UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K | | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2024 |

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File No. 1-7657

American Express Company

(Exact name of registrant as specified in its charter) | | | | | |

| New York | 13-4922250 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

200 Vesey Street New York, New York | 10285 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (212) 640-2000

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares (par value $0.20 per Share) | AXP | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o | Smaller reporting company ☐ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No þ

As of June 30, 2024, the aggregate market value of the registrant’s voting shares held by non-affiliates of the registrant was approximately $164.7 billion based on the closing sale price as reported on the New York Stock Exchange.

As of January 31, 2025, there were 702,532,111 common shares of the registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III: Portions of Registrant’s Proxy Statement to be filed with the Securities and Exchange Commission in connection with the Annual Meeting of Shareholders to be held on April 29, 2025.

TABLE OF CONTENTS

| | | | | | | | |

Form 10-K

Item Number | | Page |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| 9C. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

This Annual Report on Form 10-K, including the “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties. You can identify forward-looking statements by words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “aim,” “will,” “may,” “should,” “could,” “would,” “likely,” “estimate,” “potential,” “continue” or other similar expressions. We discuss certain factors that affect our business and operations and that may cause our actual results to differ materially from these forward-looking statements under “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any forward-looking statements.

This report includes trademarks, such as American Express®, which are protected under applicable intellectual property laws and are the property of American Express Company or its subsidiaries. This report also contains trademarks, service marks, copyrights and trade names of other companies, which are the property of their respective owners. Solely for convenience, our trademarks and trade names referred to in this report may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

Throughout this report the terms “American Express,” “we,” “our” or “us,” refer to American Express Company and its subsidiaries on a consolidated basis, unless stated or the context implies otherwise. The use of the term “partner” or “partnering” in this report does not mean or imply a formal legal partnership, and is not meant in any way to alter the terms of American Express’ relationship with any third parties. Refer to the “Glossary of Selected Terminology” under “MD&A” for the definitions of other key terms used in this report.

PART I

ITEM 1. BUSINESS

Overview

American Express is a globally integrated payments company with card-issuing, merchant-acquiring and card network businesses that offer products and services to a broad range of customers, including consumers, small businesses, mid-sized companies and large corporations around the world.

Our range of products and services includes:

•Credit card, charge card, banking and other payment and financing products

•Merchant acquisition and processing, servicing and settlement, fraud prevention, and point-of-sale marketing and information products and services

•Network services

•Travel and lifestyle services

•Expense management products and services

•Other services, such as the design and operation of customer loyalty programs

These products and services are offered through various channels, including mobile and online applications, affiliate marketing, customer referral programs, third-party service providers and business partners, in-house sales teams, direct mail, telephone and direct response advertising.

We were founded in 1850 as a joint stock association and were incorporated in 1965 as a New York corporation. American Express Company and its principal operating subsidiary, American Express Travel Related Services Company, Inc. (TRS), are bank holding companies under the Bank Holding Company Act of 1956, as amended (the BHC Act), subject to supervision and examination by The Board of Governors of the Federal Reserve System (the Federal Reserve).

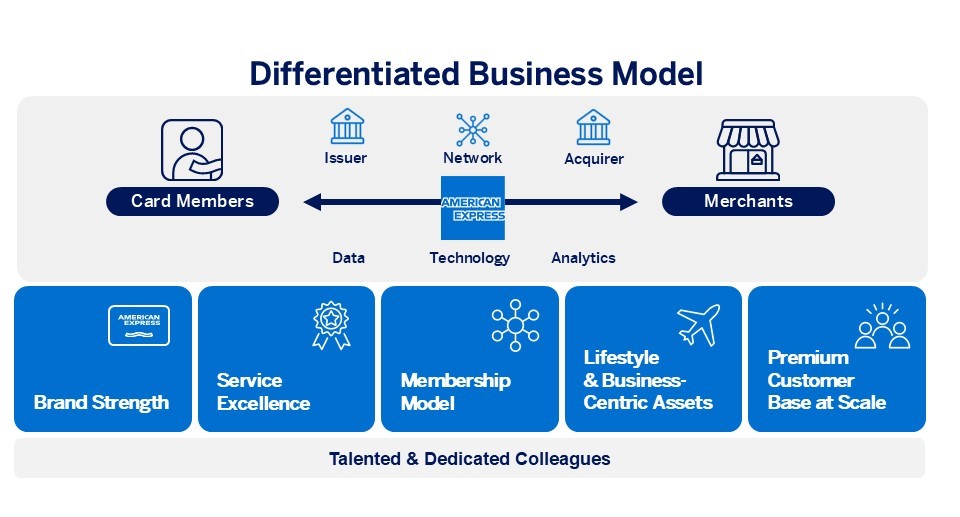

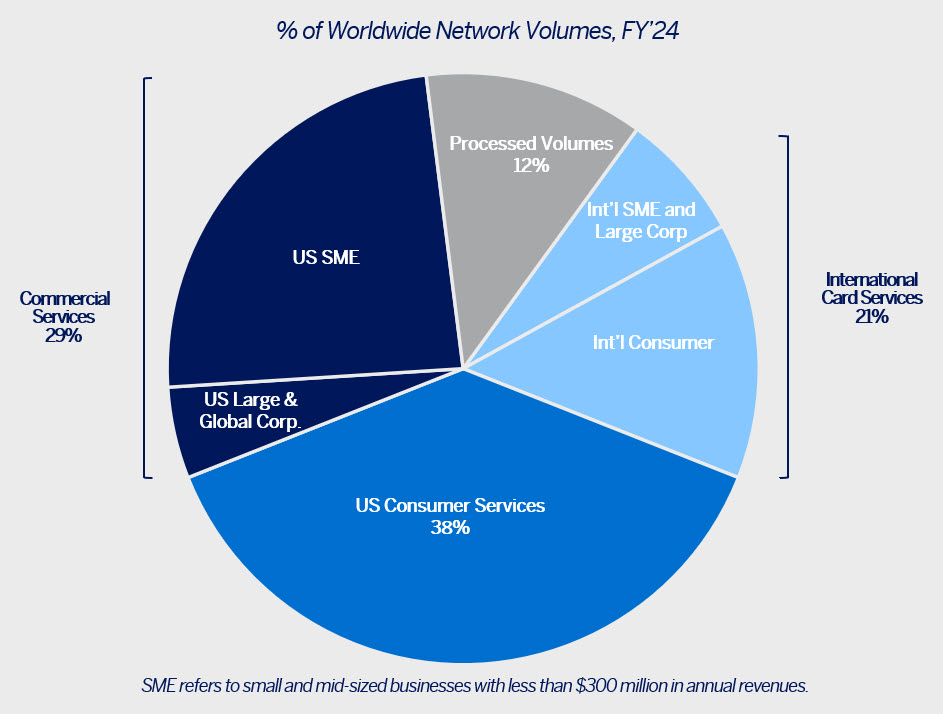

We principally engage in businesses comprising four reportable operating segments: U.S. Consumer Services (USCS), Commercial Services (CS), International Card Services (ICS) and Global Merchant and Network Services (GMNS). Corporate functions and certain other businesses are included in Corporate & Other. Our businesses function together to form our end-to-end integrated payments platform, which we believe is a differentiator that underpins our business model. For further information about our reportable operating segments, see “Business Segment Results of Operations” under “MD&A.”

Our Integrated Payments Platform and Technology

Through our card-issuing, merchant-acquiring and card network businesses, we are able to connect participants and provide differentiated value across the commerce path. We maintain direct relationships with Card Members (as a card issuer) and merchants (as an acquirer), which provides us with access to information at both ends of the card transaction, distinguishing our integrated payments platform from the bankcard networks. Through contractual relationships, we also obtain information from third-party card issuers, merchant acquirers, aggregators and processors with whom we do business.

Our integrated payments platform and the systems and infrastructure that underlie it provide us with data and analytics, while maintaining our commitment to respect Card Member preferences and protect Card Member and merchant data in compliance with applicable policies and legal requirements. Our models and analytical tools help us reduce fraud and underwrite risk, such as in determinations regarding the extension of credit. We also leverage our technology to provide differentiated value to customers, such as special offers and benefits to Card Members and targeted marketing and other information services for merchants and partners, as well as to develop and improve our service capabilities to continue to deliver a high-quality customer experience.

Card Issuing Businesses

We are a leader in providing general purpose credit and charge cards to consumers, small businesses, mid-sized companies and large corporations. We offer a broad set of card products, rewards and services to this premium consumer and broad commercial customer base, in the United States and internationally, through our USCS, CS and ICS reportable operating segments. We focus on differentiating American Express Membership through premium products, lifestyle services for consumers and business-centric solutions for our commercial customers, and benefits for our Card Members that we co-create and co-fund with our business partners. We believe the many benefits that come with American Express Membership build a strong, emotional connection with our brand across generations and geographies.

We acquire and retain high-spending, engaged and creditworthy Card Members by:

•Designing innovative credit, charge and debit card products and payment and lending solutions that appeal to our target customer base and meet their spending and borrowing needs

•Using incentives to drive spending on our various card products and increase customer engagement, including our Membership Rewards® and Amex Offers™ programs, cash-back reward features, statement credits for purchases with partners, interest rates offered on deposits and participation in loyalty programs sponsored by our cobrand and other partners

•Providing digital and mobile services and an array of benefits and experiences across card products, such as lounge access, dining experiences and other travel and lifestyle benefits

•Creating world-class service experiences by delivering exceptional customer care

•Developing a wide range of partner relationships, including designing, cobranding and distributing certain of our cards and providing benefits and services to our Card Members

We have a number of products that complement our card products, such as our business checking and consumer rewards checking account products, expense management and business-to-business (B2B) payment products and other non-card payment and financing products. Our complementary products also include digital capabilities, such as our Business Blueprint digital cash flow management hub and our Resy® dining platform, which we are enhancing through our acquisitions in 2024 of Tock, a reservation, table and event management technology provider and Rooam, a technology company that powers systems used by restaurants and entertainment venues.

We are focused on enhancing the value propositions of our products to increase engagement with existing customers and attract new customers, including Millennial and Gen Z consumers as well as customers internationally. Jurisdictions that represent a significant portion of our billed business outside of the United States include the United Kingdom (UK), the European Union (EU), Australia, Japan, Canada and Mexico.

For the year ended December 31, 2024, worldwide billed business (spending on American Express cards issued by us) was $1,551 billion and as of December 31, 2024, we had 83.6 million proprietary cards-in-force worldwide.

Merchant Acquiring Business

Our GMNS reportable operating segment builds and manages relationships with millions of merchants around the world that choose to accept American Express cards. This includes signing new merchants to accept our cards, agreeing on the discount rate (a fee charged to the merchant for accepting our cards) and handling servicing for merchants. We also build and maintain relationships with merchant acquirers, aggregators and processors to manage aspects of our merchant services business. For example, through our OptBlue® merchant-acquiring program, third-party processors contract directly with small merchants for card acceptance on our network and determine merchant pricing. We continue to grow merchant acceptance of American Express cards around the world and work with merchant partners so that our Card Members are warmly welcomed and encouraged to spend in the millions of places where their American Express cards are accepted. We also seek to drive greater usage of the American Express network by deepening merchant engagement and increasing Card Member awareness through initiatives such as our Shop Small® campaigns and expanding our payment options such as through debit and B2B capabilities.

GMNS also provides fraud-prevention tools, marketing solutions, data analytics and other programs and services to merchants and other partners that leverage the capabilities of our integrated payments platform.

Card Network Business

We operate a payments network through which we establish and maintain relationships with third-party banks and other institutions in approximately 120 countries and territories, licensing the American Express brand and extending the reach of our global network. These network partners are licensed to issue local currency American Express-branded cards in their countries and/or serve as the merchant acquirer for local merchants on our network.

For the year ended December 31, 2024, worldwide network services processed volume (spending on American Express cards issued by third parties) was $213.9 billion and as of December 31, 2024, we had 62.8 million cards-in-force issued by third parties worldwide.

Diverse Customer Base and Global Footprint

The following chart provides a summary of our diverse set of customers and broad geographic footprint based on worldwide network volumes:

Partners and Relationships

Our integrated payments platform allows us to work with a range of business partners, and our partners in return help drive the scale and relevance of the platform.

There are many examples of how we work with partners, including: issuing cards under cobrand arrangements with other corporations and institutions (e.g., Delta Air Lines (Delta), Hilton Worldwide Holdings, Marriott International and British Airways); providing greater value to our Card Members (e.g., Amex Offers and statement credits for purchases with partners); offering innovative ways for our Card Members to earn and use points with our merchants (e.g., Pay with Points at Amazon.com); expanding merchant acceptance with third-party acquirers and processors (e.g., OptBlue partners); operating through joint ventures in certain jurisdictions (e.g., in China, the Middle East and Switzerland); developing new capabilities and features with our digital partners (e.g., PayPal and i2c); enhancing our travel benefits and services (e.g., Fine Hotels and Resorts®); and providing experiences and entertainment for Card Members (e.g., via Formula 1 and AEG Worldwide). We also have an ownership position in, and commercial arrangements with, Global Business Travel Group, Inc. (GBTG), which provides business travel-related services.

Delta is our largest strategic partner. Our relationships with, and revenues and expenses related to, Delta are significant and represent an important source of value for our Card Members. We issue cards under cobrand arrangements with Delta and the Delta cobrand portfolio continued to represent approximately 12 percent of worldwide billed business and approximately 21 percent of worldwide Card Member loans as of December 31, 2024. The Delta cobrand portfolio generates fee revenue and interest income from Card Members and discount revenue from Delta and other merchants for spending on Delta cobrand cards. The current Delta cobrand agreement runs through the end of 2029 and we expect to continue to make significant investments in this partnership. Among other things, Delta is also a key participant in our Membership Rewards program, provides travel-related benefits and services, including airport lounge access for certain American Express Card Members, accepts American Express cards as a merchant and is a corporate payments customer.

Working with all of our partners, we seek to provide value, choice and unique experiences across our customer base.

Our Spend-Centric Model and Revenue Mix

Our “spend-centric” business model focuses on generating revenues primarily by driving spending on our cards and secondarily through finance charges and fees. Spending on our cards, which is higher on average on a per-card basis versus our network competitors, offers superior value to merchants in the form of loyal customers and larger transactions, and attracts partners to provide value to our Card Members and merchants. Because of the revenues generated from having high-spending Card Members and the annual card fees we charge on many of our products, we are able to invest in attractive rewards and other benefits for Card Members, as well as targeted marketing and other programs and investments for merchants. This creates incentives for Card Members to spend more on their cards and positively differentiates American Express cards.

We believe our spend-centric model gives us the ability to provide differentiated value to Card Members, merchants and business partners.

The American Express Brand and Service Excellence

Our brand and its attributes—trust, security and service—are key assets. We invest heavily in managing, marketing, promoting and protecting our brand, including through the delivery of our products and services in a manner consistent with our brand promise. The American Express brand is ranked among the most valuable brands in the world. We place significant importance on trademarks, service marks and patents, and seek to secure our intellectual property rights around the world.

We aim to provide the world’s best customer experience every day and our reputation for world-class service has been recognized by numerous awards over the years. Our customer care professionals, travel consultants and partners treat servicing interactions as an opportunity to bring the brand to life for our customers, add meaningful value and deepen relationships.

Our Business Strategies

We seek to grow our business by focusing on four strategic imperatives:

First, we aim to expand our leadership in the premium consumer space by continuing to deliver membership benefits that span our customers’ everyday spending, borrowing, travel and lifestyle needs, expanding our roster of business partners around the globe and developing a range of experiences that attract high-spending customers.

Second, we seek to build on our strong position in commercial payments by evolving our card value propositions, further differentiating our corporate card and accounts payable expense management solutions and designing innovative products and features, including financing, banking and payment solutions for our business customers.

Third, we are focused on strengthening our global, integrated network by continuing to increase merchant acceptance, providing merchants with fraud protection services, marketing insights and connections to higher-spending Card Members and working with our network partners to offer expanded products and services.

Finally, we want to continue to build on our unique global position, seeking ways to use our differentiated business model and global presence as we progress against our other strategic imperatives.

We have completed the environmental, social and governance goals under our 2021–2024 strategy, other than our continued work in support of Small Business Saturday and other Shop Small campaigns that will progress in 2025 and beyond. We are reviewing our approach on these topics as mandatory reporting requirements evolve globally.

Our Colleagues

Our colleagues are integral to executing our business strategies and to our overall success. As of December 31, 2024, we employed approximately 75,100 people, whom we refer to as colleagues, with approximately 25,800 colleagues in the United States and approximately 49,300 colleagues outside the United States. As of December 31, 2024, women represented 52.6 percent of our global workforce; Asian, Black/African American and Hispanic/Latino/a people represented 22.4 percent, 14.2 percent and 14.5 percent, respectively, of our U.S. workforce based on preliminary data for our 2024 U.S. EEO-1 submission; and 55 percent of our Executive Committee were women or from diverse races and ethnic backgrounds.

We believe that maintaining our strong workplace culture, adhering to our Blue Box values and ensuring that our people feel included, valued, recognized and backed helps us attract, retain and develop the right talent for American Express’ success. We conduct an annual Colleague Experience Survey and in 2024, 90 percent of colleagues who participated in the survey said they would recommend American Express as a great place to work.

We strive to offer a compelling colleague value proposition, which represents the many ways in which we support our colleagues to be and deliver their best. In 2024, we continued to invest in our colleagues, building on a wide range of learning and development opportunities and enhancing our competitive benefits in key areas including total compensation and holistic health and wellness.

We continuously invest in programs, benefits and resources to foster the personal and professional growth of our colleagues. We start with opportunities for colleagues to learn on the job, build cross-functional skills and grow in their careers through a defined, collaborative process for performance management. Colleagues have access to a wide variety of resources: career coaching, mentoring, professional networking, and rotation opportunities, as well as courses on-demand and with classroom-style instruction.

We aim to provide our colleagues with competitive compensation and leading benefits and take a holistic approach to well-being, providing resources that address the physical, financial and mental health of our colleagues. Our financial well-being program, Smart Saving, provides tools and resources to help colleagues build their knowledge and skills for all life stages. We support our colleagues’ physical health and well-being through our corporate wellness program, Healthy Living and we provide resources and support to increase awareness about mental health among our colleagues through our Healthy Minds Program. We also have policies and processes in place to help ensure we compensate colleagues fairly and equitably. We review our compensation practices regularly and have conducted an annual pay equity review since 2017, assessing pay on a statistical basis and considering key factors known to affect compensation, such as role, level, tenure, performance and geography. In 2024, we maintained 100 percent pay equity, meaning no statistical differences in pay, for colleagues across genders globally and across races and ethnicities in the United States.

Information About Our Executive Officers

Set forth below, in alphabetical order, is a list of our executive officers as of February 7, 2025, including each executive officer’s principal occupation and employment during the past five years. None of our executive officers has any family relationship with any other executive officer, and none of our executive officers became an officer pursuant to any arrangement or understanding with any other person. Each executive officer has been elected to serve until the next annual election of officers or until his or her successor is elected and qualified. Each officer’s age is indicated by the number in parentheses next to his or her name.

| | | | | |

| DOUGLAS E. BUCKMINSTER — | Vice Chairman |

| Mr. Buckminster (64) has been Vice Chairman since April 2021. Prior thereto, he had been Group President, Global Consumer Services Group since February 2018. |

| |

| HOWARD GROSFIELD — | Group President, U.S. Consumer Services |

| Mr. Grosfield (56) has been Group President, U.S. Consumer Services since February 2025. Prior thereto, he had been President, U.S. Consumer Services since May 2022, Executive Vice President and General Manager of U.S. Consumer Marketing and Global Premium Services since February 2021 and Executive Vice President and General Manager of U.S. Consumer Marketing Services from January 2016 to February 2021. |

| |

| MONIQUE HERENA — | Chief Colleague Experience Officer |

| Ms. Herena (53) has been Chief Colleague Experience Officer since April 2019. |

| |

| RAYMOND JOABAR — | Group President, Global Commercial Services |

| Mr. Joabar (59) has been Group President, Global Commercial Services since February 2025. Prior thereto, he had been Group President, Global Merchant and Network Services since April 2021 and President, Global Risk and Compliance and Chief Risk Officer since September 2019. |

|

| CHRISTOPHE Y. LE CAILLEC — | Chief Financial Officer |

| Mr. Le Caillec (59) has been Chief Financial Officer (CFO) since August 2023. Prior thereto, he had been Deputy CFO since December 2021 and Head of Corporate Planning since February 2019. |

| |

| RAFAEL MARQUEZ — | President, International Card Services |

| Mr. Marquez (53) has been President, International Card Services since May 2022. Prior thereto, he had been President, International Consumer Services and Global Loyalty Coalition since September 2019. |

| |

| ANNA MARRS — | Group President, Global Merchant and Network Services |

| Ms. Marrs (51) has been Group President, Global Merchant and Network Services since February 2025. Prior thereto, she had been Group President, Global Commercial Services and Credit & Fraud Risk since April 2021 and President, Global Commercial Services since September 2018. |

| |

| GLENDA MCNEAL — | Chief Partner Officer |

| Ms. McNeal (64) has been Chief Partner Officer since February 2024. Prior thereto, she had been President, Enterprise Strategic Partnerships since March 2017. |

| |

| DENISE PICKETT — | President, Enterprise Shared Services |

| Ms. Pickett (59) has been President, Enterprise Shared Services since February 2025. Prior thereto, she had been President, Global Services Group since September 2019. |

| |

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| |

| |

|

| | | | | |

| RAVI RADHAKRISHNAN — | Chief Information Officer |

| Mr. Radhakrishnan (53) has been Chief Information Officer since January 2022. Mr. Radhakrishnan joined American Express from Wells Fargo & Company, where he served as Chief Information Officer for the Commercial Banking and Corporate & Investment Banking businesses since May 2020. Prior thereto, he had been Chief Information Officer, Wholesale, Wealth & Investment Management and Innovation from May 2019 to May 2020. |

| |

| ELIZABETH RUTLEDGE — | Chief Marketing Officer |

| Ms. Rutledge (63) has been Chief Marketing Officer since February 2018. |

| |

| LAUREEN E. SEEGER — | Chief Legal Officer |

| Ms. Seeger (63) has been Chief Legal Officer since July 2014. |

| |

| JENNIFER SKYLER — | Chief Corporate Affairs Officer |

| Ms. Skyler (48) has been Chief Corporate Affairs Officer since October 2019. |

| |

| STEPHEN J. SQUERI — | Chairman and Chief Executive Officer |

| Mr. Squeri (65) has been Chairman and Chief Executive Officer since February 2018. |

| |

| DOUGLAS TABISH — | Chief Risk Officer |

| Mr. Tabish (55) has been Chief Risk Officer since April 2024. Prior thereto, he had been Executive Vice President and General Manager of Global Card & Risk Operations since January 2020. |

COMPETITION

We compete in the global payments industry with networks, issuers, acquirers and other payment service providers and methods of payment, including paper-based transactions (e.g., cash and checks) and electronic transfers (e.g., wire transfers and Automated Clearing House (ACH)), as well as evolving and growing alternative mechanisms, systems and products that leverage new technologies, business models and customer relationships to create payment, financing or banking solutions. The payments industry continues to undergo dynamic changes in response to evolving technologies, consumer habits and merchant needs.

As a card issuer, we compete with financial institutions that issue general-purpose credit and debit cards, as well as businesses that issue private label cards, operate mobile wallets, provide payment services or extend credit. We face intense competition in the premium space and for cobrand relationships, as both card issuer and network competitors have targeted high-spending customers and key business partners with attractive value propositions. We also face competition for partners and other differentiated offerings, such as lounge space in U.S. and global hub airports, dining and event reservation and operational capabilities and other experiential offerings to customers. Our banking products also face strong competition, such as with respect to the rates offered on deposits.

Our global card network competes in the global payments industry with other card networks, including, among others, Visa, China UnionPay, Mastercard, JCB, Discover and Diners Club International (which is owned by Discover). We are the fourth largest general-purpose card network globally based on purchase volume, behind Visa, China UnionPay and Mastercard. In addition to such networks, we compete against a range of companies globally, including merchant acquirers, processors and web- and mobile-based payment platforms (e.g., Alipay, PayPal and Shop Pay), as well as regional payment networks (such as the National Payments Corporation of India).

The principal competitive factors that affect card-issuing, merchant and network businesses include:

•The features, value and quality of the products and services, including customer care, rewards programs and offers, partnerships, travel and lifestyle-related benefits (including lounges, dining and other entertainment), banking services and digital and mobile services, as well as the costs associated with providing such features and services

•Reputation and brand recognition

•The number, spending characteristics and credit performance of customers

•The quantity, diversity and quality of the establishments where the cards can be used

•The attractiveness of the value proposition to card issuers, merchant acquirers, third-party processors, cardholders, corporate clients, merchants and other payment intermediaries (including the relative cost and ease of using or accepting the products and services, and capabilities such as fraud prevention and data analytics)

•The number, quality and cost of other cards and other forms of payment and financing available to customers, as well as the integration and connectivity of those products

•The security of cardholder, merchant and network partner information

•The success of marketing and promotional campaigns

•The speed of innovation and investment in systems, technologies and product and service offerings

•The nature and quality of expense management tools, electronic payment methods and data capture and reporting capabilities, particularly for business customers

Another aspect of competition is the dynamic and rapid growth of alternative payment and financing mechanisms, systems and products, which include payment facilitators and aggregators, digital payment, open banking and electronic wallet platforms, point-of-sale lenders and buy now, pay later products, real-time settlement and processing systems, financial technology companies, digital currencies developed by both central banks and the private sector, blockchain and similar distributed ledger technologies, prepaid systems and gift cards, and systems linked to customer accounts or that provide payment solutions. The integration of new or evolving technologies, such as generative artificial intelligence, has the potential to create new or better competitor products, alter the competitive environment and disintermediate our relationship with customers. Additionally, various competitors are integrating more financial services into their product offerings and competitors are seeking to attain the benefits of an integrated payments platform, such as ours.

In addition to the discussion in this section, see “Our operating results may materially suffer because of substantial and increasingly intense competition worldwide in the payments industry” under “Risk Factors” for further discussion of the potential impact of competition on our business, and “Our business is subject to evolving and comprehensive government regulation and supervision, which could materially adversely affect our results of operations and financial condition” and “Legal proceedings regarding provisions in our merchant contracts, including non-discrimination and honor-all-cards provisions, could have a material adverse effect on our business and result in additional litigation and/or arbitrations, changes to our merchant agreements and/or business practices, substantial monetary damages and damage to our reputation and brand” under “Risk Factors” for a discussion of the potential impact on our ability to compete effectively due to government regulations or if ongoing legal proceedings limit our ability to prevent merchants from engaging in various actions to discriminate against our card products.

SUPERVISION AND REGULATION

Overview

We are subject to evolving and extensive government regulation and supervision in jurisdictions around the world, and the costs of ongoing compliance are substantial. The financial services industry is subject to rigorous scrutiny, high regulatory expectations, a range of regulations and a stringent and unpredictable enforcement environment.

Governmental authorities have focused, and we believe will continue to focus, considerable attention on reviewing compliance by financial services firms and payment systems with laws and regulations, and as a result, we continually work to evolve and improve our risk management framework, governance structures, practices and procedures. Reviews by us and governmental authorities to assess compliance with laws and regulations, as well as our own internal reviews to assess compliance with internal policies, including errors or misconduct by colleagues or third parties or control failures, have resulted in, and are likely to continue to result in, changes to our products, practices and procedures, restitution to our customers and increased costs related to regulatory oversight, supervision and examination. We have also been subject to regulatory actions and may continue to be the subject of such actions, including governmental inquiries, investigations, enforcement proceedings and the imposition of fines or civil money penalties, in the event of noncompliance or alleged noncompliance with laws or regulations. For example, as previously disclosed, we entered into agreements to resolve governmental investigations related to historical sales practices for certain U.S. small business customers, which are described in more detail in Note 12 to the “Consolidated Financial Statements.” In addition, various regulatory agencies have announced they are reviewing credit card rewards programs for compliance with consumer protection laws and regulations. We have identified certain issues related to the rewards and benefits we provide including, as previously disclosed, that certain U.S. Card Members were not credited certain Membership Rewards points they had earned. We have taken actions to remediate these issues and enhance our related procedures and controls. We are cooperating with ongoing regulatory inquiries concerning our rewards and benefits programs.

Policymakers around the world continue to propose and adopt new and increasingly complex laws and regulations governing a wide variety of issues that may impact our business or change our operating environment in substantial and unpredictable ways. For example, legislators and regulators in various countries in which we operate have focused on the offering of consumer financial products and the operation of payment networks, resulting in changes to certain practices or pricing of card issuers, merchant acquirers and payment networks, and, in some cases, the establishment of broad and ongoing regulatory oversight regimes.

The following discussion summarizes elements of the extensive regulatory environment in which we operate; it does not purport to be complete or to describe all of the laws or regulations to which we are subject or all possible or proposed changes in laws or regulations that may become applicable to us. See “Operational and Compliance/Legal Risks” under “Risk Factors” for a discussion of the potential impact that changes in applicable law or regulation, and in their interpretation and application by regulatory agencies and other governmental authorities, may have on our business, results of operations and financial condition.

Banking Regulation

American Express entities are subject to banking regulation in the United States and in certain jurisdictions internationally. U.S. federal and state banking laws, regulations and policies extensively regulate the Company, TRS and our U.S. bank subsidiary, American Express National Bank (AENB). For purposes of this Supervision and Regulation section, the “Company” refers only to American Express Company, a bank holding company, and does not include its subsidiaries. Both the Company and TRS are subject to comprehensive consolidated supervision, regulation and examination by the Federal Reserve and AENB is supervised, regulated and examined by the Office of the Comptroller of the Currency (OCC). The Company and its subsidiaries are also subject to the rulemaking, enforcement and examination authority of the Consumer Financial Protection Bureau (CFPB). Banking regulators have broad examination and enforcement powers, including the power to impose substantial fines, limit dividends and other capital distributions, restrict operations and acquisitions and require divestitures, any of which could compromise our competitive position. Many aspects of our business also are subject to rigorous regulation by other U.S. federal and state regulatory agencies and by non-U.S. government agencies and regulatory bodies. For example, non-U.S. regulators supervising our international regulated financial institutions use many of the same principles of regulation and supervision that are used by U.S. federal bank regulators.

Activities

The BHC Act generally limits bank holding companies to activities that are considered to be banking activities and certain closely related activities. As noted above, each of the Company and TRS is a bank holding company and each has elected to become a financial holding company, which is authorized to engage in a broader range of financial and related activities. In order to remain eligible for financial holding company status, the Company and TRS must meet certain eligibility requirements. Those requirements include that each of the Company and AENB must be “well capitalized” and “well managed,” and AENB must have received at least a “satisfactory” rating on its most recent assessment under the Community Reinvestment Act of 1977 (the CRA). The Company, TRS and their subsidiaries engage in various activities permissible only for financial holding companies, including, in particular, providing travel agency services, acting as a finder and engaging in certain insurance underwriting and agency services. If the Company fails to meet eligibility requirements for financial holding company status, it and its subsidiaries are likely to be barred from engaging in new types of financial activities or making certain types of acquisitions or investments in reliance on its status as a financial holding company, and ultimately could be required to either discontinue the broader range of activities permitted to financial holding companies or divest AENB. In addition, the Company and its subsidiaries are prohibited by law from engaging in practices that regulatory authorities deem unsafe or unsound (which such authorities generally interpret broadly) and regulatory authorities have discretion in determining whether new or modified activities can be conducted in a safe and sound manner.

Acquisitions and Investments

Applicable federal and state laws place limitations on the ability of persons to invest in or acquire control of us without providing notice to or obtaining the approval of one or more of our regulators. In addition, we are subject to banking laws and regulations that limit our investments and acquisitions and, in some cases, subject them to the prior review and approval of our regulators, including the Federal Reserve and the OCC. Federal banking regulators have broad discretion in evaluating proposed acquisitions and investments that are subject to their prior review or approval.

Enhanced Prudential Standards

The Company is subject to the U.S. federal bank regulatory agencies’ rules that tailor the application of enhanced prudential standards to bank holding companies and depository institutions with $100 billion or more in total consolidated assets. Under these rules, each such bank holding company is assigned to one of four categories based on its status as a U.S. global systemically important banking organization and five other risk-based indicators: (i) total assets, (ii) cross-jurisdictional activity, (iii) non-bank assets, (iv) off-balance sheet exposure, and (v) weighted short-term wholesale funding, with the most stringent requirements applying to Category I firms and the least stringent requirements applying to Category IV firms. Under these rules, the Company became a Category III firm in the third quarter of 2024 as a result of the Company’s total consolidated assets exceeding $250 billion, calculated based on a daily average of total consolidated assets for the four quarters ended June 30, 2024. Category III firms are subject to heightened capital, liquidity and prudential requirements, single-counterparty credit limits and additional stress tests, which in some cases are subject to a transition period. AENB, as a depository institution subsidiary of a Category III firm, is also subject to certain enhanced prudential standards under these tailoring rules as described below.

Further changes in the levels of risk-based indicators described above, such as if we have $75 billion or more in cross-jurisdictional activity (based on a four-quarter trailing average), could result in the Company becoming a Category II firm and subject to more stringent capital, liquidity and prudential requirements. Our cross-jurisdictional activity was $66 billion as of December 31, 2024, and the four-quarter trailing average was $67 billion.

Capital and Liquidity Regulation

Capital Rules

The Company and AENB are required to comply with the applicable capital adequacy rules established by federal banking regulators. These rules are intended to ensure that bank holding companies and depository institutions (collectively, banking organizations) have adequate capital given their level of assets and off-balance sheet obligations. The federal banking regulators’ current capital rules (the Capital Rules) implement the Basel Committee on Banking Supervision’s framework for strengthening international capital regulation, known as Basel III. For additional information regarding our capital ratios, see “Consolidated Capital Resources and Liquidity” under “MD&A.”

Under the Capital Rules, banking organizations are required to maintain minimum ratios for Common Equity Tier 1 (CET1 capital), Tier 1 capital (that is, CET1 capital plus additional Tier 1 capital) and Total capital (that is, Tier 1 capital plus Tier 2 capital) to risk-weighted assets. We report our capital adequacy ratios using risk-weighted assets calculated under the standardized approach. Category III firms such as the Company are not subject to the advanced approaches capital requirements, whereas Category II firms are subject to the advanced approaches capital requirements under current capital rules, which introduce additional complexities in the methodologies used to calculate risk-weighted assets for purposes of determining capital adequacy ratios.

On July 27, 2023, the U.S. federal bank regulatory agencies issued a notice of proposed rulemaking that would significantly revise U.S. regulatory capital requirements for large banking organizations, including the Company and AENB. The proposed rules would apply a new expanded risk-based approach to calculating risk-based capital ratios, and large banking organizations would be required to calculate their risk-based capital ratios under both (i) the standardized approach and (ii) the expanded risk-based approach and use the lower of the two ratio calculations to determine binding capital constraints under each risk-based capital ratio. The expanded risk-based approach to calculating risk-weighted assets would apply more granular risk-weighting methodologies for credit risk, include a new standardized methodology for operational risk, include new approaches for calculating market and credit valuation adjustment risk and revise the treatment of equity exposures not subject to market risk capital requirements. The new approach to calculating market risk also would apply to calculations under the standardized approach. The methodology for operational risk would include differential treatment of fee and other non-interest revenues as compared to interest income for purposes of determining operational risk-weighted assets. The proposed rules would also include additional credit risk capital requirements for certain “unconditionally cancellable commitments” such as unused portions of committed lines of credit (e.g., credit cards) and would create a proxy methodology to assign capital requirements to credit exposure on products that carry no pre-set spending limits such as charge cards. The Federal Reserve has issued public statements indicating that it intends to work with other U.S. federal bank regulatory agencies on a revised proposal; however, any future rulemaking with respect to Basel III standards remains uncertain. The ultimate impact of any such rulemaking will depend on a number of factors, including the content of the final rulemaking, future minimum regulatory requirements and management decisions regarding our product constructs, capital distributions and target capital levels, and such rulemaking could result in significantly higher regulatory capital requirements for the Company and AENB.

The Company and AENB must each maintain CET1 capital, Tier 1 capital and Total capital ratios of at least 4.5 percent, 6.0 percent and 8.0 percent, respectively. On top of these minimum capital ratios, the Company is subject to a dynamic stress capital buffer (SCB) composed entirely of CET1 capital with a floor of 2.5 percent and AENB is subject to a static 2.5 percent capital conservation buffer (CCB). The SCB equals (i) the difference between a bank holding company’s starting and minimum projected CET1 capital ratios under the supervisory severely adverse scenario under the Federal Reserve’s stress tests described below, plus (ii) one year of planned common stock dividends as a percentage of risk-weighted assets. As a Category III firm, the required minimum capital ratios for the Company may be further increased by a countercyclical capital buffer of up to an additional 2.5 percent of risk-weighted assets, if enacted by the Federal Reserve, which must be held in the form of CET1 capital. The countercyclical capital buffer is currently set at zero percent; however it could change in the future. If the Federal Reserve were to raise the countercyclical capital buffer, covered banking organizations such as the Company would generally have 12 months after the announcement of such increase to meet the increased buffer requirement, unless the Federal Reserve sets an earlier effective date.

On August 28, 2024, the Federal Reserve confirmed the SCB for the Company of 2.5 percent, which remained unchanged from the level announced in July 2023. As a result, the effective minimum ratios for the Company (taking into account the SCB requirement) and AENB (taking into account the CCB requirement) are 7.0 percent, 8.5 percent and 10.5 percent for the CET1 capital, Tier 1 capital and Total capital ratios, respectively. Banking organizations with ratios of CET1 capital, Tier 1 capital or Total capital to risk-weighted assets below these effective minimum ratios face constraints on discretionary distributions such as dividends, repurchases and redemptions of capital securities and executive compensation. A bank holding company’s SCB requirement is effective on October 1 of each year and will remain in effect through September 30 of the following year unless it is reset in connection with resubmission of a capital plan, as discussed below.

The Company is also required to comply with minimum leverage ratio requirements. The leverage ratio is the ratio of a banking organization’s Tier 1 capital to its average total consolidated assets (as defined for regulatory purposes). The Company is also subject to a minimum supplementary leverage ratio, which is the ratio of Tier 1 capital to an expanded concept of leverage exposure that takes into account both on‐balance sheet assets and certain off‐balance sheet exposures. All banking organizations are required to maintain a leverage ratio of at least 4.0 percent, and Category III banking organizations such as the Company are required to maintain a minimum supplementary leverage ratio of 3.0 percent.

Liquidity Regulation

The Company and AENB are subject to two standards for liquidity risk supervision as implemented by the Federal Reserve and OCC: the minimum liquidity coverage ratio (LCR) and the net stable funding ratio (NSFR). The LCR is designed to ensure that a banking entity maintains an adequate level of unencumbered high-quality liquid assets to meet its liquidity needs for a 30-day time horizon under an acute liquidity stress scenario specified by supervisors. The LCR measures the ratio of a firm’s high-quality liquid assets to its projected net outflows. The NSFR requires a minimum amount of longer-term funding sources based on the assets, commitments and derivative exposures of banking entities. As a Category III firm with less than $75 billion in weighted short-term wholesale funding, the Company, and its depository institution subsidiary, AENB, are subject to LCR and NSFR requirements at 85 percent of the full requirements. The Company and AENB are required to calculate the LCR and NSFR on a daily basis and the Company is required to make public disclosures related to its LCR on a quarterly basis and NSFR on a semi-annual basis, in each case, subject to applicable transition periods following the Company becoming a Category III firm. Category II firms and their depository institution subsidiaries are subject to the full requirements of the LCR and NSFR, as well as a requirement to submit a liquidity monitoring report on a daily (rather than monthly) basis.

In addition, the Federal Reserve’s enhanced prudential standards rule includes heightened liquidity and risk management requirements. The rule requires the maintenance of a liquidity buffer, consisting of highly liquid assets, that is sufficient to meet projected net outflows for 30 days over a range of liquidity stress scenarios. In contrast to the LCR, which is a standardized approach, the liquidity buffer requirement is calculated based on the Company’s own models.

Proposed Long-Term Debt Requirements

On August 29, 2023, the U.S. federal bank regulatory agencies issued a notice of proposed rulemaking that, if adopted as proposed, would require covered bank holding companies such as the Company to issue and maintain minimum amounts of eligible external long-term debt with specific terms for purposes of absorbing losses or recapitalizing the covered bank holding company and its operating subsidiaries. The notice of proposed rulemaking also proposed requiring certain insured depository institutions that have at least $100 billion in consolidated assets, such as AENB, to maintain minimum amounts of eligible internal long-term debt for purposes of absorbing losses or recapitalizing the insured depository institution.

Stress Testing and Capital Planning

Under the Federal Reserve’s regulations, the Company is subject to annual supervisory stress testing requirements and biennial company-run stress testing requirements (commonly referred to as Dodd-Frank Act Stress Tests or “DFASTs”) that are designed to evaluate whether a bank holding company has sufficient capital on a total consolidated basis to absorb losses and support operations under adverse economic conditions.

As part of the Comprehensive Capital Analysis and Review (CCAR), the Federal Reserve uses pro-forma capital positions and ratios under such stress scenarios to determine the size of the SCB for each CCAR participating firm. As a Category III firm, the Company is required to develop and submit to the Federal Reserve an annual capital plan and stress testing results on or before April 5 of each year.

The Company may be required to revise and resubmit its capital plan following certain events or developments, such as a significant acquisition or an event that could result in a material change in its risk profile or financial condition. If the Company is required to resubmit its capital plan, it must receive prior approval from the Federal Reserve for any capital distributions (including common stock dividend payments and share repurchases), other than a capital distribution on a newly issued capital instrument.

Dividends and Other Capital Distributions

The Company and TRS, as well as AENB and the Company’s insurance and other regulated subsidiaries, are limited in their ability to pay dividends by statutes, regulations and supervisory policy.

Common stock dividend payments and share repurchases by the Company are subject to the oversight of the Federal Reserve and the outcome of the annual CCAR stress testing exercise, as described above. The Company will be subject to limitations and restrictions on capital distributions if, among other things, (i) the Company’s regulatory capital ratios do not satisfy applicable minimum requirements and buffers or (ii) the Company is required to resubmit its capital plan.

In general, federal laws and regulations prohibit, without first obtaining the OCC’s approval, AENB from making dividend distributions to TRS, if such distributions are not paid out of available recent earnings or would cause AENB to fail to meet capital adequacy standards. In addition to specific limitations on the dividends AENB can pay to TRS, federal banking regulators have authority to prohibit or limit the payment of a dividend if, in the banking regulator’s opinion, payment of a dividend would constitute an unsafe or unsound practice in light of the financial condition of the institution.

Prompt Corrective Action

The Federal Deposit Insurance Act (FDIA) requires, among other things, that federal banking regulators take prompt corrective action in respect of depository institutions insured by the FDIC (such as AENB) that do not meet minimum capital requirements. The FDIA establishes five capital categories for FDIC-insured banks: well capitalized, adequately capitalized, undercapitalized, significantly undercapitalized and critically undercapitalized. The FDIA imposes progressively more restrictive constraints on operations, management and capital distributions, depending on the capital category in which an institution is classified. In order to be considered “well capitalized,” AENB must maintain CET1 capital, Tier 1 capital, Total capital and Tier 1 leverage ratios of 6.5 percent, 8.0 percent, 10.0 percent and 5.0 percent, respectively.

Under the FDIA, AENB could be prohibited from accepting brokered deposits (i.e., deposits raised through third-party brokerage networks) or offering interest rates on any deposits significantly higher than the prevailing rate in its normal market area or nationally (depending upon where the deposits are solicited), unless (1) it is well capitalized or (2) it is adequately capitalized and receives a waiver from the FDIC. A portion of our outstanding U.S. retail deposits are considered brokered deposits for bank regulatory purposes. If a federal regulator determines that we are in an unsafe or unsound condition or that we are engaging in unsafe or unsound banking practices, the regulator may reclassify our capital category or otherwise place restrictions on our ability to accept or solicit brokered deposits.

Resolution and Recovery Planning

Certain bank holding companies are required to submit resolution plans to the Federal Reserve and FDIC providing for the company’s strategy for rapid and orderly resolution in the event of its material financial distress or failure. As a Category III firm, the Company is required to submit a holding company resolution plan every three years, with submissions alternating between a full plan and a plan targeted on certain areas or subjects identified by the Federal Reserve and the FDIC. The Company’s next holding company resolution plan is required to be submitted by October 1, 2025. If the Federal Reserve and the FDIC determine that the Company’s plan is not credible and we fail to cure the deficiencies, we may be subject to more stringent capital, leverage or liquidity requirements; may be subject to more restrictions on our growth, activities or operations; or may ultimately be required to divest certain assets or operations to facilitate an orderly resolution.

AENB continues to be required to prepare and provide a separate resolution plan to the FDIC that would enable the FDIC, as receiver, to effectively resolve AENB under the FDIA in the event of failure. In June 2024, the FDIC issued a final rule revising its resolution plan requirements for insured depository institutions, which requires certain insured depository institutions with $100 billion or more in assets, including AENB, to submit full resolution plans every three years with interim supplements in non-submission years. Under the final rule, resolution plans are subject to more stringent standards with respect to their assumptions and content, as well as enhanced credibility standards for the FDIC’s evaluation of resolution plans and expanded expectations regarding engagement and capabilities testing. AENB will be required to submit its initial resolution plan under the final rule on or before July 1, 2026, with its initial interim supplement due on or before July 1, 2025.

In October 2024, the OCC issued final revisions to its recovery planning guidelines, which expand the recovery planning guidelines to apply to insured national banks with $100 billion or more in total consolidated assets, including AENB. The OCC’s recovery planning guidelines require a covered bank to develop, maintain and test a recovery plan that, among other things, identifies a range of options that could be undertaken by the covered bank to restore its financial strength and viability when it experiences considerable financial or operational stress, but has not deteriorated to the point that resolution is imminent. AENB will be required to develop a recovery plan by December 31, 2025 and test it by December 31, 2026, with testing then required periodically (but not less than annually) and following any significant changes to the recovery plan made in response to a material event.

Orderly Liquidation Authority

The Company could become subject to the Orderly Liquidation Authority (OLA), a resolution regime under which the Treasury Secretary may appoint the FDIC as receiver to liquidate a systemically important financial institution, if the Company is in danger of default and is determined to present a systemic risk to U.S. financial stability. As under the FDIC resolution model, under the OLA, the FDIC has broad power as receiver. Substantial differences exist, however, between the OLA and the U.S. Bankruptcy Code, including the right of the FDIC under the OLA to disregard the strict priority of creditor claims in limited circumstances, the use of an administrative claims procedure to determine creditor claims (as opposed to the judicial procedure used in bankruptcy proceedings), and the right of the FDIC to transfer claims to a “bridge” entity.

The FDIC has developed a strategy under OLA, referred to as the “single point of entry” or “SPOE” strategy, under which the FDIC would resolve a failed financial holding company by transferring its assets (including shares of its operating subsidiaries) and, potentially, very limited liabilities to a “bridge” holding company; utilize the resources of the failed financial holding company to recapitalize the operating subsidiaries; and satisfy the claims of unsecured creditors of the failed financial holding company and other claimants in the receivership by delivering securities of one or more new financial companies that would emerge from the bridge holding company. Under this strategy, management of the failed financial holding company would be replaced and its shareholders and creditors would bear the losses resulting from the failure.

FDIC Powers upon Insolvency of AENB

If the FDIC is appointed the conservator or receiver of AENB, the FDIC has the power to: (1) transfer any of AENB’s assets and liabilities to a new obligor without the approval of AENB’s creditors; (2) enforce the terms of AENB’s contracts pursuant to their terms; or (3) repudiate or disaffirm any contract or lease to which AENB is a party, the performance of which is determined by the FDIC to be burdensome and the disaffirmation or repudiation of which is determined by the FDIC to promote the orderly administration of AENB. In addition, the claims of holders of U.S. deposit liabilities and certain claims for administrative expenses of the FDIC against AENB would be afforded priority over other general unsecured claims against AENB, including claims of debt holders and depositors in non-U.S. offices, in the liquidation or other resolution of AENB. As a result, regardless of whether the FDIC ever sought to repudiate any debt obligations of AENB, the debt holders and depositors in non-U.S. offices would be treated differently from, and could receive substantially less, if anything, than the depositors in the U.S. offices of AENB.

Other Banking Regulations

Source of Strength

The Company is required to act as a source of financial and managerial strength to its U.S. bank subsidiary, AENB, and may be required to commit capital and financial resources to support AENB. Such support may be required at times when, absent this requirement, the Company otherwise might determine not to provide it. Capital loans by the Company to AENB are subordinate in right of payment to deposits and to certain other indebtedness of AENB. In the event of the Company’s bankruptcy, any commitment by the Company to a federal banking regulator to maintain the capital of AENB will be assumed by the bankruptcy trustee and entitled to a priority of payment.

Transactions Between AENB and its Affiliates

Certain transactions (including loans and credit extensions from AENB) between AENB and its affiliates (including the Company, TRS and their other subsidiaries) are subject to quantitative and qualitative limitations, collateral requirements and other restrictions imposed by statute and regulation. Transactions subject to these restrictions are generally required to be made on an arm’s-length basis.

FDIC Deposit Insurance and Insurance Assessments

AENB accepts deposits that are insured by the FDIC up to the applicable limits. Under the FDIA, the FDIC may terminate the insurance of an institution’s deposits upon a finding that the institution has engaged in unsafe or unsound practices; is in an unsafe or unsound condition to continue operations; or has violated any applicable law, regulation, rule, order or condition imposed by the FDIC. We do not know of any practice, condition or violation that would lead to termination of deposit insurance at AENB. The FDIC’s deposit insurance fund is funded by assessments on insured depository institutions, including AENB, which are subject to adjustment by the FDIC.

Community Reinvestment Act

AENB is subject to the CRA, which imposes affirmative, ongoing obligations on depository institutions to meet the credit needs of their local communities, including low- and moderate-income neighborhoods, consistent with the safe and sound operation of the institution. AENB is currently designated a “limited purpose bank” under CRA regulations. In October 2023, the U.S. federal bank regulatory agencies adopted a final rule that makes extensive revisions to the CRA regulatory framework, including to the definition of “limited purpose bank,” which could impact AENB and alter its CRA compliance obligations. In March 2024, a preliminary injunction was granted postponing the effectiveness of the final rule and the implementation dates until the resolution of litigation challenging the final rule; whether the final rule will ultimately be implemented and any related compliance deadlines remain uncertain.

Climate Risk Management

In October 2023, the U.S. federal bank regulatory agencies issued “Principles for Climate-Related Financial Risk Management for Large Financial Institutions.” The principles apply to financial institutions with more than $100 billion in total consolidated assets, like the Company and AENB, and are broadly designed to provide a high-level framework for the safe and sound management of exposures to climate-related financial risks consistent with existing U.S. federal bank regulatory agencies’ rules and guidance. The principles outline six key aspects of climate-related financial risk management: governance; policies, procedures and limits; strategic planning; risk management; data, risk measurement and reporting; and scenario analysis. In addition, the principles offer risk assessment guidance for incorporating climate-related financial risks in various traditional risk categories.

Consumer Financial Products Regulation

Our consumer-oriented activities are subject to regulation and supervision in the United States and internationally. In the United States, our marketing, sale and servicing of consumer financial products and our compliance with certain federal consumer financial laws are supervised and examined by the CFPB, which has broad rulemaking and enforcement authority over providers of credit, savings and payment services and products, and authority to prevent “unfair, deceptive or abusive” acts or practices. The CFPB has the authority to write regulations under federal consumer financial protection laws, to enforce those laws and to examine for compliance. It is also authorized to collect fines and require consumer restitution in the event of violations, engage in consumer financial education, track consumer complaints, request data and promote the availability of financial services to underserved consumers and communities. In addition, a number of U.S. states have significant consumer credit protection, disclosure and other laws (in certain cases more stringent than U.S. federal laws). U.S. federal law also regulates abusive debt collection practices, which, along with bankruptcy and debtor relief laws, can affect our ability to collect amounts owed to us or subject us to regulatory scrutiny.

The CFPB and other regulators have recently had a heightened focus on fees, rewards and other practices related to credit cards. For example, in March 2024, the CFPB issued a final rule lowering the safe harbor amount for credit card late fees that would be considered “reasonable and proportional” to the costs incurred by credit card issuers for late payments to eight dollars, eliminating a higher late fee safe harbor amount for subsequent late payments and eliminating the annual inflation adjustment for the safe harbor amount. In May 2024, a preliminary injunction was granted staying the effectiveness of the final rule; however, whether the final rule will ultimately be implemented remains uncertain. In addition, the CFPB and the U.S. Department of Transportation (DOT) have launched inquiries focused on credit card and airline rewards programs, with the CFPB issuing a circular to other agencies in December 2024 addressing the design, marketing and administration of credit card rewards programs.

In March 2023, the CFPB adopted a final rule requiring covered financial institutions, such as us, to collect and report data to the CFPB regarding certain small business credit applications. Based on our small business credit transaction volume, we will be required to comply with this rule by July 18, 2025 and begin reporting data to the CFPB by July 1, 2026.

In October 2024, the CFPB issued a final rule on personal financial data rights that requires financial institutions, including us, and other financial service providers (collectively referred to as data providers) to provide consumers and consumer-authorized third parties with access to consumers’ financial data in electronic form free of charge. At the earliest, for certain products, we will be required to comply with the rule beginning on April 1, 2026; however, the compliance timeline is subject to change due to the outcome of pending litigation challenging the rule. While the impact of the rule will depend upon a number of factors, including consumer behavior and the actions of data providers and recipients, open banking initiatives like this final rule have the potential to change the competitive landscape, presenting challenges to our business model, such as limiting advantages provided by our integrated payments platform, as well as opportunities since we may also act as an authorized third party and receive data from data providers.

We are also regulated in the United States under the “money transmitter” or “sale of check” laws in effect in most states. In addition, we are required by the laws of many states to comply with unclaimed and abandoned property laws, under which we must pay to states the face amount of any Travelers Cheque or prepaid card that is uncashed or unredeemed after a period of time depending on the type of product. Additionally, we are regulated under insurance laws in the United States and other countries where we offer insurance services. Our merchant acquiring business, and the third-party merchant acquirers, aggregators and processors with whom we have relationships, are also subject to certain aspects of regulation under consumer protection laws, such as by the Federal Trade Commission.

In countries outside the United States, regulators continue to focus on a number of key areas impacting our card-issuing businesses, particularly consumer protection (such as in the European Union (EU), the United Kingdom and Canada) and responsible lending (such as in Australia, Mexico, New Zealand and Singapore), with increasing importance on and attention to customers and outcomes rather than just ensuring compliance with local rules and regulations. For example, the Financial Conduct Authority’s Consumer Duty in the United Kingdom, among other things, requires firms to act to deliver “good outcomes” for retail customers with respect to products and services, price and value, consumer understanding and consumer support. Regulators’ expectations of firms in relation to their compliance, risk and control frameworks continue to increase and regulators are placing significant emphasis on a firm’s systems and controls relating to the identification and resolution of issues.

Payments Regulation

Legislators and regulators in various countries in which we operate have focused on the operation of card networks, including through enforcement actions, legislation and regulations to change certain practices or pricing of card issuers, merchant acquirers and payment networks, and, in some cases, to establish broad regulatory regimes for payment systems.

Pricing for card acceptance, including interchange fees (that is, the fee paid by the bankcard merchant acquirer to the card issuer in payment networks like Visa and Mastercard), has been a focus of legislators and regulators in Australia, Canada, the EU, the United States and other jurisdictions. Recently, certain states in the United States have passed or are considering laws prohibiting interchange from being charged on all or certain components of transactions, such as sales tax and gratuities. Jurisdictions have also sought to regulate various other aspects of network operations and contract terms and practices governing merchant card acceptance, including information associated with electronic transactions, such as state legislation regarding the use of specific merchant categories codes or limiting the use of transaction data.

Regulation and other governmental actions relating to operations, pricing or practices could affect all networks and/or acquirers directly or indirectly, as well as adversely impact consumers and merchants. Among other things, regulation of bankcard fees has negatively impacted, and may continue to negatively impact, the discount revenue we earn, including as a result of downward pressure on our merchant discount rates from decreases in competitor pricing in connection with caps on interchange fees. In some cases, regulations also extend to certain aspects of our business, such as network and cobrand arrangements or the terms of card acceptance for merchants. For example, we exited our network business in the EU and Australia as a result of regulation in those jurisdictions. In addition, there is uncertainty as to when or how interchange fee caps and other provisions of the EU payments legislation might apply when we work with cobrand partners and agents in the EU. In 2018, the EU Court of Justice (CJEU) confirmed the validity of fee capping and other provisions in circumstances where three-party networks issue cards with a cobrand partner or through an agent, although its ruling provided only limited guidance as to when or how the provisions might apply in such circumstances and remains subject to differing interpretations by regulators and participants in cobrand arrangements. In December 2024, the CJEU held a hearing on questions referred by the Dutch Trade and Industry Appeals Tribunal regarding the interpretation of the application of the interchange fee caps in connection with an administrative proceeding by the Netherlands Authority for Consumers and Markets regarding our cobrand relationship with KLM Royal Dutch Airlines; the CJEU has not yet issued a decision. Given differing interpretations by regulators and participants in cobrand arrangements, we are subject to regulatory action, penalties and the possibility we will not be able to maintain our existing cobrand and agent relationships in the EU. See “Our business is subject to evolving and comprehensive government regulation and supervision, which could materially adversely affect our results of operations and financial condition” under “Risk Factors.”