| | | | |

| | OMB APPROVAL | | |

| | OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response: 20.6 | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number | | 811-02611 |

Invesco Exchange Fund

(Exact name of registrant as specified in charter)

1555 Peachtree Street, N.E., Atlanta, Georgia 30309

(Address of principal executive offices) (Zip code)

Philip A. Taylor 1555 Peachtree Street, N.E., Atlanta, Georgia 30309

(Name and address of agent for service)

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

| | |

Date of fiscal year end: | | 12/31 |

| |

Date of reporting period: | | 12/31/15 |

Item 1. Report to Stockholders.

Management’s Discussion of Fund Performance

Performance summary

For the year ended December 31, 2015, Invesco Exchange Fund (the Fund) underperformed the S&P 500 Index, the Fund’s broad market/style-specific index. The Fund does not currently offer its shares for purchase. Effective September 30, 2015, the Fund was reorganized from a California limited partnership to a Delaware statutory trust as a diversified, open-end management investment company.

Your Fund’s long-term performance appears later in this report.

| | | | | |

| Fund vs. Indexes | | | | | |

| Total returns, 12/31/14 to 12/31/15 | | | | | |

| |

| Invesco Exchange Fund | | | | -4.19 | % |

| S&P 500 Index▼ (Broad Market/Style-Specific Index) | | | | 1.38 | |

Source(s): ▼FactSet Research Systems Inc. | | | | | |

Market conditions and your Fund

The US economy continued its modest, but steady growth, during the year ended December 31, 2015 – although the health of individual economic sectors varied dramatically. The headline economic story was a steady decline in already-battered energy markets, as oil prices plummeted when increased supply overwhelmed demand. This decline particularly affected companies with US-based offshore or shale-based resources – companies whose cost to recover oil is higher than many traditional producers. On the other end of the spectrum, the improved position of the US consumer was the more subtle story which drove the US economy forward during the fiscal year.

As the year began, economic growth appeared to be stronger in the US than in the rest of the world. US equity markets were recovering from the crash of oil prices initiated by OPEC’s decision to maintain high production despite low prices and slowing global growth. The view that the US Federal Reserve (the Fed) would begin raising rates while other central banks were loosening monetary policy led the US dollar to strengthen against many currencies. This hurt

commodity- and materials-based economies – and companies in related sectors. Additionally, US-based multinational companies faced foreign exchange headwinds. Low interest rates, the increasing availability of credit and an improving employment picture all contributed to higher consumer confidence and consumer spending, which drove US equity markets higher, particularly through the spring, and helped overcome fears that Greece and the eurozone would fail to reach an agreement on a financial bailout plan.

In the summer of 2015, US equity markets moved sharply lower. A significant downturn in China’s financial markets and weak global economic growth led the Fed to delay raising interest rates; this, in turn, increased investor uncertainty and market volatility. A continued decline in oil prices also contributed to market volatility. In the fall, however, US markets rallied, the Fed saw enough economic stabilization to finally raise interest rates, and most major US market indexes ended the year barely in positive territory.

The sectors that contributed the most to relative Fund performance for the reporting period were the consumer staples and materials sectors. The energy,

health care, industrials and information technology sectors detracted from the Fund’s relative performance. The Fund’s consumer staples, financials, health care and materials sectors delivered positive absolute performance during the reporting period.

When looking at individual Fund holdings, top contributors for the year were International Flavors & Fragrances, McCormick, Intel, Pfizer and Plum Creek Timber. Top detractors included Hess, SPX, Exxon Mobil, Air Products and Chemicals and Schlumberger.

No Fund holdings were liquidated during the reporting period, and no new holdings were added.

As always, we thank you for your continued investment in Invesco Exchange Fund.

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| | |

| Portfolio Composition | | |

| By sector | | % of total net assets |

| |

| Energy | | 22.3% |

| | |

| Materials | | 22.3 |

| Health Care | | 17.6 |

| Information Technology | | 15.7 |

| Consumer Staples | | 11.8 |

| Industrials | | 5.5 |

| Financials | | 3.3 |

Money Market Funds Plus Other Assets Less Liabilities | | 1.5 |

Top 10 Equity Holdings*

| | | | | |

| |

| 1. Intel Corp. | | | | 12.0 | % |

| 2. McCormick & Co., Inc. | | | | 11.8 | |

3. International Flavors & Fragrances Inc. | | | | 10.8 | |

4. Air Products and Chemicals, Inc. | | | | 10.7 | |

| 5. Johnson & Johnson | | | | 5.1 | |

| 6. Exxon Mobil Corp. | | | | 4.9 | |

| 7. Merck & Co., Inc. | | | | 4.7 | |

| 8. Pfizer Inc. | | | | 4.5 | |

| 9. Hess Corp. | | | | 4.3 | |

| 10. Schlumberger Ltd. | | | | 4.1 | |

| | | | | |

| Total Net Assets | | | $ | 55.0 million | |

| |

| Total Number of Holdings* | | | | 28 | |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

*Excluding money market fund holdings.

Data presented here are as of December 31, 2015.

2 Invesco Exchange Fund

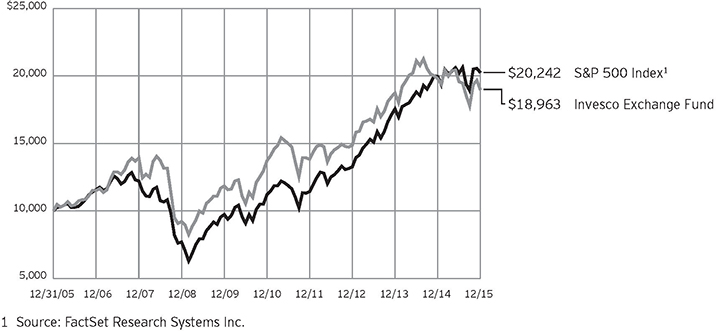

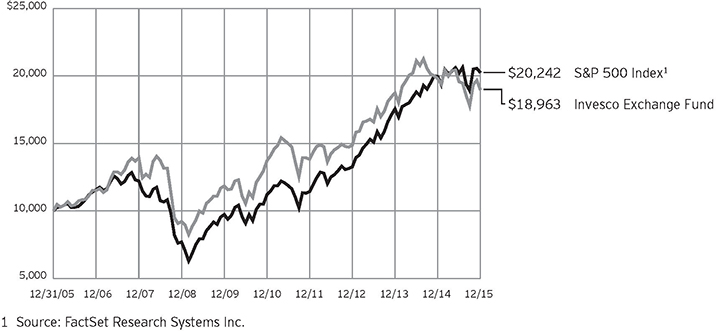

Your Fund’s Long-Term Performance

Results of a $10,000 Investment

Fund and index data from 12/31/05

Past performance cannot guarantee comparable future results.

The data shown in the chart include reinvested distributions and Fund expenses including management fees. Index results include reinvested

dividends, but they do not reflect sales charges, fund expenses or management fees. Performance shown in the chart and table(s) does not reflect deduction of taxes a partner would pay on Fund distributions or sale of Fund shares.

Average Annual Total Returns

As of 12/31/15

Invesco Exchange Fund

| | | | | |

| Inception (12/16/76) | | | | 10.64 | % |

| 10 Years | | | | 6.61 | |

| 5 Years | | | | 6.69 | |

1 Year | | | | -4.19 | |

The performance data quoted represent past performance and cannot guarantee comparable future results; current performance may be lower or higher. Performance figures reflect reinvested distributions and changes in net asset value. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

The above presentation, in accordance with requirements of the Securities and Exchange Commission, assumes the reinvestment of dividends. However, the Fund does not offer its shares and does not provide the option of reinvesting dividends in shares of the Fund; dividends may not be reinvested in the Fund

The total annual Fund operating expense ratio as of the date of this report, December 31, 2015, was 0.57%.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses

currently or in the past, returns would have been lower. See current prospectus for more information.

3 Invesco Exchange Fund

Invesco Exchange Fund’s investment objective is long-term growth of capital, while the production of current income is an important secondary objective.

| n | | Unless otherwise stated, information presented in this report is as of December 31, 2015, and is based on total net assets. |

| n | | Unless otherwise noted, all data provided by Invesco. |

Principal risks of investing in the Fund

The Fund is subject to market risk. Market risk is the possibility that the market values of securities owned by the Fund will decline. Market risk may affect a single issuer, industry, sector of the economy or the market as a whole.

Investments in common stocks and convertible securities generally are affected by changes in the stock markets, which fluctuate substantially over time, sometimes suddenly and sharply. The financial markets in general are subject to volatility and may at times experience periods of extreme volatility and uncertainty, which may affect all investment securities, including equity securities, fixed income or debt securities and derivative instruments. During such periods, fixed income or debt securities of all credit qualities may become illiquid or difficult to sell at a time and a price acceptable to the Fund. The markets for other securities in which the Fund may invest may not function properly, which may affect the value of such securities, and such securities may become illiquid.

New or proposed laws may have an impact on the Fund’s investments and the Fund’s investment adviser is unable to predict what effect, if any, such legislation may have on the Fund.

About indexes used in this report

| n | | The S&P 500® Index is an unmanaged index considered representative of the US stock market. |

| n | | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| n | | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

Other information

| n | | The returns shown in management’s discussion of Fund performance are based on net asset values (NAVs) calculated for shareholder transactions. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes, and as such, the NAVs for shareholder transactions and the returns based on those NAVs may differ from the NAVs and returns reported in the Financial Highlights. |

| n | | Industry classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

|

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. |

|

| |

| NOT FDIC INSURED I MAY LOSE VALUE I NO BANK GUARANTEE |

4 Invesco Exchange Fund

Schedule of Investments(a)

December 31, 2015

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks & Other Equity Interests–98.48% | |

| Aerospace & Defense–2.35% | |

Honeywell International Inc. | | | 12,478 | | | $ | 1,292,346 | |

|

| Biotechnology–0.71% | |

Baxalta Inc. | | | 9,960 | | | | 388,739 | |

|

| Construction & Engineering–2.20% | |

Fluor Corp. | | | 25,559 | | | | 1,206,896 | |

|

| Diversified Banks–0.82% | |

HSBC Holdings PLC–ADR (United Kingdom) | | | 11,471 | | | | 452,760 | |

|

| Forest Products–0.85% | |

Louisiana-Pacific Corp.(b) | | | 25,866 | | | | 465,847 | |

|

| Health Care Distributors–0.30% | |

Cardinal Health, Inc. | | | 1,860 | | | | 166,042 | |

|

| Health Care Equipment–0.69% | |

Baxter International Inc. | | | 9,960 | | | | 379,974 | |

|

| Health Care Services–1.56% | |

Express Scripts Holding Co.(b) | | | 9,802 | | | | 856,793 | |

|

| Industrial Gases–10.68% | |

Air Products and Chemicals, Inc. | | | 45,130 | | | | 5,871,864 | |

|

| Industrial Machinery–0.92% | |

SPX Corp. | | | 13,594 | | | | 126,832 | |

SPX FLOW, Inc.(b) | | | 13,594 | | | | 379,409 | |

| | | | | | | | 506,241 | |

|

| Integrated Oil & Gas–6.84% | |

BP PLC–ADR (United Kingdom) | | | 33,740 | | | | 1,054,712 | |

Exxon Mobil Corp. | | | 34,719 | | | | 2,706,346 | |

| | | | | | | | 3,761,058 | |

|

| IT Consulting & Other Services–3.74% | |

International Business Machines Corp. | | | 14,956 | | | | 2,058,245 | |

|

| Multi-Line Insurance–0.23% | |

American International Group, Inc. | | | 2,076 | | | | 128,650 | |

|

| Oil & Gas Drilling–0.05% | |

Transocean Ltd. | | | 2,169 | | | | 26,852 | |

| | | | | | | | |

| | | Shares | | | Value | |

| Oil & Gas Equipment & Services–9.09% | |

Baker Hughes Inc. | | | 15,331 | | | $ | 707,526 | |

Halliburton Co. | | | 60,397 | | | | 2,055,914 | |

Schlumberger Ltd. | | | 32,031 | | | | 2,234,162 | |

| | | | | | | | 4,997,602 | |

|

| Oil & Gas Exploration & Production–6.37% | |

Apache Corp. | | | 26,241 | | | | 1,166,937 | |

Hess Corp. | | | 48,192 | | | | 2,336,348 | |

| | | | | | | | 3,503,285 | |

|

| Packaged Foods & Meats–11.83% | |

McCormick & Co., Inc. | | | 76,060 | | | | 6,507,694 | |

|

| Pharmaceuticals–14.30% | |

Johnson & Johnson | | | 27,020 | | | | 2,775,495 | |

Merck & Co., Inc. | | | 49,362 | | | | 2,607,301 | |

Pfizer Inc. | | | 76,919 | | | | 2,482,945 | |

| | | | | | | | 7,865,741 | |

|

| Semiconductors–11.97% | |

Intel Corp. | | | 191,127 | | | | 6,584,325 | |

|

| Specialized REIT’s–2.21% | |

Plum Creek Timber Co., Inc. | | | 25,500 | | | | 1,216,860 | |

|

| Specialty Chemicals–10.77% | |

International Flavors & Fragrances Inc. | | | 49,513 | | | | 5,923,735 | |

Total Common Stocks & Other Equity Interests

(Cost $1,618,381) | | | | 54,161,549 | |

| | |

Money Market Funds–1.35% | | | | | | | | |

Liquid Assets Portfolio–Institutional Class, 0.29%(c) | | | 372,425 | | | | 372,425 | |

Premier Portfolio–Institutional Class, 0.24%(c) | | | 372,425 | | | | 372,425 | |

Total Money Market Funds

(Cost $744,850) | | | | | | | 744,850 | |

TOTAL INVESTMENTS–99.83%

(Cost $2,363,231) | | | | | | | 54,906,399 | |

OTHER ASSETS LESS LIABILITIES–0.17% | | | | 93,168 | |

NET ASSETS–100.00% | | | | | | $ | 54,999,567 | |

Investment Abbreviations:

| | |

| ADR | | – American Depositary Receipt |

| REIT | | – Real Estate Investment Trust |

Notes to Schedule of Investments:

| (a) | Industry and/or sector classifications used in this report are generally according to the Global Industry Classification Standard, which was developed by and is the exclusive property and a service mark of MSCI Inc. and Standard & Poor’s. |

| (b) | Non-income producing security. |

| (c) | The money market fund and the Fund are affiliated by having the same investment adviser. The rate shown is the 7-day SEC standardized yield as of December 31, 2015. |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

5 Invesco Exchange Fund

Statement of Assets and Liabilities

December 31, 2015

| | | | |

Assets: | |

Investments, at value (Cost $1,618,381) | | $ | 54,161,549 | |

Investments in affiliated money market funds, at value and cost | | | 744,850 | |

Total investments, at value (Cost $2,363,231) | | | 54,906,399 | |

Cash | | | 12,048 | |

Dividends receivable | | | 143,791 | |

Total assets | | | 55,062,238 | |

|

Liabilities: | |

Payable for: | | | | |

Accrued fees to affiliates | | | 1,363 | |

Accrued trustees’ and officers’ fees and benefits | | | 133 | |

Accrued other operating expenses | | | 61,175 | |

Total liabilities | | | 62,671 | |

Net assets applicable to shares outstanding | | $ | 54,999,567 | |

| | | | |

Net assets consist of: | |

Shares of beneficial interest | | $ | 2,454,926 | |

Undistributed net investment income | | | 1,473 | |

Undistributed net realized gain | | | — | |

Net unrealized appreciation | | | 52,543,168 | |

| | | $ | 54,999,567 | |

|

Shares outstanding, $0.01 par value per share,

with an unlimited number of shares authorized: | |

Outstanding | | | 116,721 | |

Net asset value per share | | $ | 471.21 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

6 Invesco Exchange Fund

Statement of Operations

For the year ended December 31, 2015

| | | | |

Investment income: | |

Dividends | | $ | 1,647,144 | |

Dividends from affiliated money market funds | | | 504 | |

Total investment income | | | 1,647,648 | |

| |

Expenses: | | | | |

Advisory fees | | | 196,975 | |

Administrative services fees | | | 50,000 | |

Custodian fees | | | 3,487 | |

Transfer agent fees | | | 15,555 | |

Trustees’ and officers’ fees and benefits | | | 18,020 | |

Professional services fees | | | 72,651 | |

Other | | | 19,657 | |

Total expenses | | | 376,345 | |

Less: Fees waived | | | (735 | ) |

Net expenses | | | 375,610 | |

Net investment income | | | 1,272,038 | |

| |

Realized and unrealized gain (loss) from: | | | | |

Net realized gain from: | | | | |

Investment securities | | | 8,369,290 | |

Partnership-in-kind redemptions | | | 484,921 | |

| | | | 8,854,211 | |

Change in net unrealized appreciation (depreciation) of investment securities | | | (13,632,800 | ) |

Net realized and unrealized gain (loss) | | | (4,778,589 | ) |

Net increase (decrease) in net assets resulting from operations | | $ | (3,506,551 | ) |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

7 Invesco Exchange Fund

Statement of Changes in Net Assets

For the years ended December 31, 2015 and 2014

| | | | | | | | |

| | | 2015 | | | 2014 | |

Operations: | | | | | |

Net investment income | | $ | 1,272,038 | | | $ | 1,282,848 | |

Net realized gain | | | 8,854,211 | | | | 2,927,621 | |

Change in net unrealized appreciation (depreciation) | | | (13,632,800 | ) | | | (219,798 | ) |

Net increase (decrease) in net assets resulting from operations | | | (3,506,551 | ) | | | 3,990,671 | |

Distributions from net investment income | | | (9,709,132 | ) | | | (642,837 | ) |

Distributions from net realized gains | | | (13,513 | ) | | | (13,491 | ) |

Share transactions–net | | | (1,865,649 | ) | | | (3,390,669 | ) |

Net increase (decrease) in net assets | | | (15,094,845 | ) | | | (56,326 | ) |

| | |

Net assets: | | | | | | | | |

Beginning of year | | | 70,094,412 | | | | 70,150,738 | |

End of year (includes undistributed net investment income of $1,473 and $9,233,502, respectively) | | $ | 54,999,567 | | | $ | 70,094,412 | |

Notes to Financial Statements

December 31, 2015

NOTE 1—Significant Accounting Policies

Effective September 30, 2015, Invesco Exchange Fund, (the “Fund”), reorganized to a Delaware statutory trust (“the Redomestication”) registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified, open-end management investment company. Prior to the Redomestication, the Fund was organized as a California limited partnership.

The Fund’s principal investment objective is long-term growth of capital, while the production of current income is an important secondary objective. Prior to the Redomestication, the Fund had an investment objective, investment strategies, investment guidelines and restrictions that were substantially similar to those currently applicable to the Fund.

The Fund does not currently offer shares to the public for purchase. Prior to the Redomestication, the Fund had three different types of partners: Managing General Partners, Non-Managing General Partners and Limited Partners. Except as otherwise specifically provided in the Certificate and Agreement of Limited Partnership (the “Agreement”), Managing General Partners had complete and exclusive control over the management, conduct and operations of the Fund’s business.

The following is a summary of the significant accounting policies followed by the Fund in the preparation of its financial statements.

| A. | Security Valuations — Securities, including restricted securities, are valued according to the following policy. |

A security listed or traded on an exchange (except convertible securities) is valued at its last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded, or lacking any sales or official closing price on a particular day, the security may be valued at the closing bid price on that day. Securities traded in the over-the-counter market are valued based on prices furnished by independent pricing services or market makers. When such securities are valued by an independent pricing service they may be considered fair valued. Futures contracts are valued at the final settlement price set by an exchange on which they are principally traded. Listed options are valued at the mean between the last bid and asked prices from the exchange on which they are principally traded. Options not listed on an exchange are valued by an independent source at the mean between the last bid and asked prices. For purposes of determining net asset value (“NAV”) per share, futures and option contracts generally are valued 15 minutes after the close of the customary trading session of the New York Stock Exchange (“NYSE”).

Investments in open-end and closed-end registered investment companies that do not trade on an exchange are valued at the end-of-day net asset value per share. Investments in open-end and closed-end registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security is principally traded.

Debt obligations (including convertible securities) and unlisted equities are fair valued using an evaluated quote provided by an independent pricing service. Evaluated quotes provided by the pricing service may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to specific securities, dividend rate (for unlisted equities), yield (for debt obligations), quality, type of issue, coupon rate (for debt obligations), maturity (for debt obligations), individual trading characteristics and other market data. Debt obligations are subject to interest rate and credit risks. In addition, all debt obligations involve some risk of default with respect to interest and/or principal payments.

Foreign securities’ (including foreign exchange contracts) prices are converted into U.S. dollar amounts using the applicable exchange rates as of the close of the NYSE. If market quotations are available and reliable for foreign exchange-traded equity securities, the securities will be valued at the market quotations. Because trading hours for certain foreign securities end before the close of the NYSE, closing market quotations may become unreliable. If between the time trading ends on a particular security and the close of the customary trading session on the NYSE, events occur that the Adviser determines are significant and make the closing price unreliable, the Fund may fair value the security. If the event is likely to have affected the closing price of the security, the security will be valued at fair value in good faith using procedures approved by the Board of Trustees. Adjustments to closing prices to reflect fair value may also be based on a screening process of an independent pricing service to indicate the degree of certainty, based on historical data, that the closing price in the principal market where a foreign security trades is not the current value as of the close of the NYSE. Foreign securities’ prices meeting the approved degree of certainty that the price is not reflective

8 Invesco Exchange Fund

of current value will be priced at the indication of fair value from the independent pricing service. Multiple factors may be considered by the independent pricing service in determining adjustments to reflect fair value and may include information relating to sector indices, American Depositary Receipts and domestic and foreign index futures. Foreign securities may have additional risks including exchange rate changes, potential for sharply devalued currencies and high inflation, political and economic upheaval, the relative lack of issuer information, relatively low market liquidity and the potential lack of strict financial and accounting controls and standards.

Securities for which market prices are not provided by any of the above methods may be valued based upon quotes furnished by independent sources. The last bid price may be used to value equity securities. The mean between the last bid and asked prices is used to value debt obligations, including corporate loans.

Securities for which market quotations are not readily available or became unreliable are valued at fair value as determined in good faith by or under the supervision of the Trust’s officers following procedures approved by the Board of Trustees. Issuer specific events, market trends, bid/asked quotes of brokers and information providers and other market data may be reviewed in the course of making a good faith determination of a security’s fair value.

The Fund may invest in securities that are subject to interest rate risk, meaning the risk that the prices will generally fall as interest rates rise and, conversely, the prices will generally rise as interest rates fall. Specific securities differ in their sensitivity to changes in interest rates depending on their individual characteristics. Changes in interest rates may result in increased market volatility, which may affect the value and/or liquidity of certain Fund investments.

Valuations change in response to many factors including the historical and prospective earnings of the issuer, the value of the issuer’s assets, general economic conditions, interest rates, investor perceptions and market liquidity. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

| B. | Securities Transactions and Investment Income — Securities transactions are accounted for on a trade date basis. Realized gains or losses on sales are computed on the basis of specific identification of the securities sold. Interest income (net of withholding tax, if any) is recorded on the accrual basis from settlement date. Dividend income (net of withholding tax, if any) is recorded on the ex-dividend date. |

The Fund may periodically participate in litigation related to Fund investments. As such, the Fund may receive proceeds from litigation settlements. Any proceeds received are included in the Statement of Operations as realized gain (loss) for investments no longer held and as unrealized gain (loss) for investments still held.

Brokerage commissions and mark ups are considered transaction costs and are recorded as an increase to the cost basis of securities purchased and/or a reduction of proceeds on a sale of securities. Such transaction costs are included in the determination of net realized and unrealized gain (loss) from investment securities reported in the Statement of Operations and the Statement of Changes in Net Assets and the net realized and unrealized gains (losses) on securities per share in the Financial Highlights. Transaction costs are included in the calculation of the Fund’s net asset value and, accordingly, they reduce the Fund’s total returns. These transaction costs are not considered operating expenses and are not reflected in net investment income reported in the Statement of Operations and the Statement of Changes in Net Assets, or the net investment income per share and the ratios of expenses and net investment income reported in the Financial Highlights, nor are they limited by any expense limitation arrangements between the Fund and the investment adviser. Prior to the Redomestication, net investment income was allocated daily to each partner, relative to the total number of units held. Capital gains or losses were allocated equally among units outstanding on the day recognized.

| C. | Country Determination — For the purposes of making investment selection decisions and presentation in the Schedule of Investments, the investment adviser may determine the country in which an issuer is located and/or credit risk exposure based on various factors. These factors include the laws of the country under which the issuer is organized, where the issuer maintains a principal office, the country in which the issuer derives 50% or more of its total revenues and the country that has the primary market for the issuer’s securities, as well as other criteria. Among the other criteria that may be evaluated for making this determination are the country in which the issuer maintains 50% or more of its assets, the type of security, financial guarantees and enhancements, the nature of the collateral and the sponsor organization. Country of issuer and/or credit risk exposure has been determined to be the United States of America, unless otherwise noted. |

| D. | Distributions — Distributions from net investment income, if any, are declared and paid quarterly and are recorded on the ex-dividend date. Distributions from net realized capital gain, if any, are generally declared and paid annually and recorded on the ex-dividend date. Currently all distributions are paid in cash. |

| E. | Federal Income Taxes — The Fund intends to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), necessary to qualify as a regulated investment company and to distribute substantially all of the Fund’s taxable earnings to shareholders. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore, no provision for federal income taxes is recorded in the financial statements. Prior to the Redomestication, the Fund had met the qualification to be classified as a partnership for federal income tax purposes. A partnership is not subject to federal income tax. As such, the Fund will not be subject to federal income taxes on otherwise taxable income (including net realized capital gain) that is distributed to shareholders. Therefore no provision for federal income taxes is recorded in the financial statements. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months.

The Fund files tax returns in the U.S. Federal jurisdiction and certain other jurisdictions. Generally, the Fund is subject to examinations by such taxing authorities for up to three years after the filing of the return for the tax period.

| F. | Accounting Estimates — The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period including estimates and assumptions related to taxation. Actual results could differ from those estimates by a significant amount. In addition, the Fund monitors for material events or transactions that may occur or become known after the period-end date and before the date the financial statements are released to print. |

9 Invesco Exchange Fund

| G. | Indemnifications — Under the Fund’s organizational documents, each Trustee, officer, employee or other agent of the Fund and the former General Partner of the Fund (including officers, and/or directors of a corporate General Partner, is indemnified against certain liabilities that may arise out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts, including the Fund’s servicing agreements, that contain a variety of indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss as a result of such indemnification claims is considered remote. |

NOTE 2—Advisory Fees and Other Fees Paid to Affiliates

The Fund has entered into a master investment advisory agreement with Invesco Advisers, Inc. (the “Adviser” or “Invesco”). Under the terms of the investment advisory agreement, the Fund pays an annual fee of 0.30% based on the average daily net assets of the Fund.

Under the terms of master intergroup sub-advisory agreements between the Adviser and each of Invesco Asset Management Deutschland GmbH, Invesco Asset Management Limited, Invesco Asset Management (Japan) Limited, Invesco Hong Kong Limited, Invesco Senior Secured Management, Inc. and Invesco Canada Ltd. (collectively, the “Affiliated Sub-Advisers”) the Adviser, not the Fund, may pay 40% of the fees paid to the Adviser to any such Affiliated Sub-Adviser(s) that provide(s) discretionary investment management services to the Fund based on the percentage of assets allocated to such Affiliated Sub-Adviser(s).

The Adviser has contractually agreed, through at least June 30, 2017, to waive the advisory fee payable by the Fund in an amount equal to 100% of the net advisory fees the Adviser receives from the affiliated money market funds on investments by the Fund of uninvested cash in such affiliated money market funds.

For the year ended December 31, 2015, the Adviser waived advisory fees of $735.

The Fund has entered into a master administrative services agreement with Invesco pursuant to which the Fund has agreed to pay Invesco for certain administrative costs incurred in providing accounting services to the Fund. For the year ended December 31, 2015, expenses incurred under the agreement are shown in the Statement of Operations as Administrative services fees.

The Fund has entered into a transfer agency and service agreement with Invesco Investment Services, Inc. (“IIS”) pursuant to which the Fund has agreed to pay IIS a fee for providing transfer agency and shareholder services to the Fund and reimburse IIS for certain expenses incurred by IIS in the course of providing such services. For the year ended December 31, 2015, expenses incurred under these agreements are shown in the Statement of Operations as Transfer agent fees.

Certain officers and trustees of the Fund are officers and directors of the Adviser and/or IIS. Prior to the Redomestication, a Managing General Partner of the Fund was an officer of Invesco and/or IIS.

NOTE 3—Additional Valuation Information

GAAP defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, under current market conditions. GAAP establishes a hierarchy that prioritizes the inputs to valuation methods, giving the highest priority to readily available unadjusted quoted prices in an active market for identical assets (Level 1) and the lowest priority to significant unobservable inputs (Level 3), generally when market prices are not readily available or are unreliable. Based on the valuation inputs, the securities or other investments are tiered into one of three levels. Changes in valuation methods may result in transfers in or out of an investment’s assigned level:

| | Level 1 — | Prices are determined using quoted prices in an active market for identical assets. |

| | Level 2 — | Prices are determined using other significant observable inputs. Observable inputs are inputs that other market participants may use in pricing a security. These may include quoted prices for similar securities, interest rates, prepayment speeds, credit risk, yield curves, loss severities, default rates, discount rates, volatilities and others. |

| | Level 3 — | Prices are determined using significant unobservable inputs. In situations where quoted prices or observable inputs are unavailable (for example, when there is little or no market activity for an investment at the end of the period), unobservable inputs may be used. Unobservable inputs reflect the Fund’s own assumptions about the factors market participants would use in determining fair value of the securities or instruments and would be based on the best available information. |

As of December 31, 2015, all of the securities in this Fund were valued based on Level 1 inputs (see the Schedule of Investments for security categories). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities. Because of the inherent uncertainties of valuation, the values reflected in the financial statements may materially differ from the value received upon actual sale of those investments.

NOTE 4—Cash Balances

The Fund is permitted to temporarily carry a negative or overdrawn balance in its account with State Street Bank and Trust Company, the custodian bank. Such balances, if any at period end, are shown in the Statement of Assets and Liabilities under the payable caption Amount due custodian. To compensate the custodian bank for such overdrafts, the overdrawn Fund may either (1) leave funds as a compensating balance in the account so the custodian bank can be compensated by earning the additional interest; or (2) compensate by paying the custodian bank at a rate agreed upon by the custodian bank and Invesco, not to exceed the contractually agreed upon rate.

10 Invesco Exchange Fund

NOTE 5—Distributions to Shareholders and Tax Components of Net Assets

Tax Character of Distributions to Shareholders Paid During the period September 30, 2015 (Redomestication Date) through December 31, 2015:

| | | | |

| | | 2015 | |

Ordinary income | | $ | 297,984 | |

Tax Components of Net Assets at Period-End:

| | | | |

| | | 2015 | |

Undistributed ordinary income | | $ | 1,473 | |

Net unrealized appreciation — investments | | | 52,543,168 | |

Shares of beneficial interest | | | 2,454,926 | |

Total net assets | | $ | 54,999,567 | |

Capital loss carryforward is calculated and reported as of a specific date. Results of transactions and other activity after that date may affect the amount of capital loss carryforward actually available for the Fund to utilize. The ability to utilize capital loss carryforward in the future may be limited under the Internal Revenue Code and related regulations based on the results of future transactions.

The Fund does not have a capital loss carryforward as of December 31, 2015.

On July 1, 2015, the Fund tendered securities valued at $612,102 for partnership redemptions, which resulted in a realized gain of $484,921. From a federal income tax perspective, the realized gains are not recognized.

NOTE 6—Investment Securities

The aggregate amount of investment securities (other than short-term securities, U.S. Treasury obligations and money market funds, if any) purchased and sold by the Fund during the year ended December 31, 2015 was $0 and $10,222,063, respectively. Cost of investments on a tax basis includes the adjustments for financial reporting purposes as of the most recently completed federal income tax reporting period-end.

| | | | |

| Unrealized Appreciation (Depreciation) of Investment Securities on a Tax Basis | |

Aggregate unrealized appreciation of investment securities | | $ | 52,565,452 | |

Aggregate unrealized (depreciation) of investment securities | | | (22,284 | ) |

Net unrealized appreciation of investment securities | | $ | 52,543,168 | |

Cost of investments is the same for book and tax purposes.

NOTE 7—Reclassification of Permanent Differences

Primarily as a result of differing book/tax treatment of partnerships, on December 31, 2015, undistributed net investment income was decreased by $794,935, undistributed net realized gain was decreased by $107,649,708, shares of beneficial interest was increased by $106,040,411 and net unrealized appreciation was increased by $2,404,232. This reclassification had no effect on the net assets of the Fund.

NOTE 8—Share Information

| | | | | | | | | | | | | | | | |

| | | Summary of Share Activity | |

| | | Years ended December 31, | |

| | | 2015(a) | | | 2014 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

Sold | | | 1 | | | $ | 434 | | | | 79 | | | $ | 50,000 | |

Reacquired(b) | | | (3,779 | ) | | | (1,866,083 | ) | | | (5,764 | ) | | | (3,440,669 | ) |

Net increase (decrease) in share activity | | | (3,778 | ) | | $ | (1,865,649 | ) | | | (5,685 | ) | | $ | (3,390,669 | ) |

| (a) | There are entities that are record owners of more than 5% of the outstanding shares of the Fund and in the aggregate own 54% of the outstanding shares of the Fund. IDI may have an agreement with these entities to sell Fund shares. The Fund, Invesco and/or Invesco affiliates may make payments to these entities, which are considered to be related to the Fund, for providing services to the Fund, Invesco and/or Invesco affiliates including but not limited to services such as securities brokerage, distribution, third party record keeping and account servicing. The Fund has no knowledge as to whether all or any portion of the shares owned of record by these entities are also owned beneficially. |

| (b) | Effective with the Redomestication, each unit of the Partnership was converted to one share of the Fund. The net assets of the partnership at the date of the Redomestication were $51,952,336, including $46,109,059 of unrealized appreciation. The net assets of the Fund immediately after the Redomestication were $51,952,336. |

| | Prior to the Redomestication, partners of the Fund could redeem units any time. The net asset value of units redeemed, other than redemptions under a systematic withdrawal plan, was paid in cash or securities, at the option of the Fund, and were ordinarily paid in whole or in part in securities. The Fund’s valuation determined the quantity of securities tendered. The Fund selected securities for tender in redemptions based on tax or investment considerations. |

11 Invesco Exchange Fund

NOTE 9—Financial Highlights

The following schedule presents financial highlights for a share of the Fund outstanding throughout the periods indicated.

| | | | | | | | | | | | | | | | | | | | |

| | | Years ended December 31 | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

Net asset value, beginning of period | | $ | 581.70 | | | $ | 555.94 | | | $ | 446.07 | | | $ | 419.64 | | | $ | 456.20 | |

Net investment income(a) | | | 10.68 | | | | 10.43 | | | | 8.96 | | | | 8.39 | | | | 7.89 | |

Net gains (losses) on securities (both realized and unrealized) | | | (39.46 | ) | | | 20.69 | | | | 106.83 | | | | 23.04 | | | | (3.78 | ) |

Total from investment operations | | | (28.78 | ) | | | 31.12 | | | | 115.79 | | | | 31.43 | | | | 4.11 | |

Dividends from net investment income | | | (81.60 | ) | | | (5.25 | ) | | | (5.00 | ) | | | (5.00 | ) | | | (5.00 | ) |

Distributions from net realized gains | | | (0.11 | ) | | | (0.11 | ) | | | (0.92 | ) | | | — | | | | (35.67 | ) |

Total distributions | | | (81.71 | ) | | | (5.36 | ) | | | (5.92 | ) | | | (5.00 | ) | | | (40.67 | ) |

Net asset value, end of period | | $ | 471.21 | | | $ | 581.70 | | | $ | 555.94 | | | $ | 446.07 | | | $ | 419.64 | |

Total return(b) | | | (4.20 | )% | | | 5.64 | % | | | 26.09 | % | | | 7.51 | % | | | 0.84 | % |

Net assets, end of period (000’s omitted) | | $ | 55,000 | | | $ | 70,094 | | | $ | 70,151 | | | $ | 57,343 | | | $ | 56,827 | |

Portfolio turnover rate(c) | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| | | | | |

Ratio of expenses to average net assets: | | | | | | | | | | | | | | | | | | | | |

With fee waivers and/or expense reimbursements | | | 0.57 | %(d) | | | 0.53 | % | | | 0.67 | % | | | 0.58 | % | | | 0.52 | % |

Without fee waivers and/or expense reimbursements | | | 0.57 | %(d) | | | 0.53 | % | | | 0.67 | % | | | 0.75 | % | | | 0.65 | % |

Ratio of net investment income to average net assets | | | 1.94 | %(d) | | | 1.77 | % | | | 1.76 | % | | | 1.90 | % | | | 1.70 | % |

| (a) | Calculated using average shares outstanding. |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset value and returns for shareholder transactions. Not annualized for periods less than one year, if applicable. |

| (c) | Portfolio turnover is calculated at the fund level and is not annualized for periods less than one year, if applicable. |

| (d) | Ratios are based on average daily net assets (000’s omitted) of $65,658. |

12 Invesco Exchange Fund

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Invesco Exchange Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Invesco Exchange Fund (hereafter referred to as the “Fund”) at December 31, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2015 by correspondence with the custodian, provide a reasonable basis for our opinion.

PRICEWATERHOUSECOOPERS LLP

Houston, Texas

February 24, 2016

13 Invesco Exchange Fund

Calculating your ongoing Fund expenses

Example

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period July 1, 2015 through December 31, 2015.

Actual expenses

The table below provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Actual Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The table below also provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return.

The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

| | | | | | | | | | | | | | | | | | | | | | |

Beginning

Account Value

(07/01/15) | | | ACTUAL | | | HYPOTHETICAL (5% annual return before expenses) | | | Annualized

Expense

Ratio | |

| | Ending

Account Value

(12/31/15)1 | | | Expenses

Paid During

Period2 | | | Ending

Account Value

(12/31/15) | | | Expenses

Paid During

Period2 | | |

| $ | 1,000.00 | | | $ | 969.00 | | | $ | 2.88 | | | $ | 1,022,28 | | | $ | 2.96 | | | | 0.58 | % |

| 1 | The actual ending account value is based on the actual total return of the Fund for the period July 1, 2015 through December 31, 2015, after actual expenses and will differ from the hypothetical ending account value which is based on the Fund’s expense ratio and a hypothetical annual return of 5% before expenses. |

| 2 | Expenses are equal to the Fund’s annualized expense ratio as indicated above multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent fiscal half year. |

14 Invesco Exchange Fund

Tax Information

Form 1099-DIV, Form 1042-S and other year–end tax information provide shareholders with actual calendar year amounts that should be included in their tax returns. Shareholders should consult their tax advisors.

The following distribution information is being provided as required by the Internal Revenue Code or to meet a specific state’s requirement.

The Fund designates the following amounts or, if subsequently determined to be different, the maximum amount allowable for its fiscal year ended December 31, 2015:

| | | | |

Federal and State Income Tax | |

Qualified Dividend Income* | | | 100 | % |

Corporate Dividends Received Deduction* | | | 100 | % |

U.S. Treasury Obligations* | | | 0.00 | % |

| | * | The above percentages are based on ordinary income dividends paid to shareholders during the Fund’s fiscal year. |

15 Invesco Exchange Fund

Trustees and Officers

The address of each trustee and officer is 1555 Peachtree, N.E., Atlanta, Georgia 30309. The trustees serve for the life of the Fund, subject to their earlier death, incapacitation, resignation, retirement or removal as more specifically provided in the Fund’s organizational documents. Each officer serves for a one year term or until their successors are elected and qualified. Column two below includes length of time served with predecessor entities, if any.

| | | | | | | | |

Name, Year of Birth and Position(s) Held with the Fund | | Trustee

and/or

Officer Since | | Principal Occupation(s)

During Past 5 Years | | Number of

Funds in Fund

Complex

Overseen by

Trustee | | Other Directorship(s) Held by Trustee During

Past 5 Years |

| Interested Persons | | | | | | | | |

Martin L. Flanagan1 — 1960 Trustee | | 2014 | | Executive Director, Chief Executive Officer and President, Invesco Ltd. (ultimate parent of Invesco and a global investment management firm); Advisor to the Board, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.); Trustee, The Invesco Funds; Vice Chair, Investment Company Institute; and Member of Executive Board, SMU Cox School of Business Formerly: Chairman and Chief Executive Officer, Invesco Advisers, Inc. (registered investment adviser); Director, Chairman, Chief Executive Officer and President, IVZ Inc. (holding company), INVESCO Group Services, Inc. (service provider) and Invesco North American Holdings, Inc. (holding company); Director, Chief Executive Officer and President, Invesco Holding Company Limited (parent of Invesco and a global investment management firm); Director, Invesco Ltd.; Chairman, Investment Company Institute and President, Co-Chief Executive Officer, Co-President, Chief Operating Officer and Chief Financial Officer, Franklin Resources, Inc. (global investment management organization) | | 146 | | None |

Philip A. Taylor2 — 1954 Trustee | | 2014 | | Head of North American Retail and Senior Managing Director, Invesco Ltd.; Director, Co-Chairman, Co-President and Co-Chief Executive Officer, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Director, Chairman, Chief Executive Officer and President, Invesco Management Group, Inc. (formerly known as Invesco Aim Management Group, Inc.) (financial services holding company); Director and Chairman, Invesco Investment Services, Inc. (formerly known as Invesco Aim Investment Services, Inc.) (registered transfer agent) Chief Executive Officer, Invesco Corporate Class Inc. (corporate mutual fund company) Director, Chairman and Chief Executive Officer, Invesco Canada Ltd. (formerly known as Invesco Trimark Ltd./Invesco Trimark Ltèe) (registered investment adviser and registered transfer agent); Trustee, President and Principal Executive Officer, The Invesco Funds (other than AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), Short-Term Investments Trust and Invesco Management Trust); Trustee and Executive Vice President, The Invesco Funds (AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), Short-Term Investments Trust and Invesco Management Trust only); Director, Invesco Investment Advisers LLC (formerly known as Van Kampen Asset Management); Director, Chief Executive Officer and President, Van Kampen Exchange Corp. Formerly: Director and President, INVESCO Funds Group, Inc. (registered investment adviser and registered transfer agent); Director and Chairman, IVZ Distributors, Inc. (formerly known as INVESCO Distributors, Inc.) (registered broker dealer); Director, President and Chairman, Invesco Inc. (holding company), Invesco Canada Holdings Inc. (holding company), Trimark Investments Ltd./Placements Trimark Ltèe and Invesco Financial Services Ltd/Services Financiers Invesco Ltèe; Chief Executive Officer, Invesco Canada Fund Inc (corporate mutual fund company); Director and Chairman, Van Kampen Investor Services Inc.; Director, Chief Executive Officer and President, 1371 Preferred Inc. (holding company) and Van Kampen Investments Inc.; Director and President, AIM GP Canada Inc. (general partner for limited partnerships) and Van Kampen Advisors, Inc.; Director and Chief Executive Officer, Invesco Trimark Dealer Inc. (registered broker dealer); Director, Invesco Distributors, Inc. (formerly known as Invesco Aim Distributors, Inc.) (registered broker dealer); Manager, Invesco PowerShares Capital Management LLC; Director, Chief Executive Officer and President, Invesco Advisers, Inc.; Director, Chairman, Chief Executive Officer and President, Invesco Aim Capital Management, Inc.; President, Invesco Trimark Dealer Inc. and Invesco Trimark Ltd./Invesco Trimark Ltèe; Director and President, AIM Trimark Corporate Class Inc. and AIM Trimark Canada Fund Inc.; Senior Managing Director, Invesco Holding Company Limited; Director and Chairman, Fund Management Company (former registered broker dealer); President and Principal Executive Officer, The Invesco Funds (AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), and Short-Term Investments Trust only); President, AIM Trimark Global Fund Inc. and AIM Trimark Canada Fund Inc | | 146 | | None |

| 1 | Mr. Flanagan is considered an interested person (within the meaning of Section 2(a)(19) of the 1940 Act) of the Fund because he is an officer of the Adviser to the Trust, and an officer and a director of Invesco Ltd., ultimate parent of the Adviser. |

| 2 | Mr. Taylor is considered an interested person (within the meaning of Section 2(a)(19) of the 1940 Act) of the Fund because he is an officer and a director of the Adviser. |

T-1 Invesco Exchange Fund

Trustees and Officers—(continued)

| | | | | | | | |

Name, Year of Birth and Position(s) Held with the Fund | | Trustee

and/or

Officer Since | | Principal Occupation(s) During Past 5 Years | | Number of

Funds in Fund

Complex

Overseen by

Trustee | | Other Directorship(s) Held by Trustee During

Past 5 Years |

| Independent Trustees |

Bruce L. Crockett — 1944 Trustee | | 2014 | | Chairman, Crockett Technologies Associates (technology consulting company) Formerly: Director, Captaris (unified messaging provider); Director, President and Chief Executive Officer, COMSAT Corporation; Chairman, Board of Governors of INTELSAT (international communications company); ACE Limited (insurance company); Independent Directors Council and Investment Company Institute | | 146 | | ALPS (Attorneys Liability Protection Society) (insurance company) and Globe Specialty Metals, Inc. (metallurgical company) |

David C. Arch — 1945 Trustee | | 1997 | | Chairman of Blistex Inc., a consumer health care products manufacturer | | 146 | | Board member of the Illinois Manufacturers’ Association; Member of the Board of Visitors, Institute for the Humanities, University of Michigan |

James T. Bunch — 1942 Trustee | | 2014 | | Managing Member, Grumman Hill Group LLC (family office/private equity investments) Formerly: Chairman of the Board of Trustees, Evans Scholars Foundation and Chairman, Board of Governors, Western Golf Association | | 146 | | Trustee, Evans Scholars Foundation; and Chairman of the Board, Denver Film Society |

Albert R. Dowden — 1941 Trustee | | 2014 | | Director of a number of public and private business corporations, including the Boss Group, Ltd. (private investment and management); Nature’s Sunshine Products, Inc. and Reich & Tang Funds (5 portfolios) (registered investment company) Formerly: Director, Homeowners of America Holding Corporation/Homeowners of America Insurance Company (property casualty company); Director, Continental Energy Services, LLC (oil and gas pipeline service); Director, CompuDyne Corporation (provider of product and services to the public security market) and Director, Annuity and Life Re (Holdings), Ltd. (reinsurance company); Director, President and Chief Executive Officer, Volvo Group North America, Inc.; Senior Vice President, AB Volvo; Director of various public and private corporations; Chairman, DHJ Media, Inc.; Director, Magellan Insurance Company; and Director, The Hertz Corporation, Genmar Corporation (boat manufacturer), National Media Corporation; Advisory Board of Rotary Power International (designer, manufacturer, and seller of rotary power engines); and Chairman, Cortland Trust, Inc. (registered investment company) | | 146 | | Director of: Nature’s Sunshine Products, Inc., Reich & Tang Funds, Homeowners of America Holding Corporation/ Homeowners of America Insurance Company, the Boss Group |

Jack M. Fields — 1952 Trustee | | 2014 | | Chief Executive Officer, Twenty First Century Group, Inc. (government affairs company); Owner and Chief Executive Officer, Dos Angeles Ranch, L.P. (cattle, hunting, corporate entertainment); and Discovery Global Education Fund (non-profit) Formerly: Chief Executive Officer, Texana Timber LP (sustainable forestry company); Director of Cross Timbers Quail Research Ranch (non-profit); and member of the U.S. House of Representatives | | 146 | | Insperity, Inc. (formerly known as Administaff) |

| Eli Jones — Trustee | | 2016 | | Professor and Dean, Mays Business School, Texas A&M University Formerly: Professor and Dean, Walton College of Business, University of Arkansas, and E.J. Ourso College of Business, Louisiana State University | | 146 | | Director, Insperity, Inc., (2011-present) and ARVEST Bank (2012-2015) |

Prema Mathai-Davis — 1950 Trustee | | 2014 | | Retired. Formerly: Chief Executive Officer, YWCA of the U.S.A. | | 146 | | None |

Larry Soll — 1942 Trustee | | 2014 | | Retired. Formerly: Chairman, Chief Executive Officer and President, Synergen Corp. (a biotechnology company) | | 146 | | None |

| Robert C. Troccoli — Trustee | | 2016 | | Retired. Formerly: Senior Partner, KPMG LLP | | 146 | | None |

Raymond Stickel, Jr. — 1944 Trustee | | 2014 | | Retired. Formerly: Director, Mainstay VP Series Funds, Inc. (25 portfolios) and Partner, Deloitte & Touche | | 146 | | None |

Suzanne H. Woolsey — 1941 Trustee | | 2003 | | Chief Executive Officer of Woolsey Partners LLC | | 146 | | Emeritus Chair of the Board of Trustees of the Institute for Defense Analyses; Trustee of Colorado College; Trustee of California Institute of Technology; Prior to 2014, Director of Fluor Corp.; Prior to 2010, Trustee of the German Marshall Fund of the United States; Prior to 2010 Trustee of the Rocky Mountain Institute |

T-2 Invesco Exchange Fund

Trustees and Officers—(continued)

| | | | | | | | |

Name, Year of Birth and Position(s) Held with the Fund | | Trustee

and/or

Officer Since | | Principal Occupation(s) During Past 5 Years | | Number of

Funds in Fund

Complex

Overseen by

Trustee | | Other Directorship(s) Held by Trustee During

Past 5 Years |

| Other Officers | | | | | | | | |

Russell C. Burk — 1958 Senior Vice President and Senior Officer | | 2014 | | Senior Vice President and Senior Officer, The Invesco Funds | | N/A | | N/A |

John M. Zerr — 1962 Senior Vice President, Chief Legal Officer and Secretary | | 2010 | | Director, Senior Vice President, Secretary and General Counsel, Invesco Management Group, Inc. (formerly known as Invesco Aim Management Group, Inc.) and Van Kampen Exchange Corp.; Senior Vice President, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Senior Vice President and Secretary, Invesco Distributors, Inc. (formerly known as Invesco Aim Distributors, Inc.); Director, Vice President and Secretary, Invesco Investment Services, Inc. (formerly known as Invesco Aim Investment Services, Inc.); Senior Vice President, Chief Legal Officer and Secretary, The Invesco Funds; Managing Director, Invesco PowerShares Capital Management LLC; Director, Secretary and General Counsel, Invesco Investment Advisers LLC (formerly known as Van Kampen Asset Management); Secretary and General Counsel, Invesco Capital Markets, Inc. (formerly known as Van Kampen Funds Inc.) and Chief Legal Officer, PowerShares Exchange-Traded Fund Trust, PowerShares Exchange-Traded Fund Trust II, PowerShares India Exchange-Traded Fund Trust, PowerShares Actively Managed Exchange-Traded Fund Trust, and PowerShares Actively Managed Exchange-Traded Commodity Fund Trust Formerly: Director, Vice President and Secretary, IVZ Distributors, Inc. (formerly known as INVESCO distributors, Inc.); Director and Vice President, INVESCO Funds Group, Inc.; Director and Vice President, Van Kampen Advisors Inc.; Director, Vice President, Secretary and General Counsel, Van Kampen Investor Services Inc.; Director, Invesco Distributors, Inc. (formerly known as Invesco Aim Distributors, Inc.); Director, Senior Vice President, General Counsel and Secretary, Invesco Aim Advisers, Inc. and Van Kampen Investments Inc.; Director, Vice President and Secretary, Fund Management Company; Director, Senior Vice President, Secretary, General Counsel and Vice President, Invesco Aim Capital Management, Inc.; Chief Operating Officer and General Counsel, Liberty Ridge Capital, Inc. (an investment adviser); Vice President and Secretary, PBHG Funds (an investment company) and PBHG Insurance Series Fund (an investment company); Chief Operating Officer, General Counsel and Secretary, Old Mutual Investment Partners (a broker-dealer); General Counsel and Secretary, Old Mutual Fund Services (an administrator) and Old Mutual Shareholder Services (a shareholder servicing center); Executive Vice President, General Counsel and Secretary, Old Mutual Capital, Inc. (an investment adviser); and Vice President and Secretary, Old Mutual Advisors Funds (an investment company) | | N/A | | N/A |

Sheri Morris — 1964 Vice President, Treasurer and Principal Financial Officer | | 2010 | | Vice President, Treasurer and Principal Financial Officer, The Invesco Funds; Vice President, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); and Vice President, PowerShares Exchange-Traded Fund Trust, PowerShares Exchange-Traded Fund Trust II, PowerShares India Exchange-Traded Fund Trust, PowerShares Actively Managed Exchange-Traded Fund Trust, and PowerShares Actively Managed Exchange-Traded Commodity Fund Trust Formerly: Vice President, Invesco Aim Advisers, Inc., Invesco Aim Capital Management, Inc. and Invesco Aim Private Asset Management, Inc.; Assistant Vice President and Assistant Treasurer, The Invesco Funds and Assistant Vice President, Invesco Advisers, Inc., Invesco Aim Capital Management, Inc. and Invesco Aim Private Asset Management, Inc.; and Treasurer, PowerShares Exchange-Traded Fund Trust, PowerShares Exchange-Traded Fund Trust II, PowerShares India Exchange-Traded Fund Trust and PowerShares Actively Managed Exchange-Traded Fund Trust | | N/A | | N/A |

T-3 Invesco Exchange Fund

Trustees and Officers—(continued)

| | | | | | | | |

Name, Year of Birth and Position(s) Held with the Fund | | Trustee

and/or

Officer Since | | Principal Occupation(s) During Past 5 Years | | Number of

Funds in Fund

Complex

Overseen by

Trustee | | Other Directorship(s) Held by Trustee During

Past 5 Years |

| Other Officers—(continued) | | | | | | | | |

| Karen Dunn Kelley — 1960 Vice President | | 2010 | | Senior Managing Director, Investments, Invesco Ltd.; Director, Co-President, Co-Chief Executive Officer, and Co-Chairman, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Chairman, Invesco Senior Secured Management, Inc.; Senior Vice President, Invesco Management Group, Inc. (formerly known as Invesco Aim Management Group, Inc.); Executive Vice President, Invesco Distributors, Inc. (formerly known as Invesco Aim Distributors, Inc.); Director, Invesco Mortgage Capital Inc. and Invesco Management Company Limited; Vice President, The Invesco Funds (other than AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), Short-Term Investments Trust and Invesco Management Trust); and President and Principal Executive Officer, The Invesco Funds (AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), Short-Term Investments Trust and Invesco Management Trust only) Formerly: Director and President, INVESCO Asset Management (Bermuda) Ltd., Director, INVESCO Global Asset Management Limited and INVESCO Management S.A.; Senior Vice President, Van Kampen Investments Inc. and Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser); Vice President, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.); Director of Cash Management and Senior Vice President, Invesco Advisers, Inc. and Invesco Aim Capital Management, Inc.; Director and President, Fund Management Company; Chief Cash Management Officer, Director of Cash Management, Senior Vice President, and Managing Director, Invesco Aim Capital Management, Inc.; Director of Cash Management, Senior Vice President, and Vice President, Invesco Advisers, Inc. and The Invesco Funds (AIM Treasurer’s Series Trust (Invesco Treasurer’s Series Trust), and Short-Term Investments Trust only) | | N/A | | N/A |

Crissie M. Wisdom — 1969 Anti-Money Laundering Compliance Officer | | 2013 | | Anti-Money Laundering Compliance Officer, Invesco Advisers, Inc. (formerly known as Invesco Institutional (N.A.), Inc.) (registered investment adviser), Invesco Capital Markets, Inc. (formerly known as Van Kampen Funds Inc.), Invesco Distributors, Inc., Invesco Investment Services, Inc., Invesco Management Group, Inc., Van Kampen Exchange Corp., The Invesco Funds, and PowerShares Exchange-Traded Fund Trust, PowerShares Exchange-Traded Fund Trust II, PowerShares India Exchange-Traded Fund Trust, PowerShares Actively Managed Exchange-Traded Fund Trust and PowerShares Actively Managed Exchange-Traded Commodity Fund Trust; Anti-Money Laundering Compliance Officer and Bank Secrecy Act Officer, INVESCO National Trust Company and Invesco Trust Company; and Fraud Prevention Manager and Controls and Risk Analysis Manager for Invesco Investment Services, Inc. | | N/A | | N/A |

Lisa O. Brinkley — 1959 Chief Compliance Officer | | 2015 | | Senior Vice President and Chief Compliance Officer, Invesco Advisers, Inc. (registered investment adviser) (formerly known as Invesco Institutional (N.A., Inc.); and Chief Compliance Officer, The Invesco Funds Formerly: Global Assurance Officer, Invesco Ltd. and Vice President, The Invesco Funds; Chief Compliance Officer, Invesco Distributors, Inc. (formerly known as Invesco Aim Distributors, Inc.), Invesco Investment Services, Inc. (formerly known as Invesco Aim Investment Services, Inc.) and Van Kampen Investor Services Inc.; Senior Vice President, Invesco Management Group, Inc.; Senior Vice President and Chief Compliance Officer, Invesco Advisers, Inc. and The Invesco Funds; Vice President and Chief Compliance Officer, Invesco Aim Capital Management, Inc. and Invesco Distributors, Inc.; Vice President, Invesco Investment Services, Inc. and Fund Management Company | | N/A | | N/A |

| | | | |

Office of the Fund 11 Greenway Plaza, Suite 1000 Houston, TX 77046-1173 | | Investment Adviser Invesco Advisers, Inc. 1555 Peachtree Street, N.E. Atlanta, GA 30309 | | Auditors PricewaterhouseCoopers LLP 1000 Louisiana Street, Suite 5800 Houston, TX 77002-5678 |

| | |

| | | | |

Counsel to the Fund Stradley Ronon Stevens & Young, LLP 2005 Market Street, Suite 2600 Philadelphia, PA 19103-7018 | | Transfer Agent Invesco Investment Services, Inc. 11 Greenway Plaza, Suite 1000 Houston, TX 77046-1173 | | Custodian State Street Bank and Trust Company 225 Franklin Street Boston, MA 02110-2801 |

T-4 Invesco Exchange Fund

Invesco mailing information

Send general correspondence to Invesco Investment Services, Inc., P.O. Box 219078, Kansas City, MO 64121-9078.

Important notice regarding delivery of security holder documents

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). Mailing of your shareholder documents may be householded indefinitely unless you instruct us otherwise. If you do not want the mailing of these documents to be combined with those for other members of your household, please contact Invesco Investment Services, Inc. at 800 959 4246 or contact your financial institution. We will begin sending you individual copies for each account within 30 days after receiving your request.

Fund holdings and proxy voting information

The Fund provides a complete list of its holdings four times in each fiscal year, at the quarter ends. For the second and fourth quarters, the lists appear in the Fund’s semiannual and annual reports to shareholders. For the first and third quarters, the Fund files the lists with the Securities and Exchange Commission (SEC) on Form N-Q. Shareholders can also look up the Fund’s Forms N-Q on the SEC website at sec.gov. Copies of the Fund’s Forms N-Q may be reviewed and copied at the SEC Public Reference Room in Washington, D.C. You can obtain information on the operation of the Public Reference Room, including information about duplicating fee charges, by calling 202 551 8090 or 800 732 0330, or by electronic request at the following email address: publicinfo@sec.gov. The SEC file number for the Fund is shown below.

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge, upon request, from our Client Services department at 800 959 4246 or at invesco.com/proxyguidelines. The information is also available on the SEC website, sec.gov.

| | |

Information regarding how the Fund voted proxies related to its portfolio securities during the most recent 12-month period ended June 30 is available at invesco.com/proxysearch. The information is also available on the SEC website, sec.gov. Invesco Advisers, Inc. is an investment adviser; it provides investment advisory services to individual and institutional clients and does not sell securities. Invesco Distributors, Inc. is the US distributor for Invesco Ltd.’s retail mutual funds, exchange-traded funds and institutional money market funds. Both are wholly owned, indirect subsidiaries of Invesco Ltd. | |  |

| |

| SEC file number: 811-02611 VK-EXCH-AR-1 Invesco Distributors, Inc. | | |

ITEM 2. CODE OF ETHICS.

As of the end of the period covered by this report, the Registrant had adopted a code of ethics (the “Code”) that applies to the Registrant’s principal executive officer (“PEO”) and principal financial officer (“PFO”). There were no amendments to the Code during the period covered by the report. The Registrant did not grant any waivers, including implicit waivers, from any provisions of the Code to the PEO or PFO during the period covered by this report.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The Board of Trustees has determined that the Registrant has at least one audit committee financial expert serving on its Audit Committee. The Audit Committee financial expert is Raymond Stickel, Jr. Mr. Stickel is “independent” within the meaning of that term as used in Form N-CSR.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) to (d)

Fees Billed by Principal Accountant Related to the Registrant

PWC billed the Registrant aggregate fees for services rendered to the Registrant for the last two fiscal years as follows:

| | | | | | | | |

| | | Fees Billed for

Services Rendered to

the Registrant for

fiscal year end

12/31/2015 | | (e)(2) Percentage of Fees

Billed Applicable to

Non-Audit Services

Provided for fiscal

year end 12/31/2015

Pursuant to Waiver of

Pre-Approval

Requirement(1) | | Fees Billed for

Services Rendered to

the Registrant for

fiscal year end

12/31/2014 | | (e)(2) Percentage of Fees

Billed Applicable to

Non-Audit Services

Provided for fiscal

year end 12/31/2014

Pursuant to Waiver of

Pre-Approval

Requirement(1) |

| | | | |

Audit Fees | | $ 24,925 | | N/A | | $ 24,200 | | N/A |

Audit-Related Fees | | $ 0 | | 0% | | $ 0 | | 0% |

Tax Fees | | $ 33,890 | | 0% | | $ 27,950 | | 0% |

All Other Fees | | $ 0 | | 0% | | $ 0 | | 0% |

Total Fees | | $ 58,815 | | 0% | | $ 52,150 | | 0% |

(g) PWC billed the Registrant aggregate non-audit fees of $33,890 for the fiscal year ended 2015, and $27,950 for the fiscal year ended 2014, for non-audit services rendered to the Registrant.

| (1) | With respect to the provision of non-audit services, the pre-approval requirement is waived pursuant to a de minimis exception if (i) such services were not recognized as non-audit services by the Registrant at the time of engagement, (ii) the aggregate amount of all such services provided is no more than 5% of the aggregate audit and non-audit fees paid by the Registrant to PWC during a fiscal year; and (iii) such services are promptly brought to the attention of the Registrant’s Audit Committee and approved by the Registrant’s Audit Committee prior to the completion of the audit. |