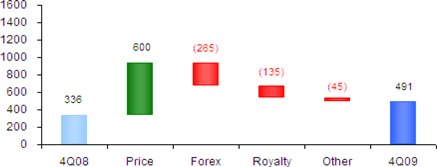

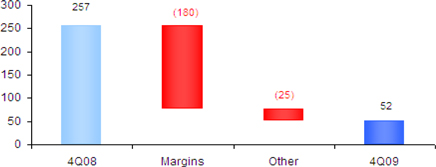

Fourth quarter 2009 vs. fourth quarter 2008 Net income for the fourth quarter of 2009 was $534 million or $0.62 a share on a diluted basis, versus $660 million or $0.76 a share for the same period of 2008. Upstream net income in the fourth quarter was $491 million, $155 million higher than the same period of 2008. Increased earnings were primarily due to higher crude oil commodity prices totaling about $600 million. Improved realizations were partially offset by the negative impacts of a stronger Canadian dollar of about $265 million, higher royalties due to higher commodity prices of about $135 million and lower Cold Lake bitumen production of about $50 million. The average price of Brent crude oil in U.S. dollars, a common benchmark for world oil markets, strengthened in the fourth quarter, averaging $74.54 a barrel, up about 36 percent from the corresponding period last year. The company’s realizations on sales of Canadian conventional crude oil and synthetic crude oil from Syncrude production mirrored the same trend as world prices. However, the effect of a stronger Canadian dollar limited improvements in the company’s Canadian-dollar realizations for conventional crude oil and synthetic crude oil from Syncrude in the fourth quarter of 2009. Prices for Canadian heavier crude oil also increased along with the lighter crude oil. The company’s average realizations for Cold Lake bitumen increased about 70 percent in the fourth quarter, compared to the corresponding period last year, reflecting the narrowing price spread between light crude oil and Cold Lake bitumen. The company’s average realizations for natural gas averaged $4.23 a thousand cubic feet in the fourth quarter, down from $7.31 in the same quarter last year. Gross production of Cold Lake bitumen averaged 134 thousand barrels a day during the fourth quarter, versus 146 thousand barrels in the same quarter last year. Lower production volumes in the fourth quarter were due to well repairs in the northern part of the field. Drilling and steaming activities have since resumed in this area, and production is expected to return to normal levels. The company’s share of Syncrude’s gross production in the fourth quarter was 82 thousand barrels a day, versus 77 thousand barrels in the fourth quarter of 2008. Volumes in the fourth quarter were higher than the same period in 2008 due to lower maintenance activities. In the fourth quarter, gross production of conventional crude oil averaged 24 thousand barrels a day, compared with 27 thousand barrels in the corresponding period in 2008. The natural reservoir decline in the Western Canadian Basin was the main reason for the reduced production. Gross production of natural gas during the fourth quarter of 2009 was 298 million cubic feet a day, essentially the same as the corresponding period last year. Net income from Downstream was $52 million in the fourth quarter of 2009, compared with $257 million in the same period a year ago. Earnings in the fourth quarter of 2009 were negatively impacted by lower overall margins of about $180 million. Also impacting fourth quarter 2009 earnings was the negative impact of a stronger Canadian dollar. Net income from Chemical was $16 million in the fourth quarter, compared with $28 million in the same quarter last year. Earnings in the fourth quarter were negatively impacted by lower overall margins as a result of the slow economy. Net income effects from Corporate and other were negative $25 million in the fourth quarter, compared with $39 million in the same period of 2008. The decrease in the fourth quarter was primarily due to changes in share-based compensation charges. In the fourth quarter of 2009, cash flow of $927 million was generated from operations, and $807 million was used to fund growth projects such as Kearl. The company’s balance of cash was $513 million at December 31, 2009, an increase of $55 million from the end of the third quarter 2009. |