Imperial Oil – Sustained Energy Leadership

Welcome Toronto

May 26, 2011

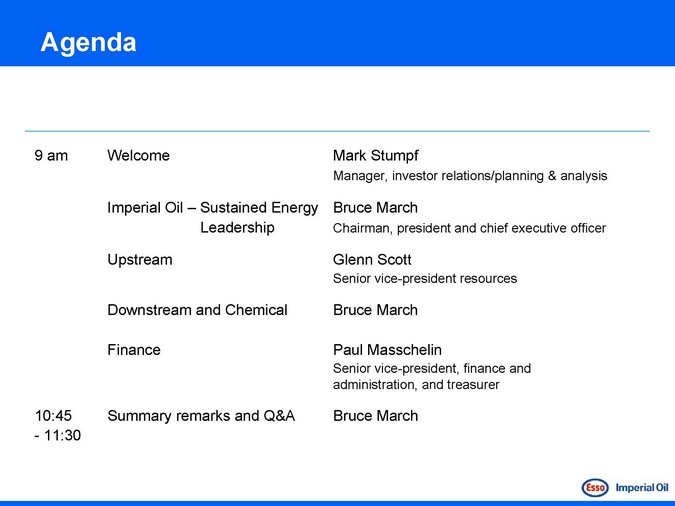

Agenda

9 am

10:45

- 11:30

Welcome

Imperial Oil – Sustained Energy Leadership

Upstream

Downstream and Chemical

Finance

Summary remarks and Q&A

Mark Stumpf

Manager, investor relations/planning & analysis

Bruce March

Chairman, president and chief executive officer

Glenn Scott

Senior vice-president resources

Bruce March

Paul Masschelin

Senior vice-president, finance and administration, and treasurer

Bruce March

Cautionary Statement

This presentation contains forward -looking information on future production, project start-ups and future capital spending. Actual results could differ materially due to changes in project schedules, operating performance, demand for oil and gas, commercial negotiations or other technical and economic factors.

Oil-equivalent barrels (OEB) may be misleading, particularly if used in isolation. An OEB conversion ratio of 6,000 cubic feet to one barrel is based on an energy -equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the well head.

Proved reserves are calculated under United States Securities and Exchange Commission (SEC) requirements, as shown in Form 10-K dated December 31, 2010.

Pursuant to National Instrument 51-101 disclosure guidelines, and using Canadian Oil and Gas Evaluation Handbook definitions, Imperial’s non-proved resources are classified as a “contingent resource. “ Such resources are a best estimate of the company’s net interest after royalties at year-end 2010, as determined by Imperial’s internal qualified reserves evaluator. Contingent resources are considered to be potentially recoverable from known accumulations, using established technology or technology under development, but are currently not considered to be commercially recoverable due to one or more contingencies. There is no certainty that it will be economically viable or technically feasible to produce any portion of the resource.

Financials in Canadian dollars.

Imperial Oil – 2011 Investor Meeting

Our Business

2010 results

Industry leading safety

Double digit returns in each business segment

Long history of excellent safety performance Sound environmental results Strong bottom -line

Earnings: $2.2 billion

Return on capital employed: 21% Cash flow from operations: $3.4 billion Investing through the cycle on high quality growth projects : $4.0 billion

Large resource base:

Reserves 2.5 billion oil-equivalent barrels*

Non-proved resource 13 billion oil-equivalent barrels*

* | | Imperial Oil interest after royalties |

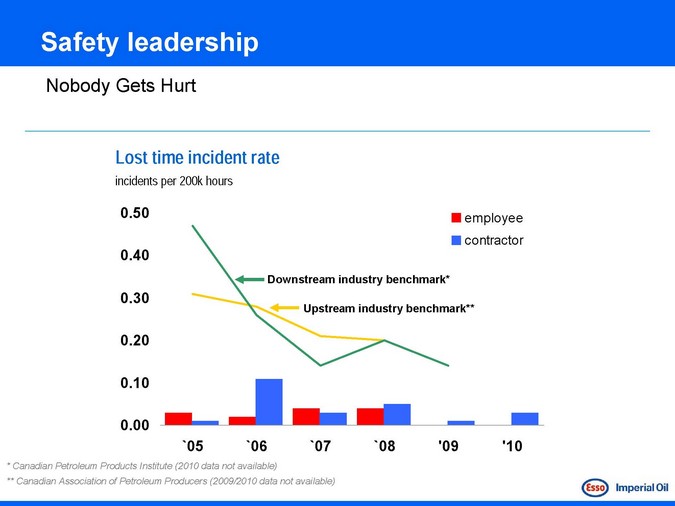

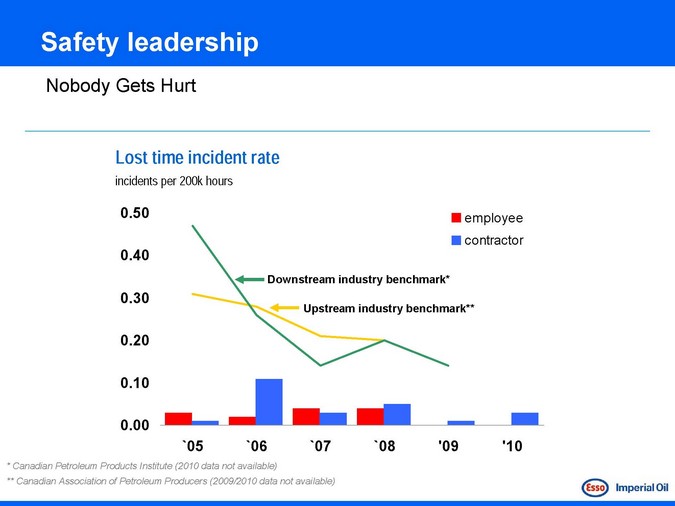

Safety leadership

Nobody Gets Hurt

Lost time incident rate

incidents per 200k hours

employee contractor

0.50 0.40 0.30 0.20 0.10 0.00

Downstream industry benchmark*

Upstream industry benchmark**

`05 `06 `07 `08 ‘09 ‘10

* | | Canadian Petroleum Products Institute (2010 data not available) |

** Canadian Association of Petroleum Producers (2009/2010 data not available)

Environmental business planning

Protect Tomorrow. Today.

Rigorous environmental planning and stewardship

Actions

Conserve:

Energy efficiency

Reduce:

Fresh water use Spills and releases Flaring & emissions Land-use footprint

Reclaim & reuse:

Return to productive use

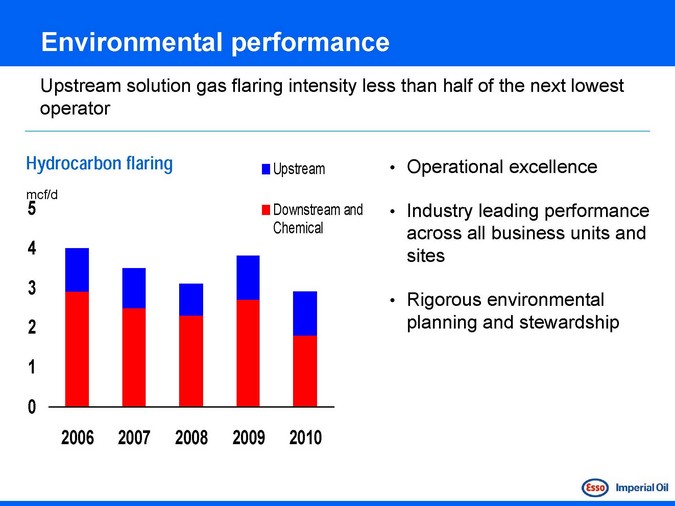

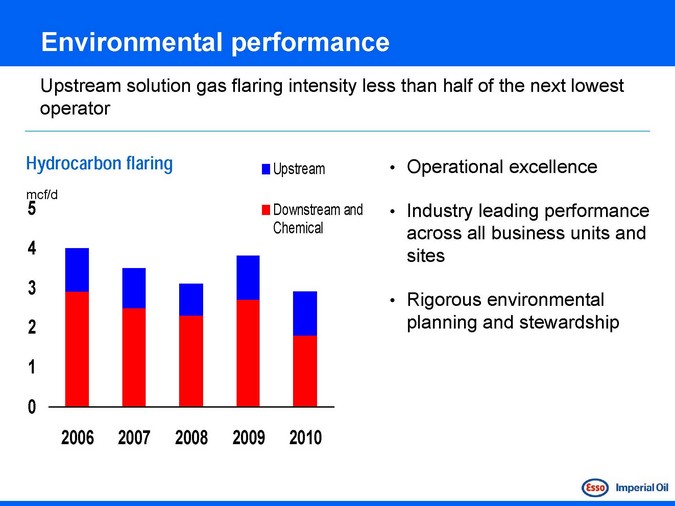

Environmental performance

Upstream solution gas flaring intensity less than half of the next lowest operator

Hydrocarbon flaring

mcf/d

2006 2007 2008 2009 2010

Upstream

Downstream and Chemical

Operational excellence

Industry leading performance across all business units and sites

Rigorous environmental planning and stewardship

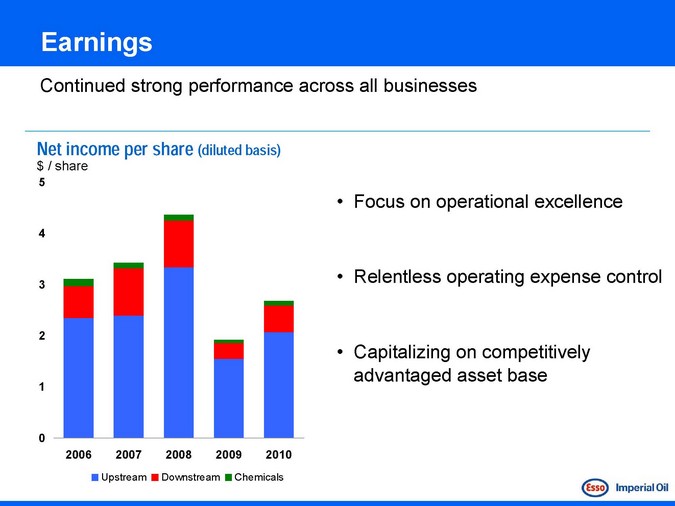

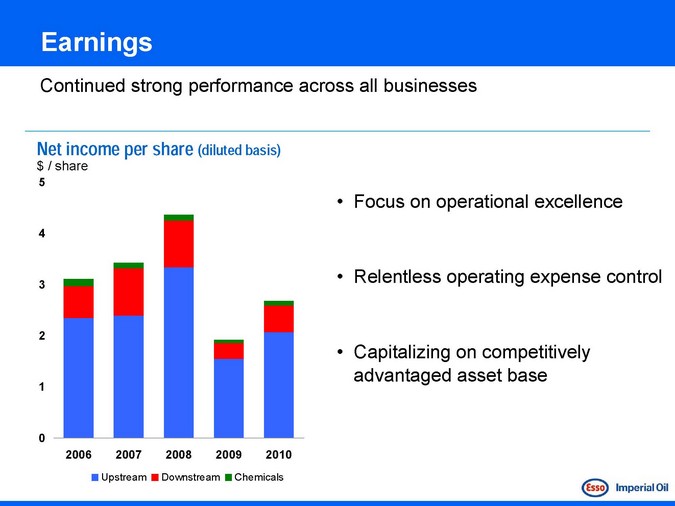

Earnings

Continued strong performance across all businesses

Net income per share (diluted basis)

$ / share

2006 2007 2008 2009 2010

Focus on operational excellence

Relentless operating expense control

Capitalizing on competitively advantaged asset base

Upstream

Downstream

Chemicals

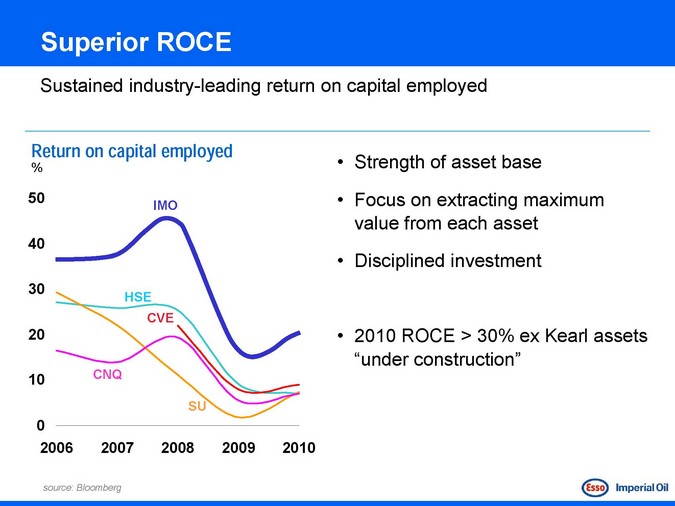

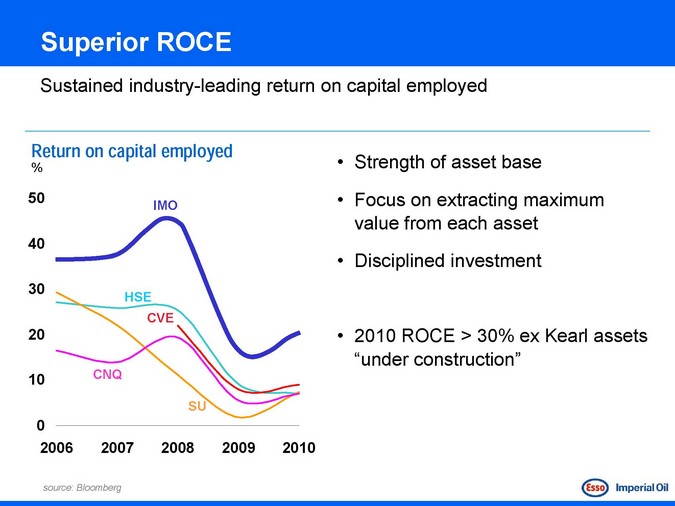

Superior ROCE

Sustained industry -leading return on capital employed

Return on capital employed

%

50 40 30 20 10 0

2006 2007 2008 2009 2010

source: Bloomberg

IMO

HSE CVE

CNQ

SU

Strength of asset base Focus on extracting maximum value from each asset Disciplined investment

2010 ROCE > 30% ex Kearl assets “under construction”

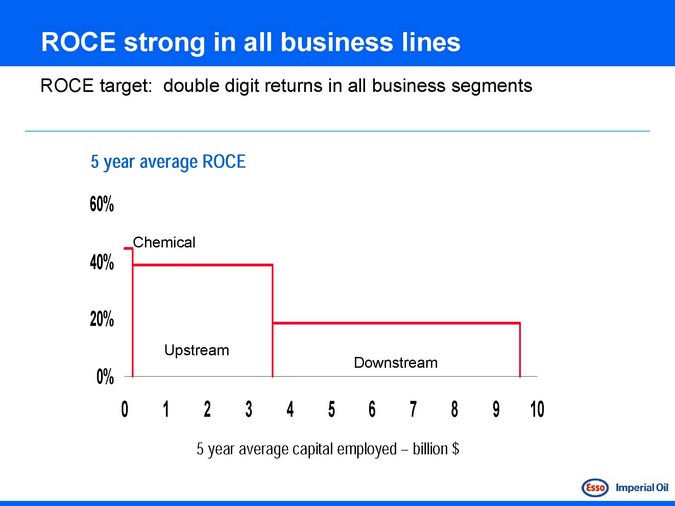

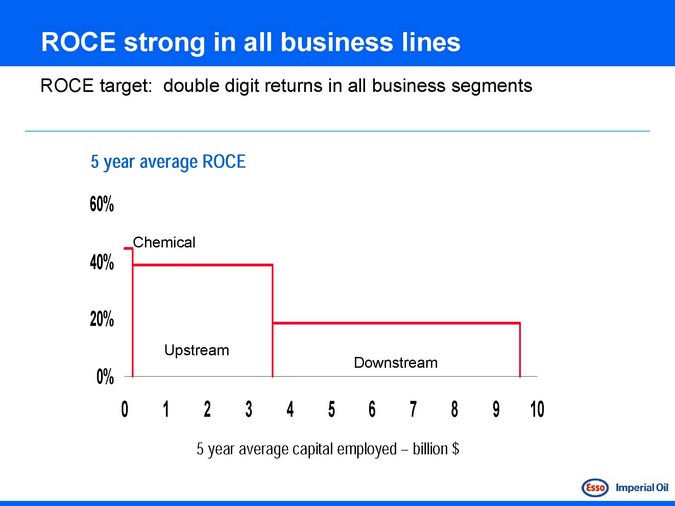

ROCE strong in all business lines

ROCE target: double digit returns in all business segments

60%

40%

20%

0%

Chemical

Upstream

Downstream

0 1 2 3 4 5 6 7 8 9 10

5 | | year average capital employed – billion $ |

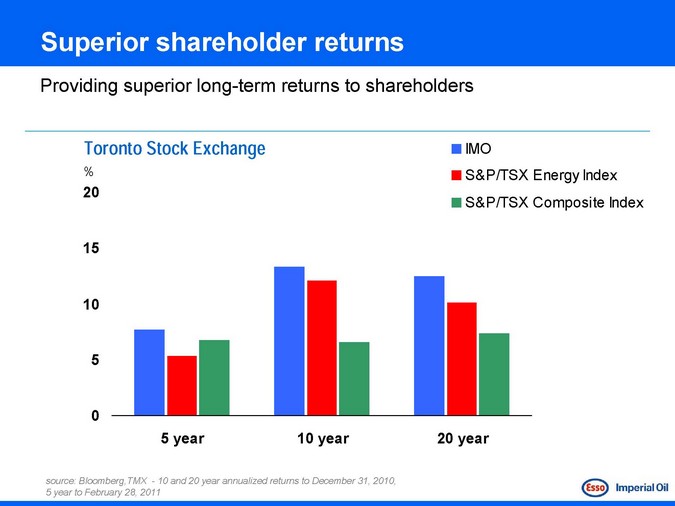

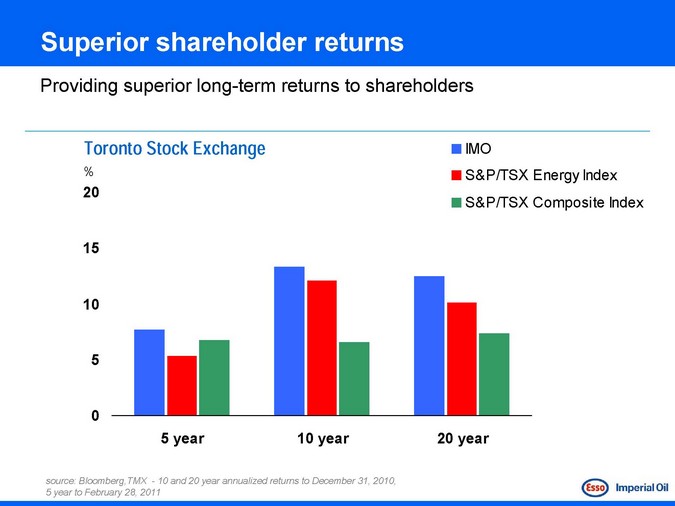

Superior shareholder returns

Providing superior long-term returns to shareholders

Toronto Stock Exchange

%

20 15 10 5 0

source: Bloomberg,TMX—10 and 20 year annualized returns to December 31, 2010, 5 year to February 28, 2011

IMO

S&P/TSX Energy Index S&P/TSX Composite Index

Imperial Oil – energy for 130 years

Leading the development of energy in Canada

69.6% owned by ExxonMobil

Competitive advantages

Discipline and consistency Portfolio quality Organizational capability Superior technology Balance sheet strength

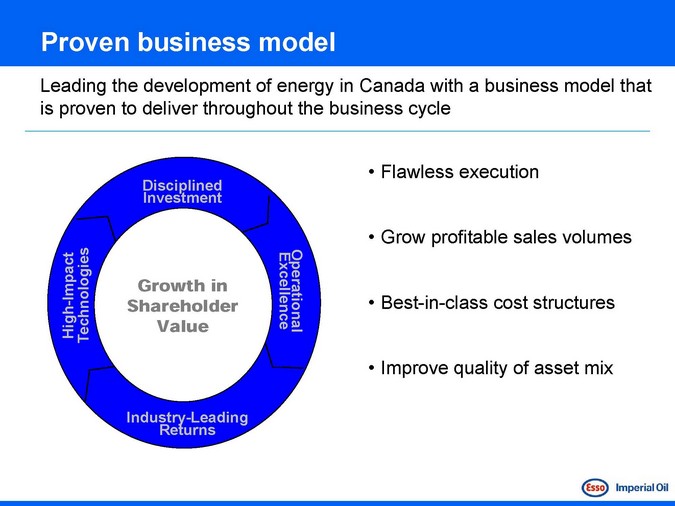

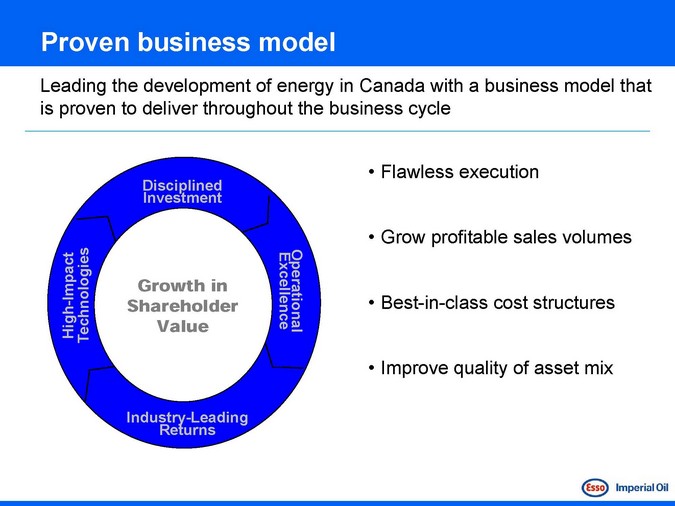

Proven business model

Leading the development of energy in Canada with a business model that is proven to deliver throughout the business cycle

Disciplined Investment

ExcellenceOperational

Industry -Leading Returns

- Impact HighTechnologies

Growth in Shareholder Value

Flawless execution

Grow profitable sales volumes Best-in-class cost structures Improve quality of asset mix

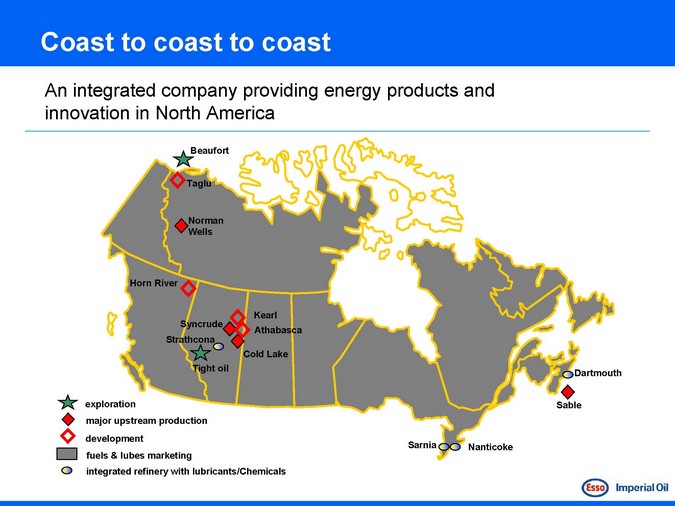

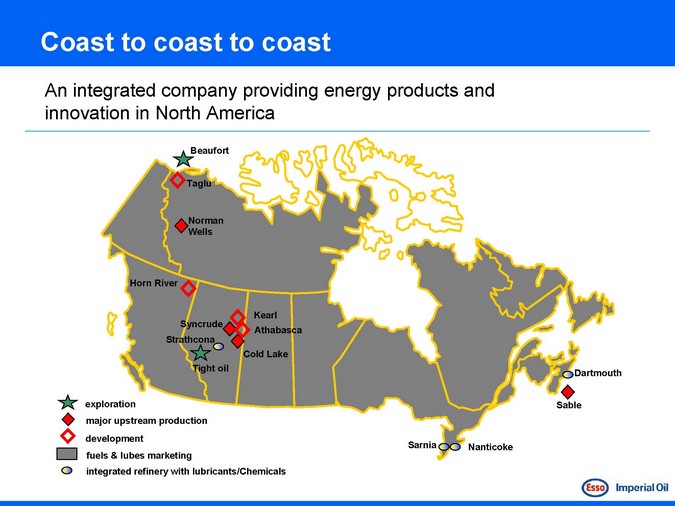

Coast to coast to coast

An integrated company providing energy products and innovation in North America

Beaufort

Taglu

Norman Wells

Horn River

Kearl Athabasca

Syncrude Strathcona

Tight oil

Cold Lake

Dartmouth

Sable

Sarnia

Nanticoke

exploration major upstream production development fuels & lubes marketing integrated refinery with lubricants/Chemicals

Leveraging the ExxonMobil relationship

Only publicly traded company in Canada with this level and depth of global support

Strategic alignment

Management systems honed worldwide

Superior project management Best practices transfer Training and development World scale operations

Leveraging the ExxonMobil relationship

Access to $1 billion per year in research and development

Shared leading edge technology Fundamental research Scale-up to commercial Across all business segments

Business fundamentals

Imperial Oil is positioned to prosper

Growing world population; strong GDP growth in developed and developing nations Long-term demand forecasts for oil, gas and petrochemicals remain robust Energy demand up with economic activity, strongly mitigated by efficiency

Continued strong growth for oil and gas from developing countries Demand for petroleum products in OECD countries flat

Increasing regulation and oversight; climate change policies uncertain

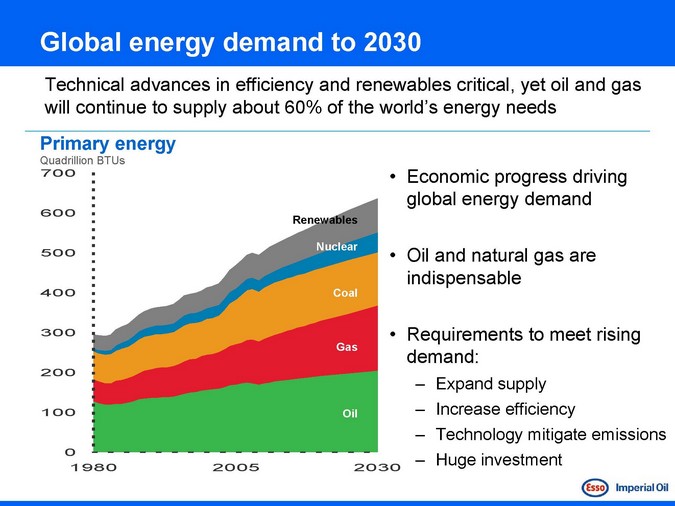

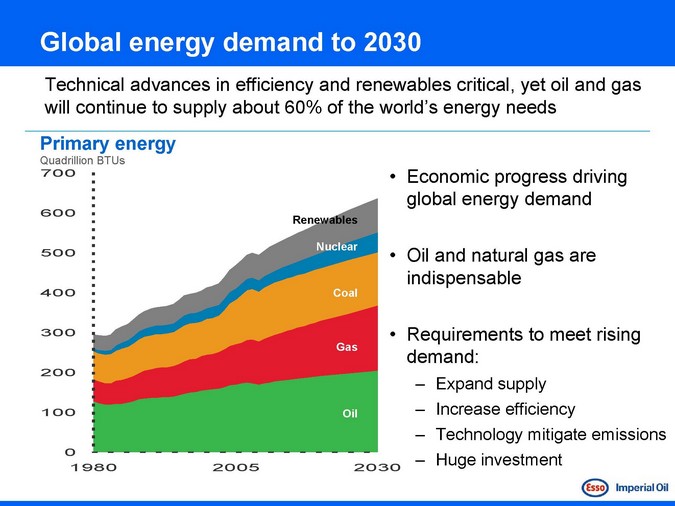

Global energy demand to 2030

Technical advances in efficiency and renewables critical, yet oil and gas will continue to supply about 60% of the world’s energy needs

Primary energy

Quadrillion BTUs

700 600 500 400 300 200 100 0

1980 2005 2030

Renewables

Nuclear

Coal Gas Oil

Economic90 progress driving global energy demand

Oil and natural gas are

60

indispensable

Requirements to meet rising demand:30

Expand supply Increase efficiency Technology mitigate emissions Huge0 investment

1980 2005

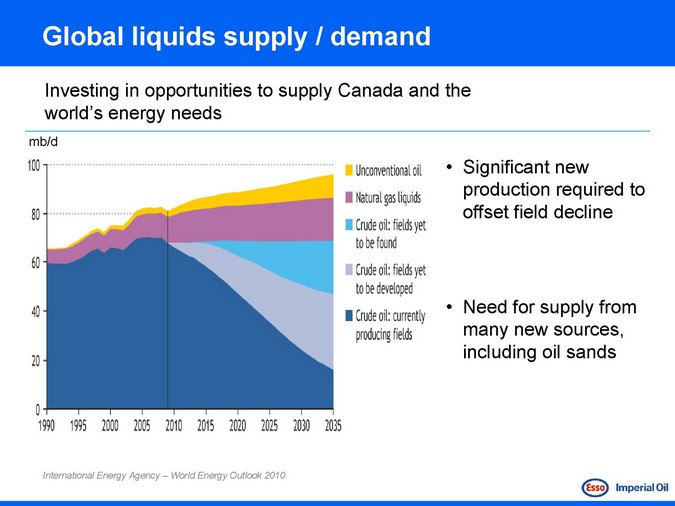

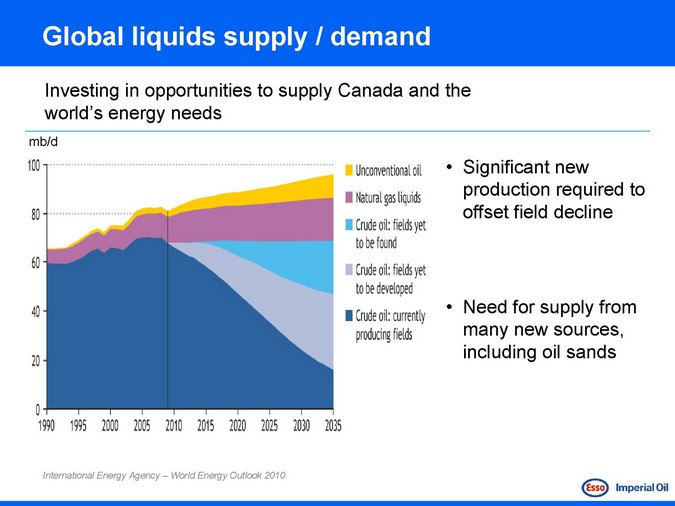

Global liquids supply / demand

Investing in opportunities to supply Canada and the world’s energy needs

mb/d

Significant new production required to offset field decline

Need for supply from many new sources, including oil sands

International Energy Agency – World Energy Outlook 2010

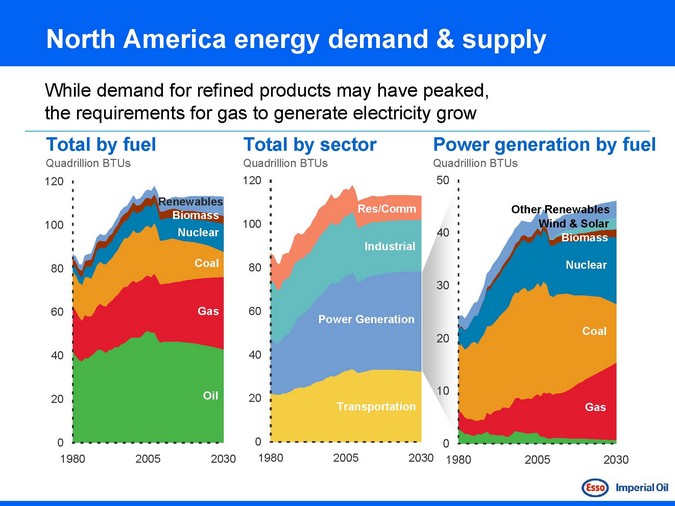

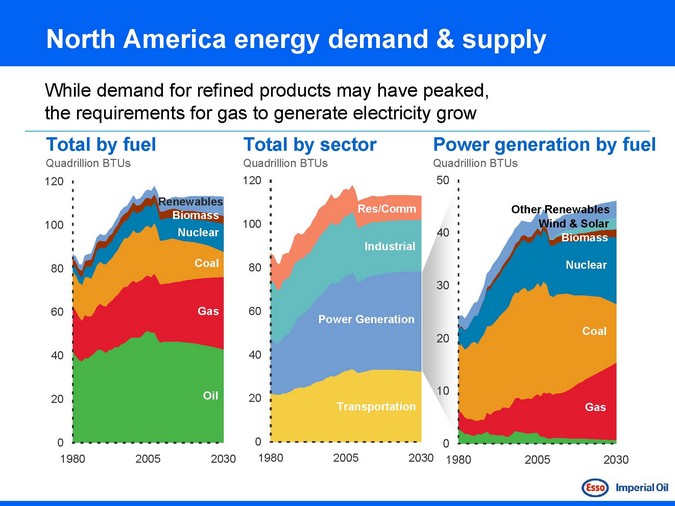

North America energy demand & supply

While demand for refined products may have peaked, the requirements for gas to generate electricity grow

Total by fuel

Quadrillion BTUs

120 100 80 60 40 20 0

1980 2005 2030

Renewables Biomass Nuclear

Coal Gas Oil

Total by sector

Quadrillion BTUs

120 100 80 60 40 20 0

1980 2005 2030

Res/Comm

Industrial

Power Generation

Transportation

Power generation by fuel

Quadrillion BTUs

50 40 30 20 10 0

Other Renewables

Wind & Solar Biomass

Nuclear Coal Gas

1980 2005 2030

Gas as a transition fuel

With a low carbon intensity, natural gas is an ideal fuel to replace coal in electricity generation

Gas is abundant, clean and affordable

Gas is excellent opportunity as we transition from mor e GHG intensive power generation to renewable forms later in the century

e GHG intensive power generation to renewable forms later in the century

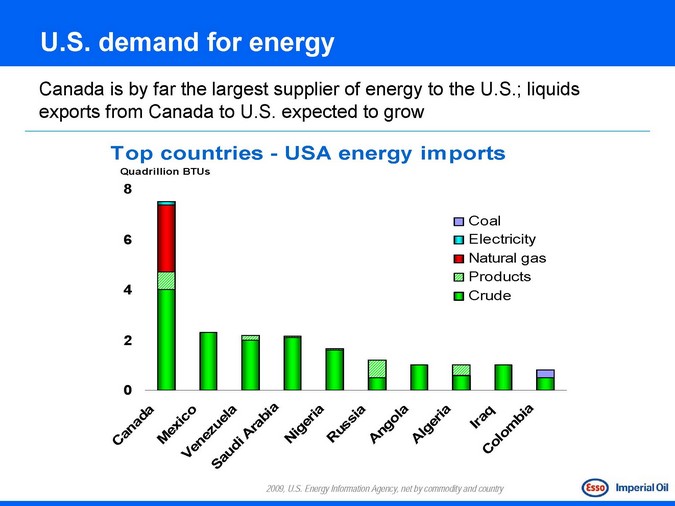

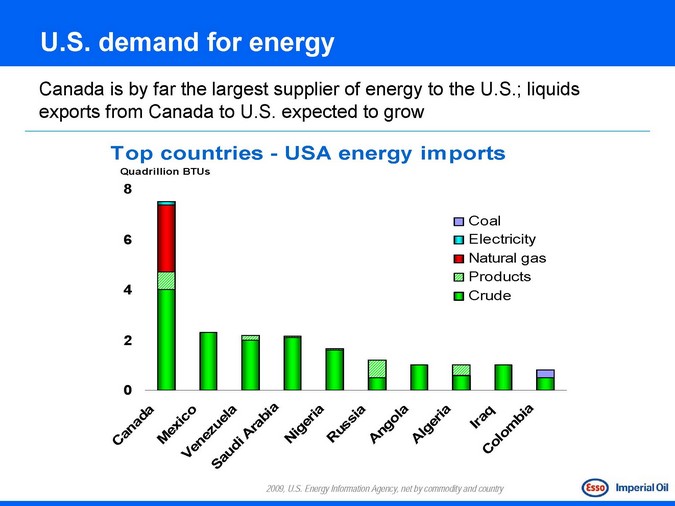

U.S. demand for energy

Canada is by far the largest supplier of energy to the U.S.; liquids exports from Canada to U.S. expected to grow

Top countries—USA energy imports

Quadrillion BTUs

Coal Electricity Natural gas Products Crude

2009, U.S. Energy Information Agency, net by commodity and country

Canada – attractive investment climate

Canada remains an excellent jurisdiction to do business

Positive attributes

Stable democracy

Encourages resource development Welcomes private investment Adept regulators

Challenges remain

Regional inflation Labour availability

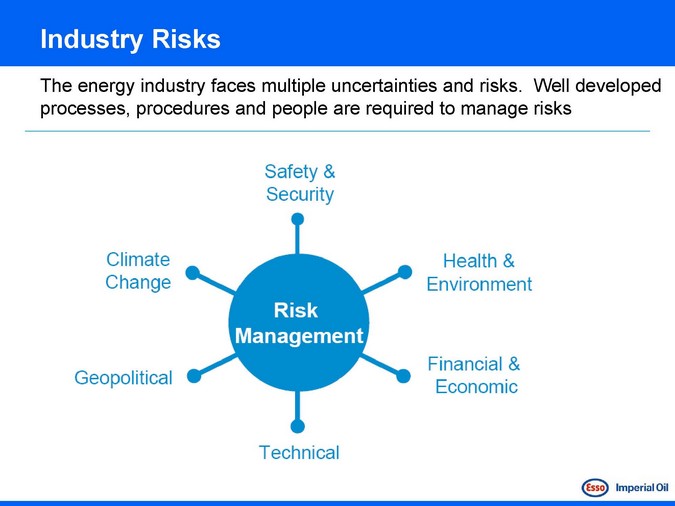

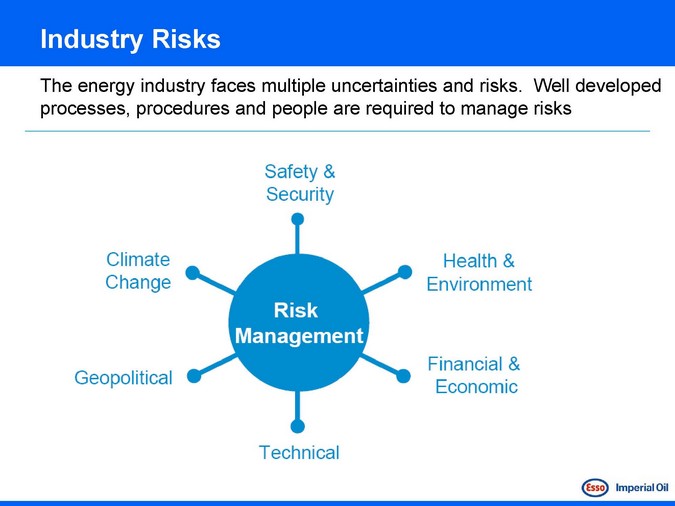

Industry Risks

The energy industry faces multiple uncertainties and risks. Well developed processes, procedures and people are required to manage risks

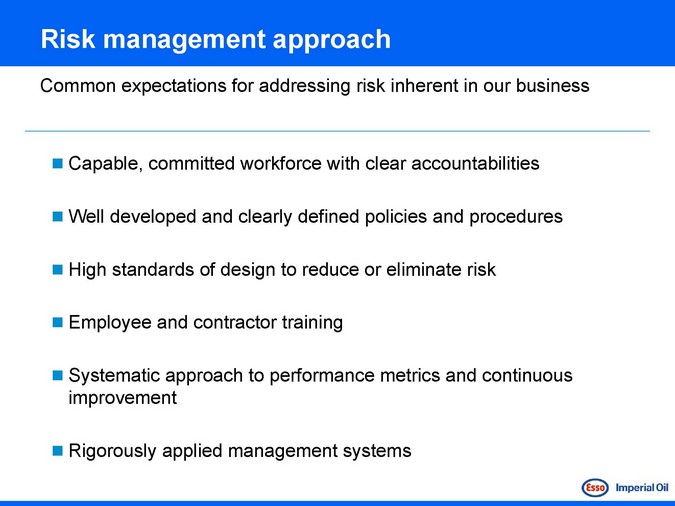

Risk management approach

Common expectations for addressing risk inherent in our business

Capable, committed workforce with clear accountabilities

Well developed and clearly defined policies and procedures

High standards of design to reduce or eliminate risk

Employee and contractor training

Systematic approach to performance metrics and continuous improvement

Rigorously applied management systems

Risk management approach

Imperial Oil employs multiple management systems to lower risk across the businesses, forming a foundation for strong financial and operating results

Operations Integrity Management System

Facilities Integrity Management System

Controls Integrity Management System

ExxonMobil Capital Project Management System

Responsible resource development

Imperial Oil continues to be at the forefront, working with stakeholders on public policy, continually improving operations and investing in technology

reclamation at Syncrude

air emissions

cogeneration

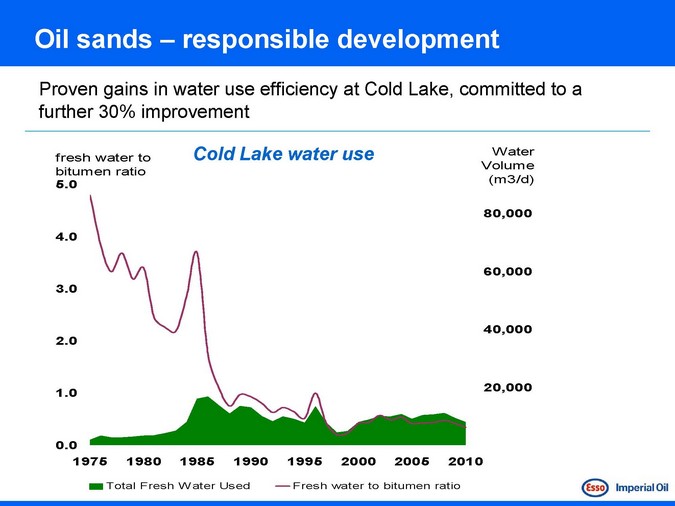

Oil sands – responsible development

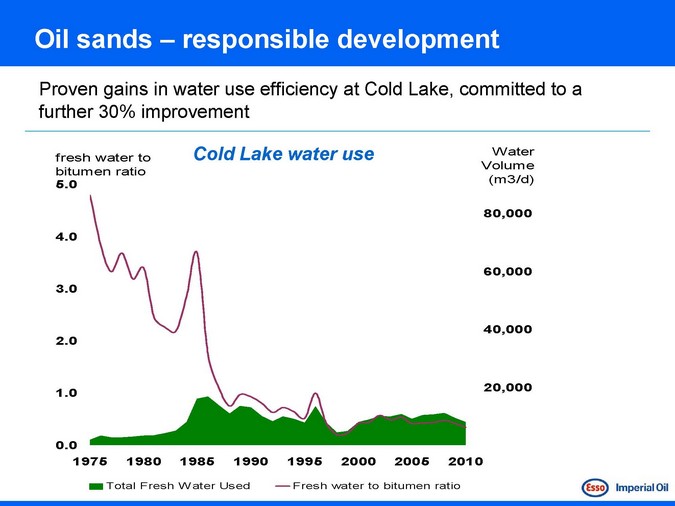

Proven gains in water use efficiency at Cold Lake, committed to a further 30% improvement

fresh water to bitumen ratio

5.0 4.0 3.0 2.0 1.0 0.0

1975 1980 1985 1990 1995 2000 2005 2010

Cold Lake water use

Water Volume (m3/d)

80,000 60,000 40,000 20,000

Total Fresh Water Used

Fresh water to bitumen ratio

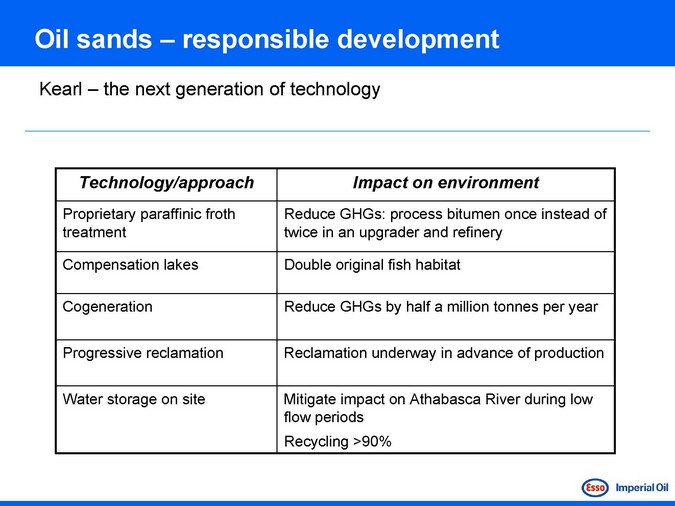

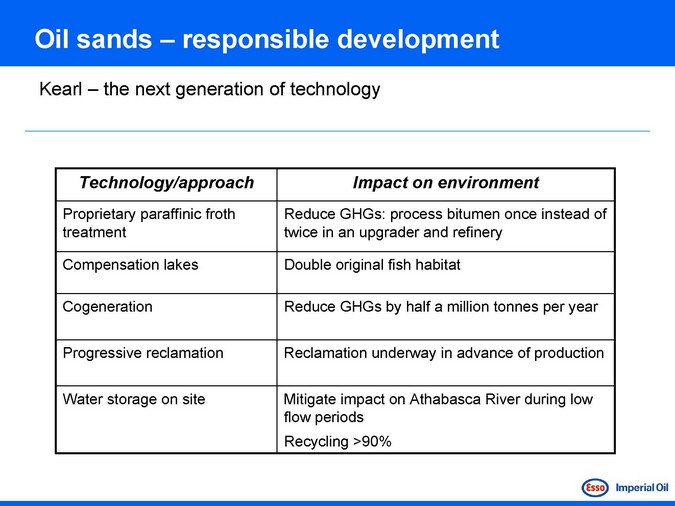

Oil sands – responsible development

Kearl – the next generation of technology

Technology/approach

Proprietary paraffinic froth treatment

Compensation lakes Cogeneration Progressive reclamation Water storage on site

Impact on environment

Reduce GHGs: process bitumen once instead of twice in an upgrader and refinery

Double original fish habitat

Reduce GHGs by half a million tonnes per year

Reclamation underway in advance of production

Mitigate impact on Athabasca River during low flow periods Recycling >90%

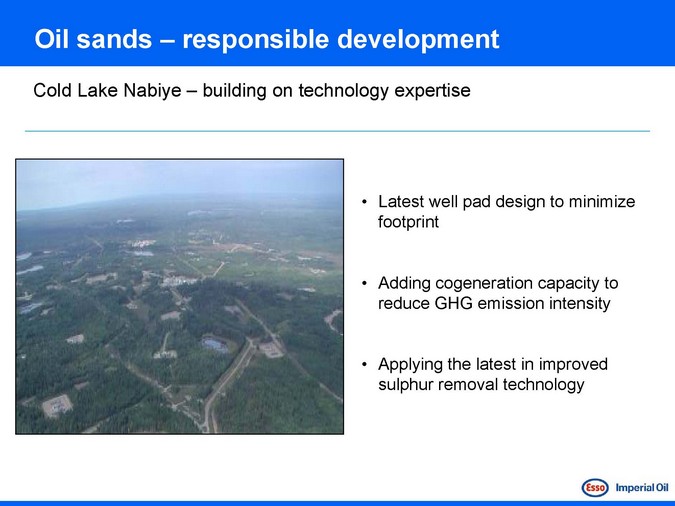

Oil sands – responsible development

Cold Lake Nabiye – building on technology expertise

Latest well pad design to minimize footprint

Adding cogeneration capacity to reduce GHG emission intensity

Applying the latest in improved sulphur removal technology

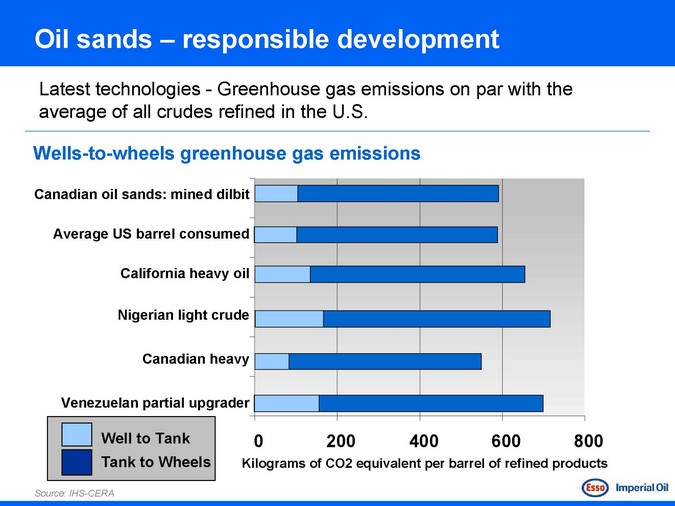

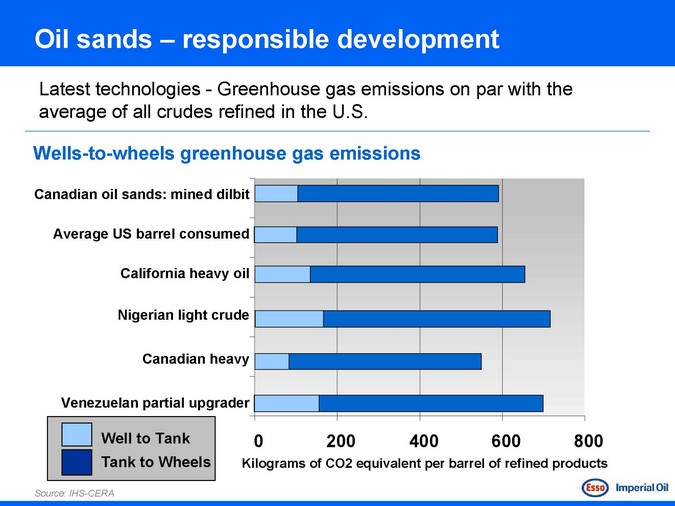

Oil sands – responsible development

Latest technologies—Greenhouse gas emissions on par with the average of all crudes refined in the U.S.

Wells-to-wheels greenhouse gas emissions

Canadian oil sands: mined dilbit

Average US barrel consumed

California heavy oil

Nigerian light crude

Canadian heavy

Venezuelan partial upgrader

Well to Tank Tank to Wheels

Source: IHS-CERA

0 200 400 600 800

Kilograms of CO2 equivalent per barrel of refined products

Oil sands – research and development

At our Calgary Research Centre, scientists’ work is focused on extraction efficiency while minimizing environmental impacts

In-situ processes

Non-aqueous extraction

Centre for Oil Sands Innovation at University of Alberta

Game changing technology focus

Industry collaboration on tailings treatment

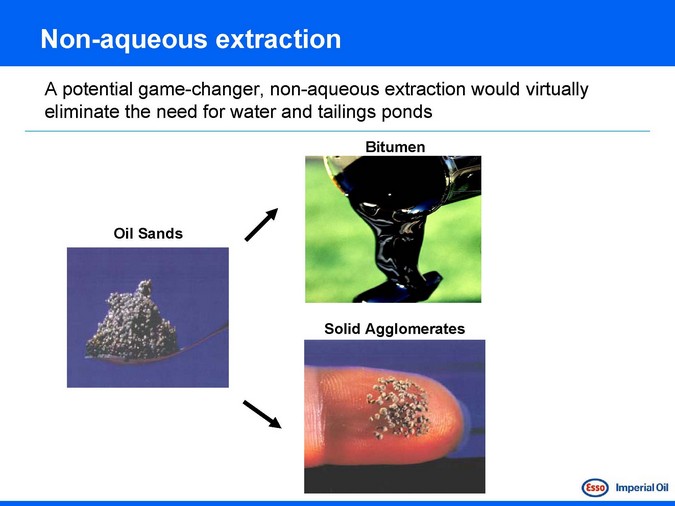

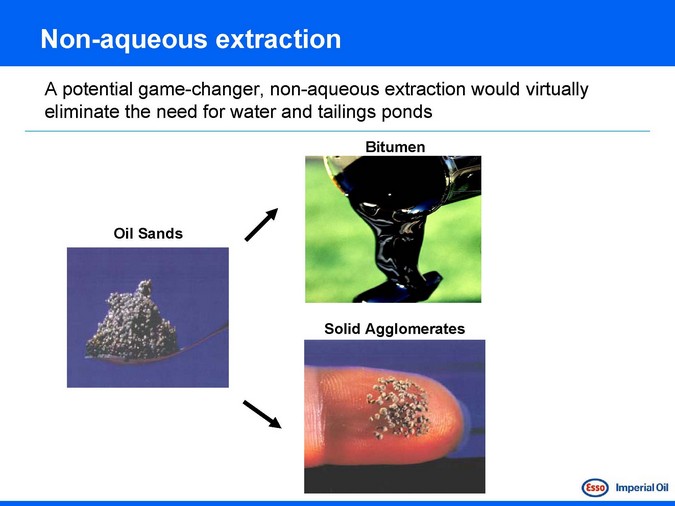

Non-aqueous extraction

A potential game-changer, non-aqueous extraction would virtually eliminate the need for water and tailings ponds

Oil Sands

Bitumen

Solid Agglomerates

Public advocacy – oil sands development

Balance economic, social and environmental aspects

Ensure all perspectives are heard and science is front and centre

Leadership position in CAPP

CAPP pan-continental communication plan

Legislators, regulators, academia, community leaders

CAPP Roundtables

Community engagement

Capability building

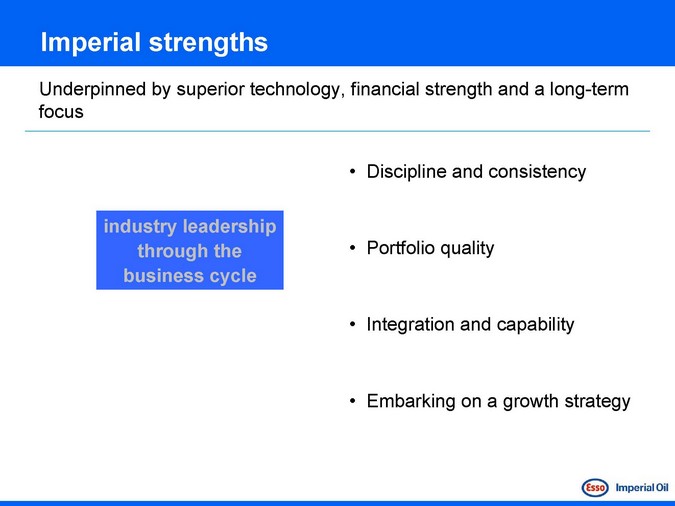

Imperial strengths

Underpinned by superior technology, financial strength and a long-term focus

industry leadership through the business cycle

Discipline and consistency

Portfolio quality

Integration and capability

Embarking on a growth strategy

Imperial Oil – 2011 Investor Meeting

Upstream – Doubling Production

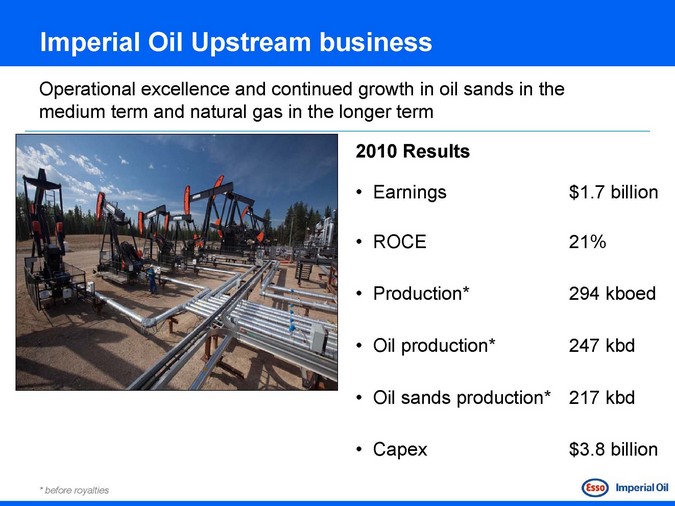

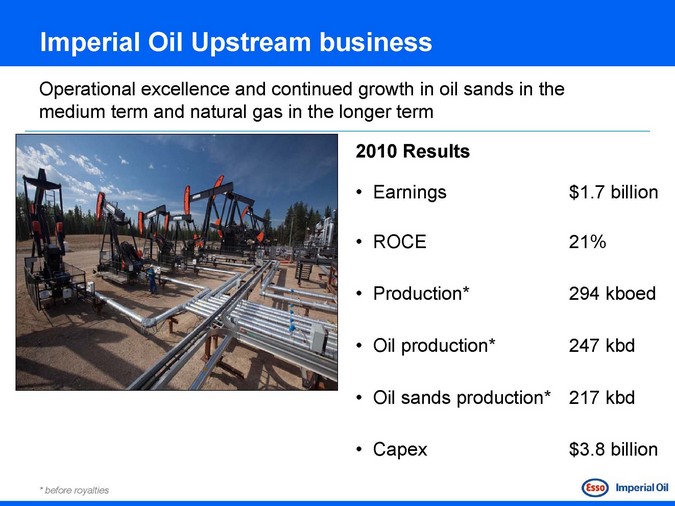

Imperial Oil Upstream business

Operational excellence and continued growth in oil sands in the medium term and natural gas in the longer term

2010 Results

Earnings

ROCE

Production*

Oil production*

Oil sands production*

Capex

$1.7 billion

21%

294 kboed

247 kbd

217 kbd

$3.8 billion

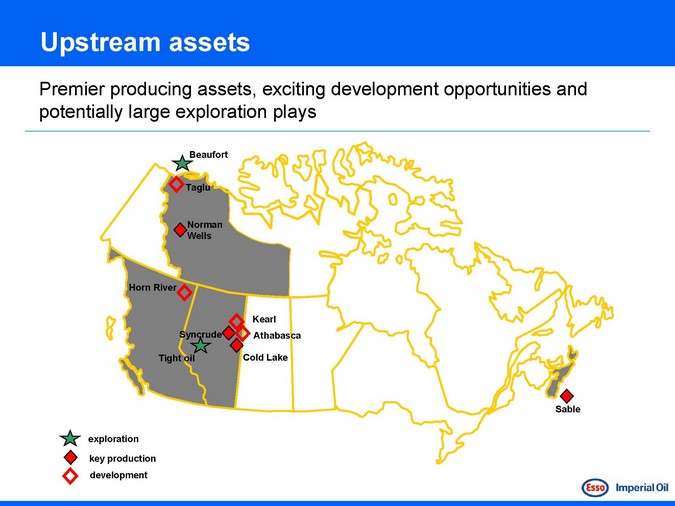

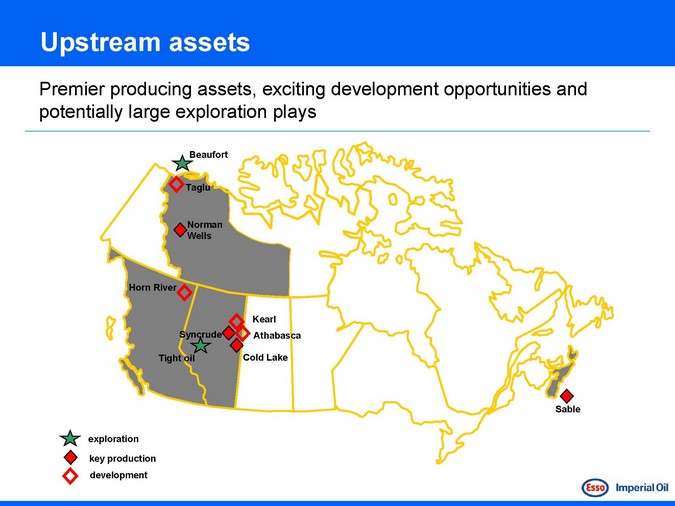

Upstream assets

Premier producing assets, exciting development opportunities and potentially large exploration plays

Beaufort

Taglu

Norman Wells

Horn River

Syncrude

Tight oil

Kearl Athabasca

Cold Lake

exploration

key production development

Sable

Imperial Oil Upstream strategy

Apply technology to find and responsibly development and operate advantaged oil and gas resources in Canada

Identify and selectively capture the highest -quality exploration opportunities

Invest in projects that deliver superior returns

Maximize profitability of existing oil and gas production

Capitalize on growing natural gas and power markets

Maximize resource value through high impact technologies and integrated solutions

Operational excellence

Focus on execution excellence leads to industry leading safety, environmental performance and reliability

3 | | year average production % of capacity |

Cold Lake MacKay River Foster Creek Christina Lake Primrose/Wolf Lake Peace River Surmont Jackfish Firebag Orion Long Lake Tucker

0% 20% 40% 60% 80% 100%

Source: CanOils

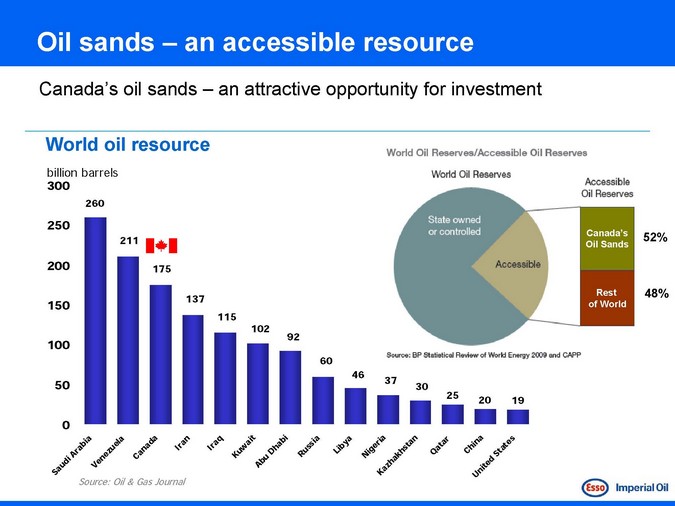

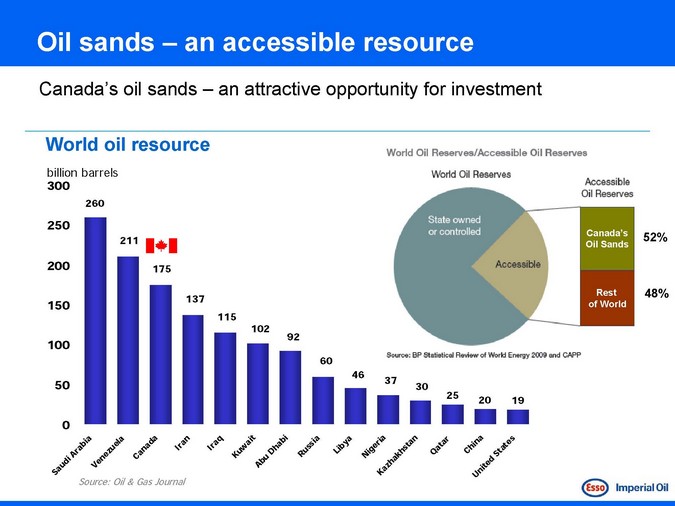

an accessible resource Oil sands –

an attractive opportunity for investment Canada’s oil sands –

World oil resource

billion barrels

300 250 200 150 100 50 0

260

211

175

137

115

102

92

60

46

37

30

25

20

19

Canada’s Oil Sands

Rest of World

52% 48%

Source: Oil & Gas Journal

Ar i uda S

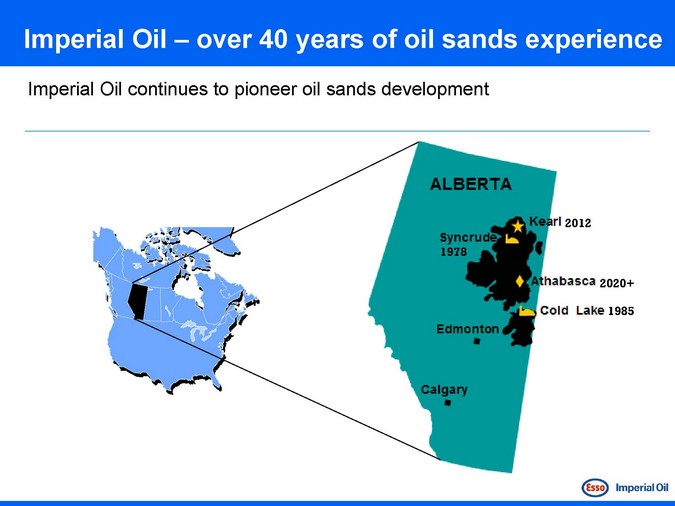

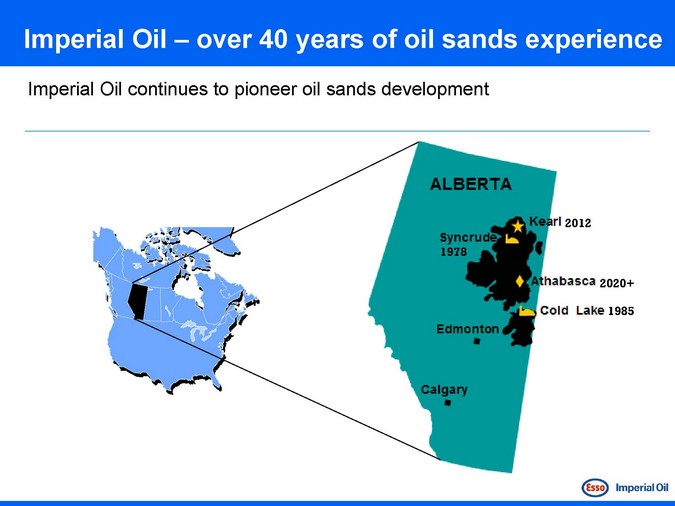

Imperial Oil – over 40 years of oil sands experience

Imperial Oil continues to pioneer oil sands development

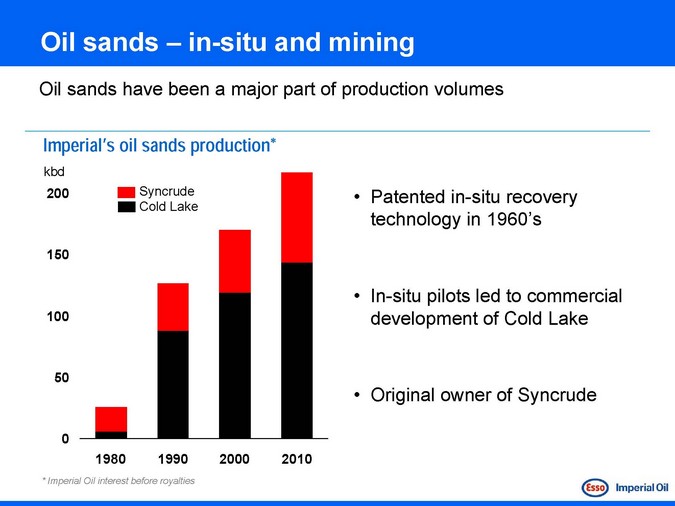

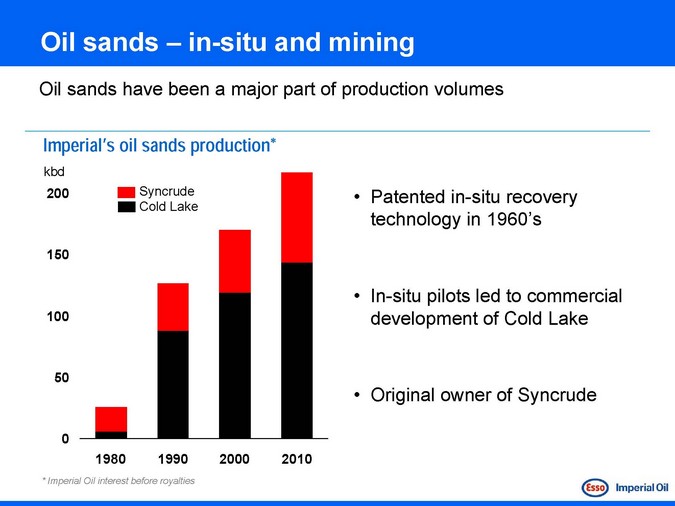

Oil sands – in-situ and mining

Oil sands have been a major part of production volumes

Imperial’s oil sands production*

kbd

200 150 100 50 0

Syncrude Cold Lake

1980 1990 2000 2010

Patented in-situ recovery technology in 1960’s

In-situ pilots led to commercial development of Cold Lake

Original owner of Syncrude

* | | Imperial Oil interest before royalties |

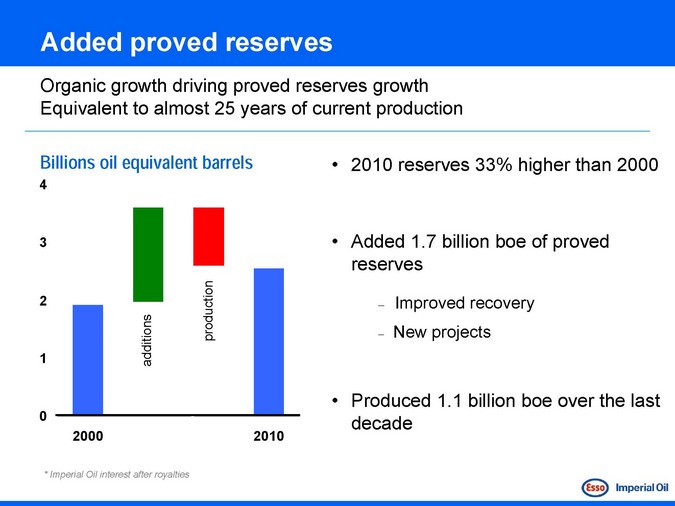

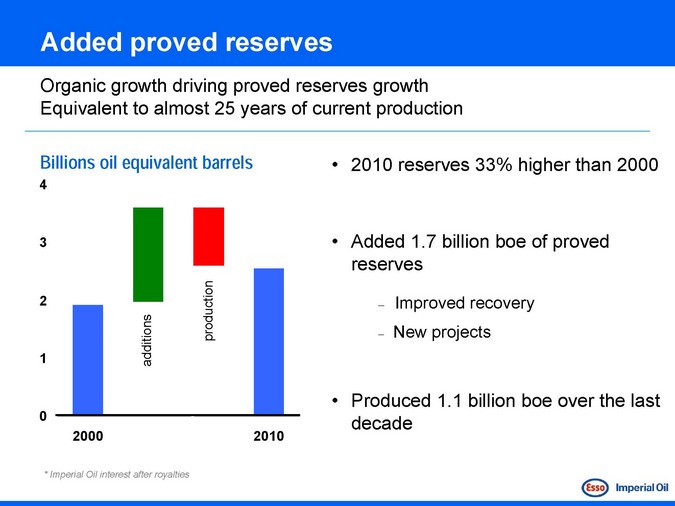

Added proved reserves

Organic growth driving proved reserves growth Equivalent to almost 25 years of current production

Billions oil equivalent barrels

0

2000

2010

additions

production

* | | Imperial Oil interest after royalties |

2010 reserves 33% higher than 2000

Added 1.7 billion boe of proved reserves

Improved recovery New projects

Produced 1.1 billion boe over the last decade

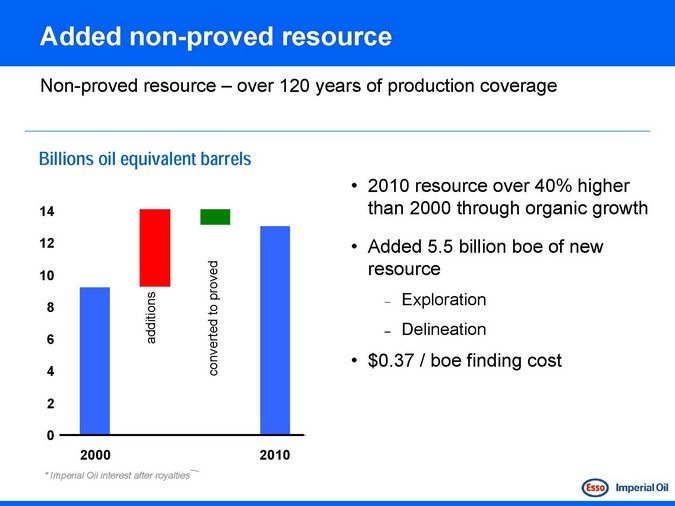

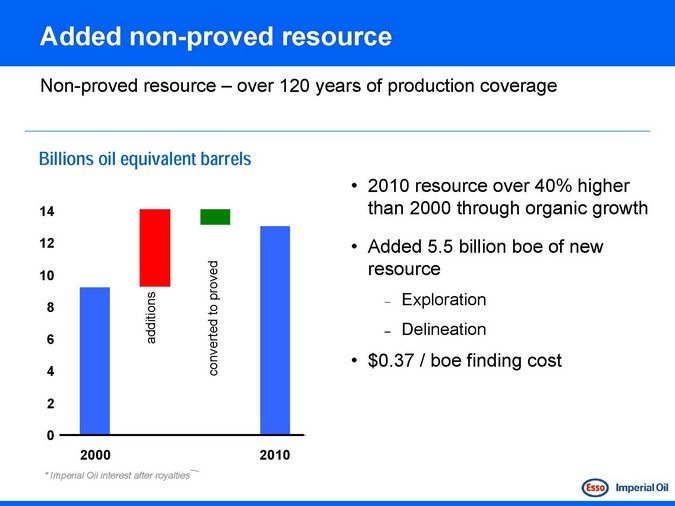

Added non-proved resource

Non-proved resource – over 120 years of production coverage

Billions oil equivalent barrels

14 12 10 8 6 4 2 0

additions

proved to converted

2000 2010

2010 resource over 40% higher than 2000 through organic growth

Added 5.5 billion boe of new resource

Exploration Delineation

$0.37 / boe finding cost

* | | Imperial Oil interest after royalties |

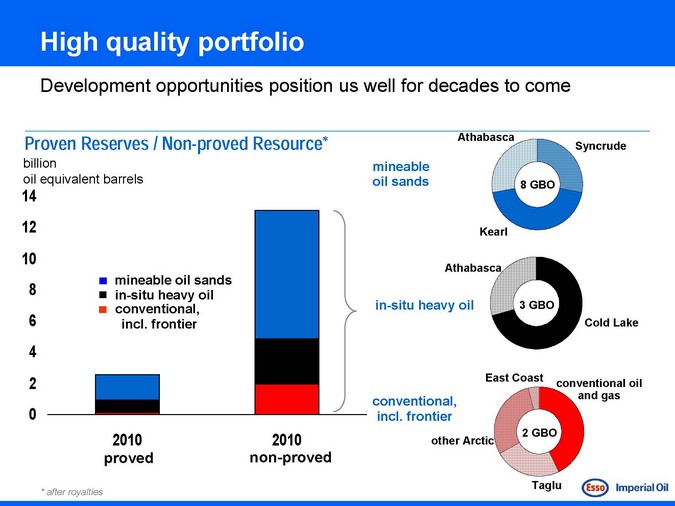

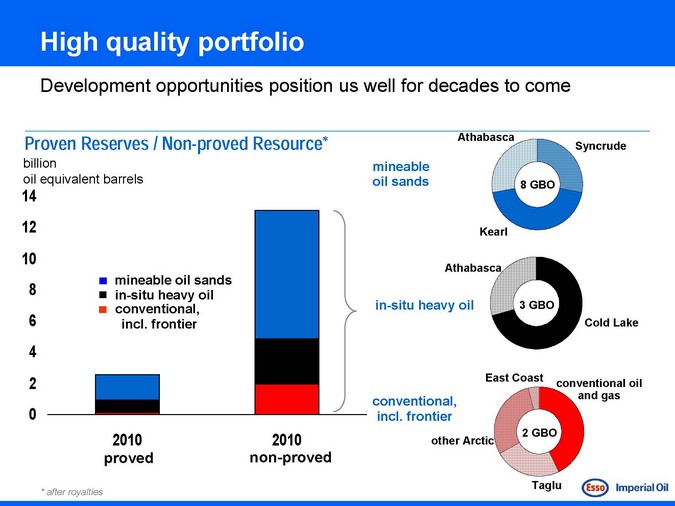

High quality portfolio

Development opportunities position us well for decades to come

Proven Reserves / Non-proved Resource*

billion oil equivalent barrels

14 12 10 8 6 4 2 0

mineable oil sands in-situ heavy oil conventional, incl. frontier

2010 proved

2010 non-proved

mineable oil sands

Athabasca

Syncrude

Kearl

Athabasca

in-situ heavy oil

Cold Lake

conventional, incl. frontier

East Coast

conventional oil and gas

other Arctic

Taglu

Adding to the resource base

Employing latest technology to find large, high quality resource opportunities

Over 500,000 acres added in the past 4 years at advantaged prices

Leveraged financial strength during market down-turn

Includes:

Over 170,000 acres in the Horn River

Oil sands land

Shale gas and oil

25% share of 1 million acres in the Beaufort Sea

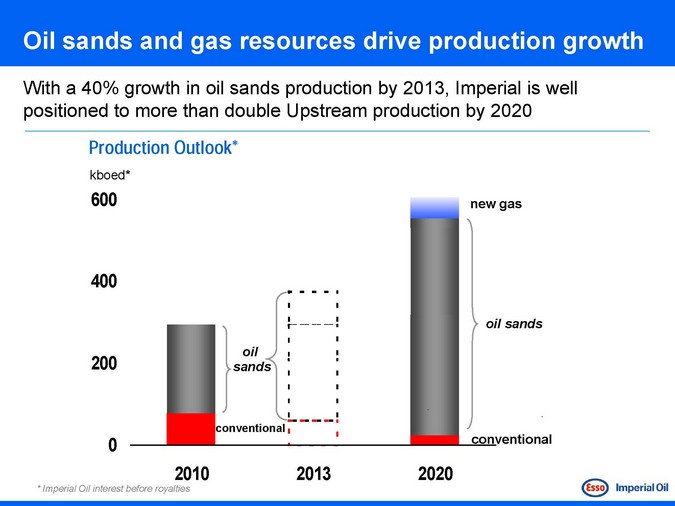

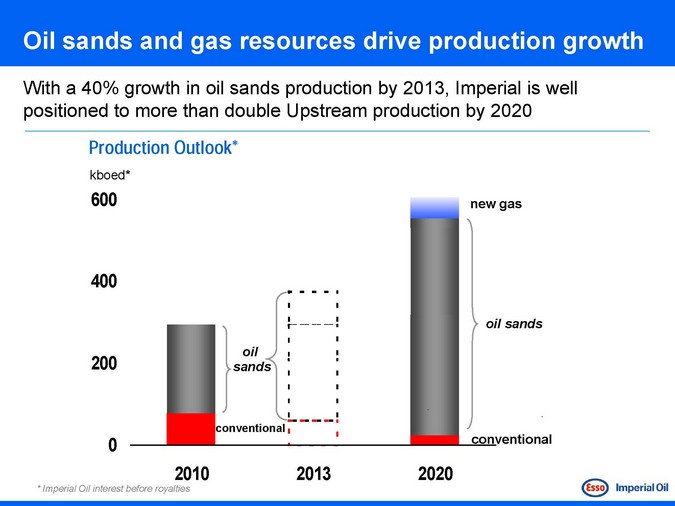

Oil sands and gas resources drive production growth

With a 40% growth in oil sands production by 2013, Imperial is well positioned to more than double Upstream production by 2020

Production Outlook*

kboed*

600 400 200 0

oil sands

conventional

new gas

oil sands

conventional

2010 2013 2020

* | | Imperial Oil interest before royalties |

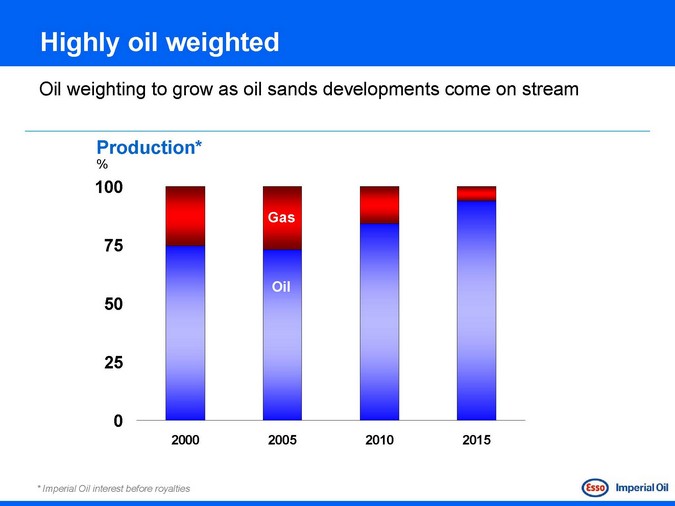

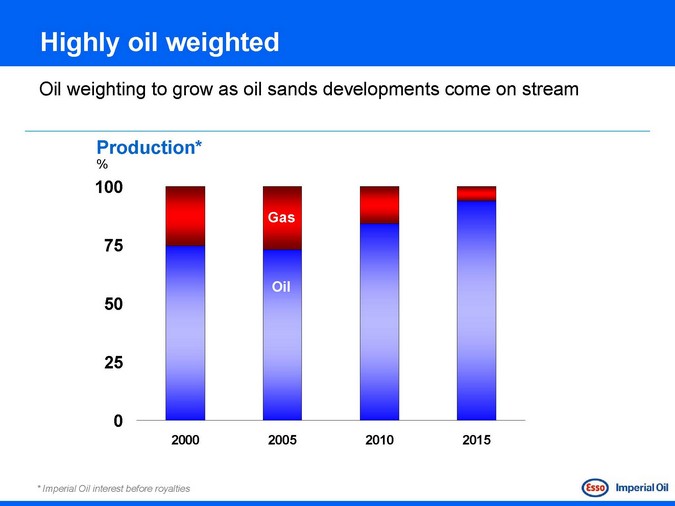

Highly oil weighted

Oil weighting to grow as oil sands developments come on stream

Production*

%

100 75 50 25 0

Gas

Oil

2000 2005 2010 2015

* | | Imperial Oil interest before royalties |

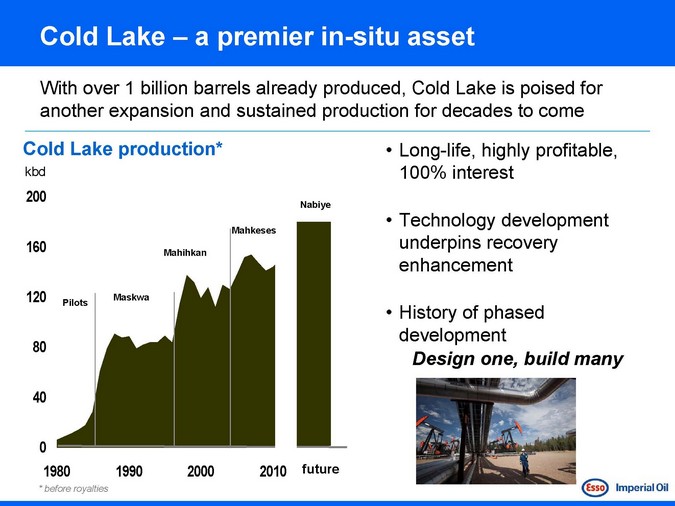

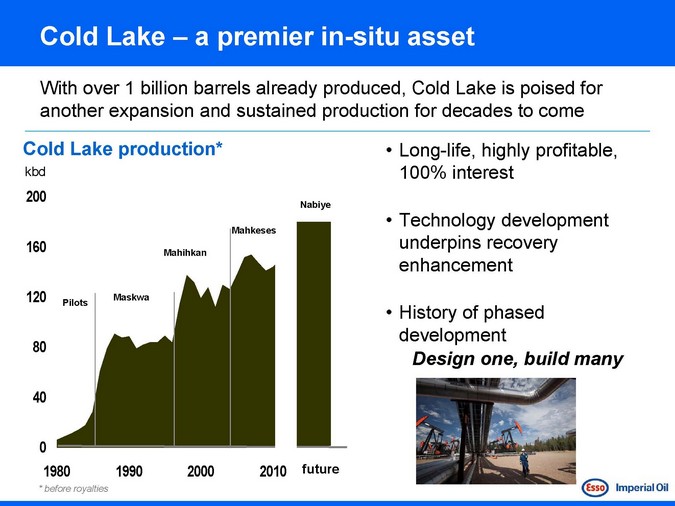

Cold Lake – a premier in-situ asset

With over 1 billion barrels already produced, Cold Lake is poised for another expansion and sustained production for decades to come

Cold Lake production*

kbd

200 160 120 80 40 0

Pilots

Maskwa

Mahihkan

Mahkeses

Nabiye

Long-life, highly profitable, 100% interest

Technology development underpins recovery enhancement

History of phased development

Design one, build many

1980 1990 2000 2010 future

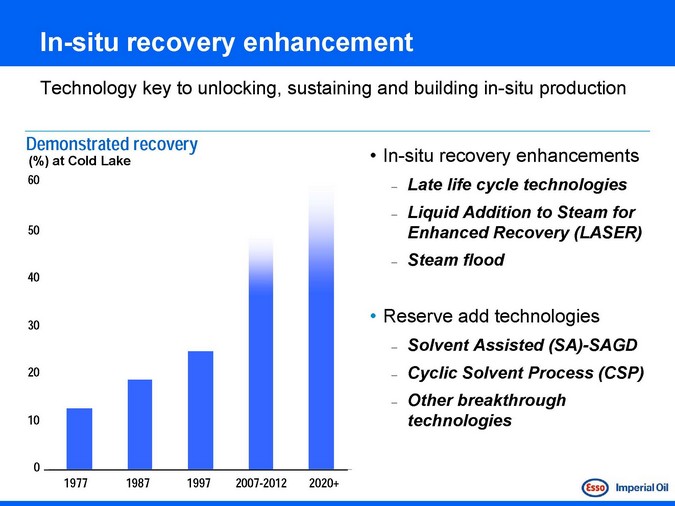

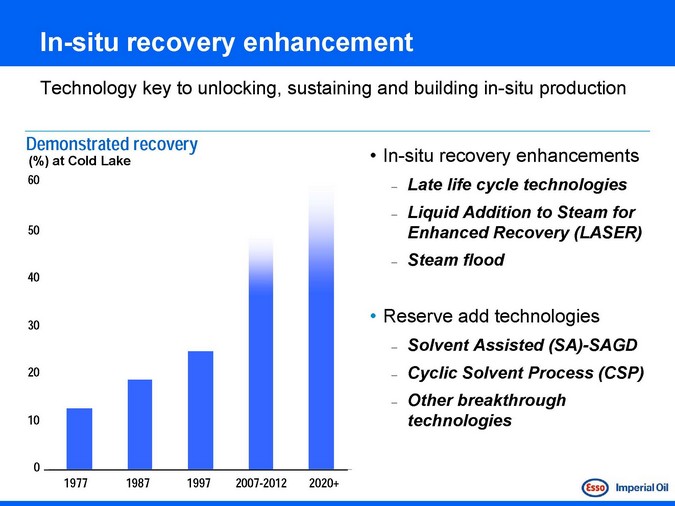

In-situ recovery enhancement

Technology key to unlocking, sustaining and building in-situ production

Demonstrated recovery

(%) at Cold Lake

60 50 40 30 20 10 0

1977 1987 1997 2007-2012 2020+

In-situ recovery enhancements

Late life cycle technologies

Liquid Addition to Steam for Enhanced Recovery (LASER) Steam flood

Reserve add technologies

Solvent Assisted (SA)-SAGD Cyclic Solvent Process (CSP) Other breakthrough technologies

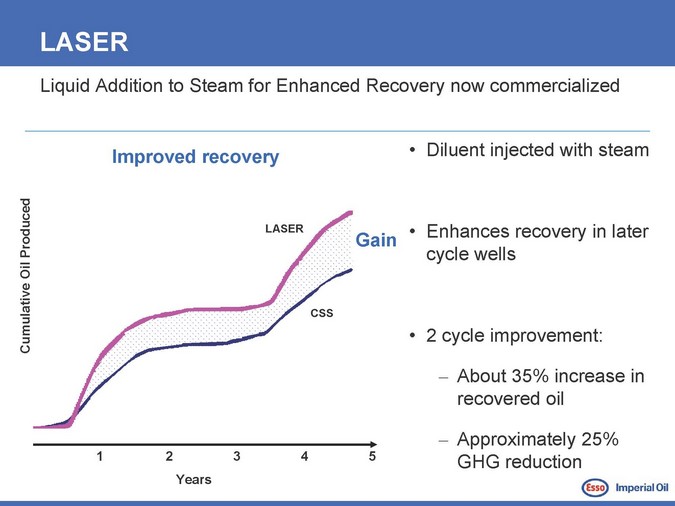

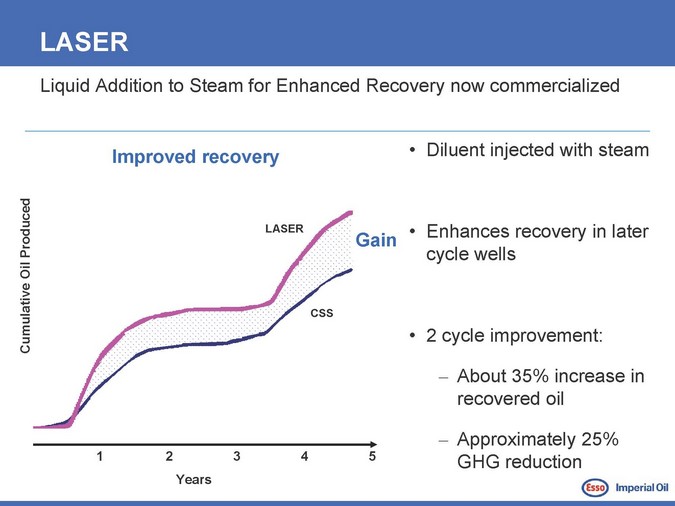

LASER

Liquid Addition to Steam for Enhanced Recovery now commercialized

Improved recovery

Produced Oil Cumulative

LASER

CSS

Years

Gain

Diluent injected with steam

Enhances recovery in later cycle wells

About 35% increase in recovered oil

Approximately 25% GHG reduction

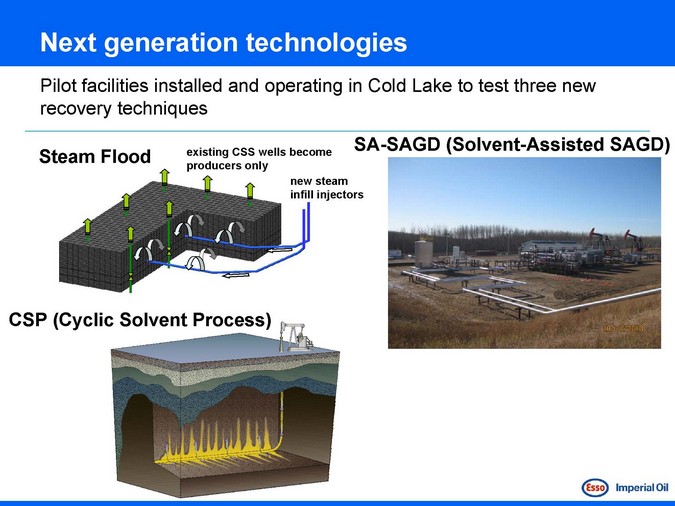

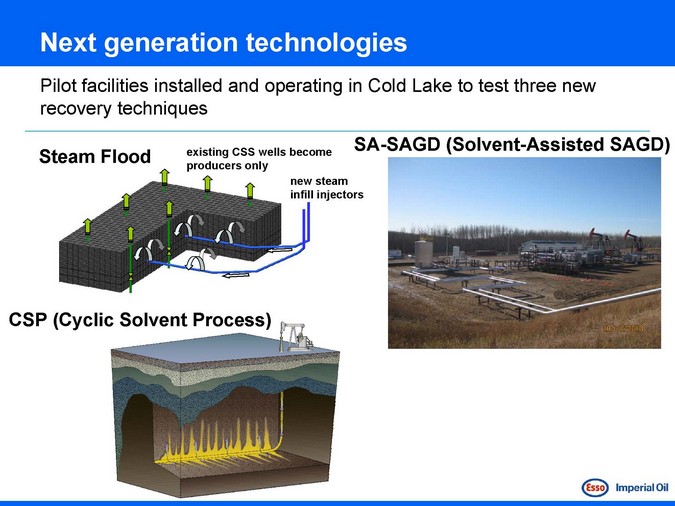

Next generation technologies

Pilot facilities installed and operating in Cold Lake to test three new recovery techniques

Steam Flood

CSP (Cyclic Solvent Process)

existing CSS wells become producers only

new steam infill injectors

SA-SAGD (Solvent -Assisted SAGD)

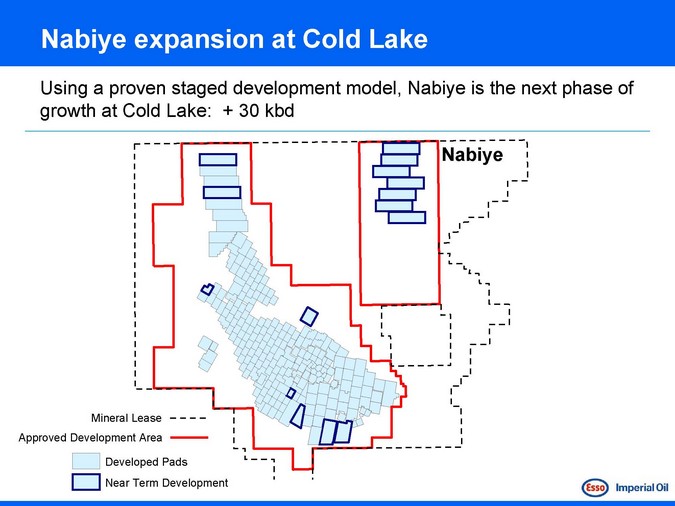

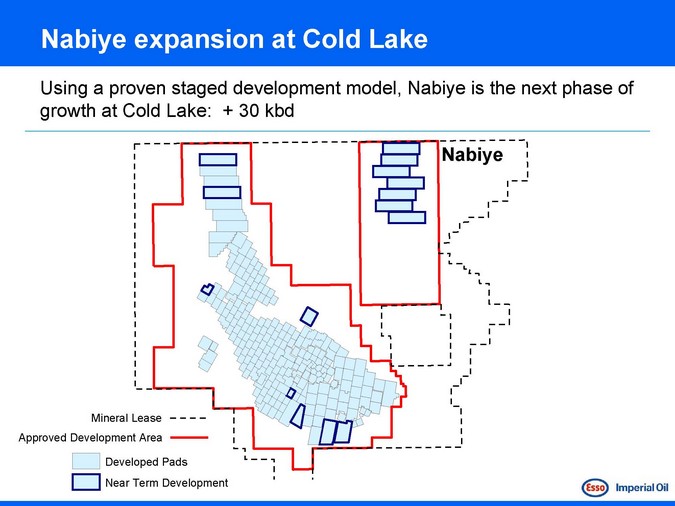

Nabiye expansion at Cold Lake

Using a proven staged development model, Nabiye is the next phase of growth at Cold Lake: + 30 kbd

Nabiye

Mineral Lease

Approved Development Area

Developed Pads

Near Term Development

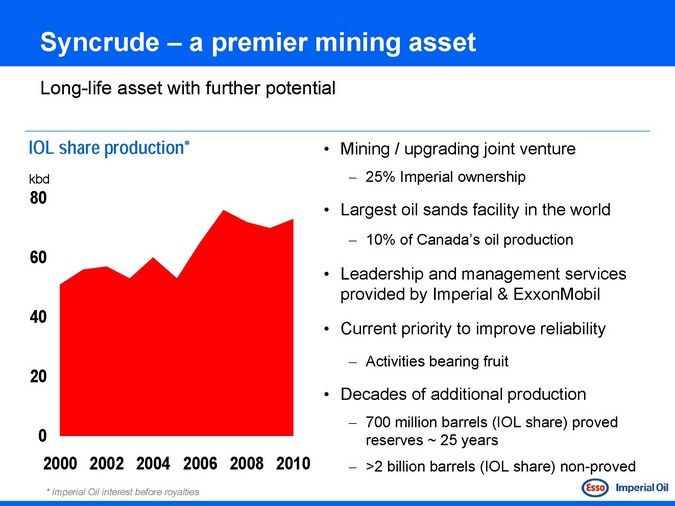

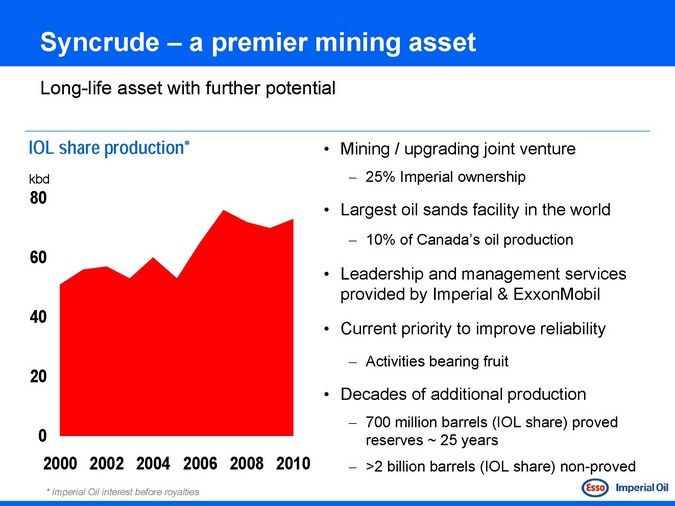

Syncrude – a premier mining asset

Long-life asset with further potential

IOL share production*

kbd

80 60 40 20 0

2000 2002 2004 2006 2008 2010

Mining / upgrading joint venture

25% Imperial ownership

Largest oil sands facility in the world

10% of Canada’s oil production

Leadership and management services provided by Imperial & ExxonMobil

Current priority to improve reliability

Activities bearing fruit

Decades of additional production

700 million barrels (IOL share) proved reserves ~ 25 years

>2 billion barrels (IOL share) non-proved

* | | Imperial Oil interest before royalties |

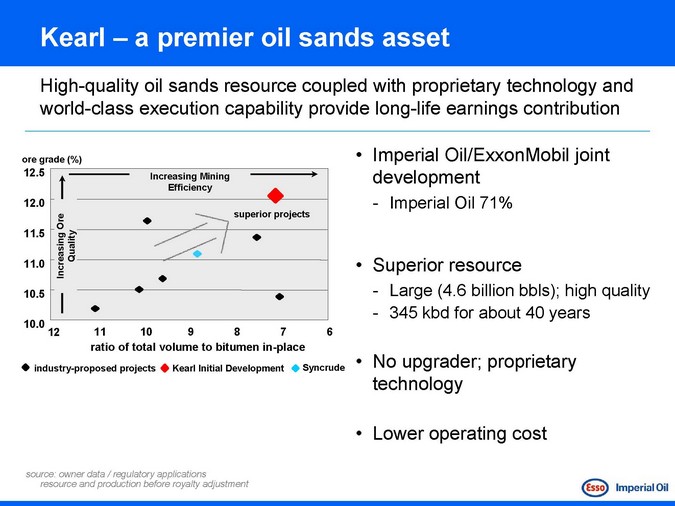

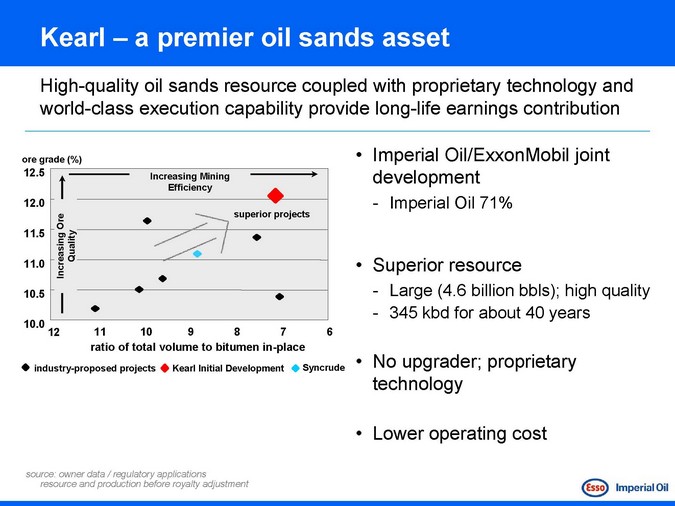

Kearl – a premier oil sands asset

High-quality oil sands resource coupled with proprietary technology and world-class execution capability provide long-life earnings contribution

ore grade (%)

12.5 Increasing Mining Efficiency 12.0

Ore superior projects 11.5 Quality 11.0 Increasing 10.5

10.0

12 11 10 9 8 7 6

ratio of total volume to bitumen in-place

industry -proposed projects

Kearl Initial Development

Syncrude

Imperial Oil/ExxonMobil joint development

Imperial Oil 71%

Superior resource

Large (4.6 billion bbls); high quality 345 kbd for about 40 years

No upgrader; proprietary technology

Lower operating cost

source: owner data / regulatory applications resource and production before royalty adjustment

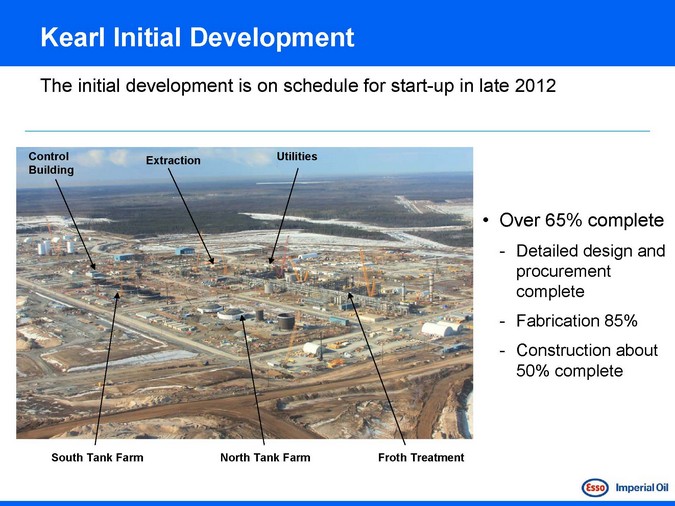

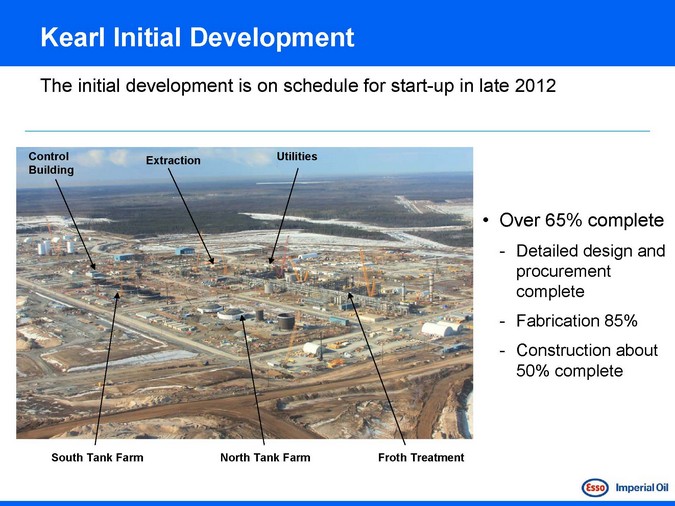

Kearl Initial Development

The initial development is on schedule for start-up in late 2012

Control Extraction Utilities Building

South Tank Farm North Tank Farm Froth Treatment

Over 65% complete

Detailed design and procurement complete Fabrication 85% Construction about 50% complete

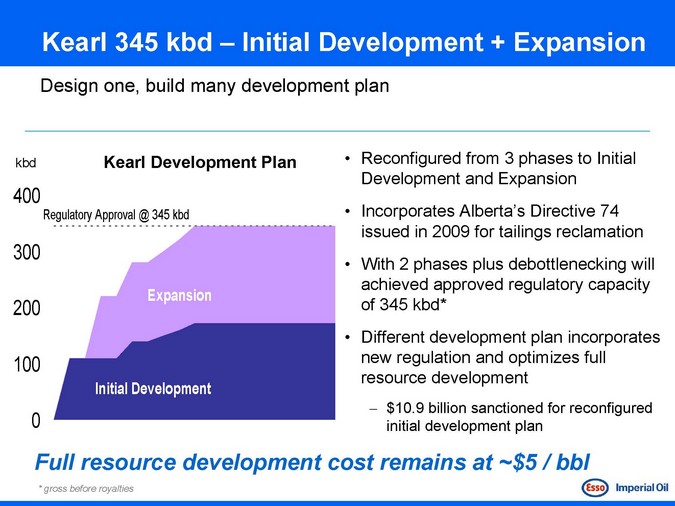

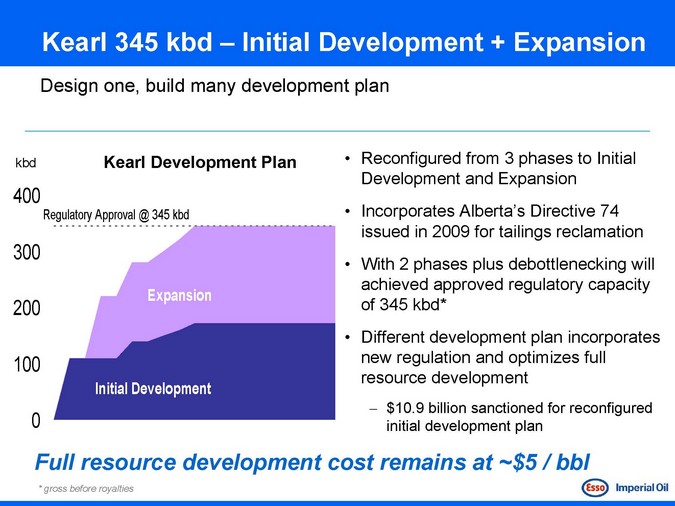

Kearl 345 kbd – Initial Development + Expansion

Design one, build many development plan

Kearl Development Plan

kbd

400 300 200 100 0

Regulatory Approval @ 345 kbd

Expansion

Initial Development

Reconfigured from 3 phases to Initial Development and Expansion Incorporates Alberta’s Directive 74 issued in 2009 for tailings reclamation With 2 phases plus debottlenecking will achieved approved regulatory capacity of 345 kbd* Different development plan incorporates new regulation and optimizes full resource development

$10.9 billion sanctioned for reconfigured initial development plan

Full resource development cost remains at ~$5 / bbl

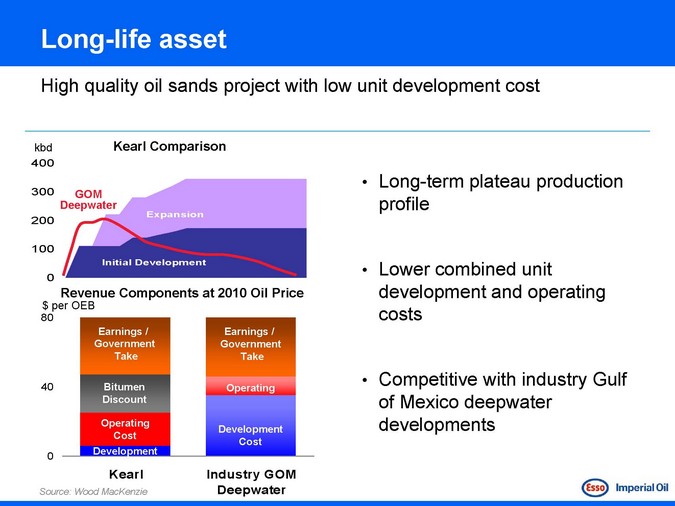

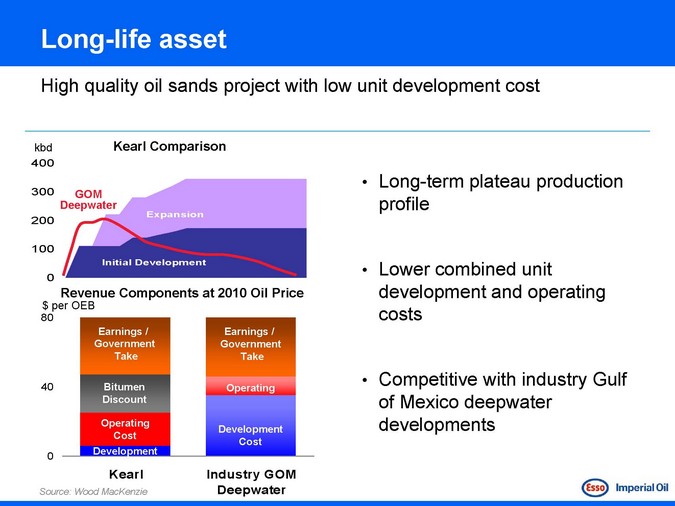

Long -life asset

High quality oil sands project with low unit development cost

Kearl Comparison

kbd

400

300 GOM Deepwater

200 100 0

Expansion

Initial Development

Revenue Components at 2010 Oil Price $ per OEB

80

40

0

Earnings / Government Take

Bitumen Discount

Operating Cost Development

Kearl

Earnings / Government Take

Operating

Development Cost

Industry GOM Deepwater

Source: Wood MacKenzie

Long-term plateau production profile

Lower combined unit development and operating costs

Competitive with industry Gulf of Mexico deepwater developments

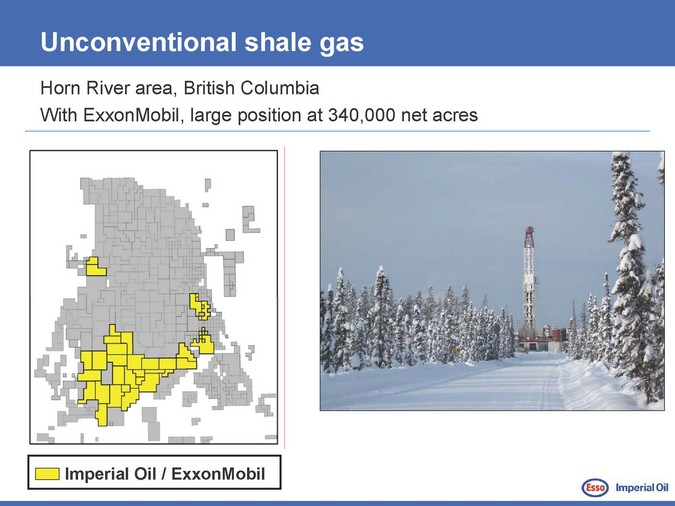

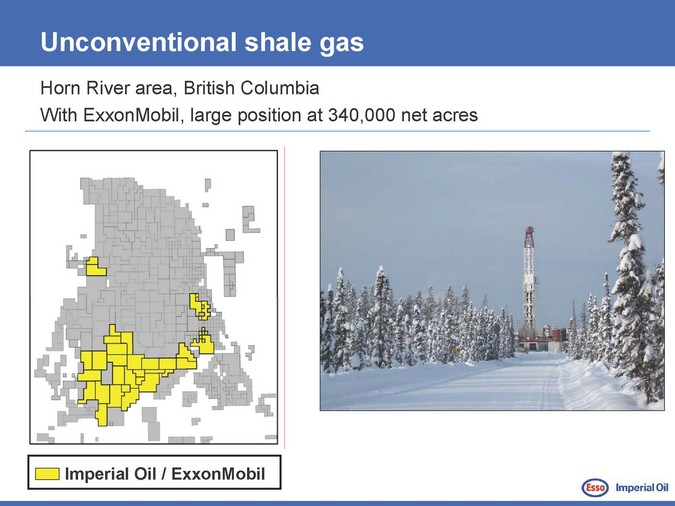

Unconventional shale gas

Horn River area, British Columbia

With ExxonMobil, large position at 340,000 net acres

Imperial Oil / ExxonMobil

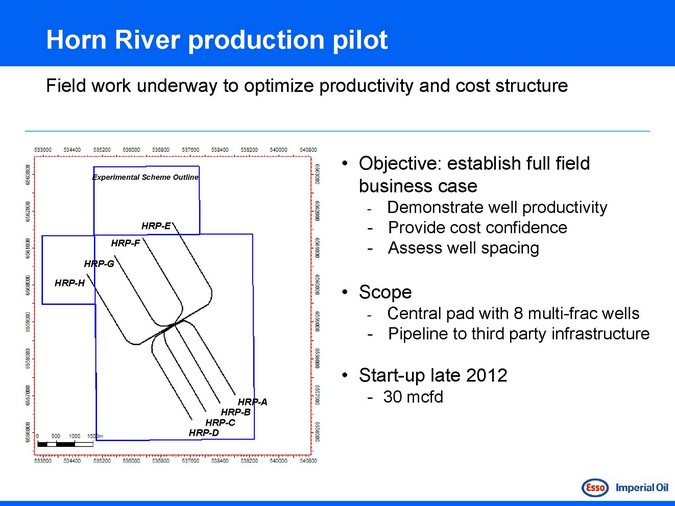

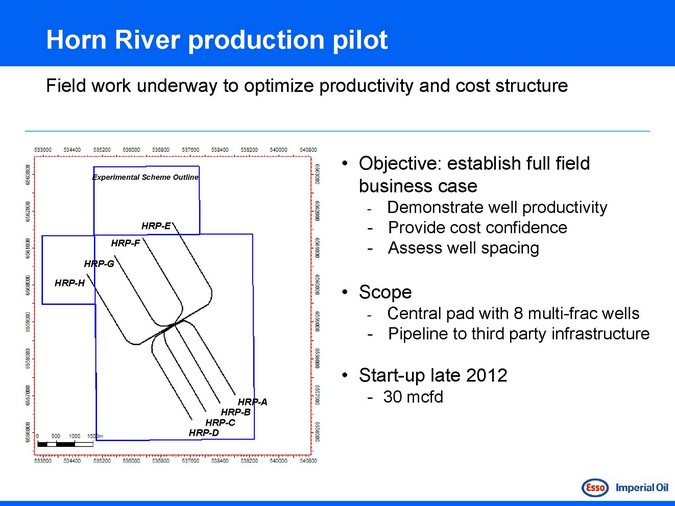

Horn River production pilot

Field work underway to optimize productivity and cost structure

Objective: establish full field business case

Demonstrate well productivity Provide cost confidence Assess well spacing

Scope

Central pad with 8 multi-frac wells Pipeline to third party infrastructure

Start-up late 2012

30 mcfd

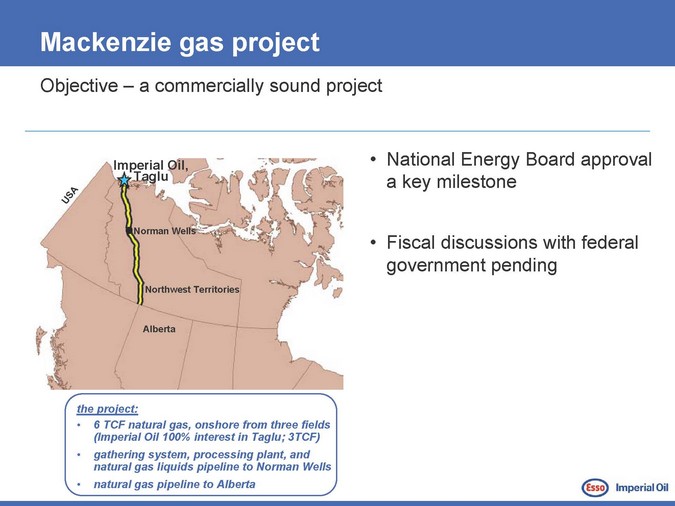

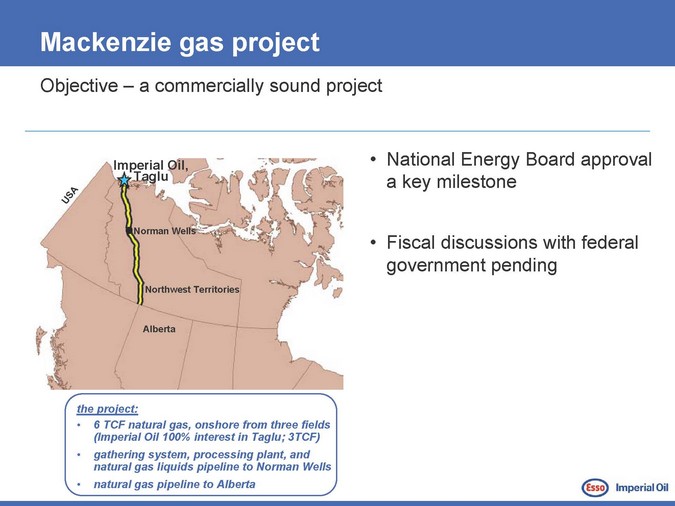

Mackenzie gas project

Objective – a commercially sound project

National Energy Board approval a key milestone

Fiscal discussions with federal government pending

Imperial Oil, Taglu

S A U

Norman Wells

Northwest Territories

Alberta

the project:

6 TCF natural gas, onshore from three fields (Imperial Oil 100% interest in Taglu; 3TCF) gathering system, processing plant, and natural gas liquids pipeline to Norman Wells natural gas pipeline to Alberta

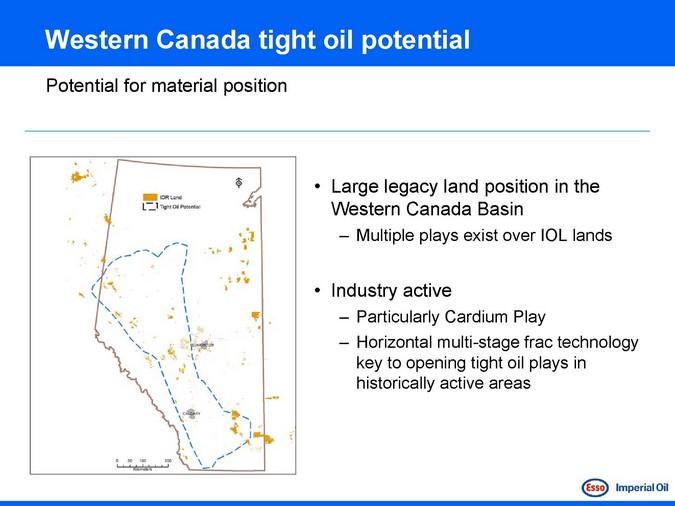

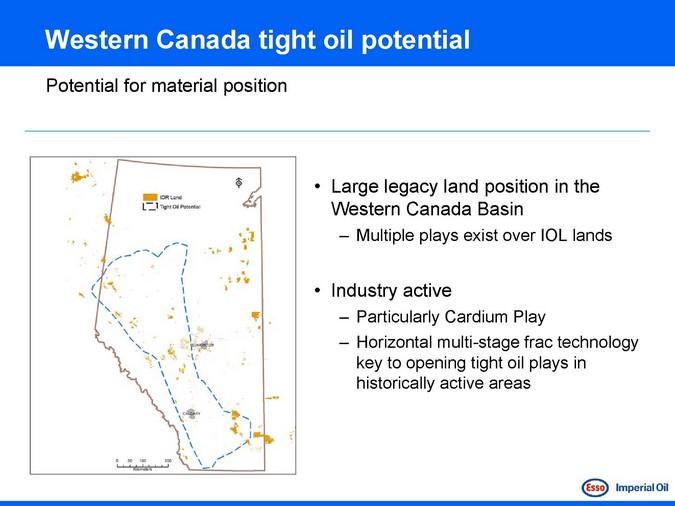

Western Canada tight oil potential

Potential for material position

Large legacy land position in the Western Canada Basin

Multiple plays exist over IOL lands

Industry active

Particularly Cardium Play

Horizontal multi-stage frac technology key to opening tight oil plays in historically active areas

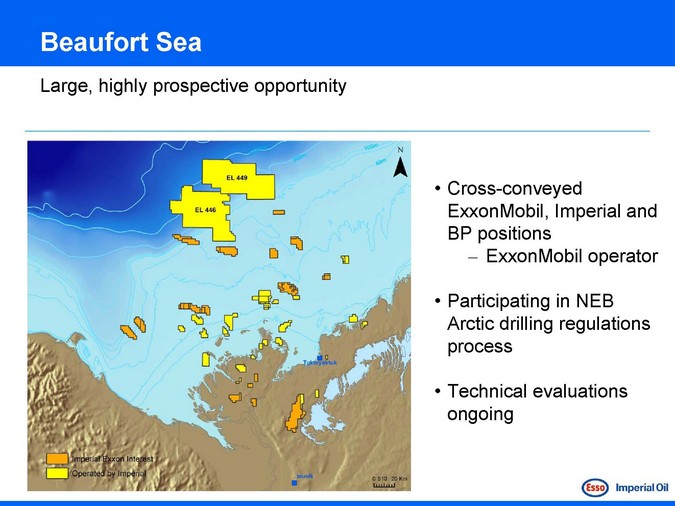

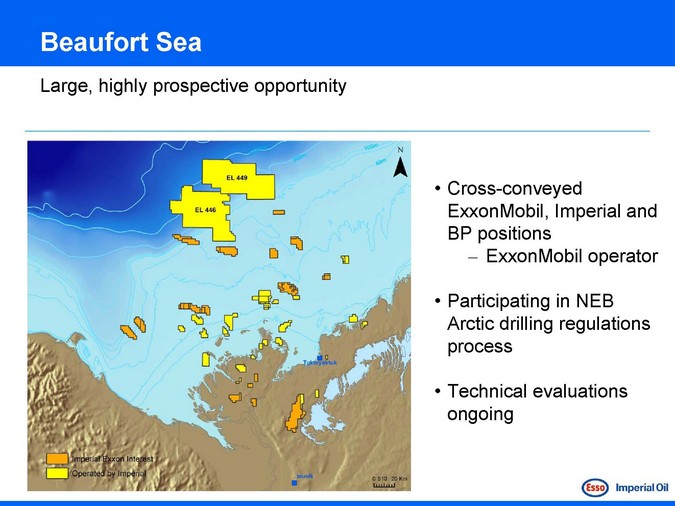

Beaufort Sea

Large, highly prospective opportunity

Cross-conveyed

ExxonMobil, Imperial and BP positions

– ExxonMobil operator

Participating in NEB Arctic drilling regulations process

Technical evaluations ongoing

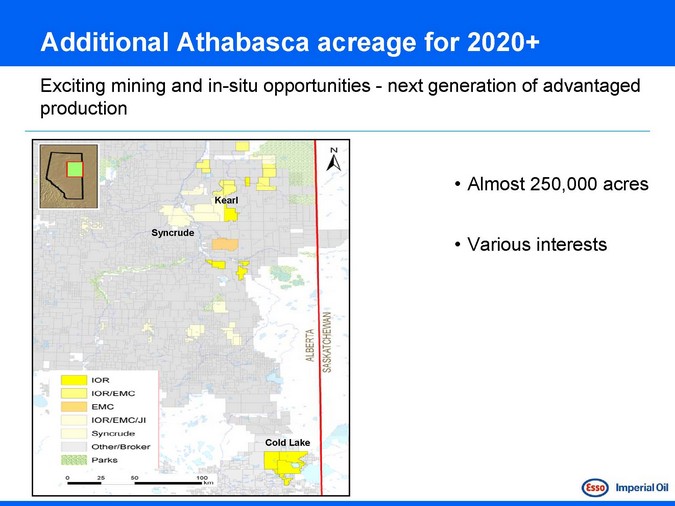

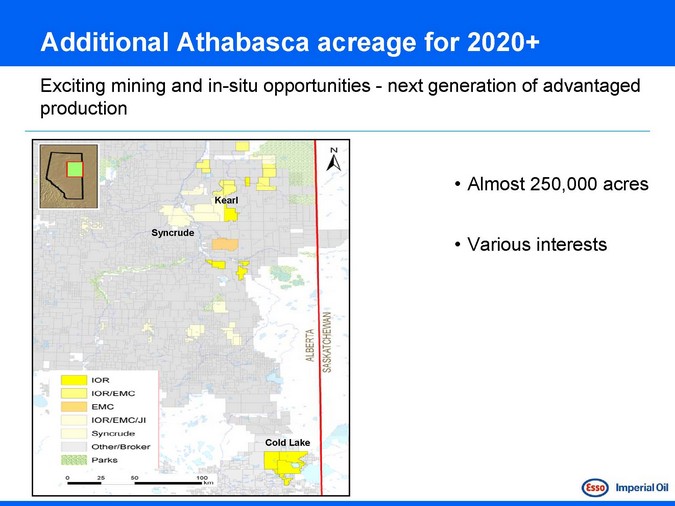

Additional Athabasca acreage for 2020+

Exciting mining and in-situ opportunities—next generation of advantaged production

Almost 250,000 acres

Various interests

Imperial Oil – 2011 Investor Meeting

Downstream and Chemical

2010 highlights

Strong results in a challenging market

Strong financial performance

Earnings ROCE Refinery throughput

Net petroleum product sales

$0.4 billion 13 % 444 kbd 442 kbd

Focus on operational excellence

Maintaining capital discipline

Results underpinned by technology, efficiency, integration and margin enhancement

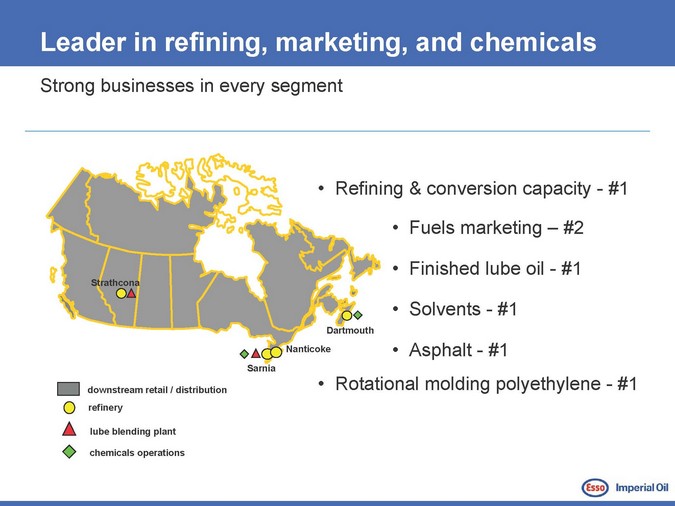

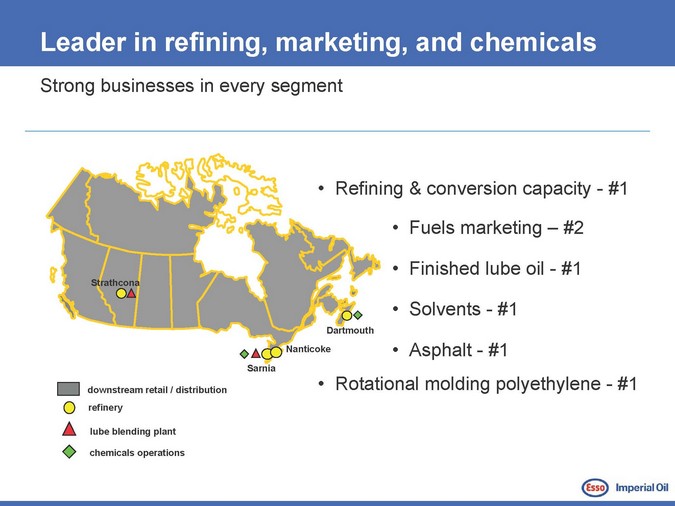

Leader in refining, marketing, and chemicals

Strong businesses in every segment

Refining & conversion capacity—#1

Fuels marketing – #2 Finished lube oil—#1 Solvents—#1 Asphalt—#1

Rotational molding polyethylene—#1

Dartmouth

Strathcona

Nanticoke

Sarnia

downstream retail / distribution refinery

lube blending plant

chemicals operations

Downstream & Chemical industry environment

Global demand steadily rising driven by developing countries; demand for refined products in North America flat to down

Global

Product growth averages about 1% per year through 2030 Diesel demand growing, gasoline demand slowing Specialty chemicals growth continuing

North America

Product demand flat to down through 2030 Improved vehicle mpg and growing biofuel mandates offsets modest increase in vehicle fleet and miles driven U.S. continues as largest import market

Downstream and Chemical strategies

A culture of continuous improvement through Self-Help drives superior results

Relentless focus on best-in-class operations

Provide valued and high quality products and services to our customers

Lead industry in efficiency and effectiveness

Capitalize on integration across Imperial and ExxonMobil operations

Disciplined and selective investments for advantaged returns

Maximize value from technology leadership

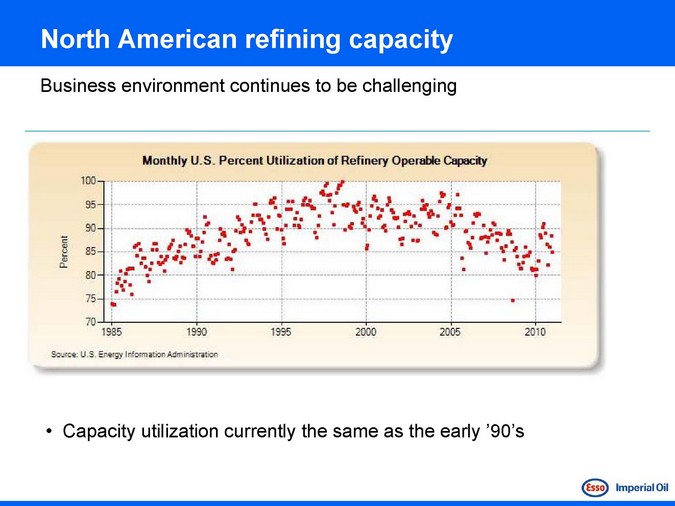

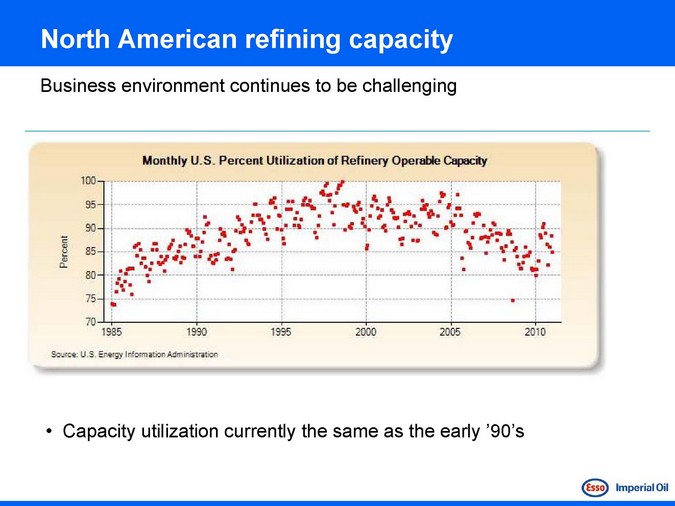

North American refining capacity

Business environment continues to be challenging

Capacity utilization currently the same as the early ‘90’s

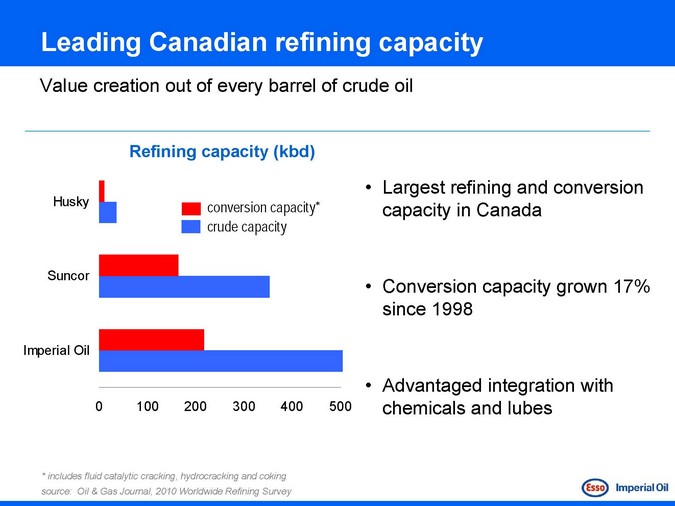

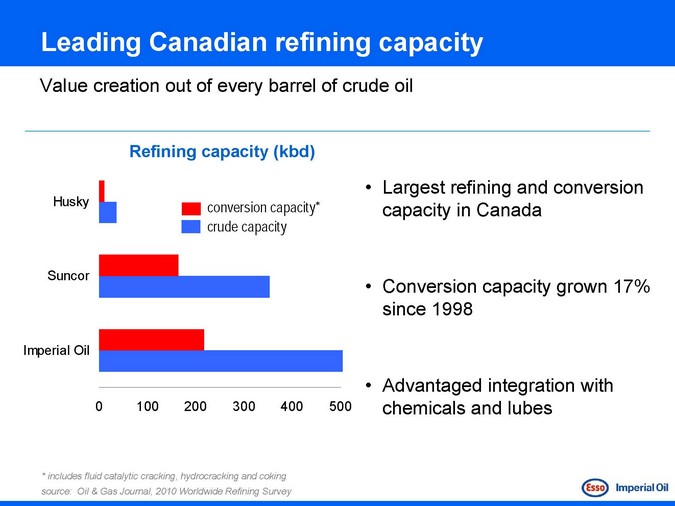

Leading Canadian refining capacity

Value creation out of every barrel of crude oil

Refining capacity (kbd)

Husky

Suncor

Imperial Oil

conversion capacity* crude capacity

0 100 200 300 400 500

Largest refining and conversion capacity in Canada

Conversion capacity grown 17% since 1998

Advantaged integration with chemicals and lubes

* includes fluid catalytic cracking, hydrocracking and coking source: Oil & Gas Journal, 2010 Worldwide Refining Survey

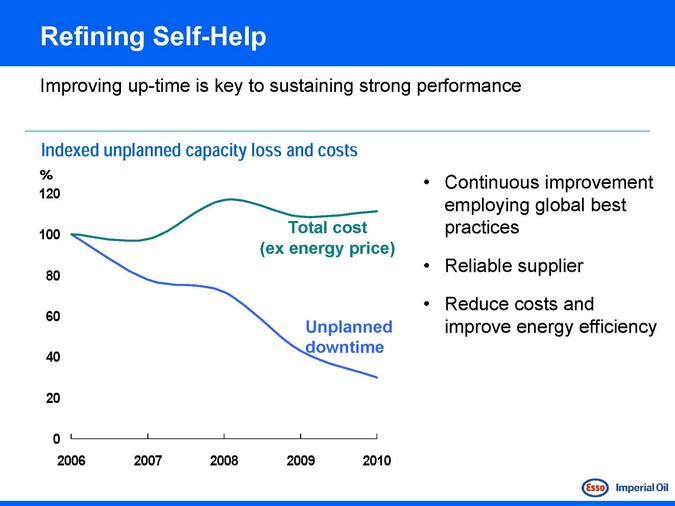

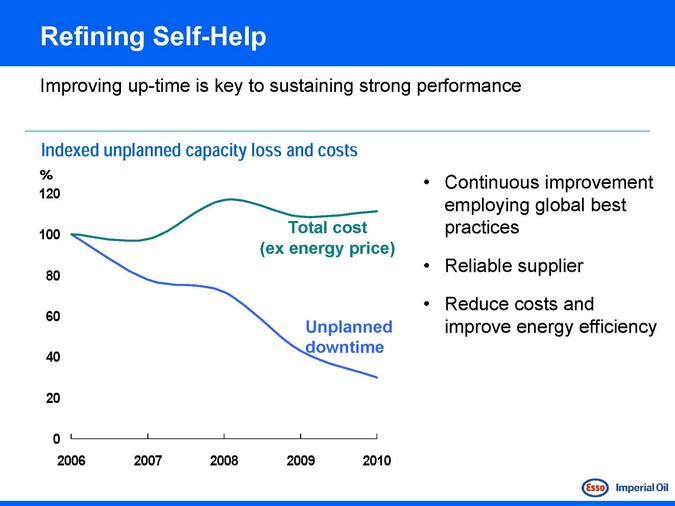

Refining Self-Help

Improving up-time is key to sustaining strong performance

Indexed unplanned capacity loss and costs

%

120 100 80 60 40 20 0

2006 2007 2008 2009 2010

Total cost (ex energy price)

Unplanned downtime

Continuous improvement employing global best practices

Reliable supplier

Reduce costs and improve energy efficiency

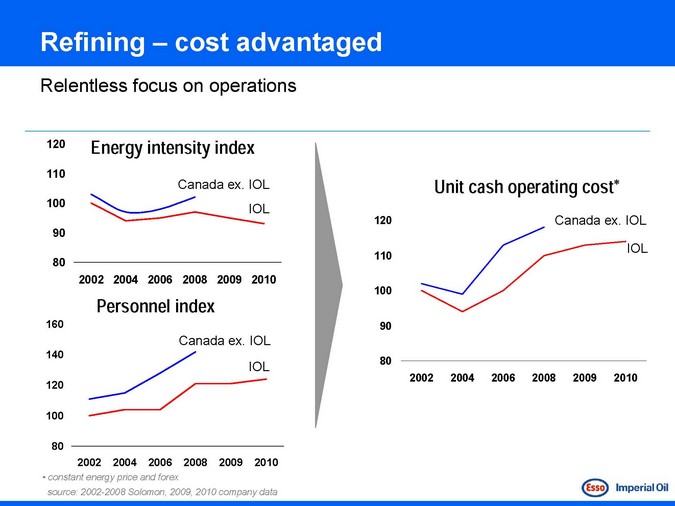

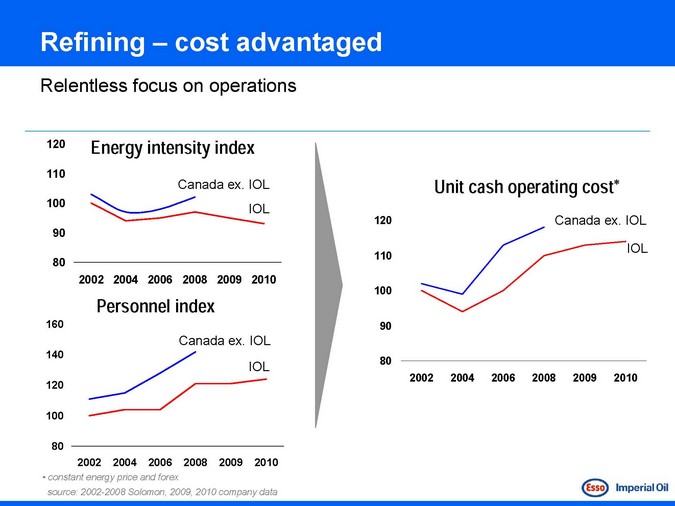

Refining – cost advantaged

Relentless focus on operations

120 110 100 90 80

Energy intensity index

Canada ex. IOL

IOL

2002 2004 2006 2008 2009 2010

Personnel index

160 140 120 100 80

Canada ex. IOL

IOL

2002 2004 2006 2008 2009 2010

• constant energy price and forex source: 2002-2008 Solomon, 2009, 2010 company data

Unit cash operating cost*

120 110 100 90 80

2002 2004 2006 2008 2009 2010

Canada ex. IOL

IOL

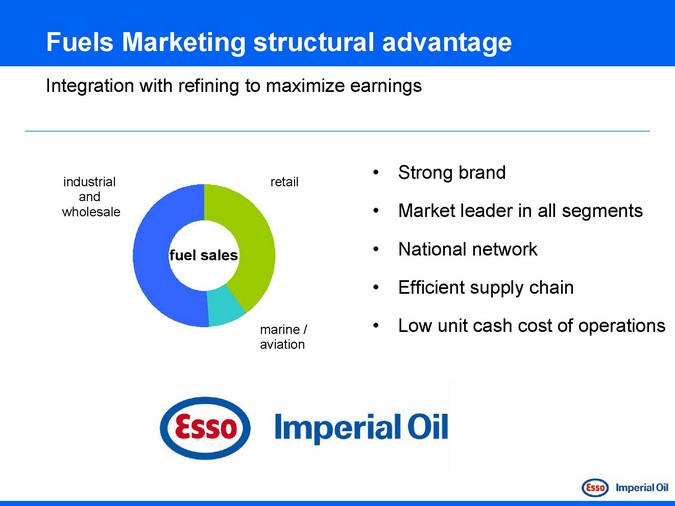

Fuels Marketing structural advantage

Integration with refining to maximize earnings

industrial and wholesale

retail

Strong brand

Market leader in all segments National network Efficient supply chain Low unit cash cost of operations

fuel sales

marine / aviation

Fuels Marketing Self-Help

Continually optimizing channels to markets

selective investment

asset restructuring

improve productivity

cost efficiency

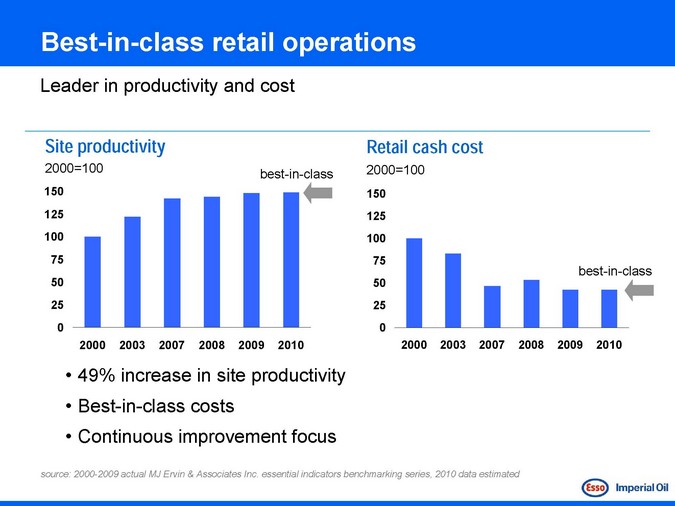

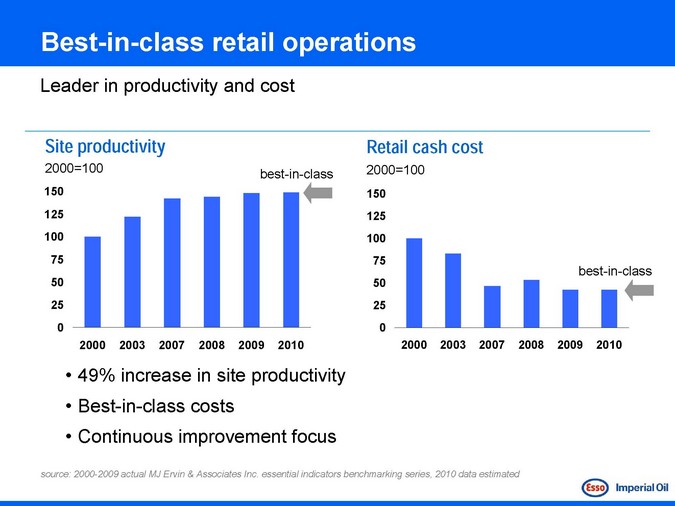

Best-in-class retail operations

Leader in productivity and cost

Site productivity

2000=100

150 125 100 75 50 25 0

2000 2003 2007 2008 2009 2010

best-in-class

Retail cash cost

2000=100

150 125 100 75 50 25 0

2000 2003 2007 2008 2009 2010

best-in-class

49% increase in site productivity Best-in-class costs Continuous improvement focus

source: 2000-2009 actual MJ Ervin & Associates Inc. essential indicators benchmarking series, 2010 data estimated

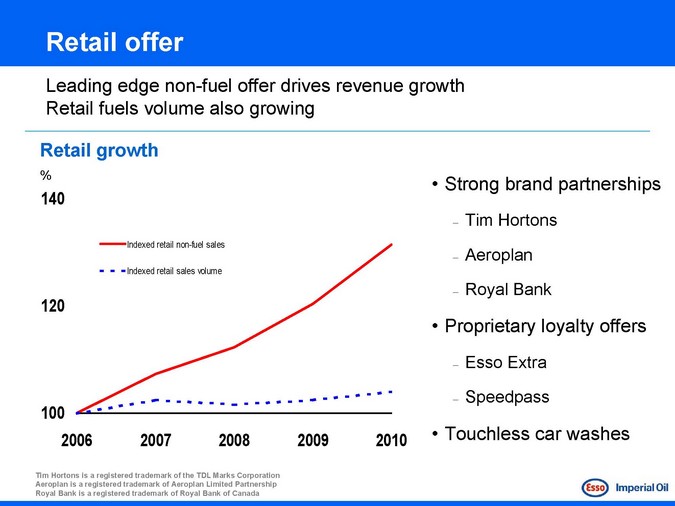

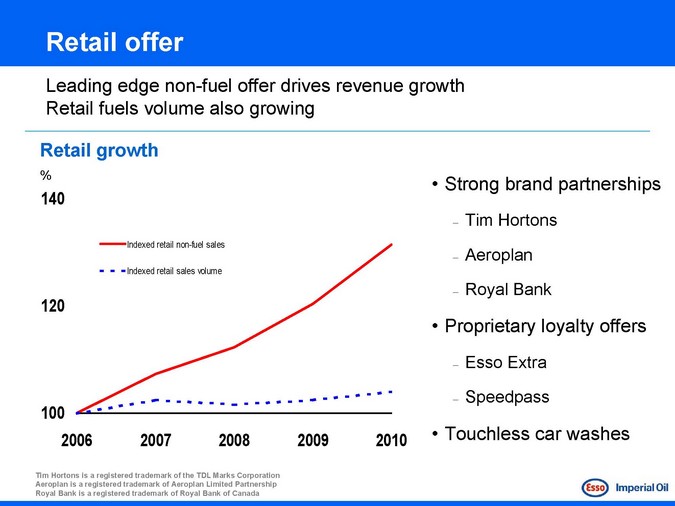

Retail offer

Leading edge non-fuel offer drives revenue growth Retail fuels volume also growing

Retail growth

%

140

Indexed retail non-fuel sales

Indexed retail sales volume

120

100

2006 2007 2008 2009 2010

Strong brand partnerships

Tim Hortons Aeroplan Royal Bank

Proprietary loyalty offers

Esso Extra

Speedpass

Touchless car washes

Tim Hortons is a registered trademark of the TDL Marks Corporation Aeroplan is a registered trademark of Aeroplan Limited Partnership Royal Bank is a registered trademark of Royal Bank of Canada

Lubricants and Specialties

Growing flagship brands in Canada

Structurally advantaged with integrated manufacturing

Optimized supply chain

Canadian distributor for Mobil Super and leading synthetic, Mobil 1

Network of technical specialists

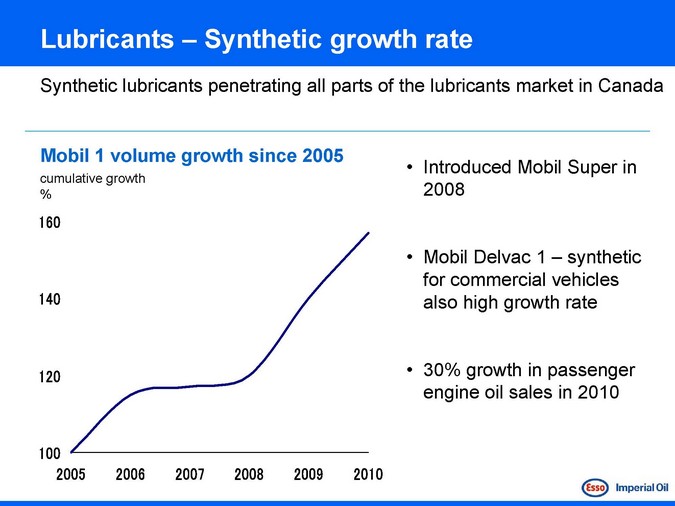

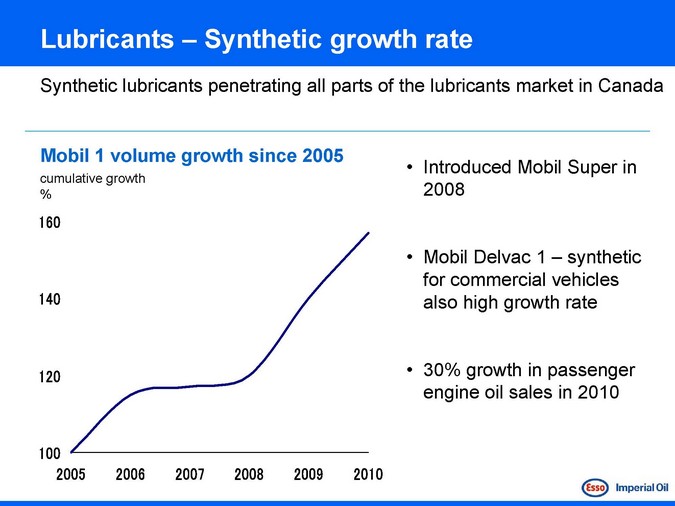

Lubricants – Synthetic growth rate

Synthetic lubricants penetrating all parts of the lubricants market in Canada

Mobil 1 volume growth since 2005

cumulative growth %

160

140

120

100 200520062007200820092010

Introduced Mobil Super in 2008

Mobil Delvac 1 – synthetic for commercial vehicles also high growth rate

30% growth in passenger engine oil sales in 2010

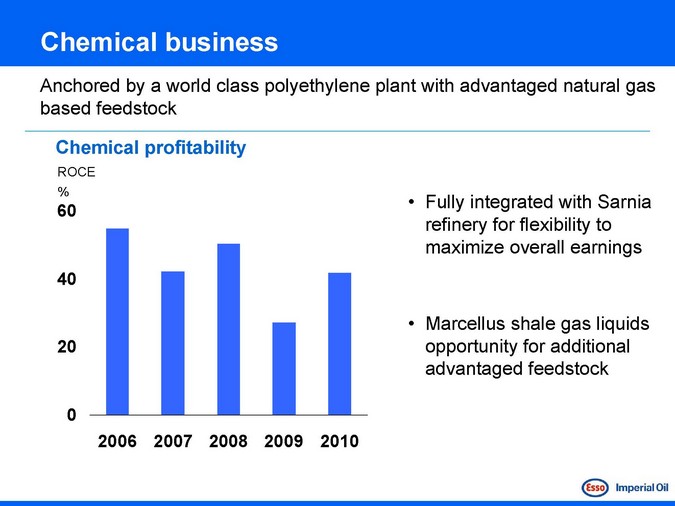

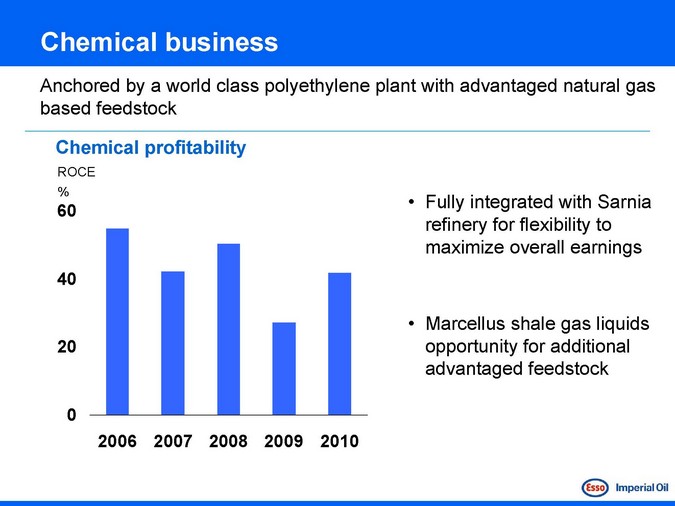

Chemical business

Anchored by a world class polyethylene plant with advantaged natural gas based feedstock

Chemical profitability

ROCE %

60

40 20 0

2006 2007 2008 2009 2010

Fully integrated with Sarnia refinery for flexibility to maximize overall earnings

Marcellus shale gas liquids opportunity for additional advantaged feedstock

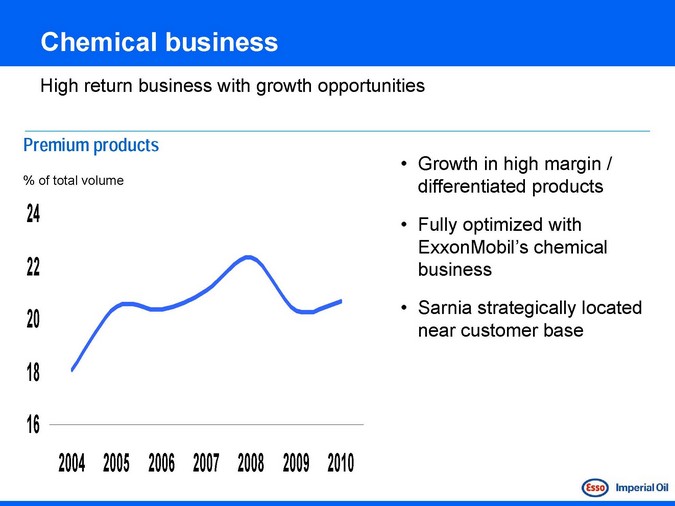

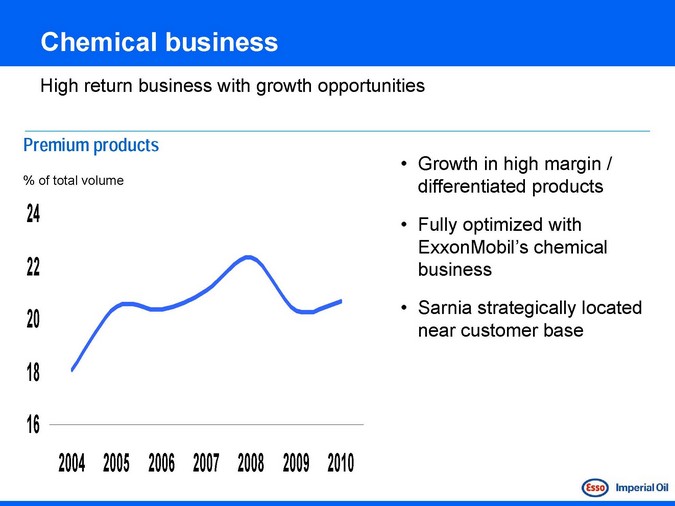

Chemical business

High return business with growth opportunities

Premium products

% of total volume

24

22 20

18 16

2004 2005 2006 2007 2008 2009 2010

Growth in high margin / differentiated products

Fully optimized with ExxonMobil’s chemical business

Sarnia strategically located near customer base

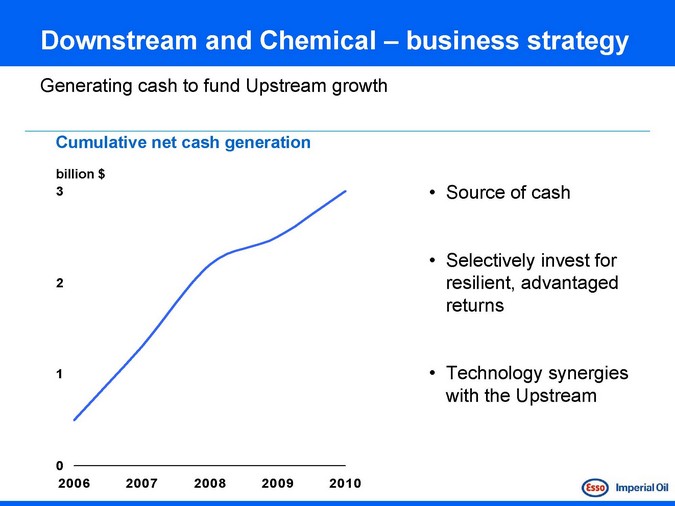

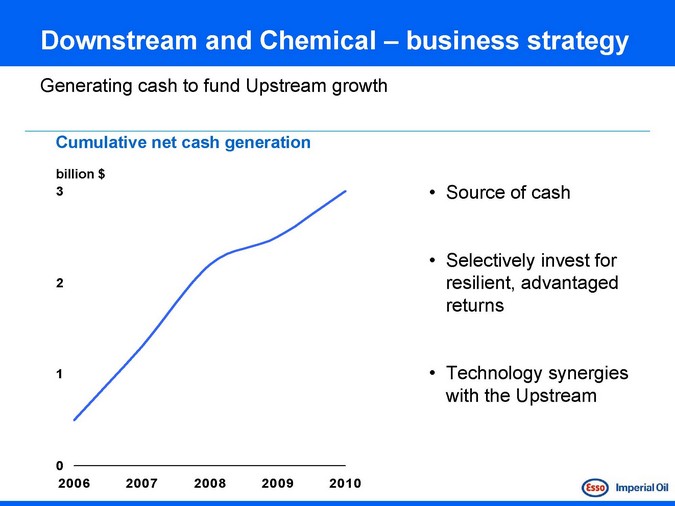

Downstream and Chemical – business strategy

Generating cash to fund Upstream growth

Cumulative net cash generation

billion $ 3

0

2006 2007 2008 2009 2010

Source of cash

Selectively invest for resilient, advantaged returns

Technology synergies with the Upstream

Imperial Oil – 2011 Investor Meeting

Finance—Flexibility

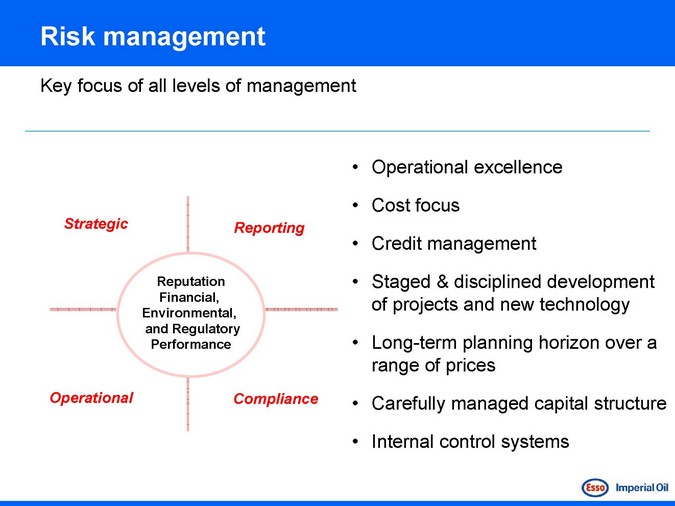

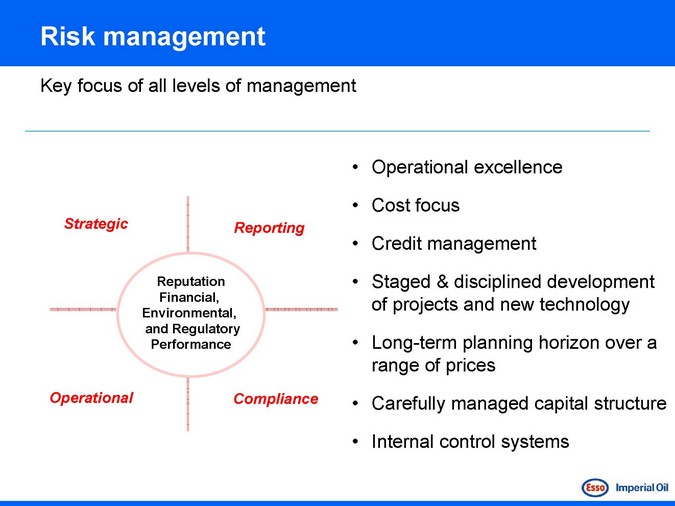

Risk management

Key focus of all levels of management

Strategic

Reporting

Operational

Reputation

Financial, Environmental, and Regulatory Performance

Compliance

Operational excellence Cost focus Credit management

Staged & disciplined development of projects and new technology

Long-term planning horizon over a range of prices

Carefully managed capital structure

Internal control systems

Consistent financial approach

Consistent management approach focused on managing risks in a volatile commodity price environment

Disciplined identification and design of investment opportunities

Cash directed to fund attractive projects Excellent project management and control No special purpose entities No derivatives No hedging Strong internal control systems—a competitive advantage

Governance and ethics

7 | | member Board of Directors: five independent directors, 1 from ExxonMobil and 1 employee director |

Ethics policy and business practices apply to all employees and directors

Full disclosure, straightforward and transparent reporting

Program depth and follow-through—a distinguishing feature

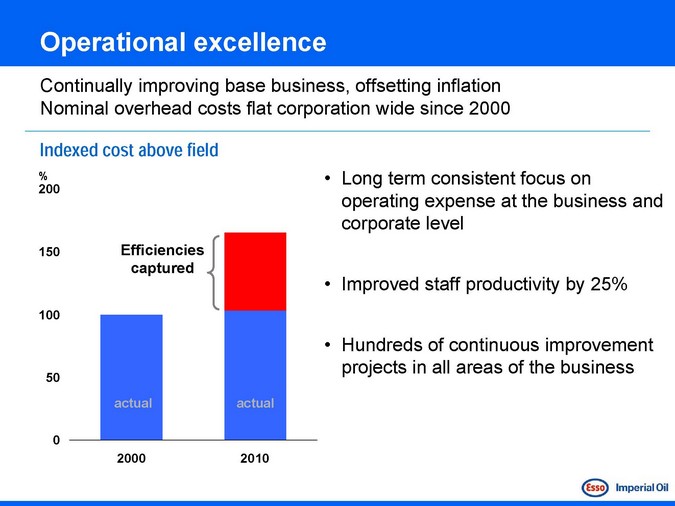

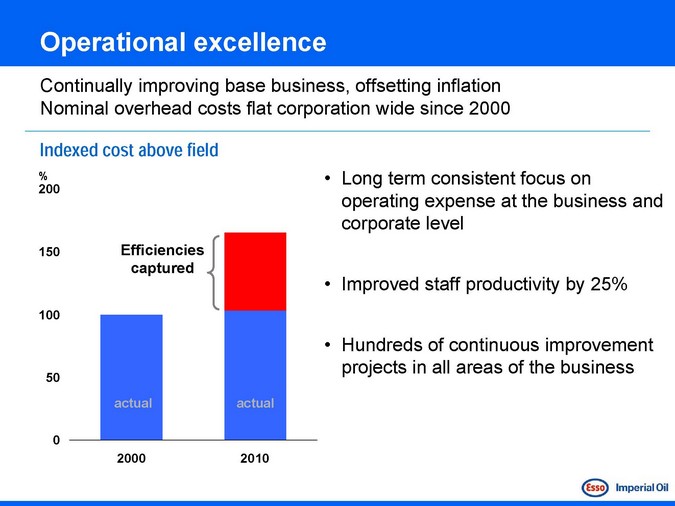

Continually improving base business, offsetting inflation Nominal overhead costs flat corporation wide since 2000

Indexed cost above field

% 200

150 100 50 0

Efficiencies captured

actual actual

2000 2010

Long term consistent focus on operating expense at the business and corporate level

Improved staff productivity by 25%

Hundreds of continuous improvement projects in all areas of the business

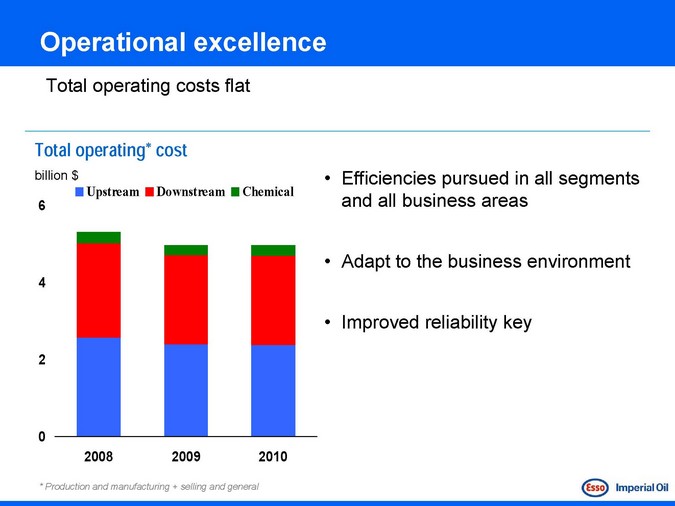

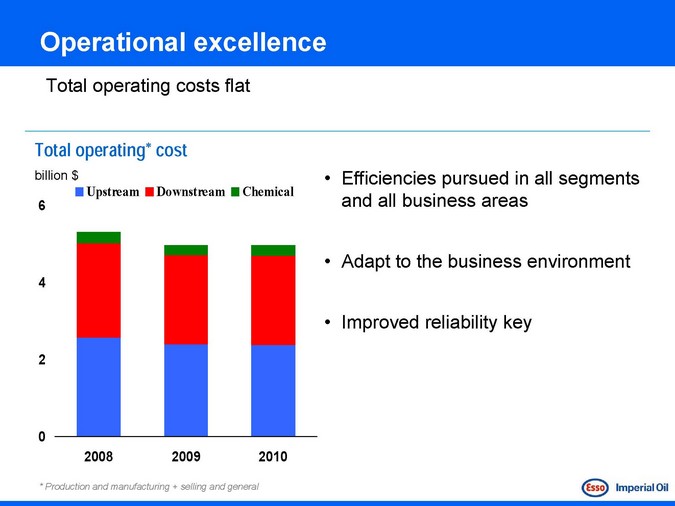

Operational excellence

Total operating costs flat

Total operating* cost

billion $

Upstream

Downst ream

Chemical

0

2008 2009 2010

* | | Production and manufacturing + selling and general |

Efficiencies pursued in all segments and all business areas

Adapt to the business environment

Improved reliability key

Cash utilization

The first and best use of cash is to fund high quality investment opportunities

billion $ 5

Dividends

Capital and Exploration

Share Buy-backs

2006 2 007 2 008 2009 2 010

Priorities

Dividends

Fund all quality opportunities

Develop advantaged projects

Share re-purchases

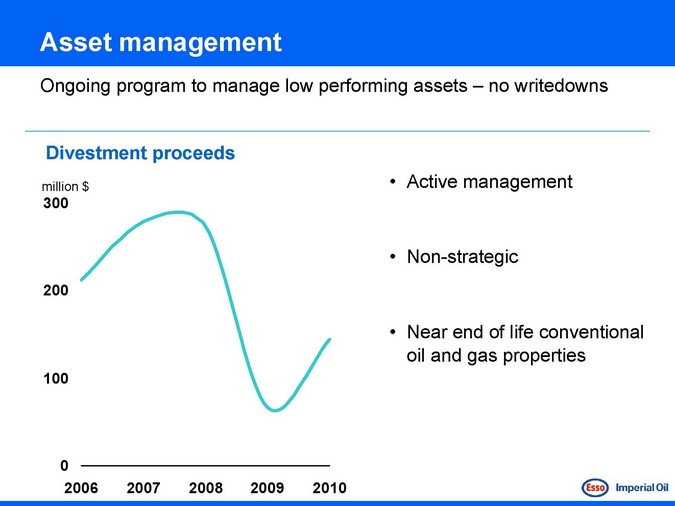

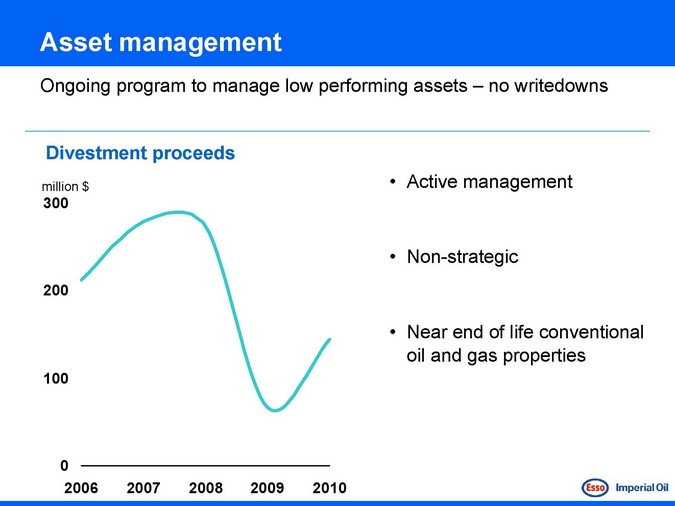

Asset management

Ongoing program to manage low performing assets – no writedowns

Divestment proceeds

million $

300

200

100

0

2006 2007 2008 2009 2010

Active management

Non-strategic

Near end of life conventional oil and gas properties

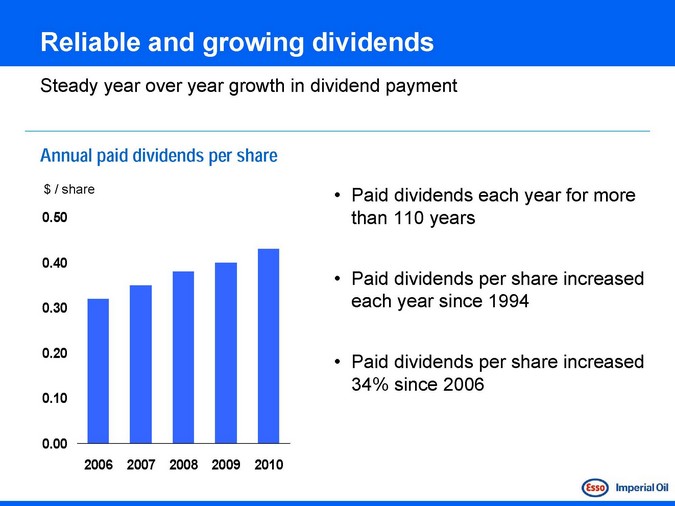

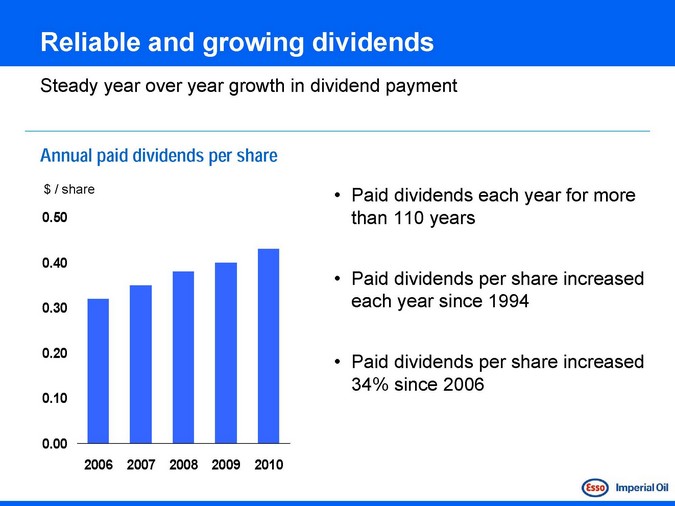

Reliable and growing dividends

Steady year over year growth in dividend payment

Annual paid dividends per share

$ / share

0.50 0.40 0.30 0.20 0.10 0.00

2006 2007 2008 2009 2010

Paid dividends each year for more than 110 years

Paid dividends per share increased each year since 1994

Paid dividends per share increased 34% since 2006

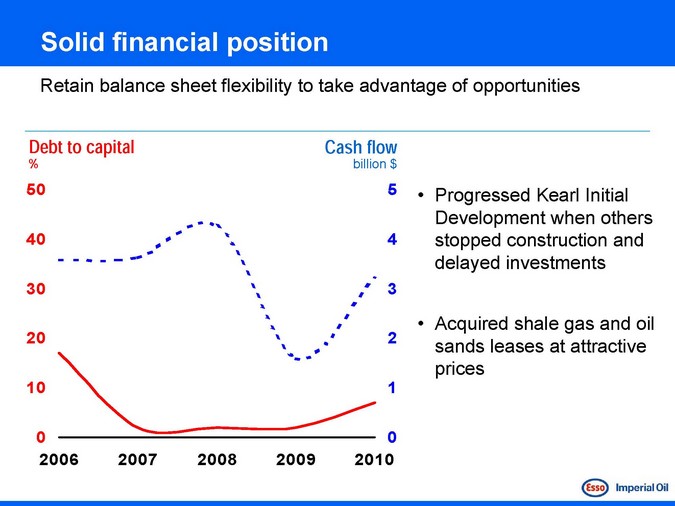

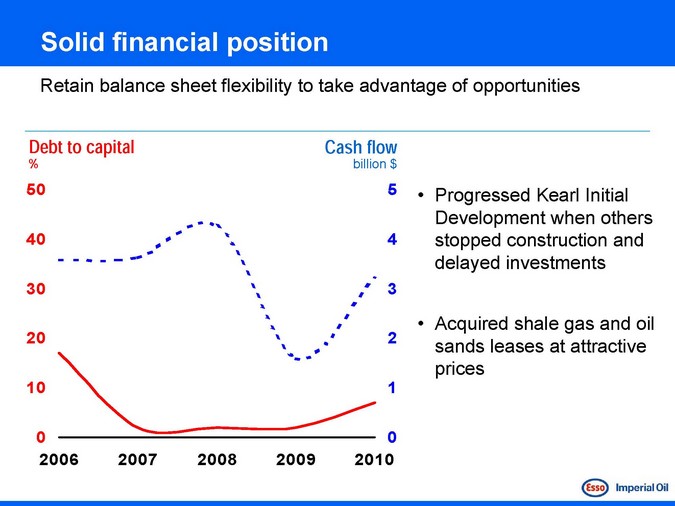

Solid financial position

Retain balance sheet flexibility to take advantage of opportunities

Debt to capital

%

50 40 30 20 10 0

2006 2007 2008 2009 2010

Cash flow

billion $

Progressed Kearl Initial Development when others stopped construction and delayed investments

Acquired shale gas and oil sands leases at attractive prices

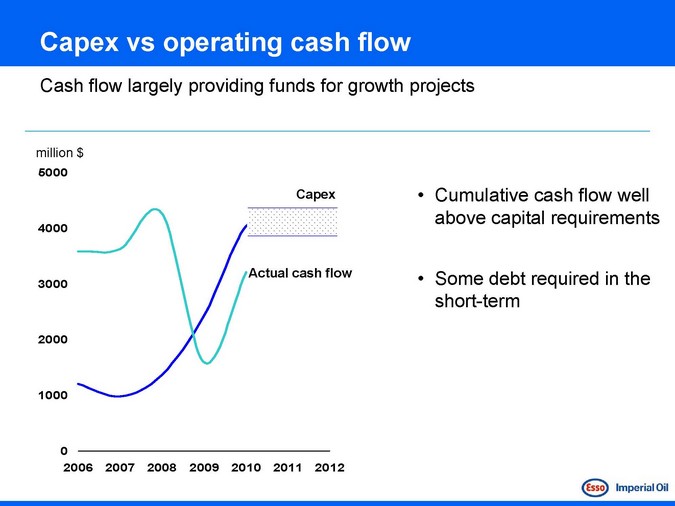

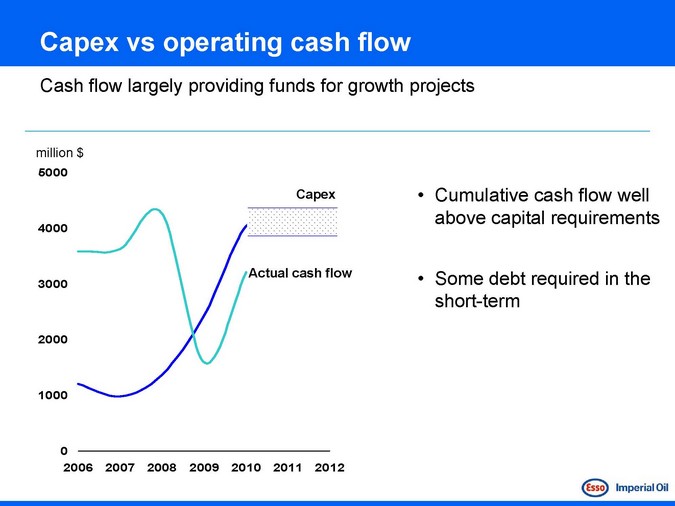

Capex vs operating cash flow

Cash flow largely providing funds for growth projects

million $

5000

4000 3000 2000 1000

0

2006 2007 2008 2009 2010 2011 2012

Capex

Actual cash flow

Cumulative cash flow well above capital requirements

Some debt required in the short-term

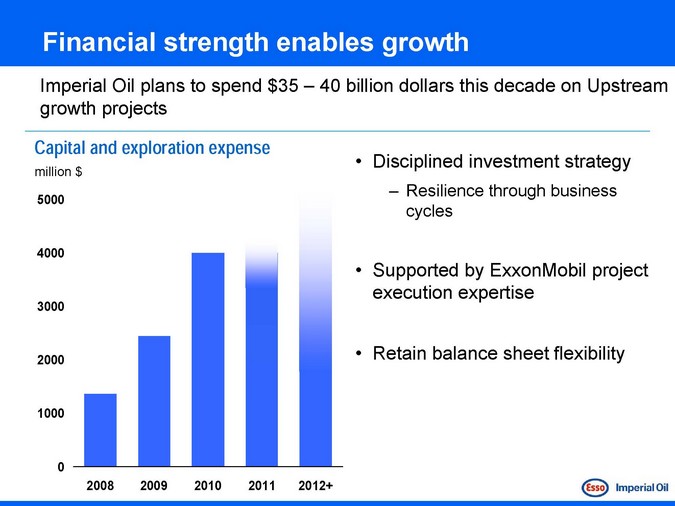

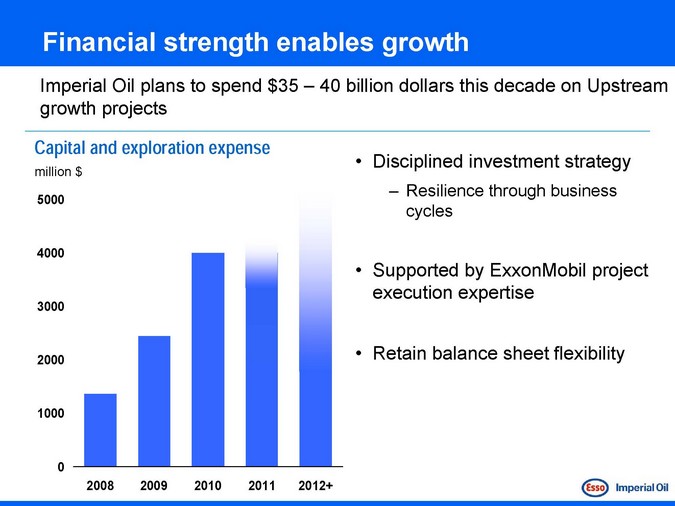

Financial strength enables growth

Imperial Oil plans to spend $35 – 40 billion dollars this decade on Upstream growth projects

Capital and exploration expense

million $

5000 4000 3000 2000 1000 0

2008 2009 2010 2011 2012+

Disciplined investment strategy

Resilience through business cycles

Supported by ExxonMobil project execution expertise

Retain balance sheet flexibility

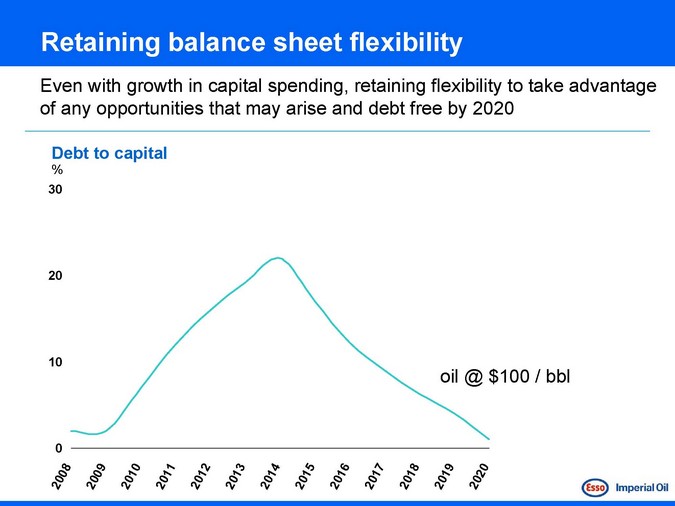

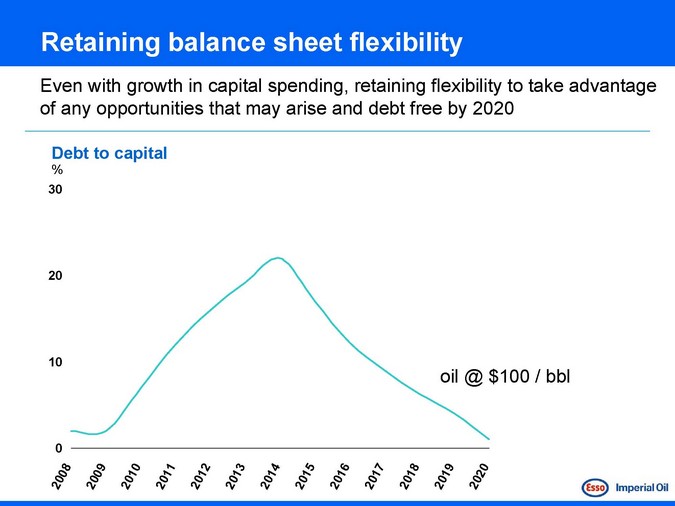

Retaining balance sheet flexibility

Even with growth in capital spending, retaining flexibility to take advantage of any opportunities that may arise and debt free by 2020

Debt to capital

%

30

20

10

0

0 8 0 9 1 0 1 1 1 2 13 1 4 1 5 1 6 1 7 18 1 9 2 0 2 0 20 2 0 2 0 20 2 0 2 0 20 2 0 2 0 2 0 2 0 20

oil @ $100 / bbl

2011 Investor Meeting

Summary Remarks

Imperial Oil – long term growth

Relentless focus on maximizing long-term shareholder value Industry leadership through the business cycle

Canada’s leading portfolio of energy businesses, assets and opportunities

Continuous improvement of base business

Commitment to technology leadership Superior financial strength and flexibility Disciplined business risk management Responsible development and operations

For more information www.imperialoil. ca.

For more detailed investor information, or to receive annual and interim reports, please contact:

Mark L. Stumpf

Manager, Investor Relations/Planning & Analysis Imperial Oil Limited 237 Fourth Avenue SW

Calgary, Alberta T2P 3M9 Email: mark.l.stumpf@esso. ca Phone: (403) 237-4537

e GHG intensive power generation to renewable forms later in the century

e GHG intensive power generation to renewable forms later in the century