| UNITED STATES | | |

| SECURITIES AND EXCHANGE COMMISSION | | |

| Washington, D.C. 20549 | | |

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

International Aluminum Corporation |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | |

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | | |

INTERNATIONAL ALUMINUM CORPORATION

767 Monterey Pass Road

Monterey Park, California 91754

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

October 27, 2005

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of International Aluminum Corporation (the “Company”) will be held at the corporate offices of the Company at 767 Monterey Pass Road, Monterey Park, California, on Thursday, October 27, 2005 at 2:00 P.M. for the following purposes:

1. To elect seven directors to serve for the ensuing year and until their successors are elected and qualified.

2. To ratify the selection of PricewaterhouseCoopers LLP as independent auditors for the Company for the fiscal year ending June 30, 2006.

3. To transact such other business as may properly come before the meeting or any adjournment thereof.

The Board of Directors has fixed the close of business on September 7, 2005 as the record date for the determination of shareholders entitled to notice of, and to vote at, the meeting.

You are cordially invited to attend the meeting in person. To assure your representation at the meeting, however, please promptly sign, date and mail the enclosed proxy in the accompanying envelope, which requires no postage, or vote your shares by Internet as directed on the enclosed proxy card. Internet voting facilities for shareholders of record will be available 24 hours a day, and will close at 8:00 P.M. Eastern Time on October 26, 2005. If you decide to attend the meeting and wish to vote your shares in person, you may revoke your proxy at that time. If you own your shares in “street name,” you must obtain a proxy from the institution in whose name your shares are held in order to vote in person at the meeting.

Since a majority of the outstanding shares must be represented at the meeting in order to transact business, your promptness in returning the enclosed proxy will be appreciated.

| By Order of the Board of Directors |

|

|

| Mitchell K. Fogelman |

| Senior Vice President and Secretary |

Monterey Park, California | |

September 20, 2005 | |

INTERNATIONAL ALUMINUM CORPORATION

767 Monterey Pass Road

Monterey Park, California 91754

PROXY STATEMENT

To the Shareholders of

International Aluminum Corporation

Your proxy, in the form enclosed, is solicited by the Board of Directors of the Company for use at the Annual Meeting of Shareholders to be held on October 27, 2005, and at any postponement or adjournment thereof, for the purposes described in the accompanying Notice of Annual Meeting and in this Proxy Statement.

It is anticipated that this Proxy Statement, together with the accompanying proxy, will first be mailed on or about September 23, 2005 to the Company’s shareholders.

Record Date and Outstanding Shares

Shareholders of record at the close of business on September 7, 2005 are entitled to receive notice of, and to vote at, the meeting. There were 4,279,281 shares of common stock outstanding as of the record date.

Quorum and Voting

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of the common stock as of the record date is necessary to constitute a quorum for the transaction of business at the meeting.

Shareholders are entitled to one vote for each share of common stock held on the record date on each matter to be presented for consideration and action by the shareholders, except that shareholders may cumulate their votes as to the election of directors. Cumulative voting means that each shareholder may cast a total number of votes equal to seven (i.e., the number of directors to be elected at the meeting) multiplied by the number of shares owned by the shareholder as of the record date. This total number of votes may be cast for one nominee, may be divided equally among the seven nominees or may be divided among two or more of the nominees in any manner the shareholder chooses. A shareholder is entitled to cumulate votes, however, only with respect to nominees whose names are placed in nomination prior to voting and only if the shareholder, prior to the voting, gives notice of his intention to cumulate votes. If any shareholder gives such notice, all shareholders may cumulate their votes.

Except as to the election of directors, approval of the matters to be considered at the meeting will require the affirmative vote of a majority of the outstanding shares of common stock represented and voting at the meeting, provided that such shares constitute at least a majority of the required quorum for the meeting. As to the election of directors, nominees receiving the highest number of votes, up to the number of directors to be elected, will be elected at the meeting.

Proxies

Unless revoked, all shares represented by a properly executed proxy received in time for the meeting will be voted by the proxy holders in accordance with the instructions specified in the enclosed proxy card. If no instruction is specified on a proxy with respect to any proposal to be acted upon, the shares represented by proxy will be voted “FOR”:

· the election of the seven director-nominees named herein.

· ratification of the selection of PricewaterhouseCoopers LLP as independent auditors for the Company.

In the event that there should be cumulative voting in the election of directors, unless otherwise specifically instructed, the proxy holders intend to distribute the total number of votes represented by each proxy among the director nominees in such proportion as they see fit. Although the Company does not presently know of any other business to come before the meeting, if any other business should properly come before the meeting, the persons named in such proxy will vote thereon in accordance with their best judgment.

A shareholder executing and returning a proxy may revoke it any time before it has been voted by:

· giving written notice of revocation to the Secretary of the Company.

· appearing in person and voting at the meeting.

· submitting to the Secretary of the Company a duly executed proxy bearing a later date.

Abstentions and Broker Non-Votes

Abstentions will be included in determining the number of shares present at the meeting for the purpose of determining the presence of a quorum for the transaction of business, and will have the same effect as a vote against proposal 2. If a broker, bank, custodian, nominee or other record holder of shares of common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular matter, which is known as a broker non-vote, those shares also will be counted for purposes of determining the presence of a quorum and have the same effect as a vote against proposal 2. Abstentions and broker non-votes will not affect the outcome of the voting as to the election of directors.

PROPOSAL 1 – ELECTION OF DIRECTORS

The By-Laws of the Company provide for seven directors. Each of the nominees has indicated his or her willingness to serve as a director if elected at the meeting. If any one or more of such nominees should for any reason be unavailable to serve, the proxy holders will vote for a substitute nominee at their discretion. Proxies received cannot be voted for a greater number of persons than the number of nominees named below.

Information about Nominees

The information below sets forth the names of all directors and nominees for director of the Company, all positions and offices each such person holds with the Company and a brief account of the principal business experience of each nominee. With the exception of Ms. Provencio, each of the nominees is an incumbent director elected at the 2004 Annual Meeting of Shareholders. Ms. Provencio has been nominated by the Board of Directors to succeed David M. Antonini, who is not standing for reelection.

Cornelius C. Vanderstar. Mr. Vanderstar, the Company’s founder, has been Chairman of the Company’s Board of Directors since its inception in 1963. He served as Chief Executive Officer from 1963 through June of 2005 and, prior to October 1972, also served as President of the Company.

Ronald L. Rudy. Mr. Rudy has been employed by the Company since 1972 and became President and Chief Executive Officer of the Company in July 2005. He served in various sales and management positions with subsidiaries of the Company prior to being elected Vice President-Operations in September 1983 and was elected Senior Vice President-Operations in June 1995.

David C. Treinen. Mr. Treinen served as President and Chief Operating Officer of the Company from July 2000 through his retirement at the conclusion of the Company’s 2005 fiscal year. He was

2

employed by the Company and its subsidiaries since 1964 and an officer of the Company since 1969. He served as Senior Vice President-Finance/Administration for 27 years prior to being elected President of the Company in June 2000. Mr. Treinen also served as Secretary of the Company from February 1973 through June 2005.

John P. Cunningham. Mr. Cunningham, retired Vice Chairman of the Board of Directors, was employed by the Company or its subsidiaries from 1959 through his retirement in June of 1999. He served as President of the Company from October 1972 through November 1998, prior to which he served as Vice President-Operations. Mr. Cunningham currently serves on the Nominating and Governance Committee of the Board of Directors.

Joel F. McIntyre. Since August 1998, Mr. McIntyre has been engaged in the practice of business and corporation law with offices in Los Angeles County. From February 1993 through July 1998 he served as Managing Partner of McIntyre, Borges & Burns LLP and successor entities. From 1963 through January 1993 he was an attorney with the law firm of Paul, Hastings, Janofsky and Walker, LLP. Mr. McIntyre is Chairman of the Board’s Nominating and Governance Committee. He is also a member of the Company’s Audit and Compensation Committees and has served as chairman of each of these committees at various times during his tenure as a director of the Company. Mr. McIntyre received a B.A. degree from Stanford University in 1960 and J.D. degree from the University of California, Los Angeles in 1963.

Norma A. Provencio. Ms. Provencio has been a certified public accountant since 1981 and was the Partner-in-Charge of Arthur Anderson’s Pharmaceutical, Biomedical and Healthcare Practice for the Pacific Southwest from 1995 to 2002. In May 2002 she joined KPMG LLP as the Partner-In-Charge of the Healthcare Industry for the Pacific Southwest. She resigned from KPMG LLP in September 2003 and formed Provencio Advisory Services, Inc., a healthcare financial advisory company. Ms. Provencio serves on the Board of Directors and the Audit Committee of Recom Managed Systems, Inc., a publicly-held company. It is contemplated that Ms. Provencio will be appointed Chair of the Company’s Audit Committee and a member of its Compensation Committee.

Alexander L. Dean. Mr. Dean is President of David Brooks Company, a manufacturer and distributor of ceramic planters located Costa Mesa, California, a position which he has held for the last 14 years. Prior to joining David Brooks Company, he served eight years as President of Builders Incorporated, a firm specializing in real estate development and apartment and commercial building management. Mr. Dean is Chairman of the Compensation Committee of the Board of Directors and also serves on the Board’s Audit and Nominating and Governance Committees. He holds Masters Degrees in Finance from Yale University and in Regional Planning from the University of North Carolina.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE ABOVE NAMED NOMINEES AS DIRECTORS. PROXIES SOLICITED BY THE BOARD WILL BE VOTED “FOR” THEIR ELECTION UNLESS OTHERWISE INSTRUCTED.

3

Principal Security Holders

To the best of the Company’s knowledge, the following table sets forth, as of September 7, 2005, the name, address and share ownership of the only person or entity, other than Cornelius C. Vanderstar (see “Security Ownership of Management”), believed to beneficially own more than 5% of the Company’s outstanding common stock. Unless otherwise noted, the named shareholder is believed to have sole voting and dispositive powers with respect to the shares listed below.

| Name and Address

of Beneficial Owner | | | Shares

Beneficially

Owned | | Percent | |

Barington Companies Equity Partners, L.P.(1)

888 Seventh Avenue, 17th Floor

New York, NY 10019 | | | 374,950 | | | | 8.8 | % | |

| | | | | | | | | | | |

(1) According to its Schedule 13D furnished to the Company reporting information as of April 15, 2005, Barington Companies Equity Partners, L.P. is a member of a “group” within the meaning of Section 13(d)(3) of the Securities Exchange Act of 1934 that includes the following “reporting entities”: Barington Companies Investors, LLC; Barington Companies Offshore Fund, Ltd. (BVI); Barington Companies Advisors, LLC; Barington Capital Group, L.P.; LNA Capital Corp.; James Mitaronda; Parche, LLC; Starboard Value & Opportunity Fund, LLC; RCG Equity Market Neutral Master Fund, Ltd.; RCG Halifax Fund, Ltd.; Admiral Advisors, LLC; Ramius Capital Group, LLC; C4S & Co., LLC; Pelter A. Cohen; Morgan B. Stark; Jeffrey M. Solomon; Thomas W. Strauss; Millenco, L.P.; Millenium Management, L.L.C.; and Israel R. Englander.

Security Ownership of Management

The following table lists information with respect to the beneficial ownership of our common stock as of September 7, 2005 by:

· Each of our directors.

· Each director-nominee.

· Each executive officer named in the Summary Compensation Table.

· All directors, director-nominees and executive officers as a group.

4

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission. The percentage ownership reflected in the table is based on 4,279,281 shares of our common stock outstanding as of September 7, 2005. Except as otherwise indicated, the persons listed below have sole voting and investment power with respect to all shares of common stock shown, subject to applicable community property laws. An asterisk (*) represents beneficial ownership of less than 1%.

| Names | | | Age | | | Present Position(s) | | | Director

Since | | | Owned | | | Percent(1) | |

Cornelius C. Vanderstar(2) | | | 90 | | | Chairman; Director | | | 1963 | | | 1,720,700 | (3) | | 40.2 | % | |

Ronald L. Rudy | | | 64 | | | President and Chief Executive

Officer; Director | | | 2000 | | | 17,575 | (4) | | * | | |

David C. Treinen | | | 66 | | | Director | | | 1993 | | | 39,533 | (5) | | * | | |

John P. Cunningham | | | 73 | | | Director | | | 1963 | | | 146,606 | (6) | | 3.4 | % | |

Joel F. McIntyre | | | 66 | | | Director | | | 1980 | | | — | | | — | | |

Alexander L. Dean | | | 60 | | | Director | | | 2000 | | | 300 | | | * | | |

David M. Antonini(7) | | | | | | Director | | | | | | | | | | | |

Norma A. Provencio | | | 47 | | | Director-nominee | | | | | | — | | | — | | |

Mitchell K. Fogelman | | | 54 | | | Senior Vice President-Finance;

Secretary | | | | | | 17,500 | | | * | | |

All directors, director-nominees and executive officers as a group (10 persons) | | | | | | | | | | | | 1,942,214 | | | 45.4 | % | |

(1) Shares which may be acquired by a person or group within 60 days of September 7, 2005, upon the exercise of stock options (“Stock Option Shares”) are treated as outstanding for purposes of calculating the percentage ownership of such person or group, but are not treated as outstanding for purposes of calculating the percentage ownership of any other person.

(2) Mr. Vanderstar’s mailing address is c/o of International Aluminum Corporation, P.O. Box 6, Monterey Park, California 91754.

(3) The shares shown are held of record by the Vanderstar Family Trust, Cornelius C. and Marguerite D. Vanderstar, Trustees. Marguerite D. Vanderstar is Mr. Vanderstar’s wife, and, as a Trustee, also is deemed to beneficially own the shares shown.

(4) Includes 16,330 shares held by the Ronald and LaJuana Rudy 2004 Trust, Ronald L. and LaJuana Rudy, Trustees. Mr. Rudy’s wife, LaJuana, as a Trustee also is deemed to beneficially own the shares shown.

(5) The shares shown held by the Treinen Family Trust, David C. and Susan M. Treinen, Trustees. Susan M. Treinen is the wife of Mr. Treinen, and, as a Trustee, also is deemed to beneficially own the shares shown.

(6) The shares shown are held by the Cunningham Family Trust, Patricia M. Cunningham, Trustee. Patricia M. Cunningham is the wife of John Cunningham, and, as a Trustee, also is deemed to beneficially own the shares shown.

(7) Mr. Antonini is not standing for reelection at the annual meeting.

5

Other Executive Officers

The executive officers of the Company who are not also directors are:

| Name | | | Age | | | Position | |

Mitchell K. Fogelman | | 54 | | Senior Vice President-Finance, Secretary |

William G. Gainer | | 45 | | Vice President-Sales and Marketing |

Mr. Fogelman was elected Senior Vice President-Finance in June 2000, and has been employed by the Company since 1982. Prior to assuming his present position, he served as Vice President-Controller. He was elected Secretary of the Company in July 2005.

Mr. Gainer joined the Company in May 2005. He has 23 years of experience in the building products and construction industries, including specific experience in both the residential and commercial sectors. His recent experience includes two years as Director of Sales for Delta Consolidated Industries (subsidiary of Danaher Corp.), a manufacturer of tool storage, and two years in residential property development and seven years in sales, operations and manufacturing management at Wayne-Dalton Corp., a manufacturer of residential and commercial garage doors.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires that the Company’s directors, executive officers and any persons who own more than 10% of the Company’s common stock file with the Securities and Exchange Commission initial reports of their ownership of common stock on Form 3 and report changes in their ownership on Form 4 or Form 5. Specific due dates for the required reports have been established, and the Company is required to disclose in this proxy statement any failure to file by the dates required. To the best of the Company’s knowledge, all filing requirements for fiscal 2005 were timely satisfied. In making this disclosure, the Company has relied on a review of copies of forms furnished to the Company, discussions with those persons known to be subject to Section 16(a) reporting requirements and written representations that no other reports were required relating to fiscal 2005.

Corporate Governance

The Company and its management are dedicated to exemplary corporate governance. In August 2004, the Company adopted the International Aluminum Corporation Code of Business Conduct and Ethics. The Code is a statement of the Company’s high standards for ethical behavior and legal compliance and governs the manner in which it conducts business. A copy of the Code can be found at the Company’s website at www.intlalum.com. The Company has adopted a separate Code of Ethics for Senior Executive and Senior Financial Officers which also may be viewed by visiting our website at www.intlalum.com. Copies of each Code may be obtained, without charge, upon request by writing to International Aluminum Corporation, 767 Monterey Pass Road, Monterey Park, California 91754, Attention: Corporate Secretary.

Board Independence

The Board of Directors has determined that each of the Company’s directors, except for Messrs. Vanderstar and Rudy, who serve as executive officers of the Company, and Mr. Treinen, who served as an executive officer until his retirement in June 2005, are independent under the NYSE listing standards. Each of the Nominating and Governance, Audit and Compensation Committees of the Board of Directors is composed entirely of independent directors. In making the independence determinations, the Board reviewed director relationships with the Company as set forth in director responses to inquiries regarding employment, business, compensation and other relationships with the Company and its management.

6

THE BOARD OF DIRECTORS

The business affairs of the Company are managed by and under the direction of the Board of Directors, although the Board is not involved in day-to-day operations. The Board currently has three standing committees: Nominating and Governance Committee, Compensation Committee and Audit Committee, each of which is governed by a charter adopted by the Board of Directors. Each committee charter may be found on the Company’s website at www.intlalum.com. Copies of each may be obtained, without charge, upon request by writing to International Aluminum Corporation, 767 Monterey Pass Road, Monterey Park, California 91754, Attn: Corporate Secretary. Each of the committees is comprised entirely of non-employee directors deemed independent under the NYSE listing standards.

During the fiscal year ended June 30, 2005, the Board held four meetings. The Audit Committee held four meetings during fiscal 2005 and the Compensation Committee met three times during the year. The Nominating and Governance Committee, created at the conclusion of the 2004 fiscal year, met once during fiscal 2005.

Each director attended at least 75% of the aggregate of (i) the total number of meetings of the Board held during the fiscal year, and (ii) the total number of meetings held by all committees of the Board on which he served.

Executive Sessions of the Board

Non-management directors meet in executive session during the year without any members of management being present and the chair of one of the Board’s committees, on a rotating basis, presides over such sessions. Three such sessions were held during fiscal 2005.

Policy Regarding Attendance at Annual Meeting

We encourage, but do not require, our Board members to attend the annual meeting of shareholders. Last year, all of our directors attended the annual meeting of shareholders.

Directors’ Compensation

Directors who are full-time employees of the Company receive no additional compensation for serving as directors. Non-employee directors during fiscal 2005 received an annual retainer of $18,000, paid quarterly, plus a fee of $500 for each meeting of the Board or a committee of the Board attended, either in person or by telephone. In addition to meeting fees, the Audit Committee Chair received an annual retainer of $14,000 and the other Audit Committee members received an annual retainer of $10,000, paid in quarterly installments.

In fiscal 2006 the Chairman of the Board will receive an annual retainer of $150,000, paid quarterly. Other non-employee directors during fiscal 2006 will receive an annual retainer of $28,000, paid quarterly, plus a fee of $500 for each meeting of the Board or a committee of the Board attended, either in person or by telephone. In addition to meeting fees, the Audit Committee Chair will receive an annual retainer of $12,000 and the other Audit Committee members will receive an annual retainer of $8,000, paid in quarterly installments

7

Nominating and Governance Committee

Members: | Joel F. McIntyre, Chair

Alexander L. Dean

John P. Cunningham |

The Nominating and Governance Committee is responsible for establishing and implementing procedures to identify and review the qualifications of nominees for Board membership including nominees recommended by shareholders. The Committee also recommends to the Board appointees to each committee of the Board and recommends to the Board the slate of nominees for election at the Company’s annual meeting of shareholders or qualified individuals to fill vacancies, if any, which may occur between annual meetings.

The Committee has not established any specific qualifications for director candidates or any specific qualities or skills that a candidate must possess in order to be considered qualified to be nominated as a director. The Committee determines the required selection criteria and qualifications of director nominees based upon the Company’s needs at the time nominees are considered. Qualifications for consideration as a director nominee may vary according to the particular areas of expertise being sought as a complement to the existing board composition. In making its nominations, the Nominating and Governance Committee generally will consider, among other things, an individual’s business experience, industry experience, financial background, breadth of knowledge about issues affecting our company, time available for meetings and consultation regarding company matters and other particular skills and experience possessed by the individual.

The Nominating and Governance Committee reviews the Company’s governance policies and business practices on a continuing basis as well as reviewing the adherence by directors and senior officers to the Company’s Code of Business Conduct and Ethics.

A copy of the Nominating and Governance Committee Charter may be found on the Company’s website at www.intlalum.com. All of the Nominating and Governance Committee members meet the independence requirement of the NYSE listing standards.

Procedure for Shareholder Recommendations of Director Candidates

A stockholder wishing to submit recommendations for director candidates for consideration by the Nominating and Governance Committee for election at an annual meeting of shareholders must do so in writing by January 31 of that year. The written recommendation must include the following information:

· A statement that the writer is a stockholder and is proposing a candidate for consideration, the name and address of the stockholder and the number of shares of our common stock owned beneficially or of record by the stockholder.

· The name and contact information for the candidate.

· A statement of the candidate’s business and educational experience.

· Information regarding the candidate’s qualifications to be a director.

· The number of shares of our common stock, if any, owned either beneficially or of record by the candidate and the length of time such shares have been so owned.

· The written consent of the candidate to serve as a director if nominated and elected.

· Information regarding any relationship or understanding between the proposing stockholder and the candidate.

8

· A statement that the proposed candidate has agreed to furnish us all information as we deem necessary to evaluate such candidate’s qualifications to serve as a director.

Any recommendations in proper form received from stockholders will be evaluated in the same manner that potential nominees recommended by our Board members or management are evaluated. Such documentation and the name of the director candidate may be sent by U.S. mail addressed to Chairman, Nominating and Governance Committee at the address indicated on the Notice of Annual Meeting of Shareholders or by e-mail to Governance@intalum.com, which site is password protected and accessible only to the Chairman of the Nominating and Governance Committee.

Procedure for Shareholder Nomination of Director

Our Bylaws specify the procedures by which stockholders may nominate director candidates directly. Any stockholder nominations must comply with the requirements of our Bylaws and should be addressed to International Aluminum Corporation, 767 Monterey Pass Road, Monterey Park, California 91754, Attn: Corporate Secretary.

Stockholder Communication with Board Members

Stockholders who wish to communicate with our Board members may contact us by telephone or via e-mail at Governance@intalum.com or the mail at our principal executive office. Written communications specifically marked as a communication for our Board of Directors, or a particular director, except those that are clearly marketing or soliciting materials, will be forwarded unopened to the Chairman of our Board, or to the particular director to which such communications are addressed, or presented to the full Board of Directors or the particular director at the next regularly scheduled Board meeting. In addition, communications sent to us for our Board of Directors or a particular director will be forwarded to the Board or director.

Audit Committee

Members: | David M. Antonini, Chair

Joel F. McIntyre

Alexander L. Dean |

The functions of the Audit Committee and its activities during fiscal 2005 are described below under the heading “Audit Committee Report.” The Board has confirmed that each member of the Audit Committee is independent within the meaning of the NYSE listing standards governing audit committees. Each committee member is financially literate and able to understand financial statements. Its Chairman, David M. Antonini, satisfies the definition of audit committee expert as set out in Item 401(h) of Regulation S-K. The Committee functions pursuant to the Audit Committee Charter which was adopted in fiscal 2003 and amended in August 2004.

9

AUDIT COMMITTEE REPORT

The following Audit Committee Report does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates the Report by reference therein:

The Audit Committee operates under a written charter adopted by the Board of Directors. The Audit Committee’s primary duties and responsibilities are:

· reviewing with the independent auditors the Company’s annual financial statements, including the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Form 10-K to be filed with the Securities and Exchange Commission, and recommending to the Board of Directors whether the financial statements should be included in the Form 10-K.

· reviewing with the independent auditors the quarterly financial statements prior to the filing of the Company’s Form 10-Q, including the results of the independent auditors review and the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

· approval of all audit engagement fees and the pre-approval of all audit and permitted non-audit services to be provided by the independent accountants.

The Audit Committee provides assistance to the Board of Directors in fulfilling its oversight responsibility to shareholders, the investment community, and others relating to the Company’s financial statements and the financial reporting process, the systems of internal accounting and financial controls, and the annual independent audit of the Company’s financial statements. The Audit Committee has the sole authority (subject, if applicable, to shareholder ratification) to appoint or replace the Company’s independent auditors.

The Audit Committee must pre-approve all audit services and all permitted non-audit services to be provided by the Company’s independent auditors. In general, the Audit Committee’s policy is to grant such approval where it determines that the non-audit services are compatible with maintaining the auditors’ independence and there are cost or other efficiencies in obtaining such services from the independent auditors as compared to other possible providers.

In performing its functions, the Committee acts in an oversight capacity. In this oversight role, the Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for the Company’s financial statements and reports, and on the Company’s independent auditors which, in their report, express their opinion on the conformity of the annual financial statements with generally accepted accounting principles. In discharging its oversight role, the Audit Committee is empowered to investigate any matter brought to its attention, with full access to all of the Company’s books, records, facilities and personnel, and to retain its own legal counsel and other advisers as it deems necessary or appropriate.

In connection with the Company’s consolidated financial statements for the fiscal year ended June 30, 2005, the Audit Committee has:

· reviewed and discussed the audited financial statements with management and with representatives of PricewaterhouseCoopers LLP, the Company’s independent auditors;

· discussed with the independent auditors the matters required to be discussed by Statement of Auditing Standards No. 61, as amended by Statement on Auditing Standards No. 90 (Communications with Audit Committees);

10

· received from the Company’s independent auditors information regarding their independence as required by Independence Board Standard No. 1 (Independence Discussions with Audit Committees); and

· discussed with the Company’s independent auditors their independence.

Based on the Audit Committee’s review and discussions noted above, the Audit Committee recommended to the Board of Directors that the Company’s financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2005 filed with the Securities and Exchange Commission.

| David M. Antonini, Chairman |

| Joel F. McIntyre |

| Alexander M. Dean |

Audit Fees

The aggregate audit fees billed or to be billed to the Company for the fiscal years ended June 30, 2005 and 2004 by PricewaterhouseCoopers LLP, its independent auditors, were $425,000 and $183,500, respectively. Audit fees were for audit work performed in preparation of the Company’s annual financial statements, review of the quarterly financial statements included in quarterly reports on Form 10-Q for fiscal 2004 and 2005, and for fiscal 2005, review of the Company’s procedures related to internal controls over financial reporting as required under Section 404 of the Sarbanes-Oxley Act of 2002.

Other Fees

The Company paid no other fees during fiscal 2004 and 2005 to its independent accountants for any nonaudit-related, tax compliance, tax advice or tax planning services.

Compensation Committee

Members: | Alexander L. Dean, Chair

Joel F. McIntyre

David M. Antonini |

The Compensation Committee recommends to the Board of Directors salary and other compensation arrangements for the senior executive officers of the Company, including the granting of stock options pursuant to the Company’s stock option plan. The Committee also reviews and makes recommendations with respect to incentive compensation plans in which senior executives are eligible to participate, including the Company’s Annual Incentive Plan. The current Compensation Committee Charter was adopted in August 2004. A copy of the charter may also be found on the Company’s website at www.intlalum.com.

11

COMPENSATION COMMITTEE REPORT

The following Compensation Committee Report does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates the Report by reference therein:

The Compensation Committee is responsible for:

· establishing compensation programs that comply with the Company’s compensation philosophy;

· determining the compensation of senior executive officers;

· administering the Company’s stock option plan; and

· administering the participation of senior executive officers in the Company’s Annual Incentive Plan.

The Committee operates under a written charter which is reviewed annually. To assist in performing its duties and to enhance its objectivity and independence, the Committee has the authority to obtain advice and seek recommendations from outside compensation consultants and to review compensation data from other companies of similar size and complexity.

The Committee is composed of three non-employee directors, all of whom are independent in accordance with the NYSE listing standards.

Compensation Philosophy

The Company’s executive compensation philosophy reflects the belief of the Board of Directors that the interests of executives should be closely aligned with those of the Company’s shareholders. As a consequence, substantially all awards of incentive bonuses and stock option grants are tied to the attainment of results that benefit the Company and its shareholders. This philosophy ensures that executives are motivated to improve the overall performance and profitability of the Company as well as any specific subsidiary or area of operation for which an individual executive is responsible.

Compensation Program

The Committee regularly reviews currently available information regarding the executive compensation programs of other companies which operate in one or more of the Company’s markets, as well as a group of comparable manufacturing companies nationwide, to ensure that the Company’s policies and practices are competitive and appropriate in light of the Company’s performance and compensation philosophy. Each executive officer’s compensation package is comprised of three principal components: (1) base salary; (2) annual incentives; and (3) stock options.

Base Salary. The Company sets executive officer base salaries at the lower end of the average range of salaries paid by United States manufacturing companies with annual revenues and operations comparable to the Company’s. The Company regularly reviews pay data available from third-party sources to determine if its base salary levels meet the Company’s objectives. A number of factors are considered in establishing base salary levels for the Company’s executive officers, including the individual’s recent performance, level of responsibility, years of service and overall competitiveness relative to comparable positions at other companies.

The Chief Executive Officer’s base salary for fiscal 2005 was $275,000, a 5.8% increase from the base salary established for fiscal 2004. The Chief Executive Officer’s base salary and other elements of his compensation are determined in accordance with the policies previously described herein which are applicable to all senior executives of the Company. The Company has no employment contract with the Chief Executive Officer, and he is not entitled to any change of control, retirement, severance or deferred compensation benefits or any other employee benefits not shared by employees generally.

12

Annual Incentives. The executive officers other than the Chief Executive Officer and administrative employees of the Company and its subsidiaries may earn annual incentive compensation under the Company’s Annual Incentive Plan (the “Plan”). Approximately 390 employees were eligible to participate in the Plan at fiscal year end. A participant’s incentive opportunity is based on his or her tier level within the Plan. Tier incentive opportunity increases based upon an individual’s potential to affect operating profitability. The Plan’s objective is to make a portion of each such employee’s total compensation incentive-based.

Each year, the Board of Directors reviews with the Chief Executive Officer and other key management personnel the Company’s Business Plan for the ensuing year, following which the Board approves the Plan with changes deemed appropriate by the Board. Target income levels (income before interest and taxes) are developed based, in part, on competitive market data and on an assessment of past and anticipated future performance. Awards for corporate-based employees are derived from overall corporate performance. Awards to operating subsidiary employees are based on a combination of corporate, segment and individual subsidiary performance.

Under the Plan, for fiscal year 2005, eligible executive officers qualified to receive annual cash bonuses in amounts up to 42.8% of their base salaries.

Stock Options. The Company considers periodic stock option grants to executive officers to encourage and facilitate stock ownership and to underscore the importance of enhancing shareholder value over the long term. Incentive stock options are granted at 100% (and, in some instances, 110%) of the fair market value of the underlying stock on the date of grant, thus rewarding optionees only for appreciation in the Company’s stock enjoyed by all shareholders. While all executives are eligible to receive stock options, participation in a grant, as well as the size and terms of the grants to participating executives, are contingent upon performance, level of responsibility and overall compensation. No stock options were granted in fiscal 2005.

Internal Revenue Code Limits on Deductibility of Compensation. For fiscal 2005, there was no occasion for the Compensation Committee to consider Section 162(m) of the Internal Revenue Code, which limits tax deductions of public companies on compensation to certain executive officers in excess of $1 million. Where applicable, the Compensation Committee intends to consider the effect of Section 162(m) on its compensation decisions, but it has no formal policy to structure executive compensation so as to be fully deductible for tax purposes.

| Alexander L. Dean, Chairman |

| Joel F. McIntyre |

| David M. Antonini |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER INFORMATION

The Compensation Committee is comprised exclusively of directors who are not, and never have been, employees of the Company. No executive officer of the Company serves on the Compensation Committee or as a director of another company for which any member of the Compensation Committee serves as a director or executive officer.

13

EXECUTIVE COMPENSATION

The following table sets forth, on an accrual basis, all cash and non-cash compensation earned by or awarded to the Company’s Chief Executive Officer and its three other most highly compensated executive officers whose total annual salary and bonus for fiscal 2005 exceeded $100,000 for all services rendered to the Company and its subsidiaries for the fiscal years indicated:

Summary Compensation Table

| | | | Annual Compensation | | Other Annual | | All Other | |

| Name and Principal Position | | | Year | | Salary | | Bonus(1) | | Compensation(2) | | Compensation(3) | |

Cornelius C. Vanderstar | | 2005 | | $ | 275,000 | | | | | $ | 5,345 | | | | | | |

Chairman of the Board | | 2004 | | 259,940 | | | | | 2,963 | | | | | | |

and Chief Executive Officer | | 2003 | | 253,600 | | | | | 1,082 | | | | | | |

David C. Treinen | | 2005 | | $ | 275,000 | | $ | 117,700 | | | $ | 5,321 | | | | $ | 82,861 | | |

President and Chief Operating Officer; | | 2004 | | 256,250 | | 153,750 | | | 2,943 | | | | | | |

Secretary | | 2003 | | 250,000 | | | | | 1,075 | | | | | | |

Ronald L. Rudy | | 2005 | | $ | 250,000 | | $ | 107,000 | | | $ | 5,136 | | | | | | |

Senior Vice President-Operations | | 2004 | | 234,730 | | 140,838 | | | 2,921 | | | | | | |

| | 2003 | | 229,000 | | | | | 1,066 | | | | | | |

Mitchell K. Fogelman | | 2005 | | $ | 220,000 | | $ | 94,160 | | | $ | 4,230 | | | | | | |

Senior Vice President-Finance | | 2004 | | 195,780 | | 117,468 | | | 2,830 | | | | | | |

| | 2003 | | 191,000 | | | | | 1,010 | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

(1) Represents amounts paid or accrued under the Company’s Annual Incentive Plan.

(2) Represents contributions, on the same basis as all eligible employees, to the Company’s Profit Sharing Plan, a defined contribution plan.

(3) Includes $42,308 of vested vacation benefits paid to Mr. Treinen upon retirement June 30, 2005. Also includes $40,553 representing the value of an automobile previously furnished to Mr. Treinen for use in the Company’s business, ownership of which was transferred to Mr. Treinen upon his retirement and “grossed up” to cover applicable income taxes relating to the transfer.

Stock Options

The following table summarizes option exercises during fiscal 2005 by named executive officers. No options were granted during fiscal 2005, and no outstanding options were held by executive officers at June 30, 2005.

| Name | | | Shares

Acquired on

Exercise(#) | | Value

Realized(1) | |

David C. Treinen | | | 10,000 | | | | $ | 62,200 | | |

Ronald L. Rudy | | | 10,000 | | | | 62,200 | | |

Mitchell K. Fogelman | | | 7,500 | | | | 50,925 | | |

(1) Represents the market value of the shares acquired at the date of exercise, less the option price.

14

Equity Compensation Plan Information

The Company has two stock option plans, both of which have been approved by shareholders. As of June 30, 2005, the number of options outstanding and remaining available under the approved plans were as follows:

| Plan category | | | Number of securities

to be issued

upon exercise of

outstanding options

(a) | | Weighted average

exercise price

of outstanding

options

(b) | | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a)

(c) | |

Equity compensation plans approved by shareholders | | | 55,526 | (1) | | | $ | 28.89 | | | | 389,700 | | |

Equity compensation plans not approved by shareholders | | | — | | | | — | | | | — | | |

Total | | | 55,526 | | | | $ | 28.89 | | | | 389,700 | | |

(1) All outstanding options were granted under the Company’s 1991 Plan, which expired on August 15, 2001. Assuming that all the options currently outstanding were to expire or be cancelled in the future without being exercised the maximum number of shares available for future issuance under the Company’s 2001 Plan would be 445,226 shares.

15

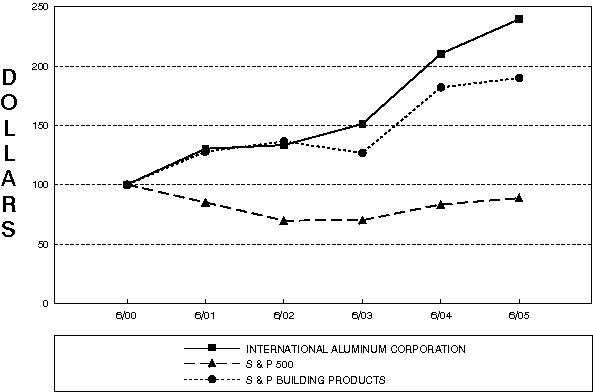

STOCK PERFORMANCE GRAPH

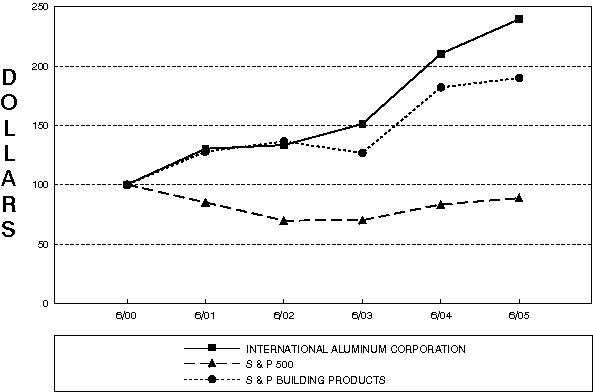

The Stock Price Performance Graph below compares the cumulative total shareholder return on the Company’s common stock against the cumulative total return of the S&P 500 Index and the S&P Building Products Index.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG INTERNATIONAL ALUMINUM CORPORATION, THE S & P 500 INDEX

AND THE S & P BUILDING PRODUCTS INDEX

* $100 invested on 6/30/00 in stock or index-including reinvestment of dividends. Fiscal year ending June 30.

Copyright © 2002, Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. All rights reserved. www.researchdatagroup.com/S&P.htm

16

PROPOSAL 2 – RATIFICATION OF SELECTION OF INDEPENDENT ACCOUNTANTS

PricewaterhouseCoopers LLP has audited the Company’s financial statements for over 25 years, and the Audit Committee has appointed that firm to serve as independent auditors to audit the Company’s consolidated financial statements for fiscal year 2006. Appointment of independent auditors is entirely at the discretion of the Audit Committee. However, as a matter of good corporate governance and practice, the Audit Committee has recommended that the Board of Directors submit the matter for ratification by shareholders. In the event shareholders fail to ratify the appointment of PricewaterhouseCoopers, LLP, the Audit Committee may choose to retain that firm or another without resubmitting the matter to the Company’s shareholders.

Representatives of PricewaterhouseCoopers LLP will be present at the annual meeting and will be available to make a statement if they wish to do so and to respond to appropriate questions.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THIS PROPOSAL. PROXIES SOLICITED BY THE BOARD WILL BE VOTED “FOR” THIS PROPOSAL UNLESS OTHERWISE INSTRUCTED.

ANNUAL REPORT ON FORM 10-K

The Company’s Annual Report on Form 10-K for the year ended June 30, 2005 is available to shareholders, without charge, upon written request. Requests should be addressed to International Aluminum Corporation, P. O. Box 6, Monterey Park, California 91754, Attn: Corporate Secretary. The report may also be obtained by visiting the Company’s website at www.intlalum.com.

SHAREHOLDER PROPOSALS FOR 2006 ANNUAL MEETING

Any shareholder who intends to present a proposal at the Company’s 2006 Annual Meeting of Shareholders is advised that in order for such proposal to be included in the Board of Directors’ proxy statement for such meeting, the proposal must be received by the Secretary of the Company at its principal executive offices no later than July 30, 2006, and the proposal must meet certain eligibility requirements of the Securities and Exchange Commission.

With respect to any matter to come before the 2006 annual meeting as to which the Company had no notice prior to September 12, 2006, the Company’s management proxies may exercise their discretionary voting authority, without any discussion of the proposal in the Company’s proxy materials.

SHAREHOLDER COMMUNICATION WITH THE BOARD OF DIRECTORS

Shareholders may direct appropriate comments to or ask pertinent questions of the Chairman and Chief Executive Officer during the Annual Meeting of Shareholders. In addition, shareholders may communicate directly with any director by writing to:

The Board of Directors |

International Aluminum Corporation |

Attention: Corporate Secretary |

P. O. Box 6 |

Monterey Park, California 91754 |

The Corporate Secretary will promptly forward to the Board of Directors or each individually named director all relevant written communications received at the above address. Alternatively, communications may be sent electronically to: Governance@intalum.com, a password protected address accessible only to the Chairman of the Nominating and Governance Committee.

17

OTHER MATTERS

The Company’s Annual Report to Shareholders, including financial statements, for the fiscal year ended June 30, 2005, accompanies this Proxy Statement.

The management of the Company does not know of any matter to be acted upon at the meeting other than the matters above described. As to any other matter that properly comes before the meeting, the proxy holders will vote the proxies received in accordance with their best judgment.

The cost of soliciting proxies will be borne by the Company. The proxy soliciting material, in addition to being mailed directly to shareholders, will be distributed through custodians, nominees and other like parties to beneficial owners of the stock. The Company expects to reimburse such parties for their reasonable charges and expenses in connection therewith.

Although it is contemplated that proxies will be solicited principally through the use of the mail, the solicitation of proxies may be made by means of personal calls upon, or telephonic or other communications with, shareholders or the personal representatives by directors, officers or employees of the Company, who will not be specially compensated for such services.

| By Order of the Board of Directors | |

|

| |

| Mitchell K. Fogelman | |

| Senior Vice President and Secretary | |

September 20, 2005 | |

18

INTERNATIONAL ALUMINUM CORPORATION

Voting by Internet is quick, easy and immediate. As an International Aluminum Corporation shareholder, you have the option of voting your shares electronically through the Internet eliminating the need to return the proxy card. Your electronic vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed, dated and returned the proxy card. Votes submitted electronically over the Internet must be received by 8:00 p.m., Eastern Time, on October 26, 2005.

To Vote Your Proxy by Internet

www.continentalstock.com

Have your proxy card available when you access the above website. Follow the prompts to vote your shares.

PLEASE DO NOT RETURN THE CARD BELOW IF YOU ARE VOTING ELECTRONICALLY.

To Vote Your Proxy by Mail

Mark, sign and date your proxy card below, detach it and return it in the postage-paid envelope provided.

FOLD AND DETACH HERE AND READ THE REVERSE SIDE

FOLD AND DETACH HERE AND READ THE REVERSE SIDE

PROXY | | Please mark

your votes

like this | | ý |

|

THIS PROXY WILL BE VOTED AS DIRECTED, OR IF NO DIRECTION IS INDICATED, WILL BE VOTED “FOR” THE PROPOSALS. |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. |

|

| | | | WITHHOLD | | | | | | | | | |

| | FOR | | AUTHORITY | | | | FOR | | AGAINST | | ABSTAIN | |

1. ELECTION OF DIRECTORS: | | o | | o | | 2. | PROPOSAL TO RATIFY SELECTION OF | | o | | o | | o | |

| | | | | PRICEWATERHOUSECOOPERS LLP | | | | |

(To withhold authority to vote for any individual nominee, | | | | | AS THE INDEPENDENT | | | | |

strike a line through that nominee’s name in the list below) | | | | | | | AUDITORS OF THE CORPORATION | | | | | | | |

| | | |

01. Cornelius C. Vanderstar | | 04. David C. Treinen | | 06. Ronald L. Rudy | | | |

02. John P. Cunningham | | 05. Joel F. McIntyre | | 07. Norma A. Provencio | | 3. | In their discretion, the proxies are authorized to vote upon such other business as | |

03. Alexander L. Dean | | | | | | | may properly come before the meeting. | |

| | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | COMPANY ID: | |

| | | | | |

| | | | PROXY NUMBER: | |

| | | | | |

| | | ACCOUNT NUMBER: | |

| |

| |

Signature | | Signature | | Date | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NOTE: Please sign exactly as name appears hereon. When shares are held by joint owners, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give title as such. If a corporation, please sign in full corporate name by President or other authorized officer. If a partnership, please sign in partnership name by authorized person.

INTERNATIONAL ALUMINUM CORPORATION

ANNUAL MEETING OF SHAREHOLDERS

2:00 P.M. Pacific Time

October 27, 2005

767 Monterey Pass Road

Monterey Park, CA 91754

FOLD AND DETACH HERE AND READ THE REVERSE SIDE

FOLD AND DETACH HERE AND READ THE REVERSE SIDE

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

INTERNATIONAL ALUMINUM CORPORATION

The undersigned appoints Cornelius C. Vanderstar and Ronald L. Rudy, and each of them, as proxies, each with the power to appoint his substitute, and authorizes each of them to represent and to vote, as designated on the reverse hereof, all of the shares of common stock of International Aluminum Corporation held of record by the undersigned at the close of business on September 7, 2005 at the 2005 Annual Meeting of Shareholders of International Aluminum Corporation to be held on October 27, 2005 or at any adjournment thereof.

(Continued, and to be marked, dated and signed, on the other side)