1

ITW Conference Call

Fourth Quarter

2008

Exhibit 99.2

2

ITW

Agenda

1. Introduction…………………….. John Brooklier/David Speer

2. Financial Overview…………….. Ron Kropp

3. Reporting Segments………..…. John Brooklier

4. Forecast 2009……….…….….… Ron Kropp

5. Q & A………………......………… John Brooklier/Ron Kropp/David Speer

3

ITW

Forward - Looking Statements

This conference call contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995 including, without limitation, statements regarding

operating performance, revenue growth, operating income,

income from continuing operations, diluted income per share

from continuing operations, use of free cash, potential

acquisitions, end market conditions, discontinued operations,

and the Company’s related forecasts. These statements are

subject to certain risks, uncertainties, and other factors which

could cause actual results to differ materially from those

anticipated. Important risks that could cause actual results to

differ materially from the Company’s expectations are set

forth in ITW’s Form 10-Q for the 2008 third quarter and Form

10-K for 2007.

4

Conference Call Playback

Replay number: 203-369-0593

No pass code necessary

Telephone replay available through midnight of

February 12, 2009

Webcast / PowerPoint replay available at

itw.com website

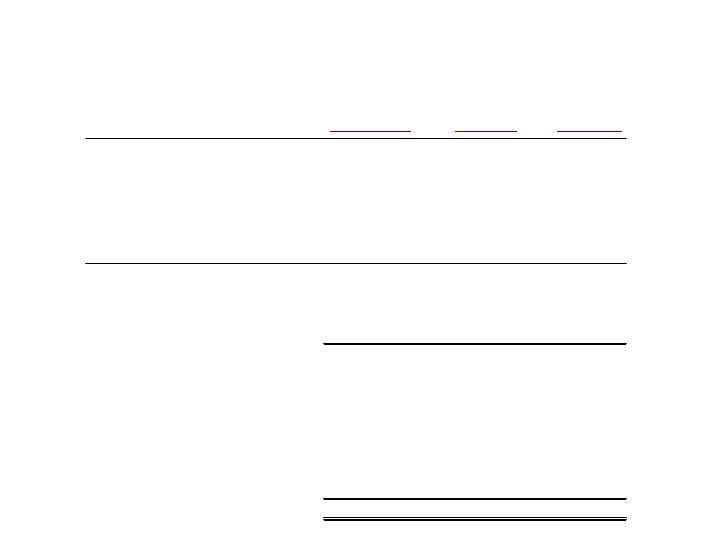

5

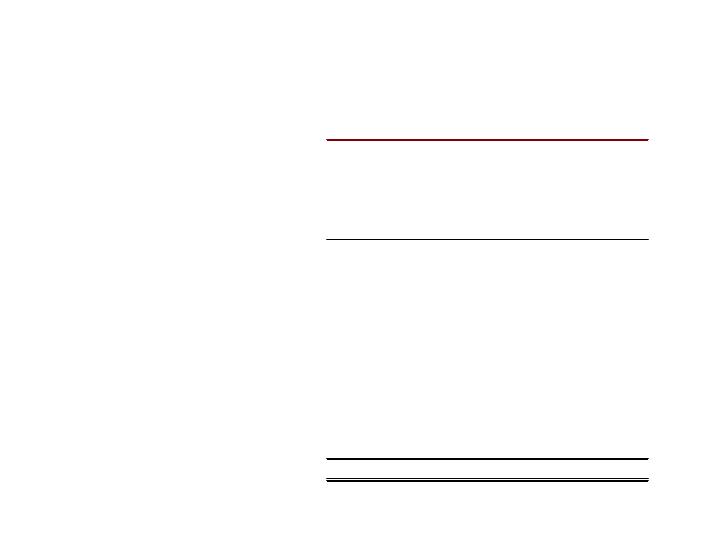

ITW

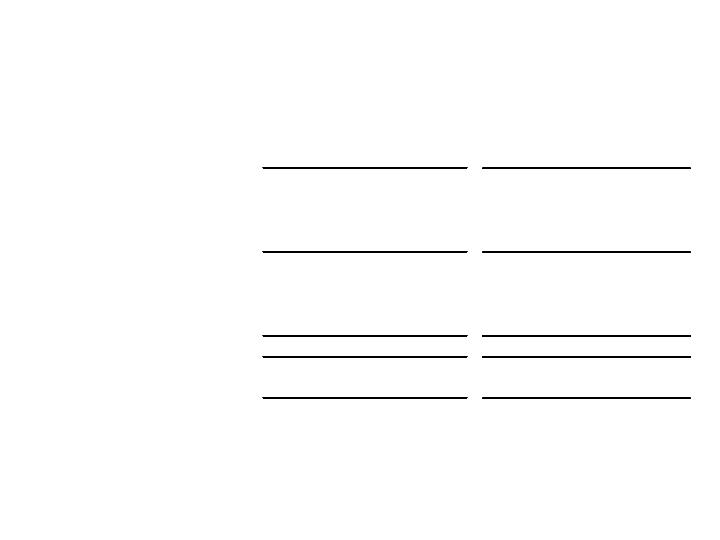

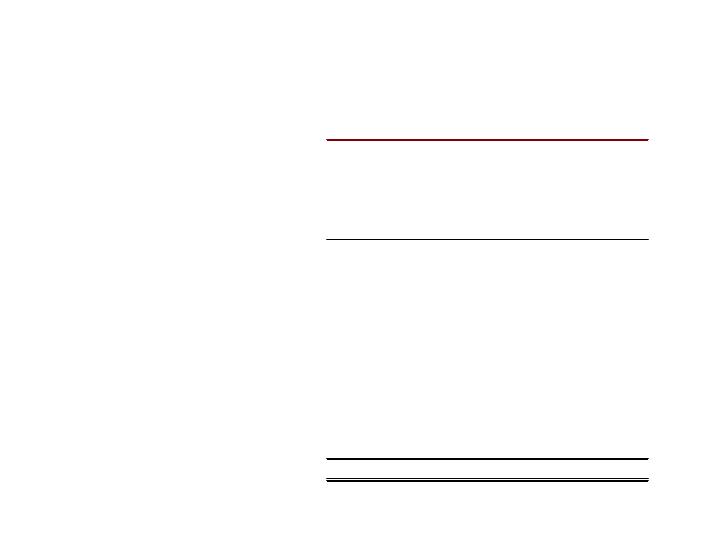

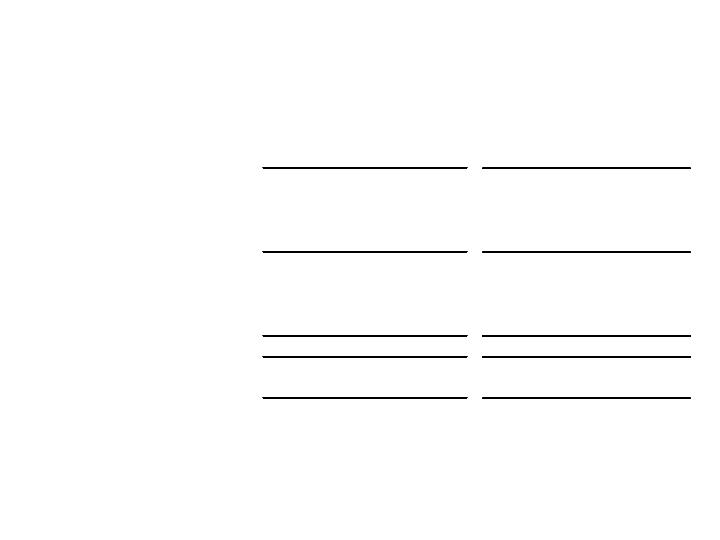

Quarterly Highlights

2007

2008

Q4

Q4

Amount

%

Operating Revenues

3,908.4

3,678.4

(230.0)

-5.9%

Operating Income

618.7

414.1

(204.6)

-33.1%

% of Revenues

15.8%

11.3%

-4.5%

Income from Continuing Operations

Income Amount

443.5

273.3

(170.2)

-38.4%

Income Per Share-Diluted

0.82

0.54

(0.28)

-34.1%

Net Income

Income Amount

470.7

233.8

(236.9)

-50.3%

Income Per Share-Diluted

0.87

0.46

(0.41)

-47.1%

Free Operating Cash Flow

694.7

508.9

(185.8)

-26.7%

% to Net Income

147.6%

217.7%

70.1%

47.5%

F(U) Last Year

6

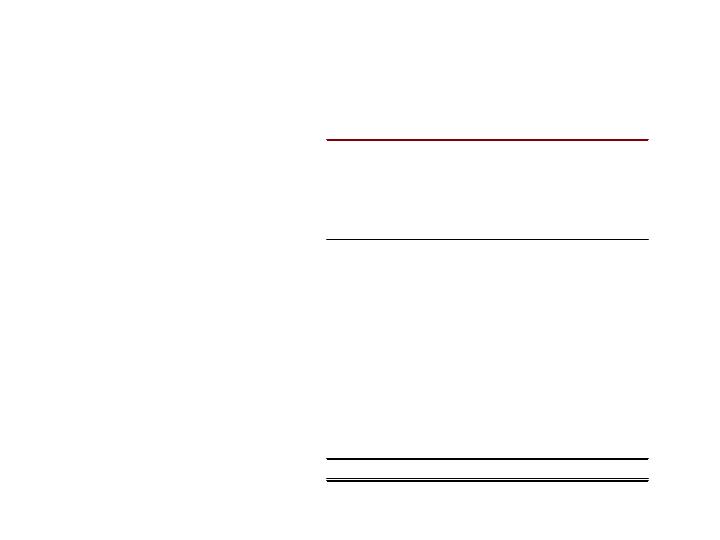

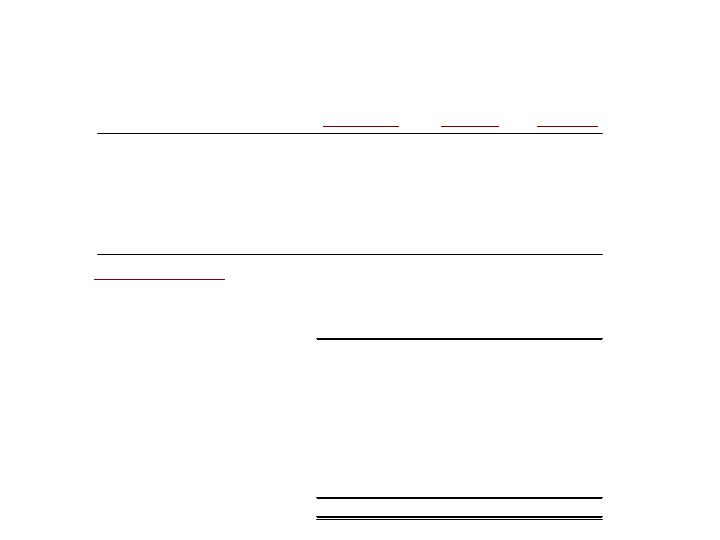

ITW

Quarterly Operating Analysis

Operating

Operating

Operating

Revenues

Income

Margins

Base Manufacturing Business

Operating Leverage

-9.2%

-24.4%

-2.6%

Changes in VM & OH costs

-

-

-

Total

-9.2%

-24.4%

-2.6%

Acquisitions/Divestitures

7.8%

0.3%

-0.9%

Translation

-4.5%

-4.7%

-0.2%

Impairment

-

-

-

Restructuring

-

-4.3%

-0.8%

Intercompany/Other

-

-

-

Total

-5.9%

-33.1%

-4.5%

% F(U) Prior Year

7

ITW

Non Operating & Taxes

2007

2008

Q4

Q4

Amount

%

Operating Income

618.7

414.1

(204.6)

-33.1%

Interest Expense

(26.2)

(40.3)

(14.1)

Other Income (expense)

4.2

(14.5)

(18.7)

Income from Continuing Operations-Pretax

596.7

359.3

(237.4)

-39.8%

Income Taxes

153.2

86.0

67.2

% to Pretax Income

25.7%

23.9%

1.8%

Income from Continuing Operations

443.5

273.3

(170.2)

-38.4%

Income (Loss) from Discontinued Operations

27.2

(39.5)

(66.7)

Net Income

470.7

233.8

(236.9)

-50.3%

F(U) Last Year

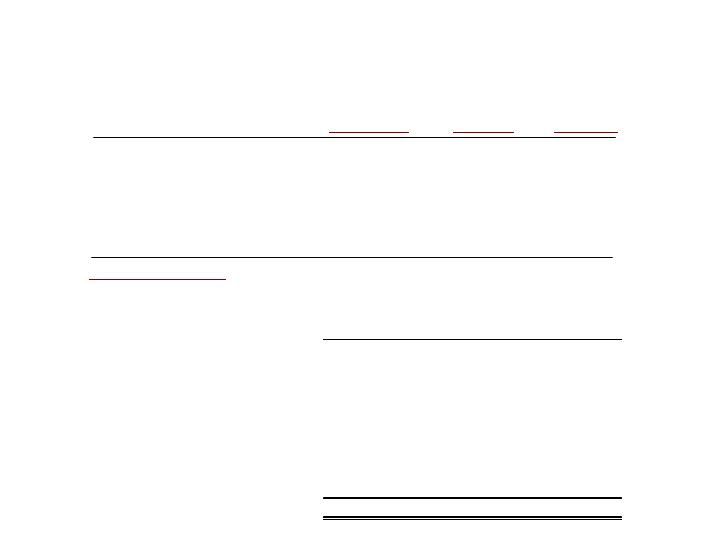

8

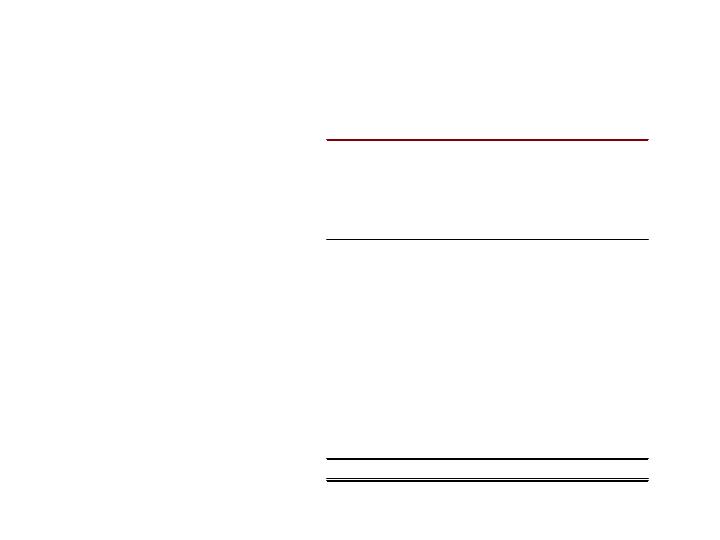

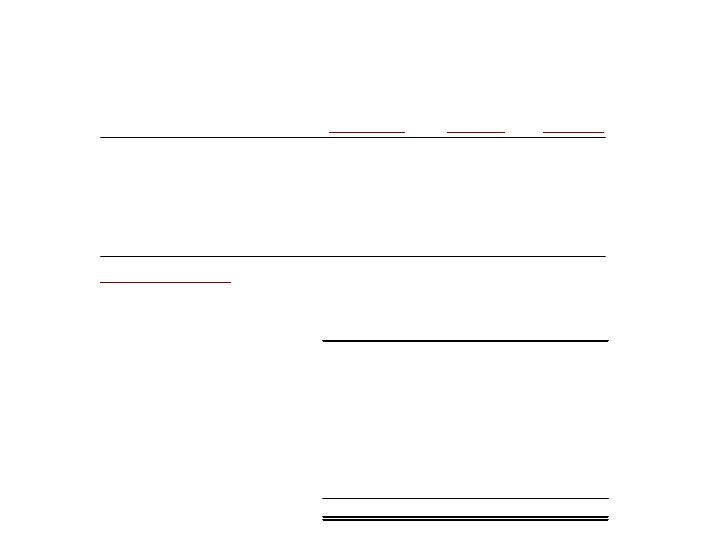

ITW

Full Year Highlights

2007

2008

Amount

%

Operating Revenues

14,871.1

15,869.4

998.3

6.7%

Operating Income

2,448.9

2,338.2

(110.7)

-4.5%

% of Revenues

16.5%

14.7%

-1.8%

Income from Continuing Operations

Income Amount

1,711.9

1,583.3

(128.6)

-7.5%

Income Per Share-Diluted

3.08

3.04

(0.04)

-1.3%

Net Income

Income Amount

1,869.9

1,519.0

(350.9)

-18.8%

Income Per Share-Diluted

3.36

2.91

(0.45)

-13.4%

Free Operating Cash Flow

2,130.9

1,867.4

(263.5)

-12.4%

% to Net Income

114.0%

122.9%

8.9%

7.8%

F(U) Last Year

9

ITW

Full Year Operating Analysis

Operating

Operating

Operating

Revenues

Income

Margins

Base Manufacturing Business

Operating Leverage

-2.5%

-6.5%

-0.7%

Changes in VM & OH costs

-

-1.0%

-0.2%

Total

-2.5%

-7.5%

-0.9%

Acquisitions/Divestitures

6.5%

1.5%

-0.7%

Translation

2.8%

2.6%

-

Impairment

-

-

-

Restructuring

-

-1.1%

-0.2%

Intercompany/Other

-0.1%

-

-

Total

6.7%

-4.5%

-1.8%

% F(U) Prior Year

10

ITW

Invested Capital

12/31/07

9/30/08

12/31/08

Trade Receivables

2,915.5

2,981.7

2,426.1

Days Sales Outstanding

62.7

64.7

59.4

Inventories

1,625.8

1,835.5

1,673.2

Months on Hand

1.8

2.0

2.1

Prepaids and Other Current Assets

464.1

505.9

367.7

Accounts Payable & Accrued Expenses

(2,190.1)

(2,240.9)

(1,893.0)

Operating Working Capital

2,815.3

3,082.2

2,574.0

% to Revenue(Prior 4 Qtrs.)

19%

19%

16%

Net Plant & Equipment

2,194.0

2,120.8

1,968.6

Investments

507.6

498.3

465.9

Goodwill and Intangibles

5,683.3

6,472.5

6,278.3

Net Assets Held for Sale

137.7

413.2

318.0

Other, net

(514.7)

(763.4)

(1,007.1)

Invested Capital

10,823.2

11,823.6

10,597.7

Return on Average Invested Capital

17.3%

15.6%

11.2%

11

ITW

Debt & Equity

12/31/07

9/30/08

12/31/08

Total Capital

Short Term Debt

410.5

2,197.1

2,433.5

Long Term Debt

1,888.8

1,398.2

1,243.7

Total Debt

2,299.3

3,595.3

3,677.2

Stockholders' Equity

9,351.3

9,095.9

7,663.5

Total Capital

11,650.6

12,691.2

11,340.7

Less:

Cash

(827.5)

(867.6)

(743.0)

Net Debt & Equity

10,823.1

11,823.6

10,597.7

Debt to Total Capital

20%

28%

32%

Shares outstanding at end of period

530.1

511.2

499.1

12

ITW

Cash Flow

2007

2008

Q4

Q4

Net Income

470.7

233.8

Adjust for Non-Cash Items

142.1

107.4

Changes in Operating Assets & Liabilities

180.6

248.9

Net Cash From Operating Activities

793.4

590.1

Additions to Plant & Equipment

(98.7)

(81.2)

Free Operating Cash Flow

694.7

508.9

Stock Repurchases

(798.9)

(399.0)

Acquisitions

(193.2)

(222.7)

Purchase of Investments

(20.6)

(16.5)

Dividends

(152.3)

(158.5)

Debt

591.6

194.6

Proceeds from Investments

40.5

5.4

Other

63.6

(36.9)

Net Cash Increase

225.4

(124.7)

13

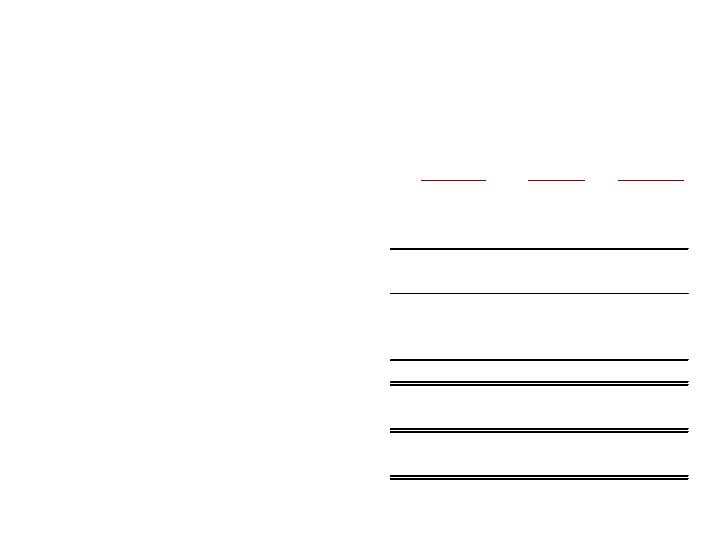

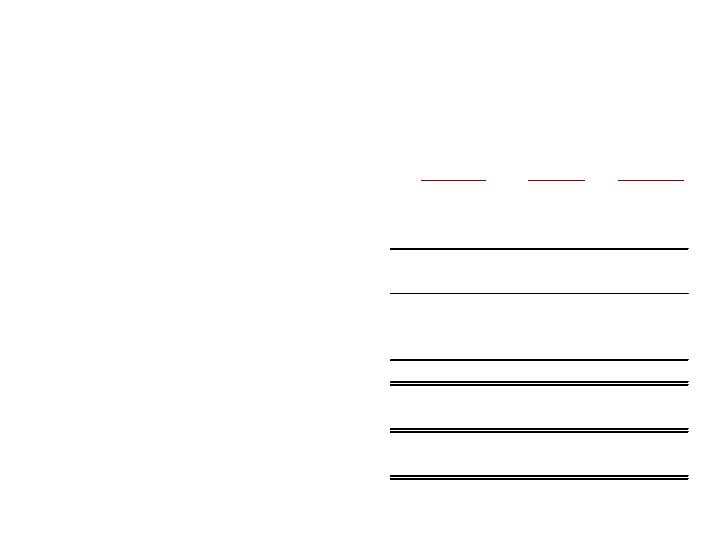

ITW

Acquisitions

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Annual Revenues Acquired

399

213

218

165

230

308

847

154

Purchase Price

Cash Paid

263

216

235

163

223

439

745

190

Stock Issued

-

-

-

-

-

-

-

-

Total

263

216

235

163

223

439

745

190

Number of Acquisitions

9

10

18

15

16

10

14

10

2007

2008

14

Macro Data and End Markets Continued to

Deteriorate in Q4

Since December 2008 Investor Meeting in New York City, macro and

end market trends have continued to deteriorate

U.S. Data

Industrial production: -6.1% in October 2008 vs. -10.2% in

December 2008

ISM Index: 36.2% in November 2008 vs. 32.4% in December 2008

Capacity utilization (manufacturing ex.tech): 79.2% in December

2007 vs. 70.5% in December 2008

NA auto: Q4 combined builds forecasted to be -18% to -20% per

December meeting vs. -26 % Q4 Actual

Q4 Housing starts forecasted to be -30% to -35% per December

meeting vs. -41% Q4 actual (680k starts in Q4)

International Data

Euro-Zone industrial production: -2.2% in October 2008 vs. -6.9% in

December 2008

Euro-Zone Purchasing Manager’s Index: 41.1% in October 2008 vs.

33.9% in December 2008

Euro-Zone capacity utilization: 83.0% for full year 2007 vs. 81.6% for

Q4 2008

European auto: Q4 builds forecasted to be -8% to -10% per

December meeting vs. -16% Q4 actual

15

Industrial Packaging

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q4

626.3

76.8

12.3%

2008 Q4

568.8

38.4

6.8%

$ F(U)

(57.5)

(38.4)

-5.5%

% F(U)

-9.2%

-50.0%

% F(U) Prior Year

Base Business

Operating Leverage

-5.7%

-18.2%

-1.6%

Changes in VM & OH costs

-

-16.2%

-2.1%

Total

-5.7%

-34.4%

-3.7%

Acquisitions/Divestitures

2.4%

0.7%

-0.1%

Translation

-5.9%

-5.6%

-0.3%

Impairment

-

-

-

Restructuring

-

-10.6%

-1.4%

Other

-

-0.1%

-

Total

-9.2%

-50.0%

-5.5%

16

Industrial Packaging

Key Points

Total segment base revenues: -5.7% for Q4 ’08 vs. +5.2 % in Q3 ’08

Q4 North America base revenues: -12.3% for Q4 ’08

Base revenue decline largely due to notable fall-off in demand

for consumable plastic and steel strapping products

Q4 International base revenues: -1.2% for Q4 ’08 as demand for

strapping products was essentially flat in the quarter

Worldwide insulation base revenues grew 24.5% in Q4 ’08

Underlying demand strong from energy-related customers

17

Power Systems and Electronics

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q4

558.4

107.5

19.2%

2008 Q4

504.9

77.7

15.4%

$ F(U)

(53.4)

(29.8)

-3.8%

% F(U)

-9.6%

-27.7%

% F(U) Prior Year

Base Business

Operating Leverage

-10.8%

-21.9%

-2.4%

Changes in VM & OH costs

-

0.7%

0.2%

Total

-10.8%

-21.2%

-2.2%

Acquisitions/Divestitures

3.2%

-3.4%

-1.3%

Translation

-1.9%

-1.3%

0.1%

Impairment

-

-

-

Restructuring

-

-1.9%

-0.4%

Other

-0.1%

0.1%

-

Total

-9.6%

-27.7%

-3.8%

18

Power Systems and Electronics

Key Points

Total segment base revenues: -10.8% in Q4 ’08 vs. +3.1% in Q3 ’08

In Q4, Welding’s worldwide base revenues: -9.0%

Welding’s Q4 North America base revenues declined 15.7% as

underlying industrial production and related end markets

continue to slow in U.S.

Welding’s Q4 International base revenues: +9.4%

18.7% base revenue increase in Asia due to high levels of demand

for specialty consumable products serving energy/pipeline, ship

building and container categories

3.9% base revenue decline in Europe in Q4

Ground Support Equipment: +17.9% in Q4

19

Transportation

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q4

567.8

94.4

16.6%

2008 Q4

541.0

16.9

3.1%

$ F(U)

(26.8)

(77.5)

-13.5%

% F(U)

-4.7%

-82.1%

% F(U) Prior Year

Base Business

Operating Leverage

-20.3%

-46.9%

-5.6%

Changes in VM & OH costs

-

-16.9%

-3.5%

Total

-20.3%

-63.8%

-9.1%

Acquisitions/Divestitures

19.8%

-4.8%

-2.0%

Translation

-4.2%

-5.4%

-0.8%

Impairment

-

-

-

Restructuring

-

-8.1%

-1.7%

Other

-

-

0.1%

Total

-4.7%

-82.1%

-13.5%

20

Transportation

Key Points

Total segment base revenues: -20.3% in Q4 ’08 vs. -9.6% in Q3 ’08

Auto OEM/Tiers:

North America Q4 base revenues: -26.5%

Q4 combined build: -26%

Q4 Detroit 3 builds decline 28%: GM: -23%; Ford: -29%; Chrysler: -37%

Q4 New Domestics: -22%

FY 2008 combined build: -16%; D3: -21%; New Domestics: -8%

International Q4 base revenues: -21.7%

International builds: -16% in Q4: GM Group: -39%; Renault: -24%; Fiat:

-21%; BMW: -18%; PSA: -15%; Ford: -14%

FY 2008 builds: -3%

2009 Forecast vs. 2008:

NA: 10 million vehicles … 21% decline

INTL: 17 million vehicles … 20% decline

Auto aftermarket Q4 worldwide base revenues: -3.6% as consumer spending

dips

21

Construction Products

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q4

532.3

73.7

13.9%

2008 Q4

415.5

35.7

8.6%

$ F(U)

(116.8)

(38.0)

-5.3%

% F(U)

-21.9%

-51.6%

% F(U) Prior Year

Base Business

Operating Leverage

-14.6%

-44.8%

-4.9%

Changes in VM & OH costs

-

7.5%

1.2%

Total

-14.6%

-37.3%

-3.7%

Acquisitions/Divestitures

0.4%

-1.4%

-0.3%

Translation

-7.7%

-9.7%

-0.8%

Impairment

-

-

-

Restructuring

-

-3.3%

-0.5%

Other

-

0.1%

-

Total

-21.9%

-51.6%

-5.3%

22

Construction Products

Key Points

Total segment base revenues: -14.6% in Q4 ’08 vs. -4.4% in Q3 ’08

North America Q4 base revenues: -23.4% vs. -6.2% in Q3 ’08

Q4 Residential: -29% base revenues vs. -41% Q4 housing starts

Q4 Commercial Construction base revenues: -16% as Dodge

Index data shows year-to-date activity (sq. footage) down 19%

Q4 Renovation: -19% due to weak demand at Big Box stores

International Q4 base revenues: -10.5% vs. -3.2% in Q3 ’08

Q4 Europe: base revenues: -16.9% as overall Europe continues

to weaken

Q4 Asia-Pacific: base revenues: -1.6% due to slowing Asia;

Australia/New Zealand flat in Q4

23

Food Equipment

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q4

565.7

80.2

14.2%

2008 Q4

542.3

87.8

16.2%

$ F(U)

(23.4)

7.7

2.0%

% F(U)

-4.1%

9.6%

% F(U) Prior Year

Base Business

Operating Leverage

1.7%

4.8%

0.4%

Changes in VM & OH costs

-

13.4%

1.9%

Total

1.7%

18.2%

2.3%

Acquisitions/Divestitures

-1.9%

-2.0%

-

Translation

-3.9%

-3.8%

0.1%

Impairment

-

-

-

Restructuring

-

-2.9%

-0.4%

Other

-

0.1%

-

Total

-4.1%

9.6%

2.0%

24

Food Equipment

Key Points

Total segment base revenues: +1.7% in Q4 ’08 vs. -1.7% in Q3 ’08

International Q4 base revenues: +3.2%

Europe base revenues increased 3.0% while Asia-Pacific base

revenues grew 6.4%

North America Q4 base revenues: -0.7%

Q4 Institutional/restaurant base revenues: -4.0% as

institutional customers delay purchases of equipment

Q4 Service base revenues: +3.5%

Q4 Retail base revenues: +6.7%

25

Polymers and Fluids

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q4

261.1

40.8

15.6%

2008 Q4

327.2

��

36.3

11.1%

$ F(U)

66.1

(4.5)

-4.5%

% F(U)

25.3%

-11.0%

% F(U) Prior Year

Base Business

Operating Leverage

-7.9%

-22.5%

-2.5%

Changes in VM & OH costs

-

2.2%

0.4%

Total

-7.9%

-20.3%

-2.1%

Acquisitions/Divestitures

38.2%

15.3%

-2.1%

Translation

-5.3%

-6.4%

-0.3%

Impairment

-

-

-

Restructuring

-

0.3%

0.1%

Other

0.3%

-

-0.1%

Total

25.3%

-11.1%

-4.5%

26

Polymers and Fluids

Key Points

Total segment base revenues: -7.9% in Q4 ’08 vs. +3.5% in Q3 ’08 as

industrial markets notably slow

Product breakdown:

Worldwide Polymers base revenues: -7.8%

Worldwide Fluids base revenues: -8.0%

North America:

Polymers Q4 base revenues: -5.4%

Fluids Q4 base revenues: -14.7% as manufacturing demand slackens

International:

Polymers Q4 base revenues: -9.1%

Fluids Q4 base revenues: -4.6%

27

All Other

Quarterly Analysis

Operating

Operating

Operating

Revenues

Income

Margins

2007 Q4

807.9

145.3

18.0%

2008 Q4

789.6

121.4

15.4%

$ F(U)

(18.3)

(24.0)

-2.6%

% F(U)

-2.3%

-16.5%

% F(U) Prior Year

Base Business

Operating Leverage

-7.5%

-19.5%

-2.3%

Changes in VM & OH costs

-

5.7%

1.1%

Total

-7.5%

-13.8%

-1.2%

Acquisitions/Divestitures

8.5%

4.2%

-0.6%

Translation

-3.3%

-3.7%

-0.2%

Impairment

-

-

-

Restructuring

-

-3.1%

-0.6%

Other

-

-0.1%

-

Total

-2.3%

-16.5%

-2.6%

28

All Other

Key Points

Total segment base revenues: -7.5% in Q4 ’08 vs. -0.7% in Q3 ’08

Q4 worldwide test and measurement base revenues: +3.0%

due to Asian operations

Q4 worldwide consumer packaging base revenues: -7.6% as

demand for graphics, foils and marking weakened; Hi-Cone

& Zip-Pak units grew base revenues in the quarter

Q4 worldwide finishing base revenues: -8.3%

Q4 worldwide industrial/appliance base revenues: -14.5%

29

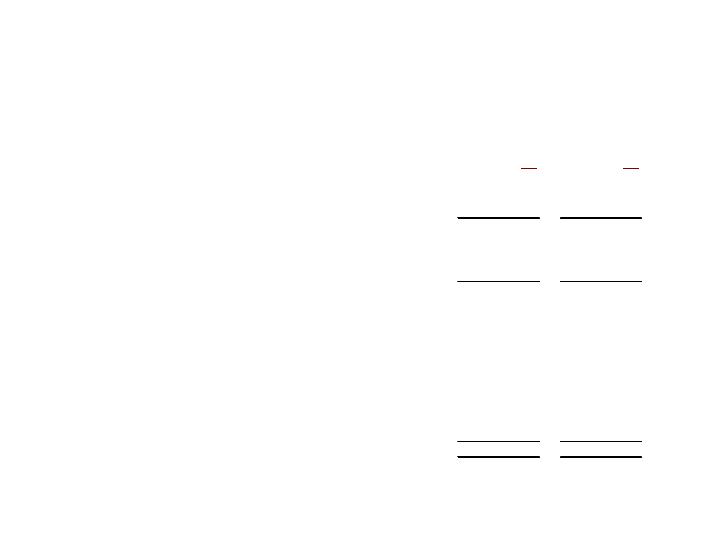

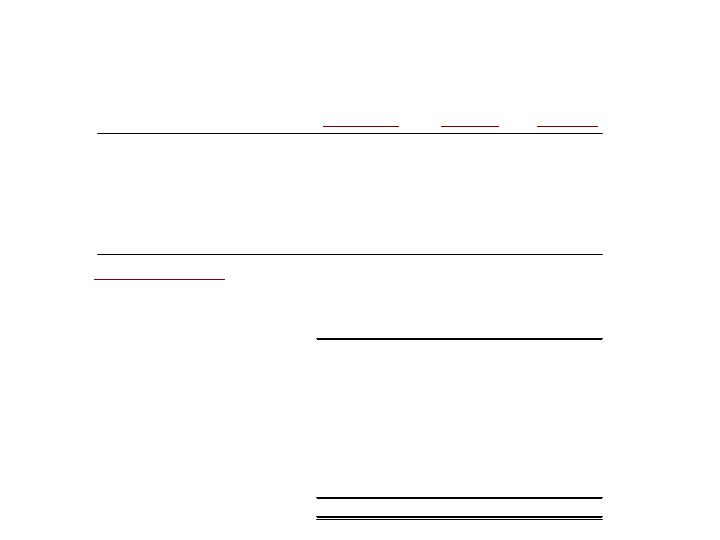

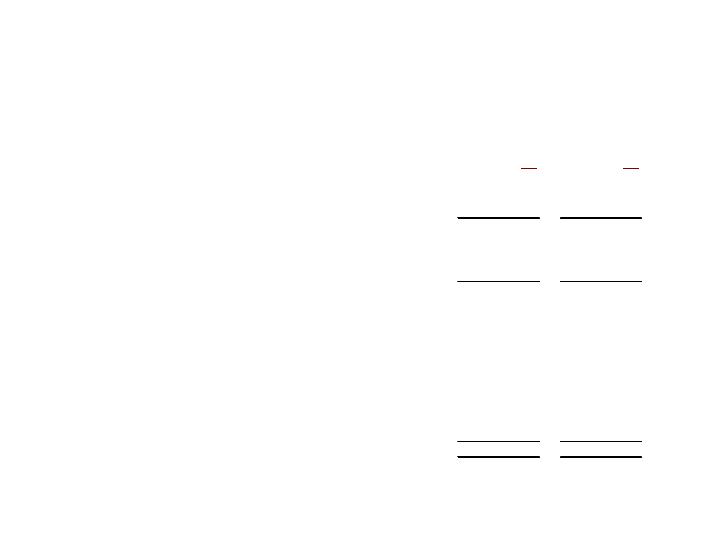

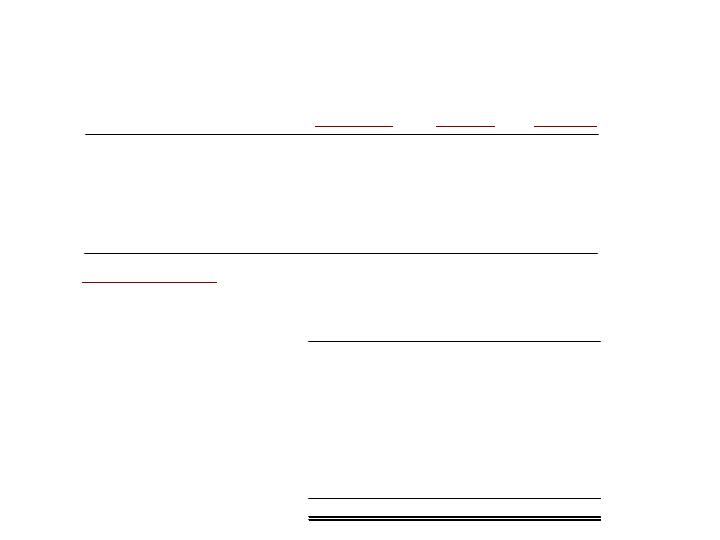

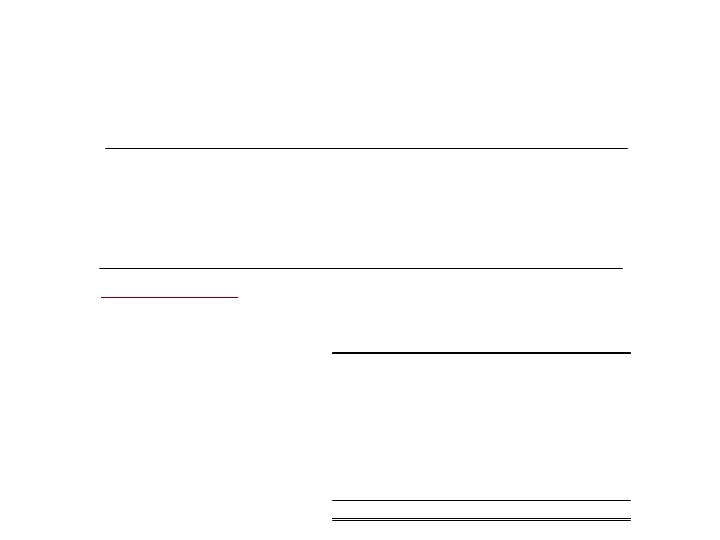

ITW

2009 Forecast

Mid

Low

High

Point

1st Quarter

Total Revenues

-17%

-11%

-14%

Diluted Income per Share - Continuing

$0.26

$0.42

$0.34

% F(U) 2008

-63%

-40%

-51%

Full Year

Total Revenues

-12%

-6%

-9%

Diluted Income per Share - Continuing

$1.84

$2.48

$2.16

% F(U) 2008

-39%

-18%

-29%

30

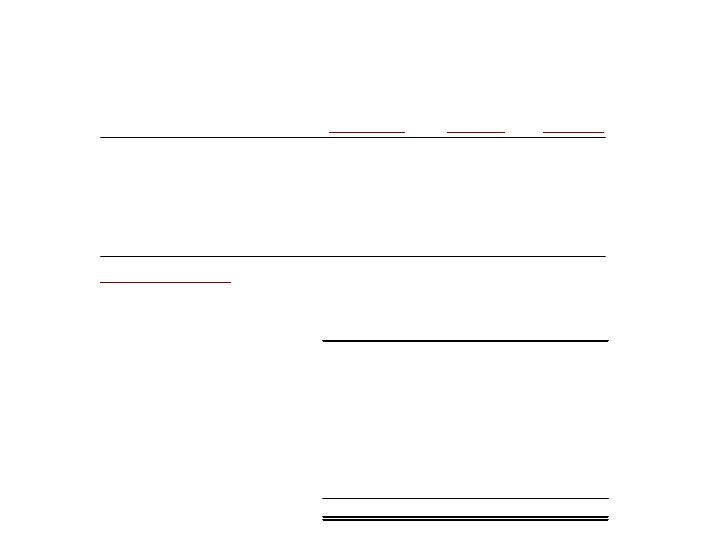

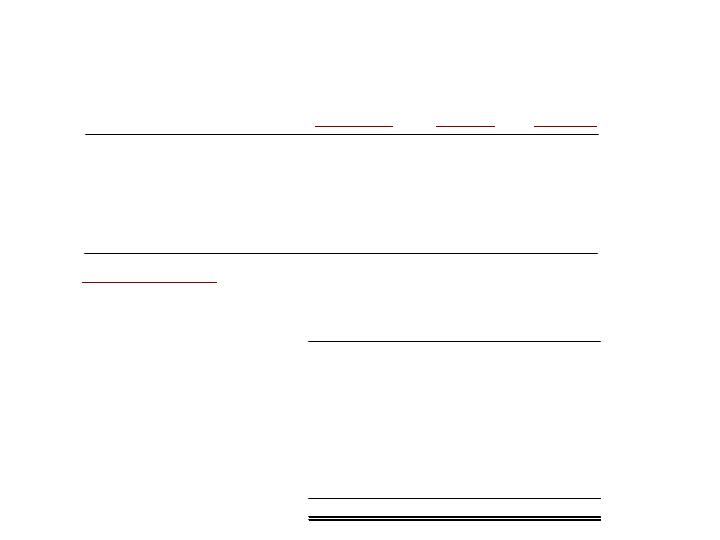

ITW 2009 Forecast

Key Assumptions

Exchange rates hold at current levels.

Acquired revenues in the $400 to $600 million range.

No share repurchases planned for the year.

Restructuring costs of $60 to $100 million

Net nonoperating expense, including interest expense

and other nonoperating income, of $90 to $100 million,

which is lower than 2008 by $47 to $57 million.

Tax rate range of 27.75% to 28.25% for the first quarter

and for the year.

31

ITW Conference Call

Q & A

Fourth Quarter

2008