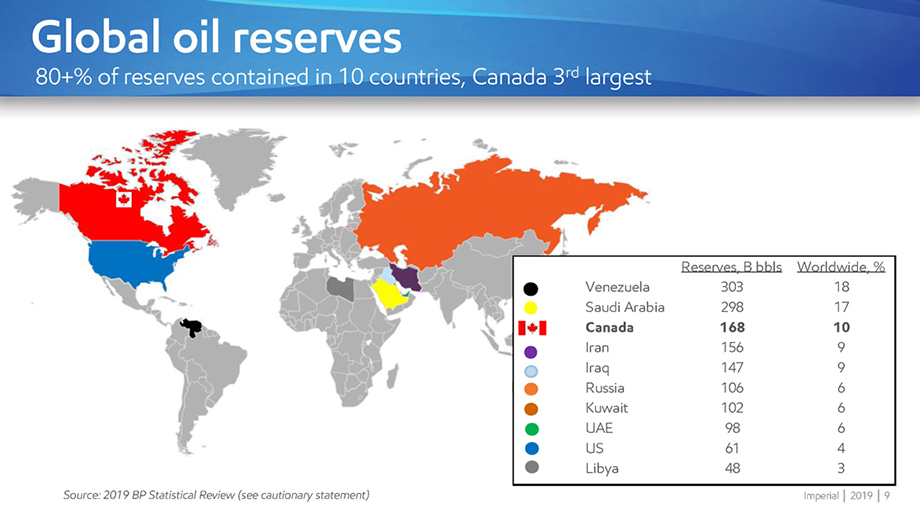

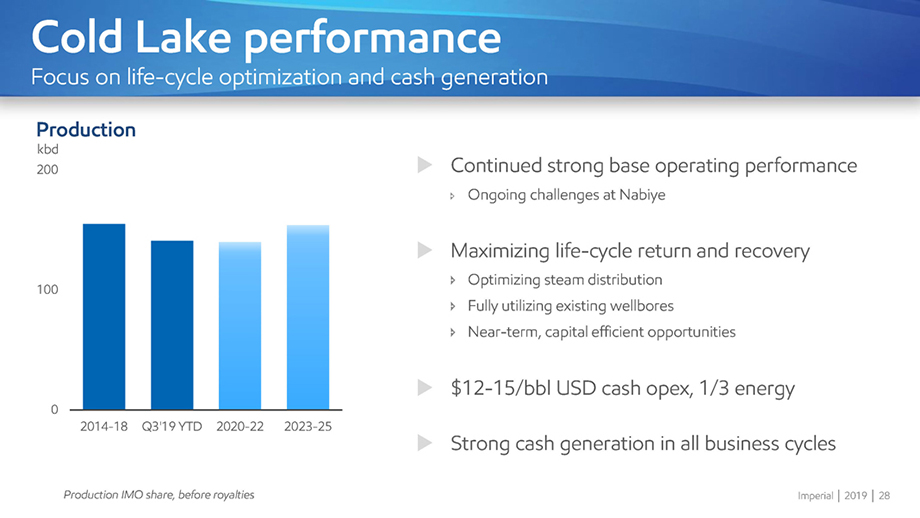

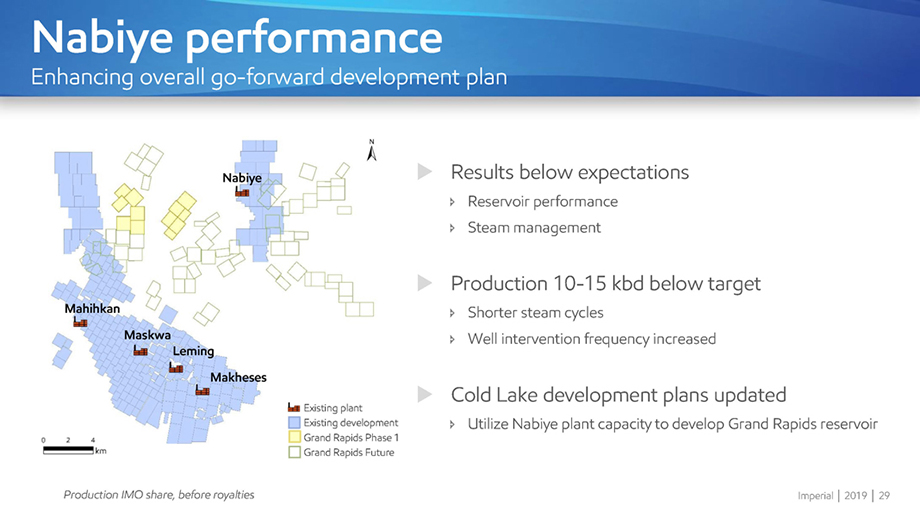

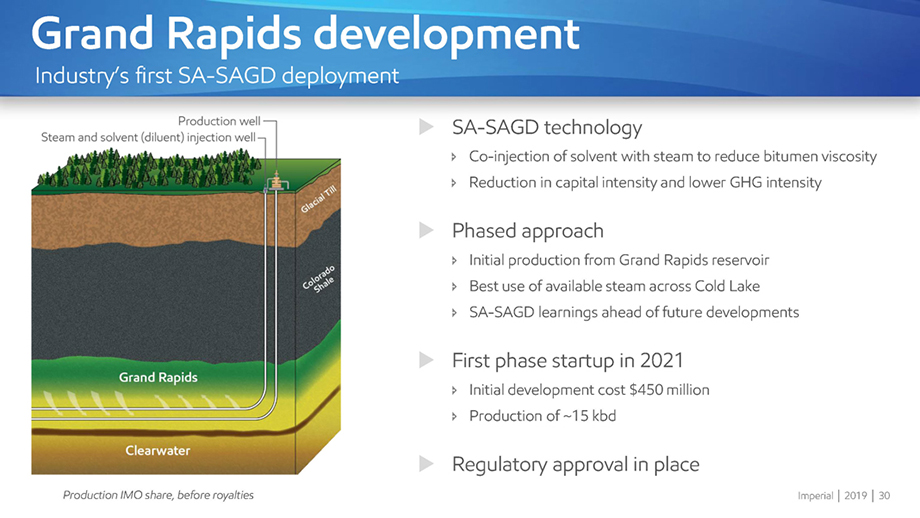

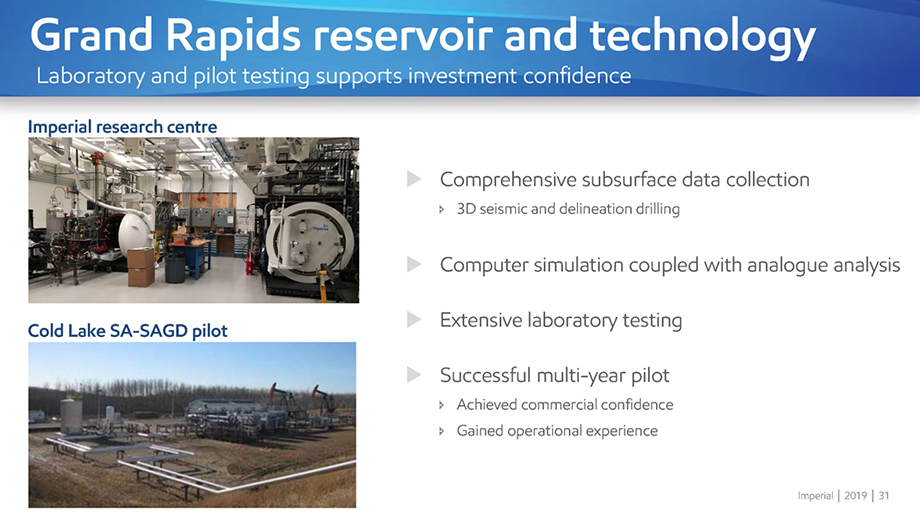

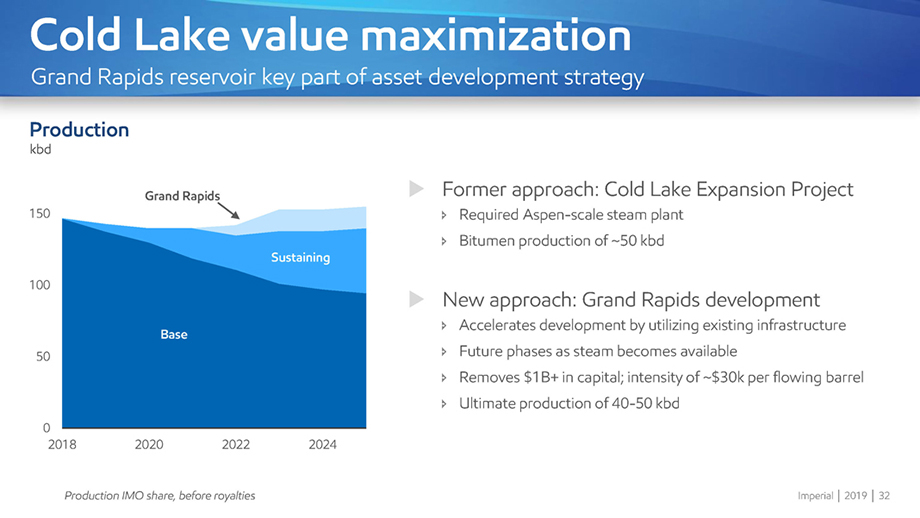

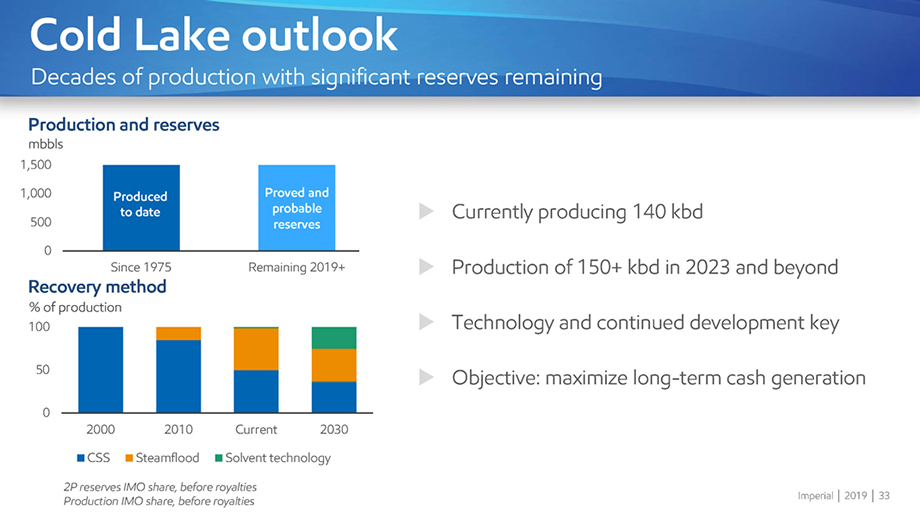

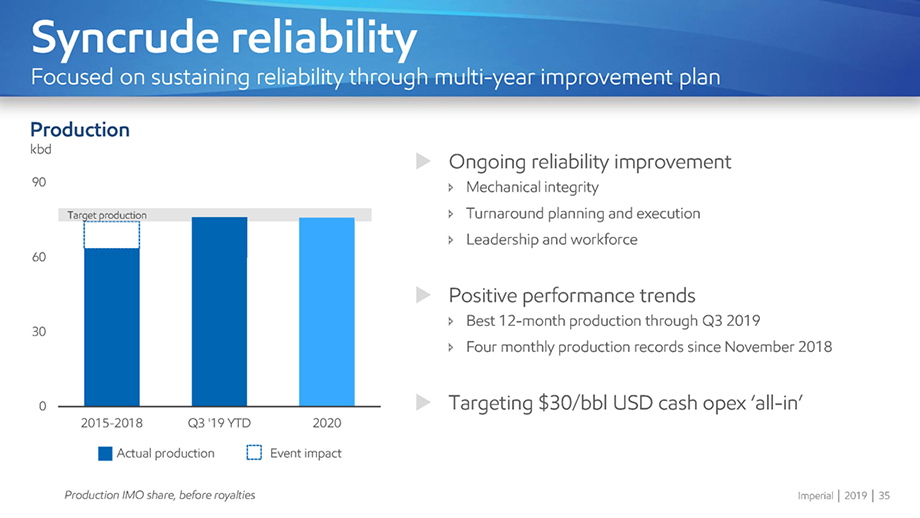

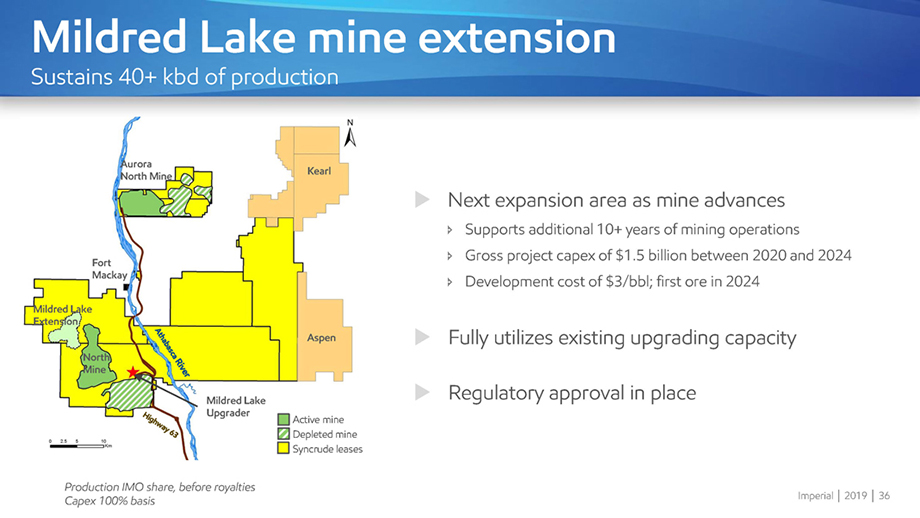

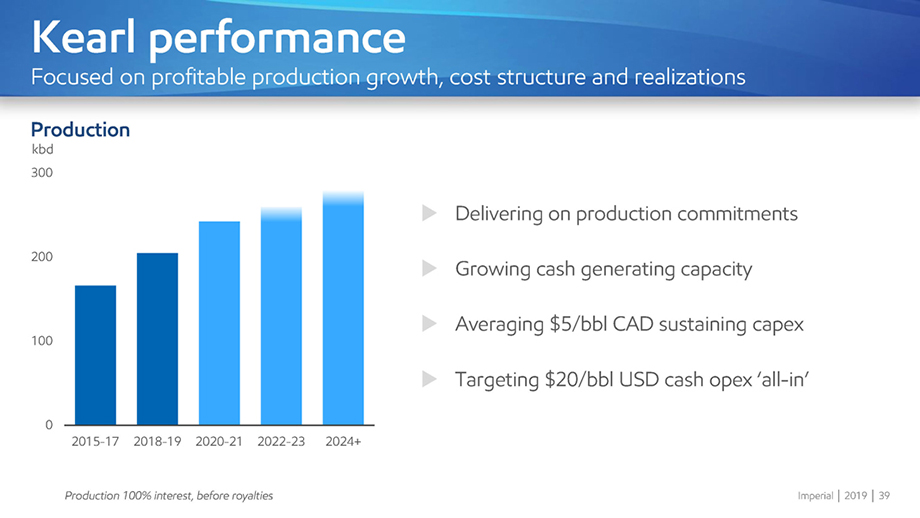

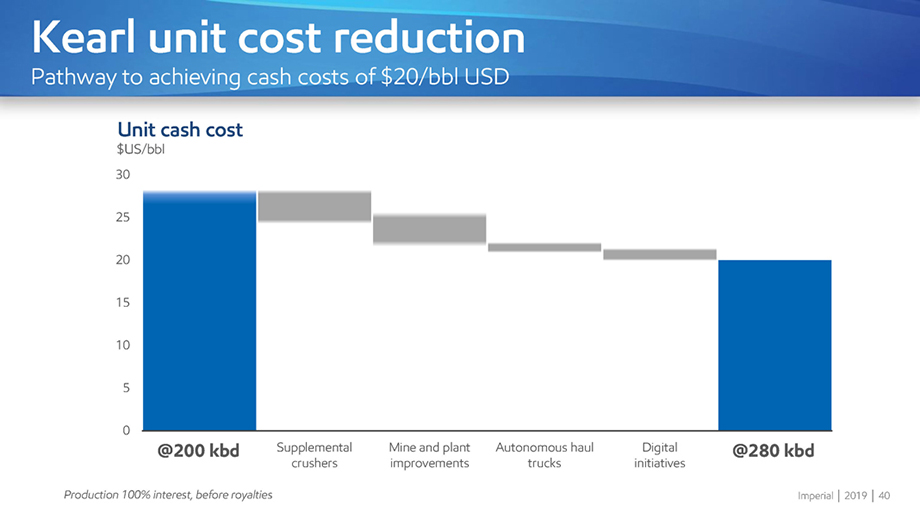

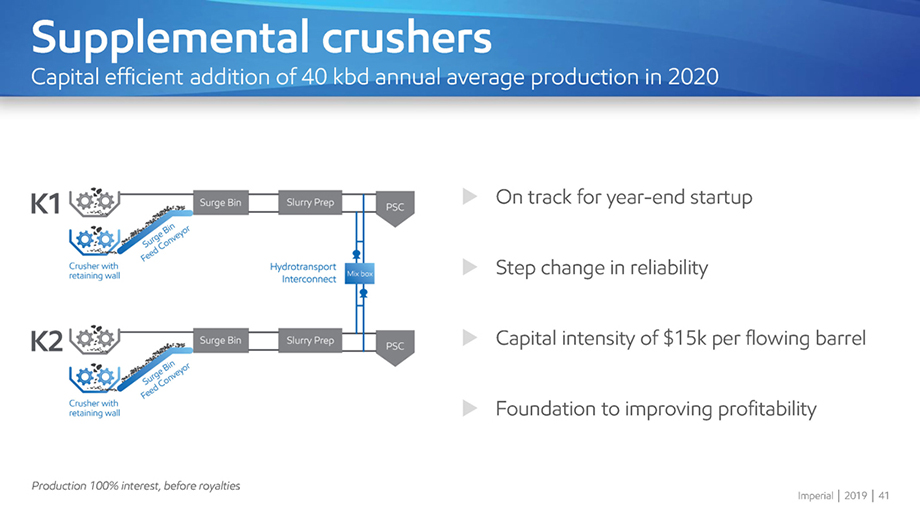

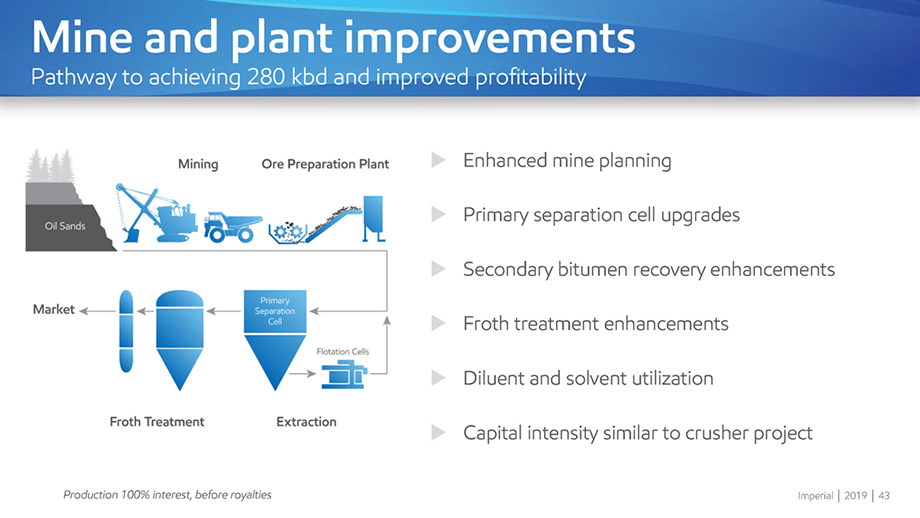

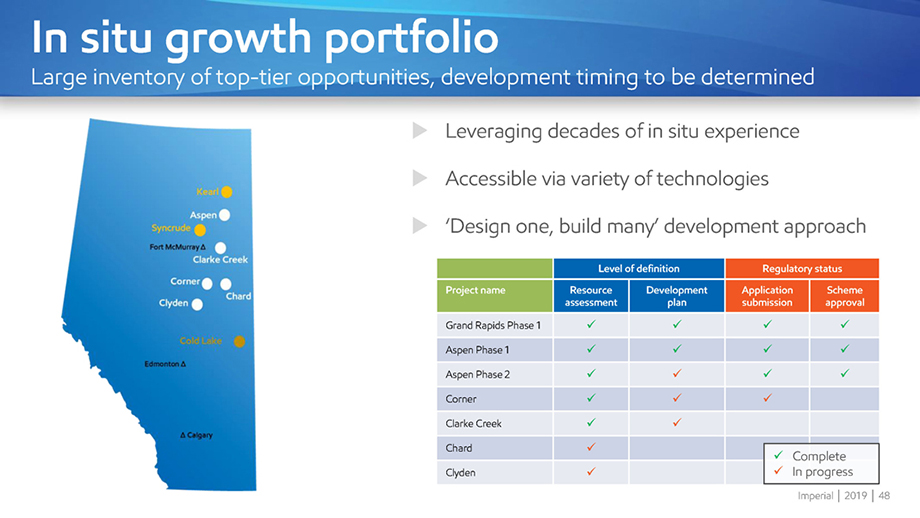

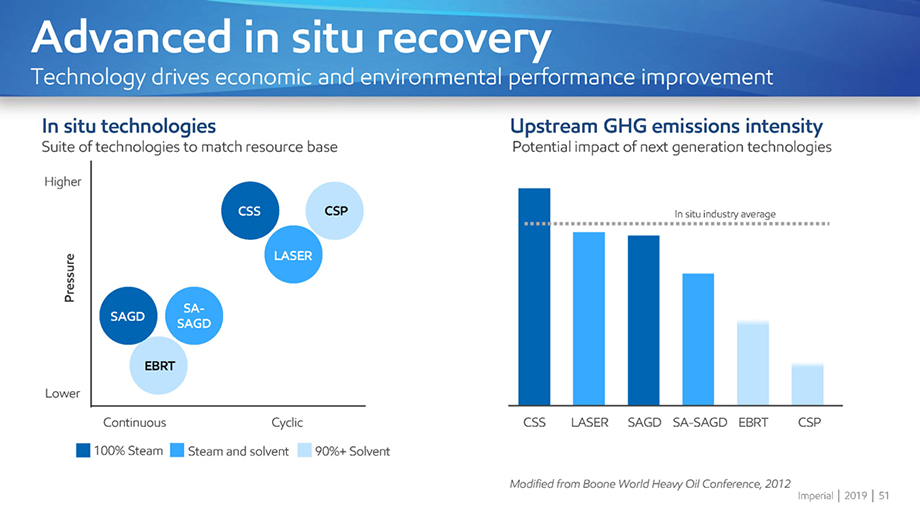

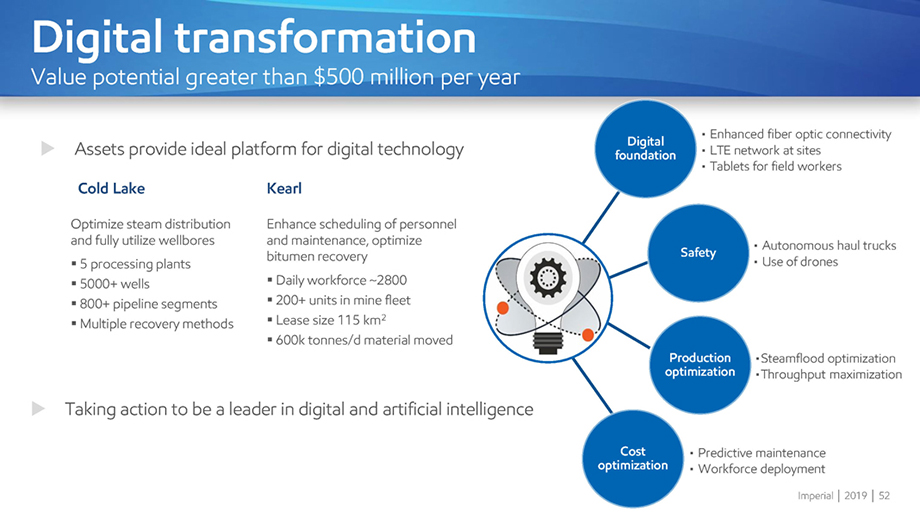

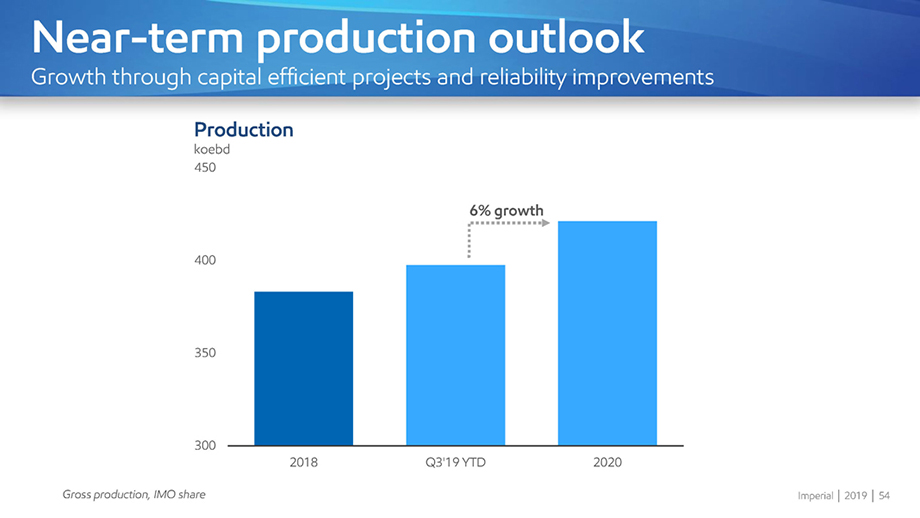

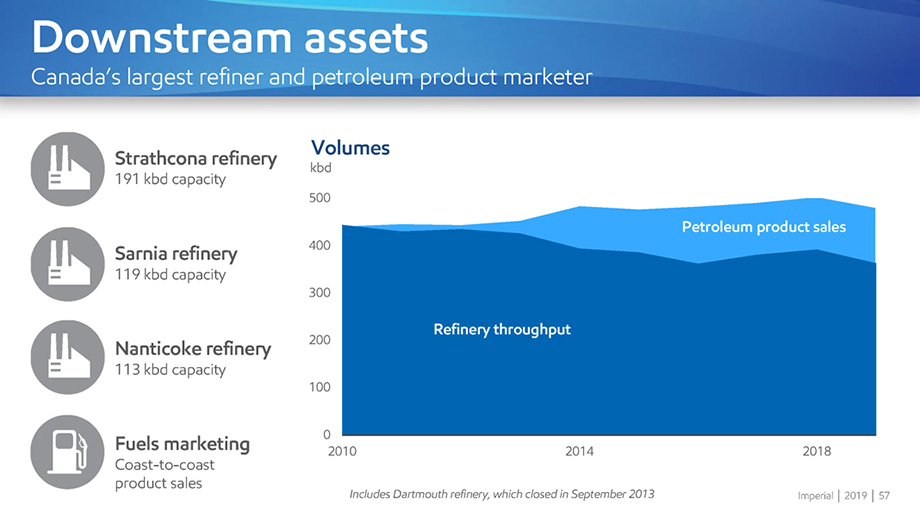

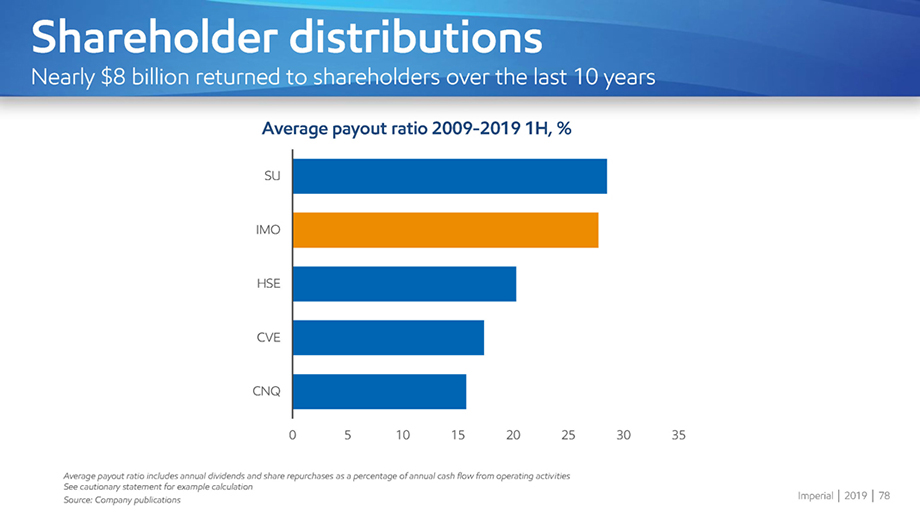

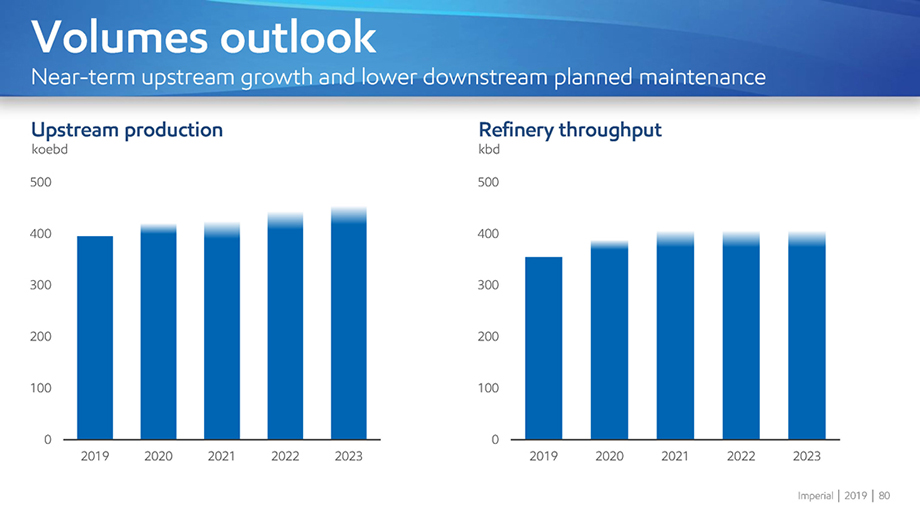

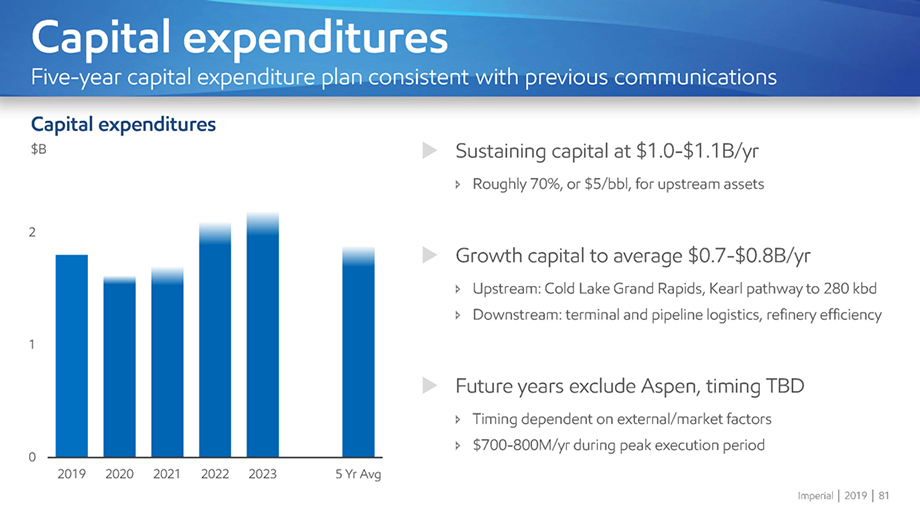

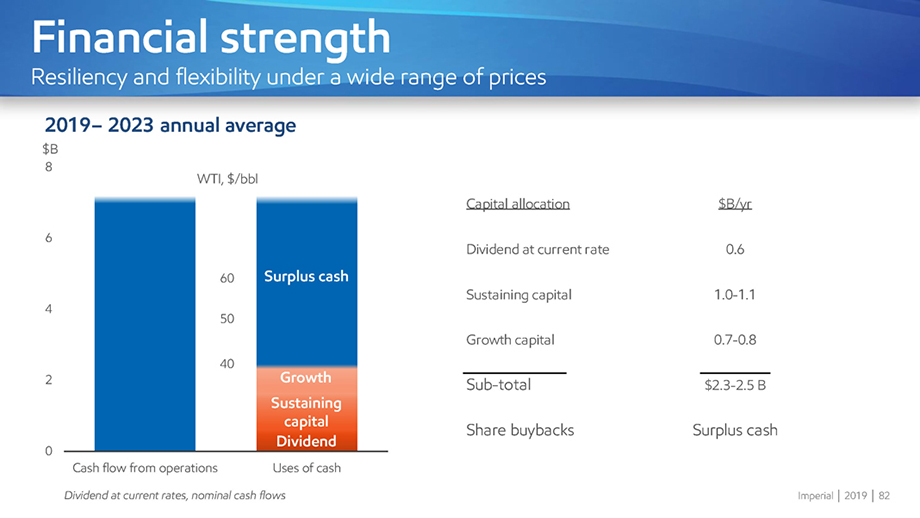

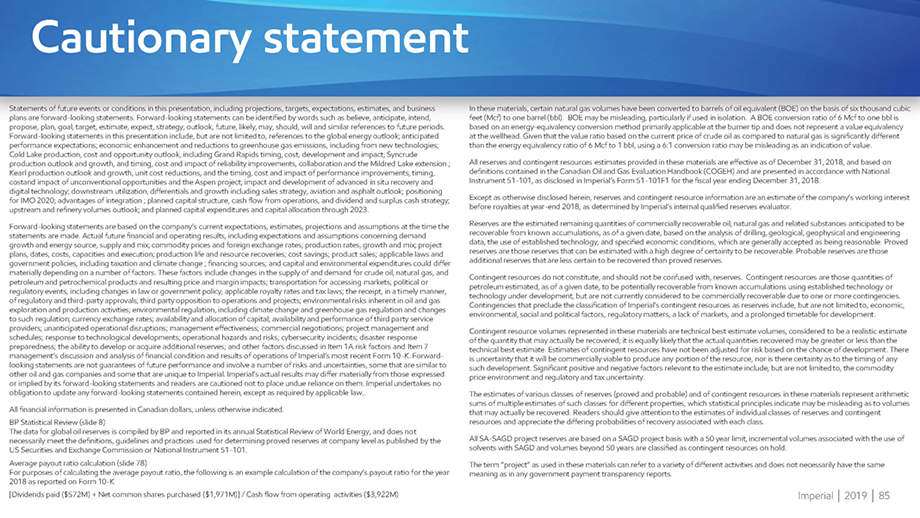

Cautionary statement Statements of future events or conditions in this presentation, including projections, targets, expectations, estimates, and business plans are forward-looking statements. Forward-looking statements can be identified by words such as believe, anticipate, intend, propose, plan, goal, target, estimate, expect, strategy, outlook, future, likely, may, should, will and similar references to future periods. Forward-looking statements in this presentation include, but are not limited to, references to the global energy outlook; anticipated performance expectations; economic enhancement and reductions to greenhouse gas emissions, including from new technologies; Cold Lake production, cost and opportunity outlook, including Grand Rapids timing, cost, development and impact; Syncrude production outlook and growth, and timing, cost and impact of reliability improvements, collaboration and the Mildred Lake extension ; Kearl production outlook and growth, unit cost reductions, and the timing, cost and impact of performance improvements; timing, costand impact of unconventional opportunities and the Aspen project; impact and development of advanced in situ recovery and digital technology; downstream utilization, differentials and growth including sales strategy, aviation and asphalt outlook; positioning for IMO 2020; advantages of integration ; planned capital structure, cash flow from operations, and dividend and surplus cash strategy; upstream and refinery volumes outlook; and planned capital expenditures and capital allocation through 2023. Forward-looking statements are based on the company’s current expectations, estimates, projections and assumptions at the time the statements are made. Actual future financial and operating results, including expectations and assumptions concerning demand growth and energy source, supply and mix; commodity prices and foreign exchange rates; production rates, growth and mix; project plans, dates, costs, capacities and execution; production life and resource recoveries; cost savings; product sales; applicable laws and government policies, including taxation and climate change ; financing sources; and capital and environmental expenditures could differ materially depending on a number of factors. These factors include changes in the supply of and demand for crude oil, natural gas, and petroleum and petrochemical products and resulting price and margin impacts; transportation for accessing markets; political or regulatory events, including changes in law or government policy, applicable royalty rates and tax laws; the receipt, in a timely manner, of regulatory and third-party approvals; third party opposition to operations and projects; environmental risks inherent in oil and gas exploration and production activities; environmental regulation, including climate change and greenhouse gas regulation and changes to such regulation; currency exchange rates; availability and allocation of capital; availability and performance of third party service providers; unanticipated operational disruptions; management effectiveness; commercial negotiations; project management and schedules; response to technological developments; operational hazards and risks; cybersecurity incidents; disaster response preparedness; the ability to develop or acquire additional reserves; and other factors discussed in Item 1A risk factors and Item 7 management’s discussion and analysis of financial condition and results of operations of Imperial’s most recent Form10-K. Forward-looking statements are not guarantees of future performance and involve a number of risks and uncertainties, some that are similar to other oil and gas companies and some that are unique to Imperial. Imperial’s actual results may differ materially from those expressed or implied by its forward-looking statements and readers are cautioned not to place undue reliance on them. Imperial undertakes no obligation to update any forward-looking statements contained herein, except as required by applicable law All financial information is presented in Canadian dollars, unless otherwise indicated. BP Statistical Review (slide 8) The data for global oil reserves is compiled by BP and reported in its annual Statistical Review of World Energy, and does not necessarily meet the definitions, guidelines and practices used for determining proved reserves at company level as published by the US Securities and Exchange Commission or National Instrument51-101. Average payout ratio calculation (slide 78) For purposes of calculating the average payout ratio, the following is an example calculation of the company’s payout ratio for the year 2018 as reported on Form10-K [Dividends paid ($572M) + Net common shares purchased ($1,971M)] / Cash flow from operating activities ($3,922M) In these materials, certain natural gas volumes have been converted to barrels of oil equivalent (BOE) on the basis of six thousand cubic feet (Mcf) to one barrel (bbl). BOE may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf to one bbl is based on an energy-equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different than the energy equivalency ratio of 6 Mcf to 1 bbl, using a 6:1 conversion ratio may be misleading as an indication of value. All reserves and contingent resources estimates provided in these materials are effective as of December 31, 2018, and based on definitions contained in the Canadian Oil and Gas Evaluation Handbook (COGEH) and are presented in accordance with National Instrument51-101, as disclosed in Imperial’s Form51-101F1 for the fiscal year ending December 31, 2018. Except as otherwise disclosed herein, reserves and contingent resource information are an estimate of the company’s working interest before royalties atyear-end 2018, as determined by Imperial’s internal qualified reserves evaluator. Reserves are the estimated remaining quantities of commercially recoverable oil, natural gas and related substances anticipated to be recoverable from known accumulations, as of a given date, based on the analysis of drilling, geological, geophysical and engineering data, the use of established technology, and specified economic conditions, which are generally accepted as being reasonable. Proved reserves are those reserves that can be estimated with a high degree of certainty to be recoverable. Probable reserves are those additional reserves that are less certain to be recovered than proved reserves. Contingent resources do not constitute, and should not be confused with, reserves. Contingent resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations using established technology or technology under development, but are not currently considered to be commercially recoverable due to one or more contingencies. Contingencies that preclude the classification of Imperial’s contingent resources as reserves include, but are not limited to, economic, environmental, social and political factors, regulatory matters, a lack of markets, and a prolonged timetable for development. Contingent resource volumes represented in these materials are technical best estimate volumes, considered to be a realistic estimate of the quantity that may actually be recovered; it is equally likely that the actual quantities recovered may be greater or less than the technical best estimate. Estimates of contingent resources have not been adjusted for risk based on the chance of development. There is uncertainty that it will be commercially viable to produce any portion of the resource, nor is there certainty as to the timing of any such development. Significant positive and negative factors relevant to the estimate include, but are not limited to, the commodity price environment and regulatory and tax uncertainty. The estimates of various classes of reserves (proved and probable) and of contingent resources in these materials represent arithmetic sums of multiple estimates of such classes for different properties, which statistical principles indicate may be misleading as to volumes that may actually be recovered. Readers should give attention to the estimates of individual classes of reserves and contingent resources and appreciate the differing probabilities of recovery associated with each class. AllSA-SAGD project reserves are based on a SAGD project basis with a 50 year limit, incremental volumes associated with the use of solvents with SAGD and volumes beyond 50 years are classified as contingent resources on hold. The term “project” as used in these materials can refer to a variety of different activities and does not necessarily have the same meaning as in any government payment transparency reports. Imperial â”, 2019 â”, 85