Filed Pursuant to Rule 433

Issuer Free Writing Prospectus

Registration No. 333-174554

June 22, 2011

Corporate Overview – June 2011

Advisories

Additional Information

The Company has filed a registration statement (including a prospectus) with the SEC for the Public Offering. Before persons invest, they should read the prospectus in that registration statement and other documents the Company has filed with the SEC or on SEDAR for more complete information about the Company and the Public Offering. Persons may obtain these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov or SEDAR at www.sedar.com. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll-free 1-877-822-4089. Also, a copy of the United States preliminary prospectus supplemental and accompanying prospectus may be obtained through this hyperlink: http://www.huskyenergy.com/downloads/investorrelations/2011/HSE_US_Prelim_2011.pdf. Prospective purchasers should consult their own advisers as to whether they are purchasing under the Canadian prospectus or the U.S. prospectus. The Common Shares may not be sold in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

Forward Looking Statements

Certain statements in this presentation are forward looking statements or information within the meaning of applicable securities legislation (collectively “forward-looking statements”). Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “intend,” “plan,” “projection,” “could,” “vision,” “goals,” “objective,” “target,” “schedules” and “outlook”) are not historical facts, are forward-looking and may involve estimates and assumptions and are subject to risks, uncertainties and other factors some of which are beyond the Company’s control and difficult to predict. Accordingly, these factors could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements.

In particular, forward-looking statements in this presentation include, but are not limited to: the Company’s general strategic plans for its core business areas and anticipated outcomes of the Company’s strategic plans; its short, medium, and long-term growth strategies and opportunities in its upstream, midstream and downstream business segments; the Company’s growth strategy; anticipated timing of project milestones; production growth and reserve replacement targets; anticipated return on capital employed; the Company’s financial strategy and anticipated outcomes of the Company’s financial strategy, including dividend sustainability and maintenance of investment grade credit ratings; 2011 capital expenditure and production guidance; intended use of proceeds; 2011 and 2012 drilling plans in Western Canada; development plans and anticipated timing and rates of production for Ansell; development opportunities and potential for oil resource recovery at the Kakwa and Wapiti areas; anticipated impact emerging technologies will have on production; expected rates and timing of production at

South Pikes Peak, Paradise Hill and other heavy oil properties; exploration and development plans for offshore China; development plans, sanctioning process, anticipated timing and rates of production, and anticipated gas sales contracts for the Liwan Gas Project; exploration plans for offshore Indonesia; anticipated timing and rates of production for the Madura BD gas development; cost estimates, anticipated timing and rates of production, project milestone timeline and downstream solution for the Sunrise Energy Project; plans for the West White Rose Extension Pilot including target timing for

first oil; evaluation of the fixed wellhead platform concept; exploration and development plans for the Atlantic Region and offshore Greenland.

Although the Company believes that the expectations reflected by the forward-looking statements in this presentation are reasonable, the Company’s forward-looking statements have been based on assumptions and factors concerning future events that may prove to be inaccurate. Those assumptions and factors are based on information currently available to the Company about itself and the businesses in which it operates. In addition, information used in developing forward-looking statements has been acquired from various sources including third party consultants, suppliers, regulators and other sources.

The Company’s Annual Information Form and other documents filed with securities regulatory authorities (accessible through the SEDAR website www.sedar.com and the EDGAR website www.sec.gov) describes the risks, material assumptions and other factors that could influence actual results and are incorporated herein by reference.

Any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by applicable law, the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in advance the impact of each such factor on the Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

Advisories

Disclosure of Oil and Gas Reserves and Other Oil and Gas Information

Unless otherwise stated, reserve and resource estimates in this presentation have an effective date of December 31, 2010. Unless otherwise noted, historical production numbers given represent Husky’s share.

The Company uses the terms barrels of oil equivalent (“boe”) and thousand cubic feet of gas equivalent (“mcfge”), which are calculated on an energy equivalence basis whereby one barrel of crude oil is equivalent to six thousand cubic feet of natural gas. Readers are cautioned that the terms boe and mcfge may be misleading, particularly if used in isolation. This measure is primarily applicable at the burner tip and does not represent value equivalence at the wellhead.

The Company has disclosed possible reserves. Possible reserves are those additional reserves that are less certain to be recovered than probable reserves. It is unlikely that the quantities actually recovered will exceed the sum of the proved plus probable plus possible reserves. There is at least a 10% probability that the quantities actually recovered will equal or exceed the sum of proved plus probable plus possible reserves.

The Company has disclosed discovered petroleum initially-in-place. Discovered petroleum initially-in-place is that quantity of petroleum that is estimated, as of a given date, to be contained in known accumulations prior to production. The recoverable portion of discovered petroleum initially-in-place includes production, reserves and contingent resources; the remainder is unrecoverable. A recovery project cannot be defined for these volumes of discovered petroleum initially-in-place at this time. There is no certainty that it will be commercially viable to produce any portion of the resources.

3P reserves for oil sands are disclosed in this presentation (slide 29). This represents the following split for 3P reserves: Sunrise - Proved reserves = 120.0 MMbbl, Probable reserves = 891.4 MMbbl, Possible reserves = 842.5; Tucker – Proved reserves = 61.9 MMbbl, Probable reserves = 103.2 MMbbl, Possible reserves = 121.9 MMbl.

In this presentation on slide 26 and 29, additional drilling will be required to delineate the resources and advance development plans to allow booking of contingent resources and/or reserves in the future.

The Company has disclosed its total reserves in Canada in its 2010 Annual Information Form dated February 28, 2011 which reserves disclosure is incorporated by reference herein. The estimates of reserves and future net revenue for individual properties may not reflect the same confidence level as estimates of reserves and future net revenue for all properties, due to the effects of aggregation.

All currency is expressed in Canadian dollars unless otherwise noted.

Corporate Overview

Financial Overview

Regenerating the Foundation

Pillars of Growth

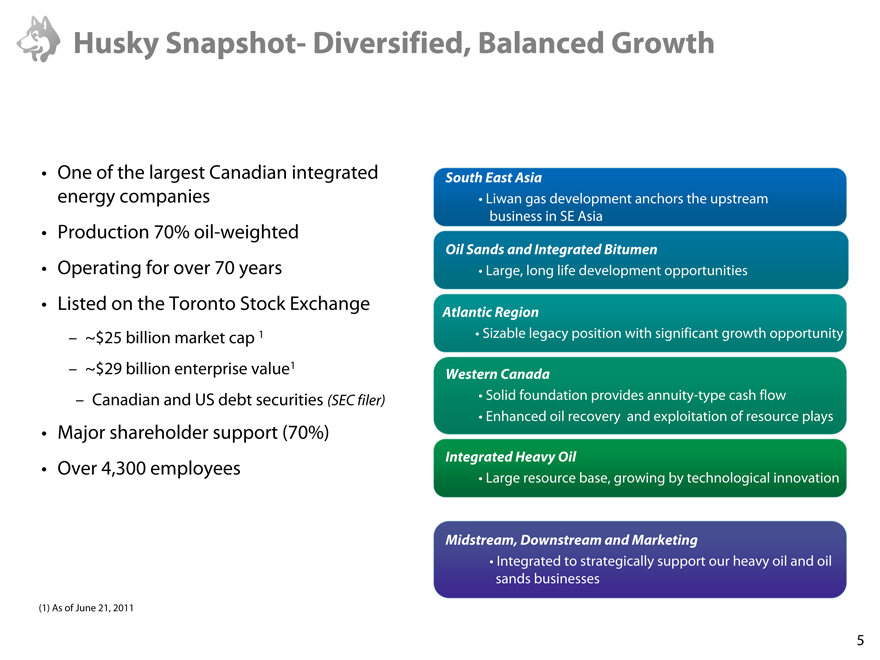

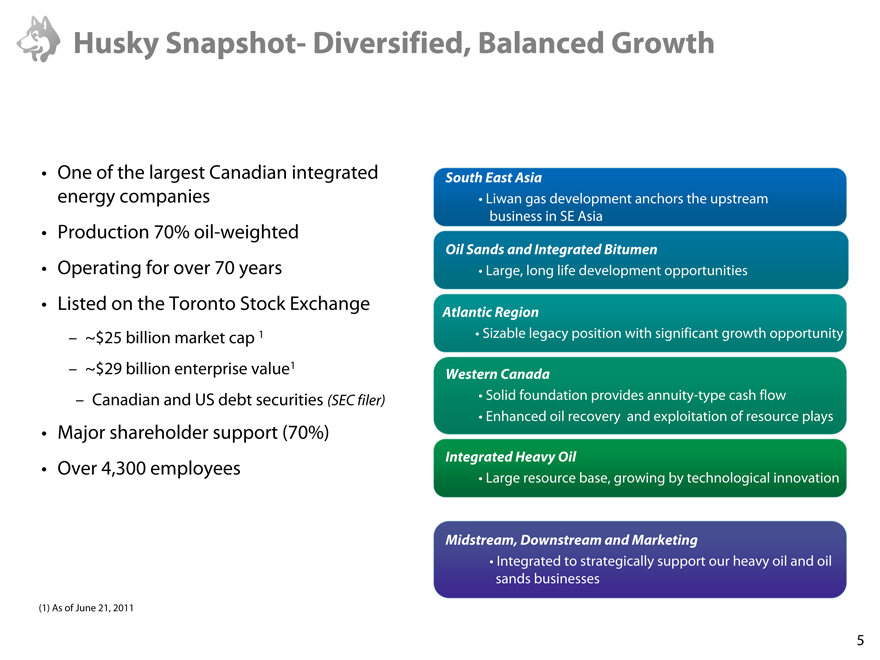

Husky Snapshot- Diversified, Balanced Growth

• One of the largest Canadian integrated energy companies

• Production 70% oil-weighted

• Operating for over 70 years

• Listed on the Toronto Stock Exchange

– ~$25 billion market cap 1

– ~$29 billion enterprise value1

– Canadian and US debt securities (SEC filer)

• Major shareholder support (70%)

• Over 4,300 employees

South East Asia

• Liwan gas development anchors the upstream business in SE Asia

Oil Sands and Integrated Bitumen

• Large, long life development opportunities

Atlantic Region

• Sizable legacy position with significant growth opportunity

Western Canada

• Solid foundation provides annuity-type cash flow

• Enhanced oil recovery and exploitation of resource plays

Integrated Heavy Oil

• Large resource base, growing by technological innovation

Midstream, Downstream and Marketing

• Integrated to strategically support our heavy oil and oil sands businesses

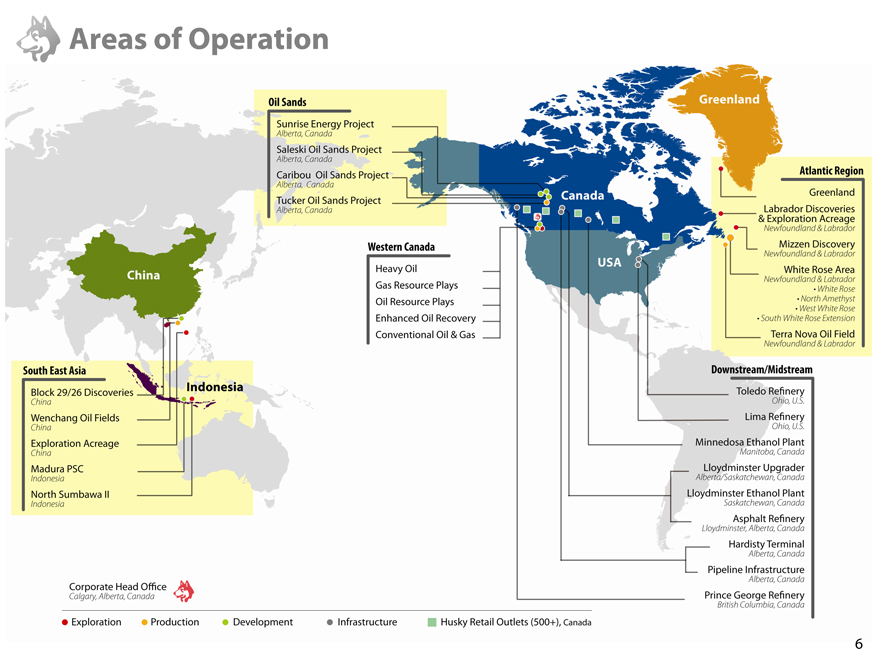

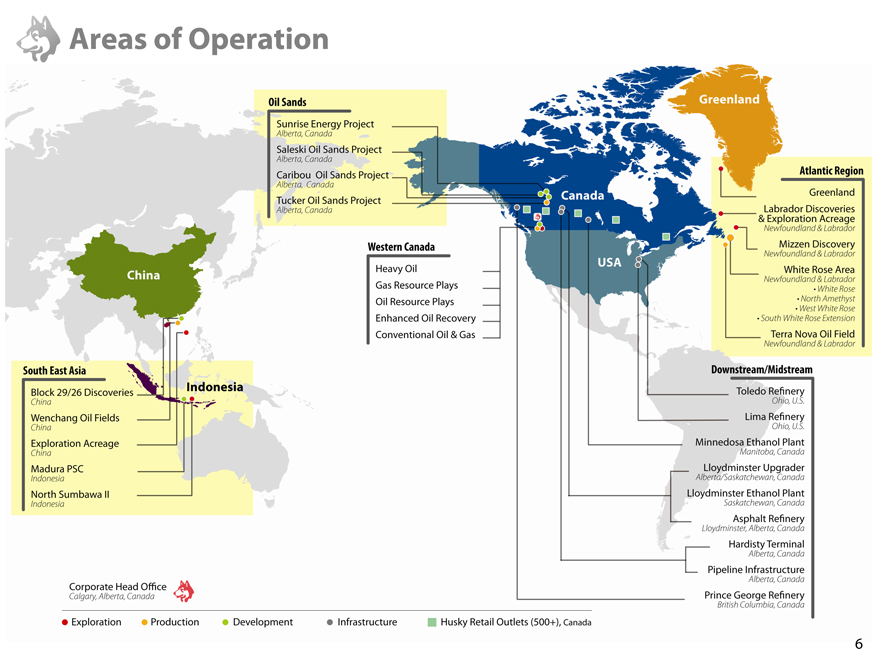

Areas of Operation Oil sands Sunrise Energy Project Alberta, Canada Saleski Oil Sands Project Alberta, Canada

Caribou Oil Sands Project Alberta, Canada Tucker Oil Sands Project Alberta, Canada China Western Canada

Heavy Oil Gas Resource Plays Oil Resource Plays Enhanced Oil Recovery Conventional Oil & Gas South East Asia

Block 29/26 Discoveries China Wenchang Oil Fields China Exploration Acreage

China Madura PSC Indonesia North Sumbawa IIIndonesia Indonesia Corporate Head Office Calgary, Alberta, Canada Canada USA

Downstream/Midstream Toledo Refinery Ohio, U.S. Lima Refinery Ohio, U.S. Minnedosa Ethanol Plant Manitoba, Canada Lloydminster Upgrader Alberta/Saskatchewan, Canada Asphalt Refinery

Lloydminster, Alberta, Canada

Hardisty Terminal

Alberta, Canada

Pipeline George Refinery

Alberta, Canada

Prince George Refinery

British Columbia, Canada

Exploration

Production

Development

Infrastructure

Husky Retail Outlets (500+), Canada

Greenland

Atlantic Region

Greenland

Labrador Discoveries & Exploration Acreage

a

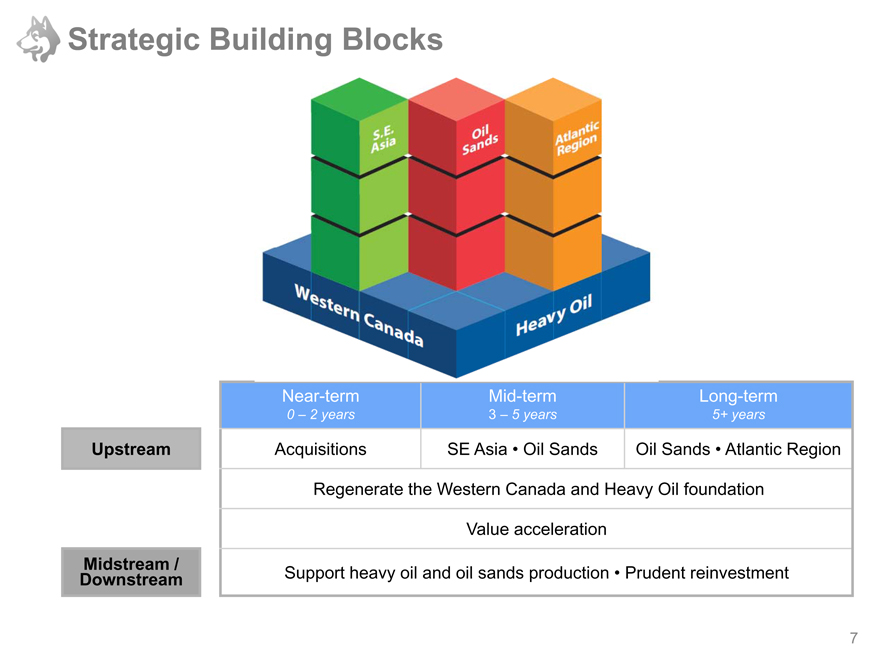

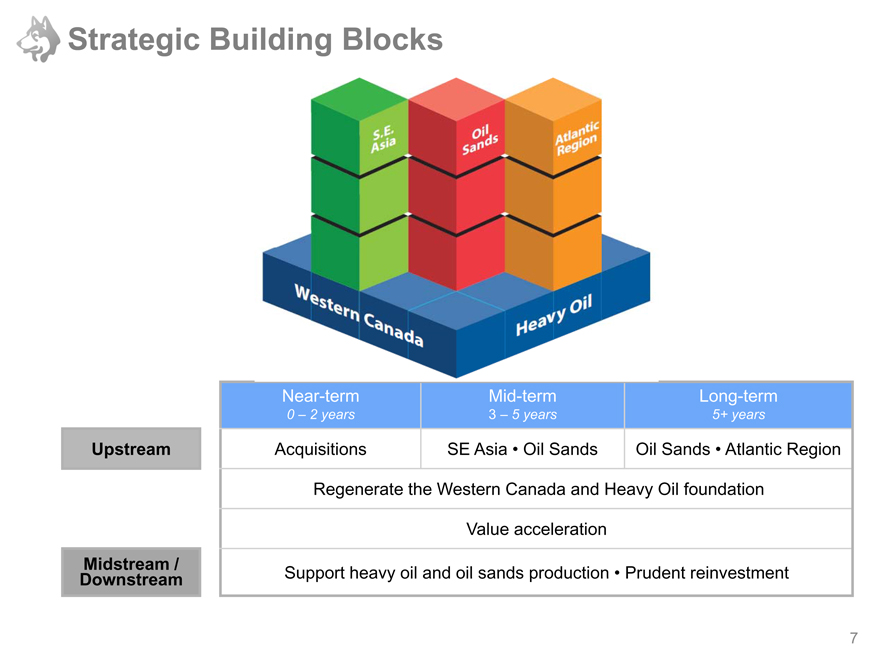

Strategic Building Blocks

S.E. Asia

Oil Sands

Atlantic Region

Western Canada

Heavy Oil

Upstream

Midstream /

Downstream

Near-term

Mid-term

Long-term

0 – 2 years

5+ years

Acquisitions

SE Asia Oil Sands

Oil Sands Atlantic Region

Regenerate the Western Canada and Heavy Oil foundation

Value acceleration

Support heavy oil and oil sands production

Prudent reinvestment

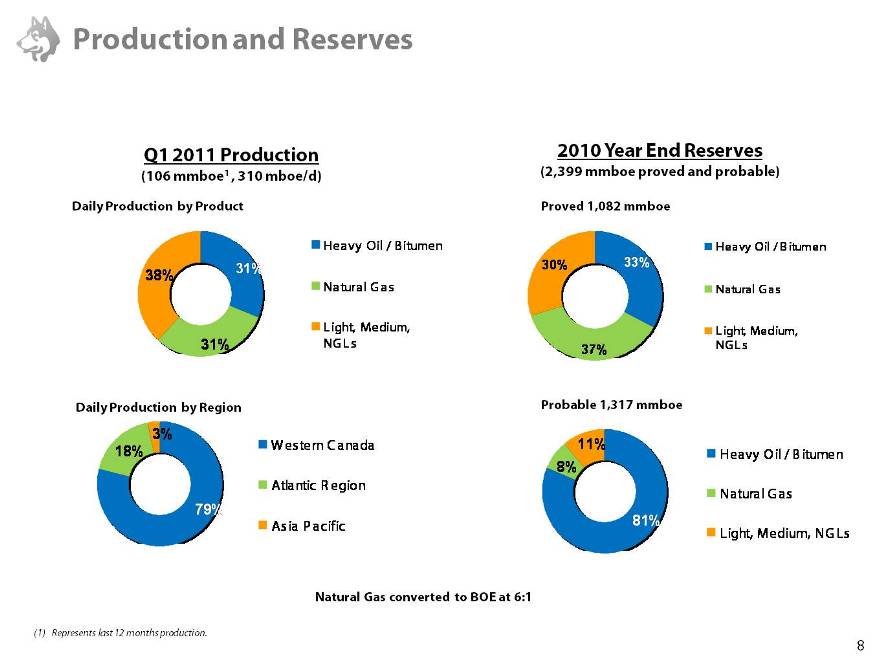

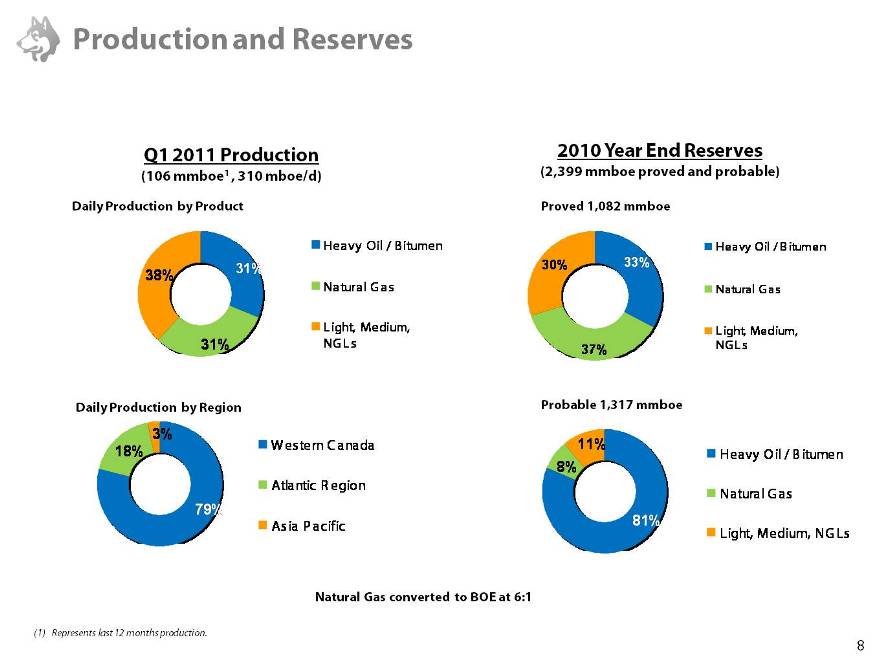

Production and Reserves

Q1 2011 Production

(106 mmboe1 , 310 mboe/d)

Daily Production by Product

38% 31% 31%

Heavy Oil / Bitumen

Natural Gas

Light, Medium, NGLs

Daily Production by Region

3% 79% 18%

Western Canada

Altantic Region

Asia Pacific

2010 Year End Reserves

(2,399 mmboe proved and probable)

Proved 1,082 mmboe

33% 37% 30%

Heavy Oil / Bitumen

Natural Gas

Light, Medium, NGLs

Probable 1,317 mmboe

81% 8% 11%

Heavy Oil / Bitumen

Natural Gas

Light, Medium, NGLs

Natural Gas converted to BOE at 6:1

(1) | | Represents last 12 months production. |

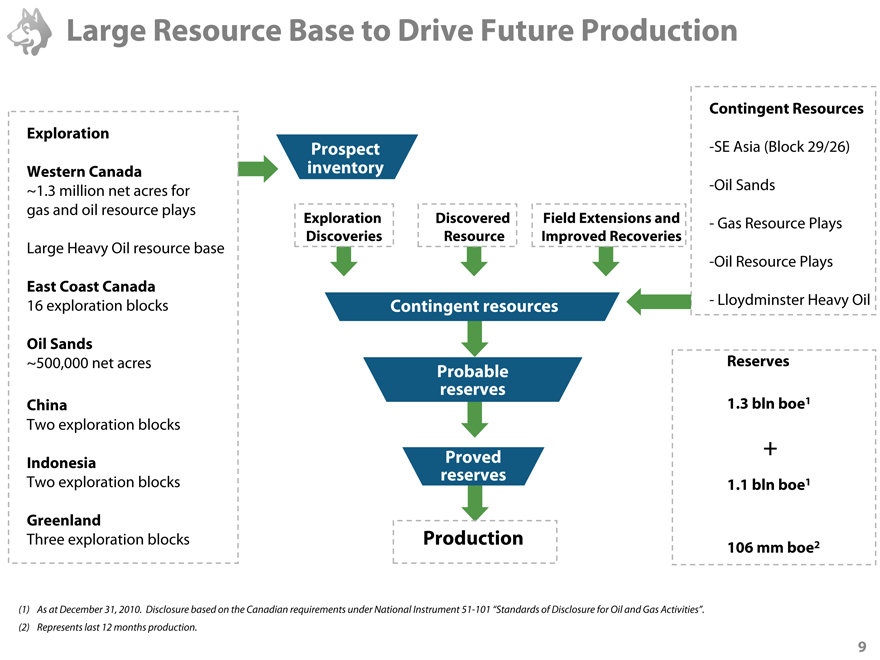

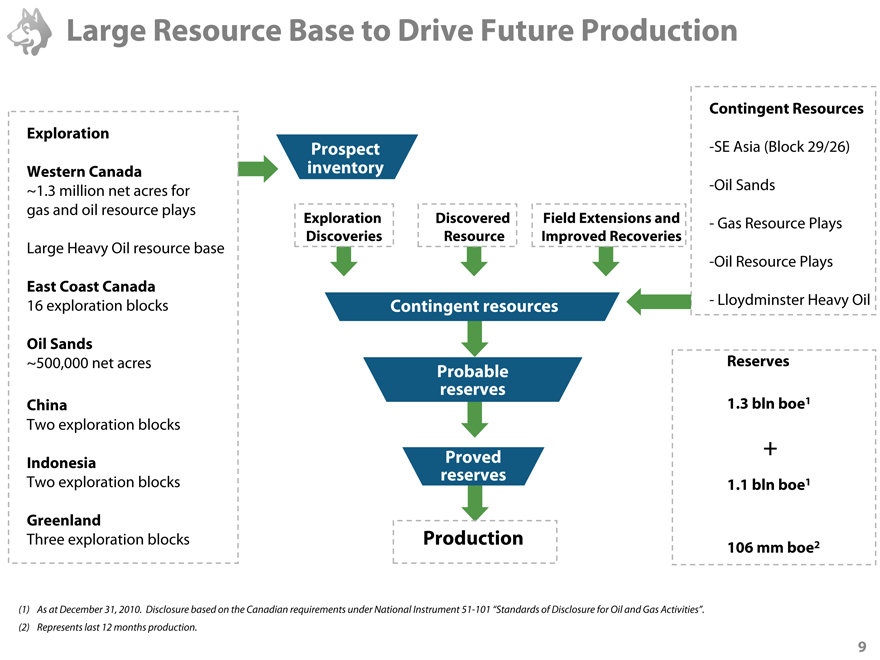

Large Resource Base to Drive Future Production

Exploration

Western Canada

~1.3 million net acres for gas and oil resource plays

Large Heavy Oil resource base

East Coast Canada

16 exploration blocks

Oil Sands

~500,000 net acres

China

Two exploration blocks

Indonesia

Two exploration blocks

Greenland

Three exploration blocks

Prospect inventory

Exploration Discovered Field Extensions Discoveries Resource Improved Recoveries

Contingent resources

Probable reserves

Proved reserves

Production

Contingent Resources

-SE Asia (Block 29/26)

-Oil Sands

- Gas Resource Plays -Oil Resource Plays

- Lloydminster Heavy Oil

Reserves

1.3 bln boe1

+

1.1 bln boe1

106 mm boe2

(1) As at December 31, 2010. Disclosure based on the Canadian requirements under National Instrument 51-101 “Standards of Disclosure for Oil and Gas Activities”.

(2) | | Represents last 12 months production. |

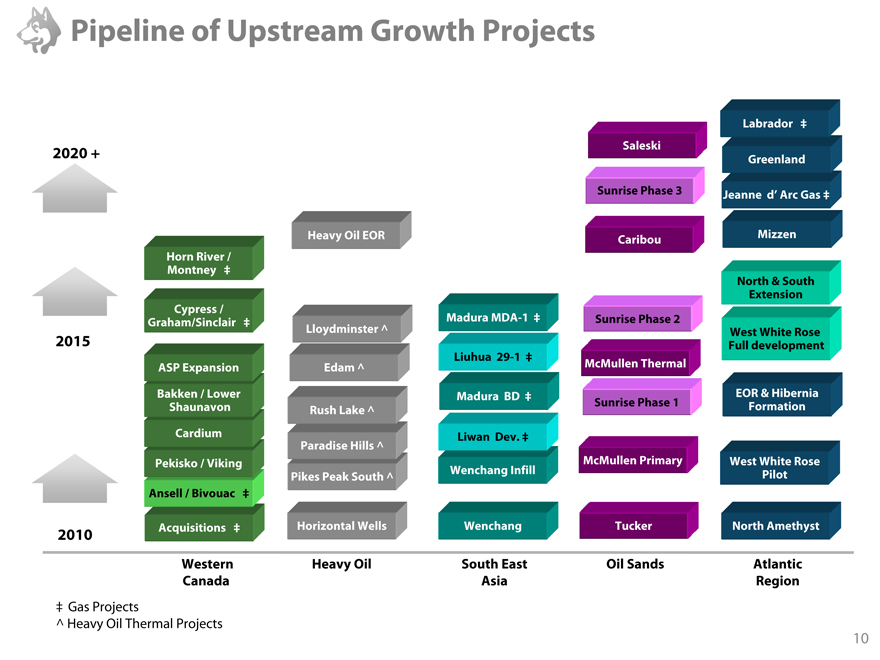

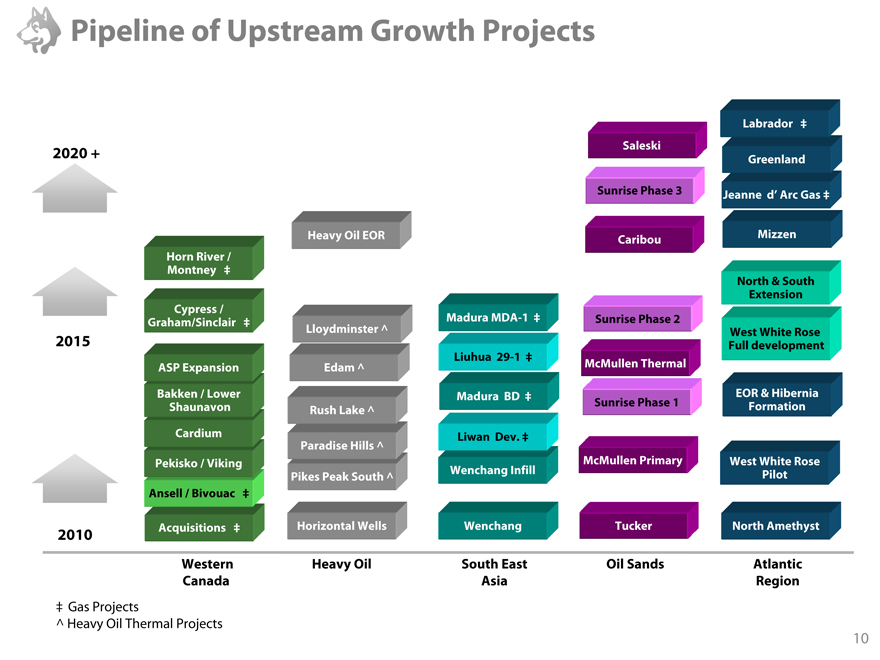

Pipeline of Upstream Growth Projects

Labrador ‡

Saleski

2020 + Greenland

Sunrise Phase 3 Jeanne d’ Arc Gas ‡

Heavy Oil EOR Caribou Mizzen

Horn River /

Montney ‡

North & South

Extension

Cypress /

Graham/Sinclair ‡ Madura MDA-1 ‡ Sunrise Phase 2

Lloydminster ^ West White Rose

2015 Full development

Liuhua 29-1 ‡

ASP Expansion Edam ^ McMullen Thermal

Bakken / Lower Madura BD ‡ EOR & Hibernia

Shaunavon Rush Lake ^ Sunrise Phase 1 Formation

Cardium Liwan Dev. ‡

Paradise Hills ^

Pekisko / Viking McMullen Primary West White Rose

Pikes Peak South ^ Wenchang Infill Pilot

Ansell / Bivouac ‡

2010 Acquisitions ‡ Horizontal Wells Wenchang Tucker North Amethyst

Western Heavy Oil South East Oil Sands Atlantic

Canada Asia Region

‡ Gas Projects

^ Heavy Oil Thermal Projects

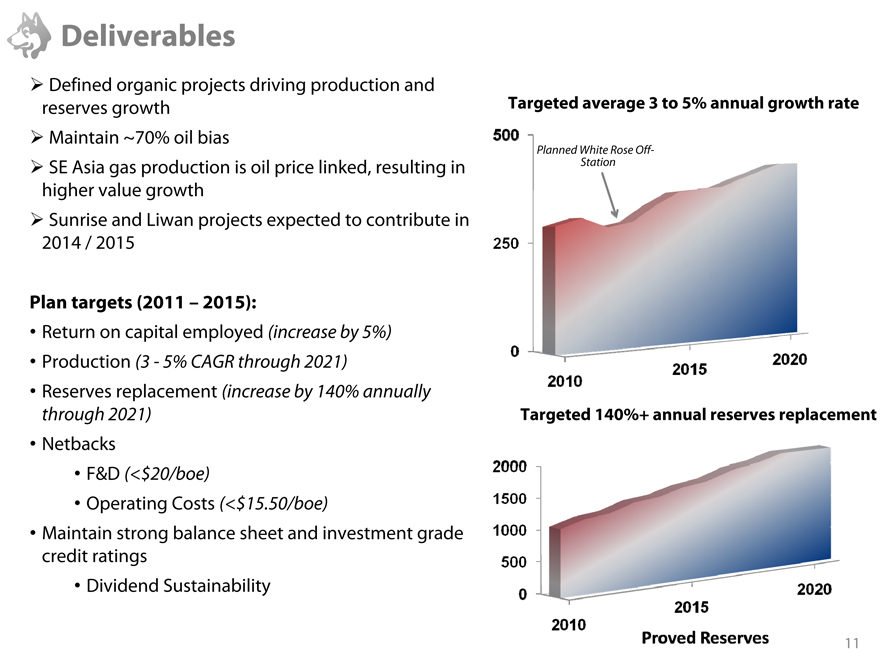

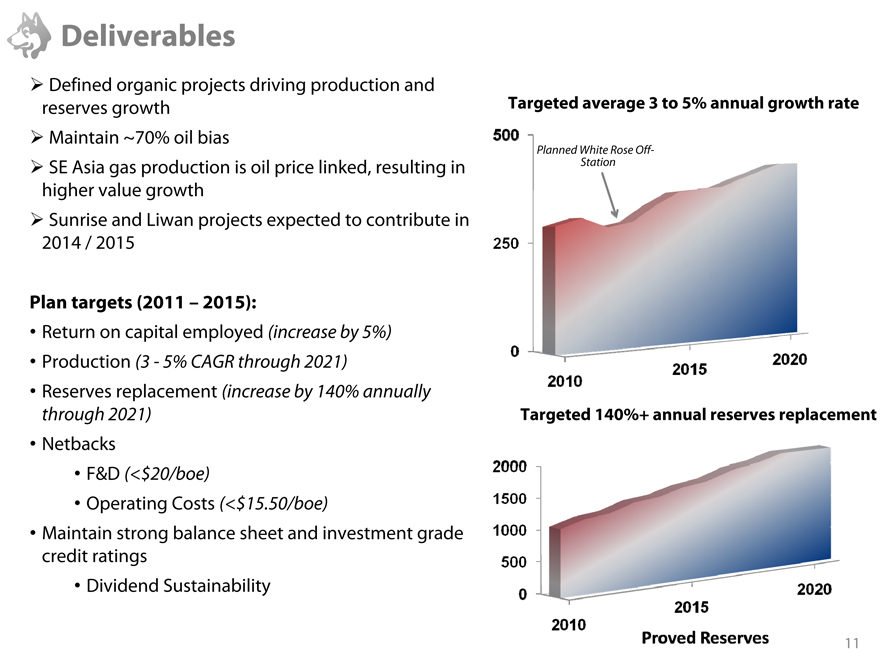

Deliverables

Defined organic projects driving production and reserves growth

Maintain ~70% oil bias

SE Asia gas production is oil price linked, resulting in higher value growth

Sunrise and Liwan projects expected to contribute in 2014 / 2015

Plan targets (2011 – 2015):

Return on capital employed (increase by 5%)

Production (3 – 5% CAGR through 2021)

Reserves replacement (increase by 140% annually through 2021)

Netbacks

F&D (<$20/boe)

Operating Costs (<$15.50/boe)

Maintain strong balance sheet and investment grade credit ratings

Dividend Sustainability

Targeted average 3 to 5% annual growth rate

Planned White Rose Off-Station

500

250

0

2010

2015

2020

Targeted 140%+ annual reserves replacement

2000

1500

1000

500

0

2010

2015

2020

Proved Reserves

Value Proposition – Balanced Growth

Clear strategy with experienced team to deliver

Oil-weighted portfolio leveraged to demand growth

Production and reserves growth through large, organic and diversified project portfolio

Significant Asian portfolio – particularly the world-scale Liwan gas development – offers significant growth opportunities

Top quartile dividend

Solid balance sheet and financial flexibility

Strong support from principal shareholders

Corporate Overview

Financial Overview Regenerating the Foundation

Pillars of Growth

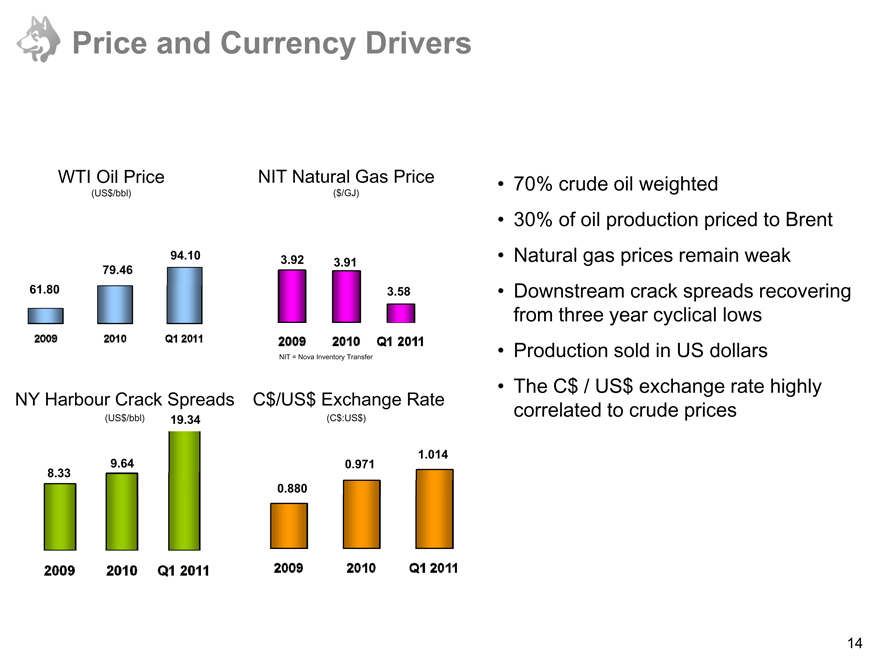

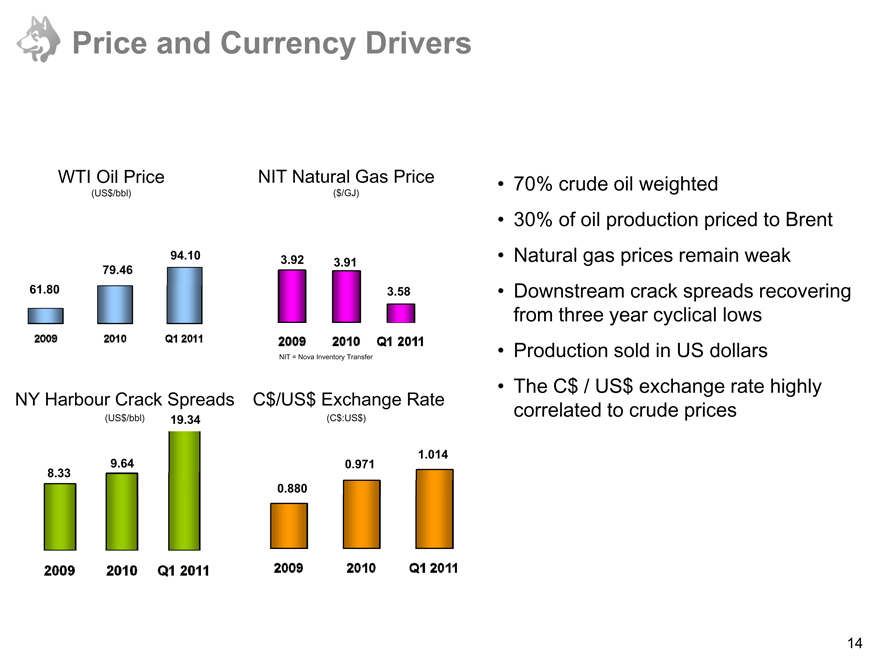

Price and Currency Drivers

WTI Oil Price

(US$/bbl)

NIT Natural Gas Price

($/GJ)

61.80

79.46

94.10

2009

2010

Q1 2011

3.92

3.91

3.58

2009

2010

Q1 2011

NIT = Nova Inventory Transfer

NY Harbour Crack Spreads

(US$/bbl)

19.34

9.64

8.33

2009

2010

Q1 2011

C$/US$ Exchange Rate

(C$:US$)

1.014

0.971

0.880

2009

2010

Q1 2011

70% crude oil weighted

30% of oil production priced to Brent

Natural gas prices remain weak

Downstream crack spreads recovering from three year cyclical lows

Production sold in US dollars

The C$ / US$ exchange rate highly correlated to crude prices

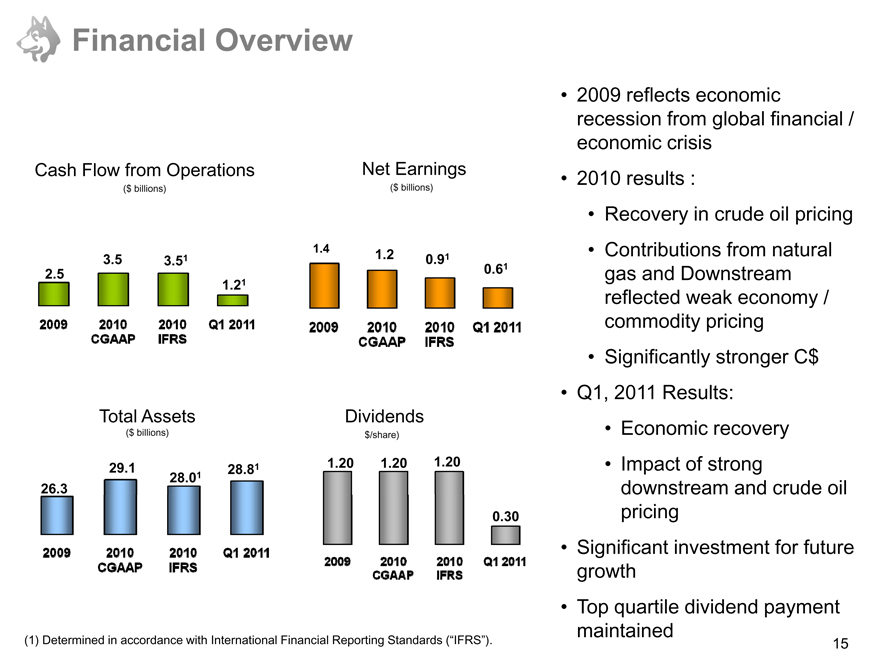

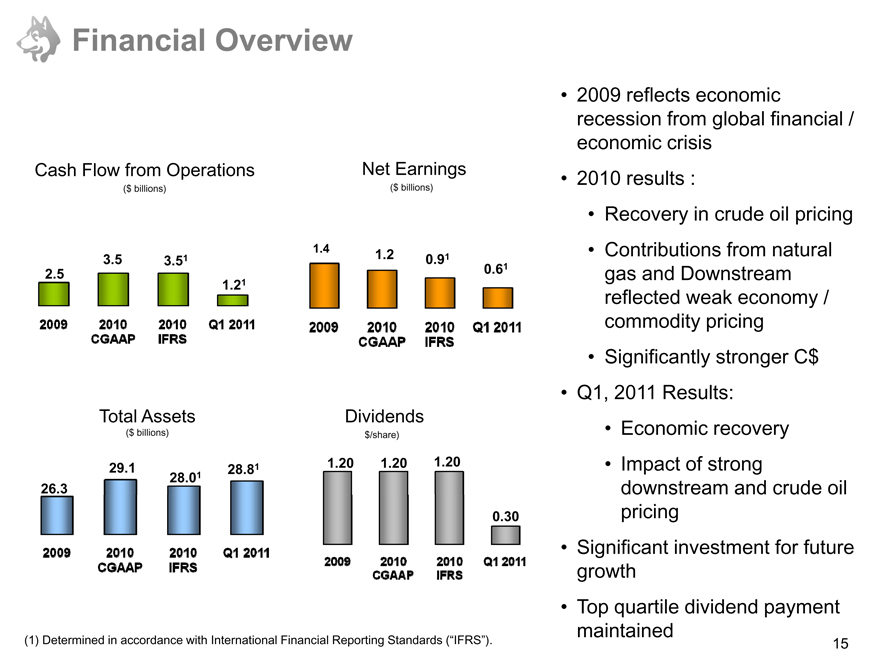

Financial Overview

Cash Flow from Operations

($ billions)

Net Earnings

($ billions)

2.5

1.21

3.5

3.51

2009

2010 CGAAP

2010 IFRS

Q1 2011

1.4

1.2

0.91

0.61

2009

2010 CGAAP

2010 IFRS

Q1 2011

Total Assets

($ billions)

Dividends

$/share)

26.3

29.1

28.0 1

28.8 1

2009

2010 CGAAP

2010 IFRS

Q1 2011

1.20

1.20

1.20

0.30

2009

2010 CGAAP

2010 IFRS

Q1 2011

2009 reflects economic recession from global financial / economic crisis

2010 results :

Recovery in crude oil pricing

Contributions from natural gas and Downstream reflected weak economy / commodity pricing

Significantly stronger C$

Q1, 2011 Results:

Economic recovery

Impact of strong downstream and crude oil pricing

Significant investment for future growth

Top quartile dividend payment maintained

(1) | | Determined in accordance with International Financial Reporting Standards (“IFRS”). |

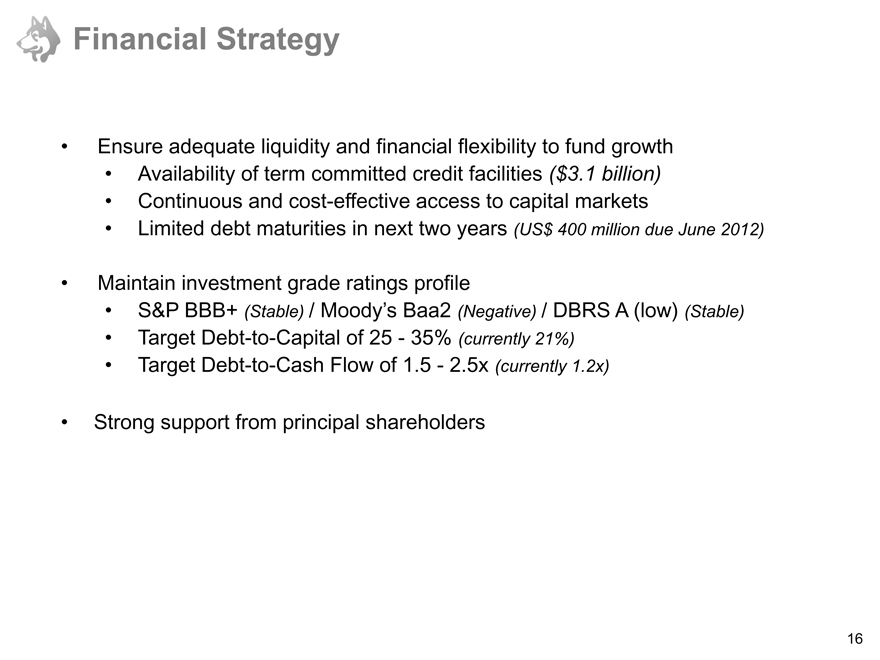

Financial Strategy

Ensure adequate liquidity and financial flexibility to fund growth

Availability of term committed credit facilities ($3.1 billion)

Continuous and cost-effective access to capital markets

Limited debt maturities in next two years (US$ 400 million due June 2012)

Maintain investment grade ratings profile

S&P BBB+ (Stable) / Moody’s Baa2 (Negative) / DBRS A (low) (Stable)

Target Debt-to-Capital of 25—35% (currently 21%)

Target Debt-to-Cash Flow of 1.5—2.5x (currently 1.2x)

Strong support from principal shareholders

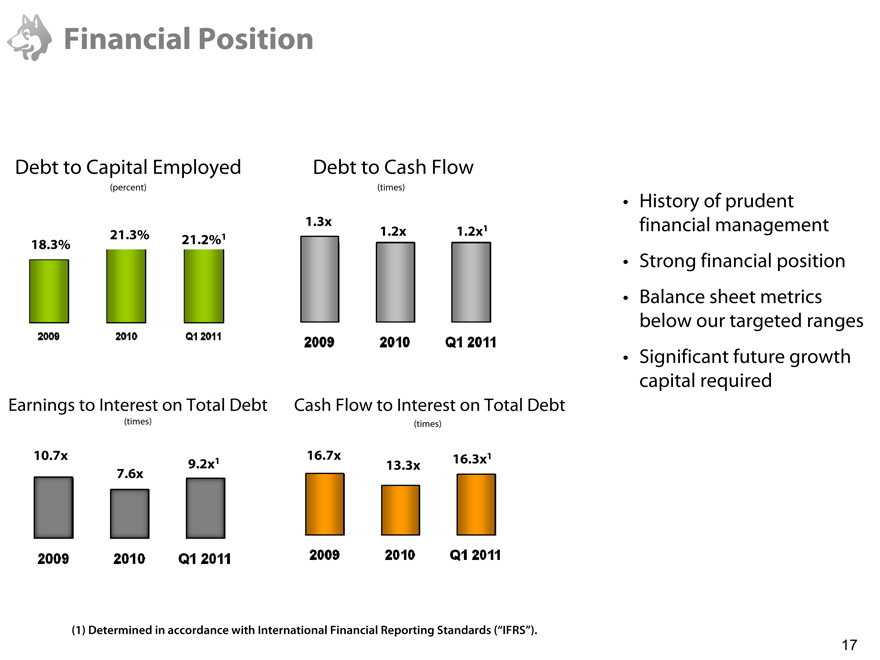

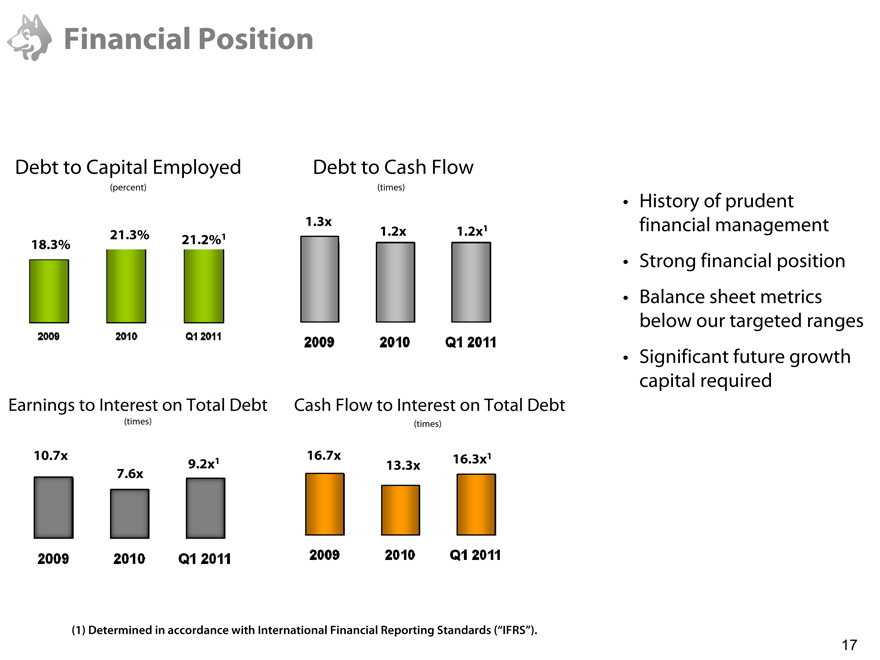

Financial Position

Debt to Capital Employed

(percent)

18.3%

21.3%

2009

2010

Q1 2011

Debt to Cash Flow

(times)

1.3X

1.2X

1.2X1

2009

2010

Q1 2011

Earnings to Interest on Total Debt

(times)

10.7X

7.6X

9.2X1

2009

2010

Q1 2011

Cash Flow to Interest on Total Debt

(times)

16.7X

13.3X

16.3X1

2009

2010

Q1 2011

History of prudent financial management

Strong financial position

Balance sheet metrics below our targeted ranges

Significant future growth capital required

(1) | | Determined in accordance with International Financial Reporting Standards (“IFRS”). |

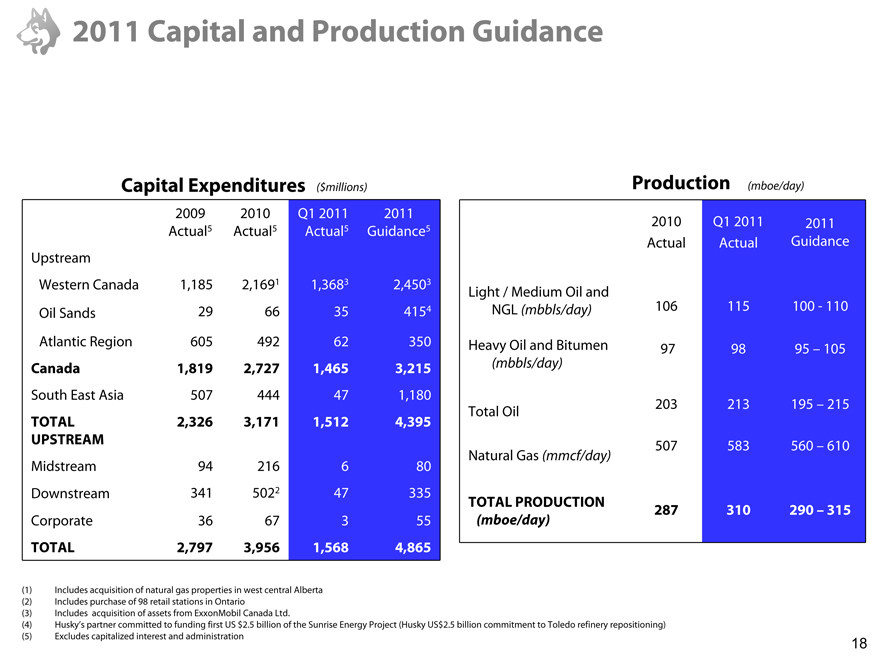

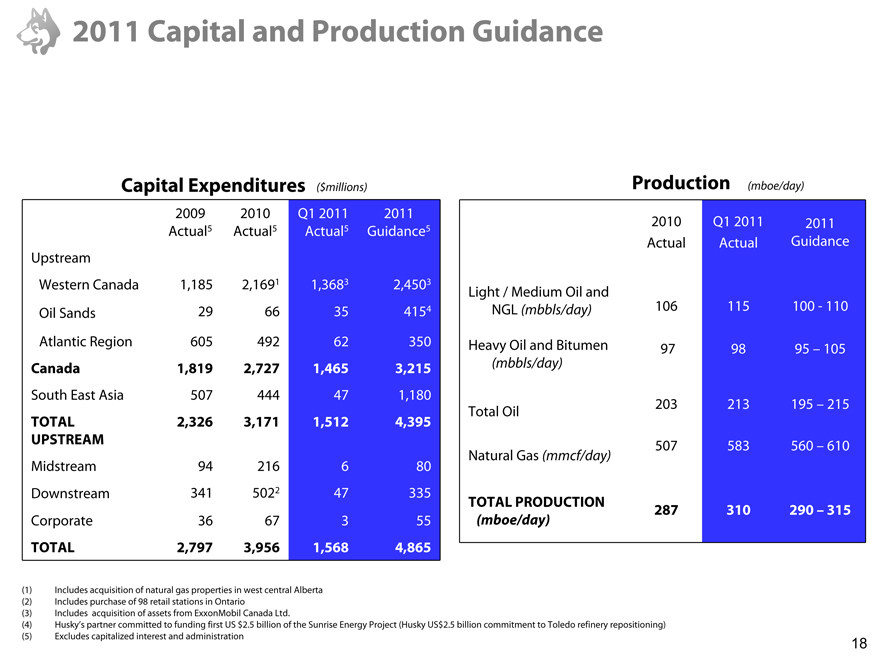

2011 Capital and Production Guidance

Capital Expenditures ($millions)

2009 2010 Q1 2011

Actual 5 Actual5 2011 5 Guidance 5

Actual

Upstream

Western Canada 1,185 2,169 1 1,368 3 2,450 3

Oil Sands 29 66 35 415 4

Atlantic Region 605 492 62 350

Canada 1,819 2,727 1,465 3,215

South East Asia 507 444 47 1,180

TOTAL 2,326 3,171 1,512 4,395

UPSTREAM

Midstream 94 216 6 80

Downstream 341 502 2 47 335

Corporate 36 67 3 55

TOTAL 2,797 3,956 1,568 4,865

Production (mboe/day)

Q1

2010 2011

2011

Actual Guidance

Actual

Light / Medium Oil and

NGL (mbbls/day) 106 115 100 – 110

Heavy Oil and Bitumen 97 98 95 – 105

(mbbls/day)

Total Oil 203 213 195 – 215

Natural Gas 507 583 560 – 610

(mmcf/day)

TOTAL PRODUCTION 287 310 290 – 315

(mboe/day)

(1) Includes acquisition of natural gas properties in west central Alberta

(2) Includes purchase of 98 retail stations in Ontario

(3) Includes acquisition of assets from ExxonMobil Canada Ltd.

(4) Husky’s partner committed to funding first US $2.5 billion of the Sunrise Energy Project (Husky US$2.5 billion commitment to Toledo refinery repositioning)

(5) Excludes capitalized interest and administration

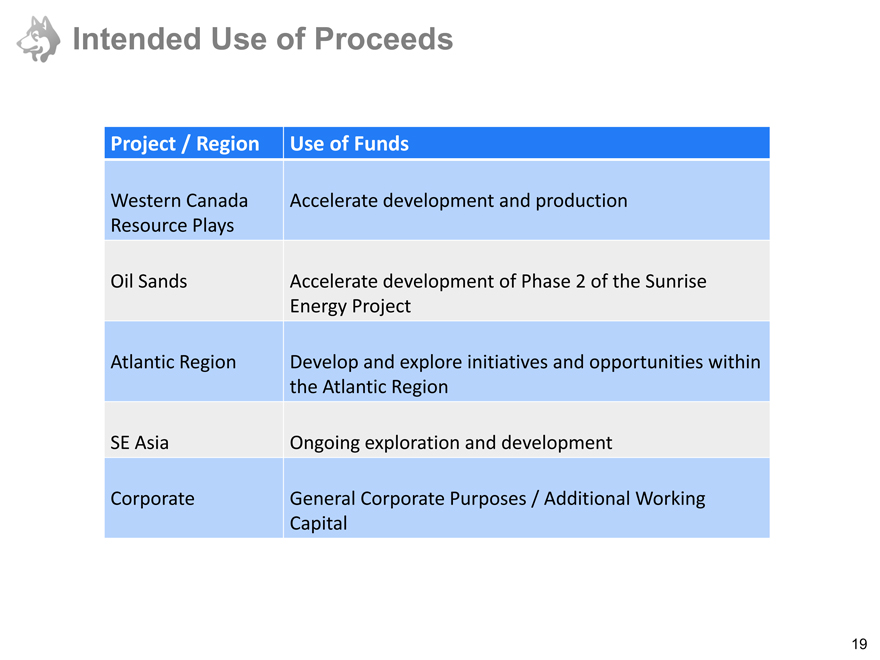

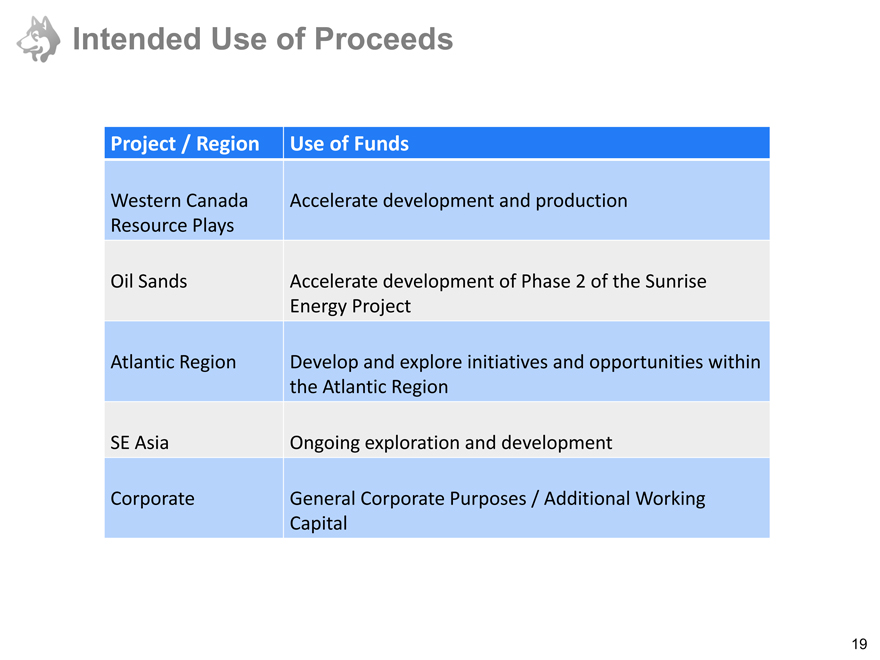

Intended Use of Proceeds

Project / Region Use of Funds

Western Canada Accelerate development and production

Resource Plays

Oil Sands Accelerate development of Phase 2 of the Sunrise

Energy Project

Atlantic Region Develop and explore initiatives and opportunities within

the Atlantic Region

SE Asia Ongoing exploration and development

Corporate General Corporate Purposes / Additional Working

Capital

Corporate Overview

Financial Overview

Regenerating the Foundation

Pillars of Growth

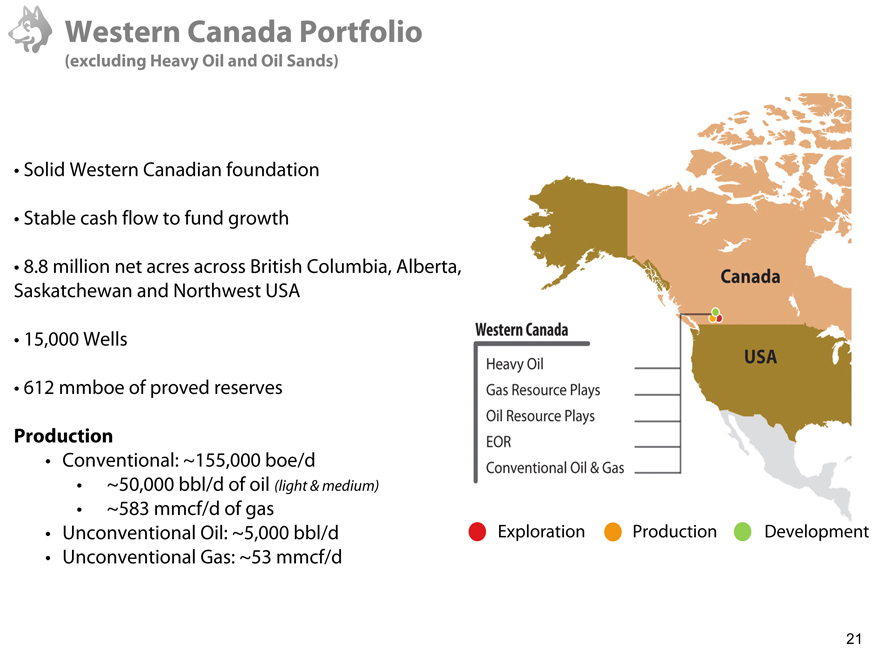

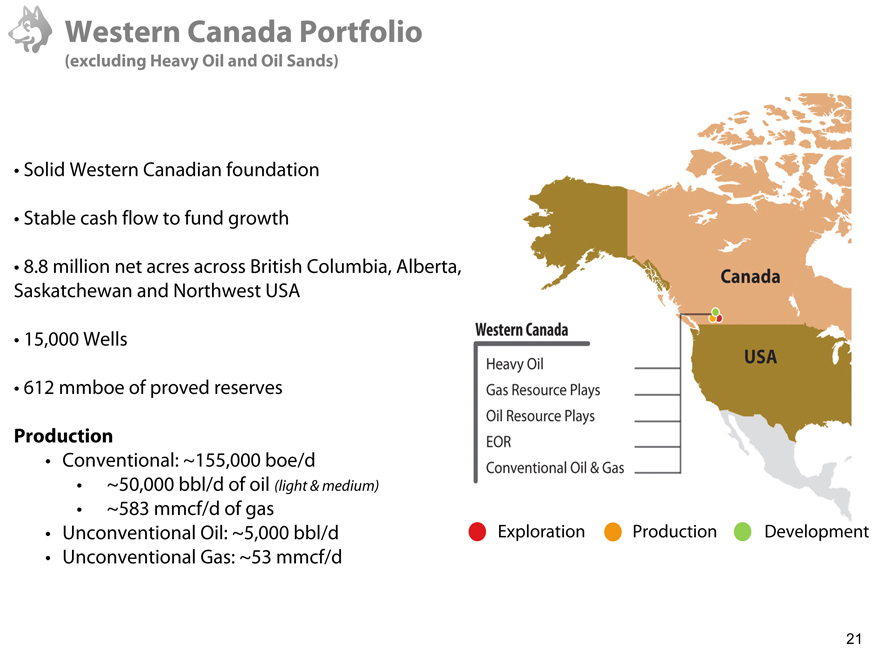

Western Canada Portfolio

(excluding Heavy Oil and Oil Sands)

• Solid Western Canadian foundation

• Stable cash flow to fund growth

• 8.8 million net acres across British Columbia, Alberta, Saskatchewan and Northwest USA

• 15,000 Wells

• 612 mmboe of proved reserves

Production

• Conventional: ~155,000 boe/d

• ~50,000 bbl/d of oil (light & medium)

• ~583 mmcf/d of gas

• Unconventional Oil: ~5,000 bbl/d

• Unconventional Gas: ~53 mmcf/d

Western Canada

Heavy Oil

Gas Resource Plays

Oil Resource Plays

EOR

Conventional Oil & Gas

Exploration Production Development

Canada

USA

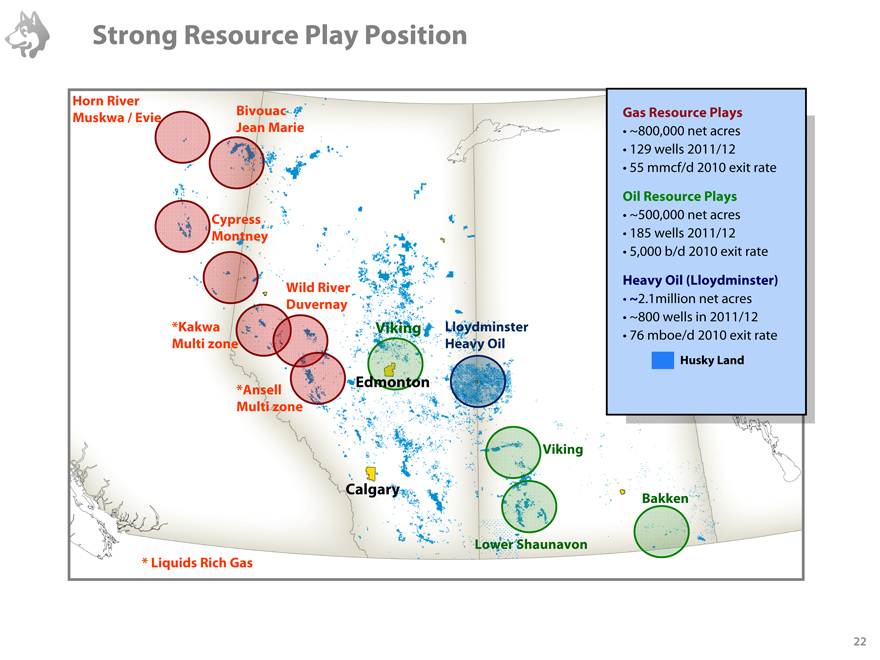

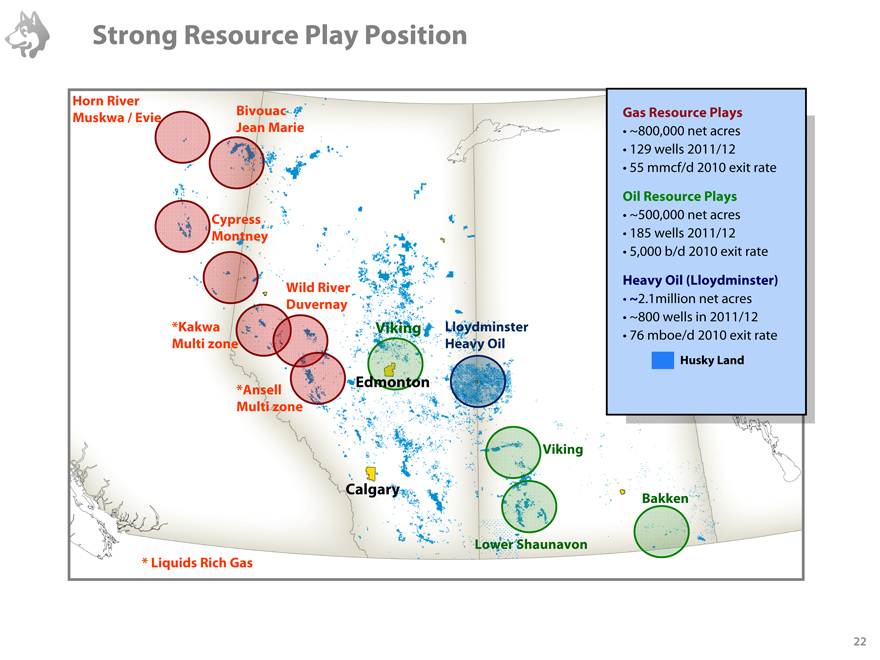

Strong Resource Play Position

Gas Resource Plays

~800,000 net acres

129 wells 2011/12

55 mmcf/d 2010 exit rate

Oil Resource Plays

~500,000 net acres

185 wells 2011/12

5,000 b/d 2010 exit rate

Heavy Oil (Lloydminster)

~2.1million net acres

~800 wells in 2011/12

76 mboe/d 2010 exit rate

Husky Land

Horn River Muskwa / Evie

Bivouac Jean Marie

Cypress Montney

Wild River Duvernay

*Kakwa Multi zone

*Ansell Multi zone

Viking

Edmonton

Lloydminster Heavy Oil

Calgary

Viking

Lower Shaunavon

Bakken

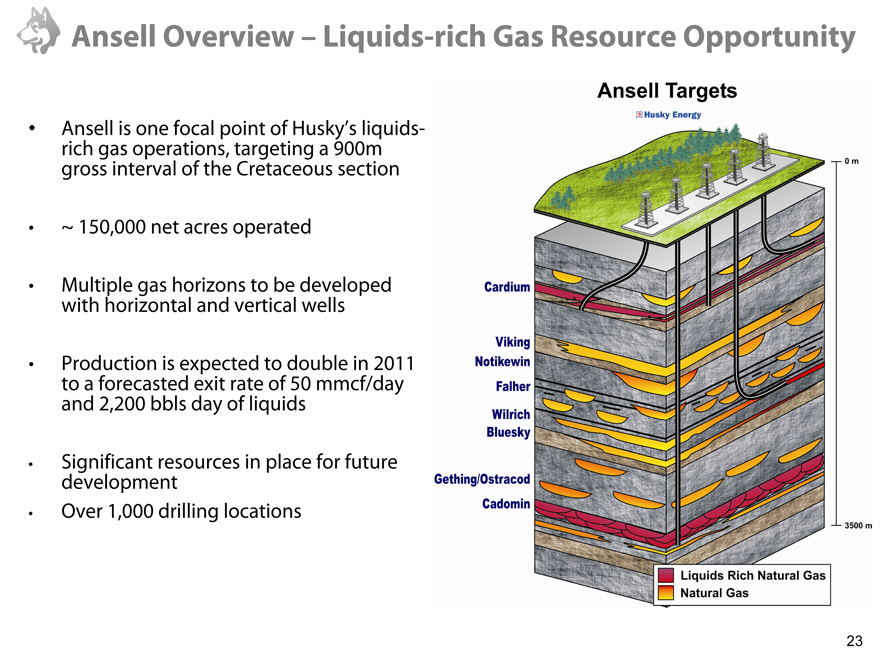

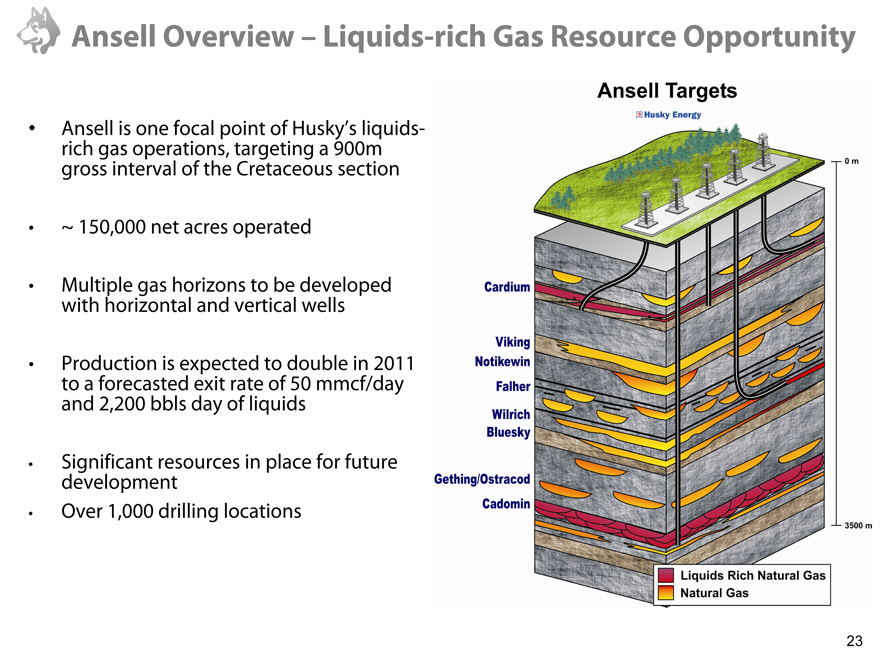

Ansell Overview – Liquids-rich Gas Resource Opportunity

Ansell is one focal point of Husky’s liquids-rich gas operations, targeting a 900m gross interval of the Cretaceous section

~150,000 net acres operated

Multiple gas horizons to be developed with horizontal and vertical wells

Production is expected to double in 2011 to a forecasted exit rate of 50 mmcf/day and 2,200 bbls day of liquids

Significant resources in place for future development

Over 1,000 drilling locations

Ansell Targets

Husky Energy

Cardium

Viking

Notikewin

Falher

Wilrich

Bluesky

Gething/Ostracod

Cadomin

Liquids Rich Natural Gas

Natural Gas

0m 3500m

Kakwa Overview-Oil Resource in Tight Sandstone

Kakwa and Wapiti areas in West Central Alberta, at the northern end of the Cardium trend

Both feature high rock quality and pay thickness with ~ 45° API oil, developable with multi-stage fracturing technology

30,000 net acres operated

Significant resources in place for future development

Over 100 drilling locations

Packers Plus QuickFRAC image

Subsurface Targets

Oilsands

Good Quality Reservoir

Poorer Quality Reservoirs

Tight reservoirs & organic rich shales have become a development target

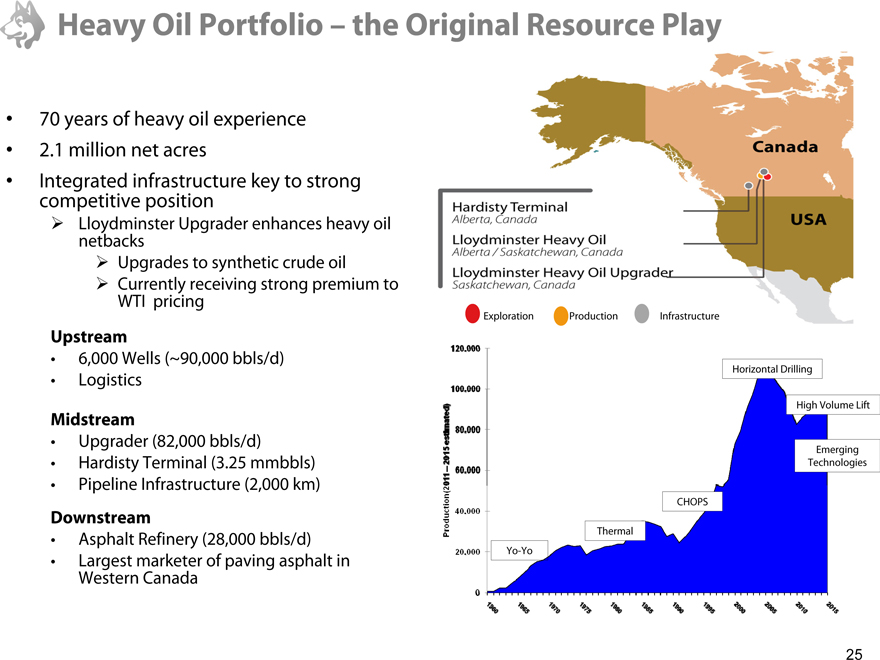

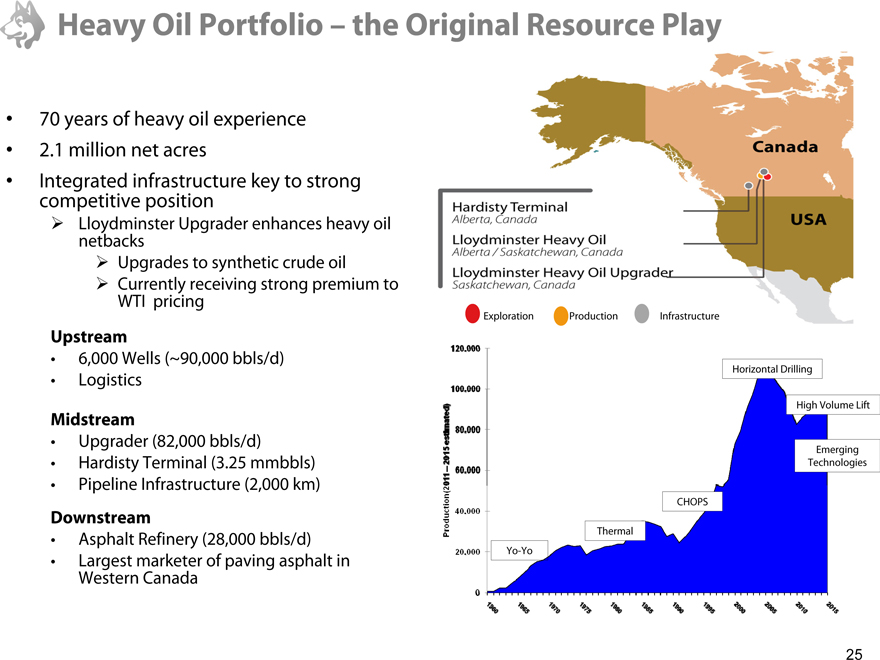

Heavy Oil Portfolio – the Original Resource Play

70 years of heavy oil experience

2.1 million net acres

Integrated infrastructure key to strong competitive position

Lloydminster Upgrader enhances heavy oil netbacks

Upgrades to synthetic crude oil

Currently receiving strong premium to WTI pricing

Upstream

6,000 Wells (~90,000 bbls/d)

Logistics

Midstream

Upgrader (82,000 bbls/d)

Hardisty Terminal (3.25 mmbbls)

Pipeline Infrastructure (2,000 km)

Downstream

Asphalt Refinery (28,000 bbls/d)

Largest marketer of paving asphalt in Western Canada

Canada

USA

Hardisty Terminal

Alberta, Canada

Lloydminster Heavy oil

Alberta/Saskatchewan, Canada

Lloydminster Heavy Oil Upgrader

Saskatchewan, Canada

Exploration

Production

Infrastructure

120,000

100,000

80,000

50,000

40,000

20,000

0

Production(2011-2015 estimated)

Yo-Yo

Thermal

Chops

Horizontal Drilling

High Volume Lift

Emerging Technologies

1960

1965

1970

1975

1980

1985

1990

1995

2000

2005

2010

2015

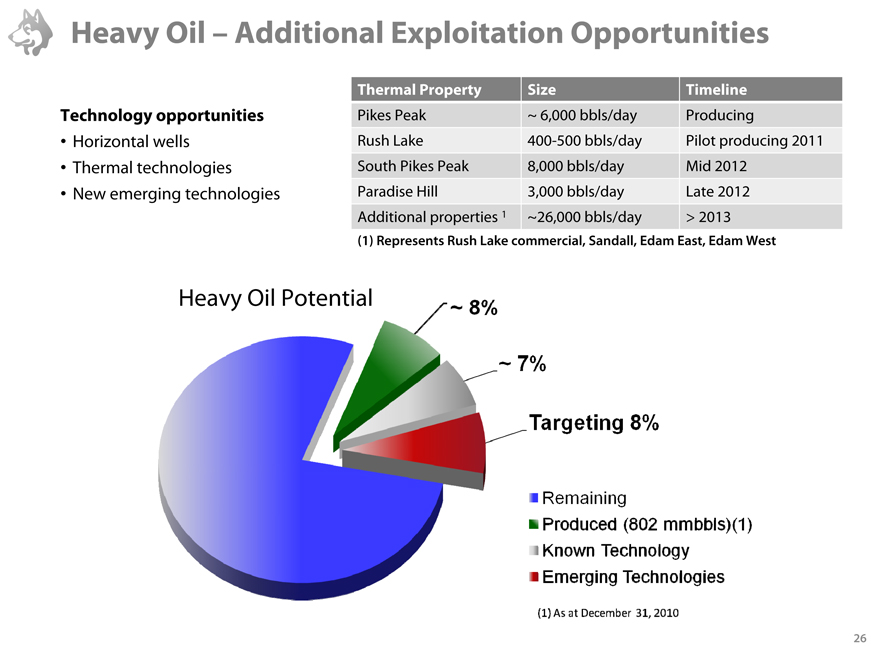

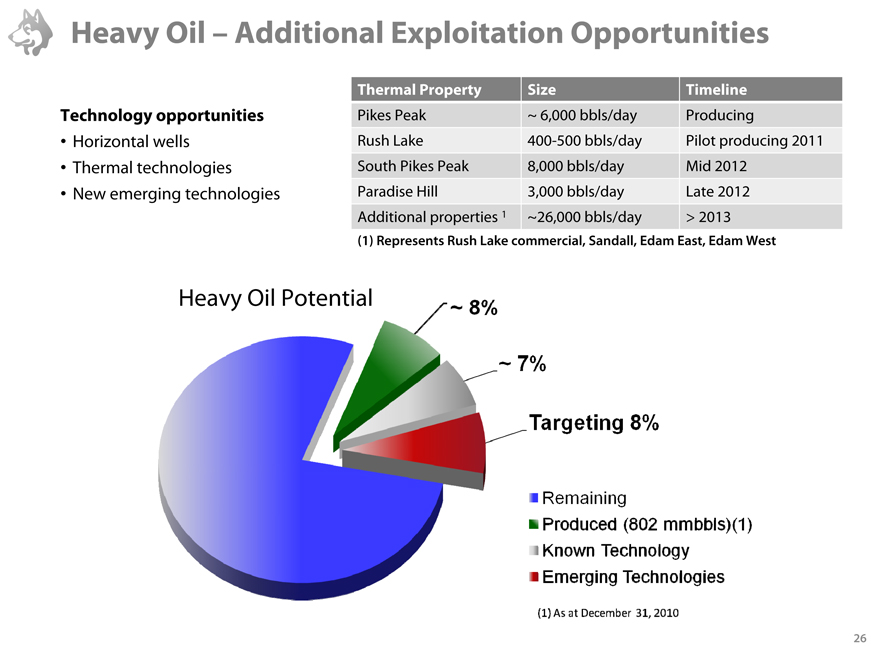

Heavy Oil – Additional Exploitation Opportunities

Technology opportunities

Horizontal wells

Thermal technologies

New emerging technologies

Thermal Property Size Timeline

Pikes Peak ~ 6,000 bbls/day Producing

Rush Lake 400-500 bbls/day Pilot producing 2011 South Pikes Peak 8,000 bbls/day Mid 2012 Paradise Hill 3,000 bbls/day Late 2012 Additional properties 1 ~26,000 bbls/day > 2013

(1) | | Represents Rush Lake commercial, Sandall, Edam East, Edam West |

Heavy Oil Potential

8%

~7%

Targeting 8%

Remaining

Produced (802 mmbbls)(1)

Emerging Technologies

Corporate Overview

Financial Overview

Regenerating the Foundation

Pillars of Growth

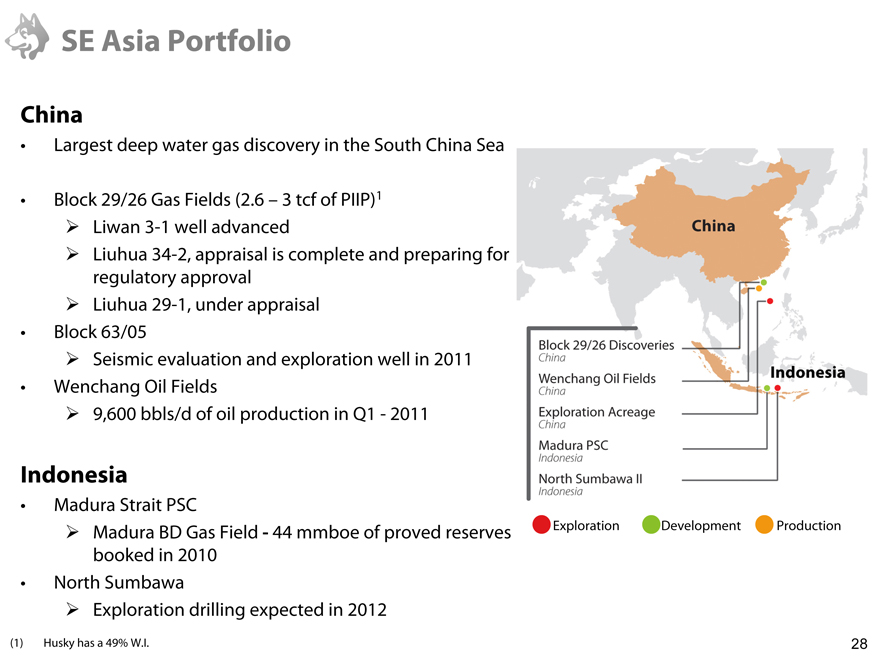

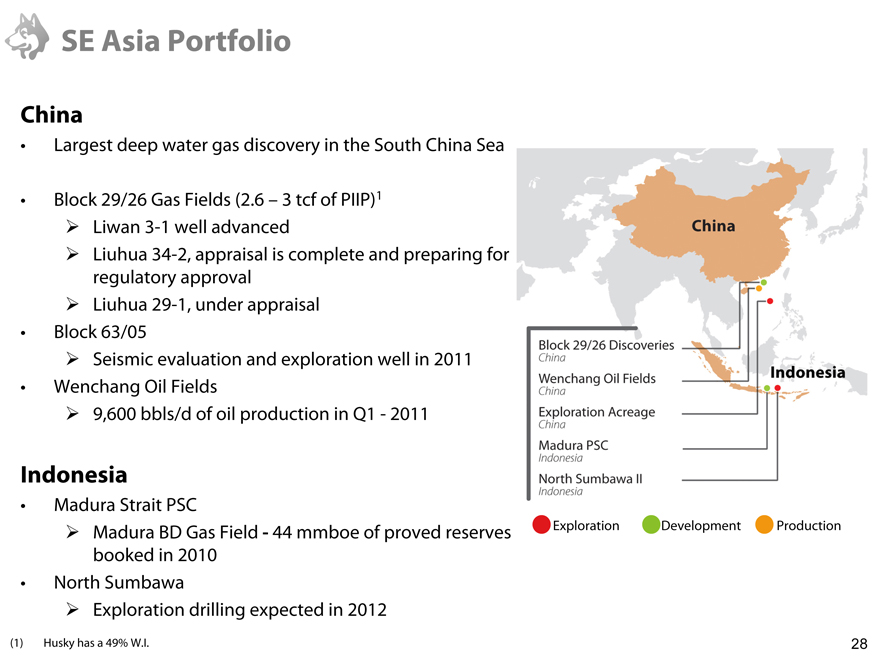

SE Asia Portfolio

China

Largest deep water gas discovery in the South China Sea

Block 29/26 Gas Fields (2.6 – 3 tcf of PIIP)1

Liwan 3-1 well advanced

Liuhua 34-2, appraisal is complete and preparing for regulatory approval

Liuhua 29-1, under appraisal

Block 63/05

Seismic evaluation and exploration well in 2011

Wenchang Oil Fields

9,600 bbls/d of oil production in Q1 - 2011

Indonesia

Madura Strait PSC

Madura BD Gas Field - 44 mmboe of proved reserves booked in 2010

North Sumbawa

Exploration drilling expected in 2012

China

Indonesia

Block 29/26 Discoveries

China

Wenchang Oil Fields

China

Exploration Acreage

China

Madura PSC

Indonesia

North Sumbawa II

Indonesia

Exploration

Development

Production

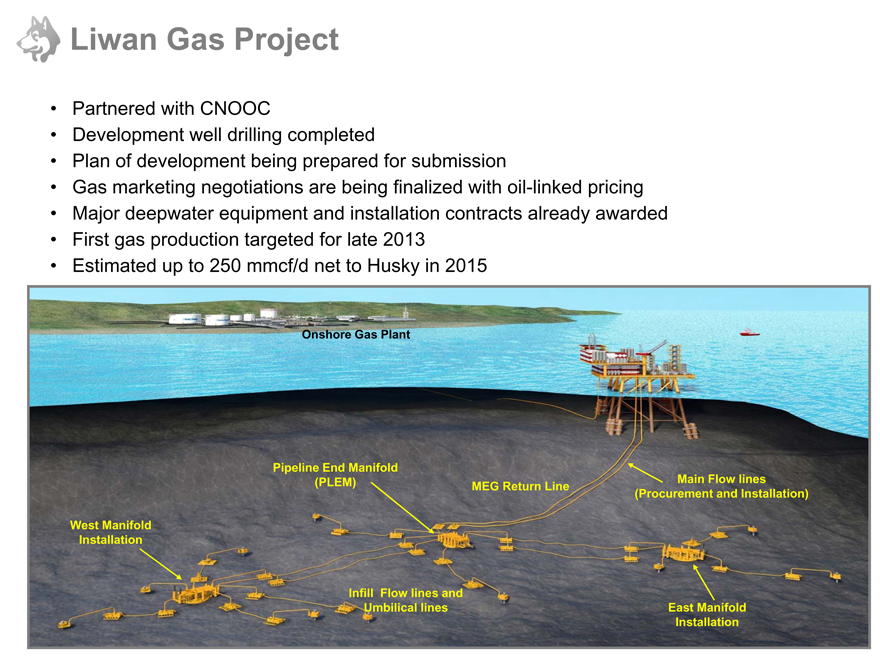

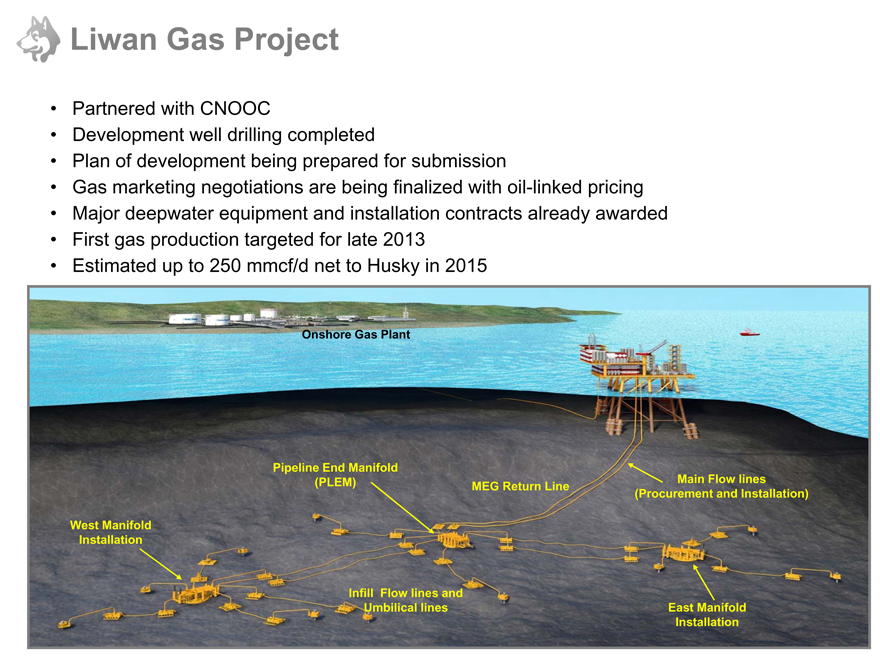

Liwan Gas Project

Partnered with CNOOC

Development well drilling completed

Plan of development being prepared for submission

Gas marketing negotiations are being finalized with oil-linked pricing

Major deepwater equipment and installation contracts already awarded

First gas production targeted for late 2013

Estimated up to 250 mmcf/d net to Husky in 2015

Onshore Gas Plant

West Manifold Installation

Pipeline End Manifold (PLEM)

Infill Flow lines and Umbilical lines

MEG Return Line

Main Flow lines (Procurement and Installation)

East Manifold Installation

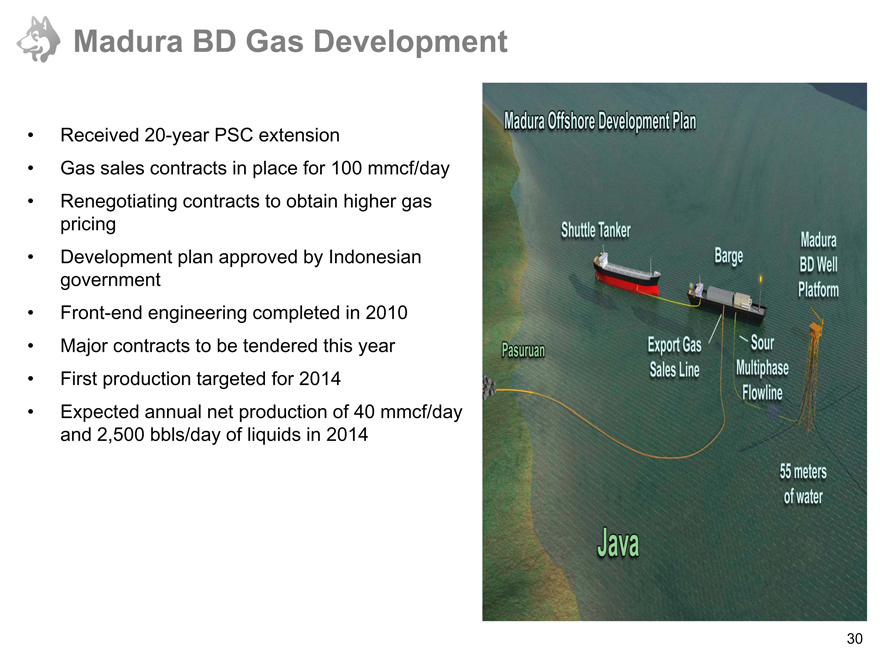

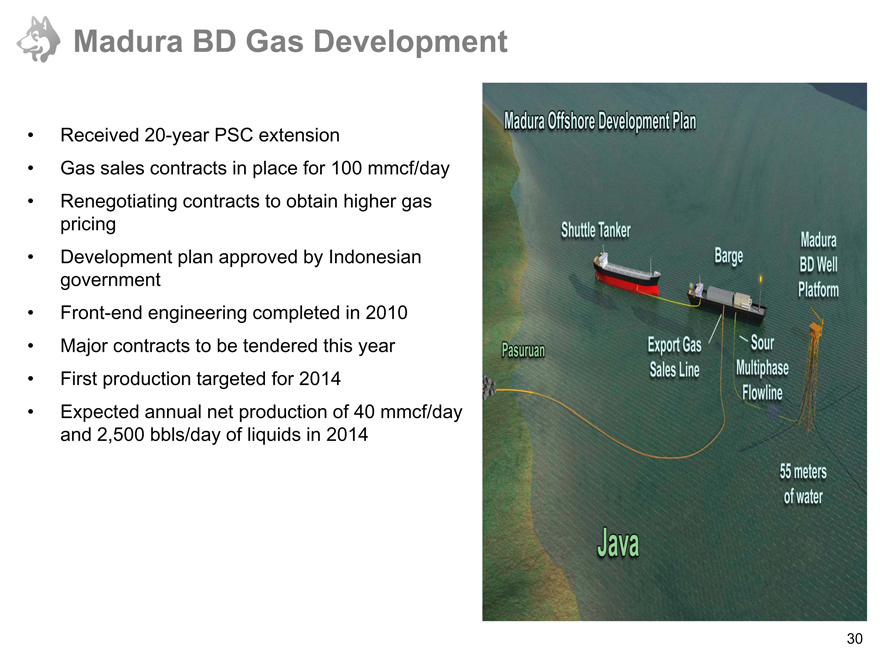

Madura BD Gas Development

Received 20-year PSC extension

Gas sales contracts in place for 100 mmcf/day

Renegotiating contracts to obtain higher gas pricing

Development plan approved by Indonesian government

Front-end engineering completed in 2010

Major contracts to be tendered this year

First production targeted for 2014

Expected annual net production of 40 mmcf/day and 2,500 bbls/day of liquids in 2014

Madura Offshore Development Plan

Pasuruan

Shuttle Tanker

Export Gas Sales Line

Barge

Sour Multiphase Flowline

Madura BD Well Platform

55 meters of water

Java

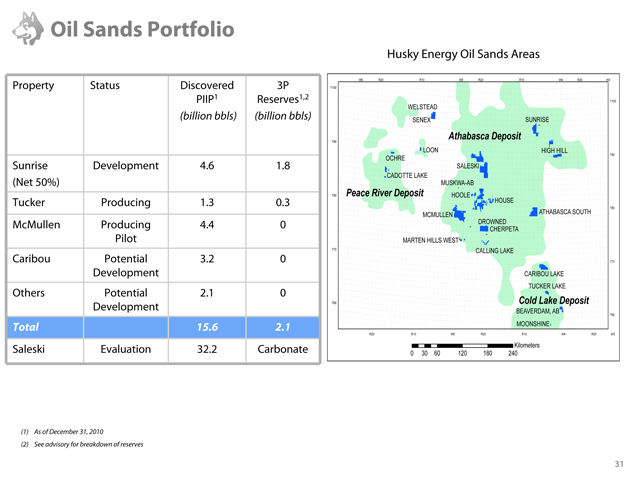

Oil Sands Portfolio

Property Status Discovered 3P

PIIP1 Reserves1,2

(billion bbls) (billion bbls)

Sunrise Development 4.6 1.8

(Net 50%)

Tucker Producing 1.3 0.3

McMullen Producing 4.4 0

Pilot

Caribou Potential 3.2 0

Development

Others Potential 2.1 0

Development

Total 15.6 2.1

Saleski Evaluation 32.2 Carbonate

Husky Energy Oil Sands Areas

(1) | | As of December 31, 2010 |

(2) | | See advisory for breakdown of reourses |

WELSTEAD

SENEX

LOON

OCHRE

CADOTTE LAKE

Peace River Deposit

Athabasca Deposit

SALESKI

MUSKWA-AB

HOOLE

MCMULLEN

MARTEN HILLS WEST

SUNRISE

HIGH HILL

ATHABASCA SOUTH

CARIBOU LAKE

TUCKER LAKE

Cold Lake Deposit

BEAVERDAM, AB

MOONSHINE

Kilometers

0

30

60

120

180

HOUSE

DROWNED

CHERPETA

CALLING CAKE

240

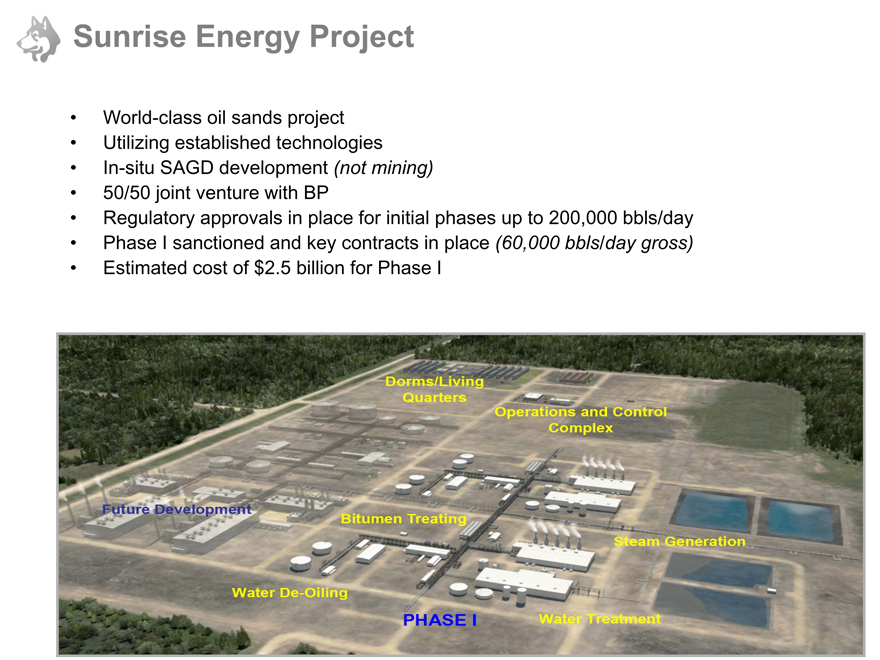

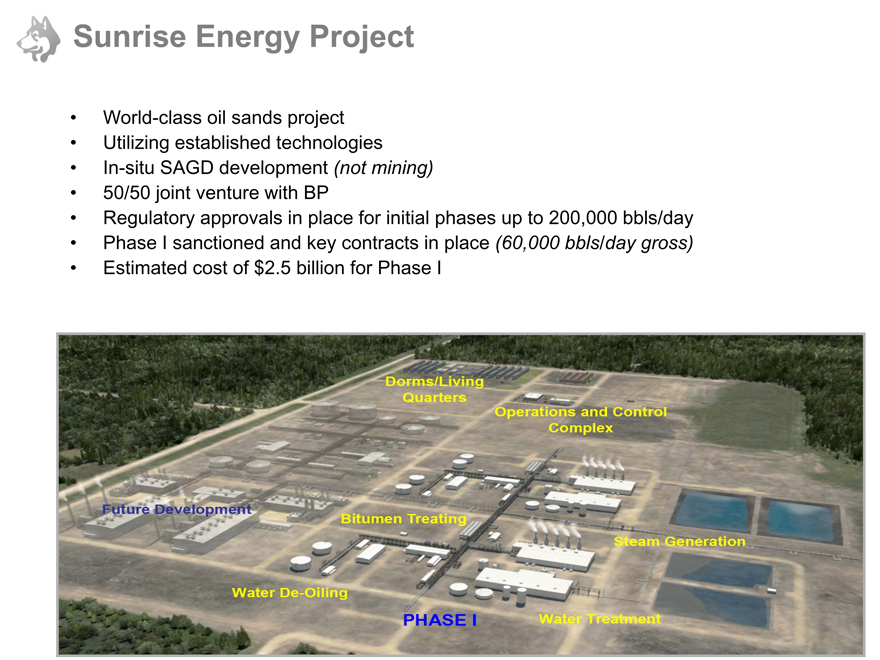

Sunrise Energy Project

World-class oil sands project

Utilizing established technologies

In-situ SAGD development (not mining)

50/50 joint venture with BP

Regulatory approvals in place for initial phases up to 200,000 bbls/day

Phase I sanctioned and key contracts in place (60,000 bbls/day gross)

Estimated cost of $2.5 billion for Phase I

Future Development

Water De-Oiling

Dorms/Living Quarters

Bitumen Treating

PHASE I

Operations and Control Complex

Water Treatment

Steam Generation

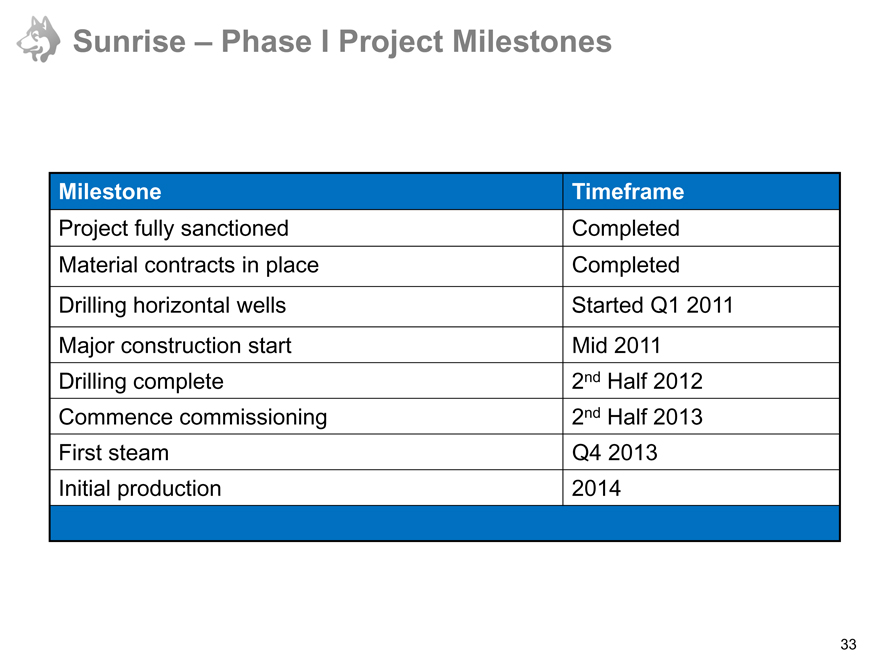

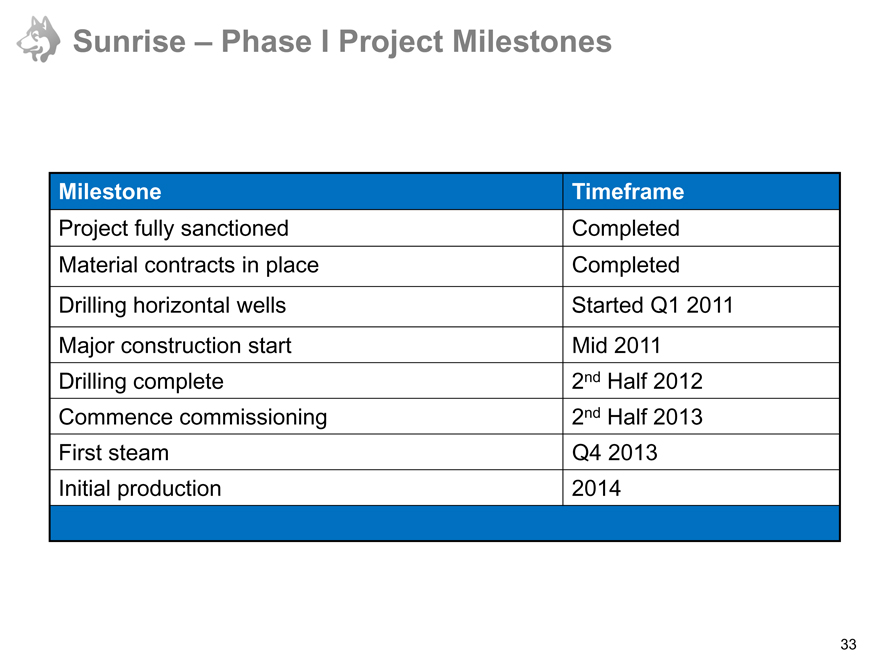

Sunrise – Phase I Project Milestones

Milestone Timeframe

Project fully sanctioned Completed

Material contracts in place Completed

Drilling horizontal wells Started Q1 2011

Major construction start Mid 2011

Drilling complete 2nd Half 2012

Commence commissioning 2nd Half 2013

First steam Q4 2013

Initial production 2014

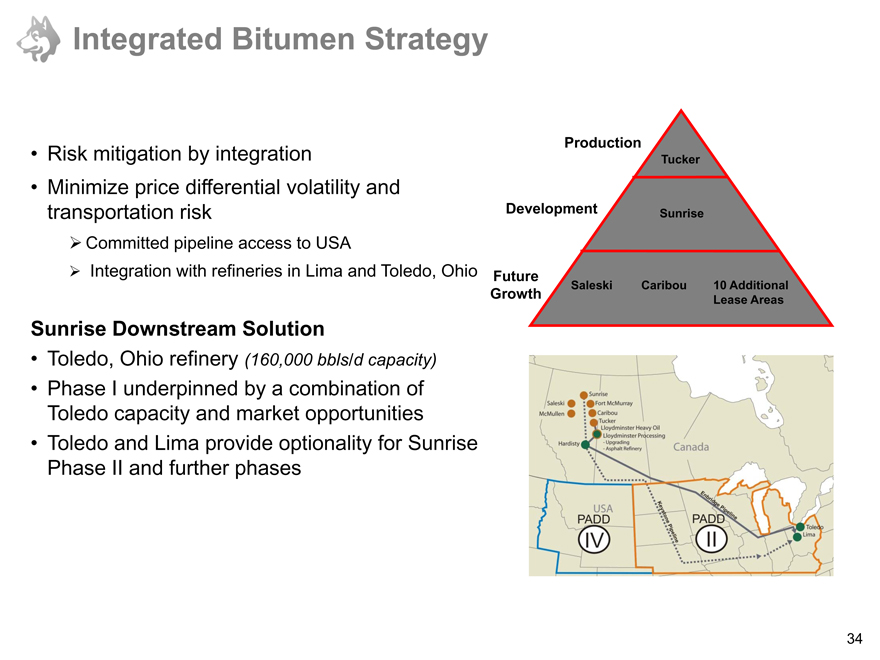

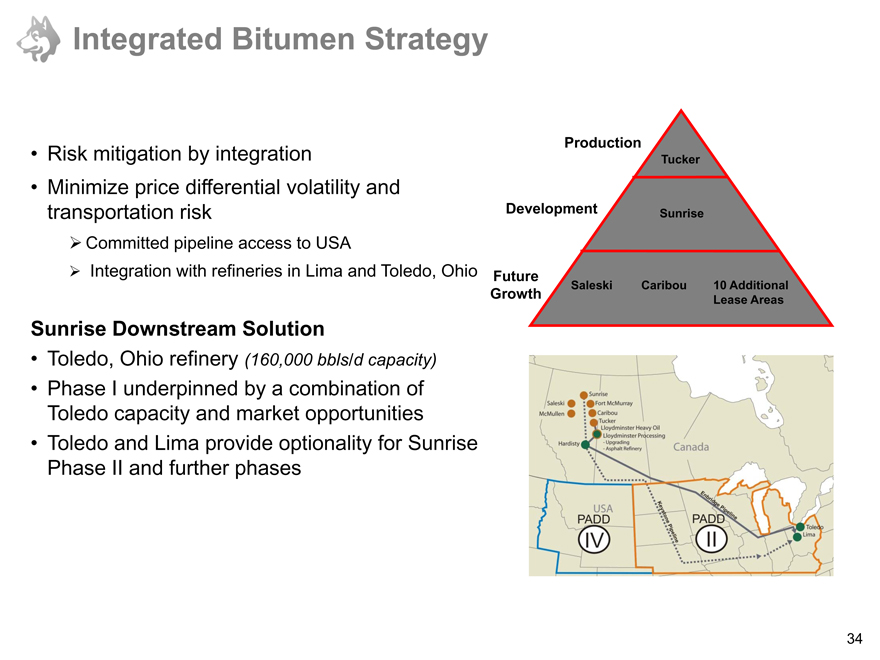

Integrated Bitumen Strategy

Risk mitigation by integration

Minimize price differential volatility and transportation risk

Committed pipeline access to USA

Integration with refineries in Lima and Toledo, Ohio

Sunrise Downstream Solution

Toledo, Ohio refinery (160,000 bbls/d capacity)

Phase I underpinned by a combination of

Toledo capacity and market opportunities

Toledo and Lima provide optionality for Sunrise Phase II and further phases

Production

Development

Future

Saleski

Growth

Tucker

Sunrise

Caribou 10 Additional Lease Areas

Saleski

McMullen

Hardisty

Sunrise

Fort mcMurray

Caribou

Tucker

Lloydminster Heavy Oil

Lloydminster Processing

-Upgrading

-Asphalt Refinery

Canada

USA

PADD

IV

Keystone Pipeline

Enbridge Pipeline

PADD

II

Toledo Lima

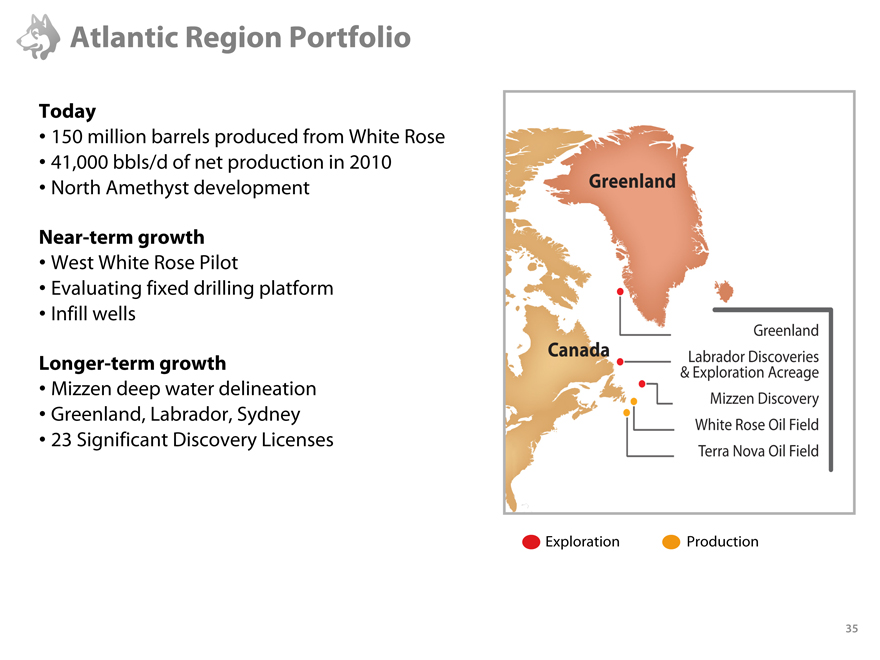

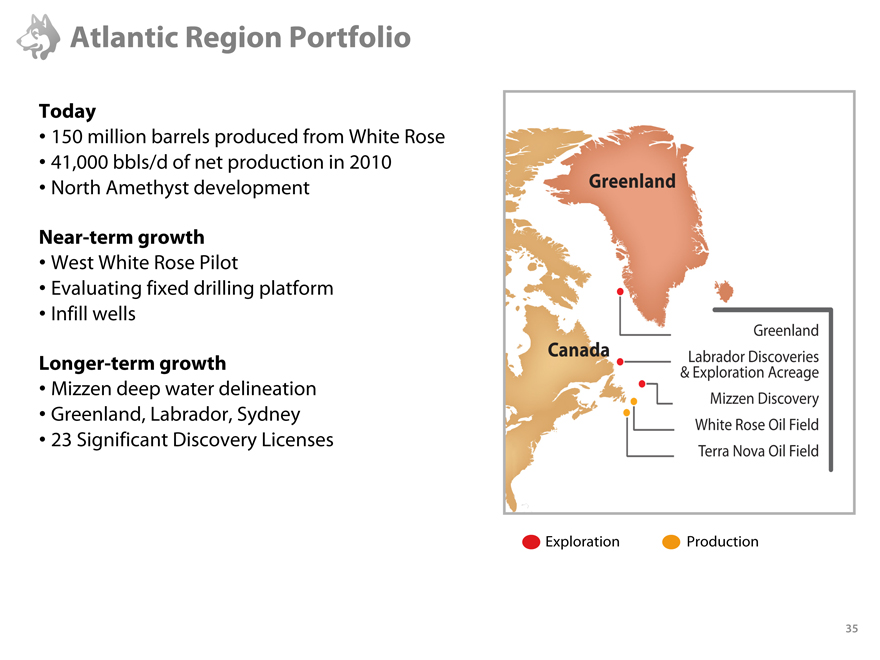

Atlantic Region Portfolio

Today

150 million barrels produced from White Rose

41,000 bbls/d of net production in 2010

North Amethyst development

Near-term growth

West White Rose Pilot

Evaluating fixed drilling platform

Infill wells

Longer-term growth

Mizzen deep water delineation

Greenland, Labrador, Sydney

23 Significant Discovery Licenses

Greenland

Canada

Greenland

Labrador Discoveries & Exploration Acreage

Mizzen Discovery

White Rose Oil Field

Terra Nova Oil Field

Exploration Production

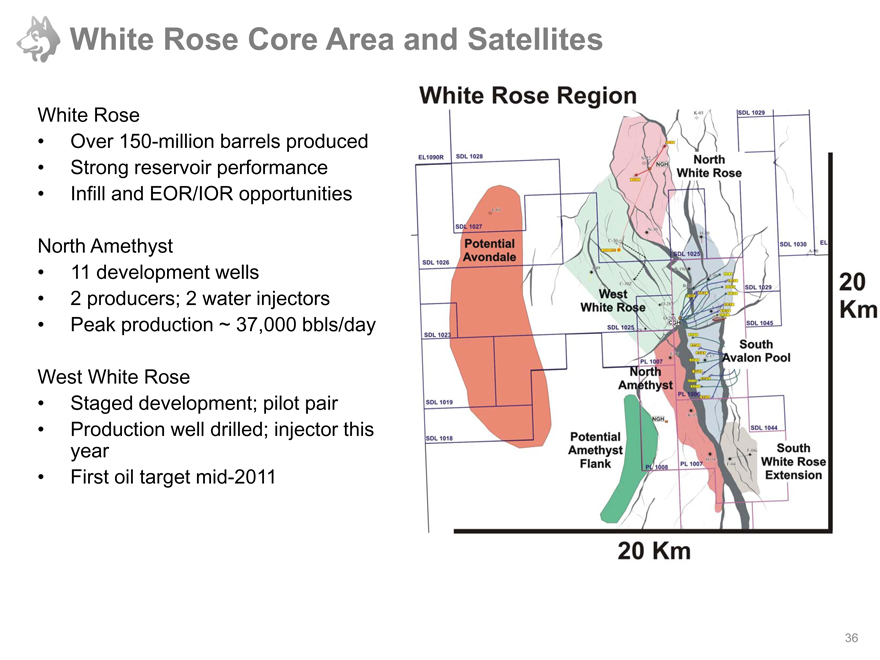

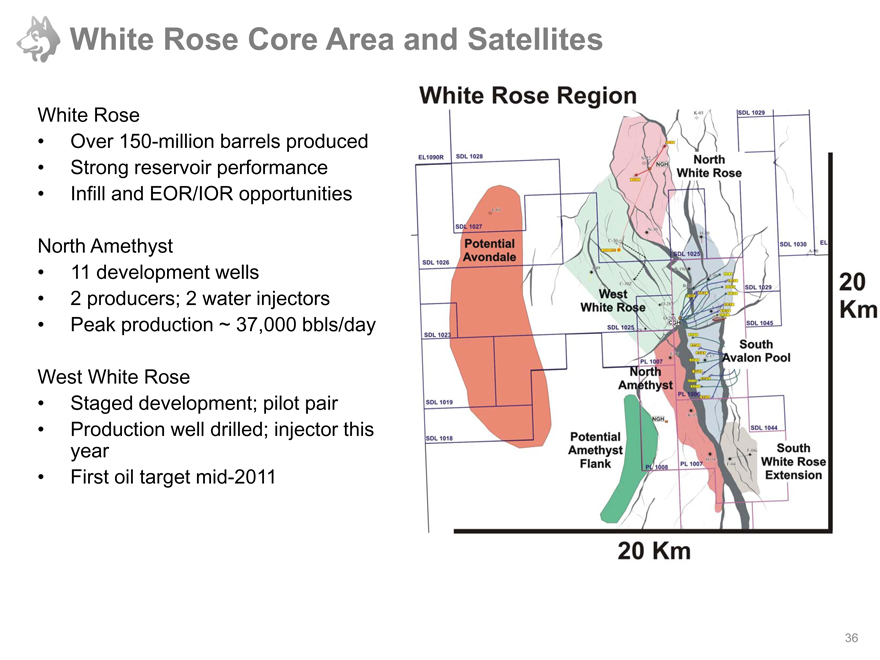

White Rose Core Area and Satellites

White Rose

Over 150-million barrels produced

Strong reservoir performance

Infill and EOR/IOR opportunities

North Amethyst

11 development wells

2 | | producers; 2 water injectors |

Peak production ~ 37,000 bbls/day

West White Rose

Staged development; pilot pair

Production well drilled; injector this year

First oil target mid-2011

White Rose Region

Potential Avondale

North White Rose

West White Rose

Potential Amethyst Flank

South Avalon Pool

South White Rose Extension

20KM North Amethyst

20KM

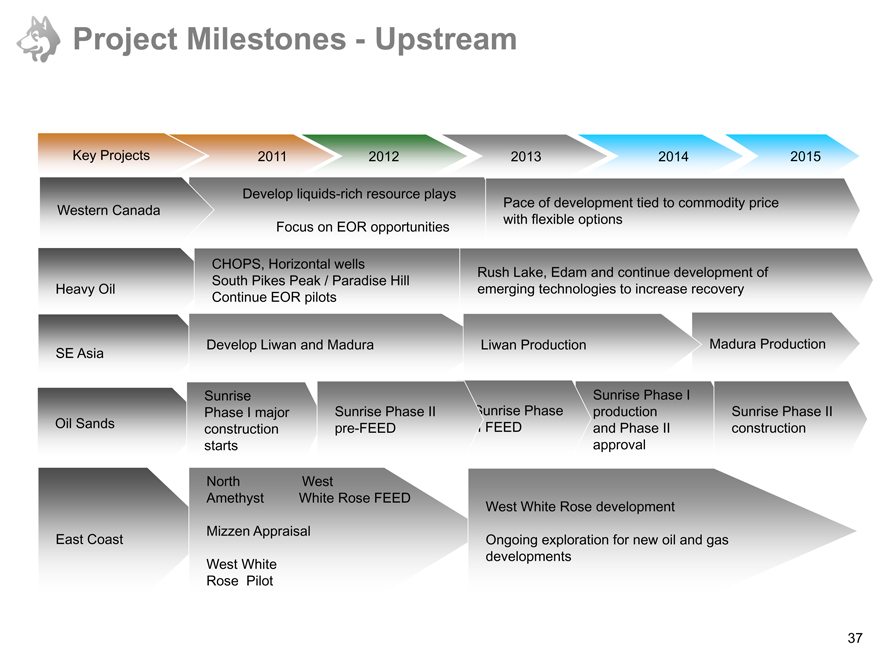

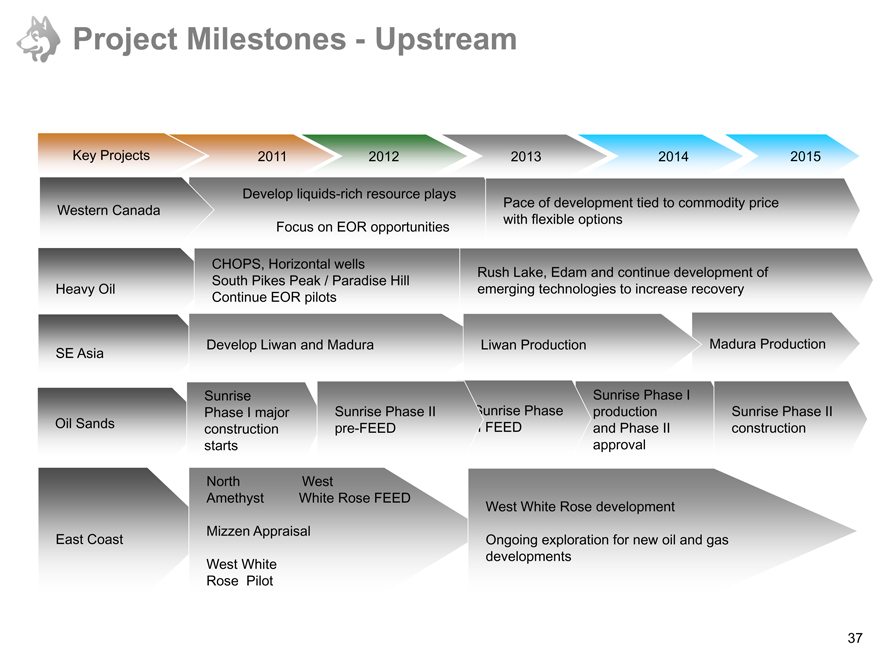

Project Milestones - Upstream

Key Projects 2011 2012 2013 2014 2015

Develop liquids-rich resource plays

Western Canada Pace of development tied to commodity price

Focus on EOR opportunities with flexible options

CHOPS, Horizontal wells Rush Lake, Edam and continue development of

South Pikes Peak / Paradise Hill

Heavy Oil emerging technologies to increase recovery

Continue EOR pilots

SE Asia Develop Liwan and Madura Liwan Production Madura Production

Sunrise Sunrise Phase I

Phase I major Sunrise Phase II Sunrise Phase production Sunrise Phase II

Oil Sands construction pre-FEED II FEED and Phase II construction

starts approval

North West

Amethyst White Rose FEED West White Rose development

Mizzen Appraisal

East Coast Ongoing exploration for new oil and gas

West White developments

Rose Pilot

Competitive Advantages

Large energy company leveraged to oil

Capturing full value for heavy oil and oil sands through focused integrated value chain

Solid foundation in Western Canada, with heavy oil plus a growing position in oil & gas resource plays

Substantial world-class assets which

form strong pillars for growth

Geographically diversified and operating in stable environments

Prudently capitalized and focused on delivering returns to shareholders

Experienced management team with track record of execution

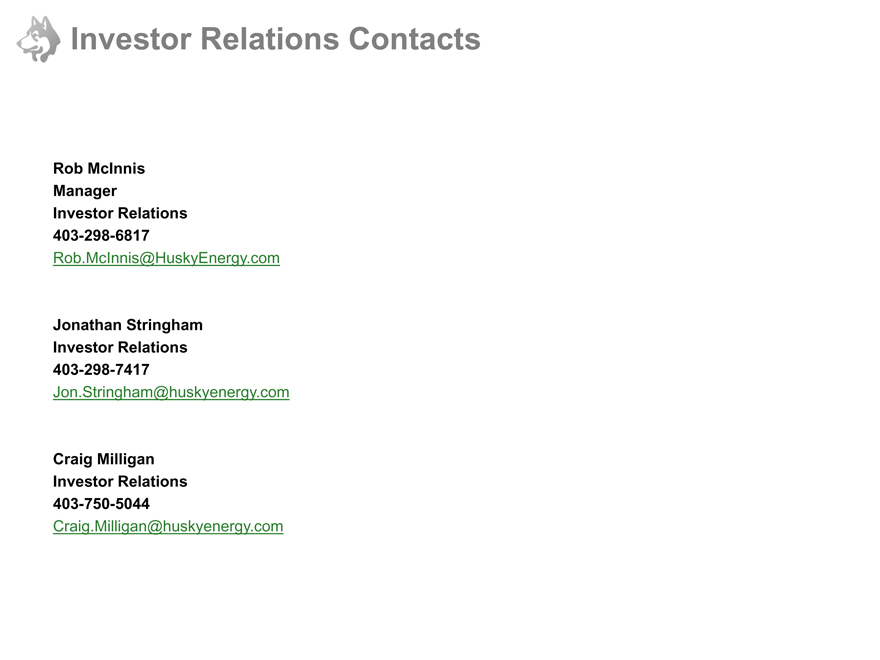

Investor Relations Contacts

Rob McInnis Manager Investor Relations 403-298-6817

Rob.McInnis@HuskyEnergy.com

Jonathan Stringham Investor Relations 403-298-7417

Jon.Stringham@huskyenergy.com

Craig Milligan Investor

Relations 403-750-5044

Craig.Milligan@huskyenergy.com

Husky Energy

Corporate Overview – June 2011

Today we have completed a key element of our financing strategy, which we first shared with you last November.

Through a bought deal common share offering and concurrent private placement, Husky has raised approximately $1.2 billion dollars.

This funding provides us with additional financial flexibility as we continue to advance and accelerate our growth strategy.

Husky is well positioned among its peers in that it is an opportunity-rich Company. We have tremendous growth opportunities, not only in our traditional base here in Western Canada, but also in our growth pillars in the Oil Sands, the Atlantic Region, and in South East Asia.

The challenge for us has been to prioritize those opportunities, and to determine how best to bring forward development so that we can deliver increased value to our shareholders.

Today’s announcement allows us to deliver on those goals.

Let’s take a quick snapshot of Husky:

Husky is one of the largest Canadian integrated energy companies. Our production is weighted at oil (70%) and will remain so. Value proposition is diversified balanced growth. We have significant principal shareholder support for execution our strategy.

We are diversified geographically and by product. We operate in stable geopolitical environments with significant portion of our resource is located in Canada which is a politically stable energy super power with the second largest reserves position in the world.

Last December we unveiled our future business strategy its based on a strong Western Canadian foundation and 3 key growth pillars. The funding we raised today supports our value acceleration strategy.

As I mentioned, Husky has good diversity in our production by product. We have 70% biased towards oil and liquids and we have intent to maintain this product split longer term. Our production is approximately 80% from Western Canada, with 87% of proven

reserves are located in the Western Canadian Sedimentary Basin. Additional upside will come from oil and gas resource plays, oil sands and SE Asia. On the sanction of Liwan, we will also book significant additional reserves

Unlike our peers, Husky doesn’t have an exploration challenge as our “Prospect Inventory” is substantial. We have significant land position. 1.3 million net acres of oil and gas resource plays in Western Canada and sizable Heavy Oil resource base given our long history here. We have 500,000 net acres of oil sands in our portfolio and also extensive exploration portfolio, both in SE Asia and in the Atlantic Region. At current production rate we have over 65 years of production. Our strategy is focused on accelerating development into production to create shareholder value.

Our strategy and commitment to the shareholders is based on clearly defined portfolio of projects. No exploration success is required to achieve our stated growth targets over the next 5 years.

Our clear and deliverable plan provides for:

| (1) | | Annual production growth of 3-5% at the high end through 2015 and continues in that range through 2021 |

| (2) | | Annual reserve replacement is targeted to be greater than 140% through 2021 |

| (3) | | Return On Capital Employed (ROCE) to be increased 5 percentage points over the plan period through 2015 |

| (4) | | Underlying all of this will be the maintenance of a strong balance sheet and investment grade rating |

| (5) | | and ensuring that we continue to sustain the level of dividend we currently share with our shareholders. |

What is our Value Proposition? It’s clearly balanced growth which will be delivered with a clear strategy and a experienced team. We are Oil-weighted portfolio and are leveraged to demand growth in the market. Our production and reserves growth through large, organic and diversified project portfolio. Our significant Asian portfolio—particularly the world-scale Liwan gas development—offers significant growth opportunities. We will sustain our top quartile dividend. Underpinned by a strong balance sheet and financial flexibility together with strong support from principal shareholders.

The key drivers of our results are:

| | • | | refining crack spreads in the U.S. |

| | • | | and of course the U.S. Canadian dollar exchange rate |

And looking at our 2011. Q1 results, we see a strong rebound in oil prices a dissolation between Brent and WTi pricing which is beneficial for Atlantic and China production, 30 percent of our total liquids production. Mid Continent crack spreads have improved significantly, however natural gas remains weak.

And looking at Q1 we achieved earnings of approximately $600 million dollars in the first quarter, compared to $900 million dollars approximately for the whole of 2010.

Our financial strategy that underpins our growth strategy is to ensure adequate liquidity and financial flexibility to fund that growth, but underpinned as I have said before with a Maintenance of investment grade credit ratings, and we continue to receive the strong support from principal shareholders towards execution of our growth plan.

We have a history of prudent financial management. With strong balance sheet metrics that we intend to maintain

Our 2011 guidance for capital expenditures is $4.8 billion, a significant increase from 2009/2010 levels and it is focused on our upstream business. Our Q1 production puts us on track for delivering towards the higher end of our guidance range for 2011.

With our financing strategy in place, we will be able to accelerate exploration and development of our emerging oil and gas resource portfolio which includes our Ansell liquids-rich gas play and Kakwa oil resource plays in west central Alberta.

We also plan to accelerate the development of Phase 2 of the Sunrise Energy Project in northern Alberta. Phase 1 of Sunrise was sanctioned in late 2010 and remains on track for first oil in 2014. The conceptual work on Phase 2 of Sunrise began in the first quarter of 2011, and we now plan to combine pre-FEED and FEED work for a larger scale Phase 2.

The financing also provides additional flexibility as we move forward with the development of the Liwan Gas Project offshore China, and we continue to see tremendous opportunity to build a growth-oriented oil and gas business in the region.

We are also moving forward with exploring options for the next phase of our East Coast White Rose satellite developments. This may include construction of a fixed drilling platform.

Western Canada is a key element of our foundation. Our strategy is to stabilize and maintain production through organic and inorganic means. Pursue high value resource and conventional plays and direct our capital to top-tier assets to deliver top-tier metrics.

We have an extensive land position within Western Canada (approximately 5.7 mm net acres undeveloped).

Included within that we have assembled a large land position (800,000 net acres) in gas resource plays. This includes established liquids rich plays at Ansell and Kakwa as well as a position in the Montney and Horn River plays. We have a large position in the Jean Marie play in Bivouac as well as an emerging position in the Wild River Duvernay play. Our portfolio is diversified in terms of reservoir comprising—tight sands, tight carbonates and shales. In oil resource plays we have approximately 500,000 net acres of land including the Viking, Bakken and Lower Shaunavon formations.

Our overall strategy is to high grade and grow our oil resource plays; in the near term to focus capital into liquids rich gas plays (Ansell & Kakwa) and de risk and maintain our dry gas position.

Ansell is a focal point of Husky’s liquids-rich gas resource development. We have nearly 150,000 net acres at Ansell operated by Husky. Multiple gas horizons to be developed with horizontal and vertical wells. Significant resources is in place for future development.

The Kakwa and Wapiti areas in West Central Alberta, at the northern end of the Cardium trend, are our initial oil resource developments. Both of these plays feature high rock quality and pay thickness with ~45° API oil, developable with multi-stage fracturing technology. We have nearly 30,000 net acres operated by Husky. And significant resources are in place for future development.

Heavy oil has been the historical foundation for Husky and will continue to be an important part of our future with the application of technology.

As I said, Heavy Oil has long been a contributor to our success. To date we have recovered approximately 8% of the resource in place (over the last 70 years). With known technologies, we are confident in our ability to access a further 7%. We have emerging technologies are targeting a further 8% at a sustainable level of production. We will be operating in this business for a long time to come.

Turning now to our Pillars of Growth, South East Asia portfolio comprises world class assets, including the Liwan gas development. And we are targeting production for the region of approximately 50,000 boe per day by 2014.

At the Liwan Gas Project, we are making significant progress in moving towards production in late 2013. Husky’s ownership share of this project is 49% of production We expect our gas contracts to be linked to LNG pricing. First gas is expected to come on stream late 2013 ramping up through 2014. Contract is in place and the project is

anticipated to be one of the fastest deep water developments in the world to go from discovery to production.

In the Madura BD Gas Development, we have moving forward with the Madura BD development following receipt of 20-year PSC extension last year. Gas sales contracts in place for 100 mmcf/day. Development plan had been approved by Indonesian government. Front-end engineering was completed in 2010 and we will be tendering major contracts this year with first production targeted for 2014.

On our Oil Sands portfolio, we have assembled an enviable position Not including Saleski, a carbonate resource, we have more than 15 billion barrels of resource in place. We had Sanctioned Phase I Sunrise Energy Project in 2010 and are looking forward to Phase 2

The Saleski Carbobnate resource is clearly a significant potential for the company going forward, but will take additional technology to develop.

The Sunrise Energy Project is the Crown Jewel in our Oil Sands Portfolio. It is a very high quality reservoir, adjoining Firebag , compared to the lower quality Tucker reservoir. Phase One as I said we sanctioned late last year and is designed to produce 60,000 bbls/day gross, 30,000 bbls/d net Husky’s share with first oil on track for late 2014. The contracting strategy is in place to maintain cost control through significant fixed by lump sum pricing. Sunrise Phase 2 pre-engineering has commenced and is being accelerated. And we certainly believe the development is capable of achieving 400,000 barrels per day.

We set out on this slide the major milestones you can expect to see on the Sunrise Phase I development activity, and as you can see we are well on track to meeting those targets.

Our Integrated Bitumen Strategy is designed to mitigate risk, reduce volatility and to capture value from our heavy oil and bitumen resources. This strategy is borne from a long experience with heavy oil and our Upgrader at Lloydminster area.

Atlantic Region has been a significant contributor to production with over 150 million barrels produced from White Rose to date, all high netback light oil. We have a strong land position in the area for near, mid and long-term growth. We are currently evaluating fixed drilling platform which will reduce F&D costs and increase resource recoverability in the region. This will allows us to regenerate growth in region from 2016.

The Jeanne d’Arc basin has proved to be a prolific basin, but we are not done yet. We have tied in the North Amethyst satellite field. We are in the process of conducting a

pilot at the West White Rose satellite. And as I said we are looking forward to the development of a fix platform to access further resources in the region.

Our strategy and committed outcomes based on a portfolio of identified projects. We are not dependant on exploration success for near term growth. As I said before, our challenge is not an exploration but to accelerate the development and commercialization of a large resource base we currently have.

With the capital raised, Husky is in a solid position to enhance its deliverables. We now project production for the 2011 to 2015 timeframe will be towards the high end of our guidance of three to five percent compound average growth. We also forecast being able to sustain a three to five percent annual growth rate through 2021. With an annual reserves replacement ratio of 140 percent annually over the same period.

We have a tremendous pipeline of growth projects and now we have the financial flexibility to accelerate developments to bring forward shareholder value.

The focus of Husky is now on execution.

Thank you for listening to our Road Show today.