SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 100 YEARS STRONG ITW Conference Call Fourth Quarter 2012 January 29, 2013

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. Forward-Looking Statements 2 Safe Harbor Statement This conference call contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, without limitation, statements regarding strategic initiatives and related benefits, operating performance, growth in free operating cash flow, revenue and margin growth, diluted income per share from continuing operations, restructuring expenses and related benefits, tax rates, exchange rates, share repurchases, end market conditions, and the Company’s related 2013 forecasts. These statements are subject to certain risks, uncertainties, and other factors which could cause actual results to differ materially from those anticipated. Important risks that could cause actual results to differ materially from the Company’s expectations include those that are detailed in ITW’s Form 10-K for 2011 and Form 10-Q for the third quarter of 2012. Non-GAAP Measures The Company uses certain non-GAAP measures in discussing the Company’s performance (denoted with *). The reconciliation of those measures to the most comparable GAAP measures is contained within the appendix of this presentation and is also available at our website www.ITW.com under “Investor Relations”.

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. Conference Call Playback • Replay number: 888-393-9645; No pass code necessary • Telephone replay available through midnight of February 12, 2013 • Webcast / PowerPoint replay available at www.itw.com • Supplemental financial and investor information will be available on the ITW website under the “Investor Relations” tab 3

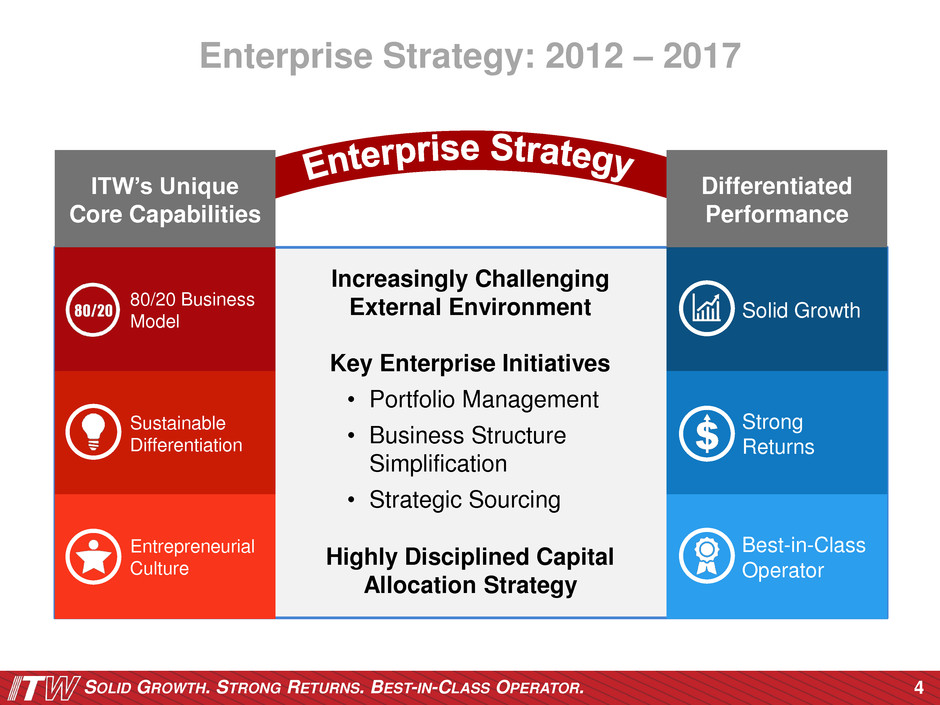

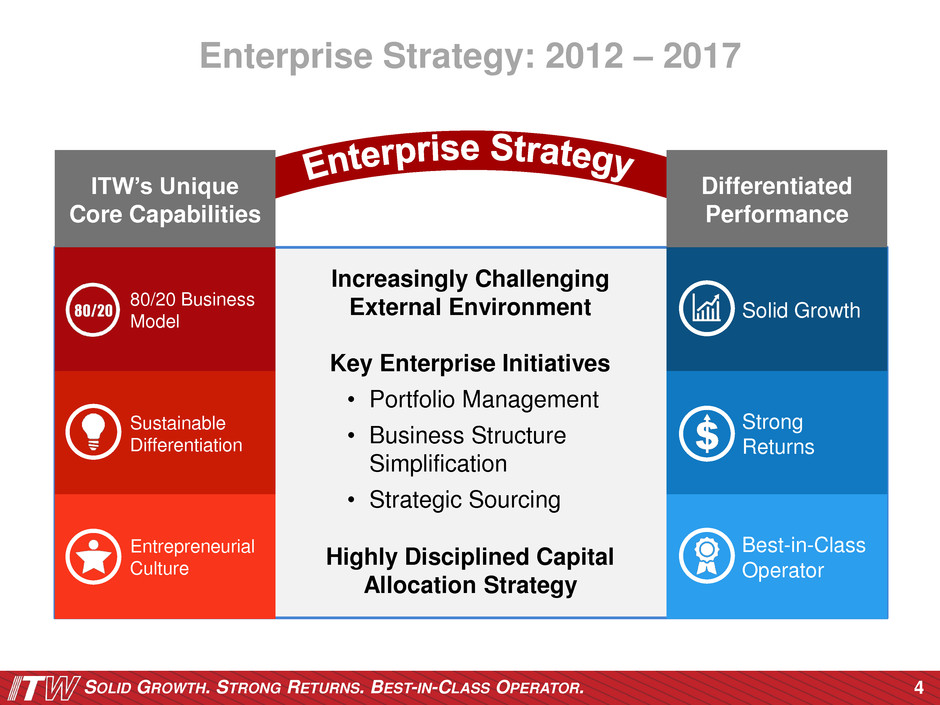

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 4 ITW’s Unique Core Capabilities 80/20 Business Model Sustainable Differentiation Entrepreneurial Culture Differentiated Performance Solid Growth Strong Returns Best-in-Class Operator Highly Disciplined Capital Allocation Strategy Key Enterprise Initiatives • Portfolio Management • Business Structure Simplification • Strategic Sourcing Increasingly Challenging External Environment Enterprise Strategy: 2012 – 2017

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. EPS Growth Target : 12%+ CAGR beyond 2017 5 • Portfolio mix and larger-scale businesses • Focused acquisitions • Highly disciplined capital allocation strategy • Key enterprise initiatives • 80/20 business model • Key enterprise initiatives Solid Growth Strong Returns Best-in-Class Operator Organic growth: 200 bps above global IP by 2017 ROIC: 20%+ by 2017 Operating margins: 20%+ by 2017 Enterprise Strategy: 2012 – 2017

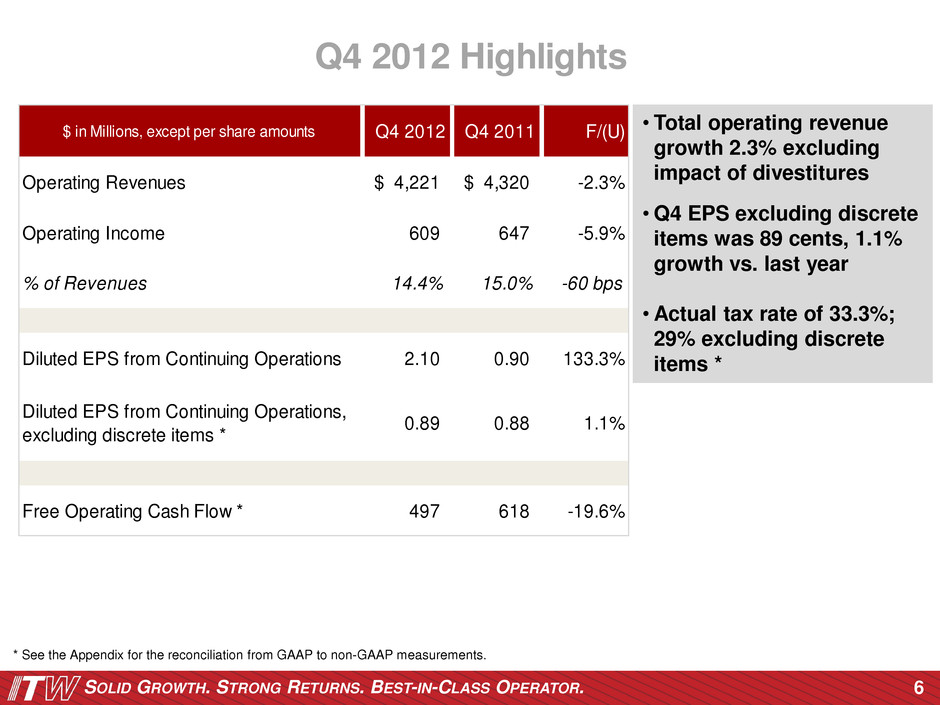

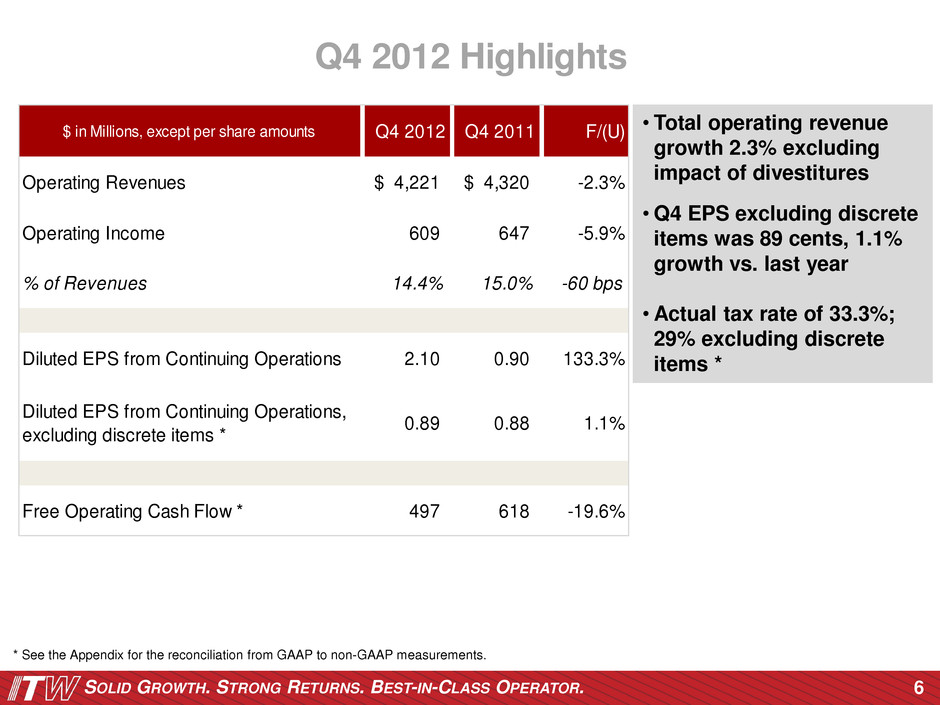

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 6 Q4 2012 Highlights $ in Millions, except per share amounts Q4 2012 Q4 2011 F/(U) Operating Revenues 4,221$ 4,320$ -2.3% Operating Income 609 647 -5.9% % of Revenues 14.4% 15.0% -60 bps Diluted EPS from Continuing Operations 2.10 0.90 133.3% Diluted EPS from Continuing Operations, excluding discrete items * 0.89 0.88 1.1% Free Operating Cash Flow * 497 618 -19.6% * See the Appendix for the reconciliation from GAAP to non-GAAP measurements. • Total operating revenue growth 2.3% excluding impact of divestitures •Q4 EPS excluding discrete items was 89 cents, 1.1% growth vs. last year •Actual tax rate of 33.3%; 29% excluding discrete items *

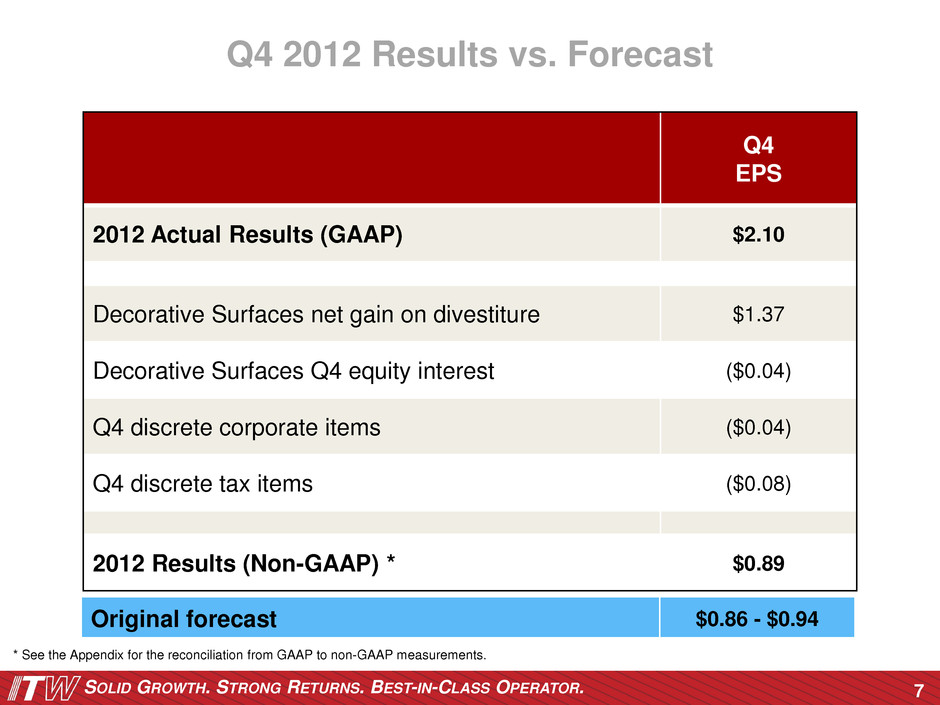

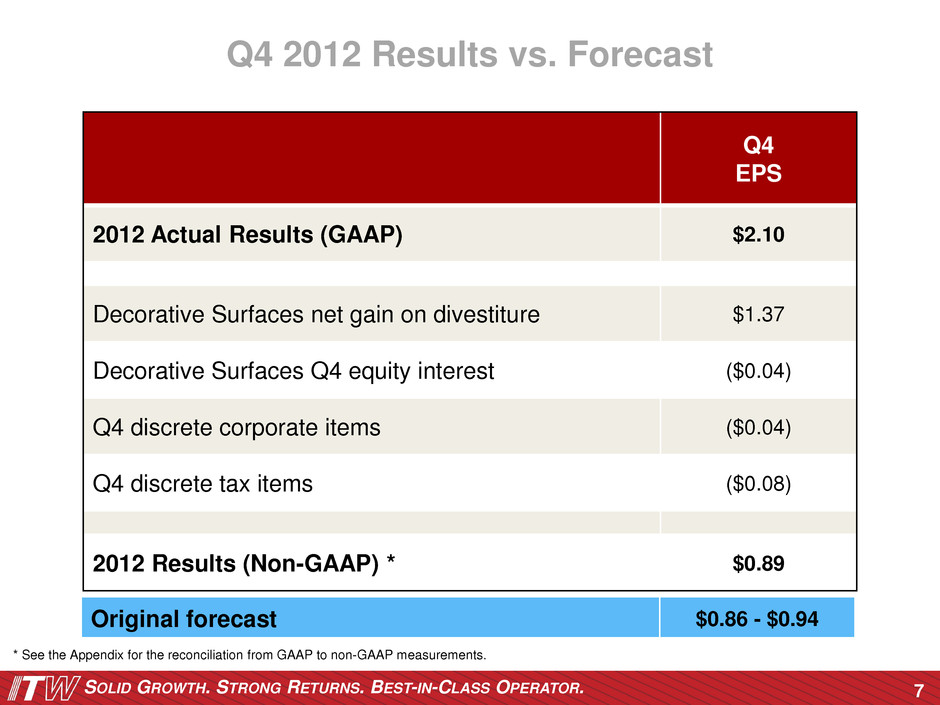

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. Q4 2012 Results vs. Forecast Q4 EPS 2012 Actual Results (GAAP) $2.10 Decorative Surfaces net gain on divestiture $1.37 Decorative Surfaces Q4 equity interest ($0.04) Q4 discrete corporate items ($0.04) Q4 discrete tax items ($0.08) 2012 Results (Non-GAAP) * $0.89 Original forecast $0.86 - $0.94 7 * See the Appendix for the reconciliation from GAAP to non-GAAP measurements.

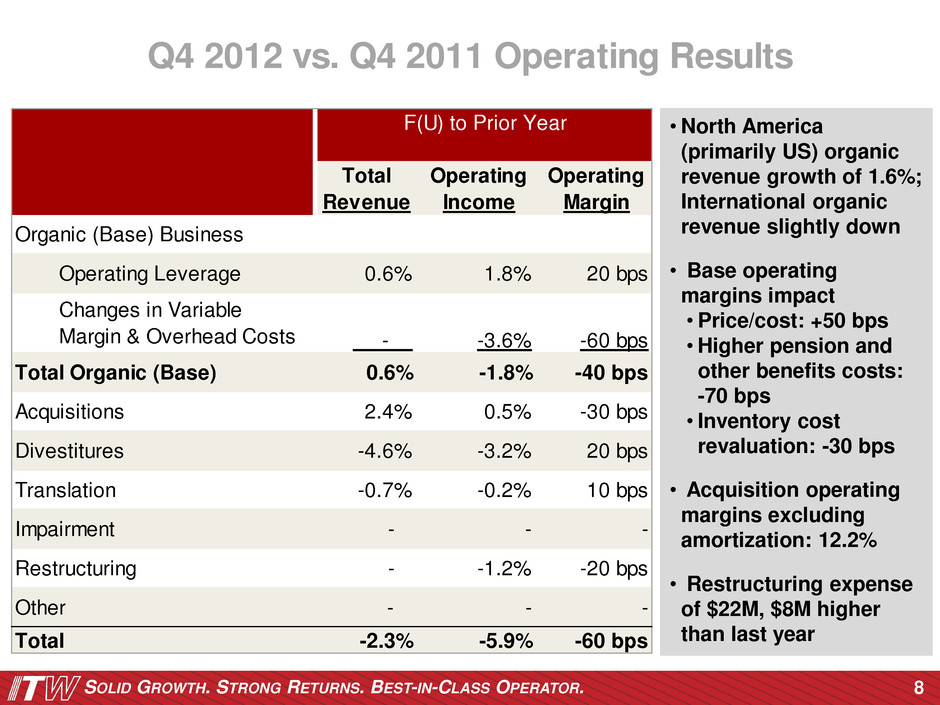

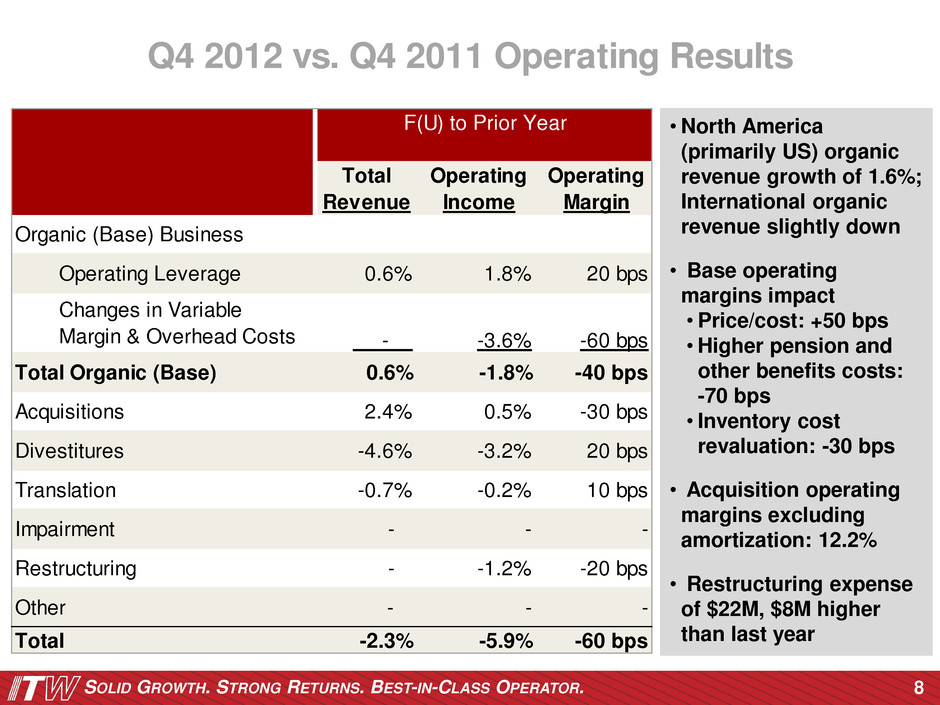

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 8 Q4 2012 vs. Q4 2011 Operating Results Total Revenue Operating Income Operating Margin Organic (Base) Business Operating Leverage 0.6% 1.8% 20 bps Changes in Variable Margin & Overhead Costs - -3.6% -60 bps Total Organic (Base) 0.6% -1.8% -40 bps Acquisitions 2.4% 0.5% -30 bps Divestitures -4.6% -3.2% 20 bps Translation -0.7% -0.2% 10 bps Impairment - - - Restructuring - -1.2% -20 bps Other - - - Total -2.3% -5.9% -60 bps F(U) to Prior Year • North America (primarily US) organic revenue growth of 1.6%; International organic revenue slightly down • Base operating margins impact •Price/cost: +50 bps • Higher pension and other benefits costs: -70 bps • Inventory cost revaluation: -30 bps • Acquisition operating margins excluding amortization: 12.2% • Restructuring expense of $22M, $8M higher than last year

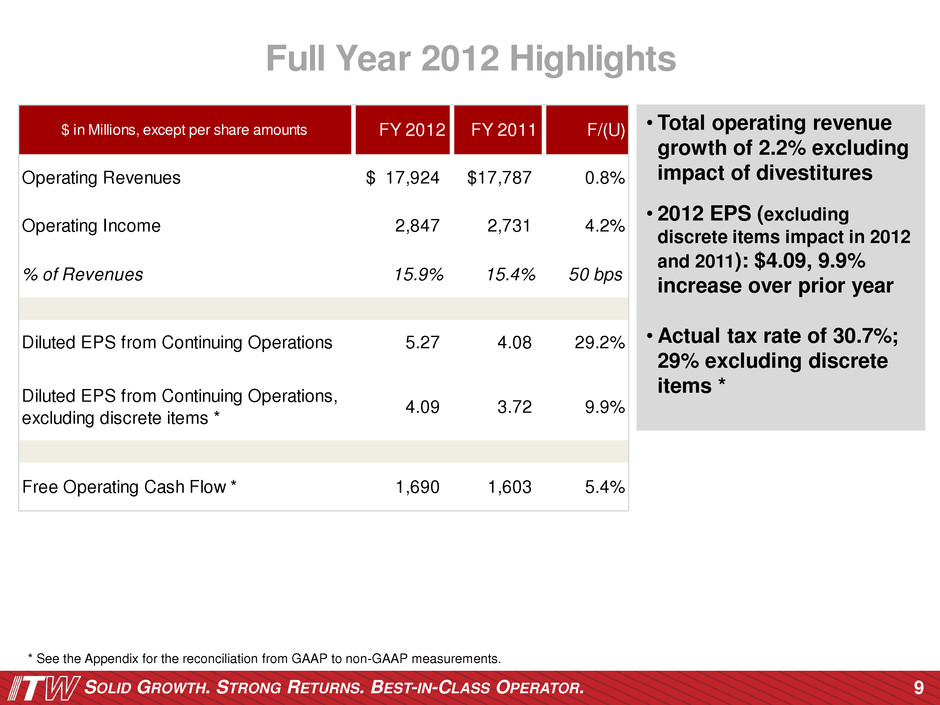

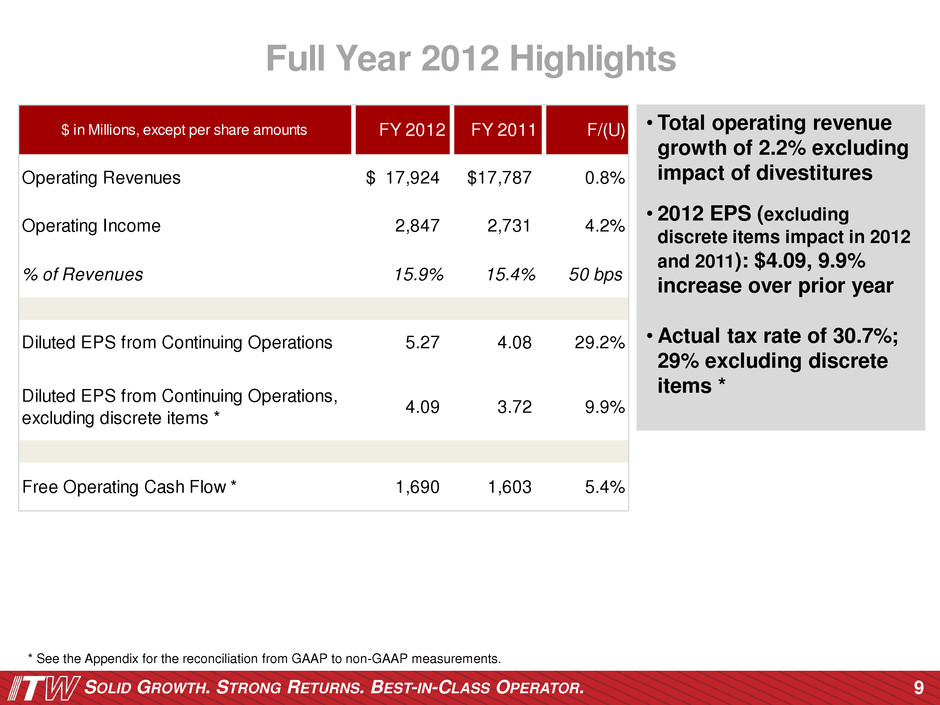

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 9 Full Year 2012 Highlights $ in Millions, except per share amounts FY 2012 FY 2011 F/(U) Operating Revenues 17,924$ 17,787$ 0.8% Operating Income 2,847 2,731 4.2% % of Revenues 15.9% 15.4% 50 bps Diluted EPS from Continuing Operations 5.27 4.08 29.2% Diluted EPS from Continuing Operations, excluding discrete items * 4.09 3.72 9.9% Free Operating Cash Flow * 1,690 1,603 5.4% * See the Appendix for the reconciliation from GAAP to non-GAAP measurements. • Total operating revenue growth of 2.2% excluding impact of divestitures • 2012 EPS (excluding discrete items impact in 2012 and 2011): $4.09, 9.9% increase over prior year •Actual tax rate of 30.7%; 29% excluding discrete items *

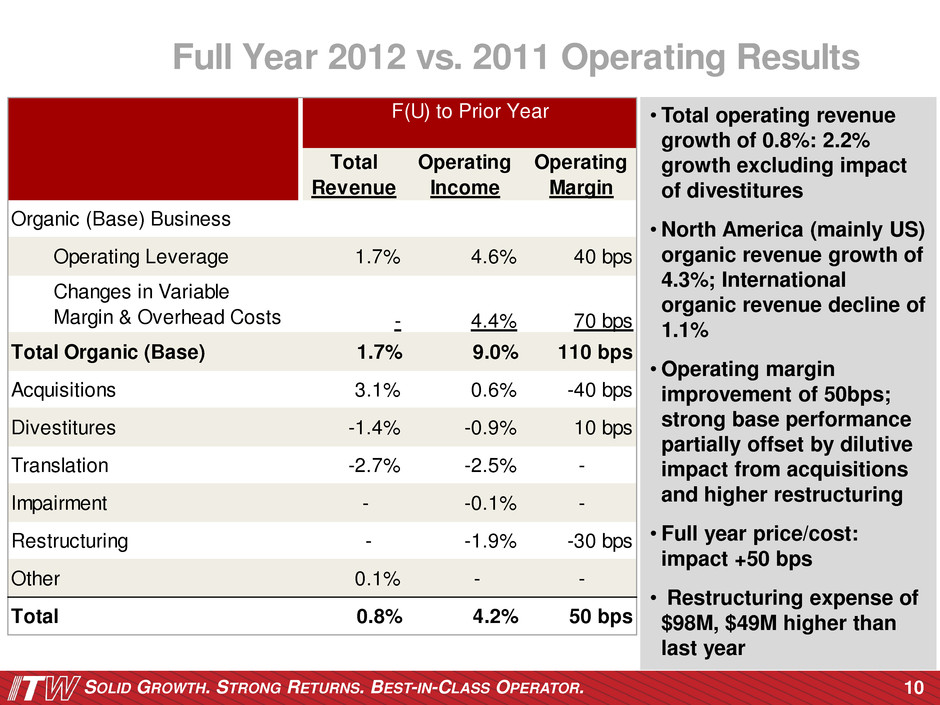

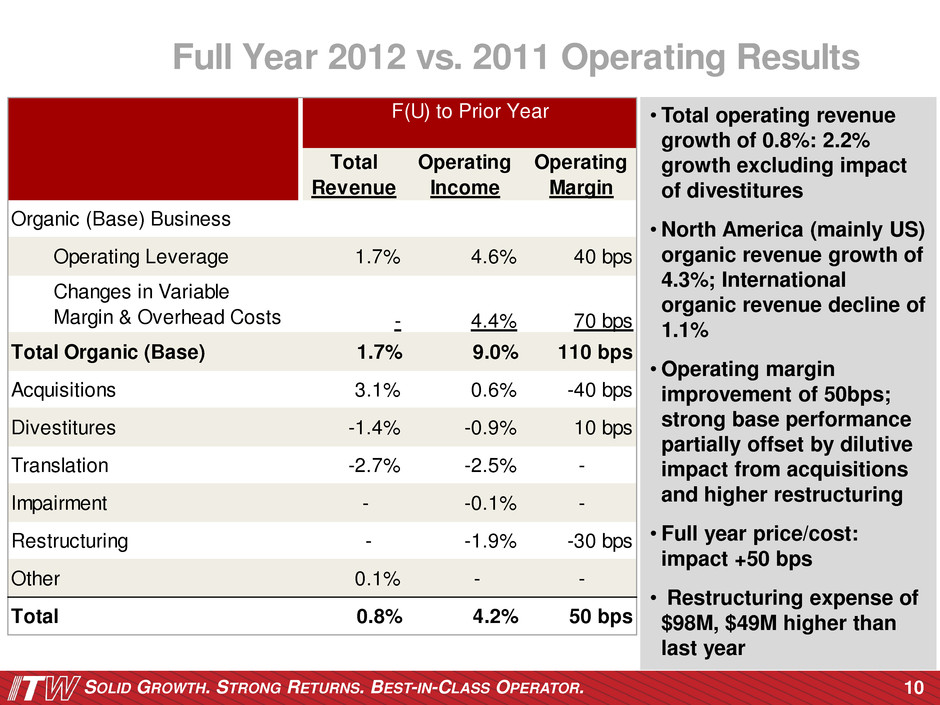

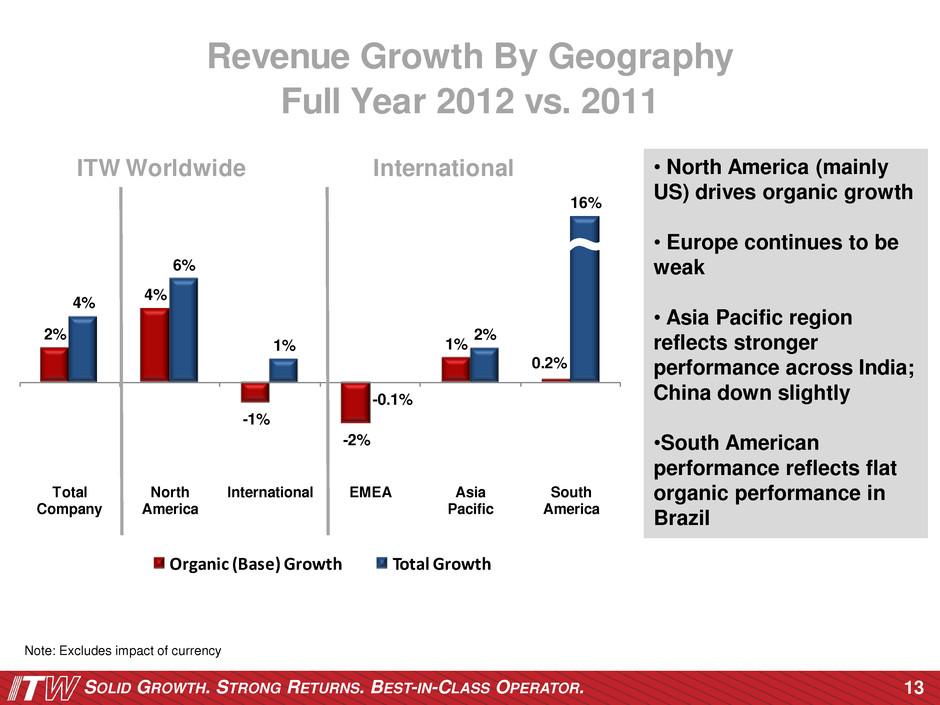

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 10 Full Year 2012 vs. 2011 Operating Results Total Revenue Operating Income Operating Margin Organic (Base) Business Operating Leverage 1.7% 4.6% 40 bps Changes in Variable Margin & Overhead Costs - 4.4% 70 bps Total Organic (Base) 1.7% 9.0% 110 bps Acquisitions 3.1% 0.6% -40 bps Divestitures -1.4% -0.9% 10 bps Translation -2.7% -2.5% - Impairment - -0.1% - Restructuring - -1.9% -30 bps Other 0.1% - - Total 0.8% 4.2% 50 bps F(U) to Prior Year • Total operating revenue growth of 0.8%: 2.2% growth excluding impact of divestitures • North America (mainly US) organic revenue growth of 4.3%; International organic revenue decline of 1.1% •Operating margin improvement of 50bps; strong base performance partially offset by dilutive impact from acquisitions and higher restructuring • Full year price/cost: impact +50 bps • Restructuring expense of $98M, $49M higher than last year

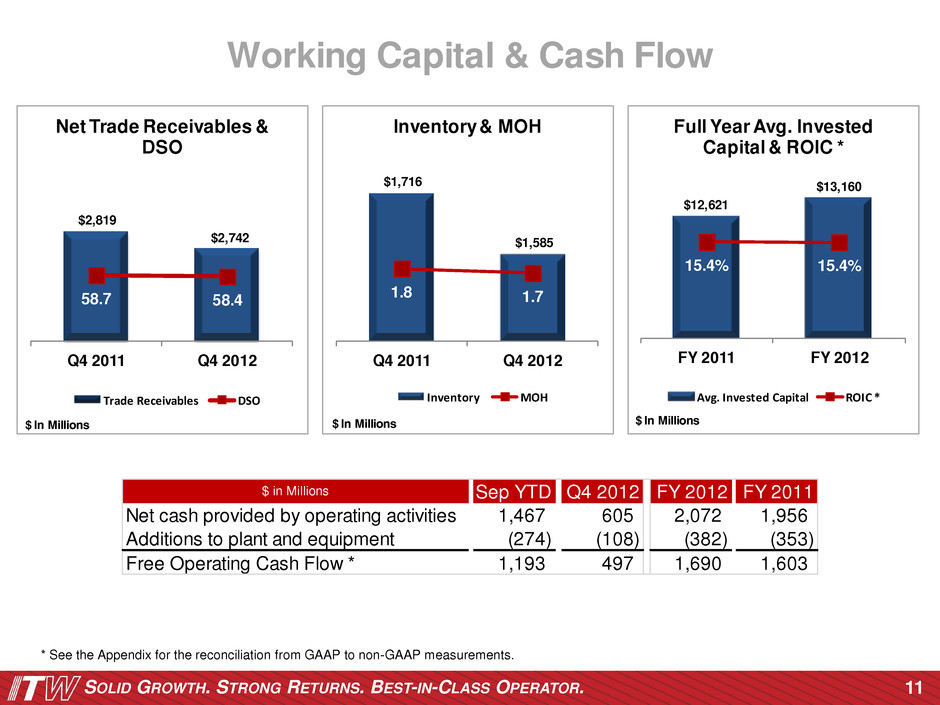

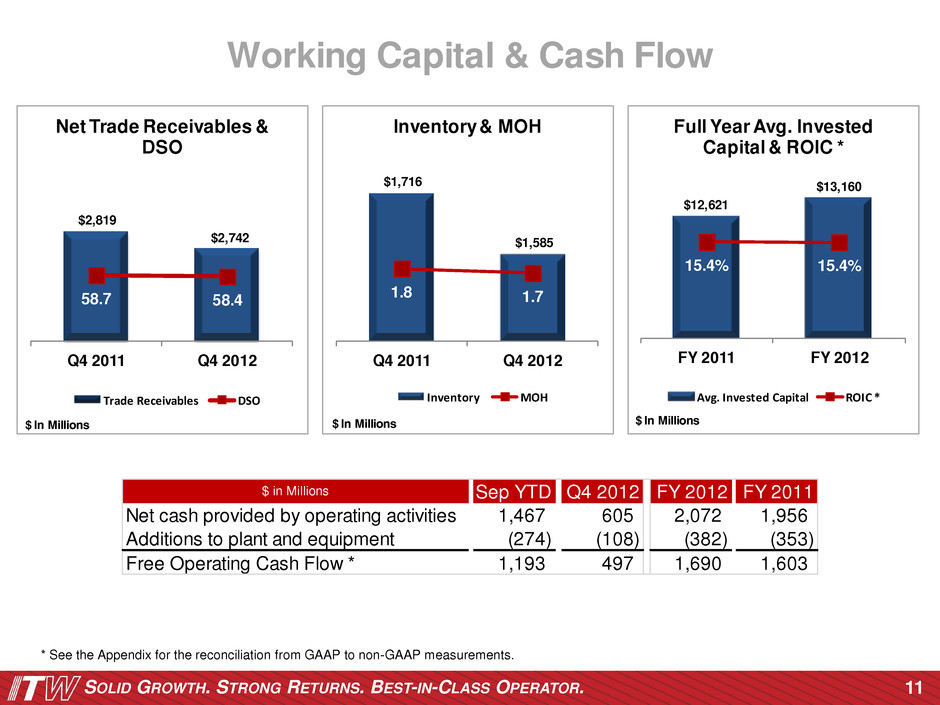

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 11 * See the Appendix for the reconciliation from GAAP to non-GAAP measurements. Working Capital & Cash Flow $2,819 $2,742 58.7 58.4 Q4 2011 Q4 2012 $ In Millions Net Trade Receivables & DSO Trade Receivables DSO $1,716 $1,585 1.8 1.7 Q4 2011 Q4 2012 $ In Millions Inventory& MOH Inventory MOH $12,621 $13,160 15.4% 15.4% FY 2011 FY 2012 $ In Millions Full Year Avg. Invested Capital & ROIC * Avg. Invested Capital ROIC * $ in Millions Sep YTD Q4 2012 FY 2012 FY 2011 Net cash provided by operating activities 1,467 605 2,072 1,956 Additions to plant and equipment (274) (1 8) (38 ) (3 3) Free Operating C sh Flow * 1,193 497 1,690 1,60

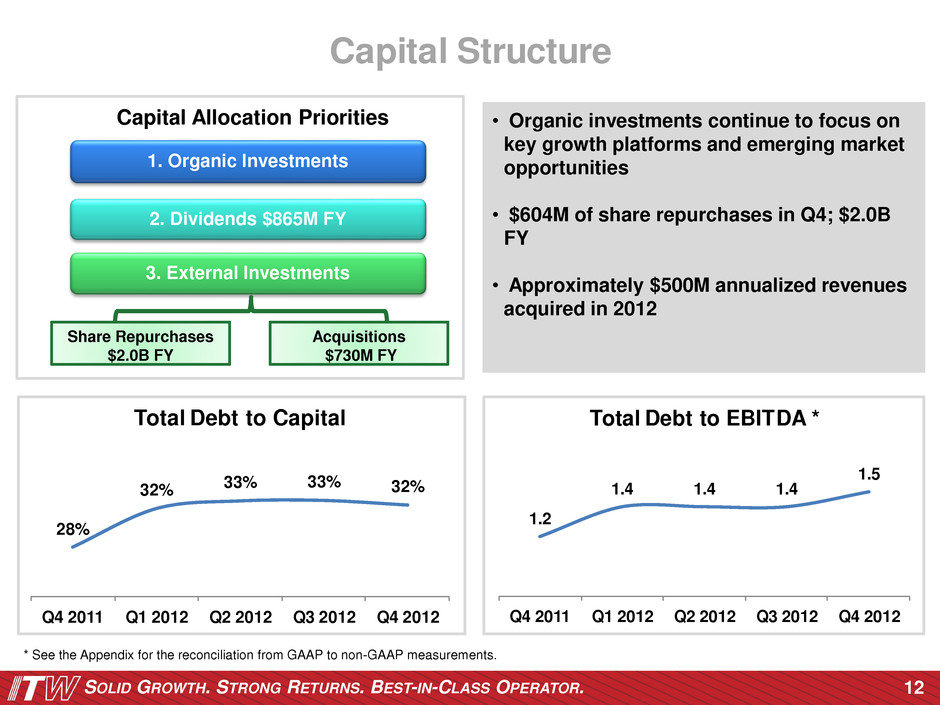

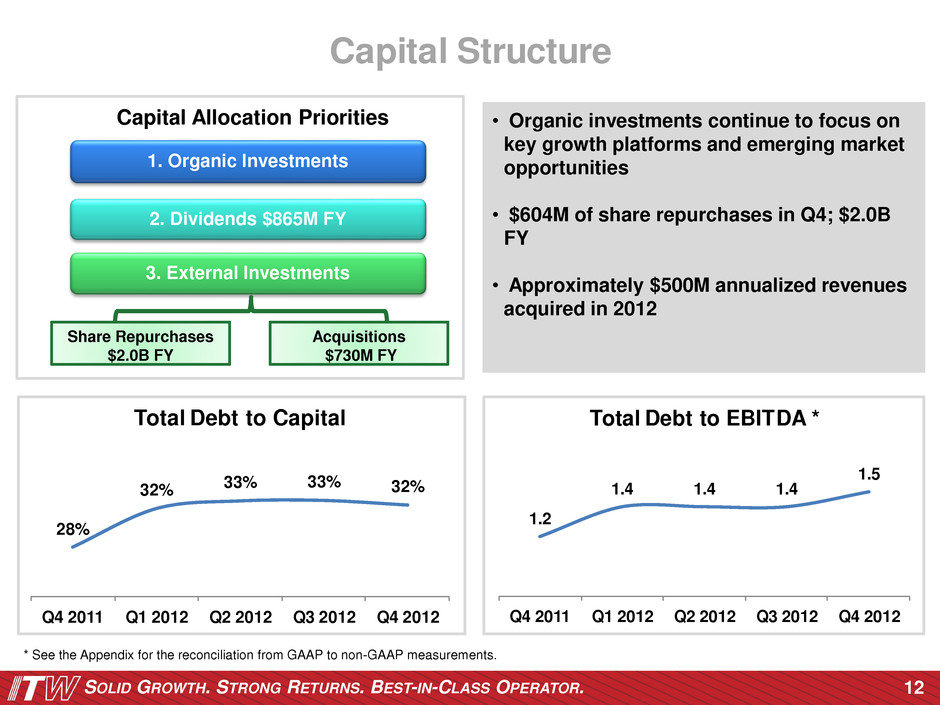

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 12 * See the Appendix for the reconciliation from GAAP to non-GAAP measurements. 28% 32% 33% 33% 32% Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Total Debt to Capital 1.2 1.4 1.4 1.4 1.5 Q4 2011 Q1 2012 Q 2012 Q3 2012 Q4 2012 Total Deb to EBITDA * Capital Structure • Organic investments continue to focus on key growth platforms and emerging market opportunities • $604M of share repurchases in Q4; $2.0B FY • Approximately $500M annualized revenues acquired in 2012 1. Organic Investments 2. Dividends $865M FY 3. External Investments Share Repurchases $2.0B FY Acquisitions $730M FY Capital Allocation Priorities

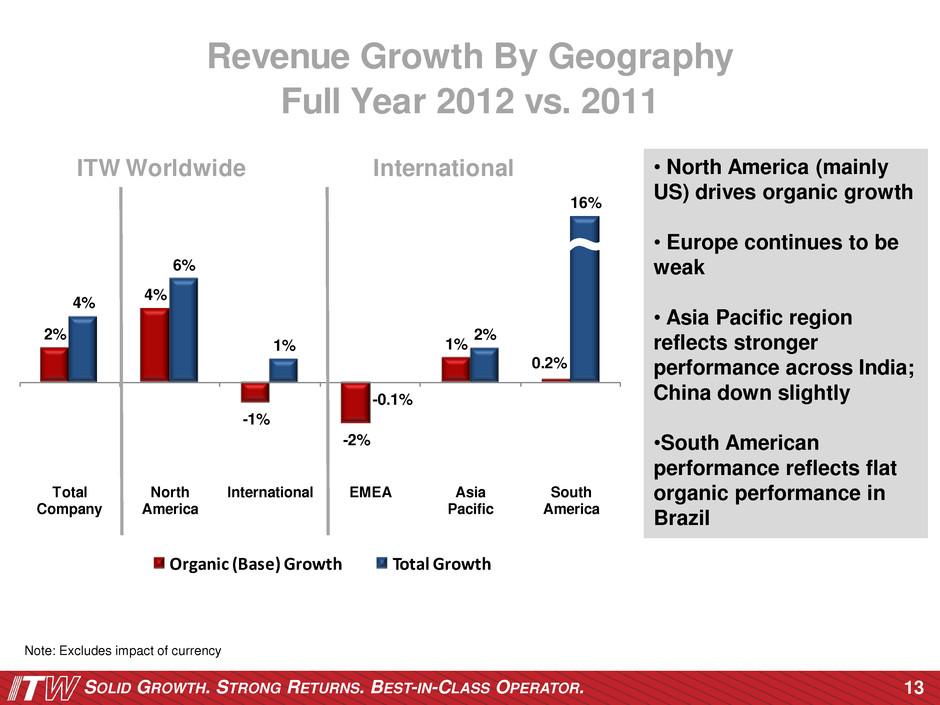

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 13 2% 4% -1% -2% 1% 0.2% 4% 6% 1% -0.1% 2% 16% Total Company North America International EMEA Asia Pacific South America Organic (Base) Growth Total Growth ITW Worldwide International Note: Excludes impact of currency Full Year 2012 vs. 2011 Revenue Growth By Geography • North America (mainly US) drives organic growth • Europe continues to be weak • Asia Pacific region reflects stronger performance across India; China down slightly •South American performance reflects flat organic performance in Brazil

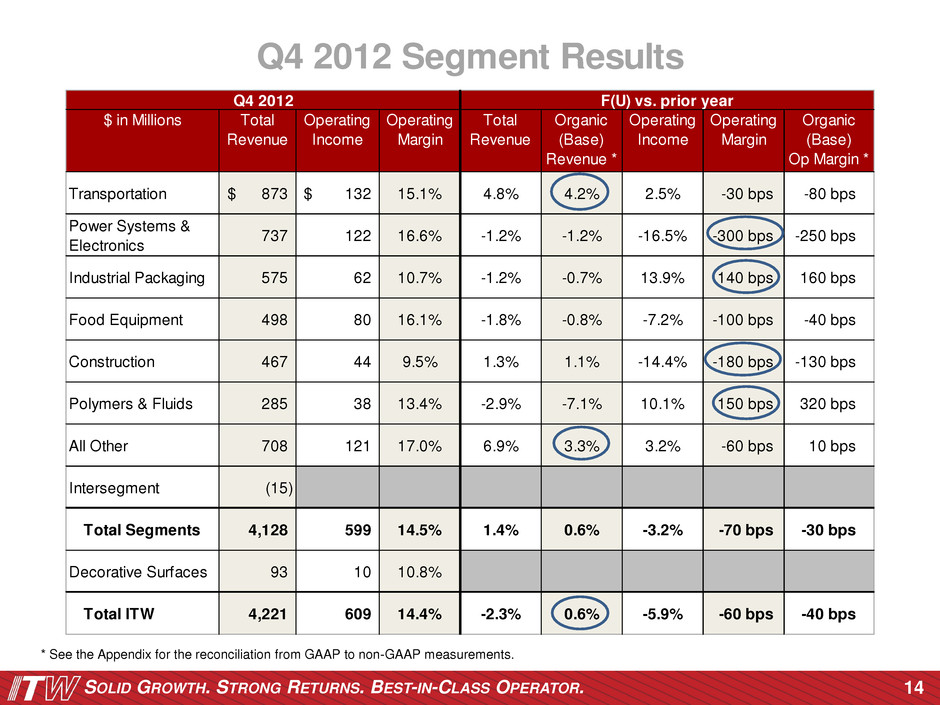

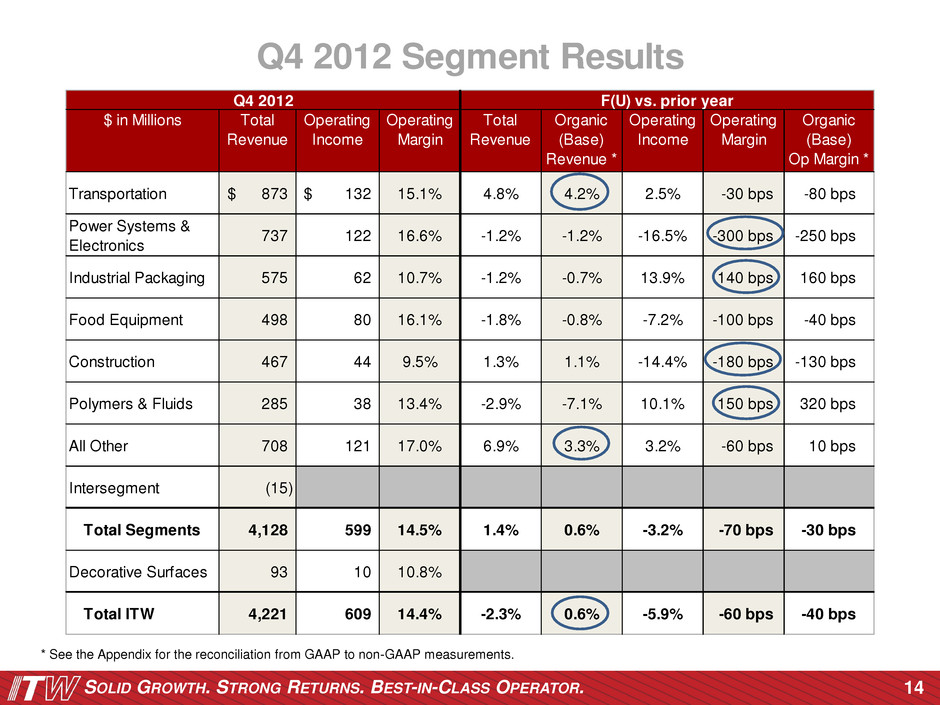

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 14 Q4 2012 Segment Results * See the Appendix for the reconciliation from GAAP to non-GAAP measurements. $ in Millions Total Revenue Operating Income Operating Margin Total Revenue Organic (Base) Revenue * Operating Income Operating Margin Organic (Base) Op Margin * Transportation 873$ 132$ 15.1% 4.8% 4.2% 2.5% -30 bps -80 bps Power Systems & Electronics 737 122 16.6% -1.2% -1.2% -16.5% -300 bps -250 bps Industrial Packaging 575 62 10.7% -1.2% -0.7% 13.9% 140 bps 160 bps Food Equipment 498 80 16.1% -1.8% -0.8% -7.2% -100 bps -40 bps Construction 467 44 9.5% 1.3% 1.1% -14.4% -180 bps -130 bps Polymers & Fluids 285 38 13.4% -2.9% -7.1% 10.1% 150 bps 320 bps All Other 708 121 17.0% 6.9% 3.3% 3.2% -60 bps 10 bps Intersegment (15) Total Segments 4,128 599 14.5% 1.4% 0.6% -3.2% -70 bps -30 bps Decorative Surfaces 93 10 10.8% Total ITW 4,221 609 14.4% -2.3% 0.6% -5.9% -60 bps -40 bps Q4 2012 F(U) vs. prior year

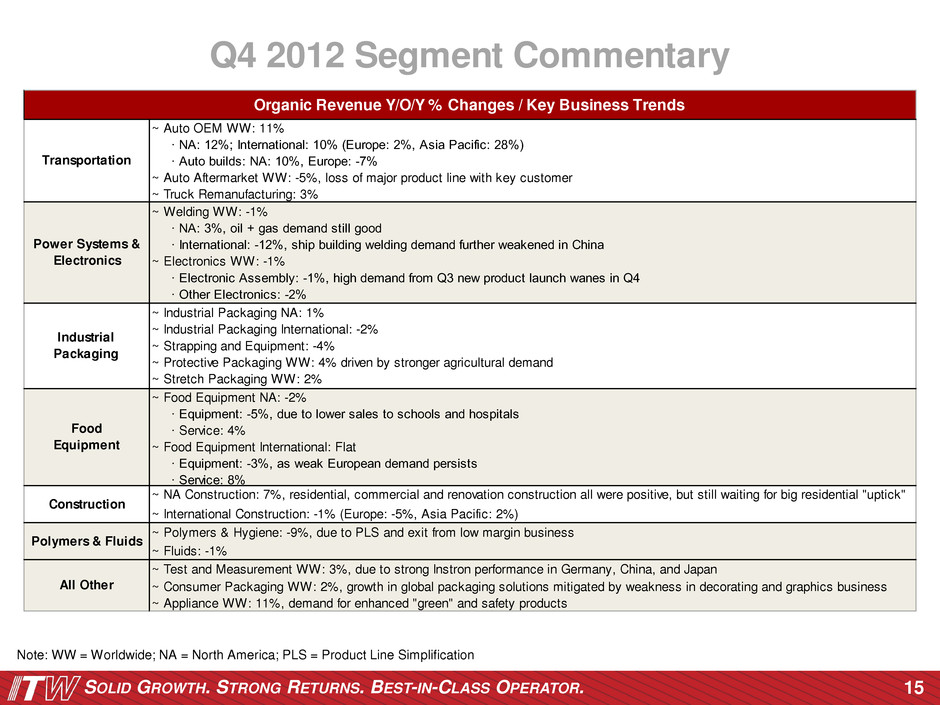

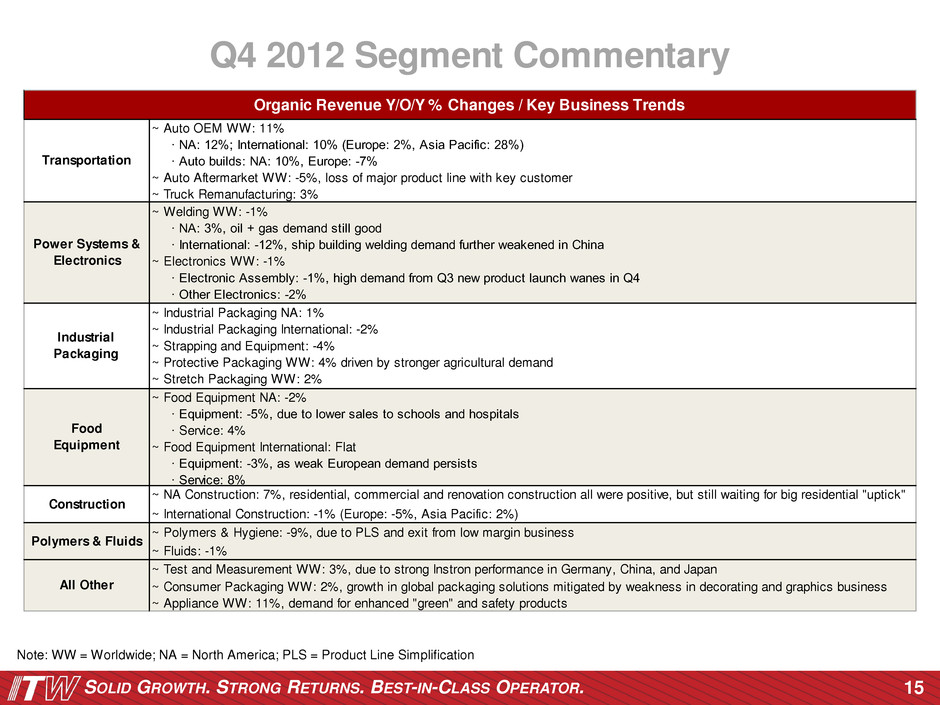

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 15 Note: WW = Worldwide; NA = North America; PLS = Product Line Simplification Q4 2012 Segment Commentary Organic Revenue Y/O/Y % Changes / Key Business Trends ~ Auto OEM WW: 11% ∙ NA: 12%; International: 10% (Europe: 2%, Asia Pacific: 28%) ∙ Auto builds: NA: 10%, Europe: -7% ~ Auto Aftermarket WW: -5%, loss of major product line with key customer ~ Truck Remanufacturing: 3% ~ Welding WW: -1% ∙ NA: 3%, oil + gas demand still good ∙ International: -12%, ship building welding demand further weakened in China ~ Electronics WW: -1% ∙ Electronic Assembly: -1%, high demand from Q3 new product launch wanes in Q4 ∙ Other Electronics: -2% ~ Industrial Packaging NA: 1% ~ Industrial Packaging International: -2% ~ Strapping and Equipment: -4% ~ Protective Packaging WW: 4% driven by stronger agricultural demand ~ Stretch Packaging WW: 2% ~ Food Equipment NA: -2% ∙ Equipment: -5%, due to lower sales to schools and hospitals ∙ Service: 4% ~ Food Equipment International: Flat ∙ Equipment: -3%, as weak European demand persists ∙ Service: 8% ~ NA Construction: 7%, residential, commercial and renovation construction all were positive, but still waiting for big residential "uptick" ~ International Construction: -1% (Europ : -5%, Asia Pacific: 2%) ~ Polymers & Hygiene: -9%, due to PLS and exit from low margin business ~ Fluids: -1% ~ Test and Measurement WW: 3%, due to strong Instron performance in Germany, China, and Japan ~ Consumer Packaging WW: 2%, growth in global packaging solutions mitigated by weakness in decorating and graphics business ~ Appliance WW: 11%, demand for enhanced "green" and safety products Polymers & Fluids All Other Construction Transportation Power Systems & Electronics Food Equipment Industrial Packaging

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 100 YEARS STRONG 2013 Forecast

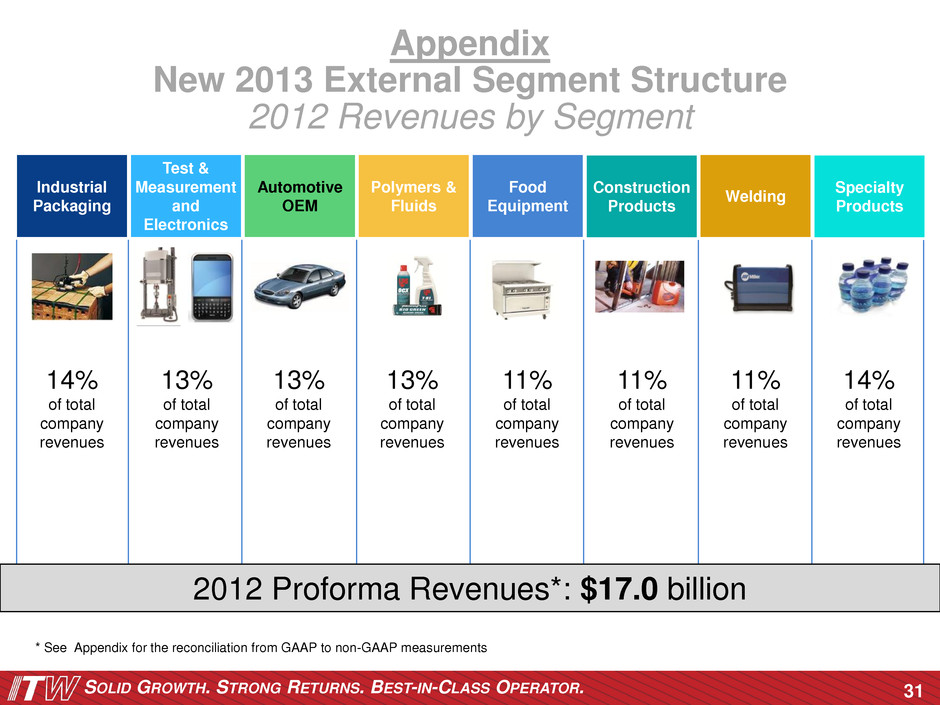

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. Segment Structure 17 Test & Measurement and Electronics Automotive OEM Welding Polymers & Fluids Specialty Products Industrial Packaging Food Equipment Construction Products Test & Measurement and Electronics platforms combined to new segment Automotive aftermarket moved to Polymers & Fluids. Truck remanufacture & service moved to Specialty Products Welding becomes independent segment. Electronics combined with Test & Measurement to form new segment. Addition of automotive aftermarket Test & Measurement moved to new segment with Electronics. Addition of truck remanufacture & service. No change No change No change Divested Transportation Power Systems & Electronics Polymers & Fluids All Other Industrial Packaging Food Equipment Construction Products Decorative Surfaces Current 2012 New 2013

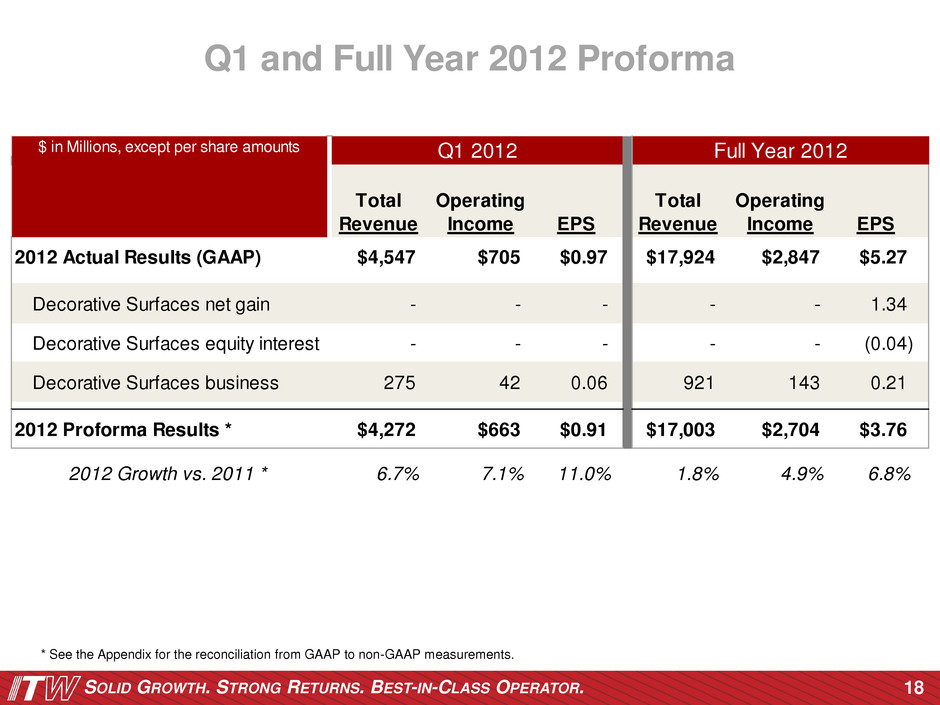

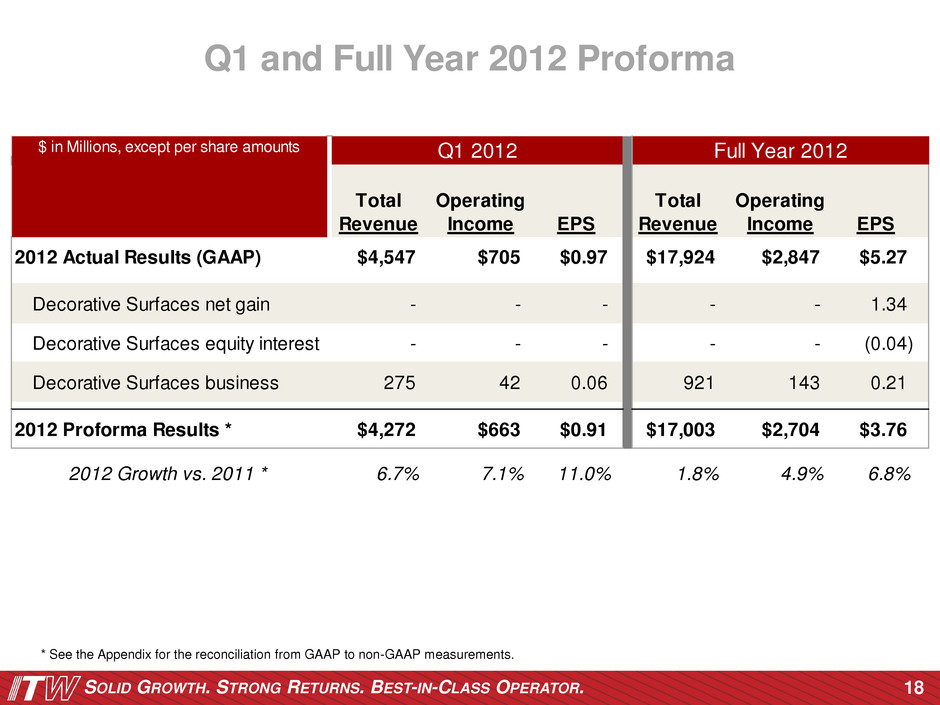

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 18 * See the Appendix for the reconciliation from GAAP to non-GAAP measurements. Q1 and Full Year 2012 Proforma $ in Millions, except per share amounts Total Revenue Operating Income EPS Total Revenue Operating Income EPS 2012 Actual Results (GAAP) $4,547 $705 $0.97 $17,924 $2,847 $5.27 Decorative Surfaces net gain - - - - - 1.34 Decorative Surfaces equity interest - - - - - (0.04) Decorative Surfaces business 275 42 0.06 921 143 0.21 2012 Proforma Results * $4,272 $663 $0.91 $17,003 $2,704 $3.76 2012 Growth vs. 2011 * 6.7% 7.1% 11.0% 1.8% 4.9% 6.8% Q1 2012 Full Year 2012

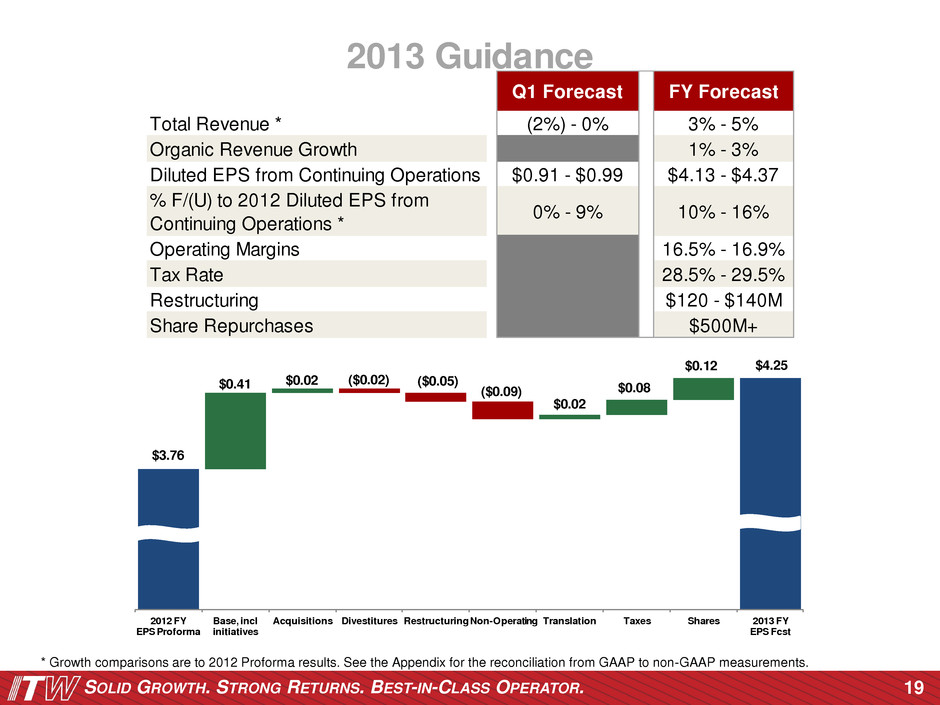

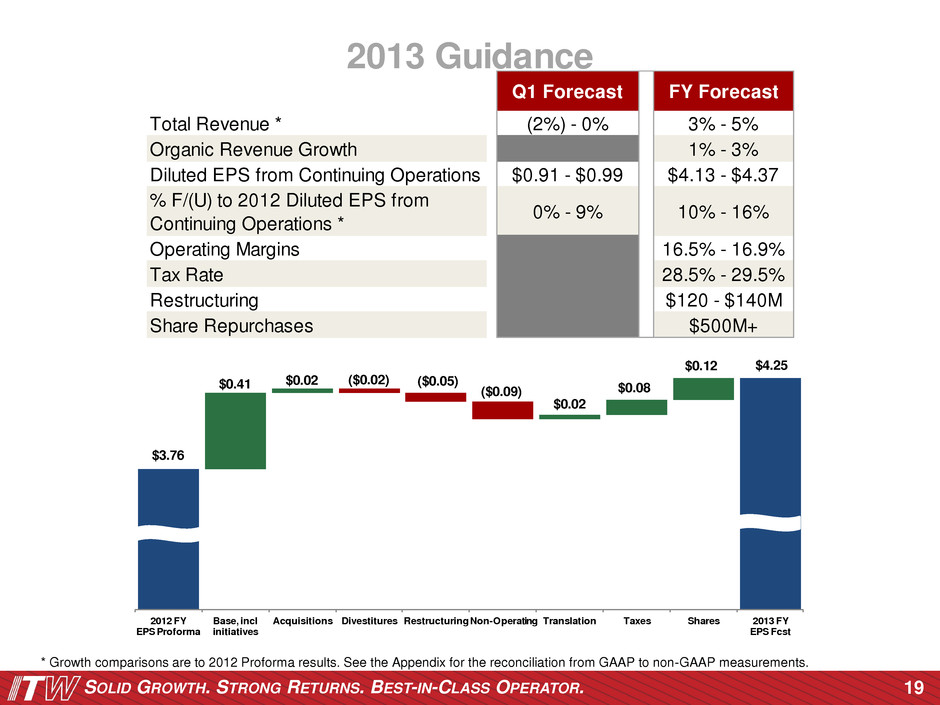

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 19 2013 Guidance $3.76 $4.25 $0.41 $0.02 ($0.02) ($0.05) ($0.09) $0.02 $0.08 $0.12 2012 FY EPS Proforma Base, incl initiatives Acquisitions Divestitures RestructuringNon-Operating Translation Taxes Shares 2013 FY EPS Fcst * Growth comparisons are to 2012 Proforma results. See the Appendix for the reconciliation from GAAP to non-GAAP measurements. Q1 Forecast FY Forecast Total Revenue * (2%) - 0% 3% - 5% Organic Revenue Growth 1% - 3% Diluted EPS from Continuing Operations $0.91 - $0.99 $4.13 - $4.37 % F/(U) to 2012 Diluted EPS from Continuing Operations * 0% - 9% 10% - 16% Operating Margins 16.5% - 16.9% Tax Rate 28.5% - 29.5% Restructuring $120 - $140M Share Repurchases $500M+

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. LID R TH. TR N ETURNS. EST-IN- LASS PERAT R. 100 YEARS STRONG Q&A 20

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. LID R TH. TR N ETURNS. EST-IN- LASS PERAT R. 100 YEARS STRONG Appendix: GAAP to Non-GAAP Reconciliations & Segment Tables 21

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 22 Appendix GAAP to Non-GAAP Reconciliations * Non-GAAP impact excludes corporate expense allocations that remain with ITW $ in Millions, except per share amounts Q4 Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Tax Rate Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Tax Rate Actual Results (GAAP) $4,221 $609 14.4% $972 $2.10 33.3% $4,320 $647 15.0% $437 $0.90 27.2% Decorative Surfaces net gain - - 632 1.37 32.2% - - - - - Decorative Surfaces equity interest - - (19) (0.04) 38.1% - - - - - Discrete corporate items - (16) (17) (0.04) 29.0% - - - - - Discrete tax items - - (36) (0.08) NM - - - - - Decorative Surfaces business, exclude Nov/Dec 2011 * - - - - - 159 18 13 0.02 29.0% Actual Results (Non-GAAP) $4,221 $625 14.8% $412 $0.89 29.0% $4,161 $629 15.1% $424 $0.88 29.0% 2012 Growth vs. 2011 1.1% $ in Millions, except per share amounts Full Year Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Tax Rate Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Tax Rate Actual Results (GAAP) $17,924 $2,847 15.9% $2,495 $5.27 30.7% $17,787 $2,731 15.4% $2,017 $4.08 22.2% Decorative Surfaces net gain - - 632 1.34 32.2% - - - - - Decorative Surfaces equity interest - - (19) (0.04) 38.1% - - - - - Discrete corporate items - (16) (17) (0.04) 29.0% - - - - - Discrete tax items - - (36) (0.08) NM - - - - - Decorative Surfaces business, exclude Nov/Dec 2011 * - - - - - 159 18 13 0.03 29.0% Australian tax matter - - - - - - - 166 0.33 NM Actual Results (Non-GAAP) $17,924 $2,863 16.0% $1,935 $4.09 29.0% $17,628 $2,713 15.4% $1,838 $3.72 28.6% 2012 Growth vs. 2011 9.9% 2012 2011 2012 2011

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 23 * Proforma impact excludes corporate expense allocations that remain with ITW $ in Millions, except per share amounts Full Year Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Tax Rate Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Tax Rate Actual Results (GAAP) $17,924 $2,847 15.9% $2,495 $5.27 30.7% $17,787 $2,731 15.4% $2,017 $4.08 22.2% Decorative Surfaces net gain - - 632 1.34 32.2% - - - - - Decorative Surfaces equity interest - - (19) (0.04) 38.1% - - - - - Decorative Surfaces business, exclude Full Year * 921 143 102 0.21 29.0% 1,084 154 109 0.22 29.0% Australian tax matter - - - - - - - 166 0.34 NM Actual Results (Proforma) $17,003 $2,704 15.9% $1,780 $3.76 30.4% $16,703 $2,577 15.4% $1,742 $3.52 28.6% 2012 Growth vs. 2011 * 1.8% 4.9% +50 bps 2.2% 6.8% 2012 2011 Full Year GAAP to Proforma Reconciliation Appendix

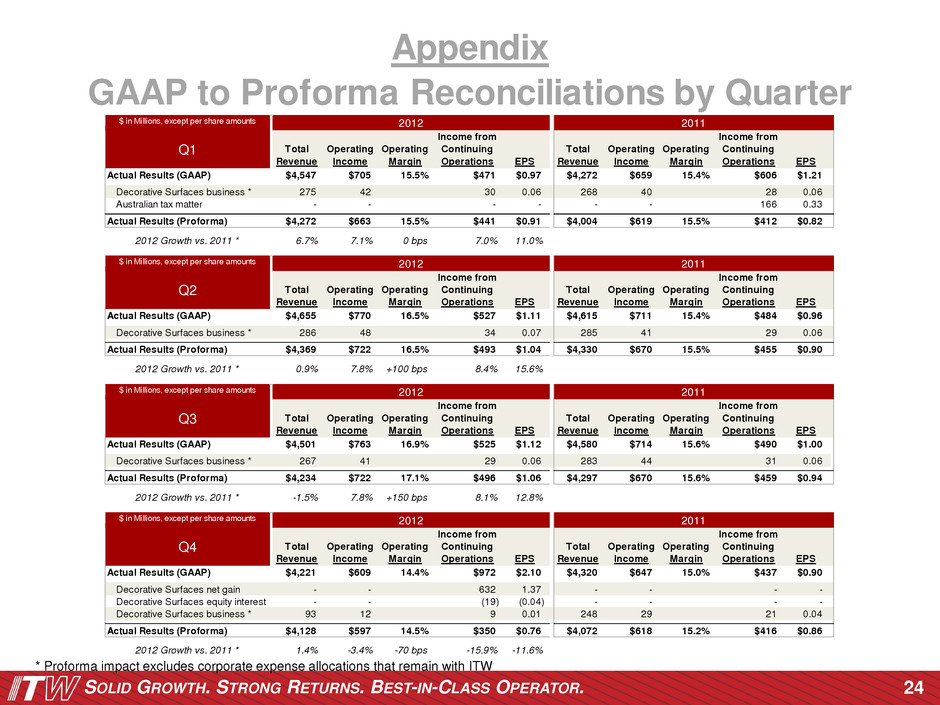

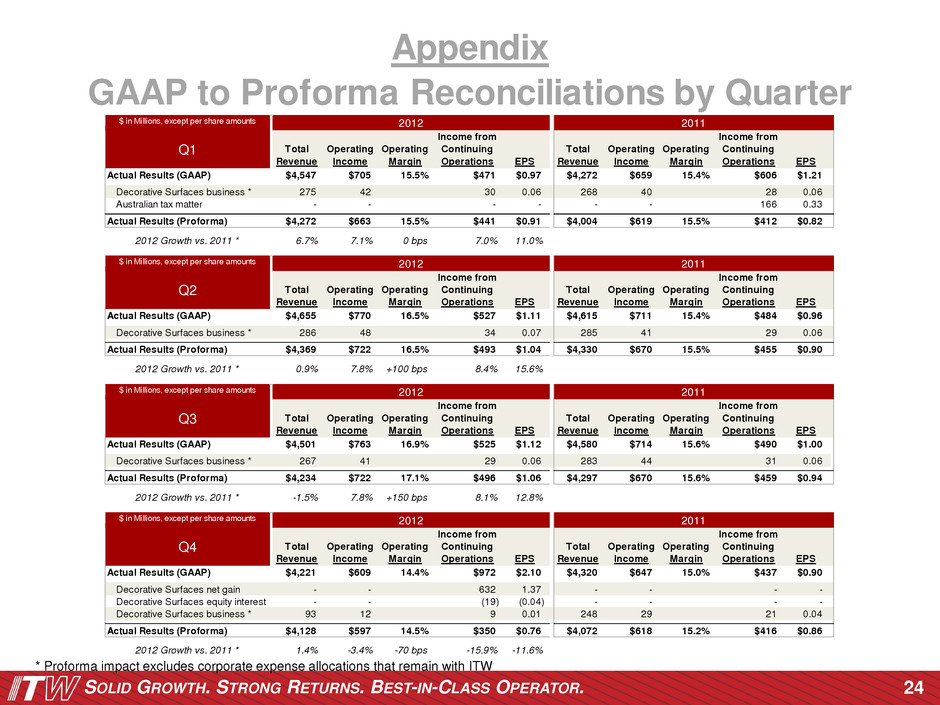

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 24 * Proforma impact excludes corporate expense allocations that remain with ITW GAAP to Proforma Reconciliations by Quarter Appendix $ in Millions, except per share amounts Q1 Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Actual Results (GAAP) $4,547 $705 15.5% $471 $0.97 $4,272 $659 15.4% $606 $1.21 Decorative Surfaces business * 275 42 30 0.06 268 40 28 0.06 Australian tax matter - - - - - - 166 0.33 Actual Results (Proforma) $4,272 $663 15.5% $441 $0.91 $4,004 $619 15.5% $412 $0.82 2012 Growth vs. 2011 * 6.7% 7.1% 0 bps 7.0% 11.0% $ in Millions, except per share amounts Q2 Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Actual Results (GAAP) $4,655 $770 16.5% $527 $1.11 $4,615 $711 15.4% $484 $0.96 Decorative Surfaces business * 286 48 34 0.07 285 41 29 0.06 Actual Results (Proforma) $4,369 $722 16.5% $493 $1.04 $4,330 $670 15.5% $455 $0.90 2012 Growth vs. 2011 * 0.9% 7.8% +100 bps 8.4% 15.6% $ in Millions, except per share amounts Q3 Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Actual Results (GAAP) $4,501 $763 16.9% $525 $1.12 $4,580 $714 15.6% $490 $1.00 Decorative Surfaces business * 267 41 29 0.06 283 44 31 0.06 Actual Results (Proforma) $4,234 $722 17.1% $496 $1.06 $4,297 $670 15.6% $459 $0.94 2012 Growth vs. 2011 * -1.5% 7.8% +150 bps 8.1% 12.8% $ in Millions, except per share amounts Q4 Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Total Revenue Operating Income Operating Margin Income from Continuing Operations EPS Actual Results (GAAP) $4,221 $609 14.4% $972 $2.10 $4,320 $647 15.0% $437 $0.90 Decorative Surfaces net gain - - 632 1.37 - - - - Decorative Surfaces equity interest - - (19) (0.04) - - - - Decorative Surfaces business * 93 12 9 0.01 248 29 21 0.04 Actual Results (Proforma) $4,128 $597 14.5% $350 $0.76 $4,072 $618 15.2% $416 $0.86 2012 Growth vs. 2011 * 1.4% -3.4% -70 bps -15.9% -11.6% 2012 2011 2012 2011 2012 2011 2012 2011

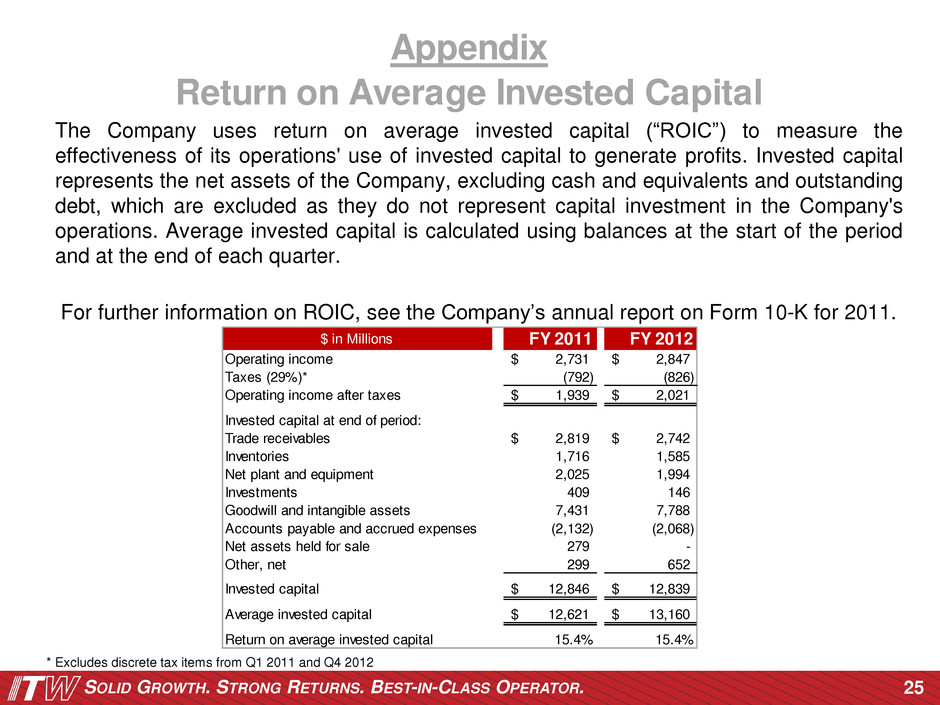

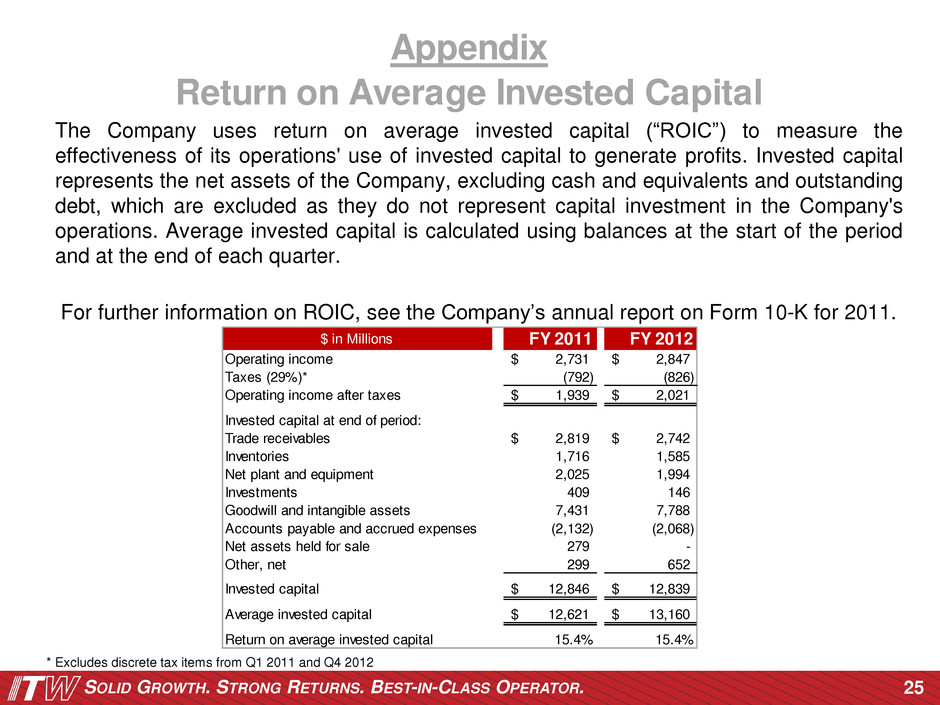

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. The Company uses return on average invested capital (“ROIC”) to measure the effectiveness of its operations' use of invested capital to generate profits. Invested capital represents the net assets of the Company, excluding cash and equivalents and outstanding debt, which are excluded as they do not represent capital investment in the Company's operations. Average invested capital is calculated using balances at the start of the period and at the end of each quarter. For further information on ROIC, see the Company’s annual report on Form 10-K for 2011. 25 $ in Millions FY 2011 FY 2012 Operating income 2,731$ 2,847$ Taxes (29%)* (792) (826) Operating income after taxes 1,939$ 2,021$ Invested capital at end of period: Trade receivables 2,819$ 2,742$ Inventories 1,716 1,585 Net plant and equipment 2,025 1,994 Investments 409 146 Goodwill and intangible assets 7,431 7,788 Accounts payable and accrued expenses (2,132) (2,068) Net assets held for sale 279 - Other, net 299 652 Invested capital 12,846$ 12,839$ Average invested capital 12,621$ 13,160$ Return on average invested capital 15.4% 15.4% Appendix Return on Average Invested Capital * Excludes discrete tax items from Q1 2011 and Q4 2012

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. The Company uses free operating cash flow to measure cash flow generated by operations that is available for dividends, acquisitions, share repurchases and debt repayment. Free operating cash flow represents net cash provided by operating activities less additions to plant and equipment. For further information on free operating cash flow, see the Company’s annual report on Form 10-K for 2011. 26 Appendix Free Operating Cash Flow $ in Millions Sep YTD Q4 2012 FY 2012 FY 2011 Net cash provided by operating activities 1,467 605 2,072 1,956 Additions to plant and equipment (274) (1 8) (38 ) (3 3) Free Operating C sh Flow 1,193 497 1,690 1,60 Free Operating Cash Flow Conversion $ in Millions Q4 2012 FY 2012 Free Operating Cash F ow 497$ 1,690$ Income from Co tinuing Operatio s (GAAP) 972 2,495 Dec rative Surfaces gain on sale, after tax 632 632 Decorative Surfaces equity interest, after tax (19) (19) Adjusted Income from Continuing Operations 359$ 1,882$ % of Adjusted Income from Continuing Operations 139% 90%

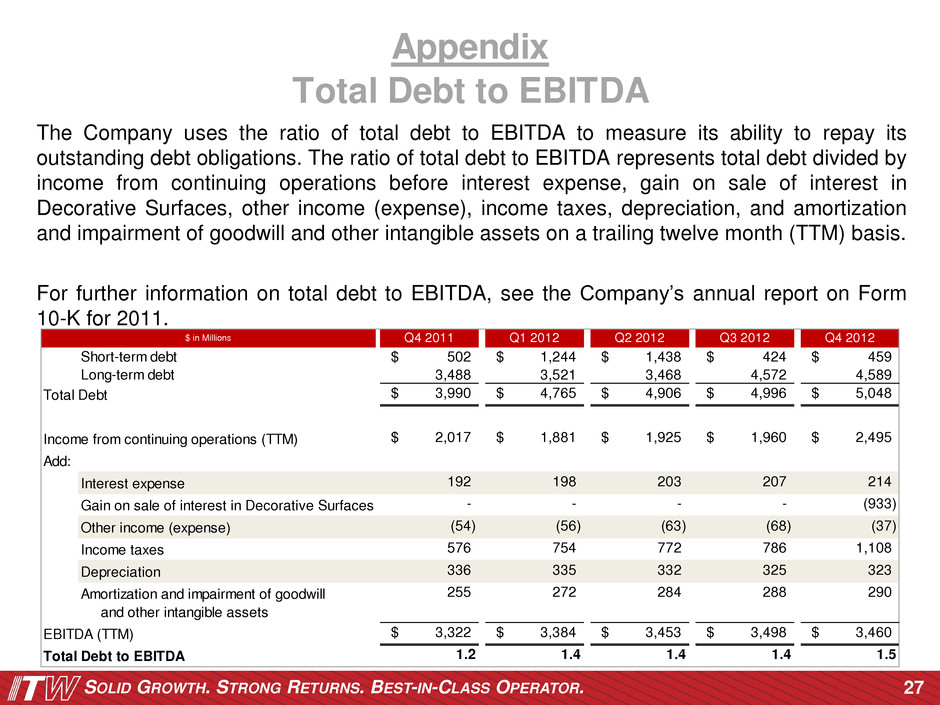

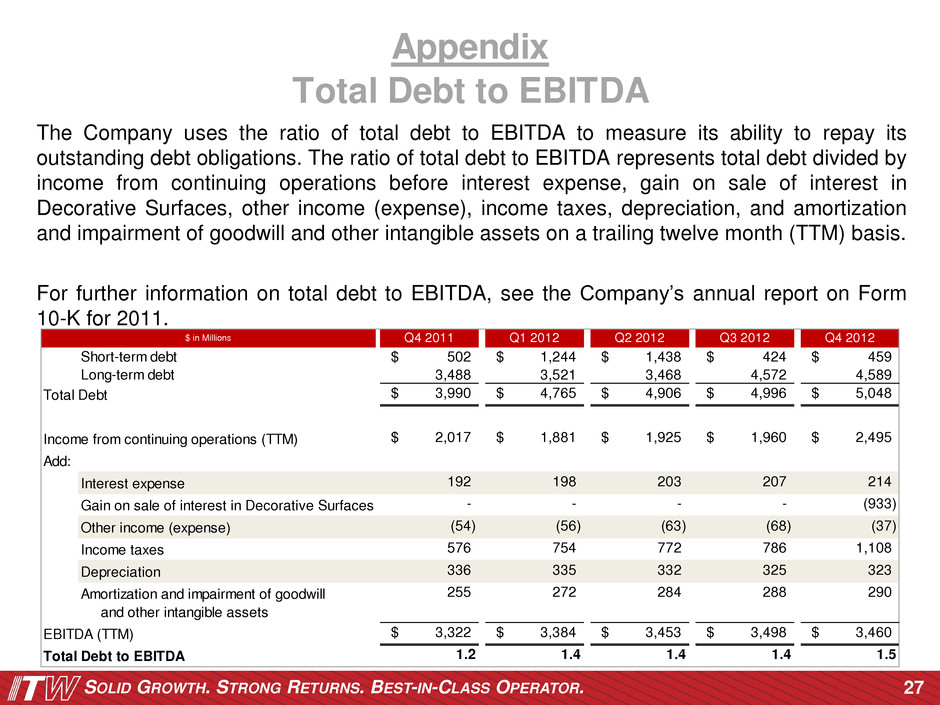

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. The Company uses the ratio of total debt to EBITDA to measure its ability to repay its outstanding debt obligations. The ratio of total debt to EBITDA represents total debt divided by income from continuing operations before interest expense, gain on sale of interest in Decorative Surfaces, other income (expense), income taxes, depreciation, and amortization and impairment of goodwill and other intangible assets on a trailing twelve month (TTM) basis. For further information on total debt to EBITDA, see the Company’s annual report on Form 10-K for 2011. 27 Appendix Total Debt to EBITDA Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Short-term debt 502$ 1,244$ 1,438$ 424$ 459$ Long-term debt 3,488 3,521 3,468 4,572 4,589 Total Debt 3,990$ 4,765$ 4,906$ 4,996$ 5,048$ Income from continuing operations (TTM) 2,017$ 1,881$ 1,925$ 1,960$ 2,495$ Add: Interest expense 192 198 203 207 214 Gain on sale of interest in Decorative Surfaces - - - - (933) Other income (expense) (54) (56) (63) (68) (37) Income taxes 576 754 772 786 1,108 Depreciation 336 335 332 325 323 Am rtization and impairment of goodwill and other intangible assets 255 272 284 288 290 EBITDA (TTM) 3,322$ 3,384$ 3,453$ 3,498$ 3,460$ Total Debt to EBITDA 1.2 1.4 1.4 1.4 1.5 $ in Millions

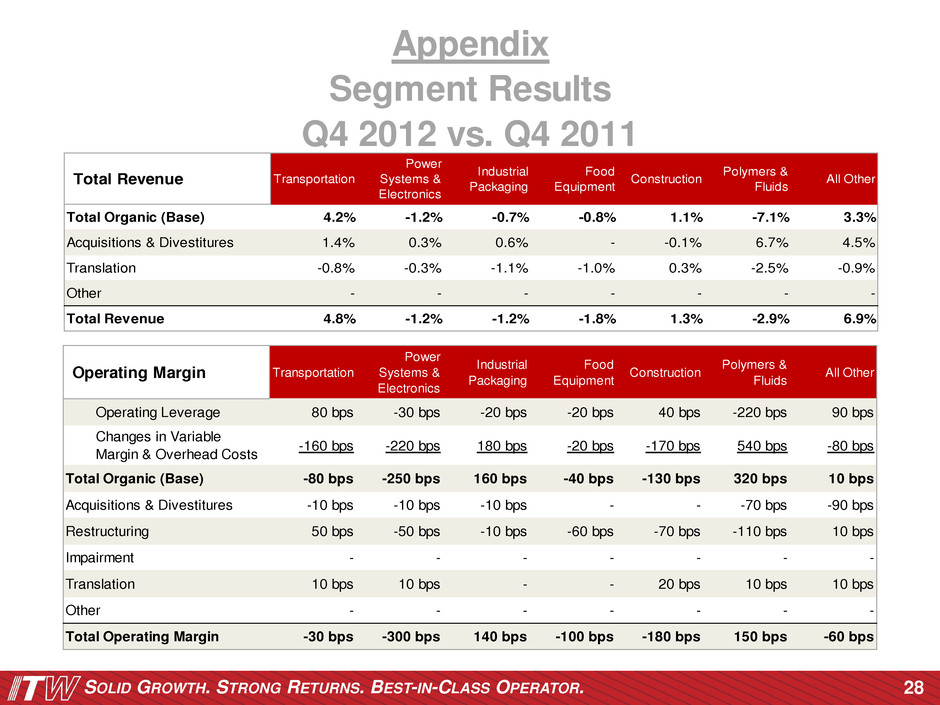

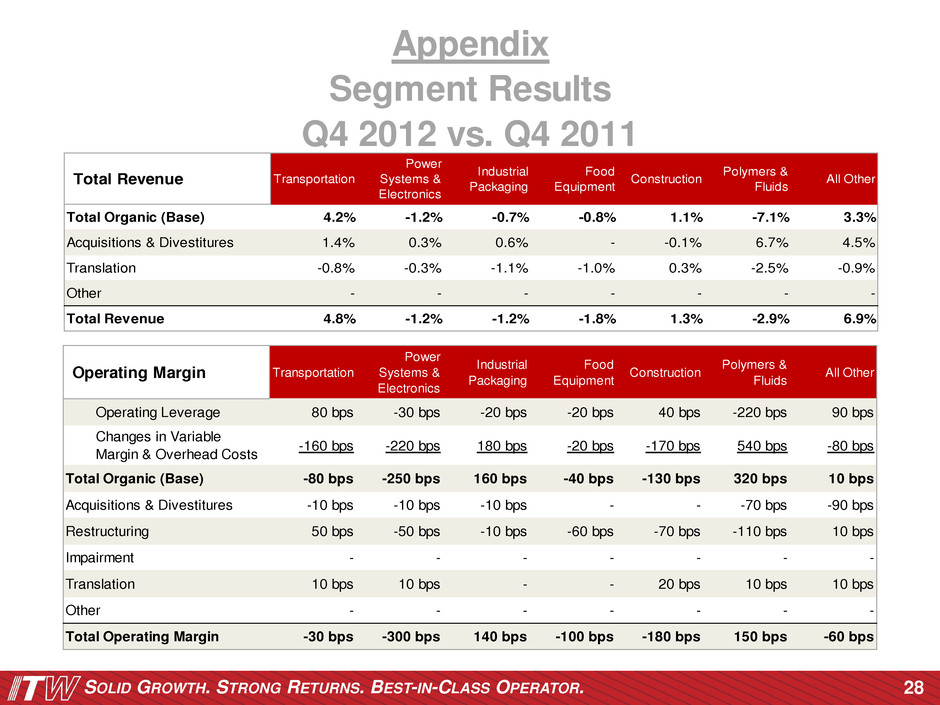

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 28 Appendix Segment Results Q4 2012 vs. Q4 2011 Total Revenue Transportation Power Systems & Electronics Industrial Packaging Food Equipment Construction Polymers & Fluids All Other Total Organic (Base) 4.2% -1.2% -0.7% -0.8% 1.1% -7.1% 3.3% Acquisitions & Divestitures 1.4% 0.3% 0.6% - -0.1% 6.7% 4.5% Translation -0.8% -0.3% -1.1% -1.0% 0.3% -2.5% -0.9% Other - - - - - - - Total Revenue 4.8% -1.2% -1.2% -1.8% 1.3% -2.9% 6.9% Operating Margin Transportation Power Systems & Electronics Industrial Packaging Food Equipment Construction Polymers & Fluids All Other Operating Leverage 80 bps -30 bps -20 bps -20 bps 40 bps -220 bps 90 bps Changes in Variable Margin & Overhead Costs -160 bps -220 bps 180 bps -20 bps -170 bps 540 bps -80 bps Total Organic (Base) -80 bps -250 bps 160 bps -40 bps -130 bps 320 bp 10 bps Acquisitions & Divestitures -10 bps -10 bps -10 bps - - -70 bps -90 bps Restructuring 5 bps -5 bps -10 bps -60 bps -7 bps -110 bps 1 bps Impairment - - - - - - - Translation 10 bps 10 bps - - 20 bps 10 bps 10 bps Other - - - - - - - Total Operating Margin -30 bps -300 bps 140 bps -100 bps -180 bps 150 bps -60 bps

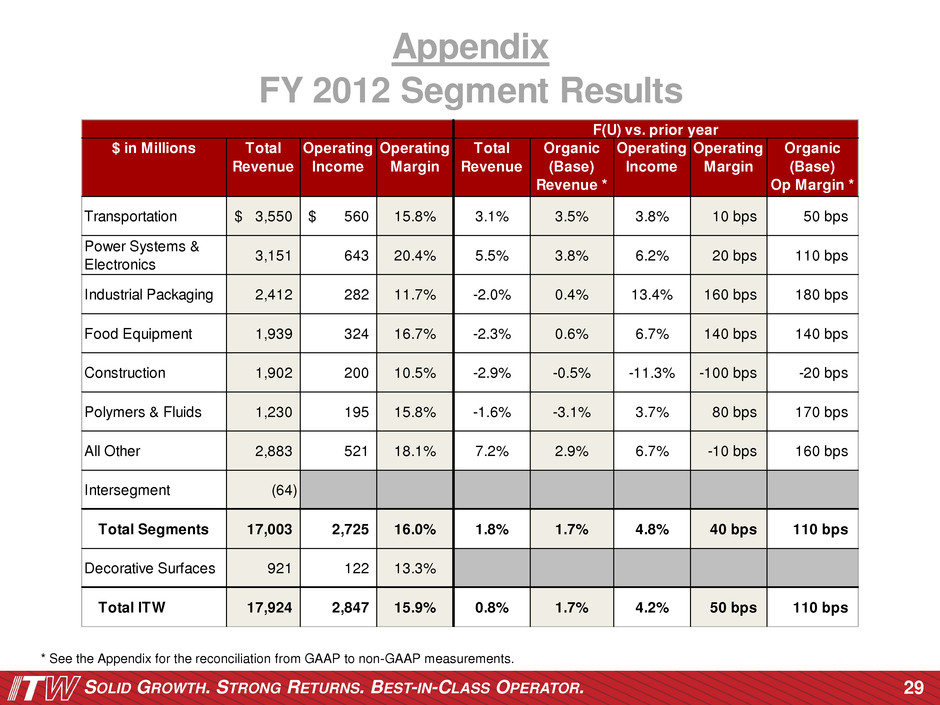

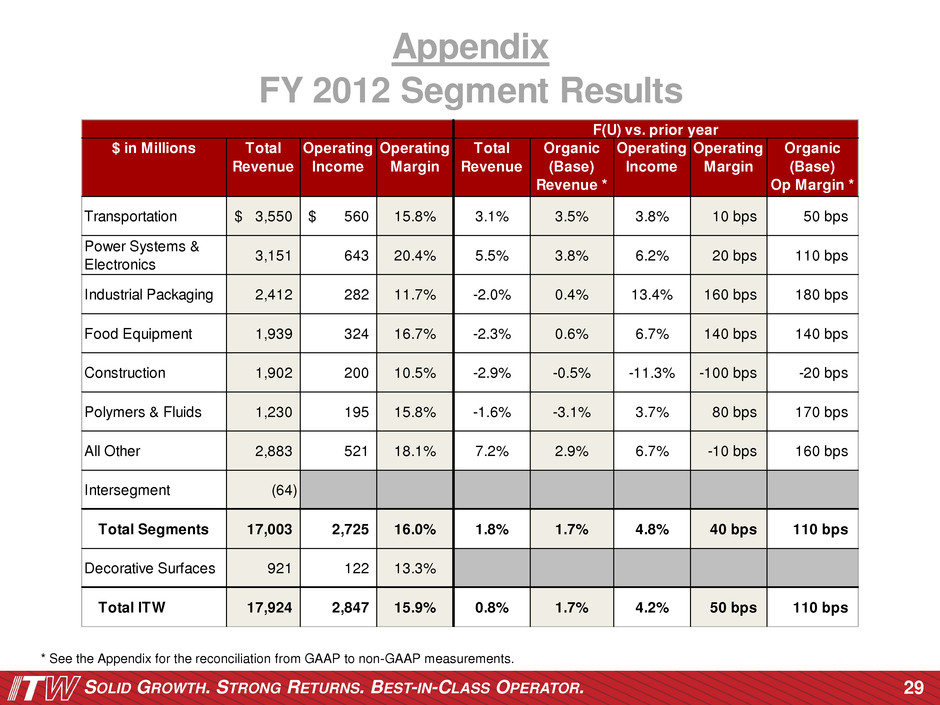

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 29 * See the Appendix for the reconciliation from GAAP to non-GAAP measurements. FY 2012 Segment Results Appendix $ in Millions Total Revenue Operating Income Operating Margin Total Revenue Organic (Base) Revenue * Operating Income Operating Margin Organic (Base) Op Margin * Transportation 3,550$ 560$ 15.8% 3.1% 3.5% 3.8% 10 bps 50 bps Power Systems & Electronics 3,151 643 20.4% 5.5% 3.8% 6.2% 20 bps 110 bps Industrial Packaging 2,412 282 11.7% -2.0% 0.4% 13.4% 160 bps 180 bps Food Equipment 1,939 324 16.7% -2.3% 0.6% 6.7% 140 bps 140 bps Construction 1,902 200 10.5% -2.9% -0.5% -11.3% -100 bps -20 bps Polymers & Fluids 1,230 195 15.8% -1.6% -3.1% 3.7% 80 bps 170 bps All Other 2,883 521 18.1% 7.2% 2.9% 6.7% -10 bps 160 bps Intersegment (64) Total Segments 17,003 2,725 16.0% 1.8% 1.7% 4.8% 40 bps 110 bps Decorative Surfaces 921 122 13.3% Total ITW 17,924 2,847 15.9% 0.8% 1.7% 4.2% 50 bps 110 bps F(U) vs. prior year

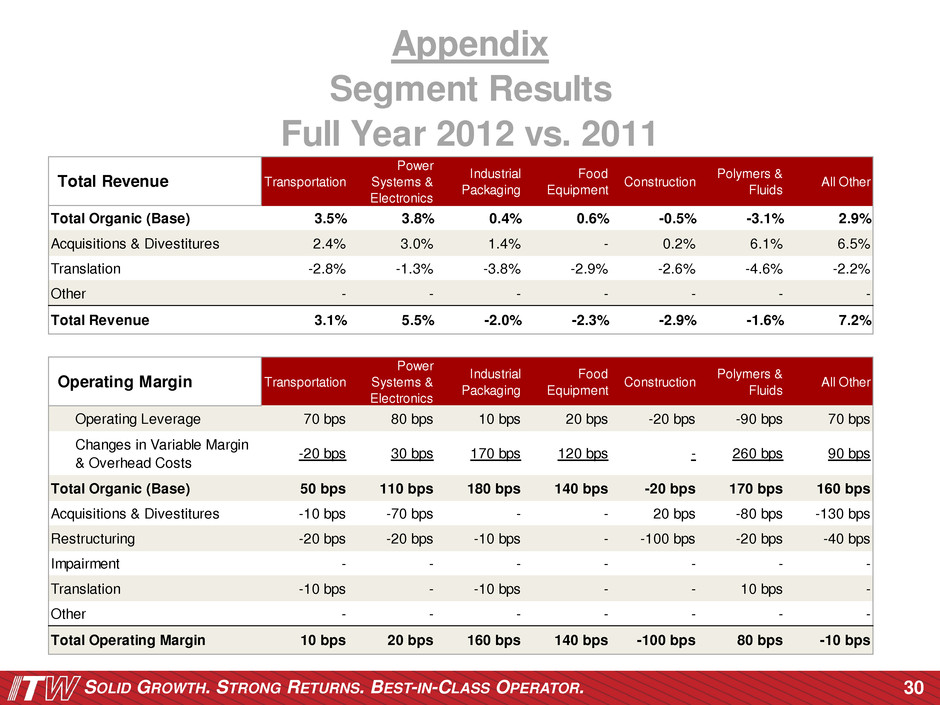

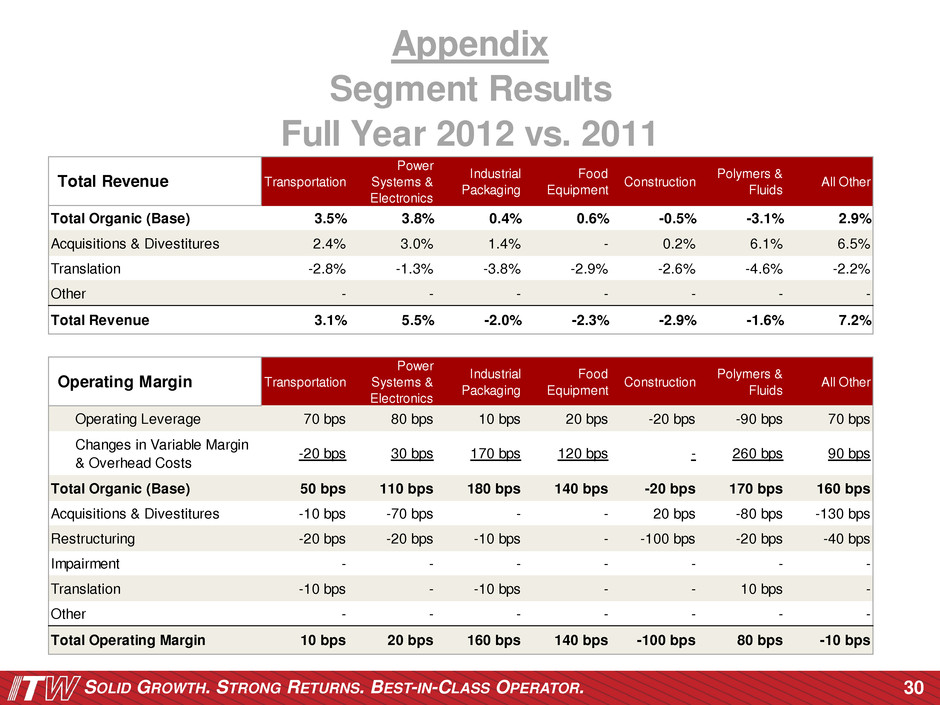

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 30 Segment Results Full Year 2012 vs. 2011 Appendix Total Revenue Transportation Power Systems & Electronics Industrial Packaging Food Equipment Construction Polymers & Fluids All Other Total Organic (Base) 3.5% 3.8% 0.4% 0.6% -0.5% -3.1% 2.9% Acquisitions & Divestitures 2.4% 3.0% 1.4% - 0.2% 6.1% 6.5% Translation -2.8% -1.3% -3.8% -2.9% -2.6% -4.6% -2.2% Other - - - - - - - Total Revenue 3.1% 5.5% -2.0% -2.3% -2.9% -1.6% 7.2% Operating Margin Transportation Power Systems & Electronics Industrial Packaging Food Equipment Construction Polymers & Fluids All Other Operating Leverage 70 bps 80 bps 10 bps 20 bps -20 bps -90 bps 70 bps Changes in Variable Margin & Overhead Costs -20 bps 30 bps 170 bps 120 bps - 260 bps 90 bps Total Organic (Base) 50 bps 110 bps 180 bps 140 bps -20 bps 170 bps 160 bps Acquisitions & Divestitures -10 bps -70 bps - - 20 bps -80 bps -130 bps Restructuring -20 bps -20 bps -10 bps - -100 bps -20 bps -40 bps Impairment - - - - - - - Translation -10 bps - -10 bps - - 10 bps - Other - - - - - - - Total Operating Margin 10 bps 20 bps 160 bps 140 bps -100 bps 80 bps -10 bps

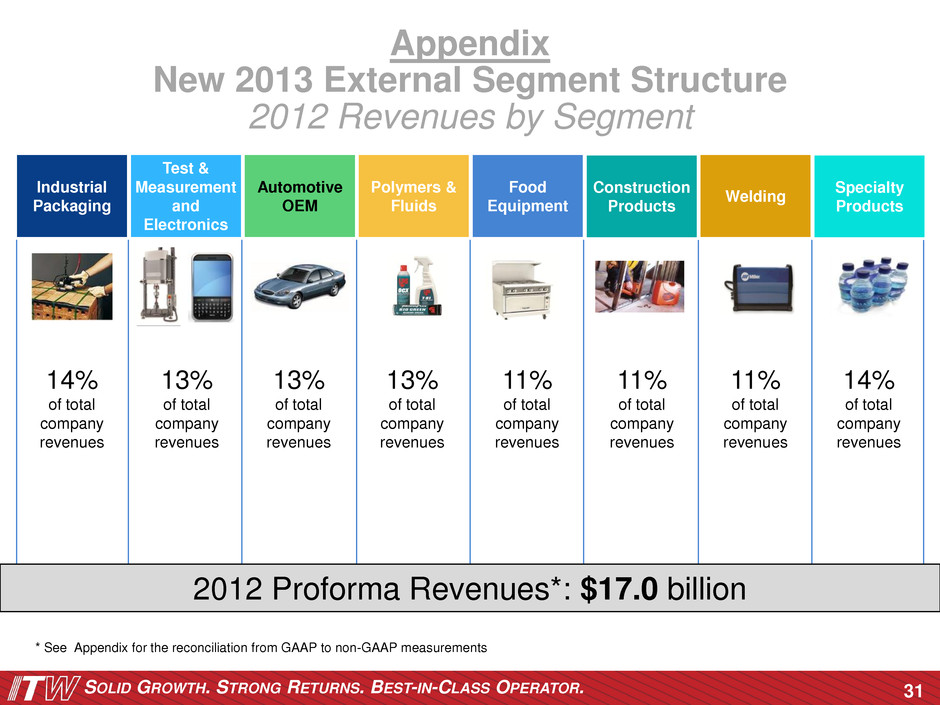

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. Appendix New 2013 External Segment Structure 2012 Revenues by Segment Test & Measurement and Electronics Automotive OEM Welding Polymers & Fluids Specialty Products Industrial Packaging Food Equipment Construction Products 14% of total company revenues 13% of total company revenues 13% of total company revenues 13% of total company revenues 11% of total company revenues 11% of total company revenues 11% of total company revenues 14% of total company revenues 2012 Proforma Revenues*: $17.0 billion 31 * See Appendix for the reconciliation from GAAP to non-GAAP measurements