Exhibit 99.1

February 3, 2014

Intel Stockholders,

Our goal is for executive compensation to be well aligned with stockholders’ interests, and the company is firm in its commitment to using executive compensation programs that are equitable and closely connected to the company’s performance. One of the top priorities of new CEO Brian Krzanich is to further strengthen our culture of accountability, engagement, and empowerment.

Over the past year, we have received helpful input from our stockholders which, combined with Board and CEO priorities, has led us to make a number of changes to the company’s compensation structure for executives and the broader employee base. These changes are designed to help drive positive business results by further increasing accountability and enhancing the link between individual pay and company performance. We’d like to summarize for you these important changes as part of our ongoing outreach to our owners.

| · | No new retention grants: In 2012, the company made retention equity grants to the top executives in conjunction with our roughly once-in-a-decade CEO transition. These grants were intended to be a one-time event, and indeed there were no retention grants in 2013. Moreover, the company does not anticipate the need to use this tool in the foreseeable future. |

| · | New CEO compensation package at roughly the 25th percentile: When Brian Krzanich was appointed CEO in May 2013 the Board’s Compensation Committee approved a compensation package at approximately the 25th percentile relative to peer company CEOs, and well below Paul Otellini’s compensation as CEO. |

| · | Equity grants will have more downside risk: Performance-based equity awards for our senior executive officers (known as Named Executive Officers or NEOs) no longer have a “floor” value. If relative Total Shareholder Return (TSR) over a three-year period falls below threshold levels, the payout will be zero. There is no change to the maximum potential value of these awards. |

| · | Stock ownership guideline extended to all senior leaders: Stock ownership guidelines have long been part of Intel’s philosophy toward compensation and accountability for approximately the top 50 executives. Beginning in 2014, ownership guidelines have been extended to approximately 350 of our senior leaders. |

| · | Annual cash bonus refocused: Our annual cash bonus program has been redesigned for all employees, with greater emphasis on a short list of critical operational objectives in an effort to enhance accountability and the link between pay and performance. |

EXECUTIVE COMPENSATION

Our CEO and president are driving a cultural shift, and among the actions being taken is creating an environment of greater accountability through changes to Intel’s compensation guidelines for a core group of the company’s top 350 senior leaders, including all of our vice presidents and Intel Fellows (our senior technical personnel).

Approximately 90% of total direct compensation for NEOs in 2014 is performance-based, consisting of 65% equity, 24% annual cash bonus and 1% profit-sharing. Only 10% of NEO compensation, in the form of base salary, is fixed, ensuring a strong link between an individual’s total compensation and the company and business unit results.

During 2013 Brian Krzanich was appointed CEO, Renee James was appointed president, Stacy Smith (CFO) was made responsible for our acquisitions and equity investment organization, Paul Otellini retired as CEO and David Perlmutter (EVP and Chief Product Officer) announced his coming retirement from the company. The Board’s Compensation Committee made a deliberate decision to award Mr. Krzanich a compensation package valued at approximately the 25th percentile for his position, and significantly below Mr. Otellini’s annualized CEO compensation level. This action reflects the Committee’s view that Mr. Krzanich is new to his role, and creates an incentive to drive value in the future. Overall, total 2013 compensation for NEOs was down year-over-year, as we followed through on our commitment to make the 2012 NEO retention grants a one-time provision. All of the recipients of the retention grants that were issued in connection with the CEO succession process are still at Intel, with the exception of Mr. Perlmutter who will be retiring from the company.

| | Year | Base Salary | Annual Bonus | Equity | Total* |

Brian Krzanich Chief Executive Officer | 2013 | $887,500 | $1,752,097 | $6,323,800 | $9,139,597 |

| 2012 | $700,000 | $1,800,900 | $13,247,200 | $15,748,100 |

Renee James President | 2013 | $775,000 | $1,394,000 | $5,359,500 | $7,694,000 |

| 2012 | $650,000 | $1,265,100 | $13,247,200 | $15,162,300 |

David Perlmutter Executive Vice President | 2013 | $700,000 | $1,470,000 | $4,345,500 | $6,670,000 |

| 2012 | $700,000 | $1,800,700 | $13,247,200 | $15,747,900 |

Stacy Smith Chief Financial Officer | 2013 | $650,000 | $1,020,834 | $4,345,500 | $6,170,834 |

| 2012 | $650,000 | $1,265,900 | $13,247,200 | $15,163,100 |

Paul Otellini Outgoing CEO | 2013 | $512,500 | $1,803,473 | $2,000,000 | $4,315,973 |

| 2012 | $1,200,000 | $5,234,500 | $11,903,600 | $18,338,100 |

*A more detailed summary of NEO compensation will be included in Intel’s proxy statement, which we expect to distribute in April

EQUITY COMPENSATION

It is our philosophy that all employees are stockholders and have an ownership stake in Intel’s future success. NEO stock compensation has been revised to increase our use of performance-based stock awards, which we call Outperformance Stock Units (OSUs). OSUs pay out based on Intel’s TSR relative to a peer group of high-performing technology companies over a three-year window. Historically there has been a 50% payout “floor” for this program. Going forward, if relative TSR falls below threshold levels, the payout will be zero. Payouts rise to up to 200% at the highest relative performance levels. Importantly, the changes made for 2014 will not increase equity awards for at-target performance or increase the maximum payout.

Outperformance Stock Unit (OSU) Payout Levels for NEOs

Performance vs. Peer-Group Median TSR

The mix of stock awarded the top 350 senior leaders, including NEOs, has also been adjusted to transition away from stock options entirely, placing an even greater emphasis on OSUs. Going forward, the top 350 senior leaders will have a mix of 60% OSUs and 40% restricted stock units (RSUs). The change is effective in 2014 for the company’s top 20 senior executives and will be phased in over the next three years for the all remaining executives.

STOCK OWNERSHIP GUIDELINES

As an additional measure to ensure broad alignment between executives’ and stockholders’ interests, new stock ownership guidelines have been instituted to cover our 350 senior employees, including all vice presidents and Intel Fellows. Each executive level requires incrementally larger amounts of shares to be owned, ranging from 5,000 shares at the first level, to 250,000 shares at the CEO level.

| NEO Stock Ownership Guidelines |

| Position | Shares | Value at $24/Share |

| Chief Executive Officer | 250,000 | $6,000,000 |

| Executive Chairman & President | 150,000 | $3,600,000 |

| Chief Financial Officer | 125,000 | $3,000,000 |

| Executive Vice President | 100,000 | $2,400,000 |

| Senior Vice President | 65,000 | $1,560,000 |

| Corporate Vice President | 35,000 | $840,000 |

| Other VPs, Fellows & senior leaders | 5,000 to 10,000 | $120,000 to $240,000 |

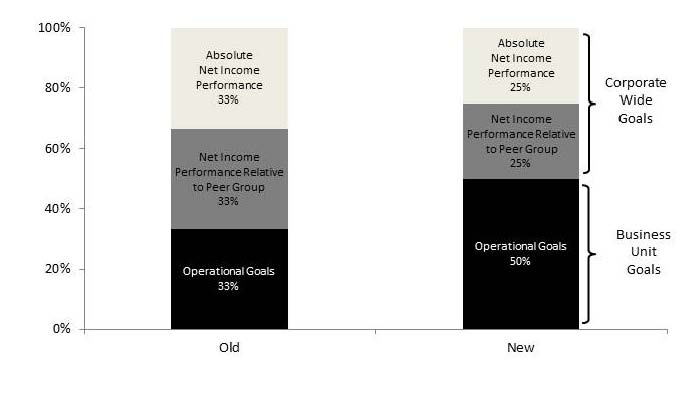

Cash compensation structures have been refined as well. Beginning in 2014, 50% of the annual cash bonus payout will be based on performance against a list of growth-oriented goals, up from 33% in 2013. These operational goals have been streamlined from approximately 150 to 30-40 goals more closely aligned with individual business units. This change is intended to drive a sharper focus on key strategic initiatives, increase visibility into those initiatives, and enhance accountability.

Annual Cash Bonus Plan Metrics

While profit sharing is a relatively small portion of executive compensation, it is an important tool to foster engagement for all Intel employees. This cash plan has been condensed from two formulas to one, which will be simpler to administer and easier to understand, and thereby enhance perceived value. The plan will now pay out quarterly, as opposed to semi-annually, further enhancing employee engagement by delivering the incentive-based compensation more frequently. Importantly, NEOs receive only 1% of total compensation in the form of profit-sharing – enough that employees know that their managers participate in the same pool as the broader employee base, but not so much as to create incentives for the NEOs to focus solely on quarterly performance. The changes to the profit sharing plan are not expected to change payout levels

As always, your input over the past year has been both welcomed and helpful. The company believes that these changes, in conjunction with a strong history of meritocracy, will continue to enhance accountability and strengthen Intel’s commitment to pay-for-performance.

This information is provided by Intel Corporation. Intel will distribute the proxy statement in April 2014, and it will also be available on the SEC's website at www.sec.gov. Stockholders are urged to read Intel's proxy statement when it becomes available because it will contain important information about the proposals to be voted on at Intel's 2014 Annual Stockholders' Meeting.