ITW Conference Call

First Quarter

2008

Exhibit 99.2

1

ITW

Agenda

1.

Introduction…………………….. John Brooklier/David Speer

2.

Financial Overview…………….. Ron Kropp

3.

Operating Segments………..…. John Brooklier

4.

Forecast 2008……….…….….… Ron Kropp

4.

Q & A………………......………… John Brooklier/Ron Kropp/David Speer

2

ITW

Forward - Looking Statements

This conference call contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995 including, without

limitation, statements regarding end market conditions, revenue growth,

earnings growth, operating income, tax rates, use of free cash, share

repurchases and potential acquisitions for the 2008 full year and the

Company’s related forecasts. These statements are subject to certain risks,

uncertainties, and other factors, which could cause actual results to differ

materially from those anticipated. Important risks that may influence future

results include (1) a downturn or further downturn in the construction,

general industrial, automotive or food institutional/restaurant and service

markets, (2) deterioration in international and domestic business and

economic conditions, particularly in North America, Europe, Asia or Australia,

(3) the unfavorable impact of foreign currency fluctuations and costs of raw

materials, (4) an interruption in, or reduction in, introducing new products

into the Company’s product lines, (5) an unfavorable environment for making

acquisitions, domestic and international, including adverse accounting or

regulatory requirements and market values of candidates, and (6) unfavorable

tax law changes and tax authority rulings. The risks covered here are not all

inclusive and given these and other possible risks and uncertainties,

investors should not place undue reliance on forward-looking statements as

a prediction of actual results.

3

Conference Call Playback

Replay number: 203-369-1304

No pass code necessary

Telephone replay available through midnight of

April 30, 2008

Webcast / PowerPoint replay available at

itw.com website

4

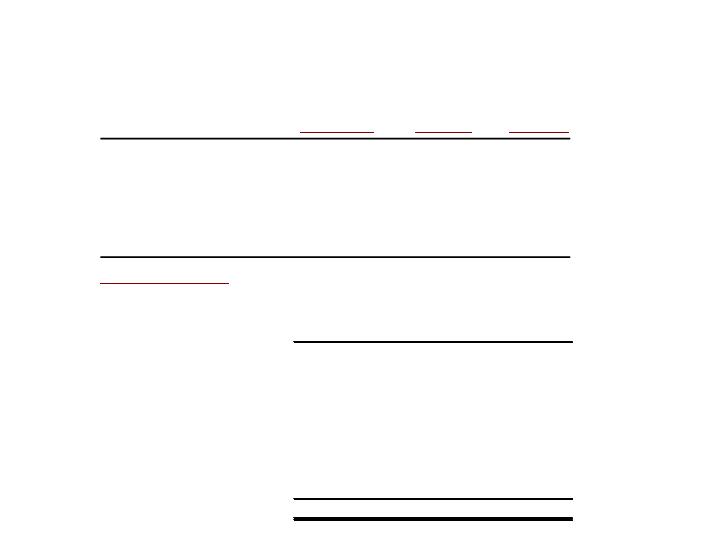

ITW

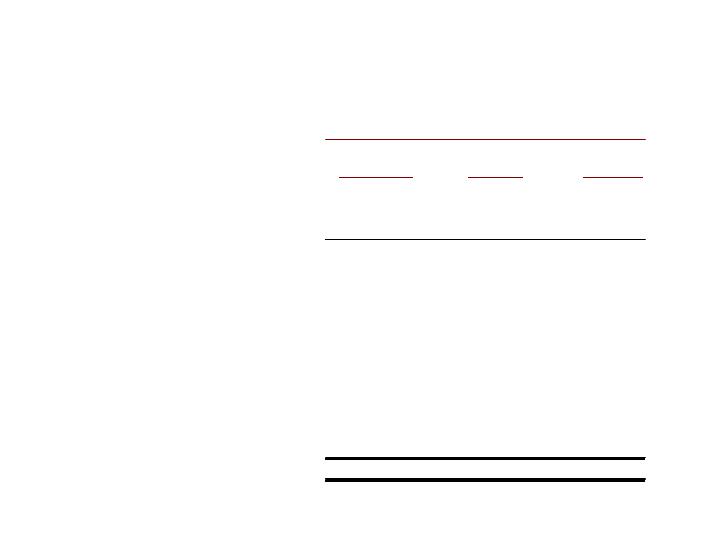

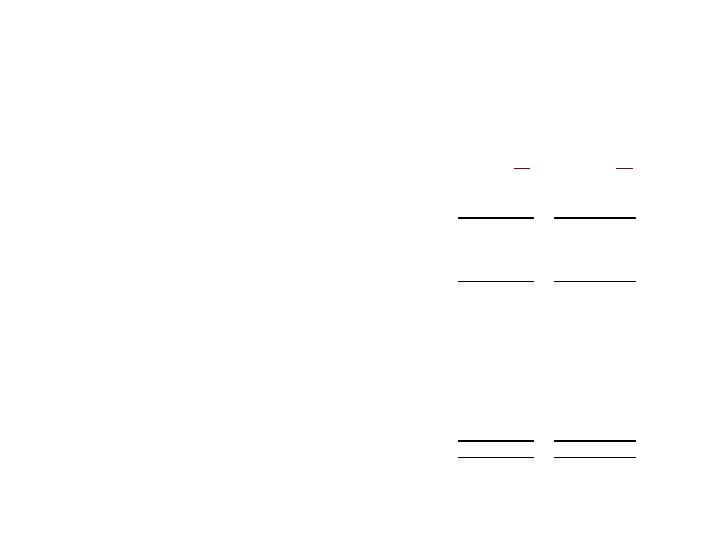

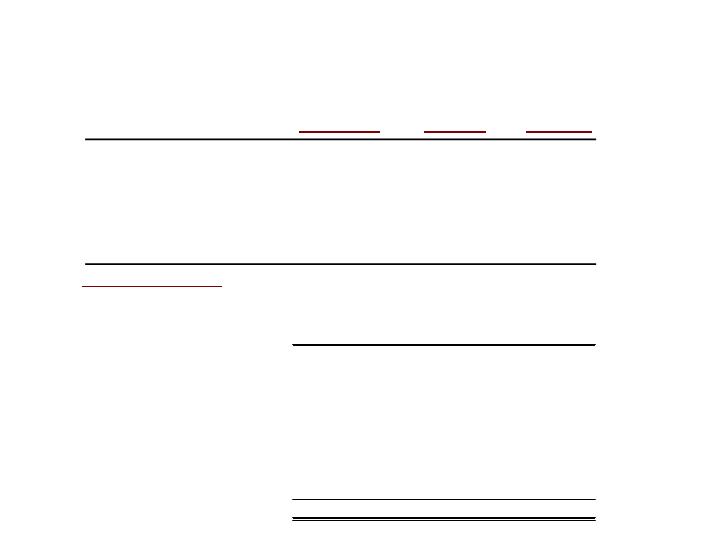

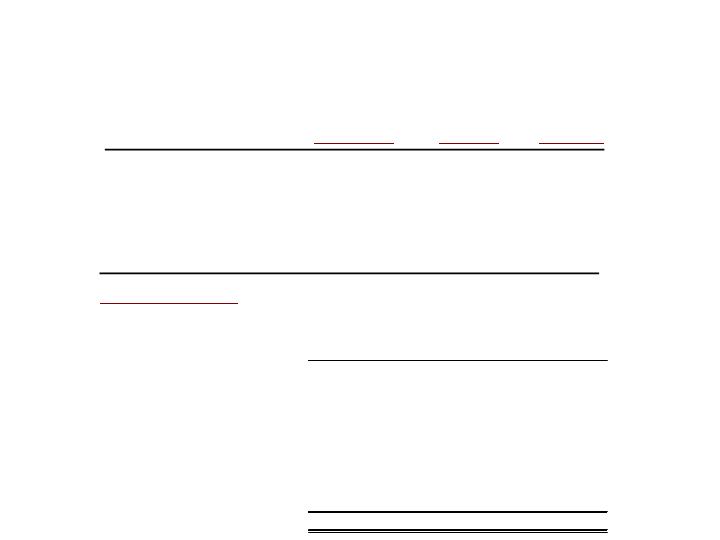

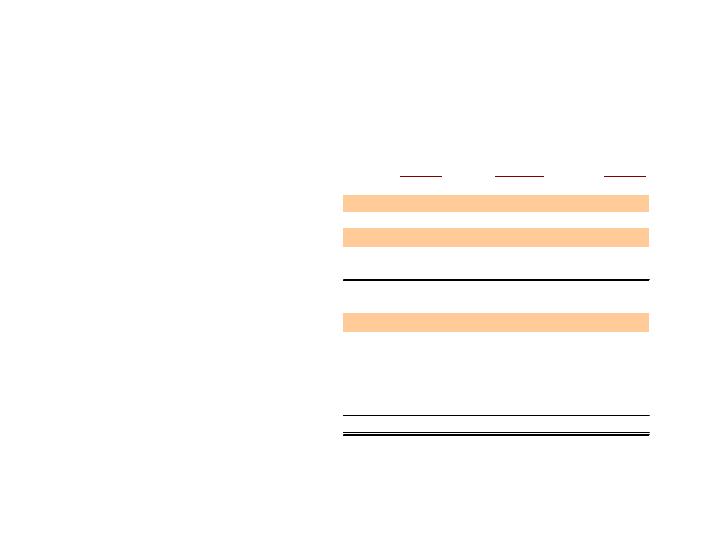

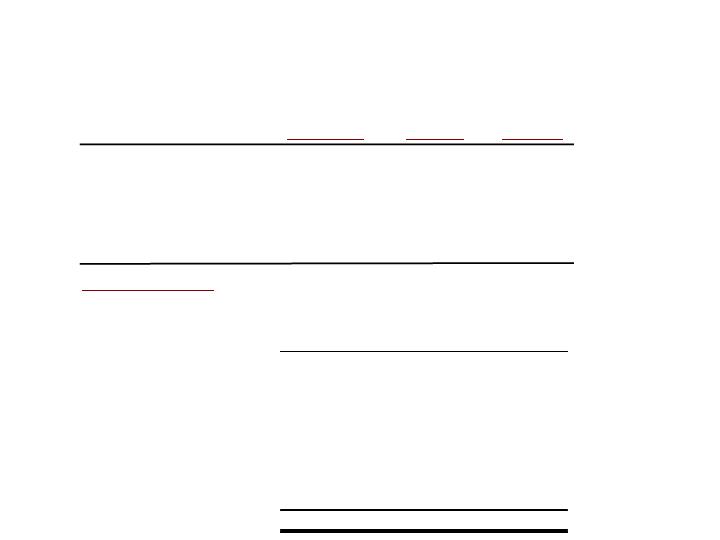

Quarterly Highlights

5

2007

2008

Q1

Q1

Amount

%

Operating Revenues

3,716.6

4,139.4

422.8

11.4%

Operating Income

568.5

520.0

(48.5)

-8.5%

% of Revenues

15.3%

12.6%

-2.7%

Income from Continuing Operations

Income Amount

385.0

301.4

(83.6)

-21.7%

Income Per Share-Diluted

0.68

0.57

(0.11)

-16.2%

Net Income

Income Amount

402.4

303.6

(98.8)

-24.6%

Income Per Share-Diluted

0.71

0.57

(0.14)

-19.7%

Free Operating Cash Flow

337.5

404.9

67.4

20.0%

F(U) Last Year

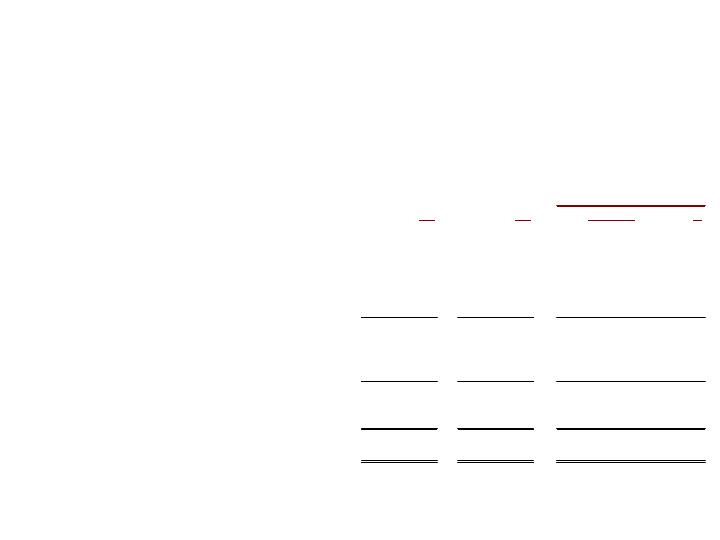

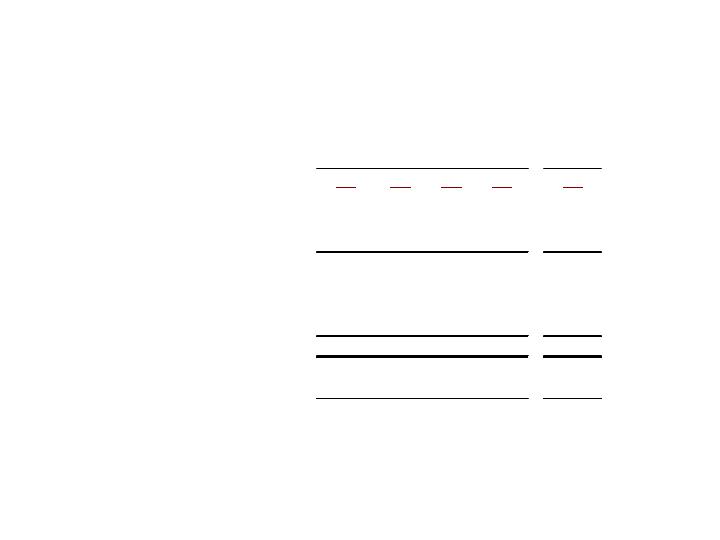

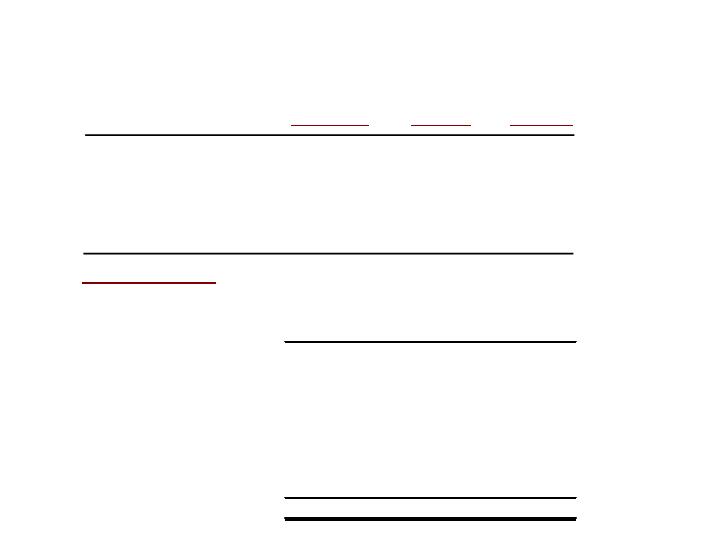

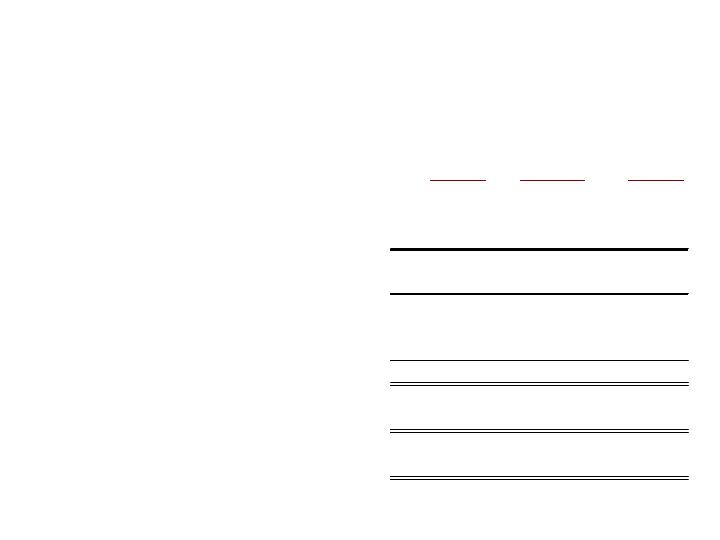

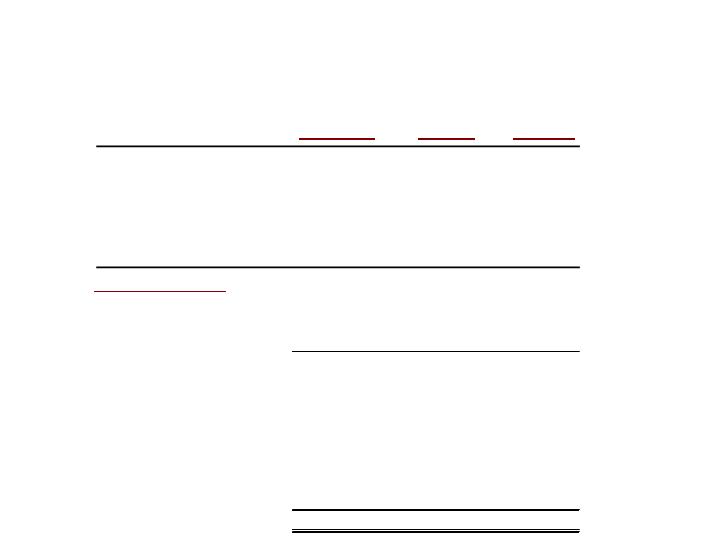

ITW

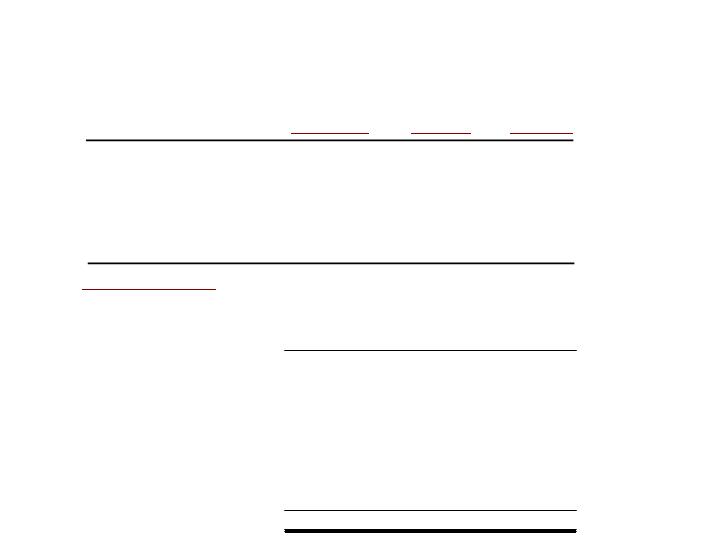

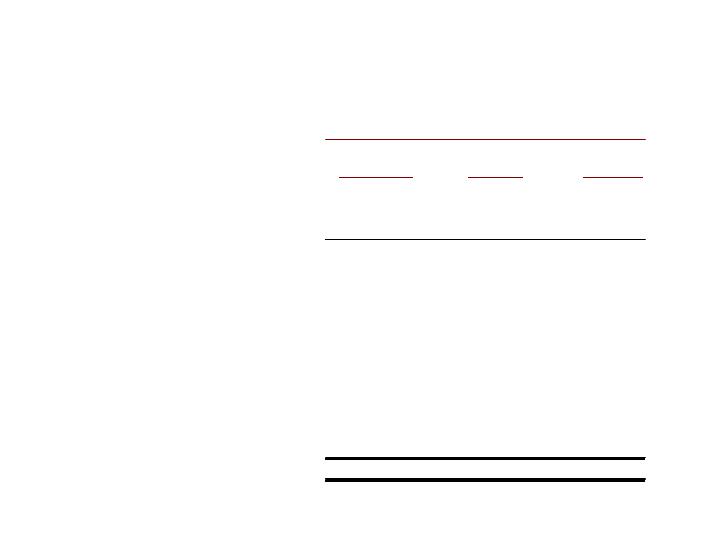

Quarterly Operating Analysis

6

Operating

Operating

Operating

Revenues

Income

Margins

Base Manufacturing Business

Operating Leverage

0.4%

1.1%

0.1%

Nonvolume-related

-

0.5%

0.1%

Total

0.4%

1.6%

0.2%

Acquisitions/Divestitures

6.2%

0.6%

-0.7%

Translation

4.8%

4.8%

0.1%

Impairment

-

-17.0%

-2.6%

Restructuring

-

1.5%

0.2%

Intercompany/Other

-

-

0.1%

Total

11.4%

-8.5%

-2.7%

% F(U) Prior Year

7

ITW

Non Operating & Taxes

2007

2008

Q1

Q1

Amount

%

Operating Income

568.5

520.0

(48.5)

-8.5%

Interest Expense

(24.4)

(37.5)

(13.1)

Other Income (Expense)

15.0

(21.4)

(36.4)

Income from Continuing Operations-Pretax

559.1

461.1

(98.0)

-17.5%

Income Taxes

174.1

159.7

14.4

% to Pretax Income

31.1%

34.6%

-3.5%

Income from Continuing Operations

385.0

301.4

(83.6)

-21.7%

Income from Discontinued Operations

17.4

2.2

(15.2)

Net Income

402.4

303.6

(98.8)

-24.6%

F(U) Last Year

8

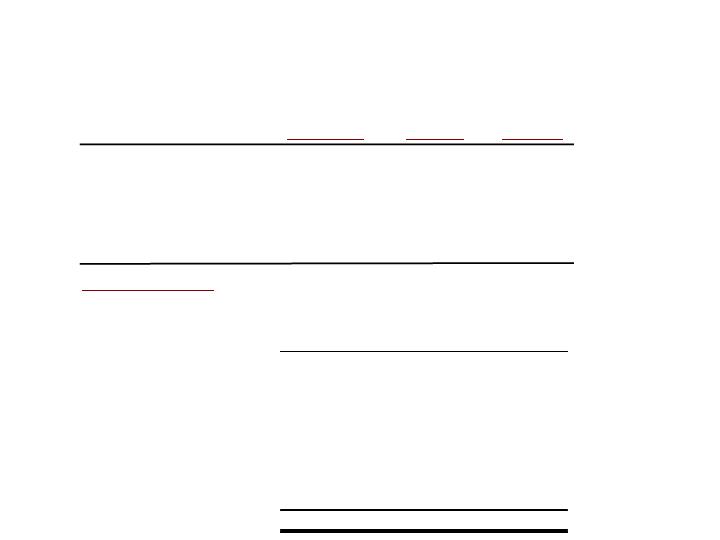

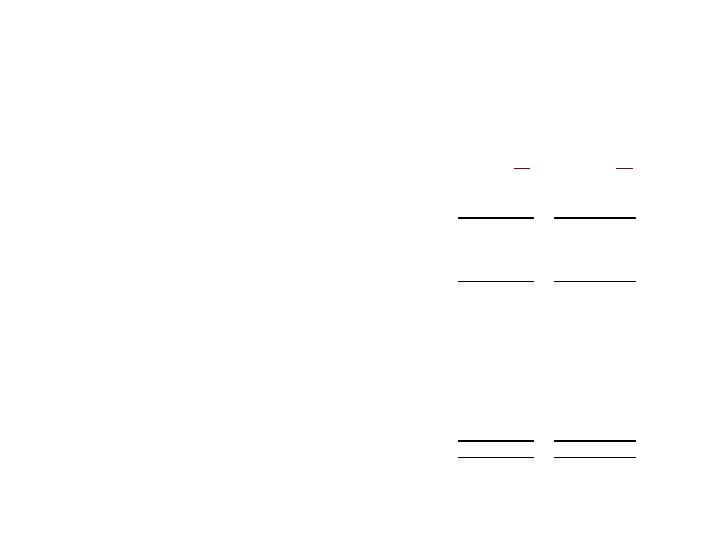

ITW

Invested Capital

3/31/07

12/31/07

3/31/08

Trade Receivables

2,681.5

2,915.5

3,014.4

Days Sales Outstanding

64.2

61.8

65.5

Inventories

1,601.7

1,625.8

1,766.0

Months on Hand

2.0

1.8

2.0

Prepaids and Other Current Assets

444.2

607.7

529.9

Accounts Payable & Accrued Expenses

(1,924.1)

(2,196.0)

(2,224.7)

Operating Working Capital

2,803.3

2,953.0

3,085.6

% to Revenue(Prior 4 Qtrs.)

19%

18%

19%

Net Plant & Equipment

2,070.5

2,194.0

2,247.6

Investments

552.2

507.6

507.0

Goodwill and Intangibles

5,283.6

5,683.3

5,839.5

Other, net

(594.0)

(514.8)

(583.7)

Invested Capital

10,115.6

10,823.1

11,096.0

Return on Average Invested Capital

15.7%

18.3%

12.4%

9

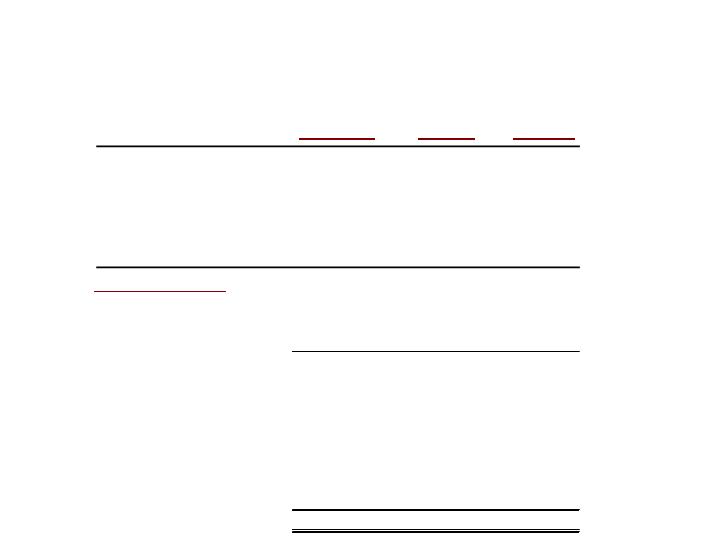

ITW

Debt & Equity

3/31/07

12/31/07

3/31/08

Total Capital

Short Term Debt

577.1

410.5

1,340.0

Long Term Debt

956.3

1,888.8

1,435.4

Total Debt

1,533.4

2,299.3

2,775.4

Stockholders' Equity

9,156.8

9,351.3

9,248.0

Total Capital

10,690.2

11,650.6

12,023.4

Less:

Cash

(574.6)

(827.5)

(927.4)

Net Debt & Equity

10,115.6

10,823.1

11,096.0

Debt to Total Capital

14%

20%

23%

Shares outstanding at end of period

556.7

530.1

522.8

10

ITW

Cash Flow

2007

2008

Q1

Q1

Net Income

402.4

303.6

Adjust for Non-Cash Items

77.2

230.8

Changes in Operating Assets & Liabilities

(56.8)

(40.5)

Net Cash From Operating Activities

422.8

493.9

Additions to Plant & Equipment

(85.3)

(89.0)

Free Operating Cash Flow

337.5

404.9

Stock Repurchase

(179.9)

(385.6)

Acquisitions

(269.1)

(236.0)

Proceeds from Divestitures

91.7

(3.7)

Dividends

(117.3)

(148.4)

Debt

89.2

425.2

Proceeds from Investments

13.1

4.4

Other

19.2

39.1

Net Cash Increase (Decrease)

(15.6)

99.9

11

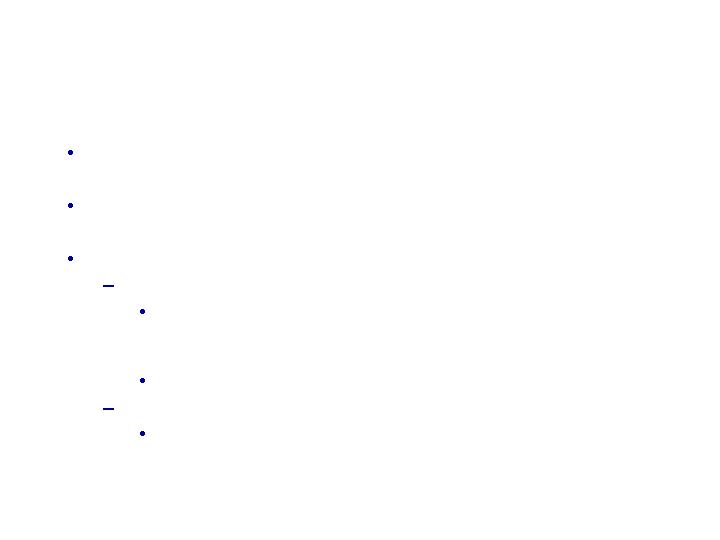

ITW

Acquisitions

Q1

Q2

Q3

Q4

Q1

Annual Revenues Acquired

399

213

218

165

230

Purchase Price

Cash Paid

263

216

235

163

219

Stock Issued

-

-

-

-

-

Total

263

216

235

163

219

Number of Acquisitions

9

10

18

15

16

2007

2008

12

Industrial Packaging

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q1

554.6

65.1

11.7%

2008 Q1

623.3

69.0

11.1%

$ F(U)

68.7

3.9

-0.6%

% F(U)

12.4%

6.1%

% F(U) Prior Year

Base Business

Operating Leverage

0.7%

2.6%

0.2%

Nonvolume-related

-

-7.1%

-0.8%

Total

0.7%

-4.5%

-0.6%

Acquisitions/Divestitures

4.9%

1.7%

-0.3%

Translation

6.7%

7.4%

0.1%

Impairment

-

-

-

Restructuring

-

1.4%

0.2%

Other

0.1%

0.1%

-

Total

12.4%

6.1%

-0.6%

Industrial Packaging

Key Points

Total segment base revenues: +1% for Q1 ’08

Strapping consumables/equipment base revenues: -1%

All other industrial packaging base revenues: +6%

Q1 International base revenues: +3%

Strapping consumables base revenues: -3%

Equipment base revenues: -2%

Q1 North America base revenues: -2%

Strapping consumables base revenues: -3%; largely driven by

weakness in residential construction and primary metals

Strapping equipment base revenues: +11%

13

14

Power Systems and Electronics

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q1

554.4

116.1

20.9%

2008 Q1

582.4

124.8

21.4%

$ F(U)

28.0

8.7

0.5%

% F(U)

5.0%

7.5%

% F(U) Prior Year

Base Business

Operating Leverage

0.9%

1.5%

0.1%

Nonvolume-related

-

3.9%

0.9%

Total

0.9%

5.4%

1.0%

Acquisitions/Divestitures

2.0%

1.1%

-0.2%

Translation

2.2%

1.9%

-0.1%

Impairment

-

-0.7%

-0.2%

Restructuring

-

-0.2%

-

Other

-0.1%

-

-

Total

5.0%

7.5%

0.5%

Power Systems and Electronics

Key Points

Total segment base revenues: +1% in Q1 ’08

Welding accounts for nearly 75% of total segment revenues

In Q1, Welding’s worldwide base revenues: +3%

Welding’s Q1 International base revenues: +18%

Double digit growth in Asia due to high levels of

demand for specialty consumable products serving

energy/pipeline and shipping end markets

Double digit base revenue growth in Europe

Welding’s Q1 North America base revenues: -2%

Weakening demand from customers in

construction/assorted manufacturing sectors

15

16

Transportation

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q1

529.3

84.3

15.9%

2008 Q1

594.3

91.7

15.4%

$ F(U)

65.0

7.4

-0.5%

% F(U)

12.3%

8.7%

% F(U) Prior Year

Base Business

Operating Leverage

1.1%

2.6%

0.2%

Nonvolume-related

-

-3.1%

-0.5%

Total

1.1%

-0.5%

-0.3%

Acquisitions/Divestitures

5.9%

1.1%

-0.7%

Translation

5.3%

5.1%

-

Impairment

-

-

-

Restructuring

-

2.9%

0.5%

Other

-

0.1%

-

Total

12.3%

8.7%

-0.5%

Transportation

Key Points

Total segment base revenues: +1% in Q1 ’08

International base revenues: +6%

North America base revenues: -3%

Auto OEM/Tiers worldwide base revenues: slightly positive in Q1

International Q1 base revenues: +6%

Growth driven by 7% increase in international builds: Renault

Group: +19%; Daimler: +17%; BMW: +10%; VW Group: +7%;

GM group: +5%; and Fiat: +3%

Expect full-year 2008 builds: +4% to +5%

North America Q1 base revenues: -5%

Q1 Detroit 3 builds decline 13%: GM: -17%; Ford: -6%;

Chrysler: -16%

Q1 New Domestics: -1%

Q1 combined build: -9%

Expect full-year 2008 combined builds to decline 6% to 8%

Auto aftermarket Q1 worldwide base revenues: +4%

17

18

Construction Products

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q1

474.5

52.6

11.1%

2008 Q1

484.0

50.4

10.4%

$ F(U)

9.5

(2.2)

-0.7%

% F(U)

2.0%

-4.1%

% F(U) Prior Year

Base Business

Operating Leverage

-5.7%

-21.0%

-1.8%

Nonvolume-related

-

-3.9%

-0.5%

Total

-5.7%

-24.9%

-2.3%

Acquisitions/Divestitures

0.6%

-1.1%

-0.2%

Translation

7.1%

9.4%

0.3%

Impairment

-

0.7%

0.1%

Restructuring

-

11.7%

1.4%

Other

-

0.1%

-

Total

2.0%

-4.1%

-0.7%

Construction Products

Key Points

Total segment base revenues: -6% in Q1 ’08

North America Q1 base revenues: -18%

Q1 Residential: -20% vs. -29% housing start decrease in Q1 ’08

Q1 Renovation: -16% due to weakness at Big Box stores

Q1 Commercial Construction base revenues: -8% largely due to

fall off in stores/food service; warehouses; manufacturing

categories

International Q1 base revenues: +4%

Q1 Asia-Pacific: base revenues: +9%

Q1 Europe: base revenues: flat: Ireland, U.K., Spain all weak

19

20

Food Equipment

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q1

390.6

69.4

17.8%

2008 Q1

509.7

71.0

13.9%

$ F(U)

119.1

1.6

-3.9%

% F(U)

30.5%

2.4%

% F(U) Prior Year

Base Business

Operating Leverage

6.1%

15.0%

1.5%

Nonvolume-related

-

-8.7%

-1.5%

Total

6.1%

6.3%

0.0%

Acquisitions/Divestitures

20.1%

-5.4%

-3.5%

Translation

4.3%

4.0%

0.1%

Impairment

-

-

-

Restructuring

-

-2.5%

-0.4%

Other

-

-

-0.1%

Total

30.5%

2.4%

-3.9%

Food Equipment

Key Points

Total segment base revenues: +6% in Q1 ’08

North America Q1 base revenues: +2%

Q1 Institutional base revenues: +1%

Q1 Service base revenues: +5%

Q1 Retail base revenues: +3%

International Q1 base revenues: +13%

Q1 Asia-Pacific: base revenues: +16%

Growth driven by demand from institutional customers

Q1 Europe: base revenues: +12%

21

22

Decorative Surfaces

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q1

283.7

28.3

10.0%

2008 Q1

302.5

33.3

11.0%

$ F(U)

18.8

5.0

1.0%

% F(U)

6.6%

17.5%

% F(U) Prior Year

Base Business

Operating Leverage

2.2%

9.0%

0.7%

Nonvolume-related

-

5.2%

0.5%

Total

2.2%

14.2%

1.2%

Acquisitions/Divestitures

-

-

-

Translation

4.5%

2.9%

-0.2%

Impairment

-

-

-

Restructuring

-

0.4%

-

Other

-0.1%

-

-

Total

6.6%

17.5%

1.0%

Decorative Surfaces

Key Points

Total segment base revenues: +2% in Q1 ’08

North America Q1 base revenues: +1% in Q1

Q1 laminate base revenues: flat due to larger commercial

construction exposure and success of premium priced high

definition laminate product line

Q1 flooring base revenues: +10% due to new products/easier

comparisons from year ago period

International Q1 base revenues: +4%

Q1 European base revenues: +4%

Q1 Asia-Pacific base revenues: +6%

23

24

Polymers and Fluids

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q1

201.7

30.4

15.1%

2008 Q1

256.8

37.3

14.5%

$ F(U)

55.1

6.9

-0.6%

% F(U)

27.3%

22.8%

% F(U) Prior Year

Base Business

Operating Leverage

4.5%

13.1%

1.3%

Nonvolume-related

-

-0.6%

-0.1%

Total

4.5%

12.5%

1.2%

Acquisitions/Divestitures

17.1%

2.0%

-2.1%

Translation

5.7%

5.9%

0.1%

Impairment

-

2.8%

0.4%

Restructuring

-

-0.2%

-

Other

-

-0.2%

-0.2%

Total

27.3%

22.8%

-0.6%

Polymers and Fluids

Key Points

Total segment base revenues: +4% in Q1 ’08

International Q1 base revenues: +7%

North America Q1 base revenues: +1%

Q1 worldwide polymers base revenues: +5%

International Q1 base revenues: +8%

North America Q1 base revenues: +2%

Industrial adhesives base revenues grew 3% with strength

in MRO/OEM and power industries

Q1 worldwide fluids base revenues: +3%

International Q1 base revenues: +5%

North America Q1 base revenues: +1%

Strength in MRO/OEM partially offset by weakness in

janitorial/sanitation categories

25

26

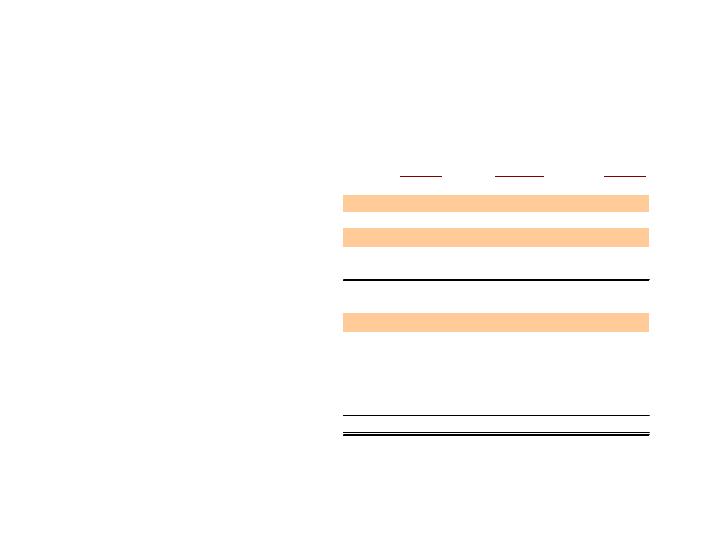

All Other

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q1

739.2

122.4

16.6%

2008 Q1

800.5

42.4

5.3%

$ F(U)

61.3

(80.0)

-11.3%

% F(U)

8.3%

-65.3%

% F(U) Prior Year

Base Business

Operating Leverage

-1.6%

-4.4%

-0.5%

Nonvolume-related

-

10.2%

1.7%

Total

-1.6%

5.8%

1.2%

Acquisitions/Divestitures

6.2%

2.8%

0.2%

Translation

3.7%

4.5%

0.5%

Impairment

-

-79.2%

-13.3%

Restructuring

-

0.7%

0.1%

Other

-

0.1%

-

Total

8.3%

-65.3%

-11.3%

All Other

Key Points

Total segment base revenues: -2% in Q1 ’08

North America Q1 base revenues: -2%

International Q1 base revenues: -3%

Q1 worldwide consumer packaging Q1 base revenues: -1%

Weakness in marking, labeling and coating offset strength in Hi-

Cone and Zip-Pak

Q1 worldwide test and measurement Q1 base revenues: +10%

Q1 worldwide finishing Q1 base revenues: -2%

Q1 worldwide appliance/industrial Q1 base revenues: -8%

Worldwide appliance base revenues decline 6% in Q1

27

28

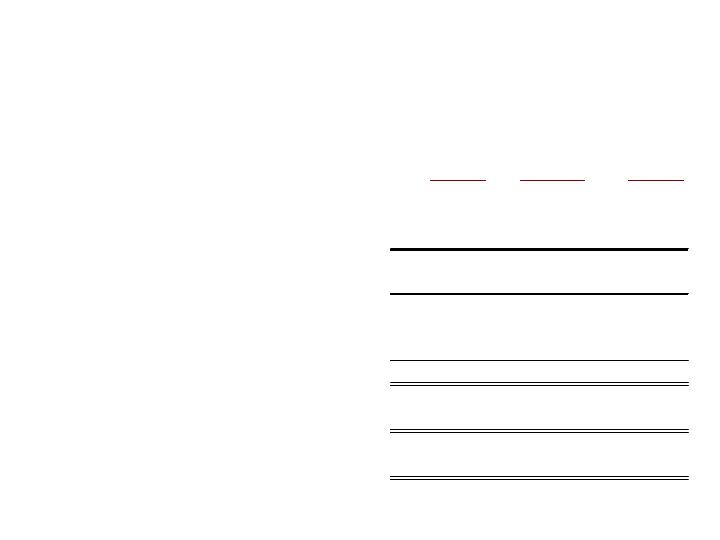

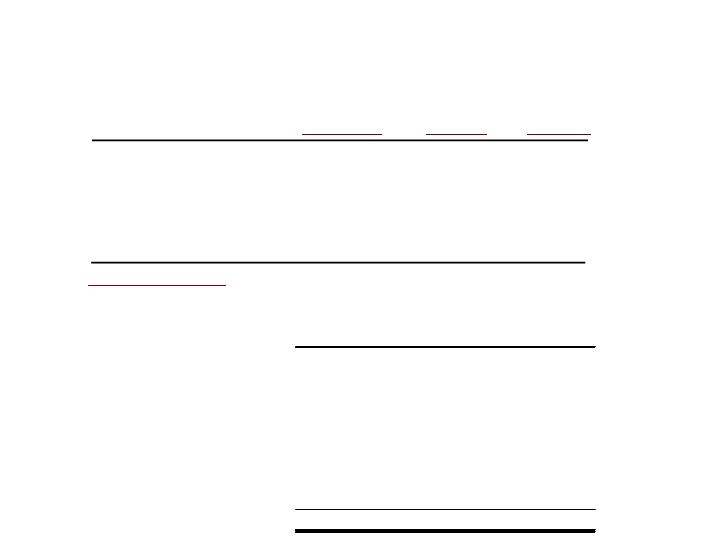

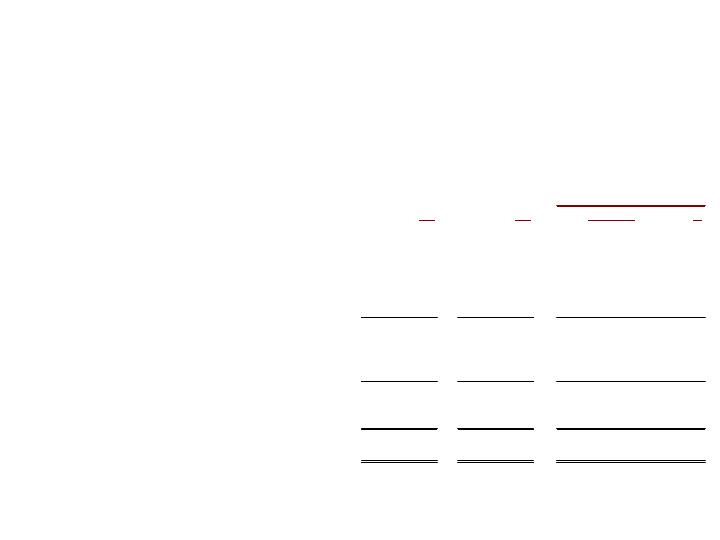

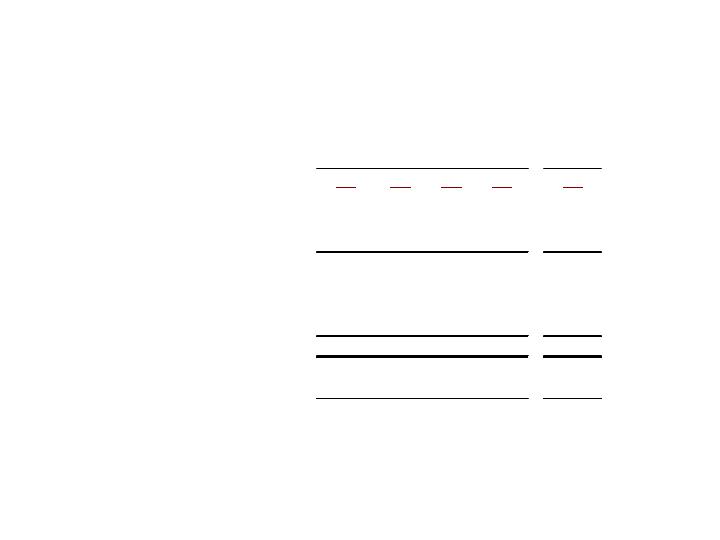

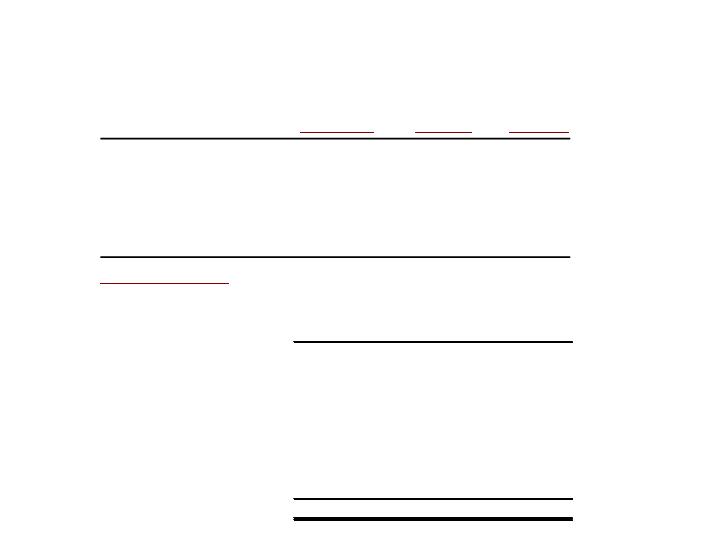

ITW

2008 Forecast

Mid

Low

High

Point

2nd Quarter

Total Revenues

9%

12%

11%

Diluted Income per Share - Continuing

$0.94

$1.00

$0.97

% F(U) 2007

8%

15%

11%

Full Year

Total Revenues

8%

12%

10%

Diluted Income per Share - Continuing

$3.35

$3.49

$3.42

% F(U) 2007

2%

6%

4%

ITW 2008 Forecast

Key Assumptions

Exchange rates hold at current levels.

Acquired revenues in the $0.8 billion to $1.2 billion

range.

Share repurchases of $0.8 billion to $1.0 billion for the

year.

No further impairment of goodwill/intangibles.

Net nonoperating expense, including interest expense

and other nonoperating income, of $135 to $145

million, which is higher than 2007 by $92 to $102

million.

Tax rate range of 28.75% to 29.25% for the second

quarter and 29.75% to 30.25% for the year.

29

ITW Conference Call

Q & A

First Quarter

2008

30