2022 SECOND QUARTER Conference Call 888-346-0688 | ID – EastGroup July 27, 2022 11:00 a.m. Eastern Time webcast available at EastGroup.net Supplemental Information 400 W. Parkway Place, Suite 100, Ridgeland, MS 39157 | TEL: 601-354-3555 | FAX: 601-352-1441 | EastGroup.net June 30, 2022

Page 2 of 24 Table of Contents Financial Information: Consolidated Balance Sheets ................................................................................ 3 Consolidated Statements of Income and Comprehensive Income ......................... 4 Reconciliations of GAAP to Non-GAAP Measures ................................................. 5 Consolidated Statements of Cash Flows ................................................................ 7 Same Property Portfolio Analysis ........................................................................... 8 Additional Financial Information ............................................................................. 9 Financial Statistics ................................................................................................. 10 Capital Deployment: Development and Value-Add Properties Summary ................................................ 11 Development and Value-Add Properties Transferred to Real Estate Properties ..... 12 Acquisitions and Dispositions ................................................................................. 13 Real Estate Improvements and Leasing Costs ....................................................... 14 Property Information: Leasing Statistics and Occupancy Summary ......................................................... 15 Core Market Operating Statistics ........................................................................... 16 Lease Expiration Summary .................................................................................... 17 Top 10 Customers by Annualized Base Rent ......................................................... 18 Capitalization: Debt and Equity Market Capitalization ................................................................... 19 Continuous Common Equity Program .................................................................... 20 Debt-to-EBITDAre Ratios ....................................................................................... 21 Other Information: Outlook for 2022 .................................................................................................... 22 Glossary of REIT Terms ........................................................................................ 23 FORWARD-LOOKING STATEMENTS The statements and certain other information contained herein, which can be identified by the use of forward-looking terminology such as “may,” “will,” “seek,” “expects,” “anticipates,” “believes,” “targets,” “intends,” “should,” “estimates,” “could,” “continue,” “assume,” “projects,” “goals” or “plans” and variations of such words or similar expressions or the negative of such words, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbors created thereby. These forward-looking statements reflect the current views of EastGroup Properties, Inc. (the “Company” or “EastGroup”) about its plans, intentions, expectations, strategies and prospects, which are based on the information currently available to the Company and on assumptions it has made. Although the Company believes that its plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, the Company can give no assurance that such plans, intentions, expectations or strategies will be attained or achieved. Furthermore, these forward-looking statements should be considered as subject to the many risks and uncertainties that exist in the Company’s operations and business environment. Such risks and uncertainties could cause actual results to differ materially from those projected. These uncertainties include, but are not limited to: international, national, regional and local economic conditions; the duration and extent of the impact of the coronavirus (“COVID-19”) pandemic, including any COVID-19 variants or the efficacy or availability of COVID-19 vaccines, on our business operations or the business operations of our tenants (including their ability to timely make rent payments) and the economy generally; disruption in supply and delivery chains; construction costs could increase as a result of inflation impacting the cost to develop properties; increase in interest rates and ability to raise equity capital on attractive terms; financing risks, including the risks that our cash flows from operations may be insufficient to meet required payments of principal and interest, and we may be unable to refinance our existing debt upon maturity or obtain new financing on attractive terms or at all; our ability to retain our credit agency ratings; our ability to comply with applicable financial covenants; the competitive environment in which the Company operates; fluctuations of occupancy or rental rates; potential defaults (including bankruptcies or insolvency) on or non-renewal of leases by tenants, or our ability to lease space at current or anticipated rents, particularly in light of the significant uncertainty as to the conditions under which current or potential tenants will be able to operate physical locations in the future; potential changes in the law or governmental regulations and interpretations of those laws and regulations, including changes in real estate laws or REIT or corporate income tax laws, and potential increases in real property tax rates; our ability to maintain our qualification as a REIT; acquisition and development risks, including failure of such acquisitions and development projects to perform in accordance with projections; natural disasters such as fires, floods, tornadoes, hurricanes and earthquakes; pandemics, epidemics or other public health emergencies, such as the outbreak of COVID-19; the terms of governmental regulations that affect us and interpretations of those regulations, including the costs of compliance with those regulations, changes in real estate and zoning laws and increases in real property tax rates; credit risk in the event of non-performance by the counterparties to our interest rate swaps; the discontinuation of London Interbank Offered Rate; lack of or insufficient amounts of insurance; litigation, including costs associated with prosecuting or defending claims and any adverse outcomes; our ability to attract and retain key personnel; risks related to the failure, inadequacy or interruption of our data security systems and processes; the consequences of future terrorist attacks or civil unrest; and environmental liabilities, including costs, fines or penalties that may be incurred due to necessary remediation of contamination of properties presently owned or previously owned by us. All forward-looking statements should be read in light of the risks identified in Part I, Item 1A. Risk Factors within the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, and in its subsequent Quarterly Reports on Form 10-Q. The Company assumes no obligation to update publicly any forward-looking statements, including its Outlook for 2022, whether as a result of new information, future events or otherwise.

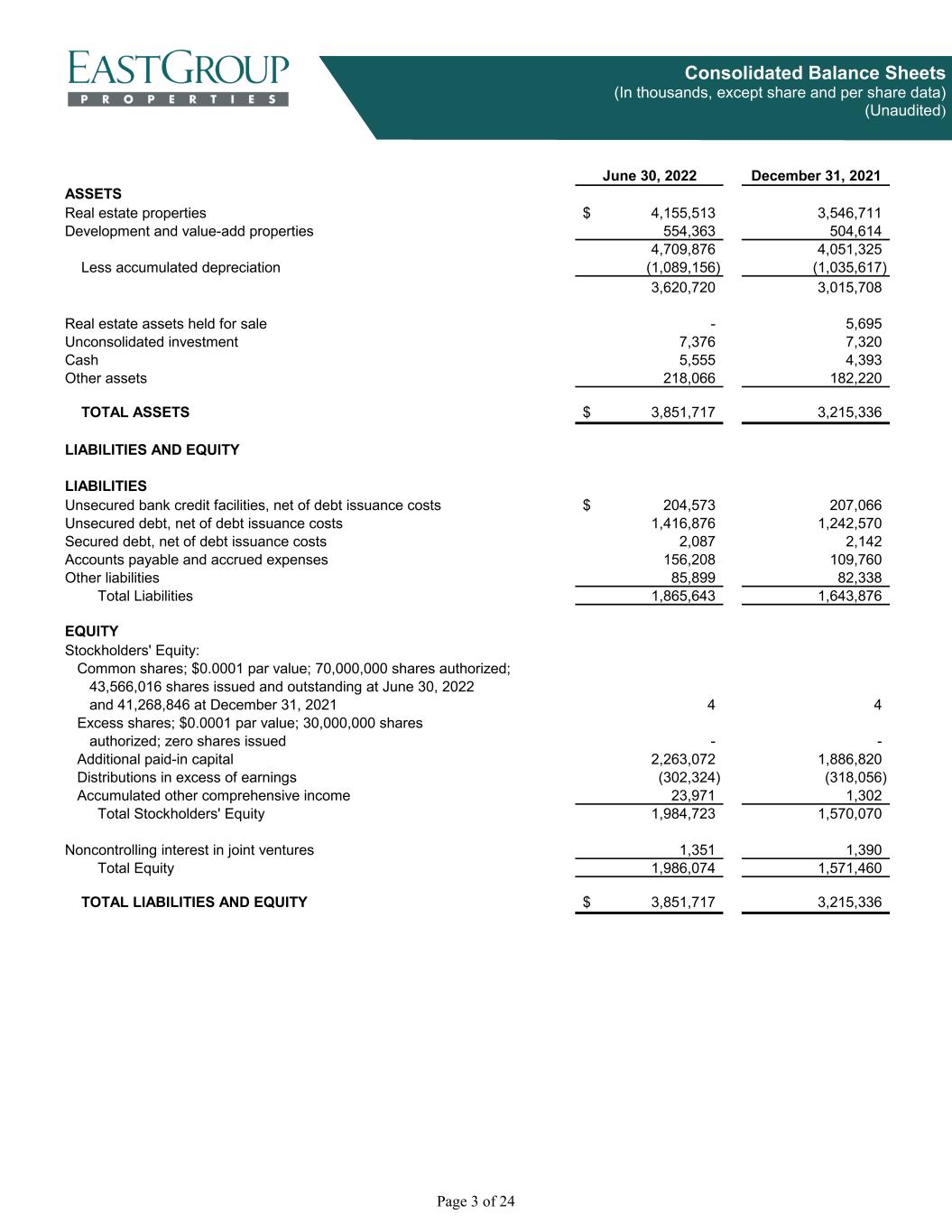

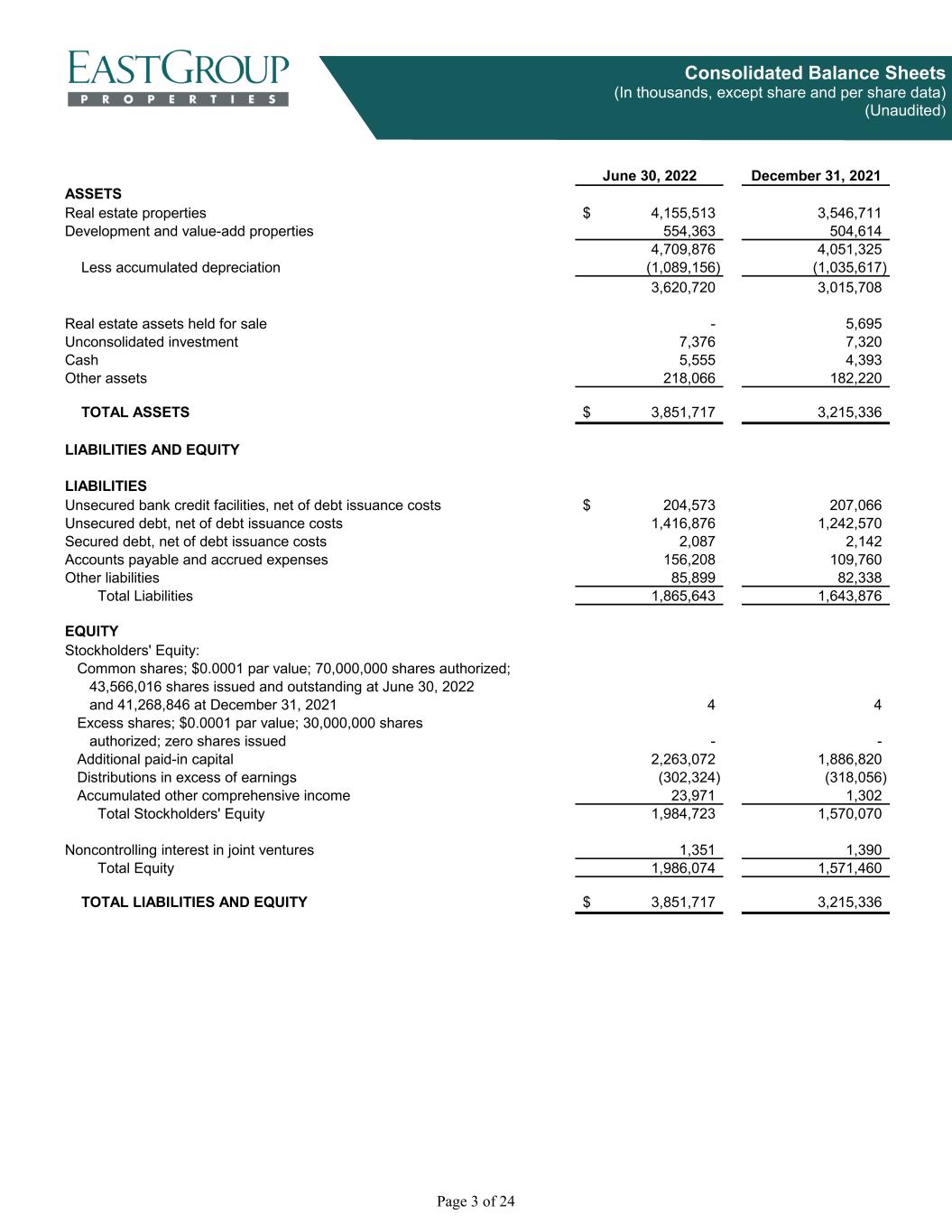

Page 3 of 24 Consolidated Balance Sheets (In thousands, except share and per share data) (Unaudited) June 30, 2022 December 31, 2021 ASSETS Real estate properties 4,155,513$ 3,546,711 Development and value-add properties 554,363 504,614 4,709,876 4,051,325 Less accumulated depreciation (1,089,156) (1,035,617) 3,620,720 3,015,708 Real estate assets held for sale - 5,695 Unconsolidated investment 7,376 7,320 Cash 5,555 4,393 Other assets 218,066 182,220 TOTAL ASSETS 3,851,717$ 3,215,336 LIABILITIES AND EQUITY LIABILITIES Unsecured bank credit facilities, net of debt issuance costs 204,573$ 207,066 Unsecured debt, net of debt issuance costs 1,416,876 1,242,570 Secured debt, net of debt issuance costs 2,087 2,142 Accounts payable and accrued expenses 156,208 109,760 Other liabilities 85,899 82,338 Total Liabilities 1,865,643 1,643,876 EQUITY Stockholders' Equity: Common shares; $0.0001 par value; 70,000,000 shares authorized; 43,566,016 shares issued and outstanding at June 30, 2022 and 41,268,846 at December 31, 2021 4 4 Excess shares; $0.0001 par value; 30,000,000 shares authorized; zero shares issued - - Additional paid-in capital 2,263,072 1,886,820 Distributions in excess of earnings (302,324) (318,056) Accumulated other comprehensive income 23,971 1,302 Total Stockholders' Equity 1,984,723 1,570,070 Noncontrolling interest in joint ventures 1,351 1,390 Total Equity 1,986,074 1,571,460 TOTAL LIABILITIES AND EQUITY 3,851,717$ 3,215,336

Page 4 of 24 Consolidated Statements of Income and Comprehensive Income (In thousands, except per share data) (Unaudited) 2022 2021 2022 2021 REVENUES Income from real estate operations 118,498$ 99,562 231,450 197,479 Other revenue 55 13 77 27 118,553 99,575 231,527 197,506 EXPENSES Expenses from real estate operations 32,546 28,057 63,610 55,877 Depreciation and amortization 37,461 31,349 73,802 61,662 General and administrative 4,226 4,486 8,536 8,522 Indirect leasing costs 116 134 291 464 74,349 64,026 146,239 126,525 OTHER INCOME (EXPENSE) Interest expense (8,970) (8,181) (17,080) (16,457) Gain on sales of real estate investments 10,647 - 40,999 - Other 284 210 562 411 NET INCOME 46,165 27,578 109,769 54,935 Net income attributable to noncontrolling interest in joint ventures (26) (20) (50) (38) NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS 46,139 27,558 109,719 54,897 Other comprehensive income (loss) - interest rate swaps 6,841 (1,263) 22,669 6,951 TOTAL COMPREHENSIVE INCOME 52,980$ 26,295 132,388 61,848 BASIC PER COMMON SHARE DATA FOR NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS Net income attributable to common stockholders 1.09$ 0.69 2.63 1.38 Weighted average shares outstanding 42,211 40,068 41,729 39,871 DILUTED PER COMMON SHARE DATA FOR NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS Net income attributable to common stockholders 1.09$ 0.69 2.62 1.37 Weighted average shares outstanding 42,316 40,165 41,838 39,965 Six Months Ended June 30,June 30, Three Months Ended

Page 5 of 24 Reconciliations of GAAP to Non-GAAP Measures (In thousands, except per share data) (Unaudited) 2022 2021 2022 2021 NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS 46,139$ 27,558 109,719 54,897 Depreciation and amortization 37,461 31,349 73,802 61,662 Company's share of depreciation from unconsolidated investment 31 34 62 68 Depreciation and amortization from noncontrolling interest (6) - (9) - Gain on sales of real estate investments (10,647) - (40,999) - FUNDS FROM OPERATIONS ("FFO") ATTRIBUTABLE TO COMMON STOCKHOLDERS 72,978$ 58,941 142,575 116,627 NET INCOME 46,165$ 27,578 109,769 54,935 Interest expense (1) 8,970 8,181 17,080 16,457 Depreciation and amortization 37,461 31,349 73,802 61,662 Company's share of depreciation from unconsolidated investment 31 34 62 68 EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION ("EBITDA") 92,627 67,142 200,713 133,122 Gain on sales of real estate investments (10,647) - (40,999) - EBITDA FOR REAL ESTATE ("EBITDAre") 81,980$ 67,142 159,714 133,122 DILUTED PER COMMON SHARE DATA FOR NET INCOME ATTRIBUTABLE TO EASTGROUP PROPERTIES, INC. COMMON STOCKHOLDERS Net income attributable to common stockholders 1.09$ 0.69 2.62 1.37 FFO attributable to common stockholders 1.72$ 1.47 3.41 2.92 Weighted average shares outstanding for EPS and FFO purposes 42,316 40,165 41,838 39,965 June 30, (1) Net of capitalized interest of $2,699 and $2,157 for the three months ended June 30, 2022 and 2021, respectively; and $4,943 and $4,394 for the six months ended June 30, 2022 and 2021, respectively. Three Months Ended June 30, Six Months Ended

Page 6 of 24 Reconciliations of GAAP to Non-GAAP Measures (Continued) (In thousands) (Unaudited) 2022 2021 2022 2021 NET INCOME 46,165$ 27,578 109,769 54,935 Gain on sales of real estate investments (10,647) - (40,999) - Interest income (6) (3) (6) (4) Other revenue (55) (13) (77) (27) Indirect leasing costs 116 134 291 464 Depreciation and amortization 37,461 31,349 73,802 61,662 Company's share of depreciation from unconsolidated investment 31 34 62 68 Interest expense (1) 8,970 8,181 17,080 16,457 General and administrative expense (2) 4,226 4,486 8,536 8,522 Noncontrolling interest in PNOI of consolidated joint ventures (32) (16) (53) (31) PROPERTY NET OPERATING INCOME ("PNOI") 86,229 71,730 168,405 142,046 PNOI from 2021 and 2022 acquisitions (3,142) (36) (5,546) (36) PNOI from 2021 and 2022 development and value-add properties (8,237) (2,008) (15,116) (3,340) PNOI from 2021 and 2022 operating property dispositions (70) (881) (237) (1,718) Other PNOI 102 (73) 112 (127) SAME PNOI (Straight-Line Basis) 74,882 68,732 147,618 136,825 Net lease termination fee income from same properties (864) (18) (1,091) (594) SAME PNOI EXCLUDING INCOME FROM LEASE TERMINATIONS (Straight-Line Basis) 74,018 68,714 146,527 136,231 Straight-line rent adjustments for same properties (143) (1,128) (1,045) (2,589) Acquired leases — market rent adjustment amortization for same properties (108) (245) (228) (438) SAME PNOI EXCLUDING INCOME FROM LEASE TERMINATIONS (Cash Basis) 73,767$ 67,341 145,254 133,204 Six Months Ended June 30, June 30, (1) Net of capitalized interest of $2,699 and $2,157 for the three months ended June 30, 2022 and 2021, respectively; and $4,943 and $4,394 for the six months ended June 30, 2022 and 2021, respectively. (2) Net of capitalized development costs of $2,617 and $1,591 for the three months ended June 30, 2022 and 2021, respectively; and $5,086 and $3,280 for the six months ended June 30, 2022 and 2021, respectively. Three Months Ended

Page 7 of 24 Consolidated Statements of Cash Flows (In thousands) (Unaudited) 2022 2021 OPERATING ACTIVITIES Net income 109,769$ 54,935 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 73,802 61,662 Stock-based compensation expense 4,320 4,011 Gain on sales of real estate investments (40,999) - Changes in operating assets and liabilities: Accrued income and other assets 598 305 Accounts payable, accrued expenses and prepaid rent 28,104 19,783 Other 558 714 NET CASH PROVIDED BY OPERATING ACTIVITIES 176,152 141,410 INVESTING ACTIVITIES Development and value-add properties (283,451) (115,113) Purchases of real estate (2,049) (9,177) Real estate improvements (21,723) (18,094) Net proceeds from sales of real estate investments 51,006 - Leasing commissions (18,362) (16,813) Changes in accrued development costs 16,062 13,126 Changes in other assets and other liabilities (2,621) 526 NET CASH USED IN INVESTING ACTIVITIES (261,138) (145,545) FINANCING ACTIVITIES Proceeds from unsecured bank credit facilities 501,523 195,137 Repayments on unsecured bank credit facilities (504,314) (320,137) Proceeds from unsecured debt 250,000 175,000 Repayments on unsecured debt (75,000) - Repayments on secured debt (60,047) (42,924) Debt issuance costs (1,030) (2,475) Distributions paid to stockholders (not including dividends accrued) (91,787) (63,403) Proceeds from common stock offerings 74,249 105,891 Common stock offering related costs (70) (146) Other (7,376) (4,264) NET CASH PROVIDED BY FINANCING ACTIVITIES 86,148 42,679 INCREASE IN CASH AND CASH EQUIVALENTS 1,162 38,544 CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 4,393 21 CASH AND CASH EQUIVALENTS AT END OF PERIOD 5,555$ 38,565 SUPPLEMENTAL CASH FLOW INFORMATION Cash paid for interest, net of amounts capitalized of $4,943 and $4,394 for 2022 and 2021, respectively 15,382$ 15,760 Cash paid for operating lease liabilities 962 751 Common stock issued in the purchase of real estate 303,682 - Debt assumed in the purchase of real estate 60,000 - NON-CASH OPERATING ACTIVITY Operating lease liabilities arising from obtaining right of use assets 398$ 348 Six Months Ended June 30,

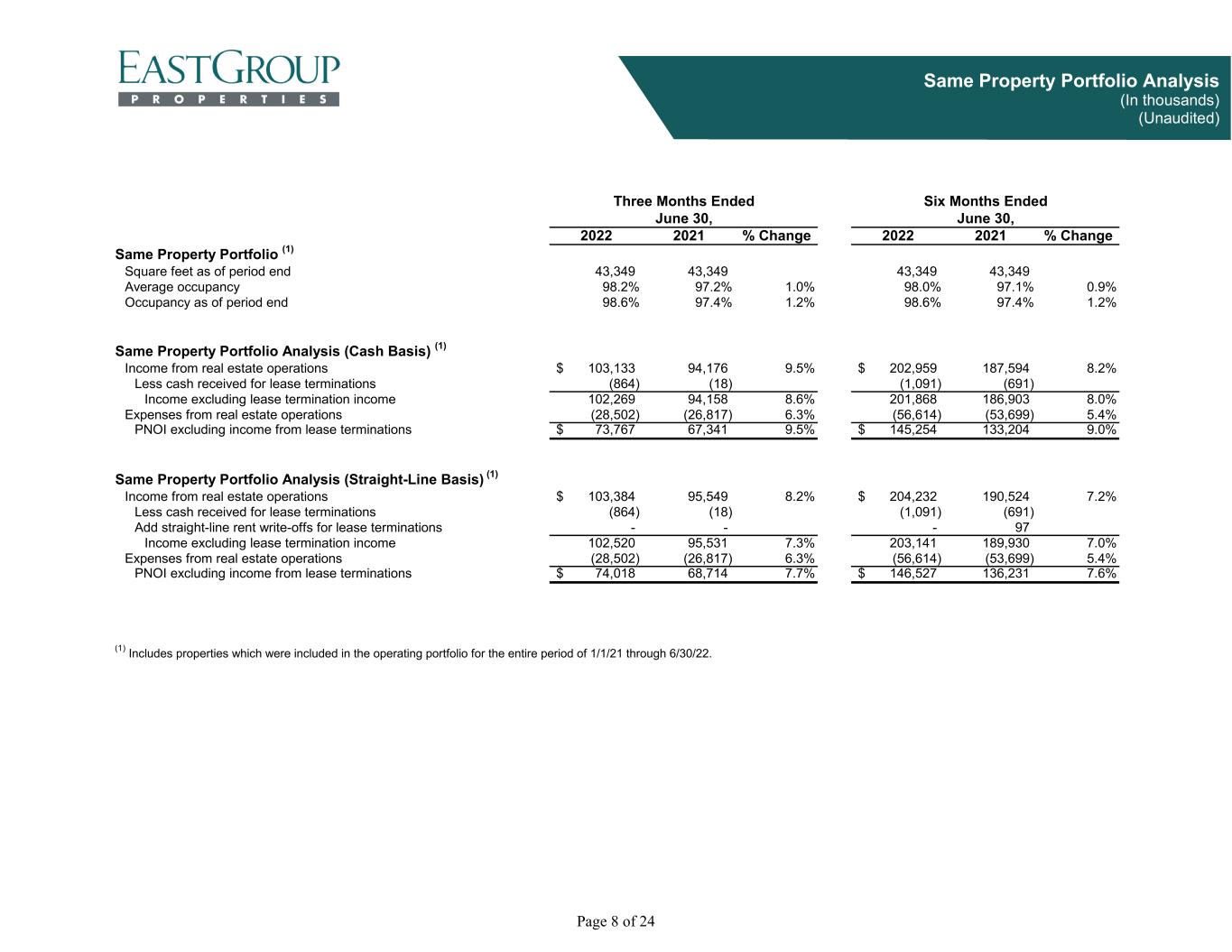

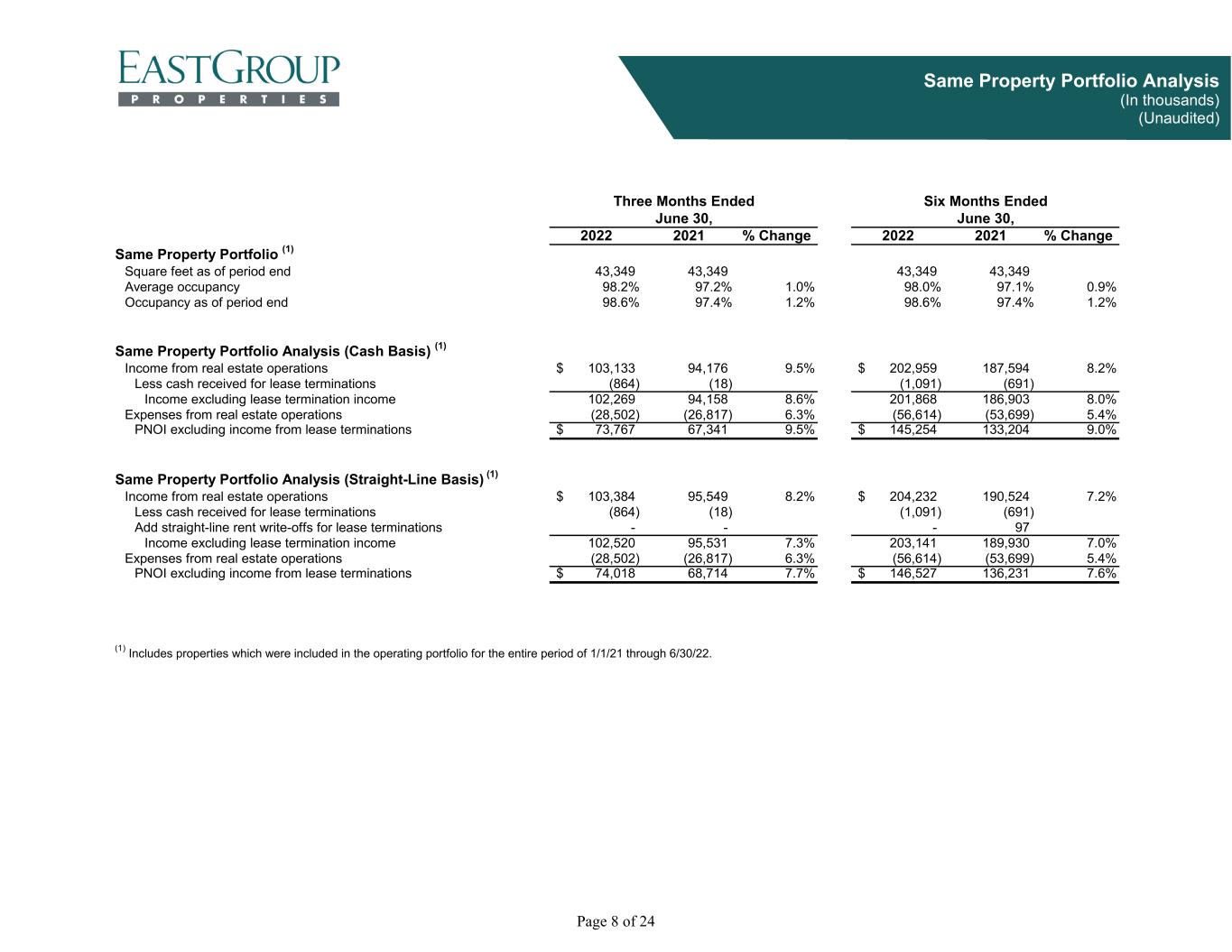

Page 8 of 24 Same Property Portfolio Analysis (In thousands) (Unaudited) 2022 2021 % Change 2022 2021 % Change Same Property Portfolio (1) Square feet as of period end 43,349 43,349 43,349 43,349 Average occupancy 98.2% 97.2% 1.0% 98.0% 97.1% 0.9% Occupancy as of period end 98.6% 97.4% 1.2% 98.6% 97.4% 1.2% Same Property Portfolio Analysis (Cash Basis) (1) Income from real estate operations 103,133$ 94,176 9.5% 202,959$ 187,594 8.2% Less cash received for lease terminations (864) (18) (1,091) (691) Income excluding lease termination income 102,269 94,158 8.6% 201,868 186,903 8.0% Expenses from real estate operations (28,502) (26,817) 6.3% (56,614) (53,699) 5.4% PNOI excluding income from lease terminations 73,767$ 67,341 9.5% 145,254$ 133,204 9.0% Same Property Portfolio Analysis (Straight-Line Basis) (1) Income from real estate operations 103,384$ 95,549 8.2% 204,232$ 190,524 7.2% Less cash received for lease terminations (864) (18) (1,091) (691) Add straight-line rent write-offs for lease terminations - - - 97 Income excluding lease termination income 102,520 95,531 7.3% 203,141 189,930 7.0% Expenses from real estate operations (28,502) (26,817) 6.3% (56,614) (53,699) 5.4% PNOI excluding income from lease terminations 74,018$ 68,714 7.7% 146,527$ 136,231 7.6% (1) Includes properties which were included in the operating portfolio for the entire period of 1/1/21 through 6/30/22. June 30, June 30, Three Months Ended Six Months Ended

Page 9 of 24 Additional Financial Information (In thousands) (Unaudited) 2022 2021 2022 2021 Straight-line rent income adjustment 1,450$ 2,102 3,890 3,969 Recoveries of uncollectible straight-line rent 6 62 35 262 Net straight-line rent adjustment 1,456 2,164 3,925 4,231 Cash received for lease terminations 979 18 2,373 691 Less straight-line rent write-offs - - - (97) Net lease termination fee income 979 18 2,373 594 Recoveries (reserves) of uncollectible cash rent (42) (50) 35 (172) Stock-based compensation expense (2,417) (2,414) (4,320) (4,011) Debt issuance costs amortization (326) (301) (636) (642) Indirect leasing costs (116) (134) (291) (464) Acquired leases - market rent adjustment amortization 507 245 1,352 474 2022 2021 2022 2021 WEIGHTED AVERAGE COMMON SHARES Weighted average common shares 42,211 40,068 41,729 39,871 BASIC SHARES FOR EARNINGS PER SHARE ("EPS") 42,211 40,068 41,729 39,871 Potential common shares: Unvested restricted stock 105 97 109 94 DILUTED SHARES FOR EPS AND FFO 42,316 40,165 41,838 39,965 (Items below represent increases or (decreases) in FFO) June 30, Three Months Ended Three Months Ended June 30, Six Months Ended June 30, Six Months Ended June 30, SELECTED INCOME STATEMENT INFORMATION

Page 10 of 24 Financial Statistics ($ in thousands, except per share data) (Unaudited) Quarter Ended 6/30/2022 2021 2020 2019 2018 ASSETS/MARKET CAPITALIZATION Assets 3,851,717$ 3,215,336 2,720,803 2,546,078 2,131,705 Equity Market Capitalization 6,723,543 9,403,107 5,477,783 5,164,306 3,348,269 Total Market Capitalization (Debt and Equity) (1) 8,352,061 10,859,473 6,791,879 6,350,438 4,458,037 Shares Outstanding - Common 43,566,016 41,268,846 39,676,828 38,925,953 36,501,356 Price per share 154.33$ 227.85 138.06 132.67 91.73 FFO CHANGE FFO per diluted share (2) 1.72$ 6.09 5.38 4.98 4.66 Change compared to same period prior year 17.0% 13.2% 8.0% 6.9% 9.6% COMMON DIVIDEND PAYOUT RATIO Dividend distribution 1.10$ 3.58 3.08 2.94 2.72 FFO per diluted share (2) 1.72 6.09 5.38 4.98 4.66 Dividend payout ratio 64% 59% 57% 59% 58% COMMON DIVIDEND YIELD Dividend distribution 1.10$ 3.58 3.08 2.94 2.72 Price per share 154.33 227.85 138.06 132.67 91.73 Dividend yield 2.85% 1.57% 2.23% 2.22% 2.97% FFO MULTIPLE FFO per diluted share (2) 1.72$ 6.09 5.38 4.98 4.66 Price per share 154.33 227.85 138.06 132.67 91.73 Multiple 22.43 37.41 25.66 26.64 19.68 INTEREST & FIXED CHARGE COVERAGE RATIO EBITDAre 81,980$ 278,959 245,669 221,517 200,788 Interest expense 8,970 32,945 33,927 34,463 35,106 Interest and fixed charge coverage ratio 9.14 8.47 7.24 6.43 5.72 DEBT-TO-EBITDAre RATIO Debt 1,623,536$ 1,451,778 1,310,895 1,182,602 1,105,787 EBITDAre 81,980 278,959 245,669 221,517 200,788 Debt-to-EBITDAre ratio 4.95 5.20 5.34 5.34 5.51 Adjusted debt-to-pro forma EBITDAre ratio 3.65 3.83 4.43 3.92 4.73 DEBT-TO-TOTAL MARKET CAPITALIZATION (1) 19.5% 13.4% 19.3% 18.7% 24.9% ISSUER RATINGS (3) Issuer Rating Outlook Moody's Investors Service Baa2 Stable (1) Before deducting unamortized debt issuance costs. (3) A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the assigning rating agency. (2) In connection with the Company's adoption of the Nareit Funds from Operations White Paper - 2018 Restatement, the Company now excludes from FFO the gains and losses on sales of non-operating real estate and assets incidental to the Company's business and therefore, adjusted the prior years' results to conform to the updated definition of FFO. Years Ended

Page 11 of 24 Development and Value-Add Properties Summary ($ in thousands) (Unaudited) Anticipated 2nd Qtr Cumulative Projected Conversion % Leased Square Feet (SF) 2022 at 6/30/22 Total Costs Date (1) 7/25/22 Lease-up Steele Creek 8 Charlotte, NC 72,000 1,858$ 7,755 8,400 07/22 100% CreekView 9 & 10 Dallas, TX 145,000 2,187 15,404 17,200 09/22 100% Horizon West 2 & 3 Orlando, FL 210,000 483 18,707 21,400 09/22 76% Ridgeview 3 San Antonio, TX 88,000 1,948 9,106 9,700 10/22 100% Mesa Gateway (2) Phoenix, AZ 147,000 18,484 18,484 22,600 11/22 100% Cypress Preserve 1 & 2 (2) Houston, TX 516,000 502 53,911 57,800 03/23 50% Zephyr (2) San Francisco, CA 82,000 28,798 28,798 29,800 04/23 42% Total Lease-up 1,260,000 54,260 152,165 166,900 72% Wgt Avg % Lease-Up: Projected Stabilized Yield (3) 5.9% Under Construction Gateway 3 Miami, FL 133,000 2,091 18,025 20,700 08/22 100% Americas Ten 2 El Paso, TX 169,000 1,249 13,715 14,900 09/22 100% SunCoast 11 Fort Myers, FL 79,000 3,327 5,985 9,900 11/22 100% SunCoast 12 Fort Myers, FL 79,000 1,641 7,138 9,300 11/22 100% Tri-County Crossing 5 San Antonio, TX 105,000 797 8,328 11,600 11/22 100% 45 Crossing Austin, TX 177,000 2,852 23,723 26,200 12/22 100% World Houston 47 Houston, TX 139,000 6,577 12,478 19,100 12/22 100% Basswood 1 & 2 Fort Worth, TX 237,000 1,597 19,406 24,400 01/23 100% Grand Oaks 75 4 Tampa, FL 185,000 2,978 14,763 17,900 07/23 0% Grand West Crossing 1 Houston, TX 121,000 474 12,709 15,700 07/23 0% Tri-County Crossing 6 San Antonio, TX 124,000 2,044 8,640 10,600 07/23 72% McKinney 3 & 4 Dallas, TX 212,000 3,584 19,213 26,800 08/23 29% LakePort 4 & 5 Dallas, TX 177,000 5,092 15,525 22,400 09/23 54% Arlington Tech 3 Fort Worth, TX 77,000 2,507 5,446 10,300 10/23 0% Horizon West 4 Orlando, FL 295,000 7,822 18,421 28,700 10/23 0% I-20 West Business Center Atlanta, GA 155,000 5,578 9,971 15,500 10/23 0% Hillside 1 Greenville, SC 122,000 1,069 1,884 11,600 12/23 0% Horizon West 1 Orlando, FL 97,000 4,182 4,182 13,200 12/23 0% Gateway 2 Miami, FL 133,000 9,277 9,277 23,700 02/24 36% Steele Creek 11 & 12 Charlotte, NC 241,000 1,071 4,212 24,900 02/24 26% Springwood 1 & 2 Houston, TX 292,000 7,647 7,647 33,300 05/24 0% Total Under Construction 3,349,000 73,456 240,688 390,700 44% Wgt Avg % Under Construction: Projected Stabilized Yield (3) 6.7% 52% Wgt Avg % Development: Projected Stabilized Yield (3) 6.8% Value-Add: Projected Stabilized Yield (3) 5.0% Prospective Development Acres Projected SF Phoenix, AZ 50 655,000 539 15,050 Sacramento, CA 7 93,000 3,051 3,051 San Francisco, CA 4 65,000 3,561 3,561 Fort Myers, FL 36 464,000 643 8,240 Miami, FL 36 510,000 8,165 23,498 Orlando, FL (4) 75 886,000 (3,314) 17,001 Tampa, FL 2 32,000 - 825 Atlanta, GA 107 934,000 4,623 9,938 Jackson, MS 3 28,000 - 706 Charlotte, NC 158 1,146,000 602 13,142 Greenville, SC 38 278,000 1,518 2,706 Austin, TX 22 274,000 2,941 10,279 Dallas, TX 26 172,000 207 8,713 Fort Worth, TX 44 575,000 952 14,519 Houston, TX 107 1,536,000 8,527 29,539 San Antonio, TX 6 55,000 11 742 Total Prospective Development 721 7,703,000 32,026 161,510 Total Development and Value-Add Properties 721 12,312,000 159,742$ 554,363 (1) Development properties will transfer to the operating portfolio at the earlier of 90% occupancy or one year after shell completion. Value-add properties will transfer at the earlier of 90% occupancy or one year after acquisition. (2) Represents value-add acquisitions. (3) Weighted average yield based on estimated annual property net operating income on a straight-line basis at 100% occupancy divided by projected total costs. (4) Negative amount represents land inventory costs transferred to Under Construction. Costs Incurred

Page 12 of 24 Development and Value-Add Properties Transferred to Real Estate Properties ($ in thousands) (Unaudited) 2nd Qtr Cumulative Conversion % Leased Square Feet (SF) 2022 at 6/30/22 Date 7/25/22 1st Quarter Access Point 1 (1) Greenville, SC 156,000 40$ 12,917 01/22 100% Speed Distribution Center San Diego, CA 519,000 (488) 72,460 03/22 100% 675,000 (448) 85,377 2nd Quarter Access Point 2 (1) Greenville, SC 159,000 611 12,305 05/22 100% Grand Oaks 75 3 Tampa, FL 136,000 961 11,516 06/22 100% Siempre Viva 3-6 (1) San Diego, CA 547,000 701 133,415 06/22 99% 842,000 2,273 157,236 Total Transferred to Real Estate Properties 1,517,000 1,825$ 242,613 Projected Stabilized Yield (2) 6.2% 100% Wgt Avg % (1) Represents value-add acquisitions. (2) Weighted average yield based on estimated annual property net operating income on a straight-line basis at 100% occupancy divided by projected total costs. Costs Incurred

Page 13 of 24 Acquisitions and Dispositions Through June 30, 2022 ($ in thousands) (Unaudited) Date Property Name Location Size Purchase Price (1) 1st Quarter 02/14/22 Gateway Interchange Land Phoenix, AZ 50.2 Acres 13,588$ 03/28/22 Cypress Preserve 1 & 2 Houston, TX 516,000 SF 54,462 (2) 2nd Quarter Various (3) Cypress Preserve Land Houston, TX 45.7 Acres 14,724 04/08/22 Zephyr Distribution Center San Francisco, CA 82,000 SF 29,017 (2) 04/15/22 Mesa Gateway Commerce Center Phoenix, AZ 147,000 SF 18,315 (2) 04/29/22 Homestead Commerce Park Land Miami, FL 28.1 Acres 15,790 Cebrian Distribution Center and Reed (4) Distribution Center 6th Street Business Center, Benicia Distribution Center 1-5, (4) Ettie Business Center, Laura Alice Business Center, Preston Distribution Center, Sinclair Distribution Center, Transit Distribution Center and Whipple Business Center 06/01/22 Reed Land Sacramento, CA 6.6 Acres 3,040 (4) 06/01/22 Hercules Land San Francisco, CA 3.9 Acres 3,561 (4) 06/30/22 Braselton 1 & 2 Land Atlanta, GA 43.0 Acres 4,048 2,451,000 SF Total Acquisitions 177.5 Acres 515,675$ Date Property Name Location Size Gross Sales Price 1st Quarter 01/06/22 Metro Business Park Phoenix, AZ 189,000 SF 33,510$ 26,971 (5) 03/31/22 Cypress Creek Business Park Fort Lauderdale, FL 56,000 SF 5,600 3,381 (5) 2nd Quarter 05/11/22 World Houston 15 East Houston, TX 42,000 SF 13,300 10,647 (5) Total Dispositions 287,000 SF 52,410$ 40,999 (3) The Cypress Preserve Land was acquired in three separate transactions on various dates in second quarter 2022. (2) Value-add property acquisition; included in Development and value-add properties on the Consolidated Balance Sheets. (1) Represents acquisition price plus closing costs. Realized Gain DISPOSITIONS ACQUISITIONS (5) Included in Gain on sales of real estate investments on the Consolidated Statements of Income and Comprehensive Income; not included in FFO. 06/01/22 Sacramento, CA 329,000 SF 49,726 06/01/22 San Francisco, CA 1,377,000 SF 309,404 (4) The Company acquired these properties in connection with its acquisition of Tulloch Corporation on June 1, 2022.

Page 14 of 24 Real Estate Improvements and Leasing Costs (In thousands) (Unaudited) REAL ESTATE IMPROVEMENTS 2022 2021 2022 2021 Upgrade on acquisitions 54$ 109 332 154 Tenant improvements: New tenants 2,882 2,525 6,338 5,167 Renewal tenants 1,161 1,507 1,871 2,184 Other: Building improvements 2,848 1,621 5,417 3,404 Roofs 1,781 3,047 2,932 6,062 Parking lots 989 169 1,225 431 Other 414 532 740 693 TOTAL REAL ESTATE IMPROVEMENTS (1) 10,129$ 9,510 18,855 18,095 CAPITALIZED LEASING COSTS (Principally Commissions) Development and value-add 2,482$ 4,731 6,768 7,559 New tenants 2,554 2,808 6,140 7,155 Renewal tenants 3,497 1,586 6,898 3,540 TOTAL CAPITALIZED LEASING COSTS (2)(3) 8,533$ 9,125 19,806 18,254 (1) Reconciliation of Total Real Estate Improvements to Real Estate Improvements on the Consolidated Statements of Cash Flows: 2022 2021 Total Real Estate Improvements 18,855$ 18,095 Change in real estate property payables (387) 735 Change in construction in progress 3,255 (736) 21,723$ 18,094 (2) Included in Other Assets on the Consolidated Balance Sheets. (3) Reconciliation of Total Capitalized Leasing Costs to Leasing Commissions on the Consolidated Statements of Cash Flows: 2022 2021 Total Capitalized Leasing Costs 19,806$ 18,254 Change in leasing commissions payables (1,444) (1,441) 18,362$ 16,813 Six Months Ended June 30, Leasing Commissions on the Consolidated Statements of Cash Flows June 30, Real Estate Improvements on the Consolidated Statements of Cash Flows Six Months Ended June 30, Six Months EndedThree Months Ended June 30,

Page 15 of 24 Leasing Statistics and Occupancy Summary (Unaudited) Three Months Ended Number of Square Feet Weighted Rental Change Rental Change PSF Tenant PSF Leasing PSF Total June 30, 2022 Leases Signed Signed Average Term Straight-Line Basis Cash Basis Improvement (1) Commission (1) Leasing Cost (1) (In Thousands) (In Years) New Leases (2) 36 691 5.3 35.8% 21.5% 3.20$ 3.55$ 6.75$ Renewal Leases 72 1,724 4.6 37.8% 22.8% 0.58 1.77 2.35 Total/Weighted Average 108 2,415 4.8 37.2% 22.4% 1.33$ 2.28$ 3.61$ Per Year 0.28$ 0.47$ 0.75$ Weighted Average Retention (3) 76.0% Six Months Ended Number of Square Feet Weighted Rental Change Rental Change PSF Tenant PSF Leasing PSF Total June 30, 2022 Leases Signed Signed Average Term Straight-Line Basis Cash Basis Improvement (1) Commission (1) Leasing Cost (1) (In Thousands) (In Years) New Leases (2) 82 1,790 5.4 36.3% 24.9% 3.80$ 3.38$ 7.18$ Renewal Leases 132 3,178 4.7 34.5% 19.8% 0.73 2.02 2.75 Total/Weighted Average 214 4,968 5.0 35.2% 21.7% 1.83$ 2.51$ 4.34$ Per Year 0.37$ 0.50$ 0.87$ Weighted Average Retention (3) 70.5% 06/30/22 03/31/22 12/31/21 09/30/21 06/30/21 Percentage Leased 99.1% 98.8% 98.7% 98.8% 98.3% Percentage Occupied 98.5% 97.9% 97.4% 97.6% 96.8% (1) Per square foot (PSF) amounts represent total amounts for the life of the lease, except as noted for the Per Year amounts. (2) Does not include leases with terms less than 12 months and leases for first generation space. (3) Calculated as square feet of renewal leases signed during the quarter / square feet of leases expiring during the quarter (not including early terminations or bankruptcies).

Page 16 of 24 Core Market Operating Statistics June 30, 2022 (Unaudited) Total % of Total Square Feet Annualized % % Straight-Line Cash Straight-Line Cash Straight-Line Cash Straight-Line Cash of Properties Base Rent (1) Leased Occupied 2022 (2) 2023 Basis Basis (4) Basis Basis (4) Basis Basis (4) Basis Basis (4) Florida Tampa 4,348,000 7.7% 98.1% 97.7% 185,000 605,000 4.8% 3.9% 3.2% 3.3% 61.0% 38.1% 54.7% 32.7% Orlando 3,685,000 7.3% 97.2% 97.2% 301,000 513,000 4.2% 6.8% 4.5% 6.5% 16.6% 5.5% 28.2% 13.1% Jacksonville 2,273,000 3.5% 99.5% 99.3% 422,000 414,000 1.7% 2.3% 5.4% 4.6% 35.3% 20.3% 33.7% 19.1% Miami/Fort Lauderdale 1,601,000 3.8% 100.0% 99.3% 33,000 233,000 6.3% 8.5% 7.1% 9.1% 60.0% 36.0% 54.4% 39.4% Fort Myers 626,000 1.5% 100.0% 100.0% 54,000 105,000 -0.1% 1.8% -0.5% 1.3% 18.5% 10.6% 18.4% 7.7% 12,533,000 23.8% 98.4% 98.2% 995,000 1,870,000 4.1% 5.1% 4.3% 5.2% 40.0% 22.9% 39.6% 22.2% Texas Houston 6,092,000 10.8% 96.9% 95.7% 444,000 772,000 3.9% 4.4% 0.5% -0.1% 24.0% 9.2% 23.8% 7.5% Dallas 4,717,000 9.0% 100.0% 100.0% 110,000 589,000 3.3% 9.0% 5.3% 9.9% 60.7% 46.2% 29.2% 37.1% San Antonio 4,093,000 8.2% 99.8% 98.8% 230,000 609,000 5.6% 5.9% 4.5% 4.6% 18.3% 8.1% 20.2% 10.2% Austin 1,146,000 2.8% 100.0% 99.0% 49,000 143,000 0.3% 3.0% 0.9% 2.4% 28.3% 15.4% 43.5% 27.5% El Paso 957,000 1.4% 100.0% 100.0% 49,000 144,000 4.9% 6.2% 4.4% 5.4% 59.3% 42.0% 56.7% 39.6% Fort Worth 794,000 1.5% 100.0% 100.0% 8,000 129,000 25.9% 39.2% 27.2% 41.8% 55.5% 30.7% 55.5% 30.7% 17,799,000 33.7% 98.9% 98.2% 890,000 2,386,000 4.8% 7.1% 3.9% 5.3% 31.4% 17.3% 28.7% 18.9% California Los Angeles (5) 2,484,000 7.5% 100.0% 100.0% 46,000 149,000 26.1% 33.6% 22.9% 29.2% 44.6% 30.5% 31.3% 18.7% San Francisco 2,421,000 6.8% 100.0% 100.0% 167,000 149,000 20.0% 7.8% 21.1% 22.1% 195.5% 142.1% 96.9% 64.8% San Diego (5) 1,933,000 5.7% 99.8% 99.8% - 123,000 32.3% 68.4% 45.1% 53.9% 27.3% 21.6% 27.3% 21.6% Fresno 398,000 0.5% 94.8% 92.3% 92,000 44,000 14.4% 15.0% 16.4% 15.5% 20.8% 14.3% 20.8% 14.3% Sacramento 329,000 0.7% 100.0% 100.0% - - N/A N/A N/A N/A N/A N/A N/A N/A 7,565,000 21.2% 99.7% 99.5% 305,000 465,000 25.4% 31.5% 26.3% 31.0% 53.5% 40.7% 54.1% 36.5% Arizona Phoenix 2,852,000 5.7% 100.0% 100.0% 41,000 410,000 10.3% 9.8% 8.2% 8.1% 40.6% 25.9% 29.3% 17.1% Tucson 848,000 1.5% 100.0% 100.0% - 83,000 0.4% 2.1% 3.3% 12.8% N/A N/A 18.7% 11.6% 3,700,000 7.2% 100.0% 100.0% 41,000 493,000 7.7% 7.8% 6.9% 9.2% 40.6% 25.9% 29.0% 17.0% Other Core Charlotte 3,569,000 5.5% 100.0% 100.0% 309,000 693,000 4.2% 1.4% 3.5% 0.9% 27.1% 15.4% 24.9% 9.5% Atlanta 1,312,000 2.2% 100.0% 100.0% 13,000 30,000 3.9% 6.8% 5.3% 16.0% 46.1% 42.4% 31.4% 25.4% Denver 886,000 2.1% 99.1% 99.1% 119,000 59,000 8.9% 10.8% 6.9% 7.7% 31.5% 12.4% 24.3% 10.0% Las Vegas 754,000 1.9% 100.0% 100.0% 12,000 182,000 14.5% 24.7% 19.6% 23.3% 57.4% 45.1% 66.3% 45.6% 6,521,000 11.7% 99.9% 99.9% 453,000 964,000 6.7% 7.4% 6.9% 7.6% 36.1% 23.9% 34.6% 19.6% Total Core Markets 48,118,000 97.6% 99.1% 98.8% 2,684,000 6,178,000 8.0% 9.8% 7.8% 9.3% 37.6% 22.7% 35.4% 21.8% Total Other Markets 1,763,000 2.4% 98.6% 92.8% 39,000 179,000 -2.5% -1.1% -0.9% 0.9% 24.0% 12.2% 24.2% 13.3% Total Operating Properties 49,881,000 100.0% 99.1% 98.5% 2,723,000 6,357,000 7.7% 9.5% 7.6% 9.0% 37.2% 22.4% 35.2% 21.7% (1) Based on the Annualized Base Rent as of the reporting period for occupied square feet (without S/L Rent). (2) Square Feet expiring during the remainder of the year, including month-to-month leases. (3) Does not include leases with terms less than 12 months and leases for first generation space. (4) Excludes straight-line rent adjustments and amortization of above/below market rent intangibles. (5) Includes the Company's share of its less-than-wholly-owned real estate investments. YTD Same Property PNOI Change Rental Change (excluding income from lease terminations) New and Renewal Leases (3) in Square Feet Lease Expirations QTR YTD QTR

Page 17 of 24 Lease Expiration Summary - Total Square Feet of Operating Properties Based on Leases Signed Through June 30, 2022 ($ in thousands) (Unaudited) Annualized Current % of Total Base Rent of Base Rent of Square Footage of % of Leases Expiring Leases Expiring LEASE EXPIRATION Leases Expiring Total SF (without S/L Rent) (without S/L Rent) Vacancy 454,000 0.9% -$ 0.0% 2022 - remainder of year (1) 2,723,000 5.5% 18,446 5.2% 2023 6,357,000 12.7% 43,184 12.2% 2024 7,750,000 15.5% 53,784 15.2% 2025 7,488,000 15.0% 55,610 15.7% 2026 8,803,000 17.7% 66,741 18.8% 2027 6,784,000 13.6% 49,582 14.0% 2028 2,912,000 5.8% 20,296 5.7% 2029 2,457,000 4.9% 15,620 4.4% 2030 773,000 1.6% 6,195 1.7% 2031 and beyond 3,380,000 6.8% 25,311 7.1% TOTAL 49,881,000 100.0% 354,769$ 100.0% (1) Includes month-to-month leases.

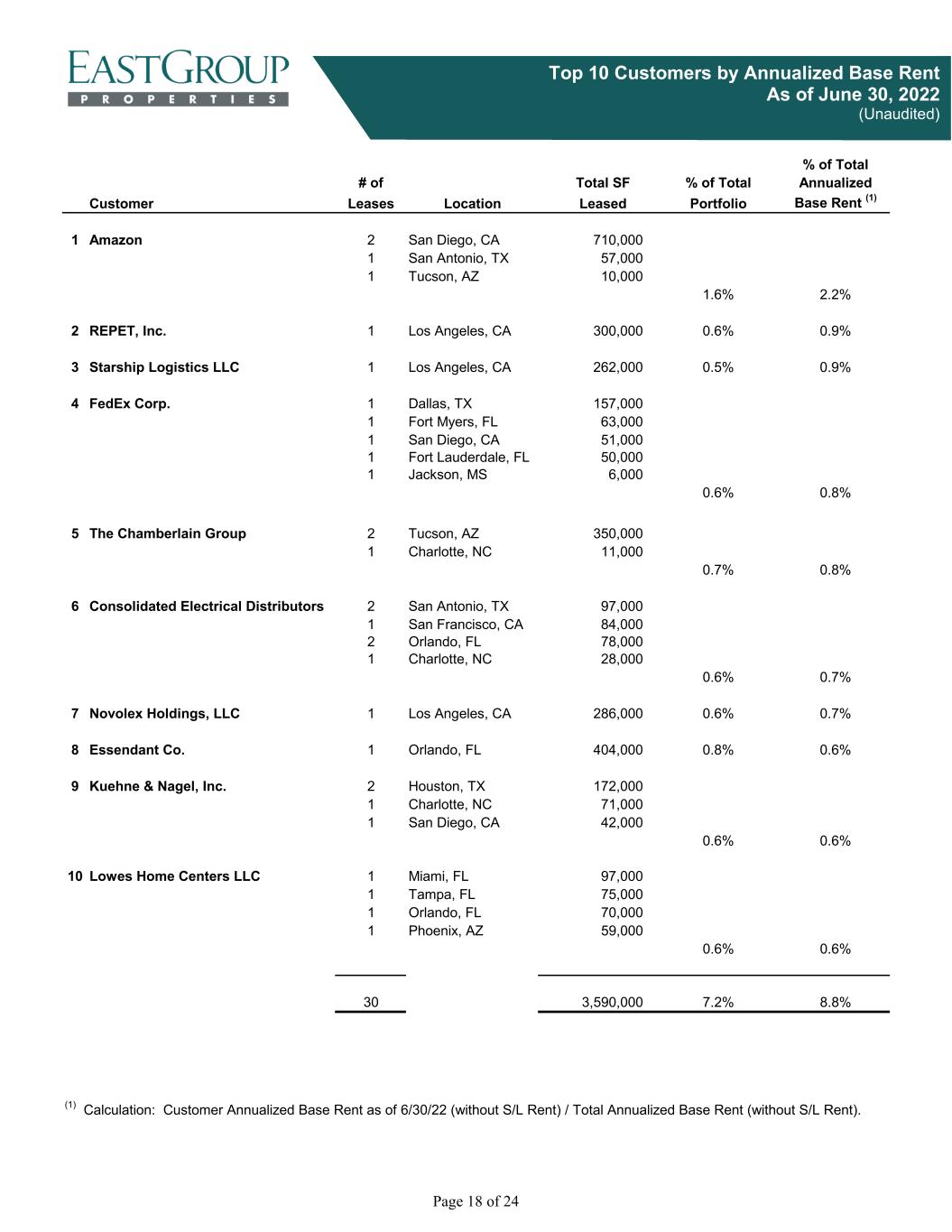

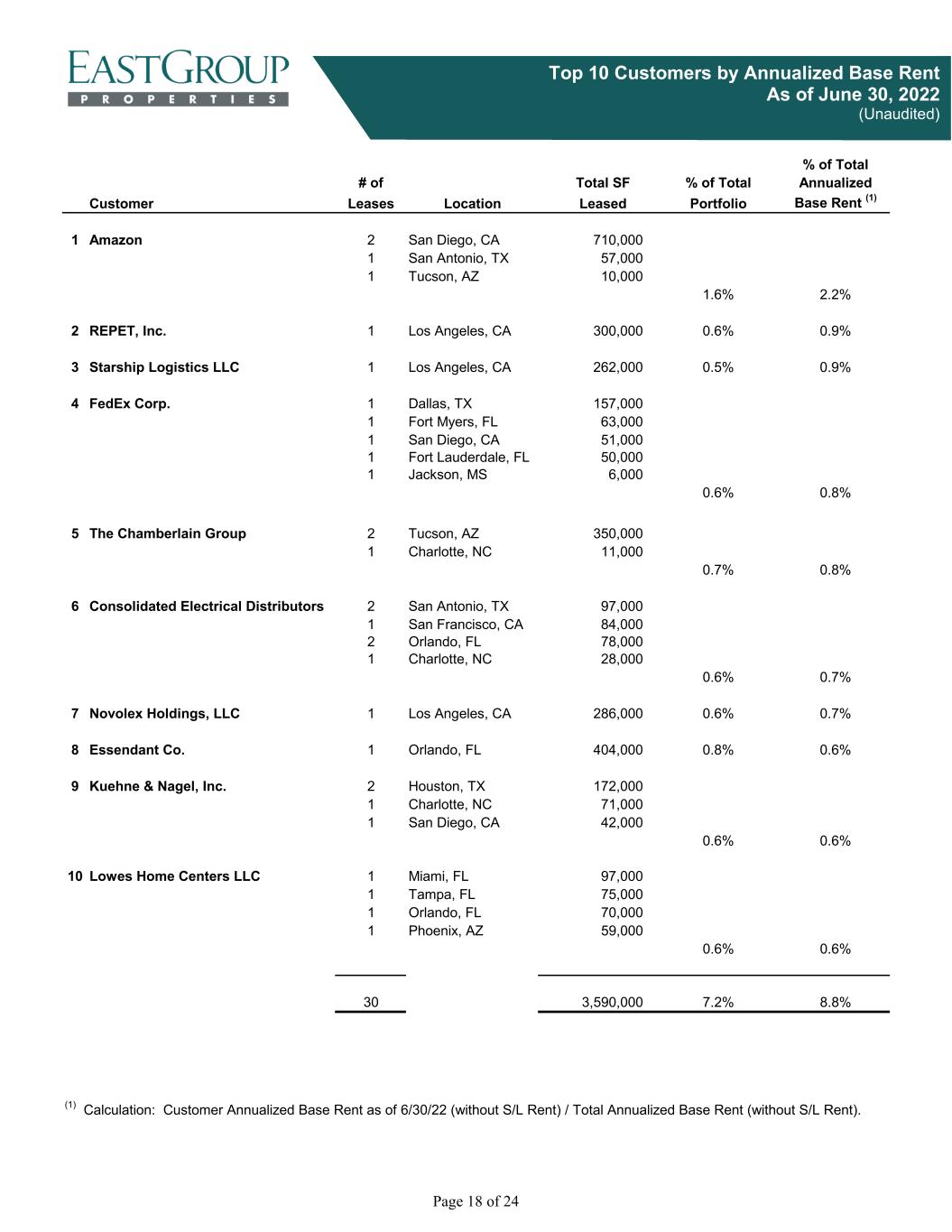

Page 18 of 24 Top 10 Customers by Annualized Base Rent As of June 30, 2022 (Unaudited) % of Total # of % of Total Annualized Customer Leases Location Portfolio Base Rent (1) 1 Amazon 2 San Diego, CA 710,000 1 San Antonio, TX 57,000 1 Tucson, AZ 10,000 1.6% 2.2% 2 REPET, Inc. 1 Los Angeles, CA 300,000 0.6% 0.9% 3 Starship Logistics LLC 1 Los Angeles, CA 262,000 0.5% 0.9% 4 FedEx Corp. 1 Dallas, TX 157,000 1 Fort Myers, FL 63,000 1 San Diego, CA 51,000 1 Fort Lauderdale, FL 50,000 1 Jackson, MS 6,000 0.6% 0.8% 5 The Chamberlain Group 2 Tucson, AZ 350,000 1 Charlotte, NC 11,000 0.7% 0.8% 6 Consolidated Electrical Distributors 2 San Antonio, TX 97,000 1 San Francisco, CA 84,000 2 Orlando, FL 78,000 1 Charlotte, NC 28,000 0.6% 0.7% 7 Novolex Holdings, LLC 1 Los Angeles, CA 286,000 0.6% 0.7% 8 Essendant Co. 1 Orlando, FL 404,000 0.8% 0.6% 9 Kuehne & Nagel, Inc. 2 Houston, TX 172,000 1 Charlotte, NC 71,000 1 San Diego, CA 42,000 0.6% 0.6% 10 Lowes Home Centers LLC 1 Miami, FL 97,000 1 Tampa, FL 75,000 1 Orlando, FL 70,000 1 Phoenix, AZ 59,000 0.6% 0.6% 30 3,590,000 7.2% 8.8% (1) Calculation: Customer Annualized Base Rent as of 6/30/22 (without S/L Rent) / Total Annualized Base Rent (without S/L Rent). Leased Total SF

Page 19 of 24 Debt and Equity Market Capitalization June 30, 2022 ($ in thousands, except per share data) (Unaudited) Remainder of 2022 2023 2024 2025 2026 2027 and Beyond Total Average Years to Maturity Unsecured debt (fixed rate) (1) -$ 115,000 120,000 145,000 140,000 900,000 1,420,000 6.0 Weighted average interest rate - 2.96% 3.47% 3.12% 2.57% 3.01% 3.01% Secured debt (fixed rate) 58 119 122 128 1,672 - 2,099 3.8 Weighted average interest rate 3.85% 3.85% 3.85% 3.85% 3.85% - 3.85% Total unsecured debt and secured debt 58$ 115,119 120,122 145,128 141,672 900,000 1,422,099 6.0 Weighted average interest rate 3.85% 2.96% 3.47% 3.12% 2.58% 3.01% 3.01% Unsecured debt and secured debt (fixed rate) 1,422,099$ Unsecured bank credit facilities (variable rate) $50MM Line - 2.562% - matures 7/30/2025 36,419 $425MM Line - 2.058% - matures 7/30/2025 170,000 Total carrying amount of debt 1,628,518$ Total unamortized debt issuance costs (4,982) Total debt, net of unamortized debt issuance costs 1,623,536$ Equity market capitalization Shares outstanding - common 43,566,016 Price per share at quarter end 154.33$ Total equity market capitalization 6,723,543$ Total market capitalization (debt and equity) (2) 8,352,061$ Total debt / total market capitalization (2) 19.5% (1) These loans have a fixed interest rate or an effectively fixed interest rate due to interest rate swaps. (2) Before deducting unamortized debt issuance costs.

Page 20 of 24 Continuous Common Equity Program Through June 30, 2022 ($ in thousands, except per share data) (Unaudited) Shares Issued and Sold (1) Average Sales Price (Per Share) Gross Proceeds Offering-Related Fees and Expenses Net Proceeds 1st Quarter 385,538 194.53$ 75,000$ (821)$ 74,179$ 2nd Quarter - - - - - TOTAL 2022 385,538 194.53$ 75,000$ (821)$ 74,179$ (1) As of July 26, 2022, the Company had common shares with an aggregate gross sales price of $306.9 million authorized and remaining for issuance under its continuous common equity program.

Page 21 of 24 Debt-to-EBITDAre Ratios ($ in thousands) (Unaudited) Quarter Ended Years Ended December 31, June 30, 2022 2021 2020 2019 2018 EBITDAre 81,980$ 278,959$ 245,669 221,517 200,788 Debt 1,623,536 1,451,778 1,310,895 1,182,602 1,105,787 DEBT-TO-EBITDAre RATIO 4.95 5.20 5.34 5.34 5.51 EBITDAre 81,980$ 278,959$ 245,669 221,517 200,788 Adjust for acquisitions as if owned for entire period 2,898 4,213 1,906 5,590 1,909 Adjust for development and value-add properties in lease-up or under construction (497) (700) (1,327) (2,072) (304) Adjust for properties sold during the period (70) (1,517) (1,081) (3,812) (474) Pro Forma EBITDAre 84,311$ 280,955$ 245,167 221,223 201,919 Debt 1,623,536$ 1,451,778$ 1,310,895 1,182,602 1,105,787 Subtract development and value-add properties in lease-up or under construction (392,853) (376,611) (225,964) (315,794) (149,860) Adjusted Debt 1,230,683$ 1,075,167$ 1,084,931 866,808 955,927 ADJUSTED DEBT-TO-PRO FORMA EBITDAre RATIO 3.65 3.83 4.43 3.92 4.73

Page 22 of 24 Outlook for 2022 (Unaudited) Q3 2022 Y/E 2022 Q3 2022 Y/E 2022 Net income attributable to common stockholders 31,416$ 171,888 34,030 177,012 Depreciation and amortization 43,053 161,103 43,053 161,103 Gain on sales of real estate investments - (40,999) - (40,999) Funds from operations attributable to common stockholders 74,469$ 291,992 77,083 297,116 Diluted shares 43,569 42,703 43,569 42,703 Per share data (diluted): Net income attributable to common stockholders 0.72$ 4.03 0.78 4.15 Funds from operations attributable to common stockholders 1.71 6.84 1.77 6.96 The following assumptions were used for the mid-point: Metrics FFO per share $6.84 - $6.96 $6.69 - $6.81 $6.09 FFO per share increase over prior year 13.3% 10.8% 13.2% Same PNOI growth: cash basis (1) 8.0% - 9.0%(2) 6.9% - 7.9%(2) 5.7% Average month-end occupancy - operating portfolio 97.3% - 98.3% 97.0% - 98.0% 97.1% Lease termination fee income $2.5 million $1.5 million $1.4 million Recoveries (reserves) of uncollectible rent (No identified bad debts for Q3-Q4) ($675,000) ($1.0 million) $475,000 Development starts: Square feet 3.2 million 3.0 million 2.8 million Projected total investment $350 million $300 million $341 million Value-add property acquisitions (Projected total investment) $125 million $125 million $178 million Operating property acquisitions $360 million $30 million $108 million Operating property dispositions (Potential gains on dispositions are not included in the projections) $70 million $70 million $45 million Unsecured debt closing in period $525 million at 3.82% weighted average interest rate $400 million at 3.59% weighted average interest rate $175 million at 2.40% weighted average interest rate Common stock issuances $75 million $250 million $274 million General and administrative expense $16.9 million $17.2 million $15.7 million Low Range High Range (In thousands, except per share data) Revised Guidance for Year 2022 April Earnings Release Guidance for Year 2022 Actual for Year 2021 (2) Includes properties which have been in the operating portfolio since 1/1/21 and are projected to be in the operating portfolio through 12/31/22; includes 43,273,000 square feet. (1) Excludes straight-line rent adjustments, amortization of market rent intangibles for acquired leases, and income from lease terminations.

Page 23 of 24 Glossary of REIT Terms Listed below are definitions of commonly used real estate investment trust (“REIT”) industry terms. For additional information on REITs, please see the National Association of Real Estate Investment Trusts (“Nareit”) web site at www.reit.com. Adjusted Debt-to-Pro Forma EBITDAre Ratio: A ratio calculated by dividing a company’s adjusted debt by its pro forma EBITDAre. Debt is adjusted by subtracting the cost of development and value-add properties in lease-up or under construction. EBITDAre is further adjusted by adding an estimate of NOI for significant acquisitions as if the acquired properties were owned for the entire period, and by subtracting NOI from development and value-add properties in lease- up or under construction and from properties sold during the period. The Adjusted Debt-to-Pro Forma EBITDAre Ratio is a non-GAAP financial measure used to analyze the Company’s financial condition and operating performance relative to its leverage, on an adjusted basis, so as to normalize and annualize property changes during the period. Cash Basis: The Company adjusts its GAAP reporting to exclude straight-line rent adjustments and amortization of market rent intangibles for acquired leases. The cash basis is an indicator of the rents charged to customers by the Company during the periods presented and is useful in analyzing the embedded rent growth in the Company’s portfolio. Debt-to-EBITDAre Ratio: A ratio calculated by dividing a company’s debt by its EBITDAre; this non-GAAP measure is used to analyze the Company’s financial condition and operating performance relative to its leverage. Debt-to-Total Market Capitalization Ratio: A ratio calculated by dividing a company’s debt by the total amount of a company’s equity (at market value) and debt. Earnings Before Interest Taxes Depreciation and Amortization for Real Estate (“EBITDAre”): In accordance with standards established by Nareit, EBITDAre is computed as Earnings, defined as Net Income, excluding gains or losses from sales of real estate investments and non-operating real estate, plus interest, taxes, depreciation and amortization. EBITDAre is a non-GAAP financial measure used to measure the Company’s operating performance and its ability to meet interest payment obligations and pay quarterly stock dividends on an unleveraged basis. Funds From Operations (“FFO”): FFO is the most commonly accepted reporting measure of a REIT’s operating performance, and the Company computes FFO in accordance with standards established by Nareit in the Nareit Funds from Operations White Paper — 2018 Restatement. It is equal to a REIT’s net income (loss) attributable to common stockholders computed in accordance with generally accepted accounting principles (“GAAP”), excluding gains and losses from sales of real estate property (including other assets incidental to the Company’s business) and impairment losses, adjusted for real estate related depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. FFO is a non-GAAP financial measure used to evaluate the performance of the Company’s investments in real estate assets and its operating results. FFO Excluding Gain on Casualties and Involuntary Conversion: A reporting measure calculated as FFO (as defined above), adjusted to exclude gain on casualties and involuntary conversion. The Company believes that the exclusion of gain on casualties and involuntary conversion presents a more meaningful comparison of operating performance. Industrial Properties: Generally consisting of four concrete walls tilted up on a slab of concrete. An internal office component is then added. Business uses include warehousing, distribution, light manufacturing and assembly, research and development, showroom, office, or a combination of some or all of the aforementioned. Leases Expiring and Renewal Leases Signed of Expiring Square Feet: Includes renewals during the period with terms commencing during the period and after the end of the period. Operating Land: Land with no buildings or improvements that generates income from leases with tenants; included in Real estate properties on the Consolidated Balance Sheets. Operating Properties: Stabilized real estate properties (land including buildings and improvements) in the Company’s operating portfolio; included in Real estate properties on the Consolidated Balance Sheets. Percentage Leased: The percentage of total leasable square footage for which there is a signed lease, including month- to-month leases, as of the close of the reporting period. Space is considered leased upon execution of the lease.

Page 24 of 24 Glossary of REIT Terms (Continued) Percentage Occupied: The percentage of total leasable square footage for which the lease term has commenced as of the close of the reporting period. Property Net Operating Income (“PNOI”): Income from real estate operations less Expenses from real estate operations (including market-based internal management fee expense) plus the Company’s share of income and property operating expenses from its less-than-wholly-owned real estate investments. PNOI is a non-GAAP, property-level supplemental measure of performance used to evaluate the performance of the Company’s investments in real estate assets and its operating results. Real Estate Investment Trust (“REIT”): A company that owns and, in most cases, operates income-producing real estate such as apartments, shopping centers, offices, hotels and warehouses. Some REITs also engage in financing real estate. The shares of most REITs are freely traded, usually on a major stock exchange. To qualify as a REIT, a company must distribute at least 90 percent of its taxable income to its stockholders annually. A company that qualifies as a REIT is permitted to deduct dividends paid to its stockholders from its corporate taxable income. As a result, most REITs remit at least 100 percent of their taxable income to their stockholders and therefore owe no corporate federal income tax. Taxes are paid by stockholders on the dividends received. Most states honor this federal treatment and also do not require REITs to pay state income tax. Rental changes on new and renewal leases: Rental changes are calculated as the difference, weighted by square feet, of the annualized base rent due the first month of the new lease’s term and the annualized base rent of the rent due the last month of the former lease’s term. If free rent is given, then the first positive full rent value is used. Rental amounts exclude base stop amounts, holdover rent, and premium or discounted rent amounts. This calculation excludes leases with terms less than 12 months and leases for first generation space on properties acquired or developed by EastGroup. Same Properties: Operating properties owned during the entire current and prior year reporting periods. Properties developed or acquired are excluded until held in the operating portfolio for both the current and prior year reporting periods. Properties sold during the current or prior year reporting periods are excluded. The Same Property Pool includes properties which were included in the operating portfolio for the entire period from January 1, 2021 through June 30, 2022. Same Property Net Operating Income (“Same PNOI”): Income from real estate operations less Expenses from real estate operations (including market-based internal management fee expense), plus the Company’s share of income and property operating expenses from its less-than-wholly-owned real estate investments, for the same properties owned by the Company during the entire current and prior year reporting periods. Same PNOI is a non-GAAP, property-level supplemental measure of performance used to evaluate the performance of the Company’s investments in real estate assets and its operating results on a same property basis. Same PNOI Excluding Income from Lease Terminations: Same PNOI (as defined above), adjusted to exclude income from lease terminations. The Company believes it is useful to evaluate Same PNOI Excluding Income from Lease Terminations on both a straight-line and cash basis. The straight-line basis is calculated by averaging the customers’ rent payments over the lives of the leases; GAAP requires the recognition of rental income on the straight-line basis. The cash basis excludes adjustments for straight-line rent and amortization of market rent intangibles for acquired leases; the cash basis is an indicator of the rents charged to customers by the Company during the periods presented and is useful in analyzing the embedded rent growth in the Company’s portfolio. Straight-Lining: The process of averaging the customer’s rent payments over the life of the lease. GAAP requires real estate companies to “straight-line” rents. Total Return: A stock’s dividend income plus capital appreciation/depreciation over a specified period as a percentage of the stock price at the beginning of the period. Value-Add Properties: Properties that are either acquired but not stabilized or can be converted to a higher and better use. Acquired properties meeting either of the following two conditions are considered value-add properties: (1) Less than 75% occupied as of the acquisition date (or will be less than 75% occupied within one year of acquisition date based on near term lease roll), or (2) 20% or greater of the acquisition cost will be spent to redevelop the property.