- INTC Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Intel (INTC) DEF 14ADefinitive proxy

Filed: 31 Mar 20, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant To Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under § 240.14a-12

INTEL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☑ | No fee required. | |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

(1) | Title of each class of securities to which transaction applies:

| |

(2) | Aggregate number of securities to which transaction applies:

| |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |

(4) | Proposed maximum aggregate value of transaction:

| |

(5) | Total fee paid:

| |

☐ | Fee paid previously with preliminary materials:

| |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid:

| |

(2) | Form, Schedule or Registration Statement No.:

| |

(3) | Filing Party:

| |

(4) | Date Filed:

| |

2020 proxy statement notice of annual stockholders' meeting

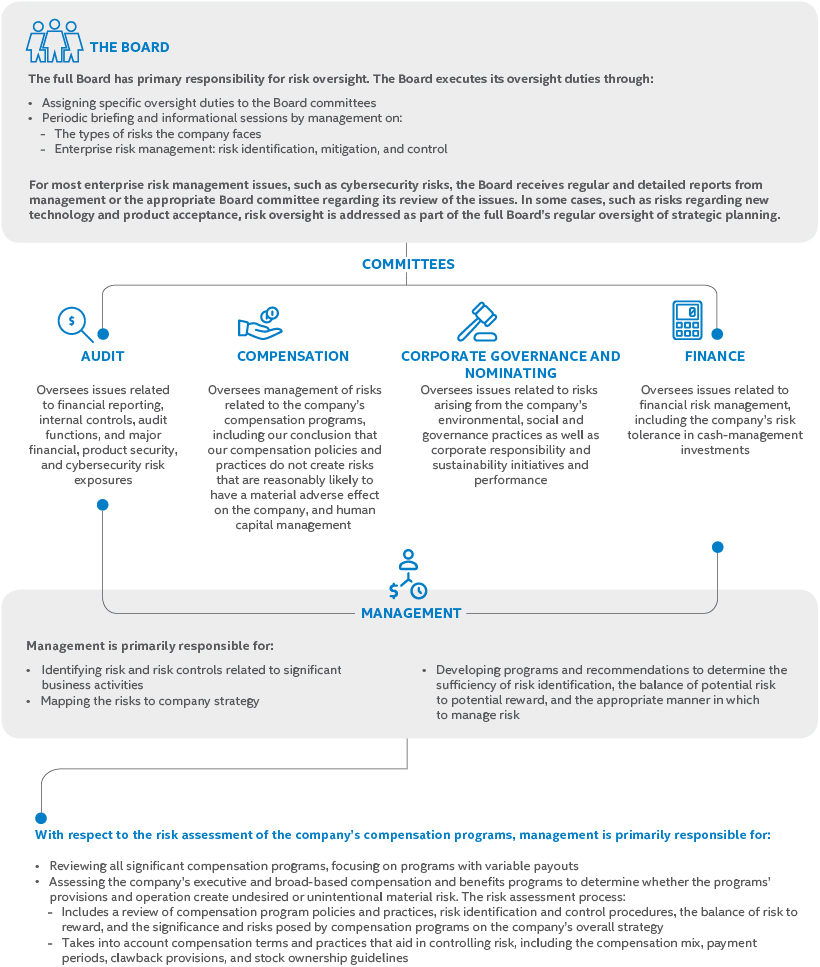

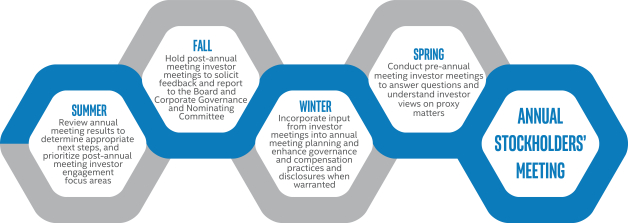

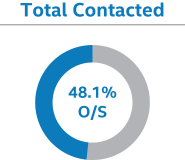

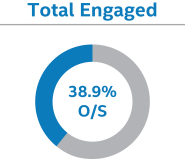

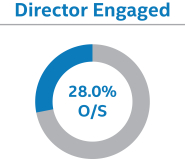

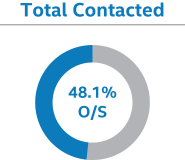

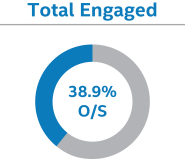

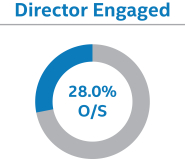

INVESTOR Engagement we heard you speak to see how we responded to your feedback, see page xxx. Total contacted 48.1% 0/s total engaged 38.9% 0/s director engaged 28.0% 0/s We are proud of our long-standing and robust investor engagement program. Our integrated outreach team, led by our investor relation group, corporate responsibility office, and the corporate secretary's office, engages proactively with our stockholders, maintaining a two-way, year-round governance calendar as shown [here][in this graphics. During 2019, our engagement program addressed corporate governance best practices, our executive compensation program, our Board's operation and experience, and our commitment to addressing environmental and social responsibility issues that are critical to our business. Through direct participation in our engagement efforts and through briefings form our engagement teams, our directors are able to monitor developments in corporate governance and social responsibility and benefit from our stockholders' perspectives on these topics. In consultation with our board, we seek to thoughtfully adopt and apply developing practices in a manner that best supports our business and our culture. SUMMER Review annual meeting results to determine appropriate next steps, and prioritize post-annual meeting investor engagement focus areas FALL Hold post-annual meeting investor meetings to solicit feedback and report to the Board and Corporate Governance and Nominating Committee WINTER Incorporate input from investor meetings into annual meeting planning and enhance governance and compensation practices and disclosures when warranted SPRING Conduct pre-annual meeting investor meetings to answer questions and understand investor views on proxy matters ANNUAL STOCKHOLDERS' MEETING Additional detail on specific topics and initiatives we have adopted is discussed under "Investor Engagement" September 30, 2019on page XX.

DEAR STOCKHOLDER,

Our strategic evolution to capitalize on the exponential growth of data and help customers unleash its potential with technology to process, store, and move more data, faster, is transforming many aspects of our company. It is particularly important that our leadership and our culture reflect and support this transformation, and we have made great progress to provide a solid foundation for our growth and leadership in this new era. This strategic evolution has driven change throughout the company, while the core fundamental principles of our operations and values remain unchanged. Key among those are our commitment to our stockholders and our recognition that leadership on environmental, social, and governance issues makes us a stronger company and enables us to create value for our community.

FRESH BOARD PERSPECTIVES

Since the beginning of 2017, we have welcomed six new independent directors to the Board, each of whom brings extensive experience and fresh perspectives to enrich Board dialogue and enhance the Board’s ability to continue effectively overseeing the business. Our Board reflects a diverse set of perspectives, skills, and experiences to position our company for the future.

“At Intel, a key question that is front and center in the boardroom is how our decisions impact our stockholders. As a result, we find it incredibly important to ensure that we have a meaningful dialogue with our investors throughout the year so we can get their feedback on important matters affecting Intel. This is particularly true in a year when our investors express dissatisfaction with some aspect of our practices, as they did through last year’s “say on pay” vote. Following this vote, I made it a priority on behalf of the board to engage directly with investors to better understand the reasons for their vote. Following meetings with investors representing 28% of our stock, I discussed your feedback with the board and have worked with management to incorporate it into our practices and disclosures.”

—Omar Ishrak

Independent Chairman

In keeping with our strong commitment to independent Board oversight, we have long separated the roles of Board Chairman and CEO. Returning to our past practice of having an independent director serve as Board Chairman, it was my honor to be elected Board Chairman in January 2020. Our immediate past Chairman, Andy Bryant, will be retiring from the Board as of the 2020 Annual Meeting. Over the past 39 years, Andy has served Intel in a number of crucial roles. He has led with integrity and an abiding focus on delivering results with the best interests of Intel and our stakeholders in mind. On behalf of myself, the rest of the Board and the broader Intel family, I thank and congratulate Andy for his service. Much of what Intel has become in its first 50 years is due in no small part to his enduring commitment to the company, its employees and its stockholders.

FULLY ALIGNED EXECUTIVE MANAGEMENT TEAM

As we continue our work to shape the future of technology, we believe our leadership team must be committed to and have a stake in that future. During the course of 2019, we made three key changes to our management leadership team. In January 2019, our Board named Bob Swan to be Chief Executive Officer, based on the Board’s conclusion after a thorough search that Bob is the right leader to drive Intel into its next era of growth. To complement Bob’s unique talents and to empower Intel’s executive leaders to drive transformative change and improve execution, in April 2019, the Board appointed George Davis as our Chief Financial Officer and in June 2019 the Board appointed Sandra Rivera as our new Chief People Officer. Both George and Sandra lead critical aspects of Intel’s long-term strategy to power a data-centric world, while remaining committed to the fundamental principles that have guided Intel through its first half-century. The Board is confident that these changes have strengthened and reinvigorated our management team and have positioned Intel for sustainable success as we continue our evolution.

CULTURAL EVOLUTION ACROSS THE ENTERPRISE

The Board understands the importance of corporate culture and firmly believes that a strong culture allows Intel to attract and retain talented and engaged employees who can deliver their best every day and who create the intellectual capital the company relies on to develop and advance our technologies and manufacturing. As we continue our strategic transformation, the Board and our management team are fully committed to evolving our corporate culture in order to capitalize on our massive market opportunity in Intel’s history and to fulfill Intel’s purpose of creating world-changing technology that enriches the lives of every person on earth.

|

2020 PROXY STATEMENT | Letter From Your Chairman |

3 | ||||

LETTER FROM YOUR CHAIRMAN CONTINUED

Like our broader strategic transformation, the transformation of our corporate culture will be a multi-year journey. Intel must be customer obsessed to deliver every aspect of our business to the highest quality, act fearlessly as “One Intel” and create an inclusive environment that welcomes truth and transparency. This cultural evolution will touch everything from the way employees work together, serve our customers and make decisions, to how we reward performance, promote our employees and enable our workplace with technology.

In 2019, we took significant steps in support of this cultural evolution. We replaced our legacy performance management system with one based on the principles driving our ongoing strategic transformation, and under the leadership of our new Chief People Officer, we are actively cultivating new employee processes and programs to promote sustainable growth and dynamic employee engagement. We also revised our annual incentive cash program for 2020 to embrace a “One Intel” approach, under which employees’ bonuses depend on our successes across the company, and not just based on individual business group achievements. Through the efforts of our Compensation Committee, the Board holds our management leaders accountable for making meaningful progress in support of our cultural evolution, which is critical in pursuit of an expanded market opportunity, fueled by data. The Board believes this will help make us even more nimble and proactive in order to compete in new markets, anticipate emerging demands and drive success.

LONGSTANDING COMMITMENT TO STOCKHOLDER ENGAGEMENT

Intel remains committed to year-round and meaningful engagement with our stockholders. Our integrated stockholder outreach team meets with a broad base of investors throughout the year to discuss corporate governance, executive compensation, corporate responsibility practices, and other matters of importance. Our team then reports to the Board on investor feedback and emerging governance issues, allowing the Board to better understand our stockholders’ priorities and perspectives and to incorporate them into the Board’s business and strategy decisions. Over the past year, we solicited feedback on and had robust discussions with stockholders regarding the best way to incentivize our management team and discussed other important issues, including Board leadership structure, Board oversight of key ESG matters and initiatives and Intel’s corporate responsibility performance and disclosures. In addition to the engagement conducted by our integrated outreach team, I personally had discussions with investors representing 28% of our stock to ensure that our deliberations in the boardroom were being informed by direct feedback in addition to the helpful insights gained through our outreach team’s engagements. These discussions prove

truly valuable to the Board and I look forward to our continued engagement with Intel stockholders and other stakeholders over the coming year.

CONTINUED ENVIRONMENTAL, SOCIAL AND GOVERNANCE LEADERSHIP

Intel has a long history of leadership in corporate governance and corporate responsibility of setting ambitious goals for our company, leading industry and multi-stakeholder initiatives, and collaborating with others to apply our technology to solve global challenges. Our integrated approach enables us to mitigate risks, reduce costs, protect brand value, and identify market opportunities, in turn creating value for Intel, our stockholders and the communities we serve. Under the Board’s oversight, we have embedded corporate responsibility and sustainability considerations into our corporate strategy, compensation, disclosure, and long-term goals. To reinforce and align our executives to these goals, since 2008 a portion of the operational performance component of our annual incentive cash program has been tied to key corporate responsibility goals within our executive and employee compensation, including inclusion and environmental metrics.

I would like to briefly highlight two of our corporate responsibility and corporate governance efforts that I feel particularly reflect Intel’s long-standing values, and I encourage you to carefully review this proxy statement as it discusses many of our other key initiatives in greater detail.

MANAGING HUMAN CAPITAL FOR SUCCESS

Given the highly technical nature of our business, our success depends on our ability to attract and retain talented and skilled employees to create the technology of the future. In order to attract, retain, and grow talented and engaged employees who can deliver their best work every day, we invest significant resources to making Intel a rewarding place to work, creating a company which our employees are proud to be a part of, and fostering an environment where we promote diversity and inclusion. For over a decade, we have tracked and publicly reported on key human capital metrics, including workforce demographics, diversity and inclusion data, turnover and training data, and all the initiatives and tracking are regularly shared with the Board. In 2018, we met our goal to achieve full representation of women and underrepresented minorities in our U.S. workforce, two years ahead of schedule, and in 2019, we continued to advance transparency in our pay and representation data by publicly releasing our 2017 and 2018 EEO-1 survey pay data. However, we know there is still more that we can do to cultivate and empower our talented workforce. With approximately 90% of our employees working in technical

4 |

Letter From Your Chairman | 2020 PROXY STATEMENT |

| ||||

LETTER FROM YOUR CHAIRMAN CONTINUED

roles, our success depends on them understanding how their work contributes to the company’s overall strategy. We use a variety of channels to facilitate open and direct communication, including open forums with executives; semiannual employee experience surveys; and engagement through more than 30 employee resource groups, including the Women at Intel Network, the Network of Intel African American Employees, the Intel Latino Network, and many others.

FOCUS ON SUSTAINABILITY AND CLIMATE IMPACT

Our commitment to environmental sustainability began over 50 years ago with our co-founder Gordon Moore. And as we look ahead to the future, our ambitions and the need for industry leadership have never been greater to continuously improve energy efficiency, reduce emissions, and conserve resources throughout our operations and beyond. We are committed to transparency and performance improvement in environmental sustainability and have established public goals regarding, among other things, reducing our greenhouse gas emissions, investing in renewable energy, conserving water, and reducing waste generation. We continue to invest in reducing our own direct climate “footprint”—the emissions resulting from our own operations, our supply chain, and the marketing and use of our products, and we also collaborate with our customers and others to increase our “handprint”—the ways in which our technology can help others reduce their environmental impact. We leverage the experience gleaned from our longstanding sustainability efforts and collaborate with others to drive industry-wide improvements and policy change. And we carry this focus to our supply chain as well, actively collaborating with others and leading industry initiatives on key issues such as advancing responsible minerals sourcing, addressing risks of human rights issues including forced and bonded labor, and improving transparency around climate and water impacts in the global electronics supply chain.

The Board receives regular updates on our progress on our performance and our corporate responsibility goals. We are proud of what our company has accomplished to date—but as we look toward the next decade, we know that even greater leadership will be required. We look forward to sharing our new 2030 corporate responsibility goals later this year, enabling Intel to continue our leadership and to collaborate with others to achieve wider global impact.

MAKING THE RIGHT INVESTMENTS FOR THE FUTURE

We believe that the strategic investments we have made in a product portfolio spanning the cloud to edge computing, including in new and growing opportunities such as AI, autonomous driving and the intelligent edge, and 5G, will continue to create new value for Intel, our stockholders, and other stakeholders.

In 2020, we will continue to support our executive leaders to make the necessary investments in R&D to deliver leadership products in both our core and emerging businesses. Importantly, capital expenditures will be applied to increase the manufacturing capacity and accelerate the pace of process node introductions.

As we continue our evolution as a company, there will be significant opportunities to apply Intel’s technology and the passion and expertise of our talented people to help solve the world’s greatest challenges in a smart, connected, and data-centric world. The Board, the management team, and our employees welcome these challenges, and appreciate your continued support.

On behalf of Board, I thank you for choosing to invest in Intel and for entrusting us to help lead the company into this new and exciting phase of our evolution.

Sincerely,

|

OMAR ISHRAK Chairman of the Board

INTEL CORPORATION 2200 Mission College Blvd. Santa Clara, CA 95054-1549 (408) 765-8080 |

|

2020 PROXY STATEMENT | Letter From Your Chairman |

5 | ||||

| DATE | TIME | RECORD DATE | ||

THURSDAY, MAY 14, 2020 |

8:30 A.M. PACIFIC TIME |

MARCH 16, 2020 | ||

HOW TO VOTE

Please act as soon as possible to vote your shares, even if you plan to attend the annual meeting online. If you are a beneficial stockholder, your broker will NOT be able to vote your shares with respect to the election of directors and most of the other matters presented during the meeting unless you have given your broker specific instructions to do so. We strongly encourage you to vote. You may vote via the Internet, by telephone, or, if you have received a printed version of these proxy materials, by mail. For more information, see “Additional Meeting Information” on page 112. | VOTE

ONLINE at www.proxyvote.com You may also attend the annual meeting online, including to vote and/or submit questions,

BY PHONE by calling the applicable number. For stockholders of record: (800) 690-6903 For beneficial stockholders: (800) 454-8683

BY MAIL if you have received a printed version of these proxy materials. |

ATTEND THE MEETING

LOGISTICS

| • | Attend the annual meeting online, including to vote and/or submit questions, at www.virtualshareholdermeeting.com/Intel20. |

| • | The annual meeting will begin at approximately 8:30 a.m. Pacific Time, with log-in beginning at 8:15 a.m., on Thursday, May 14, 2020. |

ASKING QUESTIONS

• You may submit questions for the meeting in advance at www.proxyvote.com.

• You may submit live questions during the meeting

IF YOU CANNOT ATTEND, FOLLOWING THE MEETING:

• A replay of our annual meeting webcast will be available at our Investor Relations website at

• A list of answers to investors’ questions received before and during the annual meeting will be available at the same website. | Scan this code to your phone to receive all of the meeting details:

|

MANAGEMENT PROPOSALS |

VOTING RECOMMENDATION OF THE BOARD | |

1. Election of the nine directors named in this proxy statement | FOR EACH DIRECTOR NOMINEE | |

2. Ratification of selection of Ernst & Young LLP as our independent registered public accounting firm for 2020 |

FOR | |

3. Advisory vote to approve executive compensation of our listed officers | FOR | |

4. Approval of amendment and restatement of the 2006 Employee Stock Purchase Plan | FOR | |

STOCKHOLDER PROPOSALS |

| |

5. Stockholder proposal on whether to allow stockholders to act by written consent, if properly presented at the meeting | AGAINST | |

6. Stockholder proposal requesting a report on the global median gender/racial pay gap, if properly presented at the meeting | AGAINST | |

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD MAY 14, 2020:

THE NOTICE OF 2020 ANNUAL STOCKHOLDERS’ MEETING AND PROXY STATEMENT AND THE 2019 ANNUAL REPORT ON FORM 10-K ARE AVAILABLE AT WWW.INTC.COM/ANNUALS.CFM

6 |

Intel Corporation Notice of 2020 Annual Stockholders’ Meeting | 2020 PROXY STATEMENT |

| ||||

3 |

| |||||||||||||

6 | ||||||||||||||

8 |

INDEX OF FREQUENTLY | |||||||||||||

BOARD OF DIRECTORS MATTERS | ||||||||||||||

16 | 55 | |||||||||||||

22 | 52 | |||||||||||||

25 | 26 | |||||||||||||

CORPORATE GOVERNANCE MATTERS | 27 | |||||||||||||

27 | 102 | |||||||||||||

33 | 87 | |||||||||||||

37 | 51 | |||||||||||||

40 | 35 | |||||||||||||

47 | 32 | |||||||||||||

52 | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 39 | ||||||||||||

AUDIT COMMITTEE MATTERS | 60 | |||||||||||||

54 | PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT AUDITOR | 33 | ||||||||||||

56 | 30 | |||||||||||||

LISTED OFFICER COMPENSATION MATTERS | 17 | |||||||||||||

58 | 24 | |||||||||||||

59 | 25 | |||||||||||||

59 | 66 | |||||||||||||

68 | 43 | |||||||||||||

83 | 38 | |||||||||||||

88 | 32 | |||||||||||||

89 | 60 | |||||||||||||

89 | 59 | |||||||||||||

93 | 73 | |||||||||||||

95 | 84 | |||||||||||||

96 | 86 | |||||||||||||

97 | 50 | |||||||||||||

98 | 28 | |||||||||||||

100 | 86 | |||||||||||||

ADDITIONAL COMPENSATION MATTERS | 14 | |||||||||||||

102 | 71 | |||||||||||||

103 | PROPOSAL 4: AMENDMENT AND RESTATEMENT OF THE 2006 EMPLOYEE STOCK PURCHASE PLAN | 33 | ||||||||||||

STOCKHOLDER PROPOSALS | 87

|

| ||||||||||||

108 | ||||||||||||||

110 | ||||||||||||||

ADDITIONAL MEETING INFORMATION | ||||||||||||||

112 | † Information in Proxy

| |||||||||||||

112 | ||||||||||||||

112 | ||||||||||||||

OTHER MATTERS | ||||||||||||||

115 | ||||||||||||||

115 | ||||||||||||||

117 | ||||||||||||||

A-1 | ||||||||||||||

B-1 | APPENDIX B: AMENDED AND RESTATED 2006 EMPLOYEE STOCK PURCHASE PLAN | |||||||||||||

|

2020 PROXY STATEMENT | Table of Contents |

7 | ||||

We are a world leader in the design and manufacturing of essential products and technologies that power the cloud and an increasingly smart, connected world. Our purpose we create world-changing technology that enriches the lives of every person on earth. Our commitment to corporate responsibility and sustainability leadership is deeply integrated throughout our business. Intel was founded in 1968 and our technology has been at the heart of computing breakthroughs ever since. More than 50 years later, we are a world leader in the design and manufacturing of essential technologies that power the cloud and an increasingly smart, connected world. Intel is transforming from a PC-centric company to a data-centric company, with workload-optimized solutions designed to help a broad set of customers process, move, and store ever-increasing amounts of data. This exponential growth of data is reshaping computing and expanding our opportunity. We are investing to lead data-driven technology inflections that position us to play a bigger role in the success of our customers. These include: the rise of AI, the transformation of networks, the intelligent edge1 emerging with the Internet of Things, and autonomous driving. Intel's ambitions have never been greater: to create world-changing technology that enriches the lives of every person on earth. Our commitment to corporate responsibility and to creating an inclusive environment to support the talent of our amazing people supports our ambitions and makes us stronger. When every employee has a voice and a sense of belonging, Intel can be more innovative, agile, and competitive. "We are at a key inflection point with the exponential growth of data creating massive demand for semiconductors. Cloud workloads are diversifying, networks are transforming, and more computing performance is moving to the edge. We have been on a multi-year journey to reposition the company's portfolio to take advantage of this industry catalyst. Today, we have the product and technology leadership that uniquely positions us to capitalize on these trends, and we are investing in the IP required to help our customers win the inflections of the future." -Bob Swan, Chief Executive Officer 1 Intel's definition is included in "Key Terms" within the Financial Statements and Supplemental Details in our Annual Report on Form 10-K.

OVERVIEW OF THE BOARD

For the 2020 Annual Stockholders’ Meeting, our Board recommends the following nine director nominees listed below. Our Board considers numerous factors when assessing the qualifications for each Board nominee, such as alignment with the Company’s future strategic direction; independence; understanding of and experience in manufacturing, technology, finance, and marketing; senior leadership experience; international experience; mix of ages; and gender, racial, geographic and ethnic diversity. In this regard, our Board is committed to actively seeking women and minority director candidates for consideration.

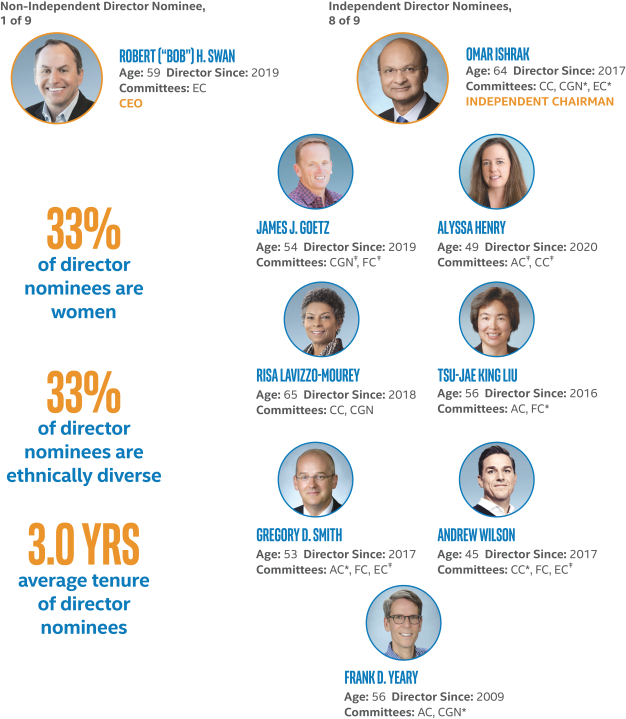

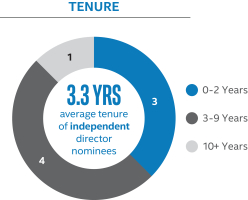

Non-Independent Directors Nominee, 1 of [9] Independent Directors, [8] of [9] ROBERT ("bob") H. SWAN Age: 59 Director Since: 2019 Committees: EC CEO OMAR ISHRAK Age: 64 Director Since: 2017 Committees: CC, CGN*, EC* INDEPENDENT CHAIRMAN 33% of director nominees are women JAMES J. GOETZ Age: 54 Director Since: 2019 Committees: ALYSSA HENRY Age: 49 Director Since: 2020 Committees: 33% of director nominees are ethnically diverse RISA LAVIZZO-MOUREY Age: 65 Director Since: 2018 Committees: CC, CGN TSU-JAE KING LIU Age: 56 Director Since: 2016 Committees: AC, FC* 3.0 YRS average tenure of director nominees GREGORY D. SMITH Age: 53 Director Since: 2017 Committees: AC*, FC ANDREW WILSON Age: 45 Director Since: 2017 Committees: CC*, FC FRANK D. YEARY Age: 56 Director Since: 2009 Committees: AC, CGN*

AC Audit Committee CC Compensation Committee CGN Corporate Governance & Nominating Committee EC Executive Committee

FC Finance Committee * Committee Chair/Co-Chair

| Effective after the conclusion of Intel’s 2020 Annual Stockholders’ Meeting, provided he/she is re-elected to the Board by stockholders at the meeting. |

|

2020 PROXY STATEMENT | Proxy Statement Highlights |

9 | ||||

BOARD RESPONSIVENESS TO INVESTORS IN 2019

Our relationship with our stockholders is an important part of our company’s success and we have a long tradition of engaging with our stockholders and obtaining their perspectives. Following a disappointing “say on pay” vote in 2019, which received approximately 60% support, we undertook extensive engagement efforts to better understand the reasons for how our investors voted, as well as to obtain their views on other key corporate governance and disclosure matters, and to determine how best to respond.

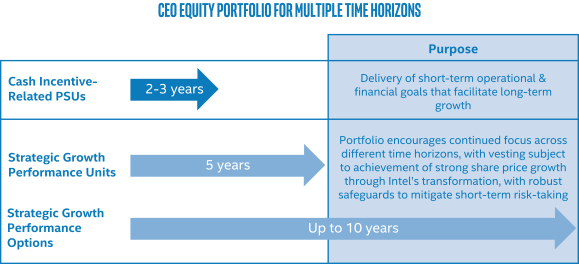

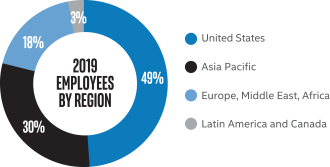

Who we met with 48.1% 38.9% 28.0% of shares contacted for engagement of shares engaged with overall of shares engaged by Chairman of the Board An integrated outreach team Corporate Legal + Executive Compensation + Corporate Responsibility + Investor Relations What we discussed Our business Our ESG practices >50 Leadership transition Strategy execution Cultural transformation Financial performance Strategic growth awards Board composition Risk oversight ESG disclosures separate investor meetings throughout the year How we responded Board Composition Added more disclosure on future director recruitment priorities See page XX Board Oversight Added more disclosure on board's oversight of cultural transformation See page XX ESG Disclosures Added more disclosure on how we integrate ESG goals into our pay programs See page XX Continuing to work to align disclosures with SASB/TCFD Strategic Growth Equity Awards Added more disclosure on rationale for awards See page XX Added that the Compensation Committee has no intention to grant additional one-time equity awards to any current executive officers Annual Bonus Plan Added more disclosure on business group operational See page XX Where to find more info See "Investor Engagement" on page XX and "Investor Engagement and the 2019 'Say on Pay' Vote" on page XX

| * | Environmental, Social, and Governance (ESG); Sustainability Accounting Standards Board (SASB); and Taskforce on Climate-Related Financial Disclosures (TCFD). |

10 |

Proxy Statement Highlights | 2020 PROXY STATEMENT |

| ||||

EXECUTIVE COMPENSATION SUMMARY

Intel’s executive compensation programs are designed to incentivize the implementation of our growth strategy. There are three key drivers of our executive compensation programs: a competitive pay positioning strategy, a heavy emphasis on incentive-driven pay, and goals that are appropriately aligned with our business strategy (in terms of both selection and attainability).

Our executive compensation programs continue to be tied to the company’s financial performance, support our commitment to good compensation governance, and provide market-based opportunities to attract, retain, and motivate our executives in an intensely competitive market for qualified talent.

LISTED OFFICER PAY OVERVIEW

| PAY ELEMENT | PURPOSE |

| PERFORMANCE PERIOD | PERFORMANCE METRICS |

| |||||

| BASE SALARY | Designed to be market-competitive and attract and retain talent | ANNUAL | — | |||||||

ANNUAL CASH BONUS | Incentivize achievement of Intel’s short-term financial and operational objectives | ANNUAL | • Net income growth (25%) • Relative net income growth vs. tech peers (25%) • Operational goals (50%) | |||||||

QUARTERLY CASH BONUS | Company-wide program that rewards quarterly profitability based on Intel’s net income relative to company compensation costs | QUARTER | • Company profitability | |||||||

RESTRICTED STOCK UNITS | Facilitates stock ownership, executive retention, and stockholder alignment | THREE YEARS | • Stock price appreciation | |||||||

PERFORMANCE STOCK UNITS | Designed to reward long-term profitability, long-term performance relative to peers, and alignment with stockholders | THREE YEARS | • Relative TSR vs. S&P 500 IT Index (50%) • Cumulative EPS growth compared to a target (50%) | |||||||

LEADERSHIP TRANSFORMATION

As described in last year’s proxy statement and discussed extensively with our stockholders both leading up to and following our 2019 Annual Stockholders’ Meeting, following a rigorous and extensive search both internally and externally and after strong performance as interim Chief Executive Officer (CEO), Mr. Swan was appointed our permanent CEO and a member of the Board of Directors in January 2019, with the mandate to carry forward our strategic transformation from a PC-centric to a data-centric company. Following Mr. Swan’s appointment as CEO, we have since appointed a new Chief Financial Officer and a new Chief People Officer, and promoted the head of our largest business group, Client Computing Group.

The Board approved certain promotion- and new hire-related compensation arrangements to facilitate this significant and impactful change in the management team. The Board is confident that our management team is the right group to position the company for continued strong, sustainable growth through this critical time of change. To support successful leadership transitions in 2018 and 2019, the Compensation Committee designed compensation programs that incentivize our executives to deliver on the full potential of our ongoing transformation. For more information regarding our 2019 pay decisions, please see the “Compensation Discussion & Analysis” on page 59.

|

2020 PROXY STATEMENT | Proxy Statement Highlights |

11 | ||||

A YEAR IN REVIEW

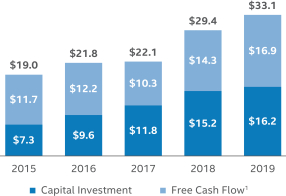

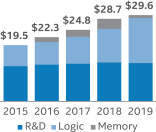

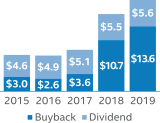

Our transformation to a data-centric company continued in 2019, and we experienced strong demand and reached critical product milestones. We achieved record revenue of $72.0 billion, 48% of which was from our data-centric businesses. We invested $13.4 billion in R&D while reducing our spending to 27% of revenue. Additionally, we made capital investments of $16.2 billion, generated $33.1 billion cash from operations and $16.9 billion of free cash flow1, and returned $5.6 billion in dividends to stockholders. We continue to focus on improving supply and supporting our customers’ growth. We increased our wafer capacity during 2019; however, we did not see a commensurate increase in client CPU unit volume as wafer capacity was largely consumed by increases in modem and chipset volumes, and unit die sizes.

Our 10nm manufacturing process entered full production as we launched our first products from this advanced technology. We are accelerating the pace of process node introductions and moving back to a 2- to 2.5-year cadence. We are on track to deliver our first 7nm-based product, a discrete GPU, at the end of 2021. 5G continues to be a strategic priority, and our exit from the 5G smartphone modem business is enabling us to increase the focus of our 5G efforts on the opportunity to modernize network and edge infrastructure. |

“We achieved record revenue for the fourth consecutive year, exercised discipline to drive spending efficiencies, and returned capital to our stockholders. Our results reflect a relentless commitment to improve execution that benefits our customers and increases shareholder value.”

— George Davis, Chief Financial Officer |

REVENUE | OPERATING INCOME | DILUTED EPS | CASH FLOWS | |||||||||||||||||||||||||

∎ PC-CENTRIC $B ∎ DATA-CENTRIC $B | ∎ GAAP $B ∎ NON-GAAP $B | ∎ GAAP ∎ NON-GAAP | ∎ OPERATING CASH FLOW $B ∎ FREE CASH FLOW1 $B | |||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||||

$72.0B

| $22.0B

| $23.8B

| $4.71

| $4.87

| $33.1B

| $16.9B

| ||||||||||||||||||||||

GAAP | GAAP | non-GAAP1 | GAAP | non-GAAP1 | GAAP | non-GAAP1 | ||||||||||||||||||||||

Revenue up 2% from 2018; Data-centric up 3% and PC-centric flat | Operating income down $1.3B or 5% from 2018; 2019 operating margin at 31%

| Operating income down $797M or 3% from 2018; 2019 operating margin at 33%

| Diluted EPS up $0.23 or 5% from 2018 | Diluted EPS up $0.29 or 6% from 2018 | Operating cash flow up $3.7B or 13%; operating cash flow to net income at 157% | Free cash flow up $2.7B or 19%; free cash flow to non-GAAP net income at 78% | ||||||||||||||||||||||

High-performance product sales in the second half of 2019, partially offset by NAND pricing pressure and decrease in platform2 unit sales | Lower gross margin from decrease in NAND market pricing and lower platform unit sales, partially offset by platform ASP strength

| Lower shares outstanding and platform ASP strength, partially offset by a decrease in platform unit sales and lower NAND market pricing | Working capital changes driven by tax and other assets and liabilities, partially offset by lower memory prepayments and inventory build | |||||||||||||||||||||||||

GOAL (2019 - 2021) | GOAL (2019 - 2021) | GOAL (2019 - 2021) | GOAL (2019 - 2021) | |||||||||||||||||||||||||

Low single-digit growth over the next three years to $76B-$78B; data-centric businesses high single-digit growth and PC-centric business approximately flat to slightly down

| Keep non-GAAP operating margin roughly flat at approximately 32% over the next three years | Grow non-GAAP diluted EPS in line with revenue over the next three years | Achieve free cash flow of approximately 80% of non-GAAP net income by 2021 | |||||||||||||||||||||||||

Progress | Progress | Progress | Progress | |||||||||||||||||||||||||

Revenue grew 2% from 2018 to 2019, to $72.0B | Non-GAAP operating margin was 33% in 2019 | Non-GAAP diluted EPS grew 6% from 2018 to 2019; revenue grew 2% over the same period | Free cash flow was 78% of non-GAAP net income | |||||||||||||||||||||||||

| 1 | See “Non-GAAP Financial Measures” in Appendix A. |

| 2 | See “Our Products” within MD&A in our 2019 Annual Report on Form 10-K. |

12 |

Proxy Statement Highlights | 2020 PROXY STATEMENT |

| ||||

DATA-CENTRIC BUSINESSES EXPAND WITH NEW OPPORTUNITIES

Data-Centric Portfolio Launch

We introduced a portfolio of data-centric solutions consisting of 2nd generation Intel® Xeon® Scalable processors, Intel® Optane™ DC memory and storage solutions, and software and platform technologies optimized to help our customers extract more value from their data. Our latest data center solutions target a wide range of use cases within cloud computing, network infrastructure, and intelligent edge applications, and support high-growth workloads, including AI and 5G.

|

|

10nm FPGAs Shipping

We began shipping engineering samples of Intel® Agilex™ FPGAs to customers. The 10nm-based FPGAs are used by our customers to develop advanced solutions for networking, 5G, and accelerated data analytics. The Intel® Agilex™ FPGA family leverages heterogeneous 3D SiP technology to deliver higher performance or higher power efficiency. |

Habana Labs Acquisition

We acquired Habana Labs Ltd., an Israel-based developer of programmable deep learning accelerators for the data center, for approximately $1.7 billion. Habana’s AI processors provide data scientists and developers with accelerator hardware that improves processing performance and reduces power consumption. Habana’s Gaudi* AI training processor is currently sampling with select hyperscale customers. Large-node training systems based on Gaudi* are expected to deliver up to four times increase in throughput versus systems built with the equivalent number of GPUs. The acquisition strengthens our AI portfolio and accelerates our efforts in the nascent, fast-growing AI silicon market.

BIG BETS UPDATE

We aim to be at the forefront of the constant technological change in our industry. We will evaluate new and existing big bets based on the following criteria: the “bet” is leading the edge of a technology inflection, it plays a significant role in our customers’ success, and it offers a clear path to profitability and attractive returns. Currently, our big bets are memory, autonomous driving, and 5G.

We exited 5G smartphone modem business to increase the focus of our 5G efforts on the broader opportunity to modernize network and edge infrastructure.

| We continue to make progress in memory and autonomous driving. We launched Intel® Optane™ DC persistent memory for the data center and continue to take steps to improve NAND profitability. Mobileye’s EyeQ*5, the vision central computer performing sensor fusion for fully autonomous driving, is operational in Mobileye’s autonomous test vehicles. |

PC-CENTRIC BUSINESS INNOVATES

10nm-based 10th Generation Intel® Core™ Shipping

We started shipping our 10nm-based 10th generation Intel® Core™ processors, previously referred to as Ice Lake. Our 10th generation Intel® Core™ processor silicon will enable the first wave of PCs with instructions for AI, includes an all-new CPU Core architecture and Gen 11 graphics engine, and is the first client CPU to integrate Wi-Fi 6 and Thunderbolt™ 3 connectivity modules.

Project Athena Innovation Program

Project Athena is a new multi-year innovation program to help the PC ecosystem create advanced laptops that meet ambitious key experience indicators in performance, responsiveness, battery life, form factor, and AI. The first laptops verified through the innovation program became |

available in 2019, identified by the visual marker “Engineered for Mobile Performance.”

“While process and CPU leadership remain fundamentally important, an extraordinary rate of innovation is required across a combination of foundational building blocks, including architecture, memory, interconnect, security, and software, to take full advantage of the opportunities created by the explosion of data.”

— Dr. Venkata (Murthy) M. Renduchintala, Group President of the Technology, Systems Architecture and Client Group and Chief Engineering Officer

|

2020 PROXY STATEMENT | Proxy Statement Highlights |

13 | ||||

Data has become a driving force in society. Our customers are asking for solutions to turn data into actionable insights, amazing experiences, and operational efficiencies. Intel platforms provide the foundation for these solutions because we have developed a portfolio of data-centric technologies that span the data center to the edge, enabling us to play a differentiated and growing role in the success of our customers.

MAKE THE WORLD’S BEST SEMICONDUCTORS

Moore’s Law, a law of economics predicted by Intel’s co-founder Gordon Moore more than 50 years ago, continues to be a strategic priority and differentiator. We make significant investments and innovations in our silicon manufacturing technologies and platforms. Our proprietary technologies make it possible to integrate products and platforms that address evolving customer needs and expand the markets we serve. However, making the best semiconductors requires more than just the best manufacturing process technologies.

LEAD TECHNOLOGY INFLECTIONS

Our strategic intent is to lead in key technology inflections that are fundamentally changing computing and communications. The most important drivers of change we see today are AI, the transformation of networks spearheaded by the transition to 5G, and the rise of the intelligent edge. We see a future where Intel® technologies enable our customers to move faster, store more, and process everything—from large complex applications in the cloud, to autonomous cars and small low-power devices on the edge.

BE THE LEADING END-TO-END PLATFORM PROVIDER FOR THE NEW DATA WORLD

Customers look to Intel for our end-to-end capability to deliver solutions that enable customers to move faster, store more, and process everything. We continue to make investments in optimizing our Intel® Xeon® processors in response to our customers’ need for high-performance computing. We continue to develop innovative memory and storage solutions, including Intel® QLC 3D NAND Technology and Intel® Optane™ memory, to provide data center products that are optimized to deliver world-class performance and drive lower total cost of ownership for cloud workloads. Our advancements in FPGAs enable efficient management of the changing demands of next-generation data centers and accelerate the performance of emerging applications.

RELENTLESS FOCUS ON OPERATIONAL EXCELLENCE AND EFFICIENCY

Underlying our transformation to a data-centric company is a relentless focus on operational excellence and efficiency. This focus includes the elimination of lower growth investments and activities, and the simplification and automation of routine processes and activities. These efforts also extend to our product design processes, where we are striving to reduce the complexity of our designs to improve our efficiency and enhance quality. These improvements enable us to achieve scale in our core operations, providing a stable and cost-effective platform to support additional investments in the design, development, and delivery of new products. Operational excellence helps us fund the expansion of our TAM through big-bet investments.

CONTINUE TO HIRE, DEVELOP, AND RETAIN THE BEST, MOST DIVERSE AND INCLUSIVE TALENT

At the core of our organization are highly skilled, diverse, and talented people capable of accelerating as one team in everything we do. We are proud of our past and inspired by how our employees are rising to the challenge to evolve our culture. Inclusion is the foundation of this evolution and runs through each of our culture attributes.

Our culture attributes reinforce:

CUSTOMER OBSESSED:

Our customer’s success is our success. We listen, learn, and anticipate our customers’ needs to deliver on their ambitions. | ONE INTEL:

We are stronger together and commit to team over individual success. | FEARLESS:

We are bold and innovative. We take risks, fail fast, and learn from mistakes. | TRUTH AND TRANSPARENCY:

We are committed to being open and honest while bringing clarity to complex challenges. | INCLUSION:

We strive to build a culture of belonging and welcome differences, knowing it makes us better. | QUALITY:

Our goal is to deliver quality products and services that our customers and partners can always rely on. | |||||||

14 |

Proxy Statement Highlights | 2020 PROXY STATEMENT |

| ||||

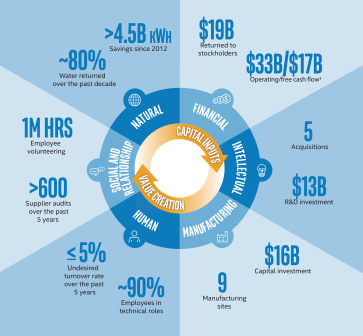

OUR CAPITAL

In line with the International Integrated Reporting Framework’s six capitals concept, we have outlined how we deploy various forms of capital to execute our strategy in a way that seeks to reflect our corporate values, help our customers succeed, and create value for our stockholders. Our six capitals are summarized here, with more detail in the “Our Capital” section of this proxy statement, and further description on our 2019 Annual Report on Form 10-K.

| CAPITAL | STRATEGY | VALUE | ||

FINANCIAL

|

Leverage cash flow to invest in ourselves and grow our capabilities, supplement and strengthen our capabilities through acquisitions and strategic investments, and provide returns to stockholders.

|

We strategically invest financial capital to create long-term value and provide returns to our stockholders in the form of dividends and buybacks.

| ||

INTELLECTUAL

|

Invest significantly in R&D and IP to ensure our process and product technologies are competitive in our strategic pursuit of making the world’s best semiconductors and realizing data-centric opportunities.

|

We develop IP for our platforms to enable next-generation products, create synergies across our businesses, provide a higher return as we expand into new markets, and establish and support our brands.

| ||

MANUFACTURING

|

Invest timely and at a level sufficient to meet customer demand for current technologies and prepare for future technologies.

|

Our manufacturing scope and scale enables innovations to provide our customers and consumers with a broad range of leading-edge products.

| ||

HUMAN

|

Develop the talent needed to remain at the forefront of innovation and create a diverse, inclusive, and safe workplace.

|

We attract and retain talented employees who enable the development of solutions and enhance the intellectual and manufacturing capital critical to helping our customers win the technology inflections of the future.

| ||

SOCIAL AND RELATIONSHIP

|

Build trusted relationships for both Intel and our stakeholders, including employees, suppliers, customers, local communities, and governments.

|

We collaborate with stakeholders on programs to empower underserved communities through education and technology, and on initiatives to advance accountability and capabilities across our global supply chain, including accountability for the respect of human rights.

| ||

NATURAL

|

Continually strive to reduce our environmental footprint through efficient and responsible use of natural resources and materials used to create our products.

|

Our proactive efforts help us mitigate climate and water impacts, achieve efficiencies and lower costs, and position us to respond to the expectations of our stakeholders.

| ||

VALUE WE CREATE

Each of our six forms of capital plays a critical role in our long-term value creation. We consider numerous indicators in determining the success of our capital deployment in creating value. The graphic highlights the value created up to and in 2019.

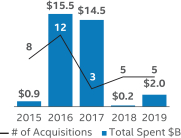

1 See “Non-GAAP Financial Measures” in Appendix A. |  |

|

2020 PROXY STATEMENT | Proxy Statement Highlights |

15 | ||||

PROXY STATEMENT |

INTEL CORPORATION 2200 Mission College Blvd. Santa Clara, CA 95054-1549 |

Our Board of Directors solicits your proxy for the 2020 Annual Stockholders’ Meeting (and any postponement or adjournment of the meeting) for the matters set forth in the “Notice of 2020 Annual Stockholders’ Meeting.” We made this proxy statement available to stockholders beginning on March 31, 2020.

|

ELECTION OF DIRECTORS

Upon the recommendation of our Corporate Governance and Nominating Committee, our Board has nominated the nine individuals listed below to serve as directors. Our nominees include eight independent directors, as defined in the rules for companies traded on the Nasdaq Global Select Market* (Nasdaq), and one Intel officer: Robert H. Swan, who became our Chief Executive Officer in January 2019. Omar Ishrak, previously the Board’s independent Lead Director, became the independent Chairman of the Board in January 2020.

Each of our director nominees currently serves on the Board and was elected to a one-year term at the 2019 Annual Stockholders’ Meeting, except for James J. Goetz and Alyssa Henry, who were appointed to the Board in November 2019 and January 2020, respectively. Andy D. Bryant, previously Chairman of the Board and Executive Vice President, and Reed E. Hundt are not standing for re-election at the annual meeting. In addition, since the 2019 Annual Stockholders’ Meeting, Aneel Bhusri retired from the Board and similarly is not standing for re-election at the meeting.

Each director’s term runs from the date of his or her election until our next annual stockholders’ meeting and until his or her successor (if any) is elected or appointed. If any director nominee is unable or unwilling to serve as a nominee at the time of the annual meeting, the individuals named as proxies may vote for a substitute nominee chosen by the present Board to fill the vacancy. Alternatively, the Board may reduce the size of the Board, or the proxies may vote just for the remaining nominees, leaving a vacancy that the Board may fill at a later date. However, we have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

Our Bylaws require that a director nominee will be elected only if he or she receives a majority of the votes cast with respect to his or her election in an uncontested election (that is, the number of votes cast “for” that nominee exceeds the number of votes cast “against” that nominee). You can vote to “abstain,” but that vote will not have an effect in determining the election results. For more information, see “Additional Meeting Information; Voting Before or During the Meeting” on page 112. If a nominee who currently serves as a director is not re-elected, Delaware law provides that the director would continue to serve on the Board as a “holdover director.” Under our Amended and Restated Bylaws (Bylaws) and the Amended and Restated Board of Directors Guidelines on Significant Corporate Governance Issues (Corporate Governance Guidelines), each director submits an advance, contingent, irrevocable resignation that the Board may accept if stockholders do not re-elect that director. In that situation, our Corporate Governance and Nominating Committee would make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action instead. Within 90 days from the date that the election results were certified, the Board would act on the Corporate Governance and Nominating Committee’s recommendation and publicly disclose its decision and the rationale behind it.

For each of the nine director nominees standing for election, the following pages set forth certain biographical information, including a description of their principal occupation, business experience, and the primary qualifications, attributes and skills (represented by the icons below) that the Corporate Governance and Nominating Committee considered in recommending them as director nominees, as well as the Board committees on which each director nominee will serve as of the 2020 Annual Stockholders’ Meeting.

| RECOMMENDATION OF THE BOARD The Board recommends that you vote “FOR” the election of each of the following nominees. | |

Senior leadership experience global/international experience industry and it/technical experience financial experience human capital experience operating and manufacturing experience sales marketing and brand management experience emerging technologies and business models experience business development and m&a experience cybersecurity/information security government, legal, and regulatory public company board

16 |

Proposal 1: Election of Directors | 2020 PROXY STATEMENT |

| ||||

|

|

AGE: 54 DIRECTOR SINCE: 2019 OTHER CURRENT PUBLIC BOARDS: Palo Alto Networks COMMITTEES: Corporate Governance and Nominating*, Finance* | ||

SKILLS & EXPERTISE:

|

|

EXPERIENCE

James J. Goetz has served as a partner of Sequoia Capital, a venture capital firm, since June 2004. Prior to joining Sequoia, Mr. Goetz co-founded VitalSigns Software, a software design, development, and strategy company, where he assembled and led the team that pioneered end-user performance management. Prior to VitalSigns, he was Vice President of Network Management for Bay Networks. Mr. Goetz previously served on the boards of directors of Barracuda Networks Inc., a data security and storage company from 2009 to 2017; Nimble Storage Inc., a data storage company, from 2007 to 2017; Jive Software Inc., a provider of social business software, from 2007 to 2015; and Ruckus Wireless Inc., a manufacturer of wireless (Wi-Fi) networking equipment, from 2012 to 2015, among others. Mr. Goetz holds a bachelor of science degree in electrical engineering from the University of Cincinnati and a master of science degree in electrical engineering from Stanford University. Mr. Goetz currently serves on the boards of several privately held companies. Mr. Goetz also serves as a member of the board of directors of Palo Alto Networks Inc., a network security solution company, since April 2005.

SKILLS & EXPERTISE

Mr. Goetz brings to the Board senior leadership, industry and information technology (IT), emerging technologies, business development, and cybersecurity experience from his experience as a partner of a venture capital firm, where he focuses on cloud, mobile, and enterprise technology investments, as well as providing guidance and counsel to a wide variety of internet and technology companies, and his prior work in networks, data security and storage, software, and manufacturing through various senior roles and other board experiences. Mr. Goetz’s experience with internet and technology companies brings depth to the Board in areas that are important to Intel’s business as it moves from a PC-centric to data-centric company.

|

ALYSSA HENRY |

AGE: 49 DIRECTOR SINCE: 2020 COMMITTEES: Audit*, Compensation* | ||

SKILLS & EXPERTISE:

|

|

EXPERIENCE

Alyssa Henry has served as Seller Lead for Square, Inc., a provider of software, hardware and financial services for small businesses and individuals, since 2014. She oversees global engineering, product management, design, sales, marketing, partnerships and support for Square’s seller-facing software and financial services products. Prior to Square, she served in various positions with Amazon.com, Inc. from 2006 to 2014, including as Vice President of Amazon Web Services Storage Services, where she led services including Amazon S3, Amazon EBS and Amazon Lambda; and as Amazon’s director of software development for ordering, with responsibility for Amazon’s ordering workflow software and databases. Before Amazon, Ms. Henry spent 12 years at Microsoft Corporation working on databases and data access technologies in a variety of engineering, program management and product unit management roles. Ms. Henry started her career as a developer in the financial services industry. Ms. Henry holds a bachelor of science degree in applied science with a specialization in computing from the University of California, Los Angeles. She has served as a member of the board of directors of Unity Technologies, a privately held video game software development company, since December 2018.

SKILLS & EXPERTISE

Ms. Henry brings senior leadership, industry and IT, emerging technologies and business models, and information security expertise to the Board from her executive experience at a mobile payment process company, including overseeing its expansion into other technology services for small businesses, and by her leadership of the software development segment of a multinational technology company that focuses on e-commerce, cloud computing, digital streaming, and artificial intelligence. Ms. Henry’s more than 25 years of experience in software engineering and development of database and storage technologies is particularly useful to the Board as Intel moves from a PC-centric to data-centric company.

| * | Effective after the conclusion of Intel’s 2020 Annual Stockholders’ Meeting, provided he/she is re-elected to the Board by stockholders at the meeting, Mr. Goetz will join the Corporate Governance and Nominating Committee and Finance Committee; Ms. Henry will join the Audit Committee and Compensation Committee; and Messrs. Smith and Wilson will join the Executive Committee. |

|

2020 PROXY STATEMENT | Proposal 1: Election of Directors |

17 | ||||

|

OMAR ISHRAK Independent Chairman |

AGE: 64 DIRECTOR SINCE: 2017 OTHER CURRENT PUBLIC BOARDS: Medtronic plc COMMITTEES: Compensation, Corporate Governance and Nominating (Co-Chair), Executive (Chair) | ||

SKILLS & EXPERTISE:

|

|

EXPERIENCE

Dr. Omar Ishrak has been Chairman and CEO of Medtronic plc, a global medical technology company, since 2011. Effective as of April 26, 2020, Dr. Ishrak will retire as CEO, become Executive Chairman, and continue to serve as Chairman of the Board of Medtronic. Prior to joining Medtronic, Dr. Ishrak served as President and CEO of GE Healthcare Systems, a comprehensive provider of medical imaging and diagnostic technology and a division of GE Healthcare, from 2009 to 2011. Dr. Ishrak was President and CEO of GE Healthcare Clinical Systems from 2005 to 2008 and President and CEO of GE Healthcare Ultrasound and BMD from 1995 to 2004. Dr. Ishrak is a member of the Board of Trustees of the Asia Society, a leading educational organization dedicated to promoting mutual understanding and strengthening partnerships among peoples, leaders, and institutions of Asia and the United States (U.S.) in a global context. Dr. Ishrak received his bachelor of science degree and PhD in Electrical Engineering from the University of London, King’s College.

SKILLS & EXPERTISE

Dr. Ishrak brings senior leadership, operating and manufacturing, and international expertise to the Board from his position as Chairman and CEO of Medtronic and his long history of success as a global executive in the medical technology industry. From his role at Medtronic, Dr. Ishrak has extensive experience identifying and developing emerging technologies and has overseen a number of strategic acquisitions, enabling him to bring business development and mergers and acquisitions (M&A) experience to the Board. Dr. Ishrak held various product development and engineering positions at Philips Ultrasound. Dr. Ishrak also provides technical, human capital, and brand marketing expertise from his role as a leader of a global medical technology company.

|

RISA LAVIZZO-MOUREY |

AGE: 65 DIRECTOR SINCE: 2018 OTHER CURRENT PUBLIC BOARDS: General Electric Company and Hess Corporation‡ COMMITTEES: Compensation, Corporate Governance and Nominating | ||

SKILLS & EXPERTISE:

|

|

EXPERIENCE

Dr. Risa Lavizzo-Mourey has been the Robert Wood Johnson Foundation PIK Professor of Population Health and Health Equity at the University of Pennsylvania in Philadelphia, Pennsylvania, since 2018. Dr. Lavizzo-Mourey was President and CEO of the Robert Wood Johnson Foundation, the nation’s largest healthcare-focused philanthropic organization, based in Princeton, New Jersey, from 2003 to 2017, and Senior Vice President of that organization from 2001 to 2003. She previously held various appointments at the University of Pennsylvania Medical School, including Sylvan Eisman Professor of Medicine and Health Care Systems from 1995 to 2001, Director of the Institute on Aging from 1994 to 2002, and Chief of Geriatric Medicine from 1986 to 1992. Dr. Lavizzo-Mourey has also held several government positions, including Deputy Administrator of the Agency for Health Care Research and Quality from 1992 to 1994, Co-Chair of the White House Health Care Reform Task Force from 1993 to 1994, and member of a number of federal advisory committees. She received her MD from Harvard Medical School and MBA from the Wharton School of Business of the University of Pennsylvania. Dr. Lavizzo-Mourey serves on the board of directors of General Electric Company and Hess Corporation‡. She is also a member of the National Academy of Medicine, American Academy of Arts and Sciences, and The American Philosophical Society.

SKILLS & EXPERTISE

Dr. Lavizzo-Mourey brings senior leadership, strategy, and human capital and talent development expertise to the Board from her leadership of the largest public health philanthropy in the U.S. for almost 15 years and, before that, serving for 15 years as a distinguished professor and administrator at the University of Pennsylvania. She also brings to the Board government experience from her various government appointments. Dr. Lavizzo-Mourey’s board service with other public companies also provides cross-board experience.

| ‡ | Dr. Lavizzo-Mourey will not be standing for re-election at Hess Corporation. |

18 |

Proposal 1: Election of Directors | 2020 PROXY STATEMENT |

| ||||

|

TSU-JAE KING LIU |

AGE: 56 DIRECTOR SINCE: 2016 COMMITTEES: Audit, Finance (Chair) | ||

SKILLS & EXPERTISE:

|

|

EXPERIENCE

Dr. Tsu-Jae King Liu has served as Dean and Roy W. Carlson Professor of Engineering in the College of Engineering at the University of California, Berkeley (UC Berkeley) since 2018. She previously held a distinguished professorship endowed by Taiwan Semiconductor Manufacturing Company, Ltd. (TSMC) in the Department of Electrical Engineering and Computer Sciences at UC Berkeley from July 2014 to July 2018. Dr. Liu has also served as Vice Provost, Academic and Space Planning, and Senior International Officer at UC Berkeley from October 2016 to June 2018. Dr. Liu has over 20 years of experience in higher education in a range of faculty and administrative roles, including Associate Dean for Academic Planning and Development, College of Engineering in 2016, Chair of the Department of Electrical Engineering and Computer Sciences from July 2014 to June 2016, and Associate Dean for Research in the College of Engineering from 2008 to 2012. Her achievements in teaching and research have been recognized by a number of awards, most recently by her induction into the Silicon Valley Engineering Hall of Fame. Dr. Liu was Co-founder and President of Progressant Technologies, a start-up company that developed negative differential resistance transistor technology, from May 2000 to October 2004. She served on the board of the Center for Advancing Women in Technology from October 2014 to May 2016. Dr. Liu received her bachelor of science, master’s degree, and PhD in Electrical Engineering from Stanford University.

SKILLS & EXPERTISE

As a scholar and educator in the field of nanometer-scale logic and memory devices, including advanced materials, process technology, and devices for energy-efficient electronics, Dr. Liu brings to the Board industry and technical experience directly related to Intel’s semiconductor device research and development, and manufacturing. As a Co-founder of Progressant Technologies, which was later acquired by Synopsys, Inc., and while serving on technical advisory boards for multiple start-up companies, Dr. Liu gained business development experience. Her inventions and contributions to the fin-shaped field-effect transistor design, dubbed “FinFET,” have given Dr. Liu extensive experience in emerging technologies. She also brings global and international experience to the Board with her work on establishing strategic international partnerships and agreements for UC Berkeley.

|

2020 PROXY STATEMENT | Proposal 1: Election of Directors |

19 | ||||

|

GREGORY D. SMITH |

AGE: 53 DIRECTOR SINCE: 2017 COMMITTEES: Audit (Chair), Finance, Executive* | ||

SKILLS & EXPERTISE:

|

|

EXPERIENCE

Gregory D. Smith has been CFO since 2012 and Executive Vice President, Enterprise Performance and Strategy since 2017 at The Boeing Company (Boeing), the world’s largest aerospace company. In his roles at Boeing, Mr. Smith is responsible for the company’s overall financial and strategic management, including the company’s financial reporting, long-range business planning, and program management. Additionally, he oversees Business Operations, Controller, Corporate Development, Strategy, Treasury, and other corporate functions and enterprise projects with the overall goal of accelerating innovation and driving market-based affordability efforts across the company. He also leads Boeing Capital Corporation, the company’s global financing arm. Mr. Smith’s portfolio also includes executing the company’s three business unit strategy with the launch of Boeing Global Services in July 2017, the One Boeing integration of the company’s organizations and initiatives, and assisting the chairman and CEO in setting enterprise goals and developing the senior leadership team. Mr. Smith previously served at Boeing as CFO, Executive Vice President, Corporate Development and Strategy from February 2015 to June 2017; Executive Vice President, CFO from February 2012 to February 2015; Vice President of Finance and Corporate Controller from February 2010 to February 2012; and Vice President of Financial Planning and Analysis from June 2008 to February 2010. Prior to that, he served for four years as Vice President of Global Investor Relations at Raytheon Company.

SKILLS & EXPERTISE

Mr. Smith brings to the Board senior leadership, financial, strategic, operational, human capital, and global expertise from his experience as Executive Vice President, Enterprise Performance and Strategy of the world’s largest aerospace company. He has experience with budgeting, accounting controls, internal audit, financial forecasting, strategic financial planning and analysis, capital commitment planning, competitive analysis and benchmarking, investor relations, and M&A from his work as Boeing’s CFO. Mr. Smith also brings substantial international and business development experience to the Board from his enterprise performance and strategy role at Boeing. Mr. Smith’s portfolio also includes Boeing HorizonX, the venture capital arm of Boeing that identifies and invests in start-ups that are developing emerging technologies and businesses in markets such as cybersecurity, AI and machine learning, and autonomous systems among others. He has continuing experience in dealing with foreign governments, including on issues related to market access and the regulation of business and investment. Mr. Smith also brings operational experience to the Board, having held a number of leadership roles at Boeing in supply chain, factory operations, and program management.

|

ROBERT (“BOB”) H. SWAN CEO |

AGE: 59 DIRECTOR SINCE: 2019 OTHER CURRENT PUBLIC BOARDS: eBay Inc. COMMITTEES: Executive | ||

SKILLS & EXPERTISE:

|

|

EXPERIENCE

Robert H. Swan has been a director and CEO of Intel since January 2019. Mr. Swan served as the interim CEO and Executive Vice President, CFO of Intel from June 2018 to January 2019, and previously served as Executive Vice President, CFO since joining Intel in October 2016. In his capacity as CFO, he oversaw Intel’s global finance organization—including finance, accounting and reporting, tax, treasury, internal audit, and investor relations—IT, Intel Capital, and the Corporate Strategy Office. Prior to joining Intel, Mr. Swan served as an Operating Partner at General Atlantic LLC, a private equity firm, from September 2015 to September 2016. He also served as Senior Vice President, Finance and CFO of eBay Inc., a multinational e-commerce company, from March 2006 to July 2015. Previously, Mr. Swan served as Executive Vice President, CFO of Electronic Data Systems Corporation, Executive Vice President, CFO of TRW Inc., and as CFO, Chief Operating Officer, and CEO of Webvan Group, Inc. Mr. Swan began his career in 1985 at General Electric (GE), serving for 15 years in numerous senior finance roles. Mr. Swan also serves as a member of the board of directors of eBay Inc. and previously served on the board of directors of Applied Materials, Inc. from 2009 to 2016, and AppDynamics from 2016 to 2017.

SKILLS & EXPERTISE

As our CEO and former CFO of Intel’s global finance organization, Mr. Swan brings significant senior leadership, global, industry, financial, human capital, operating experience, business development and M&A experience to the Board. Mr. Swan has gained extensive financial, operating and manufacturing, emerging technologies, M&A, and information security experience from serving as CFO for several international companies with complex business environments, including the 15 years at GE and the nine years he spent at eBay where he oversaw the eBay-PayPal split. As CEO and former CFO of Intel, he has direct knowledge and experience in business development, strategy, and growth. Mr. Swan also brings human capital and technical experience from his various senior leadership roles and board directorships.

| * | Effective after the conclusion of Intel’s 2020 Annual Stockholders’ Meeting, provided he/she is re-elected to the Board by stockholders at the meeting, Mr. Goetz will join the Corporate Governance and Nominating Committee and Finance Committee; Ms. Henry will join the Audit Committee and Compensation Committee; and Messrs. Smith and Wilson will join the Executive Committee. |

20 |

Proposal 1: Election of Directors | 2020 PROXY STATEMENT |

| ||||

|

ANDREW WILSON |

AGE: 45 DIRECTOR SINCE: 2017 OTHER CURRENT PUBLIC BOARDS: Electronic Arts Inc. COMMITTEES: Compensation (Chair), Finance, Executive* | ||

SKILLS & EXPERTISE:

|

|

EXPERIENCE

Andrew Wilson is the CEO of Electronic Arts Inc. (EA), a global leader in digital interactive entertainment. He joined EA in May 2000. He has served as the CEO and a director of EA since September 2013. During his tenure as CEO, EA has launched groundbreaking new games and services, reached record player engagement levels across its global franchises, and transformed into one of the world’s leading digital entertainment companies. Prior to his appointment as CEO, Mr. Wilson held several leadership positions at EA, including Executive Vice President of EA SPORTS and Origin where he oversaw all aspects of the EA SPORTS business and development, as well as EA’s digital PC service from 2011 to 2013. Mr. Wilson serves as chairman of the board for the World Surf League. He is also a member of the United Nations HeForShe IMPACT 10x10x10, a group of 10 global CEOs, 10 heads of state and 10 university presidents committed to being change agents to advance gender equality.

SKILLS & EXPERTISE

Mr. Wilson brings senior leadership, international, human capital, and emerging technologies and business models experience to the Board from his position as CEO and director of a global, digital entertainment company. In addition, Mr. Wilson’s 20 years of experience in a variety of leadership positions at EA provides the Board significant sales, marketing and brand management experience, and industry and technical experience.

|

FRANK D. YEARY |

AGE: 56 DIRECTOR SINCE: 2009 OTHER CURRENT PUBLIC BOARDS: PayPal Holdings, Inc. COMMITTEES: Audit, Corporate Governance and Nominating (Co-Chair) | ||

SKILLS & EXPERTISE:

|

|

EXPERIENCE

Frank D. Yeary has been Principal of Darwin Capital Advisors LLC, a private investment firm based in Phoenix, Arizona, since 2012. Mr. Yeary served as Executive Chairman of CamberView Partners, LLC, an advisory firm in San Francisco, California providing corporate governance and stockholder engagement advice to public companies, from 2012 to 2018. From 2012 to 2015, Mr. Yeary was Co-founder and Chairman of Level Money, Inc., a financial services company. From 2008 to 2012, Mr. Yeary was Vice Chancellor of UC Berkeley, and also Interim Chief Accounting Officer (CAO) from 2010 to 2011, where he oversaw changes to the university’s financial and operating strategy. Prior to 2008, Mr. Yeary spent nearly 25 years in the finance industry, most recently as Managing Director, Global Head of Mergers and Acquisitions, and a member of the Management Committee at Citigroup Investment Banking. Within the past five years, Mr. Yeary has served as a member of the board of directors of eBay. Mr. Yeary is a member of the board of directors of PayPal Holdings, Inc.

SKILLS & EXPERTISE

Mr. Yeary’s extensive career in investment banking and finance brings to the Board financial strategy and global M&A expertise, including expertise in financial reporting and experience in assessing the efficacy of M&A with international companies on a global scale, and experience attracting and retaining strong senior leaders. Mr. Yeary’s experience as Executive Chairman of CamberView partners and his service on the board of PayPal and his past service as a board member of eBay provides insight into matters relating to corporate governance, shareholder engagement and board best practices. As Vice Chancellor and CAO of a large public research university, Mr. Yeary gained extensive strategic and financial expertise. In addition, as co-founder of Level Money, Mr. Yeary has first-hand experience identifying and developing business models.

| * | Effective after the conclusion of Intel’s 2020 Annual Stockholders’ Meeting, provided he/she is re-elected to the Board by stockholders at the meeting, Mr. Goetz will join the Corporate Governance and Nominating Committee and Finance Committee; Ms. Henry will join the Audit Committee and Compensation Committee; and Messrs. Smith and Wilson will join the Executive Committee. |

|

2020 PROXY STATEMENT | Proposal 1: Election of Directors |

21 | ||||

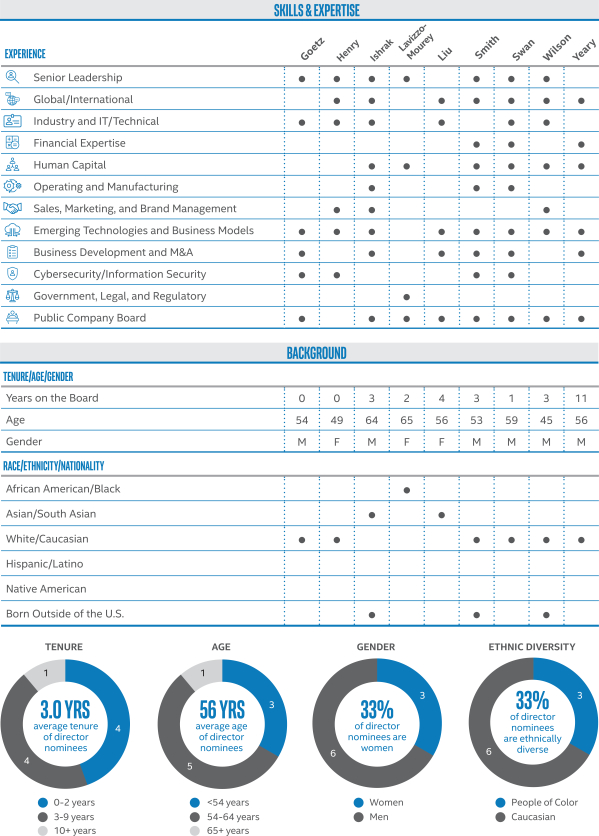

DIRECTOR SKILLS, EXPERIENCE, AND BACKGROUND

Intel is a large technology company engaged in research, manufacturing, and marketing on a global scale. We operate in highly competitive markets characterized by rapidly evolving technologies and exposure to business cycles. As we discuss below under “Board Committees and Charters,” the Corporate Governance and Nominating Committee is responsible for assessing with the Board the appropriate skills, experience, and background that we seek in Board members in the context of our business and the existing composition of the Board. This assessment includes numerous diverse factors, such as independence; understanding of and experience in manufacturing, technology, finance, and marketing; senior leadership experience; international experience; mix of ages; and gender, racial, geographic and ethnic diversity. The Board then determines whether a nominee’s background, experience, personal characteristics, and skills will advance the Board’s goal of creating and sustaining a Board with a diversity of perspectives and viewpoints that can support and oversee the company’s complex activities. Our Board is committed to actively seeking women and minority director candidates for consideration. As set forth in our Corporate Governance Guidelines, the committee and the Board periodically review and assess the effectiveness of these practices for considering potential director candidates.

Listed below are the skills and experience that we consider important for our directors in light of our current business and structure. The directors’ biographies note each director’s relevant experience, qualifications, and skills relative to this list.

|

|

| SENIOR LEADERSHIP EXPERIENCE Directors who have served in senior leadership positions are important to us because they have the experience and perspective to analyze, shape, and oversee the execution of important operational and policy issues. These directors’ insights and guidance, and their ability to assess and respond to situations encountered in serving on our Board, may be enhanced by leadership experience at businesses or organizations that operated on a global scale, faced significant competition, or involved technology or other rapidly evolving business models. | |

|

|

|