APPENDIX F

ADDITIONAL INFORMATION ABOUT THE COMPANY AND FINANCIAL STATEMENTS

Description of the Business

Overview

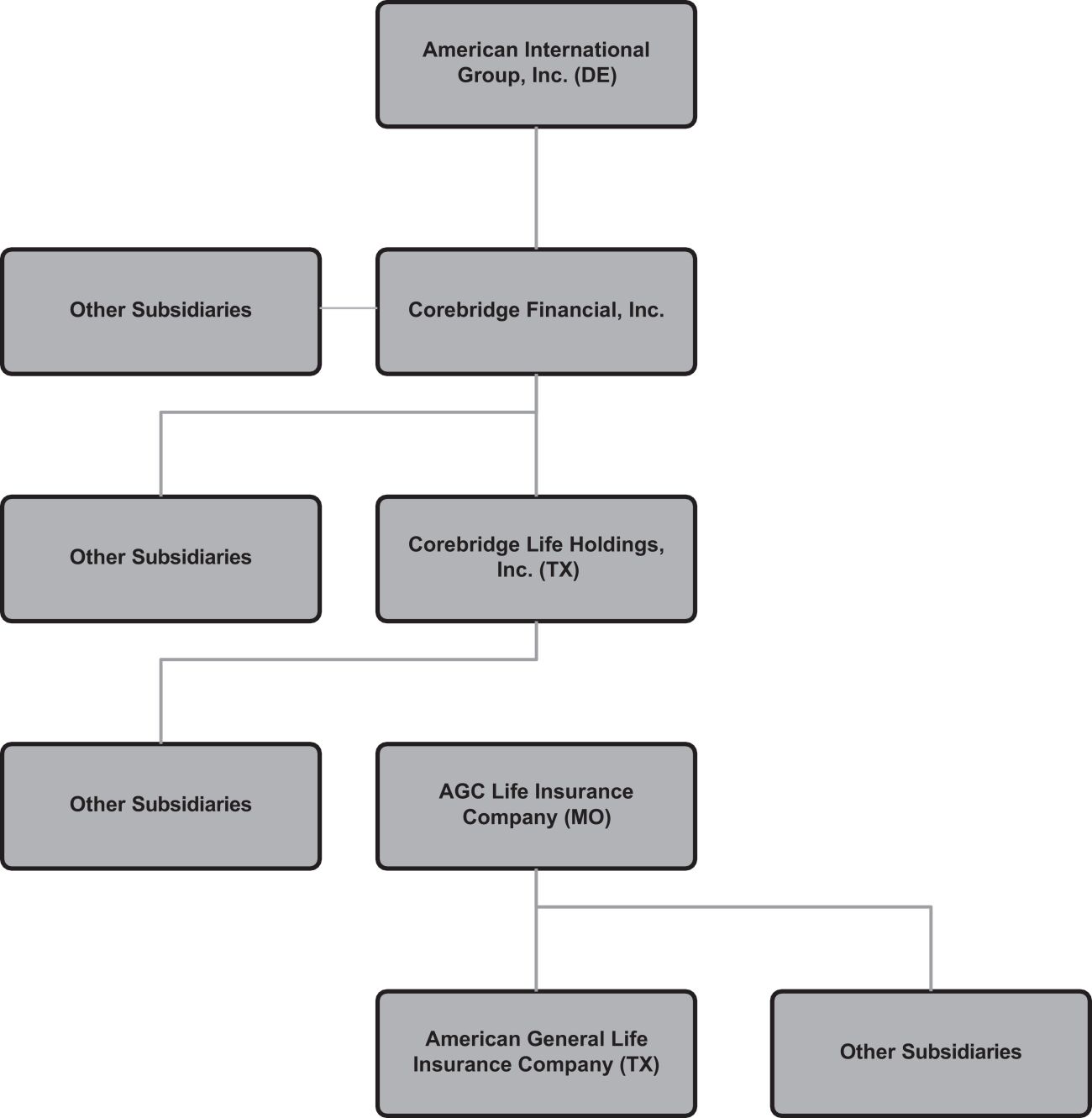

American General Life Insurance Company (“AGL” or the “Company”) is a direct, wholly-owned subsidiary of AGC Life Insurance Company (“AGC Life” or “AGC”), which is an indirect, wholly-owned subsidiary of Corebridge Financial, Inc., a Delaware corporation (“Corebridge”). AGL is a provider in the United States of individual term and universal life insurance solutions to middle-income and high-net-worth customers, as well as a provider of fixed and variable annuities. AGL is a stock life insurance company domiciled and licensed under the laws of the State of Texas and is subject to regulation by the Texas Department of Insurance and each state insurance regulator where it conducts insurance business. AGL was incorporated on April 11, 1960. The U.S. federal employer identification number of AGL is 25-0598210. The statutory home office of AGL is 2727-A Allen Parkway, 3-D1, Houston, TX 77019. The telephone number of AGL is +1 (713) 522-1111. AGL’s indirect subsidiary, Corebridge Capital Services, Inc. (“CCS”), formerly known as AIG Capital Services, Inc., is registered as a broker-dealer under the Exchange Act and is a member of FINRA.

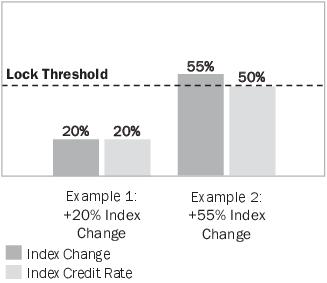

A simplified organizational structure summarizing AGL’s legal entity structure is below. On September 19, 2022, Corebridge completed an initial public offering (the “IPO”) in which American International Group, Inc., a Delaware corporation (“AIG”) sold 80.0 million shares of Corebridge common stock to the public. Since the IPO, AIG has sold portions of its interest in Corebridge through secondary public offerings. As of August 28, 2024, AIG owned approximately 49.0% of the outstanding Corebridge common stock.

On May 16, 2024, Corebridge entered into a stock purchase agreement (“Nippon Stock Purchase Agreement”) by and among Corebridge, AIG, Nippon Life Insurance Company, a mutual company organized under the laws of Japan (“Nippon”) pursuant to which AIG agreed to sell approximately 122.0 million shares, representing approximately 20% of the issued and outstanding common stock of Corebridge at the signing to Nippon. The transaction is expected to close by the first quarter of 2025, subject to the satisfaction of customary closing conditions, including the receipt of specified regulatory approvals. On May 16, 2024, in connection with the execution of the Stock Purchase Agreement, Corebridge entered into an amendment to the Separation Agreement, dated as of September 14, 20222, by and between Corebridge and AIG (the “Separation Agreement”), pursuant to which Corebridge and AIG agreed to certain changes with respect to AIG’s board designation rights and AIG’s right to consent over certain actions by Corebridge, as set forth in the Separation Agreement.

On June 9, 2024, AIG waived its right under the Separation Agreement to include a majority of the candidates on each slate of candidates recommended by the Corebridge Board of Directions to Corebridge’s stockholders in connection with a meeting of stockholders. On June 10, 2024, AIG announced that it has met the requirements for the deconsolidation for accounting purposes of Corebridge.

F-1

AGL’s diversified and comprehensive product portfolio includes term life insurance, universal, variable universal and whole life insurance, accident and health insurance, single- and flexible-premium deferred fixed and variable annuities, fixed index deferred annuities, single-premium immediate and deferred income annuities, private placement variable annuities, private placement variable universal life, structured settlements, corporate- and bank- owned life insurance, pension risk transfer annuities, guaranteed investment contracts (“GICs”), funding agreements, stable value wrap products and group benefits. The dotted line between AGL and the Issuer denotes that the Issuer is a special purpose statutory trust organized in a Series. See “Description of the Issuer.”

AGL distributes its products through a broad multi-channel distribution network, which includes independent marketing organizations, independent insurance agents, financial advisors, banks, broker-dealers and direct marketing. AGL generates revenues and profitability as follows:

| | • | | AGL earns revenues primarily from insurance premiums, policy fees and income from investments. |

| | • | | AGL’s operating expenses consist of policyholder benefits and losses incurred, interest credited to policyholders, commissions and other costs of selling and servicing its products, and general operating expenses. |

| | • | | AGL’s profitability is dependent on its ability to properly price and manage risk on insurance and annuity products, to manage its portfolio of investments effectively, and to control costs through expense discipline. |

AGL’s major product lines include:

| | • | | Life Insurance: AGL offers a competitive and flexible product suite that is designed to meet the needs of its specific customer segments and actively manages new product margins and in-force profitability. AGL actively participates in chosen product lines that it believes have better growth |

F-2

| | and margin prospects for its offerings, including term life insurance (“Term”) and index universal life insurance (“IUL”), and has reduced its exposure to interest rate sensitive products, including guaranteed universal life insurance (“GUL”) and guaranteed variable universal life insurance (“VUL”), the latter of which AGL no longer offers. AGL’s dynamic product offerings and design expertise are complemented by its (i) long-term commitment to the U.S. market; (ii) robust distribution capabilities, which enable it to expand its presence in key pockets of growth, such as guaranteed issuance whole life (“GIWL”) and simplified issue whole life (“SIWL”); and (iii) disciplined underwriting profile. AGL continues to execute its multi-year strategies to enhance returns, including building state-of-the-art digital platforms and underwriting innovations, which are expected to continue to bring process improvements and cost efficiencies. |

AGL is focused on providing financial security for its policyholders and their loved ones when they need it most. AGL’s life insurance and protection products include Term, IUL and smaller face amount whole life insurance (“Whole Life

AGL’s traditional life insurance (“Traditional Life”) products include Term and Whole Life. AGL’s universal life insurance (“Universal Life”) products include IUL and GUL.

Traditional Life

| | • | | Term Life Insurance: Term provides death benefit coverage and level premiums for a specified number of years. A focus area for AGL’s business, AGL offers Term products with coverage durations and coverage tailored to serve AGL’s customers’ financial plans. AGL has key focus ages between 20 and 70 years old. |

| | • | | Whole Life Insurance: Whole Life provides permanent death benefit coverage and a tax-advantaged savings component that accumulates at a fixed rate. AGL offers a GIWL product focused on the senior final expense market at low face amounts. With the aging U.S. population, AGL sees this as an area that AGL expects to meaningfully contribute to AGL’s growth. AGL also offers a SIWL product for this market, offering flexibility for this growing senior final expense market. For both GIWL and SIWL products, AGL targets customers between the ages of 50 and 80 years old. |

| | • | | GIWL is underwritten with a 100% acceptance rate regardless of an individual’s underlying health. This underwriting methodology is typically paired with a graded death benefit product that limits death benefit proceeds during the first few years of a life insurance policy to minimize adverse mortality impacts and keep coverage affordable. SIWL underwriting requires limited applicant information relative to traditional underwriting, requiring an abbreviated application without a physical examination or laboratory testing. This streamlined structure is typically associated with simpler products and lower death benefit amounts to ensure the product offering is made available at an affordable price and meeting different client needs. |

Universal Life

| | • | | Index Universal Life Insurance: IUL provides permanent death benefit coverage and a tax- advantaged savings component that accumulates with performance tied to a chosen index. AGL provide two main IUL products, Max Accumulator+ and Value+ Protector, to meet the accumulation and protection needs of AGL’s policyholders in a wide range of target ages from younger to middle-aged. These products allow the statutory policyholder to participate in a portion of the performance of an index price movement while also protecting them from negative return risk. Both of AGL’s IUL products provide some customers with a fluid-less option up to a $2 million face amount, offering a streamlined customer experience. The Max Accumulator+ product has key focus ages between 30 and 55 years old, while the Value+ Protector product has key focus ages between 45 and 70 years old. |

F-3

| | • | | Guaranteed Universal Life Insurance: GUL provides permanent death benefit coverage and a tax- advantaged savings component that accumulates at a crediting rate set by the insurance company. AGL issues a guaranteed death benefit product that provides low-cost permanent death benefit protection. Beginning in 2019, AGL began to diversify sales away from GUL to focus on less interest rate sensitive market segments, resulting in a steep decline in sales. AGL does not anticipate this product line to be a large contributor to AGL’s portfolio over the near term. |

| | • | | Fixed Annuities: AGL offers a range of fixed annuity products that offer principal protection and a specified rate of return over a single year or multi-year time periods. Beyond the guaranteed return periods, AGL offers renewal crediting rates that are dynamically managed in coordination with its investment team. AGL also offers optional living benefits for some of its fixed annuity products. The market risk associated with these living benefits is mitigated as the return on fixed annuities uses the guaranteed minimum interest rate as a floor, which prevents the account value from declining due to market returns. AGL bears the risk of investment performance for fixed annuity products. These products primarily generate spread-based income on the difference between the investment income earned on the assets backing the policy (which are held in AGL’s general account) and the interest credited to the policyholder. AGL’s product teams closely coordinate with its investment management function to efficiently manage this spread income. Such coordination provides AGL with the ability to quickly reprice and reposition its market offerings as new asset opportunities are sourced and as market conditions change in addition to closely managed renewal rates. |

| | • | | Variable Annuities:. AGL offers variable annuities that allow a customer to choose from a selection of investment options. AGL’s variable annuity products generate fee-based income that is typically paid as a percentage of the assets in the investment options selected by the policyholder and held in one of its separate accounts. Policyholders generally bear the risk of the investment performance of assets held in a separate account. These products typically offer, and in some cases in order to limit volatility, require a portion of the account value to be allocated to general account investment options. AGL’s variable annuity products offer guaranteed benefit features (collectively known as “GMxBs”), including GMDBs and living benefits which provide guaranteed lifetime income, such as GMWBs. |

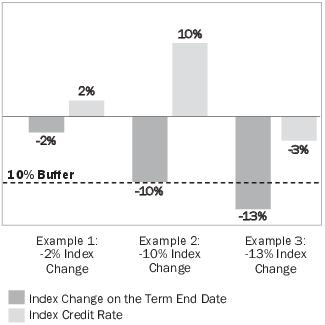

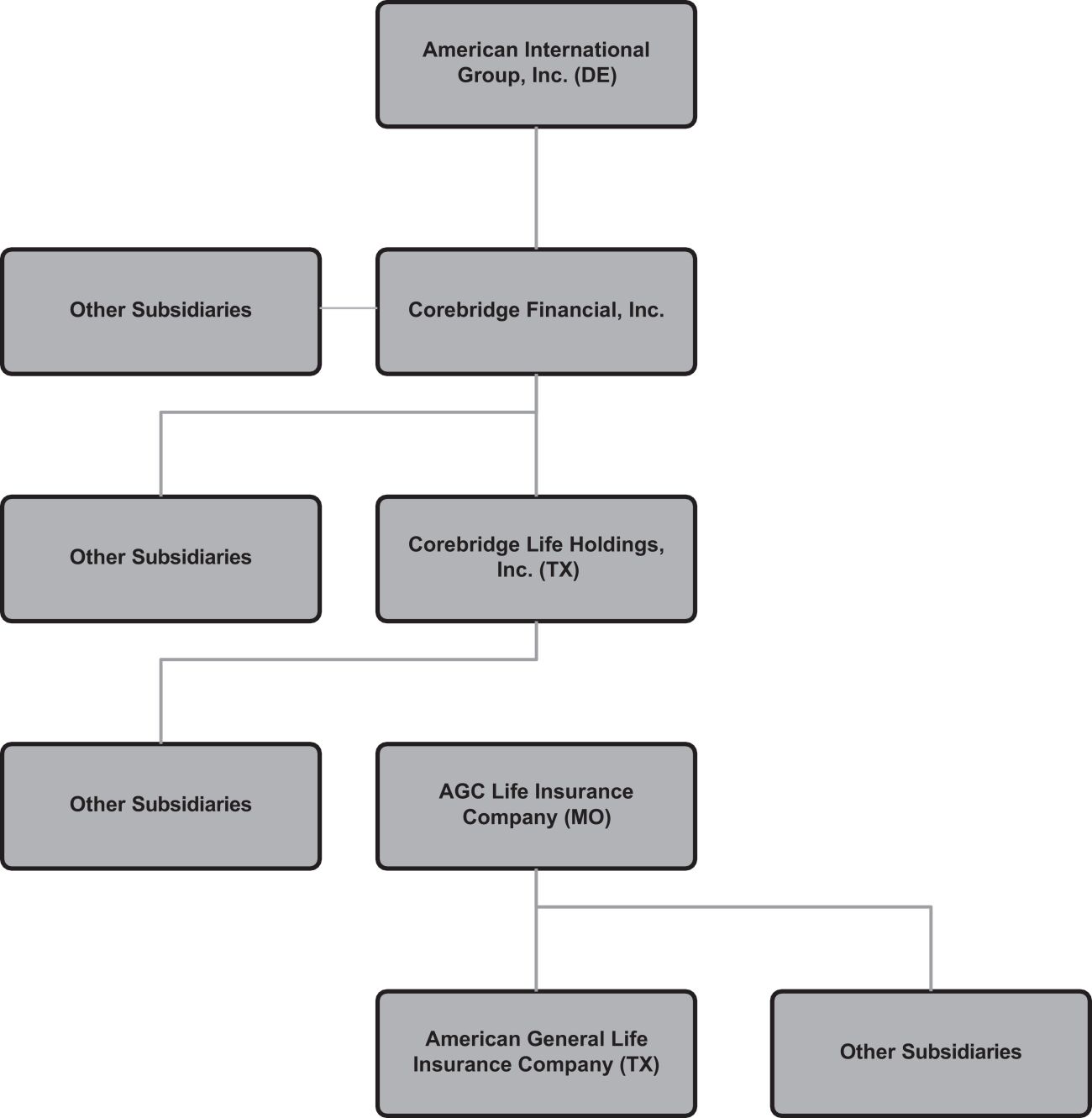

| | • | | Index Annuities: AGL offers fixed index annuity products that provide its customers with returns linked to the underlying returns of various market indices. In recent years, AGL has primarily sold modified single premium contracts that generally allow for multiple premium payments in the first 30 contract days. Virtually all of the policies in force at December 31, 2023 are single premium contracts. AGL’s products can include a range of optional benefits including guaranteed minimum death benefits (“GMDBs”) and guaranteed minimum withdrawal benefits (“GMWBs”). The market risk associated with these guarantees is mitigated as fixed index annuity account values generally do not decrease even when the chosen index has negative performance. In addition, after a contractual holding period, policyholders generally have an option to annuitize their contract and receive annual annuity payments for a stated term or for the life of the annuitant, based upon their annuitization election. Policyholders with a GMWB rider may take annual withdrawals at a stated contractual percentage after a required holding period without the need to elect annuitization. |

| | • | | Institutional Markets: AGL’s Institutional Markets business provides sophisticated, bespoke risk management solutions to both financial and non-financial institutions. Institutional Markets complements AGL’s retail businesses by targeting large institutional clients. Institutional Markets allows AGL to opportunistically source long-term liabilities with attractive risk-adjusted return profiles that are consistent with its overall risk management philosophy. AGL’s Institutional Markets products are distributed in very specialized markets. Its product portfolio consists of annuities sold through the pension risk transfer (“PRT”) markets and annuities sold in the structured settlements markets, life insurance sold through the corporate-owned life insurance (“COLI”) and bank owned life insurance (“BOLI”) markets and capital market products, including guaranteed investment contracts (“GICs”) and synthetic products such as stable value wrap (“SVW”) contracts. Institutional Markets also offers reinsurance for pension liabilities, mainly from cedants based in the United Kingdom (“UK”). The |

F-4

| | breadth of AGL’s Institutional Markets offering allows AGL to be selective in its liability generation and allocate capital towards the areas where it sees the greatest risk-adjusted returns. Over time, this approach has resulted in a collection of strong business lines that each contribute to Institutional Markets’ earnings. |

Regulatory Matters and Litigation

Various federal, state or other regulatory agencies may from time-to-time review, examine or inquire into the operations, practices and procedures of AGL, such as through financial examinations, subpoenas, investigations, market conduct exams or other regulatory inquiries. Based on the current status of pending regulatory examinations, investigations and inquiries involving AGL, AGL believes it is not likely that these regulatory examinations, investigations or inquiries will have a material adverse effect on the financial position, results of operations or cash flows of AGL.

Additionally, various lawsuits against AGL have arisen in the ordinary course of business. AGL continues to defend against Moriarty v. American General Life Insurance Co. (S.D. Cal.), a putative class action involving Sections 10113.71 and 10113.72 of the California Insurance Code, which was instituted against AGL on July 18, 2017. In general, those statutes require that for life-insurance policies issued and delivered in California: (1) the policy must contain a 60-day grace period following non-payment of premium during which the policy remains in force; (2) the insurer must provide a 30-day pre-lapse notice; and (3) the insurer must notify policy owners of the right to designate a secondary recipient for lapse notices. The plaintiff contends AGL did not comply with these requirements for a policy issued before these statutes went into effect. The plaintiff seeks damages and other relief. AGL asserts various defenses to the plaintiff’s claims and to class certification. In 2022, the District Court held that a trial was necessary to determine whether AGL was liable on the plaintiff’s breach of contract claim, and it denied class certification. In May 2023, the case was reassigned to a new judge. On August 14, 2023, the District Court granted the plaintiff’s motion for summary judgment on the plaintiff’s breach of contract claim. On September 26, 2023, the District Court decided that good cause exists to allow the plaintiff to file a third motion for class certification. At the same time, however, the District Court certified its August 14, 2023 order for interlocutory appeal to the Ninth Circuit and stayed trial court proceedings pending the outcome of AGL’s appeal. The Ninth Circuit granted AGL’s petition for interlocutory appeal on November 21, 2023, which remains pending. AGL filed its opening brief on April 15, 2024. The Ninth Circuit granted the plaintiff’s request for an extension of time to file an answering brief, which was due and filed on June July 22, 2024. AGL’s reply brief is due on September 11, 2024.

AGL is also defending other actions in California involving similar issues: (i) Allen v. Protective Life Insurance Co. and AGL (E.D. Cal.), which was filed in state court on September 26, 2022. After being removed to federal court, the plaintiffs filed a motion on August 11, 2023, seeking leave to amend the complaint to add class action allegations against AGL. On November 8, 2023, the District Court issued an order that plaintiffs’ motion will be held in abeyance pending resolution of the class certification issues in Moriarty. (ii) Chuck v. American General Life Insurance Co. (C.D. Cal.), which was filed in state court on September 6, 2023, as a putative class action. After being removed to federal court, the plaintiffs filed an amended complaint on January 8, 2024, dropping the class action allegation against AGL and adding a sales agent as a defendant. On April 15, 2024, the District Court entered a scheduling order setting the case for trial on February 18, 2025.

AGL has also recently been named as a defendant in other individual matters potentially implicating the CA Statutes: Koch Family Trust v. American General Life Insurance Co., Case No. 2:24-cv-5522 (C.D. Cal.), filed on May 15, 2024; and Wong v. American General Life Insurance Co., Case No. 24STCV19089 (Superior Court of Los Angeles County, California), filed on July 31, 2024.

These cases are in the early stages, and AGL expects their progress will be influenced by future developments in Moriarty and cases against other insurers involving the same insurance statutes. AGL has accrued its current estimate of probable loss with respect to these litigation matters.

F-5

Except as discussed above and in the Statutory-Basis Financial Statements, AGL believes it is unlikely that contingent liabilities arising from such lawsuits, will have a material adverse effect on its financial position, results of operation or cash flows.

Regulation

Dodd-Frank

The Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”), signed into law in 2010, brought about extensive changes to financial regulation in the United States and established the Financial Stability Oversight Council. Dodd-Frank also established the Federal Insurance Office (“FIO”) to serve as the central insurance authority in the federal government. While not serving a regulatory function FIO performs certain duties related to the business of insurance, represents the U.S. in international insurance forums, and has authority to collect information on the insurance industry and recommend prudential standards. Certain parts of Dodd-Frank are noted below in more detail.

Title V of Dodd-Frank authorizes the United States to enter into covered agreements with foreign governments or regulatory entities regarding the business of insurance and reinsurance. On September 22, 2017, the United States and the EU entered into such an agreement to address, among other things, reinsurance collateral and group capital requirements, and on December 18, 2018, the United States signed a covered agreement with the U.K, which is similar to the agreement with the EU. The National Association of Insurance Commissioners (“NAIC”) adopted amendments to the credit for reinsurance model law and regulation and adopted the Group Capital Calculation (“GCC”) to conform to the requirements of the covered agreements. Numerous states, including AGL’s domiciliary states, have adopted the GCC requirements in their statutes.

Title VII of Dodd-Frank provides for significantly increased regulation of, and restrictions on, swap and security-based swap markets and transactions. This regulation has affected and, as additional regulations come into effect, could further affect various activities of insurance and other financial services companies. Relevant regulatory requirements include (i) margin and collateral requirements, (ii) regulatory reporting (iii) mandated clearing through central counterparties and execution through regulated swap execution facilities for certain swaps (other than security-based swaps, which are not currently subject to mandatory execution or clearing requirements but could be in the future). The Commodities Futures Trading Commission (“CFTC”), which oversees and regulates the U.S. swap, commodities and futures markets, and the SEC, which oversees and regulates the U.S. securities and security-based swap markets, have finalized the majority of the rules to carry out their mandates under Title VII of Dodd-Frank. Increased regulation of, and restrictions on, derivatives markets and transactions, including regulations related to initial margin for swaps and securities-based swaps, could increase the cost of AGL’s trading and hedging activities, reduce liquidity and reduce the availability of customized hedging solutions and derivatives.

Dodd-Frank also mandated a study to determine whether stable value contracts should be included in the definition of “swap.” If that study concludes that stable value contracts are swaps, Dodd-Frank authorizes certain federal regulators to determine whether an exemption from the definition of a swap for stable value contracts is appropriate and in the public interest. AGL’s Institutional Markets business issues stable value contracts. AGL cannot predict what regulations might emanate from the aforementioned study or be promulgated applicable to this business in the future. In the event that the study determines that stable value contracts should be included in the definition of “swap,” Section 719(d)(1)(C) of Dodd-Frank provides that such determination would only apply to newly issued stable value contracts.

Title II of Dodd-Frank provides that a financial company whose largest United States. subsidiary is an insurer may be subject to a special orderly liquidation process outside the Bankruptcy Code. U.S. insurance subsidiaries of any such financial company, however, would be subject to rehabilitation and liquidation proceedings under state insurance law.

F-6

Pursuant to Dodd-Frank, federal banking regulators adopted regulations that apply to certain qualified financial contracts, including many derivatives contracts, securities lending agreements and repurchase agreements, with certain banking institutions and certain of their affiliates. These regulations, which became effective on January 1, 2019, generally require the covered banking institutions and affiliates to include contractual provisions in their qualified financial contracts that limit or delay certain counterparty rights that may arise in connection with the banking institution or affiliate becoming subject to a bankruptcy or similar proceeding. Nearly all of AGL’s derivatives, securities lending agreements and repurchase agreements with certain banking institutions and certain of their affiliates are subject to these regulations, and as a result, AGL may be required to delay terminating transactions, realizing collateral posted, or otherwise mitigating exposures under these agreements. AGL is subject to greater risk and could receive a more limited or delayed recovery in the event of a default by such bank institution or the applicable affiliates.

FSB and IAIS

The Financial Stability Board (the “FSB”) consists of representatives of national financial authorities of the G20 countries. The FSB is not a regulator but is focused primarily on promoting international financial stability.

The (International Association of Insurance Supervisors (“IAIS”) represents insurance regulators and supervisors of more than 200 jurisdictions (including regions and states) in nearly 140 countries and seeks to promote globally consistent insurance industry supervision. The IAIS is not a regulator, but one of its activities is to develop insurance regulatory standards for use by local authorities across the globe. IAIS has adopted ComFrame, a Common Framework for the Supervision of Internationally Active Insurance Groups (“IAIGs”). ComFrame sets out qualitative and quantitative standards for group supervision, governance and internal controls, enterprise risk management, and recovery and resolution planning. As part of ComFrame, the IAIS is developing a risk-based global insurance capital standard (“ICS”) applicable to IAIGs, with the purpose of creating a common language for supervisory discussions of group solvency of IAIGs. Although AIG has been designated as an IAIG, Corebridge is not to date separately determined to be designated as an IAIG.

The IAIS has adopted a holistic framework (“Holistic Framework”) for the assessment and mitigation of systemic risk in the insurance sector. The Holistic Framework recognizes that systemic risk can emanate from specific activities and exposures arising from either sector-wide trends or concentrations in individual insurers.

In light of the IAIS adoption of the Holistic Framework, the FSB decided in December 2022 to discontinue the annual identification of Global Systematically Important Insurers in favor of instead applying the Holistic Framework to inform the FSB’s consideration of systemic risk in insurance.

The standards issued by the FSB and/or the IAIS are not binding on the United States or other jurisdictions around the world unless and until the appropriate local governmental bodies or regulators adopt laws and regulations implementing such standards. At this time, as these standards have been adopted only relatively recently and in some cases remain under development, it is not known how the IAIS’s frameworks and/or standards might be implemented in the United States and other jurisdictions around the world or how they might ultimately apply to Corebridge or AGL.

ERISA

AGL provides products and services to certain employee benefit plans that are subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), and/or the Code. Plans subject to ERISA include certain pension and profit- sharing plans and welfare plans, including health, life and disability plans. As a result, AGL’s activities are subject to the restrictions imposed by ERISA and the Code, including the requirement under ERISA that fiduciaries must perform their duties solely in the interests of ERISA plan participants and beneficiaries, and that fiduciaries may not cause a covered plan to engage in certain prohibited transactions. The applicable provisions of ERISA and the Code are subject to enforcement by the DOL, the IRS and the Pension Benefit Guaranty Corporation.

F-7

Standard of Care Developments

AGL and its distributors are subject to laws and regulations regarding the standard of care applicable to sales of AGL’s products and the provision of advice to AGL’s customers. In recent years, many of these laws and regulations have been revised or reexamined while others have been newly adopted. AGL closely monitors these legislative and regulatory activities and evaluates the impact of these requirements on it and its customers, distribution partners and financial advisers. Where needed, AGL has made significant investments to implement and enhance its tools, processes and procedures, to comply with the final rules and interpretations. These efforts and enhancements have resulted in increased compliance costs and may impact sales results and increase regulatory and litigation risk. Additional changes in standard of care requirements or new standards issued by governmental authorities, such as the DOL, the SEC, the NAIC or state regulators and/or legislators, have impacted, and may impact AGL’s businesses, results of operations and financial condition.

DOL Fiduciary Rule

On April 25, 2024, the Department of Labor (“DOL”) published a final rule in the Federal Register updating the definition for when a person is an “investment advice fiduciary” for purposes of transactions with ERISA qualified plans, related plan participants and IRAs. The DOL also published changes with respect to existing prohibited transactions exemptions (“PTEs”) relating to such advice, including PTE 84-24 and PTE 2020-02. Orders staying the rule’s September 23, 2024 effective date were issued by the U.S. district Courts for the Eastern District of Texas and the Northern District of Texas on July 25, 2024 and July 26, 2024, respectively, in connection with separate lawsuits challenging the rule. We are actively monitoring the progress of the litigation while continuing to evaluate potential impact of the DOL rule to our business.

SEC Best Interest Regulation

In June 2020, the SEC’s Regulation Best Interest (“Regulation BI”) went into effect. Regulation BI established new duties of care, compliance, disclosure, and conflict mitigation that broker-dealers and their associated persons must meet when making a recommendation of a securities transaction or investment strategy involving securities to a retail customer. As part of the rulemaking package, Form CRS also went into effect, which requires enhanced disclosures by broker-dealers and investment advisers regarding retail client relationships and certain conflicts of interest. Regulation BI and Form CRS continue to be identified as examination priorities for the SEC and the Financial Industry Regulatory Authority (“FINRA”). AGL has implemented the requirements of Regulation BI and Form CRS, and continues to monitor interpretative guidance and enforcement activity from federal securities regulators.

State Standard of Care Developments

In 2020, the NAIC adopted revisions to its Suitability in Annuity Transactions Model Regulation (#275) (“NAIC Model”) implementing a best interest standard of care applicable to sales and recommendations of annuities. The new NAIC Model conforms in large part to Regulation BI, providing that all recommendations by agents and insurers must be in the best interest of the consumer under known circumstances at the time an annuity recommendation is made, without placing agents’ or insurers’ financial interests ahead of the consumer’s interest in making a recommendation. A substantial majority of states have adopted amendments to their suitability rules based on the NAIC Model revisions. In addition, certain state insurance and/or securities regulators and legislatures have adopted, or are considering adopting, their own standards of conduct, some of which are broader in scope than the NAIC Model. For example, in 2018, the NYDFS adopted the First Amendment to Insurance Regulation 187- Suitability and Best Interests in Life Insurance and Annuity Transactions (“Regulation 187”). As amended, Regulation 187 requires producers to act in their client’s best interest when making both point-of-sale and in-force recommendations and to deliver to the client the written basis for the recommendation, as well as the facts and analysis to support the recommendation. The amended regulation also imposes additional duties on life insurance companies in relation to these transactions, such as requiring insurers to establish and maintain procedures designed to prevent financial exploitation and abuse.

F-8

Besides New York, other states have also adopted, or are considering adopting, legislative and/or regulatory proposals implementing fiduciary duty standards with applicability to insurance producers, agents, financial advisors, investment advisers, broker-dealers and/or insurance companies. The proposals vary in scope, applicability and timing of implementation. AGL cannot predict whether any such proposals will be adopted. However, changes in standards of care could impose additional costs in the areas of compliance and employee training and affect how AGL manages its business and overall costs.

Federal Retirement Legislation

On December 20, 2019, the Setting Every Community Up for Retirement Enhancement (“SECURE”) Act was signed into law. The SECURE Act includes many provisions affecting qualified contracts, some of which became effective upon enactment on January 1, 2020, or later, and some of which were retroactively effective.

In December 2022, Congress enacted comprehensive retirement legislation known as “SECURE 2.0.” SECURE 2.0 included many provisions affecting qualified contracts, many of which became effective in 2023, and additional ones that become effective in 2024 or subsequent years. Some of the SECURE 2.0 provisions that became effective in 2023 include, without limitation: an increase in the age at which required minimum distributions generally must commence, to age 73 from the previous age of 72; elimination of the first day of the month requirement for governmental Section 457(b) plans; and optional treatment of employer contributions as Roth sources. AGL is implementing new processes and procedures, where needed, designed to comply with the new requirements.

Securities, Investment Adviser, Broker-Dealer and Investment Company Regulations

AGL’s investment products and services are subject to applicable federal and state securities, investment advisory, fiduciary, and other laws and regulations. The principal U.S. regulators of these operations include the SEC, FINRA, CFTC, Municipal Securities Rulemaking Board, state securities commissions, state insurance departments and the DOL.

AGL’s variable life insurance, variable annuity and mutual fund products generally are subject to regulation as “securities” under applicable federal securities laws, except where exempt. Such regulation includes registration of the offerings of these products with the SEC, unless exempt from such registration, and requirements of distribution participants to be registered as broker-dealers, as well as recordkeeping, reporting and other requirements. This regulation also involves the registration of mutual funds and other investment products offered by AGL’s businesses, and the separate accounts through which AGL’s variable life insurance and variable annuity products are issued, as investment companies under the Investment Company Act of 1940, as amended (the “Investment Company Act”), except where exempt. The Investment Company Act imposes requirements relating to compliance, corporate governance, disclosure, recordkeeping, registration and other matters. In addition, the offering of these products may involve filing and other requirements under the securities, corporate, or other laws of the states and other jurisdictions where offered or organized, including the District of Columbia and U.S. territories. AGL’s separate account investment products are also subject to applicable state insurance regulation.

AGL’s indirect subsidiary, Corebridge Capital Services, Inc. (“CCS”), is registered as a broker-dealer under the Exchange Act and is a member of FINRA. This broker-dealer is involved in AGL’s life and annuity product sales, including participating in their distribution. AGL’s direct subsidiary, SunAmerica Asset Management, LLC (“SAAMCo”), is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940 (the “Advisers Act”), serves as an investment adviser with respect to mutual funds that underlie variable products offered by AGL and oversees sub-advisers managing the assets of such mutual funds. In addition to registration requirements, the Exchange Act, the Advisers Act and the regulations thereunder impose various compliance, disclosure, qualification, recordkeeping, reporting and other requirements on SAAMCo and its

F-9

operations. State securities laws also impose filing and other requirements on CCS and SAAMCo, except where exempt. The SEC, FINRA and other regulatory bodies also have the authority to examine regulated entities, such as CCS, and to institute administrative or judicial proceedings that may result in censure, fines, prohibitions or restrictions on activities, or other administrative sanctions.

Further, AGL’s licensed sales professionals appointed with CCS and its other employees, insofar as they sell products that are securities, including wholesale and retail activity, are subject to the Exchange Act and to examination requirements and regulation by the SEC, FINRA and state securities commissioners. Regulation and examination requirements also extend to CCS, insofar as it employs or controls those individuals.

The business of SAAMCo will be impacted by SEC regulatory initiatives with respect to the investment management business. The SEC is engaged in various initiatives and reviews that seek to modernize the regulatory structure governing the investment management industry, including investment advisers registered under the Advisers Act and investment companies registered under the Investment Company Act. The SEC has also adopted comprehensive rules changing the regulation of investment advisers to private funds, and has proposed rules that prohibit investment advisers from outsourcing certain services or functions without meeting minimum requirements, address investment adviser custody of client assets and require investment advisers (and broker-dealers) to neutralize or eliminate conflicts of interests associated with advisers’ use of predictive data analytics in connection with certain investor interactions. In November 2022, the SEC proposed a rule and related amendments that, among other things, change how open-end funds, other than money market funds and exchange-traded funds, manage their liquidity risk. The proposed rule requires these funds to use a liquidity management tool called “swing pricing” and to implement a “hard close,” and compelling funds to provide timelier and more detailed public reporting of fund information. If adopted as proposed, the regulatory, compliance, and operational burdens associated with these proposals will be costly and may impede the growth of SAAMCo and the hard close and swing pricing proposal in particular raises significant operational challenges for mutual funds and intermediaries that offer fund shares, including AGL.

State Insurance Regulation

AGL is licensed to transact insurance business, and is subject to extensive regulation and supervision by insurance regulators. AGL is licensed in all states other than New York. The primary regulator of an insurance company, however, is located in its state of domicile. AGL is domiciled in Texas and is primarily regulated by the Texas Department of Insurance.

AGL is subject to regulation under the insurance holding company laws of Texas, which require registration and periodic reporting by insurance companies that are domiciled in the state and are controlled by other entities.

As noted above, AGL is subject to regulation and supervision in the states and other jurisdictions by which it does business. The method of such regulation varies but generally has its source in statutes that delegate regulatory and supervisory powers to a state insurance official. Such regulation and supervision relate primarily to the financial condition of the insurers and their corporate conduct and market conduct activities, investments and operational security and resiliency, including data security and privacy. In general, such regulation is for the protection of AGL’s policyholders rather than its creditors or equity owners.

Unclaimed Property

AGL is subject to the laws and regulations of states and other jurisdictions concerning identification, reporting and escheatment of unclaimed or abandoned funds, and is subject to audit and examination for compliance with these requirements.

F-10

NAIC Activities and Model Laws

In the United States, the NAIC is a standard-setting and regulatory support organization created and governed by the chief insurance regulators from the 50 states, the District of Columbia and U.S. territories. Among other things, the NAIC develops and recommends adoption of model insurance laws and regulations. With assistance from the NAIC, state insurance regulators establish standards and best practices, conduct peer reviews and coordinate regulatory oversight. Model laws and regulations promulgated by the NAIC become effective in a state once formally adopted and are subject to modification by each state. NAIC

The NAIC’s Insurance Holding Company System Regulatory Act and the Insurance Holding Company System Model Regulation (together, the “Holding Company Models”), versions of which have been enacted by all of the states in which Corebridge has domestic insurers, generally require registration and periodic reporting by insurance companies that are licensed in such jurisdictions and are controlled by other entities. They also require periodic disclosure concerning the entity that controls the registered insurer and the other companies in the holding company system and prior approval of intercompany transactions, including transfers of assets. Insurance holding company laws also generally provide that no person, corporation or other entity may acquire control of an insurance company, or a controlling interest in any direct or indirect parent company of an insurance company, without the prior approval of such insurance company’s domiciliary state insurance regulator. Under the laws of Texas, any person acquiring, directly or indirectly, 10% or more of the voting securities of an insurance company is presumed to have acquired “control” of the company, which may consider voting securities held at both the parent company and subsidiaries collectively. This statutory presumption of control may be rebutted by a showing that control does not exist in fact. State insurance regulators, however, may find that “control” exists even in certain circumstances in which a person owns or controls less than 10% of the voting securities of an insurance company.

In December 2020, the NAIC amended the Holding Company Models to incorporate a liquidity stress test (“LST”) requirement for large life insurers based on a set of scope criteria and a Group Capital Calculation (“GCC”). LST is intended to support macroprudential surveillance by the NAIC regulators, including to assess the potential impact on broader financial markets of aggregate asset sales within a liquidity stress scenario. The NAIC encouraged states to implement the GCC provisions by November 7, 2022, to satisfy group capital assessment requirements of covered agreements the United States reached with the EU and UK. Further, in December 2023, the NAIC adopted the GCC and LST amendments to the Holding Company Models accreditation standards, effective January 1, 2026. Texas has adopted the GCC requirements.

The NAIC’s Risk Management and Own Risk and Solvency Assessment Model Act (“ORSA”) requires that insurers maintain a risk management framework and conduct an internal own risk and solvency assessment of the insurer’s material risks in normal and stressed environments and submit annual ORSA summary reports to the insurance group’s lead U.S.-state regulator. The NAIC has also adopted a Corporate Governance Annual Disclosure Model Act that requires insurers to submit an annual filing regarding their corporate governance structure, policies and practices. Further, the NAIC has had an increased focus on private equity-owned life insurers following sizeable increases in the number of private equity-owned life insurers, as noted by its Capital Markets Bureau and the Federal Insurance Office in 2021. The NAIC adopted Regulatory Considerations Applicable (But Not Exclusive) to Private Equity (“PE”) Owned Insurers (the “Regulatory Considerations”) in 2022, intended to identify areas where existing disclosures, policies, control and affiliation requirements, and other procedures should be modified, or new ones created, to address any gaps based on the increase in the number of private equity-owned insurers, the role of asset managers in insurance and the potential for control via asset management arrangements, and the increase of private investments in insurers’ portfolios, among other potential gaps. Many of the Regulatory Considerations have been referred to NAIC working groups and task forces, including analysis of the definition and evaluation of control and review of the insurance industry’s reliance on rating agency ratings, while others such as new reporting on investment schedules relative to investment transactions with related parties and additional disclosures relative to private equity and complex

F-11

assets, are already effective. As part of these efforts, the NAIC recently exposed a Framework for Regulation of Insurer Investments. Their stated goal is to provide a holistic review of the NAIC groups and initiatives, which are focused on investments, and determine the most effective use of regulatory resources. Changes to model laws and regulations or NAIC handbooks resulting from an analysis for the Regulatory Considerations may impact AGL’s insurance company subsidiaries’ affiliate relationships and pursuit of strategic transactions, investment portfolios and financial condition.

Every state has adopted, in substantial part, the Risk-Based Capital (“RBC”) Model Law promulgated by the NAIC that allows states to act upon the results of RBC ratio calculations, and provides four incremental levels of regulatory action regarding insurers whose RBC ratio calculations fall below specific thresholds. Those levels of action range from the requirement to submit a plan describing how an insurer would regain a specified RBC ratio to a mandatory regulatory takeover of the company. The RBC ratio formula is designed to measure the adequacy of an insurer’s statutory surplus in relation to the risks inherent in its business. The RBC formula computes a risk-adjusted surplus level by applying discrete factors to various asset, premium, reserve and other financial statement items, or in the case of interest rate and equity return (C-3) market risk, applying stochastic scenario analyses. These factors are developed to be risk-sensitive so that higher RBC requirements are applied to items exposed to greater risk. Further, state insurance regulators have discretion in interpreting their reserving and valuation laws and regulations, which may impact the RBC ratio calculation. Certain such regulators have, from time to time, taken more stringent positions than other state insurance regulators on matters affecting, among other things, statutory capital and reserves as applied to their licensed insurance companies. The RBC ratio of AGL, determined in accordance with NAIC instructions, exceeded minimum required levels as of December 31, 2023. Additionally, the NAIC has adopted, or is considering, several changes impacting how RBC is calculated, including initiatives aimed at a comprehensive review of RBC investment framework as well as using modeling methodology to determine RBC charges for structured securities, potentially replacing the use of rating agency ratings in certain cases. There are also efforts in progress to implement a new Generator of Economic Scenarios for the RBC C-3 stochastic scenario analyses mentioned above, and the Principle-Based Reserves (“PBR”) mentioned below. AGL will continue to monitor these developments and evaluate their potential impact to its business, financial condition and legal entities.

The NAIC also provides standardized insurance industry accounting and reporting guidance through the NAIC Accounting Practices and Procedures Manual. Statutory accounting principles promulgated by the NAIC, including for AGL, have been, or may be, modified by Texas laws, regulations and permitted practices granted by Texas insurance regulators. Changes to the NAIC Accounting Practices and Procedures Manual or modifications by the Texas state insurance departments may impact the investment portfolios and the statutory capital and surplus of AGL.

The NAIC has adopted a proposal to allow some portion of net negative interest maintenance reserve to be an admitted asset, for the first time. The treatment expires in 2026 unless extended and the NAIC is working toward a long-term plan. A limit of 10% of an insurer’s capital and surplus applies, subject to certain adjustments and a minimum RBC ratio of 300% following such adjustments.

The NAIC Valuation Manual contains a PBR approach. PBR is designed to tailor the reserving process to more closely reflect the risks of specific products, rather than the factor-based approach employed historically. Subsection 20 of the Valuation Manual (“VM-20”) applies to individual life insurance reserves, most notably term insurance and universal life policies with secondary guarantees (“ULSGs”), and Subsection 21 (“VM-21”) applies to variable annuities. The NAIC’s work to update the Valuation Manual and address issues relating to the PBR framework, including VM-20, VM-21, and Subsection 22 of the Valuation Manual related to PBR for non-variable annuities, is ongoing, and AGL will continue to monitor such developments as they evolve. See also Notes 8, 11, and 13 to the 2023 Audited Annual Statutory-Basis Financial Statements for additional information related to these statutory reserving requirements.

In addition to the NAIC’s model laws and regulations, state insurance and consumer protection laws and regulations also include numerous provisions governing the marketplace activities of life and annuity insurers,

F-12

including provisions governing the form and content of disclosure to consumers, illustrations, advertising, sales practices, customer privacy protection, permissible use of data in insurance practices, and complaint handling. The regulatory landscape is developing with respect to the use of external data and artificial intelligence in insurance practices, including underwriting, marketing and claims practices. The NAIC adopted Artificial Intelligence Principles in August 2020, and a number of states have had legislative or regulatory initiatives relating to the use of external data and artificial intelligence in the insurance industry, including Colorado’s algorithmic and external data accountability law. The NAIC has adopted a model bulletin with regulatory guidance on the use of big data and artificial intelligence. AGL continues to engage through industry trade groups with its regulators with the intention of maximizing optimal customer outcomes.

Insurance regulators have also shown interest in climate change risk and disclosure. In 2022, the NAIC adopted revisions to its Climate Risk Disclosure Survey, which numerous states mandate for insurers with premiums exceeding certain thresholds. The NAIC Climate and Resiliency (EX) Task Force Solvency Workstream is also considering potential enhancements to existing regulatory tools relative to the solvency effects of climate change (e.g., on underwriting and investments) which may be incorporated into the NAIC’s Financial Analysis Handbook, the Financial Condition Examiners Handbook and the ORSA Guidance Manual, and recently adopted the NAIC National Climate Resilience Strategy for Insurance, a forward-looking climate strategy document. In addition, in 2021, the NYDFS issued final Guidance for New York Domestic Insurers on Managing the Financial Risks from Climate Change, detailing the NYDFS’s expectations related to insurers’ management of the financial risks from climate change and integration into their governance frameworks, risk management frameworks, and business and investment strategies. See “Environmental, Social and Governance Regulation” for further information.

State regulatory authorities generally enforce provisions relating to marketplace activities through periodic market conduct inquiries, data calls, investigations and examinations. Further, as part of their regulatory oversight process, state insurance departments conduct periodic financial examinations, generally once every three to five years, of the books, records, accounts and business practices of insurers domiciled in their states. Examinations are generally carried out under guidelines promulgated by the NAIC and, in the case of financial exams, in cooperation with the insurance regulators of other domiciliary states of an insurance holding company group.

State Guaranty Associations

U.S. states have state insurance guaranty associations in which insurers doing business in the state are required by law to be members. Member insurers may be assessed by the associations for certain obligations of insolvent insurance companies to policyholders and claimants. Typically, states assess member insurers in amounts related to the member’s proportionate share of the relevant type of business written by all members in the state. Some jurisdictions permit member insurers to recover assessments that they paid through full or partial premium tax offsets, usually over a period of years. The protection afforded by a state’s guaranty association to policyholders of insolvent insurers varies from state to state. The aggregate assessments levied against AGL have not been material to its financial condition in any of the past three years.

Privacy, Data Protection and Cybersecurity

AGL is subject to U.S. federal and state laws and regulations that require financial institutions and other businesses to implement and maintain technical, organizational and physical measures designed to protect the confidentiality, availability and integrity of personal, information and sensitive non-public information and the information systems used to process this information and conduct important business operations. These laws and regulations impose a broad range of obligations including collecting, disclosing, using, transferring, retaining, deleting, and otherwise processing (collectively, “Processing”) personal information in compliance with certain restrictions; notifying data subjects regarding its personal information processing practices; and maintaining a security program designed to protect the confidentiality, availability and integrity of personal information,

F-13

sensitive non-public information and AGL’s information systems. Some of these laws and regulations require AGL to notify affected individuals, regulators and self-regulatory bodies of certain events involving the unauthorized access to, use of or loss of, personal information , sensitive non-public information and information systems.

On November 1, 2023, the NYDFS published an amendment to its Part 500 Cybersecurity Regulation (“NYDFS Cybersecurity Regulation”). The amended NYDFS Cybersecurity Regulation went into effect upon publication and compliance with the amended requirements occurs in phases starting December 1, 2023 and continuing through December 2025 and includes additional certification obligations, enhanced governance requirements, new audit requirements, additional technology and business continuity requirements, enhanced security control and training requirements, and new notification obligations. Requirements under the NYDFS Cybersecurity Regulation are similar in certain respects to those under the NAIC Insurance Data Security Model Law , which requires insurers, insurance producers and other entities required to be licensed under state insurance laws to develop and maintain a written information security program, conduct risk assessments, oversee the data security practices of third-party service providers and other related requirements. Approximately 22 U.S. states have adopted a version of the Model Law as of the end of 2023.

The SEC continues to focus on cybersecurity for a range of regulated entities, including public companies, registered investment companies, broker-dealers, investment advisers and funds and has published periodic guidance on the topic, recommending periodic assessments of information, how it is stored and how vulnerable it is, as well as strategies to prevent, detect and respond to cyber threats, including as it relates to risks faced by the advisers’ third-party service providers. In July 2023, the U.S. Securities and Exchange Commission adopted the Risk Management, Strategy, Governance, and Incident Disclosure Final Rule (the “Cybersecurity Final Rule”) that enhances the disclosure requirements for registered companies covering cybersecurity risk and management and requires registrants to disclose material cybersecurity incidents on Form 8-K within four business days of a determination that the impact of a cybersecurity incident is material. These disclosure requirements under the Cybersecurity Final Rule became effective in December 2023.

On January 1, 2023, the California Privacy Rights Act (“CPRA”), which amends the California Consumer Privacy Act of 2018 (“CCPA”) became effective. The CCPA imposes a number of requirements on businesses that collect the personal information of California consumers, including requirements that provide individuals with certain rights to their personal information and make mandatory disclosures regarding how the businesses use and disclose consumers’ personal information, establishes a private right of action in some cases if consumers’ personal information is subject to a data breach as a result of the business’s violation of the duty to implement and maintain reasonable security practices and creates the California Privacy Protection Agency which is charged with drafting and adopting regulations in furtherance of the CCPA and enforcing the CCPA, as amended by the CPRA. Similar consumer privacy legislation has been enacted in other states and became effective in 2023, such as Virginia, Colorado, Connecticut and Utah.

U.S. federal and state legislatures and government agencies and self-regulatory bodies are expected to continue to consider additional laws, regulations and guidelines relating to privacy and other aspects of customer information and to protecting the ongoing confidentiality, availability and integrity of personal information, sensitive non-public information and information systems. These continued changes in the U.S. privacy and cybersecurity regulatory landscape will require additional compliance investment, including changes to policies, procedures, information systems and operations.

Environmental, Social and Governance Regulation

Federal and state laws and regulations regarding ESG issues may be applicable to AGL’s operations. At the federal level, the SEC has instituted a comprehensive regulatory agenda focusing on ESG issues. The SEC commissioners and staff announced a number of actions, including forming an enforcement task force designed to harmonize the efforts of the SEC’s divisions and offices, proposed comprehensive rulemakings for ESG disclosure for investment advisers and funds registered under the Investment Company Act and climate-specific

F-14

disclosure for public issuers and addressing stockholder rights and creating accountability in statements and conduct. The SEC’s Division of Examinations issued a risk alert in 2021 highlighting ESG deficiencies, internal control weaknesses and effective practices identified during recent examinations of investment advisers, registered investment companies and private funds. The SEC’s Division of Examinations has continued to focus on ESG-related advisory services and investment products and the SEC has continued to pursue ESG related enforcement actions. The increased regulatory and compliance burdens that AGL expects would result from the implementation of any of these initiatives could be costly.

On March 6, 2024, the SEC adopted final rules that require registrants, including Corebridge, to disclose certain climate- related information in registration statements and annual reports. The final rules require registrants to disclose, among other things: the impacts of material climate-related risks; the processes for identifying, assessing and managing such risks; information about the oversight of climate-related risks by the board of directors and management’s role in managing material climate-related risks; and information about any climate-related targets or goals that are material to a registrant’s business, results of operations, or financial condition. The final rules also require, if material, disclosure of registrants’ Scope 1 and/or Scope 2 greenhouse gas emissions. In addition, registrants must disclose certain information in their audited financial statements, including aggregate expenditures expensed and losses as well as capitalized costs and charges, in each case as a result of severe weather events and other natural conditions, subject to de minimis disclosure thresholds.

The final rules include a phased-in compliance period beginning in fiscal year 2025 for large accelerated filers such as Corebridge. Numerous legal challenges were filed after the rule’s adoption, which lawsuits have been consolidated in the Eighth Circuit. On April 4, 2024, the SEC exercised its discretion to stay the final rules pending completion of judicial review in the U.S. Court of Appeals for the Eighth Circuit. Corebridge is evaluating the potential impacts of these new requirements. However, if these requirements are implemented following completion of judicial review, they may increase the complexity of Corebridge’s periodic reporting as a U.S. public company and are expected to result in additional compliance and reporting costs.

At the state level, California adopted climate disclosure and financial reporting legislation, the Climate Corporate Data Accountability Act, and the Climate Related Financial Risk Act, in 2023, which will require, beginning in 2026, reporting from large U.S. public and private companies doing business in California on greenhouse gas emissions and biennial climate-related financial risk reports. States continue to adopt laws and regulations governing corporate ESG activity and there is increasing scrutiny and evolving expectations from investors, customers, regulators and other stakeholders on ESG practices and disclosures, including those related to environmental stewardship, climate change, diversity, equity and inclusion, racial justice, workplace conduct and other social and political mandates.

Legal Proceedings

We are regularly a party to litigation, arbitration proceedings and governmental examinations in the ordinary course of our business. While we cannot predict the outcome of any pending or future litigation or examination, we do not believe that any pending matter, individually or in the aggregate, will have a material adverse effect on our business.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Market Risks

Overview

Market risk is the risk of adverse impact due to systemic movements in one or more of the following market risk drivers: interest rates, credit spreads, equity and commodity prices, residential and commercial real estate values, foreign exchange, inflation, and their respective levels of volatility.

F-15

AGL is exposed to market risks primarily within its insurance and capital markets activities, on both the asset and the liability sides of its balance sheet through on- and off-balance sheet exposures. Many of the market risk exposures, including exposures to changes in levels of interest rates and equity prices, are generally long-term in nature. Examples of liability-related market risk exposures include interest rate sensitive surrenders in the fixed annuity and universal life product portfolios. Also, AGL has equity market risk sensitive surrenders in the variable annuity product portfolio. These interactive asset-liability types of risk exposures are regularly monitored in accordance with the risk governance framework.

The scope and magnitude of market risk exposures are managed under a robust framework that contains defined risk limits and minimum standards for managing market risk. The market risk management framework focuses on quantifying the financial repercussions to AGL of changes in the above-mentioned market risk drivers.

Key Risks

Mortality risk – represents the risk of loss arising from actual mortality rates being higher than expected mortality rates. This risk could arise from pandemics or other events, including longer-term societal changes that cause higher-than-expected mortality. This risk exists in a number of AGL’s product lines but is most significant for AGL’s life insurance products.

Longevity risk – represents the risk of a change in value of a policy or benefit as a result of actual mortality rates being lower than the expected mortality rates. This risk could arise from longer-term societal health changes as well as other factors. This risk exists in a number of AGL’s product lines but is most significant for AGL’s pension risk transfer, structured settlement and annuity products.

Policyholder behavior risk including full and partial surrender/lapse risk – represents the risk that actual policyholder behavior differs from expected behavior in a manner that has an adverse effect on AGL’s operating results. There are many related assumptions made when products are sold, including how long the contracts will persist and other assumptions which impact the expected utilization of contract benefits and features. Actual experience can vary significantly from these assumptions. This risk is impacted by a number of factors including changes in market conditions, especially changes in the levels of interest rate and equity markets, tax law, regulations, competitive landscape and policyholder preferences. This risk exists in the majority of AGL’s product lines.

Morbidity risk – represents the risk arising from actual morbidity (i.e., illness, disability or disease) incidence being higher than expected or the length of the claims extending longer than expected resulting in a higher overall benefit payout. This risk could arise from longer-term medical advances in detection and treatment for various diseases and medical conditions, as well as other factors. This risk exists in certain product lines of AGL such as group benefits, health and long-term care businesses.

Interest rate risk – represents the potential for loss due to a change in interest rates. Interest rate risk is measured with respect to assets, liabilities (both insurance-related and financial), and derivatives. This risk manifests itself when interest rates move significantly in a short period of time. Rapidly rising interest rates create the potential for increased surrenders. Interest rate risk can also manifest itself over a longer period of time, such as in a persistent low interest rate environment. Low long-term interest rates put pressure on investment returns, which may negatively affect sales of interest rate sensitive products and reduce or eliminate future profits on certain existing fixed rate products.

Equity price risk – represents the potential for loss due to changes in equity prices. It affects equity-linked insurance products, including but not limited to index annuities, variable annuities (and associated guaranteed living and death benefits), universal life insurance and variable universal life insurance. In addition, changes in the volatility of equity prices can affect the valuation of derivatives that are economic hedges of equity risk in variable guaranteed living benefits.

F-16

Credit risk – represents the risk that AGL’s customers or counterparties are unable or unwilling to repay their contractual obligations when they become due, but also may result from a downgrade of a counterparty’s credit ratings or a widening of its credit spreads. The risk exists across AGL’s product lines as counterparty exposure can be related to, but not limited to, investments, derivatives, premiums receivable and reinsurance recoverables.

Risk Management and Mitigation

In addition to an established governance framework, AGL relies on a variety of tools and techniques to manage market risk-exposures. The market risk mitigation framework incorporates the following primary elements:

Product design: Product design is the first step in managing insurance liability exposure to market risks.

Asset/liability management: AGL manages assets using an approach that is liability driven. Asset portfolios are managed to target durations based on liability characteristics and the investment objectives of that portfolio within defined ranges. Where liability cash flows exceed the maturity of available assets, AGL may support such liabilities with derivatives, interest rate curve mismatch strategies or equity and alternative investments.

Hedging: AGL’s hedging strategies include the use of derivatives to offset certain changes in the economic value of MRBs and embedded derivatives associated with the variable annuity, fixed index annuity and index universal life liabilities, within established thresholds. These hedging programs are designed to provide additional protection against large and consolidated movements in levels of interest rates, equity prices, credit spreads and market volatility under multiple scenarios.

Currency matching: AGL manages its foreign currency exchange rate exposures within risk tolerance levels. In general, investments backing specific liabilities are currency matched. This is achieved through investments in currency matching assets or the use of derivatives.

Management of portfolio concentration risk: AGL performs regular monitoring and management of key rate, foreign exchange, equity prices and other risk concentrations to support efforts to improve portfolio diversification to mitigate exposures to individual markets and sources of risk.

Sensitivities

In accordance with statutory accounting principles, the significant majority of AGL’s assets and liabilities are carried at amortized cost and not at fair value. As a result, the elements of market risk discussed above do not generally have a significant direct impact on the financial position or results of operations of AGL.

Directors and Executive Officers of American General Life Insurance Company (“AGL”)

Set forth below is a list of AGL’s directors and executive officers and a description of the business experience of each of the respective individuals.

| | | | |

Name | | Age | | Director and/or Executive Officer Positions |

| Christopher B. Smith | | 55 | | Chairman of the Board of Directors and President |

| David Ditillo | | 49 | | Director and Executive Vice President and Chief Information Officer |

| Terri N. Fiedler | | 61 | | Director |

| Christopher P. Filiaggi | | 42 | | Director and Senior Vice President and Chief Financial Officer |

| Timothy M. Heslin | | 49 | | Director and President, Life US |

F-17

| | | | |

Name | | Age | | Director and/or Executive Officer Positions |

| Lisa M. Longino | | 57 | | Director and Executive Vice President and Chief Investment Officer |

| Jonathan J. Novak | | 52 | | Director and President, Institutional Markets |

| Bryan A. Pinsky | | 49 | | Director and President, Individual Retirement |

| Elizabeth B. Cropper | | 58 | | Director and Executive Vice President and Chief Human Resources Officer |

| John P. Byrne | | 53 | | President, Financial Distributor |

| Steven D. (“Doug”) Caldwell, Jr. | | 54 | | Executive Vice President and Chief Risk Officer |

| Emily W. Gingrich | | 43 | | Senior Vice President, Chief Actuary and Corporate Illustration Actuary |

| Frank A. Kophamel | | 59 | | Senior Vice President, Deputy Chief Actuary and Appointed Actuary |

| Brigitte K. Lenz | | 49 | | Vice President and Controller |

| Justin J.W. Caulfield | | 52 | | Vice President and Treasurer |

| Julie Cotton Hearne | | 63 | | Vice President and Corporate Secretary |

Christopher B. Smith

Chris Smith has served as Chief Operating Officer of Corebridge Financial since July 2023. Prior to joining Corebridge, Mr. Smith was Head of Group Benefits for Guardian Life, and previously served as Head of Global Operations for MetLife. He has held the Chartered Financial Analyst (CFS) designation since 2003.

David Ditillo

David Ditillo has served as Chief Information Officer of Corebridge Financial since 2020. Prior to joining AIG, Mr. Ditillo served in various technology executive management roles at MetLife, Inc., including Senior Vice President and Chief Information Officer for its U.S. business and Senior Vice President of U.S. Application Development.

Terri N. Fielder

Terri Fiedler has served as President, Retirement Services since October 2022. Previously, she was President of AIG Financial Distributors since May 2019. Ms. Fiedler served as Executive Vice President, Strategic Accounts for AIG Financial Distributors, responsible for working closely with the organization’s business teams to fully meet the product and services needs of AIG Life & Retirement’s largest clients from May 2012 through April 2019. Prior to joining AIG, Ms. Fiedler was the Senior Director of National Account Management at Invesco U.S. from September 2007 to May 2012 and, prior to that, spent 12 years at AIM Distributors. She currently serves as a director of Archer Holdco, LLC. and Immediate Past Chair of the Insured Retirement Institute and a Board Director for the Foundation for Financial Planning.

Christopher P. Filiaggi

Chris Filiaggi oversees all aspects of financial reporting, including GAAP, statutory accounting and SOX compliance. Prior to his current role, he was in AIG’s Office of Accounting Policy, where he led a number of key strategic initiatives from a finance perspective, including the sale of Fortitude Re. Prior to joining AIG in 2019, Chris was a director in PricewaterhouseCoopers’ audit practice which included two years in PricewaterhouseCoopers’ National Office.

Timothy M. Heslin

Tim Heslin has served as President of Life Insurance at Corebridge Financial since August 2021. Prior to his current role, Mr. Heslin served in a number of senior roles for AIG, most recently as Chief Life Product, Pricing

F-18

and Underwriting Officer for AIG Life US. He also served as Head of Risk Selection for AIG’s Global Life Businesses and Head of Life, Health and Disability for Europe, the Middle East and Africa. Mr. Heslin is a Fellow of the Society of Actuaries and a Member of the American Academy of Actuaries.

Lisa M. Longino

Lisa Longino has served as Chief Investment Officer of Corebridge Financial since February 2023. Prior to joining Corebridge, Ms. Longino was Head of Global Investment Strategy for Prudential Financial. Previously, she held several investment roles over more than 20 years at MetLife, including Head of Insurance Asset Management, Head of Portfolio Management and Head of Investment Grade Trading. Ms. Longino has been investing for insurance companies for over three decades with a focus on fixed income portfolios matched to insurance liabilities.

Jonathan J. Novak

Jonathan Novak has served as President of Institutional Markets since April 2012 and Executive Vice President since February 2022. Mr. Novak also serves as Head of Life & Retirement Strategy, Corporate Development and Reinsurance of AIG. Mr. Novak joined AIG in April 2012. Prior to joining AIG, Mr. Novak served as Managing Director in the Financial Institutions Risk Management business at Goldman Sachs for 12 years. Prior to that, Mr. Novak served as an Associate in the Reinsurance Underwriting division at Berkshire Hathaway for four years. Mr. Novak holds the Chartered Financial Analyst professional designation.

Bryan A. Pinsky

Bryan Pinsky has served as President of Individual Retirement since August 2021. Prior to his current role, Mr. Pinsky was Senior Vice President of Individual Retirement Pricing and Product Development. Prior to joining AIG in 2014, he led the Annuity Product team at Prudential, and, before that, held various life insurance and annuity product development positions with Allstate. Mr. Pinsky is a Chartered Financial Analyst and Fellow of the Society of Actuaries.

Elizabeth B. Cropper

Liz Cropper has served a Chief Human Resources Officer since January 2024. Prior to her current role, Ms. Cropper served in a number of senior human resources roles for AIG, most recently as Global Head of Talent and Inclusion. She also served as Head of HR for General Insurance and Life and Retirement, Head of Human Resources for the Asia-Pacific region and HR Head for the UK businesses. Prior to AIG, Ms. Cropper held senior human resources positions at Banco Santander and Sainsbury’s. She is a fellow and graduate of the Chartered Institute of Personnel and Development.

John P. Byrne

John Byrne has served as President of Financial Distributors since October 2023. Prior to his current role, John served as Senior Vice President, National Sales Manager, Annuity Direct Distribution. He has a Chartered Retirement Planning Counselor designation from the College for Financial Planning.

Doug Caldwell

Doug Caldwell has served as Chief Risk Officer since July 2023. Prior to joining the Company, Mr. Caldwell held senior risk roles with MetLife, Transamerica, NN Group and ING Insurance. He has worked in actuarial, finance and risk roles in the insurance industry for more than 30 years. Mr. Caldwell is a Fellow of the Society of Actuaries and a Chartered Enterprise Risk Analyst.

F-19

Emily W. Gingrich