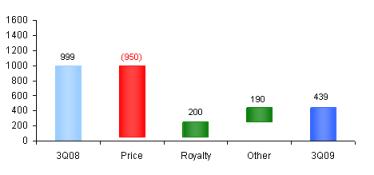

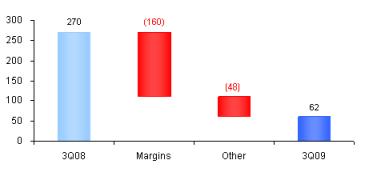

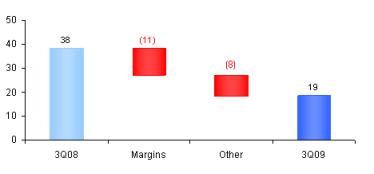

Third quarter 2009 vs. third quarter 2008 Upstream net income in the third quarter was $439 million versus $999 million in the same period of 2008. Earnings decreased primarily due to lower crude oil and natural gas commodity prices of about $950 million as a result of the global economic downturn. Lower realizations were partially offset by lower royalty costs due to lower commodity prices of about $200 million, the impact of a lower Canadian dollar of about $115 million and lower energy costs of about $95 million. The average price of Brent crude oil in U.S. dollars, a common benchmark for world oil markets, was $68.29 a barrel in the third quarter, down about 41 percent from the corresponding period last year. The company’s realizations on sales of Canadian conventional crude oil mirrored the same trend as world prices, decreasing about 43 percent in the third quarter, compared to the same period last year. The company’s average realizations for Cold Lake heavy oil also declined about 40 percent in the third quarter of 2009, compared to the corresponding period last year. The decline was less than that of lighter crude oil, due to the narrowing price spread between light crude oil and Cold Lake heavy oil. The company’s average realizations for natural gas averaged $2.90 a thousand cubic feet in the third quarter, down from $9.20 in the same quarter last year. Gross production of Cold Lake heavy oil averaged 145 thousand barrels a day during the third quarter, versus 143 thousand barrels in the same quarter last year. The cyclic nature of production at Cold Lake and lower maintenance activities contributed primarily to the increase in production in the third quarter of 2009. The company’s share of Syncrude’s gross production in the third quarter was 78 thousand barrels a day, versus 79 thousand barrels in the third quarter of 2008. Gross production of conventional crude oil averaged 25 thousand barrels a day in the third quarter, essentially the same as the corresponding period of 2008. Gross production of natural gas during the third quarter of 2009 decreased to 291 million cubic feet a day from 309 million cubic feet in the same period last year. The lower production volume was primarily a result of natural reservoir decline. Net income from Downstream was $62 million in the third quarter of 2009, compared with $270 million in the same period a year ago. When compared to the same period in 2008, earnings in the third quarter of 2009 were negatively impacted by reduced demand for products, resulting in lower overall downstream margins of about $160 million. North American refining margins in the third quarter of 2008 were significantly higher as a result of Hurricane Gustav in the Gulf of Mexico. Also impacting third quarter 2009 earnings were lower sales volumes due to the slowdown in the economy. Chemical net income was $19 million in the third quarter, compared with $38 million in the same quarter last year. Earnings were lower in the quarter primarily due to lower margins for polyethylene products. Net income effects from Corporate and other were $27 million in the third quarter, compared with $82 million in the same period of 2008. The decrease in earnings effects in the third quarter reflected changes in share-based compensation charges. Cash flow from operations was used to fund growth projects such as Kearl. The company will continue to evaluate its share-purchase program in the context of its overall capital activities. In the third quarter of 2009, the company built $68 million of cash while funding its higher capital program requirements from operating cash flow. |