Investor Presentation December 2019 NYSE American: IEC Jeff Schlarbaum, President & CEO Trusted Ingenuity. Proven Reliability. ® ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

Cautionary Note Regarding Forward Looking Statements References in this presentation to “IEC,” the “Company,” “we,” “our,” or “us” mean IEC Electronics Corp. and its subsidiaries except where the context otherwise requires. This presentation contains forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. These forward-looking statements include, but are not limited to, statements regarding future sales and operating results, future prospects, the capabilities and capacities of business operations, any financial or other guidance and all statements that are not based on historical fact, but rather reflect our current expectations concerning future results and events. The ultimate correctness of these forward-looking statements is dependent upon a number of known and unknown risks and events and is subject to various uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. The following important factors, among others, could affect future results and events, causing those results and events to differ materially from those views expressed or implied in our forward-looking statements: business conditions and growth or contraction in our customers’ industries, the electronic manufacturing services industry and the general economy; our ability to control our material, labor and other costs; our dependence on a limited number of major customers; uncertainties as to availability and timing of governmental funding for our customers; the impact of government regulations, including FDA regulations; unforeseen product failures and the potential product liability claims that may be associated with such failures; technological, engineering and other start-up issues related to new programs and products; variability and timing of customer requirements; the potential consolidation of our customer base; availability of component supplies; dependence on certain industries; the ability to realize the full value of our backlog; the types and mix of sales to our customers; litigation and governmental investigations; intellectual property litigation; variability of our operating results; our ability to maintain effective internal controls over financial reporting; the availability of capital and other economic, business and competitive factors affecting our customers, our industry and business generally; failure or breach of our information technology systems; and natural disasters. Any one or more of such risks and uncertainties could have a material adverse effect on us or the value of our common stock. For a further list and description of various risks, relevant factors and uncertainties that could cause future results or events to differ materially from those expressed or implied in our forward-looking statements, see our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our other filings with the Securities and Exchange Commission. All forward-looking statements included in this presentation are made only as of the date indicated or as of the date of this presentation. We do not undertake any obligation to, and may not, publicly update or correct any forward-looking statements to reflect events or circumstances that subsequently occur or which we hereafter become aware of, except as required by law. New risks and uncertainties arise from time to time and we cannot predict these events or how they may affect us and cause actual results to differ materially from those expressed or implied by our forward-looking statements. Therefore, you should not rely on our forward-looking statements as predictions of future events. 2 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

Electronics Manufacturing Service Provider Life-Saving and Mission Critical Products Partner to Fortune 500 Companies in Regulated Markets 100% US Manufacturing 3 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

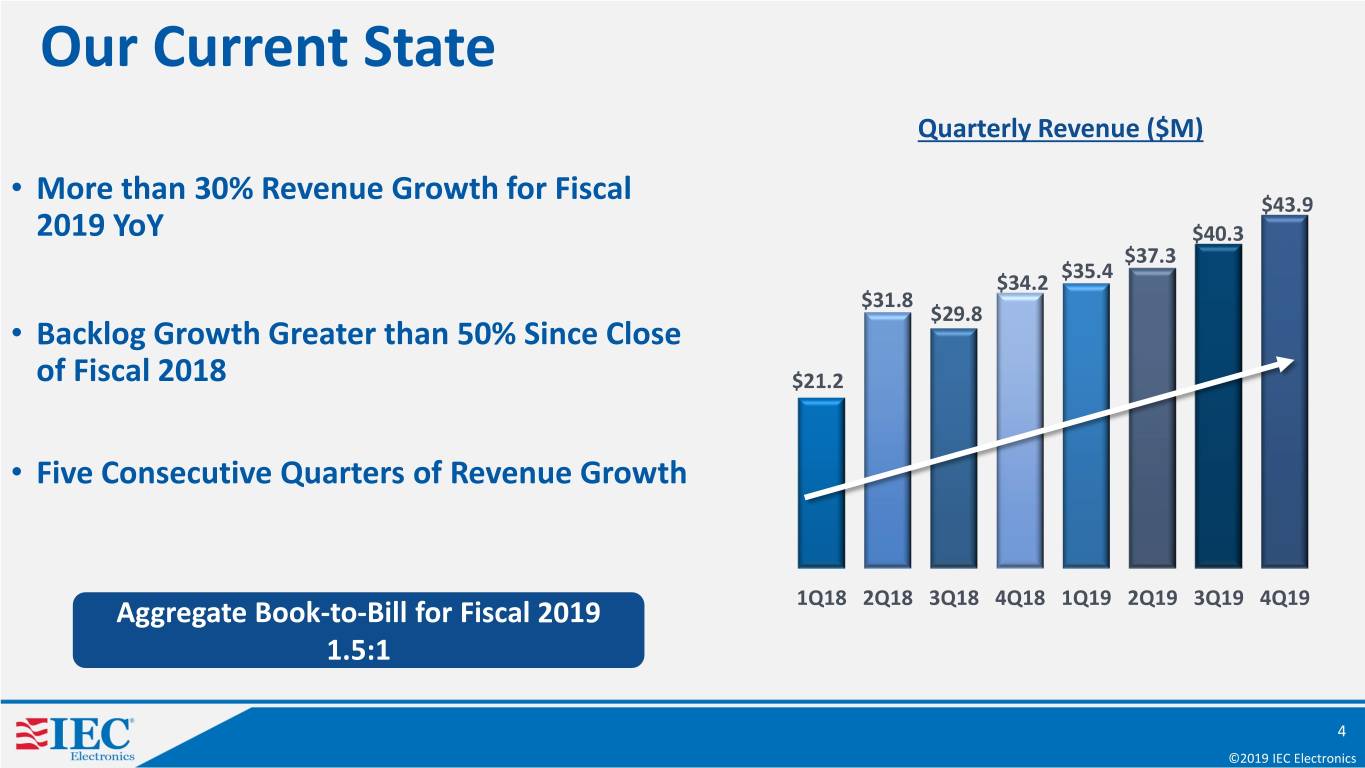

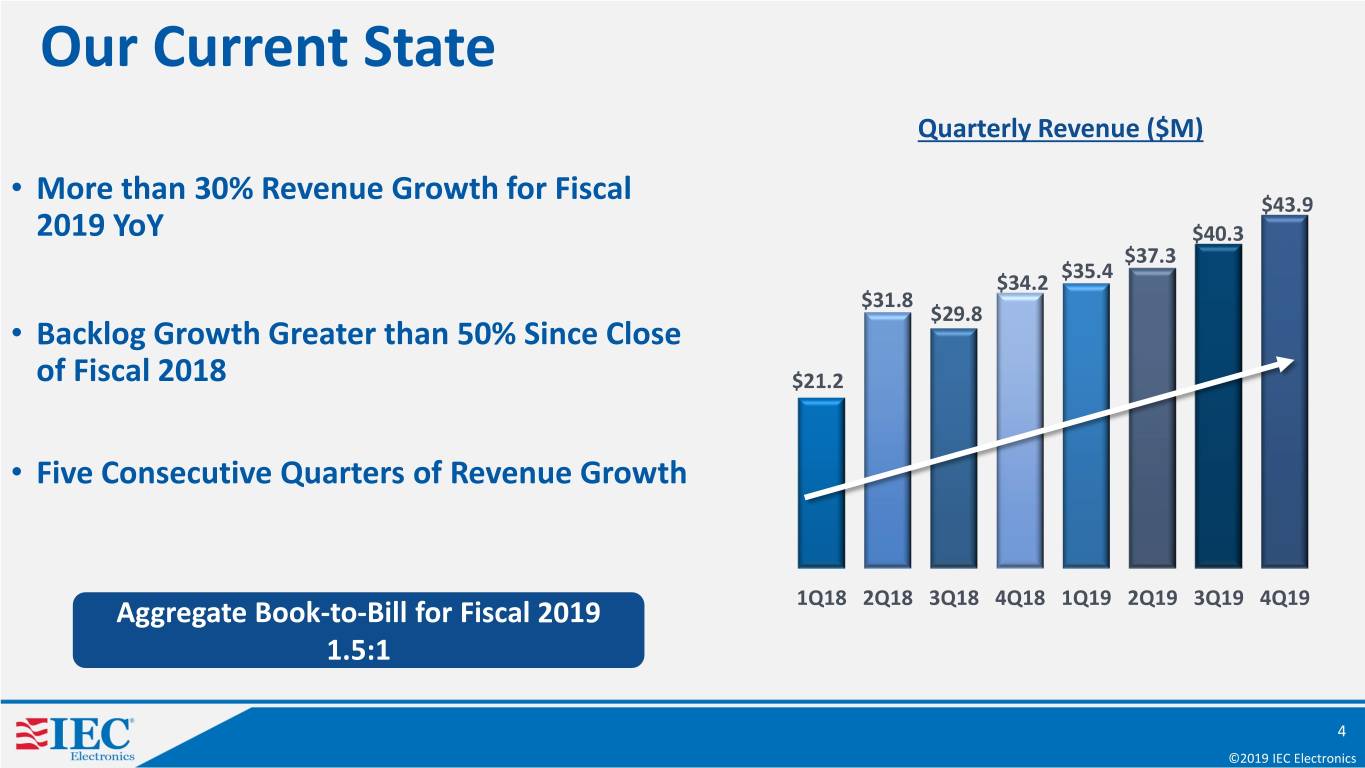

Our Current State Quarterly Revenue ($M) • More than 30% Revenue Growth for Fiscal $43.9 2019 YoY $40.3 $37.3 $35.4 $34.2 $31.8 $29.8 • Backlog Growth Greater than 50% Since Close of Fiscal 2018 $21.2 • Five Consecutive Quarters of Revenue Growth Aggregate Book-to-Bill for Fiscal 2019 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1.5:1 4 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

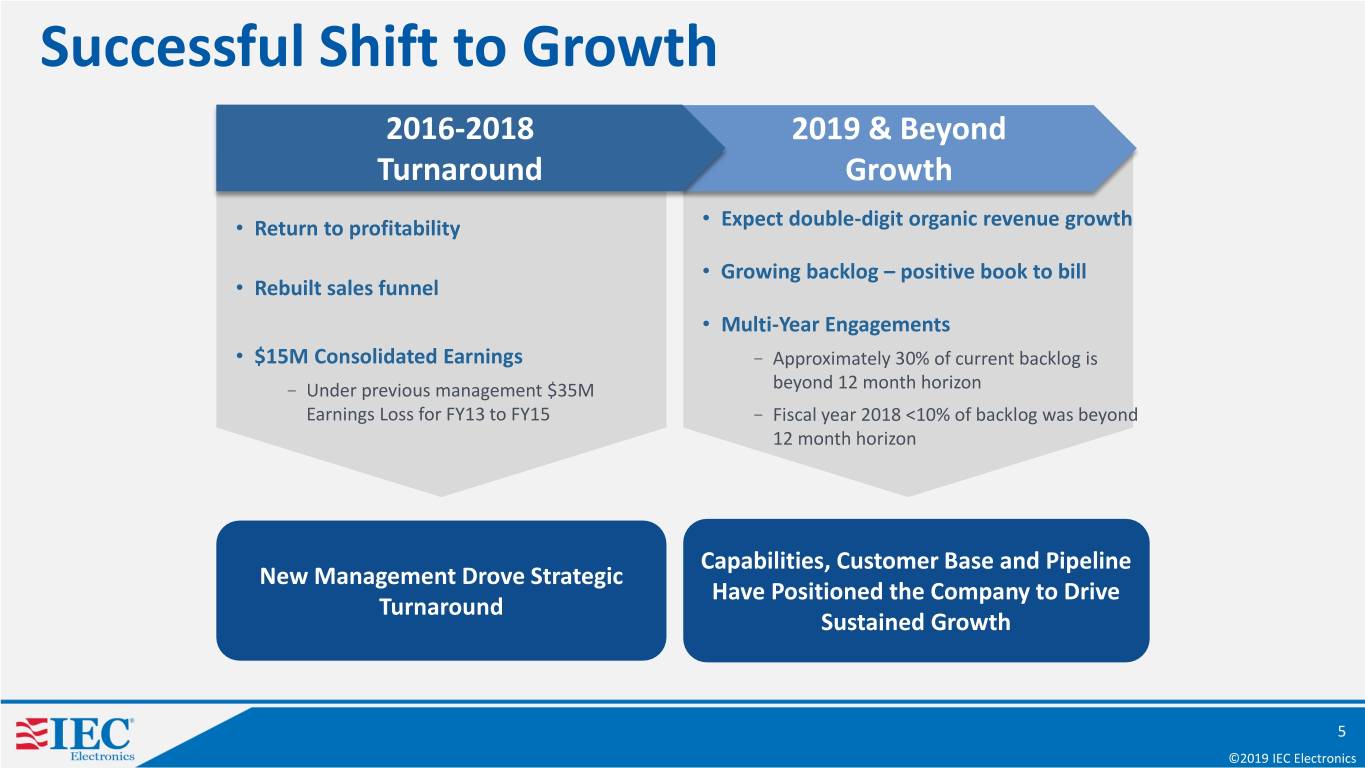

Successful Shift to Growth 2016-2018 2019 & Beyond Turnaround Growth • Return to profitability • Expect double-digit organic revenue growth • Growing backlog – positive book to bill • Rebuilt sales funnel • Multi-Year Engagements • $15M Consolidated Earnings − Approximately 30% of current backlog is − Under previous management $35M beyond 12 month horizon Earnings Loss for FY13 to FY15 − Fiscal year 2018 <10% of backlog was beyond 12 month horizon Capabilities, Customer Base and Pipeline New Management Drove Strategic Have Positioned the Company to Drive Turnaround Sustained Growth 5 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

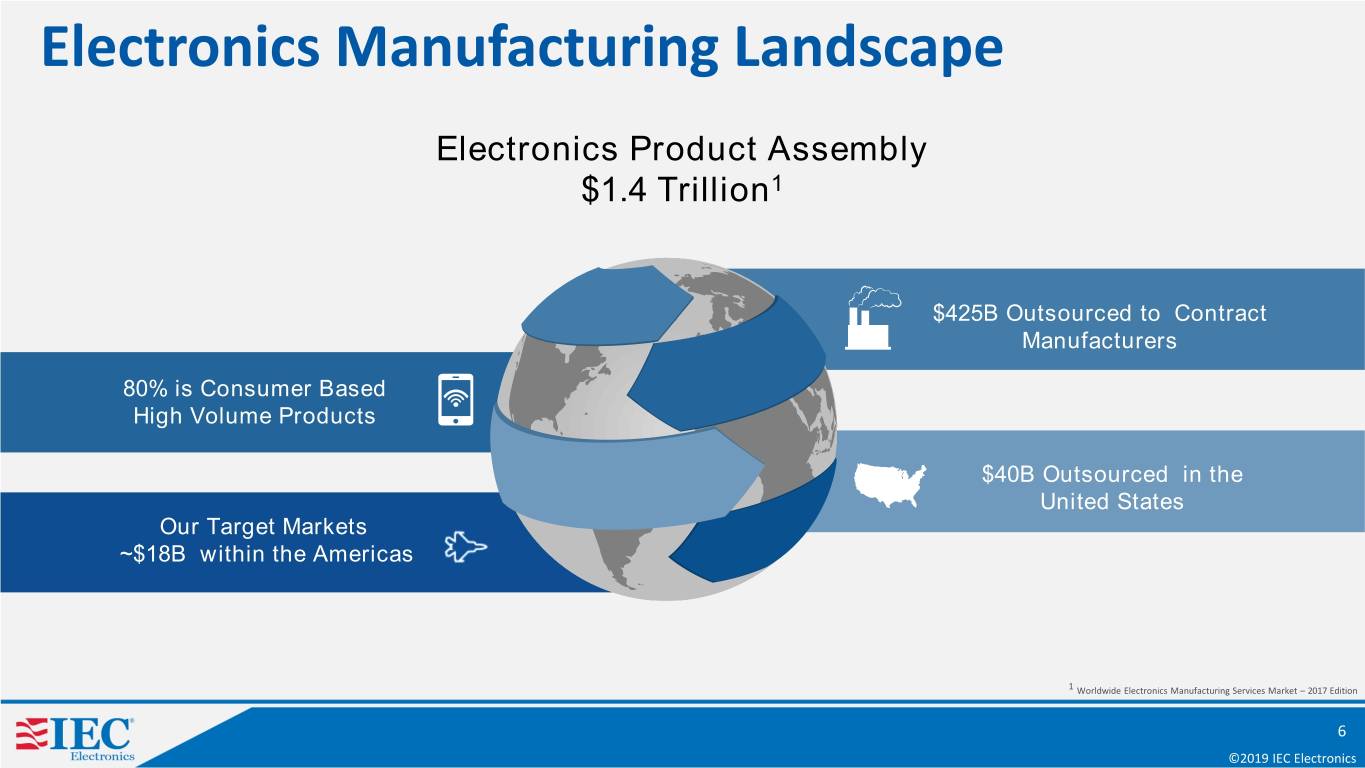

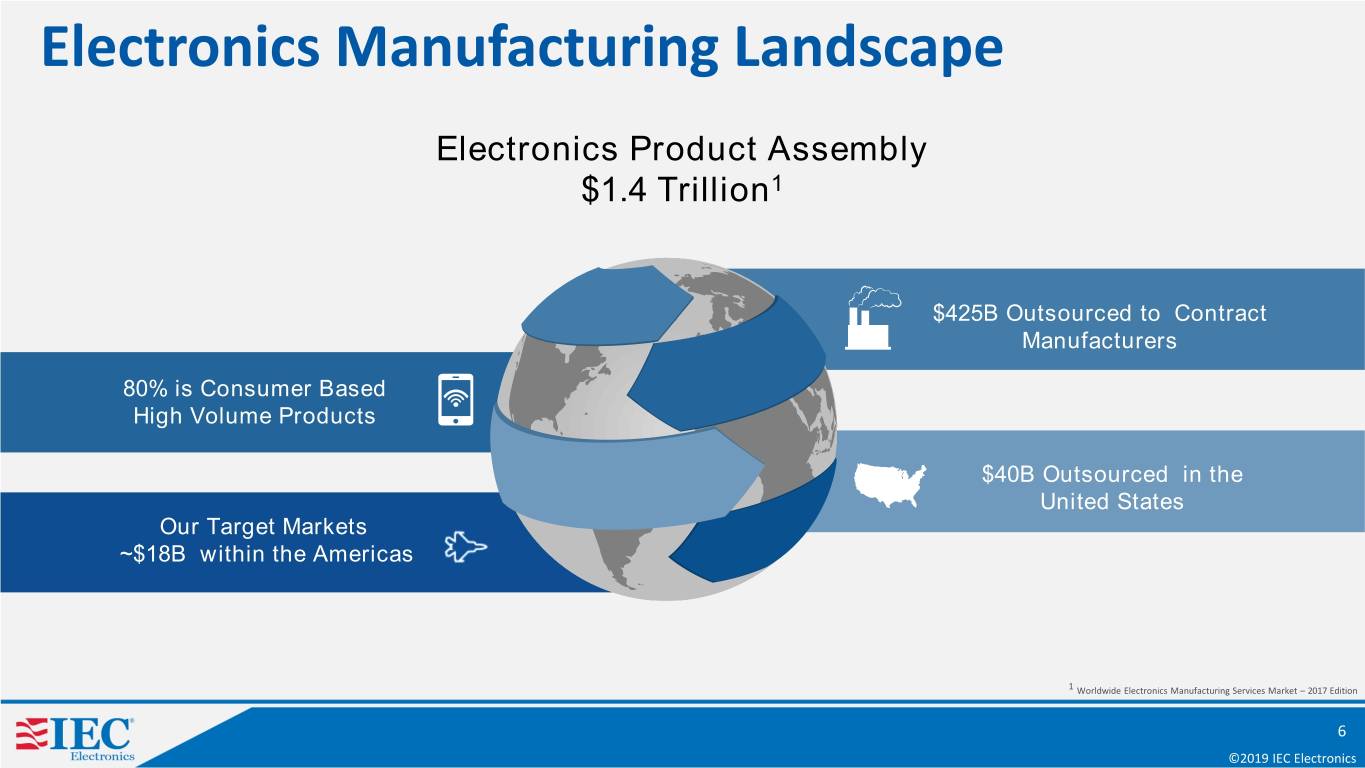

Electronics Manufacturing Landscape Electronics Product Assembly $1.4 Trillion1 $425B Outsourced to Contract Manufacturers 80% is Consumer Based High Volume Products $40B Outsourced in the United States Our Target Markets ~$18B within the Americas 1 Worldwide Electronics Manufacturing Services Market – 2017 Edition 6 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

Our Target Markets Aerospace & Defense Medical Industrial $3.1B TAM1 $6.0B TAM1 $8.8B TAM1 4.3% CAGR 5.8% CAGR 5.9% CAGR Highly Regulated Markets High Switching Costs 1 Worldwide Electronics Manufacturing Services Market – 2017 Edition 7 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

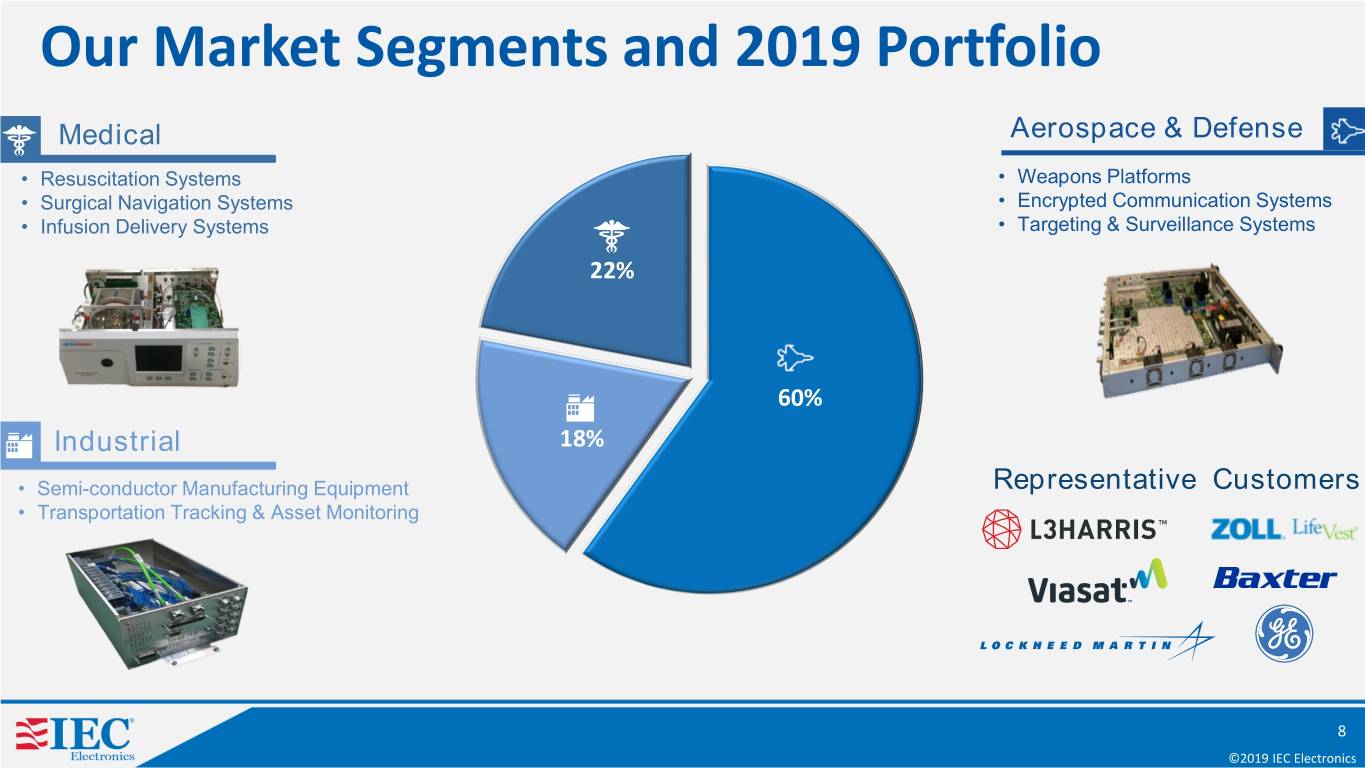

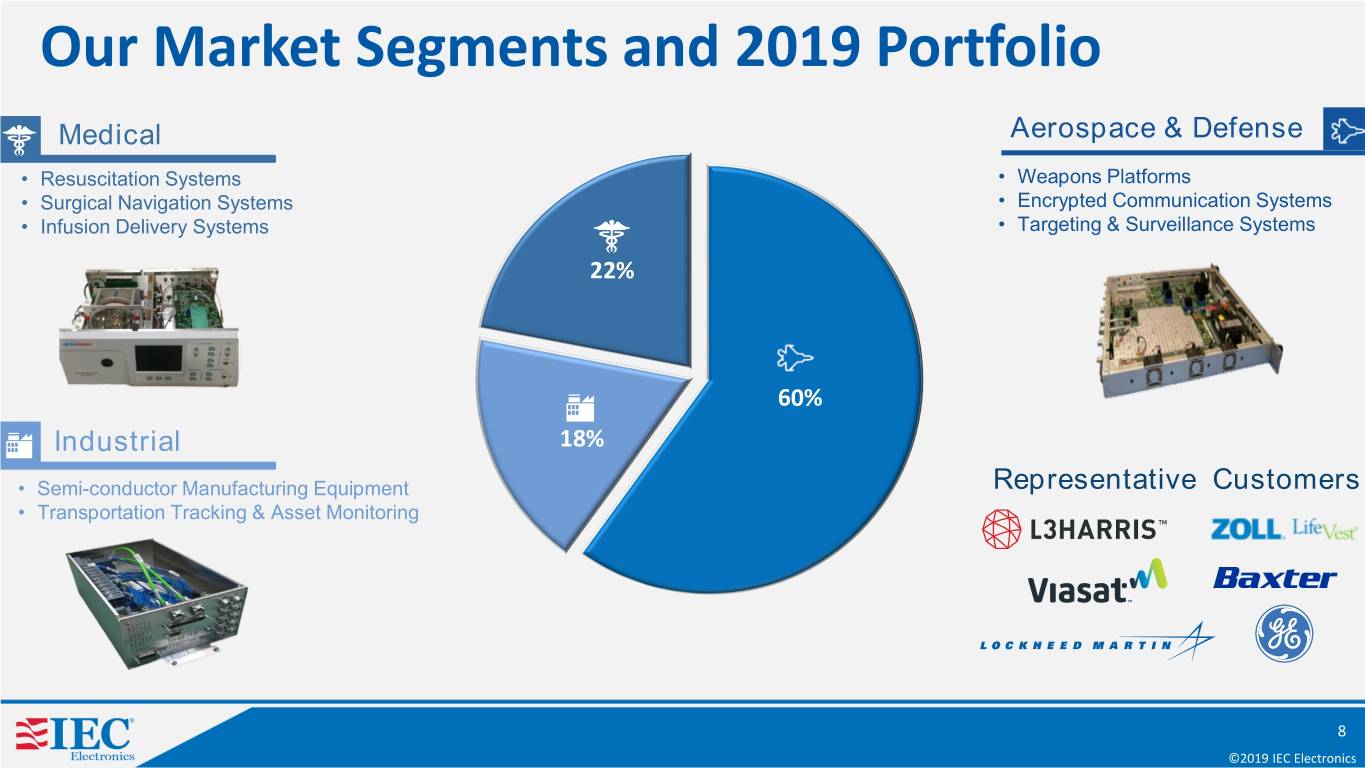

Our Market Segments and 2019 Portfolio Medical Aerospace & Defense • Resuscitation Systems • Weapons Platforms • Surgical Navigation Systems • Encrypted Communication Systems • Infusion Delivery Systems • Targeting & Surveillance Systems 22% 60% Industrial 18% • Semi-conductor Manufacturing Equipment Representative Customers • Transportation Tracking & Asset Monitoring 8 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

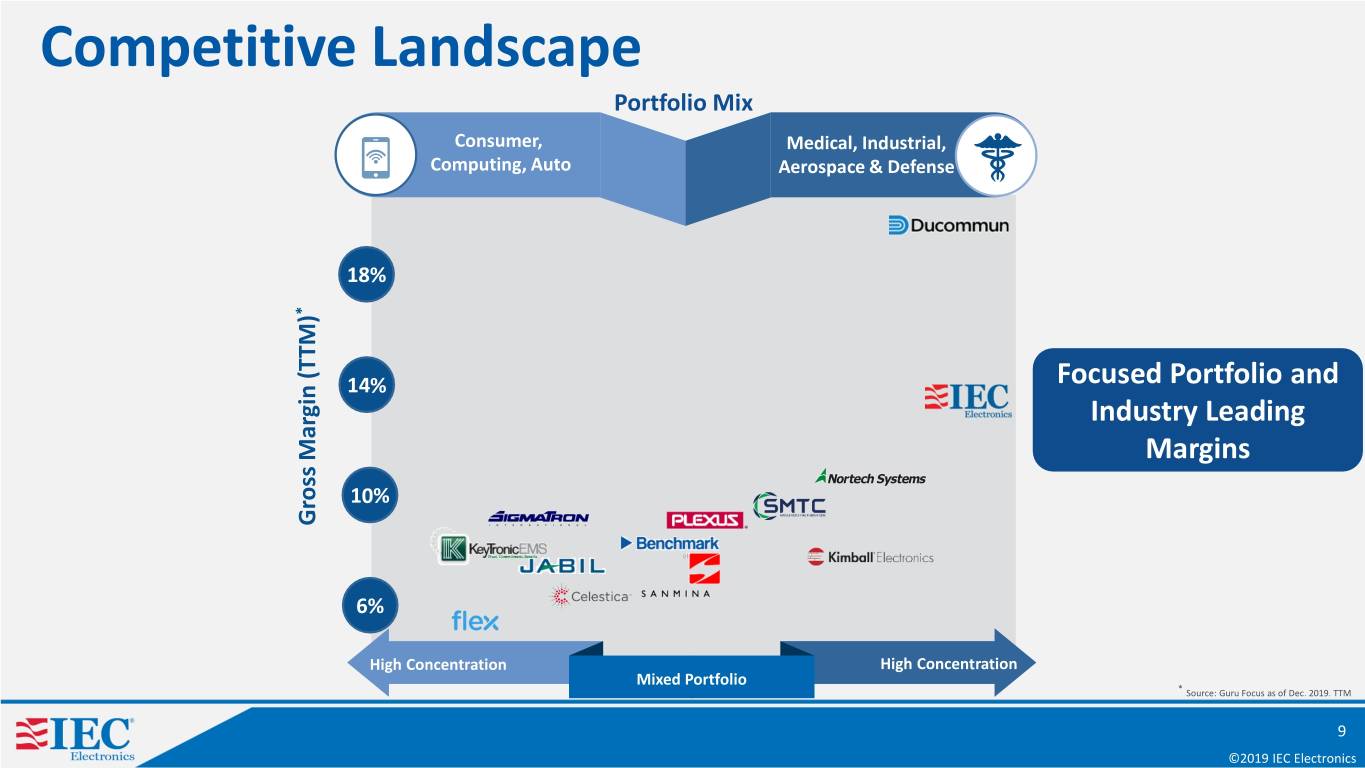

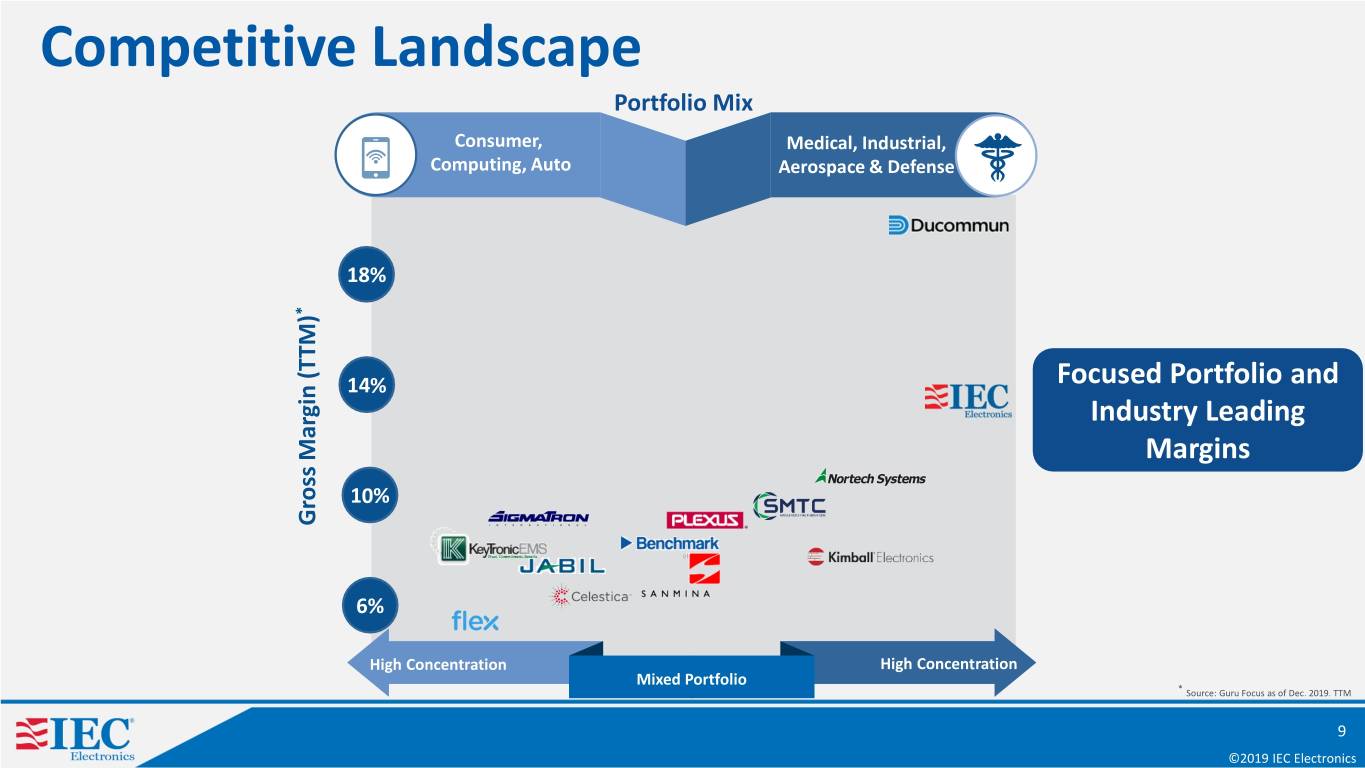

Competitive Landscape Portfolio Mix Consumer, Medical, Industrial, Computing, Auto Aerospace & Defense 18% * 14% Focused Portfolio and Industry Leading Margins 10% Gross Margin (TTM) Margin Gross 6% High Concentration High Concentration Mixed Portfolio * Source: Guru Focus as of Dec. 2019. TTM 9 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

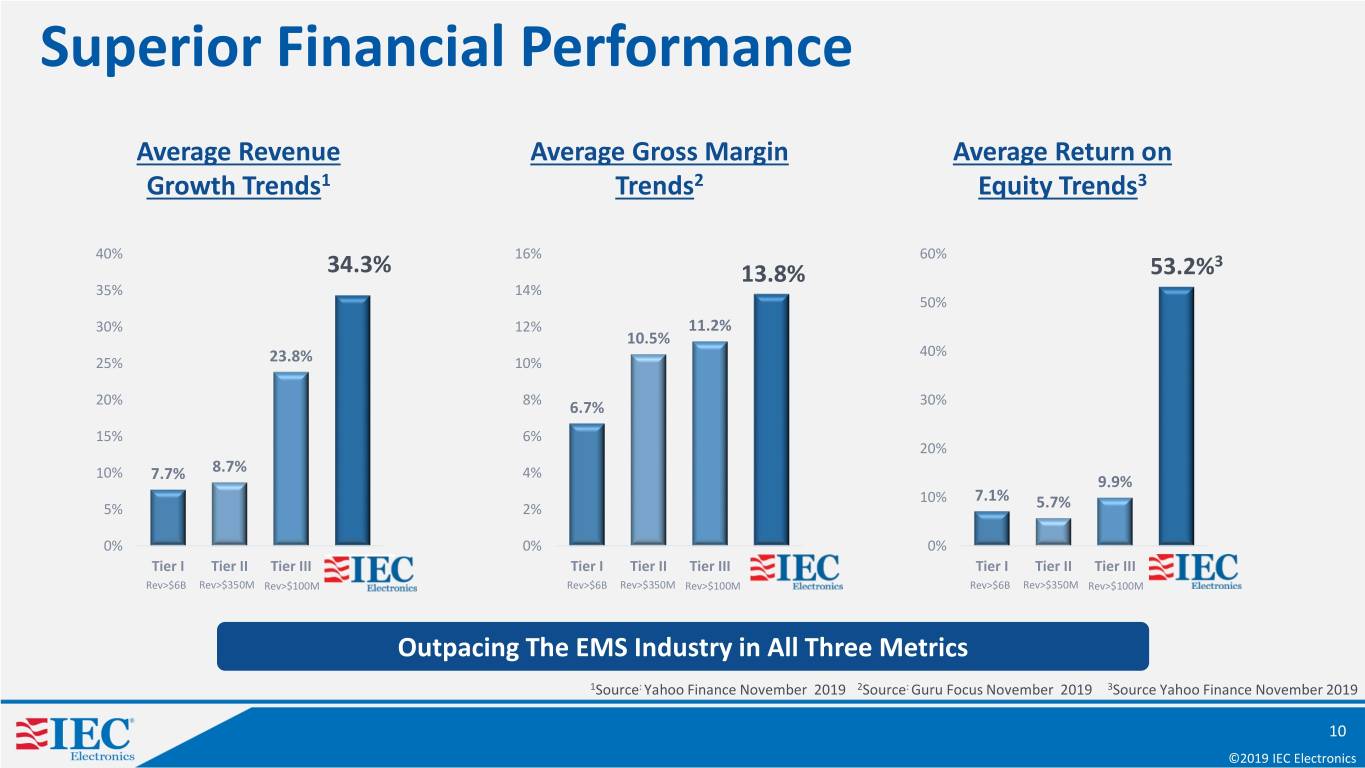

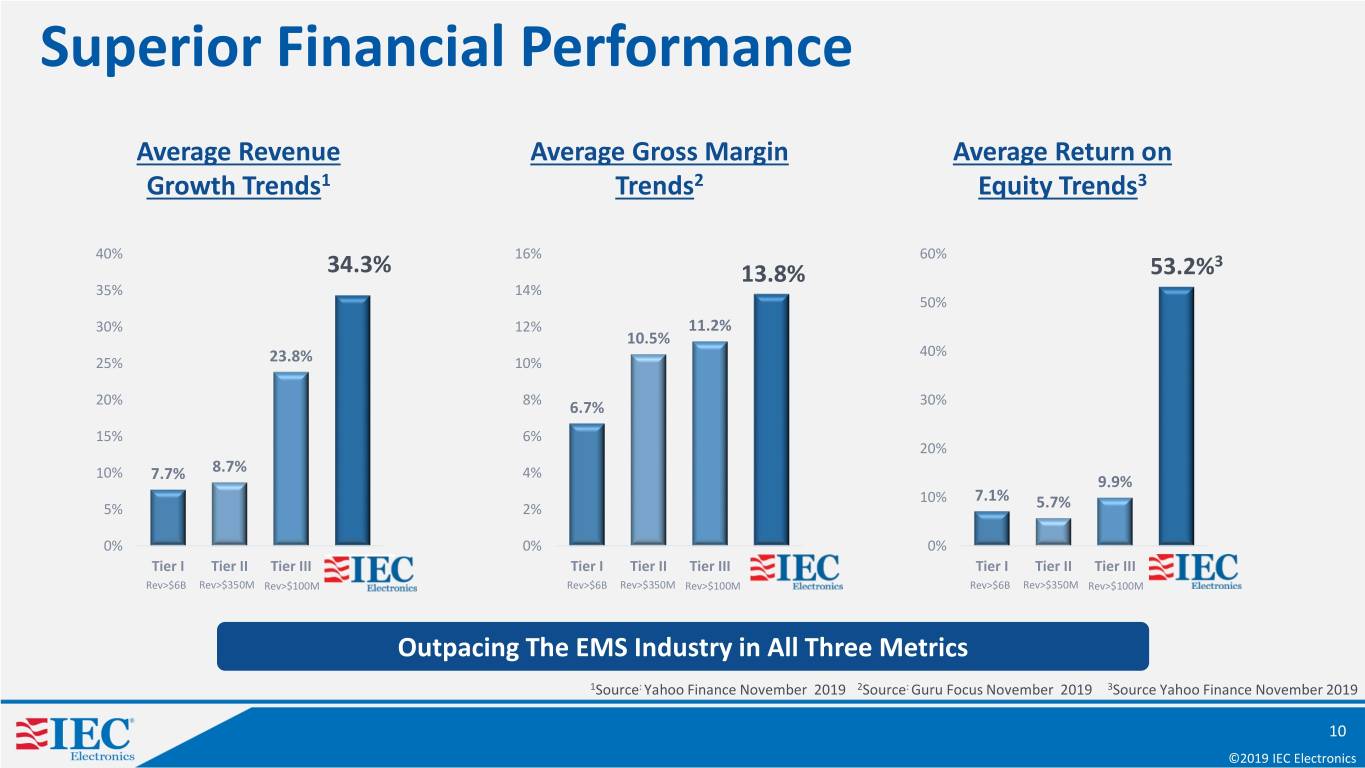

Superior Financial Performance Average Revenue Average Gross Margin Average Return on Growth Trends1 Trends2 Equity Trends3 40% 16% 60% 3 34.3% 13.8% 53.2% 35% 14% 50% 30% 12% 11.2% 10.5% 40% 25% 23.8% 10% 20% 8% 6.7% 30% 15% 6% 20% 10% 8.7% 4% 7.7% 9.9% 10% 7.1% 5% 2% 5.7% 0% 0% 0% Tier I Tier II Tier III IEC Tier I Tier II Tier III IEC Tier I Tier II Tier III IEC Rev>$6B Rev>$350M Rev>$100M Rev>$6B Rev>$350M Rev>$100M Rev>$6B Rev>$350M Rev>$100M Outpacing The EMS Industry in All Three Metrics 1Source: Yahoo Finance November 2019 2Source: Guru Focus November 2019 3Source Yahoo Finance November 2019 10 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

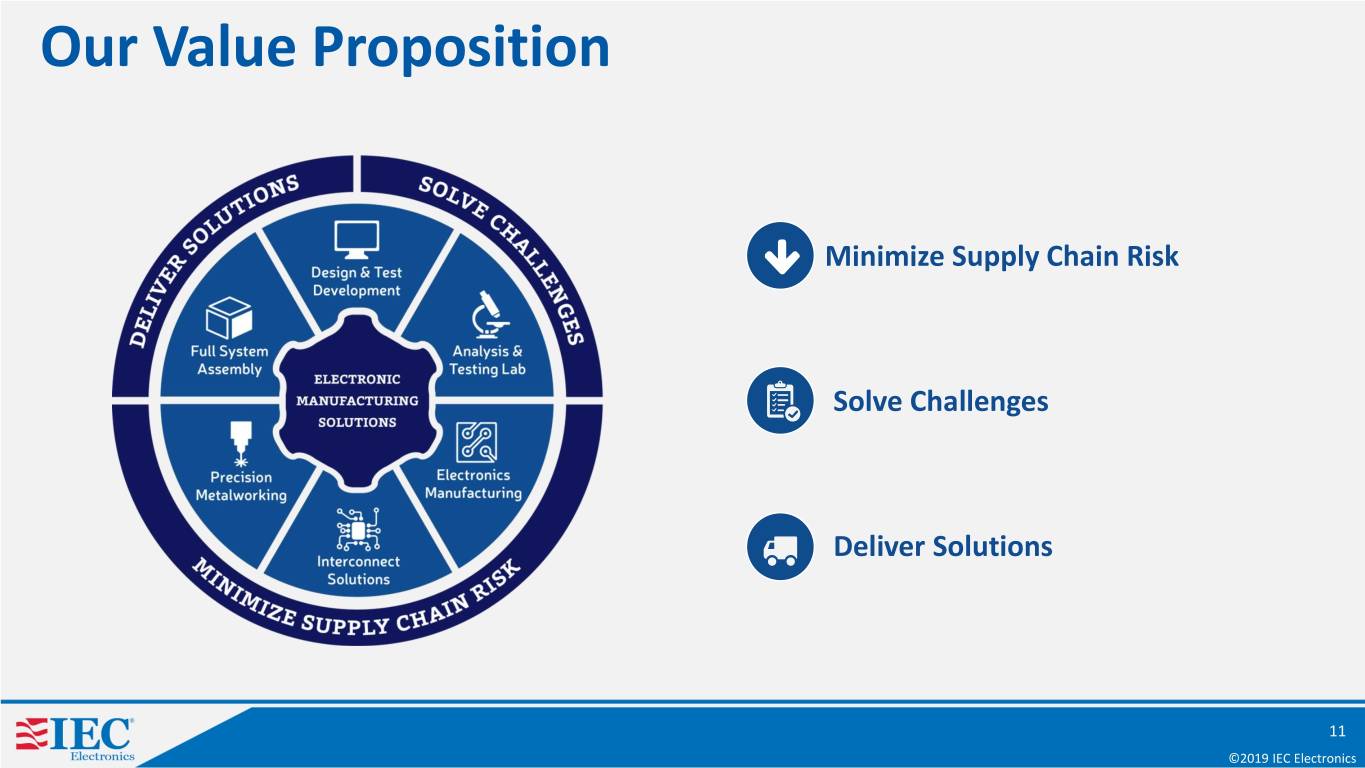

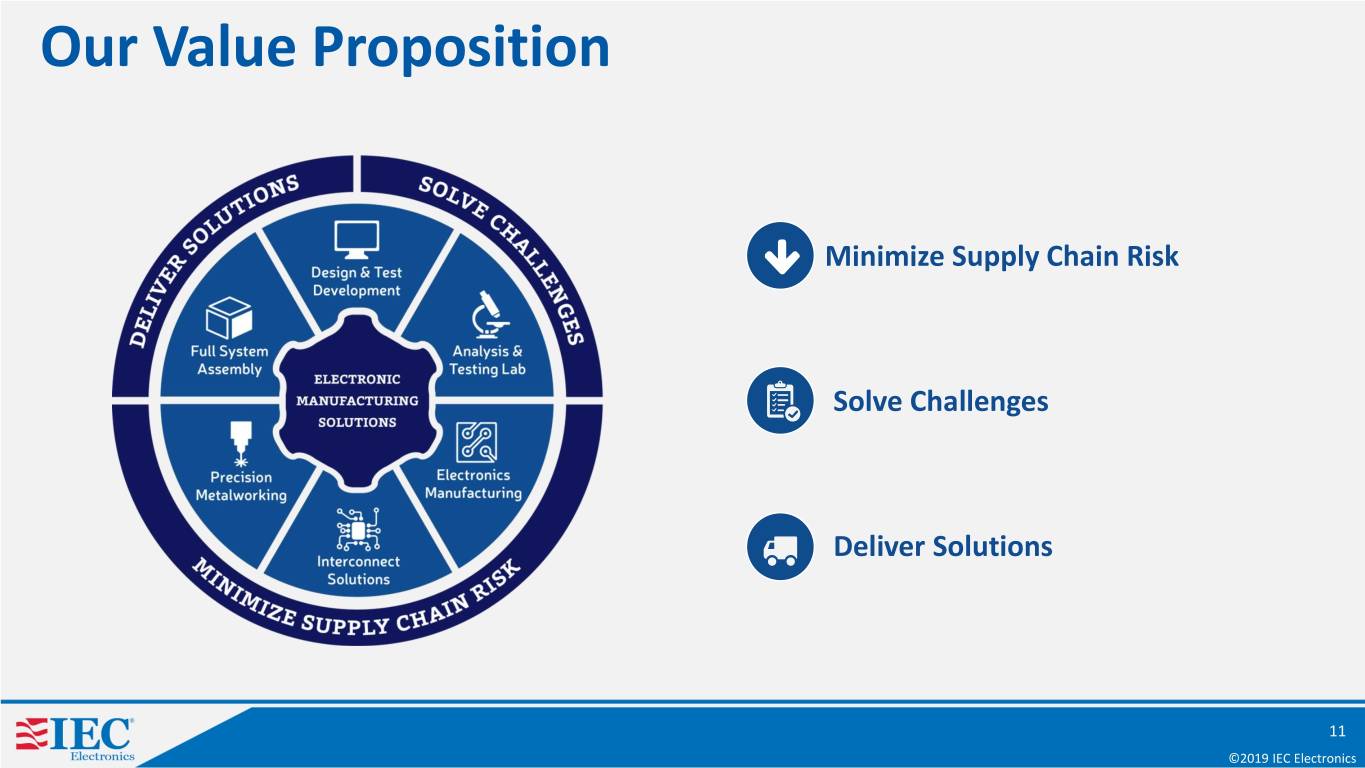

Our Value Proposition Minimize Supply Chain Risk Solve Challenges Deliver Solutions 11 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

Minimize Supply Chain Risk Vertical Manufacturing Services Printed Circuit Interconnect Precision Board Assembly Solutions Metalworking Control Cost, Quality, and Lead Time for Key Commodities 12 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

Solve Challenges & Deliver Solutions Value Added Services Design & Test Analysis & Test Full System Engineering Laboratory Assembly Specialize in Highly Complex Electronics 13 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

Strategic Initiatives 14 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

Drive Sustained Growth • Concentrate on Existing High Growth Customers • High customer satisfaction drives opportunities Top 10 Customer Revenue Profile • Reoccurrence of existing business • New program awards • Expansion to new locations • Leverage Vertical Manufacturing Services • Customers focused on simplifying their supply chain • Targeting fewer, more capable supply chain partners • Strong supply chain integration with full system assembly and fulfillment services • $50M Multi-year award received in May 2019 FY2017 FY2018 FY2019 FY 2020 Plan 15 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

Drive Sustained Growth • Robust Sales & New Opportunity Conversion Funnel • Focus on the right customers • Disciplined Process • Complex, highly engineered products • Selectively adding new customers • Long-term, strategic partners • New customer revenue growth • ~2% in Q4FY17 to >10% in second half of FY19 Steady Backlog Improvements New Customer Revenue (%) 12.0% 10.0% +85% +59% 8.0% +33% $212M 6.0% $54M $72M $133M 4.0% 9/30/16 9/30/17 9/30/18 2.0% 9/30/19 0.0% Q118 Q218 Q318 Q418 Q119 Q219 Q319 Q419 16 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

New State of the Art Facility Capital Expenditure Inventory Management Building to spec for increased Investing in automation Strategically pre-buy materials capacity & enhanced operational to improve cycle times to build in advance of efficiency and quality customers’ needs; meeting or exceeding expectations A Deliberate Focus to Scale the Business and Support Growth 17 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

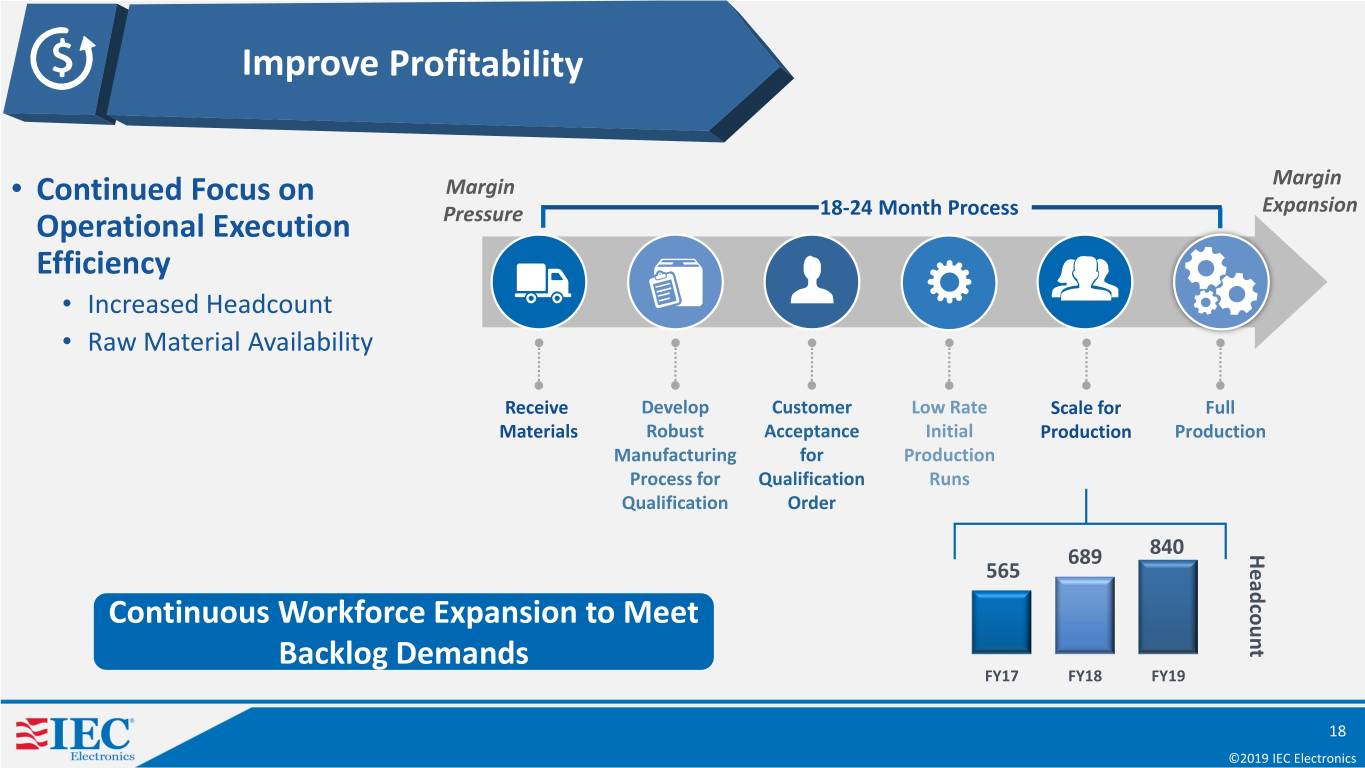

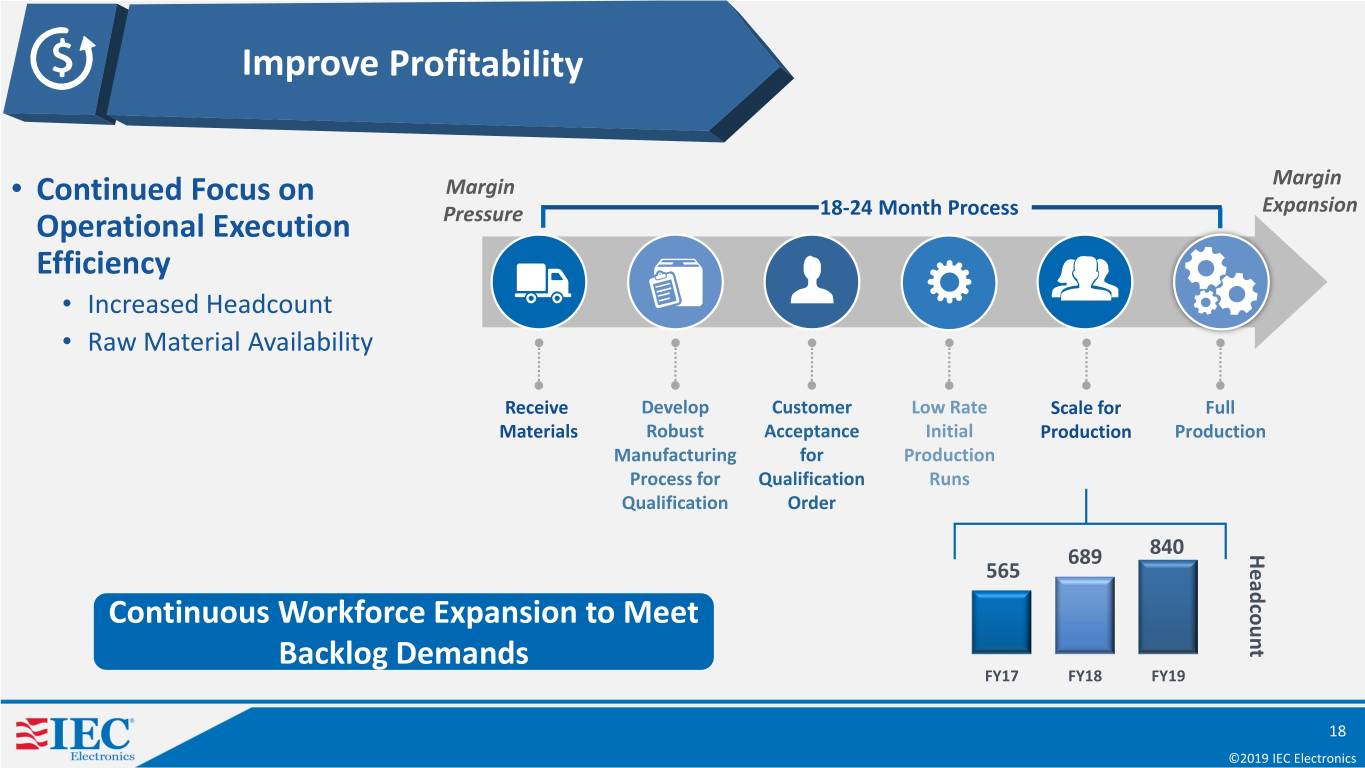

• Continued Focus on Margin Margin 18-24 Month Process Expansion Operational Execution Pressure Efficiency • Increased Headcount • Raw Material Availability Receive Develop Customer Low Rate Scale for Full Materials Robust Acceptance Initial Production Production Manufacturing for Production Process for Qualification Runs Qualification Order 689 840 Headcount 565 Continuous Workforce Expansion to Meet Backlog Demands FY17 FY18 FY19 18 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

Key Takeaways Value Proposition Resonates with Fortune 500 Customers Demonstrated Operational Excellence Enabling High Customer Satisfaction Industry Leading EMS Business Performance Demonstrating Consistent Growth With Strong Backlog in Place 19 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics

Thank You Contact Audra Gavelis Director of Marketing & Investor Relations (315) 332-4559 agavelis@iec-electronics.com 20 ANY DISTRIBUTION, REPRODUCTION OR OTHER USE OF THIS DOCUMENT WITHOUT THE EXPRESS WRITTEN CONSTENT OF IEC ELECTRONICS IS PROHIBITED ©2019 IEC Electronics