Forward-Looking Statements

This release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are subject to risks and uncertainties. The forward-looking

statements, which address the Company’s expected business and financial performance, among other matters, contain words such as “believe”, “expect”, “anticipate”, “optimistic”, “intend”,

“plan”, “aim”, “will”, “may”, “should”, “could”, “would”, “likely”, and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak

only as of the date on which they are made. The Company undertakes no obligation to update or revise any forward-looking statements. Factors that could cause actual results to differ

materially from these forward-looking statements include, but are not limited to, the following: the Company’s ability to exceed for 2010 its on-average, over-time earnings per share growth

target of 12 percent to 15 percent per annum, which will depend on, among other things, the factors described below, including the level of consumer and business spending, credit trends,

expense management, currency and interest rate fluctuations and general economic conditions, such as unemployment and GDP growth; the Company’s ability to manage credit risk related to

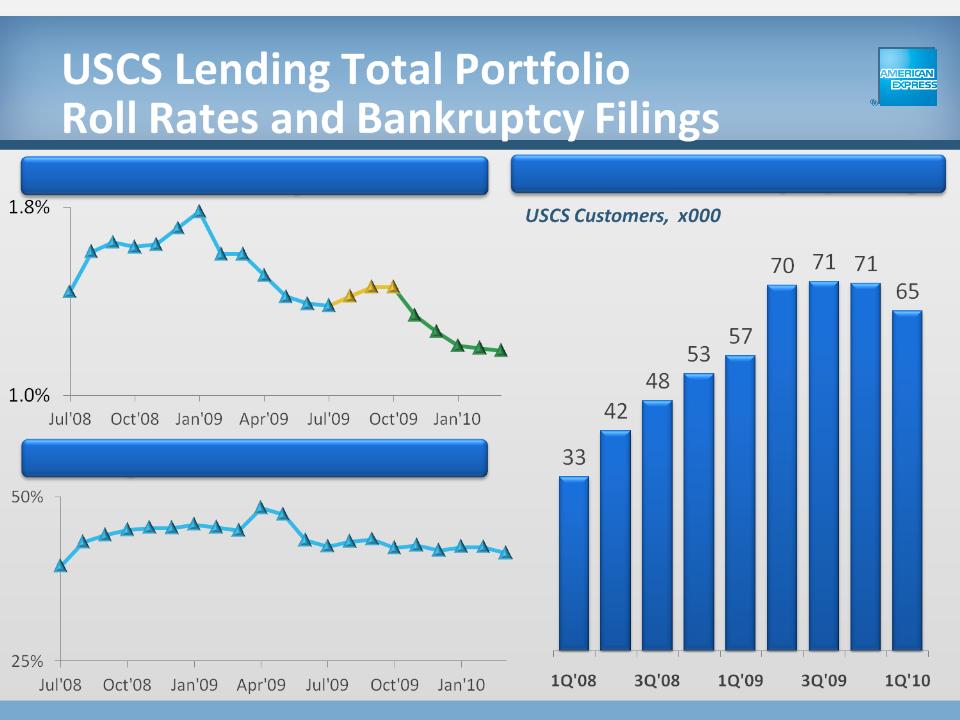

consumer debt, business loans, merchants and other credit trends, which will depend in part on (i) the economic environment, including, among other things, the housing market, the rates of

bankruptcies and unemployment, which can affect spending on card products, debt payments by individual and corporate customers and businesses that accept the Company’s card products, (ii)

the effectiveness of the Company’s credit models and (iii) the impact of recently enacted statutes and proposed legislative initiatives affecting the credit card business, including, without

limitation, The Credit Card Accountability Responsibility and Disclosure Act of 2009 (the “CARD Act”); the impact of the Company’s efforts to deal with delinquent cardmembers in the current

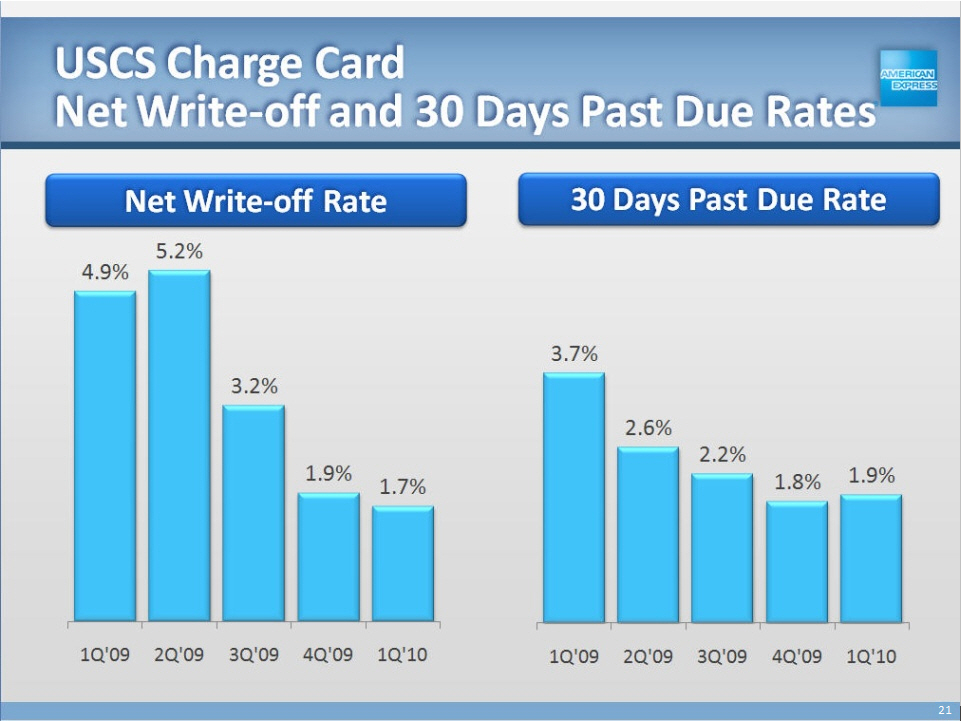

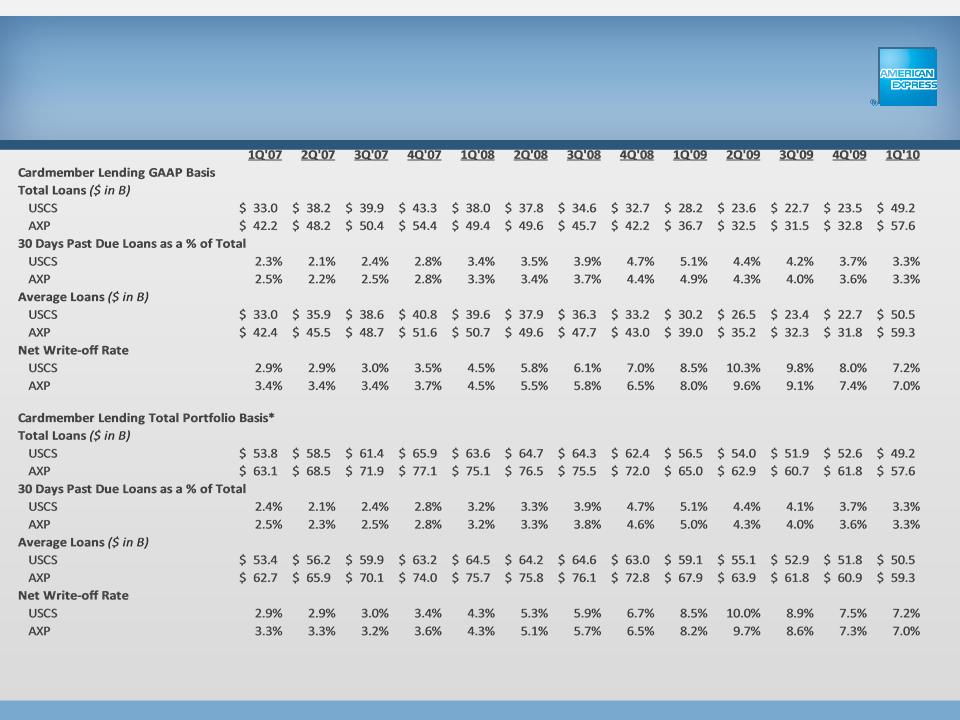

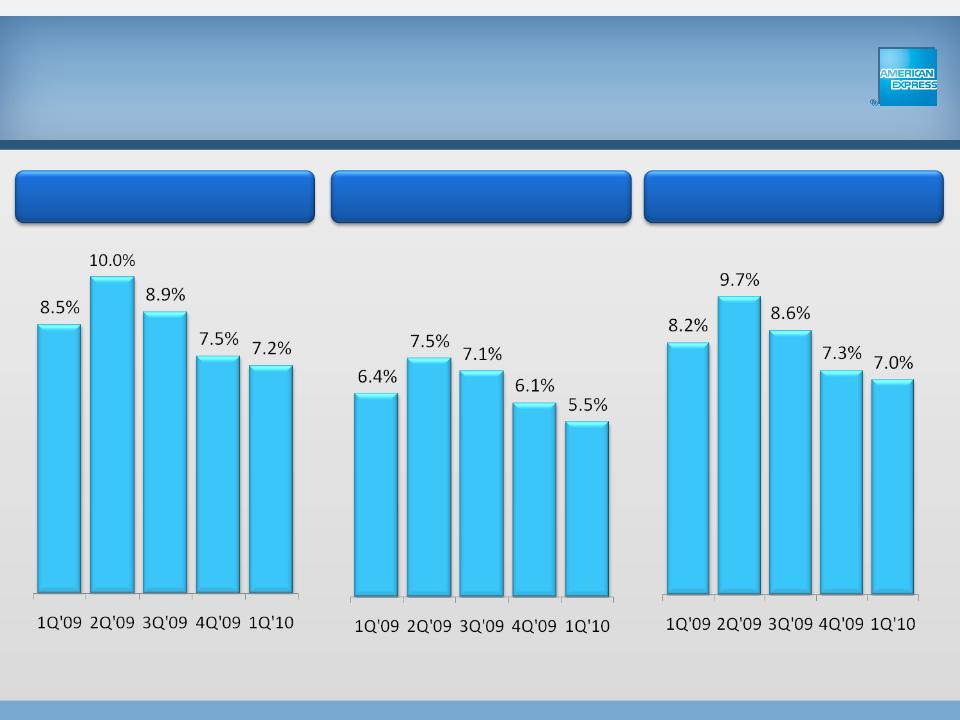

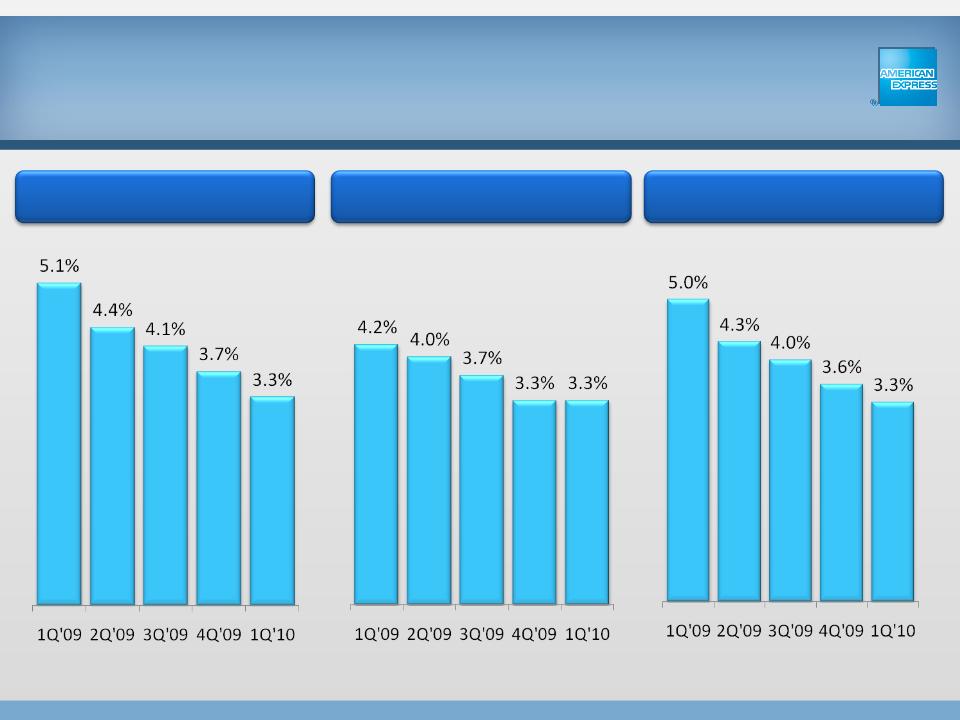

challenging economic environment, which may affect payment patterns of cardmembers and the perception of the Company’s services, products and brands; the Company’s near-term write-off

rates, including those for the second quarter of 2010, which will depend in part on changes in the level of the Company’s loan balances, delinquency rates of cardmembers, unemployment rates,

the volume of bankruptcies and recoveries of previously written-off loans; consumer and business spending on the Company’s credit and charge card products and Travelers Cheques and other

prepaid products and growth in card lending balances, which depend in part on the economic environment, and the ability to issue new and enhanced card and prepaid products, services and

rewards programs, and increase revenues from such products, attract new cardmembers, reduce cardmember attrition, capture a greater share of existing cardmembers’ spending, and sustain

premium discount rates on its card products in light of regulatory and market pressures, increase merchant coverage, retain cardmembers after low introductory lending rates have expired, and

expand the Global Network Services business; the write-off and delinquency rates in the medium- to long-term of cardmembers added by the Company during the past few years, which could

impact their profitability to the Company; the Company’s ability to effectively implement changes in the pricing of certain of its products and services; fluctuations in interest rates (including

fluctuations in benchmarks, such as LIBOR and other benchmark rates that may give rise to basis risk, and credit spreads), which impact the Company’s borrowing costs, return on lending

products and the value of the Company’s investments; the Company’s net interest yield on cardmember loans trending downward over time closer to historical levels, which will be impacted by

the affects of the CARD Act and changes in consumer behavior that affect loan balances; the actual amount to be spent by the Company on marketing, promotion, rewards and cardmember

services based on management’s assessment of competitive opportunities and other factors affecting its judgment and during 2010, the extent of provision benefit, if any, from lower than

expected write-offs; the ability to control and manage operating, infrastructure, advertising and promotion expenses as business expands or changes, including the ability to accurately estimate

the provision for the cost of the Membership Rewards program; fluctuations in foreign currency exchange rates; the Company’s ability to grow its business and generate excess capital and

earnings in a manner and at levels that will allow the Company to return a portion of capital to shareholders, which will depend on the Company’s ability to manage its capital needs, and the

effect of business mix, acquisitions and rating agency and regulatory requirements, including those arising from the Company’s status as a bank holding company; the ability of the Company to

meet its objectives with respect to the growth of its brokered retail CD program, brokerage sweep account program and the direct deposit initiative, which will depend in part on customer

demand, the perception of the Company’s brand and regulatory capital requirements; the success of the Global Network Services business in partnering with banks in the United States, which

will depend in part on the extent to which such business further enhances the Company’s brand, allows the Company to leverage its significant processing scale, expands merchant coverage of

the network, provides Global Network Services’ bank partners in the United States with the benefits of greater cardmember loyalty and higher spend per customer and benefits merchants

through, among other things, greater transaction volume and additional higher spending customers; the ability of the Global Network Services business to meet the performance requirements

called for by the Company’s settlements with MasterCard and Visa; trends in travel and entertainment spending and the overall level of consumer confidence; the uncertainties associated with

business acquisitions, including, among others, the failure to realize anticipated business retention, growth and cost savings, as well as the ability to effectively integrate the acquired business

into the Company’s

34