Imperial Investor Day November 7, 2018 Exhibit 99.1

Opening Remarks Rich Kruger Chairman, President and Chief Executive Officer

Q3 recap Results consistent with expectations for strong second half performance 393,000 boepd Upstream production 388,000 bpd Refinery throughput 516,000 bpd Petroleum product sales $749 million Net income $1.2 billion Cash from operations $573 million Returned to shareholders

Global energy outlook Energy demand to increase 25% by 2040, oil and gas to remain key Energy is required to power economic growth and improve standards of living Demand increases driven by population growth and rising incomes Increased energy use expected in wide range of sectors World will need all practical and economic energy sources Oil and natural gas will continue to meet 55-60% of total demand Society faces a dual challenge with energy development Technology is key to addressing the challenge Source: ExxonMobil 2018 Outlook for Energy

Growth driven by transportation, chemicals Global resources sufficient to meet demand New supplies required from multiple regions Major ongoing investments required Must be globally competitive for capital Global liquids outlook Oil to remain the world's largest energy source well into the future New Production Required Demand mbd Source: ExxonMobil 2018 Outlook for Energy

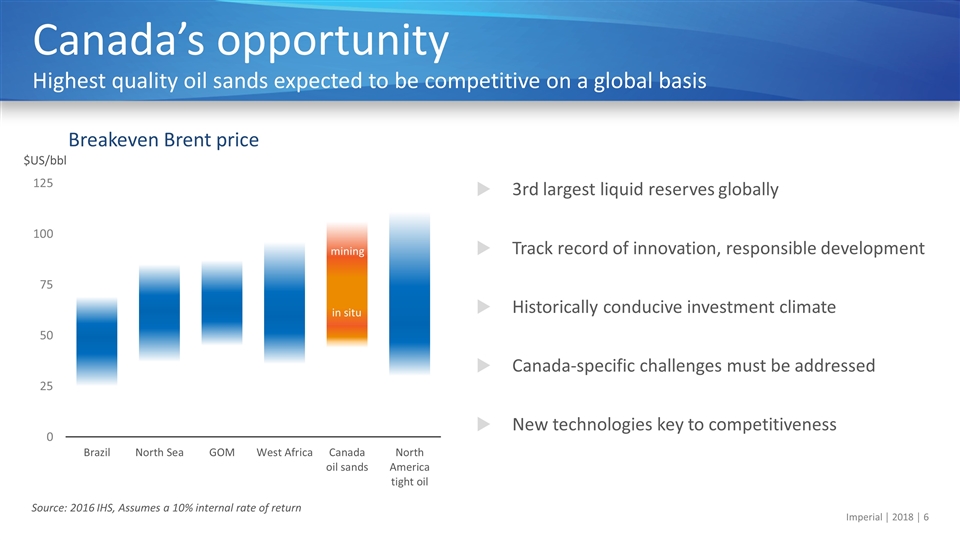

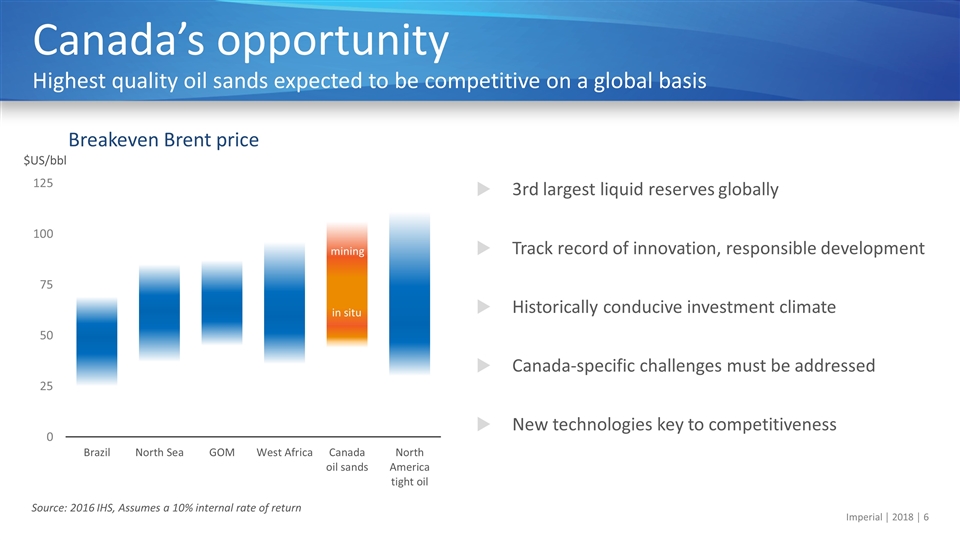

3rd largest liquid reserves globally Track record of innovation, responsible development Historically conducive investment climate Canada-specific challenges must be addressed New technologies key to competitiveness Canada’s opportunity Highest quality oil sands expected to be competitive on a global basis Source: 2016 IHS, Assumes a 10% internal rate of return mining in situ Breakeven Brent price $US/bbl

Imperial’s operations High quality, integrated, balanced, coast-to-coast asset portfolio Syncrude mining Kearl mining Cold Lake in situ Rail terminal F&L marketing Strathcona refinery Sarnia chemical Sarnia refinery Nanticoke refinery Research Distribution network

Business model Deliver superior, long-term shareholder value Long-life, competitively advantaged assets Disciplined investment and cost management Value chain integration and synergies High-impact technologies and innovation Operational excellence and responsible growth ExxonMobil relationship

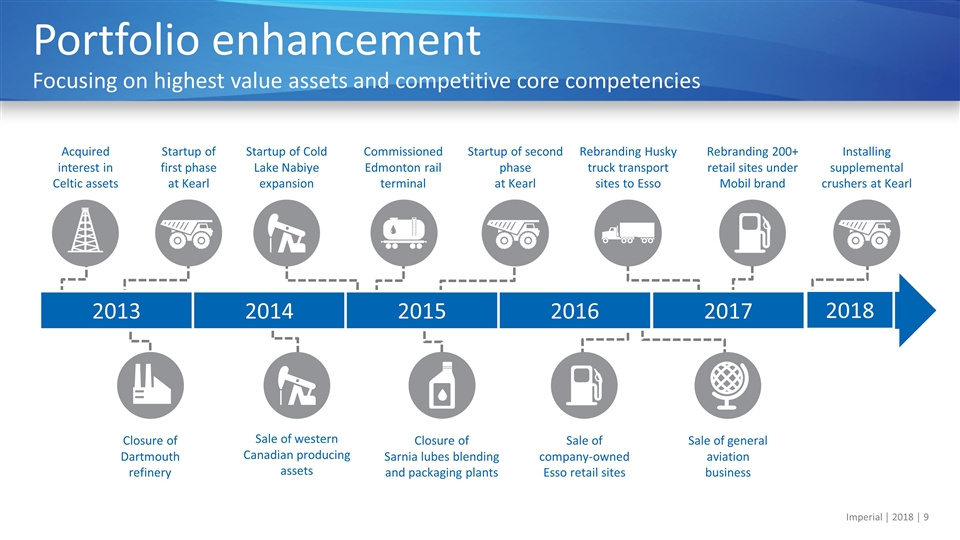

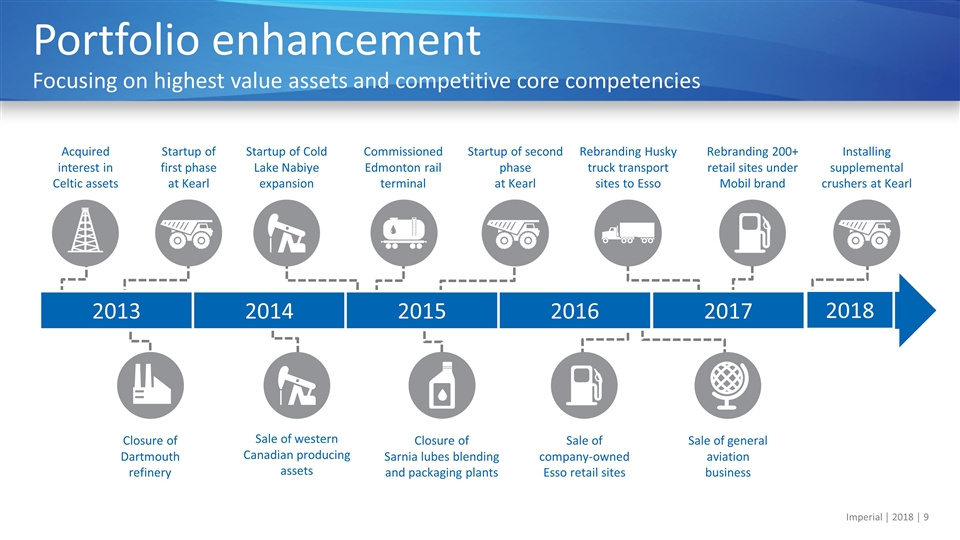

Portfolio enhancement Focusing on highest value assets and competitive core competencies Startup of Cold Lake Nabiye expansion Rebranding Husky truck transport sites to Esso Commissioned Edmonton rail terminal Acquired interest in Celtic assets Startup of first phase at Kearl Startup of second phase at Kearl Rebranding 200+ retail sites under Mobil brand 2013 2014 2015 2016 2017 Sale of general aviation business Sale of western Canadian producing assets Sale of company-owned Esso retail sites Closure of Sarnia lubes blending and packaging plants Closure of Dartmouth refinery 2018 Installing supplemental crushers at Kearl

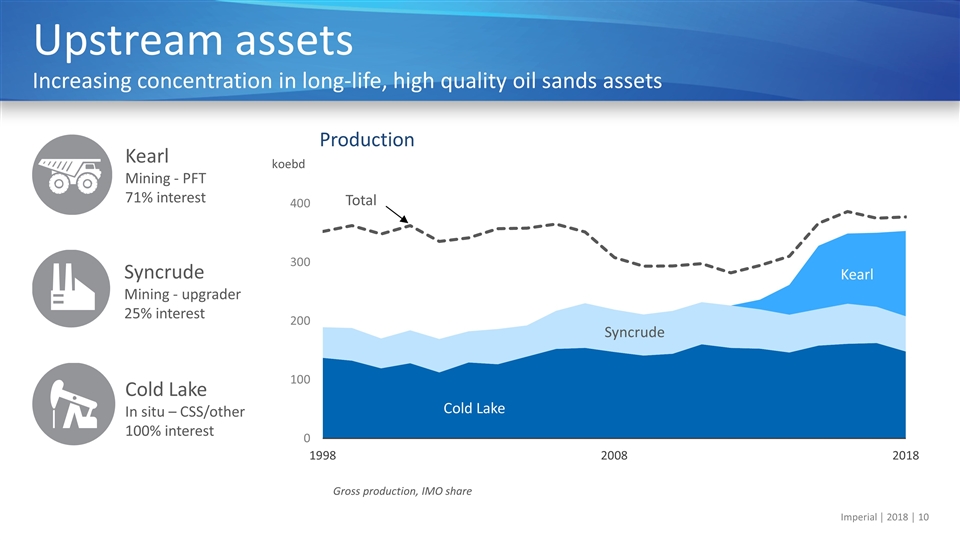

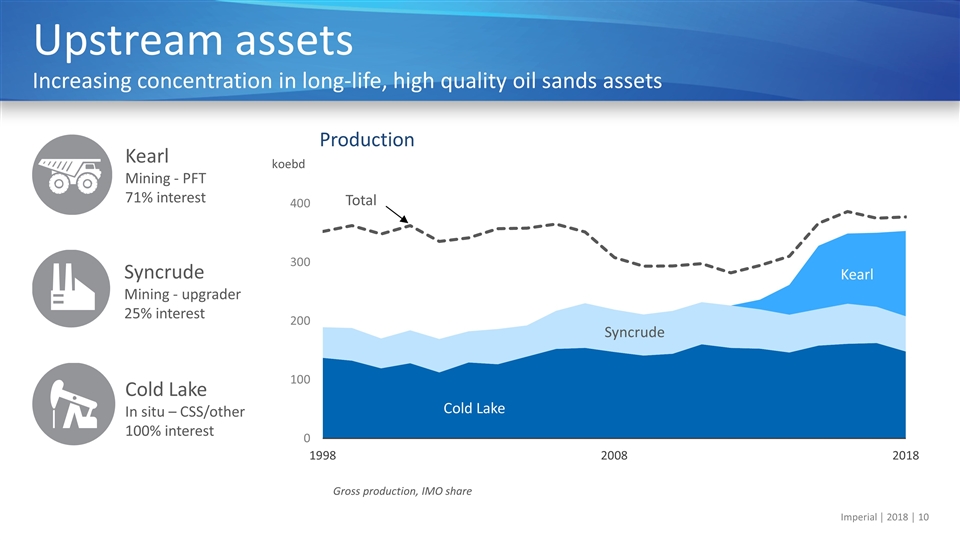

Upstream assets Increasing concentration in long-life, high quality oil sands assets Gross production, IMO share Production Syncrude Cold Lake Kearl Total Kearl Mining - PFT 71% interest Cold Lake In situ – CSS/other 100% interest Syncrude Mining - upgrader 25% interest koebd

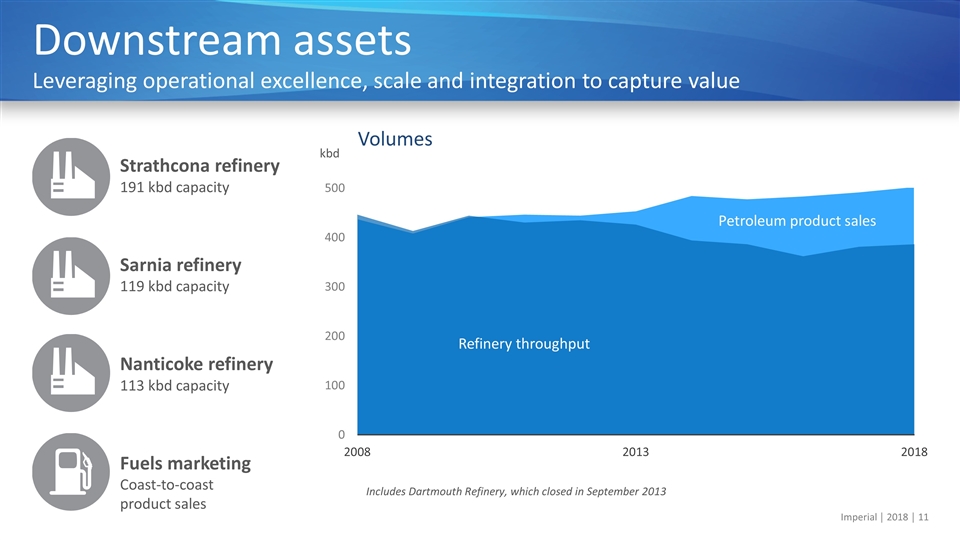

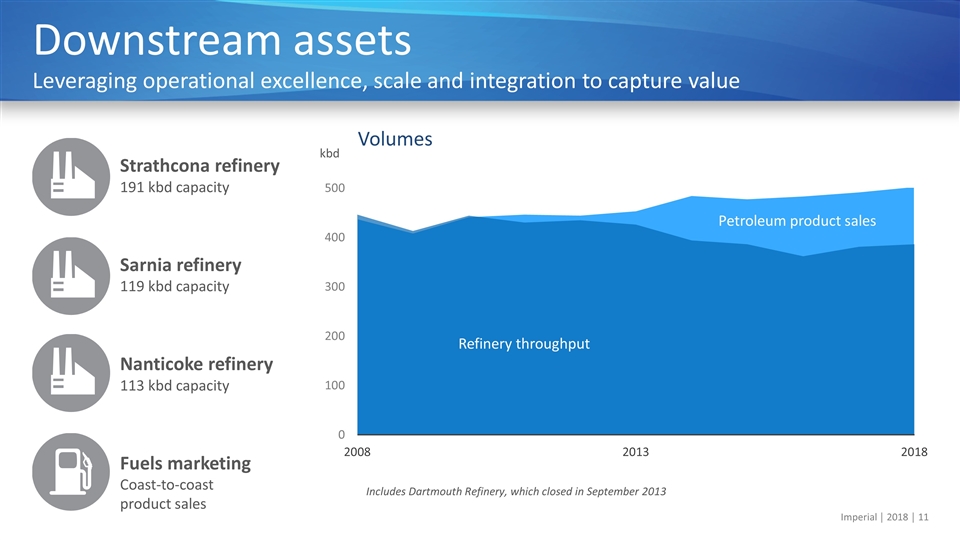

Downstream assets Leveraging operational excellence, scale and integration to capture value Volumes Strathcona refinery 191 kbd capacity Sarnia refinery 119 kbd capacity Nanticoke refinery 113 kbd capacity Fuels marketing Coast-to-coast product sales Refinery throughput Petroleum product sales Includes Dartmouth Refinery, which closed in September 2013 kbd

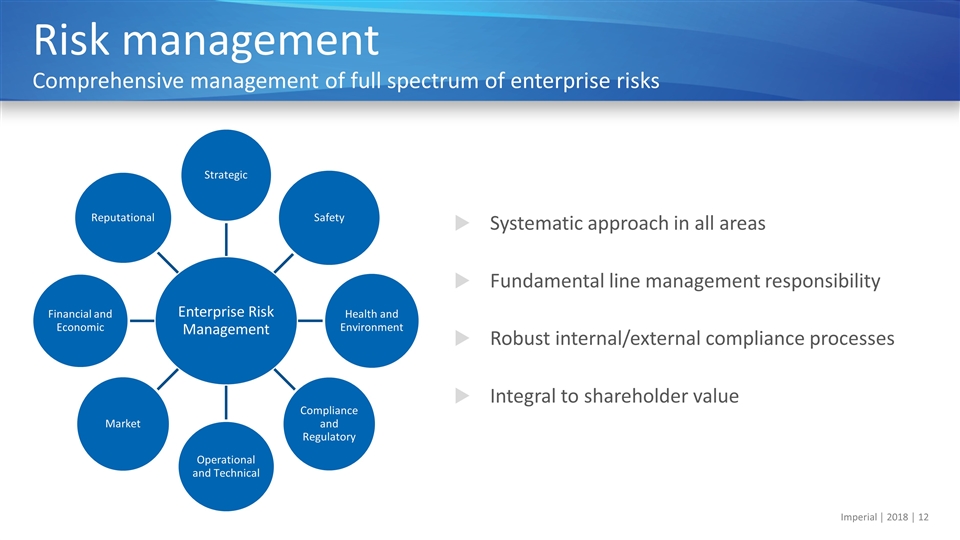

Systematic approach in all areas Fundamental line management responsibility Robust internal/external compliance processes Integral to shareholder value Risk management Comprehensive management of full spectrum of enterprise risks Enterprise Risk Management Strategic Safety Health and Environment Compliance and Regulatory Operational and Technical Market Financial and Economic Reputational

‘Taskforce on Climate-related Financial Disclosures’ guidelines Reducing GHG intensity of existing and future operations $2.4 billion spent with indigenous suppliers over last 10 years Strong commitment to local communities Diverse, independent Board of Directors Corporate responsibility Commitment to strong environmental, social and governance principles

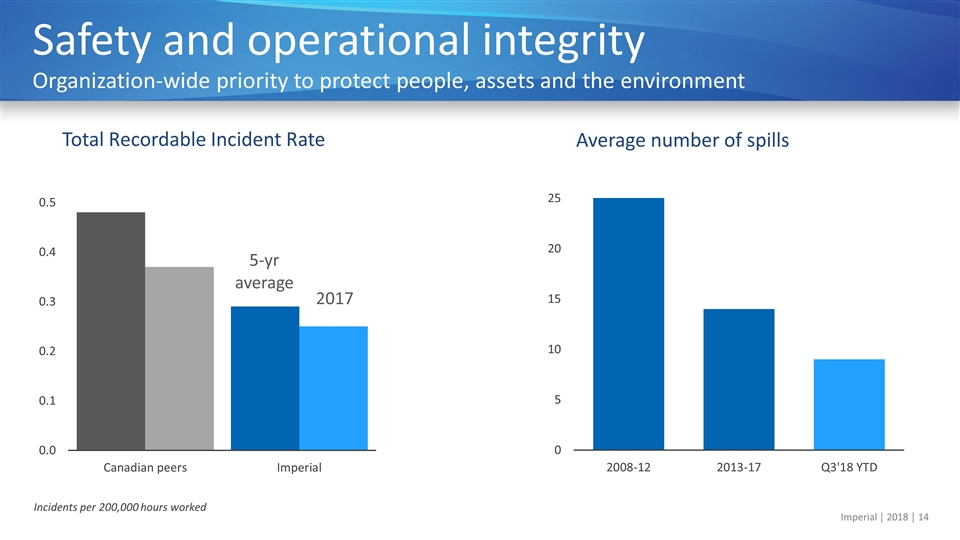

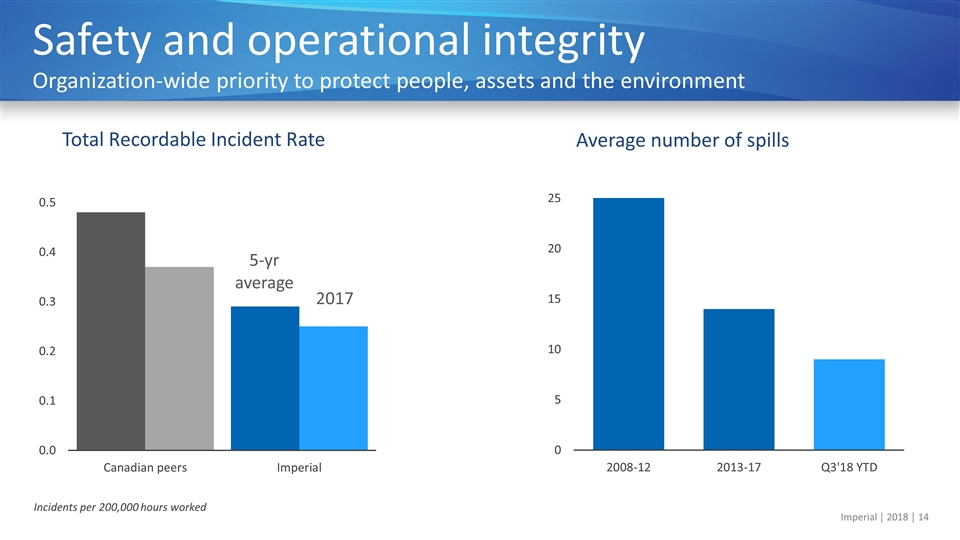

Safety and operational integrity Organization-wide priority to protect people, assets and the environment Upstream Downstream & other Total Recordable Incident Rate Incidents per 200,000 hours worked 5-yr average 2017 Upstream Downstream & other Average number of spills

Integration Delivering value, competitive advantage and resiliency across the business cycle Equity crude placed in highest netback markets Cost-advantaged feedstocks for refineries & chemical Highest value sales channels for petroleum products Multiple and optimized transportation networks Access to industry-leading technologies and know-how Chemical Commodities & specialties Downstream Refining & marketing products Upstream Oil & natural gas production

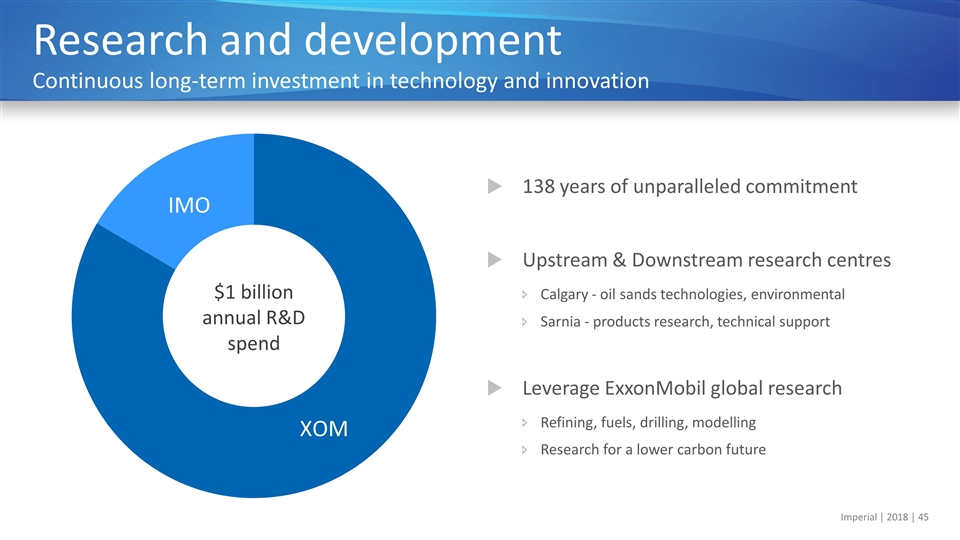

Technology and innovation Unparalleled commitment and achievement throughout 138-year history Imperial has invested more than $2.1B over the past 20 years Access to $1 billion/yr in ExxonMobil R&D investments Canada’s first research department Cyclic steam stimulation patent First horizontal well in Canada Steam-assisted gravity drainage patent Paraffinic froth treatment patents Solvent-assisted technology pilots First lube oil hydrofining New Upstream research facility

Imperial’s winning formula Increase cash flow, deliver industry-leading returns throughout the cycle Deliver industry leading performance in reliability, safety and operations integrity Be the most valued partner with key stakeholders within our industry Leverage technology, integration and ExxonMobil to differentiate versus competition Aggressively capture new opportunities and manage existing portfolio to maximize value Continue to achieve improvements in organizational efficiency & effectiveness

Upstream Overview John Whelan Senior Vice President, Upstream

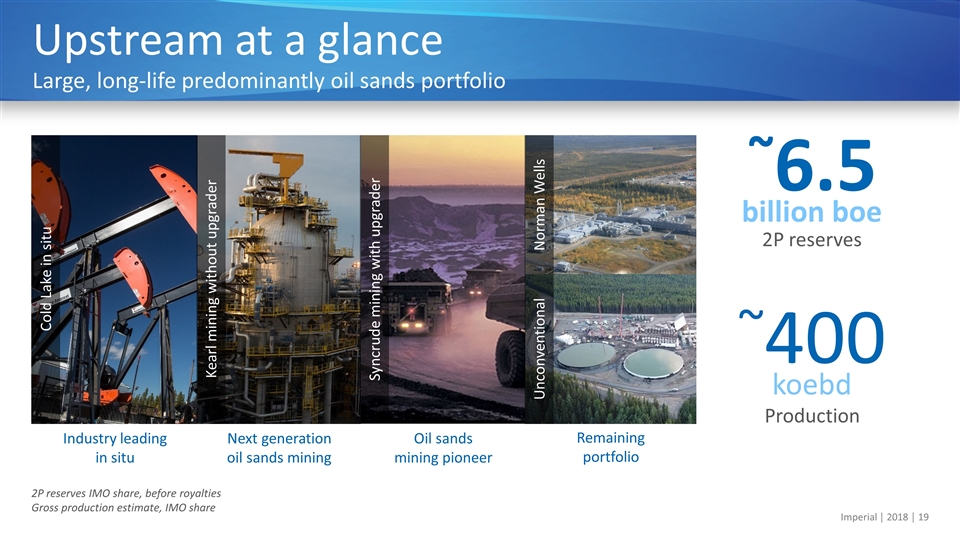

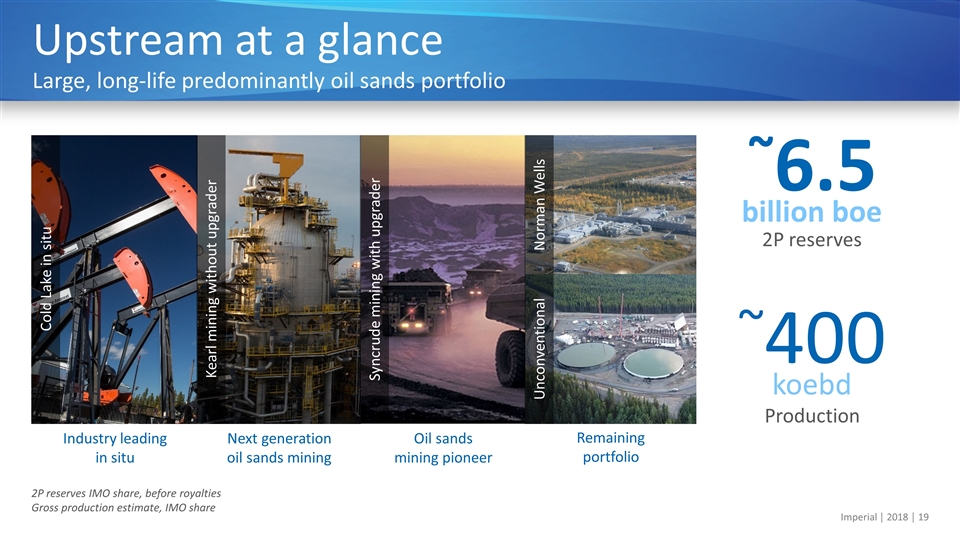

Upstream at a glance Large, long-life predominantly oil sands portfolio Cold Lake in situ Kearl mining without upgrader Syncrude mining with upgrader Unconventional billion boe 2P reserves ~6.5 koebd Production ~400 Oil sands mining pioneer Norman Wells Next generation oil sands mining Industry leading in situ Remaining portfolio 2P reserves IMO share, before royalties Gross production estimate, IMO share

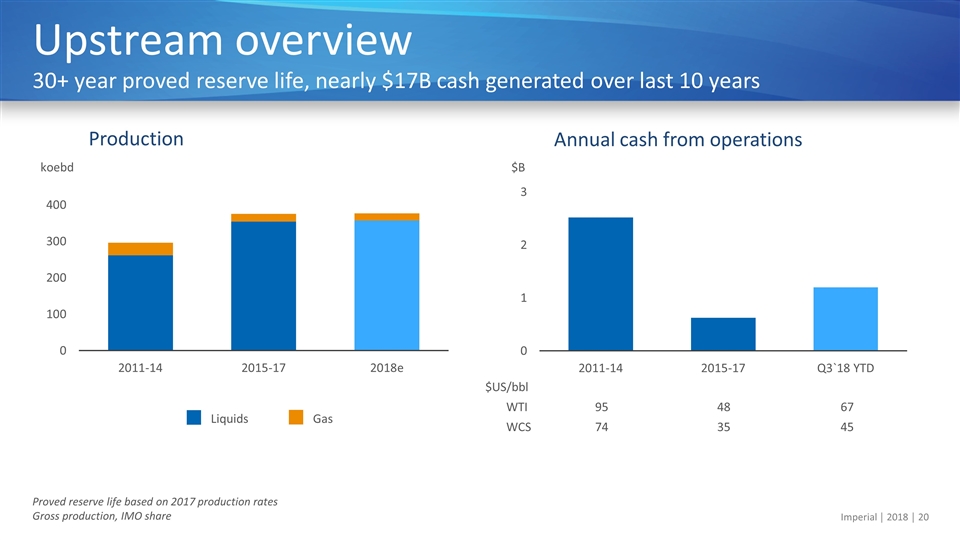

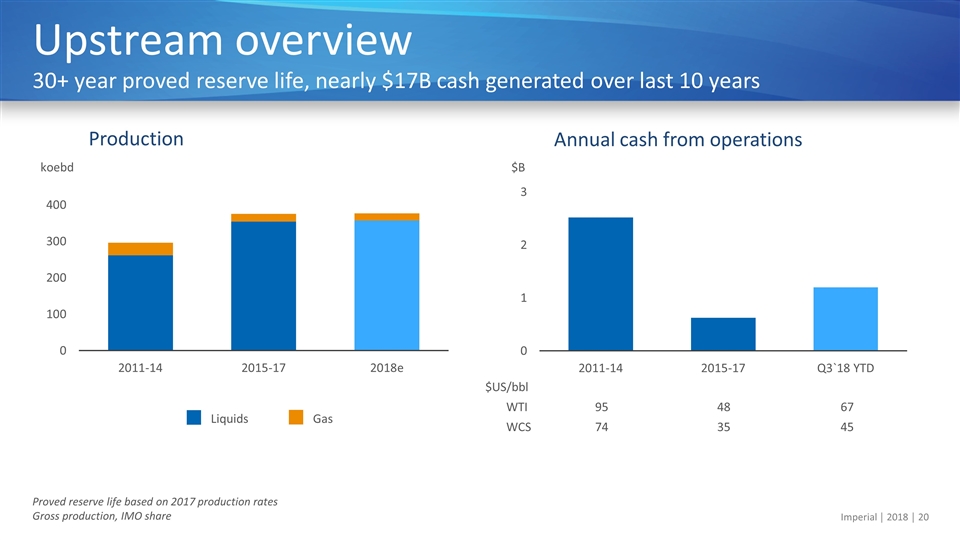

Upstream overview 30+ year proved reserve life, nearly $17B cash generated over last 10 years Production Annual cash from operations koebd $B Proved reserve life based on 2017 production rates Gross production, IMO share $US/bbl WTI 95 48 67 WCS 74 35 45

Syncrude Oil sands mining pioneer 25% IMO owned Producing since 1978 Mining with upgrader bbls 2P reserves 0.7B kbd 2018 production outlook ~60 IMO share, before royalties High value synthetic crude oil Improve reliability by eliminating major events Capture regional integration opportunities Fully leverage owner company strengths

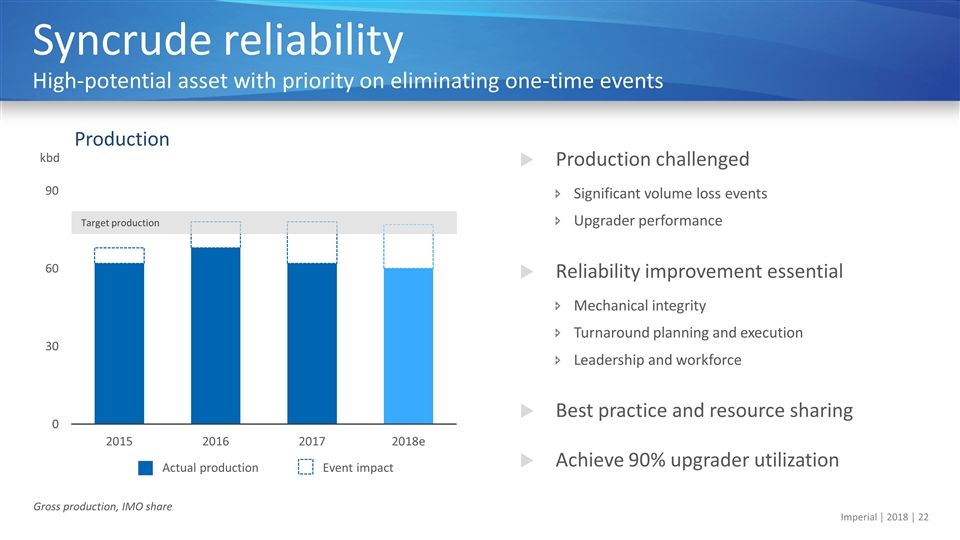

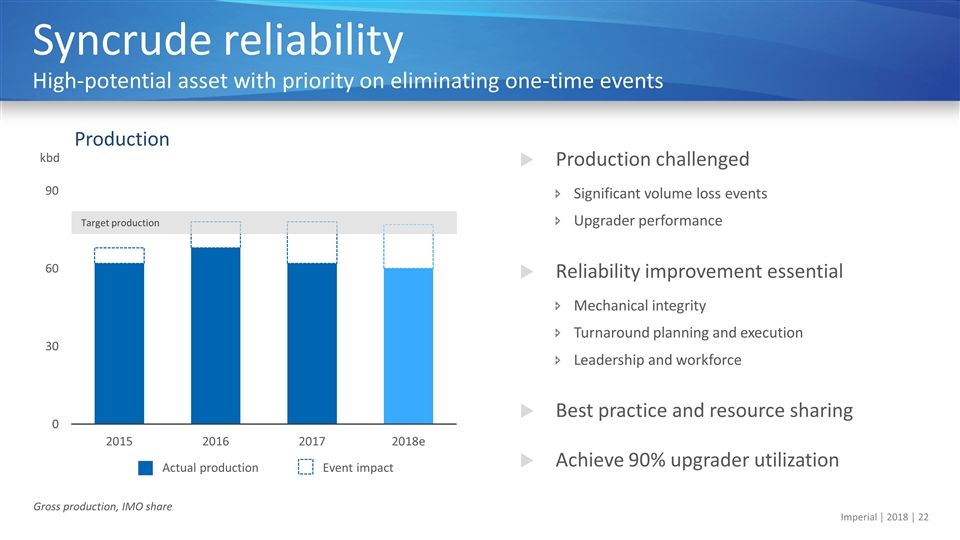

Production challenged Significant volume loss events Upgrader performance Reliability improvement essential Mechanical integrity Turnaround planning and execution Leadership and workforce Best practice and resource sharing Achieve 90% upgrader utilization Syncrude reliability High-potential asset with priority on eliminating one-time events Gross production, IMO share Production Actual production Event impact kbd

Owner company expertise Provision of business services Collaborative ‘production forums’ Regional logistics and infrastructure Commercial opportunities Syncrude collaboration Leverage owner strengths to accelerate performance improvement

Mining without upgrader Kearl Next generation oil sands mining 3.3B ~200 bbls kbd 2P reserves 2018 production outlook Large, high quality resource Improving performance Near-term production growth 2P reserves IMO share, before royalties Gross production outlook, 100% interest 71% IMO owned Producing since 2013

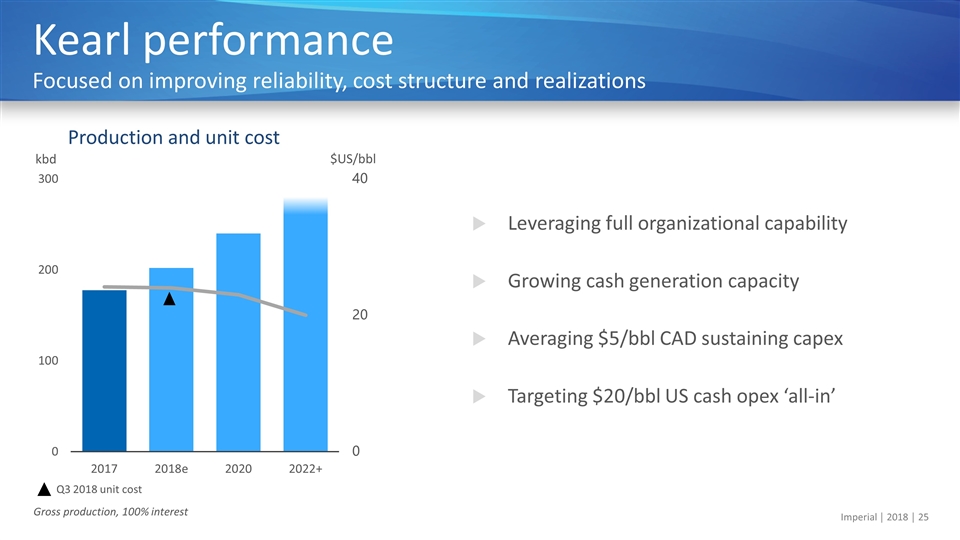

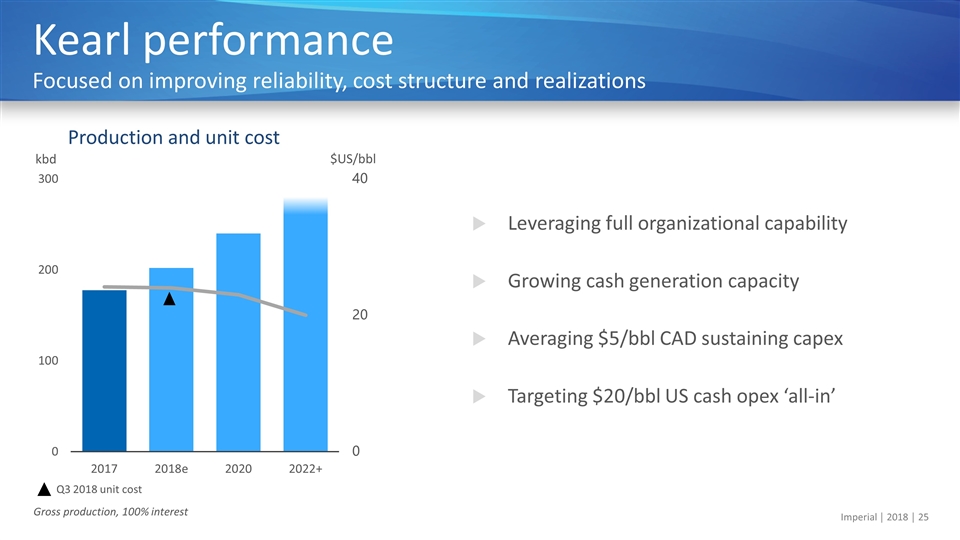

Leveraging full organizational capability Growing cash generation capacity Averaging $5/bbl CAD sustaining capex Targeting $20/bbl US cash opex ‘all-in’ Kearl performance Focused on improving reliability, cost structure and realizations Production and unit cost kbd $US/bbl Q3 2018 unit cost Gross production, 100% interest

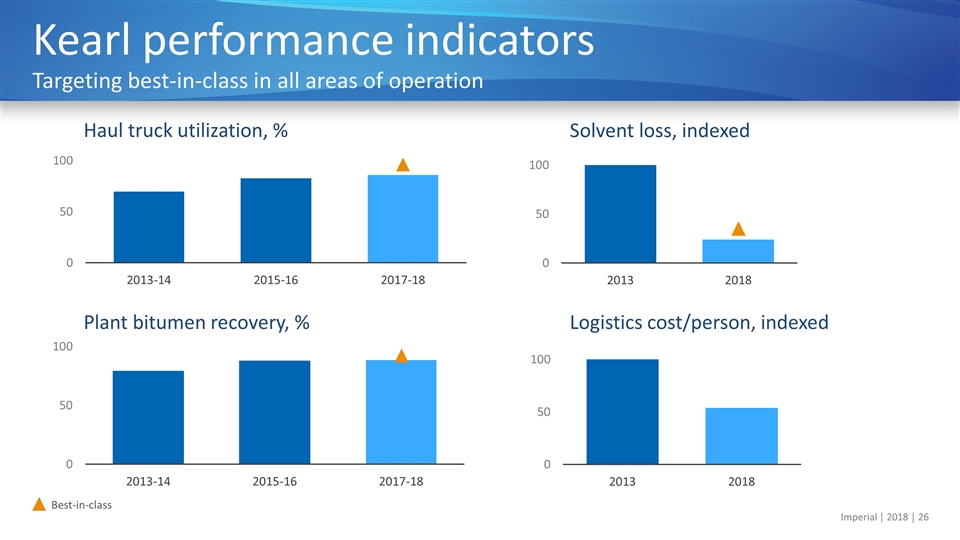

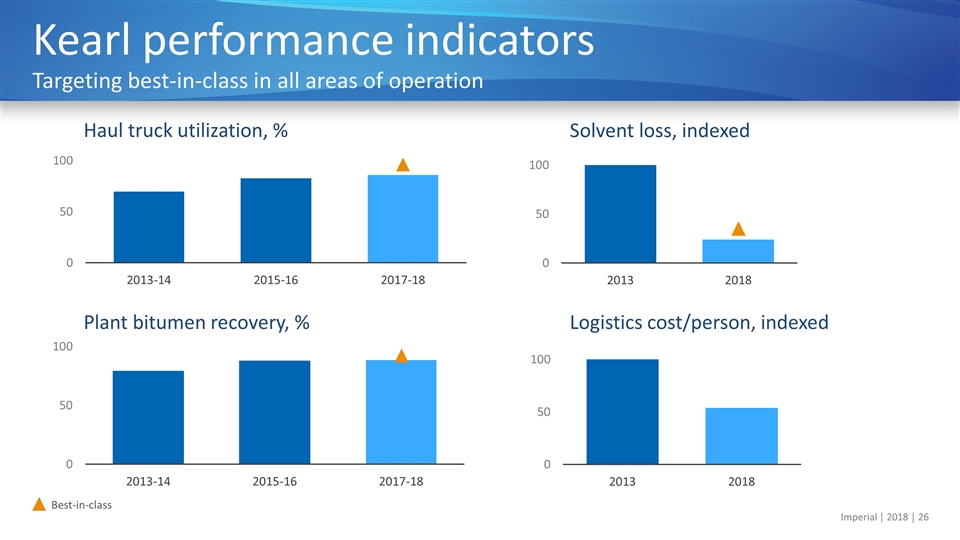

Kearl performance indicators Targeting best-in-class in all areas of operation Plant bitumen recovery, % Haul truck utilization, % Solvent loss, indexed Logistics cost/person, indexed Best-in-class

Improved ore preparation performance Crusher and dump hoppers Ore conveyor drive chains Crusher teeth and bearings Enhanced piping durability Primary separation cells Hydro-transport lines Froth interface monitors Delivering on 200 kbd Actions previously completed to deliver on commitment of 200 kbd annual average Flow system Mine equipment

Adding supplemental crushing capacity Offset equipment downtime Create surge bin conveyor redundancy Installing slurry piping interconnections Minimize maintenance impacts Optimize flow to facilities $550 million gross investment $14k per flowing barrel On schedule for 2020 start up Increasing to 240 kbd Investing to increase production from 200 to 240 kbd in 2020

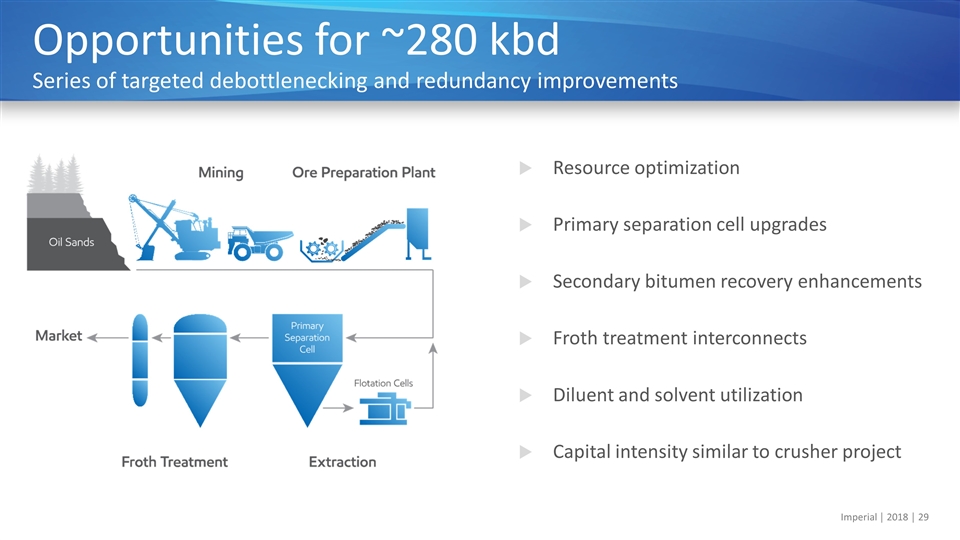

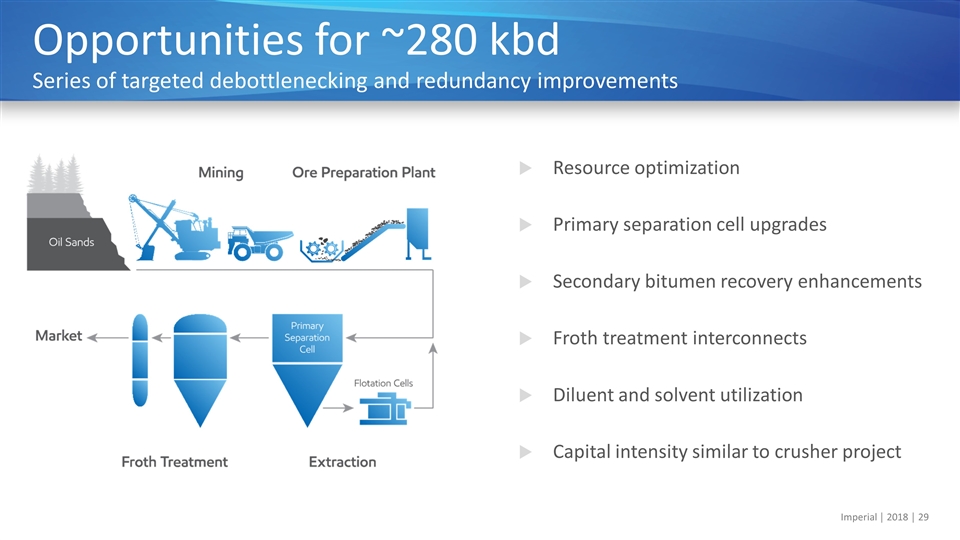

Resource optimization Primary separation cell upgrades Secondary bitumen recovery enhancements Froth treatment interconnects Diluent and solvent utilization Capital intensity similar to crusher project Opportunities for ~280 kbd Series of targeted debottlenecking and redundancy improvements

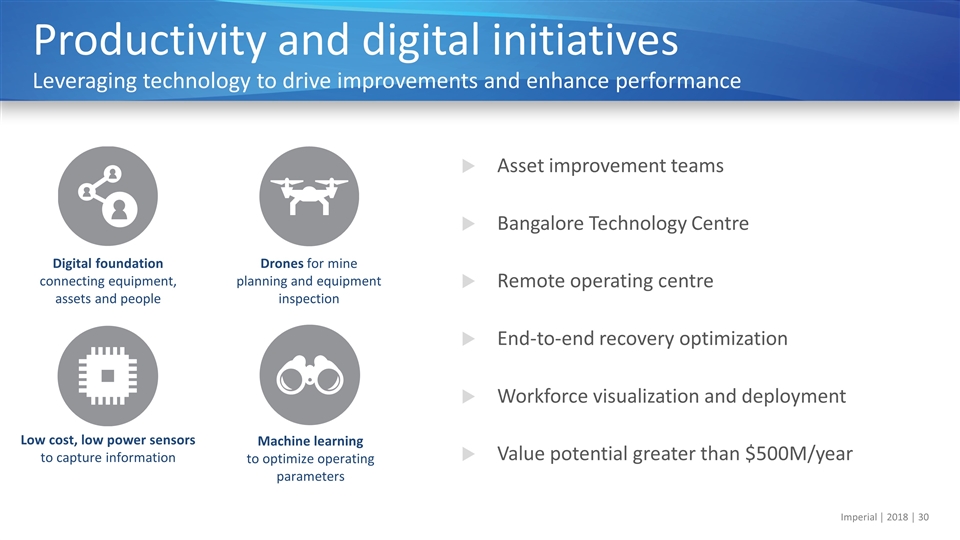

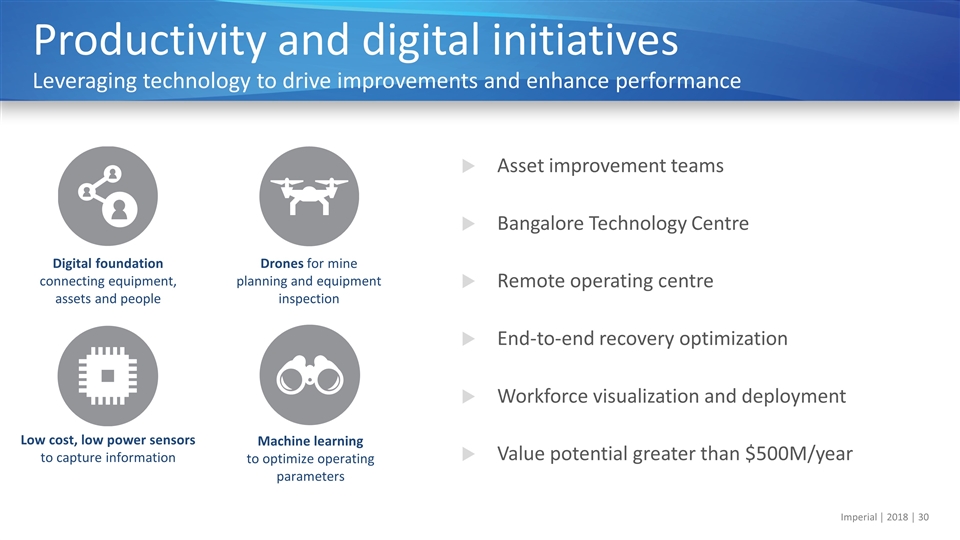

Asset improvement teams Bangalore Technology Centre Remote operating centre End-to-end recovery optimization Workforce visualization and deployment Value potential greater than $500M/year Productivity and digital initiatives Leveraging technology to drive improvements and enhance performance Machine learning to optimize operating parameters Low cost, low power sensors to capture information Digital foundation connecting equipment, assets and people Drones for mine planning and equipment inspection

Partnering with Caterpillar and Finning Fleet of seven trucks in productive service Testing for unique oil sands conditions Cost savings greater than $0.50/bbl Active workforce engagement Autonomous haul trucks Ongoing pilot to increase mine safety and productivity GPS Radar 3D sensing

Currently delivering 200 kbd Supplemental crusher to deliver 240 kbd Opportunities for ~280 kbd Leveraging capabilities of entire organization Objective: maximize long-term cash generation Maximizing Kearl value Significantly improving financial and operating performance

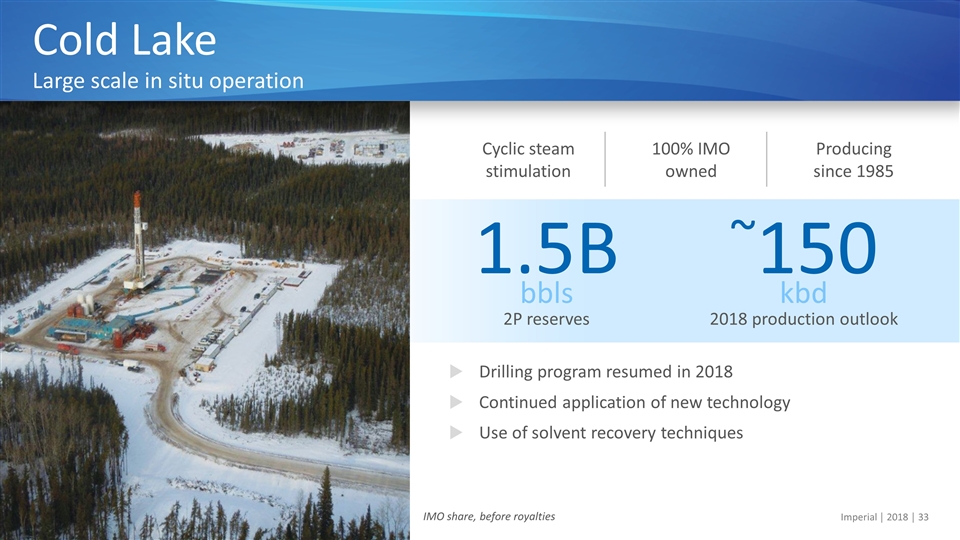

Cyclic steam stimulation Cold Lake Large scale in situ operation 1.5B ~150 bbls kbd 2P reserves 2018 production outlook Drilling program resumed in 2018 Continued application of new technology Use of solvent recovery techniques IMO share, before royalties 100% IMO owned Producing since 1985

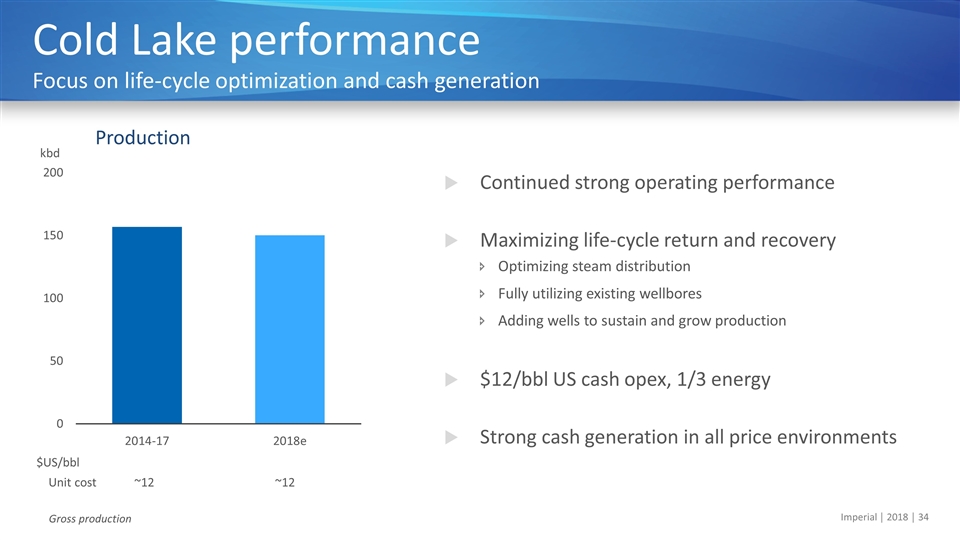

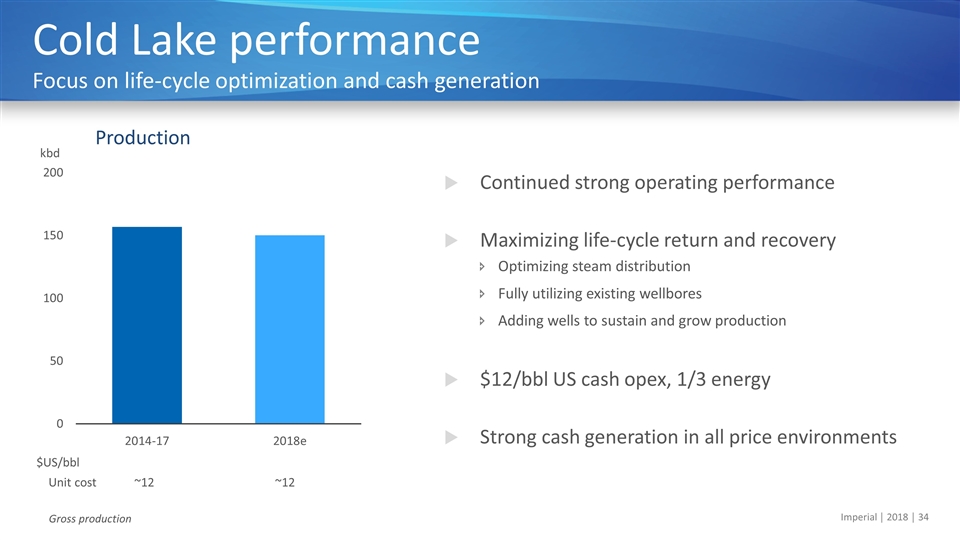

Continued strong operating performance Maximizing life-cycle return and recovery Optimizing steam distribution Fully utilizing existing wellbores Adding wells to sustain and grow production $12/bbl US cash opex, 1/3 energy Strong cash generation in all price environments Cold Lake performance Focus on life-cycle optimization and cash generation Production kbd $US/bbl Unit cost ~12 ~12 Gross production

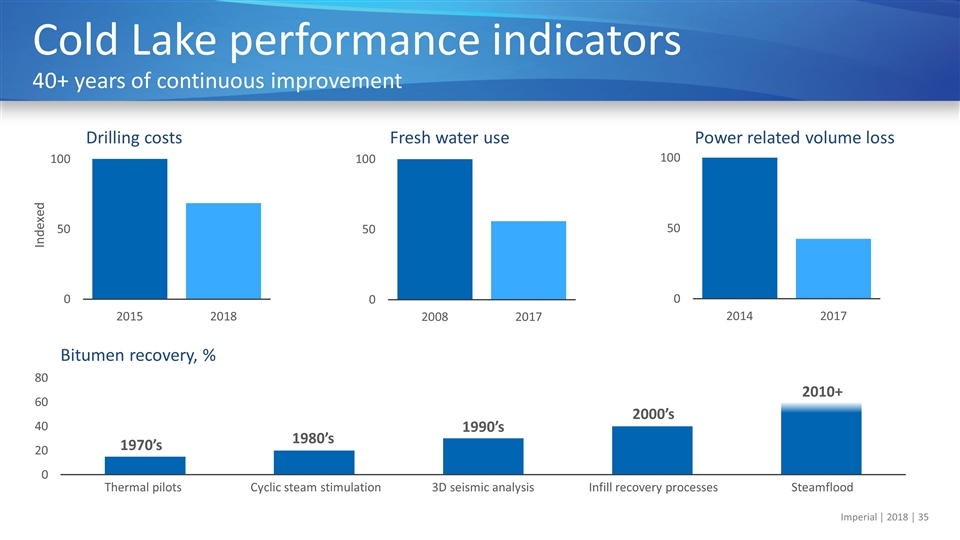

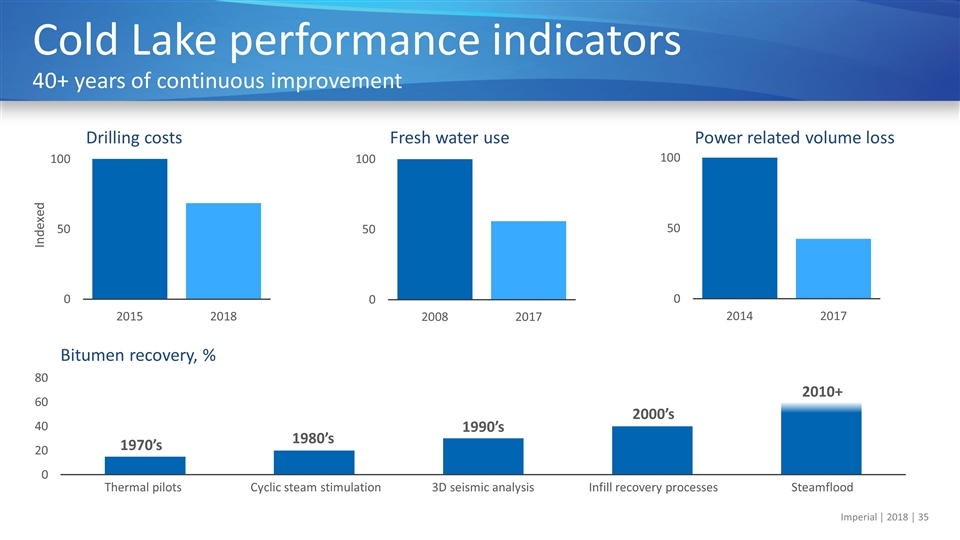

Cold Lake performance indicators 40+ years of continuous improvement Fresh water use Bitumen recovery, % Power related volume loss 1970’s 1980’s 1990’s 2000’s 2010+ 3D seismic analysis Cyclic steam stimulation Steamflood Infill recovery processes Thermal pilots Drilling costs Indexed

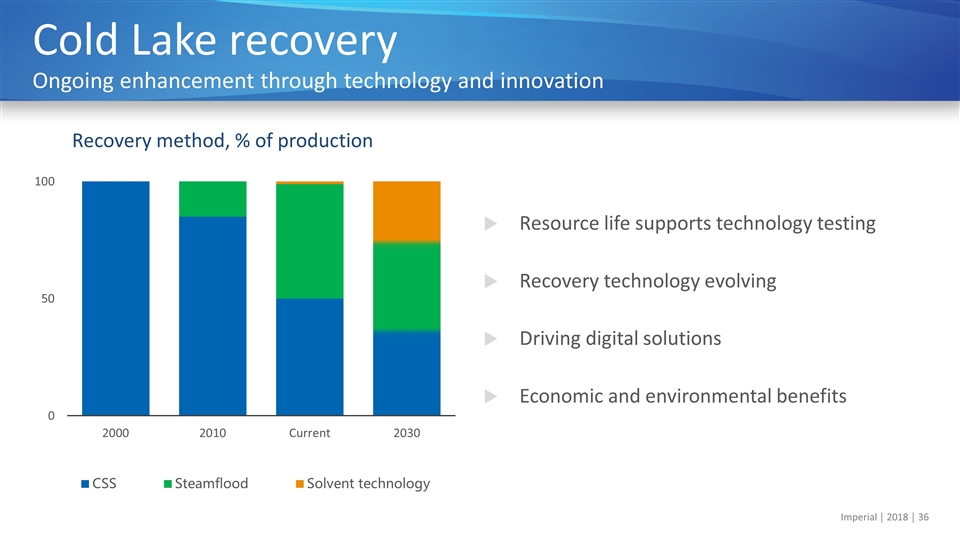

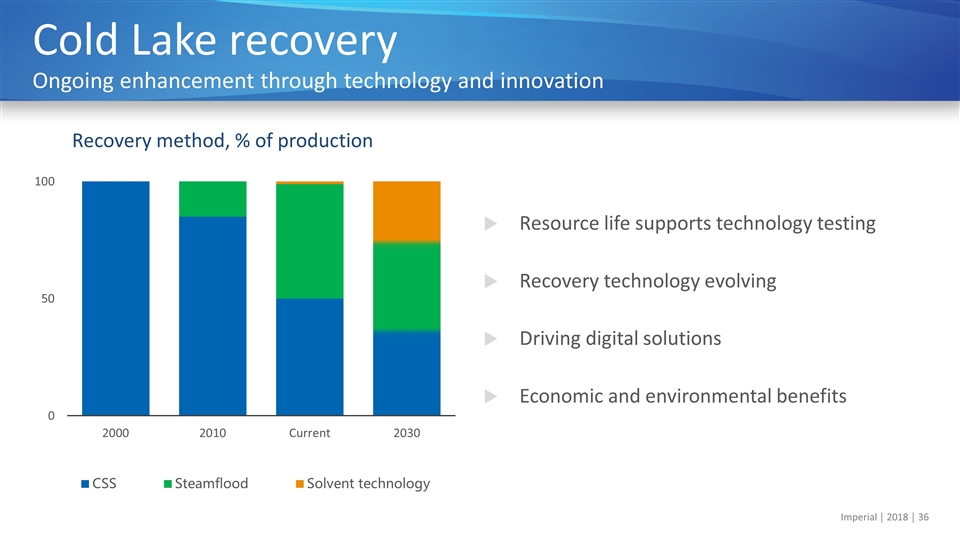

Resource life supports technology testing Recovery technology evolving Driving digital solutions Economic and environmental benefits Cold Lake recovery Ongoing enhancement through technology and innovation Recovery method, % of production

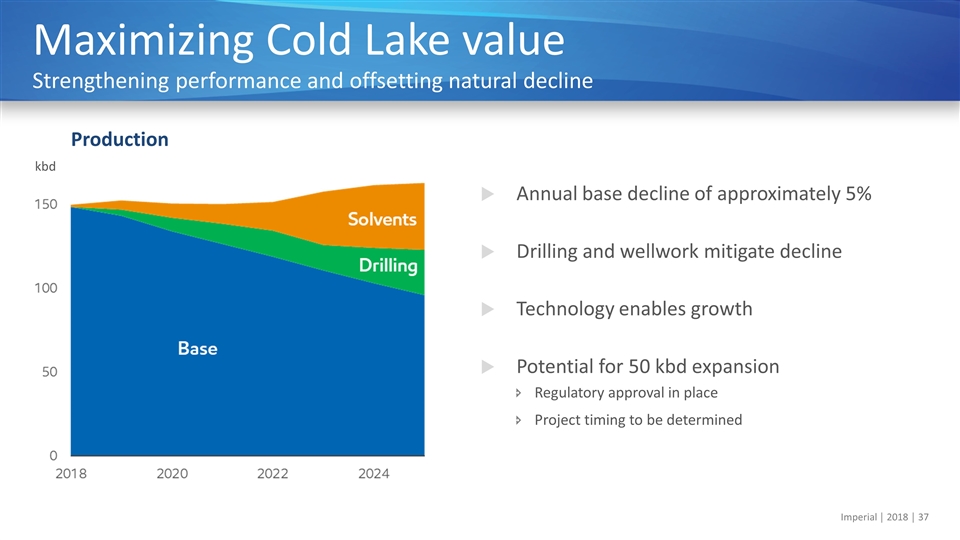

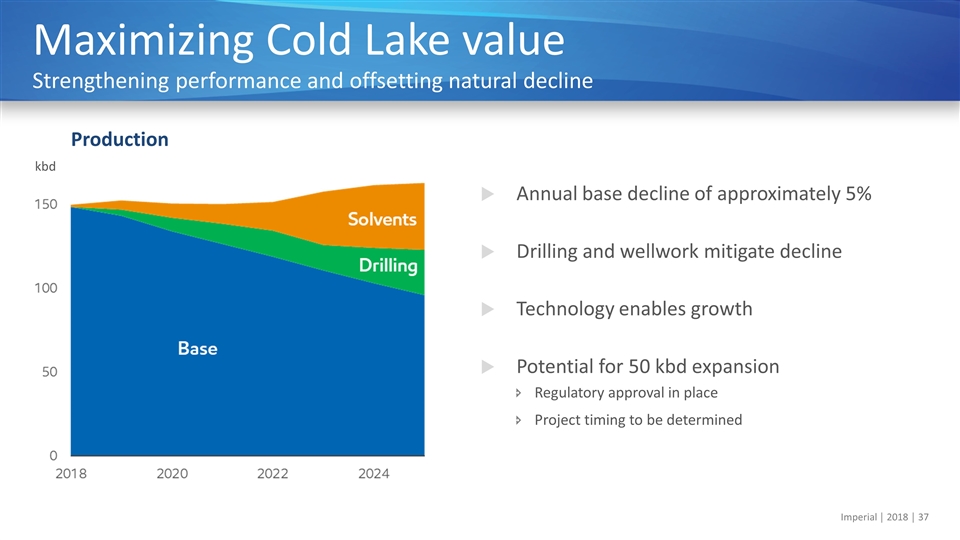

Annual base decline of approximately 5% Drilling and wellwork mitigate decline Technology enables growth Potential for 50 kbd expansion Regulatory approval in place Project timing to be determined Maximizing Cold Lake value Strengthening performance and offsetting natural decline Solvents kbd Production

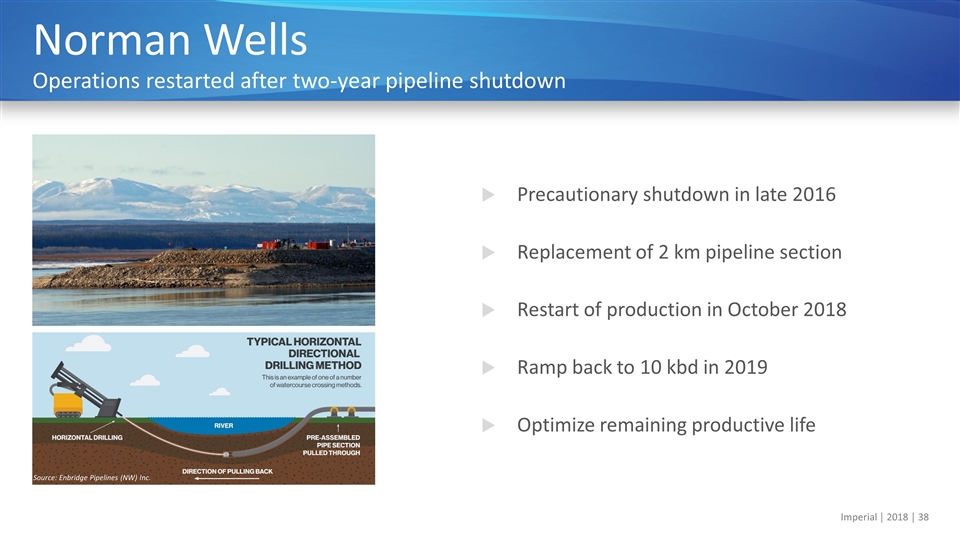

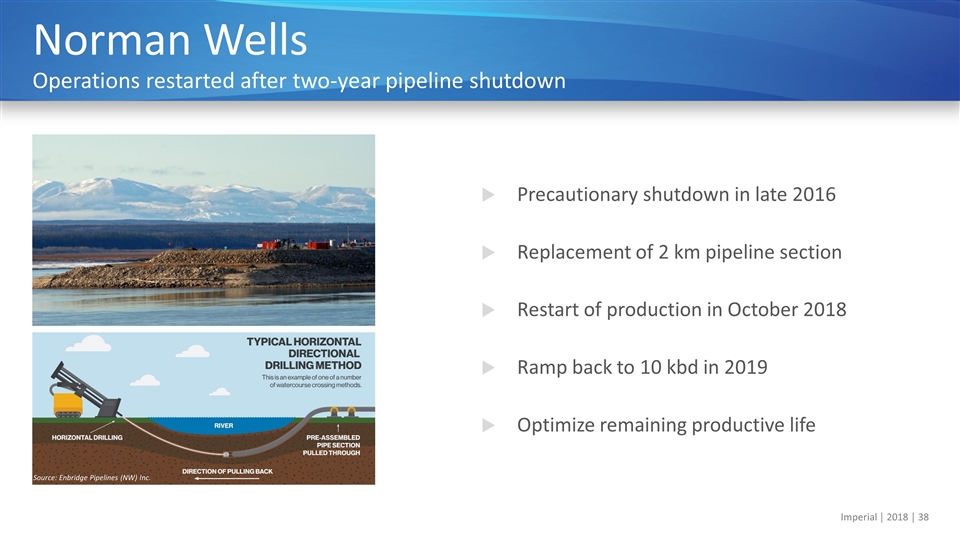

Precautionary shutdown in late 2016 Replacement of 2 km pipeline section Restart of production in October 2018 Ramp back to 10 kbd in 2019 Optimize remaining productive life Norman Wells Operations restarted after two-year pipeline shutdown Source: Enbridge Pipelines (NW) Inc.

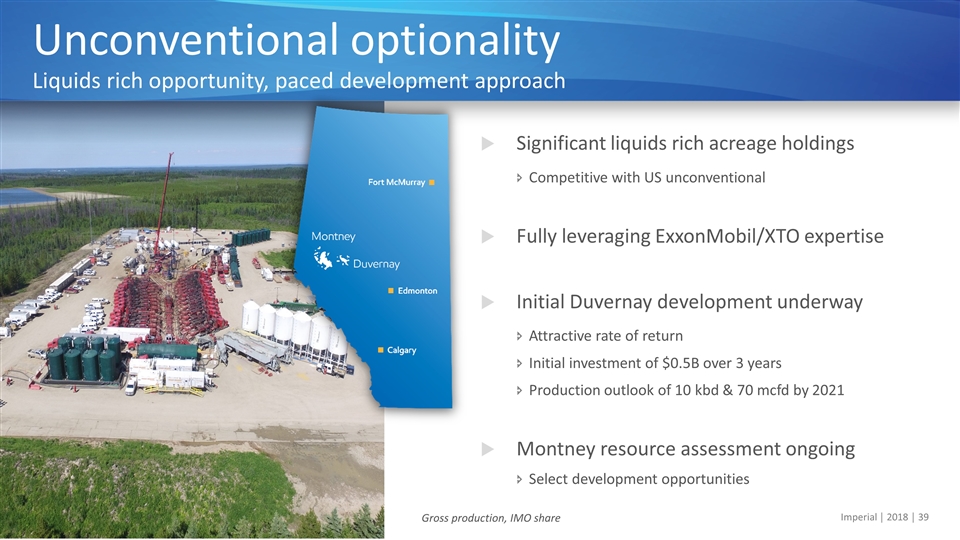

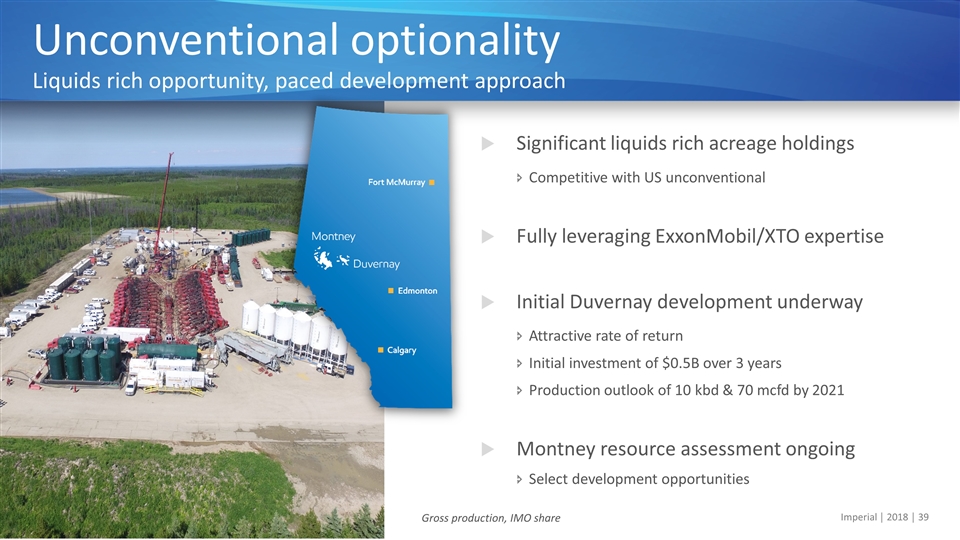

Significant liquids rich acreage holdings Competitive with US unconventional Fully leveraging ExxonMobil/XTO expertise Initial Duvernay development underway Attractive rate of return Initial investment of $0.5B over 3 years Production outlook of 10 kbd & 70 mcfd by 2021 Montney resource assessment ongoing Select development opportunities Unconventional optionality Liquids rich opportunity, paced development approach Gross production, IMO share

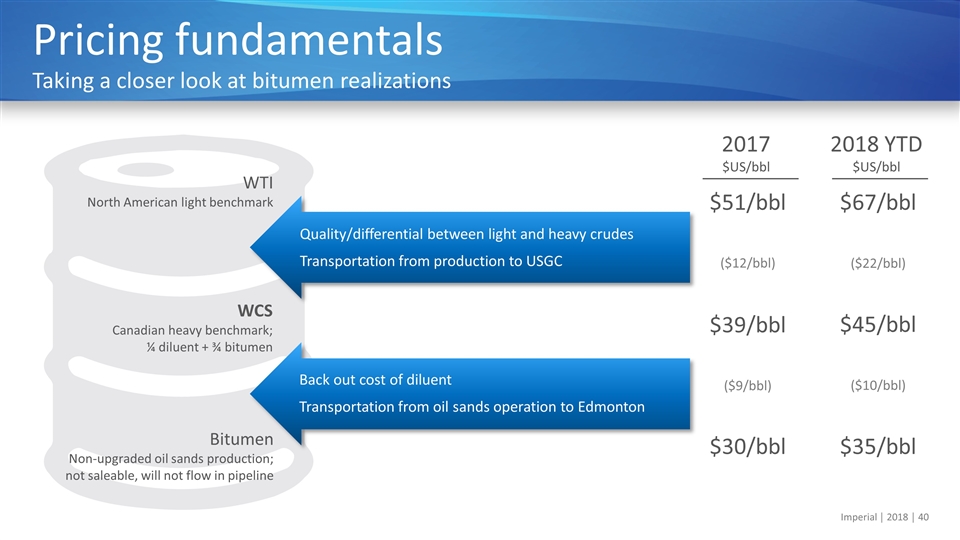

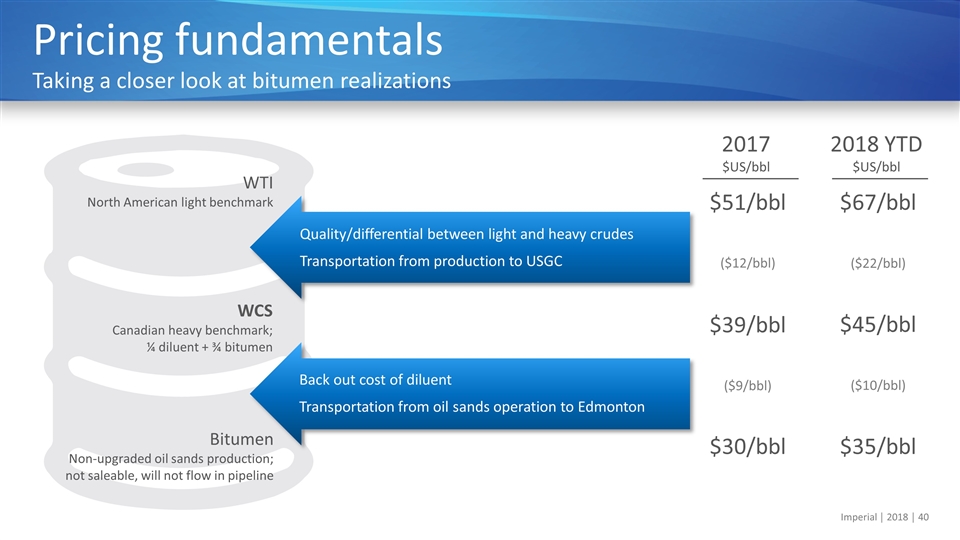

Pricing fundamentals Taking a closer look at bitumen realizations WTI North American light benchmark WCS Canadian heavy benchmark; ¼ diluent + ¾ bitumen Bitumen Non-upgraded oil sands production; not saleable, will not flow in pipeline Quality/differential between light and heavy crudes Transportation from production to USGC Back out cost of diluent Transportation from oil sands operation to Edmonton $67/bbl $45/bbl ($22/bbl) ($10/bbl) $35/bbl 2018 YTD $US/bbl $51/bbl $39/bbl ($12/bbl) ($9/bbl) $30/bbl 2017 $US/bbl

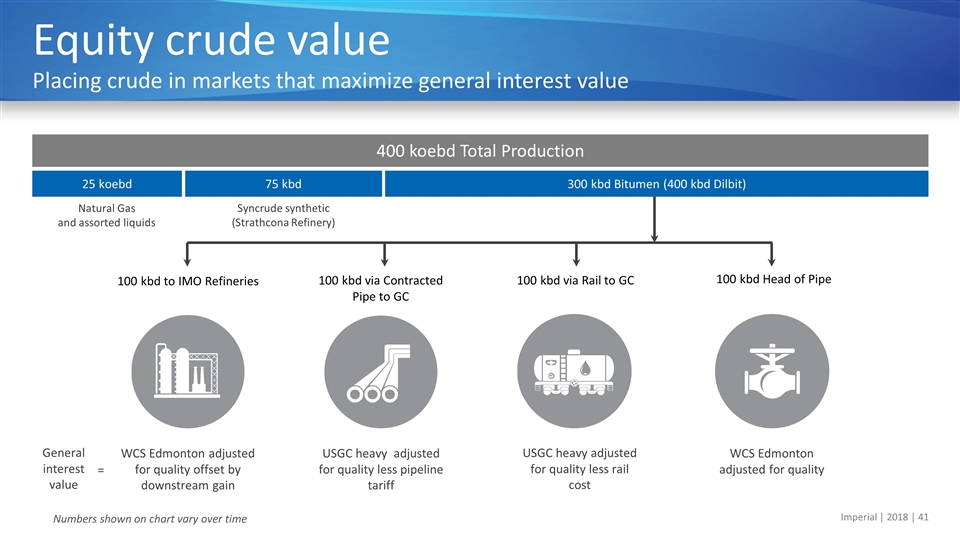

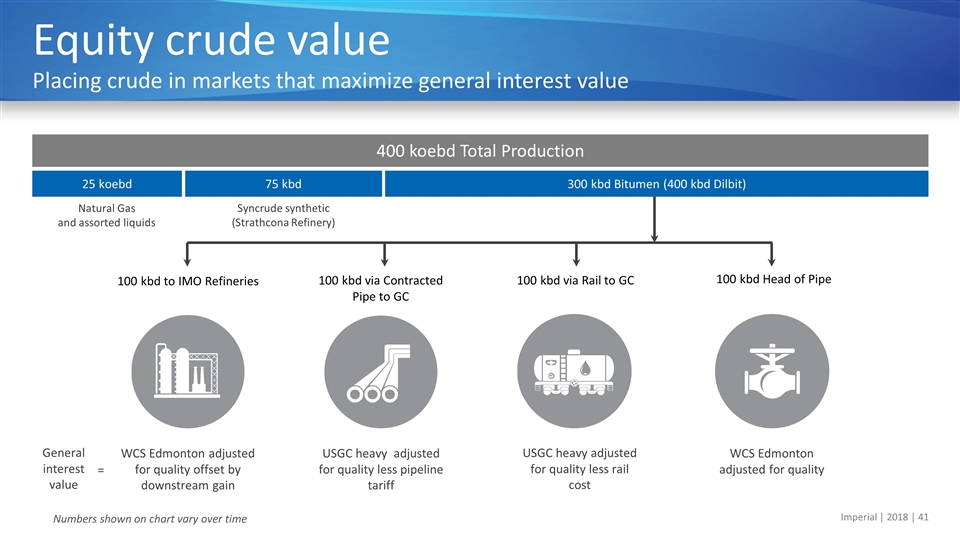

100 kbd via Contracted Pipe to GC USGC heavy adjusted for quality less pipeline tariff 100 kbd to IMO Refineries WCS Edmonton adjusted for quality offset by downstream gain Equity crude value Placing crude in markets that maximize general interest value 25 koebd 75 kbd 300 kbd Bitumen (400 kbd Dilbit) 400 koebd Total Production Natural Gas and assorted liquids Syncrude synthetic (Strathcona Refinery) General interest value = 100 kbd via Rail to GC USGC heavy adjusted for quality less rail cost 100 kbd Head of Pipe WCS Edmonton adjusted for quality Numbers shown on chart vary over time

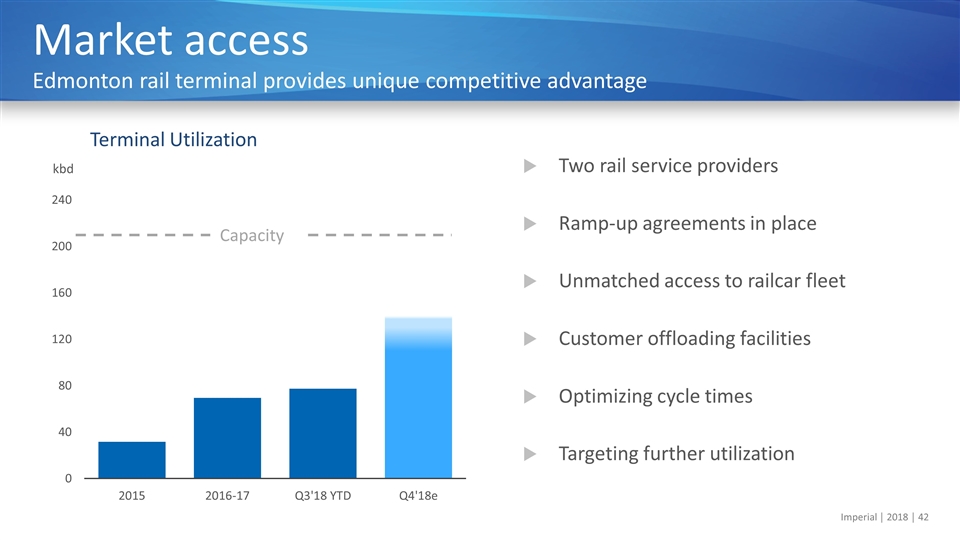

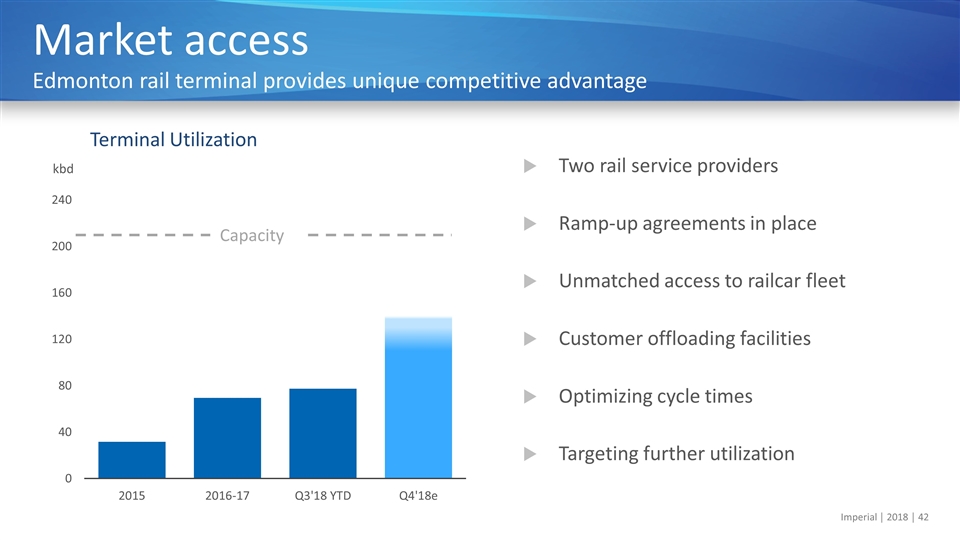

Two rail service providers Ramp-up agreements in place Unmatched access to railcar fleet Customer offloading facilities Optimizing cycle times Targeting further utilization Market access Edmonton rail terminal provides unique competitive advantage kbd Terminal Utilization Capacity

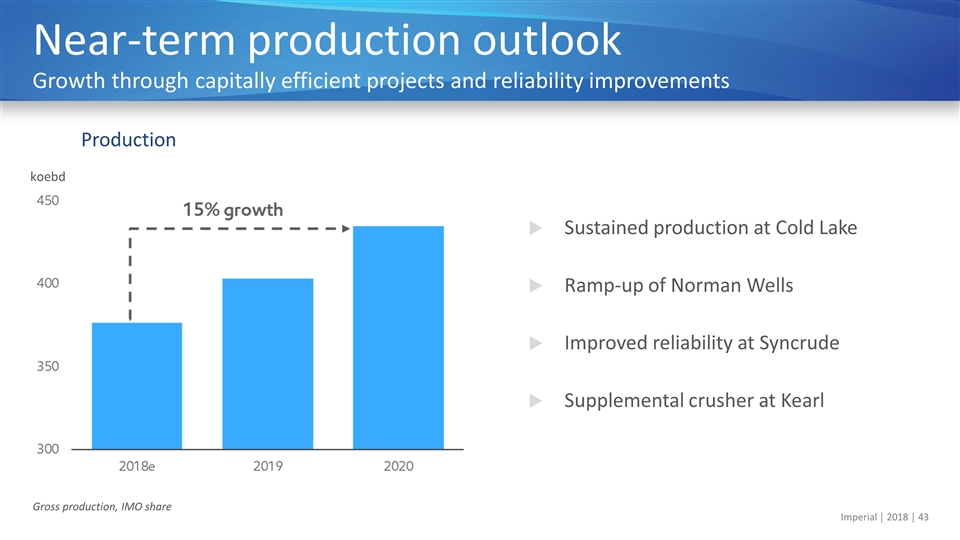

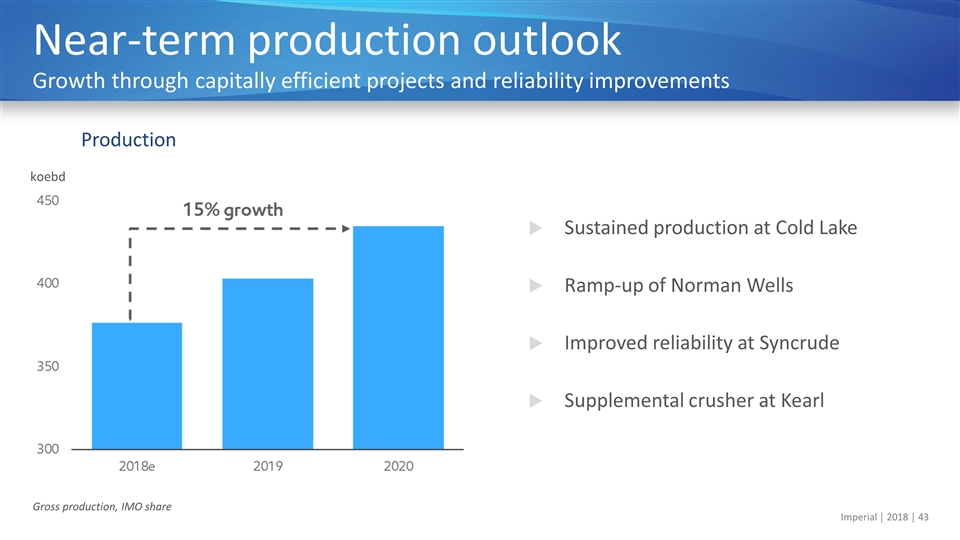

Sustained production at Cold Lake Ramp-up of Norman Wells Improved reliability at Syncrude Supplemental crusher at Kearl Near-term production outlook Growth through capitally efficient projects and reliability improvements Gross production, IMO share Production koebd

Business Development Theresa Redburn Senior Vice President, Commercial and Corporate Development

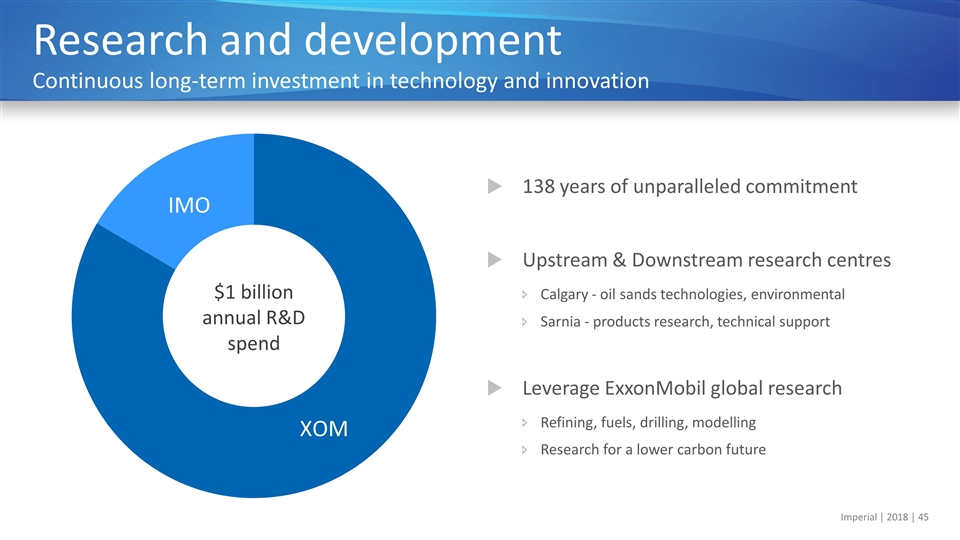

138 years of unparalleled commitment Upstream & Downstream research centres Calgary - oil sands technologies, environmental Sarnia - products research, technical support Leverage ExxonMobil global research Refining, fuels, drilling, modelling Research for a lower carbon future Research and development Continuous long-term investment in technology and innovation $1 billion annual R&D spend

Lower costs Improve performance Reduce environmental impact Unlock resources Imperial Research priorities Focused on oil sands and product research Reliability and efficiency improvements Environmental solutions Advanced recovery technology Product technologies ~$150-200 million annually Enhanced recovery technology development Environmental solutions Products technologies Reliability and efficiency improvements

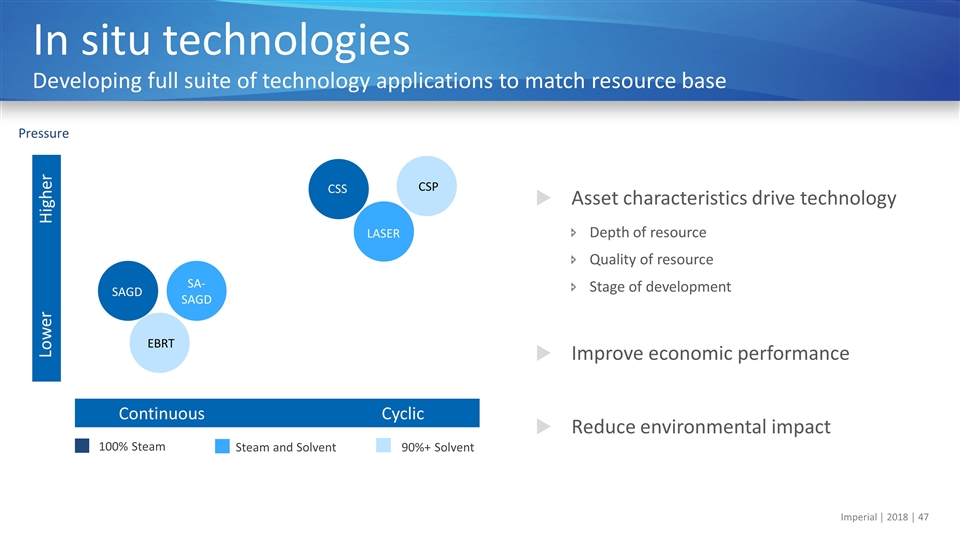

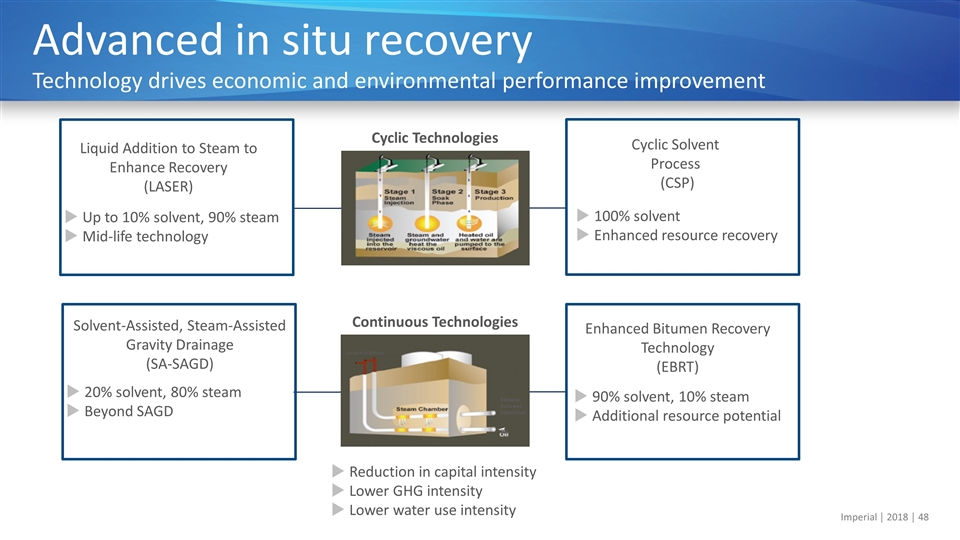

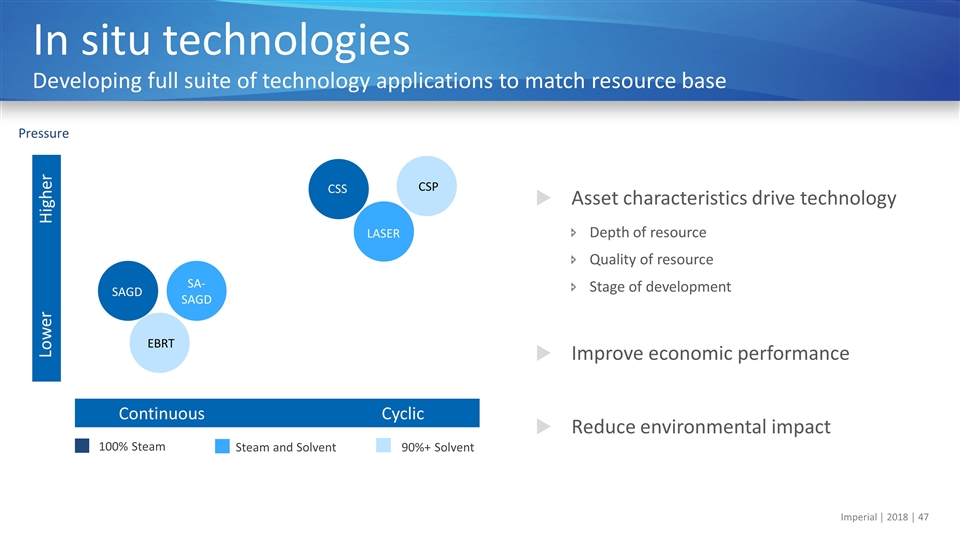

Asset characteristics drive technology Depth of resource Quality of resource Stage of development Improve economic performance Reduce environmental impact In situ technologies Developing full suite of technology applications to match resource base Pressure 100% Steam Steam and Solvent 90%+ Solvent Cyclic Higher Lower Continuous SAGD EBRT SA- SAGD LASER CSS CSP

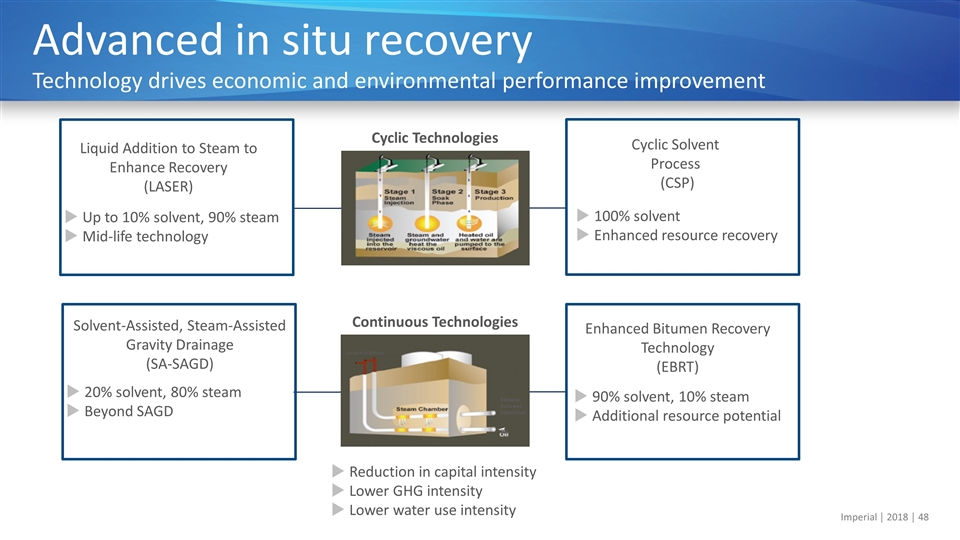

Advanced in situ recovery Technology drives economic and environmental performance improvement Reduction in capital intensity Lower GHG intensity Lower water use intensity Cyclic Technologies Continuous Technologies Liquid Addition to Steam to Enhance Recovery (LASER) Up to 10% solvent, 90% steam Mid-life technology Solvent-Assisted, Steam-Assisted Gravity Drainage (SA-SAGD) 20% solvent, 80% steam Beyond SAGD Cyclic Solvent Process (CSP) 100% solvent Enhanced resource recovery Enhanced Bitumen Recovery Technology (EBRT) 90% solvent, 10% steam Additional resource potential Steam/ Solvent Injection Oil Surface Wellhead

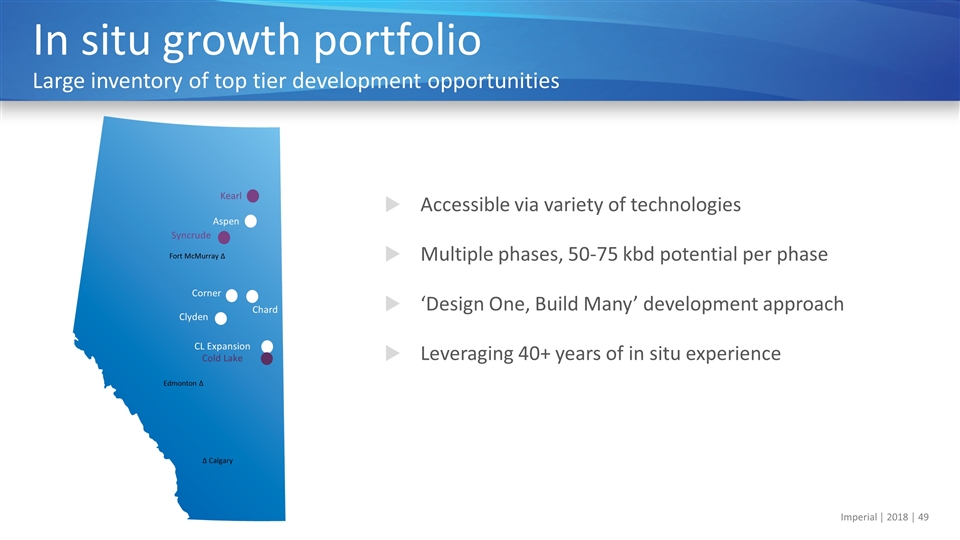

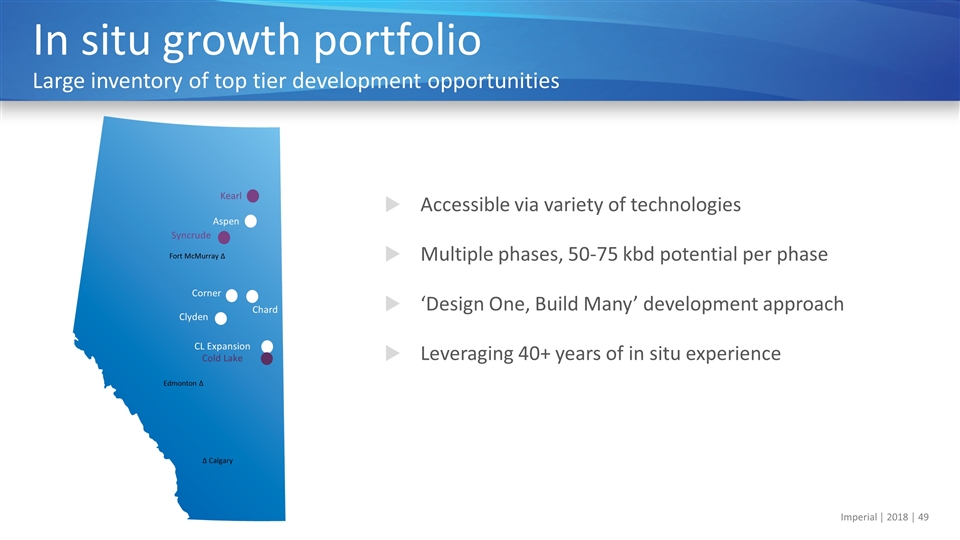

Accessible via variety of technologies Multiple phases, 50-75 kbd potential per phase ‘Design One, Build Many’ development approach Leveraging 40+ years of in situ experience In situ growth portfolio Large inventory of top tier development opportunities Kearl Aspen Corner CL Expansion Clyden Fort McMurray Δ Edmonton Δ Δ Calgary Syncrude Chard Cold Lake

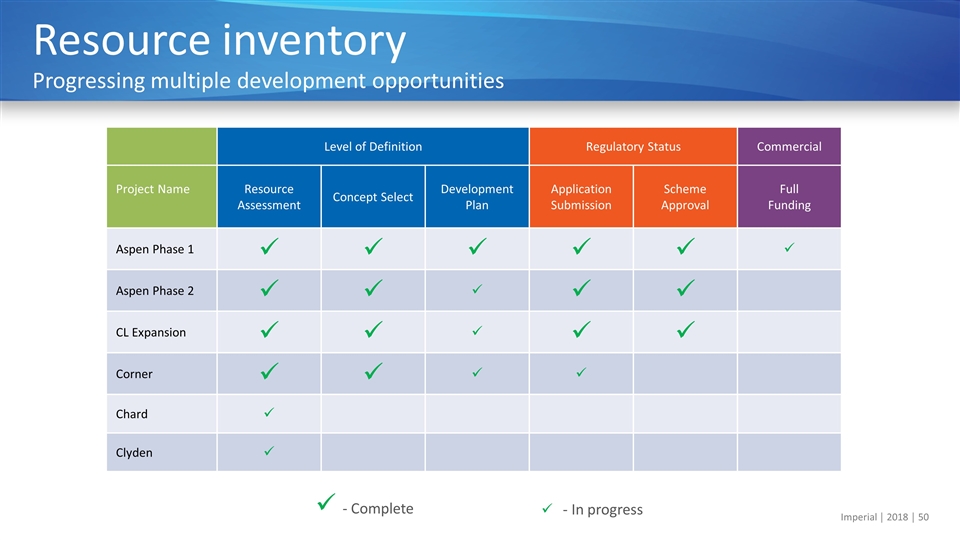

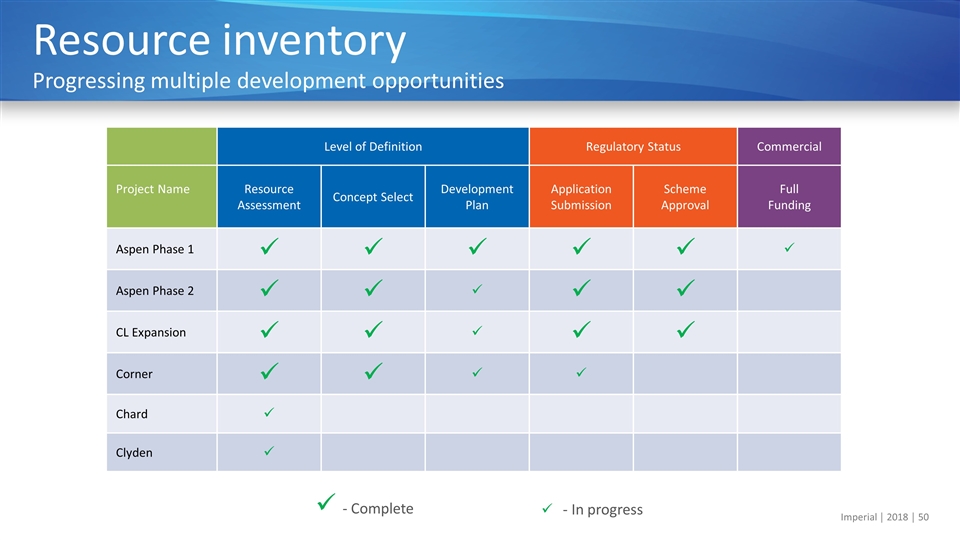

Level of Definition Regulatory Status Commercial Project Name Resource Assessment Concept Select Development Plan Application Submission Scheme Approval Full Funding Aspen Phase 1 ü ü ü ü ü ü Aspen Phase 2 ü ü ü ü ü CL Expansion ü ü ü ü ü Corner ü ü ü ü Chard ü Clyden ü Resource inventory Progressing multiple development opportunities ü - Complete ü - In progress

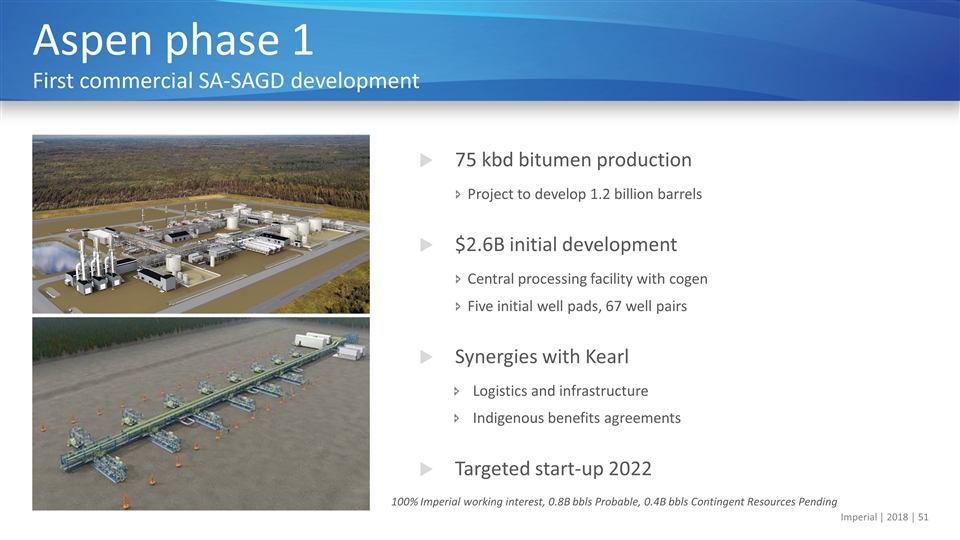

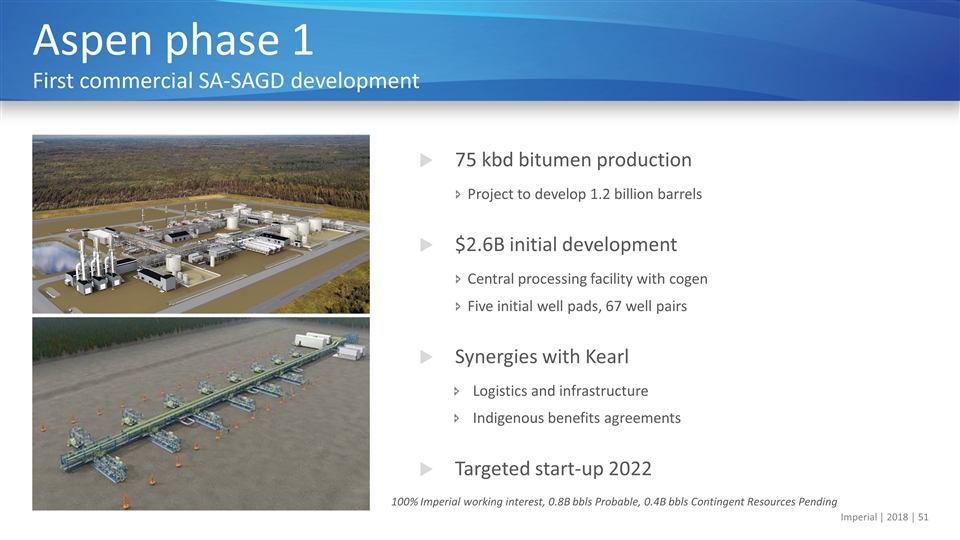

75 kbd bitumen production Project to develop 1.2 billion barrels $2.6B initial development Central processing facility with cogen Five initial well pads, 67 well pairs Synergies with Kearl Logistics and infrastructure Indigenous benefits agreements Targeted start-up 2022 Aspen phase 1 First commercial SA-SAGD development 100% Imperial working interest, 0.8B bbls Probable, 0.4B bbls Contingent Resources Pending

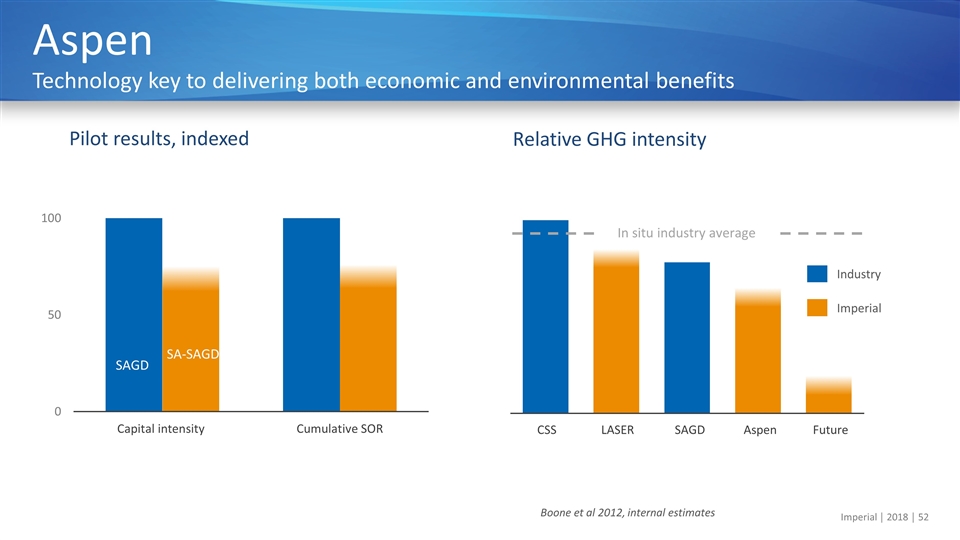

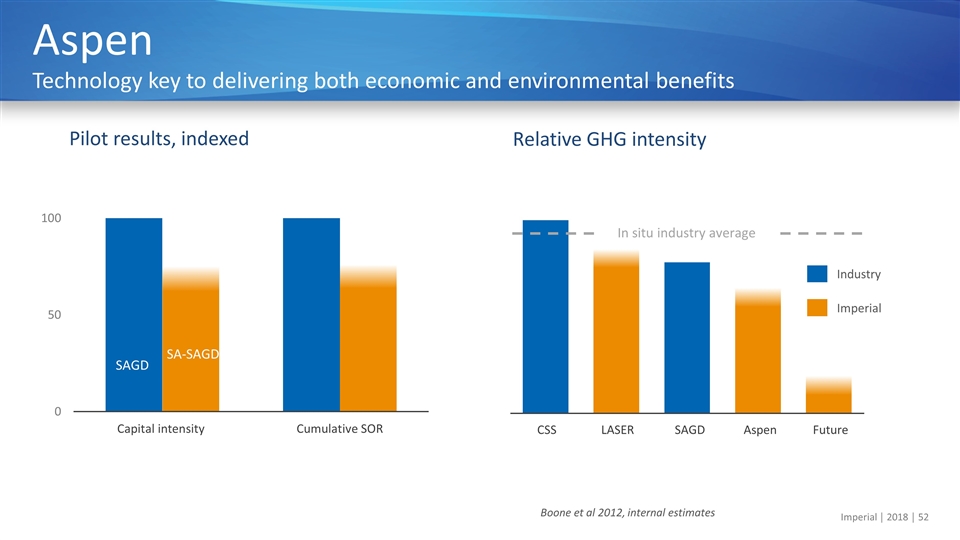

Aspen Technology key to delivering both economic and environmental benefits Pilot results, indexed Aspen LASER CSS SAGD Future Industry Imperial SAGD SA-SAGD In situ industry average Relative GHG intensity Boone et al 2012, internal estimates

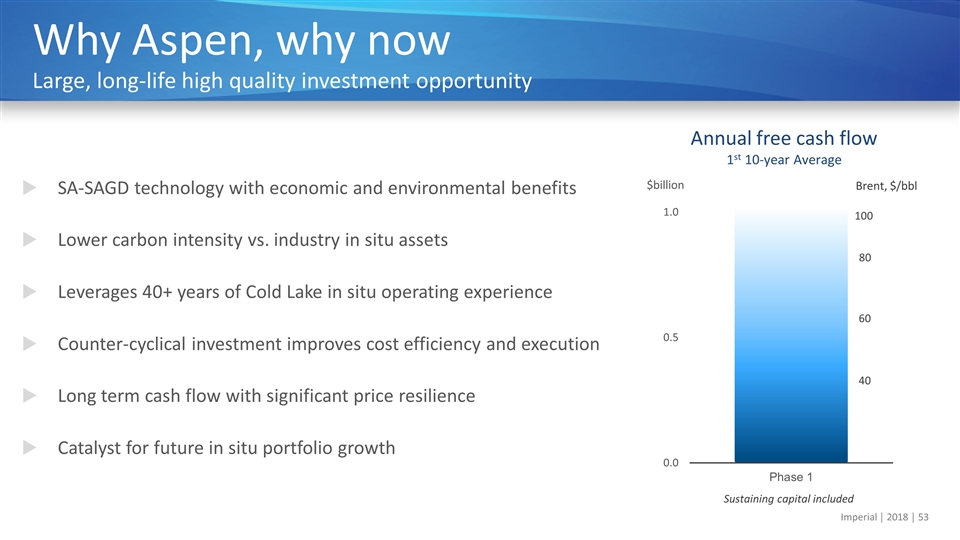

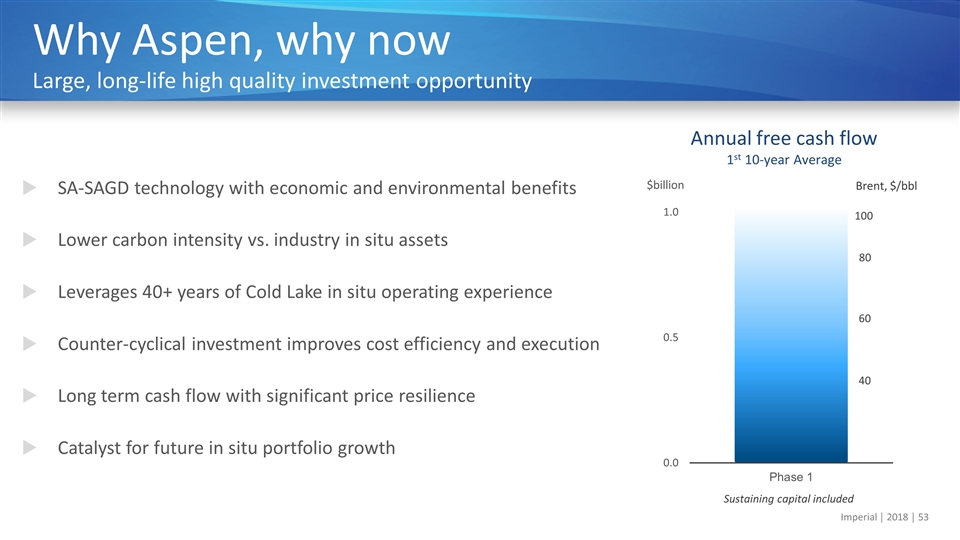

SA-SAGD technology with economic and environmental benefits Lower carbon intensity vs. industry in situ assets Leverages 40+ years of Cold Lake in situ operating experience Counter-cyclical investment improves cost efficiency and execution Long term cash flow with significant price resilience Catalyst for future in situ portfolio growth Why Aspen, why now Large, long-life high quality investment opportunity Annual free cash flow 1st 10-year Average 100 $billion Sustaining capital included 80 60 40 Brent, $/bbl

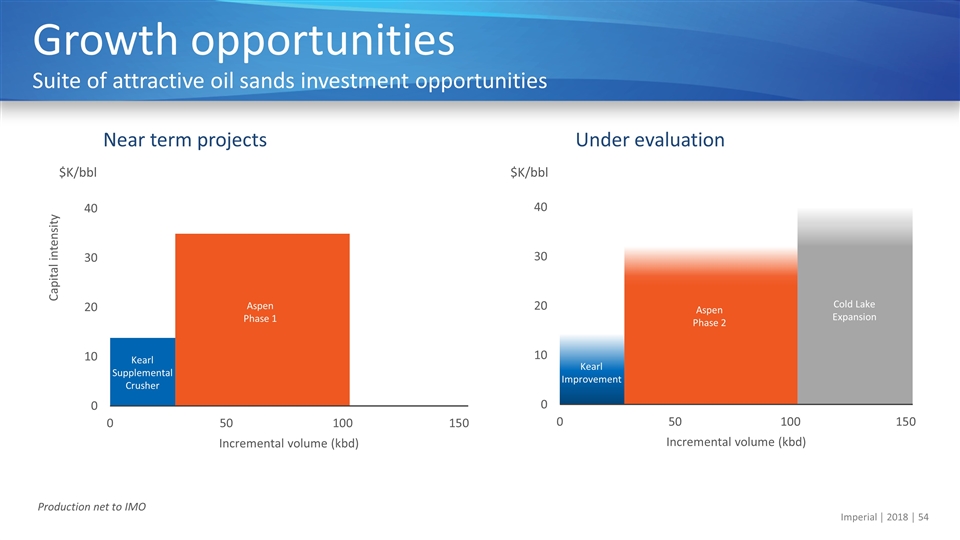

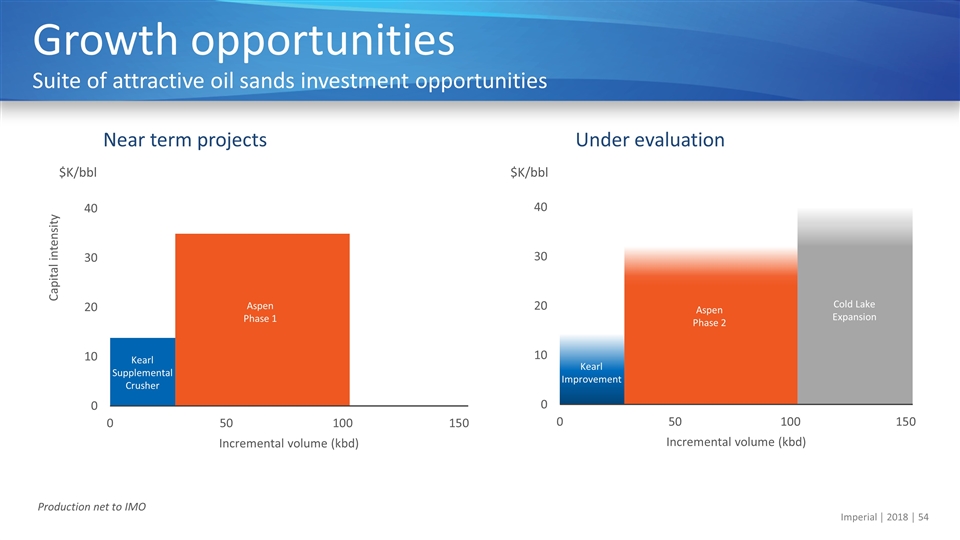

Growth opportunities Suite of attractive oil sands investment opportunities Near term projects Under evaluation Aspen Phase 1 Aspen Phase 2 Cold Lake Expansion Kearl Improvement Aspen Phase 1 Kearl Supplemental Crusher $K/bbl $K/bbl Production net to IMO

Downstream and Chemical Overview Dan Lyons Senior Vice President, Finance and Administration

Refining Downstream at a glance Well positioned, high performing and integrated Strategically positioned refineries Quality products Leading brands Strong logistics Refining capacity ~400 Product sales ~500 kbd kbd Logistics Marketing

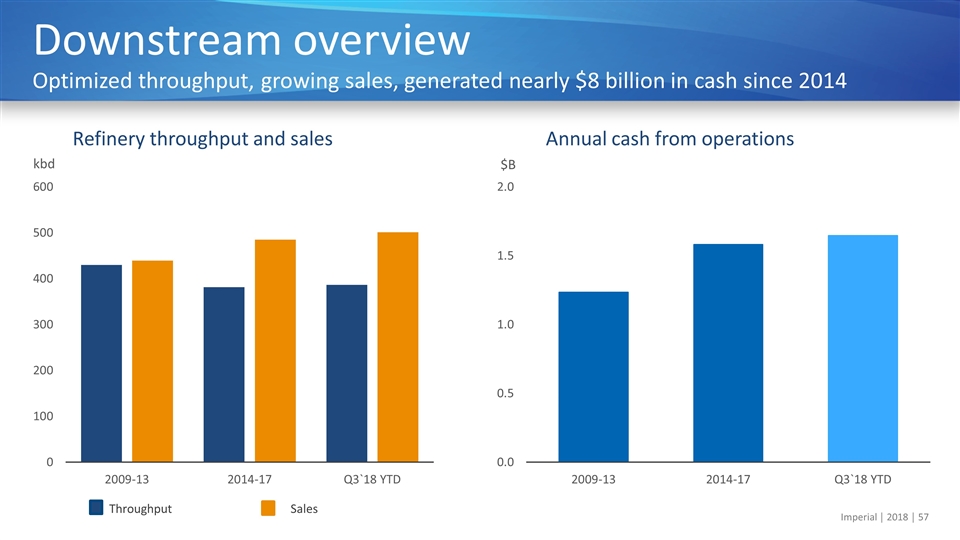

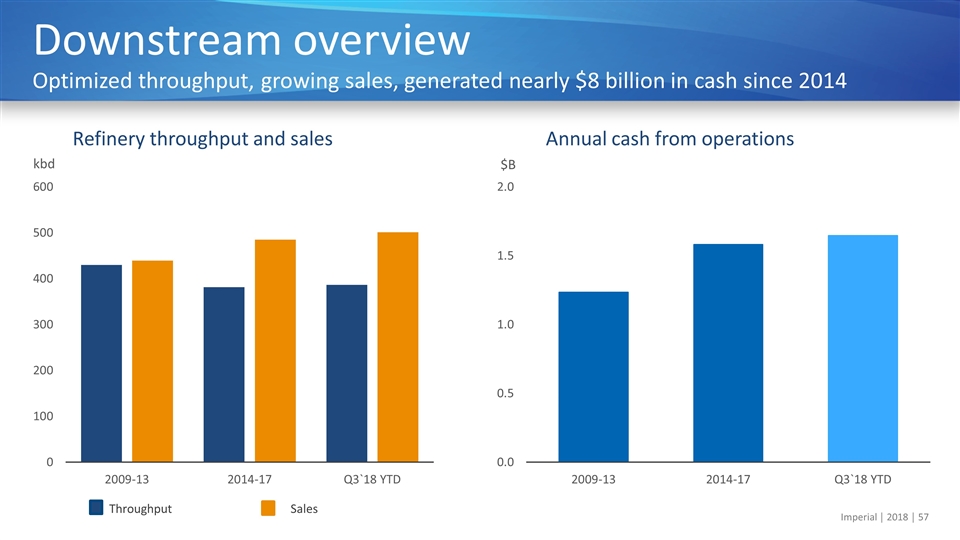

Annual cash from operations Refinery throughput and sales kbd $B Downstream overview Optimized throughput, growing sales, generated nearly $8 billion in cash since 2014 Throughput Sales

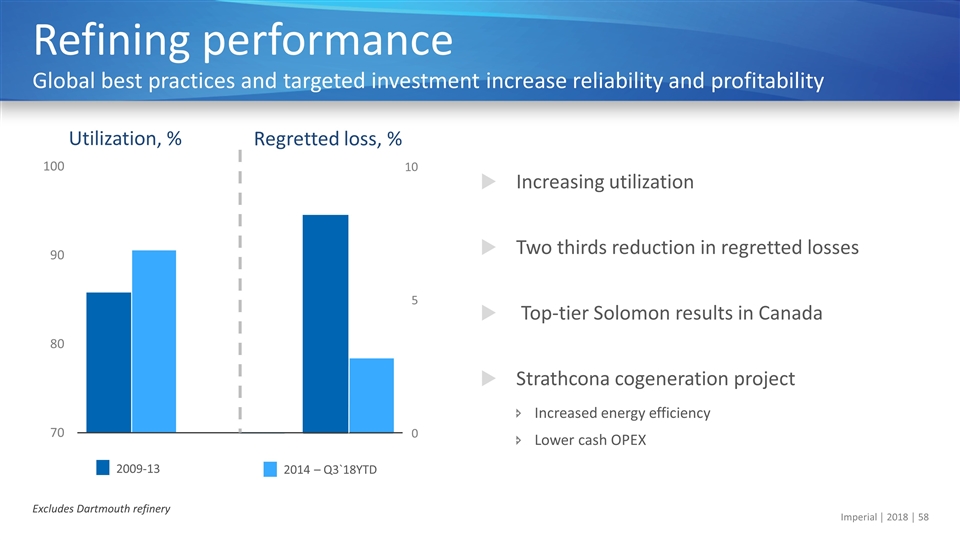

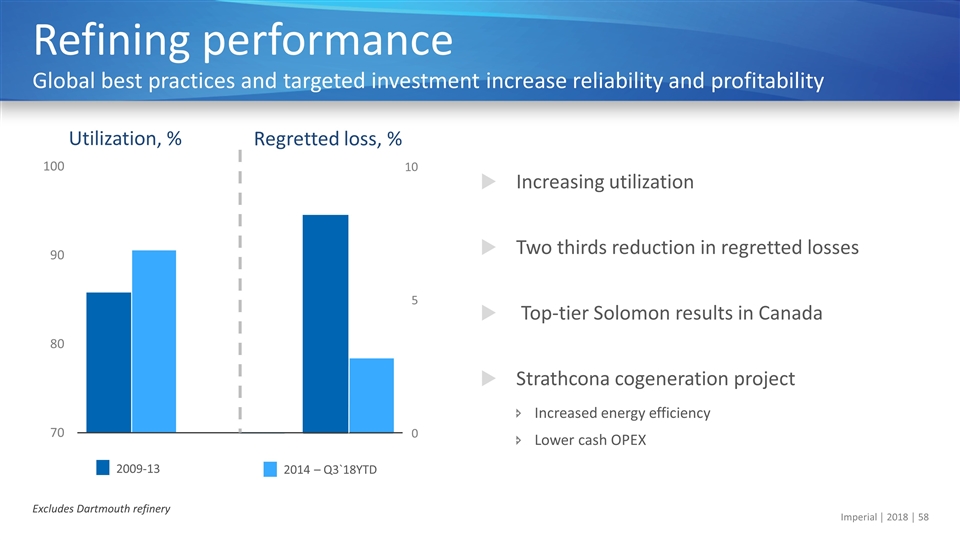

Increasing utilization Two thirds reduction in regretted losses Top-tier Solomon results in Canada Strathcona cogeneration project Increased energy efficiency Lower cash OPEX Refining performance Global best practices and targeted investment increase reliability and profitability Utilization, % Regretted loss, %

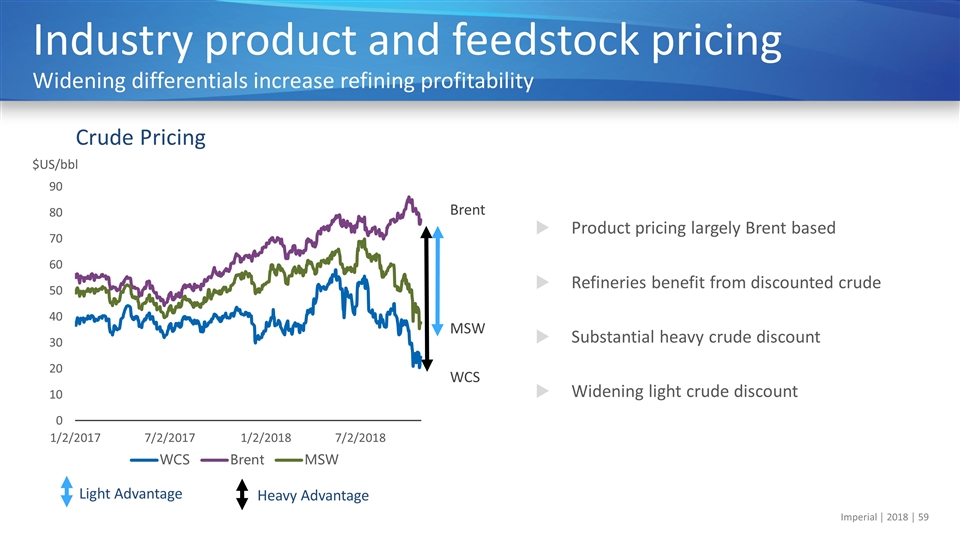

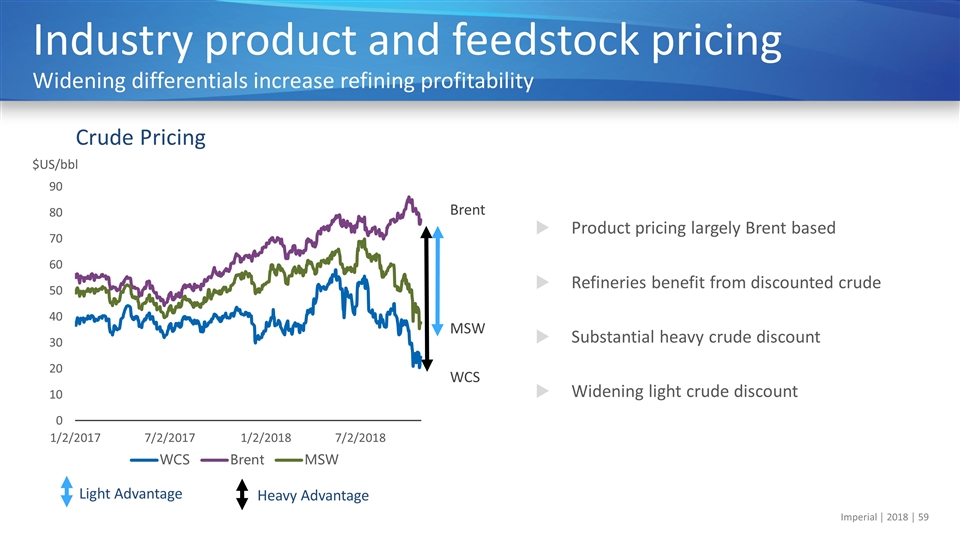

Product pricing largely Brent based Refineries benefit from discounted crude Substantial heavy crude discount Widening light crude discount Crude Pricing Industry product and feedstock pricing Widening differentials increase refining profitability Downstream & other Upstream Downstream & other Light Advantage Heavy Advantage Brent MSW WCS $US/bbl

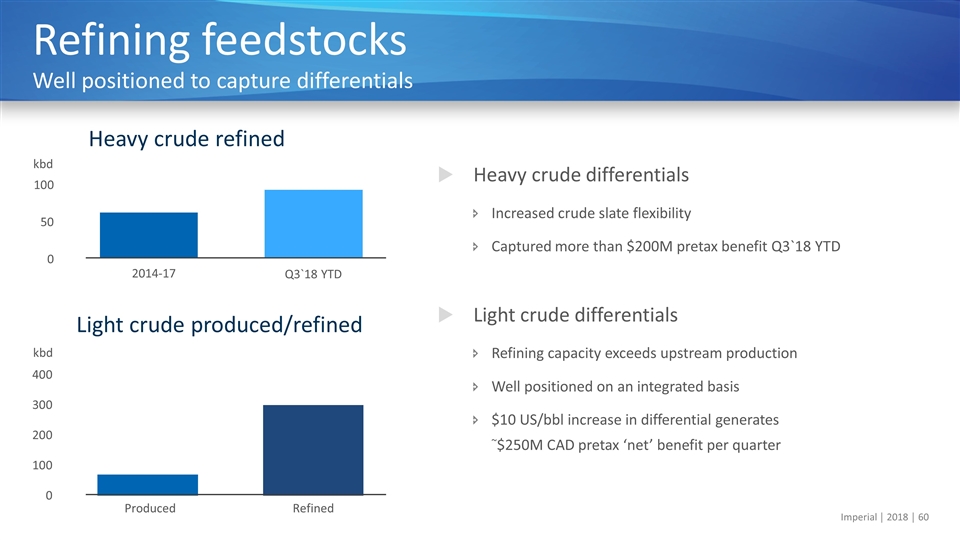

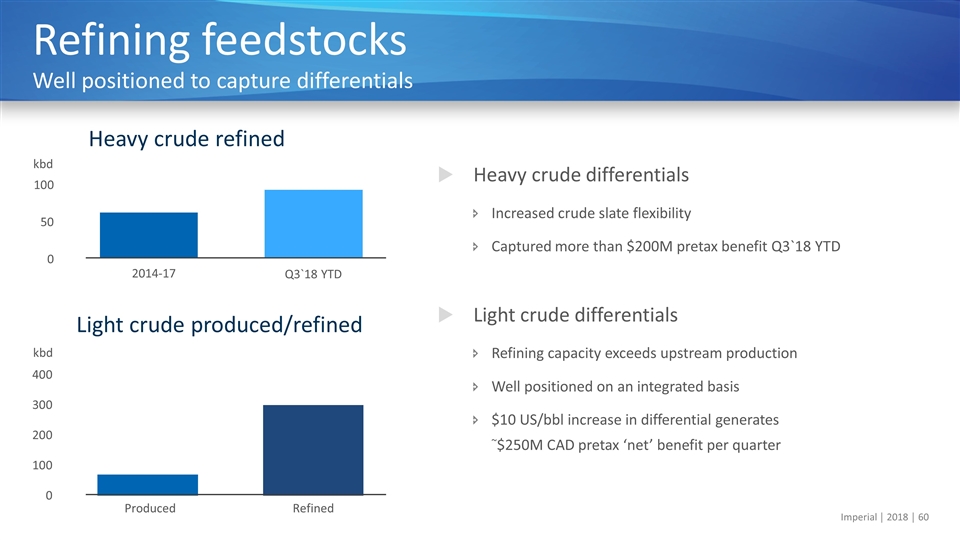

Heavy crude differentials Increased crude slate flexibility Captured more than $200M pretax benefit Q3`18 YTD Light crude differentials Refining capacity exceeds upstream production Well positioned on an integrated basis $10 US/bbl increase in differential generates ~$250M CAD pretax ‘net’ benefit per quarter Refining feedstocks Well positioned to capture differentials Heavy crude refined kbd kbd 2014-17 Q3`18 YTD Light crude produced/refined Refined Produced

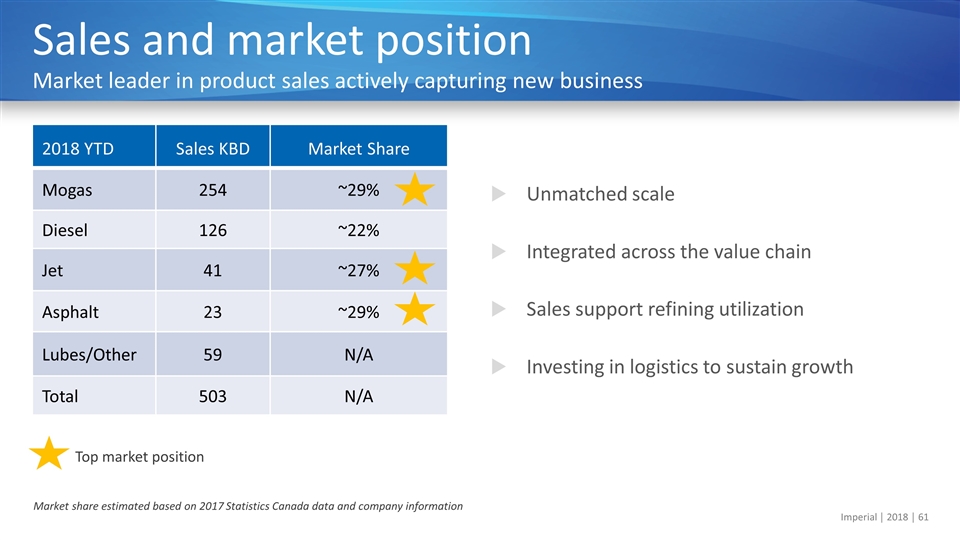

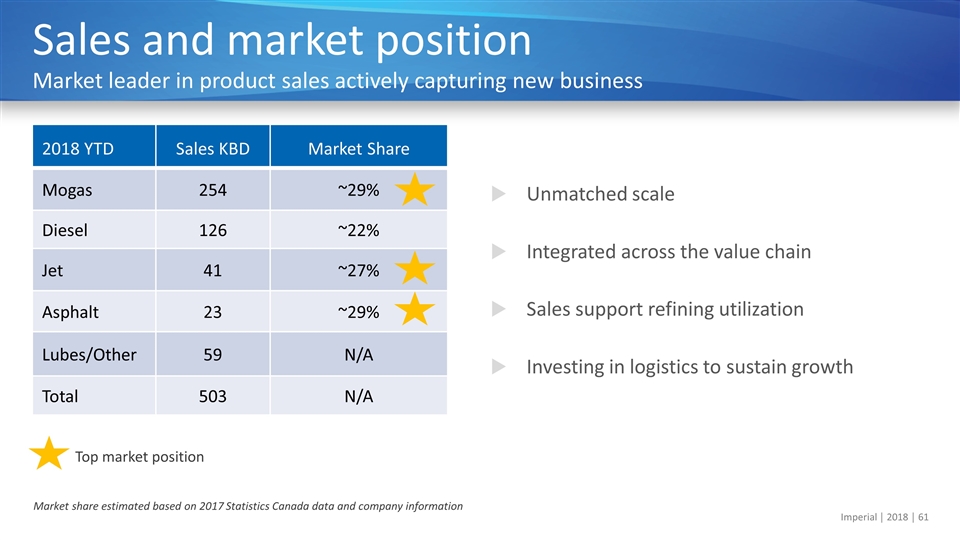

2018 YTD Sales KBD Market Share Mogas 254 ~29% Diesel 126 ~22% Jet 41 ~27% Asphalt 23 ~29% Lubes/Other 59 N/A Total 503 N/A Unmatched scale Integrated across the value chain Sales support refining utilization Investing in logistics to sustain growth Sales and market position Market leader in product sales actively capturing new business Top market position Market share estimated based on 2017 Statistics Canada data and company information

Build strategic relationships Grow ratable sales Capture brand value Optimize integrated profit Sales strategy Leverage scale, integration and brand to pursue profitable sales growth Spot Term Branded The brand advantage

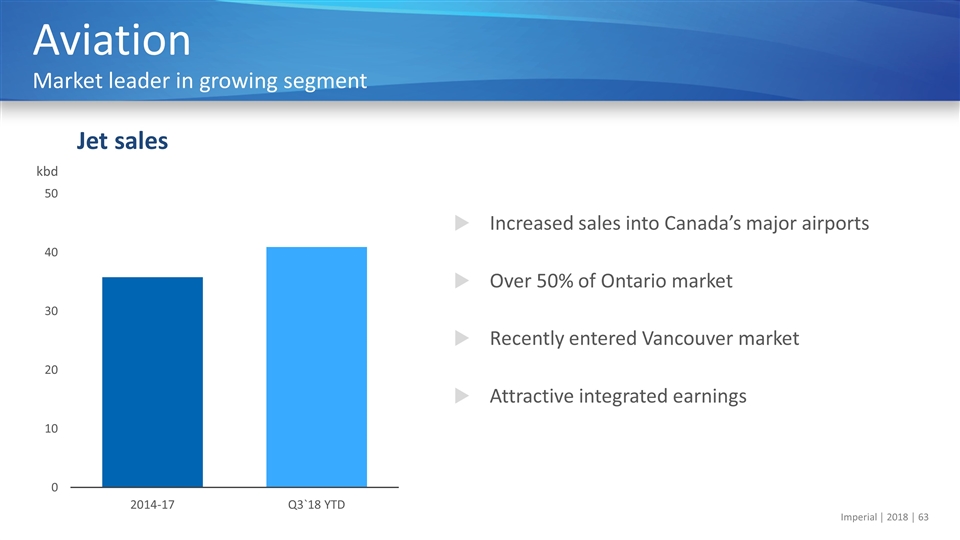

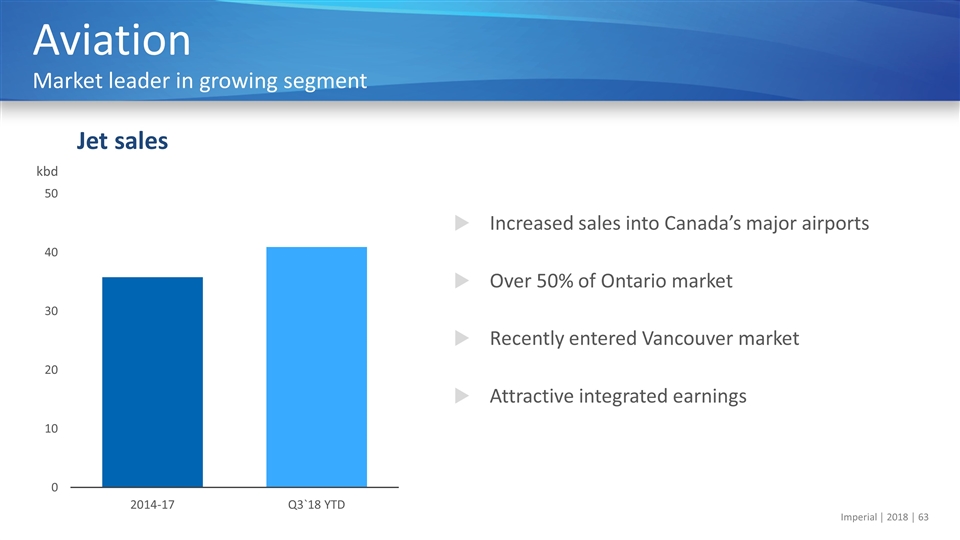

Increased sales into Canada’s major airports Over 50% of Ontario market Recently entered Vancouver market Attractive integrated earnings Aviation Market leader in growing segment kbd Jet sales

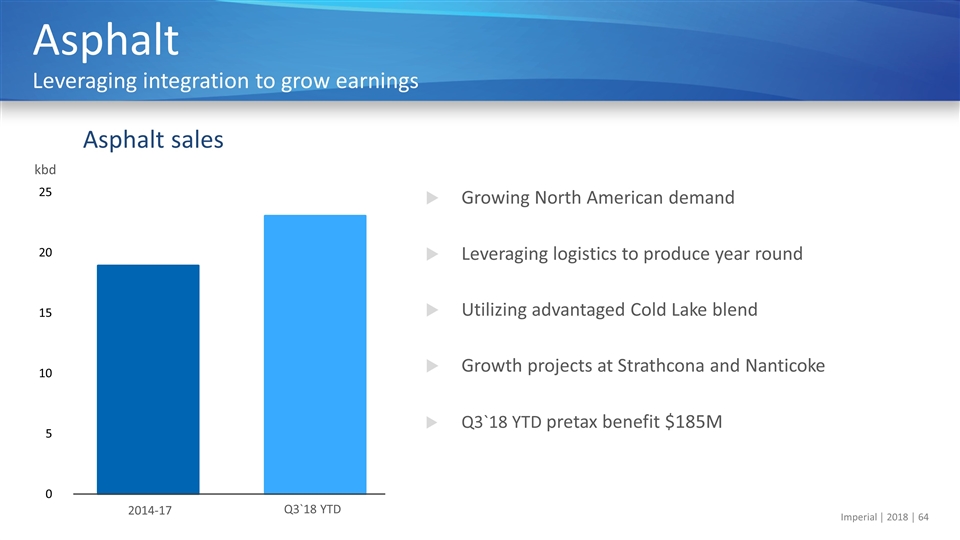

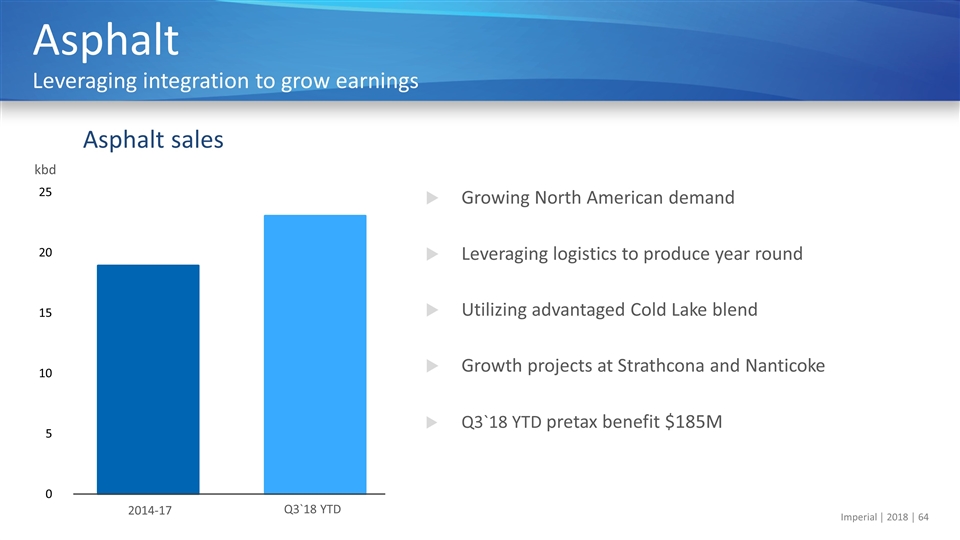

Growing North American demand Leveraging logistics to produce year round Utilizing advantaged Cold Lake blend Growth projects at Strathcona and Nanticoke Q3`18 YTD pretax benefit $185M Asphalt Leveraging integration to grow earnings 2014-17 Q3`18 YTD kbd Asphalt sales

Superior Products Synergy gasoline Synergy Diesel Efficient Convenience Nearly 2,200 locations Speedpass+ app Loyalty PC Optimum points Esso Extra Strategic partners Growth platforms Retail excellence Retail Captured # 1 position in Q3 2018 kbd Retail sales volumes Aubrey Can you Confirm the Imperial logos are our approved logos? Do you know if Synergy, Speedpass and Esso Extra need to have a TM? The Optimum one I know is ok Retail market share source: Kent Market Share. The Kent Group Ltd.

Heavy differentials to increase Diesel/jet prices to strengthen Shippers and refiners adapting Integration reduces impacts Marine fuels Well positioned for IMO 2020 sulphur specification change

High performing refineries Advantaged feedstocks Scale, integration and logistics Growing high value sales Brand advantage Strong sustained cash flow Downstream summary Positioned for industry leading financial performance

Chemical at a glance High value products, well positioned, integrated assets Integrated Sarnia Chemical Site kt Sales ~800 Billion Cash generated since 2014 $1.3 Advantaged location Integrated manufacturing High value products Polyethylene Specialty customer products

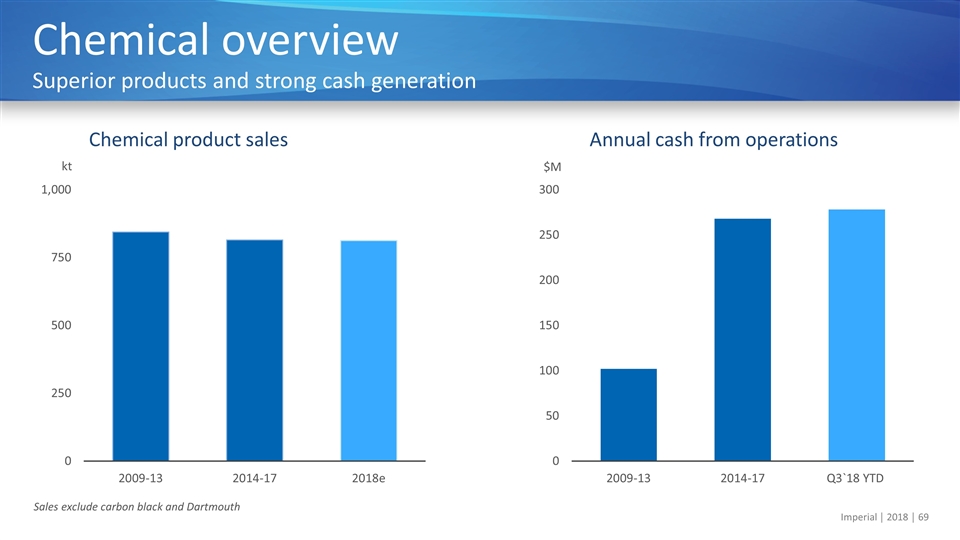

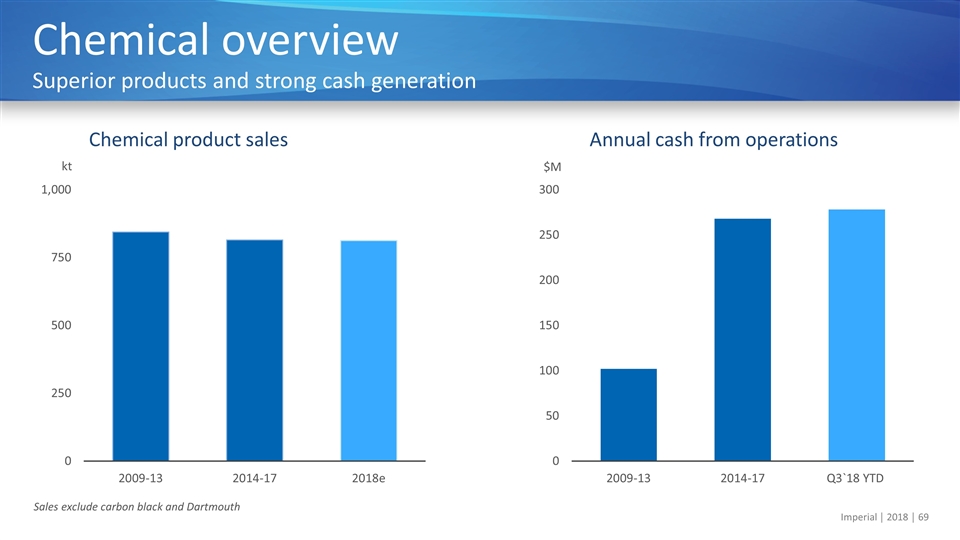

Superior products and strong cash generation Annual cash from operations $M Chemical product sales kt Chemical overview Sales exclude carbon black and Dartmouth

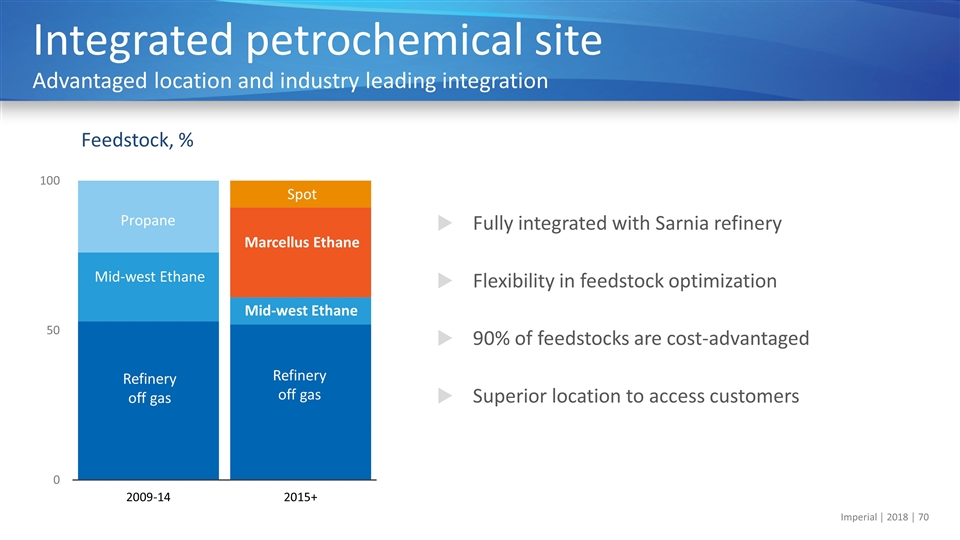

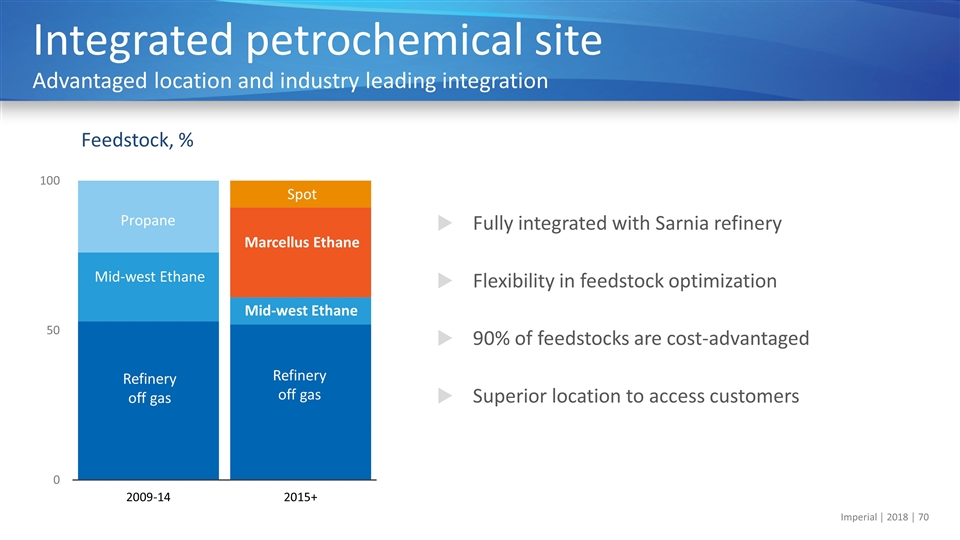

Fully integrated with Sarnia refinery Flexibility in feedstock optimization 90% of feedstocks are cost-advantaged Superior location to access customers Integrated petrochemical site Advantaged location and industry leading integration Feedstock, % Mid-west Ethane Mid-west Ethane Spot Marcellus Ethane Refinery off gas

Key end uses Injection molding (pails, containers, crates) Rotational molding (storage tanks, toys) Superior customer experience Consistent resin quality, reliable supply Highly regarded technical service Specialty products Premium products Polyethylene for rotational and injection molding drives profitability

Leverage opportunities from crude to customer Financial resilience across commodity cycles Balance sheet strength and optionality Value chain Integrated across the value chain Integration advantage Aubrey Can you edit the graphic on this page so it is all consistent Optimization Manufacturing Crude Logistics Branded Retail Commercial B2B Chemical

Delivering Value Rich Kruger Chairman, President and Chief Executive Officer

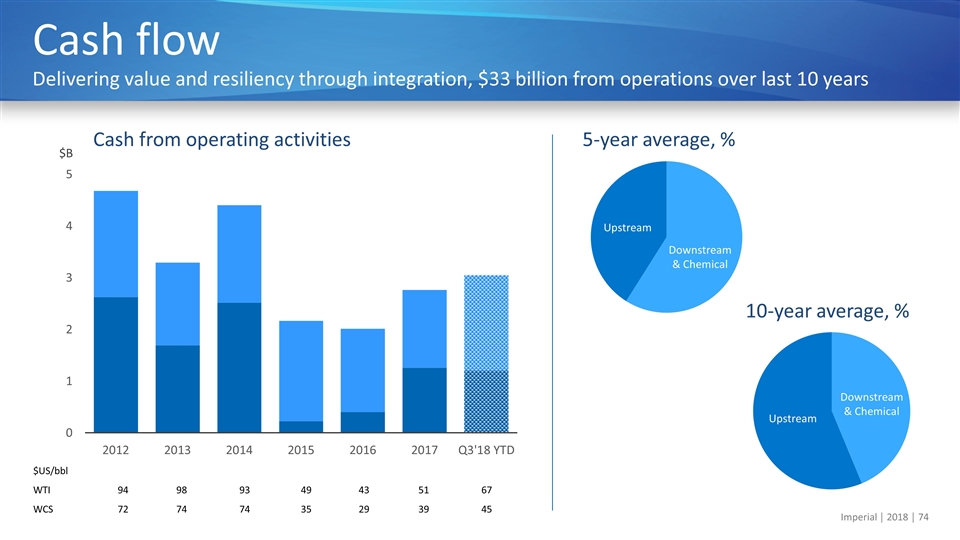

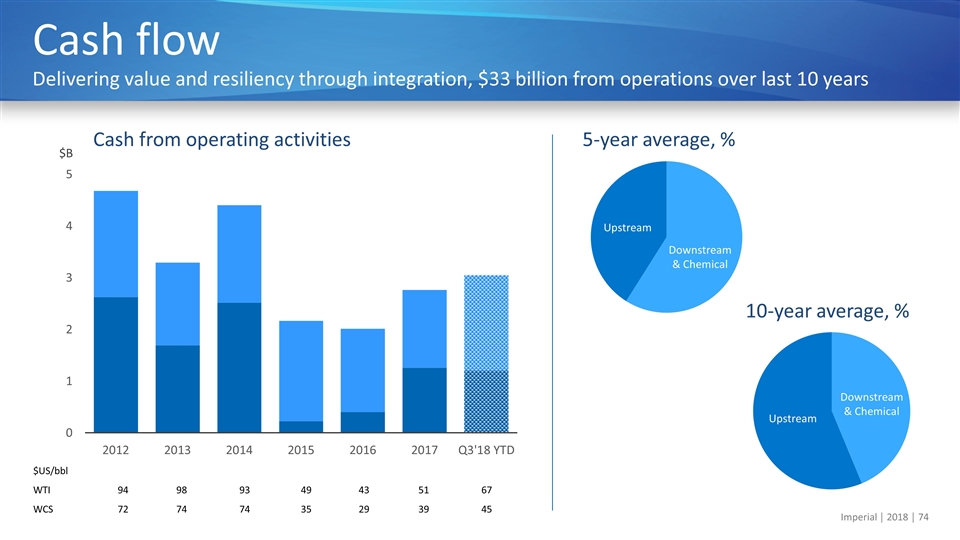

Cash flow Delivering value and resiliency through integration, $33 billion from operations over last 10 years Cash from operating activities $US/bbl WTI 94 98 93 49 43 51 67 WCS 72 74 74 35 29 39 45 10-year average, % 5-year average, % Upstream Downstream & Chemical Upstream Downstream & Chemical $B

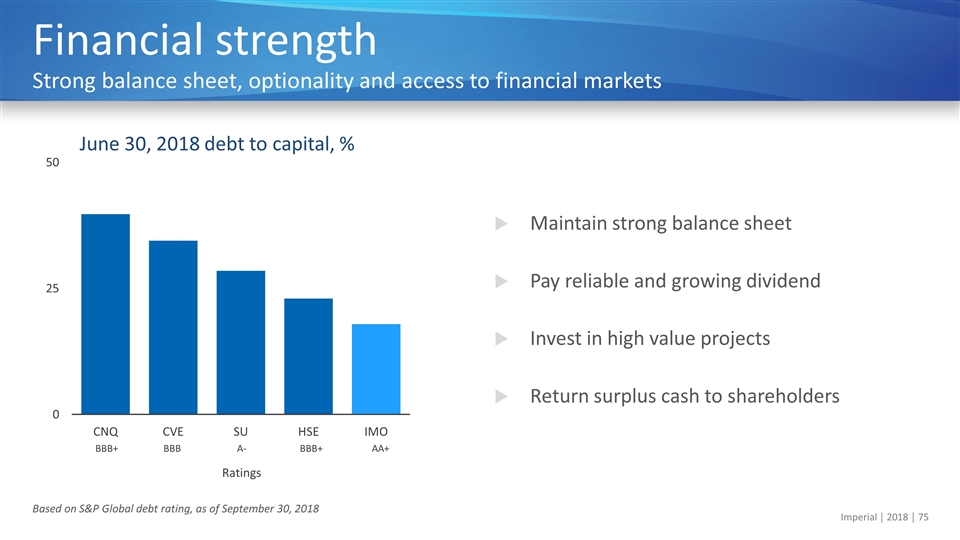

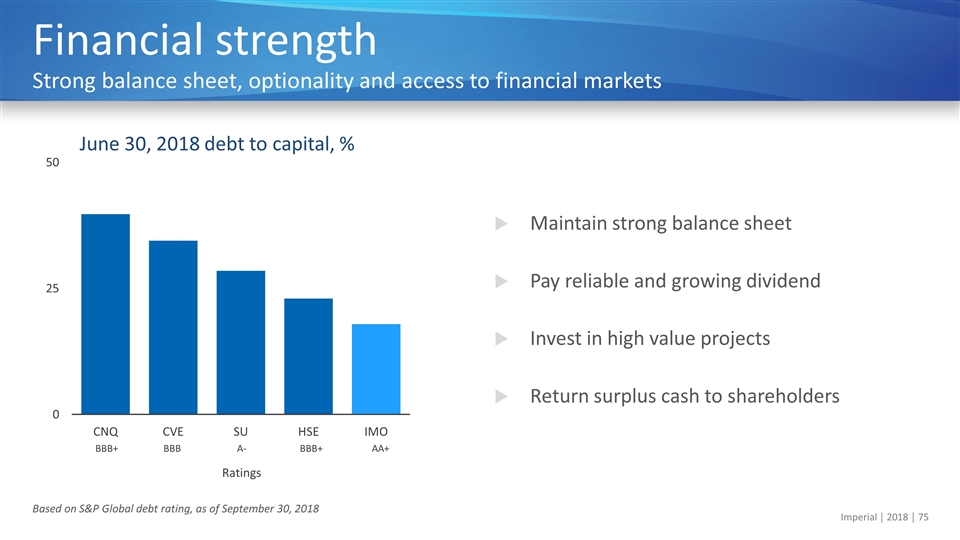

Maintain strong balance sheet Pay reliable and growing dividend Invest in high value projects Return surplus cash to shareholders Financial strength Strong balance sheet, optionality and access to financial markets June 30, 2018 debt to capital, % Ratings BBB+ BBB A- BBB+ AA+ Based on S&P Global debt rating, as of September 30, 2018

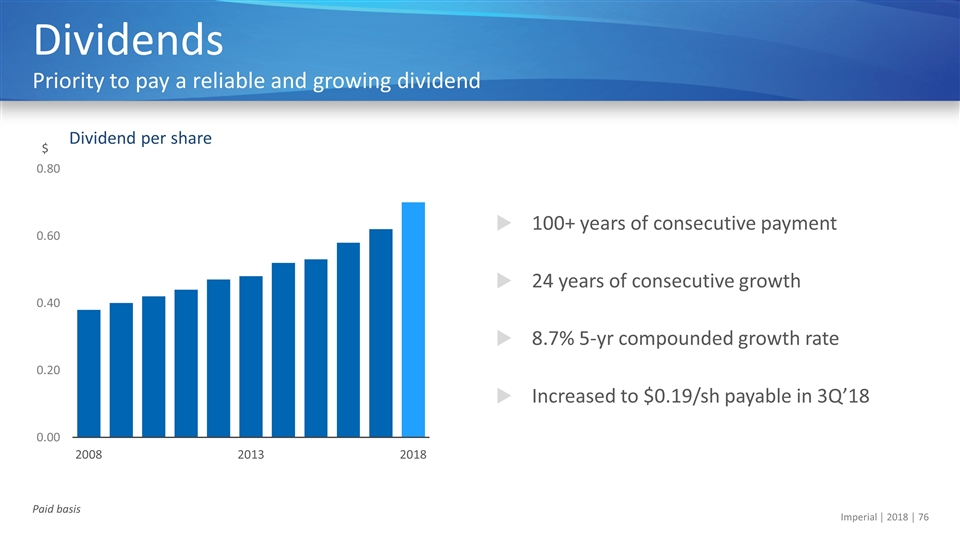

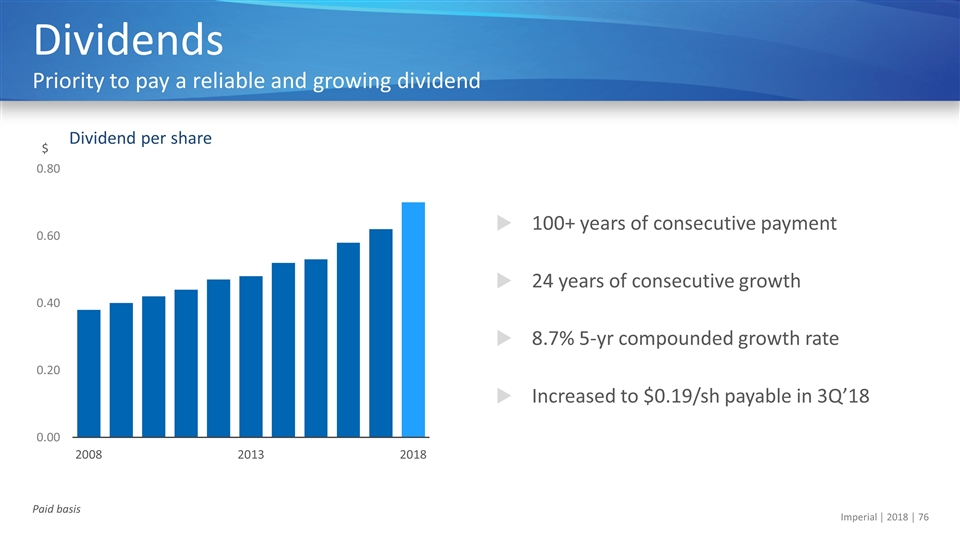

100+ years of consecutive payment 24 years of consecutive growth 8.7% 5-yr compounded growth rate Increased to $0.19/sh payable in 3Q’18 Dividends Priority to pay a reliable and growing dividend Dividend per share Paid basis $

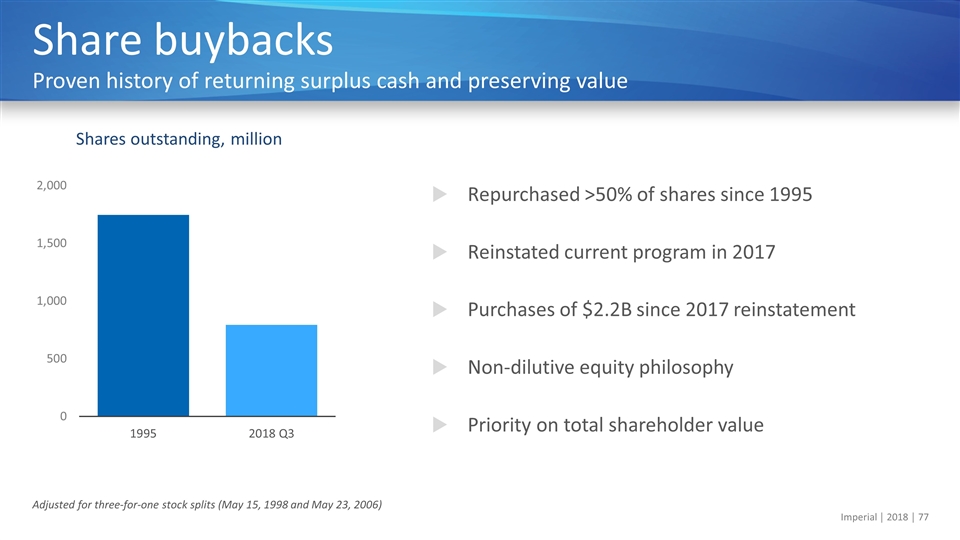

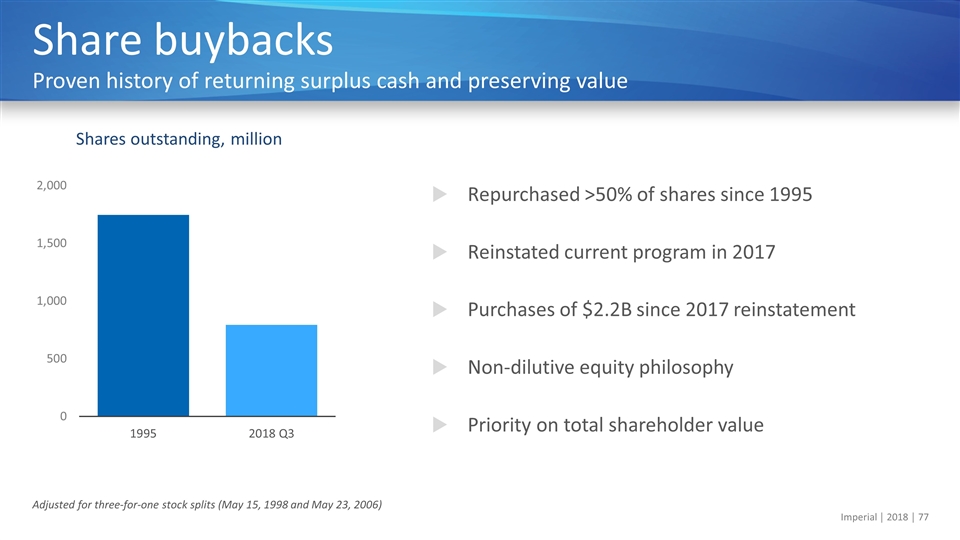

Repurchased >50% of shares since 1995 Reinstated current program in 2017 Purchases of $2.2B since 2017 reinstatement Non-dilutive equity philosophy Priority on total shareholder value Share buybacks Proven history of returning surplus cash and preserving value 1995 Adjusted for three-for-one stock splits (May 15, 1998 and May 23, 2006) Shares outstanding, million

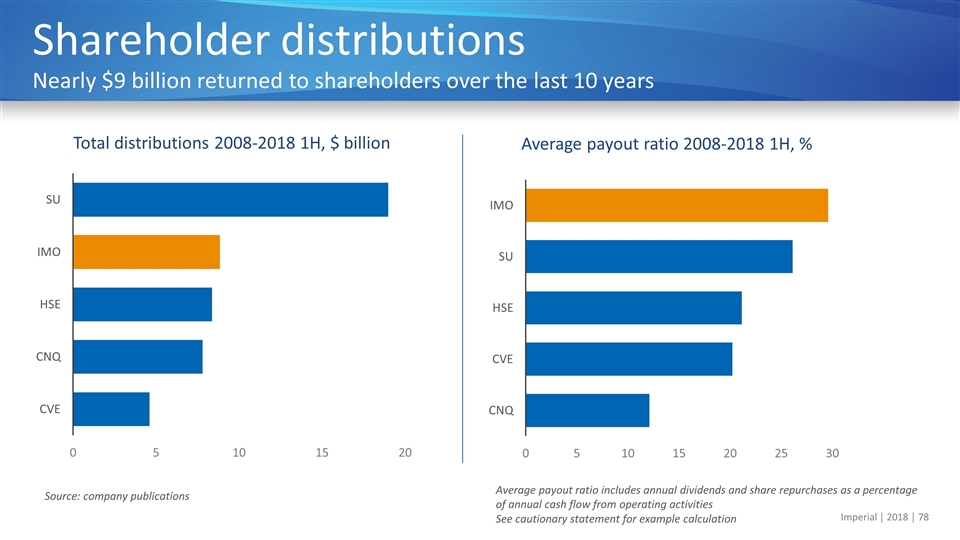

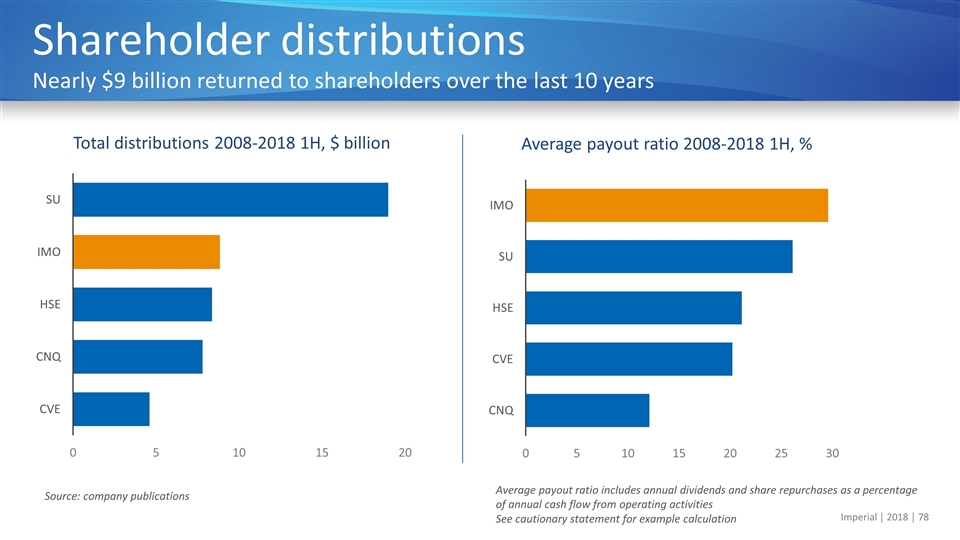

Shareholder distributions Nearly $9 billion returned to shareholders over the last 10 years Source: company publications Average payout ratio 2008-2018 1H, % Total distributions 2008-2018 1H, $ billion Average payout ratio includes annual dividends and share repurchases as a percentage of annual cash flow from operating activities See cautionary statement for example calculation

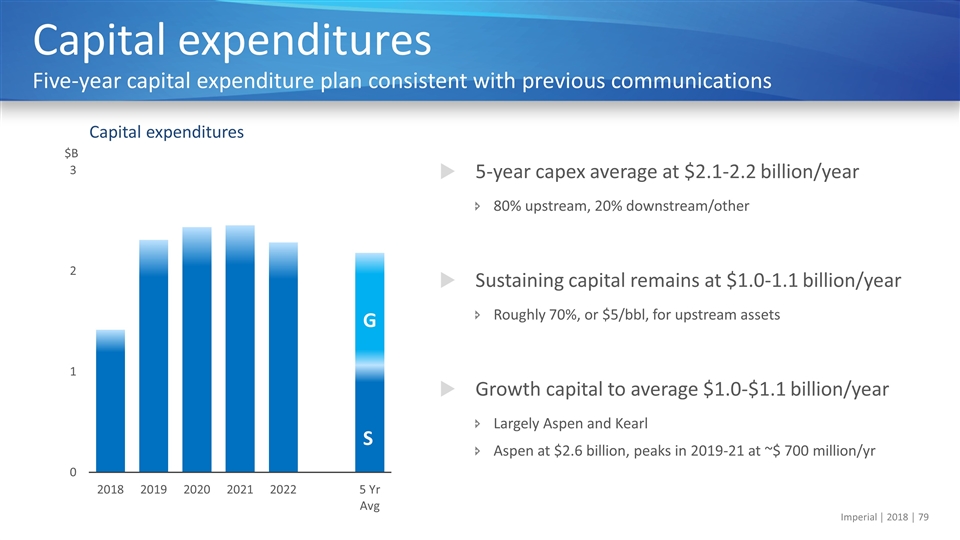

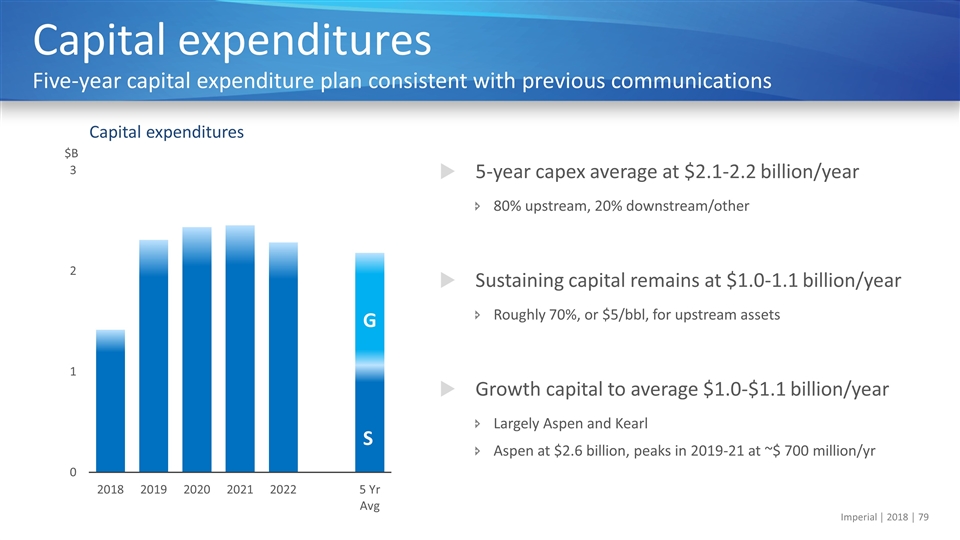

5-year capex average at $2.1-2.2 billion/year 80% upstream, 20% downstream/other Sustaining capital remains at $1.0-1.1 billion/year Roughly 70%, or $5/bbl, for upstream assets Growth capital to average $1.0-$1.1 billion/year Largely Aspen and Kearl Aspen at $2.6 billion, peaks in 2019-21 at ~$ 700 million/yr Capital expenditures Five-year capital expenditure plan consistent with previous communications $B Capital expenditures

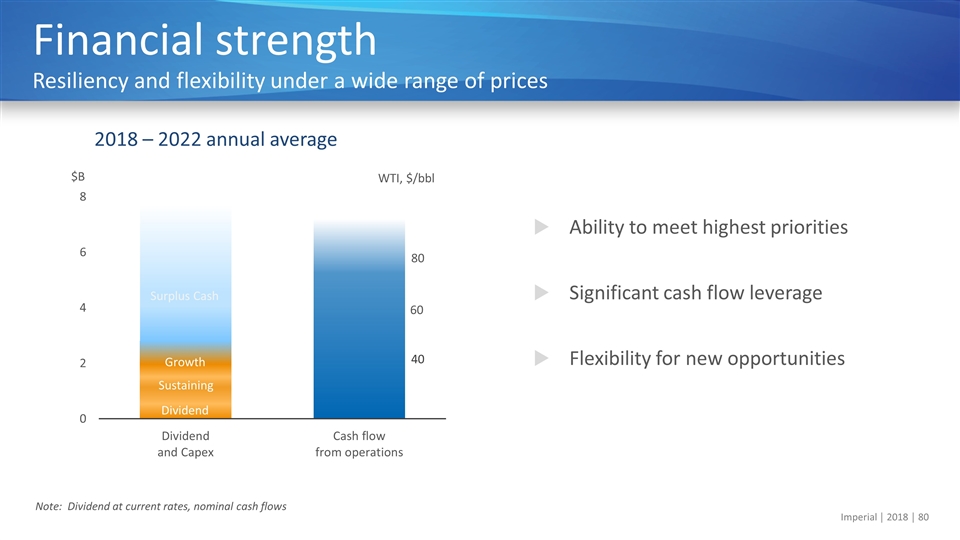

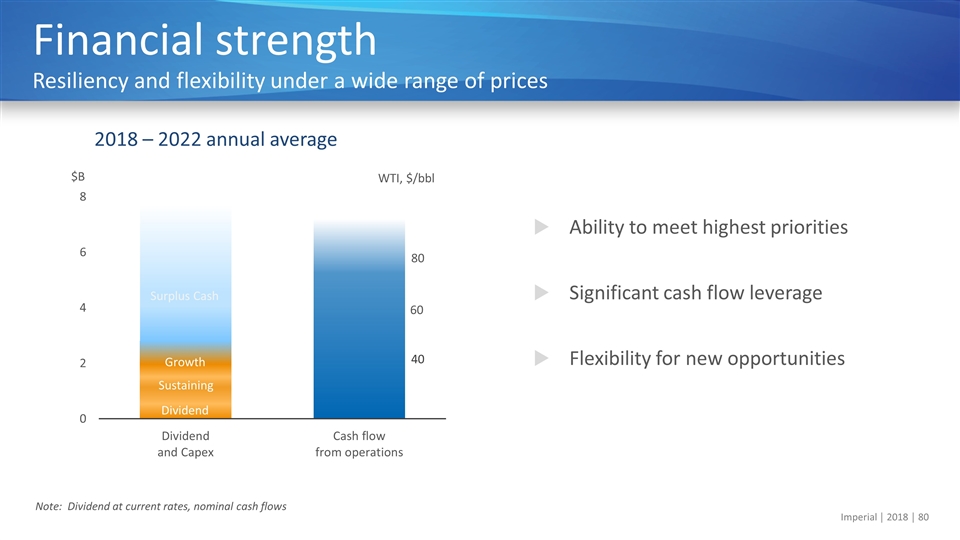

Ability to meet highest priorities Significant cash flow leverage Flexibility for new opportunities Financial strength Resiliency and flexibility under a wide range of prices 2018 – 2022 annual average Growth Growth Surplus Cash Dividend Sustaining 60 40 Note: Dividend at current rates, nominal cash flows 80 $B

Why Imperial Distinct competitive advantages that deliver long-term shareholder value Growth opportunities Large inventory of opportunities to support future upstream growth Asset base High quality, long-life assets across the portfolio Operational excellence Technical, operational and financial risk management that enhances value Technology leadership Unparalleled history of creating value through research and innovation Value chain integration Synergies across the full value chain including ExxonMobil relationship Shareholder value Demonstrated commitment to delivering value in all business environments

Cautionary statement Statements of future events or conditions in this presentation, including projections, targets, expectations, estimates, and business plans are forward-looking statements. Forward-looking statements can be identified by words such as "believe", "anticipate", "intend", “propose”, "plan", "goal", “target”, "estimate", "expect", "strategy", “outlook”, "future", "likely", "may", "should", "will" and similar references to future periods. Disclosure related to the energy outlook; anticipated performance expectations; Syncrude, Kearl and Cold Lake production outlook and growth; Syncrude and Kearl timing, cost and impact of performance improvements; Cold Lake project timing, cost and impact of new technology on recovery and production; Norman Wells restart; productivity and digital opportunities, including the application of autonomous haul trucks; economic enhancement and reductions to greenhouse gas emissions and water use, including from enhanced in-situ recovery; timing, cost, development and impact of Aspen and other future projects; Downstream utilization, differentials, growth and adaptation to IMO 2020 regulation; and planned capital structure and expenditures, cash flow from operations, and dividend and surplus cash strategy constitute forward-looking statements. Forward-looking statements are based on the company’s current expectations, estimates, projections and assumptions at the time the statements are made. Actual future financial and operating results, including expectations and assumptions concerning demand growth and energy source mix; commodity prices and foreign exchange rates; production growth and mix; production rates; production life and resource recoveries; project plans, dates, costs, capacities and execution; cost savings; product sales; applicable laws and government policies; financing sources; and capital and environmental expenditures could differ materially depending on a number of factors. These factors include changes in the supply of and demand for crude oil, natural gas, and petroleum and petrochemical products and resulting price and margin impacts; transportation for accessing markets; political or regulatory events, including changes in law or government policy, applicable royalty rates and tax laws; the receipt, in a timely manner, of regulatory and third-party approvals; third party opposition to operations and projects; environmental risks inherent in oil and gas exploration and production activities; environmental regulation, including climate change and greenhouse gas restrictions; currency exchange rates; availability and allocation of capital; availability and performance of third party service providers; unanticipated operational disruptions; management effectiveness; commercial negotiations; project management and schedules; response to unexpected technological developments; operational hazards and risks; disaster response preparedness; the ability to develop or acquire additional reserves; and other factors discussed in Item 1A of Imperial’s most recent Form 10-K and in the management's discussion and analysis of financial condition and results of operations contained in Item 7. Forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to Imperial Oil Limited. Imperial Oil Limited’s actual results may differ materially from those expressed or implied by its forward-looking statements and readers are cautioned not to place undue reliance on them. Imperial Oil Limited undertakes no obligation to update any forward-looking statements contained herein, except as required by applicable law. All financial information is presented in Canadian dollars, unless otherwise indicated. Average payout ratio calculation (slide 78) For purposes of calculating the average payout ratio, the following is an example calculation of the company’s payout ratio for the year 2017 as reported on Form 10-K [Dividends paid ($524M) + Net common shares purchased ($627M)] / Cash flow from operating activities($2,763M) In these materials, certain natural gas volumes have been converted to barrels of oil equivalent (BOE) on the basis of six thousand cubic feet (Mcf) to one barrel (bbl). BOE may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf to one bbl is based on an energy-equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different than the energy equivalency ratio of 6 Mcf to 1 bbl, using a 6:1 conversion ratio may be misleading as an indication of value. All reserves and contingent resources estimates provided in these materials are effective as of December 31, 2017, and based on definitions contained in the Canadian Oil and Gas Evaluation Handbook (COGEH) and are presented in accordance with National Instrument 51-101, as disclosed in Imperial’s Form 51-101F1 for the fiscal year ending December 31, 2017. Except as otherwise disclosed herein, reserves and contingent resource information are an estimate of the company’s working interest before royalties at year-end 2017, as determined by Imperial’s internal qualified reserves evaluator. Reserves are the estimated remaining quantities of commercially recoverable oil, natural gas and related substances anticipated to be recoverable from known accumulations, as of a given date, based on the analysis of drilling, geological, geophysical and engineering data, the use of established technology, and specified economic conditions, which are generally accepted as being reasonable. Proved reserves are those reserves that can be estimated with a high degree of certainty to be recoverable. Probable reserves are those additional reserves that are less certain to be recovered than proved reserves. Contingent resources do not constitute, and should not be confused with, reserves. Contingent resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations using established technology or technology under development, but are not currently considered to be commercially recoverable due to one or more contingencies. Contingencies that preclude the classification of Imperial’s contingent resources as reserves include, but are not limited to, economic, environmental, social and political factors, regulatory matters, a lack of markets, and a prolonged timetable for development. Contingent resource volumes represented in these materials are technical best estimate volumes, considered to be a realistic estimate of the quantity that may actually be recovered; it is equally likely that the actual quantities recovered may be greater or less than the technical best estimate. Estimates of contingent resources have not been adjusted for risk based on the chance of development. There is uncertainty that it will be commercially viable to produce any portion of the resource, nor is there certainty as to the timing of any such development. Significant positive and negative factors relevant to the estimate include, but are not limited to, the commodity price environment and regulatory and tax uncertainty. The estimates of various classes of reserves (proved and probable) and of contingent resources in these materials represent arithmetic sums of multiple estimates of such classes for different properties, which statistical principles indicate may be misleading as to volumes that may actually be recovered. Readers should give attention to the estimates of individual classes of reserves and contingent resources and appreciate the differing probabilities of recovery associated with each class. The term “project” as used in these materials can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports..

For more information: Dave Hughes Manager, Investor Relations +1 587.476.4743 dave.a.hughes@exxonmobil.com imperialoil.ca twitter.com/ImperialOil linkedin.com/company/imperial-oil youtube.com/ImperialOil