UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant To Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant☑

Filed by a Party other than the Registrant☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☑ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

INTEL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | |

☑ | | No fee required. |

☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

(1) | | Title of each class of securities to which transaction applies: |

| |

(2) | | Aggregate number of securities to which transaction applies: |

| |

(3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) | | Proposed maximum aggregate value of transaction: |

| |

(5) | | Total fee paid: |

| | |

☐ | | Fee paid previously with preliminary materials: |

| |

☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

(1) | | Amount Previously Paid: |

| |

(2) | | Form, Schedule or Registration Statement No.: |

| |

(3) | | Filing Party: |

| |

(4) | | Date Filed: |

2017 Proxy Statement Supplement

may 2017

CONTENTS

Page

Executive Summary 3 Strategy and Performance 4 Corporate Governance 8

Stockholder Engagement and Corporate Responsibility 10 Leadership and Executive Compensation 14 Voting Recommendations 19

2

Executive Summary

In 2016, we continued to transform from aPC-focused company to one that powers the cloud and billions of smart, connected computing devices that drive a flood of data. While building a strong foundation for growth in 2016, we achieved record revenue of $59.4 billion.

Our active and engaged Board regularly reviews its practices and composition to assure the right breadth and diversity of skills and experience. We have strong independent leadership with a robust lead independent director role and a track record of refreshment, having added 5 of our 11 director nominees in the past 5 years.

Our Board strives to lead in corporate governance. We were one of the first companies to adopt majority voting in director elections, we provided stockholders with an advisory vote on executive compensation several years before it was required by law, and in early 2016, we adopted proxy access.

We are committed to meaningful and transparent engagement with our stockholders. Our integrated outreach team meets with a broad base of investors throughout the year to discuss corporate governance, executive compensation, and corporate responsibility practices.

We remain a leader in corporate responsibility. We set ambitious goals and make strategic investments to drive improvements in environmental sustainability, supply chain responsibility, diversity and inclusion, and social impact and we believe our approach creates long-term value for Intel and our stockholders by helping us mitigate risks, reduce costs, build brand value, and identify new opportunities.

Our executive compensation programs are designed to link pay with performance and encourage the creation of long-term stockholder value.

3

Intel is evolving.

To a company that powers the data center and billions of smart, connected devices.

Intel’s Vision:

If it is smart and connected, it is best with Intel.

4

2016: Building a strong foundation for growth

Record revenue of $59.4 billion, up 7% from 2015, driven by our acquisition of Altera and growth in

our Data Center Group, Client Computing Group, and Internet of Things Group businesses.

Data Center: significant growth in cloud and networking businesses, and launched products in critical

data center adjacencies, including silicon photonics and Omni-Path Fabric.

Client Computing: began shipping our new 7th Gen Intel® Core™ processors and ramped our XMM™

2016 7360 LTE modem into high volume.

Highlights Internet of Things: record revenue and major design wins.

Altera/Programmable Solutions: sampled our Stratix® 10 FPGAs, the industry’s first 14nm FPGA.

Continued our investment in disruptive memory technologies (3D NAND and Intel® Optane™

memory), 5G connectivity, artificial intelligence, and data-intensive fields such as autonomous

driving, including our announcement in March 2017 of our agreement to acquire Mobileye N.V.

Venkata (Murthy) Renduchintala joins as Executive VP; President, Client and IoT Businesses and

System Architecture Group.

Leadership Robert H. Swan joins as CFO.

Developments Stacy J. Smith becomes Executive VP, Manufacturing, Operations, and Sales.

Diane M. Bryant, General Manager of the Data Center Group, is promoted to Executive VP.

5

Commitment to Stockholder returns while investing in our business

350

300 Dividend

Dividend and Share Repurchases

250

Share

Repurchase $97B since 2006

$B 200 150

R & D R & D and Capital Expenditure

100 $180B since 2006

50 Capital Expenditure

0

2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

Source: Intel 6

Total stockholder return OutPerformance

3 YEAR STOCKHOLDER RETURN

As of 12/30/2016 60%

50%

40%

INTC

30%

S&P 100 20% DOW 30

10%

0%

2014 2015 2016

PORTFOLIO 3 YEAR (GRAPH) 1 YEAR

Intel 56% 6% Dow 30 30% 13% S&P 100 32% 10%

Source: Factset. TSR was calculated as of the stock price end of day 12/30/16 (INTC stock price was $36.60). 7

Corporate governance best practices

Board

Strong independent Lead Director Annual self-evaluation of individual directors and Board as a whole

Board search process that includes actively seeking diverse Board oversight of robust investor engagement program

board candidates Limits to how many other boards on which directors may serve

Board planning for CEO succession and monitoring and Director retirement age policy

advisement on management’s succession planning for Corporate Governance and Nominating Committee review and reporting

other executives to the Board on corporate responsibility and sustainability issues

Board oversight of risk management

Stockholder Rights and Engagement

Robusttwo-way dialogue with investors Special meeting rights for stockholders

Majority voting for all directors AnnualSay-On-Pay vote

Proxy access for stockholders Biennial vote on 2006 Equity Incentive Plan

Pay Practices

Performance-based pay that uses a variety of performance Independent Compensation Committee and independent

measures and performance periods compensation consultant

Annual compensation review and risk assessment Limit on maximum incentive payouts

Robust stock ownership guidelines for all executive officers Anti-hedging policy

and directors A portion of every executive’s and employee’s compensation linked

Claw-back policy for both annual incentive cash plan and to corporate responsibility factors since 2008

equity incentive plan

8

Intel Board of Directors NOMINEES

Andy D. Brian M. CharleneAneel

Bryant Krzanich BarshefskyBhusri

Chairman of the CEO, Senior InternationalIndependent Lead

Board of Intel Partner, Wilmer CutlerDirector-Elect,

Directors, Corporation Pickering HaleandCo-Founder and

Intel Corporation Dorr LLPCEO, Workday, Inc.

Reed E. OmarTsu-JaeDavid S.

Hundt Ishrak King LiuPottruck

Principal, REH Chairman Professor,Chairman and CEO,

Advisors LLC and CEO, University ofRed Eagle

Medtronic plc California, BerkeleyVentures, Inc.

Gregory D. Frank D. David B.

Smith Yeary Yoffie

CFO, EVP Corporate Executive Professor,

Development and Chairman, Harvard

Strategy, The CamberView Business

Boeing Company Partners LLC School

9

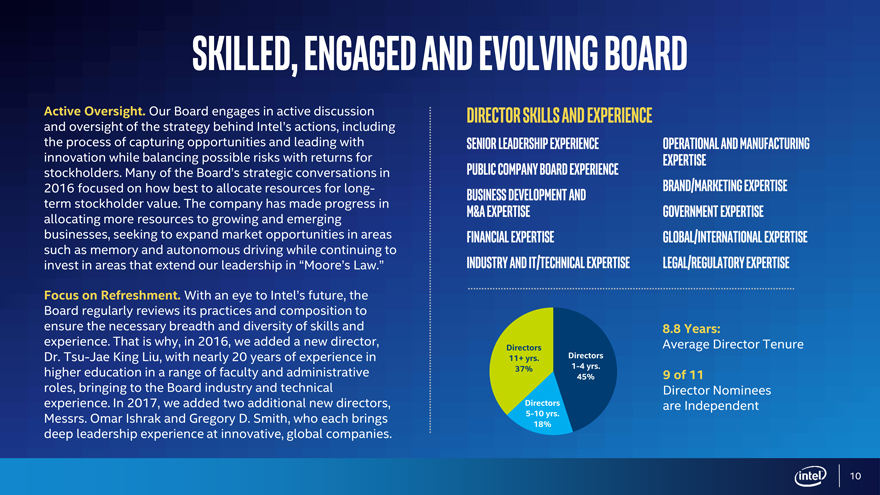

Skilled, Engaged and Evolving Board

Active Oversight. Our Board engages in active discussion and oversight of the strategy behind Intel’s actions, including the process of capturing opportunities and leading with innovation while balancing possible risks with returns for stockholders. Many of the Board’s strategic conversations in 2016 focused on how best to allocate resources for long-term stockholder value. The company has made progress in allocating more resources to growing and emerging businesses, seeking to expand market opportunities in areas such as memory and autonomous driving while continuing to invest in areas that extend our leadership in “Moore’s Law.”

Focus on Refreshment. With an eye to Intel’s future, the Board regularly reviews its practices and composition to ensure the necessary breadth and diversity of skills and experience. That is why, in 2016, we added a new director,Dr. Tsu-Jae King Liu, with nearly 20 years of experience in higher education in a range of faculty and administrative roles, bringing to the Board industry and technical experience. In 2017, we added two additional new directors, Messrs. Omar Ishrak and Gregory D. Smith, who each brings deep leadership experience at innovative, global companies.

DIRECTOR SKILLS AND EXPERIENCE

SENIOR LEADERSHIP EXPERIENCE PUBLIC COMPANY BOARD EXPERIENCE BUSINESS DEVELOPMENT AND M&A EXPERTISE

FINANCIAL EXPERTISE

INDUSTRY AND IT/TECHNICAL EXPERTISE

Operational and Manufacturing EXPERTISE

Brand/Marketing Expertise Government Expertise Global/International Expertise Legal/Regulatory Expertise

8.8 Years:

Average Director Tenure

9 of 11

Director Nominees are Independent

Directors

11+ yrs. Directors 37%1-4 yrs.

45%

Directors5-10 yrs.

18%

10

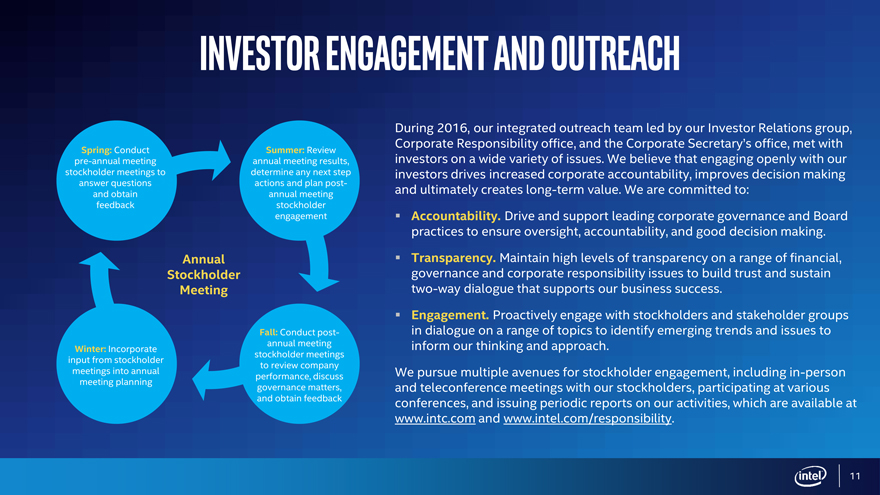

Investor Engagement and Outreach

Spring: Conduct Summer: Review

pre-annual meeting annual meeting results,

stockholder meetings to determine any next step

answer questions actions and plan post-

and obtain annual meeting feedback stockholder engagement Annual Stockholder Meeting Fall: Conduct post-annual meeting

Winter: Incorporate

stockholder meetings

input from stockholder

to review company

meetings into annual

performance, discuss

meeting planning

governance matters,

and obtain feedback

During 2016, our integrated outreach team led by our Investor Relations group, Corporate Responsibility office, and the Corporate Secretary’s office, met with investors on a wide variety of issues. We believe that engaging openly with our investors drives increased corporate accountability, improves decision making and ultimately creates long-term value. We are committed to:

Accountability. Drive and support leading corporate governance and Board practices to ensure oversight, accountability, and good decision making.

Transparency. Maintain high levels of transparency on a range of financial, governance and corporate responsibility issues to build trust and sustaintwo-way dialogue that supports our business success.

Engagement. Proactively engage with stockholders and stakeholder groups in dialogue on a range of topics to identify emerging trends and issues to inform our thinking and approach.

We pursue multiple avenues for stockholder engagement, includingin-person and teleconference meetings with our stockholders, participating at various conferences, and issuing periodic reports on our activities, which are available at www.intc.com and www.intel.com/responsibility.

11

Corporate Responsibility at Intel

We set ambitious goals and make strategic investments to drive improvements in environmental sustainability, supply chain responsibility, diversity and inclusion, and social impact that benefit the environment and society.

Our integrated approach to corporate responsibility—built on a strong foundation of transparency, governance, and ethics—creates long-term value for Intel and our stockholders by helping us mitigate risks, reduce costs, build brand value, and identify new opportunities.

Environmental Sustainability Supply Chain Responsibility Diversity and InclusionSocial Impact

We continue to drive toward the Our proactive approach to To shape the future ofOur social impact initiatives

lowest environmental footprint supplier accountability and technology, we must beempower the next generation of

possible for our own operations, capability-building creates representative of that future. Weinnovators, helping to build

and work with others to find value by reducing risk, have committed $300 million totrust with key stakeholders,

ways that technology can be improving product quality, and support our goal to achieve fullsupport our long-term talent

used as a tool to address raising the overall representation of women andand diversity objectives, and

environmental challenges. performance of our suppliers. underrepresented minorities insupport expansion of future

our U.S. workforce by 2020.market opportunities.

Read our most recent Corporate Responsibility Report at: www.intel.com/responsibility 12

Doing the Right Things Right

Intel has a long history of being recognized for our corporate responsibility and sustainability performance and leadership. We have been included in many third-party lists and rankings for more than a decade.

Barron’s. World’s Most Respected Companies

Corporate Knights. Global 100 Most Sustainable Corporations

Corporate Responsibility Magazine. 100 Best Corporate Citizens

Diversity MBA magazine. 50 Out Front Best Places for Women and Diverse Managers to Work

Dow Jones’ Sustainability Indices. North America Index

Ethisphere Institute. World’s Most Ethical Companies

Forbes. World’s Most Reputable Companies and Most Valuable Brand

Fortune magazine. Change the World List and World’s Most Admired Companies FTSE Group. Listed on the FTSE4Good Index Gartner. Top 25 Supply Chains Human Rights Campaign. Corporate Equality Index Interbrand. Best Global Brands Newsweek. Top 500 Green Companies in America and the World U.S. EPA. 100% Green Power Users List and Sustained Excellence in Green Power Award Working Mother magazine. 100 Best Companies for Working Mothers

13

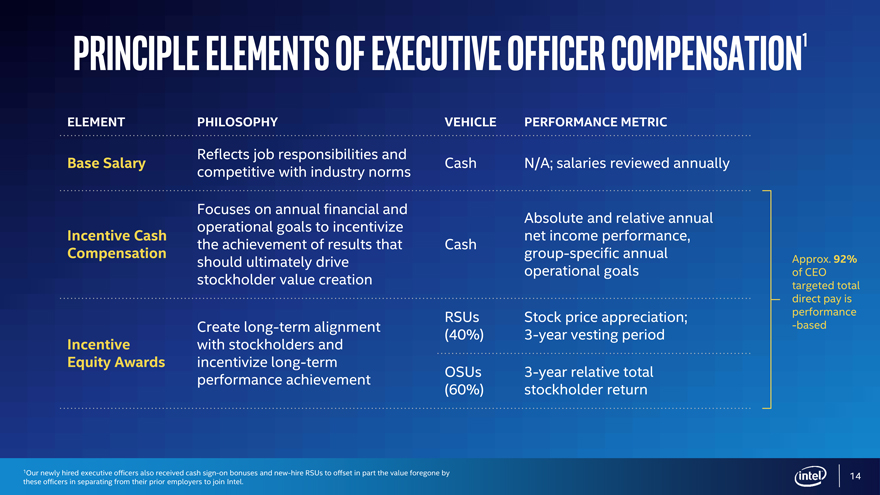

Principle Elements of Executive officer Compensation1

ELEMENT

Base Salary

Incentive Cash Compensation

Incentive Equity Awards

PHILOSOPHY

Reflects job responsibilities and competitive with industry norms

Focuses on annual financial and operational goals to incentivize the achievement of results that should ultimately drive stockholder value creation

Create long-term alignment with stockholders and incentivize long-term performance achievement

VEHICLE PERFORMANCE METRIC

Cash N/A; salaries reviewed annually

Absolute and relative annual net income performance, Cash group-specific annual operational goals

RSUs Stock price appreciation; (40%)3-year vesting period

OSUs3-year relative total (60%) stockholder return

Approx. 92% of CEO targeted total direct pay is performance -based

1Our newly hired executive officers also received cashsign-on bonuses andnew-hire RSUs to offset in part the value foregone by these officers in separating from their prior employers to join Intel.

14

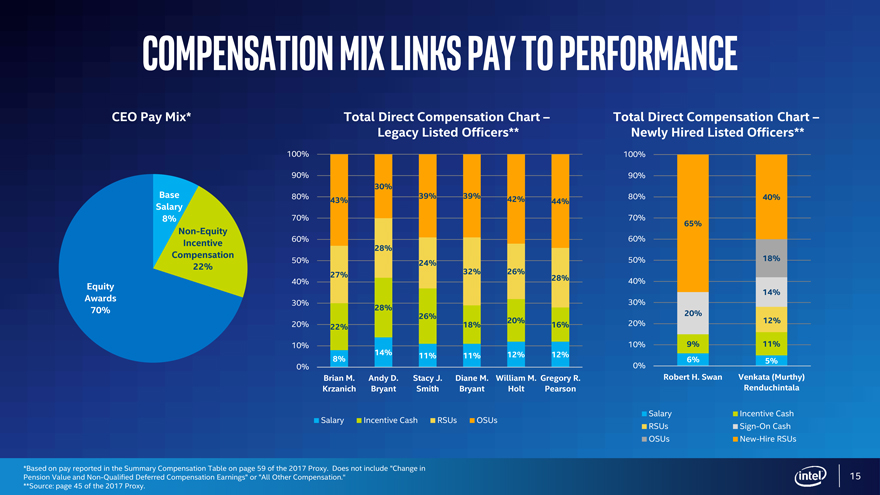

Compensation Mix Links Pay to Performance

CEO Pay Mix*

Total Direct Compensation Chart –Legacy Listed Officers**

Total Direct Compensation Chart –Newly Hired Listed Officers**

Base Salary 8%

Non-Equity Incentive Compensation 22%

Equity Awards 70%

100% 90% 30% 80% 39% 39% 43% 42% 44% 70% 60% 28% 50% 24% 32% 26% 27% 28% 40% 30%

28% 26% 20% 20% 22% 18% 16% 10% 14% 12% 12% 11% 11% 8% 0%

Brian M. Andy D. Stacy J. Diane M. William M. Gregory R. Krzanich Bryant Smith Bryant Holt Pearson

Salary Incentive Cash RSUs OSUs

100% 90% 80% 40% 70% 65% 60% 50% 18% 40% 14% 30% 20%

20% 12%

10% 9% 11%

0% 6% 5% Robert H. Swan Venkata (Murthy) Renduchintala

Salary Incentive Cash RSUsSign-On Cash OSUsNew-Hire RSUs

*Based on pay reported in the Summary Compensation Table on page 59 of the 2017 Proxy. Does not include “Change in

Pension Value andNon-Qualified Deferred Compensation Earnings” or “All Other Compensation.“ 15 **Source: page 45 of the 2017 Proxy.

Leadership Developments AND Key Compensation Decisions

We expect that the perspectives our new and current executive officers bring to the company will help accelerate our transformation from a PC company to a cloud and smart, connected device company

Brian M. Our CEO has over 31 years of service with Intel and brings senior leadership,

Krzanich experience, and a unique perspective on the company. His 2016 salary and annual

Third Year equity grant value were increased in order to bring his total compensation to the

as CEO median of market.

An industry expert and former Qualcomm executive, Mr. Renduchintala joined Intel in

Venkata late 2015, bringing a unique blend of technical, operations, business, and customer

(Murthy) relationship-building skills, as well as extensive expertise from his long career in the

Renduchintala system-on-chip, mobile, and Internet of Things areas. Hisnew-hire compensation

Key New Hire included asign-on bonus andnew-hire RSUs to offset in part the value given up in

separating from his prior employer and to encourage him to join Intel.

Mr. Swan, a former private equity partner and CFO of eBay, joined Intel in late 2016 and

Robert H. provides a wealth of financial acumen and strategic insight for Intel’s continuing

Swan transformation. Hisnew-hire compensation included asign-on bonus andnew-hire

New CFO RSUs to offset in part the value given up in separating from his prior employer and to

encourage him to join Intel.

16

Leadership Developments AND Key Compensation Decisions

We expect that the perspectives our new and current executive officers bring to the company will help accelerate our transformation from a PC company to a cloud and smart, connected device company

Stacy J. Our former CFO moved into a new role in late 2016, assuming responsibility for

overseeing manufacturing, operations, and sales. Mr. Smith had received a 3% increase

Smith in salary and 5% increase in annual equity grant value for 2016, in line with market

Critical New Role trends for his role as our then CFO.

The general manager of our Data Center Group was promoted to Executive Vice

Diane M. President and was appointed as an executive officer in 2016, reflecting the elevated role

Bryant of our cloud and data center businesses as growth drivers for the company. Ms. Bryant’s

Enhanced Role salary and annual cash incentive target were increased as a result of her promotion, and

she received a promotional grant of RSUs.

Andy D. Our former CAO and CFO provides critical Board leadership. His role has transitioned to

focus primarily on supporting and guiding the Board, and his 2016 salary, annual cash

Bryant incentive target, and annual equity grant value were reduced to reflect this change in his

Board Leadership role.

17

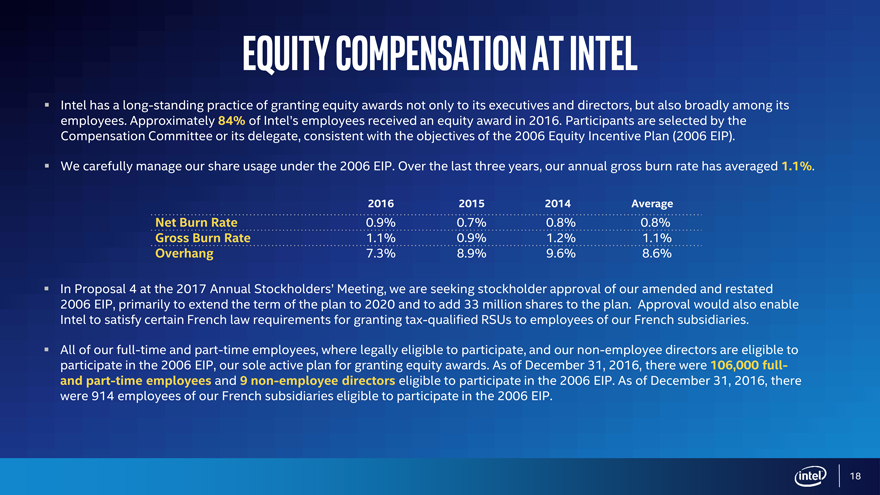

Equity Compensation at Intel

Intel has a long-standing practice of granting equity awards not only to its executives and directors, but also broadly among its employees. Approximately 84% of Intel’s employees received an equity award in 2016. Participants are selected by the Compensation Committee or its delegate, consistent with the objectives of the 2006 Equity Incentive Plan (2006 EIP).

We carefully manage our share usage under the 2006 EIP. Over the last three years, our annual gross burn rate has averaged 1.1%.

2016 2015 2014 Average

Net Burn Rate 0.9% 0.7% 0.8% 0.8% Gross Burn Rate 1.1% 0.9% 1.2% 1.1% Overhang 7.3% 8.9% 9.6% 8.6%

In Proposal 4 at the 2017 Annual Stockholders’ Meeting, we are seeking stockholder approval of our amended and restated 2006 EIP, primarily to extend the term of the plan to 2020 and to add 33 million shares to the plan. Approval would also enable Intel to satisfy certain French law requirements for grantingtax-qualified RSUs to employees of our French subsidiaries.

All of our full-time and part-time employees, where legally eligible to participate, and ournon-employee directors are eligible to participate in the 2006 EIP, our sole active plan for granting equity awards. As of December 31, 2016, there were 106,000full-and part-time employees and 9non-employee directors eligible to participate in the 2006 EIP. As of December 31, 2016, there were 914 employees of our French subsidiaries eligible to participate in the 2006 EIP.

18

Board of Directors Voting Recommendations

Annual Meeting Agenda and Voting

Voting Recommendation Proposal of the Board

1. Election of the 11 directors named in the proxy statement FOR EACH DIRECTOR NOMINEE

2. Ratification of selection of Ernst & Young LLP as our independent registered public accounting firm for 2017 FOR

3. Advisory vote to approve executive compensation FOR

4. Approval of amendment and restatement of the 2006 Equity Incentive Plan FOR

5. Advisory vote on the frequency of holding future advisory votes to approve executive compensation ONE YEAR

Stockholder Proposals

6. Stockholder proposal requesting an annual advisory vote on political contributions, if properly presented AGAINST

Stockholder proposal requesting that votes counted on stockholder proposals exclude abstentions,

7. AGAINST if properly presented

Our Board asks for your support at our 2017 Annual Stockholders’ Meeting

19

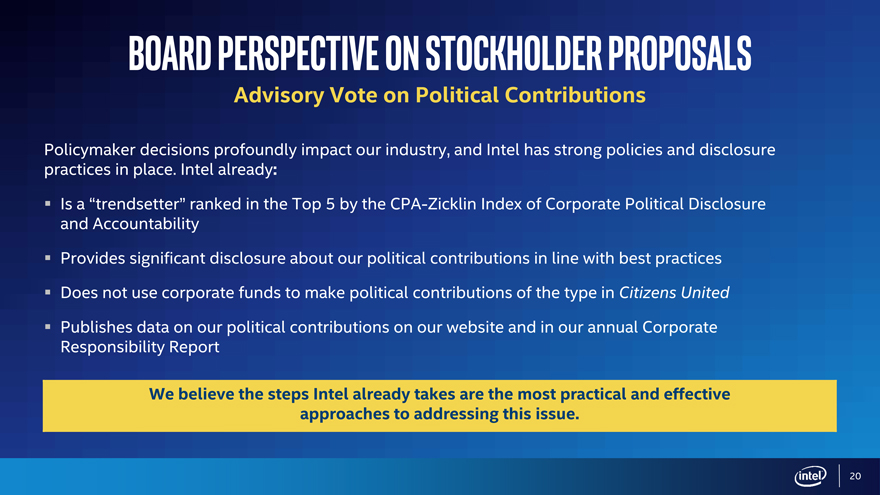

Board Perspective on Stockholder Proposals

Advisory Vote on Political Contributions

Policymaker decisions profoundly impact our industry, and Intel has strong policies and disclosure practices in place. Intel already:

Is a “trendsetter” ranked in the Top 5 by theCPA-Zicklin Index of Corporate Political Disclosure and Accountability

Provides significant disclosure about our political contributions in line with best practices

Does not use corporate funds to make political contributions of the type in Citizens United

Publishes data on our political contributions on our website and in our annual Corporate Responsibility Report

We believe the steps Intel already takes are the most practical and effective approaches to addressing this issue.

20

Board Perspective on Stockholder Proposals

Adopting an Alternative Voting Standard for Stockholder Proposals

Intel is committed to good corporate governance standards. Intel already: Employs a majority voting standard in uncontested director elections Has no supermajority voting provisions in its governing documents Provides for the annual election of all directors

Was one of the first large public companies to provide stockholders the opportunity to vote on an advisory basis to approve our executive compensation and now provides that voting opportunity on an annual basis

We believe our corporate governance practices, including our existing vote counting standards, empower and appropriately recognize all stockholders.

21

2017 Annual STOCKholders’ MEETING

This information is being provided to stockholders in addition to the proxy statement filed by Intel with the Securities Exchange Commission on April 6, 2017.

Please read the complete proxy statement and accompanying materials carefully before you make a voting decision. Voting instructions and proxies may be revoked at any time in the manner described in more detail in the proxy statement.

The proxy statement is available free of charge at www.intc.com and at www.sec.gov.

Intel, the Intel logo, Intel Core, XMM, Stratix, and Intel Optane are trademarks of Intel Corporation in the U.S. and/or other countries. *Other names and brands may be claimed as the property of others.

Forward-Looking Statements

Statements in these supplemental materials that refer to forecast, future plans, and expectations are forward-looking statements that involve a number of risks and uncertainties. Words such as “anticipates,” “expects,” “intends,” “goals,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “may,” “will,” “would,” “should,” “could,” and variations of such words and similar expressions are intended to identify such forward-looking statements. Statements that refer to or are based on projections, uncertain events, or assumptions also identify forward-looking statements. Such statements are based on management’s expectations as of May 1, 2017 and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Important factors that could cause actual results to differ materially from the company’s expectations are set forth in Intel’s earnings release dated April 27, 2017, which is included as an exhibit to Intel’s Form8-K furnished to the SEC on such date. Additional information regarding these and other factors that could affect Intel’s results is included in Intel’s SEC filings, including the company’s most recent reports on Forms10-K and10-Q. Copies of Intel’s Form10-K,10-Q and8-K reports may be obtained by visiting our Investor Relations website at www.intc.com or the SEC’s website at www.sec.gov.

22