Exhibit 99.1

Investor Days

April 1—2 , 2014

Agenda

9:30 a.m. Welcome John Charlton, Manager, Investor Relations

Executive Summary

Global Energy Outlook Rich Kruger, Chairman, President and CEO Corporate Overview

Downstream & Chemical Paul Masschelin, Senior Vice-President, Finance

BREAK (10 minutes)

Upstream Rich Kruger

Future Opportunities Paul Masschelin Final Comments Rich Kruger 11:15 a.m. Question Period Noon Lunch

2 | | | Imperial | Investor Days | 2014 |

Cautionary statement

Statements of future events or conditions in these materials, including projections, targets, expectations, estimates, and business plans are forward-looking statements. Actual future results, including demand growth and energy source mix; production growth and mix; project plans, dates, costs and capacities; production rates and resource recoveries; cost savings; product sales; financing sources; and capital and environmental expenditures could differ materially depending on a number of factors, such as changes in the price, supply of and demand for crude oil, natural gas, and petroleum and petrochemical products; political or regulatory events; project schedules; commercial negotiations; the receipt, in a timely manner, of regulatory and third-party approvals; unanticipated operational disruptions; unexpected technological developments; and other factors discussed in these materials and Item 1A of Imperial’s most recent Form 10-K. Forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to Imperial. Imperial’s actual results may differ materially from those expressed or implied by its forward-looking statements and readers are cautioned not to place undue reliance on them.

Oil-equivalent barrels (OEB) may be misleading, particularly if used in isolation. An OEB conversion ratio of 6,000 cubic feet to one barrel is based on an energy-equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the well head.

Proved reserves are calculated under United States Securities and Exchange Commission (SEC) requirements, as disclosed in Imperial’s Form 10-K dated December 31, 2013.

Reserves and contingent resource information are an estimate of the company’s net interest after royalties at year-end 2013, as determined by Imperial’s internal qualified reserves evaluator. Contingent resources are those quantities of petroleum considered to be potentially recoverable from known accumulations using established technology or technology under development, but are currently not considered to be commercially recoverable due to one or more contingencies. Contingencies on resources may include, but are not limited to, factors such as economic, legal, environmental, political and regulatory matters or a lack of markets. There is no certainty that it will be economically viable or technically feasible to produce any portion of the resource.

The term “project” as used in these materials can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports.

Financials in Canadian dollars.

3 | | | Imperial | Investor Days | 2014 |

Executive summary

4 | | | Imperial | Investor Days | 2014 |

Business overview

Participation in all aspects of the value chain

Sarnia refinery

Syncrude Kearl mining mining

Strathcona refinery

Cold Lake cyclic steam

Nanticoke refinery

Research Sarnia Fuels & Lubes marketing chemicals

5 | | | Imperial | Investor Days | 2014 |

Competitive assessment

Industry leadership across all business lines

Cold Lake Best-in-class operating performance; continued growth potential Syncrude High-value production; improvement actions ongoing Kearl Next generation mining technologies; ramp-up to capacity continuing Refining Advantaged feedstocks; reliability and energy efficiency focus Fuels/Lubes Premium brands, nationwide network; valued customer offerings Chemical Low cost feeds; strong polyethylene; focused on full utilization Research History of innovation, unmatched commitment; ExxonMobil leverage

6 | | | Imperial | Investor Days | 2014 |

Business environment

Favourable investment climate, but not without challenges

• | | Large, accessible upstream resources |

• | | Mature, competitive downstream markets |

• | | Political stability, competitive fiscal regime |

• | | Market access limitations, uncertainties |

• | | Tight labour market, regional cost pressures |

• | | Evolving regulatory, environmental framework |

7 | | | Imperial | Investor Days | 2014 |

Organizational priorities

Manage risks, maximize value and achieve profitable growth

• | | Focus on base business fundamentals |

Safety…Operational Integrity…Reliability…Profitability

• | | Implement asset-specific improvement plans |

• | | Ensure quality execution on growth projects |

• | | Engage externally on key industry issues |

Global energy outlook

A worldwide view to 2040

on the planet

130 percent

larger global economy

about 35 percent

greater demand for energy

non-OECD countries

lead the growth in demand

about 60 percent

of demand supplied by oil and natural gas

natural gas to surpass coal

as the second-largest fuel source

Source: ExxonMobil 2014 Outlook for Energy

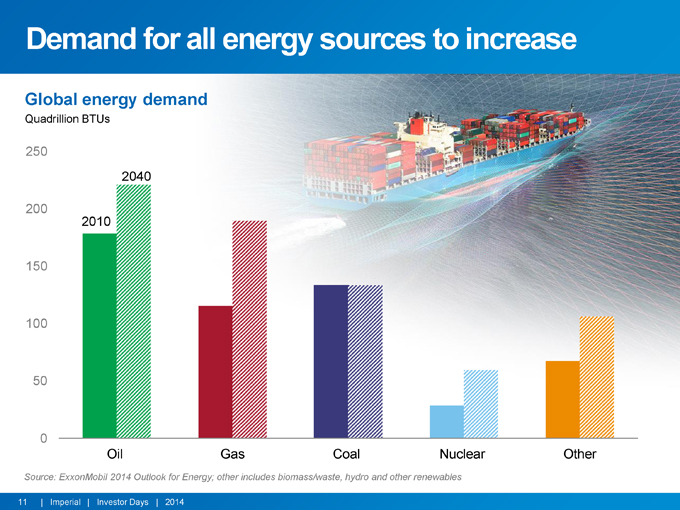

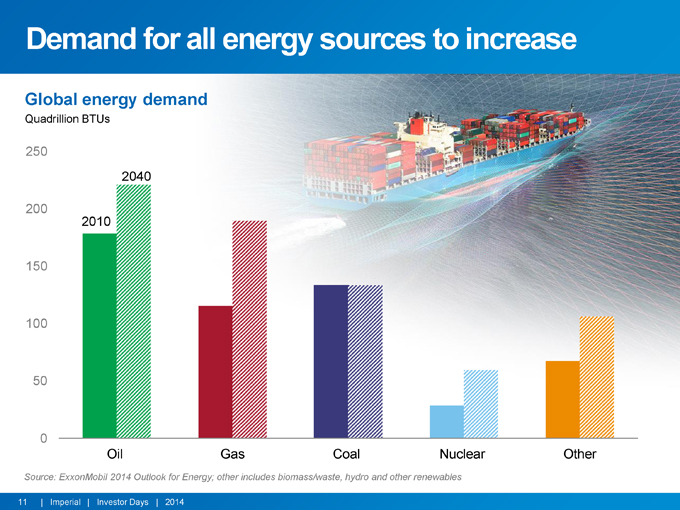

Demand for all energy sources to increase

Global energy demand

Quadrillion BTUs

250

2040

200

2010

150

100

50

0

Oil Gas Coal Nuclear Other

Source: ExxonMobil 2014 Outlook for Energy; other includes biomass/waste, hydro and other renewables

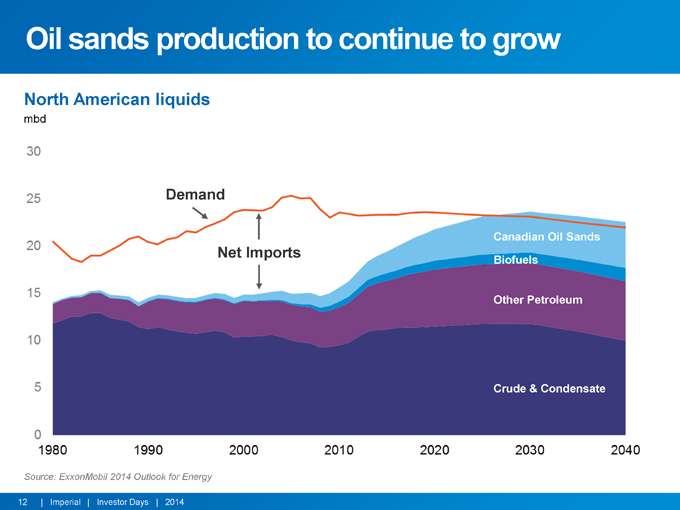

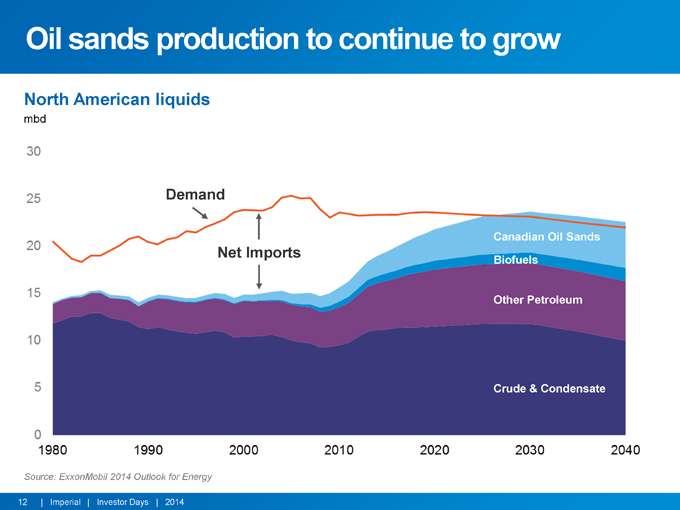

Oil sands production to continue to grow

North American liquids

mbd

Demand

Canadian Oil Sands

Net Imports

Biofuels

Other Petroleum

Crude & Condensate

Source: ExxonMobil 2014 Outlook for Energy

Corporate overview

Business model

Deliver superior, long-term shareholder value

Long-life, competitively advantaged assets

Disciplined investment and cost management

Integration and synergies

High-impact technologies and innovation

Operational excellence and responsible growth

ExxonMobil relationship

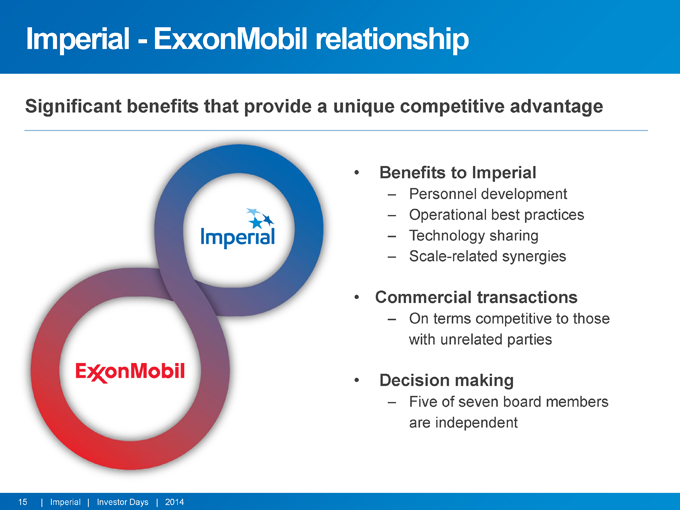

Imperial—ExxonMobil relationship

competitive advantage

nefits to Imperial

Personnel development Operational best practices Technology sharing Scale-related synergies

ercial transactions

On terms competitive to those with unrelated parties

cision making

Five of seven board members are independent

Enterprise risk management

Comprehensive systems to manage business risks

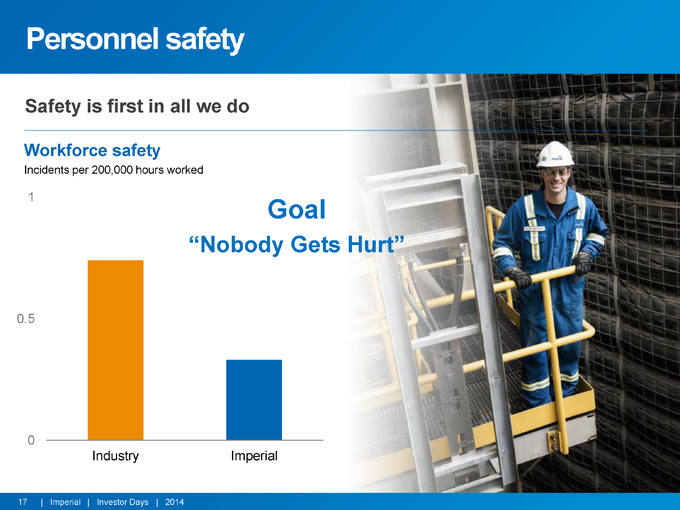

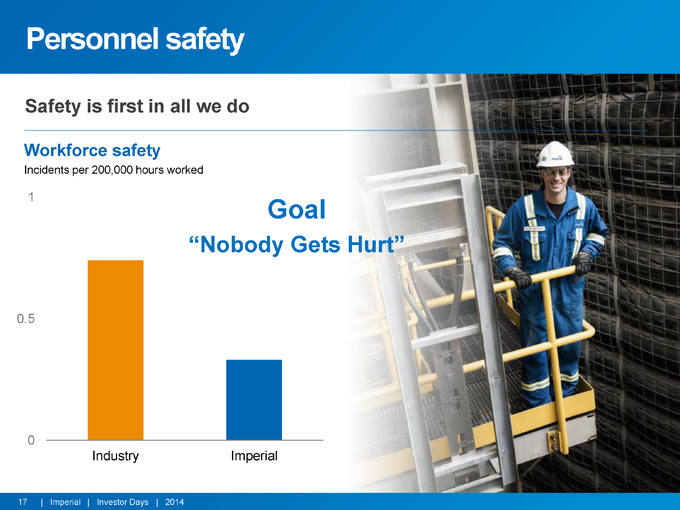

Personnel safety

Safety is first in all we do

Workforce safety

Incidents per 200,000 hours worked

“Nobody Gets Hurt”

0.5

0

Industry Imperial

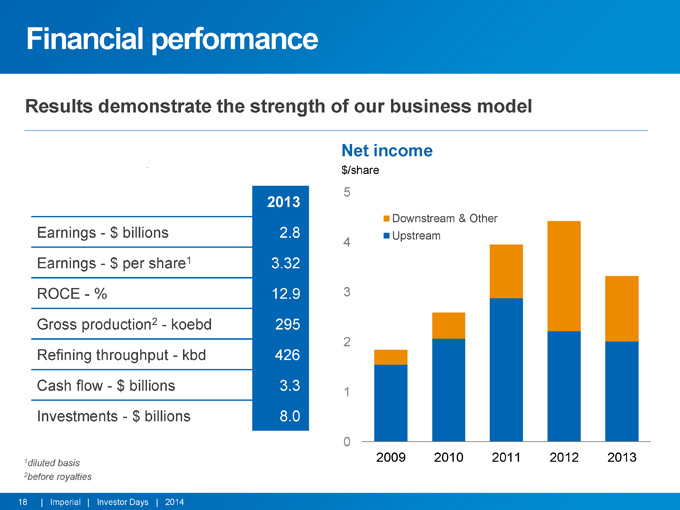

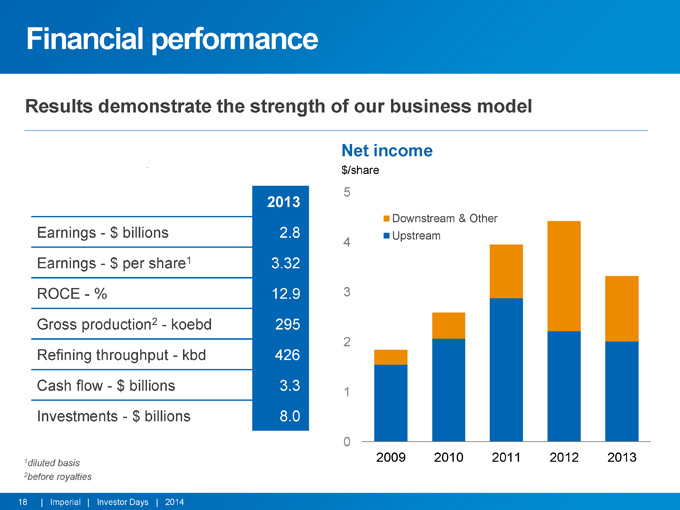

Financial performance

Results demonstrate the strength of our business model

Net income

$/share

2013

Downstream & Other

Earnings—$ billions 2.8 Upstream

Earnings—$ per share1 3.32 ROCE—% 12.9 3 Gross production2—koebd 295

Refining throughput���kbd 426

Cash flow—$ billions 3.3 1 Investments—$ billions 8.0

0

1 | | 2009 2010 2011 2012 2013 |

diluted basis 2before royalties

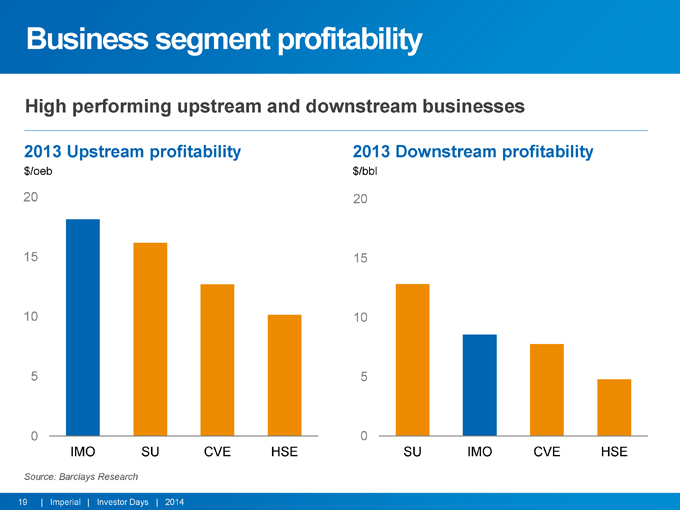

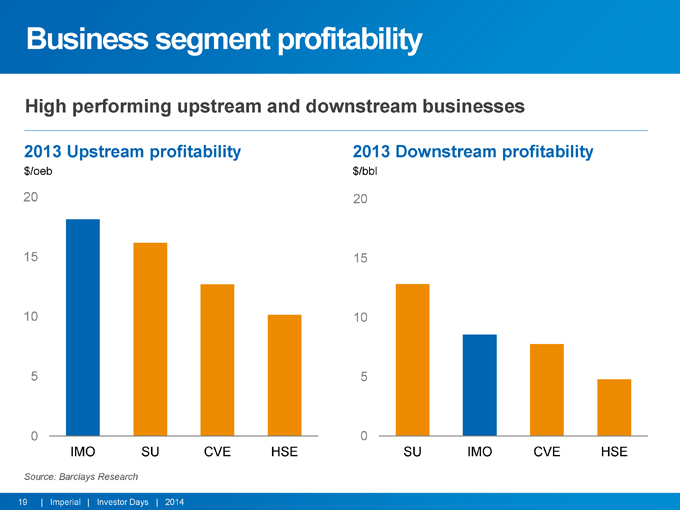

Business segment profitability

High performing upstream and downstream businesses

2013 Upstream profitability 2013 Downstream profitability

$/oeb $/bbl

20 20

15 15

10 10

0 0

IMO SU CVE HSE SU IMO CVE HSE

Source: Barclays Research

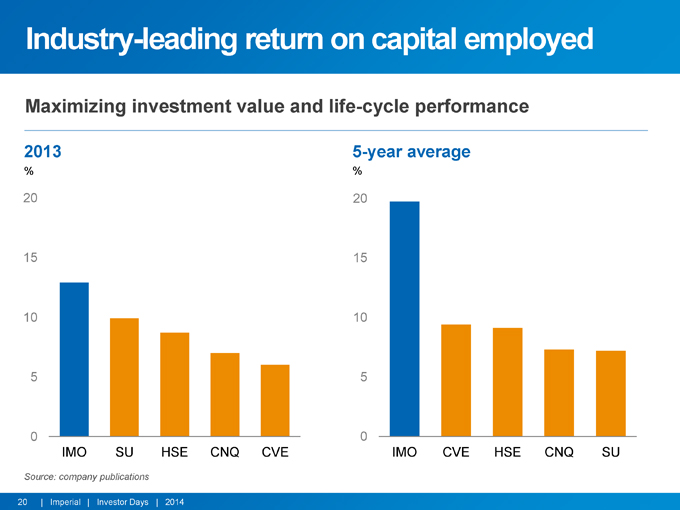

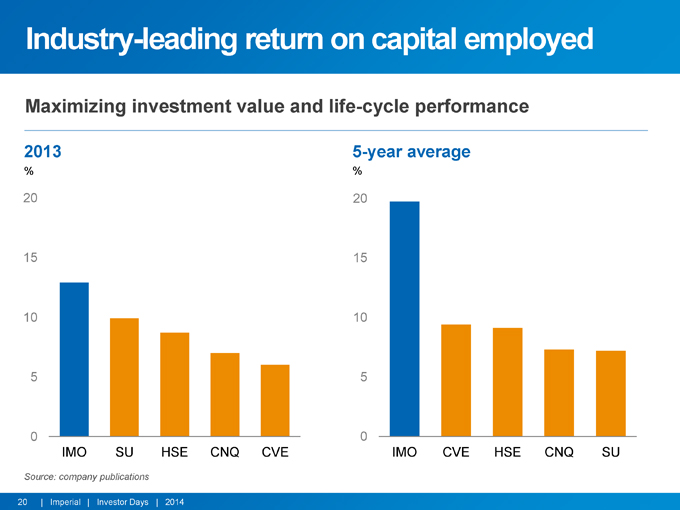

Industry-leading return on capital employed

Maximizing investment value and life-cycle performance

2013 5-year average

% %

20 20

15 15

10 10

0 0

IMO SU HSE CNQ CVE IMO CVE HSE CNQ SU

Source: company publications

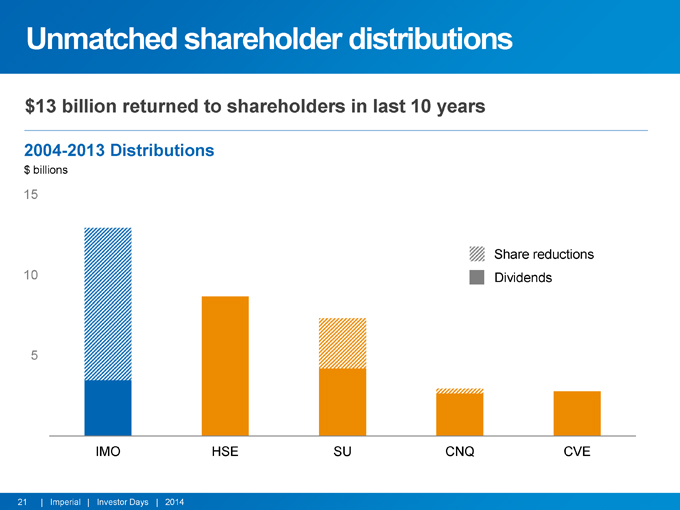

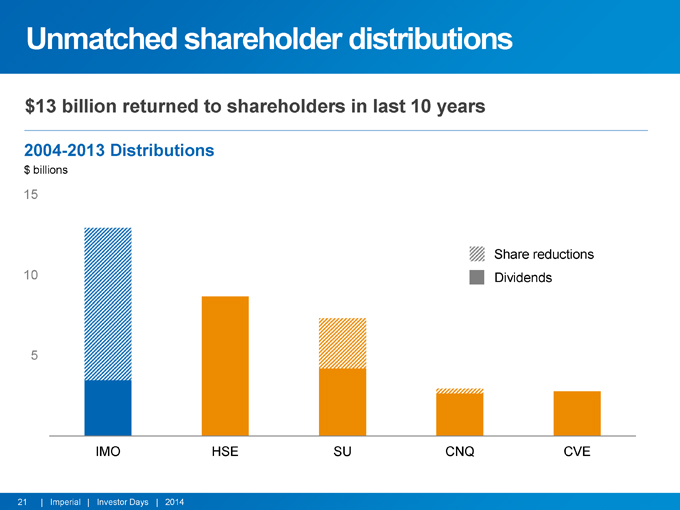

Unmatched shareholder distributions

$13 billion returned to shareholders in last 10 years

2004-2013 Distributions

$ billions

15

Share reductions

10 Dividends 5 IMO HSE SU CNQ CVE

Long-life, high-quality proved reserves

3.6 billion oil-equivalent barrels, concentrated in world-class assets

YE 2013 proved reserves

billion oeb1

Other

Syncrude

Cold Lake

0

Year-end 2012

1after royalties

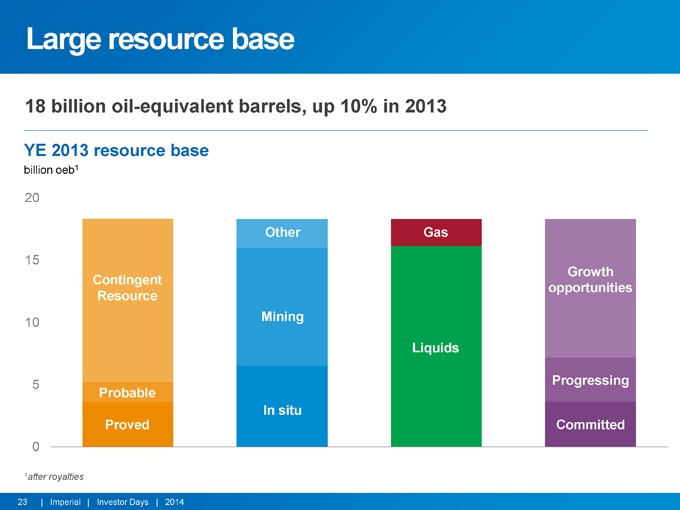

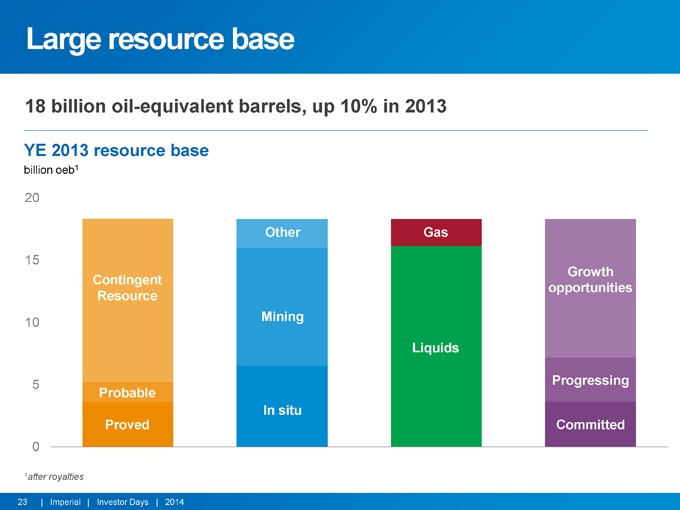

Large resource base

18 billion oil-equivalent barrels, up 10% in 2013

YE 2013 resource base

billion oeb1

20

Other Gas

15 Growth Contingent opportunities Resource

10 Mining

Liquids

5 | | Progressing Probable In situ Proved Committed |

0

1after royalties

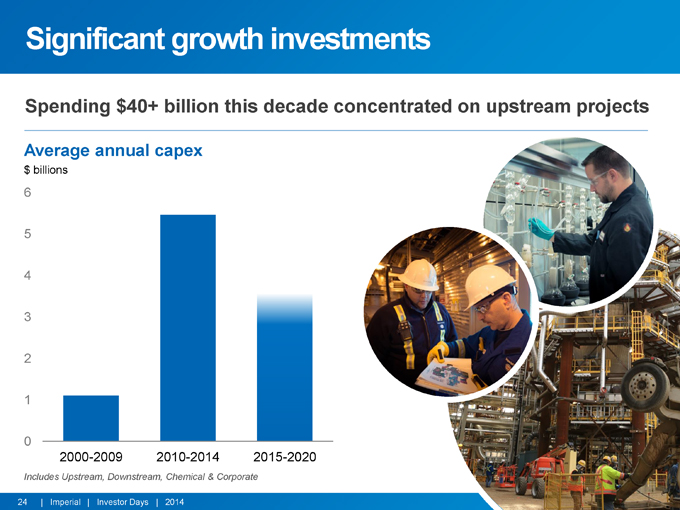

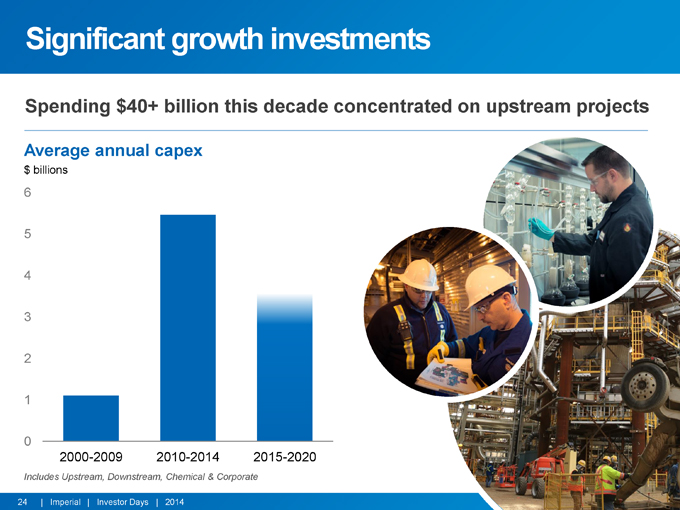

Significant growth investments

Spending $40+ billion this decade concentrated on upstream projects

Average annual capex

$ billions

0

2000-2009 2010-2014 2015-2020

Includes Upstream, Downstream, Chemical & Corporate

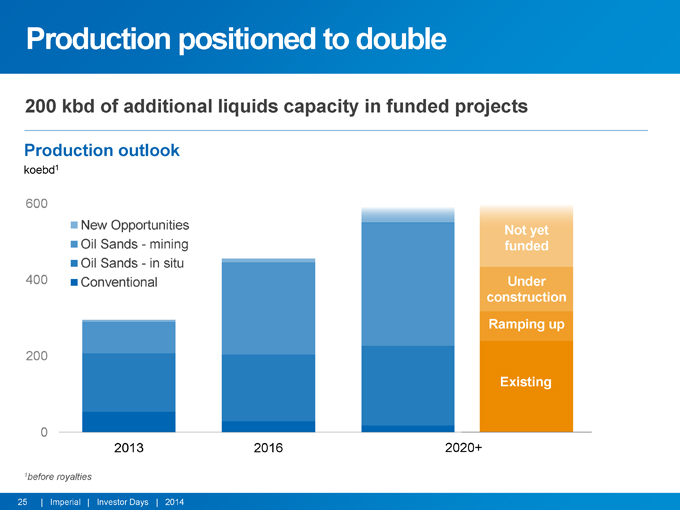

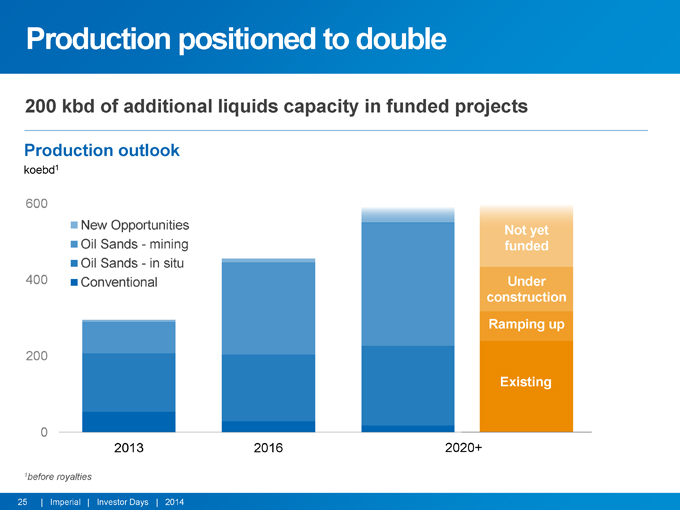

Production positioned to double

200 kbd of additional liquids capacity in funded projects

Production outlook

koebd1

600

New Opportunities Not yet Oil Sands—mining funded Oil Sands—in situ 400 Conventional Under construction

Ramping up

200

Existing

0

2013 2016 2020+

1before royalties

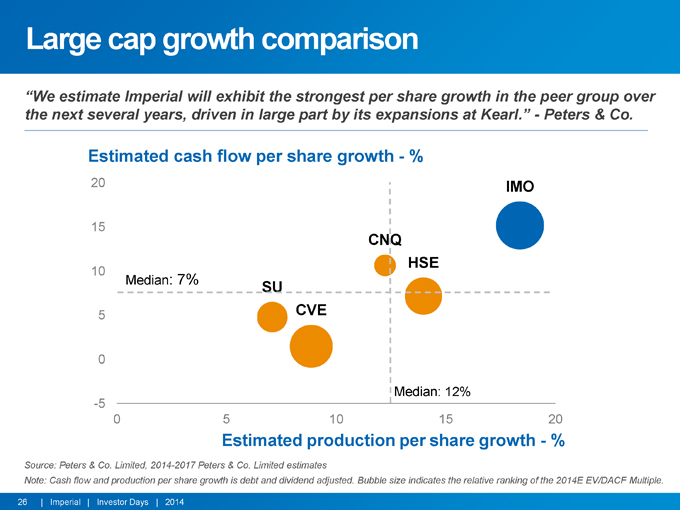

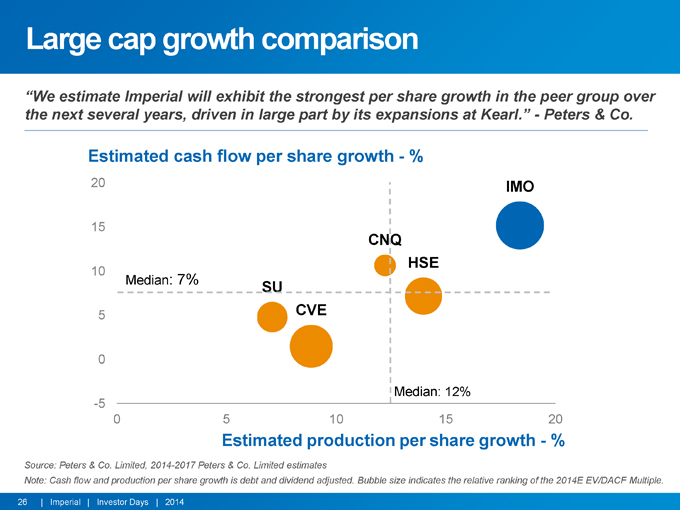

Large cap growth comparison

“We estimate Imperial will exhibit the strongest per share growth in the peer group over the next several years, driven in large part by its expansions at Kearl.”—Peters & Co.

Estimated cash flow per share growth—%

20 IMO

15 CNQ

HSE

10

Median: 7%

SU

0

-5 Median: 12%

0 5 10 15 20

Estimated production per share growth—%

Source: Peters & Co. Limited, 2014-2017 Peters & Co. Limited estimates

Note: Cash flow and production per share growth is debt and dividend adjusted. Bubble size indicates the relative ranking of the 2014E EV/DACF Multiple.

Downstream & Chemical overview

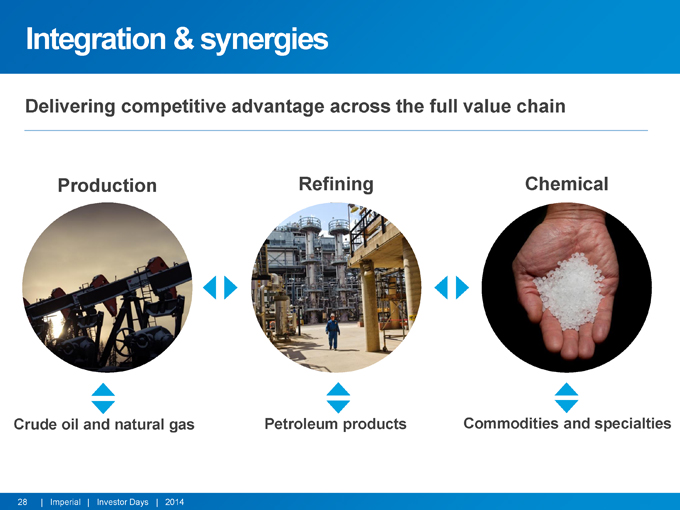

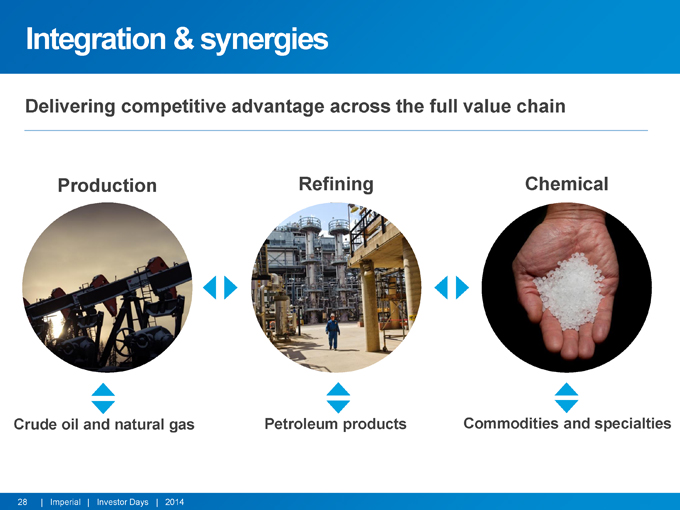

Integration & synergies

Delivering competitive advantage across the full value chain

Production Refining Chemical

Crude oil and natural gas Petroleum products Commodities and specialties

Downstream & Chemical strategies

Maximizing the value of every molecule

Consistently deliver best-in-class performance

Provide valued and high-quality products and services

Lead industry in operating efficiency and effectiveness

Selectively invest for advantaged returns

Refining & Chemical

Canada’s largest refiner, integrated chemical facility

Strathcona, Sarnia, Nanticoke Capacity: 421 kbd

Sarnia Chemicals 2013 sales: 940 KT

Efficient, well-positioned assets Integrated, advantaged feedstocks Leveraging global best practices

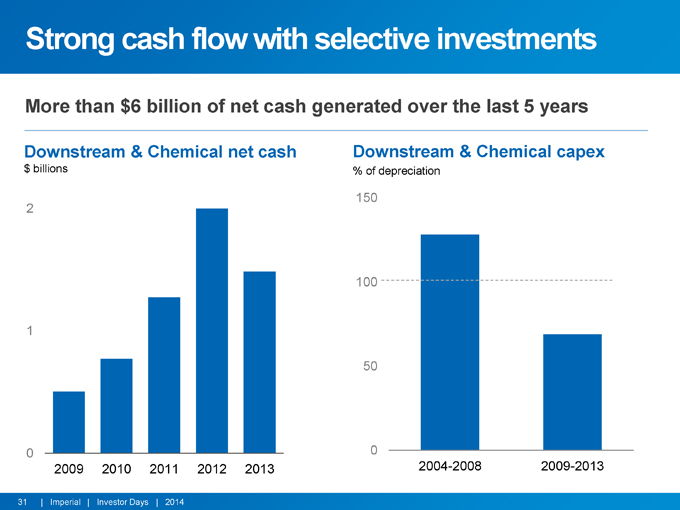

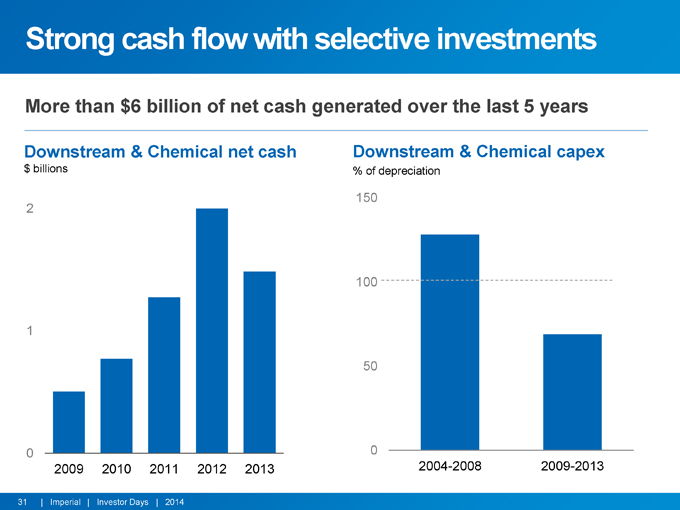

Strong cash flow with selective investments

More than $6 billion of net cash generated over the last 5 years

Downstream & Chemical net cash Downstream & Chemical capex

$ billions % of depreciation

150 2

100 1 50

0 0

2009 2010 2011 2012 2013 2004-2008 2009-2013

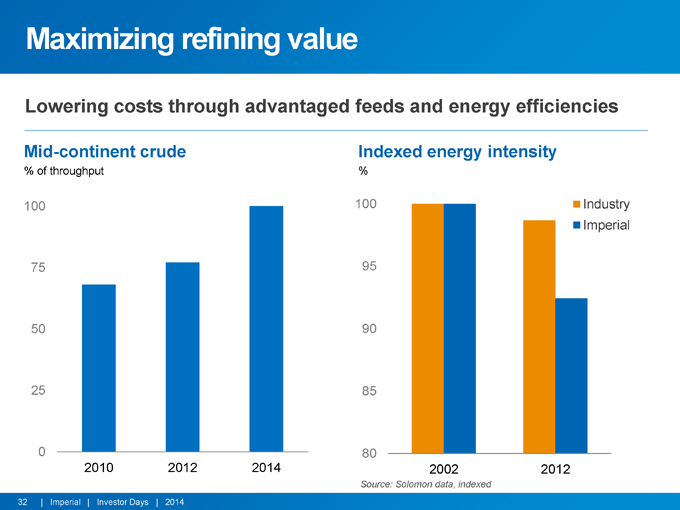

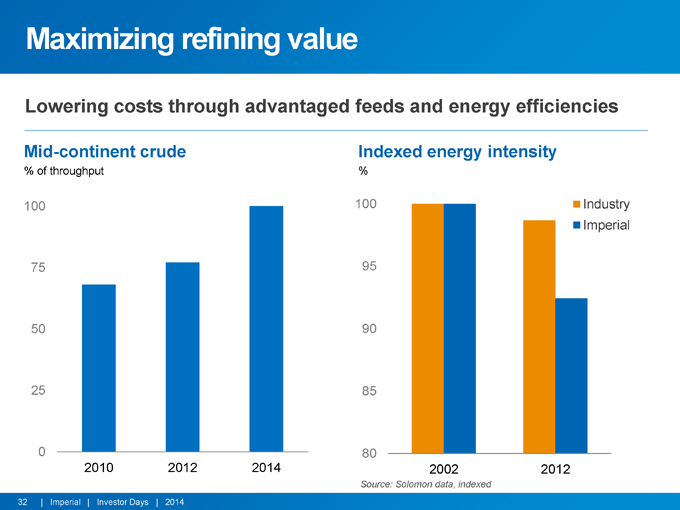

Maximizing refining value

Lowering costs through advantaged feeds and energy efficiencies

Mid-continent crude Indexed energy intensity

% of throughput %

100 100 Industry Imperial

75 95

50 90

25 85

0 80

2010 2012 2014 2002 2012

Source: Solomon data, indexed

Leveraging ExxonMobil global best practices

Unique technical, operational and commercial support networks

Systematic approach to achieve operational excellence:

Personnel safety Energy efficiency

Facility reliability Manufacturing optimization

Strathcona Nanticoke Sarnia Chemical

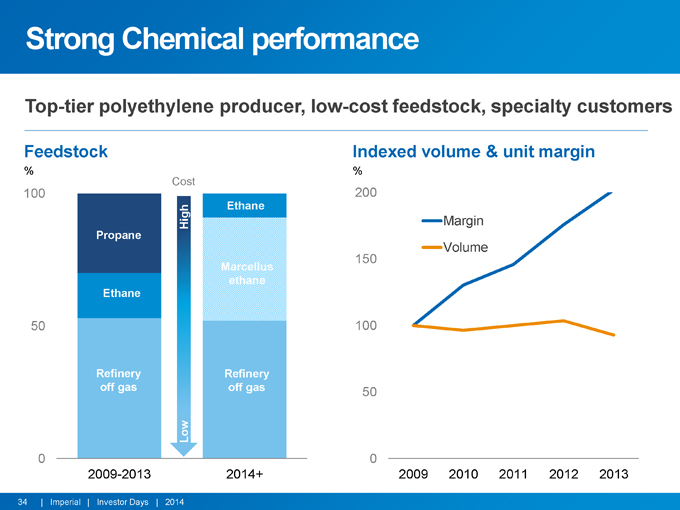

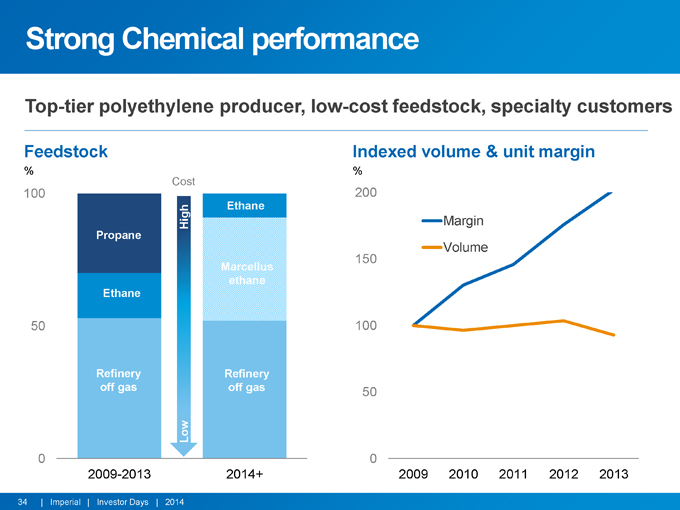

Strong Chemical performance

Top-tier polyethylene producer, low-cost feedstock, specialty customers

Feedstock Indexed volume & unit margin

% %

Cost 200

100

Ethane

High Margin

Propane

150 Volume

Marcellus ethane Ethane

50 100

Refinery Refinery off gas off gas 50

Low

0 0

2009-2013 2014+ 2009 2010 2011 2012 2013

Fuels & Lubricants marketing

World-class brands, extensive distribution system

1,700 sites; 470 company-owned

Marketing brands:

2013 sales: 454 kbd

Concentrated in premium markets High capability distributor network Profitable partnerships

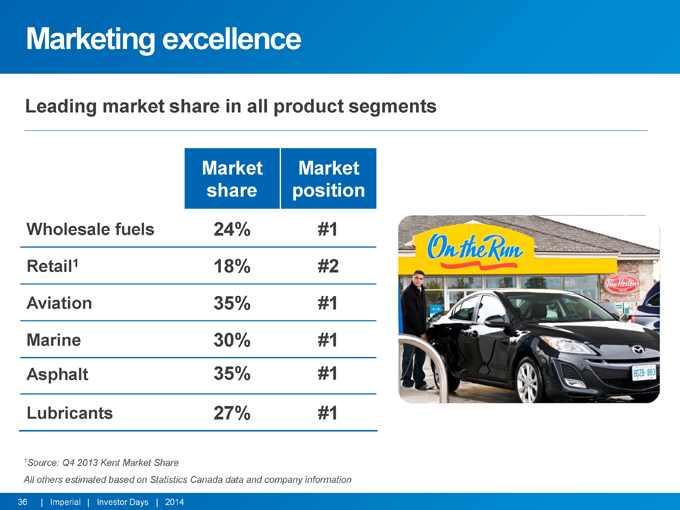

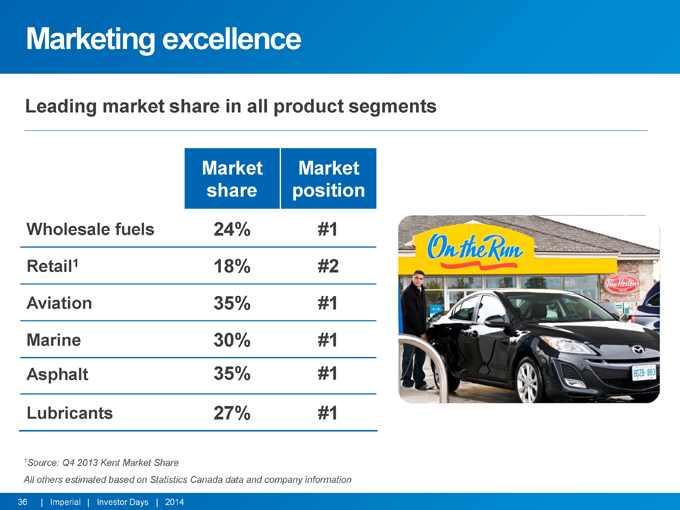

Marketing excellence

Leading market share in all product segments

Market Market share position

Wholesale fuels 24% #1 Retail1 18% #2

Aviation 35% #1

Marine 30% #1 Asphalt 35% #1

Lubricants 27% #1

1Source: Q4 2013 Kent Market Share

All others estimated based on Statistics Canada data and company information

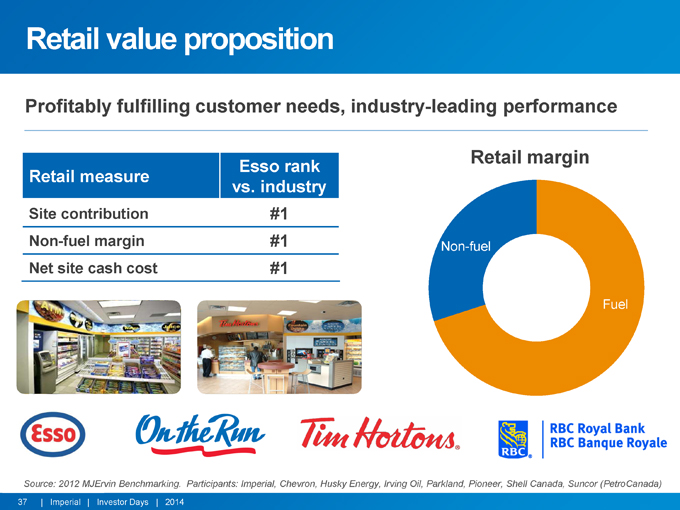

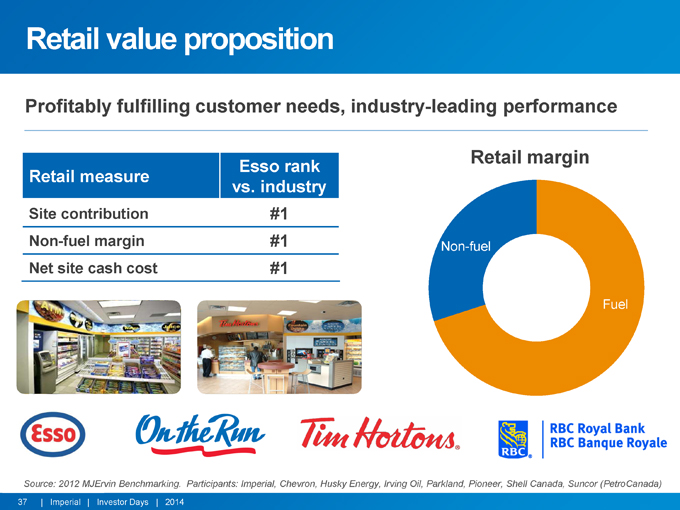

Retail value proposition

Profitably fulfilling customer needs, industry-leading performance

Retail margin

Esso rank

Retail measure vs. industry

Site contribution #1

Non-fuel margin #1 Non-fuel

Net site cash cost #1 Fuel

Non-fuel

Fuel

Source: 2012 MJErvin Benchmarking. Participants: Imperial, Chevron, Husky Energy, Irving Oil, Parkland, Pioneer, Shell Canada, Suncor (PetroCanada)

Break

Upstream overview

Upstream strategies

Operational excellence and profitable growth

• | | Maximize value of existing production |

• | | Invest in projects that deliver superior results |

• | | Enhance resource value through high-impact technologies |

• | | Pursue the highest quality exploration opportunities |

Cold Lake: a world-class in situ operation

Industry-leading performance, further growth potential

100% Imperial, 1st production in 1985

4,500 wells, 150 kbd1 production

1.7B bbls 2P, 3.3B bbls contingent1

Large, high quality resource base Highly efficient operation Significant long-term growth potential

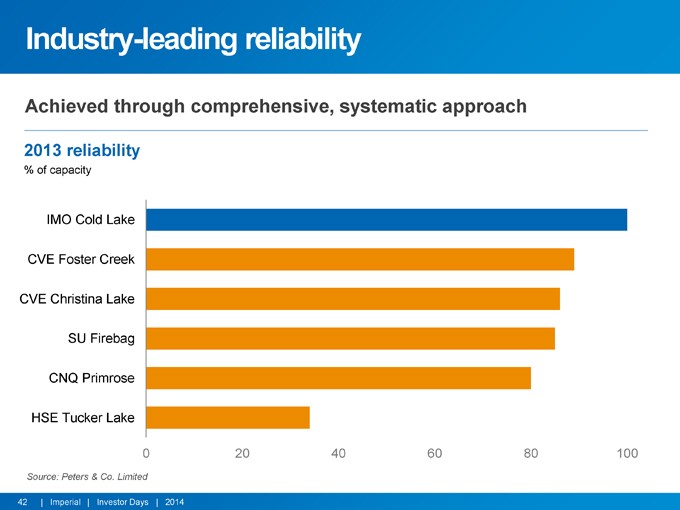

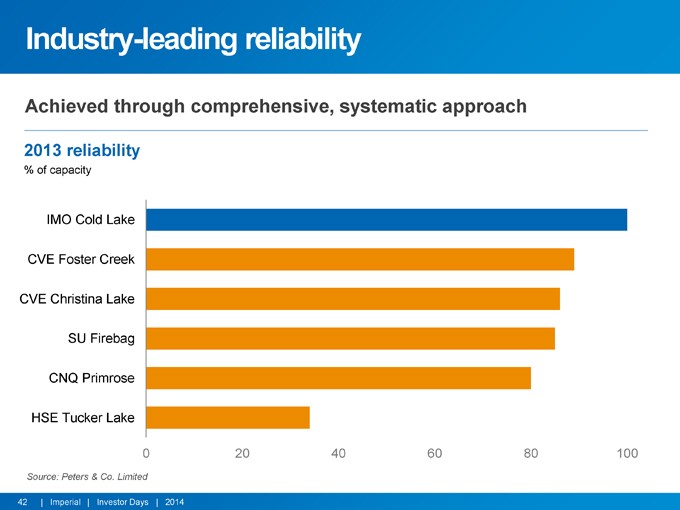

Industry-leading reliability

Achieved through comprehensive, systematic approach

2013 reliability

% of capacity

IMO Cold Lake CVE Foster Creek CVE Christina Lake SU Firebag CNQ Primrose HSE Tucker Lake

0 20 40 60 80 100

Source: Peters & Co. Limited

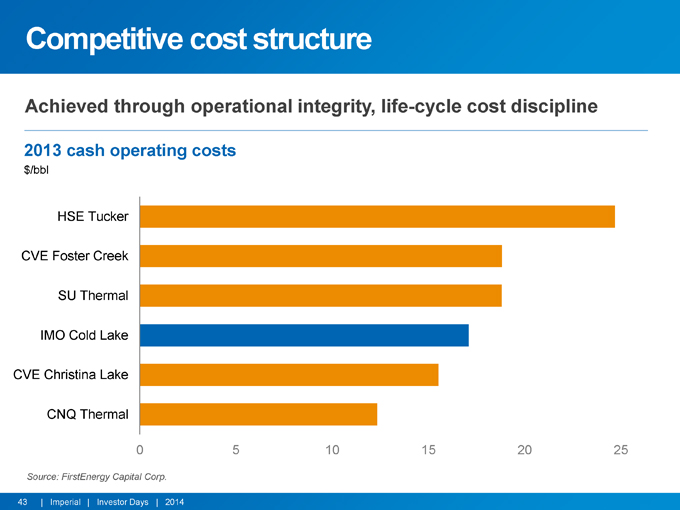

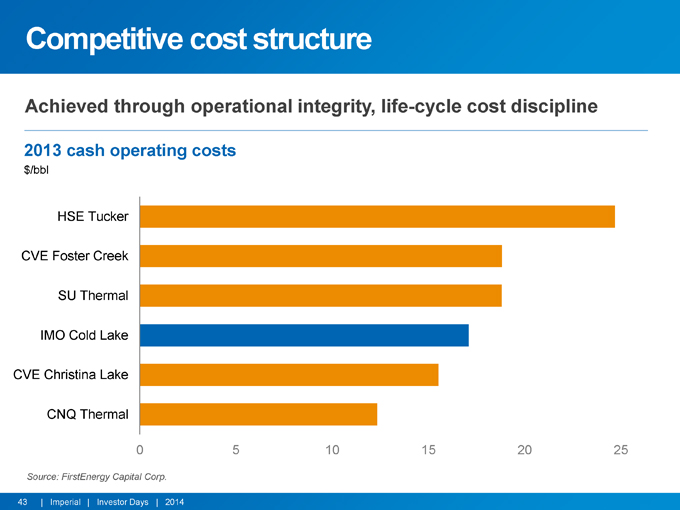

Competitive cost structure

Achieved through operational integrity, life-cycle cost discipline

2013 cash operating costs

$/bbl

HSE Tucker CVE Foster Creek SU Thermal IMO Cold Lake CVE Christina Lake CNQ Thermal

0 5 10 15 20 25

Source: FirstEnergy Capital Corp.

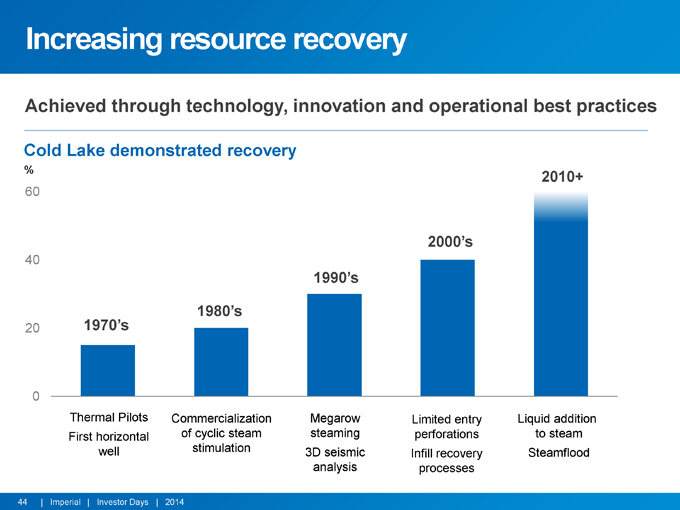

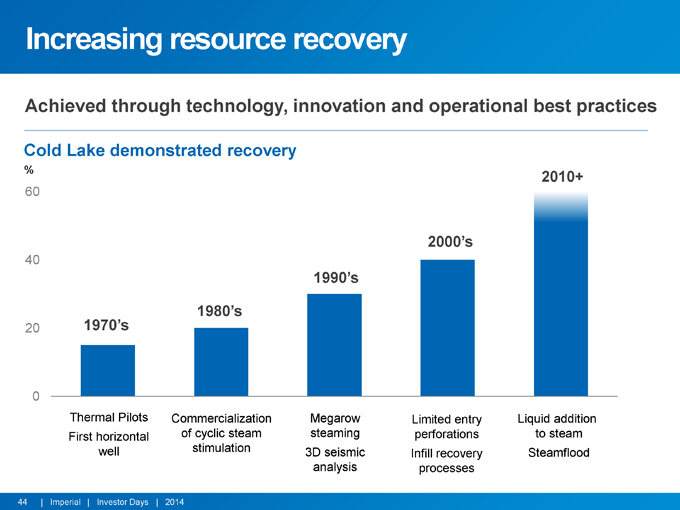

Increasing resource recovery

Achieved through technology, innovation and operational best practices

Cold Lake demonstrated recovery

% 2010+

60

2000’s

40

1990’s

1980’s

20 1970’s

0

Thermal Pilots Commercialization Megarow Limited entry Liquid addition First horizontal of cyclic steam steaming perforations to steam stimulation well 3D seismic Infill recovery Steamflood analysis processes

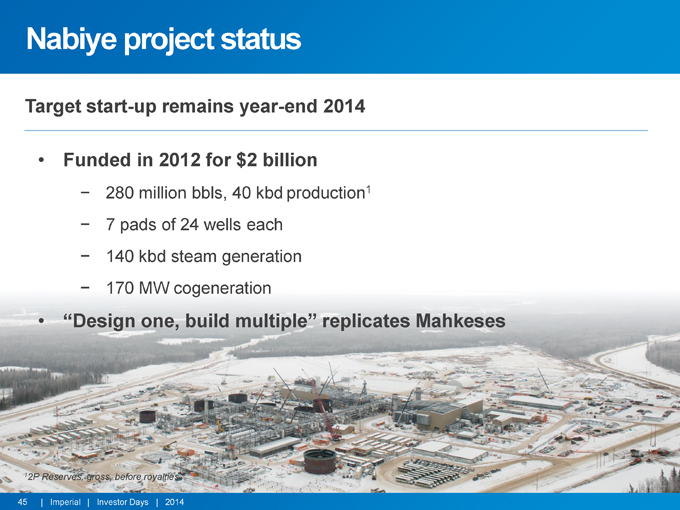

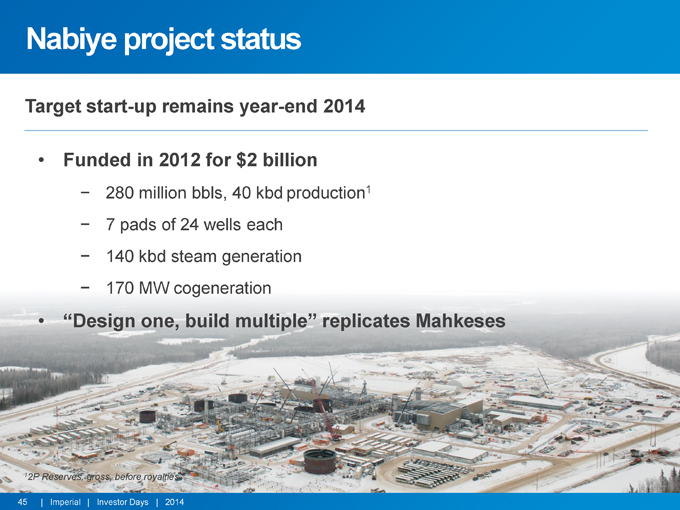

Nabiye project status

Target start-up remains year-end 2014

• | | Funded in 2012 for $2 billion |

- 280 million bbls, 40 kbd production1

- 7 pads of 24 wells each

- 140 kbd steam generation

- 170 MW cogeneration

• | | “Design one, build multiple” replicates Mahkeses |

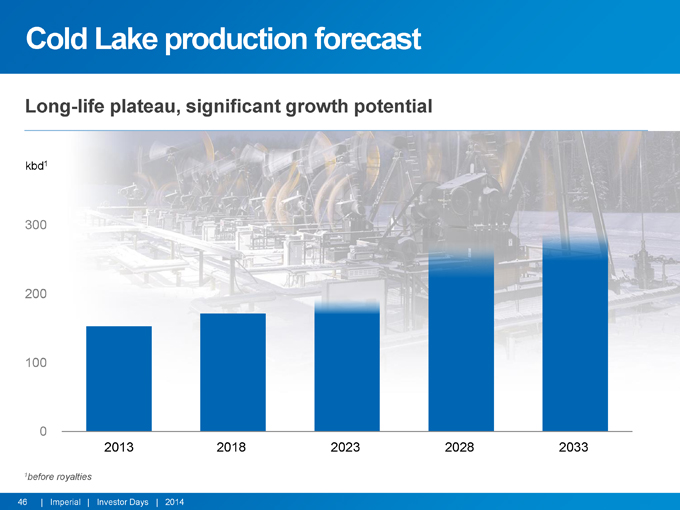

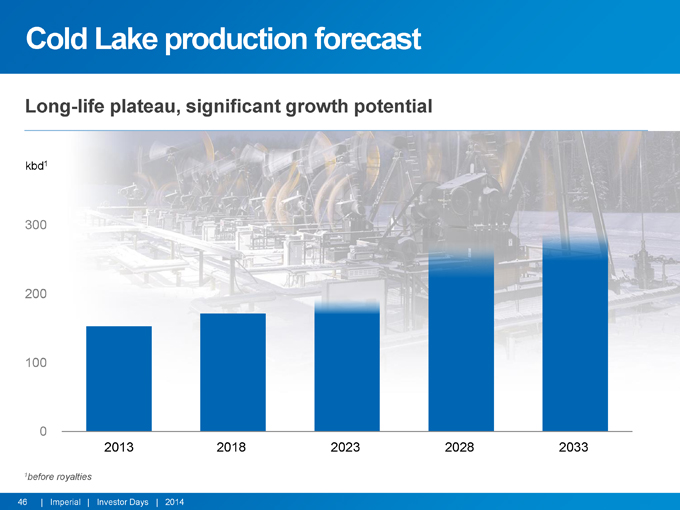

Cold Lake production forecast

Long-life plateau, significant growth potential

kbd1

300 200 100

0

2013 2018 2023 2028 2033

1before royalties

Syncrude: a pioneer in oil sands mining

Strategic asset with improvement potential

25% Imperial, 1st production in 1978

Synthetic crude, 70 kbd production1

1.2B bbls 2P, 1.6B bbls contingent1

High-value production Competitive performance Intense improvement focus

1 IMO share, before royalties

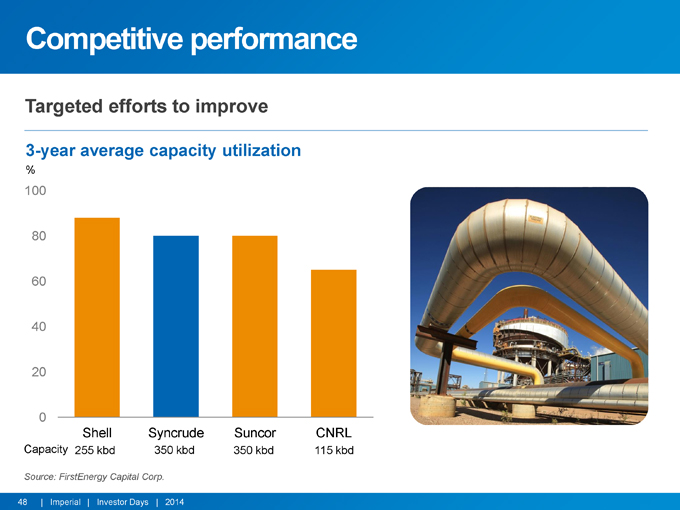

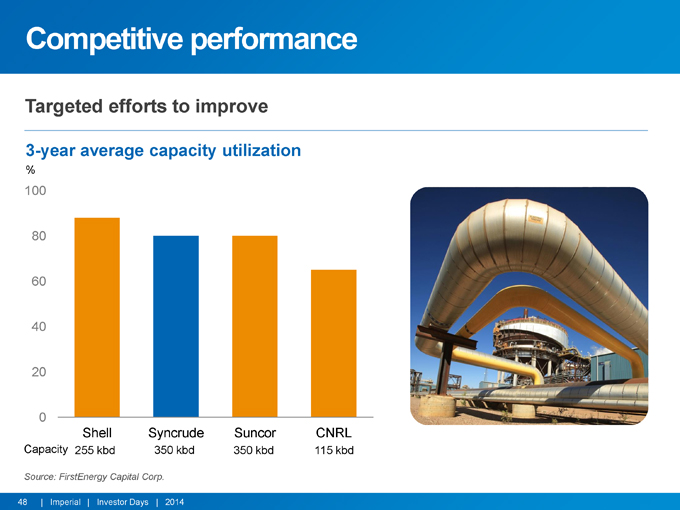

Competitive performance

Targeted efforts to improve

3-year average capacity utilization

%

100 80 60 40 20

0

Shell Syncrude Suncor CNRL

Capacity 255 kbd 350 kbd 350 kbd 115 kbd

Source: FirstEnergy Capital Corp.

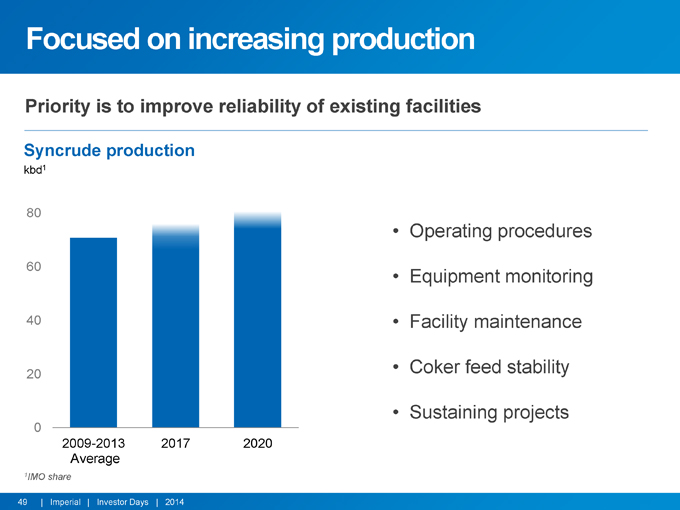

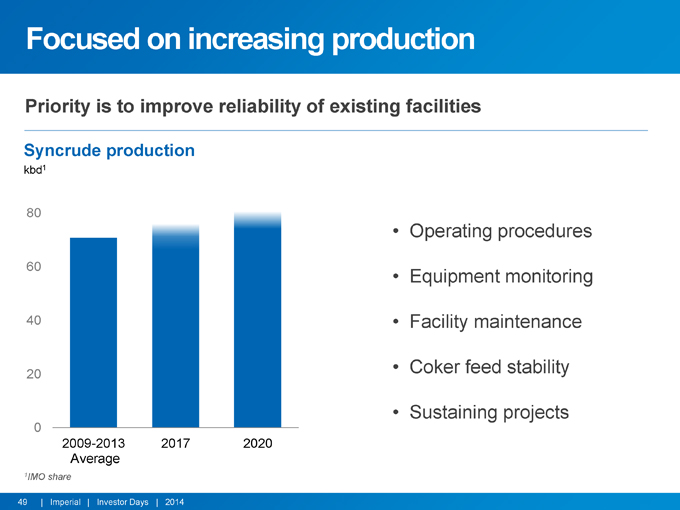

Focused on increasing production

Priority is to improve reliability of existing facilities

Syncrude production

kbd1

80

Operating procedures

60

Equipment monitoring

40 • Facility maintenance

20 • Coker feed stability

Sustaining projects

0

2009-2013 2017 2020 Average

1IMO share

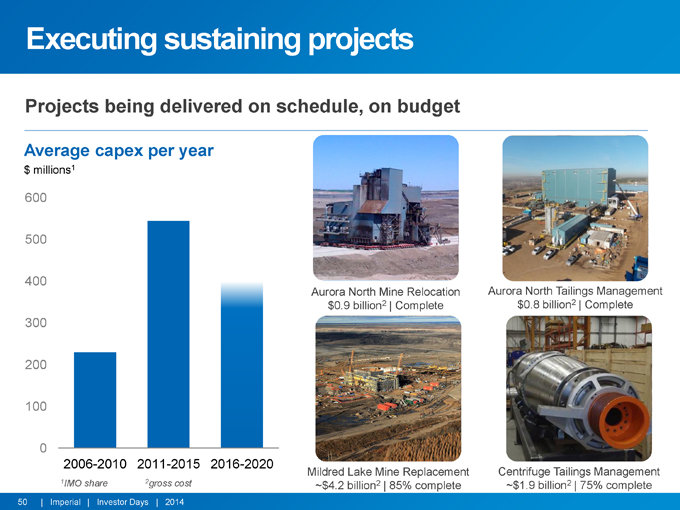

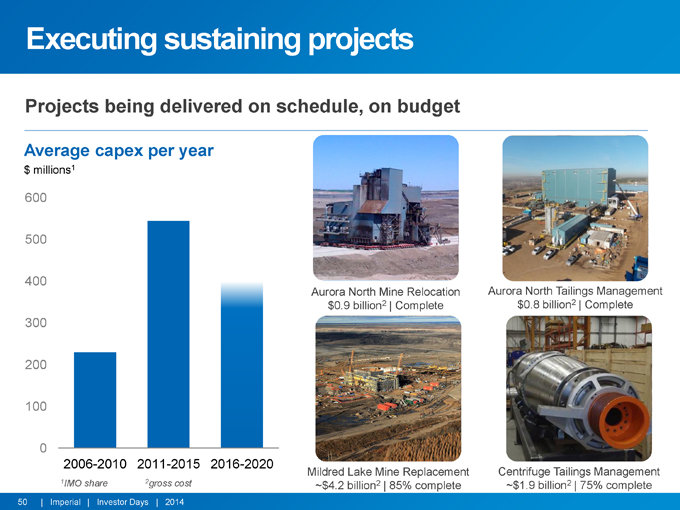

Executing sustaining projects

Projects being delivered on schedule, on budget

Average capex per year

$ millions1

600

500

400

Aurora North Mine Relocation Aurora North Tailings Management $0.9 billion2 | Complete $0.8 billion2 | Complete

300 200 100

0

2006-2010 2011-2015 2016-2020

Mildred Lake Mine Replacement Centrifuge Tailings Management 1IMO share 2gross cost ~$4.2 billion2 | 85% complete ~$1.9 billion2 | 75% complete

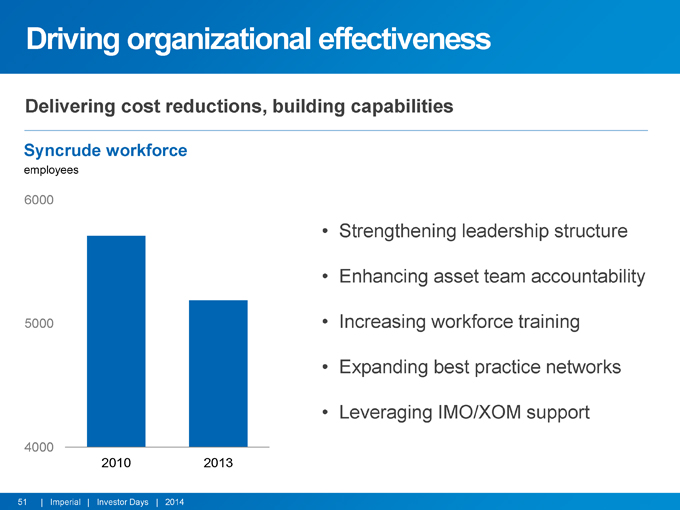

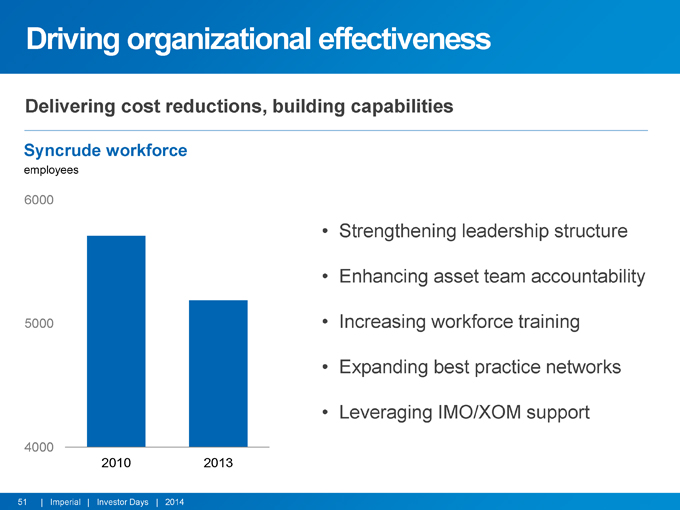

Driving organizational effectiveness

Delivering cost reductions, building capabilities

Syncrude workforce

employees

6000

Strengthening leadership structure

Enhancing asset team accountability 5000 Increasing workforce training

Expanding best practice networks

Leveraging IMO/XOM support

4000

2010 2013

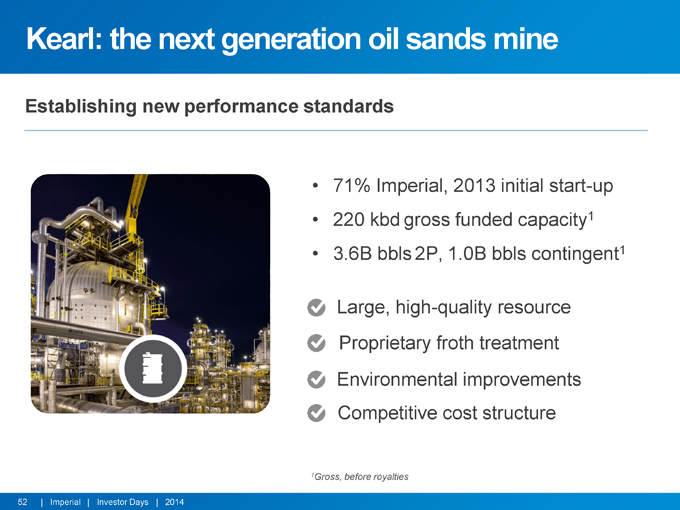

Kearl: the next generation oil sands mine

Establishing new performance standards

71% Imperial, 2013 initial start-up

220 kbd gross funded capacity1

3.6B bbls 2P, 1.0B bbls contingent1

Large, high-quality resource Proprietary froth treatment Environmental improvements Competitive cost structure

1Gross, before royalties

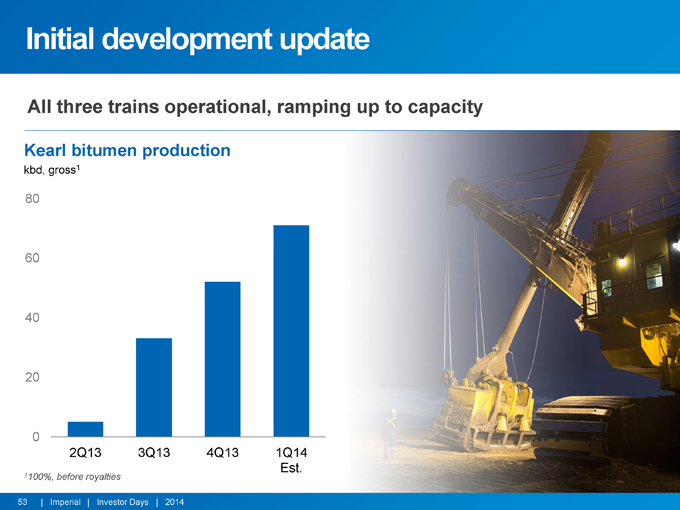

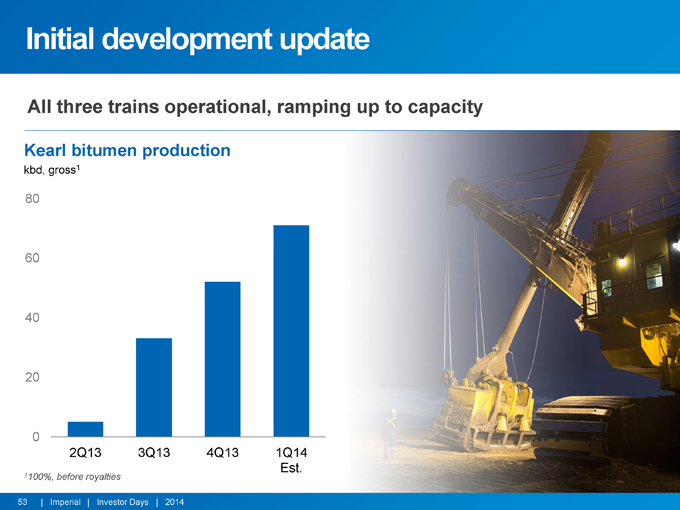

Initial development update

All three trains operational, ramping up to capacity

Kearl bitumen production

kbd, gross1

80 60 40 20

0

2Q13 3Q13 4Q13 1Q14 Est.

1100%, before royalties

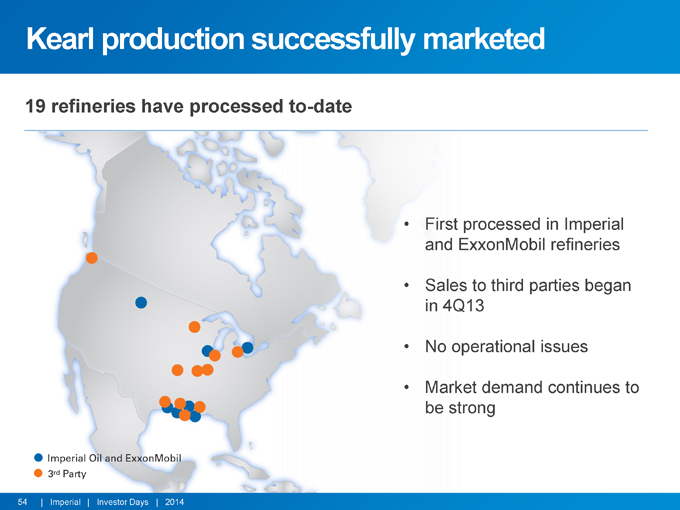

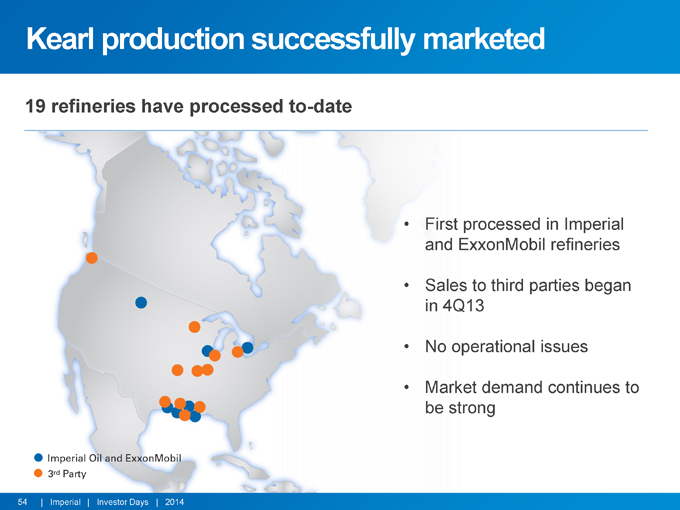

Kearl production successfully marketed

19 refineries have processed to-date

First processed in Imperial and ExxonMobil refineries

Sales to third parties began in 4Q13

No operational issues

Market demand continues to be strong

YOUTUBE

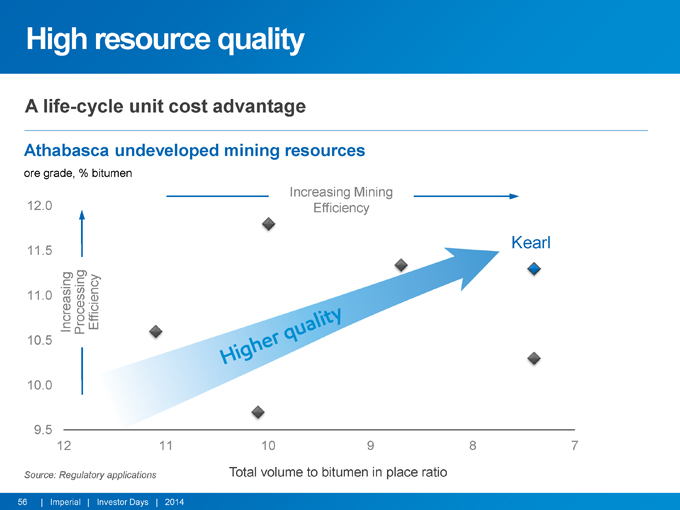

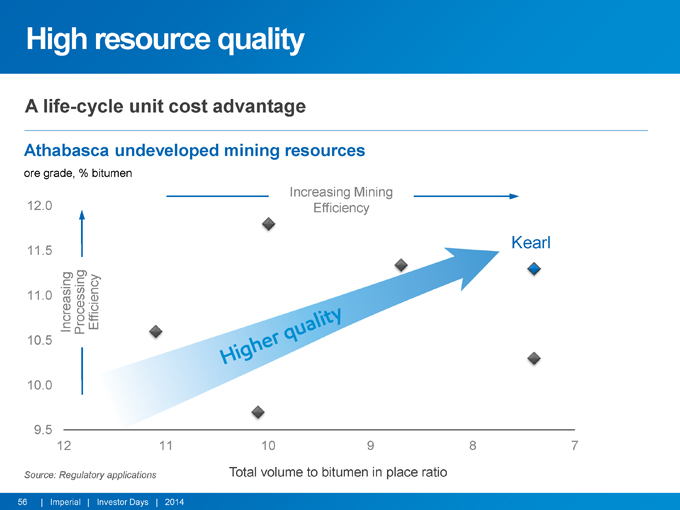

High resource quality

A life-cycle unit cost advantage

Athabasca undeveloped mining resources

ore grade, % bitumen

Increasing Mining 12.0 Efficiency

Kearl

11.5

11.0 Increasing Processing Efficiency 10.5

10.0

9.5

12 11 10 9 8 7 Source: Regulatory applications Total volume to bitumen in place ratio

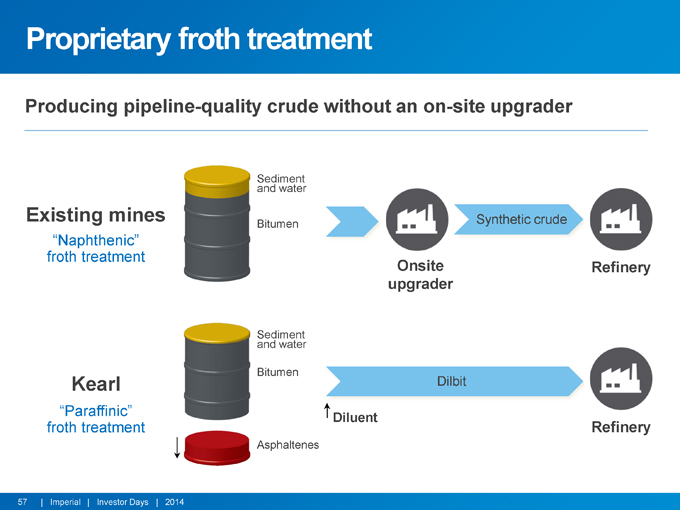

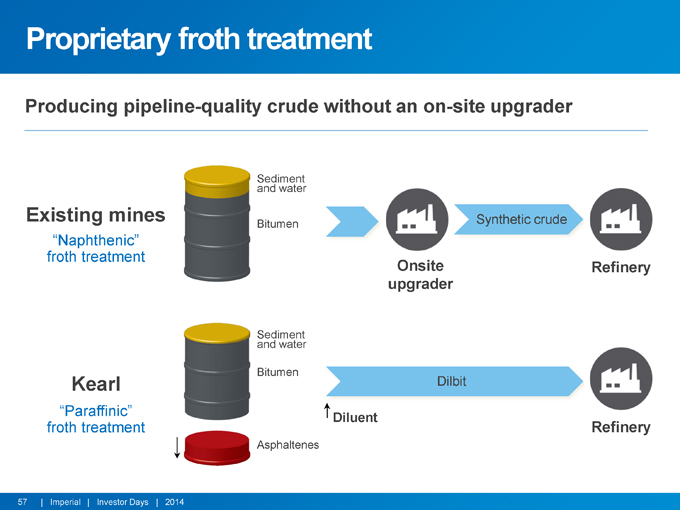

Proprietary froth treatment

Producing pipeline-quality crude without an on-site upgrader

Sediment and water

Existing mines Synthetic crude

Bitumen

“Naphthenic” froth treatment

Onsite Refinery upgrader

Sediment and water

Bitumen

Kearl Dilbit

“Paraffinic”

Diluent froth treatment Refinery

Asphaltenes

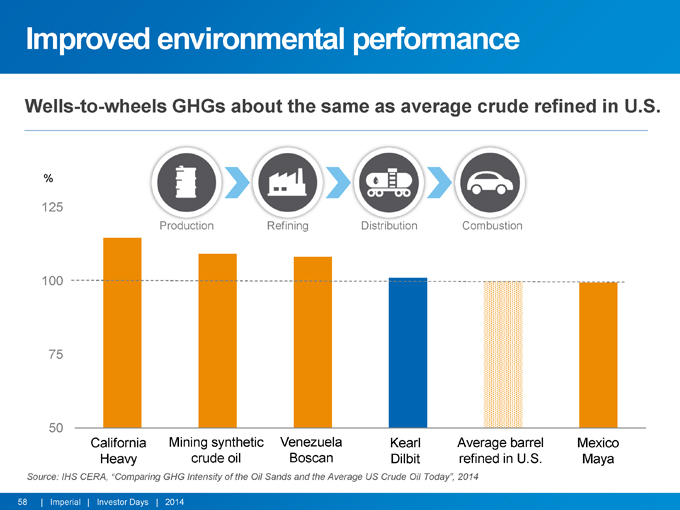

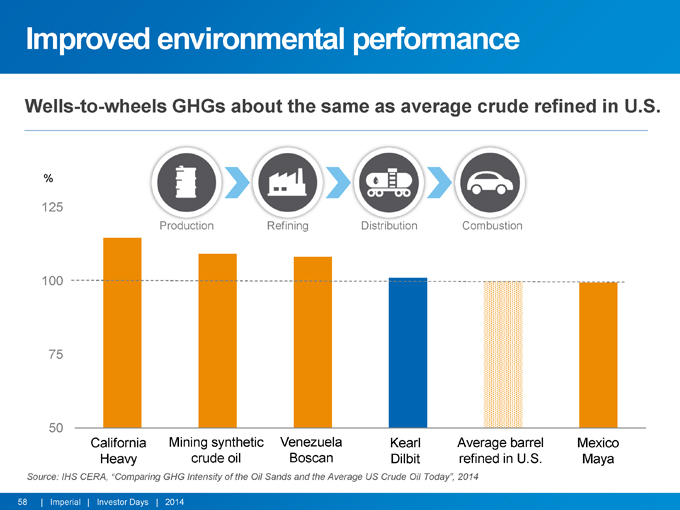

Improved environmental performance

Wells-to-wheels GHGs about the same as average crude refined in U.S.

%

125

Production Refining Distribution Combustion

100

75

50

California Mining synthetic Venezuela Kearl Average barrel Mexico Heavy crude oil Boscan Dilbit refined in U.S. Maya

Source: IHS CERA, “Comparing GHG Intensity of the Oil Sands and the Average US Crude Oil Today”, 2014

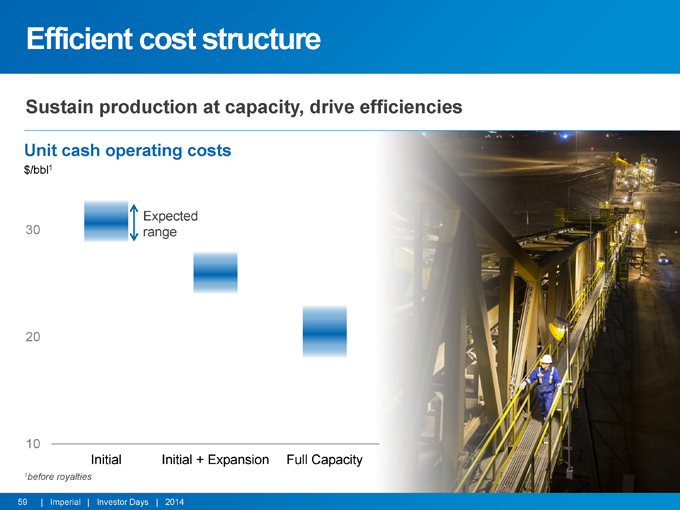

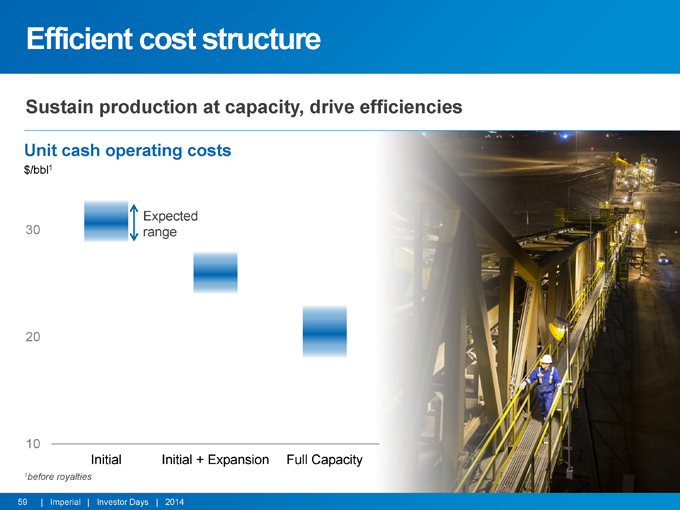

Efficient cost structure

Sustain production at capacity, drive efficiencies

Unit cash operating costs

$/bbl1

Expected 30 range

20

10

Initial Initial + Expansion Full Capacity

1before royalties

Kearl Expansion Project

YOUTUBE

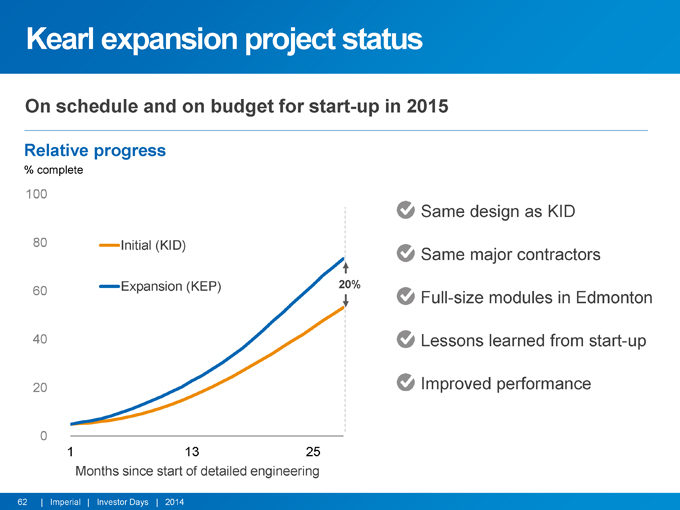

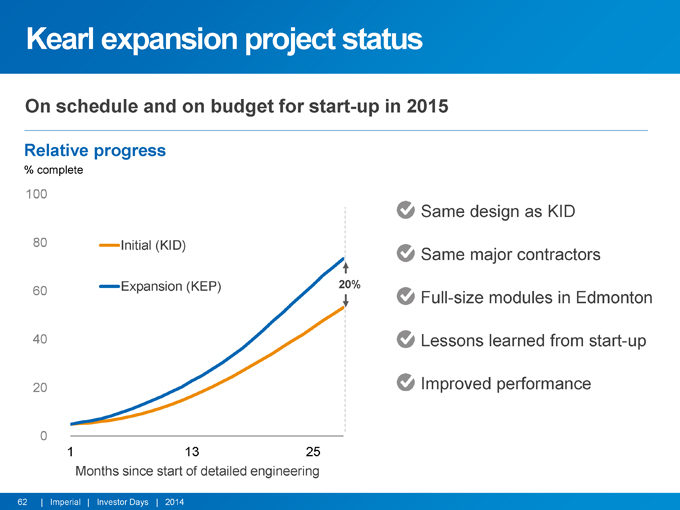

Kearl expansion project status

On schedule and on budget for start-up in 2015

Relative progress

% complete

100%

Same design as KID

80% Initial (KID)

Same major contractors

Expansion (KEP) 20%

60% Full-size modules in Edmonton

40% Lessons learned from start-up

20% Improved performance

1 | | 13 25 Months since start of detailed engineering |

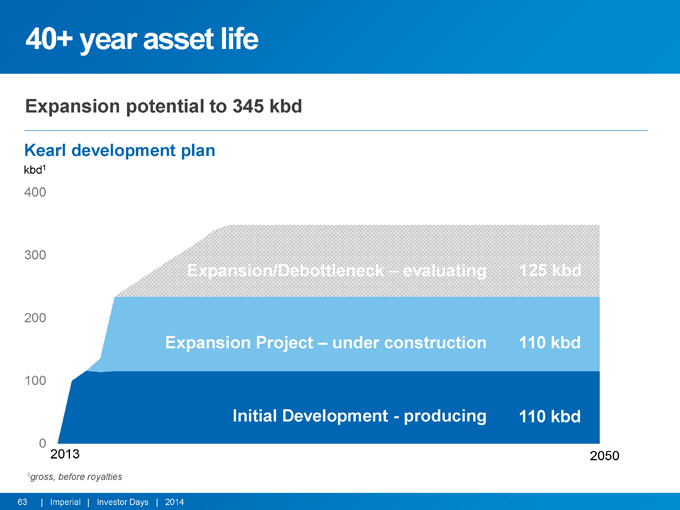

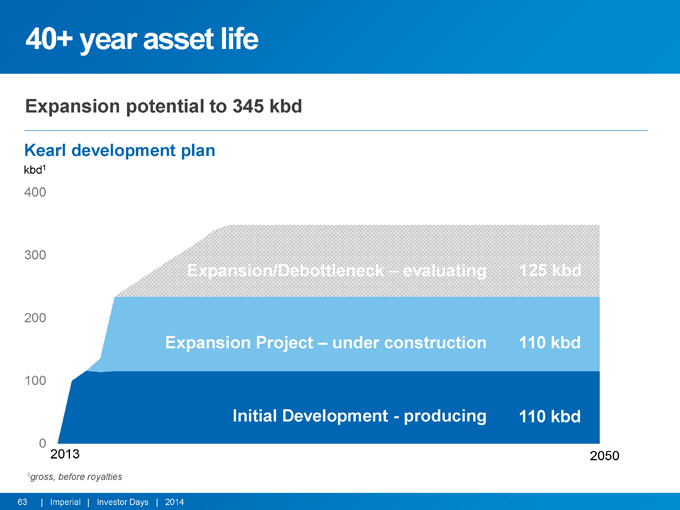

40+ year asset life

Expansion potential to 345 kbd

Kearl development plan

kbd1

400

300

Expansion/Debottleneck – evaluating 125 kbd

200

Expansion Project – under construction 110 kbd

100

Initial Development—producing 110 kbd

0

2013 2050

1gross, before royalties

Market access strategy

Ensure take-away capacity for all equity crude

Optimize use of existing systems to maximize value

Participate in multiple new pipeline opportunities

Use rail options to bridge and provide contingency

Mitigate any future surplus via portfolio optimizations

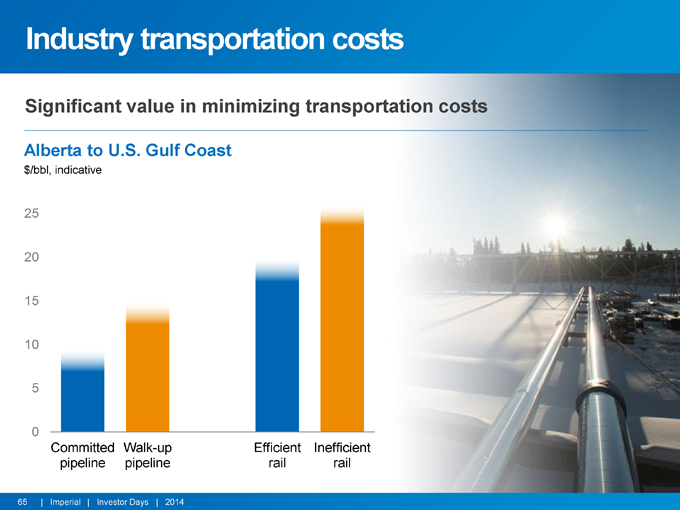

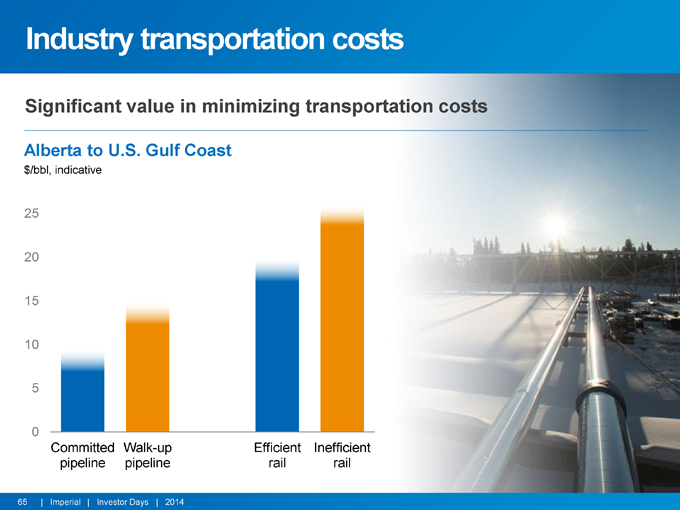

Industry transportation costs

Significant value in minimizing transportation costs

Alberta to U.S. Gulf Coast

$/bbl, indicative

25 20 15 10 5

0

Committed Walk-up Efficient Inefficient pipeline pipeline rail rail

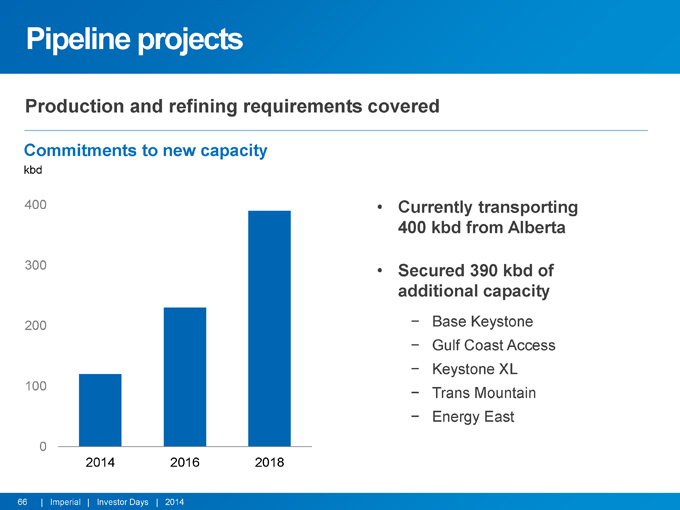

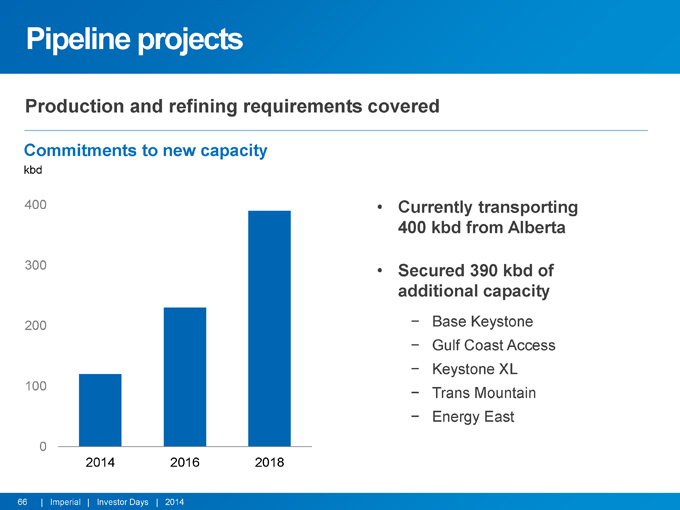

Pipeline projects

Production and refining requirements covered

Commitments to new capacity

kbd

400

Currently transporting 400 kbd from Alberta

300 • Secured 390 kbd of additional capacity

200—Base Keystone

- Gulf Coast Access

- Keystone XL

100

- Trans Mountain

- Energy East

0

2014 2016 2018

Rail projects

Capability to bridge gaps due to apportionment and pipeline timing

Edmonton rail loading terminal

- Joint venture with Kinder Morgan

- Strategically located

- 100-250 kbd unit train capacity

- In service early 2015

Additional facilities

- 20 kbd Strathcona Cold Lake loading

- 30 kbd Nanticoke crude offloading

Future opportunities

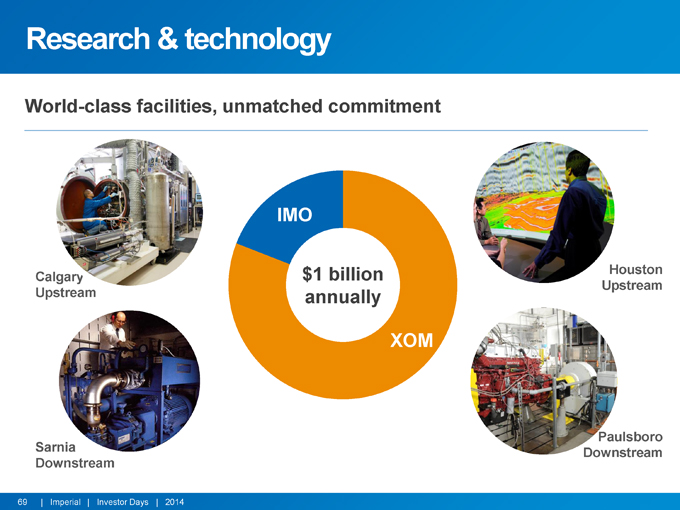

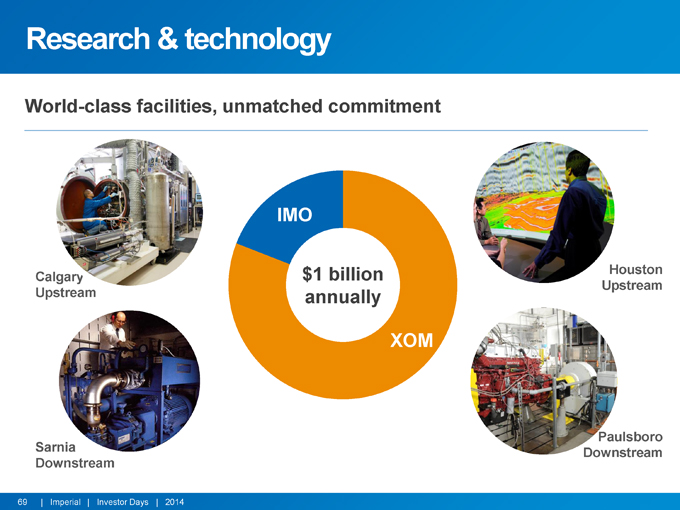

Research & technology

World-class facilities, unmatched commitment

IMO

$1 billion Houston

Calgary

Upstream Upstream annually

XOM

Paulsboro Sarnia Downstream Downstream

Oil sands research

A history of success, new technologies being advanced

In situ In situ Mining

SA-SAGD CSP NAE

Solvent-assisted Cyclic solvent Non-aqueous SAGD process extraction

Deliver performance improvements and long-term value

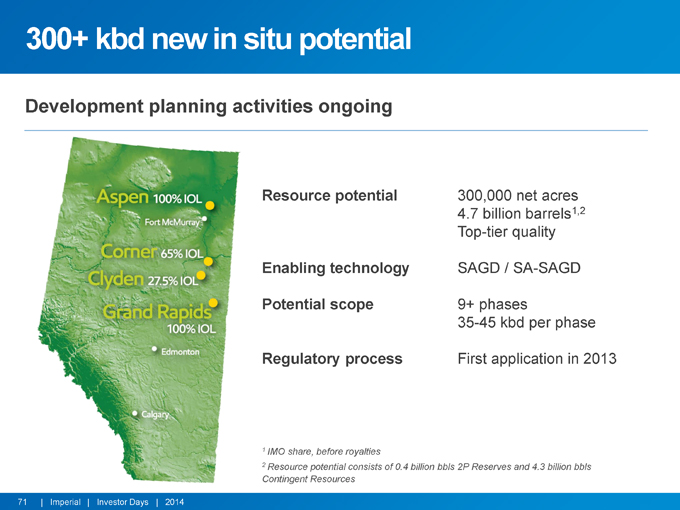

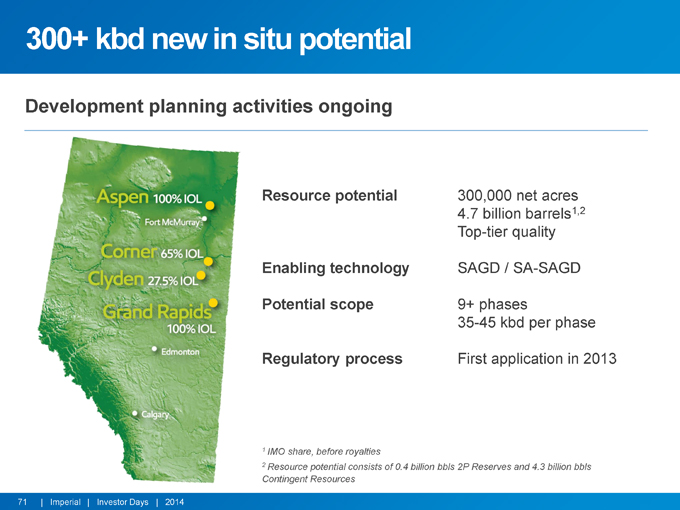

300+ kbd new in situ potential

Development planning activities ongoing

Resource potential 300,000 net acres 4.7 billion barrels1,2 Top-tier quality

Enabling technology SAGD / SA-SAGD

Potential scope 9+ phases

35-45 kbd per phase

Regulatory process First application in 2013

1 | | IMO share, before royalties |

2 | | Resource potential consists of 0.4 billion bbls 2P Reserves and 4.3 billion bbls Contingent Resources |

YOUTUBE

Aspen project

1.1 billion barrels potential, regulatory application submitted

Three phases, 45 kbd each

“Design one, build multiple”

SAGD/SA-SAGD technology

Regulatory filing: December 2013

Progressing technical definition

Resource potential consists of 0.4 billion bbls 2P Reserves and 0.7 billion bbls Contingent Resources’, before royalties

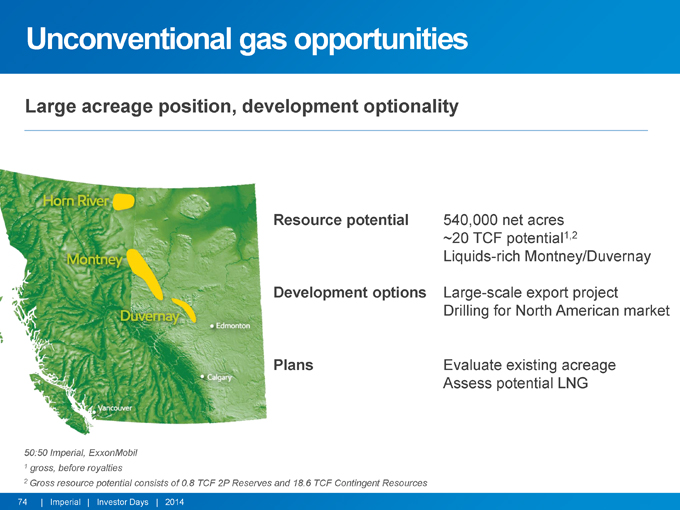

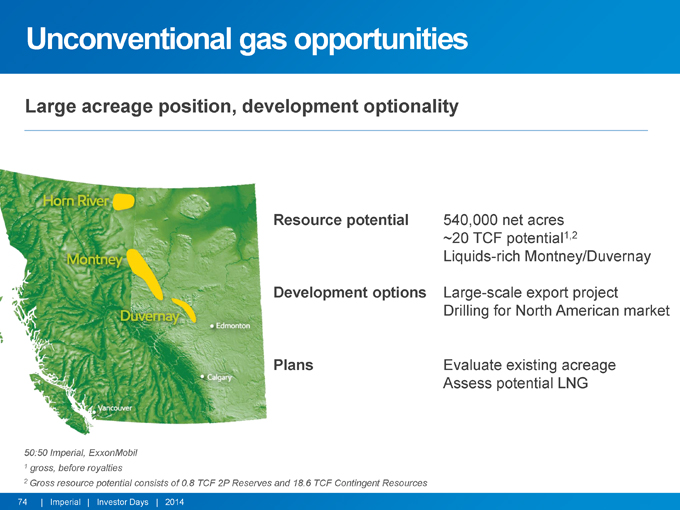

Unconventional gas opportunities

Large acreage position, development optionality

rce potential 540,000 net acres ~20 TCF potential1,2

Liquids-rich Montney/Duvernay

elopment options Large-scale export project

Drilling for North American market

Evaluate existing acreage Assess potential LNG

1 | | gross, before royalties |

2 | | Gross resource potential consists of 0.8 TCF 2P Reserves and 18.6 TCF Contingent Resources |

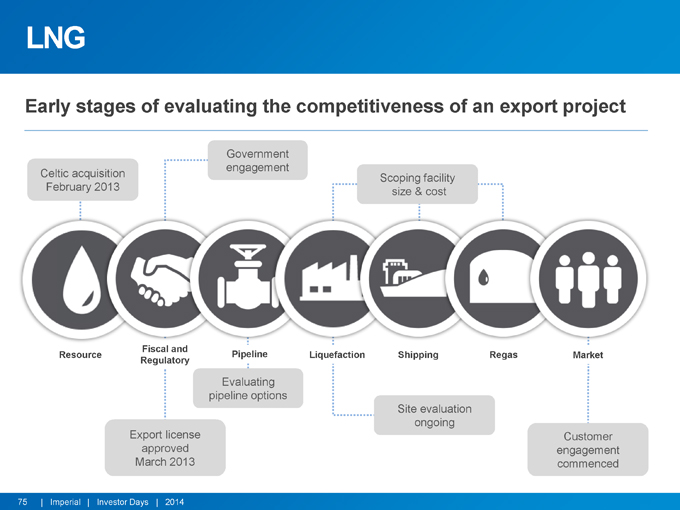

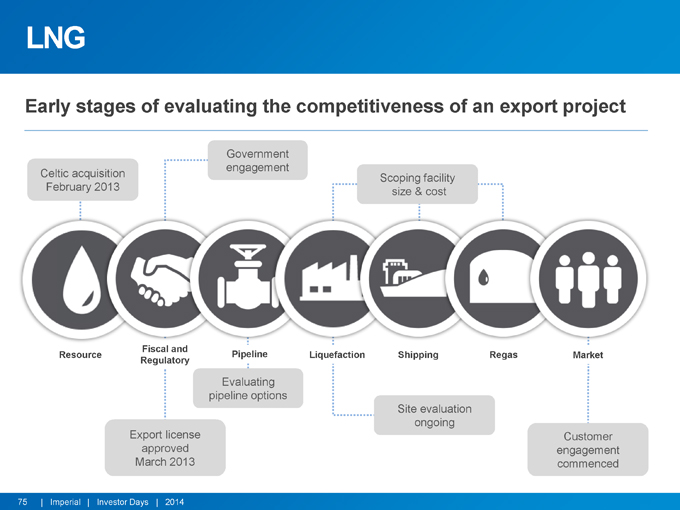

LNG

Early stages of evaluating the competitiveness of an export project

Government engagement

Celtic acquisition Scoping facility February 2013 size & cost

Fiscal and

Resource Pipeline Liquefaction Shipping Regas Market Regulatory

Evaluating pipeline options

Site evaluation ongoing

Export license Customer approved engagement March 2013 commenced

Final comments

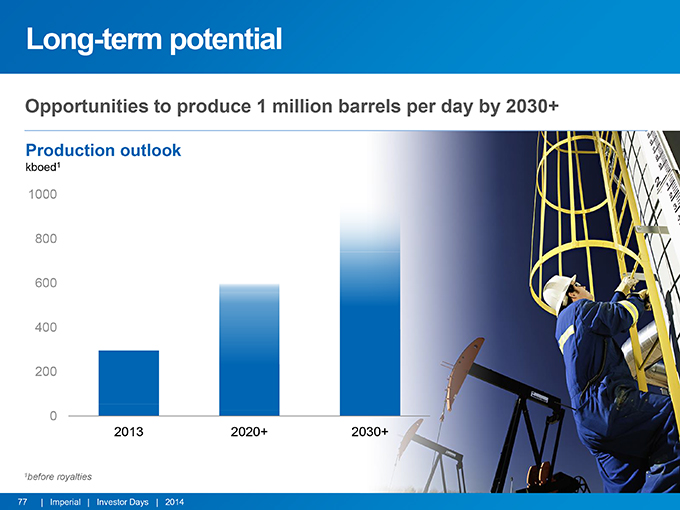

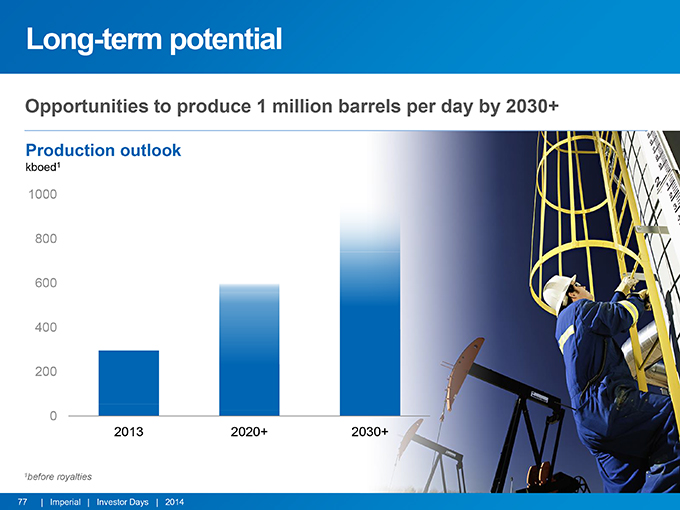

Long-term potential

Opportunities to produce 1 million barrels per day by 2030+

Production outlook

kboed1

1000

800

600 400 200

0

2013 2020+ 2030+

1before royalties

77 | Imperial | Investor Days | 2014

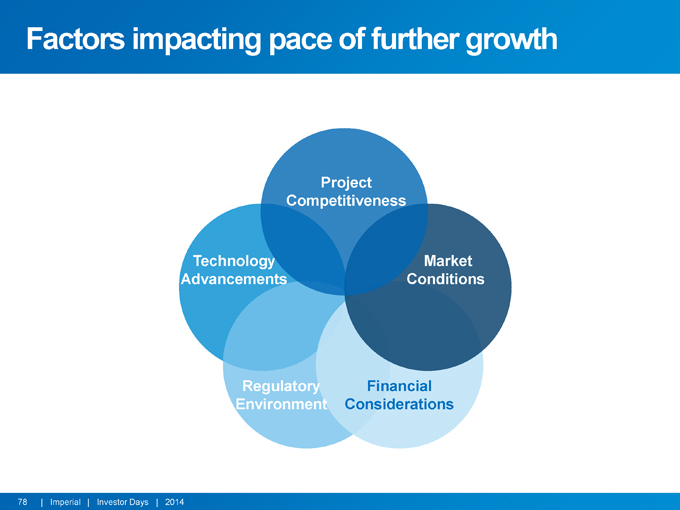

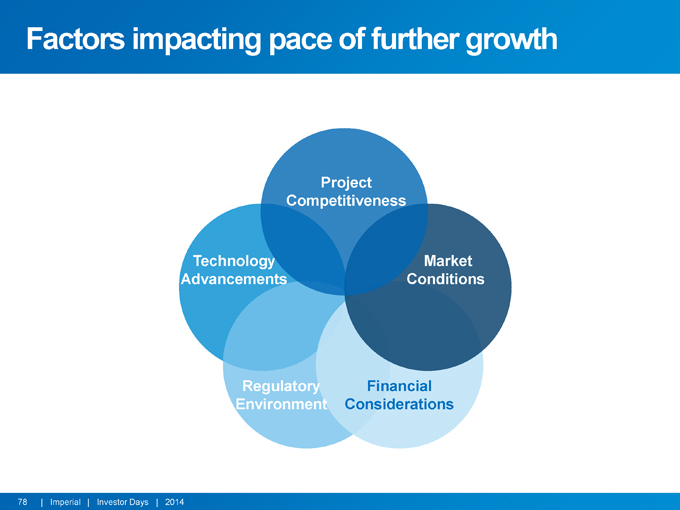

Factors impacting pace of further growth

Project Competitiveness

Technology Market Advancements Conditions

Regulatory Financial Environment Considerations

Business model

Deliver superior, long-term shareholder value

Long-life, competitively advantaged assets

Disciplined investment and cost management

Integration and synergies

High-impact technologies and innovation

Operational excellence and responsible growth

ExxonMobil relationship

For more information www.imperialoil.ca

Twitter /ImperialOil YouTube /ImperialOil LinkedIn /Imperial-Oil

For more detailed investor information, or to receive annual and interim reports, please contact:

John A. Charlton

Manager, Investor Relations Imperial Oil Limited

237 Fourth Avenue SW

Calgary, Alberta T2P 3M9 Email: john.a.charlton@esso.ca Phone: (403) 237-4537