NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

For the three- and nine-month periods ended September 30, 2024 and 2023

Amounts in tables are in millions of Canadian dollars, unless otherwise indicated.

| Note 1 | Basis of Presentation |

Hydro-Québec’s consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles.

Hydro-Québec has only one operating segment. It manages its activities using a cross-functional approach, and its results are analyzed on a consolidated basis.

These quarterly consolidated financial statements, including these notes, do not contain all the required information regarding annual consolidated financial statements and should therefore be read in conjunction with the consolidated financial statements and accompanying notes in Hydro-Québec’s Annual Report 2023.

The accounting policies used to prepare the quarterly consolidated financial statements are consistent with those

presented in Hydro-Québec’s Annual Report 2023, except in regards to the change in Note 2, Change in Accounting Policy.

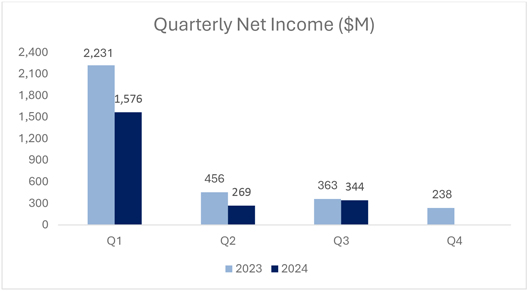

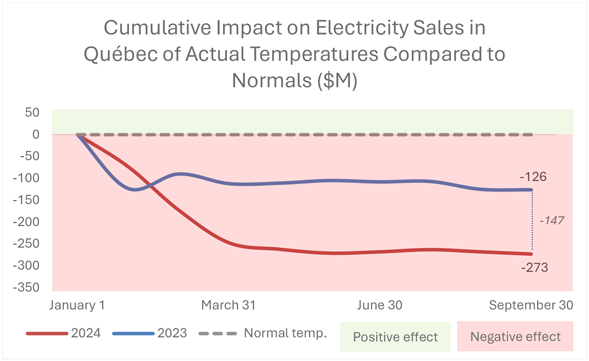

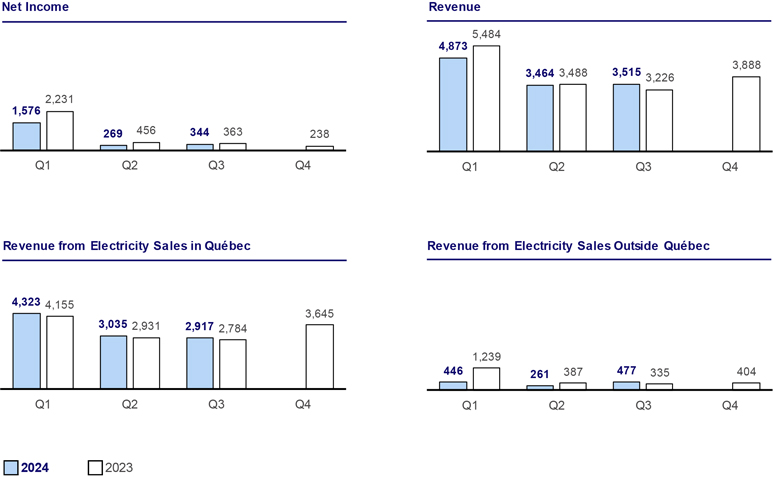

Hydro-Québec’s quarterly results are not necessarily indicative of results for the year on account of seasonal temperature fluctuations. Because of higher electricity demand during winter months, revenue from electricity sales in Québec is higher during the first and fourth quarters.

Management has reviewed events occurring until November 15, 2024, the date of approval of these quarterly consolidated financial statements by the Board of Directors, to determine whether circumstances warranted consideration of events subsequent to the balance sheet date.

| Note 2 | Change in Accounting Policy |

Financial Instruments

On July 1, 2024, Hydro-Québec adopted, on a prospective basis, the Accounting Standards Codification 848, Reference Rate Reform, issued by the Financial Accounting Standards Board.

This standard provides optional expedients for transactions affected by reference rate reform, if certain criteria are met. Hydro-Québec has elected to apply the measure that allows hedge accounting to be maintained for relationships whose derivatives have been affected by a change in the reference

rate, namely the replacement of the Canadian Dollar Offered Rate (“CDOR”) by the Canadian Overnight Repo Rate Average (“CORRA”). It has also elected to apply the measure that adjusts the discount rate of the hedged debt at the time of transition.

The change in reference rate affects fair value hedging relationships aimed at converting certain fixed-rate debts into variable-rate debts. The application of this standard did not have a significant impact on Hydro-Québec’s consolidated financial statements.

Distribution activities

Electricity distribution rates were indexed at a rate of 5.1% on April 1, 2024, with the exception of residential rates and Rate L, which were indexed at a rate of 3% and 3.3%, respectively.

- 11 -