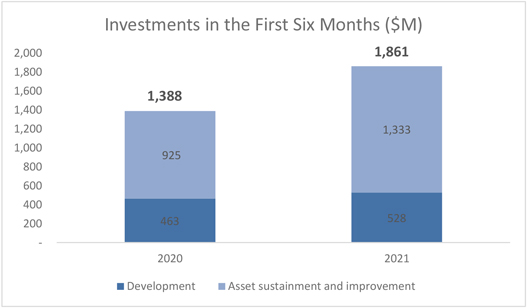

Summary of results for the first six months

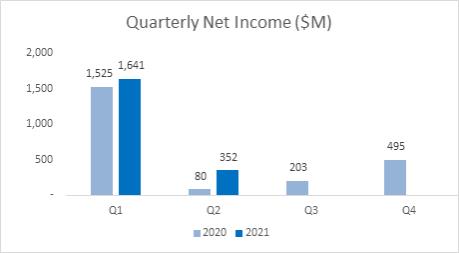

For the six-month period ended June 30, 2021, Hydro-Québec’s net income totaled $1,993 million, or $388 million more than the $1,605 million posted in the first half of 2020.

On the Québec market, net electricity sales increased by $89 million, mainly because of a $93-million rise in electricity sales. Baseload demand from business customers grew with the gradual resumption of economic activities as public health measures were eased. This factor was partly offset, however, by the fact that average spring temperatures were warmer than last year, especially in April.

On markets outside Québec, net electricity exports rose by $133 million, essentially on account of volume growth of 3.8 TWh compared to a year earlier. The company maintained its net export volume at a high level, i.e., 18.5 TWh, slightly below the record of 18.7 TWh set in the first six months of 2018.

Consequently, Hydro-Québec’s net sales volume across all its markets reached a historic peak of 109.9 TWh. It is thanks to the concerted efforts of all its employees and the smooth operation of its generating, transmission and distribution facilities that the company was able to seize business opportunities on its export markets while also meeting the needs of its Québec customer base.

Financial expenses decreased by $124 million, primarily because of the maturity of certain high-interest debts and the issuance of new debt at much lower rates.

Consolidated results for the first six months

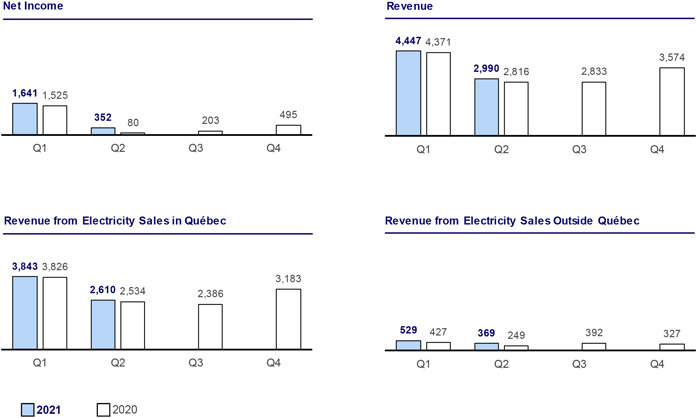

Revenue totaled $7,437 million, compared to $7,187 million in the first half of 2020.

Revenue from ordinary activities was $7,442 million, compared to $7,103 million for the same period last year, due to a $315-million increase in electricity sales. In Québec, sales rose by $93 million over the $6,360 million recorded a year earlier, in particular because of a 1.4-TWh increase in baseload demand, the resumption of economic activities and the continuation of telework for many employees having led to higher electricity consumption by business and residential customers. However, this baseload demand growth was partially offset by the fact that temperature variances resulted in a 1.0-TWh decrease in electricity sales, primarily due to the warm spring in 2021. Finally, the indexation of rates on April 1, 2021, pursuant to the Act to simplify the process for establishing electricity distribution rates, and aluminum price fluctuations, which have an impact on revenue from special contracts with certain large industrial customers, gave rise to an increase in electricity sales in Québec. Revenue from electricity sales on markets outside Québec amounted to $898 million, or $222 million more than in the first six months of 2020.

Revenue from other activities declined by $89 million due to the impact of the commercialization strategy for electricity export activities, which led to a negative variance.

Total expenditure amounted to $4,246 million, which is comparable to the $4,260 million recognized in the corresponding period last year.

Financial expenses totaled $1,198 million, a $124-million decrease from the $1,322 million recorded a year earlier.

3