Exhibit 1.01

CONFLICT MINERALS REPORT

INTEL CORPORATION

IN ACCORD WITH RULE 13P-1 UNDER THE SECURITIES EXCHANGE ACT OF 1934

This Conflict Minerals Report (Report) of Intel Corporation (Intel or we) for the year ended December 31, 2022 is presented to comply with Rule 13p-1 under the Securities Exchange Act of 1934, as amended (the Rule). The Rule was adopted by the Securities and Exchange Commission (SEC) to implement reporting requirements related to “conflict minerals,” defined by the SEC as columbite-tantalite (coltan), cassiterite, gold, wolframite, and their derivatives, which are currently limited to tantalum, tin, and tungsten.

The Rule imposes certain reporting obligations on SEC registrants whose products contain conflict minerals that are necessary to the functionality or production of their products (referred to as “conflict minerals”). For products that contain necessary conflict minerals, the registrant must conduct in good faith a reasonable country of origin inquiry designed to determine whether any of the necessary conflict minerals originated in the Democratic Republic of the Congo (DRC) or an adjoining country (collectively, the “Covered Countries”). If, based on such inquiry, the registrant knows or has reason to believe that any of the necessary conflict minerals originated or may have originated in a Covered Country and may not be solely from recycled or scrap sources, the registrant must conduct due diligence to determine if the necessary conflict minerals directly or indirectly financed or benefited armed groups (as defined by the SEC in Form SD) in the Covered Countries.

Overview of Intel’s Responsible Minerals Program and Commitment to Responsible Sourcing

As set forth in our Responsible Minerals Sourcing Policy, Intel is committed to the responsible sourcing of minerals, which we define as sourcing done in an ethical and sustainable manner that safeguards the human rights of everyone in our global supply chain. Intel’s responsible minerals program continues to expand in scope to include additional minerals, such as cobalt, and we have taken initial steps to include aluminum, copper, nickel, silver, lead and zinc in the next phase of our program. We also continue to examine human rights risks in Conflict-Affected and High-Risk Areas (CAHRAs) globally, as defined by the Organisation for Economic Co-operation and Development (OECD) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, Third Edition, and related Supplements on Tin, Tantalum and Tungsten and on Gold (collectively, “OECD Guidance”). While the focus of this Report is on conflict minerals and the Covered Countries, Intel is electing to also describe the proactive due diligence we began several years ago around cobalt as well as Intel’s public goal to responsibly source additional minerals used in semiconductor manufacturing. In the May of 2020 publication of Intel’s annual Corporate Responsibility Report, we established a new 2030 strategy and goals for continued progress for the next decade in multiple areas of corporate responsibility, including responsible minerals sourcing. An overview of this initiative and the practical steps to be taken to responsibly source beyond conflict minerals is described in a separate section below.

As we expand our program, we also continue to strengthen our approach for responsible sourcing of conflict minerals and to support the improvement of conditions of the mining communities in the Covered Countries. Many of our hardware products contain tantalum, tin, tungsten and/or gold necessary to the functionality or production of those products. Conflict minerals are obtained from sources worldwide, and our desire is not to eliminate those originating in the Covered Countries and other CAHRAs, but rather to obtain conflict minerals from sources that do not directly or indirectly finance or benefit armed groups or contribute to human rights abuses. We believe that it is important for us and other companies to support responsible in-region mineral sourcing from the Covered Countries and other CAHRAs and to not negatively affect the economies of such countries.

We have worked extensively for over a dozen years on the issue of conflict minerals, as part of our work on responsible mineral sourcing. We believe that broad collaborative efforts among governments, non-governmental organizations

(NGOs), civil society experts, and industry are needed to identify and mitigate the risk of contributing to serious human rights abuses and conflict related to mineral extraction in the Covered Countries. Intel is a steering committee member of the Responsible Minerals Initiative (RMI), unique member code INTC, and active contributor to multiple RMI sub-teams. Intel is also an active member of the OECD Multi-Stakeholder Steering Group, which advises on implementation for the OECD Guidance, and the European Partnership for Responsible Minerals (EPRM), where we collaborate with companies in the electronics and other industries (e.g. jewelry, automotive, medical instrumentation, and others) and other stakeholders, such as public authorities and civil society groups, to address responsible mineral sourcing issues. Intel also holds a leadership position in the Public-Private Alliance for Responsible Minerals Trade (PPA), which promotes responsibly sourced minerals from the Covered Countries. We are also part of the CRAFT Code Committee, which assisted in the development of the Code of Risk-mitigation for Artisanal and Small-Scale Mining engaging in Formal Trade (CRAFT).

In late 2019, Intel participated in a delegation organized by the PPA with NGOs, U.S. Government representatives, and other technology companies to visit the DRC and neighboring Rwanda to observe and discuss challenges faced in the mining industry. A key takeaway from this experience was the need for companies to increase upstream program support to support the sustainability and improve the livelihoods of the most vulnerable communities tied to our supply chain. A few examples of projects supported by Intel in 2022 are Congo Power, an alliance providing mining areas with clean power, and PACT-RMI Youth Vocational Training Program, aimed at providing mining alternatives to Congolese people. Additionally, we are seeing the impact of our donation to the University of British Columbia library for the ongoing acquisition of materials to develop the first Democratic Republic of Congo-focused North American collection for Congolese-written material. Enabling access to material written by the Congolese gives the community a voice and opportunity to share their culture, history, and experiences from their own perspective. A wider understanding of issues affecting people in the DRC as told by the people themselves is one step in helping to empower marginalized communities that supply the critical minerals to Intel products.

Intel also recognizes the local socio-economic importance of the artisanal and small-scale mining (ASM) sector in CAHRAs and seeks to assist ASM sites in meeting downstream compliance requirements through the Better Mining ASM Mine Monitoring Program in partnership with Responsible Minerals Initiative (RMI) and RCS Global Group. Intel also supported a digital suite designed specifically for the ASM sector, which was designed to create new pathways to track, access, and share data about practices in mining communities. Maintaining a connection and providing support to the communities that we depend on in our vast global supply chain is an important component to our responsible minerals program.

Products and Supply Chain Description

The Intel products we manufactured or contracted with others to manufacture that may contain necessary conflict minerals, and which are covered in this Report, include the following:

▪Our microprocessor and chipset products, such as our Intel® Core™, Intel® Xeon®, and Intel Atom® processors

▪Our accelerator products, such as our FPGA products, and Habana AI accelerators

▪Our boards and systems products, such as our Intel® NUC

▪Our connectivity products, such as our Intel® Tofino™ switch ASICs and Intel® Silicon Photonics products

▪Our memory and storage products, such as Intel® SSD, Intel® persistent memory, and memory component products

Note that Mobileye EyeQ® and other Mobileye® products are no longer included in this Report. In the fourth quarter of 2022, Mobileye Global Inc. completed its initial public offering. As of December 31, 2022, Intel held approximately 94% of the outstanding equity interest in Mobileye. For information on Mobileye products, please see Mobileye’s Form SD and CMR.

Most of our hardware products, primarily microprocessors, chipsets, and their packages, are manufactured in our own network of fabrication facilities (fabs). Intel also sells products that are manufactured for us by other companies and

products that include ready-made component parts that we purchase from third parties. Although many of our hardware products contain conflict minerals, we do not purchase ore or unrefined conflict minerals from mines. We are many steps removed in the supply chain from the mining of minerals and are therefore considered a “downstream” purchaser. We purchase materials used in our products from a large network of suppliers: some of those materials contribute necessary conflict minerals to our products. The origin of minerals cannot be determined with any certainty once the ores are smelted, refined, and converted to ingots, bullion, or other derivatives. The smelters and refiners (referred to as “facilities”) are consolidating points for ore and are in the best position in the total supply chain to know the origin of the ores. We rely on our suppliers to assist with our reasonable country of origin inquiry and due diligence efforts, including the identification of smelters and refiners, for the minerals contained in the materials which they supply to us.

Design of Responsible Minerals Program

Intel’s responsible minerals program is designed to conform with the OECD Guidance specifically as it relates to our position in the minerals supply chain as a “downstream” purchaser. Summarized below are the design components of our responsible minerals program as they relate to the five-step framework from the OECD Guidance. While our program encompasses a broad scope of minerals and regional areas, the summary of Steps 2 through 5 below focuses on the application of our program to conflict minerals and the Covered Countries.

1. Maintain strong company management systems:

▪Responsible Minerals Sourcing Policy: Maintain a supply chain policy for minerals originating from CAHRAs, including conflict minerals originating from the Covered Countries. This policy outlines our commitment to responsible mineral sourcing from CAHRAs, our commitment to exercise due diligence consistent with the OECD Guidance, and expectations that our suppliers have similarly established due diligence programs. Our policy is publicly available and can be found at www.intel.com/responsibleminerals.

▪Internal Responsible Minerals team: Operate an internal responsible minerals team led by our Manufacturing, Supply Chain & Operations team (MSO) to implement our Responsible Minerals Sourcing Policy. We review such efforts with our Chief Executive Officer (CEO) and senior management of MSO.

▪Supply chain control system: Employ a supply chain system of controls and transparency through due diligence tools such as the Conflict Minerals Reporting Template (CMRT), a supply chain survey designed by RMI to identify the smelters and refiners that process the necessary conflict minerals contained in our products and the country of origin of those conflict minerals. We employ a database to assess due diligence information and maintain records relating to our responsible minerals program for at least five years, in accordance with our record retention guidelines.

▪Supplier engagement: Feature requirements related to responsible mineral sourcing in our standard template for supplier contracts and specifications so that current and future suppliers are obligated to comply with our policies on responsible minerals sourcing, including participation in a supply chain survey and related due diligence activities. We communicate our Responsible Minerals Sourcing Policy and contractual requirements to relevant suppliers annually.

▪Company grievance mechanism: Enable employees, suppliers, and other stakeholders to report any concerns relating to our responsible minerals program through our online corporate responsibility reporting and grievance mechanism found on our company website at https://www.intel.com/content/www/us/en/corporate-responsibility/corporate-responsibility.html.

2. Identify and assess risks in our supply chain:

▪Identify smelters and refiners in our supply chain: Identify direct suppliers that supply products to Intel that may contribute necessary conflict minerals to our products. Conduct an annual supply chain survey requesting those direct suppliers to provide a conflict minerals declaration, using the CMRT, designed to identify the conflict minerals contained in the products they supply to Intel, the smelters and refiners that processed those conflict minerals, and the country of origin of those conflict minerals. We evaluate the

completeness and accuracy of the suppliers’ survey responses and contact suppliers whose survey response we identified as having contained incomplete or potentially inaccurate information to seek additional clarifying information.

▪Identify the scope of the risk assessment: Our risk assessment is designed to identify risks in our supply chain. This includes direct suppliers not meeting our contractual requirements related to conflict minerals, as well as smelters and refiners that are not conformant to a responsible mineral assurance program or that we have reason to believe may source conflict minerals from the Covered Countries. We document mineral country of origin information for the smelters and refiners identified by the supply chain survey, as provided from sources including the supply chain survey, responsible mineral assurance programs, direct contact with smelters and refiners, and from publicly available sources such as smelter and refiner websites.

▪Assess due diligence practices of smelters and refiners: Compare smelters and refiners identified by the supply chain survey against the list of facilities that are conformant to a responsible mineral assurance program such as RMI’s Responsible Minerals Assurance Program (RMAP), and other RMI cross-recognized, independent third-party audit programs. Information regarding RMAP, as well as a list of RMI cross-recognized independent third-party audit programs can be found on RMI’s website: http://www.responsiblemineralsinitiative.org/minerals-due-diligence/recognized-standards-or-programs/.

▪Carry out spot checks of smelters and refiners: Conduct spot checks of smelter and refiner due diligence practices by attempting to visit those facilities that are not conformant to a responsible mineral assurance program and which allow our visit. Our smelter and refiner visits are designed to assess their due diligence practices, request country of origin and chain of custody information for the conflict minerals processed by the facilities and encourage and assist their participation in such a program. In cases where physical visitation is not possible, such as during the COVID-19 pandemic, smelter and refiner due diligence may be conducted virtually, where appropriate.

3. Execute a strategy to respond to identified risks:

▪Report findings to senior management: Provide progress reports to our CEO and MSO senior management summarizing information gathered during our annual supply chain survey, results from the risk assessment process and status of our risk mitigation efforts.

▪Devise and adopt a risk management plan: Maintain a risk management plan that includes due diligence reviews of suppliers, smelters and refiners that may be sourcing or processing conflict minerals from Covered Countries and other CAHRAs that may not be from recycled or scrap sources. Our due diligence measures are significantly based on responsible mineral assurance programs that evaluate the procurement practices of the smelters and refiners that process and provide those conflict minerals to our supply chain.

▪Implement a risk management plan: Perform risk mitigation efforts to bring suppliers into conformity with our Responsible Minerals Sourcing Policy or contractual requirements, which efforts may include working with direct suppliers to consider an alternative source for the necessary conflict minerals. We attempt to contact smelter and refiner facilities that are not conformant to a responsible mineral assurance program to assess their due diligence practices, request country of origin and chain of custody information for the conflict minerals processed by the facilities and encourage and assist their participation in such a program.

▪Ongoing risk monitoring: Monitor and track suppliers, smelters and refiners identified as not meeting the requirements set forth in our Responsible Minerals Sourcing Policy or contractual requirements to determine their progress in meeting those requirements.

4. Support the development and implementation of independent third-party audits of smelters’ and refiners’ sourcing:

▪Support development and implementation of due diligence practices and tools such as the CMRT through our leadership in RMI’s Steering Committee and participation within RMI sub-teams.

▪Support development and implementation of the RMAP by defining the terms of the RMAP audit protocol in conjunction with RMI member companies and other industry groups.

▪Support responsible mineral assurance programs that carry out independent third-party audits of smelter and refiner facilities, such as the RMAP, through our membership in RMI.

▪5. Report on supply chain due diligence:

▪Publicly communicate our Responsible Minerals Sourcing Policy on our company website at www.intel.com/responsibleminerals.

▪Report annually on our supply chain due diligence activities in our white paper titled “Intel’s Efforts to Achieve a Responsibly Sourced Mineral Supply Chain” and Corporate Responsibility Report available on our company website at www.intel.com/responsibleminerals.

The content of any website referred to in this Report is included for general information only and is not incorporated by reference in this Report.

Description of Reasonable Country of Origin Inquiry Efforts

For 2022, our reasonable country of origin inquiry (RCOI) efforts for conflict minerals included conducting a supply chain survey of certain direct suppliers (referred to as “Surveyed Suppliers”) using the CMRT. The supply chain surveys requested that suppliers identify the smelters and refiners and countries of origin of the conflict minerals in products they supply to us. We compared the smelters and refiners identified in the surveys against the lists of facilities that are conformant to a responsible mineral assurance program, such as the RMAP or RMI cross-recognized programs. RMAP and RMI cross-recognized programs provided country of origin data for conformant smelters and refiners, including on an aggregate basis in certain cases. We documented country of origin information for the smelter and refiner facilities identified by Surveyed Suppliers as provided from sources including the supply chain survey, responsible mineral assurance programs, direct contact with smelters and refiners, and from publicly available sources such as smelter and refiner websites, if we determined such publicly available sources to be reliable.

Results of Reasonable Country of Origin Inquiry Efforts

For 2022, Intel conducted a supply chain survey of 87 suppliers that we determined may contribute necessary conflict minerals to our products.

The results of our RCOI as of March 20, 2023 were as follows:

▪100% of Surveyed Suppliers provided a CMRT in response to our supply chain survey request.

▪The Surveyed Suppliers identified 238 operational smelter and refiner facilities that may process the necessary conflict minerals contained in the products provided to us.

▪We know or have reason to believe that a portion of the conflict minerals processed by at least 38 of these 238 smelters and refiners may have originated in the Covered Countries and may not be solely from recycled or scrap sources.

Conclusion Based on Reasonable Country of Origin Inquiry

We have concluded in good faith that during 2022:

▪Intel manufactured and contracted with others to manufacture products as to which conflict minerals are necessary to the functionality or production of our products.

▪Based on our RCOI, we know or have reason to believe that a portion of the necessary conflict minerals contained in our products originated or may have originated in the Covered Countries and know or have reason to believe that those necessary conflict minerals may not be solely from recycled or scrap sources.

As a result of the above conclusion and pursuant to the Rule, we undertook due diligence measures on the source and chain of custody of the necessary conflict minerals in our products for which we had reason to believe may have originated from the Covered Countries and which may not have come from recycled or scrap sources. There is significant overlap between our RCOI efforts and our due diligence measures performed.

Description of Due Diligence Measures Performed

Below is a description of the measures performed for this reporting period, as of March 20, 2023, to exercise due diligence on the source and chain of custody of the necessary conflict minerals contained in our products:

▪Conducted a supply chain survey of suppliers that we identified may be supplying Intel with products that contain necessary conflict minerals using the CMRT, requesting country of origin information regarding the necessary conflict minerals and identification of smelters and refiners that process such minerals.

▪Contacted Surveyed Suppliers on responses to supply chain surveys that we identified as having contained incomplete or potentially inaccurate information to seek additional clarifying information.

▪Received a CMRT from 100% of our Surveyed Suppliers in response to our supply chain survey request.

▪Compared smelters and refiners identified by Surveyed Suppliers against the list of facilities that are conformant to a responsible mineral assurance program.

▪Monitored and tracked Surveyed Suppliers, and smelters and refiners identified by Surveyed Suppliers, which we identified as not meeting our Responsible Minerals Sourcing Policy or contractual requirements, to determine their progress in meeting those requirements.

▪Performed risk mitigation efforts with Surveyed Suppliers we identified as not in conformity with our Responsible Minerals Sourcing Policy or contractual requirements by working with them to bring them into compliance.

▪In 2022, met with 21 smelters and refiners to encourage and assist their participation in a responsible minerals assurance program if they were not yet participating and provide capacity-building and CAP support for those undergoing their first audit.

▪Provided two progress reports to MSO senior management and two progress reports to our CEO that summarized the status of our responsible minerals program.

Results of our Due Diligence Measures

Inherent Limitations on Due Diligence Measures

As a downstream purchaser of products that contain conflict minerals, our due diligence measures can provide only reasonable, not absolute, assurance regarding the source and chain of custody of the necessary conflict minerals. Our due diligence processes are based on the necessity of seeking data from our direct suppliers and those suppliers seeking similar information within their supply chains to identify the original sources of the necessary conflict minerals. We also rely, to a large extent, on information collected and provided by responsible mineral assurance programs. Such sources of information, as well as any of our smelters and refiner facility visits and publicly available sources, may yield inaccurate or incomplete information and may be subject to fraud.

Another complicating factor is the unavailability of country of origin and chain of custody information from our suppliers on a continuous, real-time basis. The supply chain of commodities such as conflict minerals is a multi-step process operating more or less on a daily basis, with ore being delivered to smelters and refiners, with smelters and refiners smelting or refining ores into metal containing derivatives such as ingots, with the derivatives being shipped, sold and stored in numerous market locations around the world and with distributors and purchasers holding varying amounts of the derivatives in inventory for use. Since we do not have direct contractual relationships with smelters and refiners, we rely on our direct suppliers and the entire supply chain to gather and provide specific information about the date when the ore is smelted into a derivative and later shipped, stored, sold, and first entered the stream of commerce. We directly seek sourcing data on a periodic basis from our direct suppliers, as well as certain smelters and refiners. We seek to use contract provisions requiring the suppliers to promptly update us in the event the sourcing data changes. Our due diligence processes are ongoing throughout the year.

Surveyed Supplier Due Diligence Results

Intel evaluated the accuracy and completeness of the responses to our supply chain surveys by our Surveyed Suppliers. We identified 13 Surveyed Suppliers whose initial survey response contained incomplete or potentially inaccurate information. We used various methods to identify the incomplete or inaccurate information in the Surveyed Supplier’s response, including verification checks conducted by third-party software or by members of our internal Responsible Minerals team. When an incomplete or inaccurate response was identified, we contacted the applicable Surveyed Supplier, identified the incomplete or inaccurate information, and requested that the Surveyed Supplier correct the incomplete or potentially inaccurate information and provide an updated response. All 13 Surveyed Suppliers provided an updated CMRT that we determined, using the same evaluation criteria, to be complete and accurate.

Upon receiving a survey response identified to be complete and accurate based on our evaluation criteria, we further evaluated each response for conformity with our Responsible Minerals Sourcing Policy or contractual requirements. These requirements include that our Surveyed Suppliers must maintain a publicly available conflict minerals sourcing policy, provide a CMRT upon our request, and use smelters and refiners that are either conformant to a responsible mineral assurance program or have begun participating in such a program. We identified Surveyed Suppliers that were not fully compliant with applicable requirements and monitored and tracked these suppliers’ progress in meeting the applicable requirements. We performed risk mitigation efforts by contacting each supplier, identifying action items that we requested the supplier complete, and asking the supplier to provide an updated CMRT. Our risk mitigation efforts are specifically related to meeting our Responsible Minerals Sourcing Policy or contractual requirements, with the goal of bringing each Surveyed Supplier into compliance with such requirements.

As a result of these supplier due diligence activities, Intel determined that 100% of the Surveyed Suppliers were, as of March 20, 2023, in compliance with our Responsible Minerals Sourcing Policy or contractual requirements as set for 2022. After January 1, 2023, nine smelters, reported by 41 of the 87 suppliers surveyed, were removed from the RMAP conformant list. We are working to remove these newly not conformant smelters and have set expectations with all 41 suppliers that they remove these smelters from their supply chain.

Smelter and Refiner Due Diligence Results

As of March 20, 2023, an aggregate of 238 operational smelters and refiners were identified by our Surveyed Suppliers as facilities that may process the necessary conflict minerals contained in the products these Surveyed Suppliers provided to Intel.

Intel conducted due diligence on the smelters and refiners reported during our survey process. Our due diligence activities are dominated by a regular process to determine and monitor whether the identified smelters and refiners are operational and therefore may contribute necessary conflict minerals to our final products, and whether they are conformant to a responsible mineral assurance program or have begun participating in such a program. We sought reliable information on the source and chain of custody of the conflict minerals processed by such facilities, including from publicly available sources, with the goal to determine if any of these facilities processed conflict minerals that may have originated from the Covered Countries and other CAHRAs, and may not be solely from recycled or scrap sources.

If a smelter or refiner in our supply chain was not yet conformant to a responsible mineral assurance program or had not yet begun participating in such a program, Intel and other RMI member companies proactively attempted to contact such

facilities to request country of origin information for the conflict minerals the facilities processed, as well as to encourage and assist their participation in a responsible mineral assurance program and, in some cases, visited such facilities on-site. We monitored and tracked smelters and refiners that we identified as not being conformant to a responsible mineral assurance program or not having begun participating in such a program.

During the 2022 reporting year, we identified 33 smelter and refiner facilities reported in our supply chain that were not conformant to a responsible mineral assurance program or otherwise did not meet more stringent Intel requirements based on our due diligence investigations. These facilities were the focus of our smelter and refiner due diligence activities for this reporting period and, as a result of our activities, we reasonably concluded that as of March 20, 2023:

▪10 of these 33 smelter and refiner facilities have since become conformant to a responsible mineral sourcing program.

▪Two of these 33 smelter and refiner facilities have begun participating in a responsible mineral assurance program, but are not yet conformant. Based on Intel’s due diligence, we have no reason to believe these facilities sourced conflict minerals from the Covered Countries.

▪The remaining 21 facilities decided not to or were deemed not eligible to continue participating in a responsible mineral assurance program. All smelters in our supply chain that were not conformant to a responsible mineral assurance program during 2022 have been successfully removed from our supply chain.

As result of our due diligence activities summarized above, we determined the following as of March 20, 2023:

▪96% of the 238 smelters and refiners identified by our Surveyed Suppliers are either conformant to a responsible mineral assurance program or have begun participating in such a program.

▪All nine smelters and refiners identified by our suppliers that are not participating in a responsible mineral assurance program became not conformant between January 1, 2023 and March 20, 2023. We have communicated the requirement to such suppliers to cease sourcing from these smelters and refiners and to update us confirming the changes.

•All 38 smelters and refiners that we know or have reason to believe may source conflict minerals from the Covered Countries, which may not be solely from recycled or scrap sources, are conformant to a responsible mineral assurance program.

•We have no reason to believe that any of the 238 smelter and refiner facilities directly or indirectly finance or benefit armed groups in the Covered Countries.

Below is a summary of the mineral country of origin information collected as of March 20, 2023 as a result of our due diligence activities. Intel does not source these materials directly. RMI provides Intel with a list of potential countries of origin, which includes all countries of origin compiled from RMI’s member participants. The inclusion of a country on the list from RMI is not a final indicator that Intel utilized materials sourced from this country.

Table 1

| | | | | | | | | | | | | | | | | | | | | | | |

| Mineral |

| Country of Origin | Gold | | Tantalum | | Tin | | Tungsten |

| Argentina | Gold | | | | | | |

| Australia | Gold | | Tantalum | | Tin | | Tungsten |

| Austria | | | | | | | Tungsten |

| Azerbaijan | Gold | | | | | | |

| Benin | Gold | | | | | | |

| Bolivia | Gold | | | | Tin | | Tungsten |

| Botswana | Gold | | | | | | |

| Brazil | Gold | | Tantalum | | Tin | | Tungsten |

| | | | | | | | | | | | | | | | | | | | | | | |

| Burkina Faso | Gold | | | | | | |

| Burundi** | | | Tantalum | | Tin | | Tungsten |

| Cambodia | Gold | | | | | | |

| Canada | Gold | | | | | | |

| Chile | Gold | | | | | | |

| China | Gold | | Tantalum | | Tin | | Tungsten |

| Colombia | Gold | | | | Tin | | |

| Côte d'Ivoire | Gold | | | | | | |

| Democratic Republic of the Congo** | Gold | | Tantalum | | Tin | | Tungsten |

| Dominican Republic | Gold | | | | | | |

| Ecuador | Gold | | | | | | |

| Egypt | Gold | | | | | | |

| Eritrea | Gold | | | | | | |

| Ethiopia | | | Tantalum | | | | |

| Fiji | Gold | | | | | | |

| Finland | Gold | | | | | | |

| France | | | | | Tin | | |

| French Guiana | Gold | | | | | | |

| Georgia | Gold | | | | | | |

| Ghana | Gold | | | | | | |

| Guatemala | Gold | | | | | | |

| Guinea | Gold | | | | | | |

| Guyana | Gold | | | | | | |

| Honduras | Gold | | | | | | |

| India | Gold | | | | | | |

| Indonesia | Gold | | | | Tin | | |

| Japan | Gold | | | | | | |

| Kazakhstan | Gold | | | | | | Tungsten |

| Kenya | Gold | | | | | | |

| Kyrgyzstan | Gold | | | | | | Tungsten |

| Laos | Gold | | | | Tin | | |

| Liberia | Gold | | | | | | |

| Malaysia | Gold | | | | Tin | | Tungsten |

| Mali | Gold | | | | | | |

| Mauritania | Gold | | | | | | |

| Mexico | Gold | | | | | | Tungsten |

| Mongolia | Gold | | | | | | Tungsten |

| Morocco | Gold | | | | | | |

| Mozambique | Gold | | Tantalum | | | | |

| Myanmar | | | | | Tin | | Tungsten |

| Namibia | Gold | | | | Tin | | |

| New Zealand | Gold | | | | | | |

| Nicaragua | Gold | | | | | | |

| Niger | Gold | | | | | | |

| Nigeria | | | Tantalum | | Tin | | Tungsten |

| | | | | | | | | | | | | | | | | | | | | | | |

| Oman | Gold | | | | | | |

| Panama | Gold | | | | | | |

| Papua New Guinea | Gold | | | | | | |

| Peru | Gold | | | | Tin | | Tungsten |

| Philippines | Gold | | | | | | |

| Portugal | | | | | Tin | | Tungsten |

| Russia* | Gold | | | | Tin | | Tungsten |

| Rwanda** | | | Tantalum | | Tin | | Tungsten |

| Saudi Arabia | Gold | | | | | | |

| Senegal | Gold | | | | | | |

| Serbia | Gold | | | | | | |

| Sierra Leone | | | Tantalum | | | | |

| South Africa | Gold | | | | | | |

| South Korea | Gold | | | | | | |

| Spain | Gold | | Tantalum | | Tin | | Tungsten |

| Sudan | Gold | | | | | | |

| Suriname | Gold | | | | | | |

| Swaziland | Gold | | | | | | |

| Sweden | Gold | | | | | | |

| Taiwan | | | | | Tin | | |

| Tanzania** | Gold | | | | Tin | | |

| Thailand | | | Tantalum | | Tin | | Tungsten |

| Turkey | Gold | | | | | | |

| Uganda** | | | | | | | Tungsten |

| United Kingdom | | | | | Tin | | Tungsten |

| United States of America | Gold | | | | | | Tungsten |

| Uzbekistan | Gold | | | | | | |

| Venezuela | | | | | Tin | | |

| Vietnam | | | | | Tin | | Tungsten |

| Zambia** | Gold | | | | | | |

| Zimbabwe | Gold | | Tantalum | | | | Tungsten |

* This reported RCOI list includes information covering all of 2022. Following Russia’s invasion of Ukraine on February 24, 2022, Intel joined the global community in condemning Russia’s war against Ukraine and calling for a swift return to peace. During 2022, we ceased 3TG sourcing from smelters and refiners located in Russia. We continue to work with our supply chain to eliminate sourcing from Russian mines.

**Covered Countries

Summary of Smelter and Refiner Status

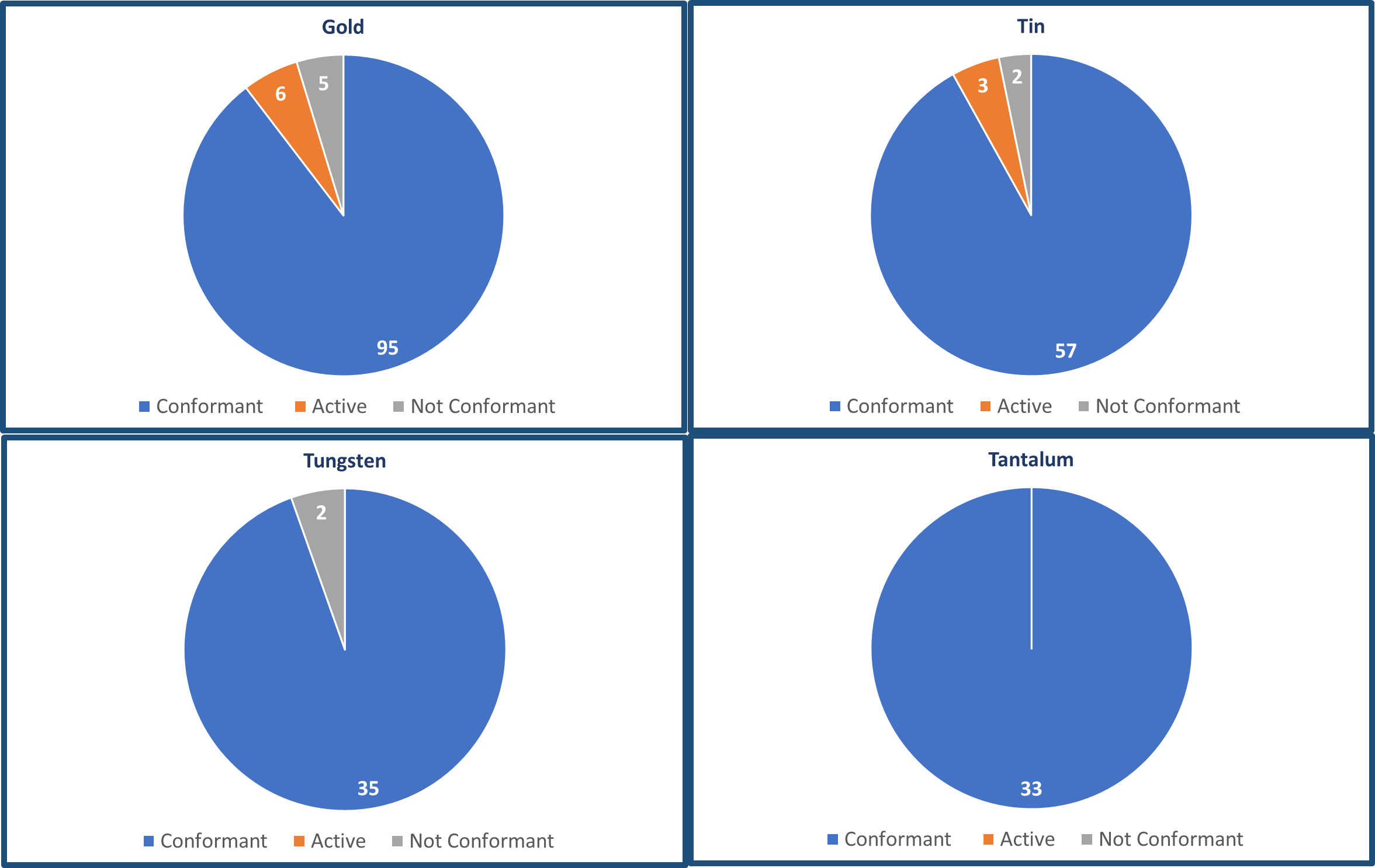

The charts below summarize, by mineral, the numbers of operational smelter and refiner facilities, identified by our Surveyed Suppliers, that as of March 20, 2023:

▪are conformant to a responsible mineral assurance program (referred to as “Conformant”),

▪have begun participating in a responsible mineral assurance program (referred to as “Active”; as noted above, we have no reason to believe, based on our due diligence, that these facilities process conflict minerals originating from the Covered Countries), or

▪are not conformant* to a responsible mineral assurance program (referred to as “Not Conformant”; as noted above, we have no reason to believe, based on our due diligence, that these facilities process conflict minerals originating from the Covered Countries).

Status of Identified Smelters and Refiners

*Included in “Not Conformant” are the 9 smelters that changed status between January 1, 2023, and March 20, 2023

The table below (Table 2) lists the facilities which, to the extent known, processed the necessary conflict minerals in our products based on responses received from our Surveyed Suppliers as of March 20, 2023. Intel conducts no direct transactions and has no contractual relationship with these smelter and refiner facilities nor their sources of ore.

Table 2

| | | | | | | | | | | |

| Metal | | Smelter Name† | Country† |

| Gold | | 8853 S.p.A. | ITALY |

| Gold | | Abington Reldan Metals, LLC* | UNITED STATES OF AMERICA |

| Gold | | Advanced Chemical Company* | UNITED STATES OF AMERICA |

| Gold | | Agosi AG* | GERMANY |

| Gold | | Aida Chemical Industries Co., Ltd.* | JAPAN |

| Gold | | Al Etihad Gold Refinery DMCC* | UNITED ARAB EMIRATES |

| Gold | | Alexy Metals** | UNITED STATES OF AMERICA |

| | | | | | | | | | | |

| Gold | | Almalyk Mining and Metallurgical Complex (AMMC)* | UZBEKISTAN |

| Gold | | AngloGold Ashanti Corrego do Sitio Mineracao* | BRAZIL |

| Gold | | Argor-Heraeus S.A.* | SWITZERLAND |

| Gold | | Asahi Pretec Corp.* | JAPAN |

| Gold | | Asahi Refining Canada Ltd.* | CANADA |

| Gold | | Asahi Refining USA Inc.* | UNITED STATES OF AMERICA |

| Gold | | Asaka Riken Co., Ltd.* | JAPAN |

| Gold | | Augmont Enterprises Private Limited** | INDIA |

| Gold | | Aurubis AG* | GERMANY |

| Gold | | Bangalore Refinery* | INDIA |

| Gold | | Bangko Sentral ng Pilipinas (Central Bank of the Philippines)* | PHILIPPINES |

| Gold | | Boliden AB* | SWEDEN |

| Gold | | C. Hafner GmbH + Co. KG* | GERMANY |

| Gold | | C.I Metales Procesados Industriales SAS** | COLOMBIA |

| Gold | | CCR Refinery - Glencore Canada Corporation* | CANADA |

| Gold | | Cendres + Metaux S.A. | SWITZERLAND |

| Gold | | Chimet S.p.A.* | ITALY |

| Gold | | Chugai Mining* | JAPAN |

| Gold | | Dowa* | JAPAN |

| Gold | | DSC (Do Sung Corporation)* | SOUTH KOREA |

| Gold | | Eco-System Recycling Co., Ltd. East Plant* | JAPAN |

| Gold | | Eco-System Recycling Co., Ltd. North Plant* | JAPAN |

| Gold | | Eco-System Recycling Co., Ltd. West Plant* | JAPAN |

| Gold | | Emirates Gold DMCC* | UNITED ARAB EMIRATES |

| Gold | | Geib Refining Corporation* | UNITED STATES OF AMERICA |

| Gold | | GGC Gujrat Gold Centre Pvt. Ltd.** | INDIA |

| Gold | | Gold by Gold Colombia* | COLOMBIA |

| Gold | | Gold Refinery of Zijin Mining Group Co., Ltd.* | CHINA |

| Gold | | Heimerle + Meule GmbH* | GERMANY |

| Gold | | Heraeus Germany GmbH Co. KG* | GERMANY |

| Gold | | Heraeus Metals Hong Kong Ltd.* | CHINA |

| Gold | | Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd.* | CHINA |

| Gold | | Ishifuku Metal Industry Co., Ltd.* | JAPAN |

| Gold | | Istanbul Gold Refinery* | TURKEY |

| Gold | | Italpreziosi* | ITALY |

| Gold | | Japan Mint* | JAPAN |

| Gold | | Jiangxi Copper Co., Ltd.* | CHINA |

| Gold | | JX Nippon Mining & Metals Co., Ltd.* | JAPAN |

| Gold | | Kazzinc* | KAZAKHSTAN |

| Gold | | Kennecott Utah Copper LLC* | UNITED STATES OF AMERICA |

| Gold | | KGHM Polska Miedz Spolka Akcyjna* | POLAND |

| Gold | | Kojima Chemicals Co., Ltd.* | JAPAN |

| Gold | | Korea Zinc Co., Ltd.* | SOUTH KOREA |

| Gold | | L'Orfebre S.A.* | ANDORRA |

| Gold | | LS-NIKKO Copper Inc.* | SOUTH KOREA |

| | | | | | | | | | | |

| Gold | | LT Metal Ltd.* | SOUTH KOREA |

| Gold | | Materion* | UNITED STATES OF AMERICA |

| Gold | | Matsuda Sangyo Co., Ltd.* | JAPAN |

| Gold | | Metal Concentrators SA (Pty) Ltd.* | SOUTH AFRICA |

| Gold | | Metalor Technologies (Hong Kong) Ltd.* | CHINA |

| Gold | | Metalor Technologies (Singapore) Pte., Ltd.* | SINGAPORE |

| Gold | | Metalor Technologies (Suzhou) Ltd.* | CHINA |

| Gold | | Metalor Technologies S.A.* | SWITZERLAND |

| Gold | | Metalor USA Refining Corporation* | UNITED STATES OF AMERICA |

| Gold | | Metalurgica Met-Mex Penoles S.A. De C.V.* | MEXICO |

| Gold | | Mitsubishi Materials Corporation* | JAPAN |

| Gold | | Mitsui Mining and Smelting Co., Ltd.* | JAPAN |

| Gold | | MKS PAMP SA* | SWITZERLAND |

| Gold | | MMTC-PAMP India Pvt., Ltd.* | INDIA |

| Gold | | Nadir Metal Rafineri San. Ve Tic. A.S.* | TURKEY |

| Gold | | Navoi Mining and Metallurgical Combinat* | UZBEKISTAN |

| Gold | | NH Recytech Company* | SOUTH KOREA |

| Gold | | Nihon Material Co., Ltd.* | JAPAN |

| Gold | | Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH* | AUSTRIA |

| Gold | | Ohura Precious Metal Industry Co., Ltd.* | JAPAN |

| Gold | | Planta Recuperadora de Metales SpA* | CHILE |

| Gold | | PT Aneka Tambang (Persero) Tbk* | INDONESIA |

| Gold | | PX Precinox S.A.* | SWITZERLAND |

| Gold | | Rand Refinery (Pty) Ltd.* | SOUTH AFRICA |

| Gold | | REMONDIS PMR B.V.* | NETHERLANDS |

| Gold | | Royal Canadian Mint* | CANADA |

| Gold | | SAAMP* | FRANCE |

| Gold | | Safimet S.p.A | ITALY |

| Gold | | SAFINA A.S.* | CZECHIA |

| Gold | | Samduck Precious Metals | SOUTH KOREA |

| Gold | | Sancus ZFS (L?Orfebre, SA)** | COLOMBIA |

| Gold | | SEMPSA Joyeria Plateria S.A.* | SPAIN |

| Gold | | Shandong Gold Smelting Co., Ltd.* | CHINA |

| Gold | | Shandong Zhaojin Gold & Silver Refinery Co., Ltd.* | CHINA |

| Gold | | Sichuan Tianze Precious Metals Co., Ltd.* | CHINA |

| Gold | | Singway Technology Co., Ltd. | TAIWAN |

| Gold | | Solar Applied Materials Technology Corp.* | TAIWAN |

| Gold | | Sumitomo Metal Mining Co., Ltd.* | JAPAN |

| Gold | | SungEel HiMetal Co., Ltd.* | SOUTH KOREA |

| Gold | | T.C.A S.p.A* | ITALY |

| Gold | | Tanaka Kikinzoku Kogyo K.K.* | JAPAN |

| Gold | | Tokuriki Honten Co., Ltd.* | JAPAN |

| Gold | | TOO Tau-Ken-Altyn* | KAZAKHSTAN |

| Gold | | Torecom* | SOUTH KOREA |

| Gold | | Umicore Precious Metals Thailand* | THAILAND |

| | | | | | | | | | | |

| Gold | | Umicore S.A. Business Unit Precious Metals Refining* | BELGIUM |

| Gold | | United Precious Metal Refining, Inc.* | UNITED STATES OF AMERICA |

| Gold | | Valcambi S.A.* | SWITZERLAND |

| Gold | | WEEEREFINING** | FRANCE |

| Gold | | Western Australian Mint (T/a The Perth Mint)* | AUSTRALIA |

| Gold | | WIELAND Edelmetalle GmbH* | GERMANY |

| Gold | | Yamakin Co., Ltd.* | JAPAN |

| Gold | | Yokohama Metal Co., Ltd.* | JAPAN |

| Gold | | Zhongyuan Gold Smelter of Zhongjin Gold Corporation* | CHINA |

| Tantalum | | AMG Brasil* | BRAZIL |

| Tantalum | | Changsha South Tantalum Niobium Co., Ltd.* | CHINA |

| Tantalum | | D Block Metals, LLC* | UNITED STATES OF AMERICA |

| Tantalum | | F&X Electro-Materials Ltd.* | CHINA |

| Tantalum | | FIR Metals & Resource Ltd.* | CHINA |

| Tantalum | | Global Advanced Metals Aizu* | JAPAN |

| Tantalum | | Global Advanced Metals Boyertown* | UNITED STATES OF AMERICA |

| Tantalum | | Hengyang King Xing Lifeng New Materials Co., Ltd.* | CHINA |

| Tantalum | | Jiangxi Dinghai Tantalum & Niobium Co., Ltd.* | CHINA |

| Tantalum | | Jiangxi Tuohong New Raw Material* | CHINA |

| Tantalum | | JiuJiang JinXin Nonferrous Metals Co., Ltd.* | CHINA |

| Tantalum | | Jiujiang Tanbre Co., Ltd.* | CHINA |

| Tantalum | | Jiujiang Zhongao Tantalum & Niobium Co., Ltd.* | CHINA |

| Tantalum | | KEMET de Mexico* | MEXICO |

| Tantalum | | Materion Newton Inc.* | UNITED STATES OF AMERICA |

| Tantalum | | Metallurgical Products India Pvt., Ltd.* | INDIA |

| Tantalum | | Mineracao Taboca S.A.* | BRAZIL |

| Tantalum | | Mitsui Mining and Smelting Co., Ltd.* | JAPAN |

| Tantalum | | Ningxia Orient Tantalum Industry Co., Ltd.* | CHINA |

| Tantalum | | NPM Silmet AS* | ESTONIA |

| Tantalum | | QuantumClean* | UNITED STATES OF AMERICA |

| Tantalum | | Resind Industria e Comercio Ltda.* | BRAZIL |

| Tantalum | | RFH Yancheng Jinye New Material Technology Co., Ltd.* | CHINA |

| Tantalum | | Taki Chemical Co., Ltd.* | JAPAN |

| Tantalum | | TANIOBIS Co., Ltd.* | THAILAND |

| Tantalum | | TANIOBIS GmbH* | GERMANY |

| Tantalum | | TANIOBIS Japan Co., Ltd.* | JAPAN |

| Tantalum | | TANIOBIS Smelting GmbH & Co. KG* | GERMANY |

| Tantalum | | Telex Metals* | UNITED STATES OF AMERICA |

| Tantalum | | Ulba Metallurgical Plant JSC* | KAZAKHSTAN |

| Tantalum | | XIMEI RESOURCES (GUANGDONG) LIMITED* | CHINA |

| Tantalum | | XinXing HaoRong Electronic Material Co., Ltd.* | CHINA |

| Tantalum | | Yanling Jincheng Tantalum & Niobium Co., Ltd.* | CHINA |

| Tin | | Alpha* | UNITED STATES OF AMERICA |

| Tin | | Aurubis Beerse* | BELGIUM |

| Tin | | Aurubis Berango* | SPAIN |

| | | | | | | | | | | |

| Tin | | Chenzhou Yunxiang Mining and Metallurgy Co., Ltd.* | CHINA |

| Tin | | Chifeng Dajingzi Tin Industry Co., Ltd.* | CHINA |

| Tin | | China Tin Group Co., Ltd.* | CHINA |

| Tin | | CRM Fundicao De Metais E Comercio De Equipamentos Eletronicos Do Brasil Ltda* | BRAZIL |

| Tin | | CRM Synergies* | SPAIN |

| Tin | | CV Ayi Jaya* | INDONESIA |

| Tin | | CV Venus Inti Perkasa* | INDONESIA |

| Tin | | Dowa* | JAPAN |

| Tin | | DS Myanmar* | MYANMAR |

| Tin | | EM Vinto* | BOLIVIA |

| Tin | | Estanho de Rondonia S.A.* | BRAZIL |

| Tin | | Fabrica Auricchio Industria e Comercio Ltda.* | BRAZIL |

| Tin | | Fenix Metals* | POLAND |

| Tin | | Gejiu Non-Ferrous Metal Processing Co., Ltd.* | CHINA |

| Tin | | Gejiu Zili Mining And Metallurgy Co., Ltd. | CHINA |

| Tin | | Guangdong Hanhe Non-Ferrous Metal Co., Ltd.* | CHINA |

| Tin | | Jiangxi New Nanshan Technology Ltd.* | CHINA |

| Tin | | Luna Smelter, Ltd.* | RWANDA |

| Tin | | Magnu's Minerais Metais e Ligas Ltda.* | BRAZIL |

| Tin | | Malaysia Smelting Corporation (MSC)* | MALAYSIA |

| Tin | | Metallic Resources, Inc.* | UNITED STATES OF AMERICA |

| Tin | | Mineracao Taboca S.A.* | BRAZIL |

| Tin | | Minsur* | PERU |

| Tin | | Mitsubishi Materials Corporation* | JAPAN |

| Tin | | O.M. Manufacturing (Thailand) Co., Ltd.* | THAILAND |

| Tin | | O.M. Manufacturing Philippines, Inc.* | PHILIPPINES |

| Tin | | Operaciones Metalurgicas S.A.* | BOLIVIA |

| Tin | | PT Aries Kencana Sejahtera* | INDONESIA |

| Tin | | PT Artha Cipta Langgeng* | INDONESIA |

| Tin | | PT ATD Makmur Mandiri Jaya* | INDONESIA |

| Tin | | PT Babel Inti Perkasa* | INDONESIA |

| Tin | | PT Babel Surya Alam Lestari* | INDONESIA |

| Tin | | PT Bangka Serumpun* | INDONESIA |

| Tin | | PT Belitung Industri Sejahtera** | INDONESIA |

| Tin | | PT Bukit Timah* | INDONESIA |

| Tin | | PT Cipta Persada Mulia* | INDONESIA |

| Tin | | PT Menara Cipta Mulia* | INDONESIA |

| Tin | | PT Mitra Stania Prima* | INDONESIA |

| Tin | | PT Mitra Sukses Globalindo* | INDONESIA |

| Tin | | PT Prima Timah Utama* | INDONESIA |

| Tin | | PT Putera Sarana Shakti (PT PSS)* | INDONESIA |

| Tin | | PT Rajawali Rimba Perkasa* | INDONESIA |

| Tin | | PT Refined Bangka Tin* | INDONESIA |

| Tin | | PT Sariwiguna Binasentosa* | INDONESIA |

| | | | | | | | | | | |

| Tin | | PT Stanindo Inti Perkasa* | INDONESIA |

| Tin | | PT Sukses Inti Makmur* | INDONESIA |

| Tin | | PT Timah Nusantara** | INDONESIA |

| Tin | | PT Timah Tbk Kundur* | INDONESIA |

| Tin | | PT Timah Tbk Mentok* | INDONESIA |

| Tin | | PT Tinindo Inter Nusa | INDONESIA |

| Tin | | PT Tommy Utama* | INDONESIA |

| Tin | | Resind Industria e Comercio Ltda.* | BRAZIL |

| Tin | | Rui Da Hung* | TAIWAN |

| Tin | | Super Ligas** | BRAZIL |

| Tin | | Thaisarco* | THAILAND |

| Tin | | Tin Smelting Branch of Yunnan Tin Co., Ltd.* | CHINA |

| Tin | | Tin Technology & Refining* | UNITED STATES OF AMERICA |

| Tin | | White Solder Metalurgia e Mineracao Ltda.* | BRAZIL |

| Tin | | Yunnan Chengfeng Non-ferrous Metals Co., Ltd.* | CHINA |

| Tungsten | | A.L.M.T. Corp.* | JAPAN |

| Tungsten | | ACL Metais Eireli | BRAZIL |

| Tungsten | | Albasteel Industria e Comercio de Ligas Para Fundicao Ltd. | BRAZIL |

| Tungsten | | Asia Tungsten Products Vietnam Ltd.* | VIETNAM |

| Tungsten | | China Molybdenum Tungsten Co., Ltd.* | CHINA |

| Tungsten | | Chongyi Zhangyuan Tungsten Co., Ltd.* | CHINA |

| Tungsten | | Cronimet Brasil Ltda* | BRAZIL |

| Tungsten | | Fujian Ganmin RareMetal Co., Ltd.* | CHINA |

| Tungsten | | Fujian Xinlu Tungsten Co., Ltd.* | CHINA |

| Tungsten | | Ganzhou Haichuang Tungsten Co., Ltd.* | CHINA |

| Tungsten | | Ganzhou Huaxing Tungsten Products Co., Ltd.* | CHINA |

| Tungsten | | Ganzhou Jiangwu Ferrotungsten Co., Ltd.* | CHINA |

| Tungsten | | Ganzhou Seadragon W & Mo Co., Ltd.* | CHINA |

| Tungsten | | Global Tungsten & Powders Corp.* | UNITED STATES OF AMERICA |

| Tungsten | | Guangdong Xianglu Tungsten Co., Ltd.* | CHINA |

| Tungsten | | H.C. Starck Tungsten GmbH* | GERMANY |

| Tungsten | | Hubei Green Tungsten Co., Ltd.* | CHINA |

| Tungsten | | Hunan Chenzhou Mining Co., Ltd.* | CHINA |

| Tungsten | | Hunan Jintai New Material Co., Ltd.* | CHINA |

| Tungsten | | Hunan Shizhuyuan Nonferrous Metals Co., Ltd. Chenzhou Tungsten Products Branch* | CHINA |

| Tungsten | | Japan New Metals Co., Ltd.* | JAPAN |

| Tungsten | | Jiangwu H.C. Starck Tungsten Products Co., Ltd.* | CHINA |

| Tungsten | | Jiangxi Gan Bei Tungsten Co., Ltd.* | CHINA |

| Tungsten | | Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd.* | CHINA |

| Tungsten | | Jiangxi Xinsheng Tungsten Industry Co., Ltd.* | CHINA |

| Tungsten | | Jiangxi Yaosheng Tungsten Co., Ltd.* | CHINA |

| Tungsten | | Kennametal Fallon* | UNITED STATES OF AMERICA |

| Tungsten | | Kennametal Huntsville* | UNITED STATES OF AMERICA |

| Tungsten | | Lianyou Metals Co., Ltd.* | TAIWAN |

| | | | | | | | | | | |

| Tungsten | | Malipo Haiyu Tungsten Co., Ltd.* | CHINA |

| Tungsten | | Masan High-Tech Materials* | VIETNAM |

| Tungsten | | Niagara Refining LLC* | UNITED STATES OF AMERICA |

| Tungsten | | Philippine Chuangxin Industrial Co., Inc.* | PHILIPPINES |

| Tungsten | | TANIOBIS Smelting GmbH & Co. KG* | GERMANY |

| Tungsten | | Wolfram Bergbau und Hutten AG* | AUSTRIA |

| Tungsten | | Xiamen Tungsten (H.C.) Co., Ltd.* | CHINA |

| Tungsten | | Xiamen Tungsten Co., Ltd.* | CHINA |

† Smelter and refiner facility names and locations as reported by RMI as of March 20, 2023.

* Denotes smelters and refiners which are conformant to a responsible mineral assurance program as of March 20, 2023.

** Denotes smelters and refiners which are participating in a responsible mineral assurance program as of March 20, 2023.

Conclusion and Future Due Diligence Measures

The facilities reported in Table 2 processed the necessary conflict minerals in our products based on responses received from our Surveyed Suppliers as of March 20, 2023. As of March 20, 2023, 96% of the reported smelter and refiner facilities are conformant or are participating in a responsible mineral assurance program. All smelters and refiners that we know or have reason to believe may source conflict minerals from the Covered Countries and that may not be solely from recycled or scrap sources were conformant to a responsible mineral assurance program as of March 20, 2023. We have no reason to believe that any of the reported smelter and refiner facilities directly or indirectly finance or benefit armed groups in the Covered Countries. We are continuing to engage in the activities described above in “Design of Responsible Minerals Program,” and we are continuing to follow up with suppliers that are not meeting our requirements, as well as contacting smelters and refiners that are not yet conformant to a responsible mineral assurance program. We are encouraging and assisting such smelters and refiners to become conformant to a responsible mineral assurance program, thus supporting our efforts to build ethical and socially responsible supply chains for our company.

Our efforts to determine the mine or location of origin of the necessary conflict minerals in all our products with the greatest possible specificity consisted of the due diligence measures described in this Report. In particular, we relied on the information made available by responsible mineral assurance programs for the smelters and refiners in our supply chain because such programs review and audit whether sufficient evidence exists regarding the mine and/or location of origin of the conflict minerals that the audited smelter and refiner facilities have processed. We also sought source and chain of custody information directly from smelters and refiners and from publicly available sources and, if we determined such information to be reliable, we used the information to make reasonable conclusions on the source and chain of custody of the conflict minerals processed by facilities that were not conformant to or participating in a responsible mineral assurance program

Efforts Pertaining to Cobalt

Intel continues to evaluate and expand upon the framework of our due diligence programs as material use and risk profiles emerge. Cobalt has been identified as a mineral of concern due to reports of child labor and other social impacts in CAHRAs. Aligned with our approach to conflict minerals, our desire is not to eliminate sourcing from CAHRAs, but rather to identify and mitigate risks in our supply chain to obtain only minerals that are sourced responsibly.

In 2022, Intel conducted a supply chain survey of 45 suppliers that we determined may contribute intentionally added cobalt to our products using the Extended Minerals Reporting Template (EMRT), a supply chain survey designed by RMI to identify the smelters and refiners that process the necessary cobalt contained in our products and the associated country of origin. All 45 suppliers responded with a completed EMRT. We are using the information obtained to conduct due diligence on the identified smelters and refiners and actively focus our outreach efforts to encourage RMAP

involvement. Participation in a program such as RMAP verifies these facilities have management systems in place to ensure the cobalt they process is responsibly sourced in alignment with OECD Guidance. We conducted virtual outreach to smelters and refiners not yet participating in RMAP and worked with direct suppliers to facilitate alternative sourcing where appropriate.

As of March 20, 2023, we have identified 69 cobalt smelters and refiners reported by Surveyed Suppliers in our supply chain. Of those 69 smelters and refiners, 42 (61%) are either conformant or have begun participating in RMAP. Of the remaining smelters and refiners, 23 are eligible to participate in RMAP, and we continue to conduct outreach to encourage participation. We identified four facilities reported in our supply chain that are not eligible for or were deemed not conformant to RMAP, and we requested all suppliers reporting these facilities to use alternate sourcing for products sold to Intel. As of March 20, 2023, eight suppliers are still reporting the four smelters and refiners that are not eligible for or were deemed not conformant to RMAP, and we are working with such suppliers to find alternate sourcing.

Intel strongly believes that collaboration among industry, government, NGOs, and civil society experts is the best way to effectively create positive change in our supply chain. Intel is participating in developing industry-wide standards to better align, and thus strengthen, the collective approach to responsible cobalt sourcing. This is demonstrated by our previous collaboration with RMI to establish industry standards regarding responsible cobalt sourcing, including the EMRT and the RMAP Cobalt Due Diligence Standard. Intel has continued its cobalt efforts by actively participating in RMI’s ASM Working Group, which contributed to The Cobalt Action Partnership’s development of a common set of best practices and minimum standards for cobalt that is mined on an artisanal and small-scale basis (ASM), and by conducting virtual outreach to 10 cobalt refiners. Intel recognizes the local socio-economic importance of the ASM sector in CAHRAs and seeks to assist ASM sites in meeting downstream compliance requirements through our contributions to the Better Mining ASM Mine Monitoring Program in partnership with RMI and RCS Global. These efforts further our pursuit of responsibly sourced cobalt in our products.

On our website at www.intel.com/responsibleminerals, we regularly update our EMRT, which contains a smelter and refiner list that includes the facilities that, to the extent known, may have processed the cobalt in our products based on responses received from our Surveyed Suppliers.

Intel RISE Responsible Minerals Sourcing Initiative

In May of 2020, we announced Intel’s corporate RISE Strategy to create a more responsible, inclusive, and sustainable world, enabled through technology and our collective actions. As a key technology industry initiative within our RISE goals, Intel committed, by 2030, to significantly broaden our impact in responsible minerals and accelerate the creation of sourcing standards for a much wider set of minerals across CAHRAs globally.

In 2022, we sent our second Intel Minerals Survey for aluminum, copper, nickel, silver, lead, and zinc to suppliers who contribute these materials to our Intel manufactured microprocessors. This is an important step in our RISE strategy as we work to map our supply chains for our highest priority minerals. Although sourcing of these minerals is not yet widely reported, we received a response from 83% of relevant suppliers. We are continuing to pursue information on smelters and refiners in our extended supply chain. To contribute to standards and help define and engage in due diligence within the copper supply chain, Intel is an active partner member of The Copper Mark, participating in the RRA Technical Revision Committee, the Technical Working Group and the Assessment sub-team. We also participate in the RMI MRT Working Group and were a key driver of RMI releasing the Pilot Reporting Template (PRT), which provides an industry standard template for additional minerals reporting. This is an important milestone in aligning the industry to increased transparency in the critical minerals supply chain. We expect our next steps to include work with our suppliers to continue mapping our supply chain for the targeted minerals, as well as other priority minerals such as silicon and battery materials. Additionally, we continue to partner with industry associations to put standards in place to enable our ultimate goal of responsible sourcing for all the minerals in our supply chain. We intend to continue to identify the highest priority minerals in pursuit of our 2030 RISE Goals.

Intel's mission for the future is to maintain the positive progress we have made on 3TG and cobalt to date, and to proactively address emerging risks from the expanding scope of materials and geographies. Our ambition is to apply our learning from the past decade and to work with our industry to broaden and accelerate the creation of sourcing standards for a much wider set of minerals globally.

Intel and the Intel logo, Intel Atom, Intel Core, Tofino, and Xeon are trademarks of Intel Corporation or its subsidiaries.

Other names and brands may be claimed as the property of others. The “Efforts Pertaining to Cobalt”, and “Intel RISE Responsible Minerals Sourcing Initiative” sections are not required by the Rule and are furnished as a supplement to this Report.