|

Exhibit 99.2

|

Intel Acquisition of Mobileye

March 13, 2017

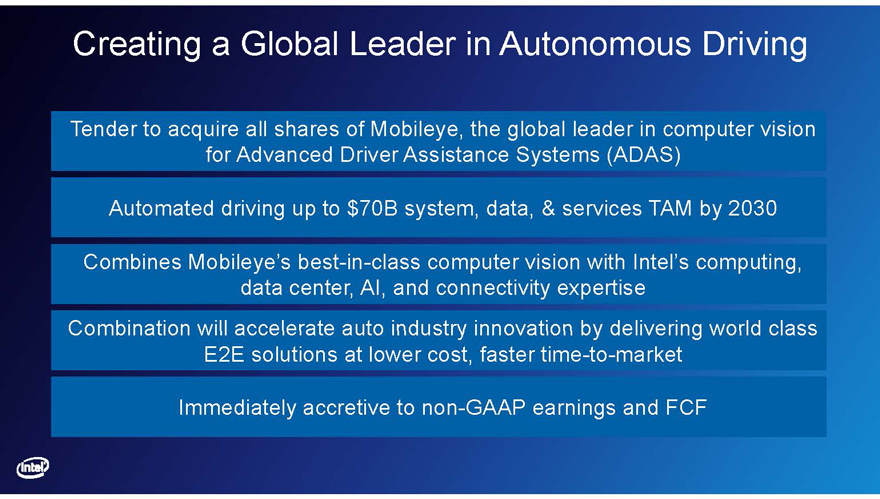

Creating a Global Leader in Autonomous Driving

Tender to acquire all shares of Mobileye, the global leader in computer vision for Advanced Driver Assistance Systems (ADAS)

Automated driving up to $70B system, data, & services TAM by 2030

Combines Mobileye’sbest-in-class computer vision with Intel’s computing, data center, AI, and connectivity expertise Combination will accelerate auto industry innovation by delivering world class E2E solutions at lower cost, fastertime-to-market

Immediately accretive tonon-GAAP earnings and FCF

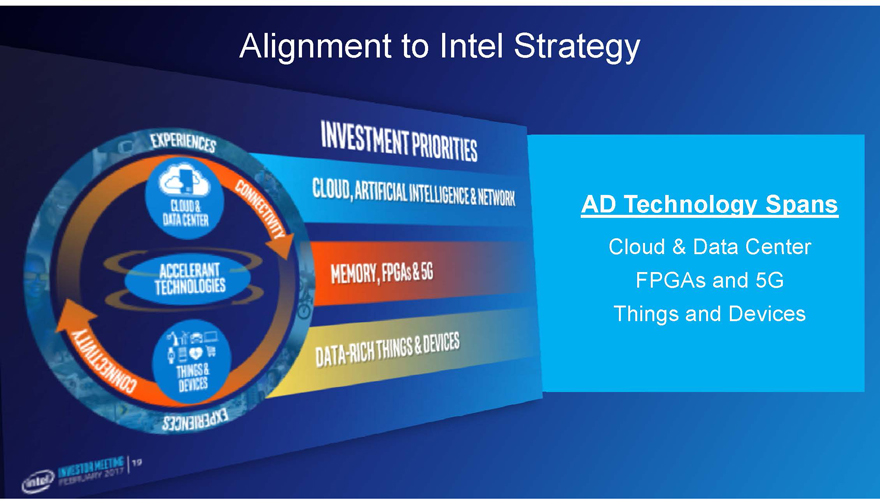

Alignment to Intel Strategy

AD Technology Spans

Cloud & Data Center FPGAs and 5G Things and Devices

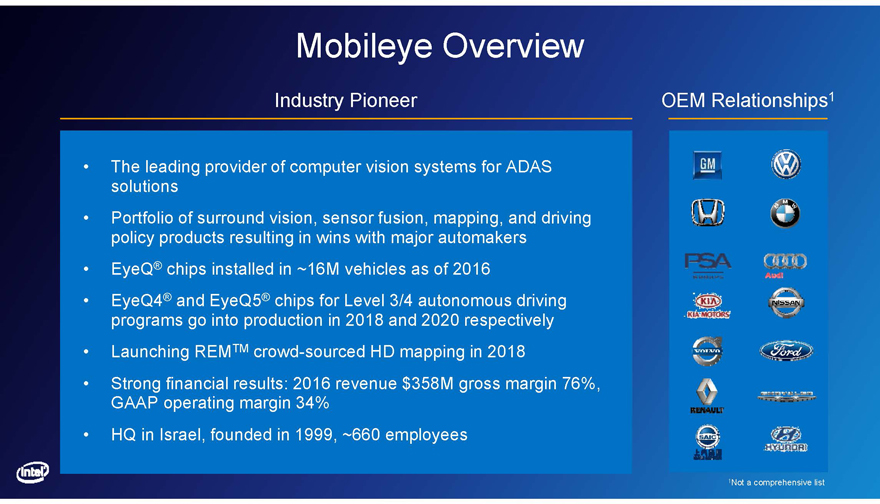

Mobileye Overview

Industry Pioneer

• The leading provider of computer vision systems for ADAS solutions

• Portfolio of surround vision, sensor fusion, mapping, and driving policy products resulting in wins with major automakers

• EyeQ® chips installed in ~16M vehicles as of 2016

• EyeQ4® and EyeQ5® chips for Level 3/4 autonomous driving programs go into production in 2018 and 2020 respectively

• Launching REMTM crowd-sourced HD mapping in 2018

• Strong financial results: 2016 revenue $358M gross margin 76%, GAAP operating margin 34%

• HQ in Israel, founded in 1999, ~660 employees

OEM Relationships1

1Not a comprehensive list

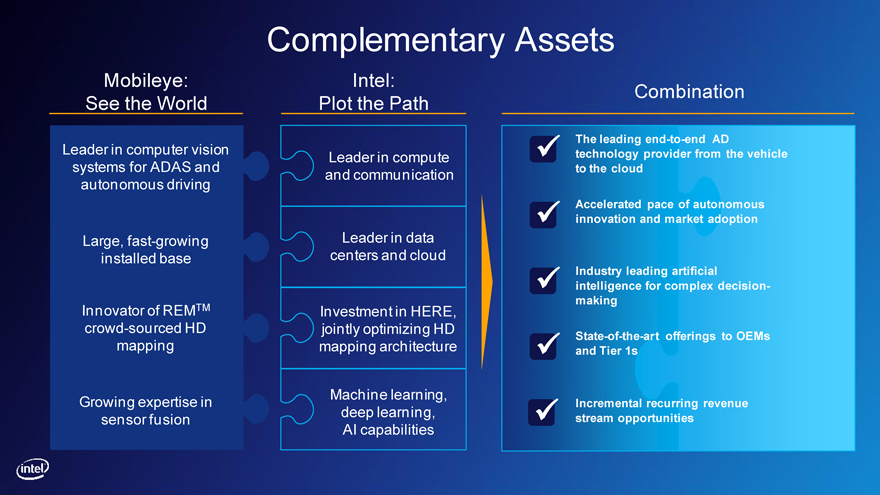

Complementary Assets

Mobileye:

See the World

Leader in computer vision systems for ADAS and autonomous driving

Large, fast-growing installed base

Innovator of REMTM crowd-sourced HD mapping

Growing expertise in sensor fusion

Intel:

Plot the Path

Leader in compute and communication

Leader in data centers and cloud

Investment in HERE, jointly optimizing HD mapping architecture

Machine learning, deep learning, AI capabilities

Combination

The leadingend-to-end AD technology provider from the vehicle to the cloud

Accelerated pace of autonomous innovation and market adoption

Industry leading artificial intelligence for complex decision-making

State-of-the-art offerings to OEMs and Tier 1s

Incremental recurring revenue stream opportunities

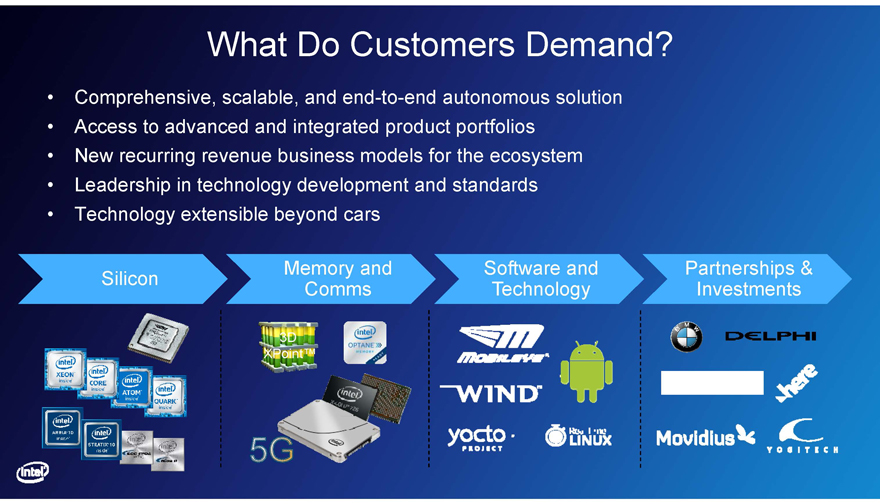

What Do Customers Demand

• Comprehensive, scalable, andend-to-end autonomous solution

• Access to advanced and integrated product portfolios

• New recurring revenue business models for the ecosystem

• Leadership in technology development and standards

• Technology extensible beyond cars

Memory and Software and Partnerships & Silicon Comms Technology Investments

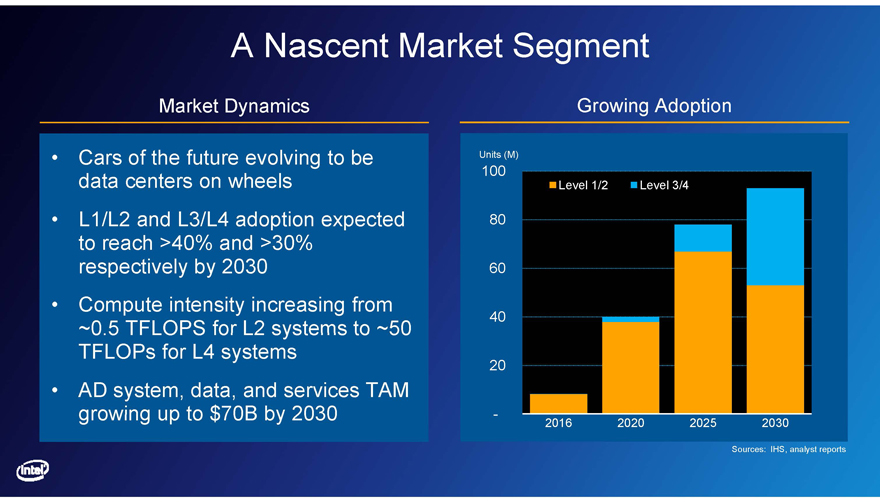

A Nascent Market Segment

Market Dynamics

• Cars of the future evolving to be data centers on wheels

• L1/L2 and L3/L4 adoption expected to reach >40% and >30% respectively by 2030

• Compute intensity increasing from

~0.5 TFLOPS for L2 systems to ~50 TFLOPs for L4 systems

• AD system, data, and services TAM growing up to $70B by 2030

Growing Adoption

Units (M)

100

Level 1/2 Level3/4

80

60

40

20

- 2016 202020252030

Sources: IHS, analyst reports

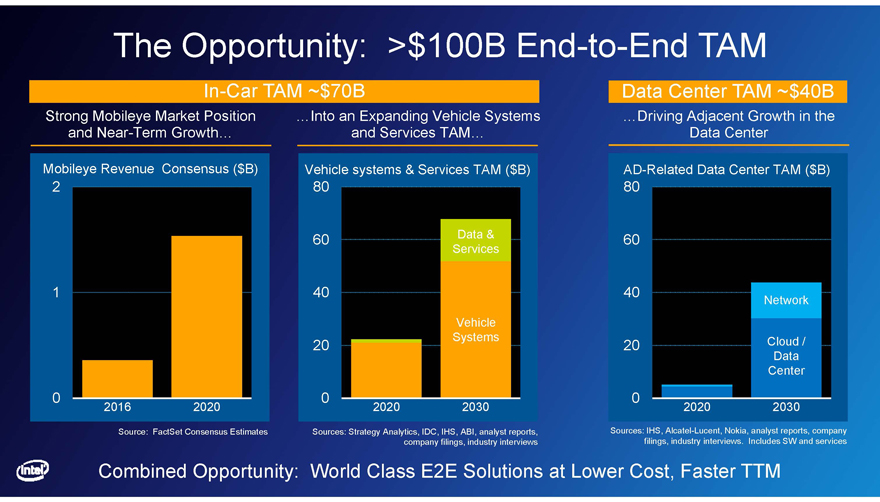

The Opportunity: >$100BEnd-to-End TAM

In-Car TAM ~$70B

Strong Mobileye Market Position and Near-Term Growth…

Mobileye Revenue Consensus ($B)

2

1

0 2016 2020

Source: FactSet Consensus Estimates

…Into an Expanding Vehicle Systems and Services TAM…

Vehicle systems & Services TAM ($B)

80

60 Data &

Services

40

Vehicle

20 Systems

0 2020 2030

Sources: Strategy Analytics, IDC, IHS, ABI, analyst reports,

company filings, industry interviews

Data Center TAM ~$40B

…Driving Adjacent Growth in the Data Center

AD-Related Data Center TAM ($B)

80

60

40 Network

20 Cloud /

Data

Center

0 2020 2030

Sources: IHS, Alcatel-Lucent, Nokia, analyst reports, company

filings, industry interviews. Includes SW and services

Combined Opportunity: World Class E2E Solutions at Lower Cost, Faster TTM

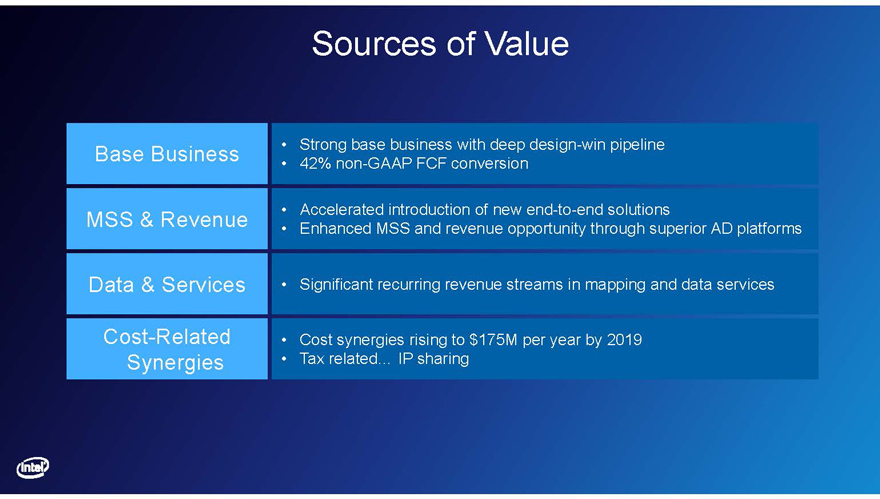

Sources of Value

Base Business • Strong base business with deepdesign-win pipeline

42%non-GAAP FCF conversion

MSS & Revenue • Accelerated introduction of newend-to-end solutions

Enhanced MSS and revenue opportunity through superior AD platforms

Data & Services • Significant recurring revenue streams in mapping and data services

Cost-Related • Cost synergies rising to $175M per year by 2019

Synergies • Tax related… IP sharing

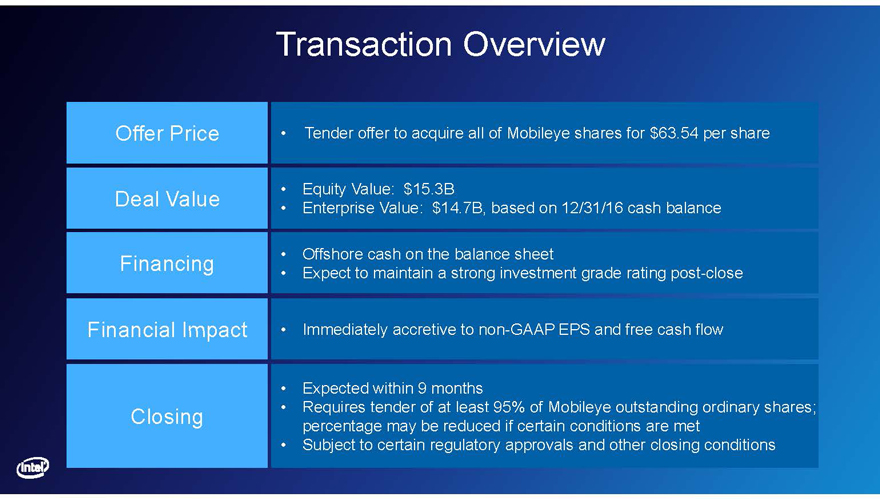

Transaction Overview

Offer Price • Tender offer to acquire all of Mobileye shares for $63.54 per share

Deal Value • Equity Value: $15.3B

Enterprise Value: $14.7B, based on 12/31/16 cash balance

Financing • Offshore cash on the balance sheet

Expect to maintain a strong investment grade rating post-close

Financial Impact • Immediately accretive tonon-GAAP EPS and free cash flow

Expected within 9 months

Closing • Requires tender of at least 95% of Mobileye outstanding ordinary shares;

percentage may be reduced if certain conditions are met

Subject to certain regulatory approvals and other closing conditions

Creating a Global Leader in Autonomous Driving

Tender to acquire all shares of Mobileye, the global leader in computer vision for Advanced Driver Assistance Systems (ADAS)

Automated driving up to $70B system, data, & services TAM by 2030

Combines Mobileye’sbest-in-class computer vision with Intel’s computing, data center, AI, and connectivity expertise Combination will accelerate auto industry innovation by delivering world class E2E solutions at lower cost, fastertime-to-market

Immediately accretive tonon-GAAP earnings and FCF

Acquisition of Mobileye

Q&A

Risk Factors and Additional Information

Additional Information and Where to Find It

The tender offer described herein has not yet commenced. This presentation is for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any ordinary shares of Mobileye N.V. (“Mobileye”) or any other securities. On the commencement date of the tender offer, a tender offer statement on Schedule TO, including an offer to purchase, a letter of transmittal and related documents, will be filed with the U.S. Securities and Exchange Commission (the “SEC”) by Intel and one or more of its subsidiaries and a solicitation/recommendation statement on Schedule14D-9 will be filed with the SEC by Mobileye. The offer to purchase all of the issued and outstanding ordinary shares of Mobileye will only be made pursuant to the offer to purchase, the letter of transmittal and related documents filed as a part of the tender offer statement on Schedule TO. THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE14D-9 WILL CONTAIN IMPORTANT INFORMATION. INVESTORS AND SHAREHOLDERS OF MOBILEYE ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT SUCH HOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR ORDINARY SHARES. Investors and security holders may obtain a free copy of these statements (when available) and other documents filed with the SEC at the website maintained by the SEC at www.sec.gov, at the transaction website (http://intelandmobileye.transactionannouncement.com), or by directing such requests to the Information Agent for the tender offer that will be named in the tender offer statement on Schedule TO.

Forward-Looking Statements

This document contains forward-looking statements related to the proposed transaction between Intel and Mobileye, including statements regarding the benefits and the timing of the transaction as well as statements regarding the companies’ products and markets. Words such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “project,” “predict,” “should,” “would” and “will” and variations of such words and similar expressions are intended to identify such forward-looking statements. Such statements are based on management’s expectations as of the date they were first made and involve risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include, among others, the outcome of regulatory reviews of the proposed transaction; the ability of the parties to complete the transaction in the time expected or at all; the ability of Intel to successfully integrate Mobileye’s business; the market for advanced driving assistance systems and autonomous driving may develop more slowly than expected or than it has in the past; evolving government regulation of the advanced driving assistance systems and autonomous driving markets; the risk that we are unable to commercially develop the technologies acquired or achieve the anticipated benefits and synergies of the transaction; the risk that we are unable to develop derivative works from the technologies acquired; our ability to attract new or maintain existing customer and supplier relationships at reasonable cost; the failure to protect and enforce our intellectual property rights; assertions or claims by third parties that we infringe their intellectual property rights; the risk of technological developments and innovations by others; the risk of potential losses related to any product liability claims and litigation; the risk that the parties are unable to retain and hire key personnel; unanticipated restructuring costs may be incurred or undisclosed liabilities assumed; and other risks detailed in Intel’s and Mobileye’s filings with the SEC, including those discussed in Intel’s most recent Annual Report on Form10-K and in any subsequent periodic reports on Form10-Q and Form8-K and Mobileye’s most recent Annual Report on Form20-F and in any subsequent reports on Form6-K, each of which is on file or furnished with the SEC and available at the SEC’s website at www.sec.gov. SEC filings for Intel are also available on Intel’s Investor Relations website at www.intc.com, and SEC filings for Mobileye are available in the Investor Relations section of Mobileye’s website at ir.mobileye.com. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. Unless otherwise required by applicable law, Intel and Mobileye undertake no obligation and do not intend to update these forward-looking statements, whether as a result of new information, future events or otherwise.