Exhibit 99.1

[Graphic Appears Here]

INNOVATION, GROWTH, INTEGRITY

InvestorDay

March, 2012

[Graphic Appears Here]

9:30 am Welcome John Charlton

Manager, investor relations

Canadian Energy Leadership

Bruce March

Chairman, president and chief executive officer

Doubling Production by 2020

Glenn Scott

Senior vice-president, resources

Break

Technology Leadership

Bruce March

NA Downstream & Chemicals

Bruce March

Financial Performance

Paul Masschelin

Senior vice-president, finance and administration, and treasurer

The Competitive Advantage

Bruce March

Noon

Lunch

Cautionary statement

This presentation contains forward-looking information on future production, project start-ups and future capital spending. Actual results could differ materially due to changes in project schedules, operating performance, demand for oil and gas, commercial negotiations or other technical and economic factors.

Oil-equivalent barrels (OEB) may be misleading, particularly if used in isolation. An OEB conversion ratio of 6,000 cubic feet to one barrel is based on an energy-equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the well head.

Proved reserves are calculated under United States Securities and Exchange Commission (SEC) requirements, as shown in Form 10-K dated December 31, 2011.

Pursuant to National Instrument 51-101 disclosure guidelines, and using Canadian Oil and Gas Evaluation Handbook definitions, Imperial’s non-proved resources are classified as a “contingent resource.” Such resources are a best estimate of the company’s net interest after royalties at year-end 2011, as determined by Imperial’s internal qualified reserves evaluator. Contingent resources are considered to be potentially recoverable from known accumulations, using established technology or technology under development, but are currently not considered to be commercially recoverable due to one or more contingencies. There is no certainty that it will be economically viable or technically feasible to produce any portion of the resource.

Financials in Canadian dollars.

3

Esso imperial oil

Canadian energy leadersjhip

bruce March

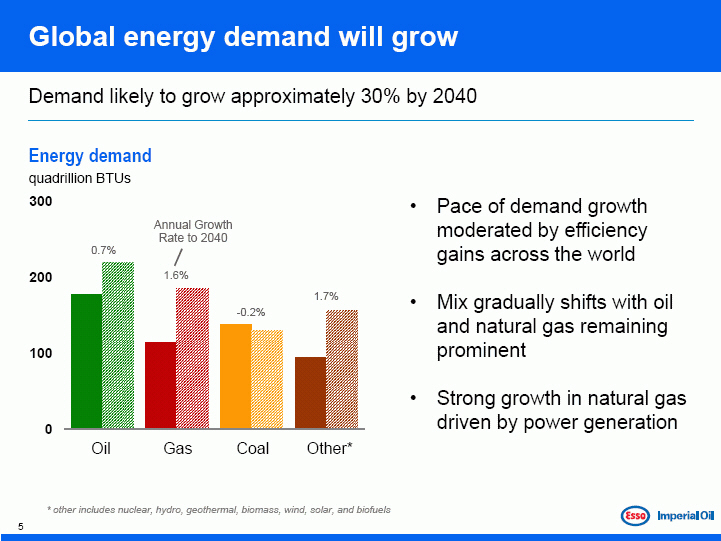

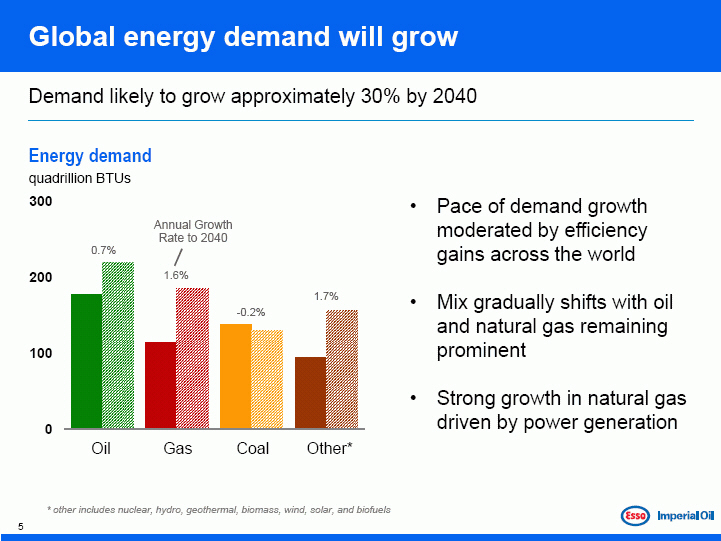

Global energy demand will grow

Demand likely to grow approximately 30% by 2040

Energy demand

[Graphic Appears Here]

* other includes nuclear, hydro, geothermal, biomass, wind, solar, and biofuels

• Pace of demand growth moderated by efficiency gains across the world

• Mix gradually shifts with oil and natural gas remaining prominent

• Strong growth in natural gas driven by power generation

[Graphic Appears Here]

5

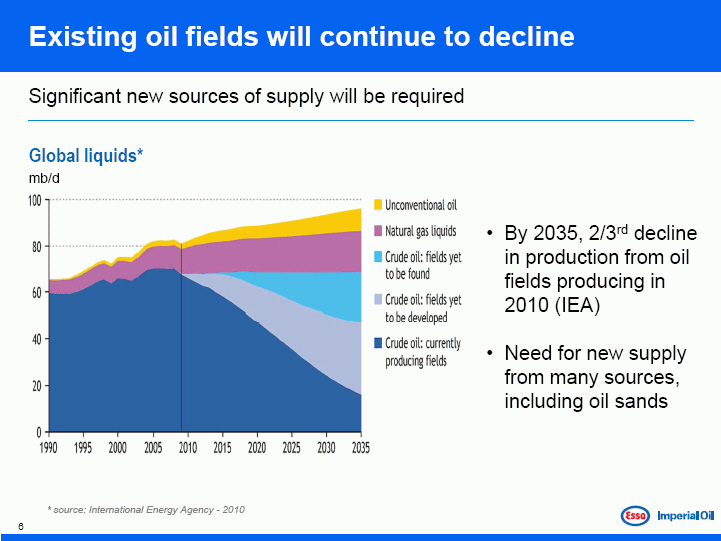

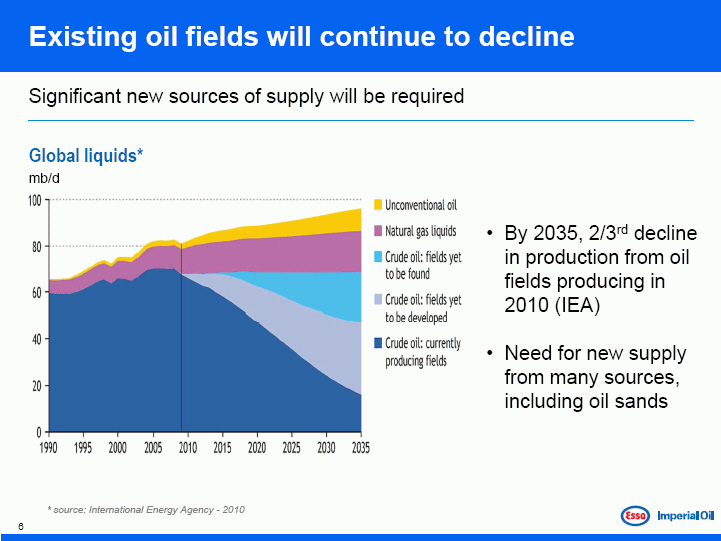

Existing oil fields will continue to decline

Significant new sources of supply will be required

[Graphic Appears Here]

* source: International Energy Agency—2010

[Graphic Appears Here]

• By 2035, 2/3rd decline in production from oil fields producing in 2010 (IEA)

• Need for new supply from many sources, including oil sands

6

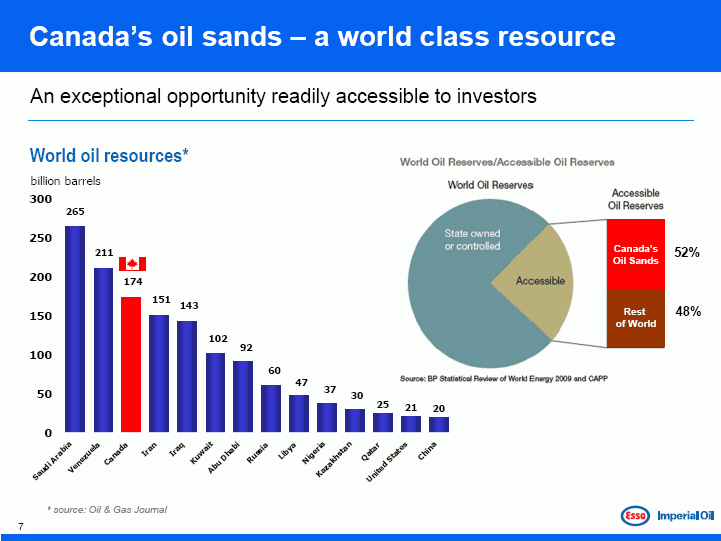

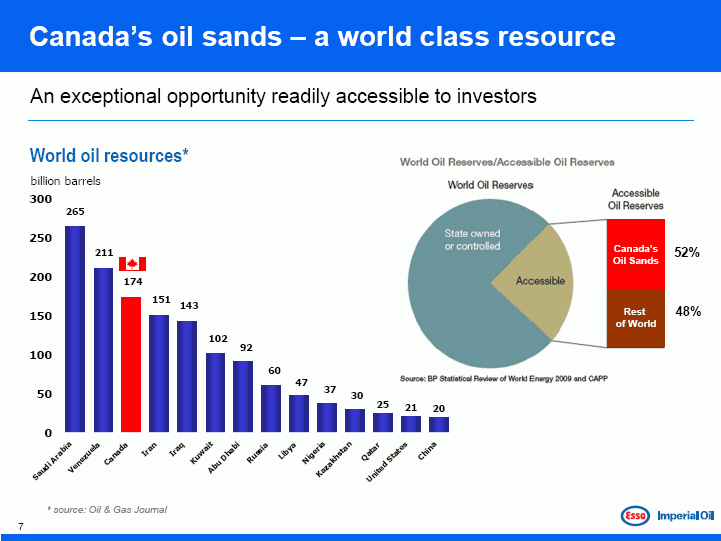

Canada’s oil sands – a world class resource

An exceptional opportunity readily accessible to investors

[Graphic Appears Here]

* source: Oil & Gas Journal

7

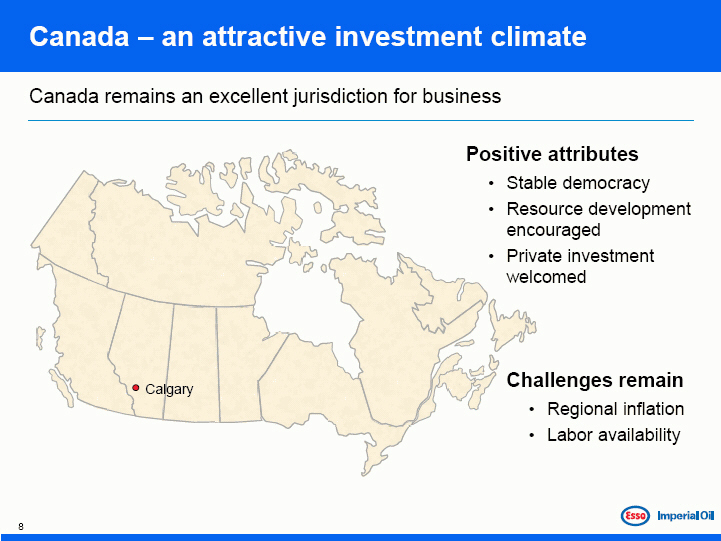

Canada – an attractive investment climate

Canada remains an excellent jurisdiction for business

Positive attributes

• Stable democracy

• Resource development encouraged

• Private investment welcomed

Challenges remain

• Regional inflation

• Labor availability

8

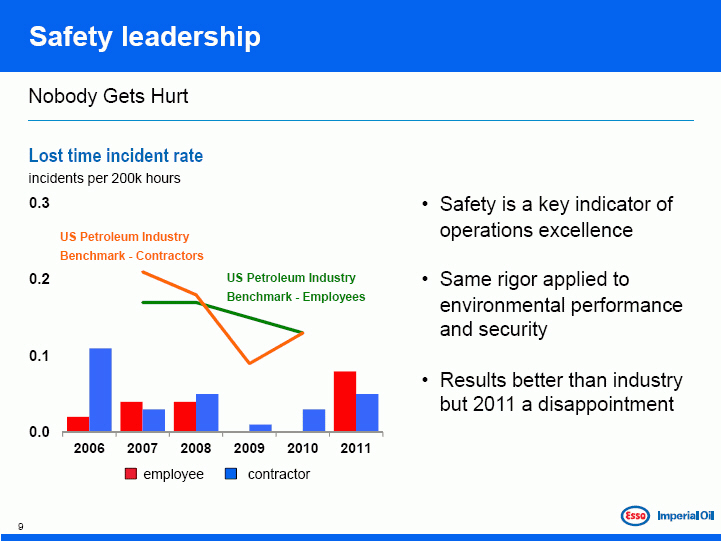

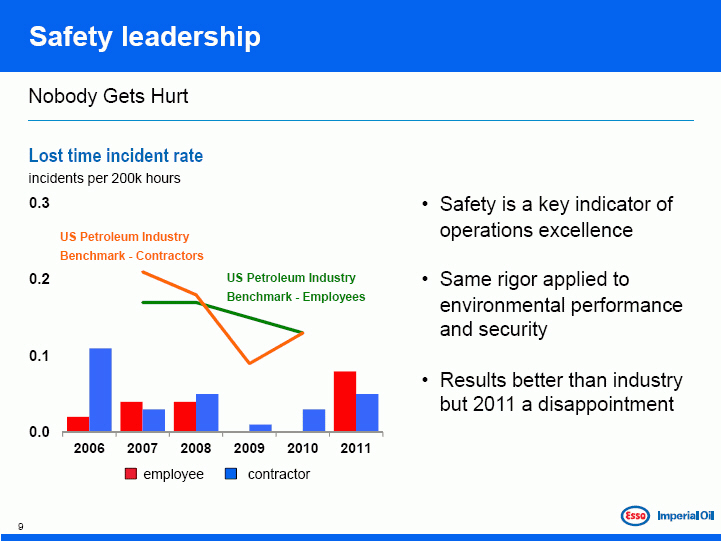

Safety leadership

Nobody Gets Hurt

Lost time incident rate

incidents per 200k hours

• Safety is a key indicator of operations excellence

• Same rigor applied to environmental performance and security

• Results better than industry but 2011 a disappointment

9

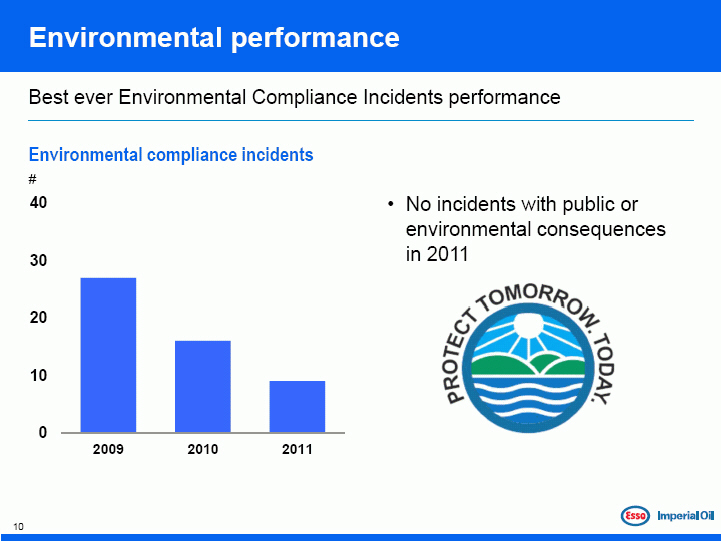

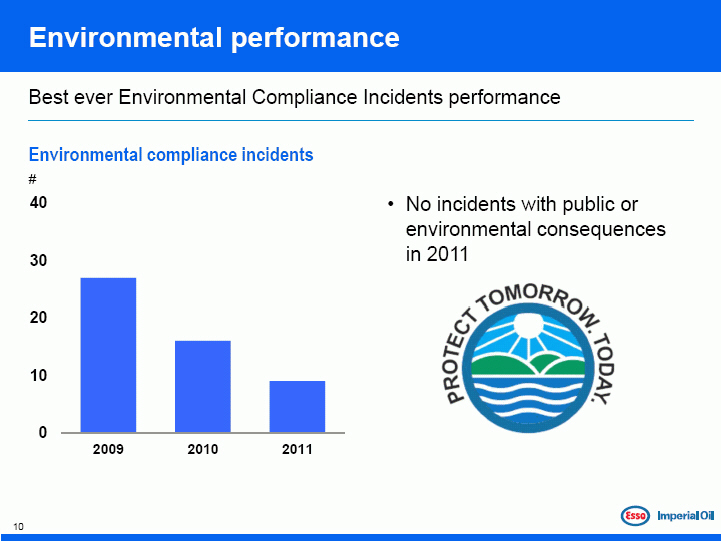

Environmental performance

Best ever Environmental Compliance Incidents performance

Environmental compliance incidents

#

• No incidents with public or environmental consequences in 2011

10

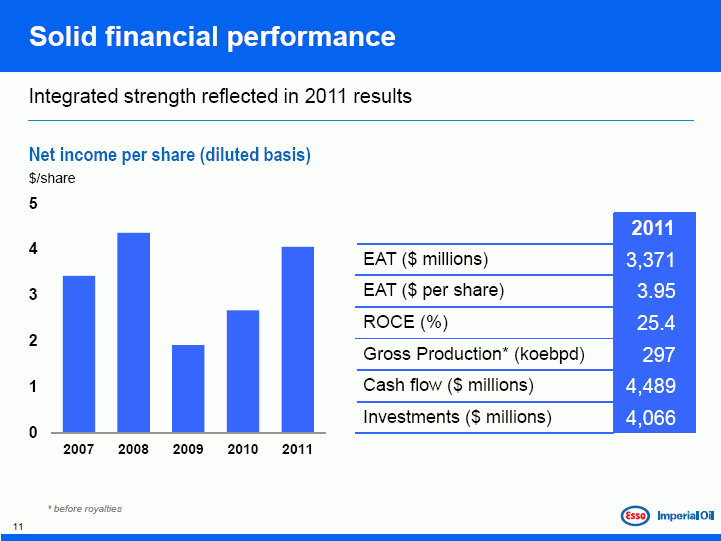

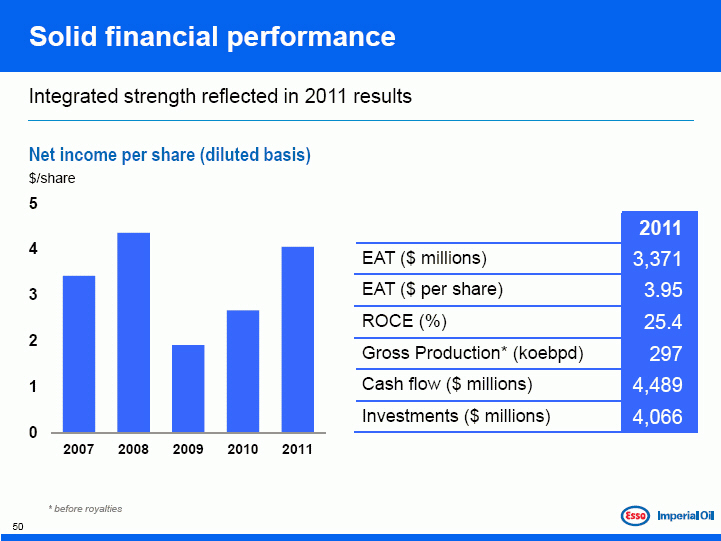

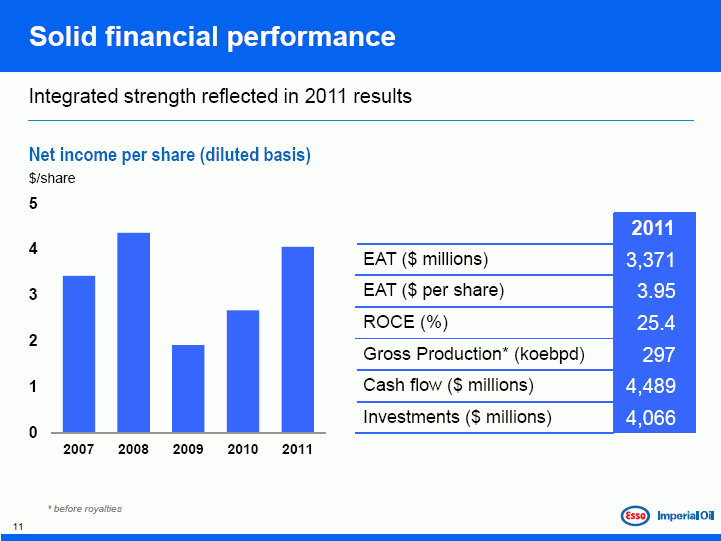

Solid financial performance

Integrated strength reflected in 2011 results

Net income per share (diluted basis)

2011

EAT ($ millions) 3,371

EAT ($ per share) 3.95

ROCE (%) 25.4

Gross Production* (koebpd) 297

Cash flow ($ millions) 4,489

Investments ($ millions) 4,066

* before royalties

11

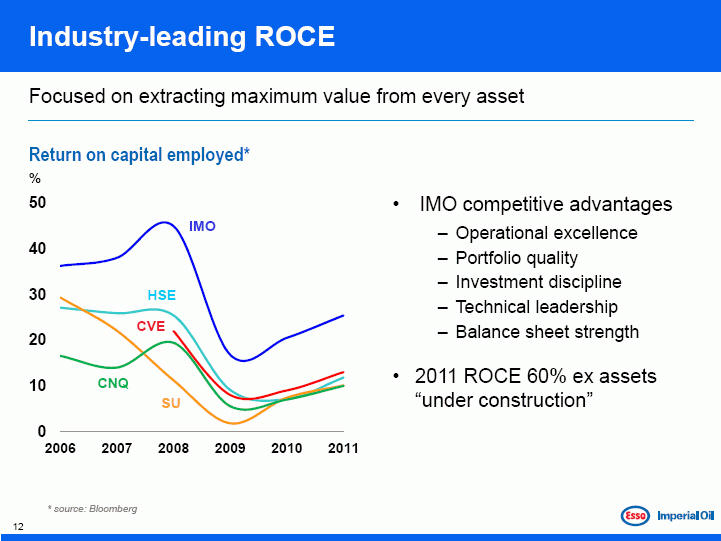

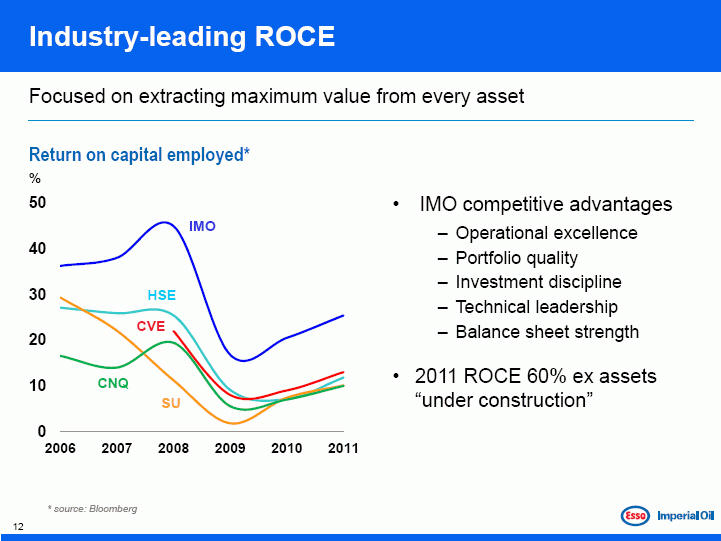

Industry-leading ROCE

Focused on extracting maximum value from every asset

[Graphic Appears Here]

• IMO competitive advantages

3 Operational excellence

3 Portfolio quality

3 Investment discipline

– Technical leadership

– Balance sheet strength

• 2011 ROCE 60% ex assets “under construction”

* source: Bloomberg

12

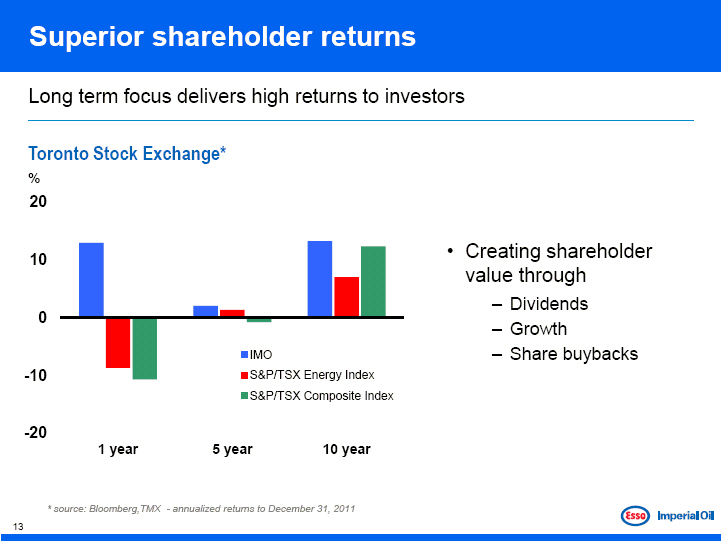

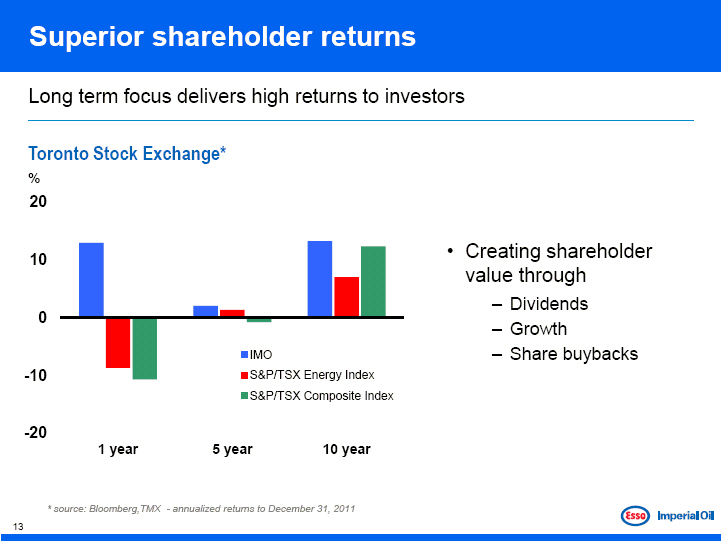

Superior shareholder returns

Long term focus delivers high returns to investors

[Graphic Appears Here]

• Creating shareholder value through

3 Dividends

– Growth

– Share buybacks

* source: Bloomberg,TMX —annualized returns to December 31, 2011

13

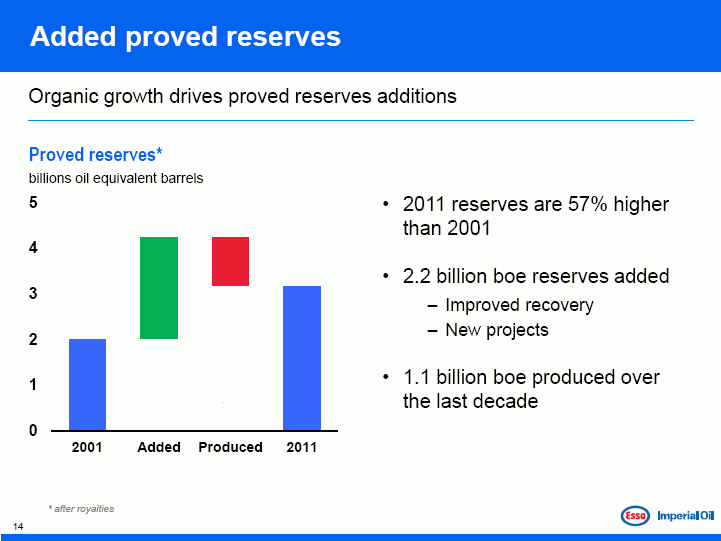

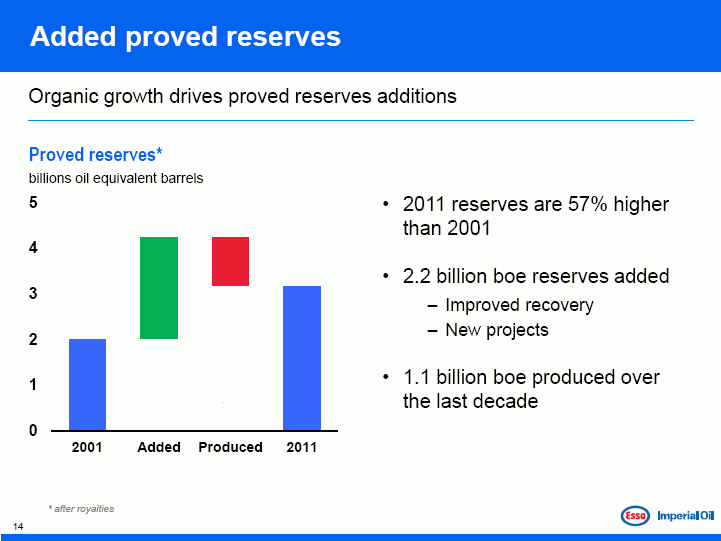

Added proved reserves

Organic growth drives proved reserves additions

[Graphic Appears Here]

• 2011 reserves are 57% higher than 2001

• 2.2 billion boe reserves added

3 Improved recovery

3 New projects

• 1.1 billion boe produced over the last decade

* after royalties

14

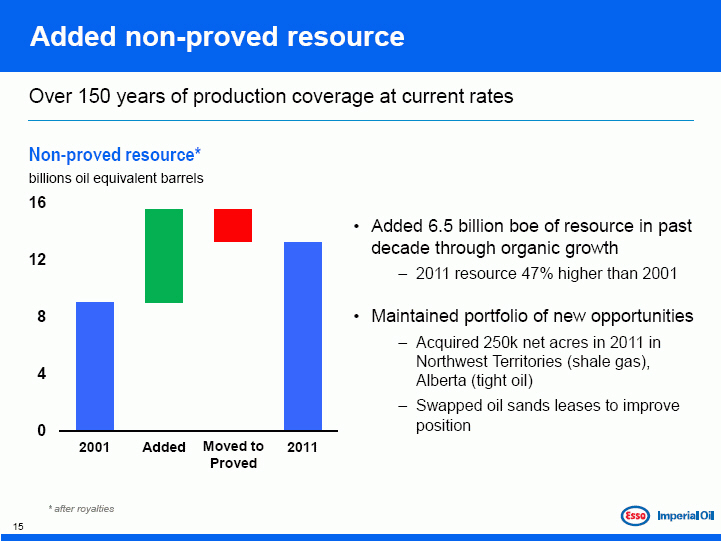

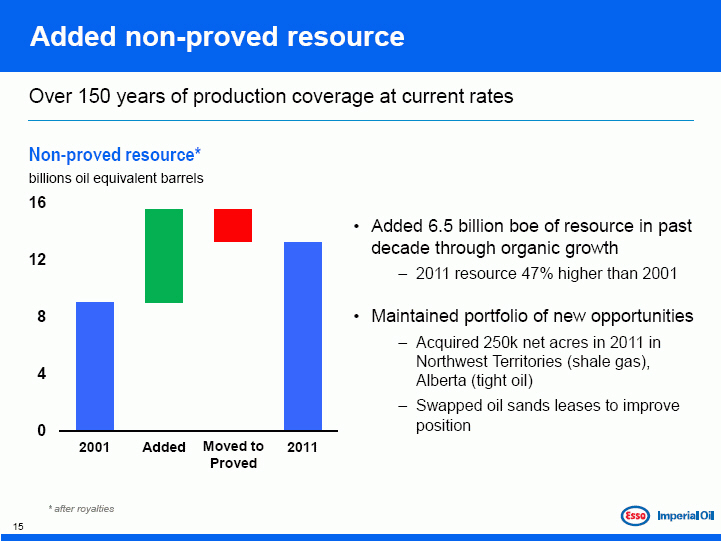

Added non-proved

Over 150 years of production coverage at current rates

[Graphic Appears Here]

• Added 6.5 billion boe of resource in past decade through organic growth

– 2011 resource 47% higher than 2001

• Maintained portfolio of new opportunities

– Acquired 250k net acres in 2011 in Northwest Territories (shale gas), Alberta (tight oil)

– Swapped oil sands leases to improve position

* after royalties

15

Unique competitive advantage – ExxonMobil

Only publicly traded Canadian company with access to leading global expertise

[Graphic Appears Here]

• Industry leading technology

• Project management expertise

• Best practices transfer

• Training and development

• World scale operations

• Strategic alignment

3 New upstream opportunity capture with ExxonMobil

16

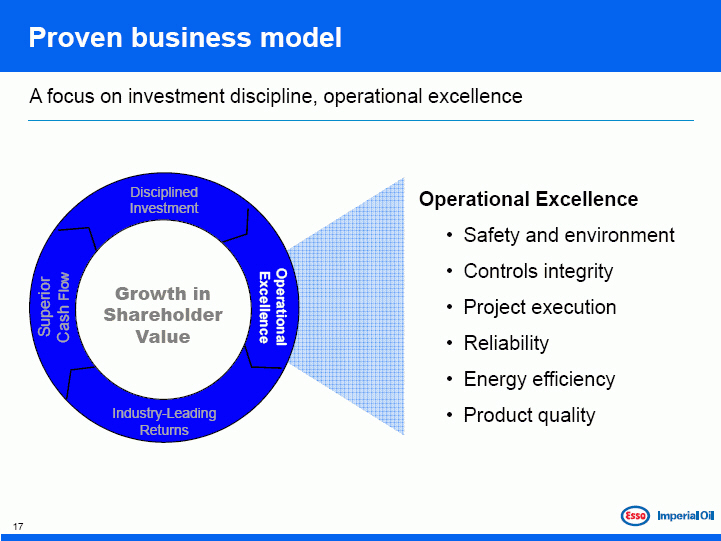

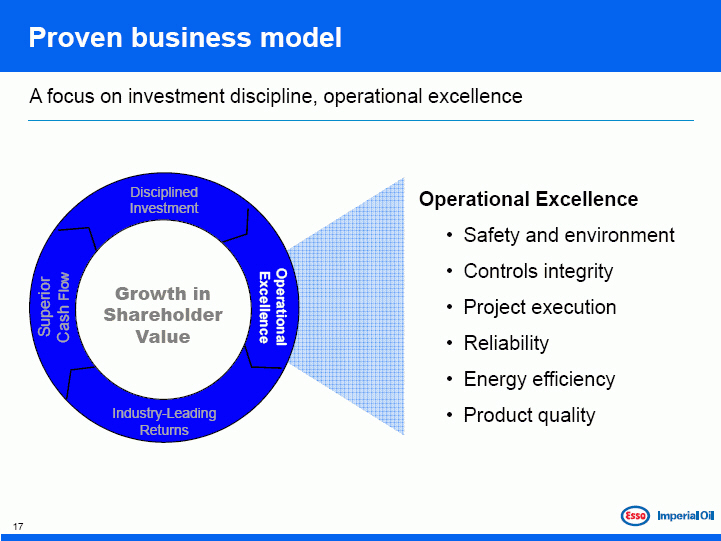

Proven business model

A focus on investment discipline, operational excellence

[Graphic Appears Here]

Operational Excellence

• Safety and environment

• Controls integrity

• Project execution

• Reliability

• Energy efficiency

• Product quality

17

[Graphic Appears Here]

Doubling Upstream Production by 2020

Glenn Scott

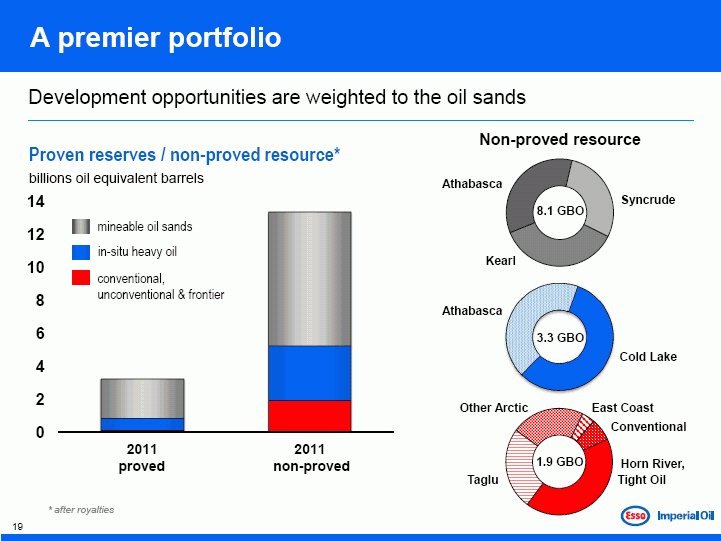

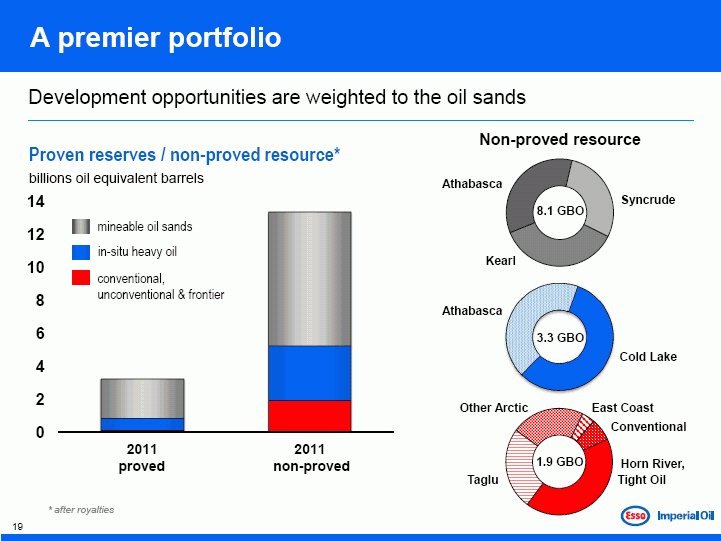

A premier portfolio

Development opportunities are weighted to the oil sands

[Graphic Appears Here]

* after royalties

19

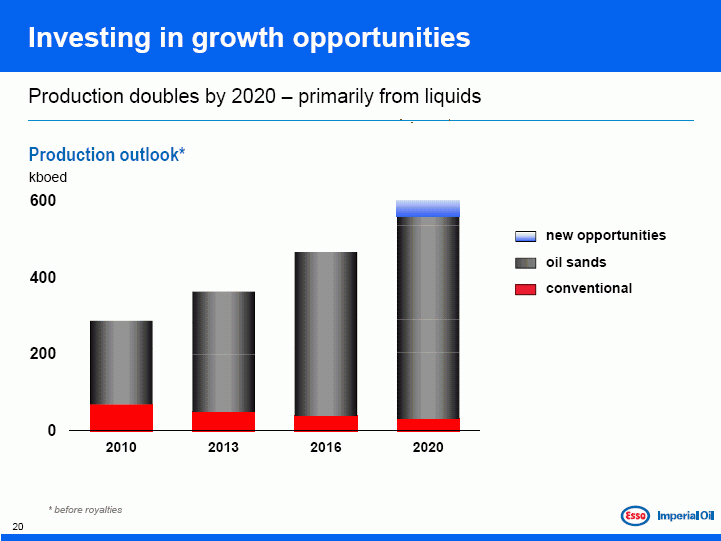

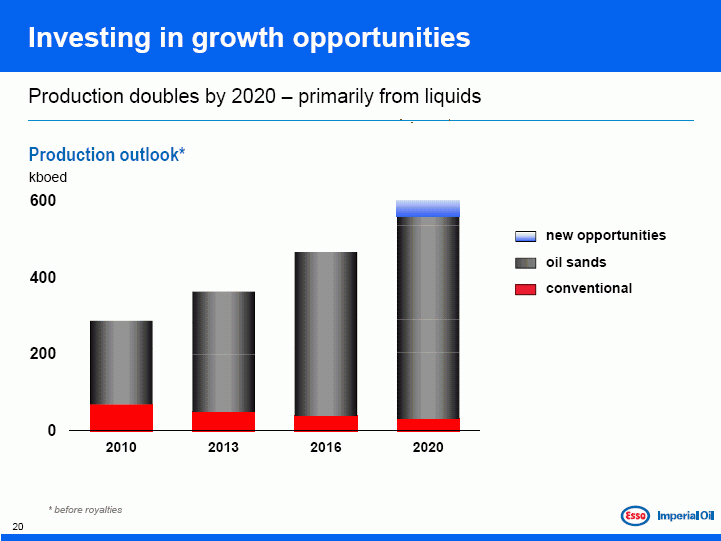

Investing in growth opportunities

Production doubles by 2020 – primarily from liquids

[Graphic Appears Here]

* before royalties

20

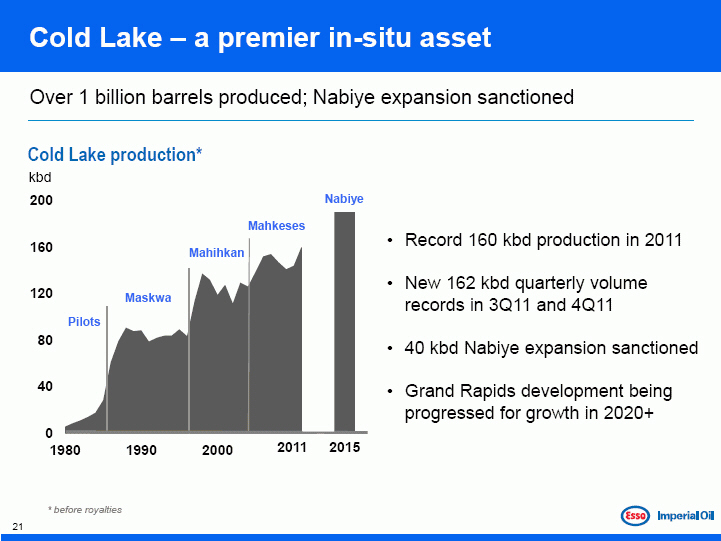

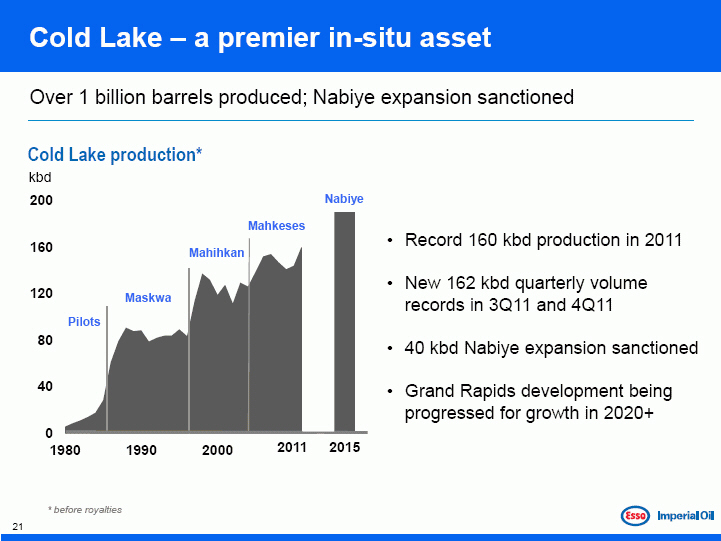

Cold Lake – a premier in-situ asset

Over 1 billion barrels produced; Nabiye expansion sanctioned

[Graphic Appears Here]

• Record 160 kbd production in 2011

• New 162 kbd quarterly volume records in 3Q11 and 4Q11

• 40 kbd Nabiye expansion sanctioned

• Grand Rapids development being progressed for growth in 2020+

* before royalties

21

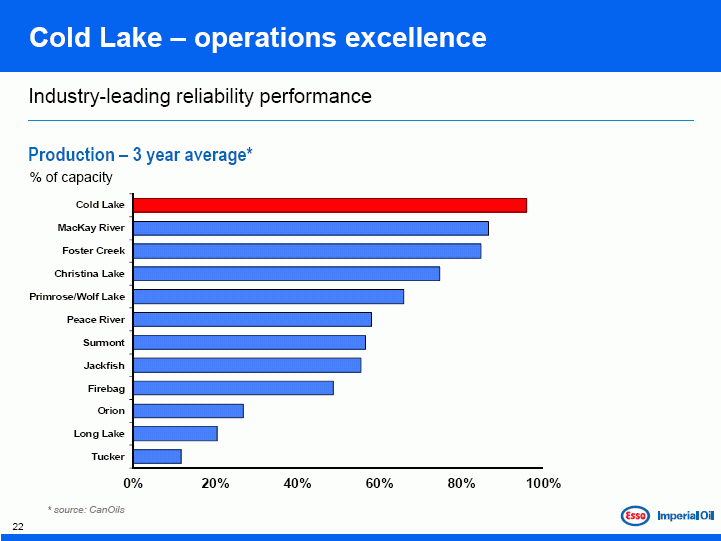

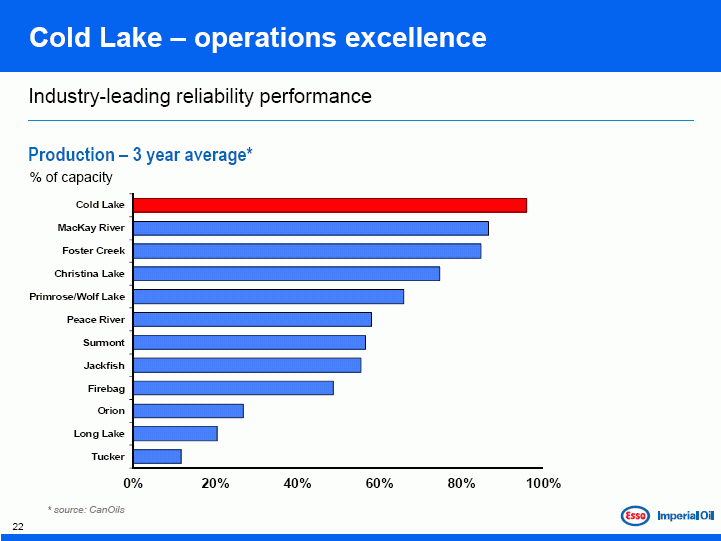

Cold Lake – operations excellence

Industry-leading reliability performance

[Graphic Appears Here]

* source: CanOils

22

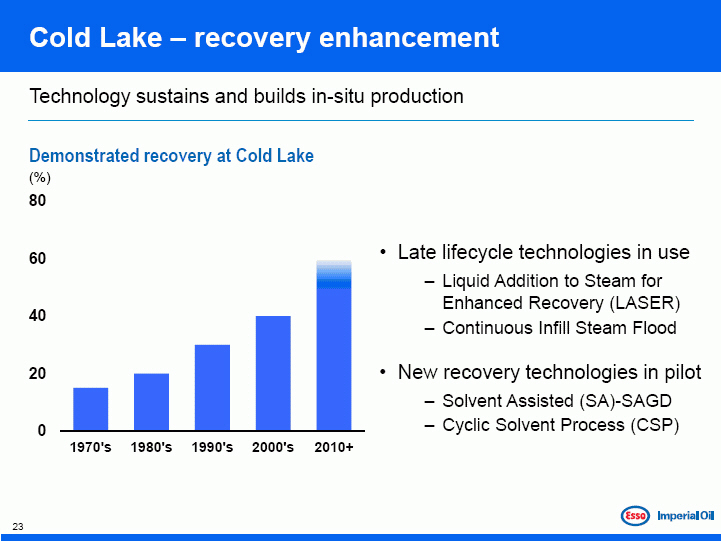

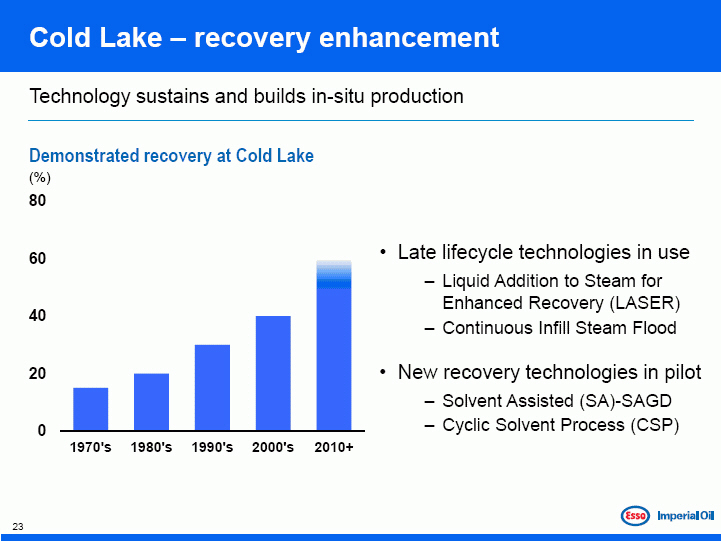

Cold Lake – recovery enhancement

Technology sustains and builds in-situ production

[Graphic Appears Here]

• Late lifecycle technologies in use

– Liquid Addition to Steam for Enhanced Recovery (LASER)

– Continuous Infill Steam Flood

• New recovery technologies in pilot

– Solvent Assisted (SA)-SAGD

– Cyclic Solvent Process (CSP)

23

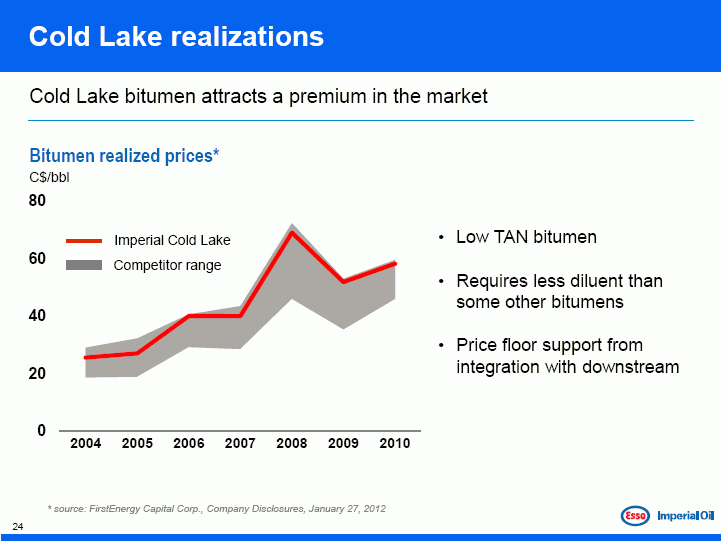

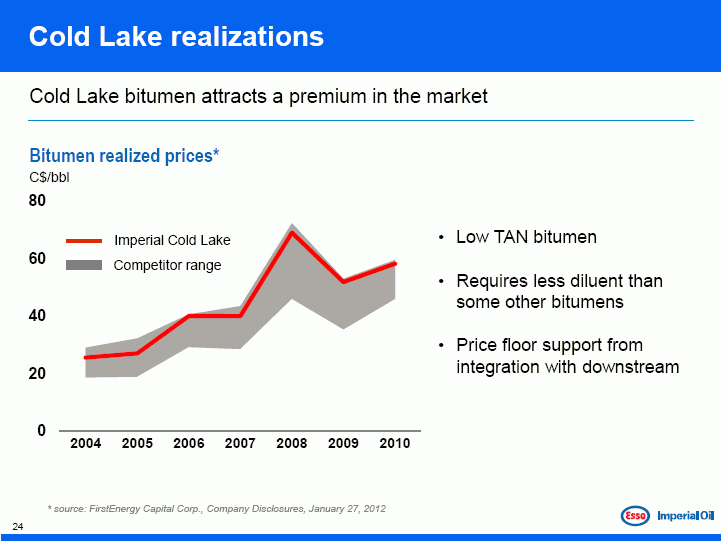

Cold Lake realizations

Cold Lake bitumen attracts a premium in the market

[Graphic Appears Here]

• Low TAN bitumen

• Requires less diluent than some other bitumens

• Price floor support from integration with downstream

* source: FirstEnergy Capital Corp., Company Disclosures, January 27, 2012

24

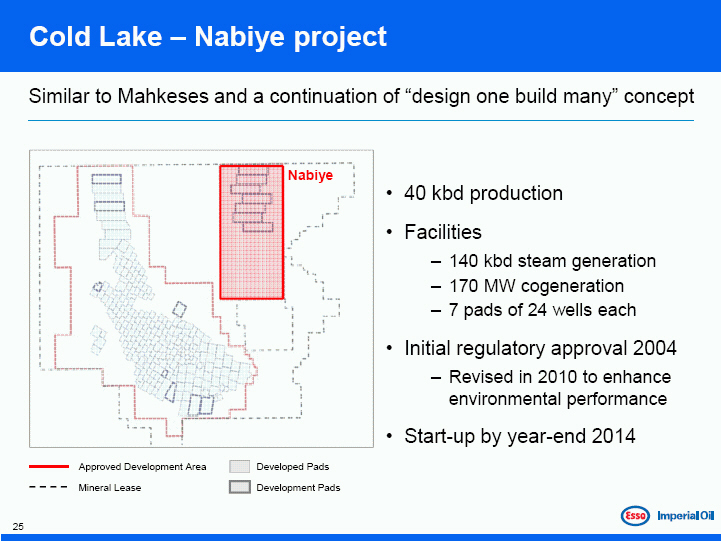

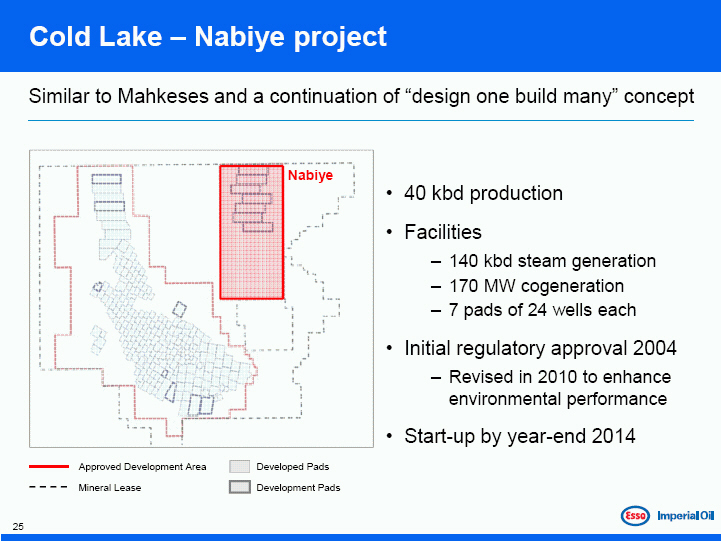

Cold Lake – Nabiye project

Similar to Mahkeses and a continuation of “design one build many” concept

Similar to Mahkeses and a continuation of “design one build many” concept

[Graphic Appears Here]

• 40 kbd production

• Facilities

3 140 kbd steam generation

3 170 MW cogeneration

3 7 pads of 24 wells each

• Initial regulatory approval 2004

3 Revised in 2010 to enhance environmental performance

• Start-up by year-end 2014

25

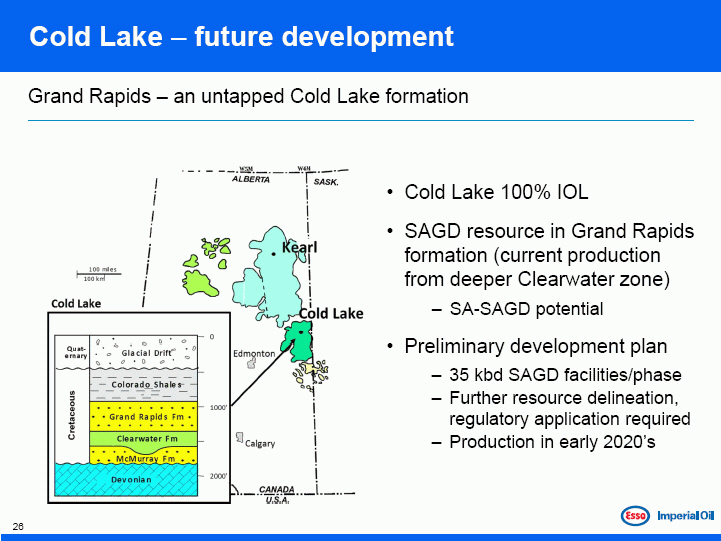

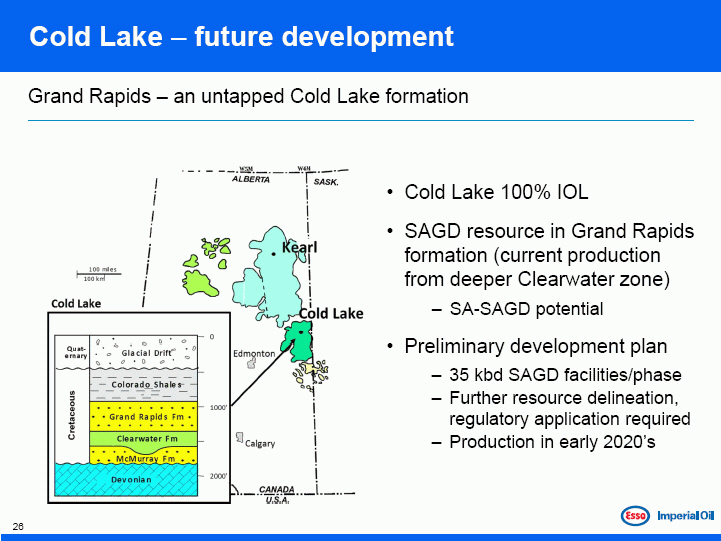

Cold Lake – future development

Grand Rapids – an untapped Cold Lake formation

[Graphic Appears Here]

• Cold Lake 100% IOL

• SAGD resource in Grand Rapids formation (current production from deeper Clearwater zone)

3 SA-SAGD potential

• Preliminary development plan

3 35 kbd SAGD facilities/phase

3 Further resource delineation, regulatory application required

3 Production in early 2020’s

26

Kearl – main plant site

[Graphic Appears Here]

27

Kearl – mining & ore preparation

[Graphic Appears Here]

28

Kearl development plan

[Graphic Appears Here]

On target to reach 345 kbd by about 2020

• 71% IOL, 29% ExxonMobil

• Initial development sanctioned May 2009

3 110 kbd initially

3 Startup 4Q12

• Expansion project sanctioned Dec 2011

3 110 kbd initially

3 Startup 4Q15

• Full capacity achieved by 2020 after

3 Mine train added

3 Processing plants debottle necked

29

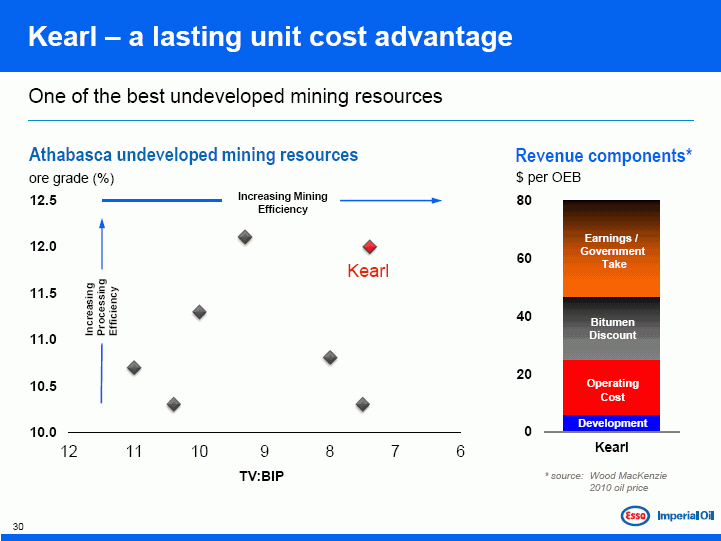

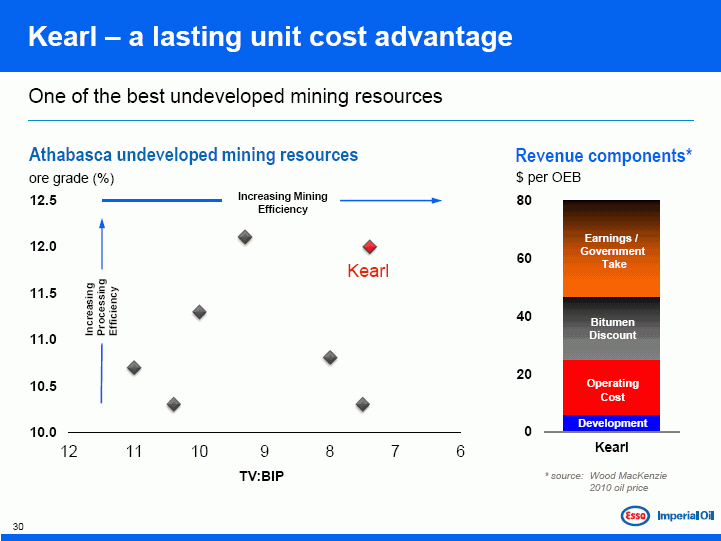

Kearl – a lasting unit cost advantage

One of the best undeveloped mining resources

[Graphic Appears Here]

* source: Wood MacKenzie 2010 oil price

30

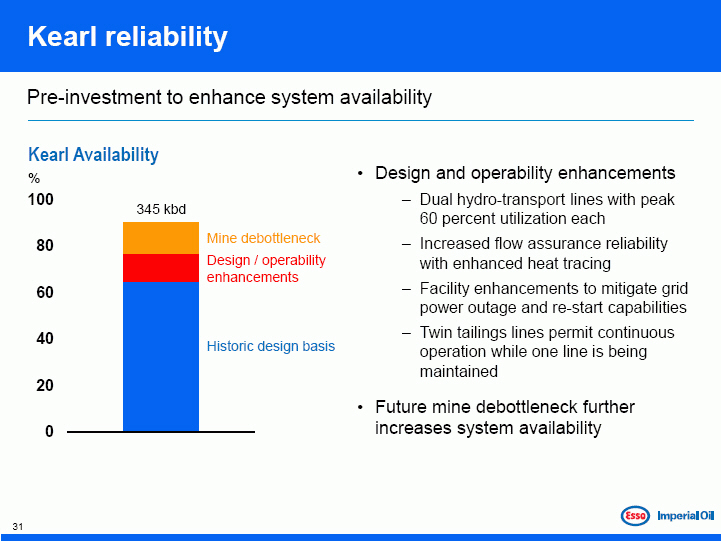

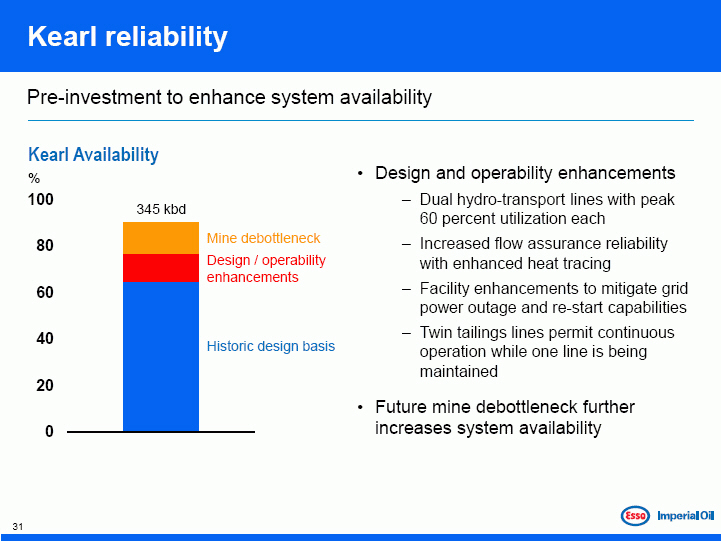

Kearl reliability

Pre-investment to enhance system availability

[Graphic Appears Here]

• Design and operability enhancements

3 Dual hydro-transport lines with peak 60 percent utilization each

3 Increased flow assurance reliability with enhanced heat tracing

3 Facility enhancements to mitigate grid power outage and re-start capabilities

3 Twin tailings lines permit continuous operation while one line is being maintained

• Future mine debottleneck further increases system availability

31

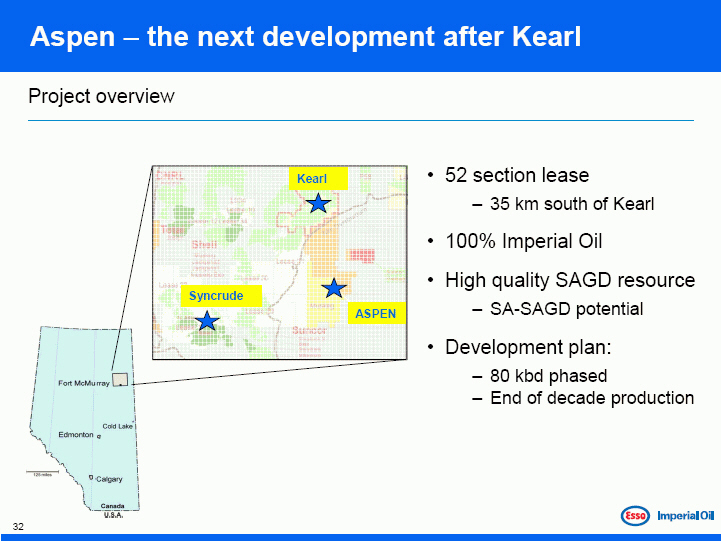

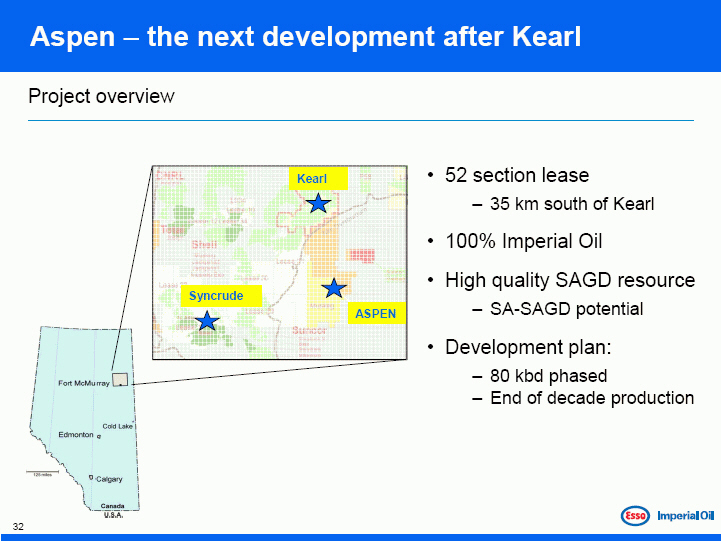

Aspen – the next development after Kearl

Project overview

[Graphic Appears Here]

• 52 section lease

3 35 km south of Kearl

• 100% Imperial Oil

• High quality SAGD resource

3 SA-SAGD potential

• Development plan:

3 80 kbd phased

3 End of decade production

32

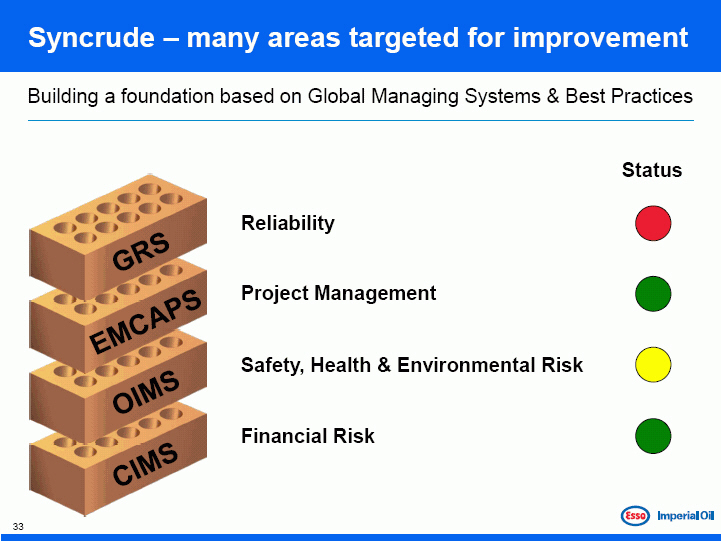

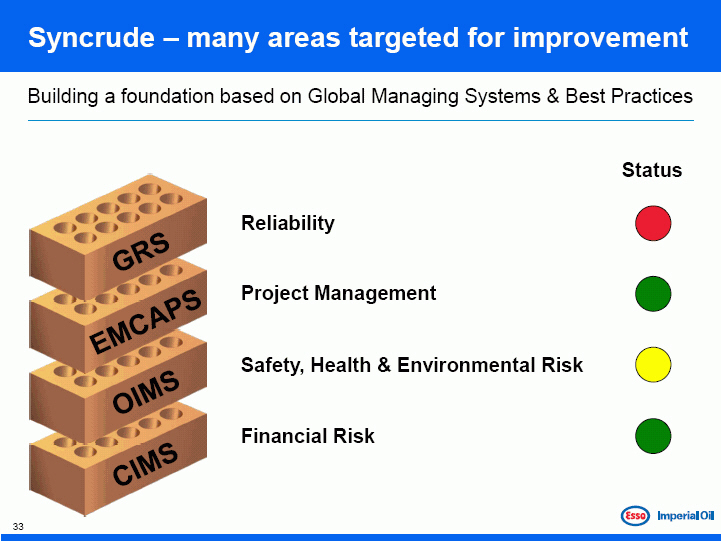

Syncrude – many areas targeted for improvement

Building a foundation based on Global Managing Systems & Best Practices

[Graphic Appears Here]

33

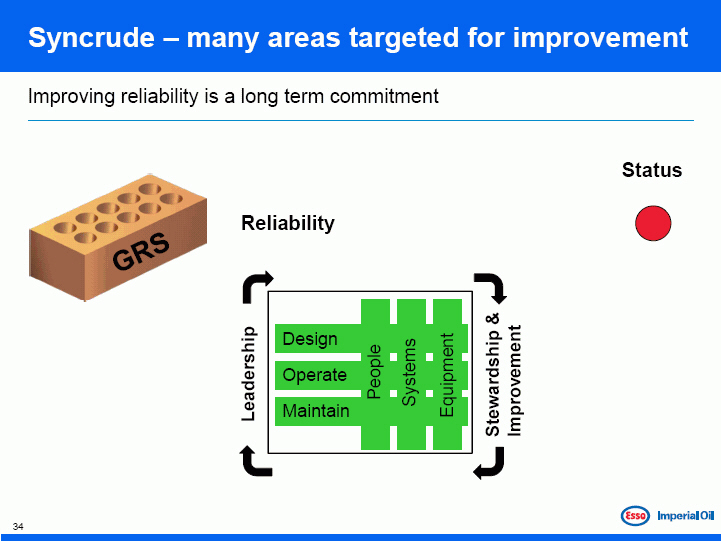

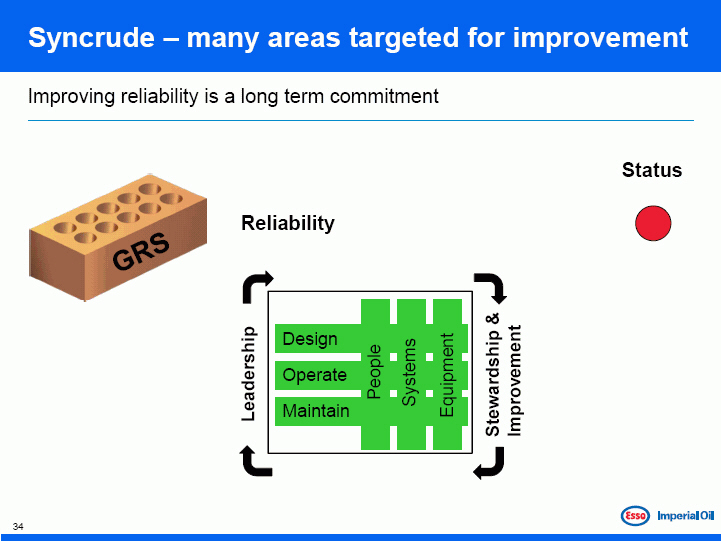

Syncrude – many areas targeted for improvement

Improving reliability is a long term commitment

[Graphic Appears Here]

34

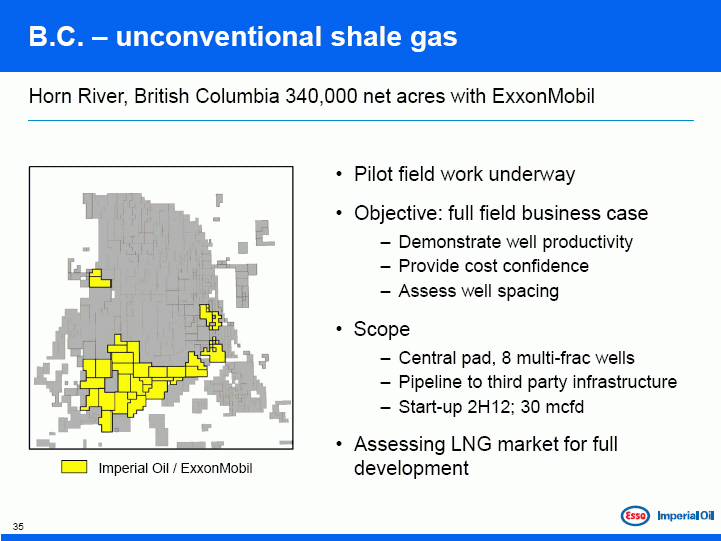

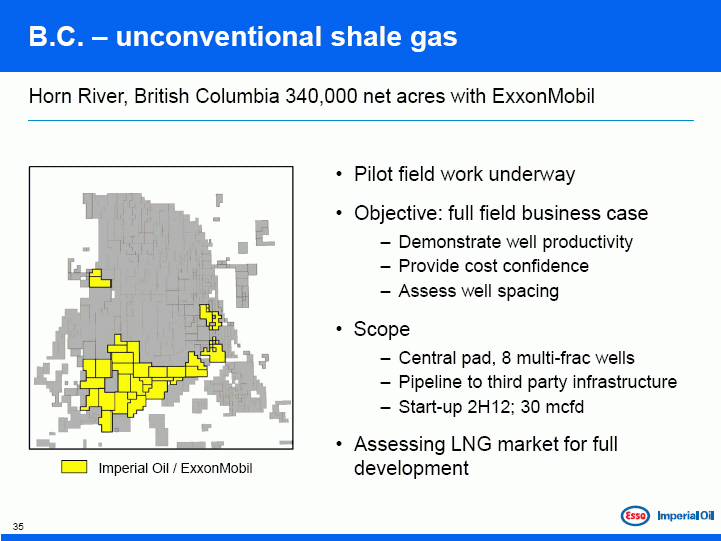

B.C. – unconventional shale gas

Horn River, British Columbia 340,000 net acres with ExxonMobil

[Graphic Appears Here]

• Pilot field work underway

• Objective: full field business case

3 Demonstrate well productivity

3 Provide cost confidence

3 Assess well spacing

• Scope

3 Central pad, 8 multi-frac wells

3 Pipeline to third party infrastructure

3 Start-up 2H12; 30 mcfd

• Assessing LNG market for full development

35

[Graphic Appears Here]

BREAK

36

Technology Leadership

Bruce March

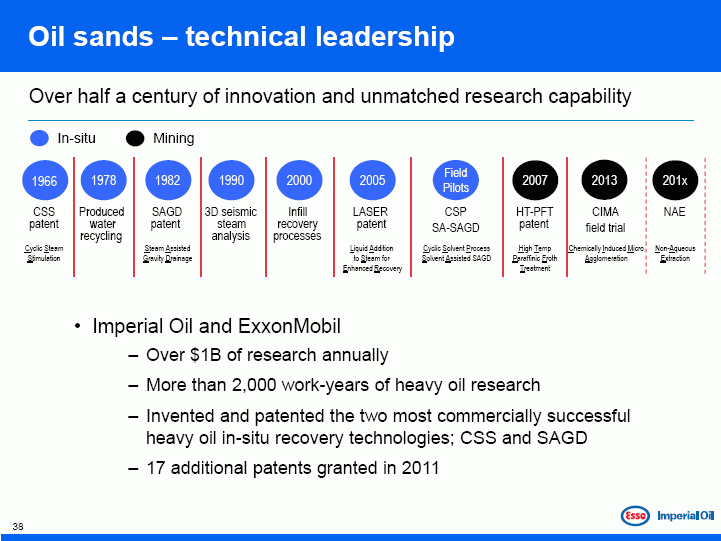

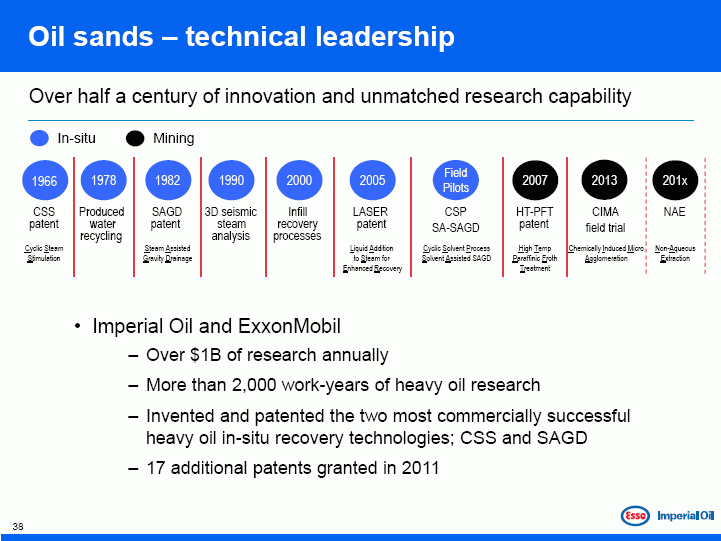

Oil sands – technical leadership

Over half a century of innovation and unmatched research capability

[Graphic Appears Here]

• Imperial Oil and ExxonMobil

– Over $1B of research annually

– More than 2,000 work-years of heavy oil research

– Invented and patented the two most commercially successful heavy oil in-situ recovery technologies; CSS and SAGD

– 17 additional patents granted in 2011

38

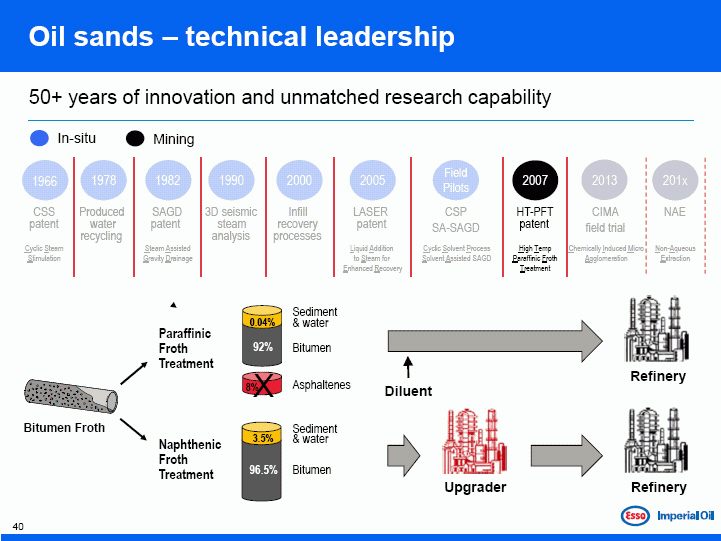

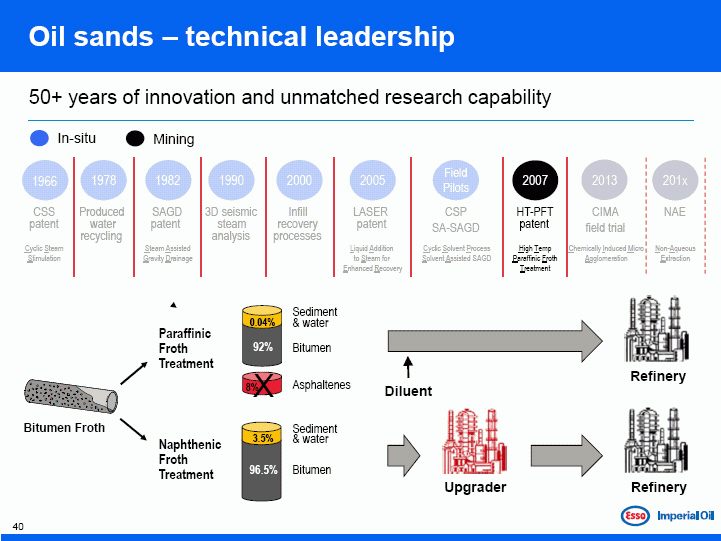

Oil | | sands – technical leadership |

50+ | | years of innovation and unmatched research capability |

Oil sands – technical leadership

50+ years of innovation and unmatched research capability

[Graphic Appears Here]

40

Oil sands – technical leadership

50+ years of innovation and unmatched research capability

[Graphic Appears Here]

41

Oil sands – technical leadership

50+ years of innovation and unmatched research capability

[Graphic Appears Here]

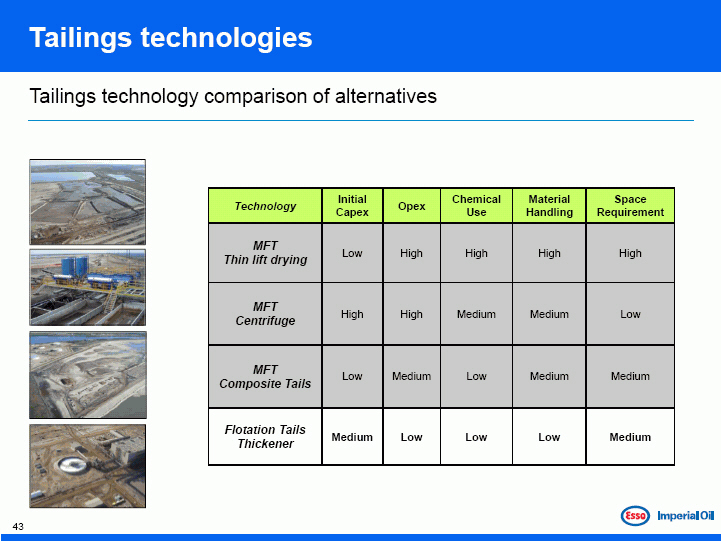

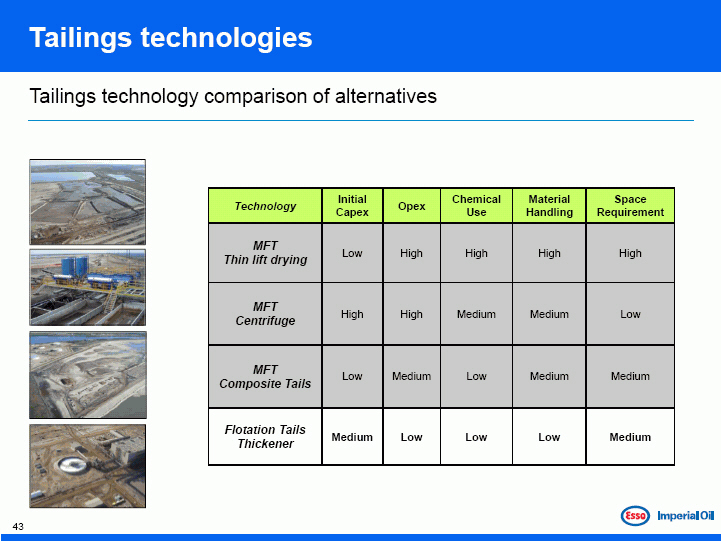

Tailings technologies

Tailings technology comparison of alternatives

[Graphic Appears Here]

43

COSIA

An industry group formed to improve oil sands environmental performance

• 12 oil sands producers working together on environmental issues

– Tailings, water, land, and greenhouse gas emissions

– Accelerate the pace and scope of environmental innovation

• Build on the successes achieved by earlier collaborative groups

Canadian Oil Sands Network for

Research and Development (CONRAD)

Oil Sands Leadership Initiative (OSLI)

Oil Sands Tailings Consortium (OSTC)

[Graphic Appears Here]

[Graphic Appears Here]

North American Downstream & Chemicals Businesses

Bruce March

North American shale gas

Upstream developments are driving downstream & chemical opportunities

[Graphic Appears Here]

• Natural gas prices to remain low

– Arbitrage opportunities for LNG, NGVs

• Ethane supply growth

3 Advantaged feedstock for ethylene producers

46

North American tight oil

Upstream developments are driving downstream opportunities

• Growing supply of mid-continent tight oil

– Volatile WTI-Brent differentials

– High utilization of complex refining but not deep resid conversion

– Supports export of gasoline and diesel

• With pipelines, Canadian oil sands meets demand growth for deep conversion capacity in PADD II, III

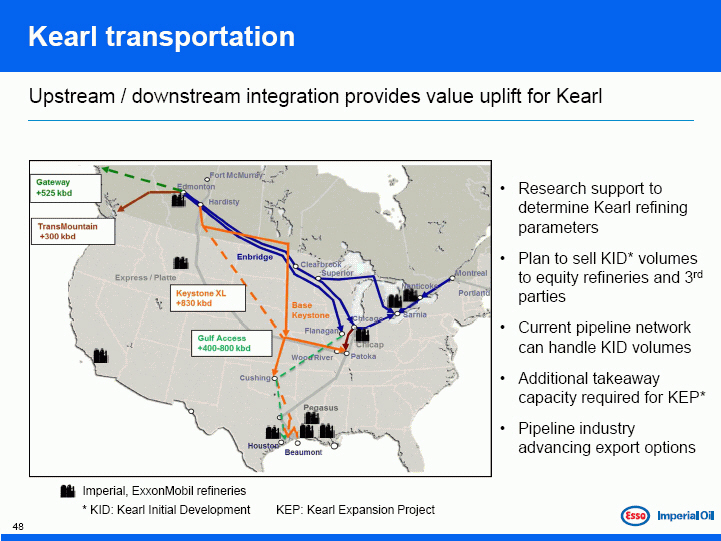

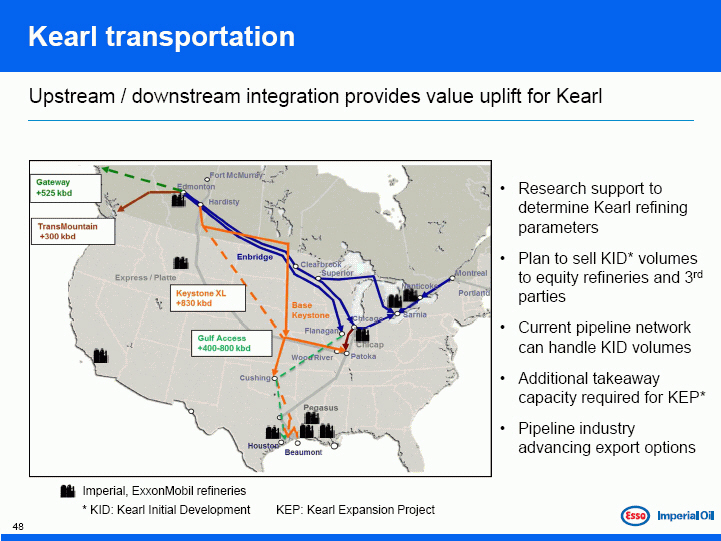

Kearl transportation

Upstream / downstream integration provides value uplift for Kearl

• Research support to determine Kearl refining parameters

• Plan to sell KID* volumes to equity refineries and 3rd parties

• Current pipeline network can handle KID volumes

• Additional takeaway capacity required for KEP*

• Pipeline industry advancing export options

Imperial, ExxonMobil refineries

* KID: Kearl Initial Development KEP: Kearl Expansion Project

Financial Performance & Discipline

Paul Masschelin

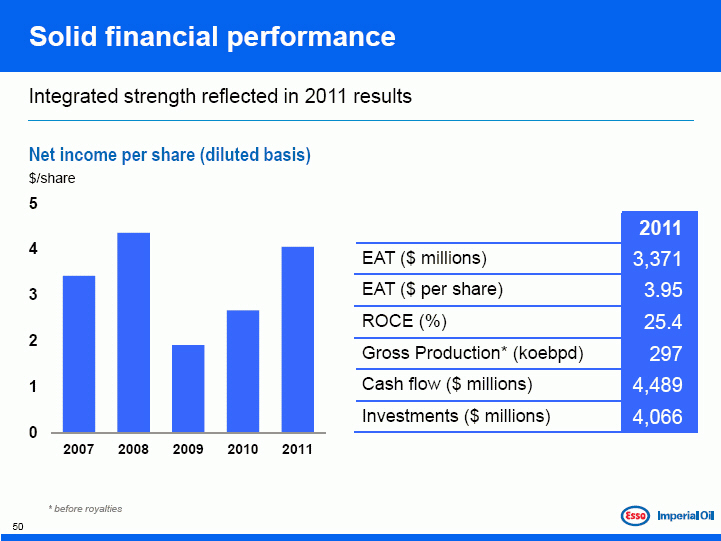

Solid financial performance

Integrated strength reflected in 2011 results

Net income per share (diluted basis)

$/share

2011

EAT ($ millions) 3,371

EAT ($ per share) 3.95

ROCE (%) 25.4

Gross Production* (koebpd) 297

Cash flow ($ millions) 4,489

Investments ($ millions) 4,066

* before royalties

Upstream business results

Operational excellence in base business while advancing future growth

2011

EAT ($ millions) 2,457

ROCE (%) 22

Gross Production* (koebpd) 297

Liquids Production* (kbd) 255

Oil sands production* (kbd) 232

Investments ($ millions) 3,880

Strategy: double production by 2020

* before royalties

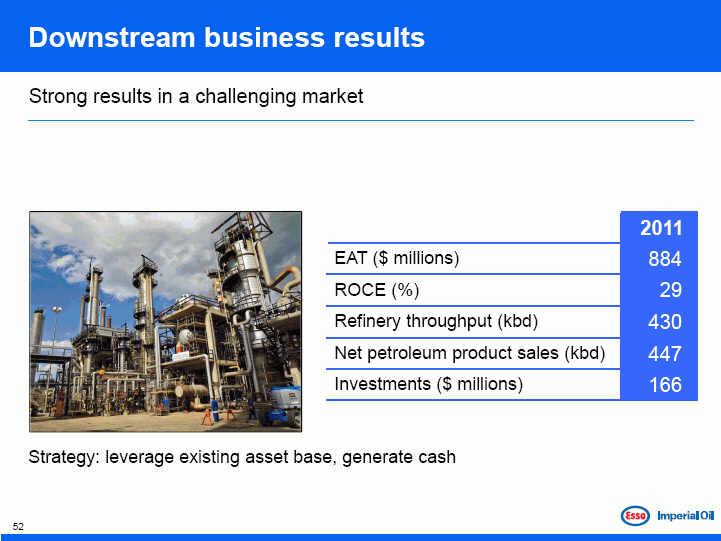

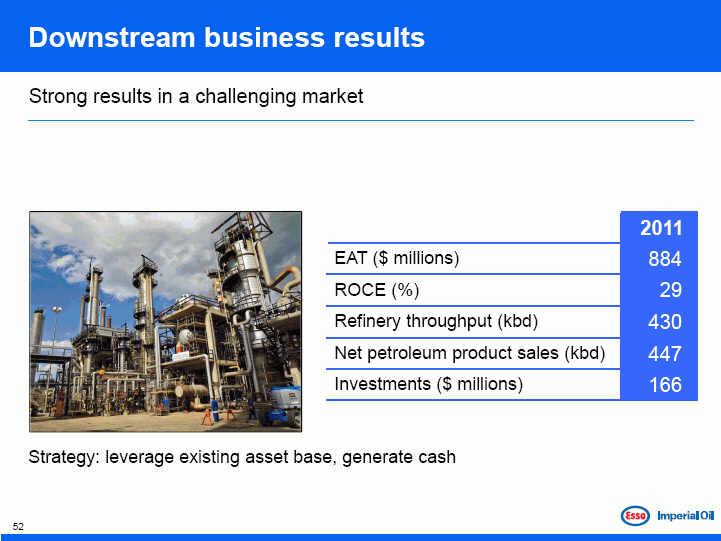

Downstream business results

Strong results in a challenging market

2011

EAT ($ millions) 884

ROCE (%) 29

Refinery throughput (kbd) 430

Net petroleum product sales (kbd) 447

Investments ($ millions) 166

Strategy: leverage existing asset base, generate cash

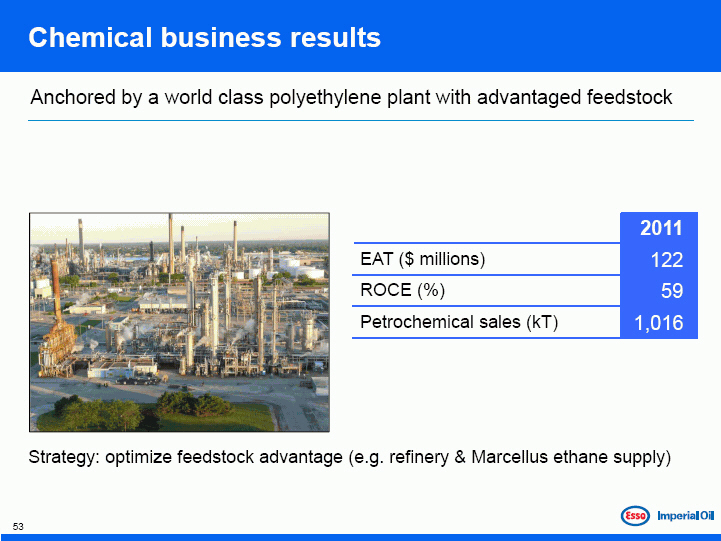

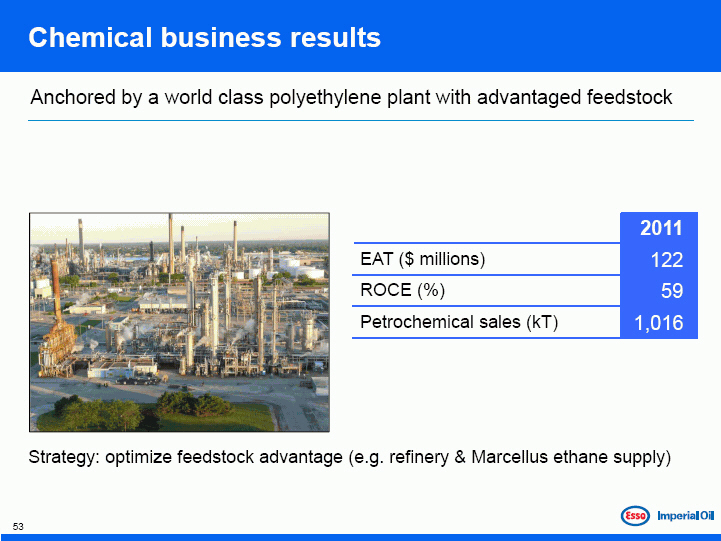

Chemical business results

Anchored by a world class polyethylene plant with advantaged feedstock

2011

EAT ($ millions) 122

ROCE (%) 59

Petrochemical sales (kT) 1,016

Strategy: optimize feedstock advantage (e.g. refinery & Marcellus ethane supply)

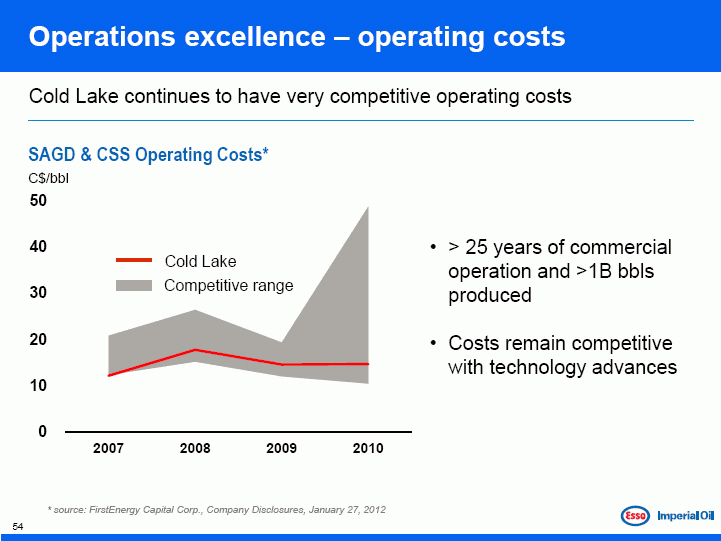

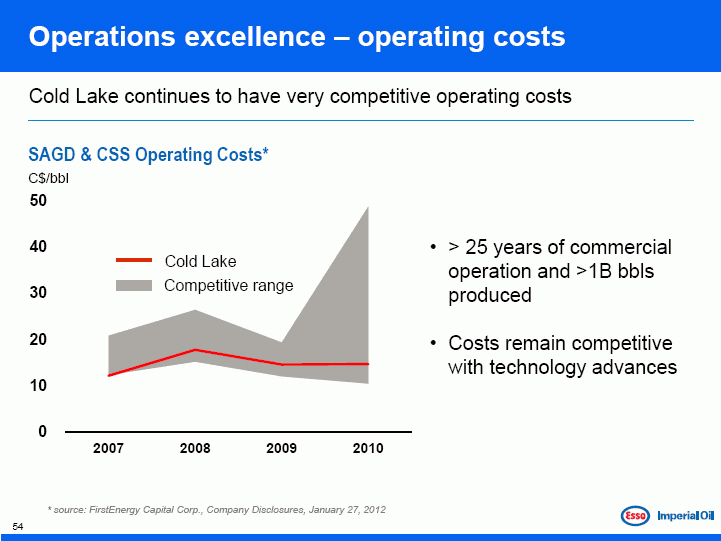

Operations excellence – operating costs

Cold Lake continues to have very competitive operating costs

SAGD & CSS Operating Costs*

C$/bbl

• > 25 years of commercial operation and >1B bbls produced

• Costs remain competitive with technology advances

* source: FirstEnergy Capital Corp., Company Disclosures, January 27, 2012

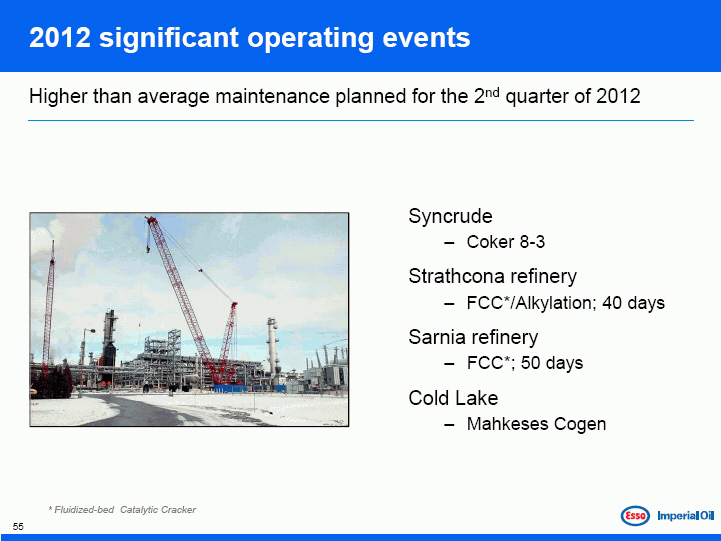

2012 significant operating events

Higher than average maintenance planned for the 2nd quarter of 2012

Syncrude

3 Coker 8-3

Strathcona refinery

3 FCC*/Alkylation; 40 days

Sarnia refinery

3 FCC*; 50 days

Cold Lake

3 Mahkeses Cogen

* Fluidized-bed Catalytic Cracker

Uninterrupted dividends since 1891

Per share dividend payments have increased every year for last 17 years

Annual paid dividends per share*

$/share

$5.7 billion returned to shareholders

• Dividends per share have increased 50% since 2006

* payments during calendar year from 1995-2011 adjusted for 3:1 share splits in 1998 and 2006

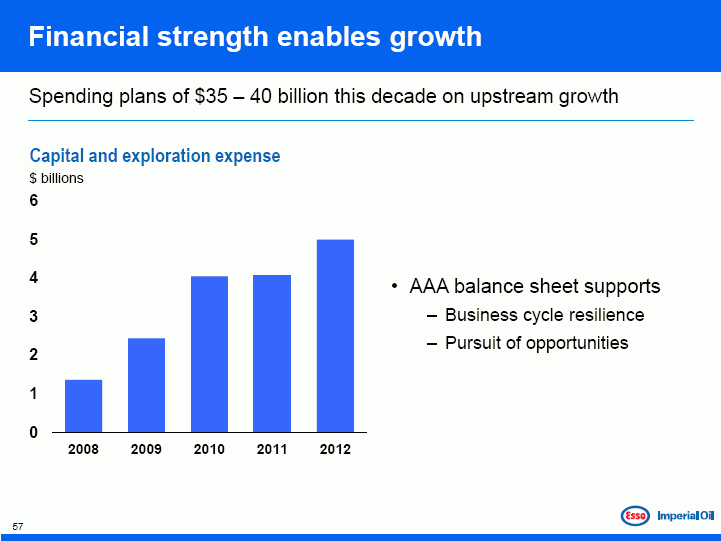

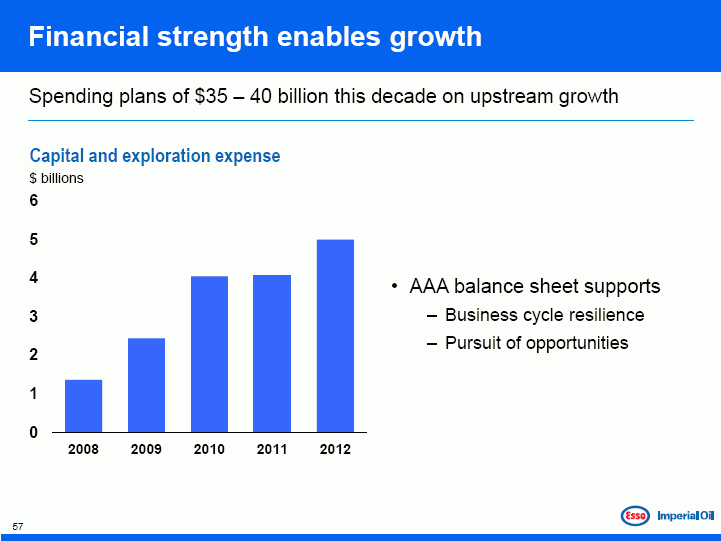

Financial strength enables growth

Spending plans of $35 – 40 billion this decade on upstream growth

Capital and exploration expense

$ billions

• AAA balance sheet supports

– Business cycle resilience

– Pursuit of opportunities

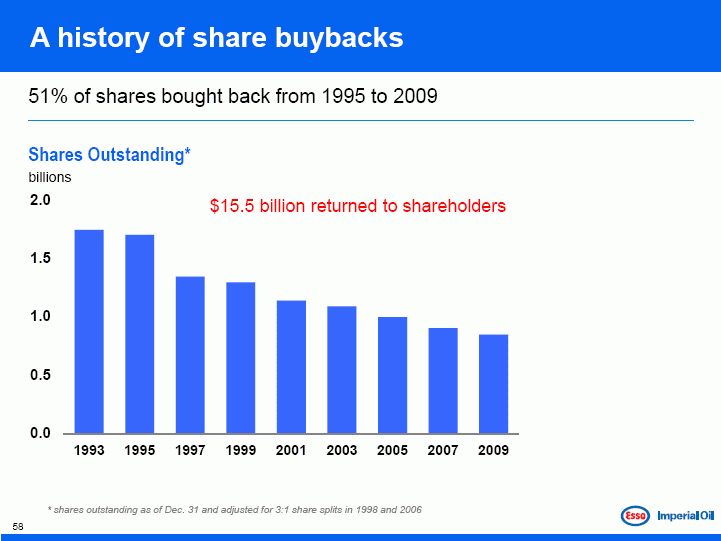

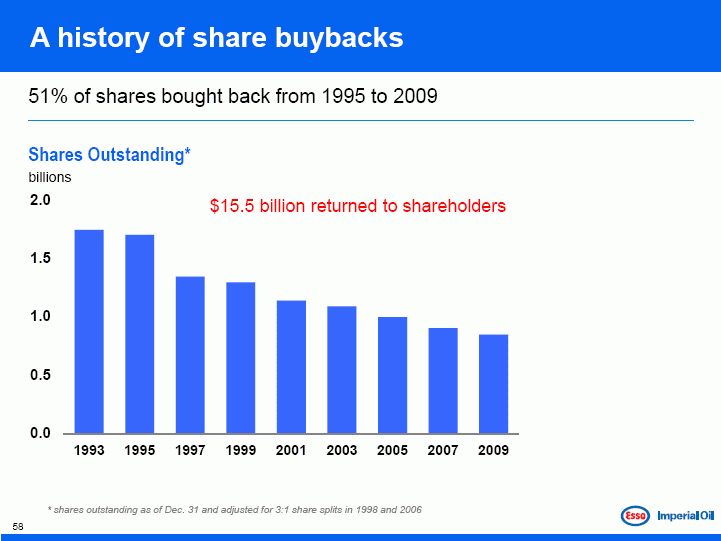

A history of share buybacks

51% of shares bought back from 1995 to 2009

Shares Outstanding*

billions

$15.5 billion returned to shareholders

* shares outstanding as of Dec. 31 and adjusted for 3:1 share splits in 1998 and 2006

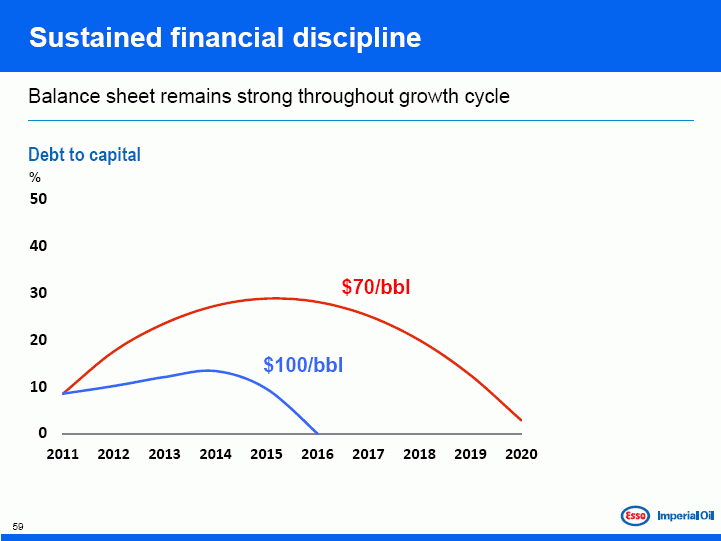

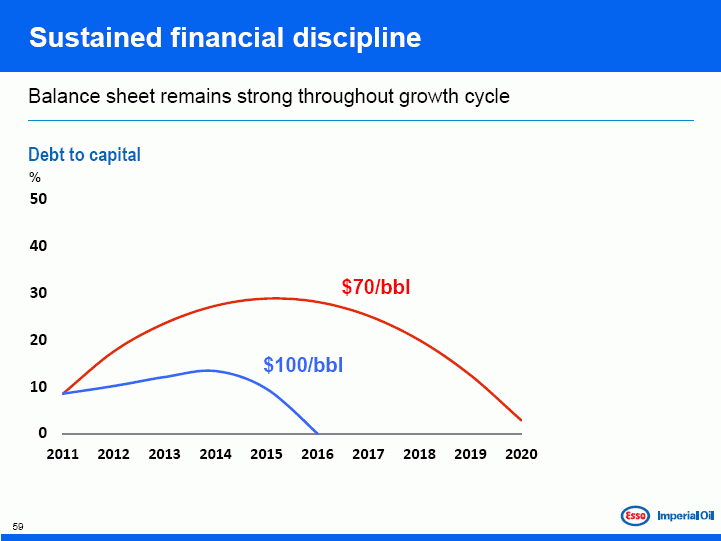

Sustained financial discipline

Balance sheet remains strong throughout growth cycle

Debt to capital

%

The Competitive Advantage

Bruce March

Imperial Oil – the competitive advantage

An investor in Imperial acquires an unmatched set of qualities

• Track record maximizing shareholder value

• Premier portfolio of assets

• High growth trajectory

3 Double production by 2020

• Technology leader & superior operator

• Exemplary financial strength and discipline

• Low country risk

For more information www.imperialoil.ca

For more detailed investor information, or to receive annual and interim reports, please contact:

John A. Charlton

Manager, Investor Relations Imperial Oil Limited 237 Fourth Avenue SW Calgary, Alberta T2P 3M9 Email: john.a.charlton@esso.ca Phone: (403) 237-4537

Imperial Oil

Esso