection and safety benefits. Such projects have included gas conservation, vapour recovery, boiler/heater efficiency and tank and pipeline integrity. At December 31, 2009, Husky had 473 retail locations in its light refined products operations, which consisted of 315 owned and leased locations (Husky controlled) and 156 independent retailer locations. An additional 98 owned and leased stations in the Toronto area will be added in 2010, acquired from Suncor/Petro-Canada. Husky is continually monitoring the owned and leased locations for environmental compliance and where required performing remediation, which have averaged approximately $6 million per year for the past five years. Husky also performs routine underground tank replacements. During 2009, 5 locations received new tanks at a cost of approximately $9 million.

Husky has several “legacy” (inactive facility) sites which require remediation. These inactive sites range from refinery sites to retail locations. In 2009, Husky spent $6 million on remediation and expects to spend approximately $15 million over the next three years to complete remediation of these locations. On-going remediation and reclamation work is occurring at over 3,000 abandoned well sites and 100 abandoned facility sites. Husky plans to spend $12 million to $15 million annually on these programs. Husky spent approximately $40 million in 2009 at the Lima Refinery in respect of vapour recovery, emission control and water treatment.

It is not possible to predict with certainty the amount of additional investment in new or existing facilities required to be incurred in the future for environmental protection or to address regulatory compliance requirements, such as reporting. Although these costs may be significant, Husky does not expect that they will have a material adverse effect on liquidity and financial position over the long-term.

Risk Factors

The following factors should be considered in evaluating Husky:

Adequacy of crude oil and natural gas prices

Husky’s results of operations and financial condition are dependent on the prices received for its crude oil and natural gas production. Lower prices for crude oil and natural gas could adversely affect the value and quantity of Husky’s oil and gas reserves. Husky has significant quantities of heavier grades of crude oil reserves that trade at a discount to light crude oil. Heavier grades of crude oil are typically more expensive to produce, process, transport and refine into high value refined products. Refining capacity for heavy crude oil is limited. As a result, wider price differentials could have adverse effects on financial performance and condition, reduce the value and quantities of Husky’s heavier crude oil reserves and delay or cancel projects that involve the development of heavier crude oil resources.

Prices for crude oil are based on world supply and demand. Supply and demand can be affected by a number of factors including, but not limited to, actions taken by OPEC, non-OPEC crude oil supply, social conditions in oil producing countries, the occurrence of natural disasters, general and specific economic conditions, prevailing weather patterns and the availability of alternate sources of energy.

Page 13

Husky’s natural gas production is located entirely in Western Canada and is, therefore, subject to North American market forces. North American natural gas supply and demand is affected by a number of factors including, but not limited to, the amount of natural gas available to specific market areas either from the well head or from storage facilities, prevailing weather patterns, the price of crude oil, the U.S. and Canadian economies, the occurrence of natural disasters and pipeline restrictions.

Demand for Husky’s other products and services and the cost of required inputs

Husky’s results of operations and financial condition are dependent on the price of refinery feedstock, the price of energy, the demand and pricing for refined petroleum products and electrical power and the ability of Husky to recover the increased cost of these inputs from the customer. Husky is also dependent on the demand for pipeline and processing capacity.

Reserves data and future net revenue estimates

The reserves data in this Annual Information Form represent estimates only. In general, estimates of economically recoverable crude oil and gas reserves and the future net cash flows therefrom are based upon a number of variable factors and assumptions, such as product prices, future operating and capital costs, historical production from the properties and the assumed effects of regulation by governmental agencies, including with respect to royalty payments, all of which may vary considerably from actual results. All such estimates are to some degree uncertain and classifications of reserves are only attempts to define the degree of uncertainty involved. For those reasons, estimates of the economically recoverable oil and gas reserves attributable to any particular group of properties, classification of such reserves based on risk of recovery and estimates of future net revenues expected therefrom, prepared by different engineers or by the same engineers at different times, may vary substantially.

Additions to reserves are required to maintain asset value and production

In order to maintain the Company’s future production of crude oil, natural gas and natural gas liquids and maintain the value of the reserves portfolio, additional reserves must be added through discoveries, extensions, improved recovery, performance related revisions and acquisitions. The production rate of oil and gas properties tends to decline as the reserves are depleted while the associated unit operating costs increase. In order to prevent this the Company must undertake successful exploration and development programs, increase the recovery factor from existing properties through applied technology and identify and execute strategic acquisitions of proved developed and undeveloped properties and unproved prospects. Maintaining an inventory of developable projects depends on, among other things, obtaining and renewing rights to explore, develop and produce oil and natural gas, drilling success, completing long-lead time capital intensive projects on budget and on schedule and the application of successful exploitation techniques on mature properties.

The Company’s reserve replacement ratio(2) for the last three years was as follows:

| | | | | | | | | |

| | | 2009 | | | 2008 | | | 2007 | |

Gross proved oil and gas reserves | | | | | | | | | |

Excluding acquisition & divestiture | | 121 | % | | NM | (1) | | 112 | % |

Including acquisition & divestiture | | 133 | % | | 9 | % | | 107 | % |

Net proved oil and gas reserves | | | | | | | | | |

Excluding acquisition & divestiture | | 118 | % | | 13 | % | | 100 | % |

Including acquisition & divestiture | | 130 | % | | 31 | % | | 95 | % |

Notes:

| (1) | NM means not meaningful. |

| (2) | Reserve replacement ratio calculated as reserves added during the period divided by total production during the period. |

Page 14

Competition

The energy industry is highly competitive with respect to gaining access to the resources required to increase oil and gas reserves and production and gain access to markets. Husky competes with others to acquire prospective lands, to retain drilling capacity and field operating and construction services, to attract and retain experienced skilled management and oil and gas professionals, to obtain sufficient pipeline and other transportation capacity, to gain access to and retain adequate markets for its products and services and gain access to capital markets. Husky’s ability to successfully complete development projects could be adversely affected by an inability to acquire economic supplies and services due to competition. Subsequent increases in the cost of, or delays in acquiring supplies and services could result in uneconomic projects. Husky’s competitors comprise all types of energy companies, some of which have greater resources.

Delays and cost overruns of capital projects

Husky is involved in capital projects such as exploration programs, development of oil and gas properties, plant and facilities construction, expansion and modification. Project delays can adversely affect expected cash flow and overall project costs thereby eroding project economics. Risk factors include, but are not limited to:

| | • | | availability and cost of capital; |

| | • | | availability of skilled labour; |

| | • | | availability of manufacturing capacity, supplies, material and equipment; |

| | • | | faulty construction and design errors; |

| | • | | accidents, labour disruptions, bankruptcies and productivity issues affecting Husky directly or indirectly; and |

| | • | | unexpected changes in the scope of a project. |

Business interruption of operations

Husky’s operations are subject to various risks with respect to normal operating conditions. These risks comprise, but are not limited to, explosions, blowouts, cratering, fires, severe storms and adverse weather, all forms of marine perils, release of toxic, combustible or explosive substances. These risks could cause loss of life, injury and destruction of public, private and Husky’s owned property.

The occurrence of any of the above listed events, or others not listed, could result in adverse financial performance and conditions that may not be fully recoverable from Husky’s insurers.

Foreign exchange risk

Husky’s results are affected by the exchange rate between the Canadian and U.S. dollar. The majority of expenditures are in Canadian dollars. The majority of revenues are received in U.S. dollars or from the sale of oil and gas commodities that receive prices determined by reference to U.S. benchmark prices. An increase in the value of the Canadian dollar relative to the U.S. dollar will decrease the revenues received from the sale of oil and gas commodities. Correspondingly, a decrease in the value of the Canadian dollar relative to the U.S. dollar will increase the revenues received from the sale of oil and gas commodities.

In addition, a change in the value of the Canadian dollar against the U.S. dollar will result in an increase or decrease in Husky’s U.S. dollar denominated debt, as expressed in Canadian dollars, as well as in the related interest expense. At December 31, 2009, 100% or $3.2 billion of Husky’s long-term debt was denominated in U.S. dollars. The percentage of long-term debt exposed to the U.S./Cdn exchange rate decreases to 88% when

Page 15

cross currency swaps are included. Additionally, U.S. $987 million of the Company’s U.S. dollar denominated debt has been designated as a hedge of a net investment and the unrealized foreign exchange gain is recorded in Other Comprehensive Income, further reducing the long-term debt exposed to the U.S./Cdn exchange rate to 57%.

The contribution receivable representing BP’s obligation to fund capital expenditures of the Sunrise partnership is denominated in U.S. dollars and gains and losses from changes in the value of the Canadian dollar versus the U.S. dollar are recorded in foreign exchange gains and losses in the current year. At December 31, 2009, Husky’s share of the balance of this receivable was U.S. $1.2 billion including accrued interest. Husky has an obligation to fund capital expenditures of the BP-Husky Toledo Refinery and this contribution payable is denominated in U.S. dollars. Gains and losses from the translation of this obligation are recorded in Other Comprehensive Income as this item relates to a self sustaining foreign operation. At December 31, 2009, Husky’s share of the balance of this obligation was U.S. $1.4 billion including accrued interest.

Environmental risks

All phases of the oil and natural gas business are subject to environmental regulation pursuant to a variety of federal, provincial, state and local laws and regulations, as well as international conventions (collectively, “environmental legislation”).

Environmental legislation imposes, among other things, restrictions, liabilities, and obligations in connection with the generation, handling, storage, transportation, treatment and disposal of hazardous substances and waste and in connection with spills, releases and emissions of various substances to the environment. Environmental legislation also requires that wells, facilities and other properties associated with Husky’s operations be operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. In addition, certain types of operations, including exploration and development projects and significant changes to certain existing projects, may require the submission and approval of environmental impact assessments. Compliance with environmental legislation can require significant expenditures and failure to comply with environmental legislation may result in the imposition of fines and penalties and liability for clean-up costs and damages. Husky cannot be certain that the costs of complying with environmental legislation in the future will not be significant, however, Husky does not expect that they will have a material adverse effect on our financial condition and results of operations.

Husky anticipates that changes in environmental legislation may require reductions in emissions from its operations and result in increased capital expenditures. Further changes in environmental legislation could occur, which may result in stricter standards and enforcement, larger fines and liability, and increased capital expenditures and operating costs, which could have a material adverse effect on our financial condition and results of operations.

In 1994, the United Nations’ Framework Convention on Climate Change came into force and three years later led to the Kyoto Protocol, which requires the reduction of greenhouse gas emissions. On December 16, 2002, Canada ratified the Kyoto Protocol. In 2007, the world’s nations met again to gain the agreement of major countries that were not signatories to the Kyoto protocol such as the United States, China and India. This meeting in Bali, Indonesia did little to advance wider agreement on limiting greenhouse gases and setting new limits for emissions, which expire in 2012 under the Kyoto Protocol. These initiatives may require Husky to significantly reduce emissions at its operations of greenhouse gases such as carbon dioxide, which may increase capital expenditures. Details regarding the implementation of the Kyoto Protocol and the ultimate completion of the Bali agreement in 2009 remain unclear.

The Copenhagen Accord is a commitment by all major emitting countries to take action to avoid dangerous human interference with the climate system. In January 2010, countries committed to nationally appropriate mitigation actions. Canada has committed to cut greenhouse gas emissions by 17% below 2005 levels by 2020;

Page 16

this aligns Canada with the stated target of the United States. The commitments will be reviewed by 2015 to assess progress toward the long-term goal to limit the global average temperature rise to 1.5 degrees Celsius. The effect of the Copenhagen Accord on Husky is currently uncertain but will continue to evolve.

The Federal Government of Canada has announced certain regulations in respect of greenhouse gases and other pollutants. Although the impact of these regulations is uncertain, they may adversely affect the Company’s operations and increase costs. These regulations may become more onerous over time as public and political pressures increase to implement initiatives that further reduce the emission of greenhouse gases.

In June 2009, the United States House of Representatives passed the Waxman-Markey American Clean Energy and Security Act, which requires a 17% reduction of greenhouse gas emissions from 2005 levels by 2020 and an 80% reduction by 2050. The bill also sets a system of permitting under which regulated industries would need to acquire sufficient allowances for their emissions. In September 2009, the Kerry-Boxer Clean Energy Jobs and American Power Act, which increases the required reduction of greenhouse gases to 20% by 2020, was introduced in the United States Senate. Each bill requires further legislative approvals before becoming law and their respective scope and requirements could be changed through this process before receiving final approval. Husky’s operations may be impacted by whatever legislation emerges as law. Such legislation could require U.S. refining operations to significantly reduce emissions and/or purchase allowances, which may increase capital and operating expenditures.

Changes to government fiscal policy

All of Husky’s oil and gas production is subject to royalties which are potentially impacted by changes in government fiscal policies. The Company maintains close contact with governments in the areas within which it operates.

General economic conditions may have a material adverse effect on the Company’s results of operations, liquidity and financial condition

The current economic and financial crisis has contributed to increased uncertainty and a deterioration of near-term expectations in respect of the global economy. Although some evidence of improvement has been reported, there is no assurance that the crisis will not continue or worsen in the future. If the economic conditions do not improve, demand for petroleum products could continue to diminish and adversely affect the price the Company receives for its commodities. The Company’s cash flow could decline, assets could be impaired, future access to capital could be restricted and major development projects delayed.

The cost or availability of oil and gas field equipment adversely affects the Company’s ability to undertake exploration, development and construction projects

The oil and gas industry is cyclical in nature and is prone to shortages of supply of equipment and services including land and offshore drilling rigs, land and offshore geological and geophysical services, engineering and construction services and construction materials. These materials and services may not be available when required at a reasonable price.

International operations can have uncertain political, economic and other risks

The Company’s operations that are in certain jurisdictions may be adversely affected by political, economic or social instability or events. These events may include, but are not limited to, acts of war, terrorism, abduction, expropriation, onerous fiscal policy, renegotiation or nullification of agreements, imposition of onerous regulation, financial constraints and unreasonable taxation. This could adversely affect the Company’s interest in its foreign operations and future profitability.

Page 17

Climatic conditions may have significant adverse effects on operations

Demand for energy can be affected to a large degree by weather and climate. In addition, the Company’s exploration, production and construction operations can be affected by extreme weather, which may result in cessation of production, delay of exploration and development activities or delay of plant construction. All of these could potentially cause financial losses.

Recruitment, retention and succession

Failure to retain current employees and attract new skilled employees could materially affect the Company’s ability to conduct its business. Demand for qualified employees with appropriate experience remains high. In addition, a significant portion of the workforce will become eligible for retirement in the near term.

Credit rating risk

The Company’s debt instruments are rated by various credit rating agencies. These ratings affect the Company’s ability to gain access to reasonably priced debt financing. If any of the Company’s credit rating agencies downgrade the Company’s debt instruments it may restrict the Company’s ability to issue debt and may also increase the cost of borrowing, including existing credit facilities.

Page 18

Upstream Operations

Disclosures of Oil and Gas Activities

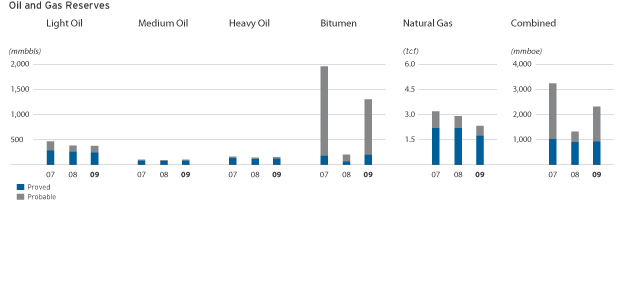

In the tables that follow, the following definitions apply: light crude oil (30° API and lighter), medium crude oil (between 20° and 30° API), heavy crude oil (between 20° API and 10° API and is liquid) and bitumen (solid or semi-solid with a viscosity greater than 10,000 centipoise).

Heavy crude oil and bitumen have been restated in accordance with the SEC definition of bitumen, as part of its new requirements for oil and gas reserves disclosure effective December 31, 2009. Under the new definition, a portion of crude oil previously reported as heavy crude oil has now been reclassified as bitumen. The presentation of heavy crude oil reported in prior periods has been restated to reflect the new definition.

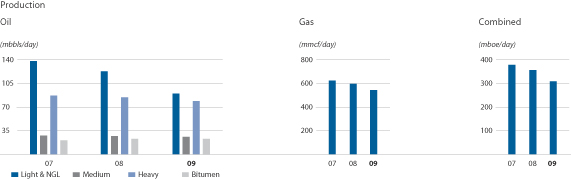

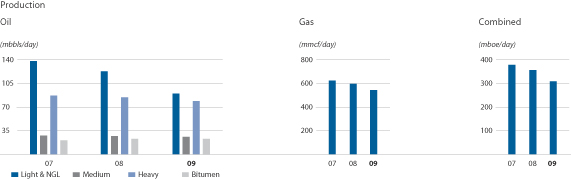

Production

| | | | | | | | | | | | |

| | | 2009 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | China | | Libya |

Crude Oil(mbbls/day) | | | | | | | | | | | | |

Light crude oil and NGL | | 89.1 | | 22.8 | | 55.1 | | 77.9 | | 11.1 | | 0.1 |

Medium crude oil | | 25.4 | | 25.4 | | — | | 25.4 | | — | | — |

Heavy crude oil | | 78.6 | | 78.6 | | — | | 78.6 | | — | | — |

Bitumen | | 23.1 | | 23.1 | | — | | 23.1 | | — | | — |

| | | | | | | | | | | | |

Total gross(1) | | 216.2 | | 149.9 | | 55.1 | | 205.0 | | 11.1 | | 0.1 |

| | | | | | | | | | | | |

Total net(1) | | 181.7 | | 130.5 | | 41.8 | | 172.3 | | 9.3 | | 0.1 |

| | | | | | | | | | | | |

Natural Gas(mmcf/day) | | | | | | | | | | | | |

Gross(1) | | 541.7 | | 541.7 | | — | | 541.7 | | — | | — |

| | | | | | | | | | | | |

Net(1) | | 457.3 | | 457.3 | | — | | 457.3 | | — | | — |

| | | | | | | | | | | | |

| |

| | | 2008 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | China | | Libya |

Crude Oil(mbbls/day) | | | | | | | | | | | | |

Light crude oil and NGL | | 122.9 | | 24.6 | | 86.1 | | 110.7 | | 12.1 | | 0.1 |

Medium crude oil | | 26.9 | | 26.9 | | — | | 26.9 | | — | | — |

Heavy crude oil | | 84.4 | | 84.4 | | — | | 84.4 | | — | | — |

Bitumen | | 22.6 | | 22.6 | | — | | 22.6 | | — | | — |

| | | | | | | | | | | | |

Total gross(1) | | 256.8 | | 158.5 | | 86.1 | | 244.6 | | 12.1 | | 0.1 |

| | | | | | | | | | | | |

Total net(1) | | 206.8 | | 134.9 | | 62.7 | | 197.6 | | 9.1 | | 0.1 |

| | | | | | | | | | | | |

Natural Gas(mmcf/day) | | | | | | | | | | | | |

Gross(1) | | 594.4 | | 594.4 | | — | | 594.4 | | — | | — |

| | | | | | | | | | | | |

Net(1) | | 464.2 | | 464.2 | | — | | 464.2 | | — | | — |

| | | | | | | | | | | | |

| |

| | | 2007 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | China | | Libya |

Crude Oil(mbbls/day) | | | | | | | | | | | | |

Light crude oil and NGL | | 138.7 | | 26.4 | | 99.5 | | 125.9 | | 12.7 | | 0.1 |

Medium crude oil | | 27.1 | | 27.1 | | — | | 27.1 | | — | | — |

Heavy crude oil | | 86.5 | | 86.5 | | — | | 86.5 | | — | | — |

Bitumen | | 20.4 | | 20.4 | | — | | 20.4 | | — | | — |

| | | | | | | | | | | | |

Total gross(1) | | 272.7 | | 160.4 | | 99.5 | | 259.9 | | 12.7 | | 0.1 |

| | | | | | | | | | | | |

Total net(1) | | 233.0 | | 134.6 | | 88.2 | | 222.8 | | 10.1 | | 0.1 |

| | | | | | | | | | | | |

Natural Gas(mmcf/day) | | | | | | | | | | | | |

Gross(1) | | 623.3 | | 623.3 | | — | | 623.3 | | — | | — |

| | | | | | | | | | | | |

Net(1) | | 492.3 | | 492.3 | | — | | 492.3 | | — | | — |

| | | | | | | | | | | | |

Note:

| (1) | Gross volumes are Husky’s lessor royalty, overriding royalty and working interest share of production before deduction of royalties. Net volumes are Husky’s gross volumes, less royalties. |

Page 19

Revenue

| | | | | | | | | | | | |

| | | 2009 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | China | | Libya |

| | | ($ millions) |

Crude Oil | | | | | | | | | | | | |

Light crude oil and NGL | | 2,042 | | 455 | | 1,300 | | 1,755 | | 283 | | 4 |

Medium crude oil | | 522 | | 522 | | — | | 522 | | — | | — |

Heavy crude oil | | 1,507 | | 1,507 | | — | | 1,507 | | — | | — |

Bitumen | | 437 | | 437 | | — | | 437 | | — | | — |

| | | | | | | | | | | | |

Total gross | | 4,508 | | 2,921 | | 1,300 | | 4,221 | | 283 | | 4 |

| | | | | | | | | | | | |

Total net | | 3,650 | | 2,403 | | 1,010 | | 3,413 | | 233 | | 4 |

| | | | | | | | | | | | |

Natural Gas | | | | | | | | | | | | |

Gross | | 759 | | 759 | | — | | 759 | | — | | — |

| | | | | | | | | | | | |

Net | | 727 | | 727 | | — | | 727 | | — | | — |

| | | | | | | | | | | | |

Processing/Transportation | | 46 | | 46 | | — | | 46 | | — | | — |

| | | | | | | | | | | | |

| |

| | | 2008 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | China | | Libya |

| | | ($ millions) |

Crude Oil | | | | | | | | | | | | |

Light crude oil and NGL | | 4,374 | | 780 | | 3,157 | | 3,937 | | 433 | | 4 |

Medium crude oil | | 805 | | 805 | | — | | 805 | | — | | — |

Heavy crude oil | | 2,223 | | 2,223 | | — | | 2,223 | | — | | — |

Bitumen | | 582 | | 582 | | — | | 582 | | — | | — |

| | | | | | | | | | | | |

Total gross | | 7,984 | | 4,390 | | 3,157 | | 7,547 | | 433 | | 4 |

| | | | | | | | | | | | |

Total net | | 6,225 | | 3,621 | | 2,289 | | 5,910 | | 312 | | 3 |

| | | | | | | | | | | | |

Natural Gas | | | | | | | | | | | | |

Gross | | 1,876 | | 1,876 | | — | | 1,876 | | — | | — |

| | | | | | | | | | | | |

Net | | 1,563 | | 1,563 | | — | | 1,563 | | — | | — |

| | | | | | | | | | | | |

Processing/Transportation | | 72 | | 72 | | — | | 72 | | — | | — |

| | | | | | | | | | | | |

| |

| | | 2007 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | China | | Libya |

| | | ($ millions) |

Crude Oil | | | | | | | | | | | | |

Light crude oil and NGL | | 3,722 | | 626 | | 2,736 | | 3,362 | | 357 | | 3 |

Medium crude oil | | 504 | | 504 | | — | | 504 | | — | | — |

Heavy crude oil | | 1,276 | | 1,276 | | — | | 1,276 | | — | | — |

Bitumen | | 291 | | 291 | | — | | 291 | | — | | — |

| | | | | | | | | | | | |

Total gross | | 5,793 | | 2,697 | | 2,736 | | 5,433 | | 357 | | 3 |

| | | | | | | | | | | | |

Total net | | 4,965 | | 2,256 | | 2,421 | | 4,677 | | 285 | | 3 |

| | | | | | | | | | | | |

Natural Gas | | | | | | | | | | | | |

Gross | | 1,430 | | 1,430 | | — | | 1,430 | | — | | — |

| | | | | | | | | | | | |

Net | | 1,200 | | 1,200 | | — | | 1,200 | | — | | — |

| | | | | | | | | | | | |

Processing/Transportation | | 64 | | 64 | | — | | 64 | | — | | — |

| | | | | | | | | | | | |

Page 20

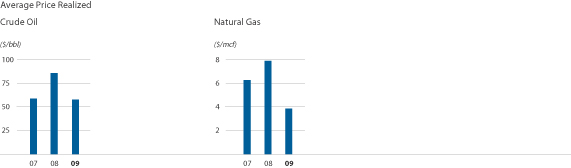

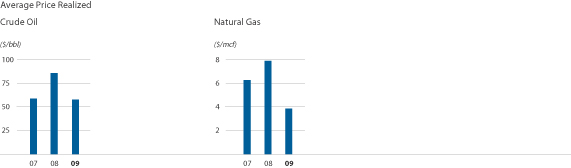

Sales Prices

| | | | | | | | | | | | |

| | | 2009 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | China | | Libya |

Crude Oil($/bbl) | | | | | | | | | | | | |

Light crude oil and NGL | | 62.70 | | 54.62 | | 64.60 | | 61.68 | | 69.62 | | 80.28 |

Medium crude oil | | 56.37 | | 56.37 | | — | | 56.37 | | — | | — |

Heavy crude oil | | 52.54 | | 52.54 | | — | | 52.54 | | — | | — |

Bitumen | | 51.90 | | 51.90 | | — | | 51.90 | | — | | — |

| | | | | | | | | | | | |

Total crude oil and NGL | | 57.11 | | 53.40 | | 64.60 | | 56.42 | | 69.62 | | 80.28 |

| | | | | | | | | | | | |

Natural Gas($/mcf) | | 3.83 | | 3.83 | | — | | 3.83 | | — | | — |

| | | | | | | | | | | | |

| | | 2008 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | China | | Libya |

Crude Oil($/bbl) | | | | | | | | | | | | |

Light crude oil and NGL | | 97.28 | | 86.65 | | 100.12 | | 97.13 | | 98.56 | | 118.97 |

Medium crude oil | | 81.79 | | 81.79 | | — | | 81.79 | | — | | — |

Heavy crude oil | | 71.98 | | 71.98 | | — | | 71.98 | | — | | — |

Bitumen | | 70.24 | | 70.24 | | — | | 70.24 | | — | | — |

| | | | | | | | | | | | |

Total crude oil and NGL | | 84.96 | | 75.67 | | 100.12 | | 84.28 | | 98.56 | | 118.97 |

| | | | | | | | | | | | |

Natural Gas($/mcf) | | 7.94 | | 7.94 | | — | | 7.94 | | — | | — |

| | | | | | | | | | | | |

| | | 2007 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | China | | Libya |

Crude Oil($/bbl) | | | | | | | | | | | | |

Light crude oil and NGL | | 73.54 | | 65.01 | | 75.37 | | 73.18 | | 77.03 | | 82.21 |

Medium crude oil | | 51.12 | | 51.12 | | — | | 51.12 | | — | | — |

Heavy crude oil | | 40.43 | | 40.43 | | — | | 40.43 | | — | | — |

Bitumen | | 38.96 | | 38.96 | | — | | 38.96 | | — | | — |

| | | | | | | | | | | | |

Total crude oil and NGL | | 58.24 | | 46.12 | | 75.37 | | 57.31 | | 77.03 | | 82.21 |

| | | | | | | | | | | | |

Natural Gas($/mcf) | | 6.19 | | 6.19 | | — | | 6.19 | | — | | — |

Page 21

Capital Expenditures

| | | | | | | | | | | | | | | | | | |

| | | 2009 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | United

States | | China | | Greenland | | Indonesia | | Libya |

| | | ($ millions) |

Property acquisition | | 309 | | 307 | | — | | 307 | | 2 | | — | | — | | — | | — |

Exploration | | 841 | | 228 | | 64 | | 292 | | 23 | | 457 | | 32 | | 37 | | — |

Development | | 1,176 | | 654 | | 510 | | 1,164 | | — | | 7 | | — | | — | | 5 |

| | | | | | | | | | | | | | | | | | |

| | 2,326 | | 1,189 | | 574 | | 1,763 | | 25 | | 464 | | 32 | | 37 | | 5 |

| | | | | | | | | | | | | | | | | | |

| |

| | | 2008 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | United

States | | China | | Greenland | | Indonesia | | Libya |

| | | ($ millions) |

Property acquisition | | 530 | | 485 | | — | | 485 | | 45 | | — | | — | | — | | — |

Exploration | | 836 | | 436 | | 160 | | 596 | | 15 | | 214 | | — | | 11 | | — |

Development | | 2,214 | | 1,640 | | 569 | | 2,209 | | — | | 3 | | — | | — | | 2 |

| | | | | | | | | | | | | | | | | | |

| | 3,580 | | 2,561 | | 729 | | 3,290 | | 60 | | 217 | | — | | 11 | | 2 |

| | | | | | | | | | | | | | | | | | |

| |

| | | 2007 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | United

States | | China | | Greenland | | Indonesia | | Libya |

| | | ($ millions) |

Property acquisition | | 172 | | 172 | | — | | 172 | | — | | — | | — | | — | | — |

Exploration | | 564 | | 410 | | 83 | | 493 | | — | | 54 | | — | | 17 | | — |

Development | | 1,652 | | 1,449 | | 197 | | 1,646 | | — | | 1 | | — | | 5 | | — |

| | | | | | | | | | | | | | | | | | |

| | 2,388 | | 2,031 | | 280 | | 2,311 | | — | | 55 | | — | | 22 | | — |

| | | | | | | | | | | | | | | | | | |

Page 22

Oil and Gas Netbacks(1)

| | | | | | | | | | | | |

| | | 2009 |

| | | Total | | Western

Canada | | East

Coast | | Canada | | China | | Libya |

Crude Oil($/bbl) | | | | | | | | | | | | |

Light crude oil | | | | | | | | | | | | |

Sales revenue | | 62.38 | | 52.28 | | 64.60 | | 61.28 | | 69.62 | | 80.28 |

Royalties | | 13.36 | | 6.03 | | 16.34 | | 13.56 | | 12.16 | | — |

Operating costs | | 9.96 | | 15.79 | | 8.73 | | 10.63 | | 5.35 | | 16.35 |

| | | | | | | | | | | | |

Netback | | 39.06 | | 30.46 | | 39.53 | | 37.09 | | 52.11 | | 63.93 |

| | | | | | | | | | | | |

Medium crude oil | | | | | | | | | | | | |

Sales revenue | | 54.88 | | 54.88 | | — | | 54.88 | | — | | — |

Royalties | | 8.67 | | 8.67 | | — | | 8.67 | | — | | — |

Operating costs | | 15.40 | | 15.40 | | — | | 15.40 | | — | | — |

| | | | | | | | | | | | |

Netback | | 30.81 | | 30.81 | | — | | 30.81 | | — | | — |

| | | | | | | | | | | | |

Heavy crude oil | | | | | | | | | | | | |

Sales revenue | | 51.95 | | 51.95 | | — | | 51.95 | | — | | — |

Royalties | | 7.24 | | 7.24 | | — | | 7.24 | | — | | — |

Operating costs | | 13.26 | | 13.26 | | — | | 13.26 | | — | | — |

| | | | | | | | | | | | |

Netback | | 31.45 | | 31.45 | | — | | 31.45 | | — | | — |

| | | | | | | | | | | | |

Bitumen | | | | | | | | | | | | |

Sales revenue | | 51.90 | | 51.90 | | — | | 51.90 | | — | | — |

Royalties | | 7.13 | | 7.13 | | — | | 7.13 | | — | | — |

Operating costs | | 16.38 | | 16.38 | | — | | 16.38 | | — | | — |