Imperial 2025 Corporate Guidance December 12, 2024 Exhibit 99.2

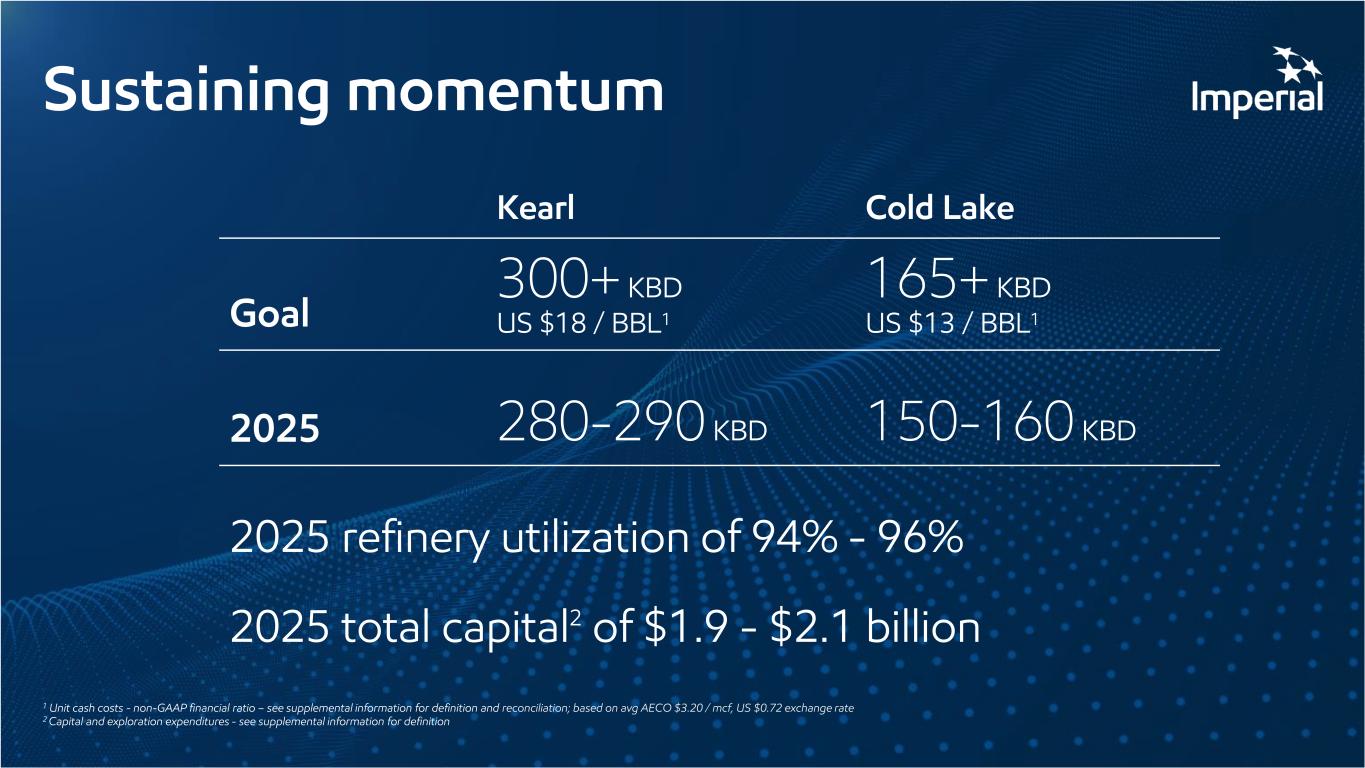

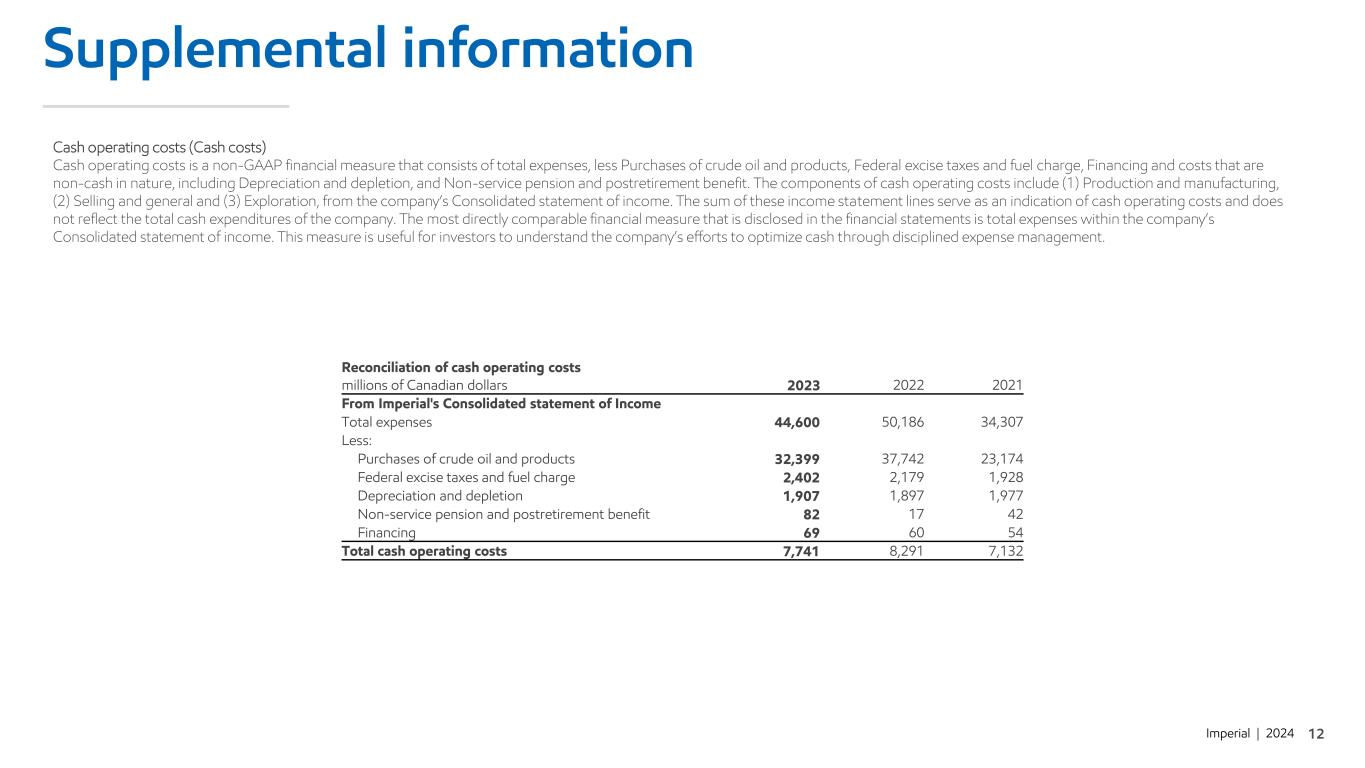

Sustaining momentum Kearl Cold Lake Goal 300+ KBD US $18 / BBL1 165+ KBD US $13 / BBL1 2025 280-290 KBD 150-160 KBD 2025 total capital2 of $1.9 - $2.1 billion 1 Unit cash costs - non-GAAP financial ratio – see supplemental information for definition and reconciliation; based on avg AECO $3.20 / mcf, US $0.72 exchange rate 2 Capital and exploration expenditures - see supplemental information for definition 2025 refinery utilization of 94% - 96%

Imperial | 2024 29 22 20 18 20 17 15 13 $10 $20 $30 2022A 2023A 2024 3Q YTD Future Upstream unit cash costs1 Kearl Cold Lake US$/bbl 416 413 431 445 - 100 200 300 400 500 2022A 2023A 2024G 2025G Upstream production A= Actuals, G= Guidancekoebd Upstream momentum Growing volume with lower unit cash costs 1 Non-GAAP financial ratio – see supplemental information for definition and reconciliation ▪ 2025 total Upstream production of 433 - 456 koebd ▪ Kearl - structural growth and lower unit cash costs1 through capital efficient debottlenecking ▪ Targeting US $18/bbl unit cash costs1 ▪ Accelerating projects to support 300+ kbd future ▪ Cold Lake - fully realizing Grand Rapids production and unit cash costs1 benefits ▪ Targeting US $13/bbl unit cash costs1 ▪ Late 2025 Leming SAGD start up supports 165+ kbd future

Imperial | 2024 Downstream momentum Continuing strong operational performance ▪ Refinery throughput of 405 – 415 kbd ▪ 94% - 96% utilization rate ▪ Turnaround activity significantly lower than 2024 ▪ Volumetric impact 12 kbd → 50% lower ▪ Operating costs1 of $111 million → 30% lower ▪ Completion of 2024 turnaround work at Nanticoke, Sarnia and Strathcona ahead of schedule and on budget ▪ Strathcona renewable diesel project start up mid-20252 1 Non-GAAP financial measure – see supplemental information for definition and reconciliation 2 Renewable diesel production excluded from refinery throughput and utilization 418 407 393 410 85% 90% 95% 100% 300 340 380 420 2022A 2023A 2024G 2025G Refinery crude throughput and utilization % A= Actuals, G= Guidance Refinery crude throughput Utilization kbd

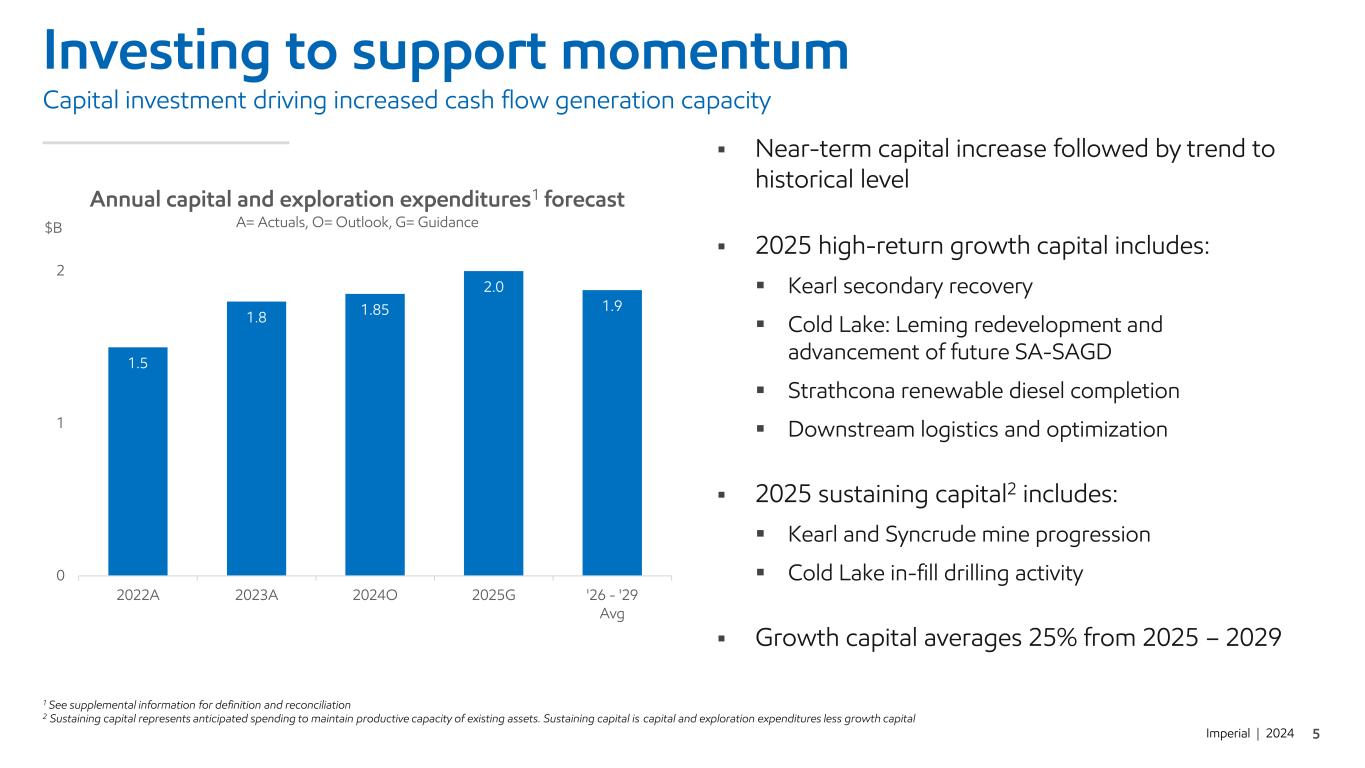

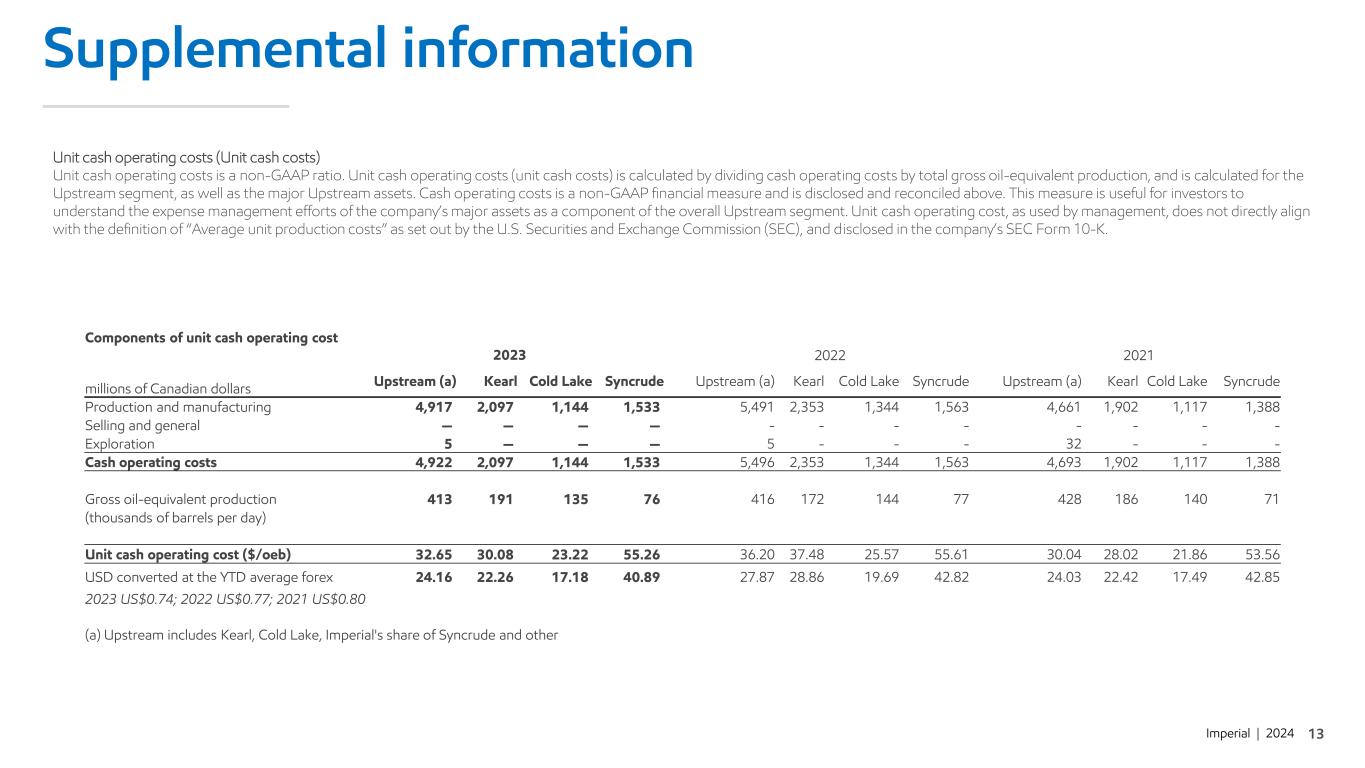

Imperial | 2024 Investing to support momentum Capital investment driving increased cash flow generation capacity ▪ Near-term capital increase followed by trend to historical level ▪ 2025 high-return growth capital includes: ▪ Kearl secondary recovery ▪ Cold Lake: Leming redevelopment and advancement of future SA-SAGD ▪ Strathcona renewable diesel completion ▪ Downstream logistics and optimization ▪ 2025 sustaining capital2 includes: ▪ Kearl and Syncrude mine progression ▪ Cold Lake in-fill drilling activity ▪ Growth capital averages 25% from 2025 – 2029 1 See supplemental information for definition and reconciliation 2 Sustaining capital represents anticipated spending to maintain productive capacity of existing assets. Sustaining capital is capital and exploration expenditures less growth capital 1.5 1.8 1.85 2.0 1.9 0 1 2 2022A 2023A 2024O 2025G '26 - '29 Avg Annual capital and exploration expenditures1 forecast A= Actuals, O= Outlook, G= Guidance $B

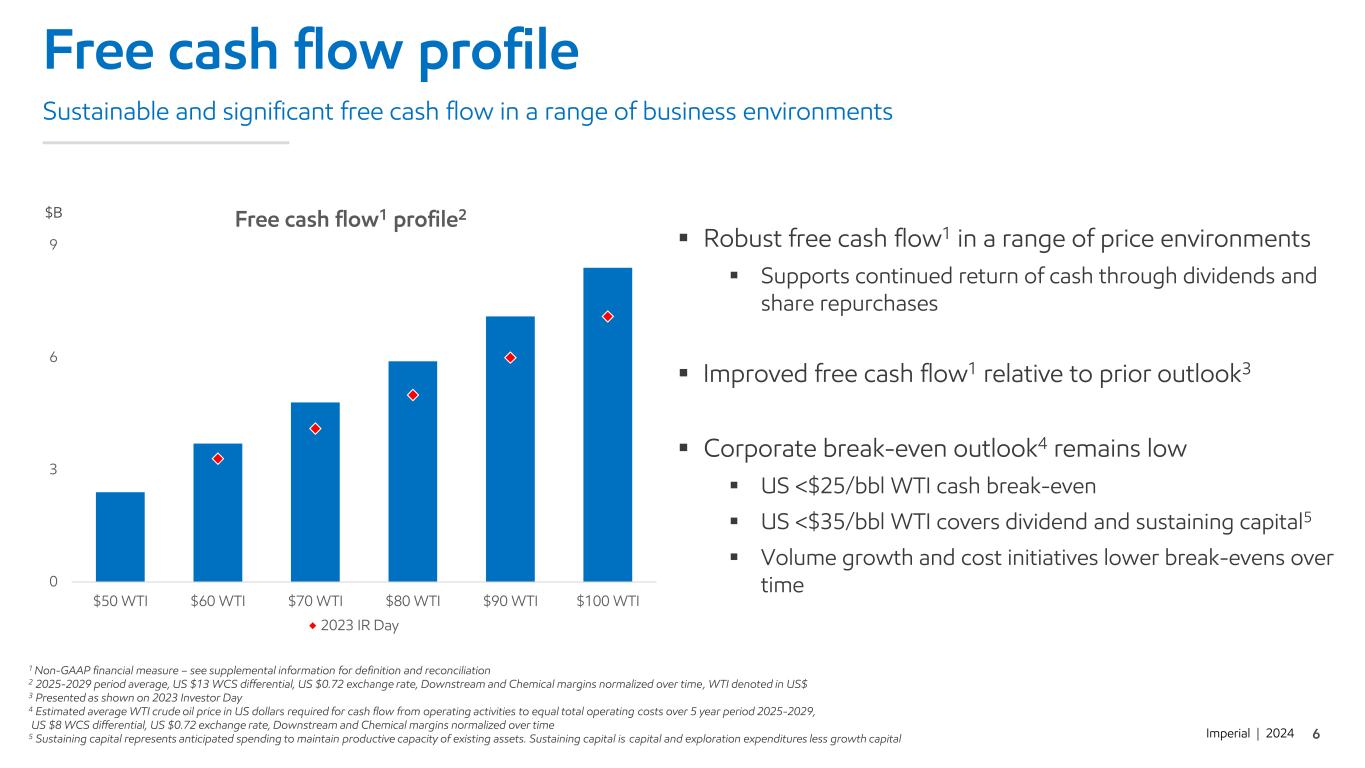

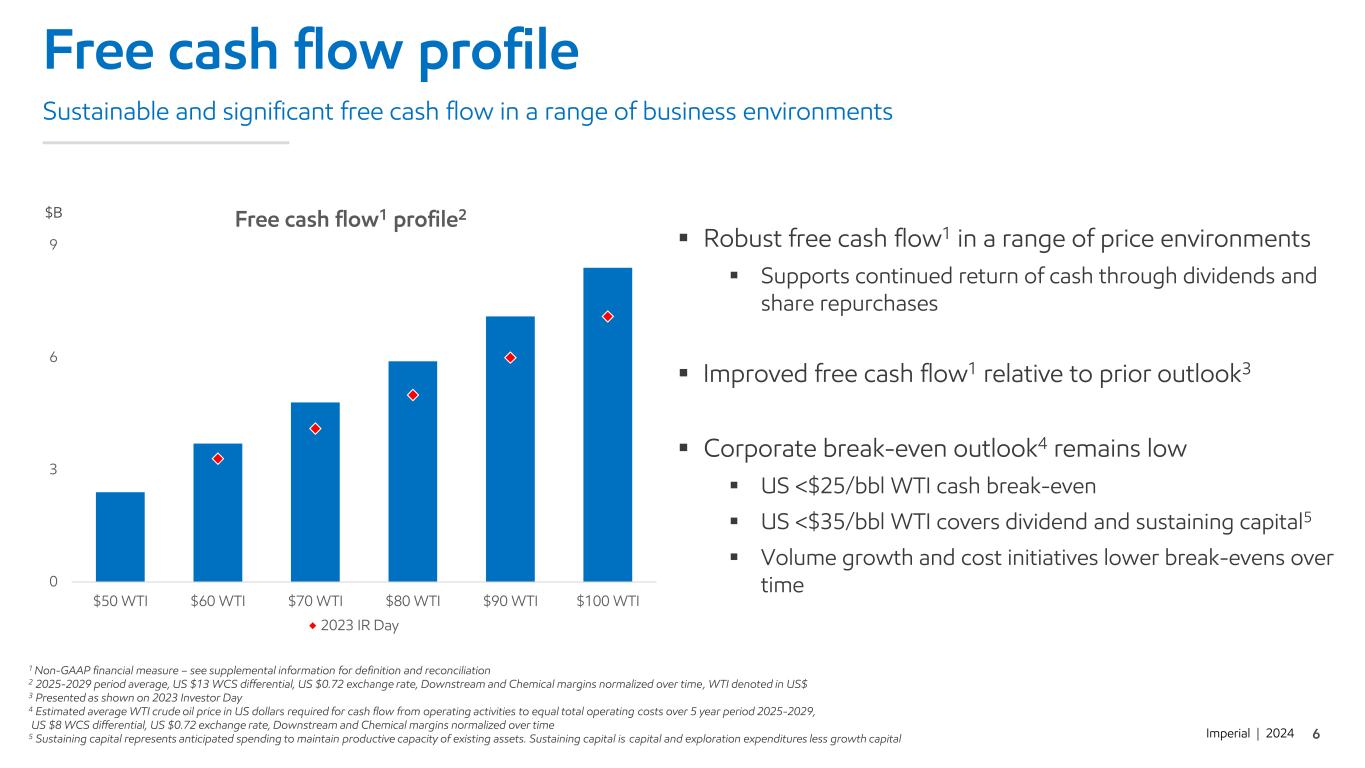

Imperial | 2024 0 3 6 9 $50 WTI $60 WTI $70 WTI $80 WTI $90 WTI $100 WTI Free cash flow1 profile2 2023 IR Day $B Free cash flow profile ▪ Robust free cash flow1 in a range of price environments ▪ Supports continued return of cash through dividends and share repurchases ▪ Improved free cash flow1 relative to prior outlook3 ▪ Corporate break-even outlook4 remains low ▪ US <$25/bbl WTI cash break-even ▪ US <$35/bbl WTI covers dividend and sustaining capital5 ▪ Volume growth and cost initiatives lower break-evens over time 1 Non-GAAP financial measure – see supplemental information for definition and reconciliation 2 2025-2029 period average, US $13 WCS differential, US $0.72 exchange rate, Downstream and Chemical margins normalized over time, WTI denoted in US$ 3 Presented as shown on 2023 Investor Day 4 Estimated average WTI crude oil price in US dollars required for cash flow from operating activities to equal total operating costs over 5 year period 2025-2029, US $8 WCS differential, US $0.72 exchange rate, Downstream and Chemical margins normalized over time 5 Sustaining capital represents anticipated spending to maintain productive capacity of existing assets. Sustaining capital is capital and exploration expenditures less growth capital Sustainable and significant free cash flow in a range of business environments

Imperial | 2024 Discussion Brad Corson Chairman, president and chief executive officer Sherri Evers Senior vice-president, sustainability, commercial development and product solutions Cheryl Gomez-Smith Senior vice-president, upstream Dan Lyons Chief financial officer

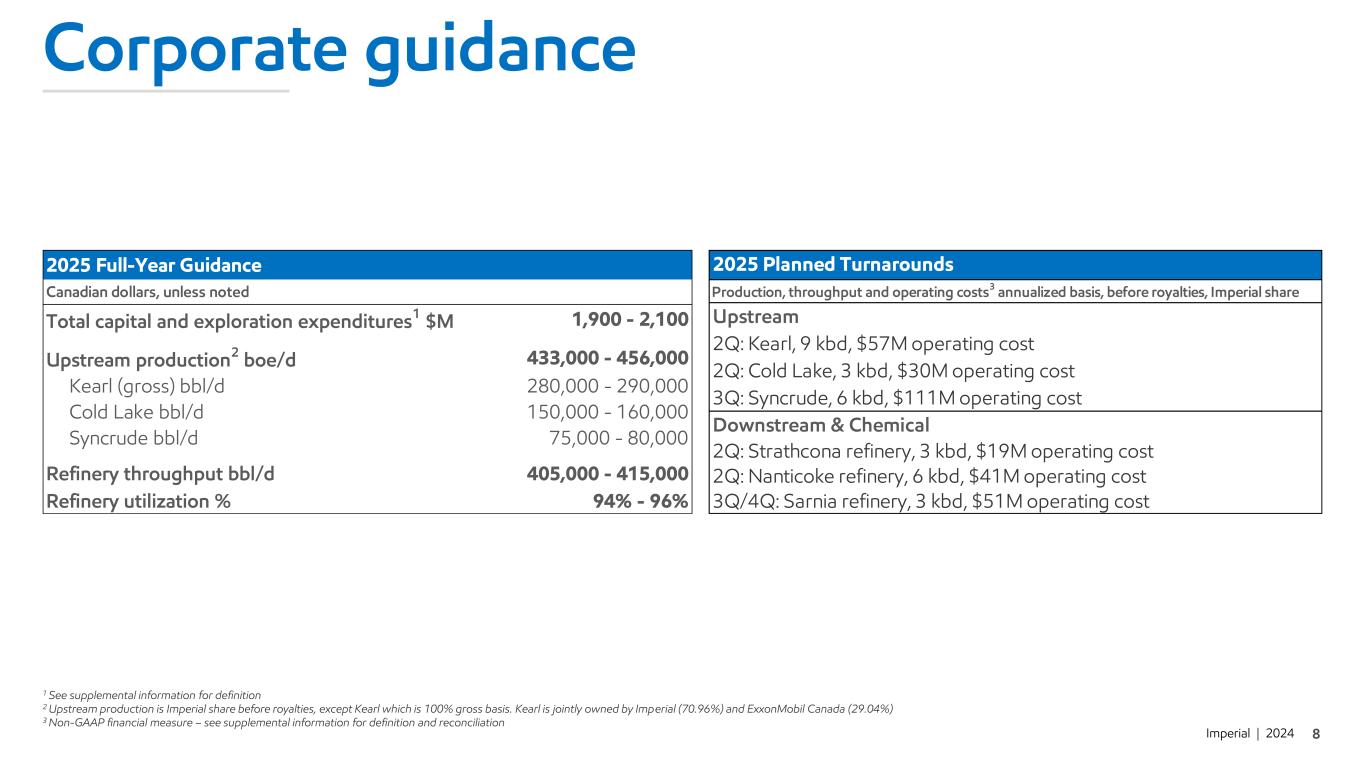

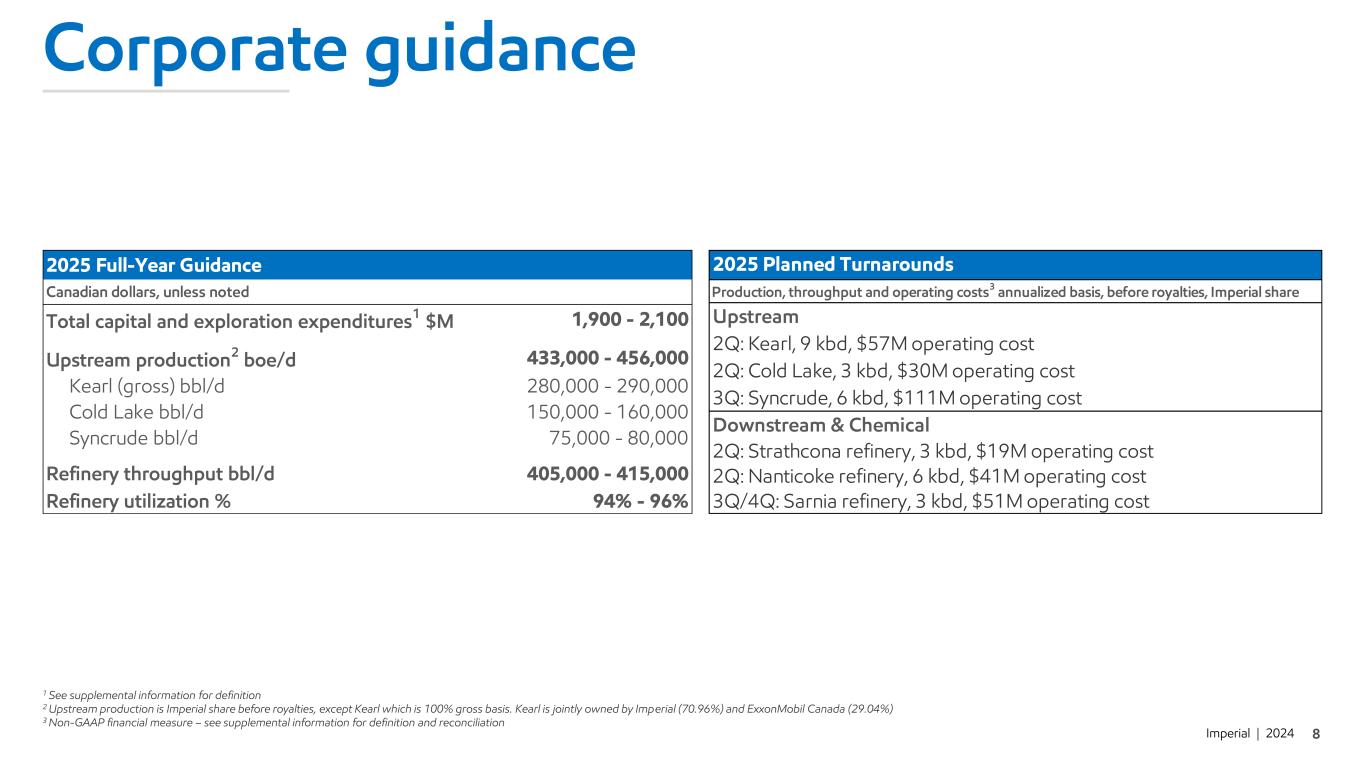

Imperial | 2024 Corporate guidance 1 See supplemental information for definition 2 Upstream production is Imperial share before royalties, except Kearl which is 100% gross basis. Kearl is jointly owned by Imperial (70.96%) and ExxonMobil Canada (29.04%) 3 Non-GAAP financial measure – see supplemental information for definition and reconciliation Total capital and exploration expenditures 1 $M 1,900 - 2,100 Upstream production2 boe/d 433,000 - 456,000 Kearl (gross) bbl/d 280,000 - 290,000 Cold Lake bbl/d 150,000 - 160,000 Syncrude bbl/d 75,000 - 80,000 Refinery throughput bbl/d 405,000 - 415,000 Refinery utilization % 94% - 96% 2025 Full-Year Guidance Canadian dollars, unless noted Upstream 2Q: Cold Lake, 3 kbd, $30M operating cost 3Q: Syncrude, 6 kbd, $111M operating cost Downstream & Chemical 2Q: Strathcona refinery, 3 kbd, $19M operating cost 2Q: Nanticoke refinery, 6 kbd, $41M operating cost 3Q/4Q: Sarnia refinery, 3 kbd, $51M operating cost 2025 Planned Turnarounds Production, throughput and operating costs3 annualized basis, before royalties, Imperial share 2Q: Kearl, 9 kbd, $57M operating cost

Imperial | 2024 Cautionary statement Statements of future events or conditions in this presentation, including projections, targets, goals, expectations, estimates, and business plans are forward-looking statements. Forward-looking statements can be identified by words such as believe, anticipate, intend, propose, plan, goal, seek, project, predict, target, estimate, expect, strategy, outlook, forecast, schedule, future, continue, likely, may, should, will and similar references to future periods. Forward-looking statements in this presentation include, but are not limited to, references to Imperial’s 2025 corporate guidance outlook, plan, and goals; tota l Upstream and asset production guidance for 2025; Downstream throughput and utilization guidance; the cost, scope and impact of 2025 planned turnarounds; unit cash cost targets and anticipated reductions at Kearl and Cold Lake; capital and exploration expenditures, and spending on sustaining capital and growth capital, for 2025 and subsequent periods; plans for capital spending in 2025; the company’s free cash flow profile and break-even outlook; future dividends and share repurchases by the company; timing, expected capacity and impact of the company’s Strathcona renewable diesel project and the Leming redevelopment project; and future production from Cold Lake. Forward-looking statements are based on the company's current expectations, estimates, projections and assumptions at the time the statements are made. Actual future financial and operating results, including expectations and assumptions concerning future energy demand, supply and mix; commodity prices, foreign exchange rates and general market conditions; production rates, growth and mix across various assets; project plans, timing, costs, technical evaluations and capacities and the company’s ability to effectively execute on these plans and operate its assets, including the Cold Lake Grand Rapids and Leming redevelopment projects, the Strathcona renewable diesel project, and any changes in the scope, terms, or costs of such projects; the adoption and impact of new facilities or technologies on reductions to greenhouse gas emissions intensity, including but not limited to technologies using solvents to replace energy intensive steam at Cold Lake, Strathcona renewable diesel, carbon capture and storage including in connection with hydrogen for the renewable diesel project, recovery technologies and efficiency projects, and any changes in the scope, terms, or costs of such projects; the results of research programs and new technologies, including with respect to greenhouse gas emissions, and the ability to bring new technologies to scale on a commercially competitive basis, and the competitiveness of alternative energy and other emission reduction technologies; receipt of regulatory approvals in a timely manner, especially with respect to large scale emissions reduction projects; the amount and timing of emissions reductions, including the impact of lower carbon fuels; that any required support from policymakers and other stakeholders for various new technologies such as carbon capture and storage will be provided; for renewable diesel, the availability and cost of locally-sourced and grown feedstock and the supply of renewable diesel to British Columbia in connection with its low-carbon fuel legislation; applicable laws and government policies, including with respect to climate change, greenhouse gas emissions reductions and low carbon fuels; maintenance and turnaround activity and cost; cash generation, financing sources and capital structure, such as dividends and shareholder returns, including the timing and amounts of share repurchases; capital and environmental expenditures; refinery utilization; and performance of third-party service providers, could differ materially depending on a number of factors. These factors include global, regional or local changes in supply and demand for oil, natural gas, and petroleum and petrochemical products and resulting price, differential and margin impacts, including foreign government action with respect to supply levels and prices, and the occurrence of wars; environmental regulation, including climate change and greenhouse gas regulation and changes to such regulation; project management and schedules and timely completion of projects; availability and performance of third-party service providers; unanticipated technical or operational difficulties; operational hazards and risks; third-party opposition to company and service provider operations, projects and infrastructure; the results of research programs and new technologies, and ability to bring new technologies to commercial scale on a cost-competitive basis; failure, delay or uncertainty regarding supportive policy and market development for the adoption of emerging lower emission energy technologies and other technologies that support emissions reductions; environmental risks inherent in oil and gas exploration and production activities; the receipt, in a timely manner, of regulatory and third-party approvals; transportation for accessing markets; political or regulatory events, including changes in law or government policy, applicable royalty rates, tariffs, and tax laws; management effectiveness and disaster response preparedness; cybersecurity incidents; availability and allocation of capital; currency exchange rates; general economic conditions, including inflation and the occurrence and duration of economic recessions or downturns; and other factors discussed in Item 1A risk factors and Item 7 management’s discussion and analysis of Imperial Oil Limited’s most recent annual report on Form 10-K. Forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to Imperial. Imperial’s actual results may differ materially from those expressed or implied by its forward-looking statements and readers are cautioned not to place undue reliance on them. Imperial undertakes no obligation to update any forward-looking statements contained herein, except as required by applicable law. Forward-looking and other statements regarding Imperial's environmental, social and other sustainability efforts and aspirations are not an indication that these statements are material to investors or require disclosure in the company's filings with securities regulators. In addition, historical, current and forward-looking environmental, social and sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future, including future rule-making. Individual projects or opportunities may advance based on a number of factors, including availability of supportive policy, technology for cost- effective abatement, company planning process, and alignment with our partners and other stakeholders. In this presentation all dollar amounts are expressed in Canadian dollars unless otherwise stated. This presentation should be read in conjunction with Imperial’s most recent Form 10-K. The term “project” as used in this presentation can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports.

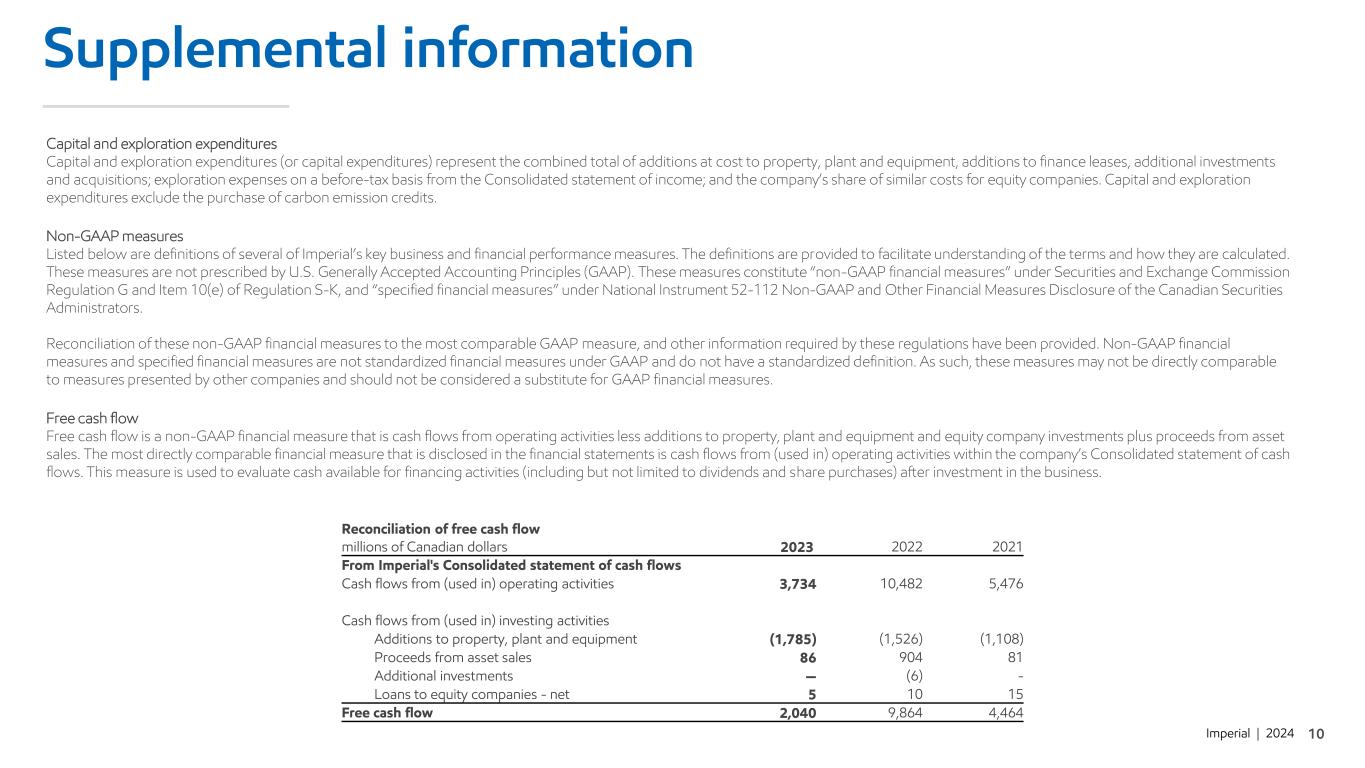

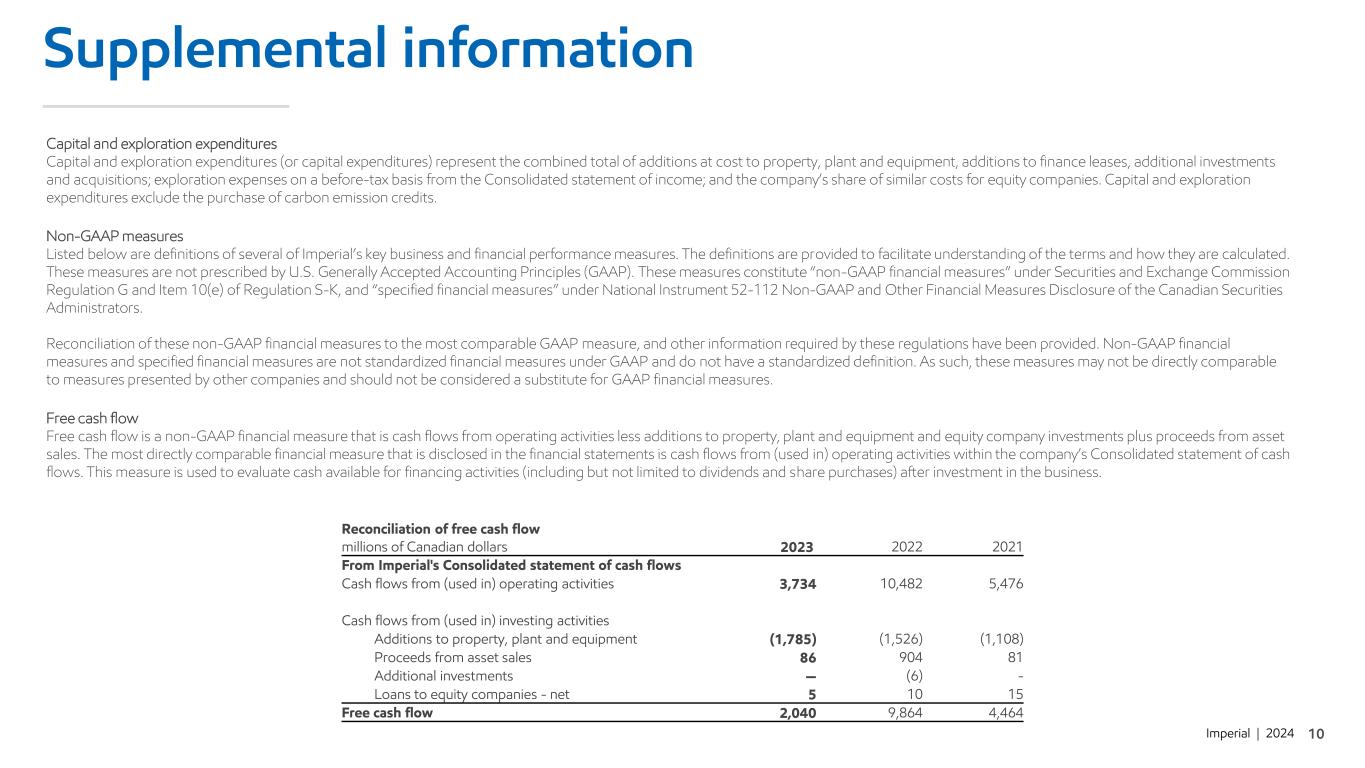

Imperial | 2024 Supplemental information Capital and exploration expenditures Capital and exploration expenditures (or capital expenditures) represent the combined total of additions at cost to property, plant and equipment, additions to finance leases, additional investments and acquisitions; exploration expenses on a before-tax basis from the Consolidated statement of income; and the company’s share of similar costs for equity companies. Capital and exploration expenditures exclude the purchase of carbon emission credits. Non-GAAP measures Listed below are definitions of several of Imperial’s key business and financial performance measures. The definitions are provided to facilitate understanding of the terms and how they are calculated. These measures are not prescribed by U.S. Generally Accepted Accounting Principles (GAAP). These measures constitute “non-GAAP financial measures” under Securities and Exchange Commission Regulation G and Item 10(e) of Regulation S-K, and “specified financial measures” under National Instrument 52-112 Non-GAAP and Other Financial Measures Disclosure of the Canadian Securities Administrators. Reconciliation of these non-GAAP financial measures to the most comparable GAAP measure, and other information required by these regulations have been provided. Non-GAAP financial measures and specified financial measures are not standardized financial measures under GAAP and do not have a standardized definition. As such, these measures may not be directly comparable to measures presented by other companies and should not be considered a substitute for GAAP financial measures. Free cash flow Free cash flow is a non-GAAP financial measure that is cash flows from operating activities less additions to property, plant and equipment and equity company investments plus proceeds from asset sales. The most directly comparable financial measure that is disclosed in the financial statements is cash flows from (used in) operating activities within the company’s Consolidated statement of cash flows. This measure is used to evaluate cash available for financing activities (including but not limited to dividends and share purchases) after investment in the business. Reconciliation of free cash flow millions of Canadian dollars 2023 2022 2021 From Imperial's Consolidated statement of cash flows Cash flows from (used in) operating activities 3,734 10,482 5,476 Cash flows from (used in) investing activities Additions to property, plant and equipment (1,785) (1,526) (1,108) Proceeds from asset sales 86 904 81 Additional investments — (6) - Loans to equity companies - net 5 10 15 Free cash flow 2,040 9,864 4,464

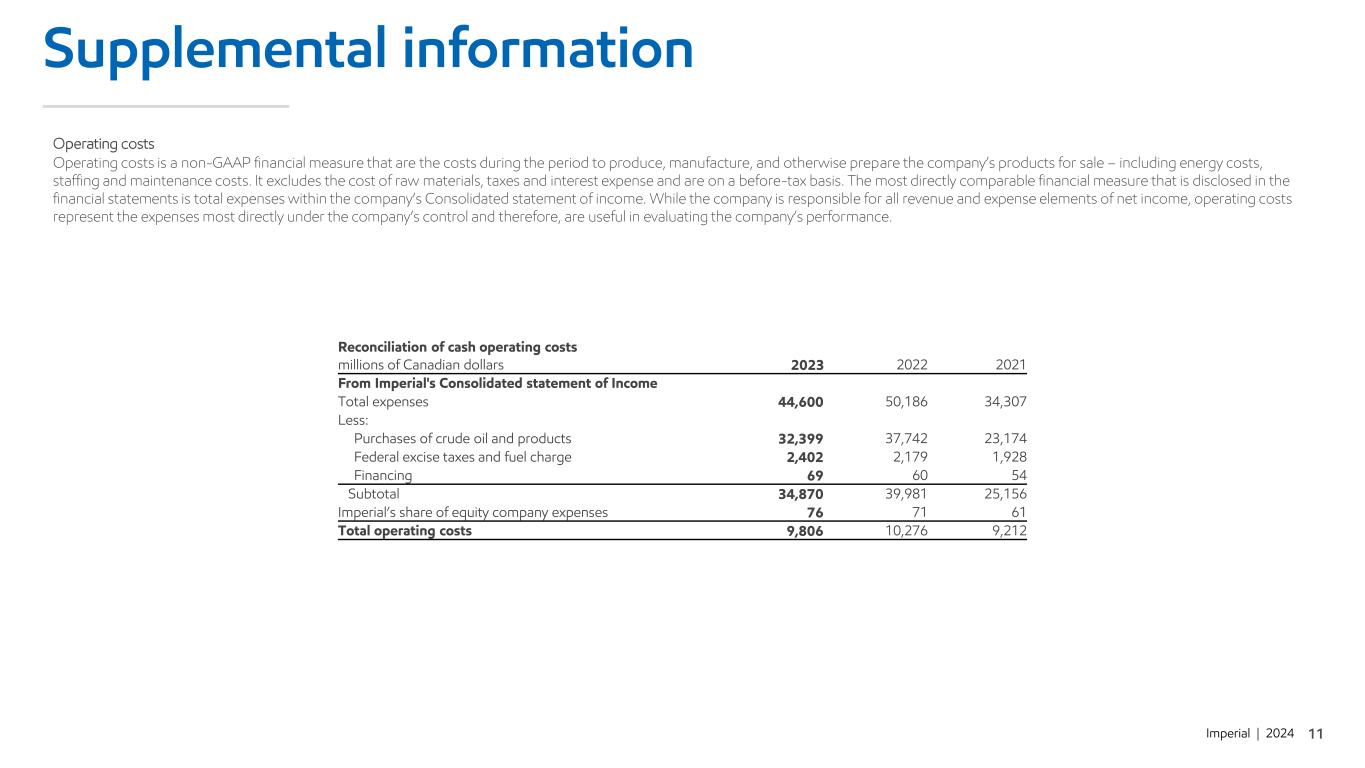

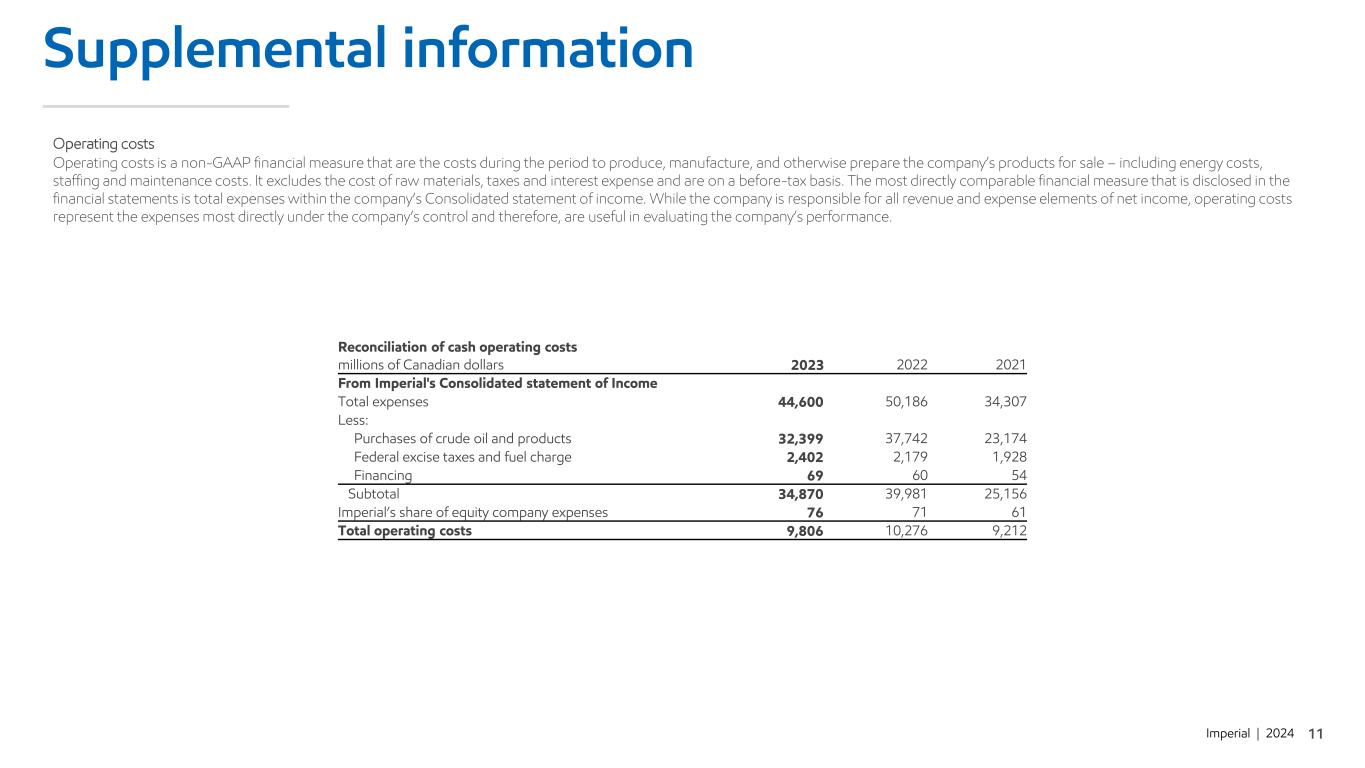

Imperial | 2024 Supplemental information Operating costs Operating costs is a non-GAAP financial measure that are the costs during the period to produce, manufacture, and otherwise prepare the company’s products for sale – including energy costs, staffing and maintenance costs. It excludes the cost of raw materials, taxes and interest expense and are on a before-tax basis. The most directly comparable financial measure that is disclosed in the financial statements is total expenses within the company’s Consolidated statement of income. While the company is responsible for all revenue and expense elements of net income, operating costs represent the expenses most directly under the company’s control and therefore, are useful in evaluating the company’s performance. Reconciliation of cash operating costs millions of Canadian dollars 2023 2022 2021 From Imperial's Consolidated statement of Income Total expenses 44,600 50,186 34,307 Less: Purchases of crude oil and products 32,399 37,742 23,174 Federal excise taxes and fuel charge 2,402 2,179 1,928 Financing 69 60 54 Subtotal 34,870 39,981 25,156 Imperial’s share of equity company expenses 76 71 61 Total operating costs 9,806 10,276 9,212

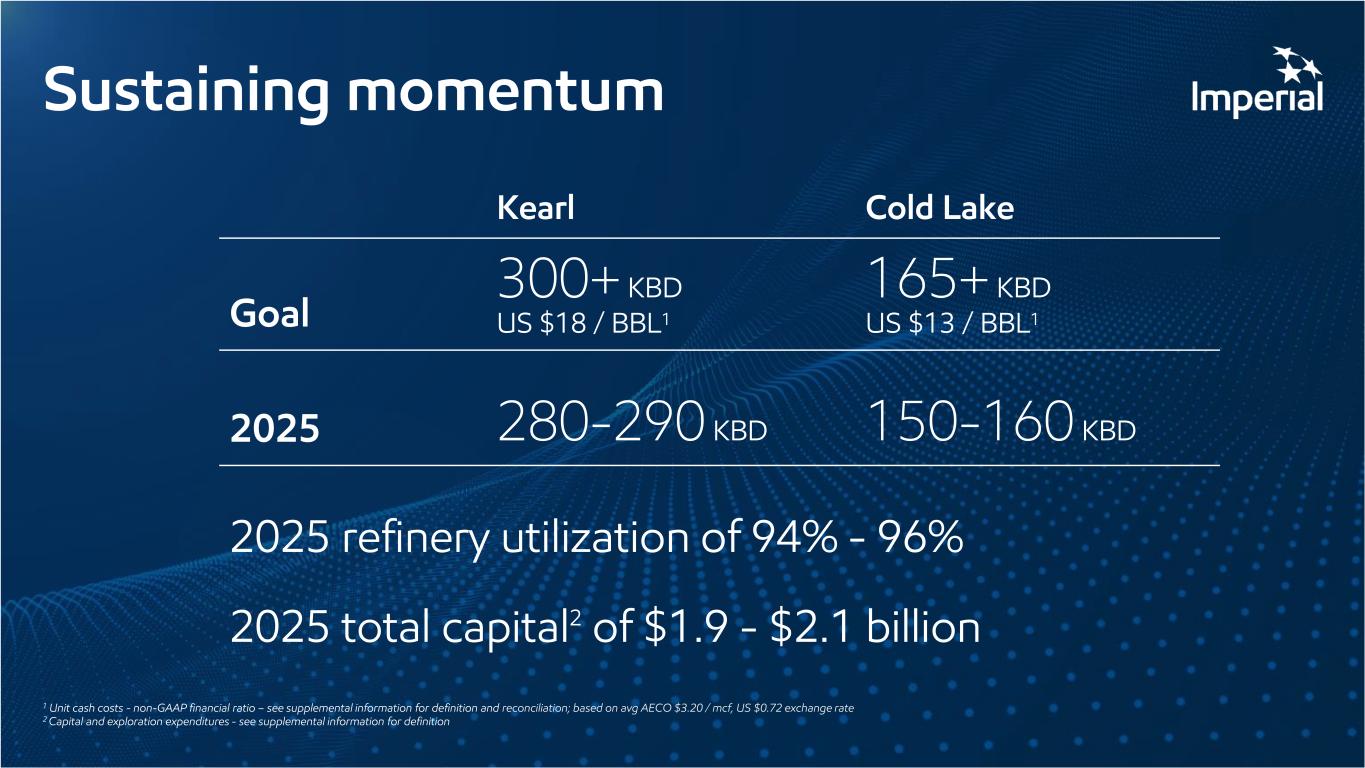

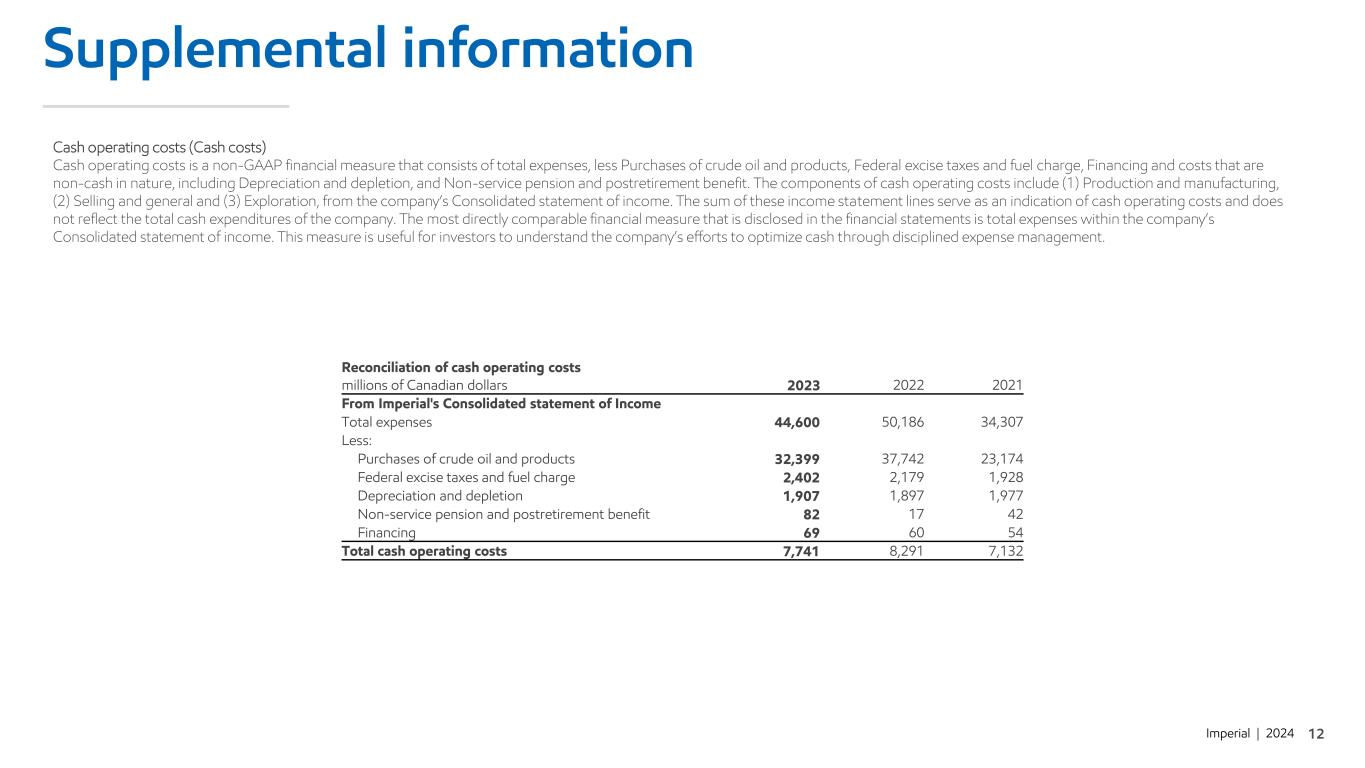

Imperial | 2024 Supplemental information Cash operating costs (Cash costs) Cash operating costs is a non-GAAP financial measure that consists of total expenses, less Purchases of crude oil and products, Federal excise taxes and fuel charge, Financing and costs that are non-cash in nature, including Depreciation and depletion, and Non-service pension and postretirement benefit. The components of cash operating costs include (1) Production and manufacturing, (2) Selling and general and (3) Exploration, from the company’s Consolidated statement of income. The sum of these income statement lines serve as an indication of cash operating costs and does not reflect the total cash expenditures of the company. The most directly comparable financial measure that is disclosed in the financial statements is total expenses within the company’s Consolidated statement of income. This measure is useful for investors to understand the company’s efforts to optimize cash through disciplined expense management. Reconciliation of cash operating costs millions of Canadian dollars 2023 2022 2021 From Imperial's Consolidated statement of Income Total expenses 44,600 50,186 34,307 Less: Purchases of crude oil and products 32,399 37,742 23,174 Federal excise taxes and fuel charge 2,402 2,179 1,928 Depreciation and depletion 1,907 1,897 1,977 Non-service pension and postretirement benefit 82 17 42 Financing 69 60 54 Total cash operating costs 7,741 8,291 7,132

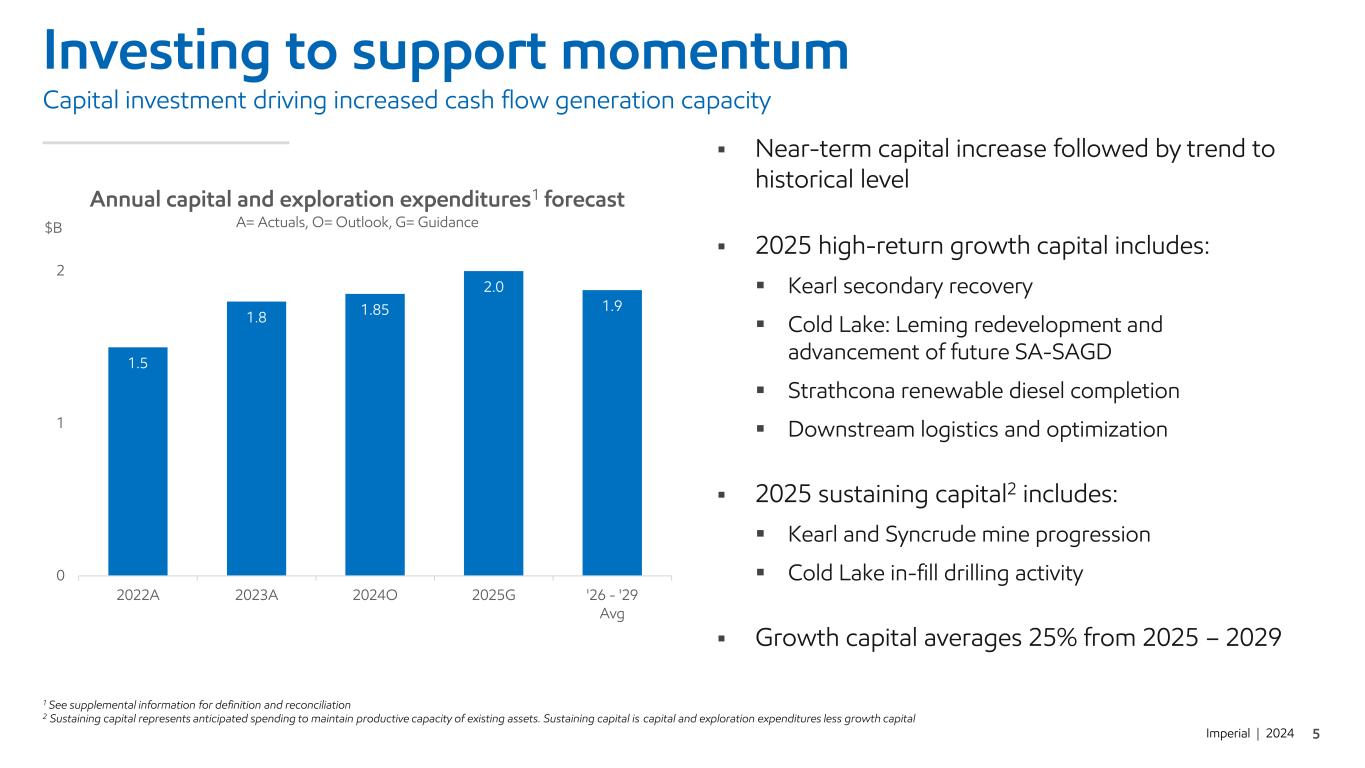

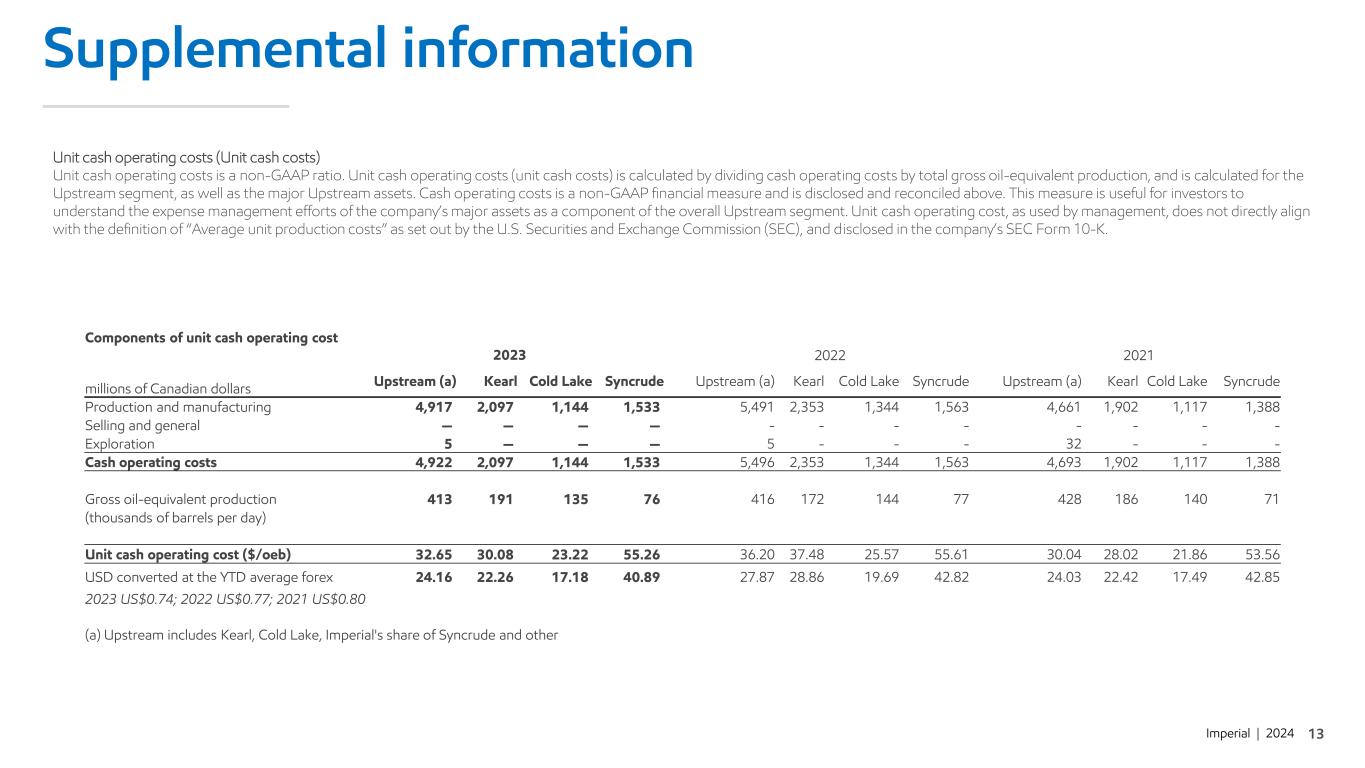

Imperial | 2024 Supplemental information Unit cash operating costs (Unit cash costs) Unit cash operating costs is a non-GAAP ratio. Unit cash operating costs (unit cash costs) is calculated by dividing cash operating costs by total gross oil-equivalent production, and is calculated for the Upstream segment, as well as the major Upstream assets. Cash operating costs is a non-GAAP financial measure and is disclosed and reconciled above. This measure is useful for investors to understand the expense management efforts of the company’s major assets as a component of the overall Upstream segment. Unit cash operating cost, as used by management, does not directly align with the definition of “Average unit production costs” as set out by the U.S. Securities and Exchange Commission (SEC), and disclosed in the company’s SEC Form 10-K. Components of unit cash operating cost 2023 2022 2021 millions of Canadian dollars Upstream (a) Kearl Cold Lake Syncrude Upstream (a) Kearl Cold Lake Syncrude Upstream (a) Kearl Cold Lake Syncrude Production and manufacturing 4,917 2,097 1,144 1,533 5,491 2,353 1,344 1,563 4,661 1,902 1,117 1,388 Selling and general — — — — - - - - - - - - Exploration 5 — — — 5 - - - 32 - - - Cash operating costs 4,922 2,097 1,144 1,533 5,496 2,353 1,344 1,563 4,693 1,902 1,117 1,388 Gross oil-equivalent production 413 191 135 76 416 172 144 77 428 186 140 71 (thousands of barrels per day) Unit cash operating cost ($/oeb) 32.65 30.08 23.22 55.26 36.20 37.48 25.57 55.61 30.04 28.02 21.86 53.56 USD converted at the YTD average forex 24.16 22.26 17.18 40.89 27.87 28.86 19.69 42.82 24.03 22.42 17.49 42.85 2023 US$0.74; 2022 US$0.77; 2021 US$0.80 (a) Upstream includes Kearl, Cold Lake, Imperial's share of Syncrude and other