- INTC Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC TO-C Filing

Intel (INTC) SC TO-CInformation about tender offer

Filed: 9 Sep 09, 12:00am

Underwater Stock Option Exchange Program

August 2009

You’ve seen that the value of your stock options has not delivered what you

may have expected over recent years.

Stock

Option

Intel is giving you the opportunity to exchange your current stock options and

renew your stake in the future of the company.

Stock

Option

Stock

Option

This is Intel's Stock Option Exchange in Plain English.

Intel’s Stock Option Exchange

in Plain English

Let's get started by talking about the situation. Most employees hold stock

options that have a specific price - the grant price

Stock

Option

Stock

Option

Once these options vest,

4 Years

Stock

Option

Stock

Option

You may choose to exercise them when the market price is greater than the

grant price.

Years

Grant

Price

Stock

Option

Stock

Option

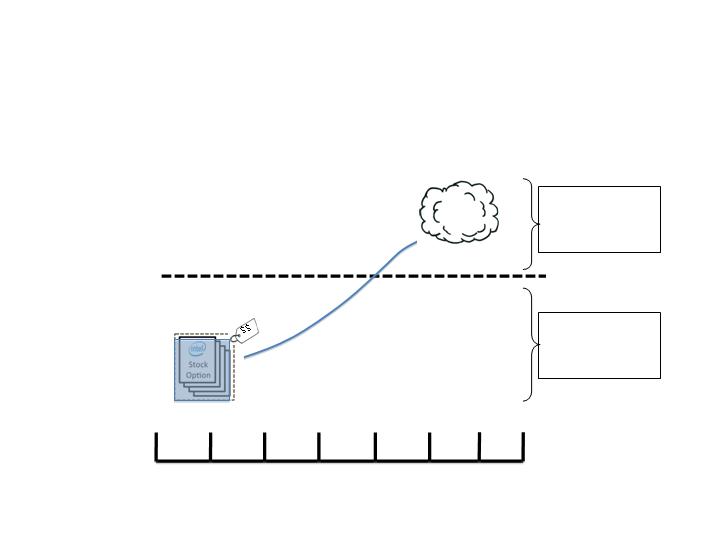

If you're like most employees, some of your stock options are currently

underwater

Stock

Optio

n

Grant Price

Stock

Option

And the clock is ticking. Your stock options and the opportunity for any gains,

may be close to expiring.

Stock

Option

Exp. 2011

2009

2011

Home

Away

:

0

0

0

3

We are giving you the opportunity to re-set the clock by exchanging your

current stock options for new ones

Home

Away

:

7

0

0

0

NOTE: Clock will tick down 3,2,1

and then ref will restart at 7:00.

Stock

Option

Stock

Option

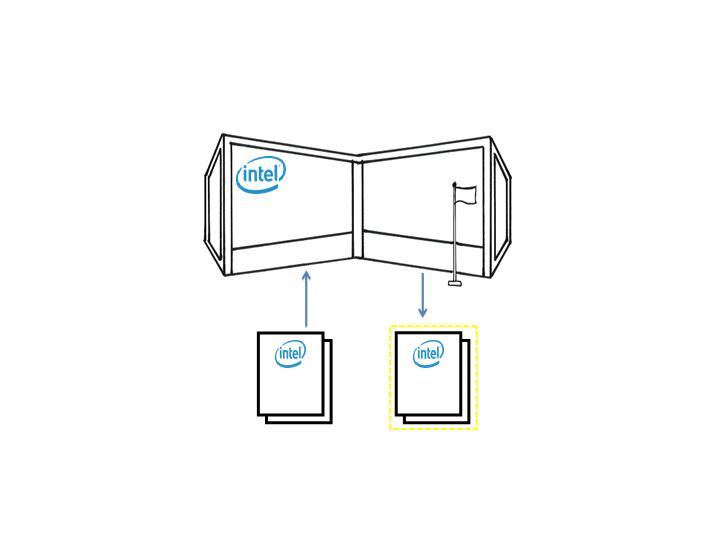

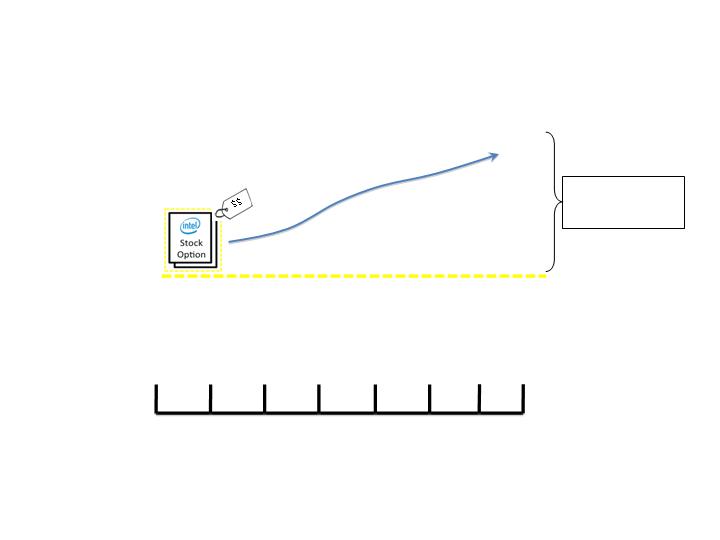

This means that you'll have a choice, on each grant, if you want to keep your

current options or exchange them for a smaller number of new ones.

Stock

Option

Stock

Option

Stock

Option

Stock

Option

Stock

Option

If you choose new ones, it will be a fresh start.

Stock Option

The new grant will have a new 7 year term

Stock Option

+7 Years

A new grant price

Stock Option

+7 Years

and will vest over four years, even if your current options were fully vested.

4 Years

Stock

Option

Stock

Option

Let’s see how to make this decision. First, meet Serena.

Her decision depends on several factors

Stock

Option

Stock

Option

Among them are the number of options, grant prices, and expiration dates of

both current

Expires

2012

Expires

2011

And new grants.

Expires

2012

Expires

2011

Expires

2016

Plus, how she believes Intel's stock price will change in the future,

Expires

2012

Expires

2011

?

Expires

2016

These help her understand when her options will give her the most value.

Expires

2012

Expires

2011

?

?

Expires

2016

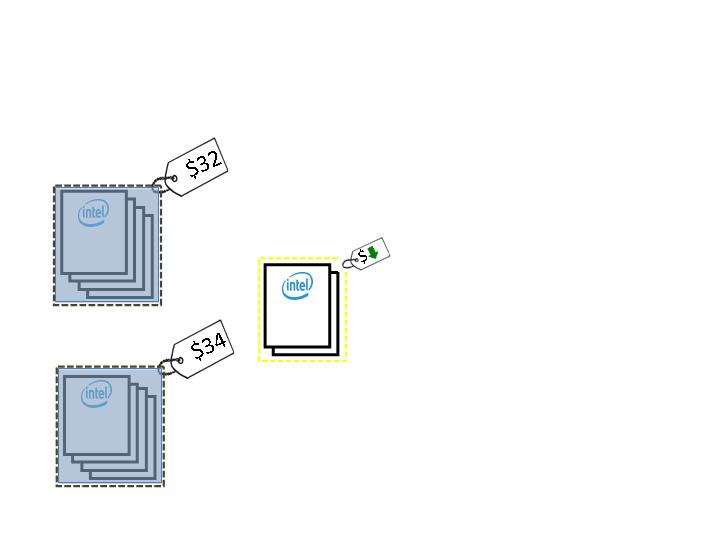

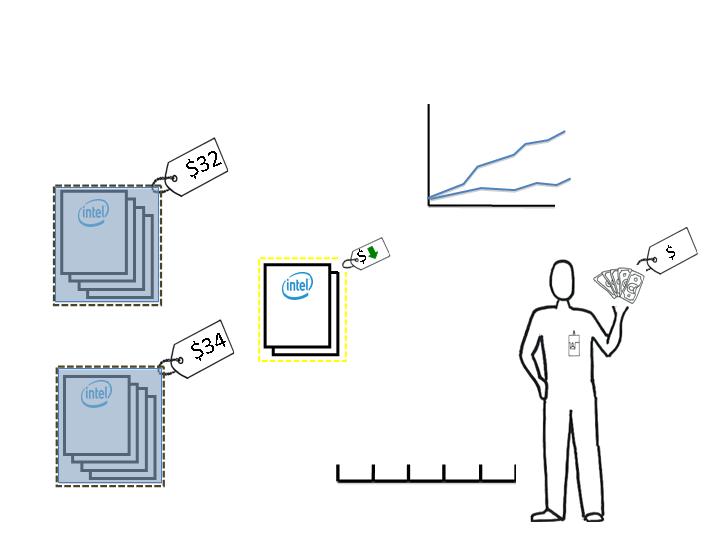

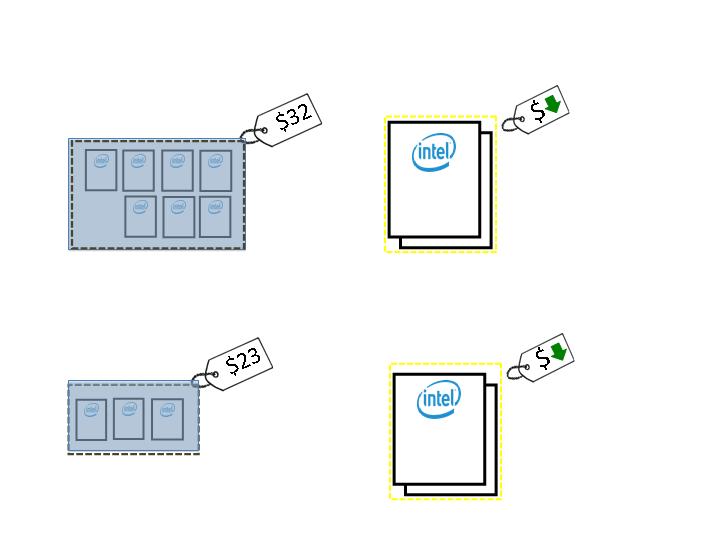

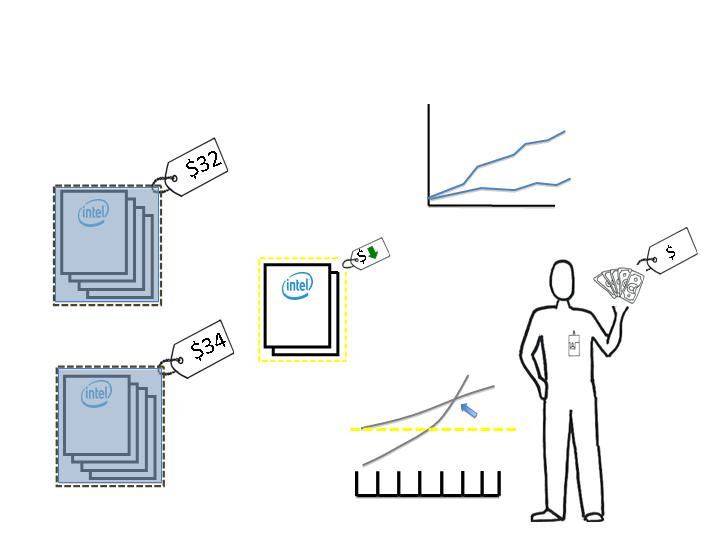

Serena sees her current options have grant prices in the $30s and a few years

before they expire.

1

2

3

1

Expires

2012

Expires

2011

2

4

3

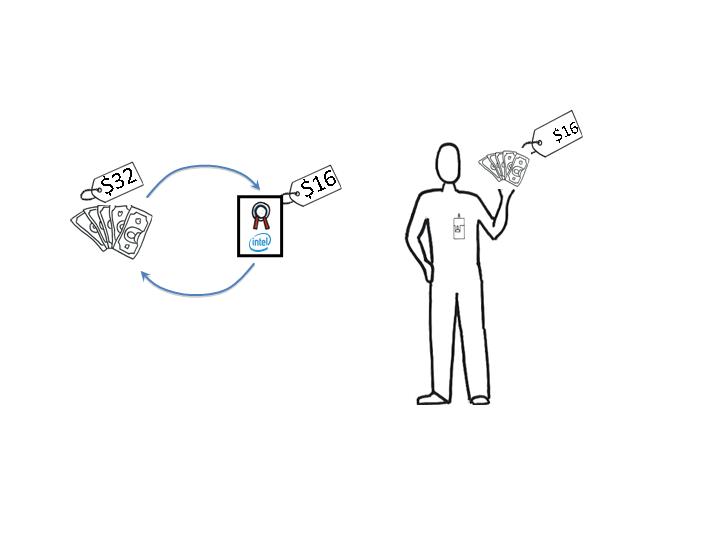

Because Intel’s market price is $16 in our example, she can see that her

current options will expire underwater unless the stock price doubles in the

next 4 years.

$16

Grant Price = $32

4 Years Remaining

But if Intel stock rises above the grant price before expiration, it might be

better for her to keep her current options.

$16

Grant Price = $32

4 Years Remaining

Then she can choose to exercise them before they expire.

However, if Serena doesn’t think the stock price will double before her

options expire …

Grant Price = $32

4 Years Remaining

… exchanging may be a good move.

Stock

Option

Stoc

k

Opti

on

Stoc

k

Opti

on

Stoc

k

Opti

on

Stoc

k

Opti

on

Stoc

k

Opti

on

Stoc

k

Opti

on

Stoc

k

Opti

on

If she does, she can start fresh by exchanging her underwater options for a

smaller number of new ones with a new expiration date.

$16

NEW Grant Price $16

7 Year Expiration

OLD Grant Price $32

1

2

3

4

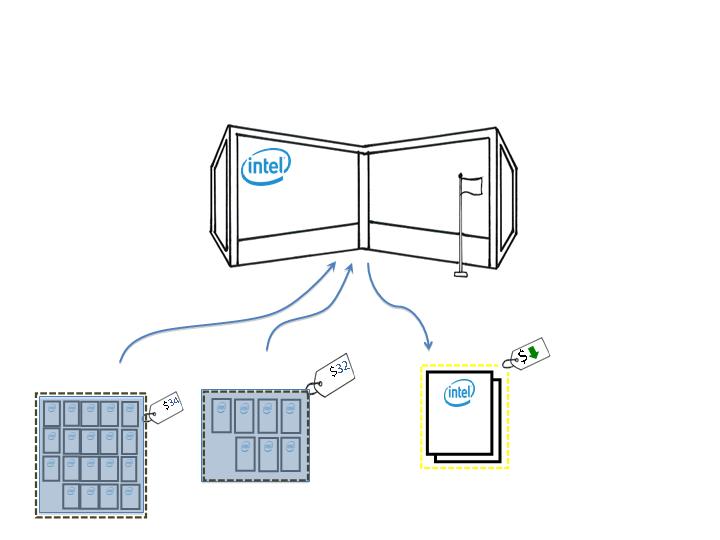

Now, you might remember Nigel.

He's been with the company for about 10 years and has a number of grants

with different grant prices and expiration dates.

2009

2012

2009

2011

Expires

2011

Expires

2012

Expires

2011

2009

2011

As we’ve described, for Nigel’s underwater options to have any value, the

stock price must exceed the grant price before they expire

Grant Price

Grant has

value

Grant has

no value

Stock

Price

Time

The new grant will have a new, lower grant price, new vesting and a full

seven year term. And it’ll have value if the stock price rises.

Grant Price

Grant has

value

Stock

Price

Time

So why wouldn’t Nigel exchange all his current options?

Well, he has to consider the quantity of options.

Stock

Option

Stock

Option

Stock

Option

Stock

Option

Stock

Option

Stock

Option

Stock

Option

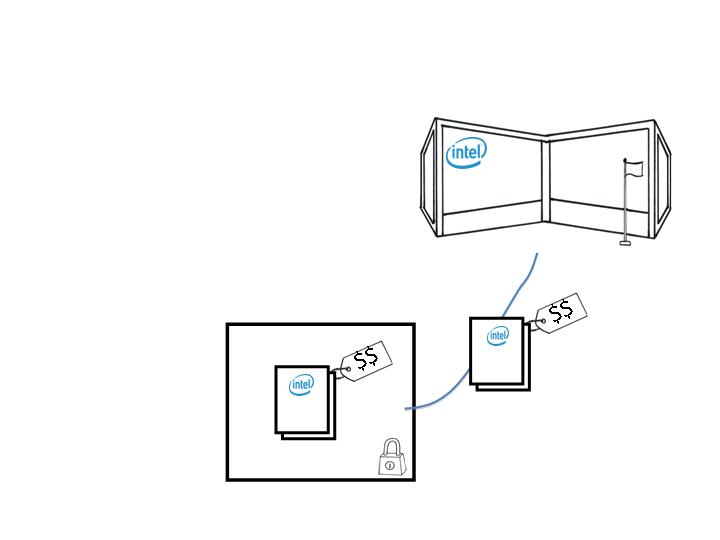

Nigel learns that each grant has its own exchange ratio. This particular grant

has a 7 to 1 exchange ratio, that is, 7 underwater options can be exchanged

for 1 new option

Stock Option

+7 Years

=

Stock

Option

Stock

Option

7:1

Stock

Option

The exchange ratios mean he can choose to receive fewer options but with a

new, lower grant price.

Stock Option

+7 Years

Stock Option

+7 Years

Stock

Option

Stock

Option

Stock

Option

Stock

Option

Stock

Option

Stock

Option

Stock

Option

Stock

Option

Stock

Option

7:1

3:1

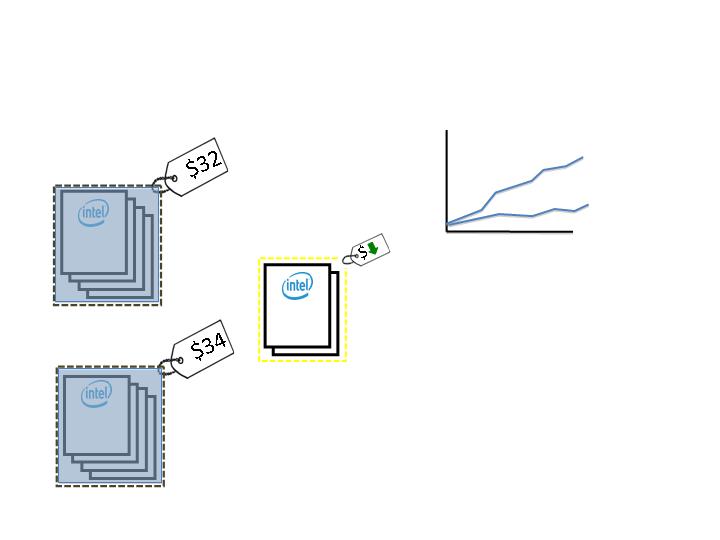

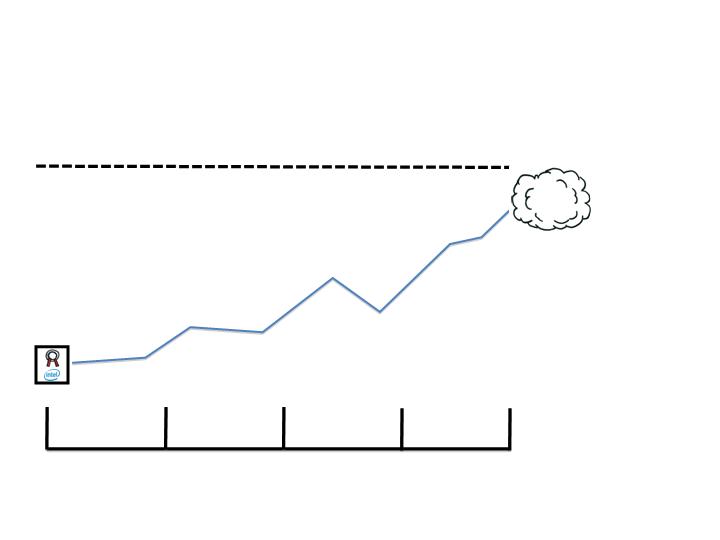

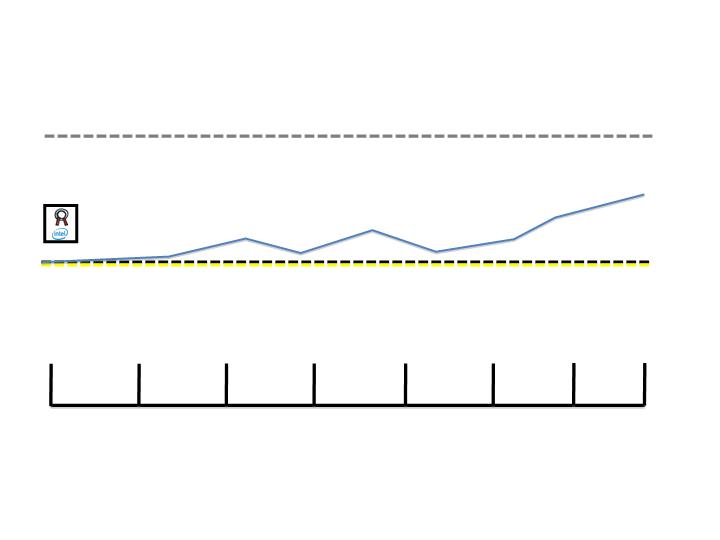

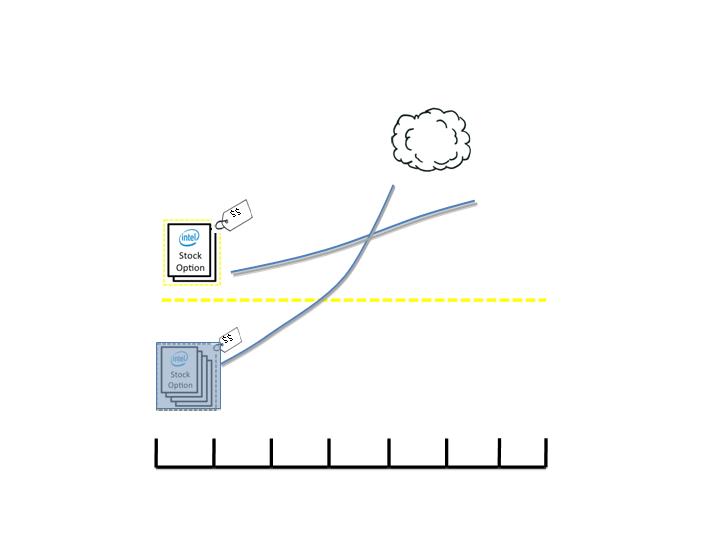

If the stock price climbs only moderately, his current options may expire

underwater and the new options would have more value as they vest, even

though there are fewer of them.

Grant Price

Stock

Price

Time

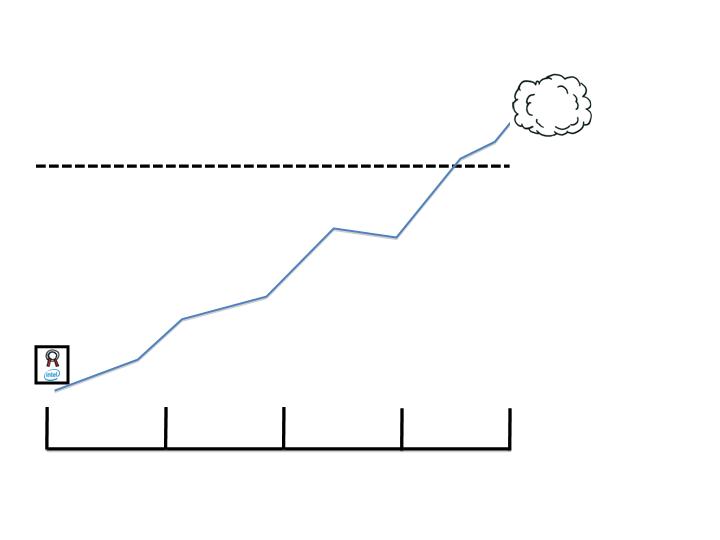

But, if the stock climbs quickly enough before his current options expire, they

will have more value than the new ones because there are more of them.

Grant Price

Stock

Price

Time

The point when the current options become worth more is called the ‘cross-

over’ point.

Grant Price

Stock

Price

Time

And it depends on how quickly the stock price climbs over time.

Grant Price

Stock

Price

Time

If Nigel sees a quick climb, his new options have more value in the first few

years but the current options have more value after that, until they expire.

Grant Price

Stock

Price

Time

But if Nigel doesn’t see the stock price growing above the current grant price

before expiration, there is no cross-over point and the new options would have

more value.

Grant Price

Stock

Price

Time

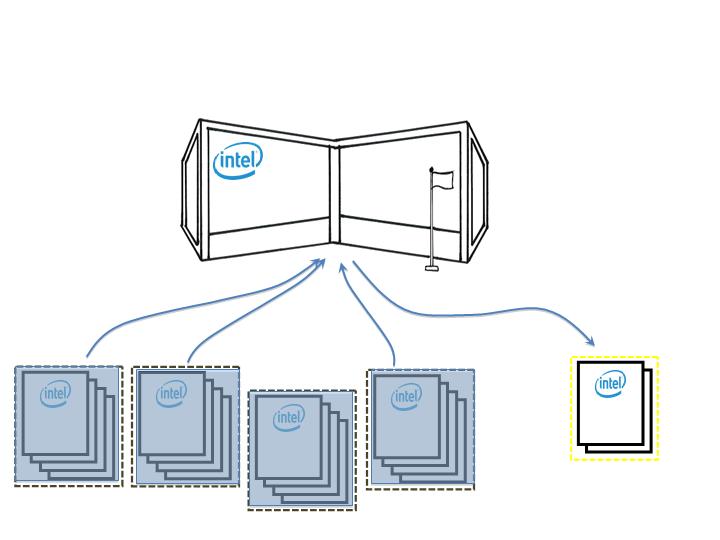

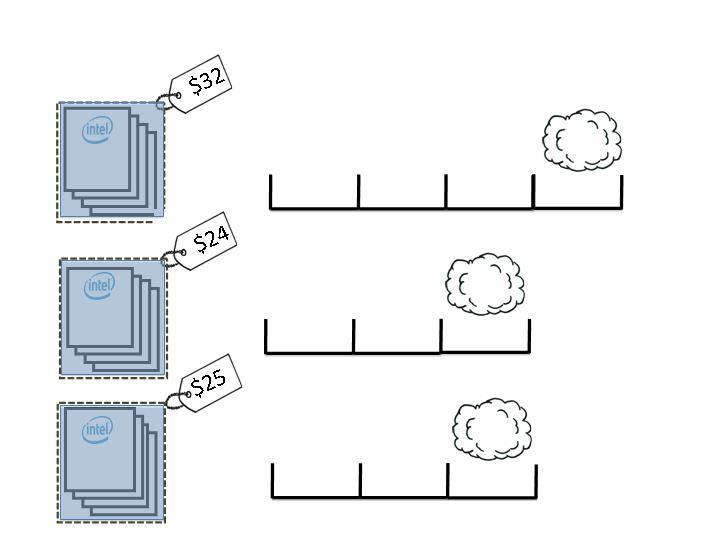

So - - First, you, Serena, and Nigel need to understand your current grants

and what your new grant would be – the number of options, the grant price,

the expiration dates.

Expires

2012

Expires

2011

Expires

2016

Then the questions to ask are: How high will the stock go and how quickly will

it get there?

?

Expires

2012

Expires

2011

Expires

2016

And finally, when do my options have the most value?

?

Expires

2012

Expires

2011

Expires

2016

And you’ll have help - We’ll provide you with information and tools to help

you evaluate whether or not to participate in the exchange.

For more information, go to Circuit and search for stock option exchange

program. Make sure you look into the exchange - remember, it’s your option.