Exhibit 99.2

First Quarter 2013

| Message from the Chairman of the Board

and the President and Chief Executive Officer |

| |

| |

Net result | In the first quarter of 2013, Hydro-Québec posted a net result of $1,360 million, an increase of $24 million over the $1,336 million recorded in the same period last year. This growth is due, among other things, to higher revenue from net electricity exports by Hydro-Québec Production and to a decrease in electricity purchases from Rio Tinto Alcan. These factors were partly offset by the impact of the deferred implementation of Hydro-Québec Distribution’s rate adjustment, which was amplified in 2013. |

| |

| |

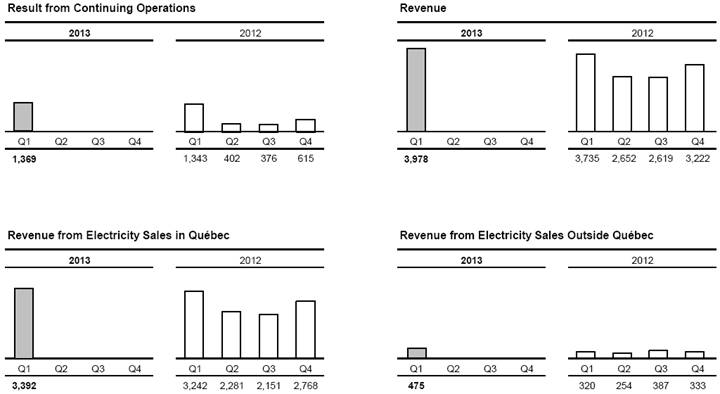

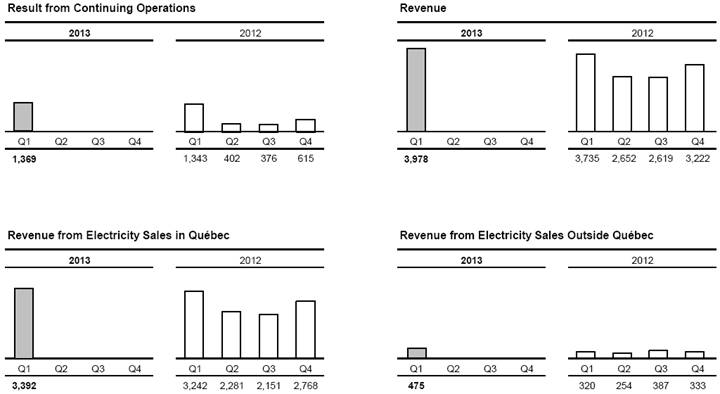

Result from

continuing

operations | The result from continuing operations amounted to $1,369 million, an increase of $26 million over the $1,343 million posted in 2012. Revenue totaled $3,978 million, compared to $3,735 million a year earlier. In Québec, revenue from electricity sales amounted to $3,392 million, or $150 million more than in 2012, mainly because temperatures were close to normal in first quarter 2013, whereas they had been milder in 2012. Higher demand was also a factor, primarily in the residential sector. On markets outside Québec, revenue from electricity sales was $475 million, compared to $320 million in 2012. The $155-million increase resulted from growth in Hydro-Québec Production’s export revenue. Other revenue totaled $111 million, a $62-million decrease compared to 2012 that stems, among other things, from revenue variances related to climate conditions given that temperatures were close to normal in first quarter 2013, whereas they had been milder in 2012. Total expenditure amounted to $2,001 million, or $219 million more than in 2012. This variance is largely due to a $182-million rise in electricity and fuel purchases, including a $94-million increase in electricity purchases made by Hydro-Québec Distribution from independent wind power and biomass energy producers, among others, and a $64-million increase in electricity purchases made by Hydro-Québec Production, associated mainly with trading activities outside Québec. In addition, bad debt related to electricity sales in Québec was $15 million higher than in 2012. |

Segmented results | Generation Hydro-Québec Production recorded a result from continuing operations of $745 million, compared to $620 million in 2012. This $125-million increase is due to a $67-million growth in revenue from net electricity exports and to a $52-million growth in revenue from electricity sales to Hydro-Québec Distribution, including special contracts, mainly on account of the mild temperatures in 2012. In addition, electricity purchases from Rio Tinto Alcan decreased by $29 million. When the discontinued operations are factored in, the net result for the first three months of the year totaled $736 million in 2013, compared to $613 million in 2012. Gentilly-2 nuclear generating station’s 2012 operating result is presented under discontinued operations for comparison purposes, in accordance with accounting standards. Transmission Hydro-Québec TransÉnergie’s result from continuing operations was $168 million, an $11-million increase over 2012 that is notably due to an $11-million decrease in depreciation and amortization expense. Distribution Hydro-Québec Distribution posted a result from continuing operations of $442 million, compared to $549 million in 2012. Revenue from electricity sales increased by $140 million, mainly on account of the mild temperatures in 2012 and higher demand, primarily in the residential sector. These factors were partly offset by the effect of the leap year, namely sales on February 29, 2012. They were also mitigated by the impact of the deferred implementation of Hydro-Québec Distribution’s rate adjustment, i.e., the difference between the April 1 effective date of the rate adjustment and the recording of additional costs as of January 1, notably for electricity purchases from independent producers, which was amplified in 2013. Moreover, revenue variances related to climate conditions were less favorable in 2013 than in 2012. In addition, electricity purchases from Hydro-Québec Production increased by $46 million. Finally, bad debt related to electricity sales in Québec was $15 million higher than in 2012. Construction The Construction segment includes activities related to the projects carried out by Hydro-Québec Équipement et services partagés and by Société d’énergie de la Baie James (SEBJ). The volume of activity at Hydro-Québec Équipement et services partagés and SEBJ totaled $442 million, compared to $385 million in 2012. Projects carried out for Hydro-Québec Production included ongoing construction at the Romaine jobsites and work to complete the Eastmain-1-A/Sarcelle/Rupert development. Projects done for Hydro-Québec TransÉnergie included expansion of the transmission system in the Minganie region, the addition of a 735/315-kV section and related work at Bout-de-l’Île substation, as well as continued investment in asset sustainment. |

| |

| |

Page 2 | First Quarter 2013 |

Investment | During the first three months of 2013, Hydro-Québec invested $793 million in property, plant and equipment and intangible assets, including the Energy Efficiency Plan, compared to $738 million in 2012. As expected, a large portion of this amount was devoted to the major hydroelectric projects of Hydro-Québec Production, especially ongoing construction at the Romaine jobsites and work to complete the Eastmain-1-A/Sarcelle/Rupert development. Hydro-Québec TransÉnergie continued investing in its transmission system. Work progressed on Romaine-2 substation and the 735-kV line that will connect it to Arnaud substation. The division also carried on with its investments in maintenance and improvement activities to ensure the reliability and long-term operability of its transmission assets and enhance service quality. Hydro-Québec Distribution kept up investments to handle the growth of its Québec customer base and to maintain its facilities in good operating condition. It also continued implementation of the Energy Efficiency Plan. |

| |

| |

| |

| | | |

| Pierre Karl Péladeau | | Thierry Vandal |

| | | |

| Chairman of the Board | | President and Chief Executive Officer |

| | | |

| May 17, 2013 | | |

CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

CONSOLIDATED STATEMENTS OF OPERATIONS

In millions of Canadian dollars

(unaudited) | | | | Three months ended

March 31 |

| | Notes | | 2013 | | 2012 |

Revenue | | 3 | | 3,978 | | 3,735 |

Expenditure | | | | | | |

Operations | | | | 626 | | 586 |

Electricity and fuel purchases | | | | 513 | | 331 |

Depreciation and amortization | | 4 | | 580 | | 596 |

Taxes | | | | 282 | | 269 |

| | | | 2,001 | | 1,782 |

Operating result | | | | 1,977 | | 1,953 |

Financial expenses | | 5 | | 608 | | 610 |

Result from continuing operations | | | | 1,369 | | 1,343 |

Result from discontinued operations | | 6 | | (9) | | (7) |

Net result | | | | 1,360 | | 1,336 |

CONSOLIDATED STATEMENTS OF RETAINED EARNINGS

In millions of Canadian dollars

(unaudited) | | | | Three months ended

March 31 |

| | | | 2013 | | 2012 |

Balance, beginning of period | | | | 14,833 | | 14,618 |

Net result | | | | 1,360 | | 1,336 |

Balance, end of period | | | | 16,193 | | 15,954 |

The accompanying notes are an integral part of the consolidated financial statements.

| |

Page 4 | First Quarter 2013 |

CONSOLIDATED BALANCE SHEETS

In millions of Canadian dollars

(unaudited) | | As at March 31,

2013 | | As at December 31,

2012 |

ASSETS | | | | |

Current assets | | | | |

Cash and cash equivalents | | 1,150 | | 2,183 |

Short-term investments | | 639 | | 609 |

Accounts receivable and other receivables | | 2,681 | | 1,838 |

Derivative instruments | | 922 | | 1,052 |

Regulatory assets | | 25 | | 22 |

Materials, fuel and supplies | | 184 | | 178 |

| | 5,601 | | 5,882 |

Property, plant and equipment | | 57,416 | | 57,174 |

Intangible assets | | 2,232 | | 2,241 |

Investments | | 139 | | 134 |

Derivative instruments | | 1,160 | | 1,269 |

Regulatory assets | | 9 | | 18 |

Other assets | | 3,914 | | 3,799 |

| | 70,471 | | 70,517 |

LIABILITIES | | | | |

Current liabilities | | | | |

Borrowings | | 384 | | 19 |

Accounts payable and accrued liabilities | | 2,144 | | 2,078 |

Dividend payable | | – | | 645 |

Accrued interest | | 460 | | 835 |

Asset retirement obligations | | 181 | | 178 |

Derivative instruments | | 616 | | 663 |

Current portion of long-term debt | | 2,099 | | 694 |

| | 5,884 | | 5,112 |

Long-term debt | | 40,640 | | 42,555 |

Asset retirement obligations | | 759 | | 774 |

Derivative instruments | | 1,685 | | 1,816 |

Other long-term liabilities | | 1,007 | | 1,003 |

Perpetual debt | | 280 | | 275 |

| | 50,255 | | 51,535 |

EQUITY | | | | |

Share capital | | 4,374 | | 4,374 |

Retained earnings | | 16,193 | | 14,833 |

Accumulated other comprehensive income | | (351) | | (225) |

| | 15,842 | | 14,608 |

| | 20,216 | | 18,982 |

| | 70,471 | | 70,517 |

The accompanying notes are an integral part of the consolidated financial statements.

On behalf of the Board of Directors, | | |

| | |

| | |

| | |

/s/ Jacques Leblanc | | | | /s/ Pierre Karl Péladeau |

Chair of the Audit Committee | | Chairman of the Board |

| | | | |

CONSOLIDATED STATEMENTS OF CASH FLOWS

In millions of Canadian dollars

(unaudited) | | | | Three months ended

March 31 |

| | Notes | | 2013 | | 2012 |

Operating activities | | | | | | |

Net result | | | | 1,360 | | 1,336 |

Adjustments to determine net cash flows from operating activities | | | | | | |

Depreciation and amortization | | 4 | | 580 | | 600 |

Amortization of premiums, discounts and issue expenses related to debt securities | | | | 51 | | 90 |

Other | | | | 168 | | (13) |

Change in non-cash working capital items | | 7 | | (1,169) | | (1,144) |

Net change in accrued benefit assets and liabilities | | | | (75) | | (102) |

| | | | 915 | | 767 |

Investing activities | | | | | | |

Additions to property, plant and equipment | | | | (753) | | (690) |

Additions to intangible assets | | | | (40) | | (48) |

Cash receipts from the government reimbursement for the 1998 ice storm | | | | 2 | | 2 |

Net (acquisition) disposal of short-term investments | | | | (28) | | 447 |

Other | | | | 5 | | 4 |

| | | | (814) | | (285) |

Financing activities | | | | | | |

Repayment of long-term debt | | | | (995) | | (519) |

Cash receipts arising from credit risk management | | | | 1,347 | | 1,112 |

Cash payments arising from credit risk management | | | | (1,198) | | (980) |

Net change in borrowings | | | | 356 | | 1,132 |

Dividend paid | | | | (645) | | (1,958) |

Other | | | | – | | (1) |

| | | | (1,135) | | (1,214) |

Foreign currency effect on cash and cash equivalents | | | | 1 | | (2) |

Net change in cash and cash equivalents | | | | (1,033) | | (734) |

Cash and cash equivalents, beginning of period | | | | 2,183 | | 1,377 |

Cash and cash equivalents, end of period | | | | 1,150 | | 643 |

Supplementary cash flow information | | 7 | | | | |

The accompanying notes are an integral part of the consolidated financial statements.

| |

Page 6 | First Quarter 2013 |

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

In millions of Canadian dollars

(unaudited) | | | | Three months ended

March 31 |

| | | | 2013 | | 2012 |

Net result | | | | 1,360 | | 1,336 |

Other comprehensive income | | | | | | |

Change in deferred (losses) gains on items designated as cash flow hedges | | | | (162) | | 227 |

Reclassification to operations of deferred losses (gains) on items designated as cash flow hedges | | | | 36 | | (79) |

| | | | (126) | | 148 |

Comprehensive income | | | | 1,234 | | 1,484 |

The accompanying notes are an integral part of the consolidated financial statements.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

For the three-month periods ended March 31, 2013 and 2012

Amounts shown in tables are in millions of Canadian dollars.

Note 1 Basis of Presentation

The Canadian Accounting Standards Board has authorized rate-regulated entities to defer the adoption of International Financial Reporting Standards until January 1, 2015. Since Hydro-Québec was entitled to exercise this deferral right, it opted to prepare its 2013 and 2012 financial statements in accordance with Canadian generally accepted accounting principles as set forth in Part V of the Canadian Institute of Chartered Accountants Handbook, “Pre-Changeover Accounting Standards.”

Hydro-Québec’s consolidated financial statements also reflect the decisions of the Régie de l’énergie (the “Régie”). These decisions may affect the timing of the recognition of certain transactions in the consolidated operations, resulting in the recognition of regulatory assets and liabilities, which Hydro-Québec considers it is likely to recover or settle subsequently through the rate-setting process.

The quarterly consolidated financial statements, including these notes, do not contain all the required information regarding annual consolidated financial statements and should therefore be read in conjunction with the consolidated financial statements and accompanying notes in Hydro-Québec’s Annual Report 2012.

The accounting policies used to prepare the quarterly consolidated financial statements are consistent with those presented in Hydro-Québec’s Annual Report 2012.

Hydro-Québec’s quarterly results are not necessarily indicative of results for the year on account of seasonal temperature fluctuations. Because of higher electricity demand during winter months, revenue from electricity sales in Québec is higher during the first and fourth quarters.

Note 2 Effects of Rate Regulation on the Consolidated Financial Statements

Distribution

In decision D-2013-043 of March 22, 2013, the Régie authorized an across-the-board increase of 2.41% in Hydro-Québec’s electricity rates, effective April 1, 2013. The authorized return on the rate base was set at 6.38%, assuming a capitalization with 35% equity.

In decision D-2013-037 of March 12, 2013, the Régie asked the Distributor to recognize in a separate account any variance between the actual amount of the expense related to the activities of the Bureau de l’efficacité et de l’innovation énergétiques and the amount provided in rate cases for this item. As at March 31, 2013, no amount had been recognized in this account.

Note 3 Revenue

| | Three months ended

March 31 |

| | 2013 | | 2012 |

Electricity salesa | | 3,867 | | 3,562 |

Other | | 111 | | 173 |

| | 3,978 | | 3,735 |

a) Including unbilled electricity deliveries, which totaled $1,080 million as at March 31, 2013 ($936 million as at March 31, 2012).

| |

Page 8 | First Quarter 2013 |

Note 4 Depreciation and Amortization

| | Three months ended

March 31 |

| | 2013 | | 2012 |

Property, plant and equipment | | 505 | | 529 |

Intangible assets | | 67 | | 60 |

Regulatory assets | | 6 | | 4 |

Retirement of capital assets | | 2 | | 3 |

| | 580 | | 596a |

a) The depreciation and amortization expense presented in the consolidated statement of cash flows for the first quarter of 2012 includes an amount of $4 million for assets related to discontinued operations. These assets were impaired in their entirety in the third quarter of 2012.

Note 5 Financial Expenses

| | Three months ended

March 31 |

| | 2013 | | 2012 |

Interest on debt securities | | 644 | | 636 |

Net exchange (gain) loss | | (8) | | 3 |

Guarantee fees related to debt securities | | 50 | | 49 |

| | 686 | | 688 |

Less | | | | |

Capitalized financial expenses | | 71 | | 71 |

Net investment income | | 7 | | 7 |

| | 78 | | 78 |

| | 608 | | 610 |

Note 6 Discontinued Operations

In September 2012, the decision was made to abandon the project to refurbish Gentilly-2 nuclear generating station and to terminate all nuclear power operations. The facility continued to generate electricity until the end of 2012, in accordance with the terms and conditions of its operating licence, after which time Hydro-Québec started to prepare it for dormancy with a view to dismantling it around the year 2060.

The abandonment of the refurbishment project led to the write-off of the property, plant and equipment under construction for this project and to the impairment of the assets related to the facility.

For comparison purposes, Gentilly-2’s operating result is presented under discontinued operations in the consolidated statements of operations for all periods concerned.

Note 7 Supplementary Cash Flow Information

| | Three months ended

March 31 |

| | 2013 | | 2012 |

Change in non-cash working capital items | | | | |

Accounts receivable and other receivables | | (841) | | (640) |

Materials, fuel and supplies | | (6) | | 2 |

Accounts payable and accrued liabilities | | 52 | | (75) |

Accrued interest | | (374) | | (431) |

| | (1,169) | | (1,144) |

Investing activities not affecting cash | | | | |

Increase in property, plant and equipment and intangible assets | | 16 | | 38 |

Interest paid | | 875 | | 880 |

Note 8 Employee Future Benefits

| | | | | | | Three months ended

March 31 |

| | | | | | | | | |

| | | | | Pension Plan | | | | Other plans |

| | | | | | | | | |

| | | 2013 | | 2012 | | 2013 | | 2012 |

| | | | | | | | | |

| | | | | | | | | |

Accrued benefit cost recognized | | | 77 | | 51 | | 31 | | 28 |

| | | | | | | | | |

| |

Page 10 | First Quarter 2013 |

Note 9 Segmented Information

The following tables contain information related to operations and assets by segment:

| | | | | | | | | | | | Three months ended

March 31, 2013 | |

| | | | | | | | | | | | | | | |

| | Generation | | Transmission | | Distribution | | Construction | | Corporate

and Other

Activities | | Intersegment

eliminations

and

adjustments | | Total | |

Revenue | | | | | | | | | | | | | | | |

External customers | | 510 | | 38 | | 3,421 | | – | | 9 | | – | | 3,978 | |

Intersegment customers | | 1,510 | | 749 | | 20 | | 442 | | 351 | | (3,072 | ) | – | |

Result from continuing operations | | 745 | | 168 | | 442 | | – | | 14 | | – | | 1,369 | |

Result from discontinued operations | | (9 | ) | – | | – | | – | | – | | – | | (9 | ) |

Net result | | 736 | | 168 | | 442 | | – | | 14 | | – | | 1,360 | |

Total assets as at March 31, 2013 | | 31,510 | | 19,432 | | 13,899 | | 435 | | 5,381 | | (186 | ) | 70,471 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | Three months ended

March 31, 2012 | |

| | | | | | | | | | | | | | | |

| | Generation | | Transmission | | Distribution | | Construction | | Corporate

and Other

Activities | | Intersegment

eliminations

and

adjustments | | Total | |

Revenue | | | | | | | | | | | | | | | |

External customers | | 348 | | 31 | | 3,340 | | – | | 16 | | – | | 3,735 | |

Intersegment customers | | 1,456 | | 753 | | 20 | | 385 | | 341 | | (2,955 | ) | – | |

Result from continuing operations | | 620 | | 157 | | 549 | | – | | 17 | | – | | 1,343 | |

Result from discontinued operations | | (7 | ) | – | | – | | – | | – | | – | | (7 | ) |

Net result | | 613 | | 157 | | 549 | | – | | 17 | | – | | 1,336 | |

Total assets as at March 31, 2012 | | 32,108 | | 18,662 | | 13,410 | | 429 | | 4,969 | | (219 | ) | 69,359 | |

| | | | | | | | | | | | | | | |

Note 10 Comparative Information

Some corresponding period data of the previous year have been reclassified to conform to the presentation adopted in the current period. These notably include the operating result of Gentilly-2 nuclear generating station, which must be presented under discontinued operations for comparison purposes.

| |

First Quarter 2013 | Page 11 |

CONSOLIDATED FINANCIAL HIGHLIGHTS

(UNAUDITED)

Amounts shown in tables are in millions of Canadian dollars.

| | | | | Three months ended

March 31 | |

Summary of Operations | | | 2013 | | 2012 | | | Change (%) | |

Revenue | | | 3,978 | | 3,735 | | | 6.5 | | Û | |

Expenditure | | | 2,001 | | 1,782 | | | 12.3 | | Û | |

Financial expenses | | | 608 | | 610 | | | 0.3 | | Ü | |

Result from continuing operations | | | 1,369 | | 1,343 | | | 1.9 | | Û | |

Result from discontinued operations | | | (9) | | (7) | | | 28.6 | | Ü | |

Net result | | | 1,360 | | 1,336 | | | 1.8 | | Û | |

| | | | | | | | | | | |

Highlights of Continuing Operations

|

Note: Throughout the Consolidated Financial Highlights, certain comparative figures have been reclassified to conform to the presentation adopted in the current period. These notably include the operating result of Gentilly-2 nuclear generating station, which must be presented under discontinued operations for comparison purposes. |

| |

Page 12 | First Quarter 2013 |

| Highlights |

| |

| |

Governance | On April 17, 2013, the Québec Cabinet appointed Pierre Karl Péladeau as Chairman of the Board of Hydro-Québec, effective May 15, 2013. |

| |

| |

Generation | Commissioning of the first unit at Sarcelle powerhouse On April 5, 2013, the Eastmain-1-A/Sarcelle/Rupert project reached another major milestone with the commissioning of the first generating unit at Sarcelle powerhouse, namely a 50-MW bulb-type unit. |

| |

| |

Transmission | A historic demand peak On January 23, 2013, power demand in Québec reached a historic peak of 39,120 MW. Hydro-Québec’s power system performed well throughout the peak period. |

| |

| |

Distribution | Régie de l’énergie decision In March, the Régie de l’énergie handed down its decision regarding Hydro-Québec Distribution’s rate request for 2013-2014. This decision gave rise to an across-the-board increase of 2.41% in Hydro-Québec’s electricity rates, effective April 1, 2013. Edison Electric Institute recognition In January, the Edison Electric Institute (EEI) honored Hydro-Québec with an Emergency Assistance Award in recognition of its exceptional efforts to help a number of American utilities restore power in the wake of two extreme weather events that occurred in 2012: the severe thunderstorms that struck the Midwest and Mid-Atlantic regions in June, and Hurricane Sandy, which ravaged the east coast in October. The EEI is a large association of U.S. power companies. |

| |

| |

Transportation

electrification | New partners, new charging stations The Electric Circuit welcomed several new partners during the first quarter: the Bell Centre (Montréal), the Cégep de Saint-Hyacinthe, the Société des casinos du Québec and DeSerres. For its part, the Agence métropolitaine de transport de Montréal (AMT), a founding partner of the Electric Circuit, installed 20 new charging stations for electric vehicles at its park-and-ride facilities. This second rollout phase brings the total number of charging stations available to AMT customers to 40. |

| |

First Quarter 2013 | Page 13 |

Hydro-Québec, 75, boul. René-Lévesque Ouest, Montréal (Québec) H2Z 1A4 |

Ce document est également publié en français. |

www.hydroquebec.com |

ISSN 0848-5836 |