Table of Contents Conference Call 877-876-9173 | ID – EastGroup April 23, 2019 11:00 a.m. Eastern Time 201 9 webcast available at EastGroup.net F IRST QUARTER Supplemental Information March 31, 2019 400 W. Parkway Place, Suite 100, Ridgeland, MS 39157 | TEL: 601-354-3555 | FAX: 601-352-1441 | EastGroup.net Page 1 of 24

Table of Contents Consolidated Balance Sheets....................................................................... 3 Consolidated Statements of Income and Comprehensive Income .............. 4 Reconciliations of GAAP to Non-GAAP Measures ................................... 5 Consolidated Statements of Cash Flows ..................................................... 6 Same Property Portfolio Analysis ............................................................... 7 Additional Financial Information ................................................................ 8 Development and Value-Add Properties Summary .................................... 9 Development and Value-Add Properties Transferred to Real Estate Properties ... 10 Debt and Equity Market Capitalization ....................................................... 11 Continuous Common Equity Program ........................................................ 12 Adjusted Debt-to-Pro Forma EBITDAre Reconciliation ............................ 13 Acquisitions and Dispositions ..................................................................... 14 Real Estate Improvements and Leasing Costs ............................................ 15 Leasing Statistics and Occupancy Summary .............................................. 16 Core Market Operating Statistics ................................................................ 17 Lease Expiration Summary ......................................................................... 18 Top 10 Customers by Annualized Base Rent .............................................. 19 Unconsolidated Investment Information ..................................................... 20 Financial Statistics ....................................................................................... 21 Outlook for 2019 ......................................................................................... 22 Glossary of REIT Terms ............................................................................. 23 FORWARD-LOOKING STATEMENTS The statements and certain other information contained in this press release, which can be identified by the use of forward-looking terminology such as "believes," "expects," "may," "should," "intends," "plans," "estimates" or "anticipates" and variations of such words or similar expressions or the negative of such words, constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbors created thereby. These forward-looking statements reflect the Company's current views about its plans, intentions, expectations, strategies and prospects, which are based on the information currently available to the Company and on assumptions it has made. Although the Company believes that its plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, the Company can give no assurance that such plans, intentions, expectations or strategies will be attained or achieved. Furthermore, these forward-looking statements should be considered as subject to the many risks and uncertainties that exist in the Company's operations and business environment. Such risks and uncertainties could cause actual results to differ materially from those projected. These uncertainties include, but are not limited to: changes in general economic conditions; the extent of customer defaults or of any early lease terminations; the Company's ability to lease or re-lease space at current or anticipated rents; the availability of financing; failure to maintain credit ratings with rating agencies; changes in the supply of and demand for industrial/warehouse properties; increases in interest rate levels; increases in operating costs; natural disasters, terrorism, riots and acts of war, and the Company's ability to obtain adequate insurance; changes in governmental regulation, tax rates and similar matters; attracting and retaining key personnel; other risks associated with the development and acquisition of properties, including risks that development projects may not be completed on schedule, development or operating costs may be greater than anticipated or acquisitions may not close as scheduled; and other risks detailed in the sections of the Company's most recent Forms 10-K and 10-Q filed with the SEC titled "Risk Factors." The Company assumes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Page 2 of 24

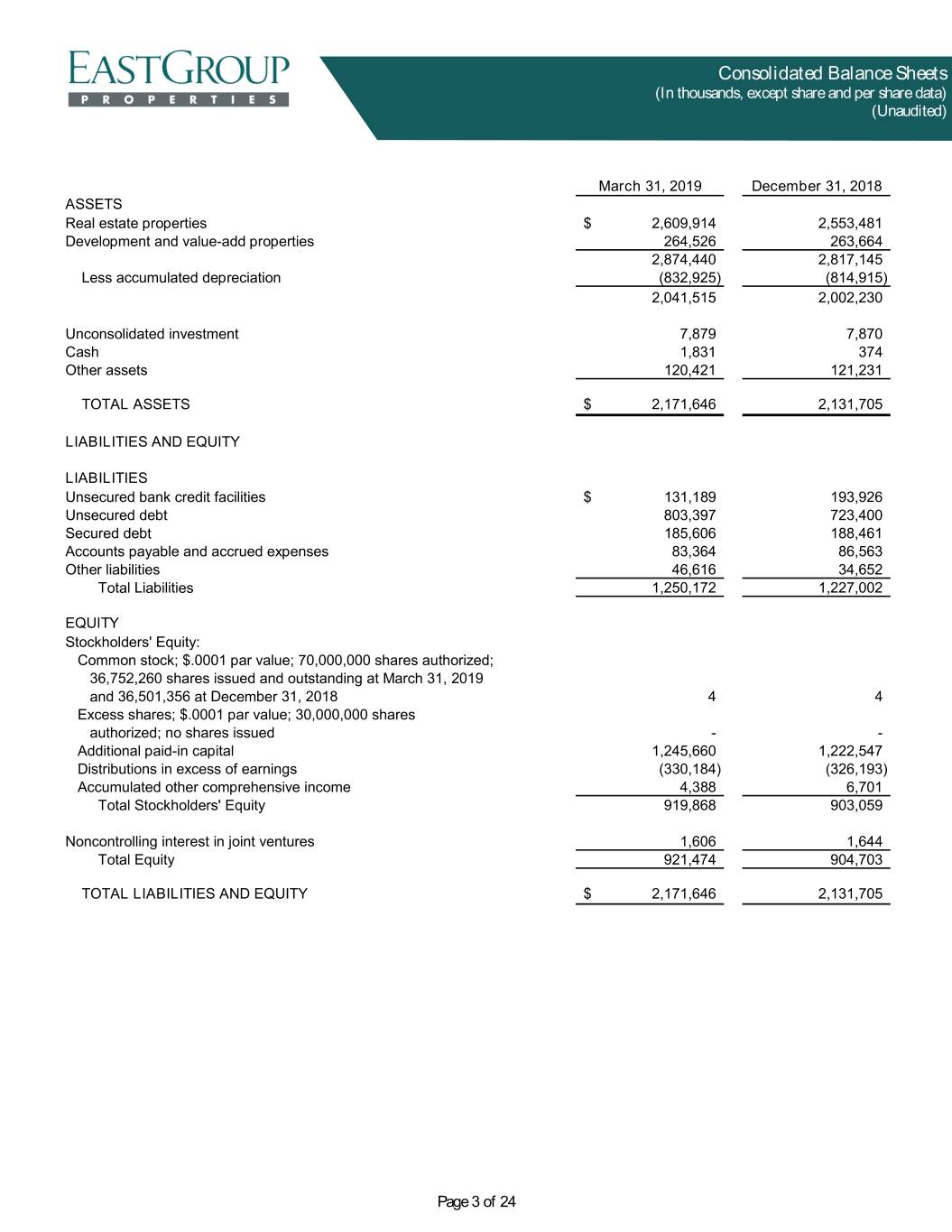

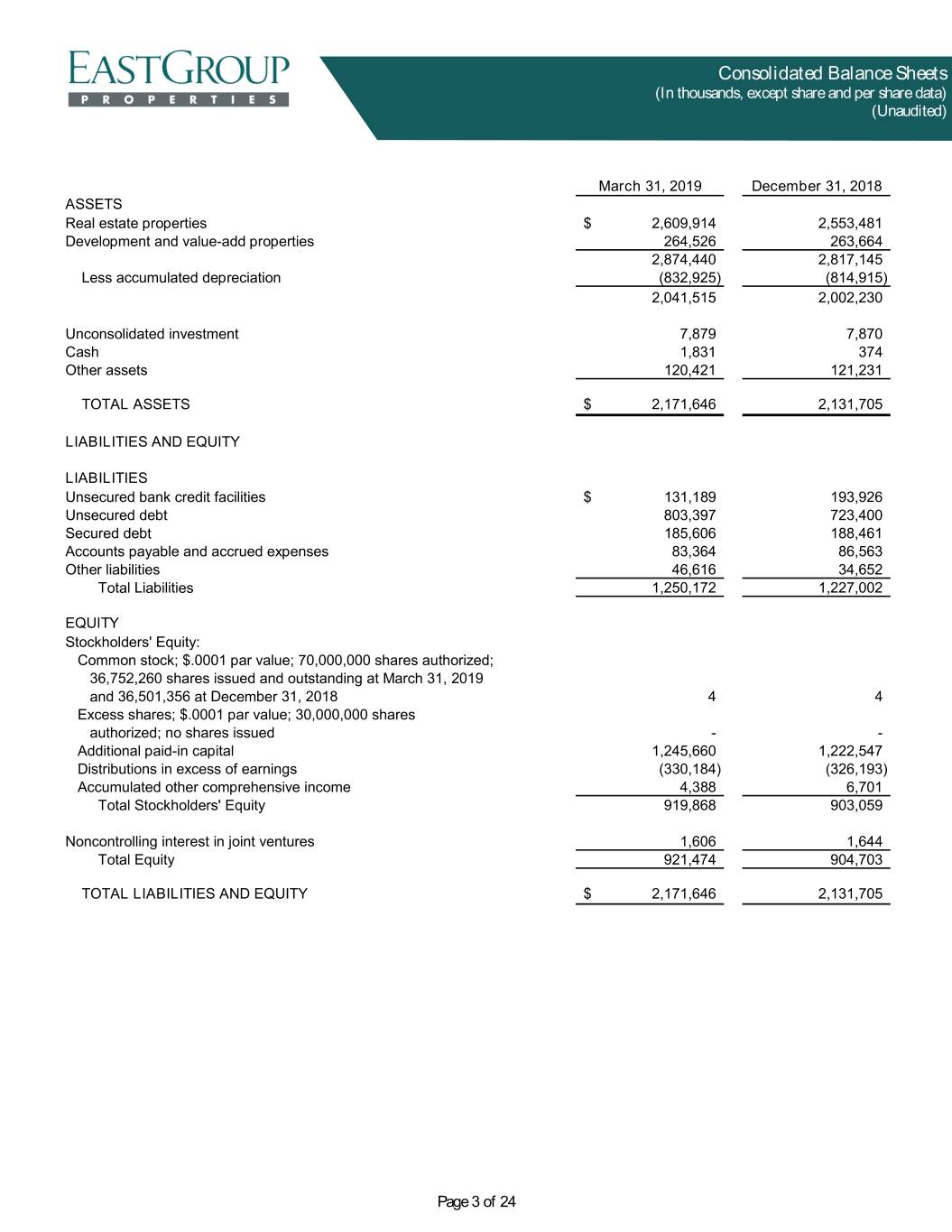

Consolidated Balance Sheets (In thousands, except share and per share data) (Unaudited) March 31, 2019 December 31, 2018 ASSETS Real estate properties $ 2,609,914 2,553,481 Development and value-add properties 264,526 263,664 2,874,440 2,817,145 Less accumulated depreciation (832,925) (814,915) 2,041,515 2,002,230 Unconsolidated investment 7,879 7,870 Cash 1,831 374 Other assets 120,421 121,231 TOTAL ASSETS $ 2,171,646 2,131,705 LIABILITIES AND EQUITY LIABILITIES Unsecured bank credit facilities $ 131,189 193,926 Unsecured debt 803,397 723,400 Secured debt 185,606 188,461 Accounts payable and accrued expenses 83,364 86,563 Other liabilities 46,616 34,652 Total Liabilities 1,250,172 1,227,002 EQUITY Stockholders' Equity: Common stock; $.0001 par value; 70,000,000 shares authorized; 36,752,260 shares issued and outstanding at March 31, 2019 and 36,501,356 at December 31, 2018 4 4 Excess shares; $.0001 par value; 30,000,000 shares authorized; no shares issued - - Additional paid-in capital 1,245,660 1,222,547 Distributions in excess of earnings (330,184) (326,193) Accumulated other comprehensive income 4,388 6,701 Total Stockholders' Equity 919,868 903,059 Noncontrolling interest in joint ventures 1,606 1,644 Total Equity 921,474 904,703 TOTAL LIABILITIES AND EQUITY $ 2,171,646 2,131,705 Page 3 of 24

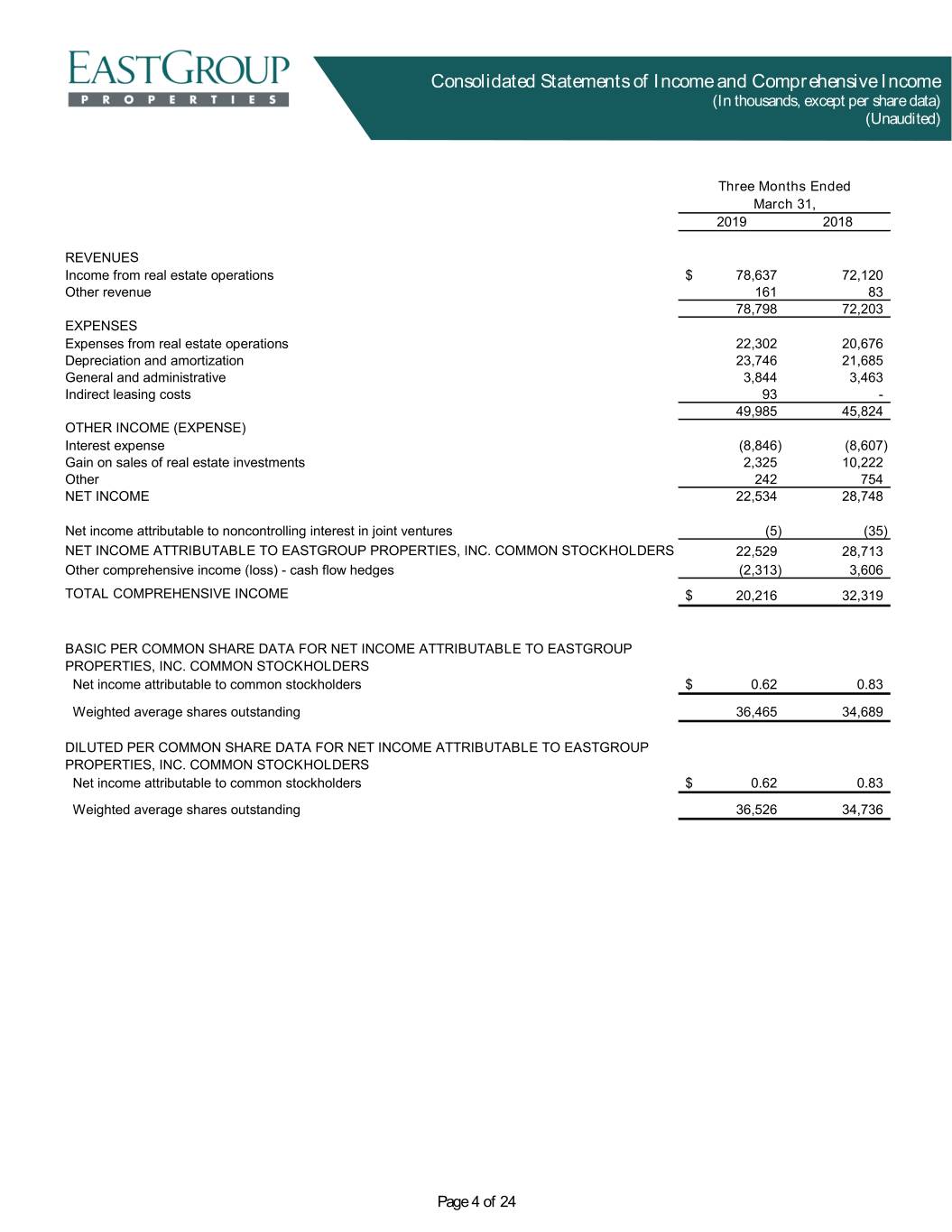

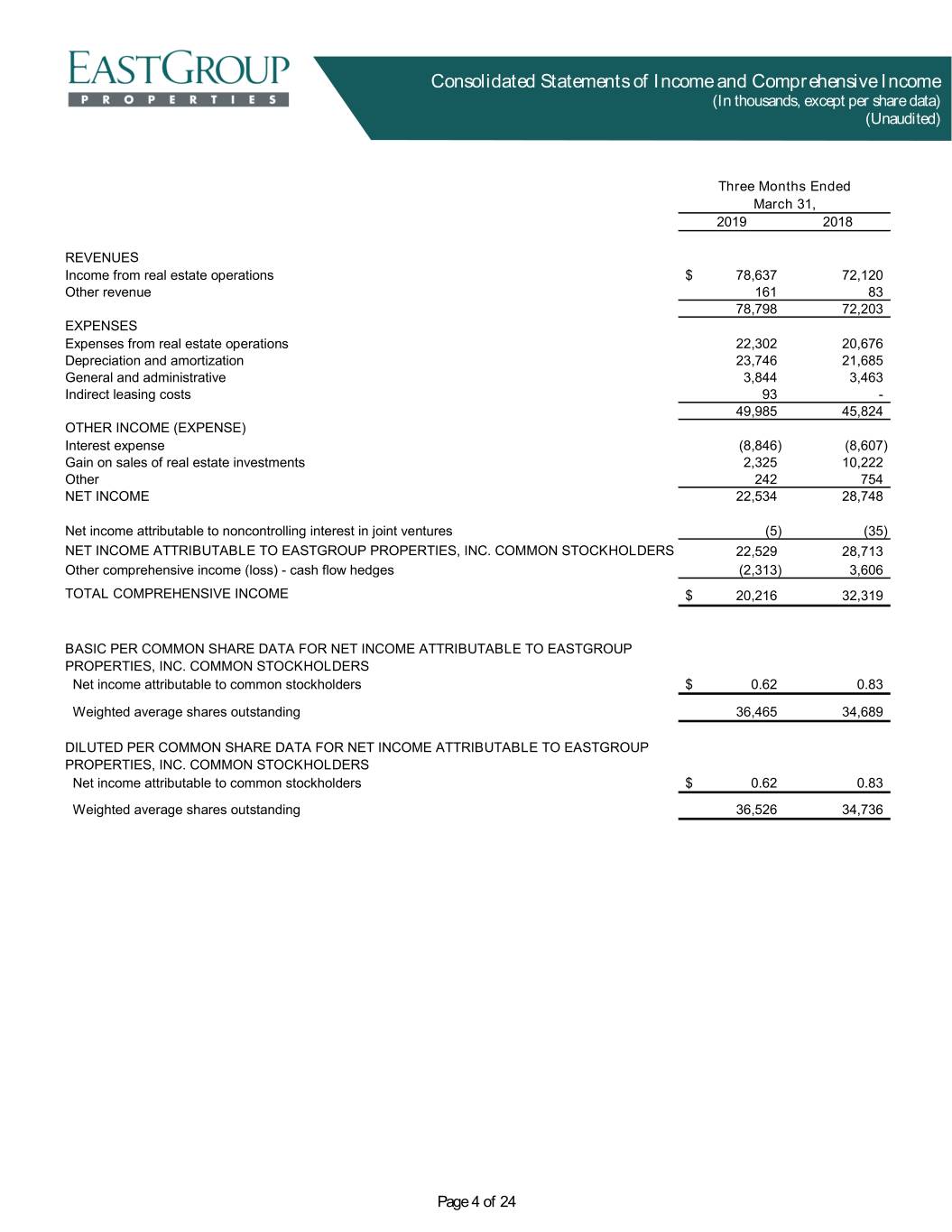

Consolidated Statements of Income and Comprehensive Income (In thousands, except per share data) (Unaudited) Three Months Ended March 31, 2019 2018 REVENUES Income from real estate operations $ 78,637 72,120 Other revenue 161 83 78,798 72,203 EXPENSES Expenses from real estate operations 22,302 20,676 Depreciation and amortization 23,746 21,685 General and administrative 3,844 3,463 Indirect leasing costs 93 - 49,985 45,824 OTHER INCOME (EXPENSE) Interest expense (8,846) (8,607) Gain on sales of real estate investments 2,325 10,222 Other 242 754 NET INCOME 22,534 28,748 Net income attributable to noncontrolling interest in joint ventures (5) (35) NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS 22,529 28,713 Other comprehensive income (loss) - cash flow hedges (2,313) 3,606 TOTAL COMPREHENSIVE INCOME $ 20,216 32,319 BASIC PER COMMON SHARE DATA FOR NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS Net income attributable to common stockholders $ 0.62 0.83 Weighted average shares outstanding 36,465 34,689 DILUTED PER COMMON SHARE DATA FOR NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS Net income attributable to common stockholders $ 0.62 0.83 Weighted average shares outstanding 36,526 34,736 Page 4 of 24

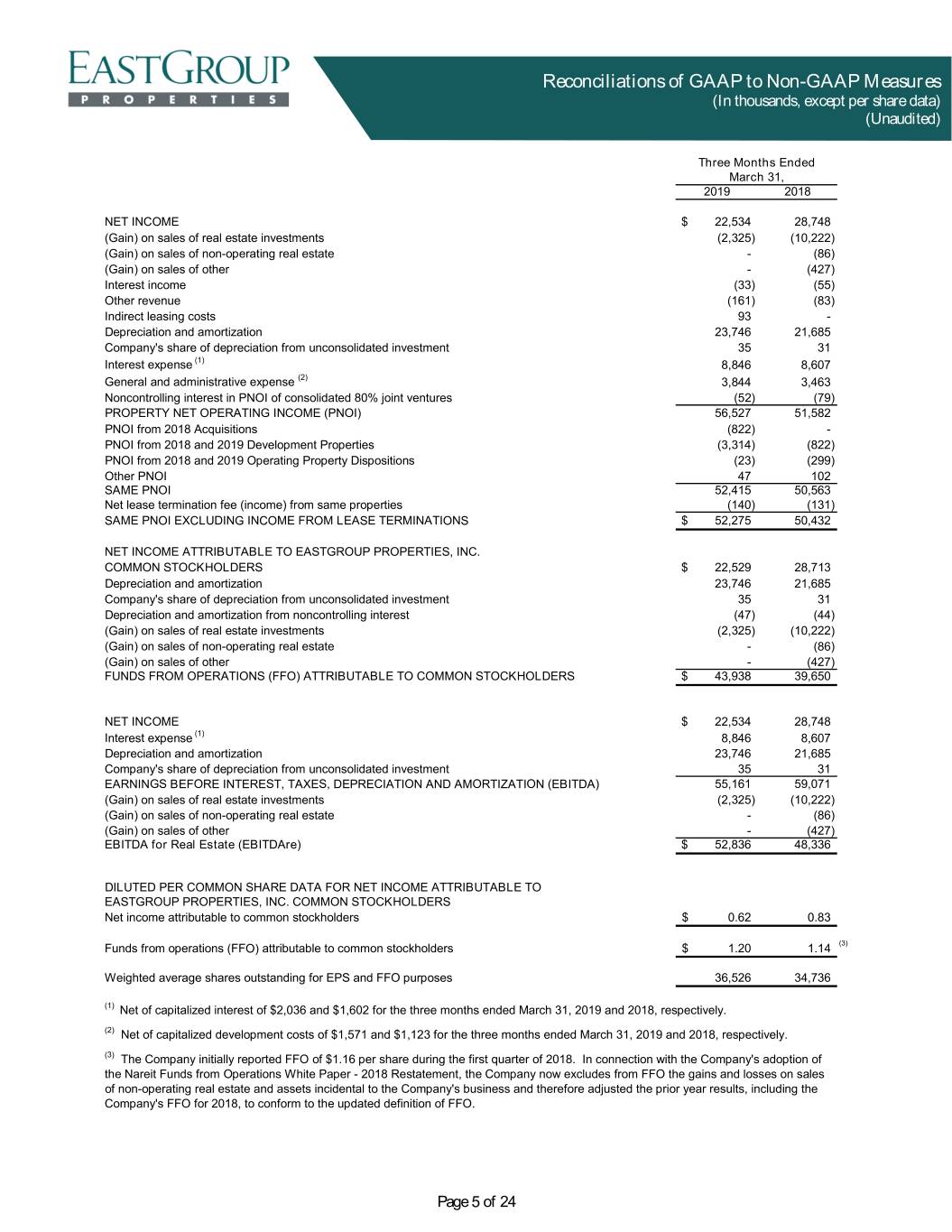

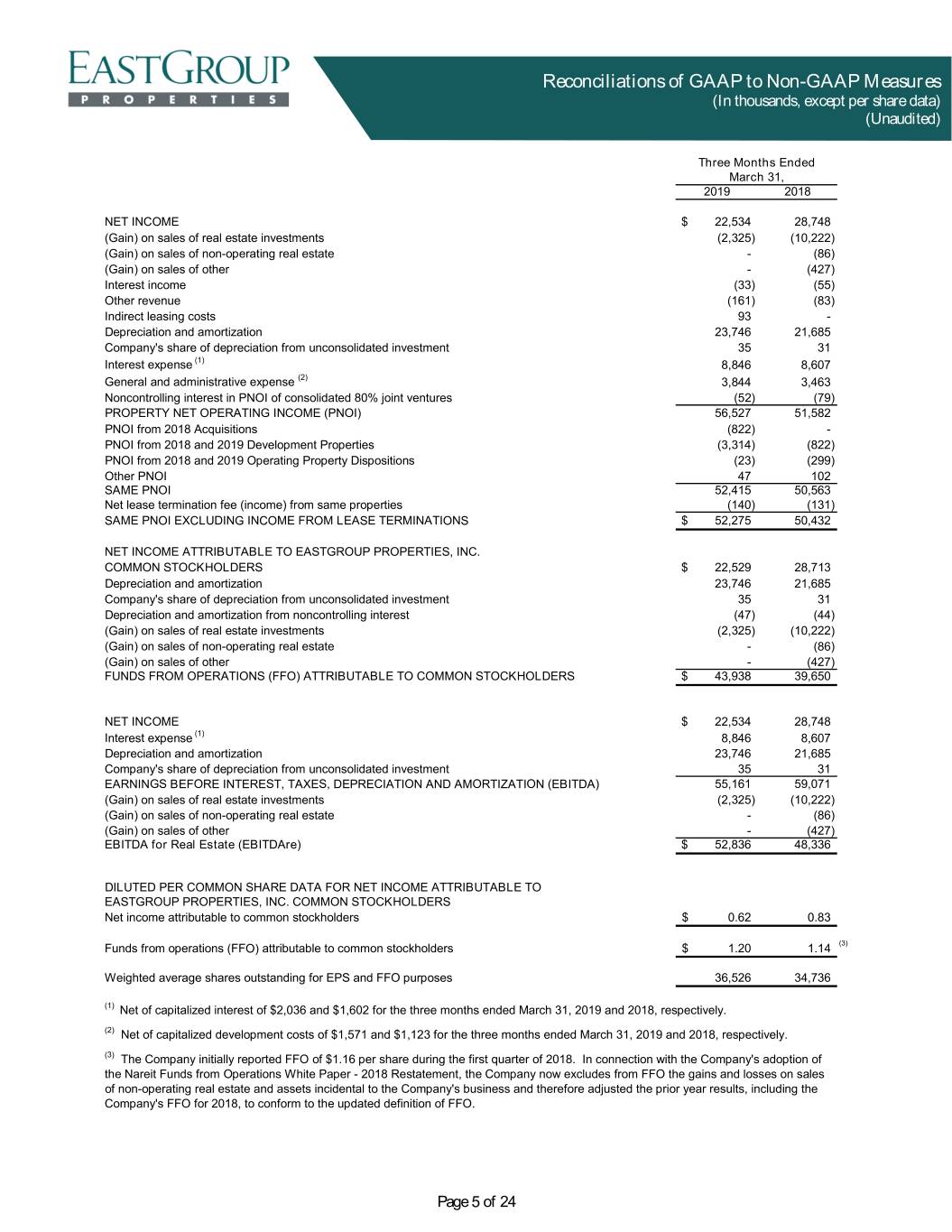

Reconciliations of GAAP to Non-GAAP Measures (In thousands, except per share data) (Unaudited) Three Months Ended March 31, 2019 2018 NET INCOME $ 22,534 28,748 (Gain) on sales of real estate investments (2,325) (10,222) (Gain) on sales of non-operating real estate - (86) (Gain) on sales of other - (427) Interest income (33) (55) Other revenue (161) (83) Indirect leasing costs 93 - Depreciation and amortization 23,746 21,685 Company's share of depreciation from unconsolidated investment 35 31 Interest expense (1) 8,846 8,607 General and administrative expense (2) 3,844 3,463 Noncontrolling interest in PNOI of consolidated 80% joint ventures (52) (79) PROPERTY NET OPERATING INCOME (PNOI) 56,527 51,582 PNOI from 2018 Acquisitions (822) - PNOI from 2018 and 2019 Development Properties (3,314) (822) PNOI from 2018 and 2019 Operating Property Dispositions (23) (299) Other PNOI 47 102 SAME PNOI 52,415 50,563 Net lease termination fee (income) from same properties (140) (131) SAME PNOI EXCLUDING INCOME FROM LEASE TERMINATIONS $ 52,275 50,432 NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS $ 22,529 28,713 Depreciation and amortization 23,746 21,685 Company's share of depreciation from unconsolidated investment 35 31 Depreciation and amortization from noncontrolling interest (47) (44) (Gain) on sales of real estate investments (2,325) (10,222) (Gain) on sales of non-operating real estate - (86) (Gain) on sales of other - (427) FUNDS FROM OPERATIONS (FFO) ATTRIBUTABLE TO COMMON STOCKHOLDERS $ 43,938 39,650 NET INCOME $ 22,534 28,748 Interest expense (1) 8,846 8,607 Depreciation and amortization 23,746 21,685 Company's share of depreciation from unconsolidated investment 35 31 EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION (EBITDA) 55,161 59,071 (Gain) on sales of real estate investments (2,325) (10,222) (Gain) on sales of non-operating real estate - (86) (Gain) on sales of other - (427) EBITDA for Real Estate (EBITDAre) $ 52,836 48,336 DILUTED PER COMMON SHARE DATA FOR NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS Net income attributable to common stockholders $ 0.62 0.83 Funds from operations (FFO) attributable to common stockholders $ 1.20 1.14 (3) Weighted average shares outstanding for EPS and FFO purposes 36,526 34,736 (1) Net of capitalized interest of $2,036 and $1,602 for the three months ended March 31, 2019 and 2018, respectively. (2) Net of capitalized development costs of $1,571 and $1,123 for the three months ended March 31, 2019 and 2018, respectively. (3) The Company initially reported FFO of $1.16 per share during the first quarter of 2018. In connection with the Company's adoption of the Nareit Funds from Operations White Paper - 2018 Restatement, the Company now excludes from FFO the gains and losses on sales of non-operating real estate and assets incidental to the Company's business and therefore adjusted the prior year results, including the Company's FFO for 2018, to conform to the updated definition of FFO. Page 5 of 24

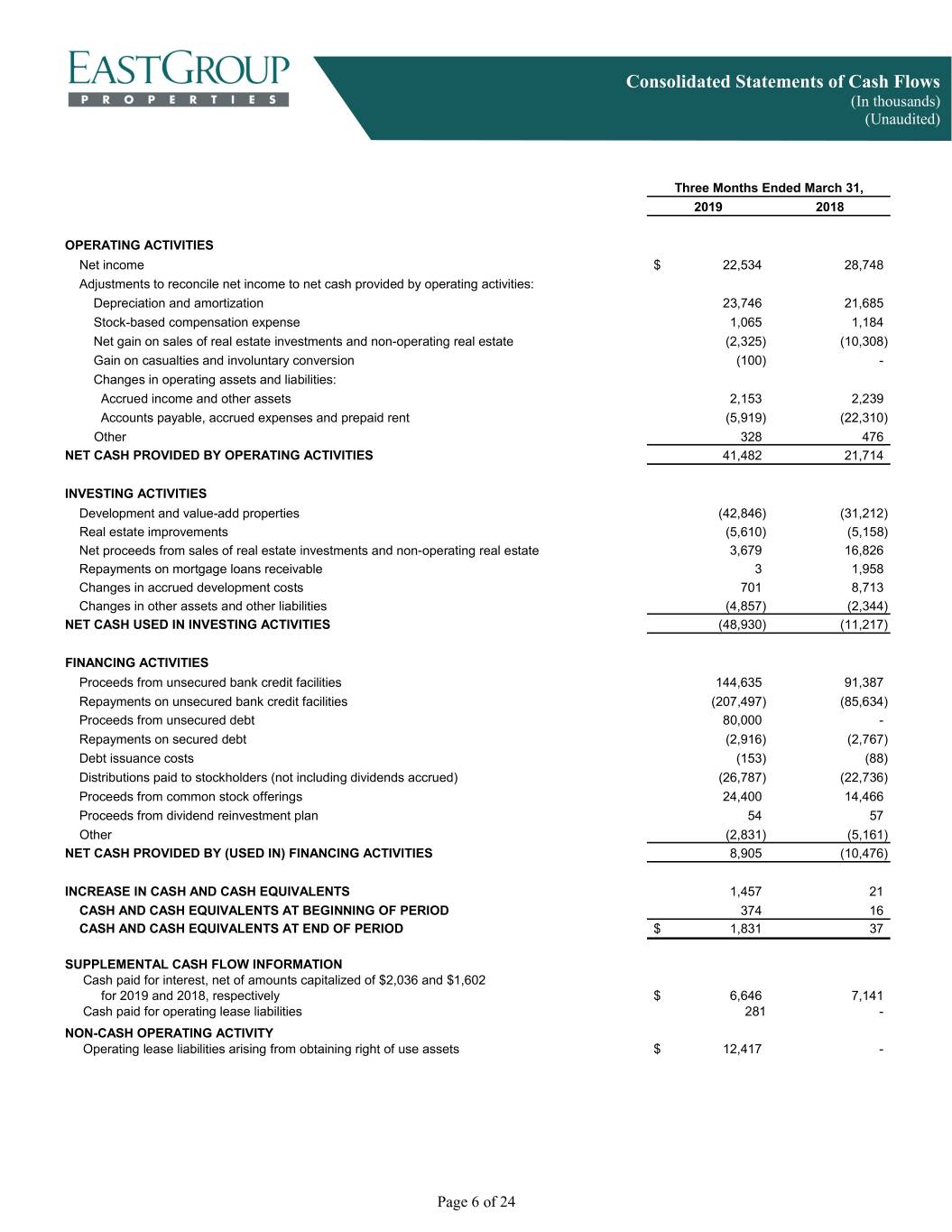

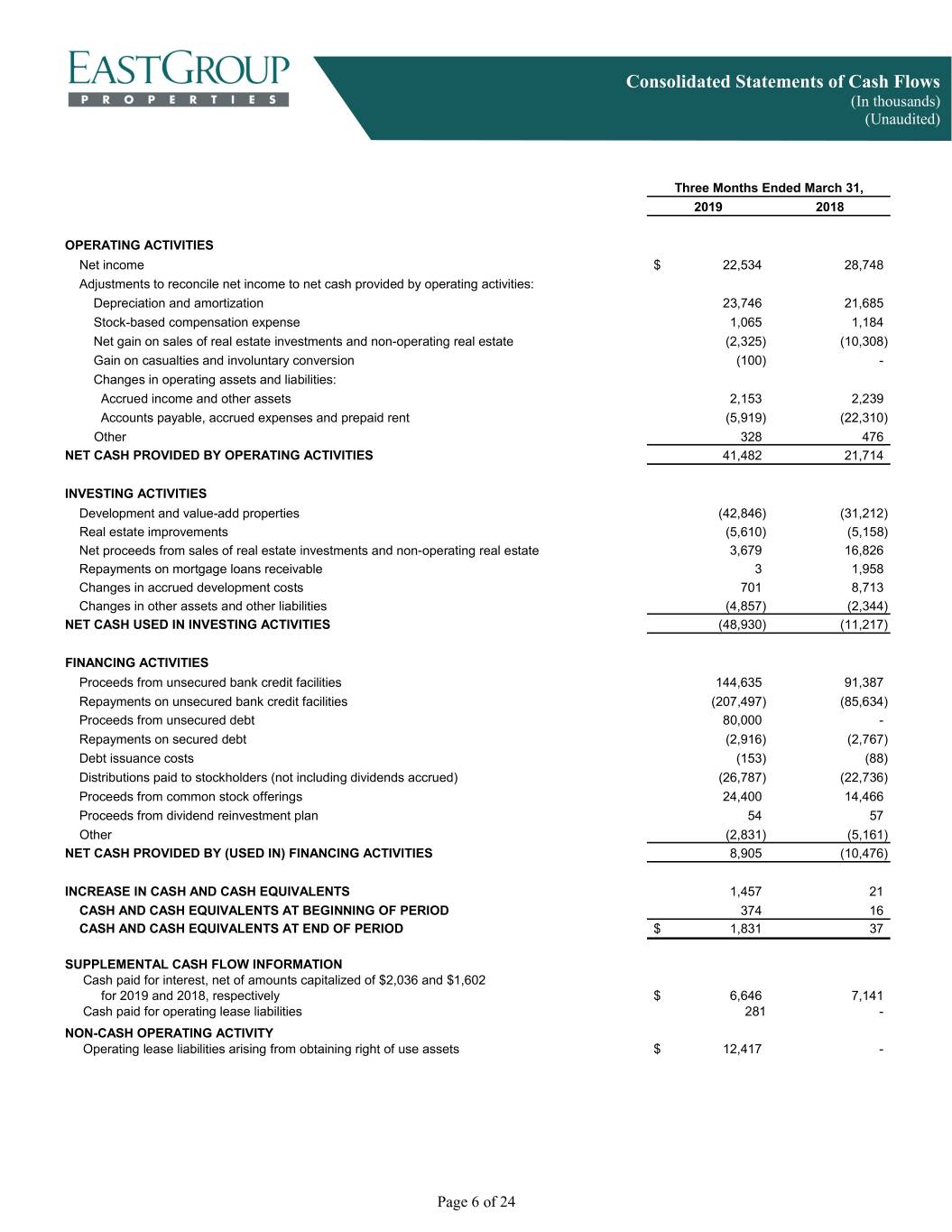

Consolidated Statements of Cash Flows (In thousands) (Unaudited) Three Months Ended March 31, 2019 2018 OPERATING ACTIVITIES Net income $ 22,534 28,748 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 23,746 21,685 Stock-based compensation expense 1,065 1,184 Net gain on sales of real estate investments and non-operating real estate (2,325) (10,308) Gain on casualties and involuntary conversion (100) - Changes in operating assets and liabilities: Accrued income and other assets 2,153 2,239 Accounts payable, accrued expenses and prepaid rent (5,919) (22,310) Other 328 476 NET CASH PROVIDED BY OPERATING ACTIVITIES 41,482 21,714 INVESTING ACTIVITIES Development and value-add properties (42,846) (31,212) Real estate improvements (5,610) (5,158) Net proceeds from sales of real estate investments and non-operating real estate 3,679 16,826 Repayments on mortgage loans receivable 3 1,958 Changes in accrued development costs 701 8,713 Changes in other assets and other liabilities (4,857) (2,344) NET CASH USED IN INVESTING ACTIVITIES (48,930) (11,217) FINANCING ACTIVITIES Proceeds from unsecured bank credit facilities 144,635 91,387 Repayments on unsecured bank credit facilities (207,497) (85,634) Proceeds from unsecured debt 80,000 - Repayments on secured debt (2,916) (2,767) Debt issuance costs (153) (88) Distributions paid to stockholders (not including dividends accrued) (26,787) (22,736) Proceeds from common stock offerings 24,400 14,466 Proceeds from dividend reinvestment plan 54 57 Other (2,831) (5,161) NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES 8,905 (10,476) INCREASE IN CASH AND CASH EQUIVALENTS 1,457 21 CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 374 16 CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 1,831 37 SUPPLEMENTAL CASH FLOW INFORMATION Cash paid for interest, net of amounts capitalized of $2,036 and $1,602 for 2019 and 2018, respectively $ 6,646 7,141 Cash paid for operating lease liabilities 281 - NON-CASH OPERATING ACTIVITY Operating lease liabilities arising from obtaining right of use assets$ 12,417 - Page 6 of 24

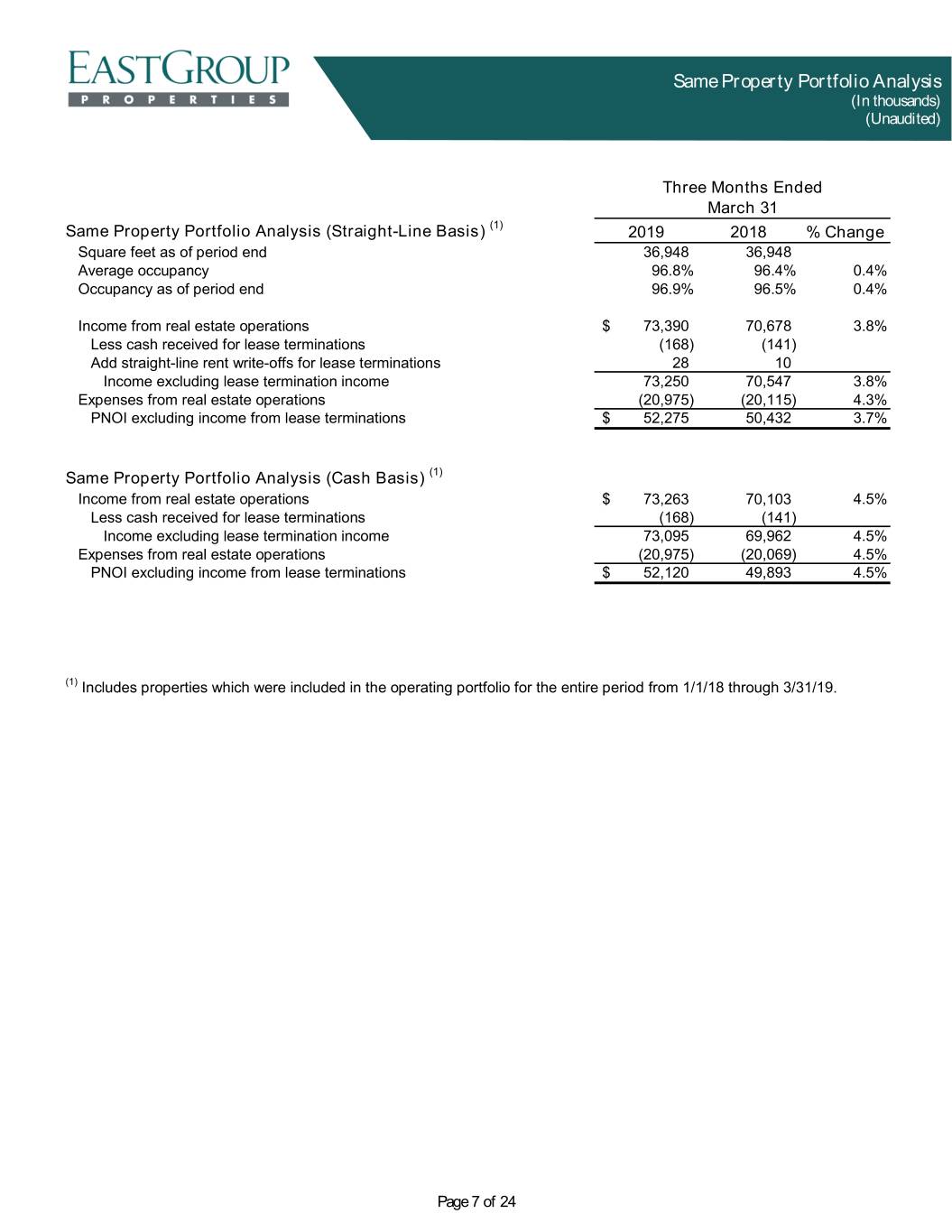

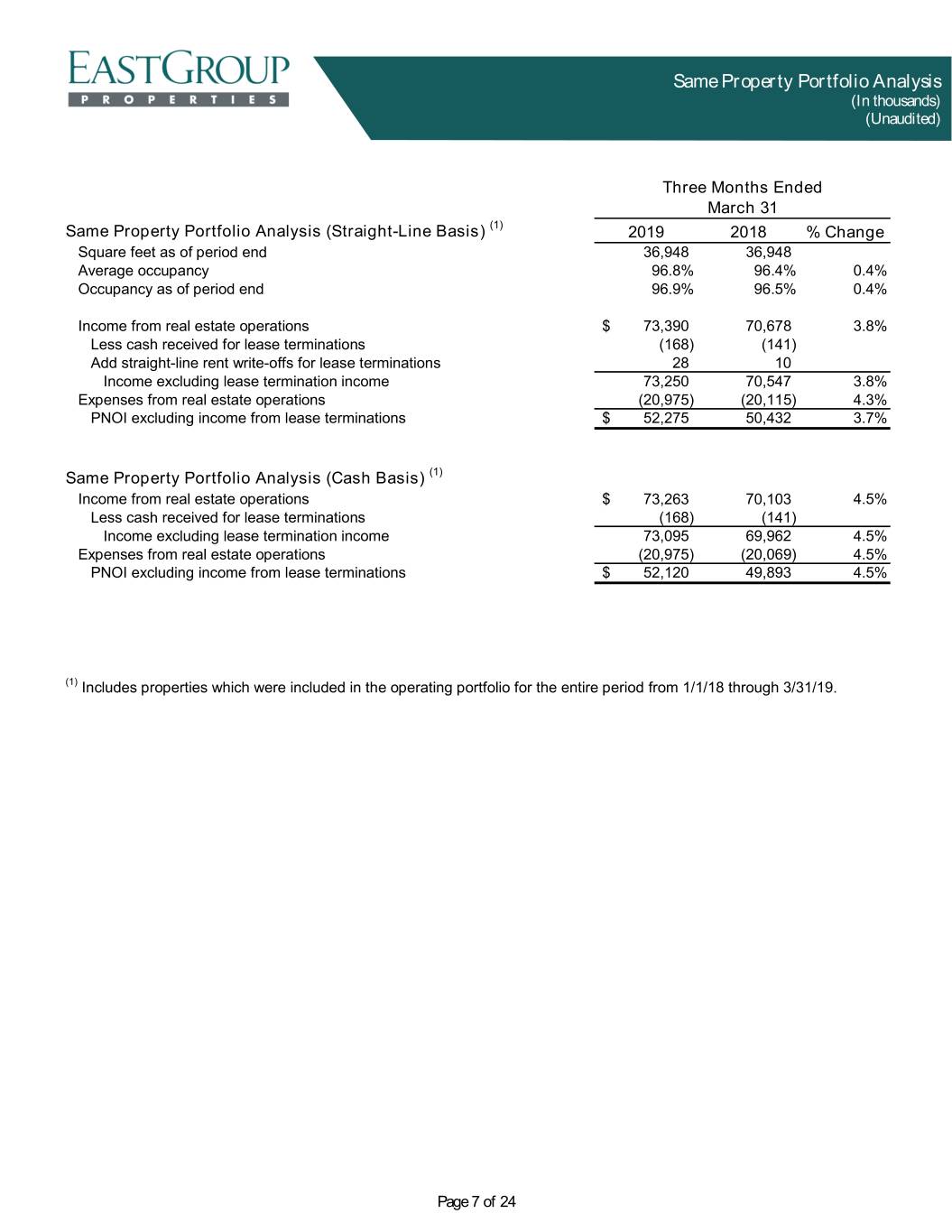

Same Property Portfolio Analysis (In thousands) (Unaudited) Three Months Ended March 31 Same Property Portfolio Analysis (Straight-Line Basis) (1) 2019 2018 % Change Square feet as of period end 36,948 36,948 Average occupancy 96.8% 96.4% 0.4% Occupancy as of period end 96.9% 96.5% 0.4% Income from real estate operations $ 73,390 70,678 3.8% Less cash received for lease terminations (168) (141) Add straight-line rent write-offs for lease terminations 28 10 Income excluding lease termination income 73,250 70,547 3.8% Expenses from real estate operations (20,975) (20,115) 4.3% PNOI excluding income from lease terminations $ 52,275 50,432 3.7% Same Property Portfolio Analysis (Cash Basis) (1) Income from real estate operations $ 73,263 70,103 4.5% Less cash received for lease terminations (168) (141) Income excluding lease termination income 73,095 69,962 4.5% Expenses from real estate operations (20,975) (20,069) 4.5% PNOI excluding income from lease terminations $ 52,120 49,893 4.5% (1) Includes properties which were included in the operating portfolio for the entire period from 1/1/18 through 3/31/19. Page 7 of 24

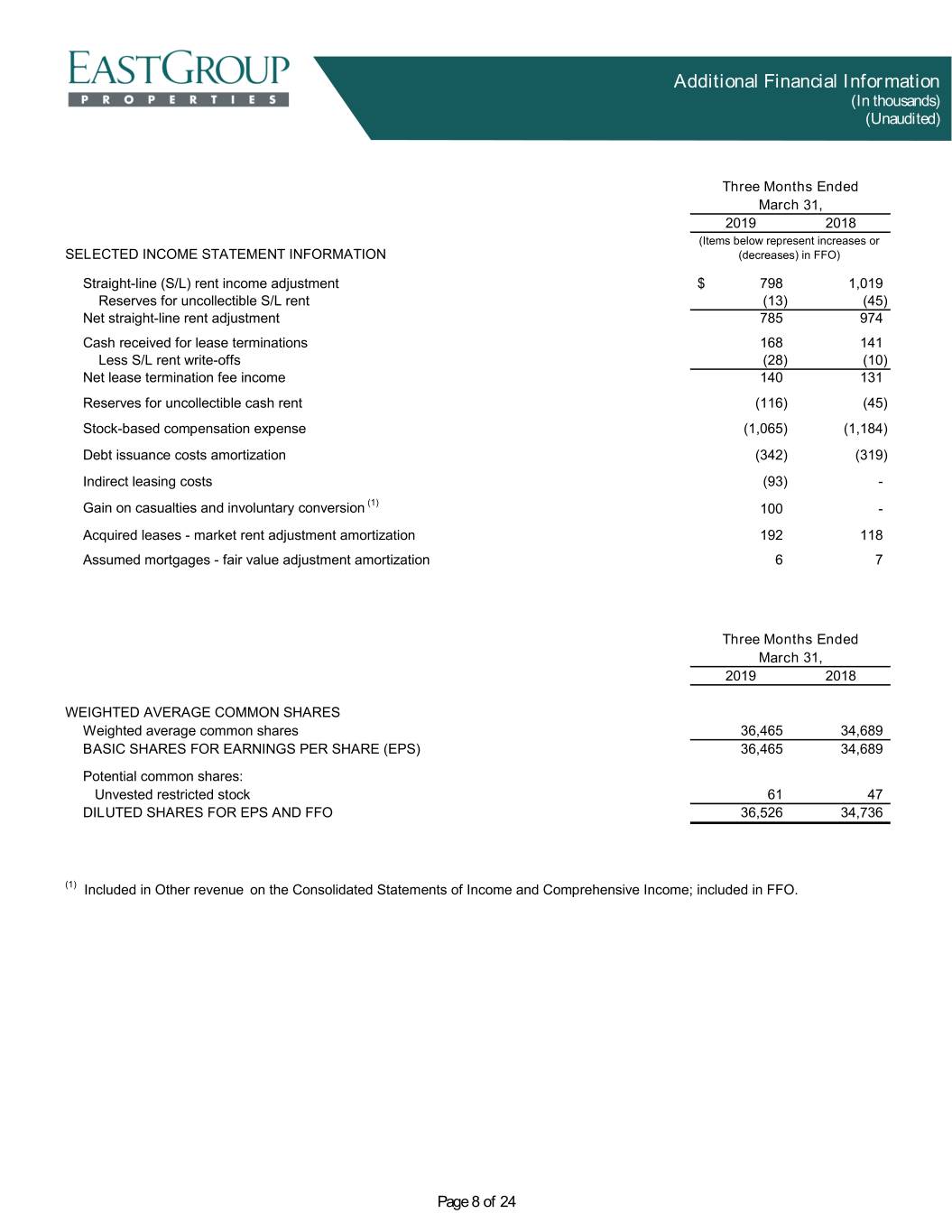

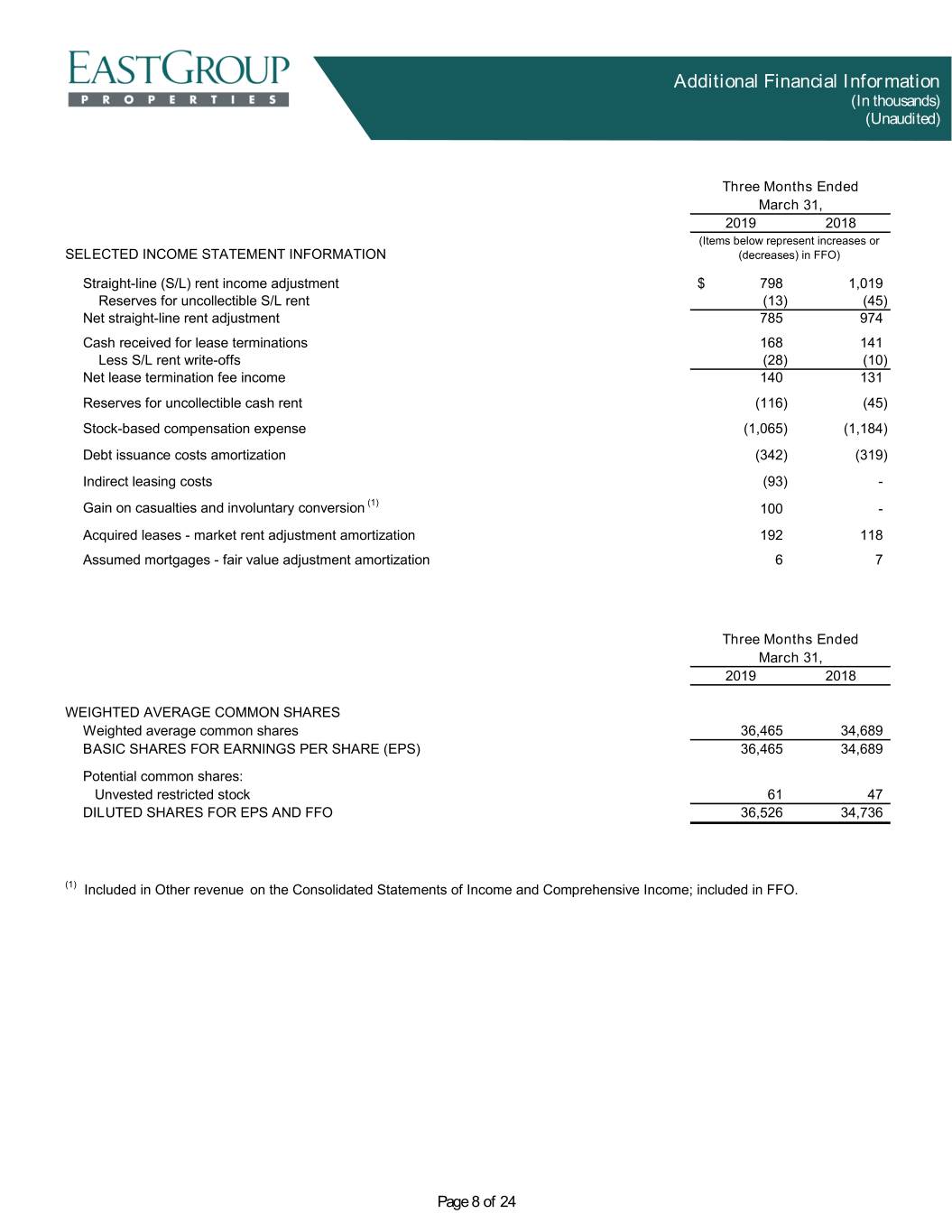

Additional Financial Information (In thousands) (Unaudited) Three Months Ended March 31, 2019 2018 (Items below represent increases or SELECTED INCOME STATEMENT INFORMATION (decreases) in FFO) Straight-line (S/L) rent income adjustment $ 798 1,019 Reserves for uncollectible S/L rent (13) (45) Net straight-line rent adjustment 785 974 Cash received for lease terminations 168 141 Less S/L rent write-offs (28) (10) Net lease termination fee income 140 131 Reserves for uncollectible cash rent (116) (45) Stock-based compensation expense (1,065) (1,184) Debt issuance costs amortization (342) (319) Indirect leasing costs (93) - Gain on casualties and involuntary conversion (1) 100 - Acquired leases - market rent adjustment amortization 192 118 Assumed mortgages - fair value adjustment amortization 6 7 Three Months Ended March 31, 2019 2018 WEIGHTED AVERAGE COMMON SHARES Weighted average common shares 36,465 34,689 BASIC SHARES FOR EARNINGS PER SHARE (EPS) 36,465 34,689 Potential common shares: Unvested restricted stock 61 47 DILUTED SHARES FOR EPS AND FFO 36,526 34,736 (1) Included in Other revenue on the Consolidated Statements of Income and Comprehensive Income; included in FFO. Page 8 of 24

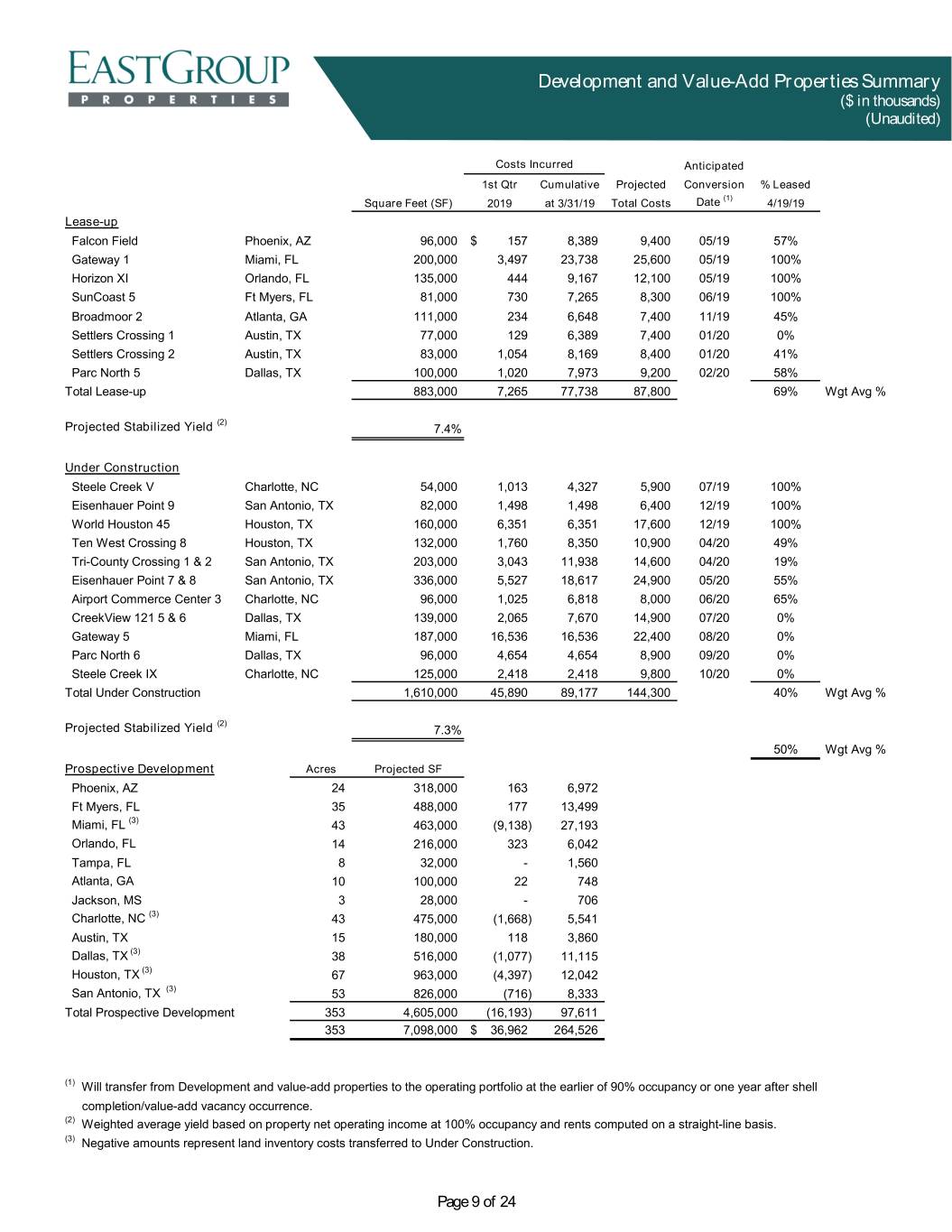

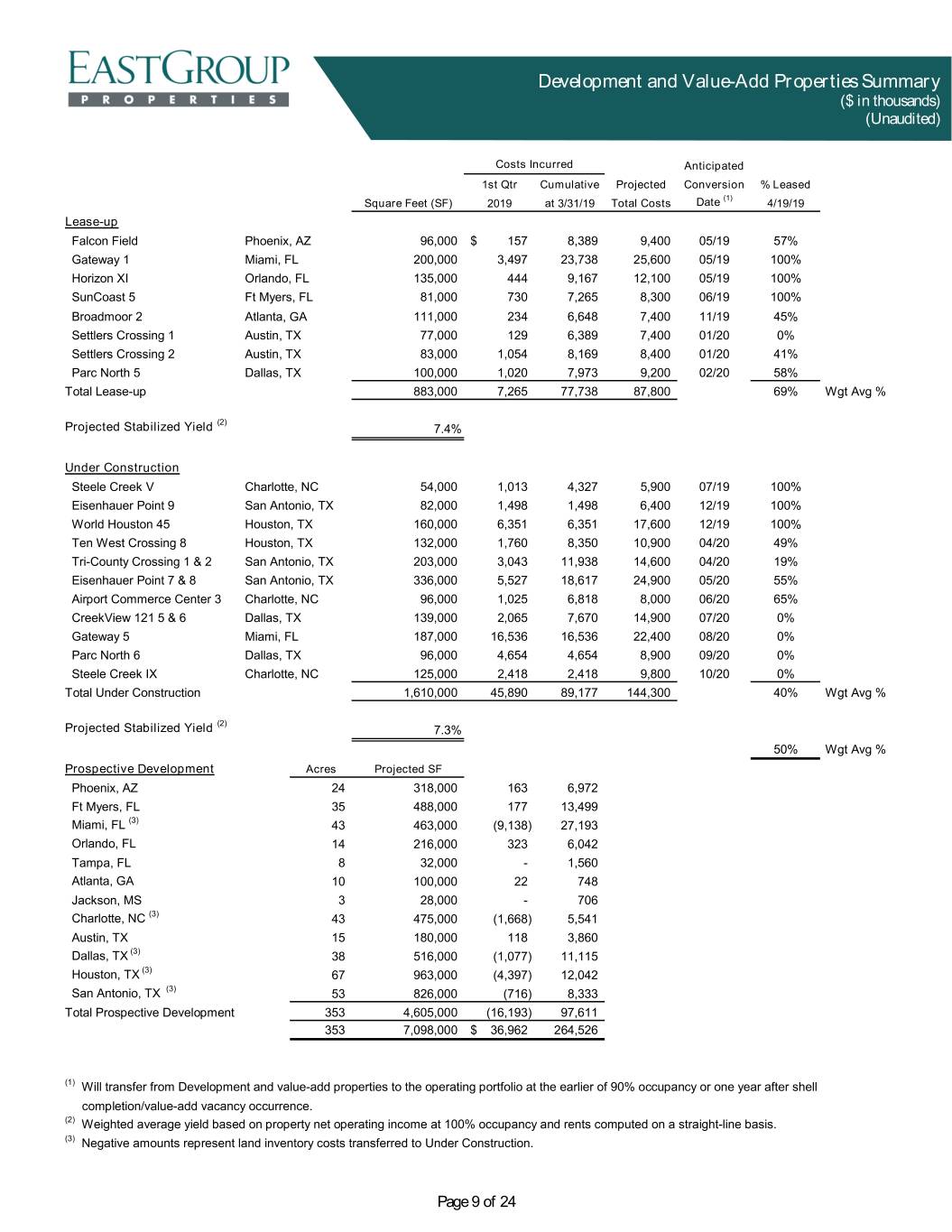

Development and Value-Add Properties Summary ($ in thousands) (Unaudited) Costs Incurred Anticipated 1st Qtr Cumulative Projected Conversion % Leased (1) Square Feet (SF) 2019 at 3/31/19 Total Costs Date 4/19/19 Lease-up Falcon Field Phoenix, AZ 96,000 $ 157 8,389 9,400 05/19 57% Gateway 1 Miami, FL 200,000 3,497 23,738 25,600 05/19 100% Horizon XI Orlando, FL 135,000 444 9,167 12,100 05/19 100% SunCoast 5 Ft Myers, FL 81,000 730 7,265 8,300 06/19 100% Broadmoor 2 Atlanta, GA 111,000 234 6,648 7,400 11/19 45% Settlers Crossing 1 Austin, TX 77,000 129 6,389 7,400 01/20 0% Settlers Crossing 2 Austin, TX 83,000 1,054 8,169 8,400 01/20 41% Parc North 5 Dallas, TX 100,000 1,020 7,973 9,200 02/20 58% Total Lease-up 883,000 7,265 77,738 87,800 69% Wgt Avg % (2) Projected Stabilized Yield 7.4% Under Construction Steele Creek V Charlotte, NC 54,000 1,013 4,327 5,900 07/19 100% Eisenhauer Point 9 San Antonio, TX 82,000 1,498 1,498 6,400 12/19 100% World Houston 45 Houston, TX 160,000 6,351 6,351 17,600 12/19 100% Ten West Crossing 8 Houston, TX 132,000 1,760 8,350 10,900 04/20 49% Tri-County Crossing 1 & 2 San Antonio, TX 203,000 3,043 11,938 14,600 04/20 19% Eisenhauer Point 7 & 8 San Antonio, TX 336,000 5,527 18,617 24,900 05/20 55% Airport Commerce Center 3 Charlotte, NC 96,000 1,025 6,818 8,000 06/20 65% CreekView 121 5 & 6 Dallas, TX 139,000 2,065 7,670 14,900 07/20 0% Gateway 5 Miami, FL 187,000 16,536 16,536 22,400 08/20 0% Parc North 6 Dallas, TX 96,000 4,654 4,654 8,900 09/20 0% Steele Creek IX Charlotte, NC 125,000 2,418 2,418 9,800 10/20 0% Total Under Construction 1,610,000 45,890 89,177 144,300 40% Wgt Avg % (2) Projected Stabilized Yield 7.3% 50% Wgt Avg % Prospective Development Acres Projected SF Phoenix, AZ 24 318,000 163 6,972 Ft Myers, FL 35 488,000 177 13,499 Miami, FL (3) 43 463,000 (9,138) 27,193 Orlando, FL 14 216,000 323 6,042 Tampa, FL 8 32,000 - 1,560 Atlanta, GA 10 100,000 22 748 Jackson, MS 3 28,000 - 706 Charlotte, NC (3) 43 475,000 (1,668) 5,541 Austin, TX 15 180,000 118 3,860 Dallas, TX (3) 38 516,000 (1,077) 11,115 Houston, TX (3) 67 963,000 (4,397) 12,042 San Antonio, TX (3) 53 826,000 (716) 8,333 Total Prospective Development 353 4,605,000 (16,193) 97,611 353 7,098,000 $ 36,962 264,526 (1) Will transfer from Development and value-add properties to the operating portfolio at the earlier of 90% occupancy or one year after shell completion/value-add vacancy occurrence. (2) Weighted average yield based on property net operating income at 100% occupancy and rents computed on a straight-line basis. (3) Negative amounts represent land inventory costs transferred to Under Construction. Page 9 of 24

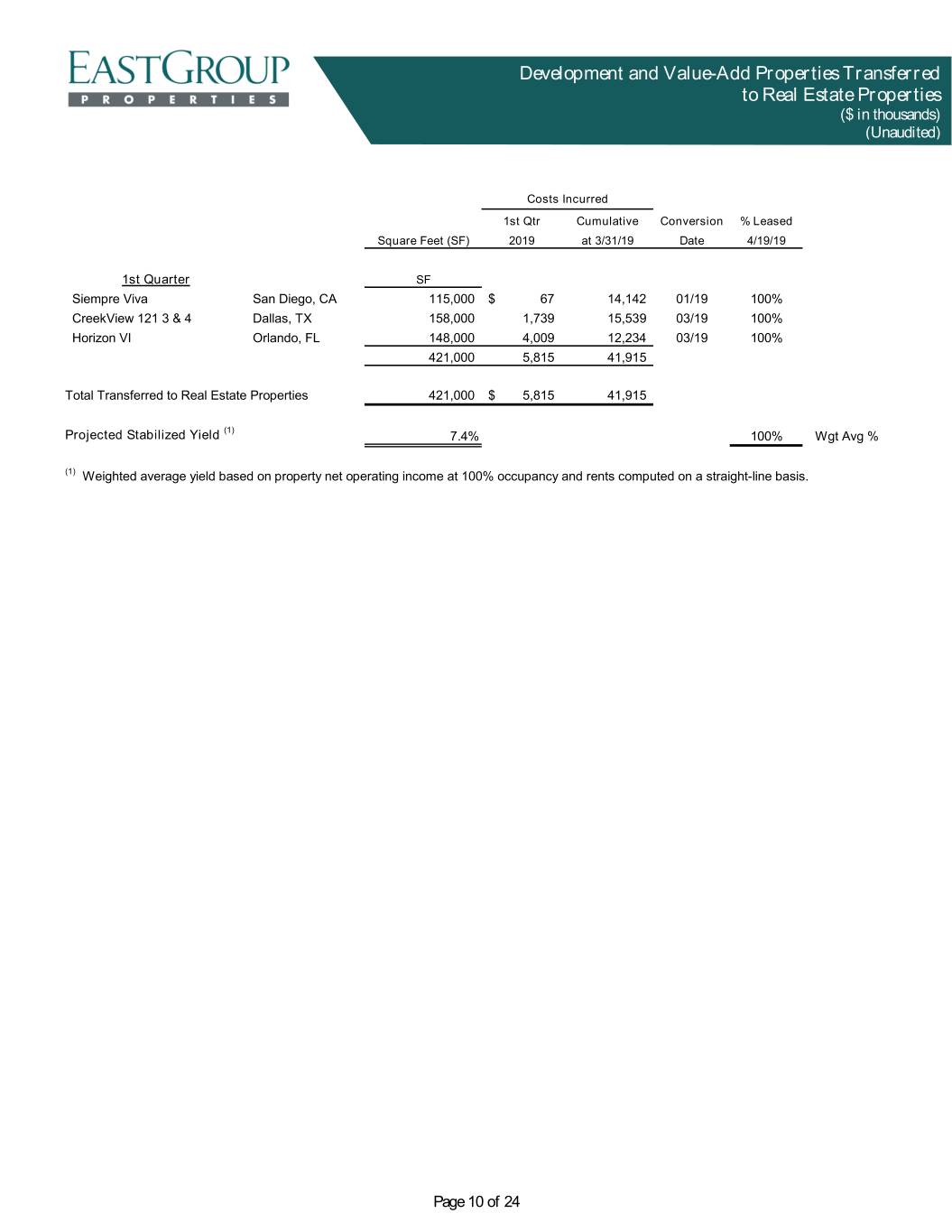

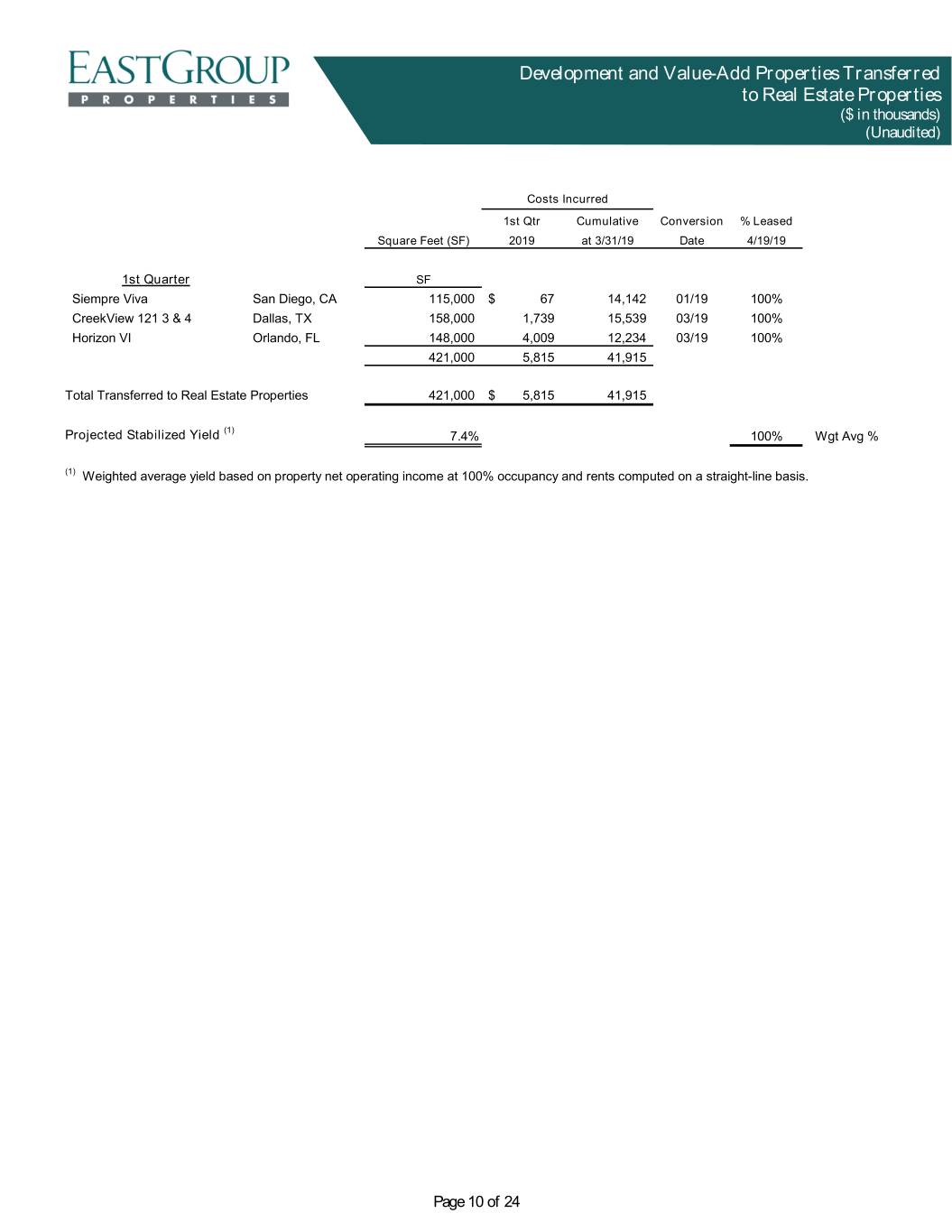

Development and Value-Add Properties Transferred to Real Estate Properties ($ in thousands) (Unaudited) Costs Incurred 1st Qtr Cumulative Conversion % Leased Square Feet (SF) 2019 at 3/31/19 Date 4/19/19 1st Quarter SF Siempre Viva San Diego, CA 115,000 $ 67 14,142 01/19 100% CreekView 121 3 & 4 Dallas, TX 158,000 1,739 15,539 03/19 100% Horizon VI Orlando, FL 148,000 4,009 12,234 03/19 100% 421,000 5,815 41,915 Total Transferred to Real Estate Properties 421,000 $ 5,815 41,915 (1) Projected Stabilized Yield 7.4% 100% Wgt Avg % (1) Weighted average yield based on property net operating income at 100% occupancy and rents computed on a straight-line basis. Page 10 of 24

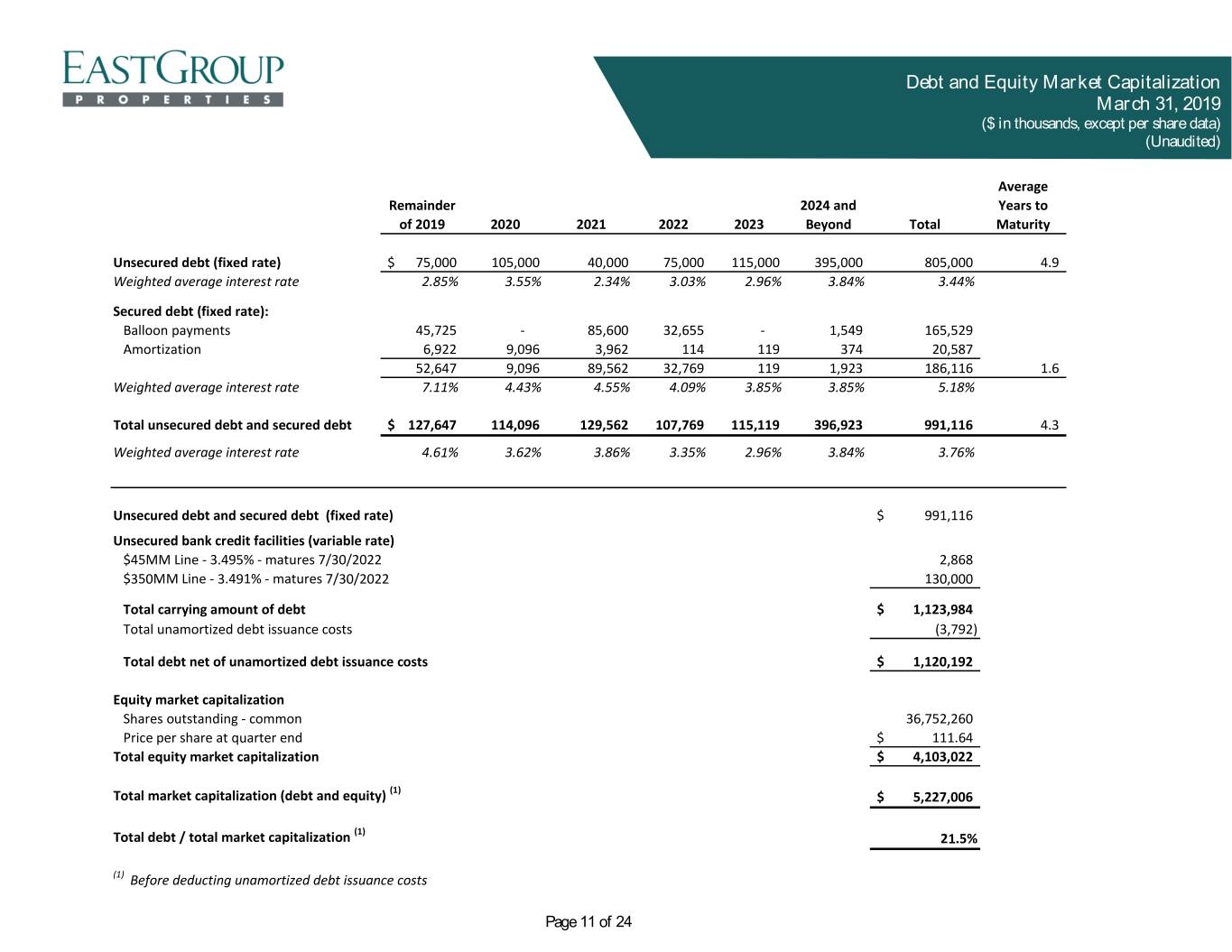

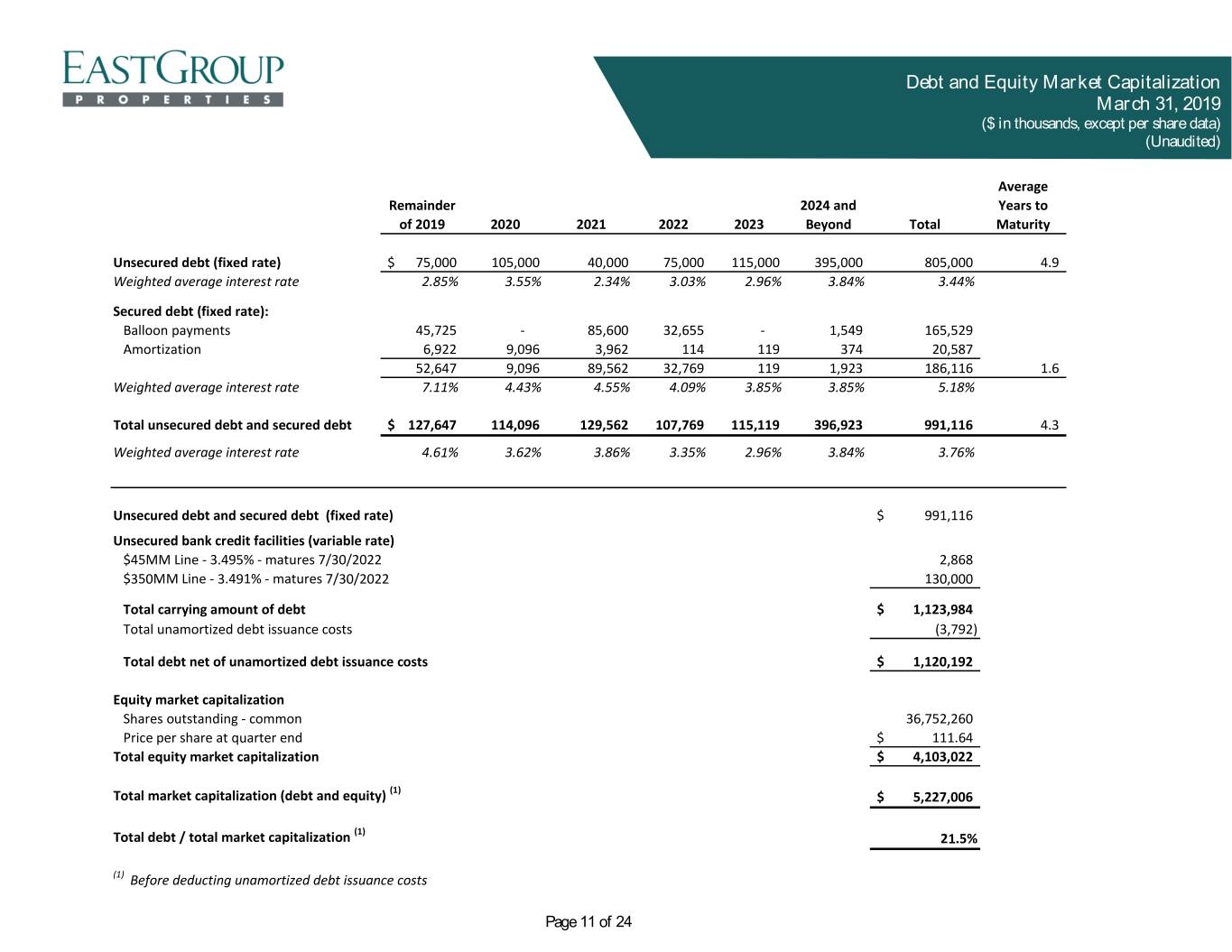

Debt and Equity Market Capitalization March 31, 2019 ($ in thousands, except per share data) (Unaudited) Average Remainder 2024 and Years to of 2019 2020 2021 2022 2023 Beyond Total Maturity Unsecured debt (fixed rate) $ 75,000 105,000 40,000 75,000 115,000 395,000 805,000 4.9 Weighted average interest rate 2.85% 3.55% 2.34% 3.03% 2.96% 3.84% 3.44% Secured debt (fixed rate): Balloon payments 45,725 - 85,600 32,655 - 1,549 165,529 Amortization 6,922 9,096 3,962 114 119 374 20,587 52,647 9,096 89,562 32,769 119 1,923 186,116 1.6 Weighted average interest rate 7.11% 4.43% 4.55% 4.09% 3.85% 3.85% 5.18% Total unsecured debt and secured debt $ 127,647 114,096 129,562 107,769 115,119 396,923 991,116 4.3 Weighted average interest rate 4.61% 3.62% 3.86% 3.35% 2.96% 3.84% 3.76% Unsecured debt and secured debt (fixed rate) $ 991,116 Unsecured bank credit facilities (variable rate) $45MM Line - 3.495% - matures 7/30/2022 2,868 $350MM Line - 3.491% - matures 7/30/2022 130,000 Total carrying amount of debt $ 1,123,984 Total unamortized debt issuance costs (3,792) Total debt net of unamortized debt issuance costs $ 1,120,192 Equity market capitalization Shares outstanding - common 36,752,260 Price per share at quarter end $ 111.64 Total equity market capitalization $ 4,103,022 (1) Total market capitalization (debt and equity) $ 5,227,006 (1) Total debt / total market capitalization 21.5% (1) Before deducting unamortized debt issuance costs Page 11 of 24

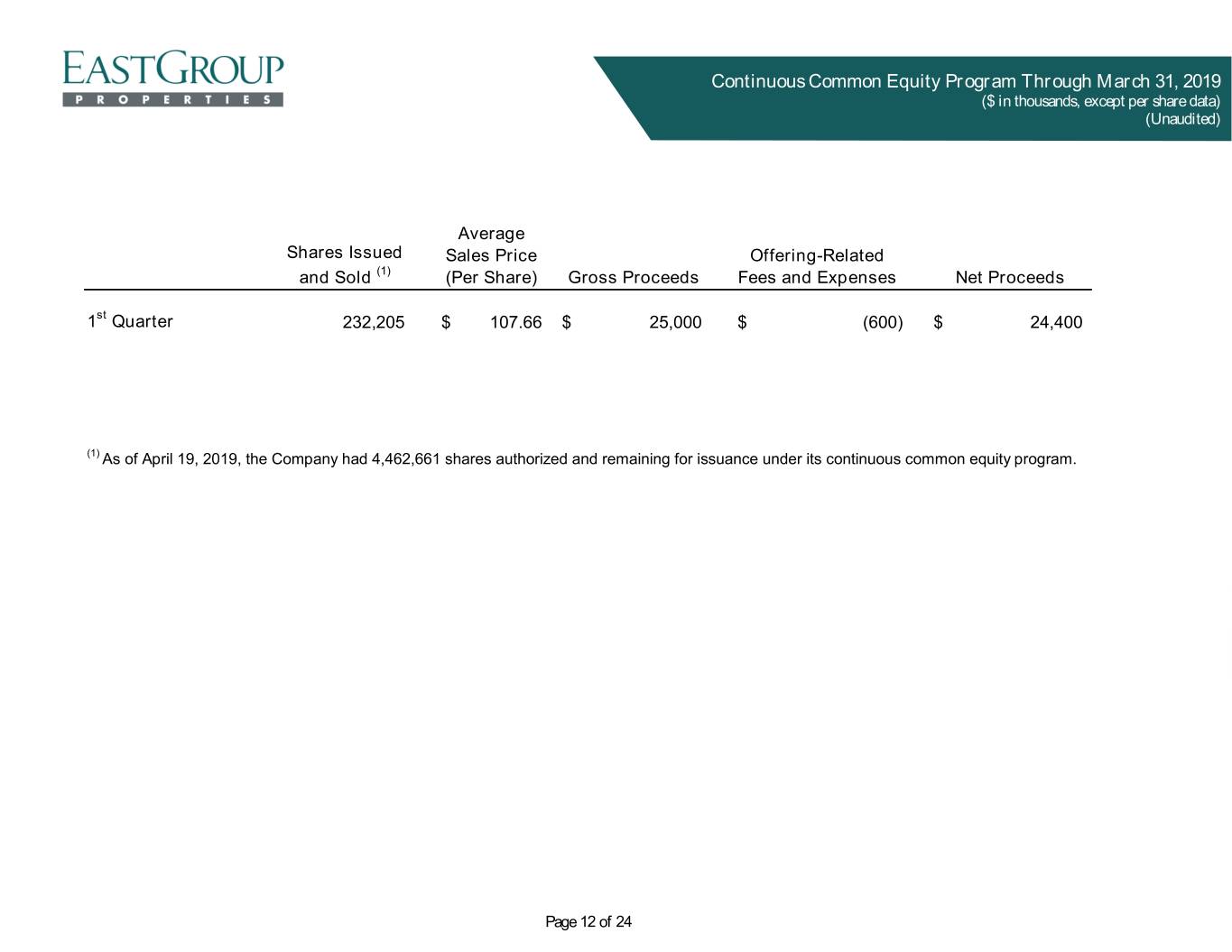

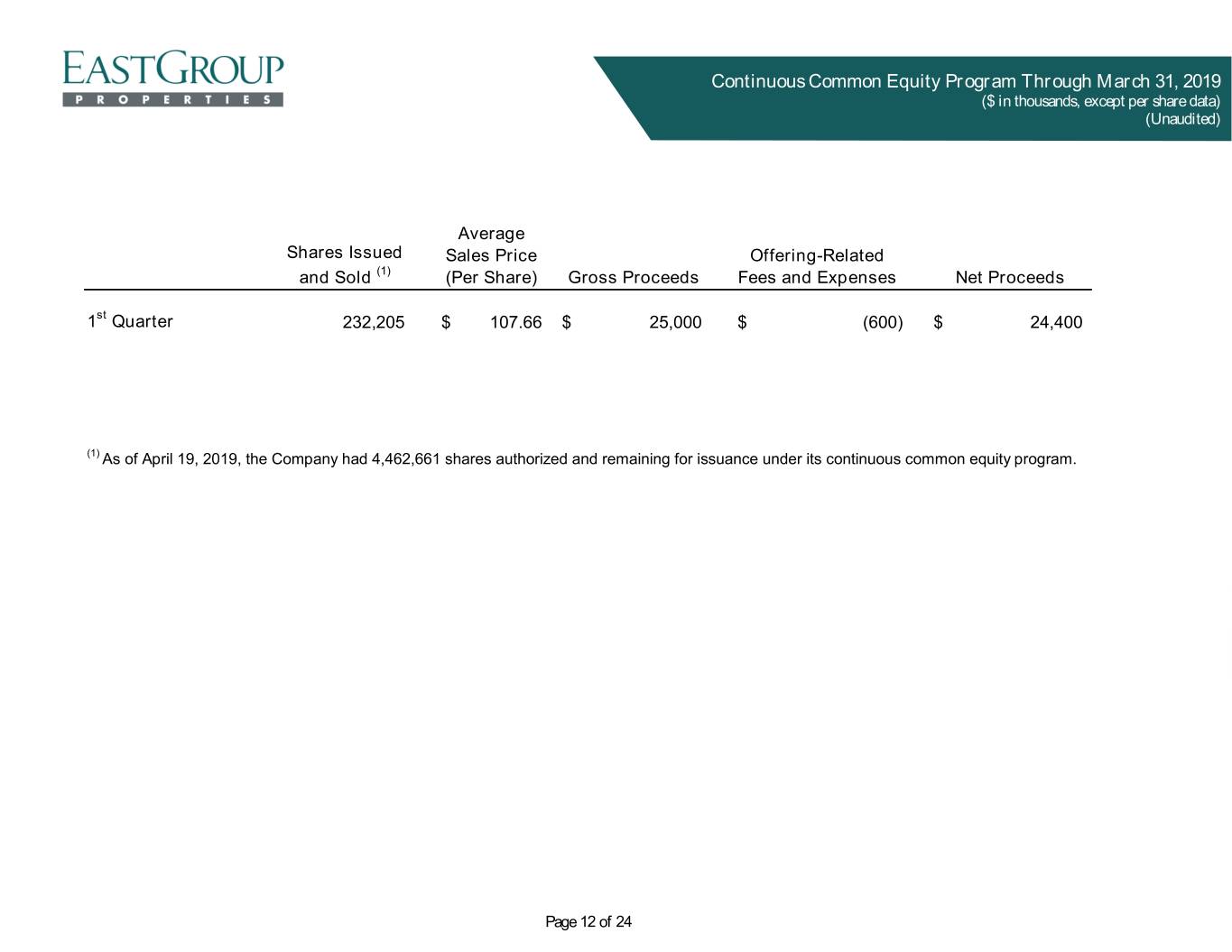

Continuous Common Equity Program Through March 31, 2019 ($ in thousands, except per share data) (Unaudited) Average Shares Issued Sales Price Offering-Related and Sold (1) (Per Share) Gross Proceeds Fees and Expenses Net Proceeds 1st Quarter 232,205 $ 107.66 $ 25,000 $ (600) $ 24,400 (1) As of April 19, 2019, the Company had 4,462,661 shares authorized and remaining for issuance under its continuous common equity program. Page 12 of 24

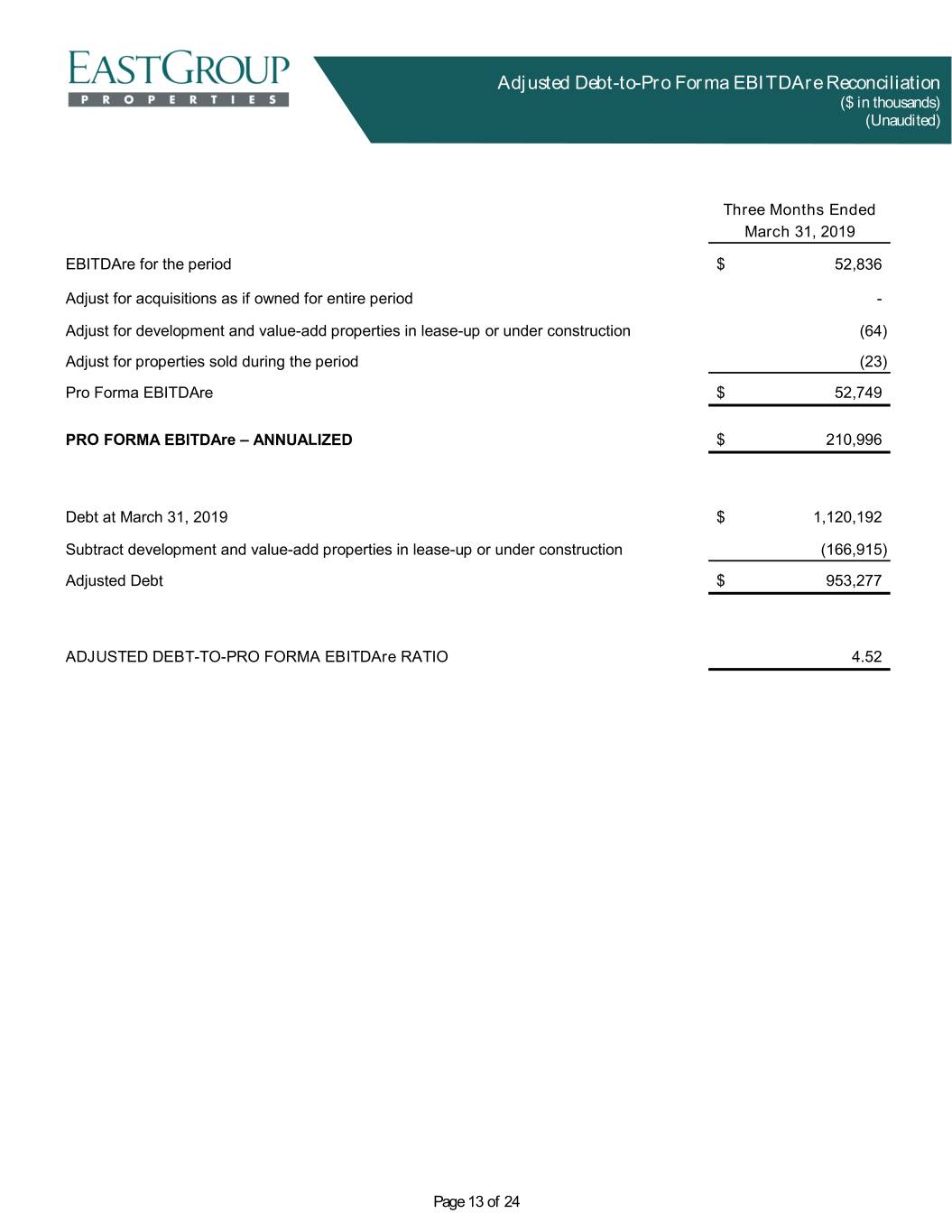

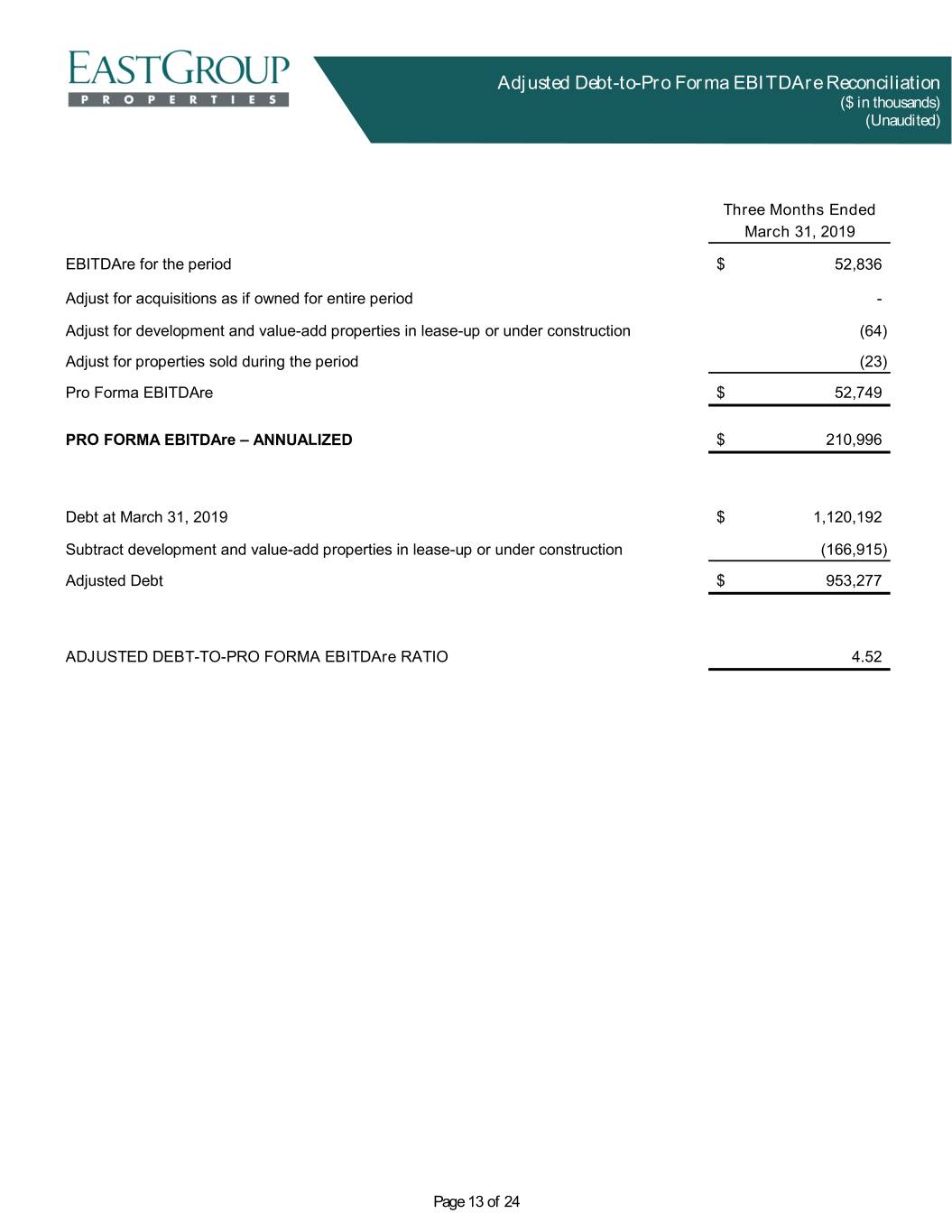

Adjusted Debt-to-Pro Forma EBITDAre Reconciliation ($ in thousands) (Unaudited) Three Months Ended March 31, 2019 EBITDAre for the period $ 52,836 Adjust for acquisitions as if owned for entire period - Adjust for development and value-add properties in lease-up or under construction (64) Adjust for properties sold during the period (23) Pro Forma EBITDAre $ 52,749 PRO FORMA EBITDAre – ANNUALIZED $ 210,996 Debt at March 31, 2019 $ 1,120,192 Subtract development and value-add properties in lease-up or under construction (166,915) Adjusted Debt $ 953,277 ADJUSTED DEBT-TO-PRO FORMA EBITDAre RATIO 4.52 Page 13 of 24

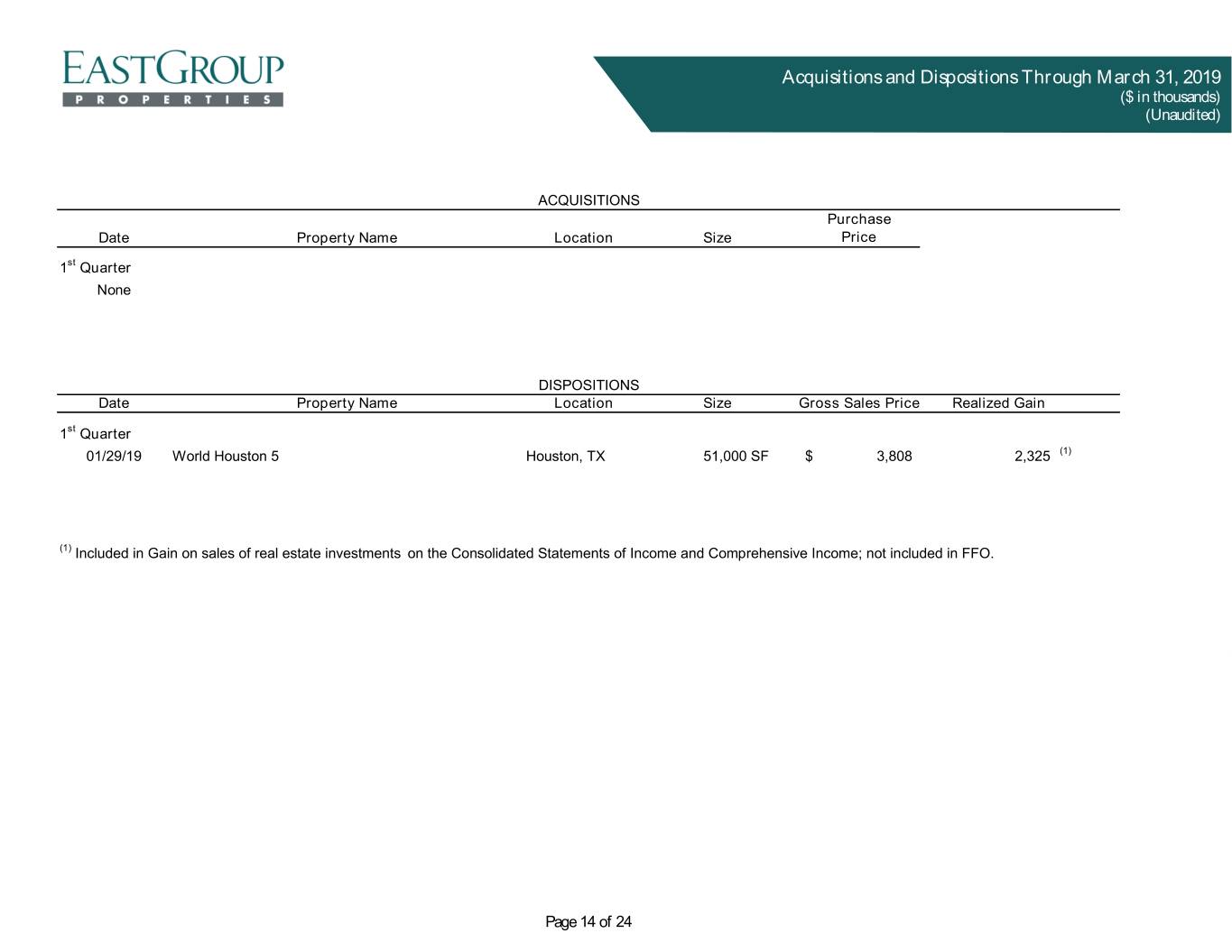

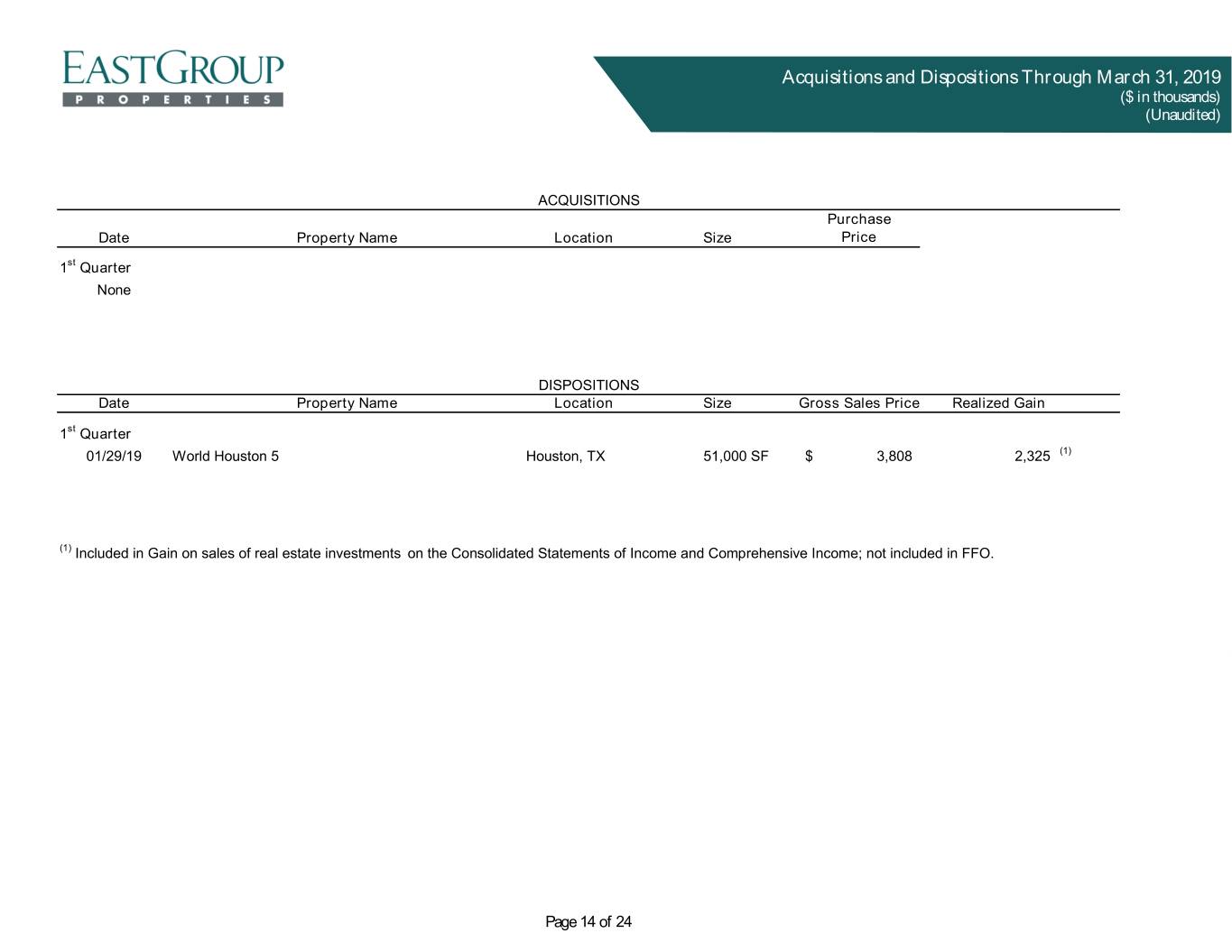

Acquisitions and Dispositions Through March 31, 2019 ($ in thousands) (Unaudited) ACQUISITIONS Purchase Date Property Name Location Size Price 1st Quarter None DISPOSITIONS Date Property Name Location Size Gross Sales Price Realized Gain 1st Quarter 01/29/19 World Houston 5 Houston, TX 51,000 SF $ 3,808 2,325 (1) (1) Included in Gain on sales of real estate investments on the Consolidated Statements of Income and Comprehensive Income; not included in FFO. Page 14 of 24

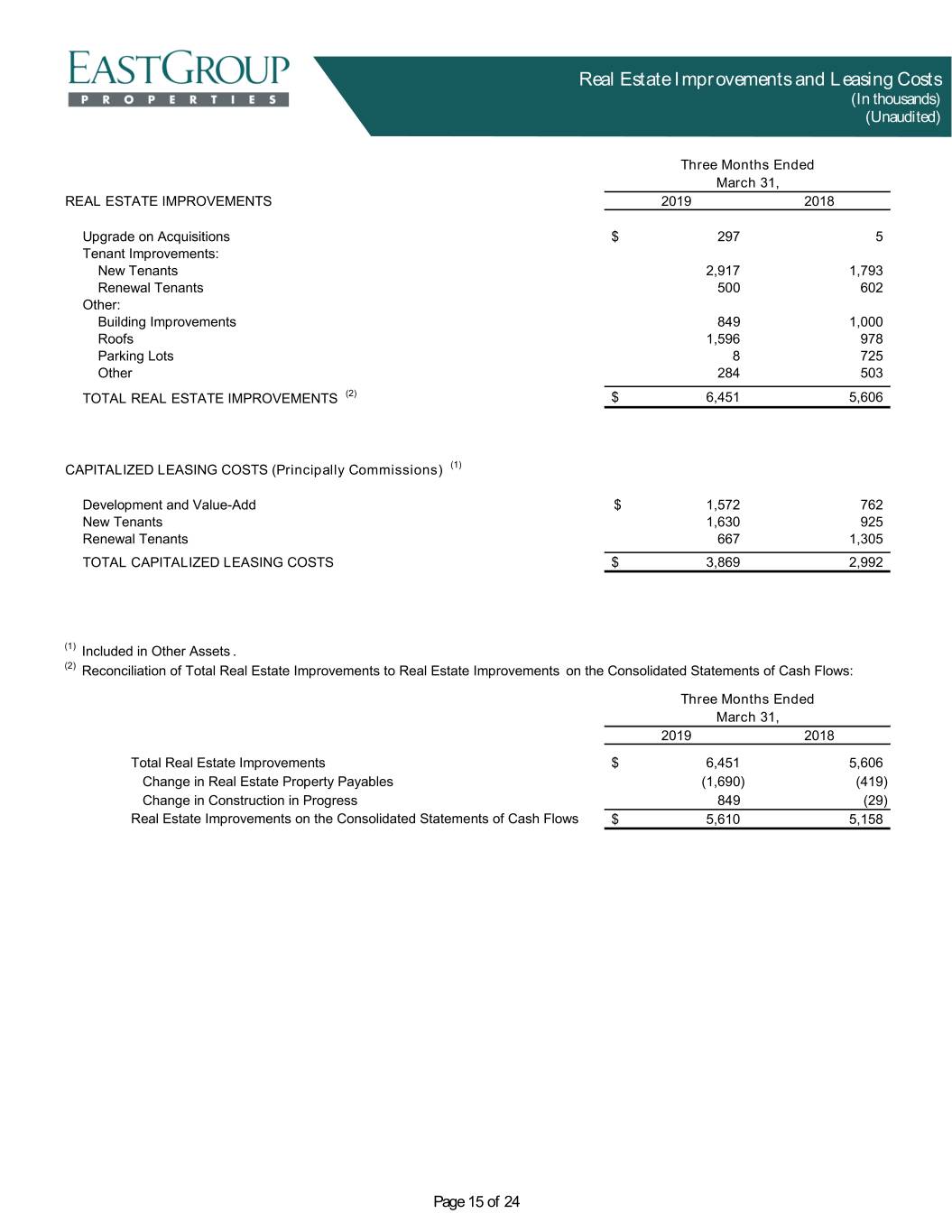

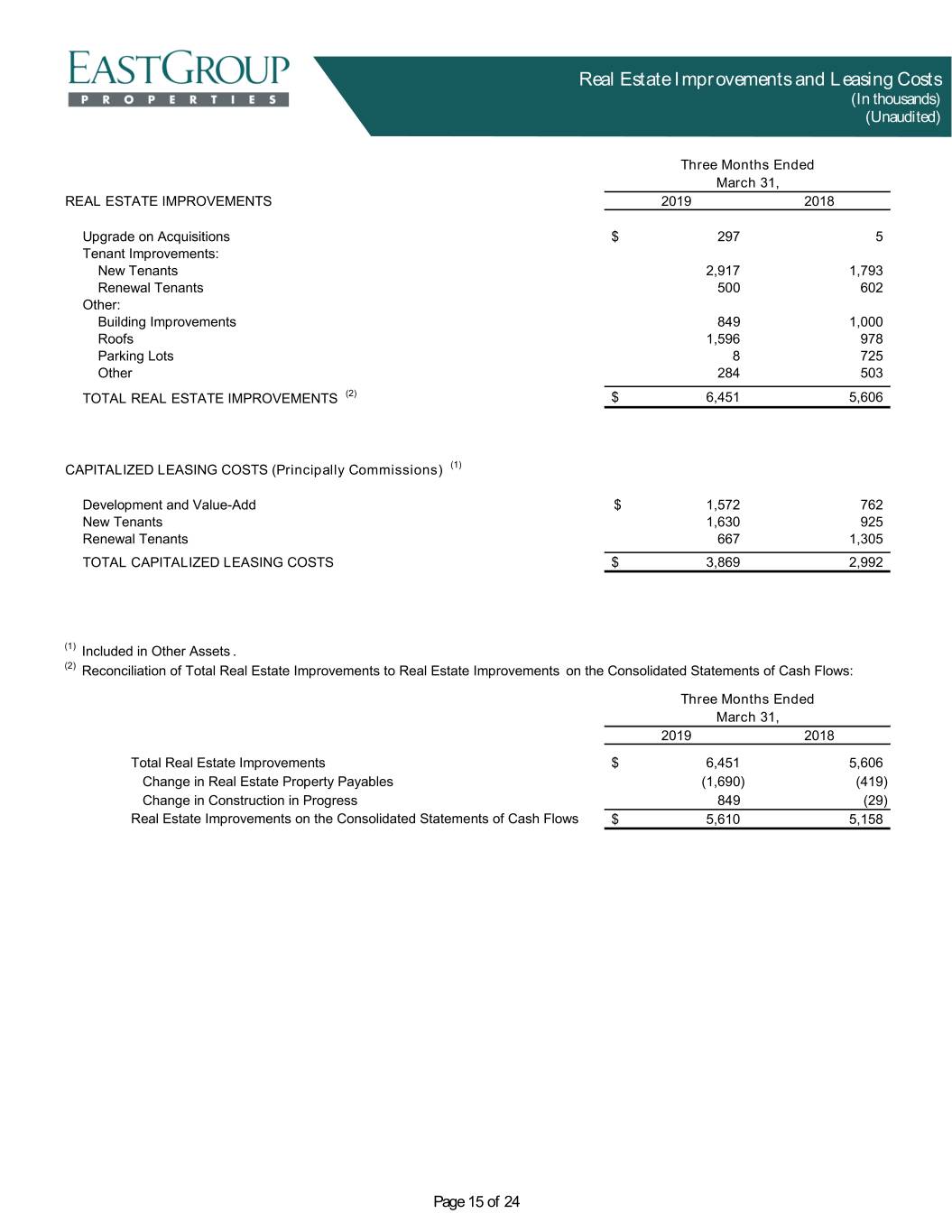

Real Estate Improvements and Leasing Costs (In thousands) (Unaudited) Three Months Ended March 31, REAL ESTATE IMPROVEMENTS 2019 2018 Upgrade on Acquisitions $ 297 5 Tenant Improvements: New Tenants 2,917 1,793 Renewal Tenants 500 602 Other: Building Improvements 849 1,000 Roofs 1,596 978 Parking Lots 8 725 Other 284 503 TOTAL REAL ESTATE IMPROVEMENTS (2) $ 6,451 5,606 CAPITALIZED LEASING COSTS (Principally Commissions) (1) Development and Value-Add $ 1,572 762 New Tenants 1,630 925 Renewal Tenants 667 1,305 TOTAL CAPITALIZED LEASING COSTS $ 3,869 2,992 (1) Included in Other Assets . (2) Reconciliation of Total Real Estate Improvements to Real Estate Improvements on the Consolidated Statements of Cash Flows: Three Months Ended March 31, 2019 2018 Total Real Estate Improvements $ 6,451 5,606 Change in Real Estate Property Payables (1,690) (419) Change in Construction in Progress 849 (29) Real Estate Improvements on the Consolidated Statements of Cash Flows $ 5,610 5,158 Page 15 of 24

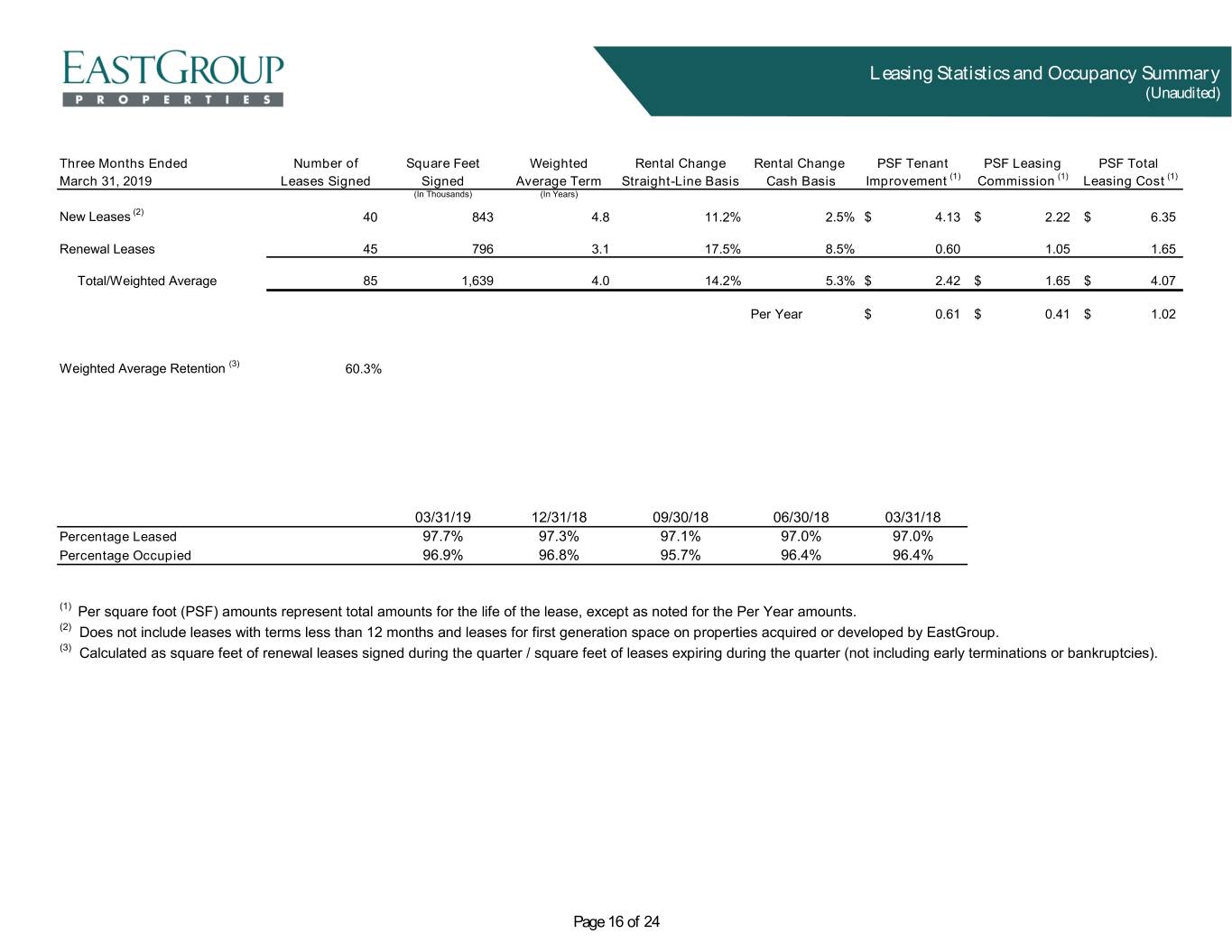

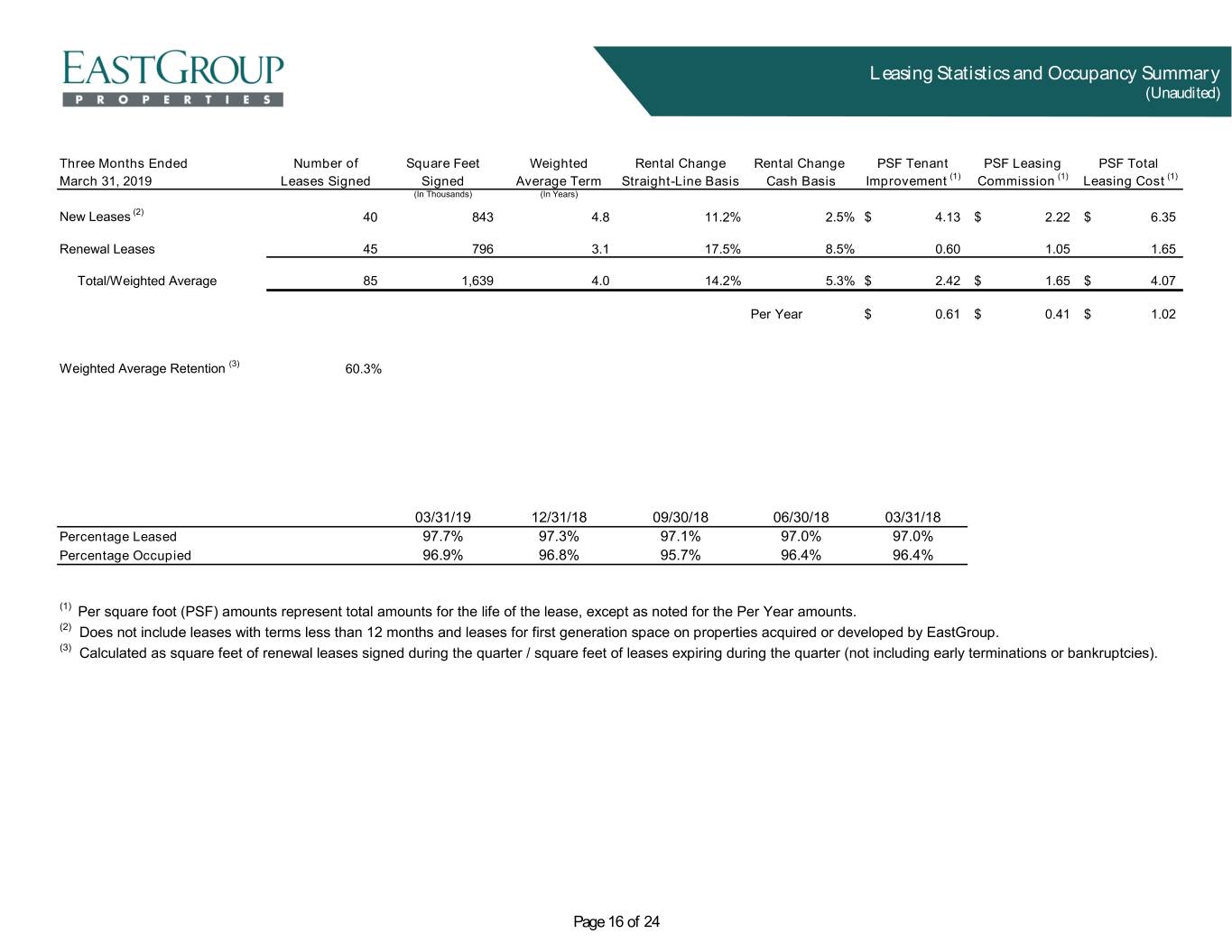

Leasing Statistics and Occupancy Summary (Unaudited) Three Months Ended Number of Square Feet Weighted Rental Change Rental Change PSF Tenant PSF Leasing PSF Total March 31, 2019 Leases Signed Signed Average Term Straight-Line Basis Cash Basis Improvement (1) Commission (1) Leasing Cost (1) (In Thousands) (In Years) New Leases (2) 40 843 4.8 11.2% 2.5% $ 4.13 $ 2.22 $ 6.35 Renewal Leases 45 796 3.1 17.5% 8.5% 0.60 1.05 1.65 Total/Weighted Average 85 1,639 4.0 14.2% 5.3% $ 2.42 $ 1.65 $ 4.07 Per Year $ 0.61 $ 0.41 $ 1.02 Weighted Average Retention (3) 60.3% 03/31/19 12/31/18 09/30/18 06/30/18 03/31/18 Percentage Leased 97.7% 97.3% 97.1% 97.0% 97.0% Percentage Occupied 96.9% 96.8% 95.7% 96.4% 96.4% (1) Per square foot (PSF) amounts represent total amounts for the life of the lease, except as noted for the Per Year amounts. (2) Does not include leases with terms less than 12 months and leases for first generation space on properties acquired or developed by EastGroup. (3) Calculated as square feet of renewal leases signed during the quarter / square feet of leases expiring during the quarter (not including early terminations or bankruptcies). Page 16 of 24

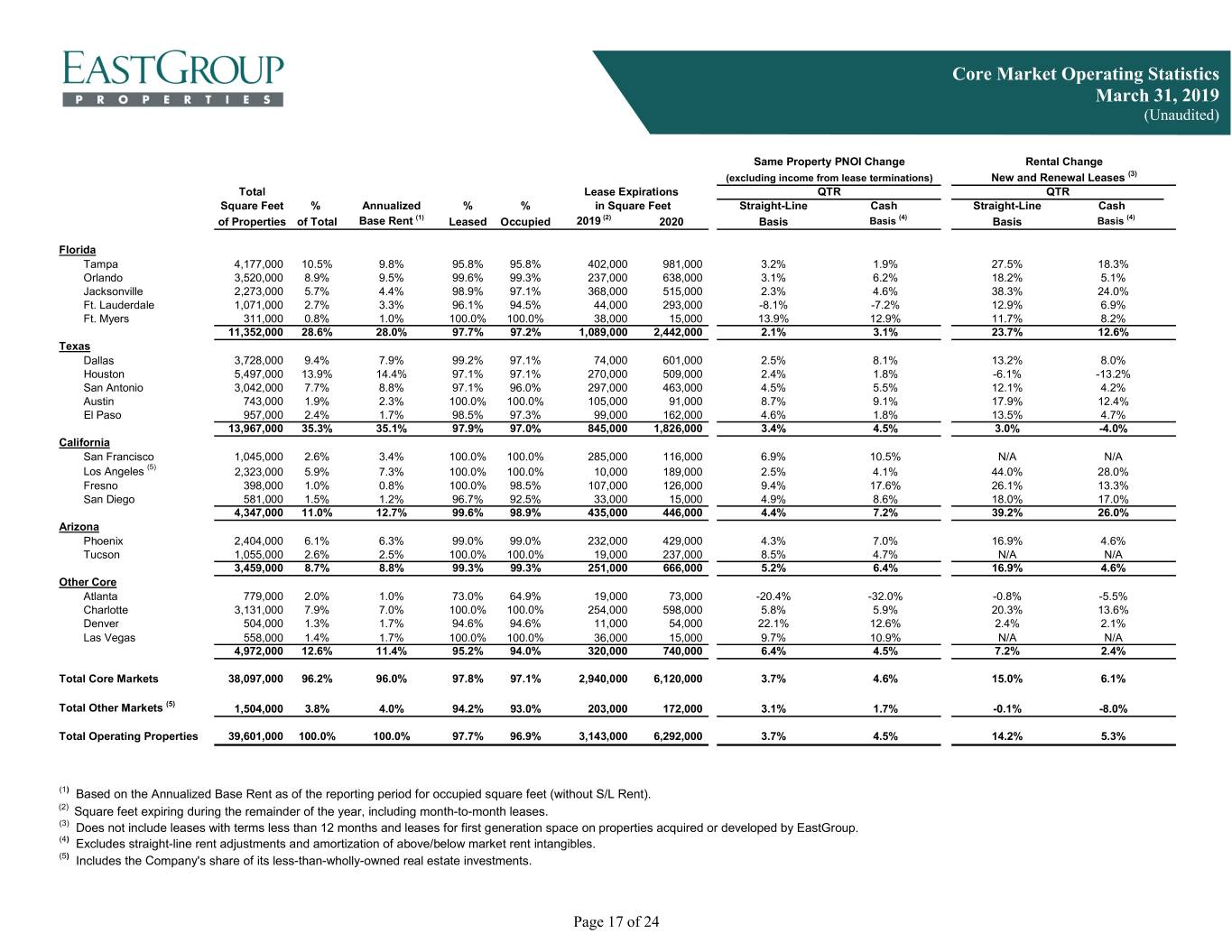

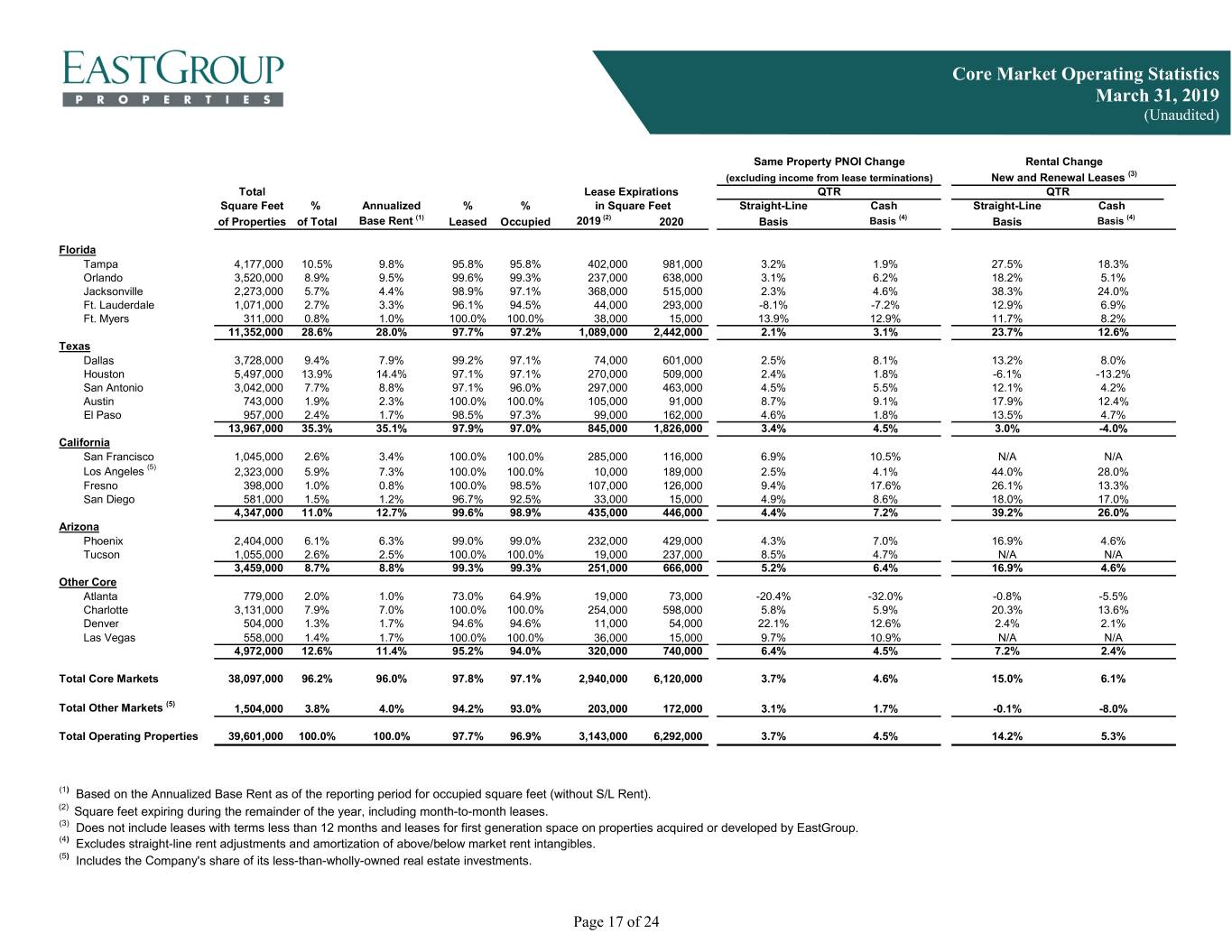

Core Market Operating Statistics March 31, 2019 (Unaudited) Same Property PNOI Change Rental Change (excluding income from lease terminations) New and Renewal Leases (3) Total Lease Expirations QTR QTR Square Feet % Annualized % % in Square Feet Straight-Line Cash Straight-Line Cash of Properties of Total Base Rent (1) Leased Occupied 2019 (2) 2020 Basis Basis (4) Basis Basis (4) Florida Tampa 4,177,000 10.5% 9.8% 95.8% 95.8% 402,000 981,000 3.2% 1.9% 27.5% 18.3% Orlando 3,520,000 8.9% 9.5% 99.6% 99.3% 237,000 638,000 3.1% 6.2% 18.2% 5.1% Jacksonville 2,273,000 5.7% 4.4% 98.9% 97.1% 368,000 515,000 2.3% 4.6% 38.3% 24.0% Ft. Lauderdale 1,071,000 2.7% 3.3% 96.1% 94.5% 44,000 293,000 -8.1% -7.2% 12.9% 6.9% Ft. Myers 311,000 0.8% 1.0% 100.0% 100.0% 38,000 15,000 13.9% 12.9% 11.7% 8.2% 11,352,000 28.6% 28.0% 97.7% 97.2% 1,089,000 2,442,000 2.1% 3.1% 23.7% 12.6% Texas Dallas 3,728,000 9.4% 7.9% 99.2% 97.1% 74,000 601,000 2.5% 8.1% 13.2% 8.0% Houston 5,497,000 13.9% 14.4% 97.1% 97.1% 270,000 509,000 2.4% 1.8% -6.1% -13.2% San Antonio 3,042,000 7.7% 8.8% 97.1% 96.0% 297,000 463,000 4.5% 5.5% 12.1% 4.2% Austin 743,000 1.9% 2.3% 100.0% 100.0% 105,000 91,000 8.7% 9.1% 17.9% 12.4% El Paso 957,000 2.4% 1.7% 98.5% 97.3% 99,000 162,000 4.6% 1.8% 13.5% 4.7% 13,967,000 35.3% 35.1% 97.9% 97.0% 845,000 1,826,000 3.4% 4.5% 3.0% -4.0% California San Francisco 1,045,000 2.6% 3.4% 100.0% 100.0% 285,000 116,000 6.9% 10.5% N/A N/A Los Angeles (5) 2,323,000 5.9% 7.3% 100.0% 100.0% 10,000 189,000 2.5% 4.1% 44.0% 28.0% Fresno 398,000 1.0% 0.8% 100.0% 98.5% 107,000 126,000 9.4% 17.6% 26.1% 13.3% San Diego 581,000 1.5% 1.2% 96.7% 92.5% 33,000 15,000 4.9% 8.6% 18.0% 17.0% 4,347,000 11.0% 12.7% 99.6% 98.9% 435,000 446,000 4.4% 7.2% 39.2% 26.0% Arizona Phoenix 2,404,000 6.1% 6.3% 99.0% 99.0% 232,000 429,000 4.3% 7.0% 16.9% 4.6% Tucson 1,055,000 2.6% 2.5% 100.0% 100.0% 19,000 237,000 8.5% 4.7% N/A N/A 3,459,000 8.7% 8.8% 99.3% 99.3% 251,000 666,000 5.2% 6.4% 16.9% 4.6% Other Core Atlanta 779,000 2.0% 1.0% 73.0% 64.9% 19,000 73,000 -20.4% -32.0% -0.8% -5.5% Charlotte 3,131,000 7.9% 7.0% 100.0% 100.0% 254,000 598,000 5.8% 5.9% 20.3% 13.6% Denver 504,000 1.3% 1.7% 94.6% 94.6% 11,000 54,000 22.1% 12.6% 2.4% 2.1% Las Vegas 558,000 1.4% 1.7% 100.0% 100.0% 36,000 15,000 9.7% 10.9% N/A N/A 4,972,000 12.6% 11.4% 95.2% 94.0% 320,000 740,000 6.4% 4.5% 7.2% 2.4% Total Core Markets 38,097,000 96.2% 96.0% 97.8% 97.1% 2,940,000 6,120,000 3.7% 4.6% 15.0% 6.1% Total Other Markets (5) 1,504,000 3.8% 4.0% 94.2% 93.0% 203,000 172,000 3.1% 1.7% -0.1% -8.0% Total Operating Properties 39,601,000 100.0% 100.0% 97.7% 96.9% 3,143,000 6,292,000 3.7% 4.5% 14.2% 5.3% (1) Based on the Annualized Base Rent as of the reporting period for occupied square feet (without S/L Rent). (2) Square feet expiring during the remainder of the year, including month-to-month leases. (3) Does not include leases with terms less than 12 months and leases for first generation space on properties acquired or developed by EastGroup. (4) Excludes straight-line rent adjustments and amortization of above/below market rent intangibles. (5) Includes the Company's share of its less-than-wholly-owned real estate investments. Page 17 of 24

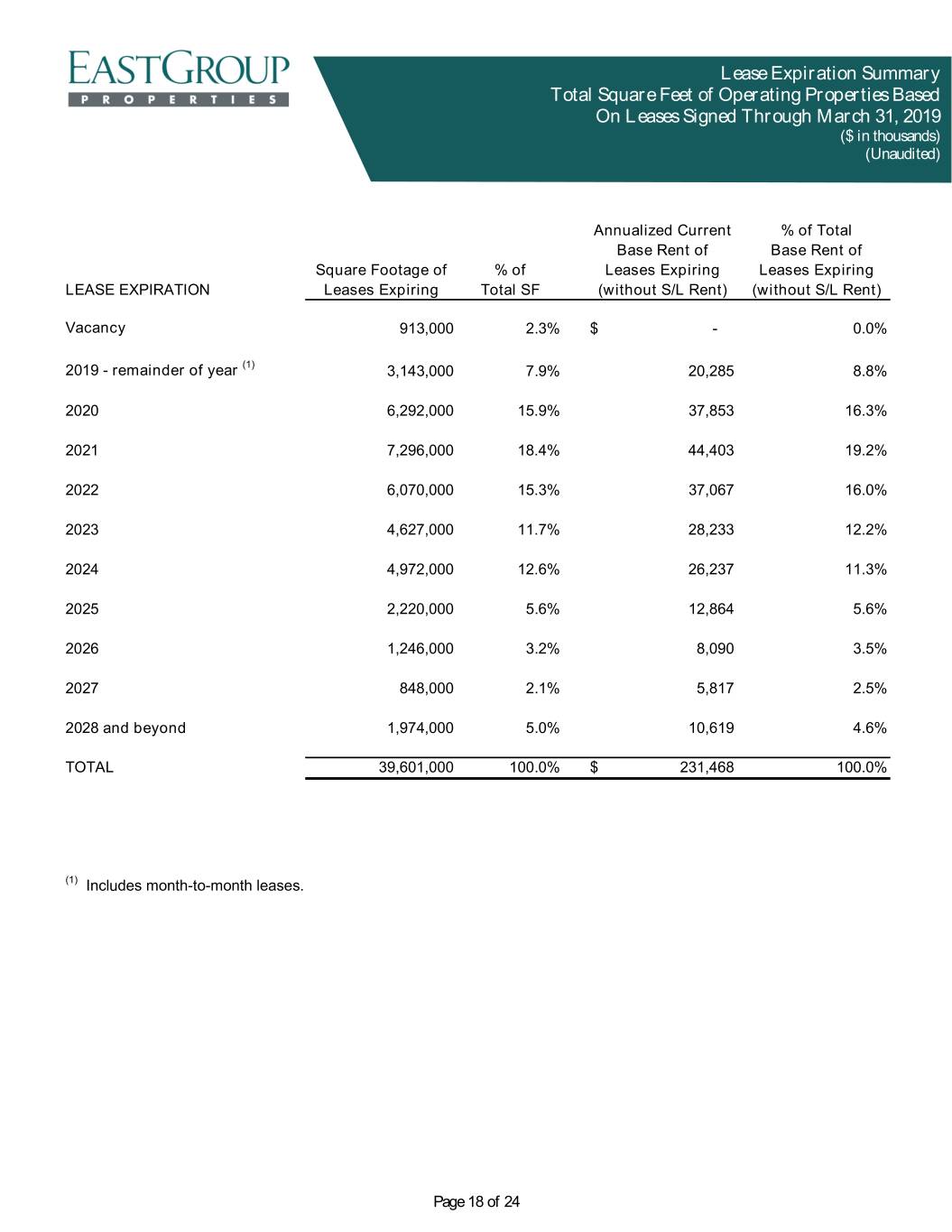

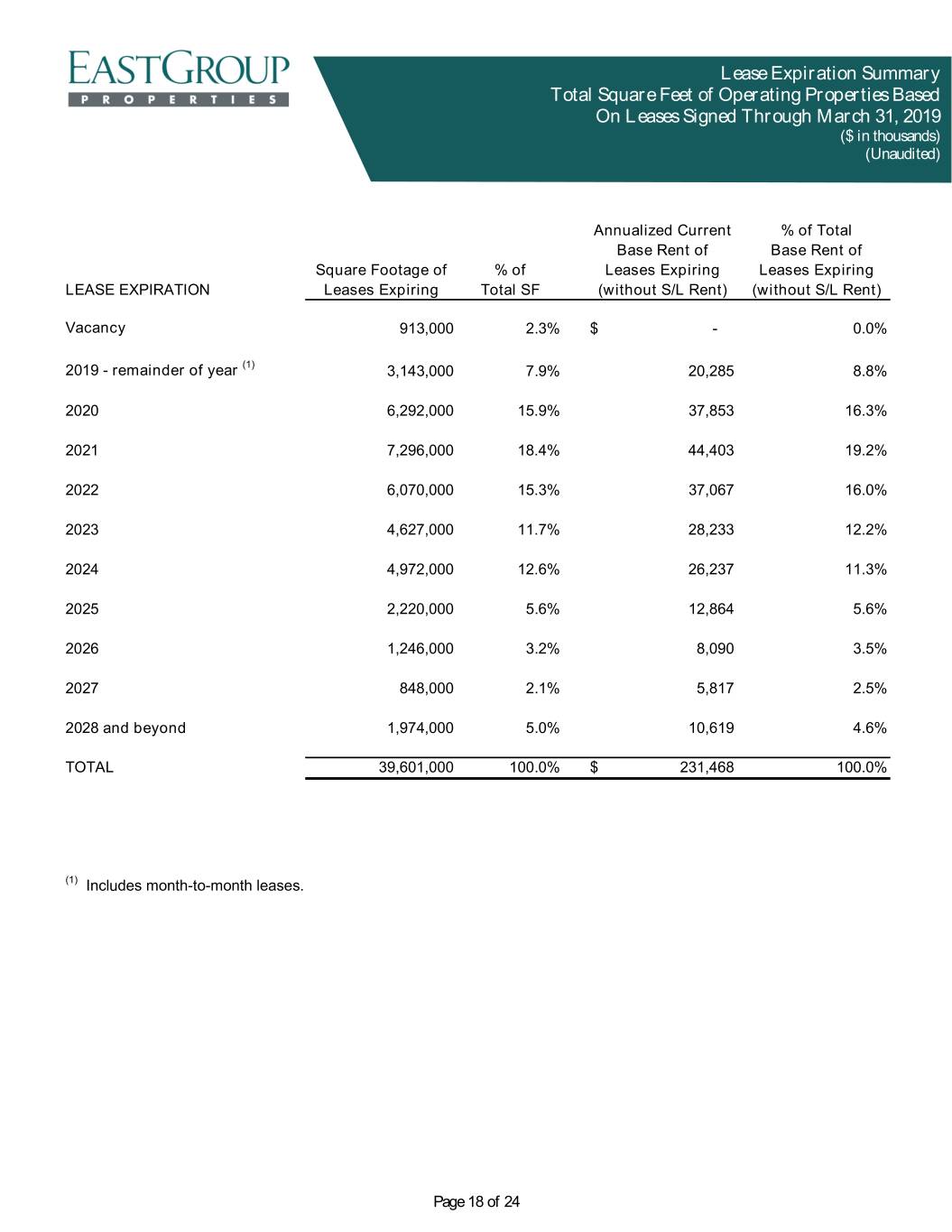

Lease Expiration Summary Total Square Feet of Operating Properties Based On Leases Signed Through March 31, 2019 ($ in thousands) (Unaudited) Annualized Current % of Total Base Rent of Base Rent of(Unaudited) Square Footage of % of Leases Expiring Leases Expiring LEASE EXPIRATION Leases Expiring Total SF (without S/L Rent) (without S/L Rent) Vacancy 913,000 2.3% $ - 0.0% 2019 - remainder of year (1) 3,143,000 7.9% 20,285 8.8% 2020 6,292,000 15.9% 37,853 16.3% 2021 7,296,000 18.4% 44,403 19.2% 2022 6,070,000 15.3% 37,067 16.0% 2023 4,627,000 11.7% 28,233 12.2% 2024 4,972,000 12.6% 26,237 11.3% 2025 2,220,000 5.6% 12,864 5.6% 2026 1,246,000 3.2% 8,090 3.5% 2027 848,000 2.1% 5,817 2.5% 2028 and beyond 1,974,000 5.0% 10,619 4.6% TOTAL 39,601,000 100.0% $ 231,468 100.0% (1) Includes month-to-month leases. Page 18 of 24

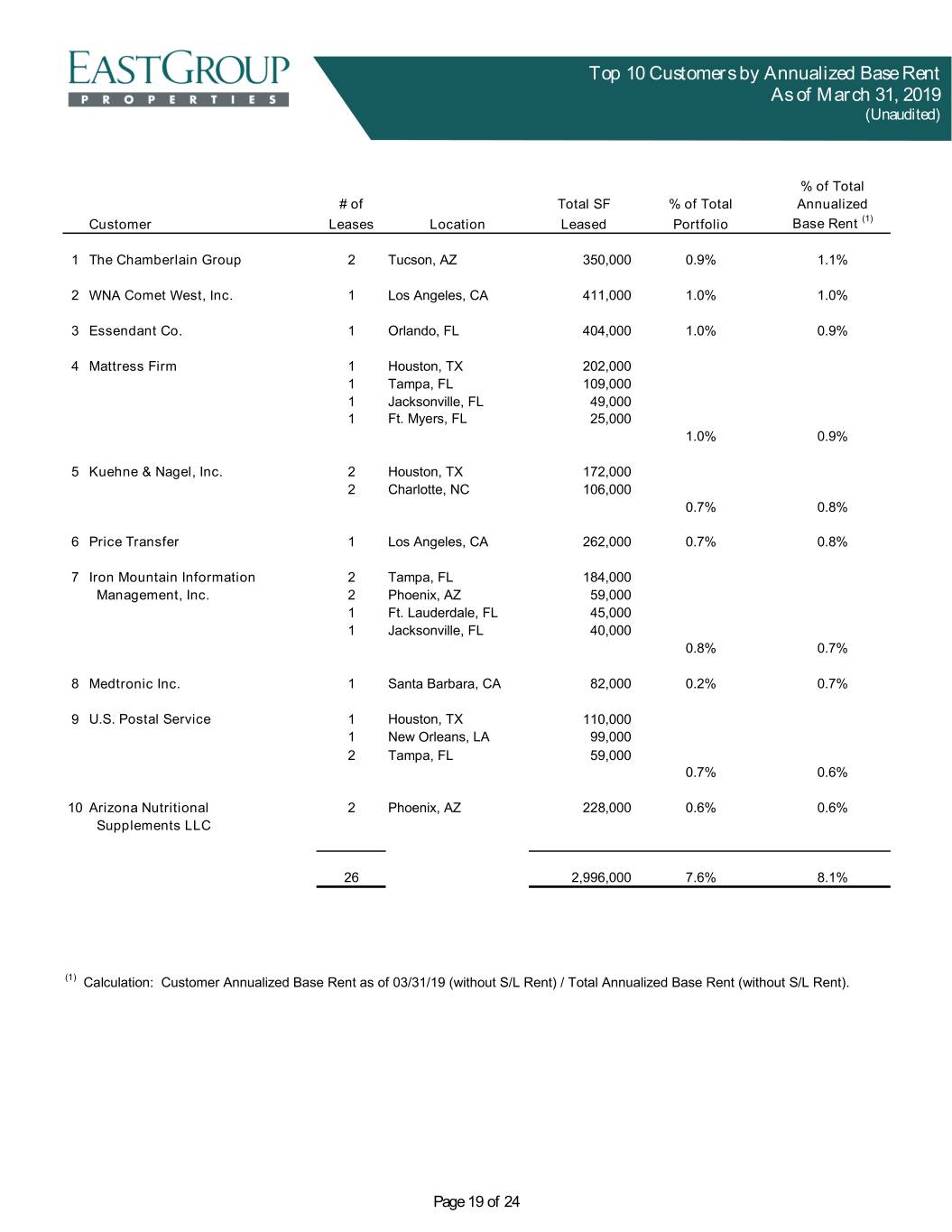

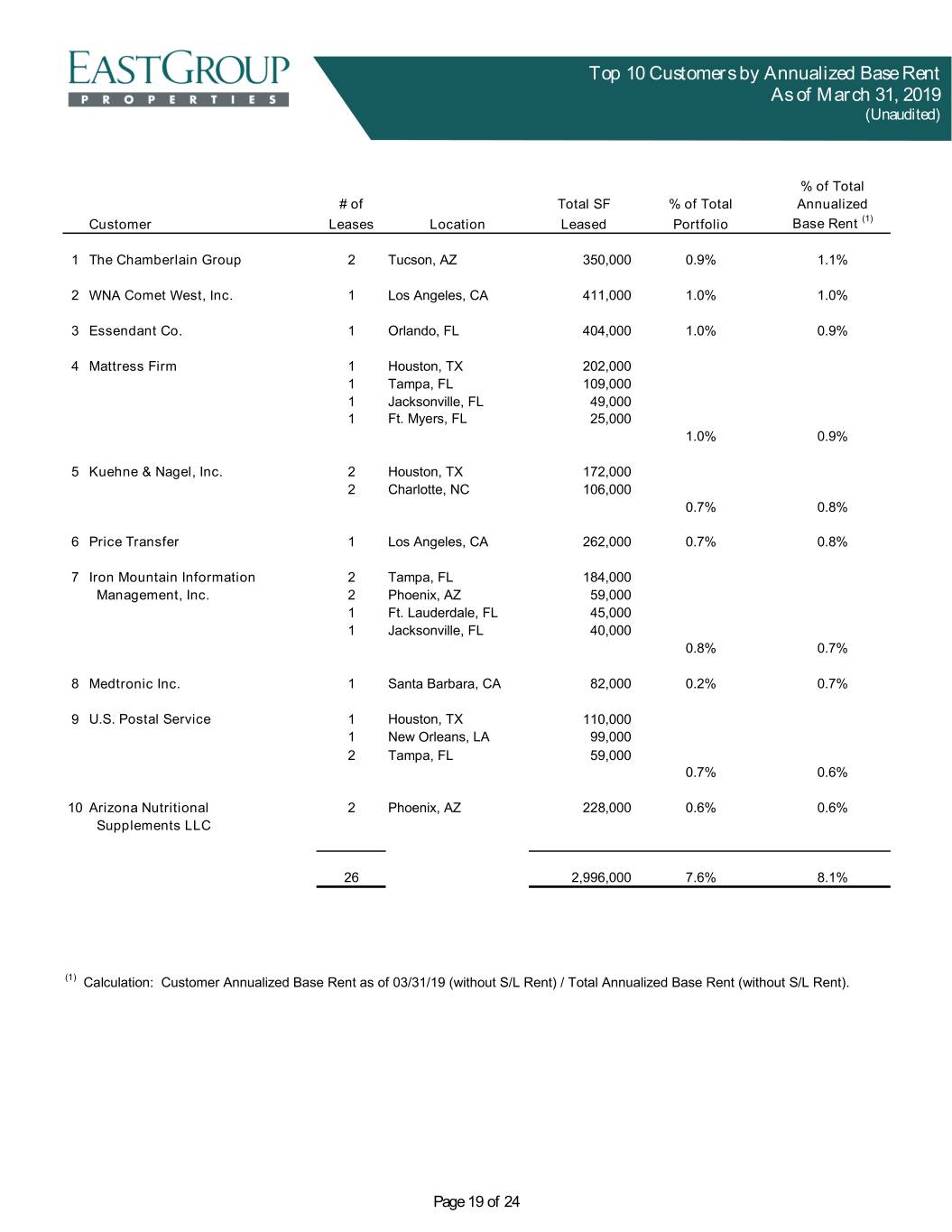

Top 10 Customers by Annualized Base Rent As of March 31, 2019 (Unaudited) % of Total # of Total SF % of Total Annualized(Unaudited) Customer Leases Location Leased Portfolio Base Rent (1) 1 The Chamberlain Group 2 Tucson, AZ 350,000 0.9% 1.1% 2 WNA Comet West, Inc. 1 Los Angeles, CA 411,000 1.0% 1.0% 3 Essendant Co. 1 Orlando, FL 404,000 1.0% 0.9% 4 Mattress Firm 1 Houston, TX 202,000 1 Tampa, FL 109,000 1 Jacksonville, FL 49,000 1 Ft. Myers, FL 25,000 1.0% 0.9% 5 Kuehne & Nagel, Inc. 2 Houston, TX 172,000 2 Charlotte, NC 106,000 0.7% 0.8% 6 Price Transfer 1 Los Angeles, CA 262,000 0.7% 0.8% 7 Iron Mountain Information 2 Tampa, FL 184,000 Management, Inc. 2 Phoenix, AZ 59,000 1 Ft. Lauderdale, FL 45,000 1 Jacksonville, FL 40,000 0.8% 0.7% 8 Medtronic Inc. 1 Santa Barbara, CA 82,000 0.2% 0.7% 9 U.S. Postal Service 1 Houston, TX 110,000 1 New Orleans, LA 99,000 2 Tampa, FL 59,000 0.7% 0.6% 10 Arizona Nutritional 2 Phoenix, AZ 228,000 0.6% 0.6% Supplements LLC 26 2,996,000 7.6% 8.1% (1) Calculation: Customer Annualized Base Rent as of 03/31/19 (without S/L Rent) / Total Annualized Base Rent (without S/L Rent). Page 19 of 24

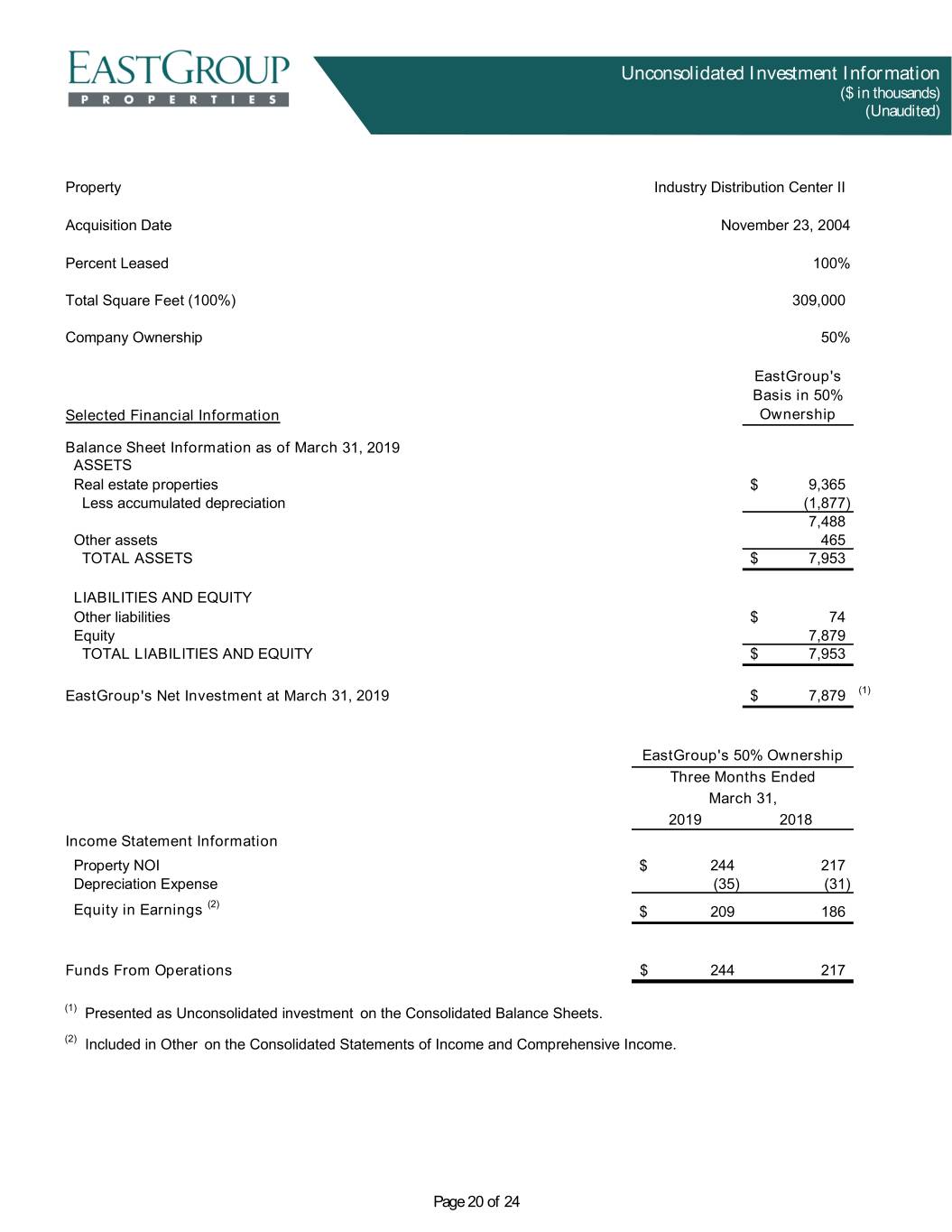

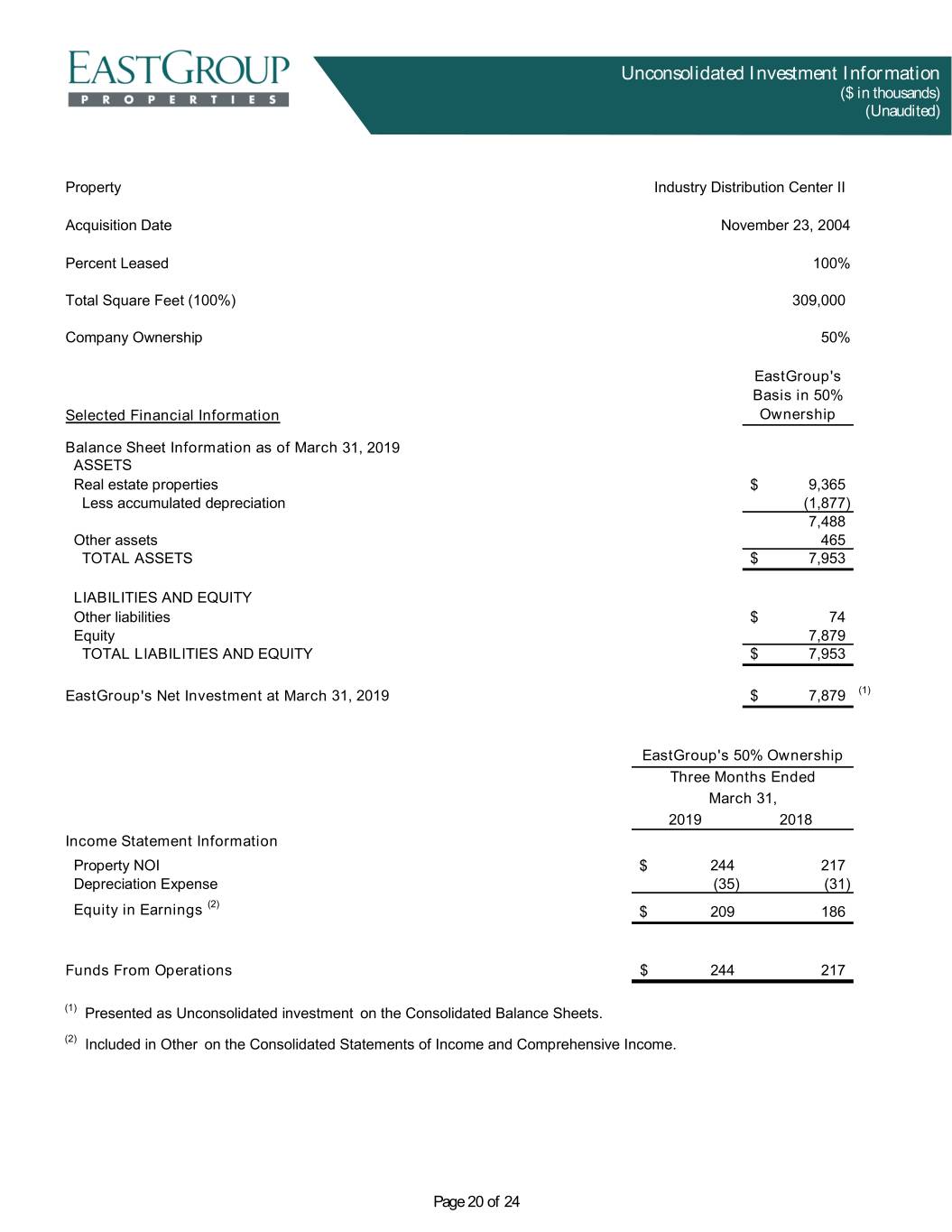

Unconsolidated Investment Information ($ in thousands) (Unaudited) Property Industry Distribution Center II (Unaudited) Acquisition Date November 23, 2004 Percent Leased 100% Total Square Feet (100%) 309,000 Company Ownership 50% EastGroup's Basis in 50% Selected Financial Information Ownership Balance Sheet Information as of March 31, 2019 ASSETS Real estate properties $ 9,365 Less accumulated depreciation (1,877) 7,488 Other assets 465 TOTAL ASSETS $ 7,953 LIABILITIES AND EQUITY Other liabilities $ 74 Equity 7,879 TOTAL LIABILITIES AND EQUITY $ 7,953 EastGroup's Net Investment at March 31, 2019 $ 7,879 (1) EastGroup's 50% Ownership Three Months Ended March 31, 2019 2018 Income Statement Information Property NOI $ 244 217 Depreciation Expense (35) (31) (2) Equity in Earnings $ 209 186 Funds From Operations $ 244 217 (1) Presented as Unconsolidated investment on the Consolidated Balance Sheets. (2) Included in Other on the Consolidated Statements of Income and Comprehensive Income. Page 20 of 24

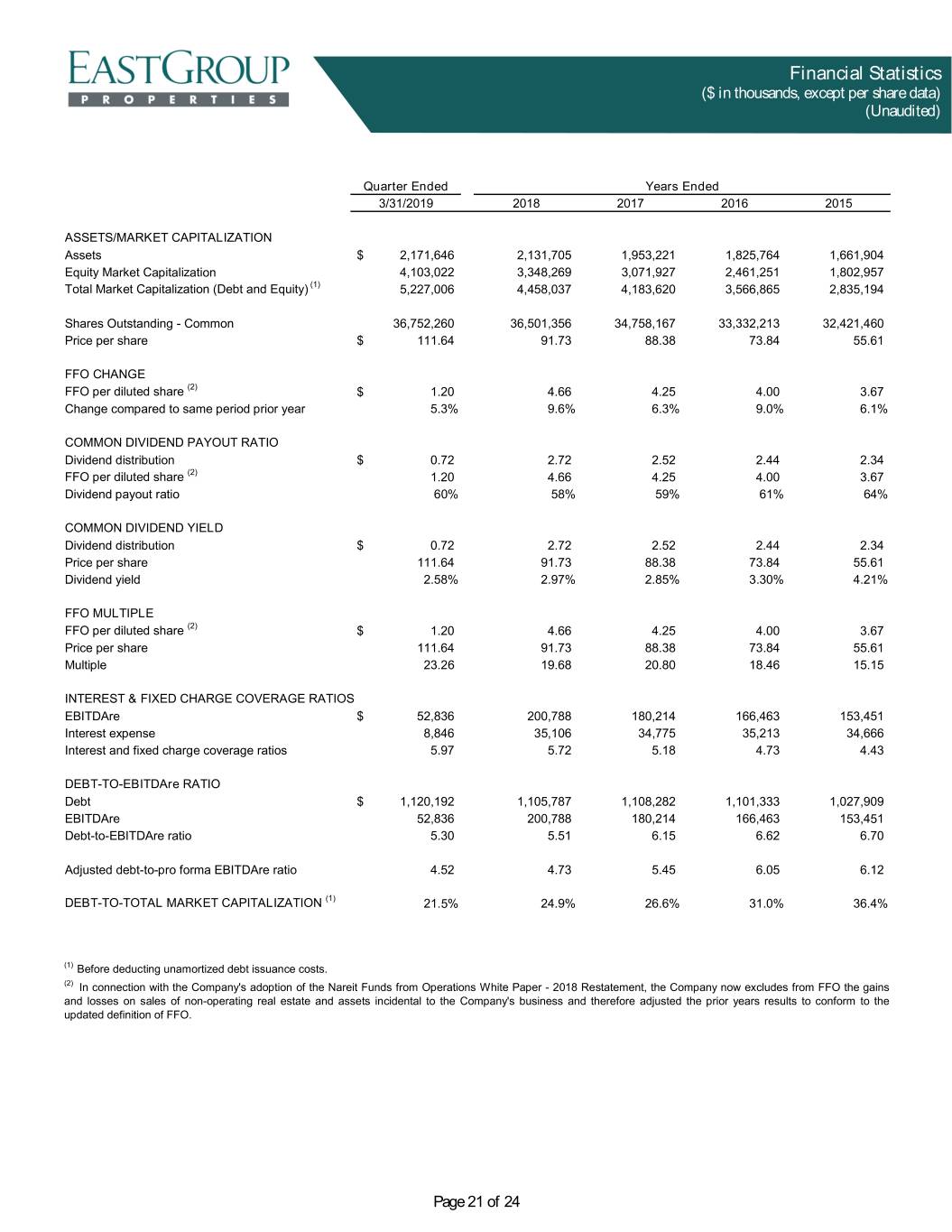

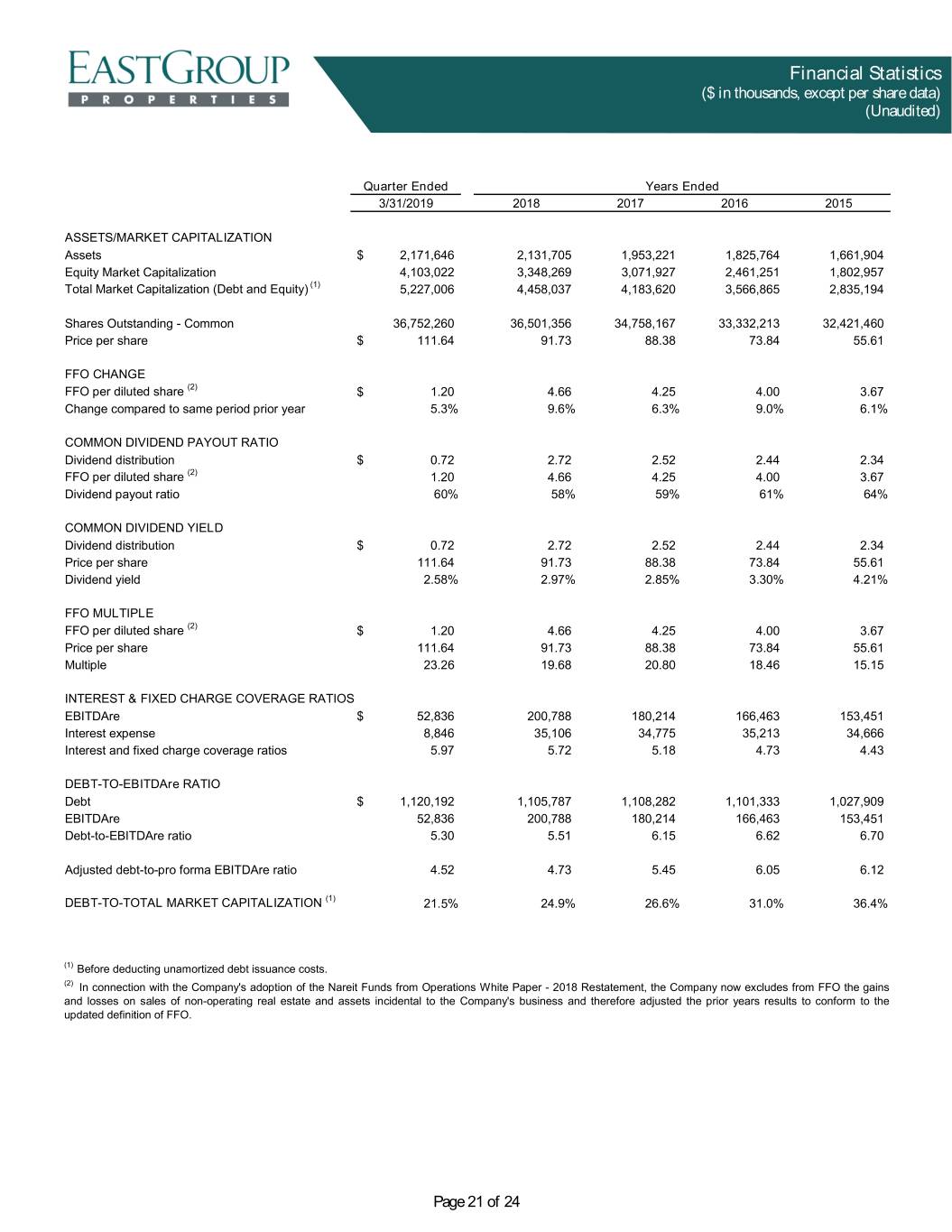

Financial Statistics ($ in thousands, except per share data) (Unaudited) Quarter Ended Years Ended 3/31/2019 2018 2017 2016 2015(Unaudited) ASSETS/MARKET CAPITALIZATION Assets $ 2,171,646 2,131,705 1,953,221 1,825,764 1,661,904 Equity Market Capitalization 4,103,022 3,348,269 3,071,927 2,461,251 1,802,957 (1) Total Market Capitalization (Debt and Equity) 5,227,006 4,458,037 4,183,620 3,566,865 2,835,194 Shares Outstanding - Common 36,752,260 36,501,356 34,758,167 33,332,213 32,421,460 Price per share $ 111.64 91.73 88.38 73.84 55.61 FFO CHANGE FFO per diluted share (2) $ 1.20 4.66 4.25 4.00 3.67 Change compared to same period prior year 5.3% 9.6% 6.3% 9.0% 6.1% COMMON DIVIDEND PAYOUT RATIO Dividend distribution $ 0.72 2.72 2.52 2.44 2.34 FFO per diluted share (2) 1.20 4.66 4.25 4.00 3.67 Dividend payout ratio 60% 58% 59% 61% 64% COMMON DIVIDEND YIELD Dividend distribution $ 0.72 2.72 2.52 2.44 2.34 Price per share 111.64 91.73 88.38 73.84 55.61 Dividend yield 2.58% 2.97% 2.85% 3.30% 4.21% FFO MULTIPLE FFO per diluted share (2) $ 1.20 4.66 4.25 4.00 3.67 Price per share 111.64 91.73 88.38 73.84 55.61 Multiple 23.26 19.68 20.80 18.46 15.15 INTEREST & FIXED CHARGE COVERAGE RATIOS EBITDAre $ 52,836 200,788 180,214 166,463 153,451 Interest expense 8,846 35,106 34,775 35,213 34,666 Interest and fixed charge coverage ratios 5.97 5.72 5.18 4.73 4.43 DEBT-TO-EBITDAre RATIO Debt $ 1,120,192 1,105,787 1,108,282 1,101,333 1,027,909 EBITDAre 52,836 200,788 180,214 166,463 153,451 Debt-to-EBITDAre ratio 5.30 5.51 6.15 6.62 6.70 Adjusted debt-to-pro forma EBITDAre ratio 4.52 4.73 5.45 6.05 6.12 DEBT-TO-TOTAL MARKET CAPITALIZATION (1) 21.5% 24.9% 26.6% 31.0% 36.4% (1) Before deducting unamortized debt issuance costs. (2) In connection with the Company's adoption of the Nareit Funds from Operations White Paper - 2018 Restatement, the Company now excludes from FFO the gains and losses on sales of non-operating real estate and assets incidental to the Company's business and therefore adjusted the prior years results to conform to the updated definition of FFO. Page 21 of 24

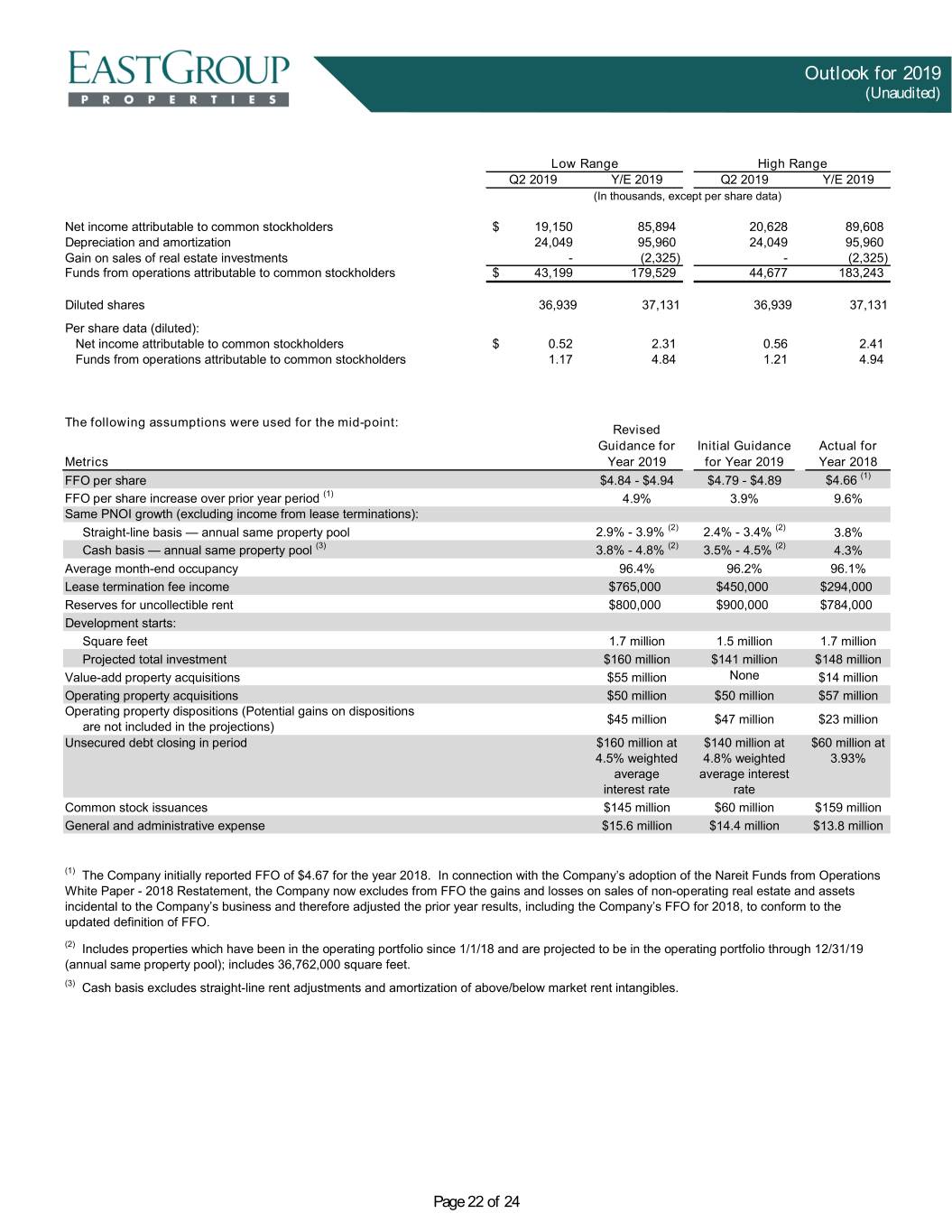

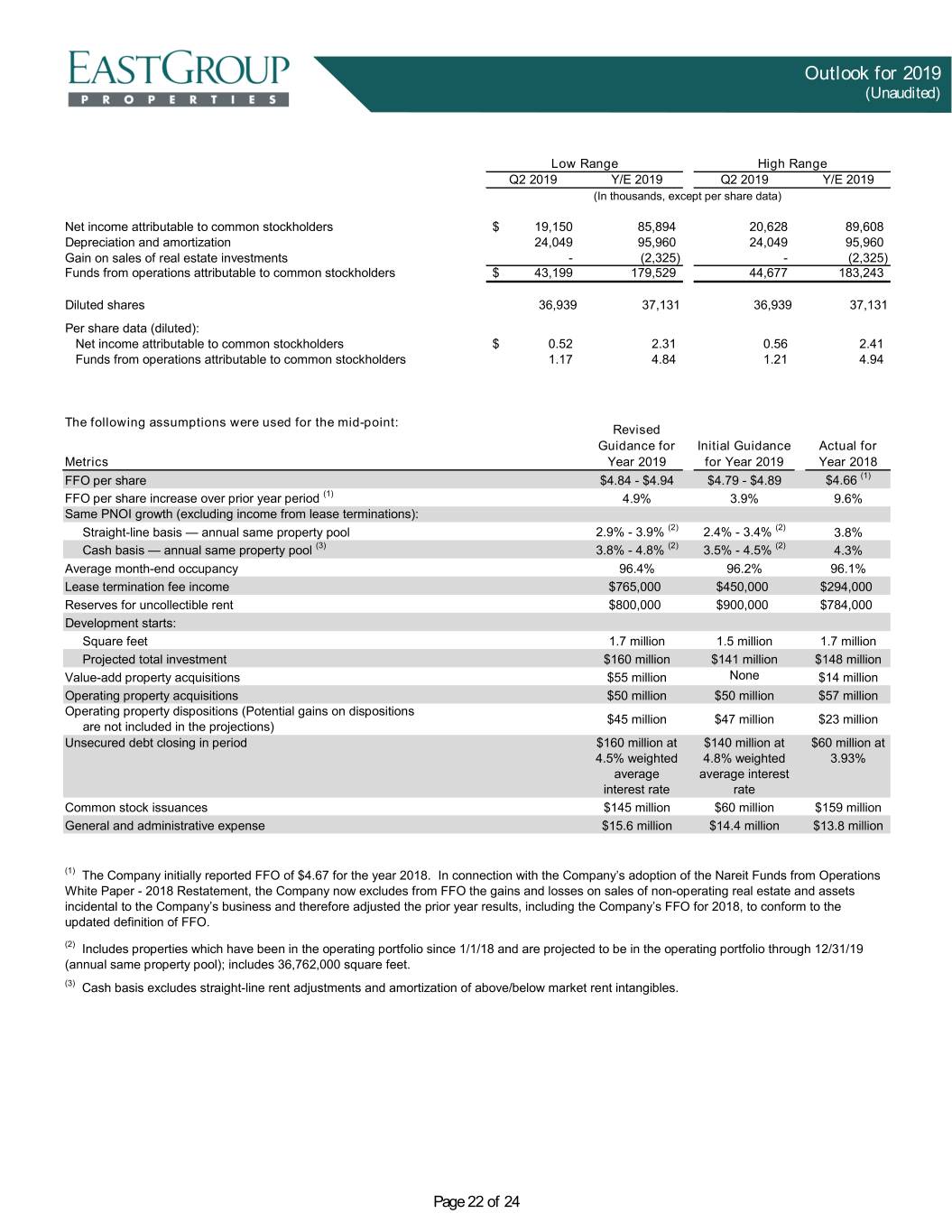

Outlook for 2019 (Unaudited) Low Range High Range Q2 2019 Y/E 2019 Q2 2019 Y/E 2019(Unaudited) (In thousands, except per share data) Net income attributable to common stockholders $ 19,150 85,894 20,628 89,608 Depreciation and amortization 24,049 95,960 24,049 95,960 Gain on sales of real estate investments - (2,325) - (2,325) Funds from operations attributable to common stockholders $ 43,199 179,529 44,677 183,243 Diluted shares 36,939 37,131 36,939 37,131 Per share data (diluted): Net income attributable to common stockholders $ 0.52 2.31 0.56 2.41 Funds from operations attributable to common stockholders 1.17 4.84 1.21 4.94 The following assumptions were used for the mid-point: Revised Guidance for Initial Guidance Actual for Metrics Year 2019 for Year 2019 Year 2018 FFO per share $4.84 - $4.94 $4.79 - $4.89 $4.66 (1) FFO per share increase over prior year period (1) 4.9% 3.9% 9.6% Same PNOI growth (excluding income from lease terminations): Straight-line basis — annual same property pool 2.9% - 3.9% (2) 2.4% - 3.4% (2) 3.8% Cash basis — annual same property pool (3) 3.8% - 4.8% (2) 3.5% - 4.5% (2) 4.3% Average month-end occupancy 96.4% 96.2% 96.1% Lease termination fee income $765,000 $450,000 $294,000 Reserves for uncollectible rent $800,000 $900,000 $784,000 Development starts: Square feet 1.7 million 1.5 million 1.7 million Projected total investment $160 million $141 million $148 million Value-add property acquisitions $55 million None $14 million Operating property acquisitions $50 million $50 million $57 million Operating property dispositions (Potential gains on dispositions $45 million $47 million $23 million are not included in the projections) Unsecured debt closing in period $160 million at $140 million at $60 million at 4.5% weighted 4.8% weighted 3.93% average average interest interest rate rate Common stock issuances $145 million $60 million $159 million General and administrative expense $15.6 million $14.4 million $13.8 million (1) The Company initially reported FFO of $4.67 for the year 2018. In connection with the Company’s adoption of the Nareit Funds from Operations White Paper - 2018 Restatement, the Company now excludes from FFO the gains and losses on sales of non-operating real estate and assets incidental to the Company’s business and therefore adjusted the prior year results, including the Company’s FFO for 2018, to conform to the updated definition of FFO. (2) Includes properties which have been in the operating portfolio since 1/1/18 and are projected to be in the operating portfolio through 12/31/19 (annual same property pool); includes 36,762,000 square feet. (3) Cash basis excludes straight-line rent adjustments and amortization of above/below market rent intangibles. Page 22 of 24

Glossary of REIT Terms Listed below are definitions of commonly used real estate investment trust (“REIT”) industry terms. For additional information on REITs, please see the National Association of Real Estate Investment Trusts (“Nareit”) web site at www.reit.com. (Unaudited) Adjusted Debt-to-Pro Forma EBITDAre Ratio: A ratio calculated by dividing a company’s adjusted debt by its pro forma EBITDAre. Debt is adjusted by subtracting the cost of development and value-add properties in lease-up or under construction. EBITDAre is further adjusted by adding an estimate of NOI for significant acquisitions as if the acquired properties were owned for the entire period, and by subtracting NOI from development and value-add properties in lease- up or under construction and from properties sold during the period. The Adjusted Debt-to-Pro Forma EBITDAre Ratio is a non-GAAP financial measure used to analyze the Company’s financial condition and operating performance relative to its leverage, on an adjusted basis, so as to normalize and annualize property changes during the period. Cash Basis: The Company adjusts its GAAP reporting to exclude straight-line rent adjustments and amortization of above/below market rent intangibles. Debt-to-EBITDAre Ratio: A ratio calculated by dividing a company’s debt by its EBITDAre; this non-GAAP measure is used to analyze the Company’s financial condition and operating performance relative to its leverage. Debt-to-Total Market Capitalization Ratio: A ratio calculated by dividing a company’s debt by the total amount of a company’s equity (at market value) and debt. Earnings Before Interest Taxes Depreciation and Amortization for Real Estate (“EBITDAre”): Earnings, defined as Net Income, excluding gains or losses from sales of real estate investments and non-operating real estate, plus interest, taxes, depreciation and amortization. EBITDAre is a non-GAAP financial measure used to measure the Company’s operating performance and its ability to meet interest payment obligations and pay quarterly stock dividends on an unleveraged basis. Funds From Operations (“FFO”): FFO is the most commonly accepted reporting measure of a REIT’s operating performance, and the Company computes FFO in accordance with standards established by Nareit in the Nareit Funds from Operations White Paper — 2018 Restatement. It is equal to a REIT’s net income (loss) attributable to common stockholders computed in accordance with generally accepted accounting principles (“GAAP”), excluding gains and losses from sales of real estate property (including other assets incidental to the Company’s business) and impairment losses, adjusted for real estate related depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. FFO is a non-GAAP financial measure used to evaluate the performance of the Company’s investments in real estate assets and its operating results. Industrial Properties: Generally consisting of four concrete walls tilted up on a slab of concrete. An internal office component is then added. Business uses include warehousing, distribution, light manufacturing and assembly, research and development, showroom, office, or a combination of some or all of the aforementioned. Leases Expiring and Renewal Leases Signed of Expiring Square Feet: Includes renewals during the period with terms commencing during the period and after the end of the period. Percentage Leased: The percentage of total leasable square footage for which there is a signed lease, including month-to- month leases, as of the close of the reporting period. Space is considered leased upon execution of the lease. Percentage Occupied: The percentage of total leasable square footage for which the lease term has commenced as of the close of the reporting period. Page 23 of 24

Glossary of REIT Terms (Continued) Property Net Operating Income (“PNOI”): Income from real estate operations less Expenses from real estate operations (including market-based internal management fee expense) plus the Company’s share of income and property operating(Unaudited) expenses from its less-than-wholly-owned real estate investments. PNOI is a non-GAAP, property-level supplemental measure of performance used to evaluate the performance of the Company’s investments in real estate assets and its operating results. Real Estate Investment Trust: A company that owns and, in most cases, operates income-producing real estate such as apartments, shopping centers, offices, hotels and warehouses. Some REITs also engage in financing real estate. The shares of most REITs are freely traded, usually on a major stock exchange. To qualify as a REIT, a company must distribute at least 90 percent of its taxable income to its stockholders annually. A company that qualifies as a REIT is permitted to deduct dividends paid to its stockholders from its corporate taxable income. As a result, most REITs remit at least 100 percent of their taxable income to their stockholders and therefore owe no corporate federal income tax. Taxes are paid by stockholders on the dividends received. Most states honor this federal treatment and also do not require REITs to pay state income tax. Rental changes on new and renewal leases: Rental changes are calculated as the difference, weighted by square feet, of the annualized base rent due the first month of the new lease’s term and the annualized base rent of the rent due the last month of the former lease’s term. If free rent is given, then the first positive full rent value is used. Rental amounts exclude base stop amounts, holdover rent, and premium or discounted rent amounts. This calculation excludes leases with terms less than 12 months and leases for first generation space on properties acquired or developed by EastGroup. Same Properties: Operating properties owned during the entire current and prior year reporting periods. Properties developed or acquired are excluded until held in the operating portfolio for both the current and prior year reporting periods. Properties sold during the current or prior year reporting periods are excluded. • Quarterly Same Property Pool: Includes properties which were included in the operating portfolio for the entire period from January 1, 2018 through March 31, 2019. For first quarter results, the Quarterly Same Property Pool is the same as the Annual Same Property Pool. • Annual Same Property Pool: Includes properties which were included in the operating portfolio for the entire period from January 1, 2018 through March 31, 2019. Same Property Net Operating Income (“Same PNOI”): Income from real estate operations less Expenses from real estate operations (including market-based internal management fee expense), plus the Company’s share of income and property operating expenses from its less-than-wholly-owned real estate investments, for the same properties owned by the Company during the entire current and prior year reporting periods. Same PNOI is a non-GAAP, property-level supplemental measure of performance used to evaluate the performance of the Company’s investments in real estate assets and its operating results on a same property basis. Straight-Lining: The process of averaging the customer’s rent payments over the life of the lease. GAAP requires real estate companies to “straight-line” rents. Total Return: A stock’s dividend income plus capital appreciation over a specified period as a percentage of the stock price at the beginning of the period. Value-Add Properties: Properties that are either acquired but not stabilized or can be converted to a higher and better use. Acquired properties meeting either of the following two conditions are considered value-add properties: (1) Less than 75% occupied as of the acquisition date (or will be less than 75% occupied within one year of acquisition date based on near term lease roll), or (2) 20% or greater of the acquisition cost will be spent to redevelop the property. Page 24 of 24