SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. ITW Conference Call Third Quarter 2013 October 22, 2013

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. Forward-Looking Statements 2 Safe Harbor Statement This conference call contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, without limitation, statements regarding the expected impact and timing of strategic initiatives and related benefits, operating performance, growth in free operating cash flow, organic and total revenue, operating margin growth, diluted income per share from continuing operations, restructuring expenses and related benefits, tax rates, exchange rates, timing and amount of share repurchases, end market conditions, and the Company’s related 2013 forecasts. These statements are subject to certain risks, uncertainties, and other factors which could cause actual results to differ materially from those anticipated. Important risks that could cause actual results to differ materially from the Company’s expectations include those that are detailed in ITW’s Form 10-K for 2012. Non-GAAP Measures The Company uses certain non-GAAP measures in discussing the Company’s performance. The reconciliation of those measures to the most comparable GAAP measures is contained throughout this presentation and is also available at our website www.itw.com under “Investor Relations”.

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. Conference Call Playback ●Replay number: 866-431-5846; No pass code necessary ●Telephone replay available through midnight of November 5, 2013 ●Webcast / PowerPoint replay available at www.itw.com ●Supplemental financial and investor information will be available on the ITW website under the “Investor Relations” tab 3

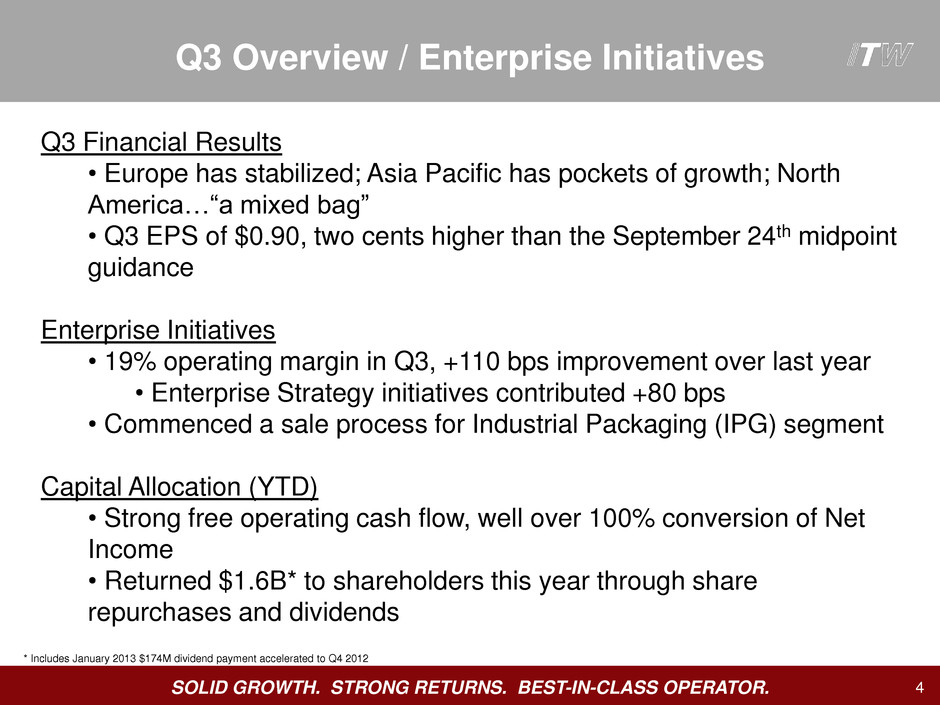

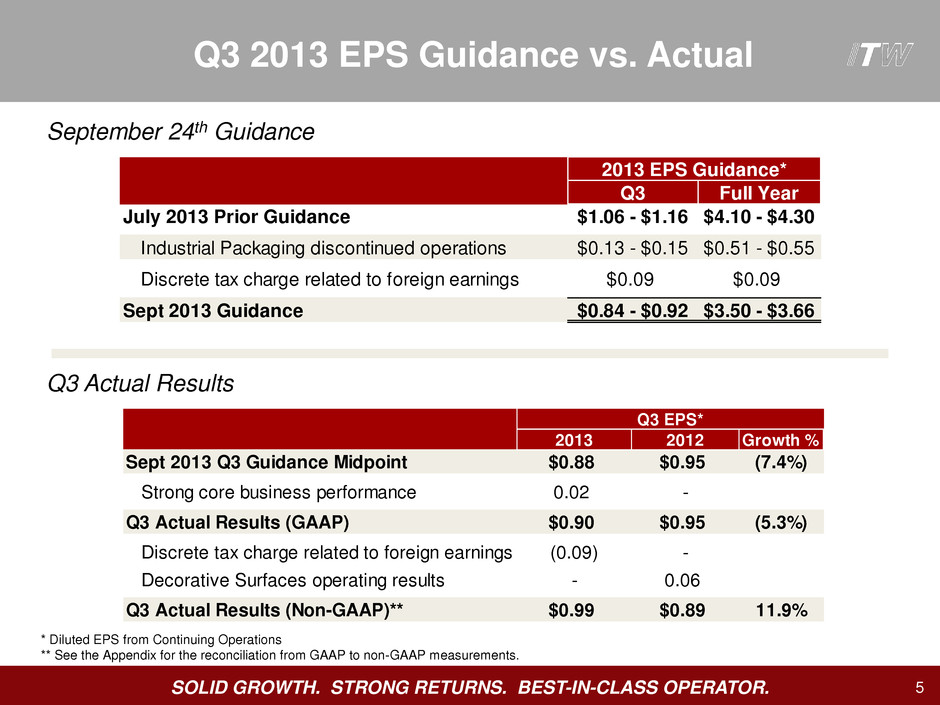

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. Q3 Overview / Enterprise Initiatives 4 Q3 Financial Results • Europe has stabilized; Asia Pacific has pockets of growth; North America…“a mixed bag” • Q3 EPS of $0.90, two cents higher than the September 24th midpoint guidance Enterprise Initiatives • 19% operating margin in Q3, +110 bps improvement over last year • Enterprise Strategy initiatives contributed +80 bps • Commenced a sale process for Industrial Packaging (IPG) segment Capital Allocation (YTD) • Strong free operating cash flow, well over 100% conversion of Net Income • Returned $1.6B* to shareholders this year through share repurchases and dividends * Includes January 2013 $174M dividend payment accelerated to Q4 2012

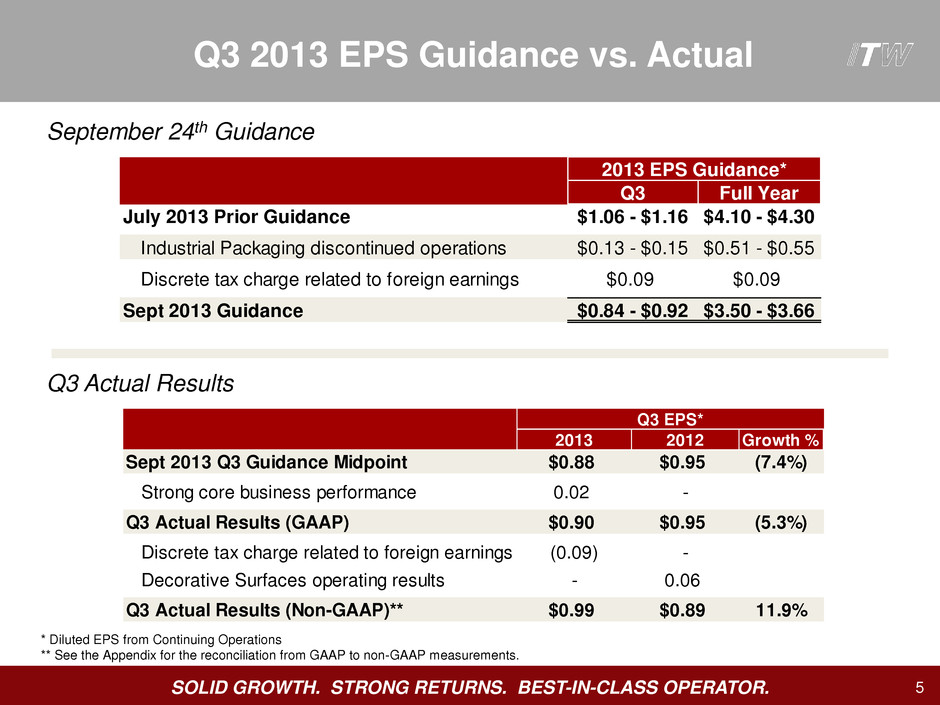

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. Q3 2013 EPS Guidance vs. Actual 5 September 24th Guidance Q3 Full Year July 2013 Prior Guidance $1.06 - $1.16 $4.10 - $4.30 Industrial Packaging discontinued operations $0.13 - $0.15 $0.51 - $0.55 Discrete tax charge related to foreign earnings $0.09 $0.09 Sept 2013 Guidance $0.84 - $0.92 $3.50 - $3.66 2013 EPS Guidance* Q3 Actual Results 2013 2012 Growth % Sept 2013 Q3 Guidanc Midpoint .88 .95 (7.4%) Strong core business performance 0.02 Q3 Actual Results (GAAP) $0.90 $0.95 (5.3%) Discrete tax charge related to foreign earnings (0.09) - Decorative Surfaces operating results - 0.06 Q3 Actual Results (Non-GAAP)** $0.99 $0.89 11.9% Q3 EPS* * Diluted EPS from Continuing Operations ** See the Appendix for the reconciliation from GAAP to non-GAAP measurements.

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 6 • Total operating revenues increased 2.9%, excluding 2012 Decorative Surfaces •Organic revenues up +0.4% •Operating margins improved +110 bps •Q3 EPS $0.99, up 11.9% vs. adjusted Q3 2012 Q3 2013 Highlights $ in Millions, except per share amounts Q3 2013 Q3 2012 F/(U) GAAP Operating Revenues 3,568$ 3,733$ (4.4%) Operating Income 678$ 667$ 1.8% % of Revenues 19.0% 17.9% 110 bps Diluted EPS from Continuing Operations 0.90$ 0.95$ (5.3%) Free Operating Cash Flow* 732$ 545$ 34.2% Non-GAAP * Operating Revenues 3,568$ 3,466$ 2.9% Operating Income 678$ 626$ 8.4% % of Reve es 19.0% 18.1% 90 bps Diluted EPS from Continuing Operations 0.99$ 0.89$ 11.9% * See the Appendix for the reconciliation from GAAP to non-GAAP measurements.

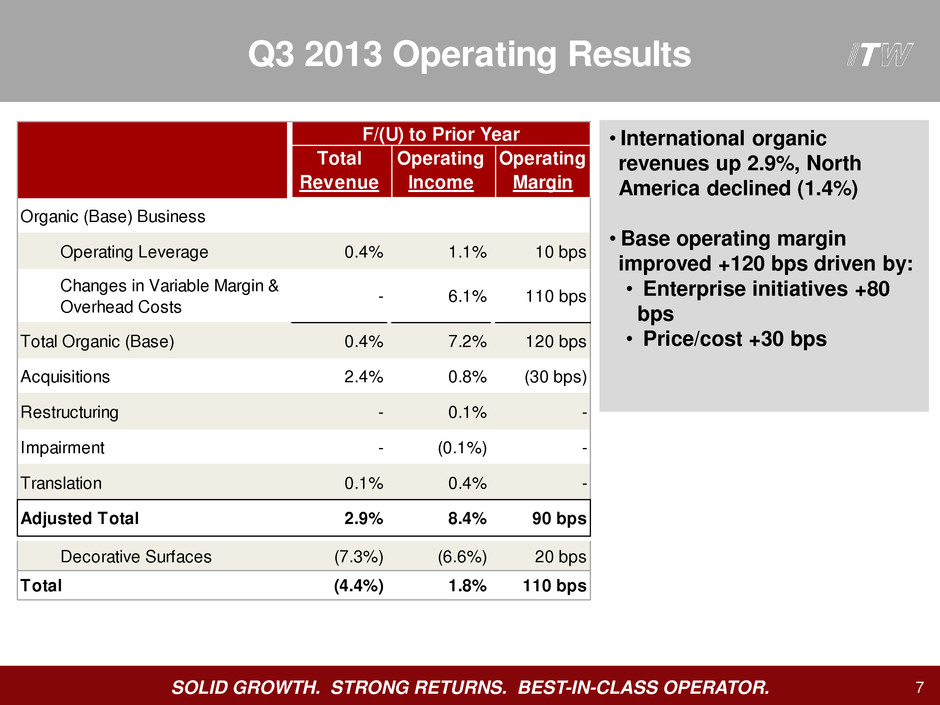

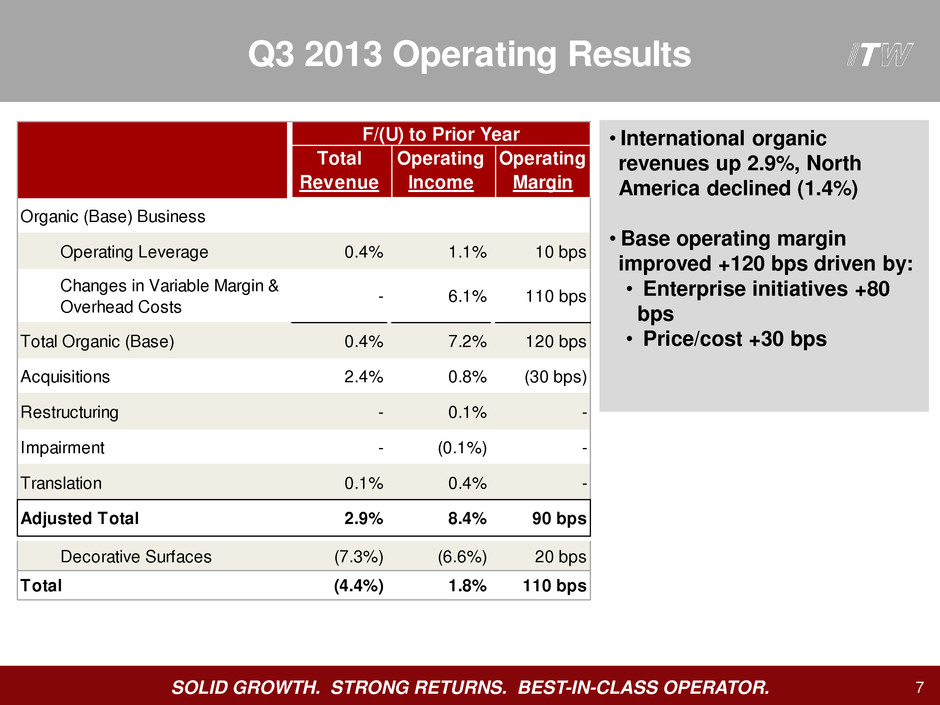

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 7 • International organic revenues up 2.9%, North America declined (1.4%) • Base operating margin improved +120 bps driven by: • Enterprise initiatives +80 bps • Price/cost +30 bps Q3 2013 Operating Results Total Revenue Operating Income Operating Margin Organic (Base) Business Operating Leverage 0.4% 1.1% 10 bps Changes in Variable Margin & Overhead Costs - 6.1% 110 bps Total Organic (Base) 0.4% 7.2% 120 bps Acquisitions 2.4% 0.8% (30 bps) Restructuring - 0.1% - Impairment - (0.1%) - Translation 0.1% 0.4% - Adjusted Total 2.9% 8.4% 90 bps Decorative Surfaces (7.3%) (6.6%) 20 bps Total (4.4%) 1.8% 110 bps F/(U) to Prior Year

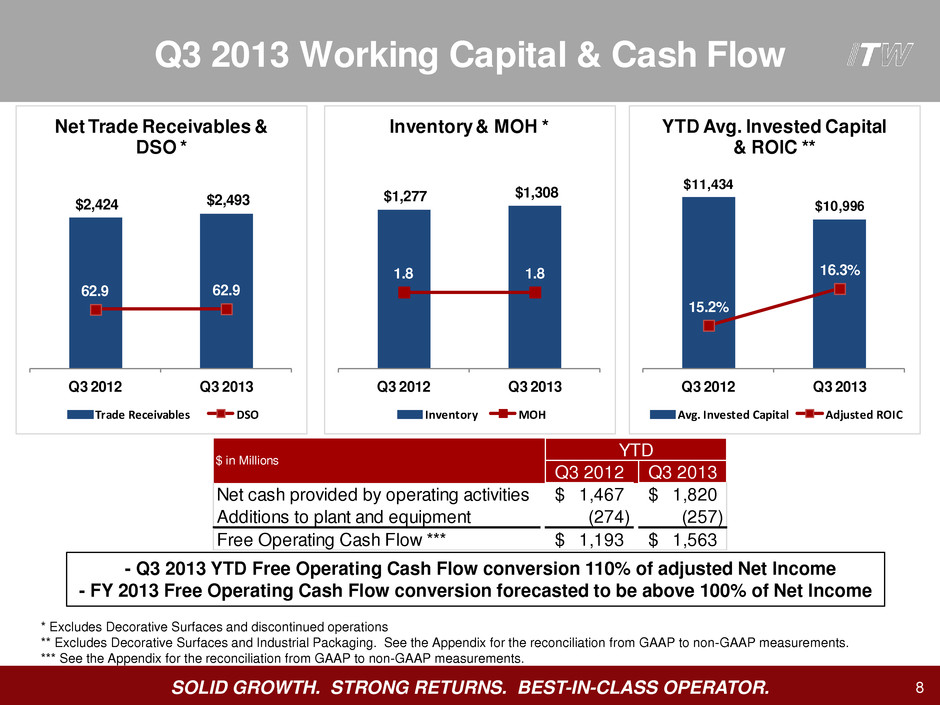

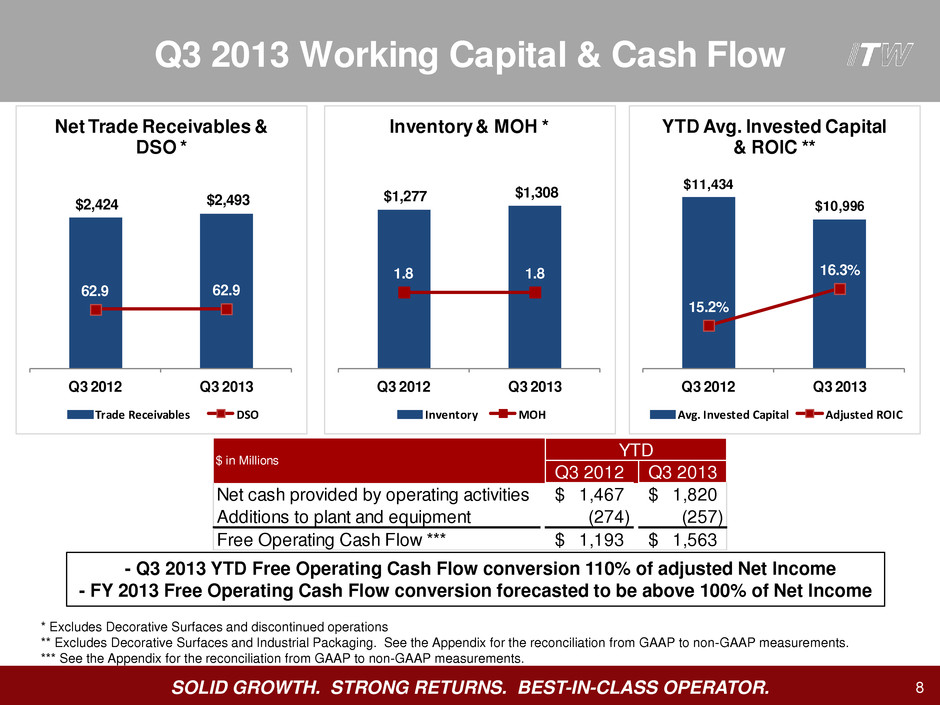

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 8 * Excludes Decorative Surfaces and discontinued operations ** Excludes Decorative Surfaces and Industrial Packaging. See the Appendix for the reconciliation from GAAP to non-GAAP measurements. *** See the Appendix for the reconciliation from GAAP to non-GAAP measurements. $2,424 $2,493 62.9 62.9 Q3 2012 Q3 2013 Net Trade Receivables & DSO * Trade Receivables DSO $1,277 $1,308 1.8 1.8 Q3 2012 Q3 2013 In entory & MOH * Inventory MOH - Q3 2013 YTD Free Operating Cash Flow conversion 110% of adjusted Net Income - FY 2013 Free Operating Cash Flow conversion forecasted to be above 100% of Net Income Q3 2012 Q3 2013 Net cash provided by operating activities 1,467$ 1,820$ Additions to plant and equipment (274) (257) Free Operating Cash Flow *** 1,193$ 1,563$ YTD $ in Millions $11,434 $10,996 15.2% 16.3% Q3 2012 Q3 2013 YTD Avg. Invested Capital & ROIC ** Avg. Invested Capital Adjusted ROIC Q3 2013 Working Capital & Cash Flow

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 9 * Includes January 2013 $174M dividend payment accelerated to Q4 2012. ** See the Appendix for the reconciliation from GAAP to non-GAAP measurements. 1. Organic Investments 2. Dividends 3. External Investments Share Repurchases Acquisitions 2013 Capital Allocation 33% 32% 33% 33% 33% Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Total Debt to Capital 1.6 1.7 1.7 1.7 1.8 Q3 2012 Q4 2012 Q1 2013 Q 2013 Q3 2013 Total Debt to Adjusted EBITDA** Capital Structure • ~5 million shares repurchased in Q3 • Expect to repurchase ~50 million shares to offset dilution of Industrial Packaging •Acquired ~$300M annualized revenues in 2013 • $1.6B* returned to shareholders YTD

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 0.4% (1%) 3% 1% 7% 4% 3% (1%) 7% 5% 11% 9% Total Company North America International EMEA Asia Pacific South America Organic (Base) Growth Total Growth ITW Worldwide International 10 Note: Excludes Decorative Surfaces 2012 revenue and impact of currency • EMEA organic: +1% • North America organic: (-1%) • Asia Pacific organic growth (+7%) reflects strong performance from China (+22%) and Australia/New Zealand (+5%) Revenue Growth by Geography Q3 2013 vs. 2012

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 11 Note: Adjusted operating margin excludes intangible amortization, impairment, and other non-cash acquisition accounting items. * See the Appendix for the reconciliation from GAAP to non-GAAP measurements. Q3 2013 Segment Results $ in Millions Total Revenue Operating Income Operating Margin Adjusted Operating Margin * Total Revenue Organic (Base) Revenue Operating Margin Test & Measurement and Electronics 555$ 91$ 16.3% 20.6% (10.9%) (11.8%) (190 bps) Automotive OEM 589 124 21.1% 21.3% 13.2% 11.5% 200 bps Polymers & Fluids 504 91 18.1% 22.1% (1.1%) - 220 bps Food Equipment 542 108 19.9% 21.2% 10.4% 4.4% 90 bps Welding 438 111 25.4% 26.0% (1.0%) (3.5%) 90 bps Construction Products 440 71 16.2% 17.0% 1.7% 3.3% 250 bps Specialty Products 510 108 21.1% 23.5% 11.4% 1.9% 150 bps Intersegment (10) Total Segments 3,568$ 704$ 19.7% 21.6% 2.9% 0.4% 110 bps Decorative Surfaces (100.0%) (100.0%) - Unallocated - (26) Total Company 3,568$ 678$ 19.0% 20.9% (4.4%) 0.4% 110 bps Q3 2013 F/(U) vs. prior year

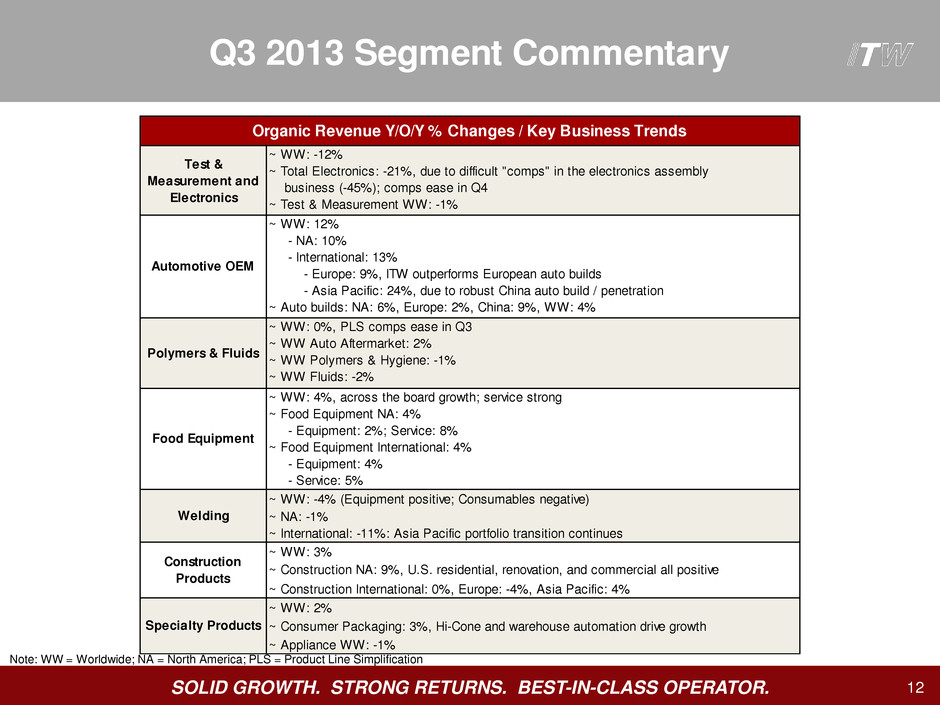

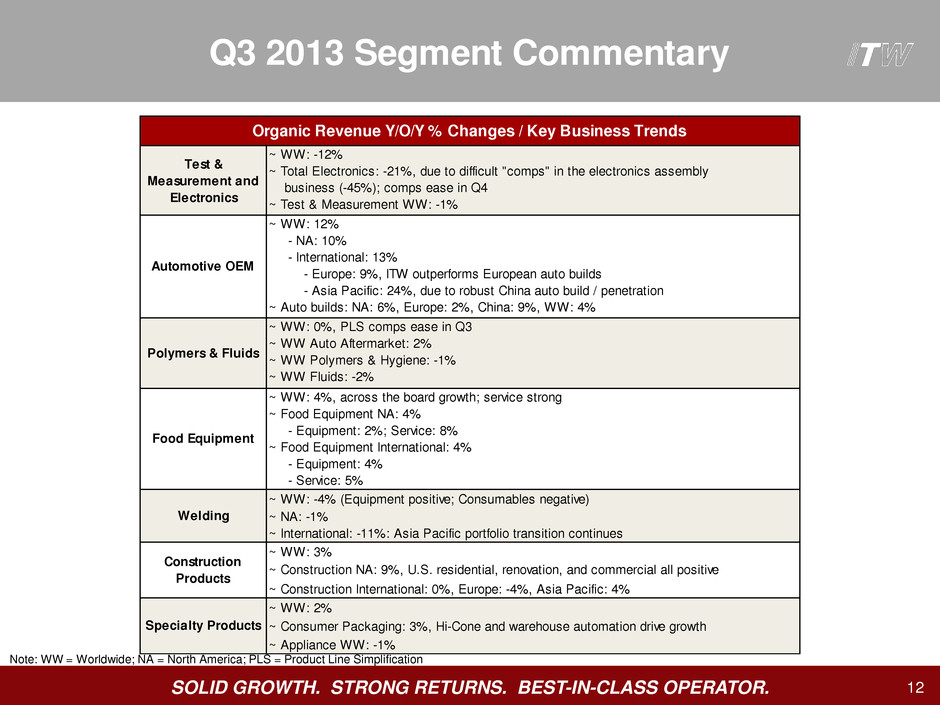

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 12 Note: WW = Worldwide; NA = North America; PLS = Product Line Simplification Q3 2013 Segment Commentary Organic Revenue Y/O/Y % Changes / Key Business Trends Test & Measurement and Electronics ~ WW: -12% ~ Total Electronics: -21%, due to difficult "comps" in the electronics assembly business (-45%); comps ease in Q4 ~ Test & Measurement WW: -1% Polymers & Fluids ~ WW: 0%, PLS comps ease in Q3 ~ WW Auto Aftermarket: 2% ~ WW Polymers & Hygiene: -1% ~ WW Fluids: -2% ~ WW: -4% (Equipment positive; Consumables negative) ~ NA: -1% ~ International: -11%: Asia Pacific portfolio transition continues ~ WW: 3% ~ Construction NA: 9%, U.S. residential, renovation, and commercial all positive ~ Construction International: 0%, Europe: -4%, Asia Pacific: 4% ~ WW: 2% ~ Consumer Packaging: 3%, Hi-Cone and warehouse automation drive growth ~ Appliance WW: -1% Construction Products Specialty Products Automotive OEM Food Equipment Welding ~ WW: 12% - NA: 10% - International: 13% - Europe: 9%, ITW outperforms European auto builds - Asia Pacific: 24%, due to robust China auto build / penetration ~ Auto builds: NA: 6%, Europe: 2%, China: 9%, WW: 4% ~ WW: 4%, across the board growth; service strong ~ Food Equipment NA: 4% - Equipment: 2%; Service: 8% ~ Food Equipment International: 4% - Equipment: 4% - Service: 5%

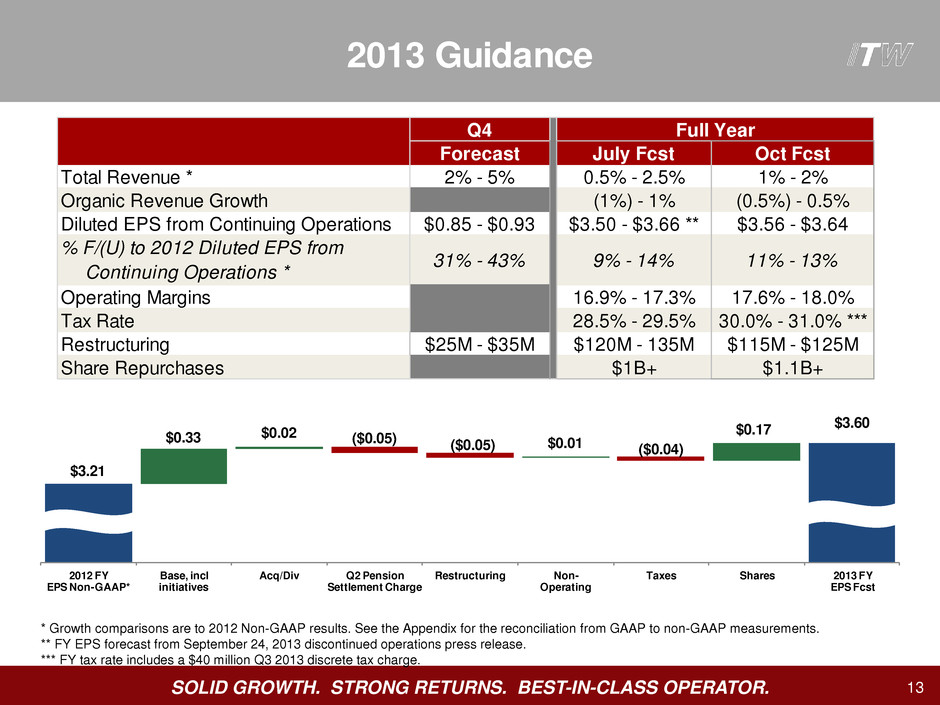

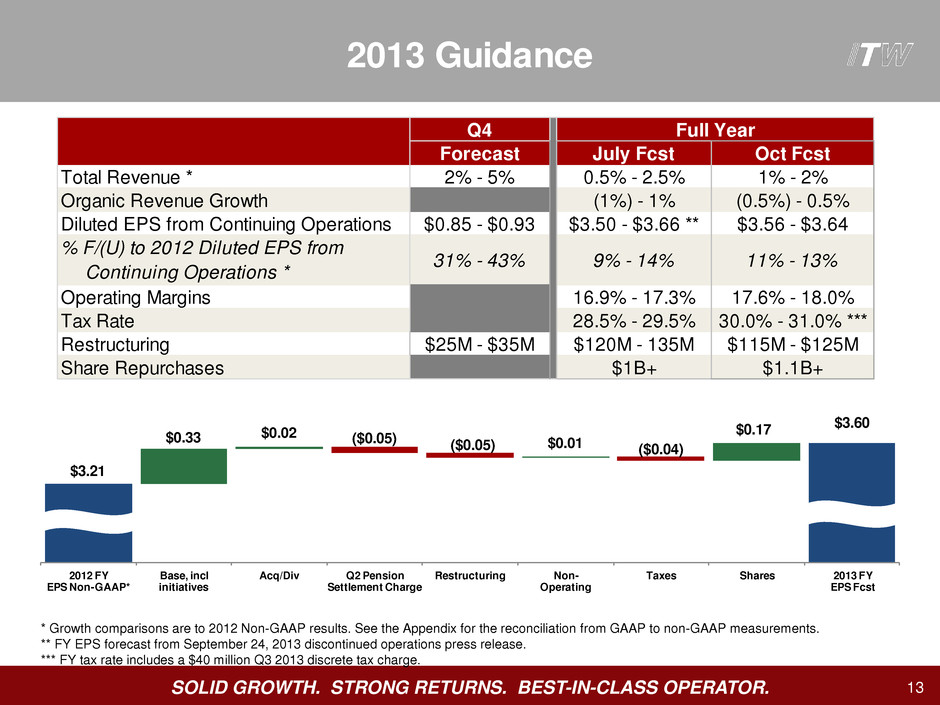

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. $3.21 $3.60 $0.33 $0.02 ($0.05) ($0.05) $0.01 ($0.04) $0.17 2012 FY EPS Non-GAAP* Base, incl initiatives Acq/Div Q2 Pension Settlement Charge Restructuring Non- Operating Taxes Shares 2013 FY EPS Fcst 13 * Growth comparisons are to 2012 Non-GAAP results. See the Appendix for the reconciliation from GAAP to non-GAAP measurements. ** FY EPS forecast from September 24, 2013 discontinued operations press release. *** FY tax rate includes a $40 million Q3 2013 discrete tax charge. Q4 Forecast July Fcst Oct Fcst Total Revenue * 2% - 5% 0.5% - 2.5% 1% - 2% Organic Revenue Growth (1%) - 1% (0.5%) - 0.5% Diluted EPS from Continuing Operations $0.85 - $0.93 $3.50 - $3.66 ** $3.56 - $3.64 % F/(U) to 2012 Diluted EPS from Continuing Operations * 31% - 43% 9% - 14% 11% - 13% Operating Margins 16.9% - 17.3% 17.6% - 18.0% Tax Rate 28.5% - 29.5% 30.0% - 31.0% *** Restructuring $25M - $35M $120M - 135M $115M - $125M Share Repurchases $1B+ $1.1B+ Full Year 2013 Guidance

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 14 Q&A

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 15 Appendix: GAAP to Non-GAAP Reconciliations & Segment Tables

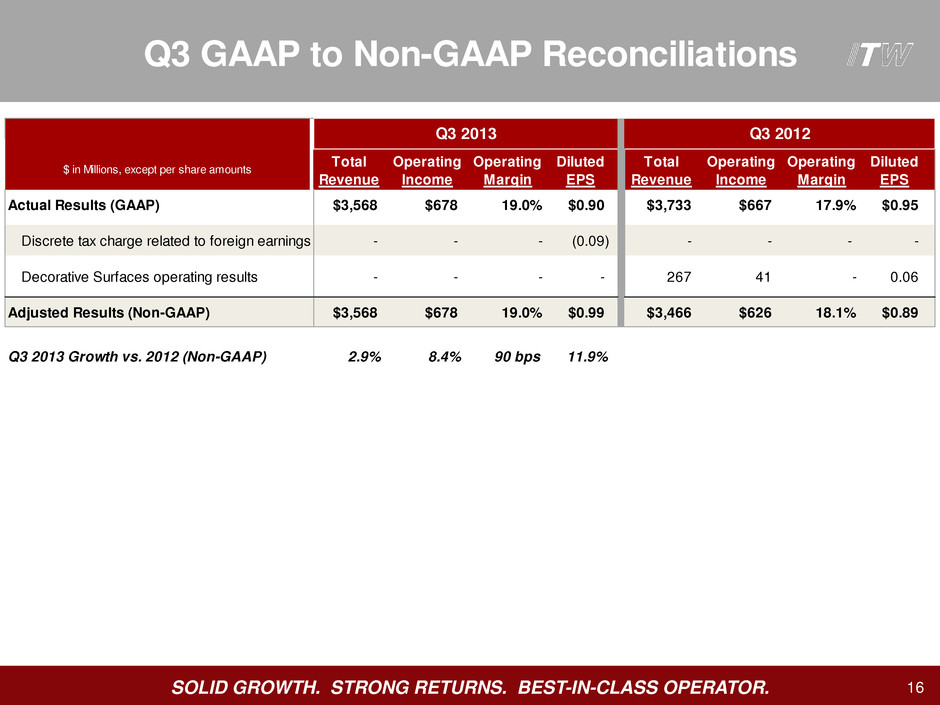

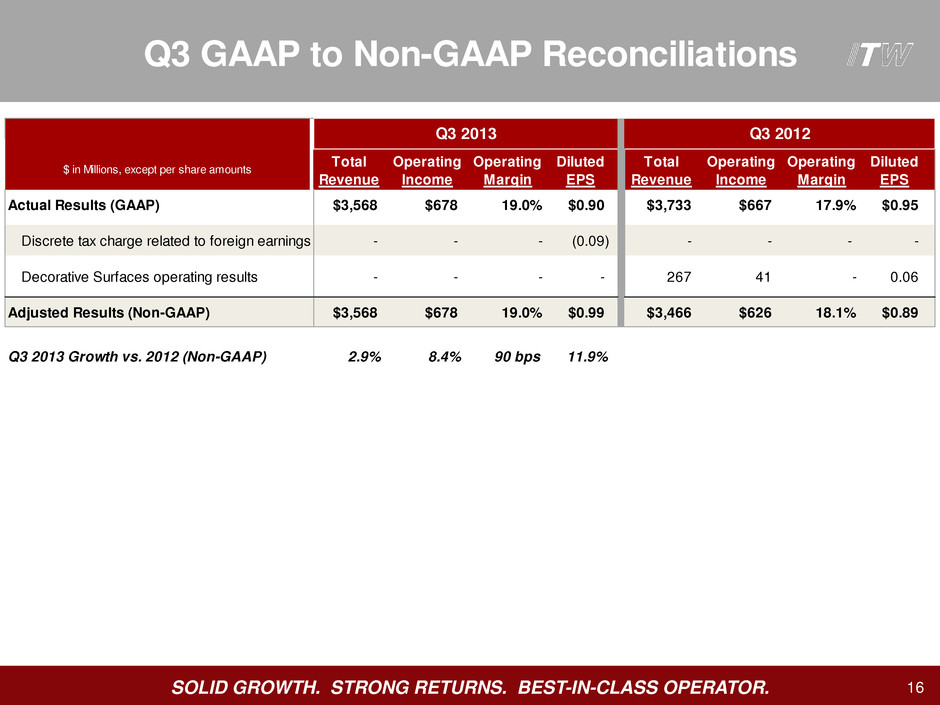

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 16 $ in Millions, except per share amounts Total Revenue Operating Income Operating Margin Diluted EPS Total Revenue Operating Income Operating Margin Diluted EPS Actual Results (GAAP) $3,568 $678 19.0% $0.90 $3,733 $667 17.9% $0.95 Discrete tax charge related to foreign earnings - - - (0.09) - - - - Decorative Surfaces operating results - - - - 267 41 - 0.06 Adjusted Results (Non-GAAP) $3,568 $678 19.0% $0.99 $3,466 $626 18.1% $0.89 Q3 2013 Growth vs. 2012 (Non-GAAP) 2.9% 8.4% 90 bps 11.9% Q3 2013 Q3 2012 Q3 GAAP to Non-GAAP Reconciliations

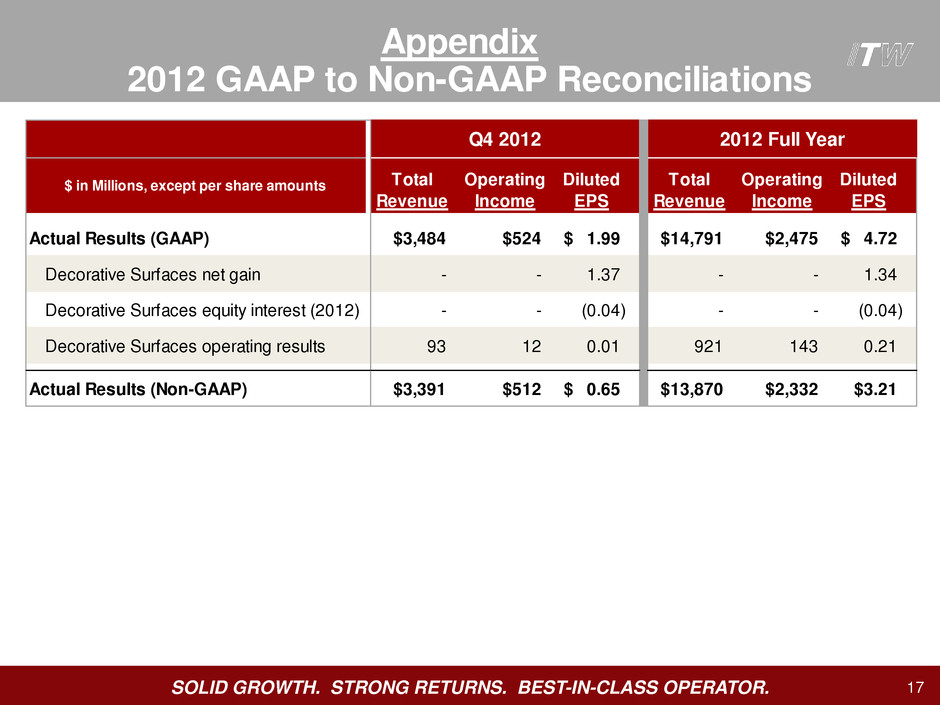

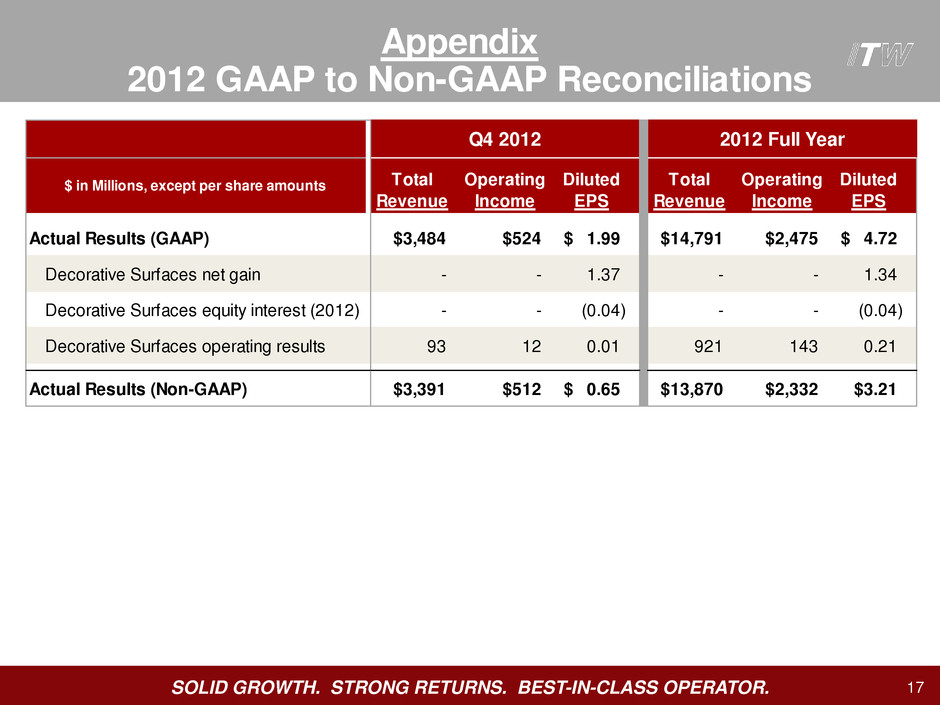

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 17 2012 GAAP to Non-GAAP Reconciliations Appendix $ in Millions, except per share amounts Total Revenue Operating Income Diluted EPS Total Revenue Operating Income Diluted EPS Actual Results (GAAP) $3,484 $524 1.99$ $14,791 $2,475 4.72$ Decorative Surfaces net gain - - 1.37 - - 1.34 Decorative Surfaces equity interest (2012) - - (0.04) - - (0.04) Decorative Surfaces operating results 93 12 0.01 921 143 0.21 Actual Results (Non-GAAP) $3,391 $512 0.65$ $13,870 $2,332 $3.21 2012 Full YearQ4 2012

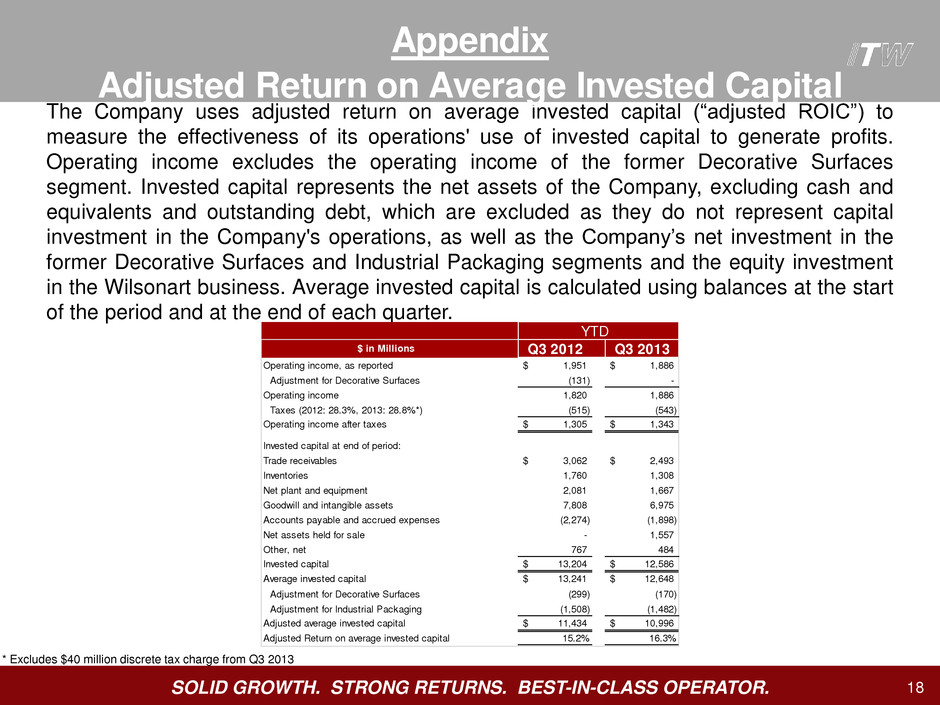

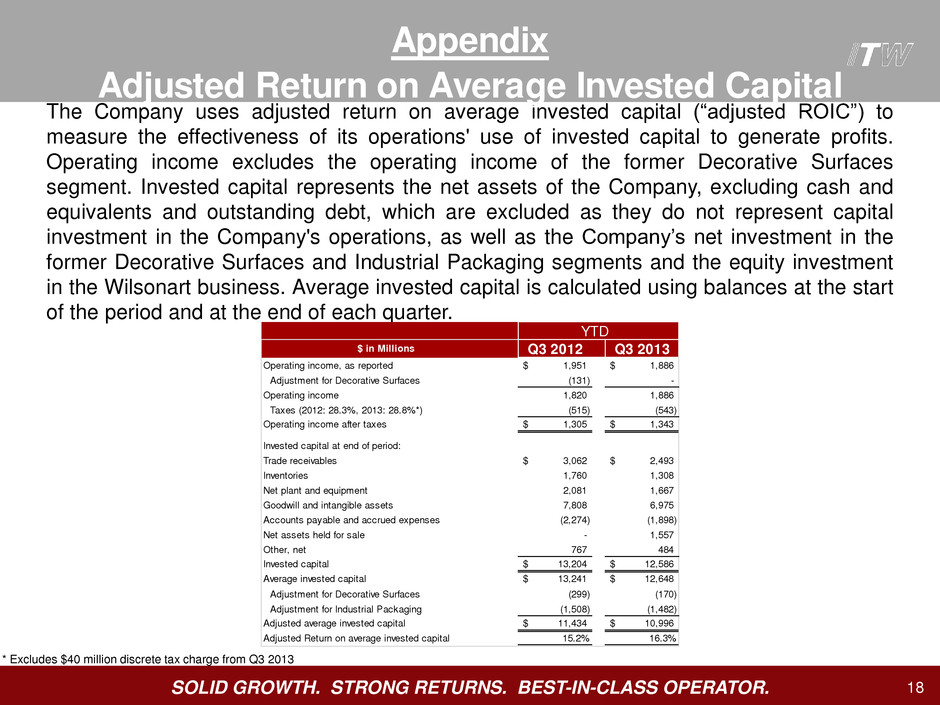

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. The Company uses adjusted return on average invested capital (“adjusted ROIC”) to measure the effectiveness of its operations' use of invested capital to generate profits. Operating income excludes the operating income of the former Decorative Surfaces segment. Invested capital represents the net assets of the Company, excluding cash and equivalents and outstanding debt, which are excluded as they do not represent capital investment in the Company's operations, as well as the Company’s net investment in the former Decorative Surfaces and Industrial Packaging segments and the equity investment in the Wilsonart business. Average invested capital is calculated using balances at the start of the period and at the end of each quarter. 18 Adjusted Return on Average Invested Capital Appendix * Excludes $40 million discrete tax charge from Q3 2013 $ in Millions Q3 2012 Q3 2013 Operating income, as reported 1,951$ 1,886$ Adjustment for Decorative Surfaces (131) - Operating income 1,820 1,886 Taxes (2012: 28.3%, 2013: 28.8%*) (515) (543) Operating income after taxes 1,305$ 1,343$ Invested capital at end of period: Trade receivables 3,062$ 2,493$ Inventories 1,760 1,308 Net plant and equipment 2,081 1,667 Goodwill and intangible assets 7,808 6,975 Accounts payable and accrued expenses (2,274) (1,898) Net assets held for sale - 1,557 Other, et 767 484 Invested capital 13,204$ 12,586$ Average invested capital 13,241$ 12,648$ Adjustment for Decorative Surfaces (299) (170) Adjustment for Industrial Packaging (1,508) (1,482) Adjusted average invested capital 11,434$ 10,996$ Adjusted Return on average invested capital 15.2% 16.3% YTD

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. The Company uses free operating cash flow to measure cash flow generated by operations that is available for dividends, acquisitions, share repurchases and debt repayment. Free operating cash flow represents net cash provided by operating activities less additions to plant and equipment. For further information on free operating cash flow, see the Company’s annual report on Form 10-K for 2012. 19 Appendix Free Operating Cash Flow Q3 2012 Q3 2013 Net cash provided by operating activities 1,467$ 1,820$ Additions to plant and equipment (274) (257) Free Operating Cash Flow 1,193$ 1,563$ YTD $ in Millions $ in Millions Q3 2012 Q3 2013 Net cash provided by operating activities 635$ 811$ Additions to plant and equipment (90) (79) Free Operating Cash Flow 545$ 732$

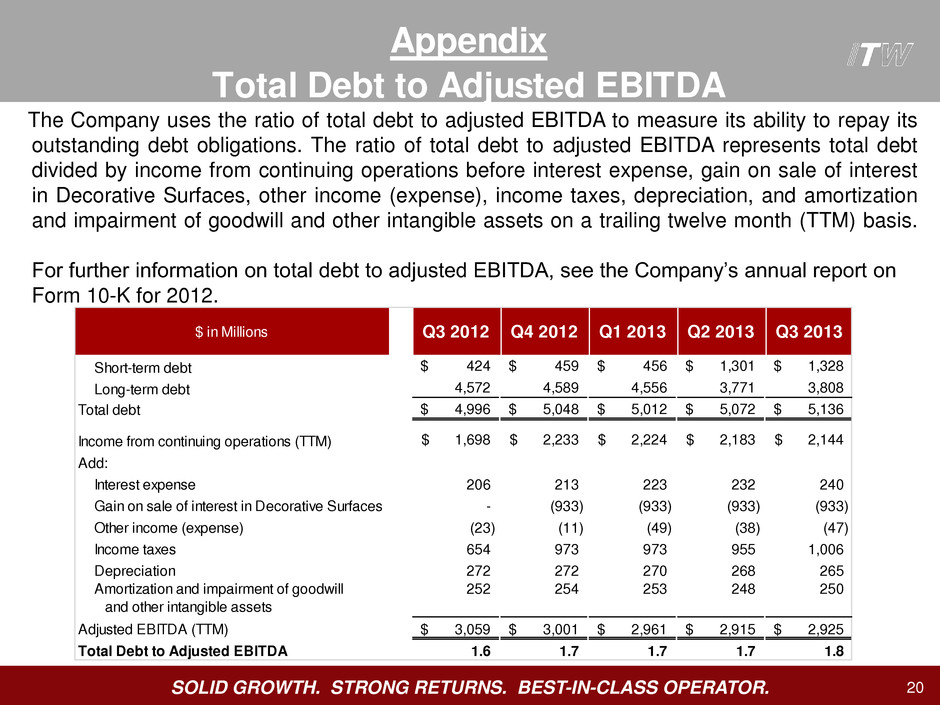

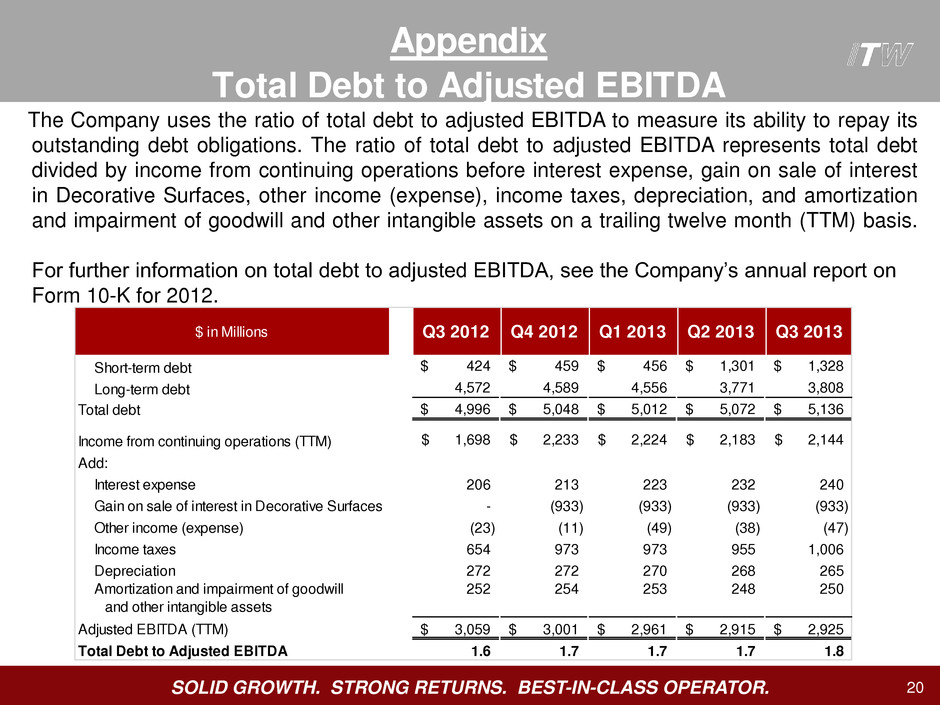

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. The Company uses the ratio of total debt to adjusted EBITDA to measure its ability to repay its outstanding debt obligations. The ratio of total debt to adjusted EBITDA represents total debt divided by income from continuing operations before interest expense, gain on sale of interest in Decorative Surfaces, other income (expense), income taxes, depreciation, and amortization and impairment of goodwill and other intangible assets on a trailing twelve month (TTM) basis. For further information on total debt to adjusted EBITDA, see the Company’s annual report on Form 10-K for 2012. 20 T tal Debt to Adjusted EBITDA Appendix $ in Millions Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Short-term debt 424$ 459$ 456$ 1,301$ 1,328$ Long-term debt 4,572 4,589 4,556 3,771 3,808 Total debt 4,996$ 5,048$ 5,012$ 5,072$ 5,136$ Income from continuing operations (TTM) 1,698$ 2,233$ 2,224$ 2,183$ 2,144$ Add: Interest expense 206 213 223 232 240 Gain on sale of interest in Decorative Surfaces - (933) (933) (933) (933) Other income (expense) (23) (11) (49) (38) (47) I om taxes 654 973 973 955 1,006 Depreciation 272 272 270 268 265 Amortization and impairment of goodwill and other intangible assets 252 254 253 248 250 Adjusted EBITDA (TTM) 3,059$ 3,001$ 2,961$ 2,915$ 2,925$ Total Debt to Adjusted EBITDA 1.6 1.7 1.7 1.7 1.8

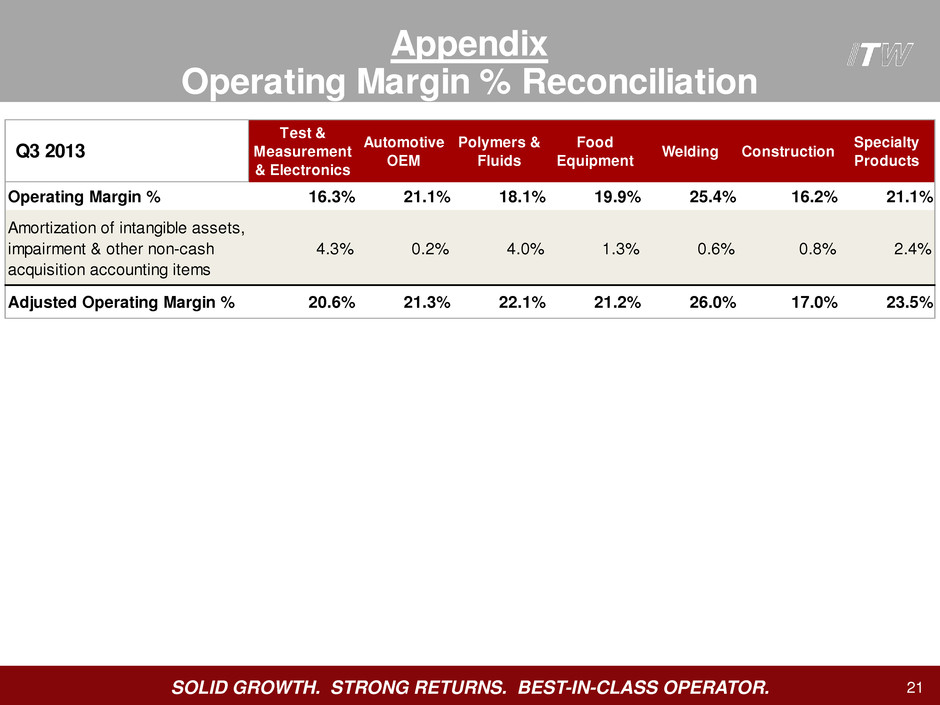

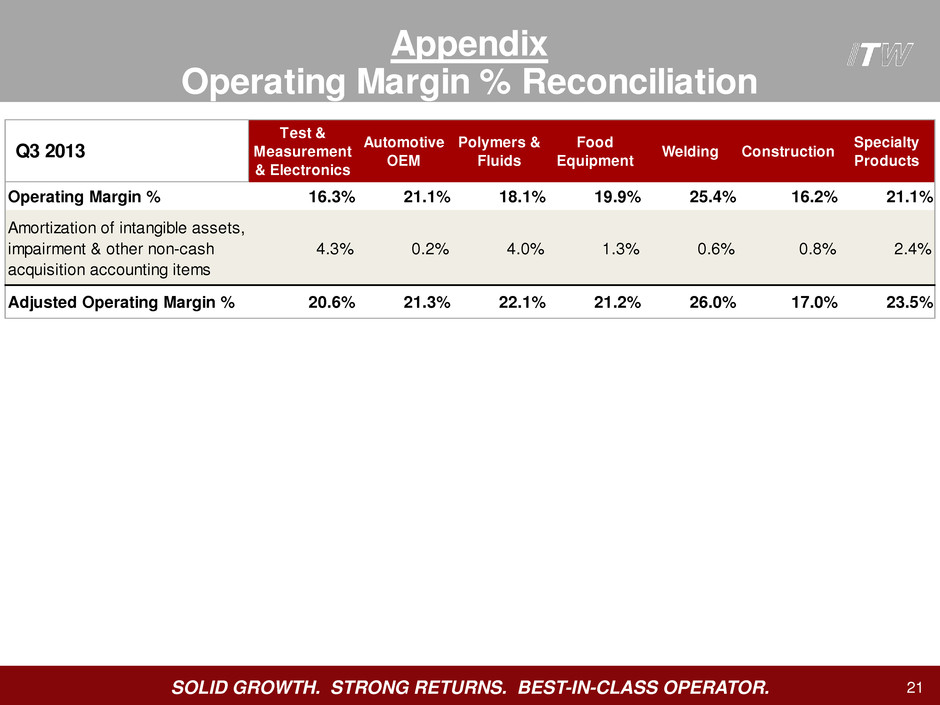

SOLID GROWTH. STRONG RETURNS. BEST-IN-CLASS OPERATOR. 21 Appendix Operating Margin % Reconciliation Q3 2013 Test & Measurement & Electronics Automotive OEM Polymers & Fluids Food Equipment Welding Construction Specialty Products Operating Margin % 16.3% 21.1% 18.1% 19.9% 25.4% 16.2% 21.1% Amortization of intangible assets, impairment & other non-cash acquisition accounting items 4.3% 0.2% 4.0% 1.3% 0.6% 0.8% 2.4% Adjusted Operating Margin % 20.6% 21.3% 22.1% 21.2% 26.0% 17.0% 23.5%