EXHIBIT 10.4

LONG BEACH

BERTH ACCESS, USE AND THROUGHPUT AGREEMENT

ThisLONG BEACH BERTH ACCESS, USE AND THROUGHPUT AGREEMENT (the “Agreement”) is executed as of September 14, 2012 (the “Execution Date”), and dated effective as of the Commencement Date (as defined below in Section 3), by and between Tesoro Logistics Operations LLC, a Delaware limited liability company (“Operator”), and for purposes of Section 22 only, Tesoro Logistics GP, LLC, a Delaware limited liability company (“General Partner”) and Tesoro Logistics LP, a Delaware limited partnership (“Partnership”), on the one hand, and Tesoro Refining and Marketing Company, a Delaware corporation (“Customer”), on the other hand.

RECITALS

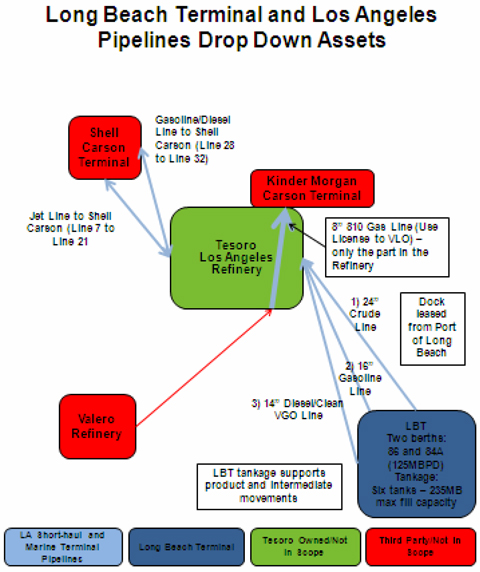

WHEREAS, pursuant to that certain Long Beach Harbor Department Lease Document HD-2114 (as such lease may be amended, restated, modified or supplemented from time to time, “Lease HD-2114”) with the City of Long Beach, California (the “City”), Customer has leasehold interests in (A) Berths 84A and 86 (together, the “Berths”; and each, individually, a “Berth”) and the dock related thereto (together with the Berths, the “Dock”), (B) various fixtures and improvements located in, on and around the Dock, including piping, loading arms and sheds (together with the Dock, the “Wharf”), and (C) subject to various permits, licenses and easements, Customer owns six (6) staging tanks at the Wharf with an aggregate shell capacity of 235,000 barrels for the storage of intermediate and refined petroleum products, along with related hydrocarbon transfer pumps, piping, sheds and equipment (including electrical switching and communications facilities and equipment) for such staging tanks (collectively, the “Staging Facility”), all of which is situated at the Long Beach Terminal (the “Marine Terminal”) located in the Port of Long Beach (“POLB”) in the City;

WHEREAS, subject to various permits, licenses and easements, Customer owns (i) one 24” dark oil pipeline (the “Crude Oil Pipeline”), depicted on Schedule A as Items No. 1, between the Wharf and Customer’s Los Angeles Refinery located in Carson and Los Angeles, California (the “Wilmington Refinery”), (ii) one 16” gasoline pipeline (the “Gasoline Pipeline”), depicted on Schedule A as Item No. 2, between the Wharf and the Wilmington Refinery, and (iii) one 14” diesel/clear VGO pipeline (the “Clear Products Pipeline,” depicted on Schedule A as Item No. 3, between the Wharf and the Wilmington Refinery; and together with the Gasoline Pipeline, the “Refined Products Pipelines”; and collectively, the Refined Products Pipelines and the Crude Oil Pipeline, the “Pipelines”);

WHEREAS, Lease HD-2114, including the rights, obligations and other restrictions set forth therein, and the leasehold interests in the Wharf are expected to be assigned (the “Lease Assignment”) or subleased from Customer to Operator (the “Sublease”), as the case may be, upon receipt of the City’s consent;

WHEREAS, the operation of the Staging Facility and the Pipelines by Operator, as lessee or sub-lessee under Lease HD-2114 will require a Certificate of Financial Responsibility (“COFR”) issued by the California Department of Fish and Game (“CDFG”) in favor of Operator, which Operator expects to be issued contemporaneously with the Lease Assignment or Sublease;

WHEREAS, upon receipt of approval from the City of the Lease Assignment or Sublease, as the case may be, of Lease HD-2114 and the issuance by the CDFG of the COFR, Lease HD-2114 and the leasehold interests in the Wharf, such items along with the Staging Facility and the Pipelines, are to be formally subleased and/or assigned and conveyed to Operator;

WHEREAS, during the period commencing on the Commencement Date and continuing until the date of the Lease Assignment or Sublease (the “Interim Period”), Operator shall provide services to Customer to manage and operate the Wharf, the Staging Facility and the Pipelines (collectively, and along with Lease HD-2114, the “Long Beach Assets”) pursuant to a stand-alone operating agreement by and between Customer and Operator (the “Operating Agreement”);

WHEREAS, during the Term (as defined below and which shall encompass the Interim Period), Customer desires for Operator to provide the services set forth herein relating to the Long Beach Assets in order to enable Customer to receive and ship Products to and from Marine Vessels and other third party terminals and pipelines;

WHEREAS, Operator is willing to provide such services to Customer relating to the Long Beach Assets; and

WHEREAS, Operator and Customer desire to enter into this Agreement to memorialize the foregoing and the terms of their commercial relationship regarding the Long Beach Assets.

NOW, THEREFORE, in consideration of the covenants and obligations contained herein, the Parties (as defined below) to this Agreement hereby agree as follows:

SECTION 1 DEFINITIONS

Capitalized terms used throughout this Agreement shall have the meanings set forth below, unless otherwise specifically defined herein.

“Agreement” has the meaning set forth in the Preamble.

“Ancillary Facilities” means all wharves, personnel, spill response equipment, emergency response equipment, fire pumps, fire extinguishers, fire monitors, Self Contained Breathing Apparatus (SCBA), toxic gas monitoring equipment, mooring equipment, winches, loading arms, hoses, drains, pipes, valves, manifolds, pumps, meters, and all other related equipment and facilities that support the infrastructure required to deliver Customer’s Product from a Marine Vessel to the Pipelines or from the Pipelines to a Marine Vessel.

“Annual Minimum Throughput Volume” means the Minimum Marine Throughput Volume multiplied by 12 (e.g., 50,000 Barrels per day x 365 days = 18,250,000 Barrels for a calendar year).

“API” means the American Petroleum Institute.

“Applicable Law” means any applicable statute, law, regulation, ordinance, rule, determination, judgment, rule of law, order, decree, permit, approval, concession, grant, franchise, license, requirement, or any similar form of decision of, or any provision or condition of any permit, license or other operating authorization issued by any Governmental Authority having or asserting jurisdiction over the matter or matters in question, whether now or hereafter in effect.

“ASTM” means the American Society for Testing and Materials.

“Barrel” means a volume equal to 42 U.S. gallons or 231 cubic inches, each at 60 degrees Fahrenheit under one atmosphere of pressure.

2

“Berth” or “Berths” has the meaning set forth in the Recitals.

“Business Day” means a day, other than a Saturday or Sunday, on which banks in New York, New York are open for the general transaction of business.

“CDFG” has the meaning set forth in the Recitals.

“City” has the meaning set forth in the Recitals.

“Claim” has the meaning set forth in Section 19(a).

“Clear Products Pipeline” has the meaning set forth in the Recitals.

“COFR” has the meaning set forth in the Recitals.

“Commencement Date” has the meaning set forth in Section 3.

“Confidential Information” has the meaning set forth in Section 26.

“Contaminated Product” means Product that has one or more of the following characteristics: (a) contains foreign substances not inherent or naturally occurring in Product; and/or (b) fails to meet Operator’s minimum specifications.

“Contract Year” means the period commencing on the Commencement Date and ending on the date that is twelve calendar Months after the Commencement Date and each successive calendar year thereafter.

“Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of voting securities, by contract, or otherwise.

“CPI-U” ” means Consumer Price Index for all Urban Consumers for the Los Angeles, Riverside and Orange County area as published by the Bureau of Labor Statistics of the United States Department of Labor.

“Crude Oil” means crude petroleum, synthetic crude oil, topped crude oil, condensate, and all associated blends thereof.

“Crude Oil Pipeline” has the meaning set forth in the Recitals.

“Customer” has the meaning set forth in the Preamble.

“Customer Group” has the meaning set forth in Section 19(a).

“Customer Insurance Group” has the meaning set forth in Section 23(b).

“Customer’s Percentage Allocation” means the higher of: (i) Customer’s actual volumetric percentage utilization of the Berths (as compared to the total volumetric utilization of the Berths) for any calendar year in which the Customer’s actual throughput volume is equal to or greater than the Annual Minimum Marine Throughput Volume; or (ii) the volumetric percentage determined by the Annual Minimum Marine Throughput Volume divided by the Theoretical Throughput Volume for any calendar year in which the Customer’s actual throughput volume is less than the Annual Minimum Marine Throughput Volume.

3

“Customer’s Proportionate Share of MPC” has the meaning set forth in Section 7(a)(ii).

“Default Notice” has the meaning set forth in Section 20(a).

“Defaulting Party” has the meaning set forth in Section 20(a).

“Dock” has the meaning set forth in the Recitals.

“Execution Date” has the meaning set forth in the Recitals.

“Extended Term” has the meaning set forth in Section 4.

“Extension Period” has the meaning set forth in Section 4.

“Force Majeure” means any event or circumstances, or any combination of events and/or circumstances, whether foreseeable or not, the occurrence and/or effects of which is beyond the reasonable control of the Party claiming suspension and which by the exercise of due diligence such Party could not avoid or overcome, including:

(i) strikes, picketing, lockouts or other industrial disputes or disturbances;

(ii) acts of the public enemy or of belligerents, hostilities or other disorders, wars (declared or undeclared), blockades, thefts, insurrections, acts of terrorism, riots, civil disturbances or sabotage;

(iii) acts of God, acts of nature, landslides, subsidence, severe lightning, earthquakes, volcanic eruptions, fires, tornadoes, hurricanes, storms, floods, washouts, freezing of machinery, equipment or lines of pipe, tidal waves, perils of the sea and other adverse weather conditions;

(iv) arrests and restraints or other interference or restrictions imposed by federal, state or local government whether legal or de facto or purporting to act under some constitution, decree, law or otherwise, necessity for compliance with any court order, or any law, statute, ordinance, regulation, or order promulgated by a federal, state, or local governmental authority having or asserting jurisdiction, embargoes or export or import restrictions, expropriation, requisition, confiscation or nationalization; and

(v) epidemics or quarantine, explosions, breakage or accidents to equipment, machinery, plants, facilities or lines of pipe, or electric power, natural gas, or water shortages.

A Party’s inability economically to perform its obligations hereunder does not constitute an event of Force Majeure.

“Gasoline Pipeline” has the meaning set forth in the Recitals.

“General Partner” has the meaning set forth in the Recitals.

“Governmental Authority” means any federal, state, local or foreign government or any provincial, departmental or other political subdivision thereof, or any entity, body, port authority or other

4

authority exercising executive, legislative, judicial, regulatory, administrative or other governmental functions or any court, department, commission, board, bureau, agency, instrumentality or administrative body of any of the foregoing.

“Gross Standard Volume (GSV)” means the total volume of all petroleum liquids and sediment and water, excluding free water, corrected by the appropriate volume correction factor (Ctl) for the observed temperature and API gravity, relative density, or density to a standard temperature such as 60°F and also corrected by the applicable pressure correction factor (Cpl) and meter factor.

“Interim Period” has the meaning set forth in the Recitals.

“Lease Assignment” has the meaning set forth in the Recitals.

“Lease HD-2114” has the meaning set forth in the Recitals.

“Long Beach Assets” has the meaning set forth in the Recitals.

“MAOP” has the meaning set forth in Section 14(g).

“Marine Terminal” has the meaning set forth in the Recitals.

“Marine Vessel” means any ocean tanker, ocean barge, river barge or other vessel.

“Minimum Marine Throughput Volume” means an aggregate volume of 1,520,833 Barrels of Products per Month throughput across the Berths (50,000 Barrels per day multiplied by 365 days divided by 12),provided,however, that all volumes of Product throughput across the Berths will be applied towards the Minimum Marine Throughput Volume andprovided,further,however, that the Minimum Marine Throughput Volume during the Month in which the Commencement Date occurs shall be prorated in accordance with the ratio of the number of days, including and following the Commencement Date, in such Month to the total number of days in such Month.

“Minimum Pipeline Throughput Volume” means (i) an aggregate volume of 912,500 Barrels of Products per Month throughput between the Marine Terminal and the Wilmington Refinery or any other destination designated by Customer from the Commencement Date through December 31, 2014, or (ii) an aggregate volume of 1,520,833 Barrels of Products per Month throughput between the Marine Terminal and the Wilmington Refinery or any other destination designated by Customer from January 1, 2015 through the expiration or termination of this Agreement;provided,however, that all volumes of Product throughput between the Marine Terminal and the Wilmington Refinery or any other destination designated by Customer will be applied towards the Minimum Pipeline Throughput Volume andprovided,further,however, that the Minimum Pipeline Throughput Volume during the Month in which the Commencement Date occurs shall be prorated in accordance with the ratio of the number of days, including and following the Commencement Date, in such Month to the total number of days in such Month.

“Month” means the period commencing on the Commencement Date and ending on the last day of that calendar month and each successive calendar month thereafter.

“MOTEMS” has the meaning set forth in Section 6(b)(ii).

“MPA” has the meaning set forth in Section 6(a)(iii)(5).

5

“MPC” has the meaning set forth in Section 7(a)(i).

“MTVF” has the meaning set forth in Section 5(a)(i).

“MVR” has the meaning set forth in Section 5(a)(ii)

“Non-Defaulting Party” has the meaning set forth in Section 20(a).

“OCR” has the meaning set forth in Section 6(b).

“Omnibus Agreement” means that certain Amended and Restated Omnibus Agreement dated as of the date hereof, as amended from time to time, by and among Tesoro Corporation, Tesoro Companies, Inc., TRMC, Tesoro Alaska Company, the General Partner, the Partnership and TLO.

“Operating Agreement” has the meaning set forth in the Recitals.

“Operator” has the meaning set forth in the Preamble.

“Operator Group” has the meaning set forth in Section 19(b).

“Partnership” has the meaning set forth in the Preamble.

“Partnership Change of Control” means Tesoro Corporation ceases to Control the General Partner.

“Party” or “Parties” means that each of Operator and Customer is a “Party” and collectively are the “Parties” to this Agreement.

“PCR” has the meaning set forth in Section 7(b)(ii).

“Person” means any individual, partnership, limited partnership, joint venture, corporation, limited liability company, limited liability partnership, trust, unincorporated organization or Governmental Authority or any department or agency thereof.

“Pipeline” or “Pipelines” has the meaning set forth in the Recitals.

“Pipeline Use Fee” has the meaning set forth in Section 5(a)(iii).

“POLB” has the meaning set forth in the Recitals.

“Pollution Event” has the meaning set forth in Section 19(c).

“Product” or “Products” means Crude Oil and Refined Products.

“Project” has the meaning set forth in Section 7(a)(i).

“Project Cost Reimbursements” has the meaning set forth in Section 7(b)(ii).

“Refined Products” means gasoline, gasoline blend component, diesel, distillate, distillate blend components, jet/aviation fuel, fuel oil, cut back resid, cutter stock, gas oil and/or other commodity other than Crude Oil specified in this Agreement or otherwise mutually agreed upon by the Parties.

6

“Refined Products Pipelines” has the meaning set forth in the Recitals.

“Regulatory Obligations” means standards, regulations, permits or conditions required by a Governmental Authority.

“Shell Lubes” means Pennzoil-Quaker State Company d/b/a SOPUS Products.

“Shell Berth Use Agreement” means that certain Berth Use Agreement dated as May 10, 2007 by and between Shell and Customer, which shall be assigned to Operator.

“Shortfall Credit” has the meaning set forth in Section 9(a).

“Staging Facility” has the meaning set forth in the Recitals.

“Storage and Transportation Fee” has the meaning set forth in Section 5(a)(iv).

“Sublease” has the meaning set forth in the Recitals.

“Term” and “Initial Term” each have the meaning set forth in Section 4.

“Term Customer” means a user of the Berths that has entered into a take-or-pay agreement for a designated minimum throughput volume in excess of 1,216,667 barrels per month.

“Theoretical Throughput Volume” shall mean, during any calendar year, (i) the total Berth volumetric throughput by all Personsplus (ii) the sum of the absolute value of the difference between each customer’s actual calendar year throughput volume and such customer’s annual minimum marine throughput volume for those customers whose actual throughput volume is less than those customers’ calendar year minimum marine throughput volume.

“Waste” means any (a) spent or remnant commercial chemical products, previously of beneficial use, or other inherently waste-like material; and/or (b) oily ballast water, oily bilge water, sludge, and/or cargo residue by a Marine Vessel transferring Product into or out of the Marine Terminal. Residual Product that retains a beneficial use, including recycling, oil recovery and re-refining, is not Waste unless it is destined for disposal.

“Wharf” has the meaning set forth in the Recitals.

“Wilmington Refinery” has the meaning set forth in the Recitals.

SECTION 2 GENERAL UNDERTAKINGS

Subject to the terms and conditions of this Agreement, Operator’s operating permits, the limitations of the Berths, the limitations of connecting carriers, the rules and procedures set forth inAnnexes B andC, and all Applicable Law, Operator shall provide throughput service for Customer’s Marine Vessels, subject to Berth availability as provided herein, for the loading and unloading of Products to be received or delivered to the manifold connection with the Pipelines, and each Month during the Term, Customer shall throughput across the Berths the Minimum Marine Throughput Volume and shall throughput between the Marine Terminal and the Wilmington Refinery or any other destination designated by Customer, the Minimum Pipeline Throughput Volume, subject to reduction as set forth herein. Customer’s personnel shall be granted access to the Beth for the purpose of boarding and unboarding its Marine Vessels. For purposes of this Agreement, Customer’s Marine Vessels and personnel shall include those of Customer and/or its suppliers and trade partners accessing the Berths.

7

SECTION 3 COMMENCEMENT DATE

The “Commencement Date” will be the date on which the Sublease or Lease Assignment, as applicable, becomes effective.

SECTION 4 TERM

Commencing on the Commencement Date, the initial term of this agreement shall be for a period of ten (10) years until the anniversary of the Commencement Date in 2022 (the “Initial Term”), provided, however, that Customer may, at its sole option, extend the Initial Term for up to two (2) renewal terms of five (5) years each (each, an “Extension Period”) by providing written notice of its intent to Operator no less than ninety (90) days prior to the end of the Initial Term or the then-current Extension Period. Customer shall also have the option to modify the Term of this Agreement so that it continues for twenty (20) years after the Commencement Date (the “Extended Term”). If applicable, Customer shall notify Operator of its desire to invoke the Extended Term no later than the fifth anniversary of the Commencement Date. The Initial Term, Extended Term and any extensions of this Agreement as provided above, shall be referred to herein as the “Term”. The Term shall extend into any extensions or renewal of Lease HD-2114; however, the Term shall terminate if Lease HD-2114 is not extended or renewed or is terminated by the POLB.

Notwithstanding the foregoing, and in addition to terms and conditions contained in Sections 20, 21, 28 (a)(v)(3)(III) and 28 (a)(v)(3)(IV), the applicable Party may terminate this Agreement if any of the following events occur:

(a) receipt of written notice from Customer of termination at least ninety (90) Days prior to the commencement of an Extension Period, whereupon this Agreement shall automatically terminate upon the end of the then-existing Term;

(b) the termination or cancellation of Lease HD-2114 for any reason other than renewal and/or amendment, whereupon this Agreement shall terminate immediately upon such event; and

(c) upon twelve (12) Month notification by Customer for the termination of process unit operations, in all or in part, at the Wilmington Refinery.

SECTION 5 THROUGHPUT FEES

(a)Throughput Fees. Customer agrees to pay to Operator the following fees for all Barrels of Product throughput across the Berths:

(i) a $0.40 per barrel fee, subject to a Minimum Marine Throughput Volume Fee (the “MTVF”) of $608,333 per Month ($0.40/Barrel multiplied by 1,520,833), subject to escalation as provided in Section 8(a)(i) below;plus

(ii) a $0.15 per Barrel use fee for marine vapor recovery throughput at the Marine Terminal ( the “MVR Fee”), when applicable, subject to escalation as provided in Section 8(a)(i) below;plus

8

(iii) a $0.10 per Barrel pipeline use fee for Product volumes loaded and offloaded to marine vessels throughput through the Pipelines, as follows: (A) subject to a minimum of $91,250 per Month from the Commencement Date through December 31, 2014; and (B) subject to a minimum of $152,083 per Month from January 1, 2015 through the termination or expiration of this Agreement (the “Pipeline Use Fee”), subject to escalation as provided in Section 8(a)(i) below;plus

(iv) a $0.70/Barrel storage and transportation fee for the use of the 235,000 shell capacity of the Staging Facility for a fee of $164,500 per Month (the “Storage and Transportation Fee”), subject to escalation as provided in Section 8(a)(i) below.

(b)MTVF Relief. During any Month that one or both of the Berths are not available to receive any customer’s Marine Vessels on a day in which Customer’s Marine Vessel is scheduled to have access to a Berth, for any reason other than Customer’s actions, including without limitation, Operator’s actions, Force Majeure, and the actions of a Governmental Authority, and such unavailability prevents Customer from throughputting the Minimum Marine Throughput Volume, the Minimum Marine Throughput Volume (and resulting MTVF) and the Minimum Pipeline Throughput Volume (and resulting Pipeline Use Fee) for such Month will be reduced as follows:

(i) If both Berths are unavailable, then the MTVF and the minimum Pipeline Use Fee will be proportionally reduced in proportion to the number of days in such Month when Customer’s vessels were prevented from having access to the Berths as a result of the Berths being unavailable, divided by the total days in such Month; or

(ii) If only one Berth is available, then the MTVF and the minimum Pipeline Use Fee will be proportionally reduced in proportion to the number of days in such Month when Customer’s vessels were prevented from having access to the Berths for more than two (2) days after delivering NOR (as a result of one Berth being unavailable) divided by the total days in such Month.

SECTION 6 PASS THROUGH AND REGULATORY OBLIGATION COST REIMBURSEMENTS

(a)Pass Through Costs. During the Term, Customer agrees to pay or reimburse Operator for the following pass through costs:

(i)Labor Services. Stand-by dock Operator fees per person for all actual time that Operator’s personnel are required for the loading and unloading of Customer’s Marine Vessels pursuant to this Agreement, and any additional services not expressly covered by this Agreement which are requested by Customer and agreed to by Operator. The initial hourly rate for such labor services shall be as set forth onSchedule 6(a). Operator may adjust such rates once per calendar year subject to escalation as indicated in Section 8(a) to account for changes in Operator’s costs of providing such labor services. In addition, Customer shall pay Operator for any materials used in the performance of such services outside the ordinary course of business an amount equal to the cost of such materials plus 20%. Materials used in the performance of services outside the ordinary course of business of providing routine berthing and throughput services shall include, but not be limited to:

(1) Chemicals (e.g. hydrogen sulfide scavenger, drag reducer, etc.); and

9

(2) Materials used in an emergency response (e.g. oil boom, oil absorbing materials, oil clean up materials, fire suppression foam and extinguishing agents, etc.).

(ii)Booming Services. The initial rate for booming services shall be as set forth onSchedule 6(a). Operator may adjust such rates annually subject to escalation as indicated in Section 8(a) to account for changes in Operator’s costs of providing such booming services.

(iii)Marine Terminal Fees. Customer shall pay, either directly or by reimbursement to Operator, all applicable third-party charges and related pass-through fees assessed to Operator, by any Governmental Authority, or by any other Persons that are related directly or indirectly to the throughput of Product across the Berths via Marine Vessel, including but not limited to the City, POLB or any other governmental, regulatory, local authority, or agency or utility. These charges shall include, but not be limited to:

(1) Wharfage and dockage fees (such charges presently based on the POLB’s Tariff No.4, which may be amended from time to time);

(2) All U.S. Customs and Border Protection related fees;

(3) Marine pollution, protection and/or conservation fees;

(4) Oil spill contingency fees and charges;

(5) Marine Preservation Association (“MPA”) fees due on Qualified Barrels as defined by the MPA;

(6) Marine Spill Response Corporation charges and fees;

(7) California Oil Spill Response Fund charges and fees;

(8) POLB pilot fees; and

(9) All other similar existing or future Federal, State, or local volume related pass-through fees and facility use permit fees that are directly associated with the services provided to Customer pursuant to this Agreement.

(iv)Shore Side Survey or Inspector Fees. Customer shall pay or reimburse Operator for 100% of all shore side survey or inspector fees incurred and attributable to each Customer shipment across the Berths.

(b)Regulatory Obligation Cost Reimbursements. Customer will also pay Operator a Monthly regulatory Obligation Cost Reimbursement (“OCR”).

(i) The OCR shall equal the average of Customer’s Percentage Allocation for the prior two calendar years multiplied by the amount, as reasonably determined by Operator, which is sufficient to reimburse Operator for the portion of Operator’s actual additional recurring costs incurred after the Commencement Date attributable to Regulatory Obligations.

(ii) Such costs shall include, but not be limited to, additional costs, fees and charges for: marine vapor recovery; shore side pumping; power, Clean Air Action Plan compliance; compliance under the State of California’s Marine Oil Terminals Engineering and Maintenance Standards (“MOTEMS”); and any other similar costs, fees and charges that are as a result of action by a Governmental Authority.

10

(iii) Before the start of each Contract Year, Operator will provide Customer with its projected OCR for such Contract Year, with all reasonable supporting documentation and back up in calculating the OCR. Pursuant to Section 9, such OCR shall be payable Monthly.

(iv) Within 90 days after the end of each Contract Year in which OCR is charged to Customer, Operator shall reconcile the projected OCR charged to and paid by Customer during such Contract Year with the actual additional operating costs incurred by Operator during such Contract Year and shall credit or debit Customer’s next recurring invoice according to such reconciliation.

(c)Taxes. All taxes (other than property taxes, ad valorem taxes, income taxes, gross receipt taxes, payroll taxes and other similar taxes) that Operator incurs on Customer’s behalf for services provided hereunder shall be reimbursed by Customer unless prohibited by Applicable Law.

(d)Limitation. In no event will Operator charge or be entitled to pass-through costs or OCR which (i) result from any criminal act of Operator or any of its agents, employees or representatives, or (ii) are in the nature of late fees, penalties or interest that could have been avoided by Operator in the exercise of ordinary diligence.

(e)Adjustments. All pass through costs may be adjusted at Operator’s sole discretion to reflect applicable changes in the particular fee.

SECTION 7 MAJOR PROJECT COSTS AND PROJECT COST REIMBURSEMENTS

(a)Major Project Costs. Customer shall reimburse Operator for Customer’s Proportionate Share of MPC incurred by Operator relating to the Wharf and Ancillary Facilities as follows:

(i) “MPC” or “Major Project Costs” means those actual capital expenditures (whether capitalized or expensed by Operator for accounting or tax purposes) for major, non-recurring projects (each, a “Project”) involving substantial changes to the Wharf or Ancillary Facilities or access to the Wharf, incurred after the Commencement Date attributable to Regulatory Obligations, including without limitation changes required under MOTEMS, Clean Air Action Plans, harbor channel deepening and/or similar regulatory or environmental operating expenses or capital expenses as a result of action by a Governmental Authority.

(ii) “Customer’s Proportionate Share of MPC” for a Project means the average of Customer’s Percentage Allocation for the two calendar years before the year in which a Project is completedmultiplied by the MPC for such Project. If needed, up to two calendar years of actual throughput data prior to the Commencement Date year may be used to determine the average of Customer’s Percentage Allocation for the two calendar years before the year in which a Project is completed. If, however, Customer’s Proportionate Share of MPC for a Project is to be paid for through PCR payments (as defined and pursuant to subparagraph 7(b)(ii) below), and during any calendar year there are cumulative changes in Customer’s Percentage Allocation in an amount greater than ten percent (10%), then the outstanding principal balance of Customer’s Proportionate Share of MPC will be adjusted up or down at the start of the next calendar year to correspond to the cumulative changes, but subject to terms and conditions of subparagraph 7(b)(ii)(2)(III) below;

11

(iii) Operator shall provide Customer with reasonable supporting information and cost accounting for: its expenses relating to the MPC; the basis for determining Customer’s Proportionate Share of MPC;provided that, Operator will not be required to divulge any information in violation of any applicable anti-competition laws, rules or regulations. Customer may audit such supporting documentation pursuant to the terms and conditions of Section 25 below.

(iv) Notwithstanding anything contained herein, Customer will have the right to review and consent to the scope, design or implementation of a Project; provided, however, (x) Operator will provide Customer regular updates of Project scope and design and obtain Customer consent to scope and cost at each stage of the Project design for all Projects with estimated cost in excess of $100,000, (y) Operator will provide Customer a written summary of any Project (including a +/-10% cost estimate for the Project) at least 90 days prior to commencement of construction of the Project, and (z) Operator and Customer shall meet to discuss Customer’s Proportionate Share of MPC at least 30 days prior to commencement of construction of the Project. Operator shall design and construct the Project in accordance with customary industry standards and the requirements of the applicable Governmental Authority.

(b)MPC Payment Methods. Customer may, at its option, elect to pay Customer’s Proportionate Share of MPC for a Project by one of the two following methods, to be selected on or before the date Operator begins construction work on a Project:

(i) Customer may pay Operator the Customer’s Proportionate Share of the MPC in full upon completion of the applicable Project; or

(ii) Customer may pay Customer’s Proportionate Share of MPC in Monthly installments (the “Project Cost Reimbursements” or “PCR”) pursuant to the following conditions:

(1) The PCR payment obligation shall commence upon completion of the applicable Project, with the first PCR payment to be made in accordance with the first regular Monthly invoice delivered by Operator following completion of the Project.

(2) The outstanding principal balance of Customer’s Proportionate Share of MPC shall bear interest at the lesser of a per annum rate of fifteen percent (15%) or the highest rate of interest (if any) permitted by Applicable Law, and shall be repaid in equal Monthly installments of principal and interest, with such payment to be based on the outstanding principal balance of Customer’s Proportionate Share of MPC amortized over (A) five (5) years, or (B) the number of years remaining in the Term, whichever time period is shorter;provided,however, that if this Agreement is terminated pursuant to Sections 4, 20, 21 or 28(a), then the remaining unpaid principal balance of Customer’s Proportionate Share of MPC will be due and payable pursuant to the following conditions:

(I) If, upon termination of this Agreement, Operator has not replaced Customer’s Annual Minimum Throughput Volume with a new third-party take or pay commitment for use of the Wharf, then the remaining unpaid principal balance of Customer’s Proportionate Share of MPC will be due and payable by Customer upon the date of such termination.

(II) Except as provided in subparagraph (III) below, if upon termination of this Agreement, Operator has replaced Customer’s Annual Minimum Throughput Volume with a new third-party take or pay commitment for use of the Wharf, then Customer’s remaining unpaid balance will be reduced by the percentage of Customer’s Annual Minimum Throughput Volume replaced

12

by such new third party, up to a maximum of 100% of the remaining unpaid balance, with any remaining unpaid balance to be due and payable on the date of such termination. In other words, and by way of example only, if Operator replaces 9,125,000 Barrels per year of Annual Minimum Throughput Volume with a new take or pay commitment upon termination, then Customer’s remaining unpaid balance would be reduced by 50% (9,125,000 Barrels per year /18,250,000 Barrels per year = 50%), and the remaining 50% unpaid balance would be due and payable by Customer upon the date of such termination.

(III) The extent to which new third-party commitments are considered new commitments eligible to reduce the unpaid balance of Customer’s Proportionate Share of MPC, as set forth in subparagraph (II) immediately above, shall be determined as the difference between the throughput commitments for the calendar year preceding the date the notice of cancellation is delivered minus the total committed throughput volumes during the first calendar year after cancellation of this Agreement.

(c)Anticipated Projects. Attached hereto asSchedule 7(C) is a non-exhaustive list of the types of Projects Operator anticipates will generate MPC over the Term of this Agreement. Such list may be amended, restated, modified, or supplemented by Operator from time to time over the Term without the need for an amendment to this Agreement.

(d)Customer Tie-In Projects. Any MPC required by the POLB, any state or federal agencies, or any other Governmental Authority, including without limitation, MPC associated with shore side pumping or emission reduction requirements, which are attributable to specific Projects relating to the installation of Customer’s pipeline tie-in or other similar Customer Projects will be 100% allocable to and reimbursed by Customer. Customer shall pay such reimbursements either on an ongoing basis or upon Project completion, as Operator shall elect in its commercially reasonable discretion. Subsequent requirements by Governmental Authority which require MPC will be reimbursed as determined in Section 7.

SECTION 8 ADJUSTMENTS – FEES AND COSTS

(a)Fee Adjustments.

(i) Starting July 1, 2013, the Schedule 6(A) Flat Rate Fees and all fees in Section 5(a) above shall automatically be increased on the first day of July for each year of the Term, by a percentage equal to the greater of zero or the positive change in the CPI-U for the prior calendar year, rounded to the nearest one-tenth of one percent.

(ii) The MTVF will be adjusted upon the Lease Assignment or Sublease, as applicable, and any renewal, reopening, or fee adjustment of Lease HD-2114 if Operator’s payment obligations thereunder change such that Operator’s Term and non-Term throughput pass-through fees are insufficient to meet Operator’s minimum guaranteed payment obligation to the POLB. Any such adjustment(s) is to be commensurate with any percentage change greater than zero percent (0%) to Operator’s guaranteed minimum payment obligations thereunder.

(b)OCR Adjustments. If, at any time during a Contract Year, Operator determines in its commercially reasonable discretion that the then-applicable OCR is not sufficient in amount to reflect Operator’s actual operating costs for the Wharf and Ancillary Facilities, then Operator may revise the OCR by providing Customer with 30-days prior written notice of such revised OCR, such notice to contain all reasonable backup information in respect of the revised OCR.

13

(c)Total Fee Adjustment. If, at any time during a Contract Year, the total per-Barrel fee paid by Customer to throughput Product across the Berths (including the MTVF, any pass-through costs, any OCR, any MPC, and any other fees) exceeds the total fees paid by any customer, other than Shell Lubes, for use of the Berths, Dock, Wharf, or Marine Terminal, then Operator shall refund Customer, on a per-Barrel basis, any excess paid by Customer in such Contract Year. In such event, Operator shall adjust Customer’s future fees such that Customer’s total per-Barrel fees are no more than any customer, other than Shell Lubes, at the Berths, Dock, Wharf, or Marine Terminal.

SECTION 9 PAYMENTS

(a)Monthly Shortfall Credit. If the Minimum Marine Throughput Volume and/or the Minimum Pipeline Throughput Volume are not met, then Customer shall receive a “Shortfall Credit” calculated as the difference between actual total volumes received during such Month and the Minimum Marine Throughput Volume and/or the Minimum Pipeline Throughput Volume multiplied by the sum of the MTVF and/or the Pipeline Use Fee, each on a per Barrel basis.

(b)Monthly Reconciliation. Actual volumes of Barrels throughput across the Berths are to be determined Monthly, based upon Marine Vessel deliveries, Marine Vessel receipts and Pipeline transfers during that Month and credited towards the Minimum Marine Throughput Volume in such Month. A Marine Vessel’s cargo will apply to the Month in which loading and unloading is completed, provided that if a cargo is unable to be loaded or unloaded in the Month in which loading or unloading was scheduled due to the failure of Operator to perform as scheduled, then the Parties shall negotiate in good faith to determine the appropriate Month in which to credit receipt of such cargo. The Shortfall Credit shall be credited as follows:

(i) The dollar amount of any Shortfall Credit included in the Monthly invoice will be posted as a credit to Customer’s account and may be applied against amounts owed by Customer for volumes in excess of the Minimum Marine Throughput Volume and/or the Minimum Pipeline Throughput Volume during any of the succeeding three (3) Months; and

(ii) Any portion of the Shortfall Credit that is not used by Customer during the succeeding three (3) Months will expire at the end of said three (3) Month period relating to the respective credit and be reset to zero.

(c)Fee Calculation. At the end of each Month, Operator will calculate the total fees that Customer incurred for throughputting Barrels across the Berths and through the Pipelines during such Month, as follows:

(i) $0.40 per barrel for all Products throughput across the berths, subject to the MTVF for the Minimum Marine Throughput Volume (with a statement of any applicable Shortfall Credit for underdeliveries);plus

(ii) $0.10 per barrel pipeline use fee for all Products loaded and offloaded to marine vessels and throughput through the Pipelines, subject to the Pipeline Use Fee for the Minimum Pipeline Throughput Volume (with a statement of any applicable Shortfall Credits for underdeliveries);plus

14

(iii) the Storage and Transportation fee;plus

(iv) any MVR Fees, pass through costs, OCR and MPC for such Month pursuant to Sections 6(a), 6(b) and 7.

(d)Invoices. Operator will invoice Customer Monthly, providing its calculations of all applicable items set forth above. All amounts set forth above shall be due and payable no later than ten (10) days after Customer’s receipt of Operator’s invoice. The invoiced amount shall be for the items described above and other charges during the prior Month. Any past due payments owed by either Party shall accrue interest, payable on demand, at the lesser of (i) the rate of interest announced publicly by JPMorgan Chase Bank, in New York, New York, as JPMorgan Chase Bank’s prime rate (which Parties acknowledge and agree is announced by such bank and used by the Parties for reference purposes only and may not represent the lowest or best rate available to any of the customers of such bank or the Parties),plus four percent (4%), and (ii) the highest rate of interest (if any) permitted by Applicable Law, from the due date of the payment through the actual date of payment.

(e)Disputed Amounts. If Customer reasonably disputes any amount invoiced by Operator, Customer shall pay the amount of the invoice when due and provide Operator with written notice stating the nature of the dispute prior to thirty (30) days after the due date of the invoice. Customer and Operator shall use reasonable commercial diligence to resolve disputes in a timely manner through the dispute resolution procedures provide for herein. All portions of the disputed amount determined to be owed the Customer shall be refunded to the Customer within ten (10) days of the dispute resolution.

SECTION 10 PRODUCT SPECIFICATIONS

(a)Product Quality.

(i)Product Testing. Upon request, Customer shall provide Operator a laboratory report for each Product delivery by Customer or Customer’s supplier. Operator will not be obligated to receive Contaminated Product for throughput across the Berths, nor will Operator be obligated to accept Product that fails to meet the quality specifications set forth in the arrival notice.

(ii)Off-Spec/Contaminated Product. Operator may, without prejudice to any other remedy available to Operator, reject and return Contaminated Product to Customer, even after delivery to Operator at the Berths. Customer at its sole cost and expense shall be responsible for all damages of any kind, in addition to commodity or Waste removal and cleaning costs for connecting pipelines or third party tankage, resulting from the introduction of Contaminated Product. Customer shall remove and replace any Contaminated Product or reimburse Operator for any and all expenses incurred in removing and/or replacing any such Contaminated Product received.

(iii)Minimum Specifications. Operator retains at all times under the term of this Agreement the right to establish and/or change Operator’s minimum specifications, subject to Section 28(a), for any Product introduced at the Berths with thirty (30) days advance notice to Customer. Changes will not affect previously accepted nominated volumes unless immediate action is required by Applicable Law. Operator’s Minimum Specifications shall allow the throughput of the grades and approximate qualities of crude oil specified in Annex D.

15

(b)Product Warranty. Customer warrants to Operator that all Product tendered by or for the account of Customer for throughput across the Berths will conform to Operator’s minimum specifications for such Product and the most recently available and commonly accepted assay and any applicable API or ASTM standards. Operator may rely upon the specifications and representations of Customer as to Product quality.

(c)Material Safety Data Sheet. Customer will provide Operator with a Material Safety Data Sheet and any other information required by any federal, state, or local authority for all Product throughput across the Berths. Customer shall provide its customers with the appropriate information on all Products throughput across the Berths.

(d)Quality Analysis. Operator will not perform any Product quality analysis on behalf of Customer unless Customer so requests in writing. Any such quality analyses, including any costs for independent inspectors appointed by Customer, are for Customer’s account. In the absence of fraud or manifest error, any quality determination performed by Operator hereunder shall be binding on both Parties. Customer or its designated independent inspector may observe Operator in any measurement or sampling.

SECTION 11 PRODUCT QUANTITY

(a)Measurement. The quantity of Product received from or loaded to Customer’s Marine Vessels shall be based on Gross Standard Volume (GSV) using the applicable API and ASTM or equivalent standards as follows:

(i)Marine. For Marine Vessel movements by the following (in order of preference), subject to Operator’s reasonable discretion to choose an alternative method: (i) by meters; (ii) by static shore tank gauges of the tank; otherwise (iii) by a mutually agreeable method. The custody transfer quantity shall not be determined by vessel gauges or bills of lading unless otherwise mutually agreed to in writing by Customer and Operator. Customer shall provide Operator with all reasonable documentation with respect to the volumes throughput across the Berths, including but not limited to, inspection reports, meter tickets or other similar documentation within three (3) Business Days of completion of Marine Vessel discharge.

(ii)Pipeline.For Pipeline movements, the volume will be determined by the Marine Vessel receipt and/or load volumes in Section 11(a)(i) above for the portion of the Marine Vessel receipt and/or load volume delivered to or received from the Wilmington Refinery by the Pipelines. For Marine Vessel discharge or load volume which is delivered to or received from third party pipelines or terminals and the Wilmington Refinery, the Pipeline movement volume will be determined by the difference between the total volume discharged from or loaded to the Marine Vessel less the volume delivered to or received from a third-party pipeline or terminal. Customer shall provide Operator with all reasonable documentation with respect to the volumes throughput across the Berths, including but not limited to, inspection reports, meter tickets or other similar documentation within three (3) Business Days of completion of Marine Vessel discharge.

SECTION 12 WASTE AND HAZARDOUS MATERIALS

(a)Storage, Handling and Disposal of Waste. Operator and Customer will comply with Applicable Law regarding the storage and handling of Product and the disposal of any Waste. Customer shall pay or reimburse Operator for removal from the Berths of any Waste or residuals, including all costs

16

associated with any liabilities arising from such Waste or residual. During such removal, the fees and charges set forth in this Agreement will remain in effect. Unless stated otherwise herein, Operator shall be responsible for any fines, penalties, claims, violations, or similar obligations related to Operator’s operation of the Berths and Ancillary Facilities.

(b)Waste Discharge from Marine Vessels. Operator will not accept Waste from Marine Vessels that discharge cargoes at the Berths. If Waste is tendered from Marine Vessels as required by any MARPOL Annex, similar regulations, Applicable Law, or the United States Coast Guard, Customer agrees to arrange, or authorize a representative of the Marine Vessel to arrange on the Marine Vessel’s or on Customer’s behalf, for disposal of all such Waste using third-party services approved by Operator, such approval not to be unreasonably withheld, conditioned or delayed. If Customer or its authorized representative refuses to arrange for the removal of such Waste, Operator will arrange for the removal and disposal of such Waste, and Customer shall reimburse Operator for the cost of receiving, handling, storing, and shipping such Waste and shall pay for appropriate treatment, storage and disposal of such Waste in compliance with Applicable Law. In addition to such reimbursement, subject to Applicable Law, Customer shall pay Operator an administrative fee equal to twenty percent (20%) of the reimbursement amount.

(c)Hazardous Materials – Reporting. Operator will report its handling of all hazardous materials for Customer as required by Applicable Law. Customer will accurately and properly represent the nature of all such materials to Operator. Customer agrees to reimburse Operator for any reasonable, direct charges that Operator may be required to pay for the handling of Product, excluding penalties, fines or excess charges resulting from material errors or omissions in Operator’s reporting as required by Applicable Law.

SECTION 13 SERVICES; HOURS; VOLUME GAINS AND LOSSES

(a)Services. Operator shall throughput and handle Customer’s Products across the Berths, make all tie-ups and connections at the Berths (excluding all connection and disconnection of cargo hoses or loading arms at a Marine Vessel’s manifold), provide regulatory compliance reporting that Operator is required to perform as the Berth operator, and provide such other services set forth for in this Agreement (the “Services”). Operator will timely provide Customer with a copy of any regulatory compliance report filed by Operator regarding Customer’s Product upon request by Customer. Operator will provide the labor and supervision necessary to perform the Services contemplated by this Agreement, and Operator will provide and maintain the equipment necessary to perform the Services contemplated by this Agreement. Operator will maintain the Berths according to Lease HD-2114 and good industry practice and will use reasonable care in performing the Services consistent with customary industry practices. Customer personnel shall make all other Marine Vessel connections to the Berths, chicksans or hoses.

(b)Hours. Subject to the terms and conditions of Annexes B and C, the Berths will be available on 24/7/365 basis, as needed.

(c)Volume Gains and Losses. Operator shall have no obligation to measure volume gains and losses and shall have no liability whatsoever for normal course physical losses that may result from the transportation of the Products across the Berths or Pipelines, except if such losses are caused by the negligence or willful misconduct of Operator. Customer will bear any volume gains and losses that may result from the transportation of the Products across the Berths and Pipelines.

17

SECTION 14 OPERATIONS

(a)Nominations and Scheduling. Subject to the terms and conditions ofAnnexes B andC, subsections (b) through (g) below and the physical constraints of the Berths, Operator shall provide Customer’s Marine Vessels non-discriminatory, priority access rights to access the Berths to throughput Customer’s Products. Operator shall schedule Customer’s Marine Vessel nominations on a “first available” basis, subject to coincident Berth and Pipelines availability. Customer’s Marine Vessel nomination and schedule priority shall not be less than any customer, other than Shell Lubes.

(b)Term Commitment/Pipeline Access. Operator will not increase the total term commitments for Dock utilization to greater than forty-five percent (45%) of the total available hours of the Marine Terminal or provide access to or use of the Pipelines to any third party without the prior written consent of Customer.

(c)Priority. Customer’s request for Berth access shall be given the same priority access for all Product, as well as for throughput above the Minimum Marine Throughput Volume. The existing priorities for lubricant blendstocks provided to Shell Lubes pursuant to the Shell Berth Use Agreement will be honored and maintained; provided, however, Customer’s Marine Vessels priority shall not be less than any customer, other than Shell Lubes.

(d)Unavailability of Berths for Maintenance. The Berths may be unavailable for short periods of time due to routine maintenance and repair. Operator shall use reasonable commercial diligence to maintain at least one Berth available to receive deliveries;provided,however, Section 5(b) hereof shall apply to any such unavailability. To the extent practicable, Operator shall use reasonable commercial efforts to provide Customer at least one hundred twenty (120) days or as soon as practicable advance written notice of planned maintenance of the Berths.

(e)Marine Vessel Scheduling Procedures. Operator will not modify the Marine Vessel scheduling procedures at the Berths without the prior written consent of Customer.

(f)Modification of Nomination Procedures. Operator may not modify its nomination procedures without prior consent of Customer.

(g)MAOP.

(i) From time to time, Operator may designate a maximum allowable operating pressure (“MAOP”) on each Pipeline, which may be changed by Operator in its sole discretion upon notice to Customer; provided, however, that if Operator should ever reduce the maximum operating pressure of a Pipeline below 180 psig, then Operator shall use all reasonable efforts to restore the Pipelines to a MAOP of at least 180 psig as quickly as reasonably possible. As of the date hereof, the designated maximum operating pressure on each of the Pipelines is 180 psig. If Operator reduces MAOP below 180 psig, then Operator and Customer will utilize the procedure in Section 28(a)(v) to identify and mitigate the physical and financial impacts of the reduction in MAOP in the same manner that a change in Dock Specification or Product Specification would be resolved.

(ii) During any time period in which the MAOP of the Pipelines is reduced below 180 psig, the Minimum Pipeline Throughput Volume shall be reduced proportionately to the extent that such reduced pressure impairs Customer’s ability to actually throughput Products at the Minimum Pipeline Throughput Volume. Customer shall not deliver any Products into a

18

Pipeline at a pressure that exceeds or could cause the Pipeline to exceed its MAOP, and in the event that Customer determines that an ongoing delivery through a Pipeline may exceed the MAOP of that Pipeline, then Customer shall immediately shut down the delivery and cause the pressure to be reduced. Customer shall immediately notify Operator at any time that the MAOP of a Pipeline has been exceeded. Customer shall conduct all pumping operations in accordance with applicable U.S. Department of Transportation regulations, using adequately trained and qualified personnel. Customer shall maintain and make available for Operator’s inspection recording charts reflecting a true and accurate record of line pressure. Upon request, Customer shall provide Operator with dynamic volumetric pipeline monitoring or volumetric flow rates and cumulative total volumes of total volumes. In the event that the difference between pipeline monitoring readings or shipper and receiver total volumes exceed three percent (3%) or becomes greater than two percent (2%) for longer than four (4) hours, Customer shall shut down the transfer and shall not resume such transfer until the pipeline monitoring readings can be reconciled or the difference between shipper and receiver cumulative totals reconciles to within two percent (2%).

(h)Marine Vessel Shifting. If Customer, Operator or a third party requires priority access to a Berth that is being occupied by a Marine Vessel of another party or during a scheduled allocation period for another party in order to accommodate a special access need, then the parties shall cooperate in a good faith and commercially reasonable manner to accommodate such request, including the relocation of the Marine Vessel, if appropriate, provided however the MTVF and the minimum Pipeline Use Fee for the Month in which such shifting occurs shall be determined as if the volumes were delivered as originally scheduled, without regard to such shifting.

(i)Relocation and Demurrage. Operator will not pay demurrage, except if such demurrage is the result of Operator’s negligence or willful misconduct;provided,however, that if any party is requested to move a Marine Vessel on a Berth or to delay the movement of a Marine Vessel to a Berth during its scheduled allocation period in order to accommodate a special access need of another party, then the party requiring such movement shall be responsible for paying all resulting Marine Vessel relocation, demurrage and other associated charges.

SECTION 15 TITLE AND RISK OF LOSS; CUSTODY AND CONTROL

Title and the risk of loss or damage to the Product shall remain at all times with the owner of the Product, subject to any lien in favor of Operator under Applicable Laws. For Marine Vessel deliveries, Operator will have custody of Product from the time it passes the flange connecting the delivery line of the delivering Marine Vessel to the time it either passes the manifold of the receiving third party pipelines or it passes from the Pipelines to the flange connecting the Pipelines and the Wilmington Refinery. For Marine Vessel loading, Operator will have custody of Product from the time it passes the flange connecting the Wilmington Refinery and the Pipelines to the time it passes the manifold of the Marine Vessel. All Product in the Staging Facility shall remain in the custody of the Operator.

SECTION 16 NEW TAXES AND ASSESSMENTS

(a)New Taxes and Assessments. Without duplication of matters addressed in Section 6 and/or Section 7, which shall control with respect to such matters, Customer shall promptly pay or reimburse Operator for any newly imposed taxes, duties, import fees, assessments or other charges of any federal, state, or local Governmental Authority that Operator is required to pay or collect, including oil spill response fund assessments, spill taxes, pollution control taxes, coastal protection fees, marine preservation association fees, emission fees, charges, excises, duties, tariffs, inspections, if any, now or

19

during the Term of this Agreement that are hereafter imposed on Product and on the transfer, handling or disposal of Waste, or on any other use thereof. Further, Customer shall promptly pay or reimburse Operator for any additional or increased taxes levied upon Operator by reason of Customer’s use of Operator’s leased premises or any equipment thereon;provided,however, that Customer shall not pay any more than Customer’s Percentage Allocation of such taxes or increased or additional taxes if such premises or equipment are used by Customer jointly with others. Notwithstanding the foregoing, each Party shall pay its own personal property, ad valorem, income, profit, franchise, or similar tax.

(b)Excise Taxes. Customer is responsible for the collecting and remitting of all applicable federal and state excise taxes on Product from its customers and accounts for which Customer would ordinarily be responsible.

(c)Exemption. If Customer is exempt from the payment of any taxes allocated to Customer under the foregoing provisions, Customer shall furnish Operator with the proper exemption certificates.

SECTION 17 COMPLIANCE WITH LAW AND GOVERNMENT REGULATIONS

(a)Compliance with Applicable Law. Each Party certifies that none of the Products covered by this Agreement were or will be derived from Crude Oil, petrochemical, or gas which was produced, withdrawn from storage or imported in violation of any federal, state or other governmental law, nor in violation of any rule, regulation or promulgated by any governmental agency having jurisdiction in the premises.

(b)Applicable Law. The Parties are entering into this Agreement in reliance upon and shall fully comply with all Applicable Law which directly or indirectly affects the Products throughput hereunder, or any receipt, throughput delivery, transportation, or handling of Products hereunder or the ownership, operation or condition of the Berths. Each Party shall be responsible for compliance with all Applicable Laws associated with such Party’s respective performance hereunder and the operation of such Party’s facilities. To the extent required by Applicable Law, and as applicable to the services performed under this Agreement, each Party shall specifically comply, and require its contractors and subcontractor(s) to comply with California Civil Code, Section 1714.43, as applicable to ensure that all contractors, subcontractors, vendors and suppliers comply with all labor laws, including laws against slave labor and human trafficking and that such contractors, subcontractors, vendors and suppliers verify that the materials incorporated into any products manufactured for either Party are in compliance with all such laws. In the event any action or obligation imposed upon a Party under this Agreement shall at any time be in conflict with any requirement of Applicable Law, then this Agreement shall immediately be modified to conform the action or obligation so adversely affected to the requirements of the Applicable Law, and all other provisions of this Agreement shall remain effective.

(c)New or Changed Applicable Law. If during the Term, any new Applicable Law becomes effective or any existing Applicable Law or its interpretation is materially changed, which change is not addressed by another provision of this Agreement and which has a material adverse economic impact upon a Party, then either Party, acting in good faith, shall have the option to request renegotiation of the relevant provisions of this Agreement with respect to future performance. The Parties shall then meet and negotiate in good faith amendments to this Agreement that will conform this Agreement to the new Applicable Law while preserving the Parties’ economic, operational, commercial and competitive arrangements in accordance with the understandings set forth herein.

20

SECTION 18 LIMITATION ON LIABILITY

(a)Waiver of Consequential and Other Damages. IN NO EVENT SHALL A PARTY BE LIABLE TO THE OTHER PARTY FOR ANY LOST PROFITS OR INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL OR PUNITIVE DAMAGES, NO MATTER HOW CHARACTERIZED, RELATING TO THIS AGREEMENT AND ARISING FROM ANY CAUSE WHATSOEVER, EXCEPT WITH RESPECT TO INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL OR PUNITIVE DAMAGES ACTUALLY AWARDED TO A THIRD PARTY OR ASSESSED BY A GOVERNMENTAL AUTHORITY AND FOR WHICH A PARTY IS PROPERLY ENTITLED TO INDEMNIFICATION FROM THE OTHER PARTY PURSUANT TO THE EXPRESS PROVISIONS OF THIS AGREEMENT.

(b)Limitation of Liability

(i) Notwithstanding anything to the contrary contained in this Agreement, but excluding liabilities caused by the willful misconduct of any member of the Operator Group (as defined in Section 19(b) below), the Parties hereby agree that Operator’s total aggregate liability to the Customer Group (as defined in Section 19(a) below) under this Agreement for any particular liability shall be limited to (a) the amount of total fees collected by Operator from Customer pursuant to this Agreement during the twelve (12) Months immediately preceding the alleged liability, or (b) if the Agreement has been in effect for less than twelve (12) Months, the amount equal to twelve (12) times the average of the Monthly fees that would have been collected for the transport of Product across the Berths.

(ii) Notwithstanding anything to the contrary contained in this Agreement, but excluding liabilities caused by the willful misconduct of any member of the Customer Group (as defined in Section 19(a) below), the Parties hereby agree that Customer’s liability to indemnify the Operator Group pursuant to Section 19 of this Agreement for each occurrence shall be limited to:

(1) For all indemnities except those arising under Section 19(c), the greater of:

(I) (x) the amount of total fees collected by Operator from Customer pursuant to this Agreement during the twelve (12) months immediately preceding the alleged liability, or (y) if the Agreement has been in effect for less than twelve (12) months, the amount equal to twelve (12) times the average of the monthly fees collected during such less than twelve (12) month period; or

(II) the limits stated under Section 23 below for the insurance policies required under Section 23 to be maintained by the Customer Insurance Group to provide coverage with respect to the particular occurrence that is the subject of such indemnity,

(2) For indemnities arising from or relating to a Pollution Event under Section 19(c), the sum of:

(I) The amount of insurance coverage actually provided by Customer’s marine carriers who access the Berths, required as set forth under Section 23(c) below, and

21

(II) Five hundred million dollars ($500,000,000), if the actual insurance coverage provided by Customer’s marine carriers who access the Berths is below the limits stated in Section 23(c) below;

(III) Provided that (x) in no event shall the aggregate liability of the Customer Group under (I) and (II) above exceed one billion dollars ($1,000,000,000) for all indemnities arising from or relating to a pollution event under Section 19(c) and (y) the limitation set forth in this Section 18(b)(ii)(2) shall also apply to the indemnity set forth in Section 19(d) as it relates to a Pollution Event.

(3) Provided, however, that for indemnities arising under Sections 19(b) and 19(c), the Customer Group’s amounts and obligations shall not be limited if the cause of the Claim or Pollution Event giving rise to the indemnity is Customer Group’s violation of Section 14(g).

(4) Provided, further, however, the foregoing limitation shall not limit Operator’s ability to collect as breach of contract damages the fees, pass through costs and reimbursements payable by Customer to Operator that are expressly provided in this Agreement.

(c)Claims and Liability for Lost Product. Operator shall not be liable to Customer for lost or damaged Product unless Customer notifies Operator in writing within ninety (90) days of the report of any incident or the date Customer learns or should have learned of any such loss or damage to the Product, whichever is earlier. Subject always to Section 18(b), Operator’s maximum liability to Customer for any lost or damaged Product shall be limited to (a) the lesser of (i) the replacement value of the Product at the time of the incident based upon the price as posted by Platts for similar Product in the same locality, and if no other similar Product is in the locality, then in the state, or (ii) the actual cost paid for the Product by Customer (copies of Customer’s invoices of cost paid must be provided), less (b) the salvage value, if any, of the damaged Product.

(d)Demurrage. Operator assumes no liability for demurrage (whether related to marine movements or otherwise), except if such demurrage is the result of Operator’s negligence or willful misconduct and except as provided in Section 14(i).

(e)No Guarantees or Warranties. Except as expressly provided in this Agreement, neither Customer nor Operator makes any guarantees or warranties of any kind, expressed or implied. Operator specifically disclaims all implied warranties of any kind or nature, including any implied warranty of merchantability and/or any implied warranty of fitness for a particular purpose.

SECTION 19 INDEMNIFICATION

(a)Duty to Indemnify Customer Group. Except as expressly provided otherwise in this Agreement, Operator SHALL RELEASE, DEFEND, INDEMNIFY, AND HOLD HARMLESS Customer, its marine carriers, and each of its and their respective affiliates, officers, directors, employees, agents, contractors, successors, and assigns (collectively the “Customer Group”) from and against all claims, suits, causes of action, demands, losses, liabilities, damages, costs, expenses, fees (including, but not limited to, reasonable attorney’s fees), and court costs (collectively “Claims”), inclusive of Claims made by third parties, arising from or relating to any injury to or death of persons and/or damage, loss, or injury to any property (excluding Product) TO THE EXTENT OF THE PERCENTAGE OR

22

PROPORTION OF DETERMINED FAULT ARISING FROM THE BREACH, DEFAULT, STRICT LIABILITY, OR THE NEGLIGENT ACTS, ERRORS, OR OMISSIONS OF OPERATOR OR ANY MEMBER OF THE OPERATOR GROUP (AS DEFINED BELOW) WHILE PERFORMING OR RELATING TO ITS OR THEIR OBLIGATIONS UNDER THIS AGREEMENT. Notwithstanding the foregoing, Operator’s obligation to indemnify Customer Group hereunder shall not apply to any Claims caused by Customer Group’s violation of Section 14(g) except to the extent such violation is the result of acts or omissions of Operator.

(b)Duty to Indemnify Operator Group. Except as expressly provided otherwise in this Agreement, CUSTOMER SHALL RELEASE, DEFEND, INDEMNIFY, AND HOLD HARMLESS Operator and Operator’s affiliates, officers, directors, members, managers, employees, agents, contractors, successors, and assigns (excluding any member of Customer Group) (collectively the “Operator Group”) from and against all Claims, inclusive of Claims made by third parties, arising from or relating to any injury to or death of persons and/or damage, loss, or injury to any property (excluding Product) TO THE EXTENT OF THE PERCENTAGE OR PROPORTION OF DETERMINED FAULT ARISING FROM THE BREACH, DEFAULT, STRICT LIABILITY, OR THE NEGLIGENT ACTS, ERRORS, OR OMISSIONS OF CUSTOMER OR ANY MEMBER OF CUSTOMER GROUP WHILE USING THE BERTHS AND/OR TO THE EXTENT OF THE PERCENTAGE OR PROPORTION OF DETERMINED FAULT ARISING FROM THE BREACH, DEFAULT, STRICT LIABILITY, OR THE NEGLIGENT ACTS, ERRORS, OR OMISSIONS OF CUSTOMER WHILE PERFORMING OR RELATING TO CUSTOMER’S OBLIGATIONS UNDER THIS AGREEMENT. Customer Group’s obligation to indemnify Operator hereunder shall include any Claims arising from Customer Group’s violation of Section 14(g) except to the extent such violation is the result of acts or omissions of Operator.

(c)Duty to Indemnify for Pollution Events. Notwithstanding anything to the contrary in this Agreement, in the event of any escape, release, discharge, threat of discharge, or disposal of any pollutants or hazardous materials from any member of Customer Group’s vehicles, Marine Vessels or equipment or otherwise caused by any member of the Customer Group while in, on, or adjacent to the Berths (each such event a “Pollution Event”), Operator shall have the right to commence emergency response and containment or clean-up activities, as deemed appropriate or necessary by Operator or required by any Governmental Authority, and shall notify Customer, as soon as reasonably possible, of such activities. CUSTOMER SHALL ASSUME ALL RESPONSIBILITY FOR, AND SHALL RELEASE, DEFEND, INDEMNIFY, AND HOLD HARMLESS THE OPERATOR GROUP FROM AND AGAINST, ANY AND ALL CLAIMS ARISING FROM OR RELATING TO A POLLUTION EVENT EXCEPT TO THE EXTENT OF THE PERCENTAGE OR PROPORTION OF DETERMINED FAULT THAT CUSTOMER SHALL SHOW ANY SUCH POLLUTION EVENT IS CAUSED BY THE NEGLIGENCE OF OPERATOR. Customer Group’s obligation to indemnify Operator hereunder shall include any pollution event arising from Customer Group’s violation of Section 14(g) unless such violation is the result of acts or omissions of Operator.

(d)Failure to Maintain Required Coverages. In the event that (i) Customer does not maintain, or does not cause the Customer Insurance Group (as defined below) members to maintain, the insurance coverages required by Section 23 of this Agreement or (ii) Customer fails to include Operator as an additional insured on all policies of insurance required by Section 23 of this Agreement, then Customer shall hold harmless and indemnify Operator against all Claims that otherwise would have been insured.

(e)Written Claim. Neither Party shall be obligated to indemnify the other Party or be liable to the other Party unless a written claim for indemnity is delivered to the other Party within ninety (90) days after the date that a Claim is reported or discovered, whichever is earlier.

23

(f)No Limitation. Except as expressly provided otherwise in this Agreement, the scope of these indemnity provisions may not be altered, restricted, limited, or changed by any other provision of this Agreement. The indemnity obligations of the Parties as set out in this Section 19 are independent of any insurance requirements as set out in Section 23, and such indemnity obligations shall not be lessened or extinguished by reason of a Party’s failure to obtain the required insurance coverages or by any defenses asserted by a Party’s insurers.

(g)Mutual and Express Acknowledgement. THE INDEMNIFICATION PROVISIONS PROVIDED FOR IN THIS AGREEMENT HAVE BEEN EXPRESSLY NEGOTIATED IN EVERY DETAIL, ARE INTENDED TO BE GIVEN FULL AND LITERAL EFFECT, AND SHALL BE APPLICABLE WHETHER OR NOT THE LIABILITIES, OBLIGATIONS, CLAIMS, JUDGMENTS, LOSSES, COSTS, EXPENSES OR DAMAGES IN QUESTION ARISE OR AROSE SOLELY OR IN PART FROM THE GROSS, ACTIVE, PASSIVE OR CONCURRENT NEGLIGENCE, STRICT LIABILITY, OR OTHER FAULT OF ANY INDEMNIFIED PARTY. EACH PARTY ACKNOWLEDGES THAT THIS STATEMENT COMPLIES WITH THE EXPRESS NEGLIGENCE RULE AND CONSTITUTES CONSPICUOUS NOTICE. NOTICE IN THIS CONSPICUOUS NOTICE IS NOT INTENDED TO PROVIDE OR ALTER THE RIGHTS AND OBLIGATIONS OF THE PARTIES, ALL OF WHICH ARE SPECIFIED ELSEWHERE IN THIS AGREEMENT.

(h)Survival. These indemnity obligations shall survive the termination of this Agreement until all applicable statutes of limitation have run regarding any Claims that could be made with respect to the activities contemplated by this Agreement.

(i)Third Party Indemnification. If any Party has the rights to indemnification from a third party, the indemnifying party under this Agreement shall have the right of subrogation with respect to any amounts received from such third-party indemnification claim.

SECTION 20 DEFAULT

(a)Failure to Perform. If either Party breaches this Agreement or defaults in the prompt performance and observance of any of the terms or conditions of this Agreement (the “Defaulting Party”), then the other Party (the “Non-Defaulting Party”) shall as soon as reasonably possible after discovery of the breach/default, and before pursuing any remedy, notify the Defaulting Party of the breach/default (the “Default Notice”). The Default Notice shall include the following with specificity: a description of the breach/default and a good faith estimate of any damage resulting from the breach/default.

(b)Remedy. If a breach/default is not remedied, or if substantive action has not been commenced to remedy such breach/default (which action is not thereafter diligently pursued until remedied), within thirty (30) days after receiving the Default Notice, or within five (5) Business Days in the event of payment default, the Non-Defaulting Party may, at its election: (a) terminate this Agreement; (b) seek any other available remedies; or (c) seek any other appropriate or applicable remedies available at law or in equity.

(c)Waiver. The waiver by the Non-Defaulting Party of any right under this Agreement will not operate to waive any other right nor operate as a waiver of such right at any future date upon another default by the other Party under this Agreement. A single or partial exercise of that right, power or privilege will not be presumed to preclude any subsequent or further exercise of that right, power or privilege or the exercise of any other right, power or privilege.

24

(d)Cumulative Nature of Remedies. The remedies of Customer provided for in this Agreement shall not be exclusive, but shall be cumulative and shall be in addition to all other remedies at law or in equity.

SECTION 21 FORCE MAJEURE