UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011.

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File Number 000-06217

INTEL CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 94-1672743 |

State or other jurisdiction of incorporation or organization | | (I.R.S. Employer Identification No.) |

| |

| 2200 Mission College Boulevard, Santa Clara, California | | 95054-1549 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code(408) 765-8080

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

| Common stock, $0.001 par value | | The NASDAQ Global Select Market* |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yesx No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

| | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of July 1, 2011, based upon the closing price of the common stock as reported by The NASDAQ Global Select Market* on such date, was

$119.0 billion

4,996 million shares of common stock outstanding as of February 10, 2012

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement related to its 2012 Annual Stockholders’ Meeting to be filed subsequently—Part III of this Form 10-K.

INTEL CORPORATION

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

INDEX

PART I

Company Overview

We design and manufacture advanced integrated digital technology platforms. A platform consists of a microprocessor and chipset, and may be enhanced by additional hardware, software, and services. We sell these platforms primarily to original equipment manufacturers (OEMs), original design manufacturers (ODMs), and industrial and communications equipment manufacturers in the computing and communications industries. Our platforms are used in a wide range of applications, such as PCs (including Ultrabook™ systems), data centers, tablets, smartphones, automobiles, automated factory systems, and medical devices. We also develop and sell software and services primarily focused on security and technology integration. We were incorporated in California in 1968 and reincorporated in Delaware in 1989.

Company Strategy

Our goal is to be the preeminent computing solutions company that powers the worldwide digital economy. We believe that the proliferation of the Internet and cloud computing has driven fundamental changes in the computing industry. We are transforming our primary focus from the design and manufacture of semiconductor chips for PCs and servers to the delivery of solutions consisting of hardware and software platforms and supporting services. The number and variety of devices connected to the Internet are growing, and computing is becoming an increasingly engaging and personal experience. End users value consistency across devices that connect seamlessly and effortlessly to the Internet and to each other. We enable this experience by innovating around three pillars of computing: energy-efficient performance, connectivity, and security.

| • | | Energy-Efficient Performance. We are focusing on improved energy-efficient performance for computing and communications systems and devices. Improved energy-efficient performance involves balancing higher performance with lower power consumption, and may result in longer battery life, reduced system heat output, power savings, and lower total cost of ownership. |

| • | | Connectivity. We are positioning our business to take advantage of the growth in devices that compute and connect to the Internet and to each other. In the first quarter of 2011, we acquired the Wireless Solutions (WLS) business of Infineon Technologies AG. This acquisition enables us to offer a portfolio of products that covers a broad range of wireless connectivity options. |

| • | | Security. Our goal is to enhance security features through a combination of hardware and software solutions. This may include identity protection and fraud deterrence; detection and prevention of malware; securing data and assets; as well as system recovery and enhanced security patching. In the first quarter of 2011, we acquired McAfee, Inc. We believe this acquisition accelerates and enhances our hardware and software security solutions, improving the overall security of our platforms. |

To succeed in the changing computing environment, we have the following key objectives:

| • | | Strive to ensure that Intel® technology remains the best choice for the PC as well as cloud computing and the data center. |

| • | | Expand platforms into adjacent market segments to bring compelling new solutions to the smartphone, the tablet, the car, and the embedded world. |

| • | | Enable devices that connect to the Internet and to each other to create a continuum of personal computing. This continuum would give consumers a set of secure, consistent, engaging, and personalized computing experiences. |

| • | | Positively impact the world through our actions and the application of our energy-efficient technology. |

We will use our core assets to meet these objectives. Our core assets include our silicon and process technology, our architecture and platforms, our global presence, our strong relationships across the industry, and our brand recognition. We believe that applying these core assets to our key focus areas provides us with the scale, capacity, and global reach to establish new technologies and respond to customers’ needs quickly. Some of our core assets and key focus areas are:

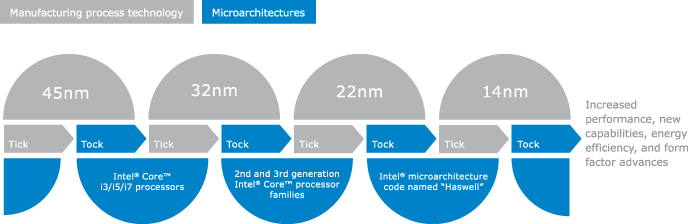

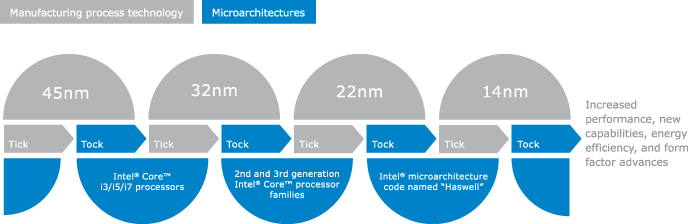

| • | | Silicon and Manufacturing Technology Leadership. We have long been a leader in silicon process technology and manufacturing, and we aim to continue our lead through investment and innovation in this critical area. We drive a regular two-year upgrade cycle—introducing a new microarchitecture approximately every two years and ramping the next generation of silicon process technology in the intervening years. We refer to this as our “tick-tock” technology development cadence. Additionally, we aim to have the best process technology, and unlike most semiconductor companies, we primarily manufacture our products in our own facilities. This allows us to optimize performance, reduce our time to market, and scale new products more rapidly. |

| • | | Architecture and Platforms. We are developing a wide range of solutions for devices that span the computing continuum, from PCs (including Ultrabook systems), tablets, and smartphones to in-vehicle infotainment systems and beyond. Users want computing experiences that are consistent and devices that are interoperable. Users and developers value consistency of architecture, which provides a common framework that allows for reduced time to market, with the ability to leverage technologies across multiple form factors. We believe that we can meet the needs of both users and developers by offering Intel® architecture-based computing solutions across the computing continuum. We continue to invest in improving Intel architecture to deliver increased value to our customers and expand the capabilities of the architecture in adjacent market segments. |

| • | | Software. We enable and advance the computing ecosystem by providing development tools and support to help software developers create software applications and operating systems that take advantage of our platforms. We seek to expedite growth in various market segments, such as the embedded market segment, through our software offerings. Additionally, we have collaborated with other companies to develop software platforms optimized for our Intel® Atom™ processors and that support multiple hardware architectures as well as multiple operating systems. We also deliver solutions and services that help secure systems and networks around the world. |

| • | | Customer Orientation. Our strategy focuses on developing our next generation of products based on the needs and expectations of our customers. In turn, our products help enable the design and development of new form factors and usage models for businesses and |

| | | consumers. We offer platforms that incorporate various components designed and configured to work together to provide an optimized solution compared to components that are used separately. Additionally, we promote industry standards that we believe will yield innovation and improved technologies for users. |

| • | | Strategic Investments. We make investments in companies around the world that we believe will generate financial returns, further our strategic objectives, and support our key business initiatives. Our investments, including those made through Intel Capital, generally focus on investing in companies and initiatives to stimulate growth in the digital economy, create new business opportunities for Intel, and expand global markets for our products. |

| • | | Stewardship. We are committed to developing energy-efficient technology solutions that can be used to address major global problems while reducing our environmental impact. We are also committed to helping transform education globally through our technology, program, and policy leadership, as well as funding through the Intel Foundation. In addition, we strive to cultivate a work environment in which engaged, energized employees can thrive in their jobs and in their communities. |

Our continued investment in developing our assets and execution on key focus areas will strengthen our competitive position as we enter and expand into new market segments. We believe that these new market segments will result in demand that is incremental to that of microprocessors designed for notebook and desktop computers, and Ultrabook systems. We also believe that increased Internet traffic and use of cloud computing create a need for greater server infrastructure, including server products optimized for energy-efficient performance and virtualization.

Business Organization

As of December 31, 2011, we managed our business through the following operating segments.

For a description of our operating segments, see “Note 30: Operating Segment and Geographic Information,” in Part II, Item 8 of this Form 10-K.

Products

Platforms

We offer platforms that incorporate various components and technologies, including a microprocessor and chipset, and may be enhanced by additional hardware, software, and services.

A microprocessor—the central processing unit (CPU) of a computer system—processes system data and controls other devices in the system. We offer microprocessors with one or multiple processor cores. Multi-core microprocessors can enable improved multitasking and energy-efficient performance by distributing computing tasks across two or more cores. Our 2nd and 3rd generation Intel® Core™ processor families integrate graphics functionality onto the processor die. In contrast, some of our previous-generation processors incorporated a separate graphics chip inside the processor package. We also offer graphics functionality as part of a separate chipset outside the processor package. Processor packages may also integrate the memory controller.

A chipset sends data between the microprocessor and input, display, and storage devices, such as the keyboard, mouse, monitor, hard drive or solid-state drive, and CD, DVD, or

Blu-ray* drive. Chipsets extend the audio, video, and other capabilities of many systems and perform essential logic functions, such as balancing the performance of the system and removing bottlenecks. Some chipsets may also include graphics functionality or a memory controller, for use with our microprocessors that do not integrate those system components.

We offer and are continuing to develop System-on-Chip (SoC) products that integrate our core processing functions with other system components, such as graphics, audio, and video, onto a single chip. SoC products are designed to reduce total cost of ownership, provide improved performance due to higher integration and lower power consumption, and enable smaller form factors.

We also offer features to improve our platform capabilities. For example, we offer Intel® vPro™ technology, a computer hardware-based security technology for the notebook and desktop market segments, designed to provide businesses with increased manageability, upgradeability, energy-efficient performance, and security while lowering the total cost of ownership. In 2011, we introduced the 2nd generation Intel® Core™vPro™ processor family, designed to deliver security, manageability, and power management on the 32-nanometer (nm) process technology.

We offer a range of platforms that are based upon the following microprocessors:

Phone Components

In addition to our Intel Atom processor-based products for the smartphone market segment, we offer components and platforms for mobile phones and connected devices. Key mobile phone components include baseband processors, radio frequency transceivers, and power management integrated circuits. We also offer complete mobile phone platforms, including Bluetooth* wireless technology and GPS receivers, software solutions, customization, and essential interoperability tests. Our mobile phone solutions based on multiple industry standards enable mobile voice and high-speed data communications for a broad range of devices around the world.

McAfee

McAfee offers software products that provide security solutions for consumer, mobile, and corporate environments designed to protect systems from malicious virus attacks as well as loss of data. McAfee’s products include endpoint security, network and content security, risk and compliance, and consumer and mobile security.

Wind River Software Group

The Wind River Software Group develops and licenses embedded and mobile device software products, including operating systems, virtualization technologies, middleware, and development tools.

Non-Volatile Memory Solutions

We offer NAND flash memory products primarily used in solid-state drives (SSDs), portable memory storage devices, digital camera memory cards, and other devices. We offer SSDs in densities ranging from 32 gigabytes (GB) to 600 GB. Our NAND flash memory products are manufactured by IM Flash Technologies, LLC (IMFT) and IM Flash Singapore, LLP (IMFS).

Products and Product Strategy by Operating Segment

OurPC Client Groupoperating segment offers products that are incorporated into notebook platforms (including Ultrabook systems), and desktop computers for consumers and businesses.

| • | | Our strategy for the notebook computing market segment is to offer notebook PC technologies designed to improve performance, battery life, and wireless connectivity, as well as to allow for the design of smaller, lighter, and thinner form factors. We are also increasing our focus on notebook products designed to offer technologies that provide increased manageability and security. In addition, we are focusing on providing seamless connectivity within our platforms through the use and development of communication technologies such as wireless wide area network, WiFi, and 4G LTE. |

| • | | Our strategy for the Ultrabook systems market segment is to offer designs that enable a new user experience by accelerating a new class of mobile computers that use low power processors. These computers combine the performance and capabilities of today’s notebooks and tablets in a thin and light form factor that is highly responsive, secure, and seamlessly connects to the Internet and other enabled devices. The first generation of Ultrabook systems, which were released in the fourth quarter of 2011, was built using our 2nd generation Intel® Core™ processor family. |

| • | | Our strategy for the desktop computing market segment is to offer products that provide increased manageability, security, and energy-efficient performance while lowering total cost of ownership for businesses. For consumers in the desktop computing market segment, we also focus on the design of products for high-end enthusiast PCs and mainstream PCs with rich audio and video capabilities. |

OurData Center Group operating segment offers products that provide leading performance, energy efficiency, and virtualization technology for server, workstation, and storage platforms. We are also increasing our focus on products designed for high-performance and mission-critical computing, cloud computing services, and emerging markets. Such products include the introduction of our new server platform, which incorporates our 32nm Intel® Xeon® processors supporting up to 10 cores. In addition, we offer wired connectivity solutions, such as our Thunderbolt™ technology, that are incorporated into products that make up the infrastructure for the Internet.

Ourother Intel architecture operating segments offer products that are designed for use in the mobile communications, embedded, netbook, tablet, and smartphone market segments.

| • | | Our strategy for the mobile communications market segment is to offer a portfolio of products that covers a broad range of wireless connectivity options by combining Intel® WiFi technology with our 2G and 3G technologies, and creates a combined path to accelerate industry adoption of 4G LTE. These products feature low power consumption, innovative designs, and multi-standard platform solutions. |

| • | | Our strategy for the embedded market segment is to drive Intel architecture as a solution for embedded applications by delivering long life-cycle support, software and architectural scalability, and platform integration. |

| • | | Our strategy for the netbook market segment is to enable small form-factor and portable companion devices that are affordable for entry-level computing. We are focusing on offering performance capabilities and features across multiple operating systems that allow for enhanced end-user experiences, such as all-day battery life, seamless connectivity, improved synchronization of content between devices, and enhanced media sharing. |

| • | | Our strategy for the tablet market segment is to offer Intel architecture solutions optimized for multiple operating systems and application ecosystems, such as our recent introduction of a platform for tablets that incorporates the Intel Atom processor (formerly code named Oak Trail). We are accelerating the process technology development for our Intel Atom product line to deliver increased battery life, performance, and feature integration. |

| • | | Our strategy for the smartphone device market segment is to offer Intel Atom processor-based products that enable smartphones to deliver innovative content and services. Such products include the introduction of a new platform for smartphones that incorporates the Intel Atom processor (formerly code named Medfield), which will deliver increased performance and system responsiveness while also enabling a longer battery life. |

Oursoftware and services operating segments create differentiated user experiences on Intel platforms. We differentiate by combining Intel platform features and enhanced software and services. Our three main initiatives include:

| • | | developing platforms that can be used across multiple operating systems, applications, and services across all Intel products; |

| • | | optimizing features and performance by enabling the software ecosystem to quickly take advantage of new platform features and capabilities; and |

| • | | delivering complete solutions by utilizing software, services, and hardware to create a more secure online experience, such as our recent introduction of McAfee DeepSAFE* technology, which provides additional security below the operating system of the platform. |

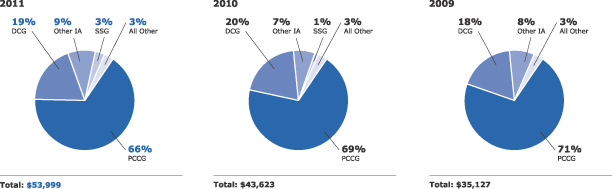

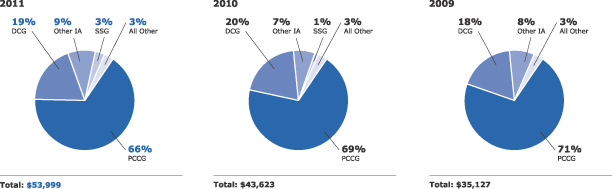

Revenue by Major Operating Segment

Net revenue for the PC Client Group (PCCG) operating segment, the Data Center Group (DCG) operating segment, the other Intel architecture (Other IA) operating segments, and the software and services (SSG) operating segments is presented as a percentage of our consolidated net revenue. Other IA includes Intel Mobile Communications, the Intelligent Solutions Group, the Netbook and Tablet Group, and the Ultra-Mobility Group operating segments. SSG includes McAfee, the Wind River Software Group, and the Software and Services Group operating segments. All other consists primarily of revenue from the Non-Volatile Memory Solutions Group.

Percentage of Revenue by Major Operating Segment

(Dollars in Millions)

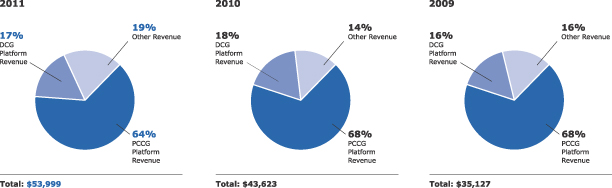

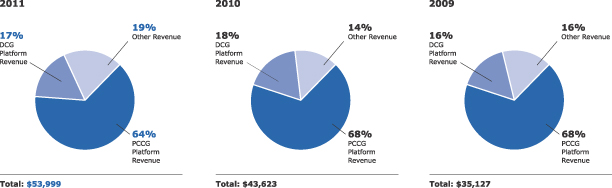

Revenue from sales of platforms presented as a percentage of our consolidated net revenue was as follows:

Percentage of Revenue from Platform Sales

(Dollars in Millions)

Competition

Over the past few years, the number and variety of computing devices have expanded rapidly, creating a connected computing landscape that extends from the largest supercomputers and data centers to the smallest mobile and embedded devices. There are frequent product introductions, and these products are becoming increasingly capable. The competitive environment in the computing industry is in a constant state of flux, as customers and collaborators in one part of our business can quickly become competitors in another. New market segments can emerge rapidly. We are focused on our strategy to expand into market segments beyond our traditional PC and server businesses—including consumer electronics devices, embedded applications, smartphones, and tablets—where we face several incumbent suppliers.

One of our important competitive advantages is the combination of our network of manufacturing and assembly and test facilities with our global architecture design teams. This network enables us to have more direct control over our processes, quality control, product cost, production timing, performance, and other factors. Most of our competitors rely on third-party foundries and subcontractors such as Taiwan Semiconductor Manufacturing Company, Ltd. or GlobalFoundries Inc. for their manufacturing and assembly and test needs.

Our process technology leadership allows us to shrink the size of our transistors, optimizing power and performance characteristics and improving our ability to add more transistors and features. This leads to more powerful, energy-efficient microprocessors. We believe that as the need for computing power in smartphones and tablets grows, our ability to add transistors will become an important competitive advantage for our offerings in those market segments.

Our platforms primarily compete based on performance, energy efficiency, innovative design and features, price, quality and reliability, brand recognition, and availability. Other important competitive factors include development of

the software ecosystem, security, connectivity, and compatibility with other devices in the computing continuum. The ability of our architecture to support multiple operating systems, including legacy environments based on x86, is an advantage in offering OEM customers operating system choices. We believe that our platform strategy to integrate multiple hardware and software technologies gives us a significant competitive advantage.

For many years, Advanced Micro Devices, Inc. (AMD) has been our primary competitor in the market segments for platforms used in notebooks and desktops. AMD also competes with us in the server market segment along with International Business Machines Corporation (IBM) and Oracle Corporation. Companies offering ARM Limited (ARM) based designs are also attempting to expand into the notebook, desktop, and server market segments. In addition, our platforms with integrated graphics and chipsets compete with NVIDIA Corporation’s graphics processors; NVIDIA has shifted some of the workload traditionally performed by the microprocessor to its graphics processor.

Companies using ARM or MIPS Technologies, Inc. (MIPS) based designs are our primary competitors in the consumer electronics devices and embedded applications market segments. In smartphones and tablets, we face established competitors such as QUALCOMM Incorporated, NVIDIA, and Texas Instruments Incorporated, which deliver SoC solutions based on the ARM architecture and complementary wireless technologies, as well as companies that incorporate SoC solutions that they manufacture. The primary competitor for McAfee’s family of security products and services is Symantec Corporation.

Manufacturing and Assembly and Test

As of December 31, 2011, 78% of our wafer fabrication, including microprocessors and chipsets, was conducted within the U.S. at our facilities in Arizona, New Mexico, Oregon, and Massachusetts. The remaining 22% of our wafer fabrication was conducted outside the U.S. at our facilities in Ireland, China, and Israel.

As of December 31, 2011, we primarily manufactured our products in wafer fabrication facilities at the following locations:

| | | | | | |

Products | | Wafer Size | | Process Technology | | Locations |

Microprocessors | | 300mm | | 22nm | | Oregon, Arizona, Israel |

Microprocessors and chipsets | | 300mm | | 32nm | | New Mexico, Arizona, Oregon |

Microprocessors | | 300mm | | 45nm | | New Mexico |

Chipsets | | 300mm | | 65nm | | Ireland, Arizona, China |

Chipsets, microprocessors, and other products | | 300mm | | 90nm | | Ireland |

Chipsets | | 200mm | | 130nm | | Massachusetts |

As of December 31, 2011, a substantial majority of our microprocessors were manufactured on 300-millimeter (mm) wafers using our 32nm process technology. In the second half of 2011, we began manufacturing microprocessors using our 22nm process technology. As we move to each succeeding generation of manufacturing process technology, we incur significant start-up costs to prepare each factory for manufacturing. However, continuing to advance our process technology provides benefits that we believe justify these costs. The benefits of moving to each succeeding generation of manufacturing process technology can include using less space per transistor, reducing heat output from each transistor, and increasing the number of integrated features on each chip. These advancements can result in microprocessors that are higher performing, consume less power, and cost less to manufacture. In addition, with each shift to a new process technology, we are able to produce more microprocessors per square foot of our wafer fabrication facilities. The costs to develop our process technology are significantly less than adding capacity by building additional wafer fabrication facilities using older process technology.

We use third-party manufacturing companies (foundries) to manufacture wafers for certain components, including networking and communications products. In addition, we primarily use subcontractors to manufacture board-level products and systems, and purchase certain communications networking products and mobile phone components from external vendors primarily in the Asia-Pacific region.

Following the manufacturing process, the majority of our components are subject to assembly and test. We perform our components assembly and test at facilities in Malaysia, China, Costa Rica, and Vietnam. To augment capacity, we use subcontractors to perform assembly of certain products, primarily chipsets and networking and communications products. In addition, we use subcontractors to perform assembly and test of our mobile phone components.

Our NAND flash memory products are manufactured by IMFT and IMFS using 20nm, 25nm, 34nm, or 50nm process technology, and assembly and test of these products is performed by Micron Technology, Inc. and other external subcontractors. For further information, see “Note 11: Equity Method and Cost Method Investments” in Part II, Item 8 of this Form 10-K.

Our employment practices are consistent with, and we expect our suppliers and subcontractors to abide by, local country law. In addition, we impose a minimum employee age requirement as well as progressive Environmental, Health, and Safety (EHS) requirements, regardless of local law.

We have thousands of suppliers, including subcontractors, providing our various materials and service needs. We set expectations for supplier performance and reinforce those expectations with periodic assessments. We communicate those expectations to our suppliers regularly and work with them to implement improvements when necessary. We seek, where possible, to have several sources of supply for all of these materials and resources, but we may rely on a single or limited number of suppliers, or upon suppliers in a single country. In those cases, we develop and implement plans and actions to reduce the exposure that would result from a disruption in supply. We have entered into long-term contracts with certain suppliers to ensure a portion of our silicon supply.

Our products are typically produced at multiple Intel facilities at various sites around the world, or by subcontractors that have multiple facilities. However, some products are produced in only one Intel or subcontractor facility, and we seek to implement action plans to reduce the exposure that would result from a disruption at any such facility. See “Risk Factors” in Part I, Item 1A of this Form 10-K.

Research and Development

We are committed to investing in world-class technology development, particularly in the design and manufacture of integrated circuits. Research and development (R&D) expenditures were $8.4 billion in 2011 ($6.6 billion in 2010 and $5.7 billion in 2009).

Our R&D activities are directed toward developing the technology innovations (such as three-dimensional Tri-Gate and Hi-k metal gate transistor technologies) that we believe will deliver our next generation of products, which will in turn enable new form factors and usage models for businesses and consumers. Our R&D activities range from designing and developing new products and manufacturing processes to researching future technologies and products.

We are focusing our R&D efforts on advanced computing technologies, developing new microarchitectures, advancing our silicon manufacturing process technology, delivering the next generation of microprocessors and chipsets, improving our platform initiatives, and developing software solutions and tools to support our technologies. Our R&D efforts enable new levels of performance and address areas such as energy efficiency, security, scalability for multi-core architectures, system manageability, and ease of use. We continue to make significant R&D investments in the development of SoCs to enable growth in areas such as smartphones, tablets, and embedded applications. In addition, we continue to make significant investments in wireless technologies, graphics, and high-performance computing.

As part of our R&D efforts, we plan to introduce a new microarchitecture for our notebook, Ultrabook system, desktop, and Intel Xeon processors approximately every two years and ramp the next generation of silicon process technology in the intervening years. We refer to this as our “tick-tock” technology development cadence. In 2011, we started manufacturing products (formerly code named Ivy Bridge) using our new 22nm three-dimensional Tri-Gate transistor process technology (22nm process technology). This technology is the first to use a three-dimensional transistor design, which is expected to improve performance

and energy efficiency compared to the existing two-dimensional transistor structure, and significantly decreases the power targets for notebook processors. We expect to begin manufacturing products using a new microarchitecture using our 22nm process technology in 2012. We are currently developing 14nm process technology, our next-generation process technology, and expect to begin manufacturing products using that technology in 2013. Our leadership in silicon technology has enabled us to make “Moore’s Law” a reality. Moore’s Law predicted that transistor density on integrated circuits would double about every two years.

Our leadership in silicon technology has also helped expand on the advances anticipated by Moore’s Law by bringing new capabilities into silicon and producing new products optimized for a wider variety of applications. We have accelerated the Intel Atom processor-based SoC roadmap for netbooks, smartphones, tablets, and other devices, from 32nm through 22nm to 14nm within three successive years. Intel Atom processors will eventually be on the same process technology as our leading-edge products. We expect that this acceleration will result in a significant reduction in transistor leakage, lower active power, and an increase in transistor density to enable more powerful smartphones, tablets, and netbooks with more features and longer battery life.

Our R&D model is based on a global organization that emphasizes a collaborative approach to identifying and developing new technologies, leading standards initiatives, and influencing regulatory policies to accelerate the adoption of new technologies, including joint pathfinding conducted between researchers at Intel Labs and our business groups. We centrally manage key cross-business group product initiatives to align and prioritize our R&D activities across these groups. In addition, we may augment our R&D activities by investing in companies or entering into agreements with companies that have similar R&D focus areas, as well as directly purchasing intellectual property rights (IP) applicable to our R&D initiatives.

Employees

As of December 31, 2011, we had 100,100 employees worldwide (82,500 as of December 25, 2010), with approximately 55% of those employees located in the U.S. (55% as of December 25, 2010). The majority of the increase in employees was due to employees hired as a result of the acquisitions of McAfee and the WLS business of Infineon.

Sales and Marketing

Customers

We sell our products primarily to OEMs and ODMs. ODMs provide design and/or manufacturing services to branded and unbranded private-label resellers. In addition, we sell our products to other manufacturers, including makers of a wide range of industrial and communications equipment. Our customers also include those who buy PC components and our other products through distributor, reseller, retail, and OEM channels throughout the world.

Our worldwide reseller sales channel consists of thousands of indirect customers—systems builders that purchase Intel microprocessors and other products from our distributors. We have a boxed processor program that allows distributors to sell Intel microprocessors in small quantities to these systems-builder customers; boxed processors are also available in direct retail outlets.

In 2011, Hewlett-Packard Company accounted for 19% of our net revenue (21% in 2010 and 2009) and Dell Inc. accounted for 15% of our net revenue (17% in 2010 and 2009). No other customer accounted for more than 10% of our net revenue. For information about revenue and operating income by operating segment, and revenue from unaffiliated customers by geographic region/country, see “Results of Operations” in Part II, Item 7 and “Note 30: Operating Segment and Geographic Information” in Part II, Item 8 of this Form 10-K.

Sales Arrangements

Our products are sold through sales offices throughout the world. Sales of our products are typically made via purchase order acknowledgments that contain standard terms and conditions covering matters such as pricing, payment terms, and warranties, as well as indemnities for issues specific to our products, such as patent and copyright indemnities. From time to time, we may enter into additional agreements with customers covering, for example, changes from our standard terms and conditions, new product development and marketing, private-label branding, and other matters. Most of our sales are made using electronic and web-based processes that allow the customer to review inventory availability and track the progress of specific goods ordered. Pricing on particular products may vary based on volumes ordered and other factors. We also offer discounts, rebates, and other incentives to customers to increase acceptance of our products and technology.

Our products are typically shipped under terms that transfer title to the customer, even in arrangements for which the recognition of revenue and related costs of sales is deferred. Our standard terms and conditions of sale typically provide that payment is due at a later date, generally 30 days after shipment or delivery. Our credit department sets accounts receivable and shipping limits for individual customers to control credit risk to Intel arising from outstanding account balances. We assess credit risk through quantitative and qualitative analysis, and from this analysis, we establish credit limits and determine whether we will use one or more credit support devices, such as a third-party guarantee or standby letter of credit, or credit insurance. Credit losses may still be incurred due to bankruptcy, fraud, or other failure of the customer to pay. For information about our allowance for doubtful receivables, see “Schedule II—Valuation and Qualifying Accounts” in Part IV of this Form 10-K.

Most of our sales to distributors are made under agreements allowing for price protection on unsold merchandise and a right of return on stipulated quantities of unsold merchandise. Under the price protection program, we give distributors credits for the difference between the original price paid and the current price that we offer. On most products, there is no

contractual limit on the amount of price protection, nor is there a limit on the time horizon under which price protection is granted. The right of return granted generally consists of a stock rotation program in which distributors are able to exchange certain products based on the number of qualified purchases made by the distributor. We have the option to grant credit for, repair, or replace defective products, and there is no contractual limit on the amount of credit that may be granted to a distributor for defective products.

Distribution

Distributors typically handle a wide variety of products, including those that compete with our products, and fill orders for many customers. We also utilize third-party sales representatives who generally do not offer directly competitive products but may carry complementary items manufactured by others. Sales representatives do not maintain a product inventory; instead, their customers place orders directly with us or through distributors. We have several distribution warehouses that are located in close proximity to key customers.

Backlog

Over time, our larger customers have generally moved to lean-inventory or just-in-time operations rather than maintaining larger inventories of our products. We have arrangements with these customers to seek to quickly fill orders from regional warehouses. As a result, our manufacturing production is based on estimates and advance non-binding commitments from customers as to future purchases. Our order backlog as of any particular date is a mix of these commitments and specific firm orders that are made primarily pursuant to standard purchase orders for delivery of products. Only a small portion of our orders is non-cancelable, and the dollar amount associated with the non-cancelable portion is not significant.

Seasonal Trends

Our platform sales generally have followed a seasonal trend. Historically, our sales have been higher in the second half of the year than in the first half of the year, accelerating in the third quarter and peaking in the fourth quarter. Consumer and business purchases of PCs have historically been higher in the second half of the year.

Marketing

Our corporate marketing objectives are to build a strong, well-known Intel corporate brand that connects with businesses and consumers, and to offer a limited number of meaningful and valuable brands in our portfolio to aid businesses and consumers in making informed choices about technology purchases. The Intel® Core™ processor family and the Intel Atom, Intel® Pentium®, Intel® Celeron®, Intel Xeon, and Intel® Itanium® trademarks make up our processor brands.

We promote brand awareness and generate demand through our own direct marketing as well as co-marketing programs. Our direct marketing activities include television, print, and Internet advertising, as well as press relations, consumer and trade events, and industry and consumer communications. We market to consumer and business audiences, and focus on building awareness and generating demand for increased performance, improved energy efficiency, and other capabilities such as Internet connectivity and security.

Purchases by customers often allow them to participate in cooperative advertising and marketing programs such as the Intel Inside® Program. This program broadens the reach of our brands beyond the scope of our own direct marketing. Through the Intel Inside Program, certain customers are licensed to place Intel logos on computing devices containing our microprocessors and processor technologies, and to use our brands in their marketing activities. The program includes a market development component that accrues funds based on purchases and partially reimburses the OEMs for marketing activities for products featuring Intel brands, subject to the OEMs meeting defined criteria. These marketing activities primarily include television, print, and Internet marketing. We have also entered into joint marketing arrangements with certain customers.

Intellectual Property Rights and Licensing

IP that applies to our products and services includes patents, copyrights, trade secrets, trademarks, and maskwork rights. We maintain a program to protect our investment in technology by attempting to ensure respect for our IP. The extent of the legal protection given to different types of IP varies under different countries’ legal systems. We intend to license our IP where we can obtain adequate consideration. See “Competition” earlier in this section, “Risk Factors” in Part I, Item 1A, and “Note 29: Contingencies” in Part II, Item 8 of this Form 10-K.

We have obtained patents in the U.S. and other countries. While our patents are an important element of our success, our business as a whole is not significantly dependent on any one patent. Because of the fast pace of innovation and

product development, and the comparative pace of governments’ patenting processes, our products are often obsolete before the patents related to them expire, and may sometimes be obsolete before the patents related to them are even granted. As we expand our products into new industries, we also seek to extend our patent development efforts to patent such products. Established competitors in existing and new industries, as well as companies that purchase and enforce patents and other IP, may already have patents covering similar products. There is no assurance that we will be able to obtain patents covering our own products, or that we will be able to obtain licenses from other companies on favorable terms or at all.

The software that we distribute, including software embedded in our component-level and system-level products, is entitled to copyright protection. To distinguish Intel products from our competitors’ products, we have obtained trademarks and trade names for our products, and we maintain cooperative advertising programs with customers to promote our brands and to identify products containing genuine Intel components. We also protect details about our processes, products, and strategies as trade secrets, keeping confidential the information that we believe provides us with a competitive advantage.

In the first quarter of 2011, we entered into a long-term patent cross-license agreement with NVIDIA. Under the agreement, we received a license to all of NVIDIA’s patents with a capture period that runs through March 2017 while NVIDIA products are licensed to our patents, subject to exclusions for x86 products, certain chipsets, and certain flash memory technology products.

Compliance with Environmental, Health, and Safety Regulations

Our compliance efforts focus on monitoring regulatory and resource trends and setting company-wide performance targets for key resources and emissions. These targets address several parameters, including product design; chemical, energy, and water use; waste recycling; the source of certain minerals used in our products; climate change; and emissions.

Intel focuses on reducing natural resource use, the solid and chemical waste by-products of our manufacturing processes, and the environmental impact of our products. We currently use a variety of materials in our manufacturing process that have the potential to adversely impact the environment and are subject to a variety of EHS laws and regulations. Over the past several years, we have significantly reduced the use of lead and halogenated flame retardants in our products and manufacturing processes.

We work with the U.S. Environmental Protection Agency (EPA), non-governmental organizations, OEMs, and retailers to help manage e-waste (which includes electronic products nearing the end of their useful lives) and promote recycling. The European Union requires producers of certain electrical and electronic equipment to develop programs that allow consumers to return products for recycling. Many states in the U.S. have similar e-waste take-back laws. Although these laws are typically targeted at the end electronic product and not the component products that Intel manufactures, the inconsistency of many e-waste take-back laws and the lack of local e-waste management options in many areas pose a challenge for our compliance efforts.

Intel is an industry leader in efforts to build ethical sourcing of minerals for our products. Intel has partnered with the U.S. State Department and the U.S. Agency for International Development to create pilot programs that would allow for tracking and tracing of our source materials, in particular those minerals sourced from the Democratic Republic of the Congo. In 2012, Intel will continue to work to establish a conflict-free supply chain for our company and our industry. Intel’s goal for 2012 is to verify that the tantalum we use in our microprocessors is conflict-free, and our goal for 2013 is to manufacture the world’s first verified, conflict-free microprocessor.

Intel seeks to reduce our global greenhouse gas emissions by investing in energy conservation projects in our factories and working with suppliers to improve energy efficiency. We take a holistic approach to power management, addressing the challenge at the silicon, package, circuit, micro/macro architecture, platform, and software levels. We recognize that climate change may cause general economic risk. For further information on the risks of climate change, see “Risk Factors” in Part I, Item 1A of this Form 10-K. We see the potential for higher energy costs driven by climate change regulations. This could include items applied to utilities that are passed along to customers, such as carbon taxes or costs associated with obtaining permits for our U.S. manufacturing operations, emission cap and trade programs, or renewable portfolio standards.

We are committed to sustainability and take a leadership position in promoting voluntary environmental initiatives and working proactively with governments, environmental groups, and industry to promote global environmental sustainability. We believe that technology will be fundamental to finding solutions to the world’s environmental challenges, and we are joining forces with industry, business, and governments to find and promote ways that technology can be used as a tool to combat climate change.

We have been purchasing wind power and other forms of renewable energy at some of our major sites for several years. We purchase renewable energy certificates under a multi-year contract. The purchase has placed Intel at the top of the EPA’s Green Power Partnership for the past four years and was intended to help stimulate the market for green power, leading to additional generating capacity and, ultimately, lower costs.

Distribution of Company Information

Our Internet address iswww.intel.com. We publish voluntary reports on our web site that outline our performance with respect to corporate responsibility, including EHS compliance.

We use our Investor Relations web site,www.intc.com, as a routine channel for distribution of important information, including news releases, analyst presentations, and financial information. We post filings as soon as reasonably practicable after they are electronically filed with, or furnished to, the U.S. Securities and Exchange Commission (SEC), including our annual and quarterly reports on Forms 10-K and 10-Q and current reports on Form 8-K; our proxy statements; and any amendments to those reports or statements. All such postings and filings are available on our Investor Relations web site free of charge. In addition, our Investor Relations web site allows interested persons to sign up to automatically receive e-mail alerts when we post news releases and financial information. The SEC’s web site,www.sec.gov, contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The content on any web site referred to in this Form 10-K is not incorporated by reference in this Form 10-K unless expressly noted.

Executive Officers of the Registrant

The following sets forth certain information with regard to our executive officers as of February 23, 2012 (ages are as of December 31, 2011):

| | |

| Andy D. Bryant, age 61 |

| • 2012 – present, | | Vice Chairman of the Board |

| • 2011 – 2012, | | Vice Chairman of the Board, Executive VP, Technology, Manufacturing and Enterprise Services, Chief Administrative Officer |

| • 2009 – 2011, | | Executive VP, Technology, Manufacturing, and Enterprise Services, Chief Administrative Officer |

| • 2007 – 2009, | | Executive VP, Finance and Enterprise Services, Chief Administrative Officer |

| • 2001 – 2007, | | Executive VP, Chief Financial and Enterprise Services Officer |

| • Member of Intel Corporation Board of Directors |

• Member of Columbia Sportswear Company Board of Directors |

• Member of McKesson Corporation Board of Directors |

• Joined Intel 1981 |

|

| William M. Holt, age 59 |

| • 2006 – present, | | Senior VP, GM, Technology and Manufacturing Group |

| • 2005 – 2006, | | VP, Co-GM, Technology and Manufacturing Group |

• Joined Intel 1974 |

|

| Thomas M. Kilroy, age 54 |

| • 2010 – present, | | Senior VP, GM, Sales and Marketing Group |

| • 2009 – 2010, | | VP, GM, Sales and Marketing Group |

| • 2005 – 2009, | | VP, GM, Digital Enterprise Group |

| • Joined Intel 1990 |

|

| Brian M. Krzanich, age 51 |

| • 2012 – present, | | Senior VP, Chief Operating Officer |

| • 2010 – 2012, | | Senior VP, GM, Manufacturing and Supply Chain |

| • 2006 – 2010, | | VP, GM, Assembly and Test |

| • Joined Intel 1982 |

| | |

| A. Douglas Melamed, age 66 |

| • 2009 – present, | | Senior VP, General Counsel |

| • 2001 – 2009, | | Partner, Wilmer Cutler Pickering Hale and Dorr LLP |

• Joined Intel 2009 |

|

| Paul S. Otellini, age 61 |

• 2005 – present, | | President, Chief Executive Officer |

• Member of Intel Corporation Board of Directors |

• Member of Google, Inc. Board of Directors |

| • Joined Intel 1974 |

|

| David Perlmutter, age 58 |

| • 2012 – present, | | Executive VP, GM, Intel Architecture Group, Chief Product Officer |

| • 2009 – 2012, | | Executive VP, GM, Intel Architecture Group |

| • 2007 – 2009, | | Executive VP, GM, Mobility Group |

| • 2005 – 2007, | | Senior VP, GM, Mobility Group |

• Joined Intel 1980 |

|

| Stacy J. Smith, age 49 |

| • 2010 – present, | | Senior VP, Chief Financial Officer |

| • 2007 – 2010, | | VP, Chief Financial Officer |

| • 2006 – 2007, | | VP, Assistant Chief Financial Officer |

| • 2004 – 2006, | | VP, Finance and Enterprise Services, Chief Information Officer |

• Member of Autodesk, Inc. Board of Directors |

• Member of Gevo, Inc. Board of Directors |

• Joined Intel 1988 |

|

| Arvind Sodhani, age 57 |

| • 2007 – present, | | Executive VP of Intel, President of Intel Capital |

| • 2005 – 2007, | | Senior VP of Intel, President of Intel Capital |

• Member of SMART Technologies, Inc. Board of Directors |

• Joined Intel 1981 |

Changes in product demand may harm our financial results and are hard to predict.

If product demand decreases, our revenue and profit could be harmed. Important factors that could cause demand for our products to decrease include changes in:

| • | | business conditions, including downturns in the computing industry, regional economies, and the overall economy; |

| • | | consumer confidence or income levels caused by changes in market conditions, including changes in government borrowing, taxation, or spending policies; the credit market; or expected inflation, employment, and energy or other commodity prices; |

| • | | the level of customers’ inventories; |

| • | | competitive and pricing pressures, including actions taken by competitors; |

| • | | customer product needs; |

| • | | market acceptance of our products and maturing product cycles; and |

| • | | the high-technology supply chain, including supply constraints caused by natural disasters or other events. |

Our operations have high costs, such as those related to facility construction and equipment, R&D, and employment and training of a highly skilled workforce, that are either fixed or difficult to reduce in the short term. At the same time, demand for our products is highly variable. If product demand decreases or we fail to forecast demand accurately, we could be required to write off inventory or record excess capacity charges, which would lower our gross margin. Our manufacturing or assembly and test capacity could be underutilized, and we may be required to write down our long-lived assets, which would increase our expenses. Factory-planning decisions may shorten the useful lives of facilities and equipment and cause us to accelerate depreciation. If product demand increases, we may be unable to add capacity fast enough to meet market demand. These changes in product demand, and changes in our customers’ product needs, could negatively affect our competitive position and may reduce our revenue, increase our costs, lower our gross margin percentage, or require us to write down our assets.

We operate in highly competitive industries, and our failure to anticipate and respond to technological and market developments could harm our ability to compete.

We operate in highly competitive industries that experience rapid technological and market developments, changes in industry standards, changes in customer needs, and frequent product introductions and improvements. If we are unable to anticipate and respond to these developments, we may weaken our competitive position, and our products or technologies may be uncompetitive or obsolete. As computing market segments emerge, such as netbooks, smartphones, tablets, and consumer electronics devices, we face new sources of competition and customers with different needs than customers in our PC business. To be successful, we need to cultivate new industry relationships in these market segments. As the number and variety of

Internet-connected devices increase, we need to improve the cost, connectivity, energy efficiency, and security of our platforms to succeed in these new market segments. And we need to expand our software capabilities in order to provide customers with complete computing solutions.

To compete successfully, we must maintain a successful R&D effort, develop new products and production processes, and improve our existing products and processes ahead of competitors. Our R&D efforts are critical to our success and are aimed at solving complex problems, and we do not expect that all of our projects will be successful. We may be unable to develop and market new products successfully, the products we invest in and develop may not be well received by customers, and products and technologies offered by others may affect demand for our products. These types of events could negatively affect our competitive position and may reduce revenue, increase costs, lower gross margin percentage, or require us to impair our assets.

Changes in the mix of products sold may harm our financial results.

Because of the wide price differences in notebook, netbook, smartphone, tablet, desktop, and server microprocessors, the mix of microprocessors sold affects the average selling prices of our products and has a large impact on our revenue and gross margin. Our financial results also depend on the mix of other products that we sell, such as chipsets, flash memory, and other semiconductor products. More recently introduced products tend to have higher costs because of initial development and production, and changes in the mix of products sold may affect our ability to recover our fixed costs and product investments.

Our global operations subject us to risks that may harm our results of operations and financial condition.

We have sales offices, R&D, manufacturing, assembly and test facilities, and other facilities in many countries, and some business activities may be concentrated in one or more geographic areas. As a result, our ability to manufacture, assemble and test, design, develop, or sell products may be affected by:

| • | | security concerns, such as armed conflict and civil or military unrest, crime, political instability, and terrorist activity; |

| • | | natural disasters and health concerns; |

| • | | inefficient and limited infrastructure and disruptions, such as supply chain interruptions and large-scale outages or interruptions of service from utilities, transportation, or telecommunications providers; |

| • | | restrictions on our operations by governments seeking to support local industries, nationalization of our operations, and restrictions on our ability to repatriate earnings; |

| • | | differing employment practices and labor issues; and |

| • | | local business and cultural factors that differ from our normal standards and practices, including business practices that we are prohibited from engaging in by the Foreign Corrupt Practices Act (FCPA) and other anti-corruption laws and regulations. |

Legal and regulatory requirements differ among jurisdictions worldwide. Violations of these laws and regulations could result in fines; criminal sanctions against us, our officers, or our employees; prohibitions on the conduct of our business; and damage to our reputation. Although we have policies, controls, and procedures designed to ensure compliance with these laws, our employees, contractors, or agents may violate our policies.

Although most of our sales occur in U.S. dollars, expenses such as payroll, utilities, tax, and marketing expenses may be paid in local currencies. We also conduct certain investing and financing activities in local currencies. Our hedging programs reduce, but do not eliminate, the impact of currency exchange rate movements; therefore, changes in exchange rates could harm our results and financial condition. Changes in tariff and import regulations and in U.S. and non-U.S. monetary policies may harm our results and financial condition by increasing our expenses and reducing revenue. Varying tax rates in different jurisdictions could harm our results of operations and financial condition by increasing our overall tax rate.

We maintain a program of insurance coverage for a variety of property, casualty, and other risks. We place our insurance coverage with multiple carriers in numerous jurisdictions. However, one or more of our insurance providers may be unable or unwilling to pay a claim. The types and amounts of insurance we obtain vary depending on availability, cost, and decisions with respect to risk retention. The policies have deductibles and exclusions that result in us retaining a level of self-insurance. Losses not covered by insurance may be large, which could harm our results of operations and financial condition.

Failure to meet our production targets, resulting in undersupply or oversupply of products, may harm our business and results of operations.

Production of integrated circuits is a complex process. Disruptions in this process can result from errors; difficulties in our development and implementation of new processes; defects in materials; disruptions in our supply of materials or resources; and disruptions at our fabrication and assembly and test facilities due to accidents, maintenance issues, or unsafe working conditions—all of which could affect the timing of production ramps and yields. We may not be successful or efficient in developing or implementing new production processes. Production issues may result in our failure to meet or increase production as desired, resulting in higher costs or large decreases in yields, which could affect our ability to produce sufficient volume to meet product demand. The unavailability or reduced availability of products could make it more difficult to deliver computing platforms. The occurrence of these events could harm our business and results of operations.

We may have difficulties obtaining the resources or products we need for manufacturing, assembling and testing our products, or operating other aspects of our business, which could harm our ability to meet demand and increase our costs.

We have thousands of suppliers providing materials that we use in production and other aspects of our business, and we seek, where possible, to have several sources of supply for all of those materials. However, we may rely on a single or a limited number of suppliers, or upon suppliers in a single location, for these materials. The inability of suppliers to deliver adequate supplies of production materials or other supplies could disrupt our production processes or make it more difficult for us to implement our business strategy. Production could be disrupted by the unavailability of resources used in production, such as water, silicon, electricity, gases, and other materials. Future environmental regulations could restrict the supply or increase the cost of materials that we use in our business and make it more difficult to obtain permits to build or modify manufacturing capacity to meet demand. The unavailability or reduced availability of materials or resources may require us to reduce production or incur additional costs. The occurrence of these events could harm our business and results of operations.

Costs related to product defects and errata may harm our results of operations and business.

Costs of product defects and errata (deviations from published specifications) due to, for example, problems in our design and manufacturing processes, could include:

| • | | writing off the value of inventory; |

| • | | disposing of products that cannot be fixed; |

| • | | recalling products that have been shipped; |

| • | | providing product replacements or modifications; and |

| • | | defending against litigation. |

These costs could be large and may increase expenses and lower gross margin. Our reputation with customers or end users could be damaged as a result of product defects and errata, and product demand could be reduced. The announcement of product defects and errata could cause customers to purchase products from competitors as a result of possible shortages of Intel components or for other reasons. These factors could harm our business and financial results.

Third parties may attempt to breach our network security, which could damage our reputation and financial results.

We regularly face attempts by others to gain unauthorized access through the Internet or introduce malicious software to our IT systems. These attempts—which might be the result of industrial or other espionage, or actions by hackers seeking to harm the company, its products, or end users—are sometimes successful. In part because of the high profile of our McAfee subsidiary in the network and system protection business, we might become a target of computer hackers who create viruses to sabotage or otherwise attack our products and services. Hackers might attempt to penetrate our network security and gain access to our network and our data centers, steal proprietary information, including personally identifiable information, or interrupt our internal systems and services. We seek to detect and investigate these security incidents and to prevent their recurrence, but in some cases we might be unaware of an incident or its magnitude and effects.

Third parties may claim infringement of IP, which could harm our business.

We may face IP infringement claims from individuals and companies, including those who have acquired patent portfolios to assert claims against other companies. We are engaged in a number of litigation matters involving IP. Claims that our products or processes infringe the IP of others could cause us to incur large costs to respond to, defend, and resolve the claims, and may divert the efforts and attention of management and technical personnel. As a result of IP infringement claims, we could:

| • | | pay infringement claims; |

| • | | stop manufacturing, using, or selling products or technology subject to infringement claims; |

| • | | develop other products or technology not subject to infringement claims, which could be time-consuming and costly or may not be possible; or |

| • | | license technology from the party claiming infringement, which license may not be available on commercially reasonable terms. |

These actions could harm our competitive position, result in expenses, or require us to impair our assets. If we alter or stop production of affected items, our revenue could be harmed.

We may be unable to enforce or protect our IP, which may harm our ability to compete and harm our business.

Our ability to enforce our patents, copyrights, software licenses, and other IP is subject to general litigation risks, as well as uncertainty as to the enforceability of our IP in various countries. When we seek to enforce our rights, we are often subject to claims that the IP is invalid, not enforceable, or licensed to the opposing party. Our assertion of IP often results in the other party seeking to assert claims against us,

which could harm our business. Governments may adopt regulations—and governments or courts may render decisions—requiring compulsory licensing of IP, or governments may require products to meet standards that serve to favor local companies. Our inability to enforce our IP under these circumstances may harm our competitive position and business.

We may be subject to IP theft or misuse, which could result in claims and harm our business and results of operations.

The theft or unauthorized use or publication of our trade secrets and other confidential business information could harm our competitive position and reduce acceptance of our products; the value of our investment in R&D, product development, and marketing could be reduced; and third parties might make claims related to losses of confidential or proprietary information or end-user data, or system reliability. These incidents and claims could severely disrupt our business, and we could suffer losses, including the cost of product recalls and returns and reputational harm.

Our licenses with other companies and participation in industry initiatives may allow competitors to use our patent rights.

Companies in the computing industry often bilaterally license patents between each other to settle disputes or as part of business agreements between them. Our competitors may have licenses to our patents, and under current case law, some of the licenses may permit these competitors to pass our patent rights on to others under some circumstances. Our participation in industry standards organizations or with other industry initiatives may require us to license our patents to companies that adopt industry-standard specifications. Depending on the rules of the organization, we might have to grant these licenses to our patents for little or no cost, and as a result, we may be unable to enforce certain patents against others, our costs of enforcing our licenses or protecting our patents may increase, and the value of our IP may be impaired.

Litigation or regulatory proceedings could harm our business.

We may face legal claims or regulatory matters involving stockholder, consumer, competition, and other issues on a global basis. As described in “Note 29: Contingencies” in Part II, Item 8 of this Form 10-K, we are engaged in a number of litigation and regulatory matters. Litigation and regulatory proceedings are inherently uncertain, and adverse rulings could occur, including monetary damages, or an injunction stopping us from manufacturing or selling products, engaging in business practices, or requiring other remedies, such as compulsory licensing of patents.

We face risks related to sales through distributors and other third parties.

We sell a portion of our products through third parties such as distributors, value-added resellers, OEMs, Internet service providers, and channel partners (collectively referred to as distributors). Using third parties for distribution exposes us to many risks, including competitive pressure, concentration, credit risk, and compliance risks. Distributors may sell products that compete with our products, and we may need to provide financial and other incentives to focus distributors on the sale of our products. We may rely on one or more key distributors for a product, and the loss of these distributors could reduce our revenue. Distributors may face financial difficulties, including bankruptcy, which could harm our collection of accounts receivable and financial results. Violations of FCPA or similar laws by distributors or other third-party intermediaries could have a material impact on our business. Failing to manage risks related to our use of distributors may reduce sales, increase expenses, and weaken our competitive position.

We face risks related to sales to government entities.

We derive a portion of our revenue from sales to government entities and their respective agencies. Government demand and payment for our products may be affected by public sector budgetary cycles and funding authorizations. Government contracts are subject to oversight, including special rules on accounting, expenses, reviews, and security. Failing to comply with these rules could result in civil and criminal penalties and sanctions, including termination of contracts, fines and suspensions, or debarment from future government business.

We invest in companies for strategic reasons and may not realize a return on our investments.

We make investments in companies around the world to further strategic objectives and support key business initiatives. These investments include equity or debt instruments of public or private companies, and many of these instruments are non-marketable at the time of our initial investment. Companies range from early-stage companies that are still defining their strategic direction to more mature companies with established revenue streams and business models. The companies in which we invest may fail because they may be unable to secure additional funding, obtain favorable terms for future financings, or participate in liquidity events such as public offerings, mergers, and private sales. If any of these private companies fail, we could lose all or part of our investment. If we determine that an other-than-temporary decline in the fair value exists for an investment, we write down the investment to its fair value and recognize a loss. We have large investments in the flash memory market segment, and declines in this market segment or changes in management’s plans with respect to our investments in this market segment could result in large impairment charges, impacting gains (losses) on equity investments, net.

When the strategic objectives of an investment have been achieved, or if the investment or business diverges from our strategic objectives, we may decide to dispose of the investment. We may incur losses on the disposal of non-marketable investments. For cases in which we are required under equity method accounting to recognize a proportionate share of another company’s income or loss, such income or loss may impact earnings. Gains or losses from equity securities could vary from expectations, depending on gains or losses realized on the sale or exchange of securities, gains or losses from equity investments, and impairment charges for equity and other investments.

Our results of operations could vary as a result of the methods, estimates, and judgments that we use in applying accounting policies.

The methods, estimates, and judgments that we use in applying accounting policies have a large impact on our results of operations. For further information, see “Critical Accounting Estimates” in Part II, Item 7 of this Form 10-K. These methods, estimates, and judgments are subject to large risks, uncertainties, and assumptions, and changes could affect our results of operations.

Changes in our effective tax rate may harm our results of operations.

A number of factors may increase our effective tax rates, which could reduce our net income, including:

| • | | the jurisdictions in which profits are determined to be earned and taxed; |

| • | | the resolution of issues arising from tax audits; |

| • | | changes in the valuation of our deferred tax assets and liabilities, and in deferred tax valuation allowances; |

| • | | adjustments to income taxes upon finalization of tax returns; |

| • | | increases in expenses not deductible for tax purposes, including write-offs of acquired in-process research and development and impairments of goodwill; |

| • | | changes in available tax credits; |

| • | | changes in tax laws or their interpretation, including changes in the U.S. to the taxation of foreign income and expenses; |

| • | | changes in U.S. generally accepted accounting principles; and |

| • | | our decision to repatriate non-U.S. earnings for which we have not previously provided for U.S. taxes. |

Decisions about the scope of operations of our business could affect our results of operations and financial condition.

Changes in the business environment could lead to changes in the scope of our operations, resulting in restructuring and asset impairment charges. Factors that could affect our results of operations and financial condition due to a change in the scope of our operations include:

| • | | timing and execution of plans and programs subject to local labor law requirements, including consultation with work councils; |

| • | | changes in assumptions related to severance and postretirement costs; |

| • | | new business initiatives and changes in product roadmap, development, and manufacturing; |

| • | | changes in employment levels and turnover rates; |

| • | | changes in product demand and the business environment; and |

| • | | changes in the fair value of long-lived assets. |

Our acquisitions, divestitures, and other transactions could disrupt our ongoing business and harm our results of operations.

In pursuing our business strategy, we routinely conduct discussions, evaluate opportunities, and enter into agreements for possible investments, acquisitions, divestitures, and other transactions, such as joint ventures. Acquisitions and other transactions involve large challenges and risks, including risks that:

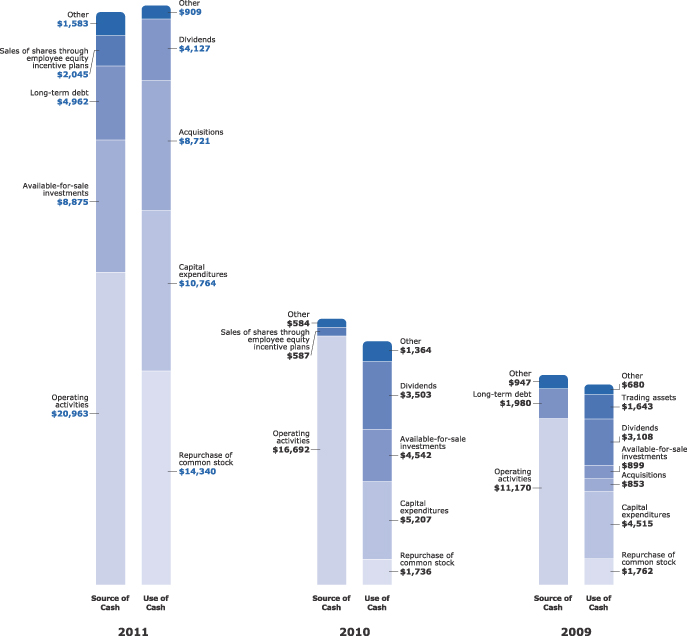

| • | | we may be unable to identify opportunities on terms acceptable to us; |