NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

For the three- and six-month periods ended June 30, 2023 and 2022

Amounts in tables are in millions of Canadian dollars, unless otherwise indicated.

Note 1 Basis of Presentation

Hydro-Québec’s consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles.

These quarterly consolidated financial statements, including these notes, do not contain all the required information regarding annual consolidated financial statements and should therefore be read in conjunction with the consolidated financial statements and accompanying notes in Hydro-Québec’s Annual Report 2022.

The accounting policies used to prepare the quarterly consolidated financial statements are consistent with those presented in Hydro-Québec’s Annual Report 2022, except as regards the recent change described in Note 2, Change to Accounting Policy, as

well as the policies presented in Note 4, Acquisition of a Company, as well as in Note 7, Financial Instruments, with regard to hedges of net investments.

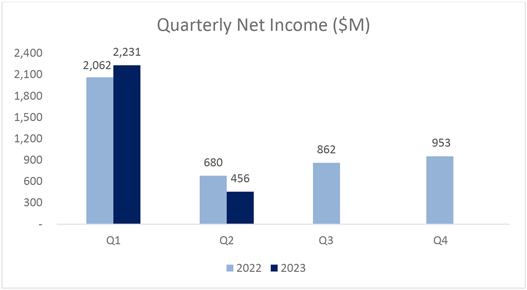

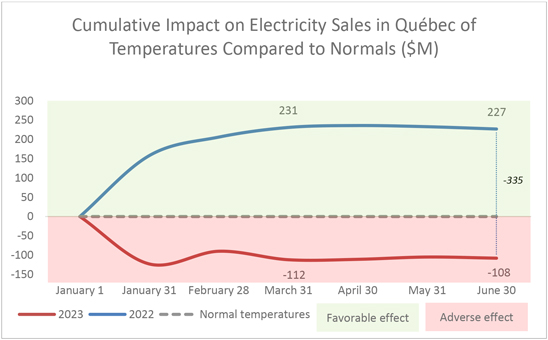

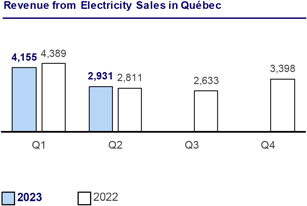

Hydro-Québec’s quarterly results are not necessarily indicative of results for the year on account of seasonal temperature fluctuations. Because of higher electricity demand during winter months, revenue from electricity sales in Québec is higher during the first and fourth quarters.

Management has reviewed events occurring until August 25, 2023, the date of approval of these quarterly consolidated financial statements by the Board of Directors, to determine whether circumstances warranted consideration of events subsequent to the balance sheet date.

Note 2 Change to Accounting Policy

Recent change

Financial instruments

On January 1, 2023, Hydro-Québec adopted, on a modified retrospective basis, the Accounting Standards Codification 326, Financial Instruments—Credit Losses issued by the Financial Accounting Standards Board.

This standard provides new guidance on the impairment of financial assets that are not accounted for at fair value in results. It replaces the method based on incurred losses by a method based on expected losses

and it did not have a significant impact on Hydro-Québec’s consolidated financial statements.

The accounting policy on accounts receivable was changed accordingly. These accounts are recognized at the amount invoiced, net of the allowance for credit losses. This allowance is based on the status and risk profile of customer files, the recovery experience for each age group of accounts, the current economic conditions and the future economic forecasts on the balance sheet date.

Note 3 Regulation

Distribution activities

Electricity distribution rates were indexed at a rate of 6.5% on April 1, 2023, with the exception of residential rates and Rate L, which were indexed at a rate of 3% and 4.2%, respectively.

12