July 24, 2024 ibm.com/investor 2Q 2024 Earnings Exhibit 99.2

Forward-looking statements and non-GAAP information Certain comments made in this presentation may be characterized as forward looking under the Private Securities Litigation Reform Act of 1995. Forward- looking statements are based on the company’s current assumptions regarding future business and financial performance. Those statements by their nature address matters that are uncertain to different degrees. Those statements involve a number of factors that could cause actual results to differ materially. Additional information concerning these factors is contained in the Company’s filings with the SEC. Copies are available from the SEC, from the IBM website, or from IBM Investor Relations. Any forward-looking statement made during this presentation speaks only as of the date on which it is made. The company assumes no obligation to update or revise any forward-looking statements except as required by law; these charts and the associated remarks and comments are integrally related and are intended to be presented and understood together. In an effort to provide additional and useful information regarding the company’s financial results and other financial information as determined by generally accepted accounting principles (GAAP), the company also discusses, in its earnings press release and presentation materials, certain non-GAAP information including operating earnings and other “operating” financial measures, free cash flow, net cash from operating activities excluding IBM Financing receivables, adjusted EBITDA and adjustments for currency. The rationale for management’s use of this non-GAAP information is included as Exhibit 99.2 to the company’s Form 8-K submitted to the SEC on July 24, 2024. The reconciliation of non-GAAP information to GAAP is included in the press release within Exhibit 99.1 to the company’s Form 8-K submitted to the SEC on July 24, 2024, as well as on the slides entitled “Non-GAAP supplemental materials” in this presentation. To provide better transparency, the company also discusses management performance metrics including annual recurring revenue, annual bookings, signings, and book-to-bill. The metrics are used to monitor the performance of the business and are viewed as useful decision-making information for management and stakeholders. The rationale for management’s use of these performance metrics and their calculation, as well as other information including the definition of book of business, are included in Exhibit 99.2 to the company’s Form 8-K submitted to the SEC on July 24, 2024, or in the Management Discussion section of the company’s 2023 Annual Report, which is Exhibit 13 to the Form 10-K submitted with the SEC on February 26, 2024. For other related information please visit the Company’s investor relations website at: https://www.ibm.com/investor/events/earnings-2Q24 2

3 Arvind Krishna Chairman and Chief Executive Officer James Kavanaugh SVP, Finance & Operations and Chief Financial Officer

“We had a strong second quarter, exceeding our expectations, driven by growth in both revenue and free cash flow. We continue to see that clients turn to IBM for our technology and our expertise in enterprise AI, and our book of business for generative AI has grown to more than two billion dollars since the launch of watsonx one year ago. Given our first-half results, we are raising our full-year view of free cash flow, which we now expect to be more than $12 billion.” Arvind Krishna IBM Chairman and CEO 4 2Q24 Performance Investments, innovation and clients Generative AI CEO perspective

Financial highlights 5Revenue growth rates @CC $15.8B Revenue $4.5B Free cash flow ytd 2Q24 “In the quarter, we accelerated our revenue growth as we continue to execute well on our strategy. Our business fundamentals, operating leverage, product mix and productivity initiatives all contributed to significant margin expansion and increased profit and free cash flow. Our strong cash generation enables us to continue investing in innovation and expertise across the portfolio, while returning value to shareholders through dividends.” James Kavanaugh IBM SVP & CFO $1.1B Free cash flow ytd yr/yr 220bps Pre-tax margin expansion (operating) 11% Diluted EPS growth (operating) 4% Revenue growth 190bps Gross margin expansion (operating) 17% Pre-tax income growth (operating)

6 Revenue categories Red Hat +8% Automation +16% Data & AI (2%) Security +3% Software 2Q24 results; revenue growth rates @CC *Annual recurring revenue for Hybrid Platform & Solutions, growth rate @CC Transaction Processing +13% yr/yr Hybrid Platform & Solutions +6% yr/yr Strong revenue growth including 6+ points of organic contribution Accelerated Red Hat annual bookings growth and 6-month revenue under contract up mid-teens Solid and growing recurring revenue base; ARR* of $14.1 billion, +9% yr/yr Gross and segment profit margin expansion $6.7B Revenue +8% Revenue growth

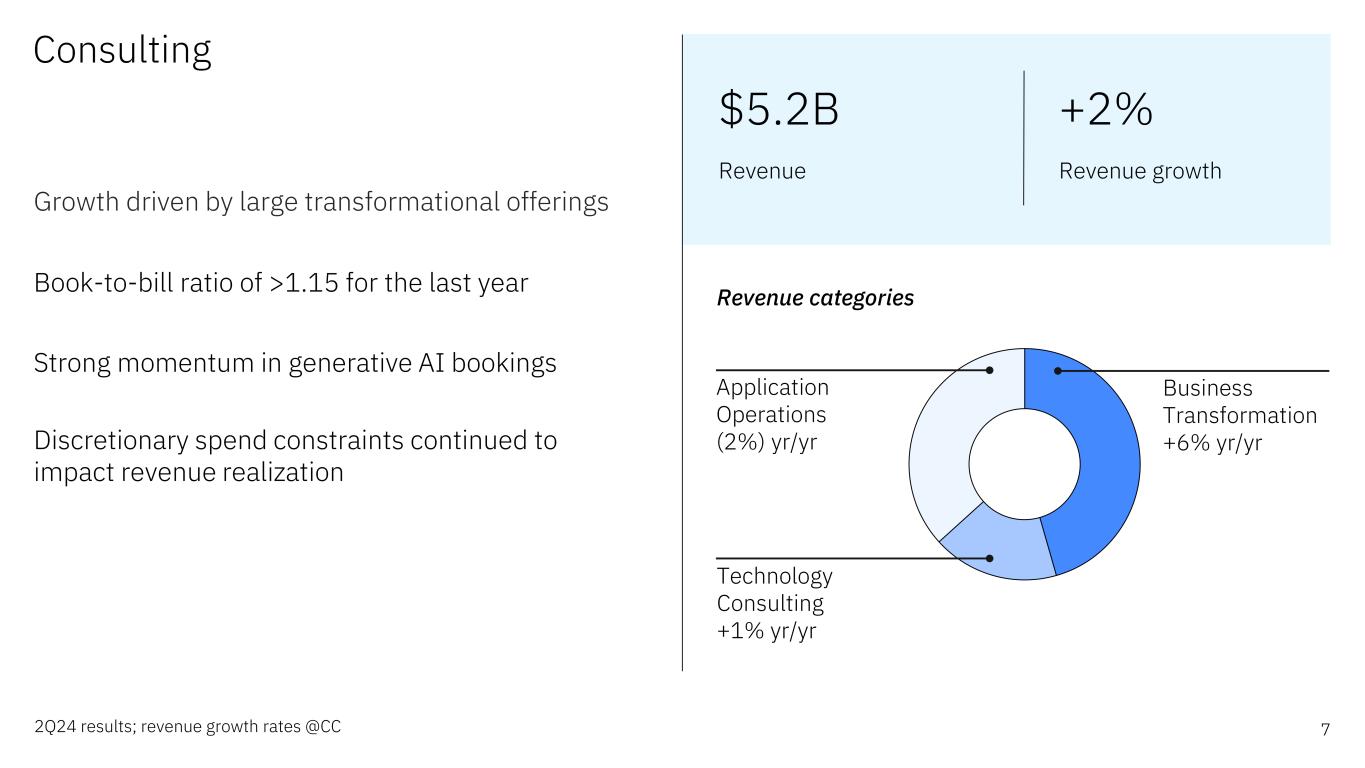

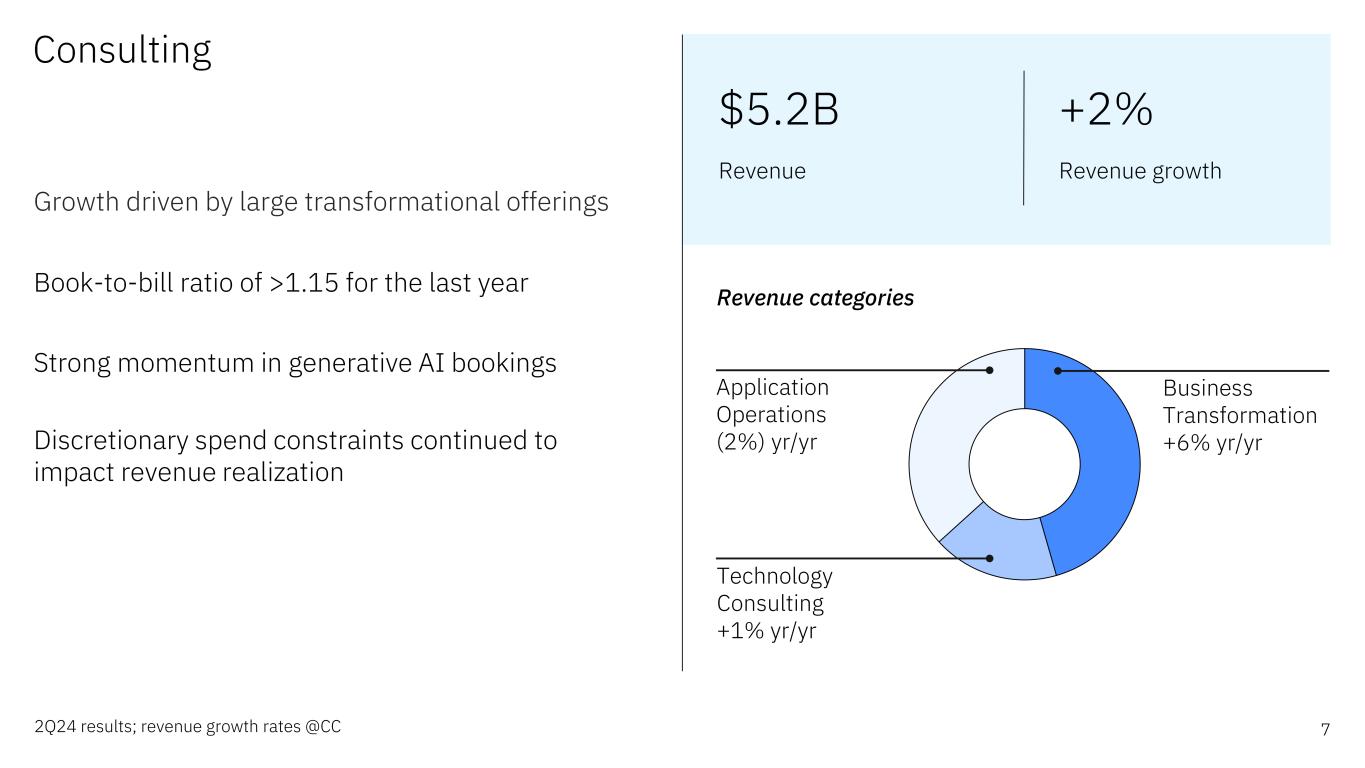

7 Technology Consulting +1% yr/yr Consulting 2Q24 results; revenue growth rates @CC Revenue categories Application Operations (2%) yr/yr Business Transformation +6% yr/yr Growth driven by large transformational offerings Book-to-bill ratio of >1.15 for the last year Strong momentum in generative AI bookings Discretionary spend constraints continued to impact revenue realization $5.2B Revenue +2% Revenue growth

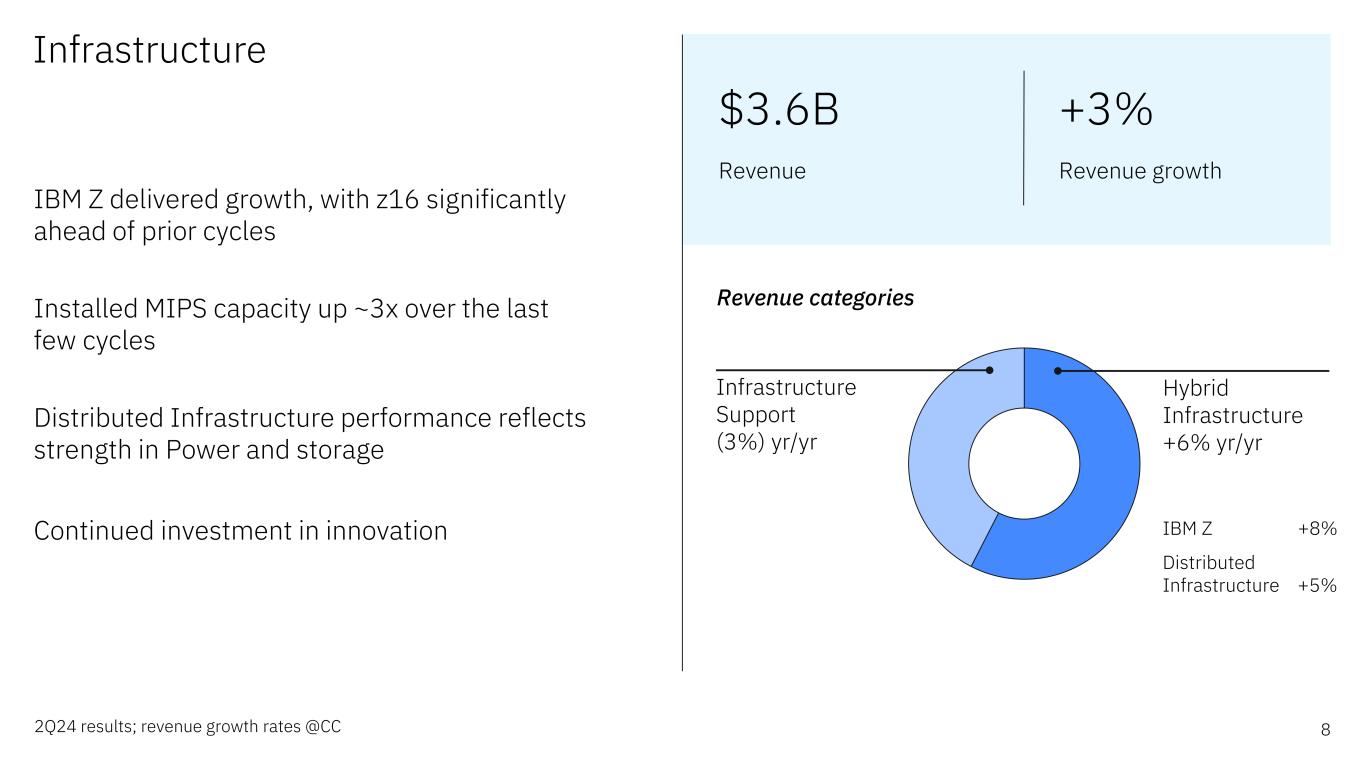

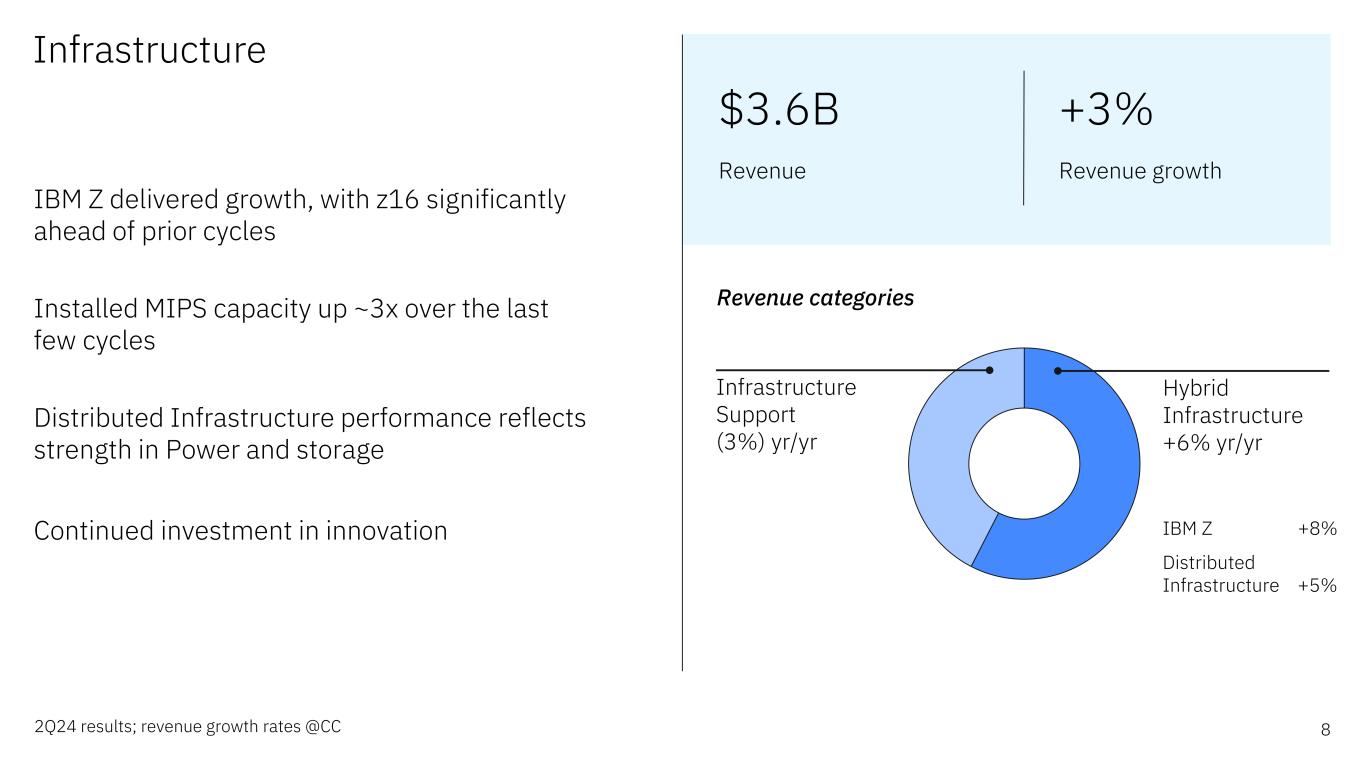

8 Infrastructure 2Q24 results; revenue growth rates @CC Revenue categories IBM Z +8% Distributed Infrastructure +5% Infrastructure Support (3%) yr/yr Hybrid Infrastructure +6% yr/yr IBM Z delivered growth, with z16 significantly ahead of prior cycles Installed MIPS capacity up ~3x over the last few cycles Distributed Infrastructure performance reflects strength in Power and storage Continued investment in innovation $3.6B Revenue +3% Revenue growth

9 Summary 2024 Expectations Revenue growth @CC in line with mid-single digit model Raising operating pre-tax margin expansion to over half a point Raising free cash flow to over $12 billion 2Q24 Summary Exceeded our expectations for key metrics Investments in innovation driving strong organic growth Generative AI continues to gain traction; book of business greater than $2 billion inception to date Operating leverage and productivity initiatives reflected in margin performance Strong first half free cash flow generation, +$1.1 billion ytd yr/yr

ibm.com/investor

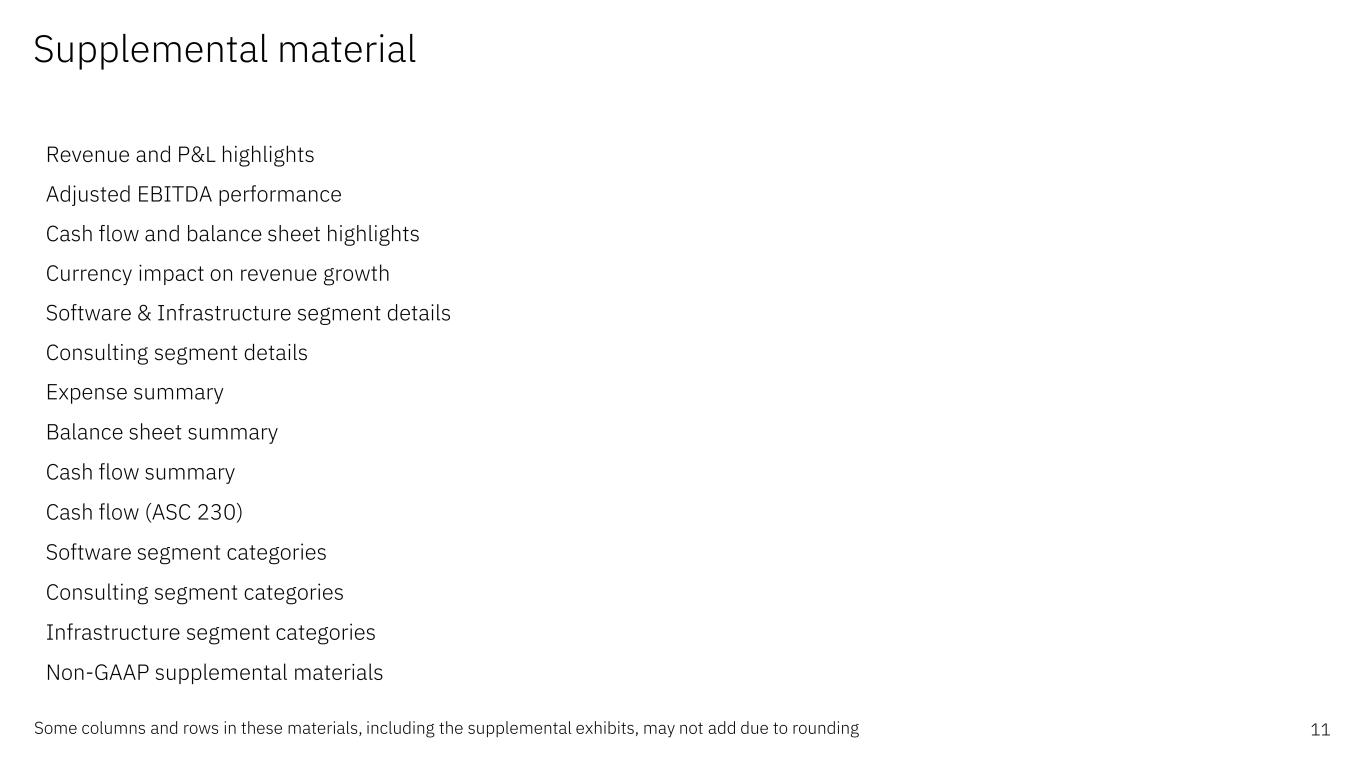

Supplemental material 11Some columns and rows in these materials, including the supplemental exhibits, may not add due to rounding Revenue and P&L highlights Adjusted EBITDA performance Cash flow and balance sheet highlights Currency impact on revenue growth Software & Infrastructure segment details Consulting segment details Expense summary Balance sheet summary Cash flow summary Cash flow (ASC 230) Software segment categories Consulting segment categories Infrastructure segment categories Non-GAAP supplemental materials

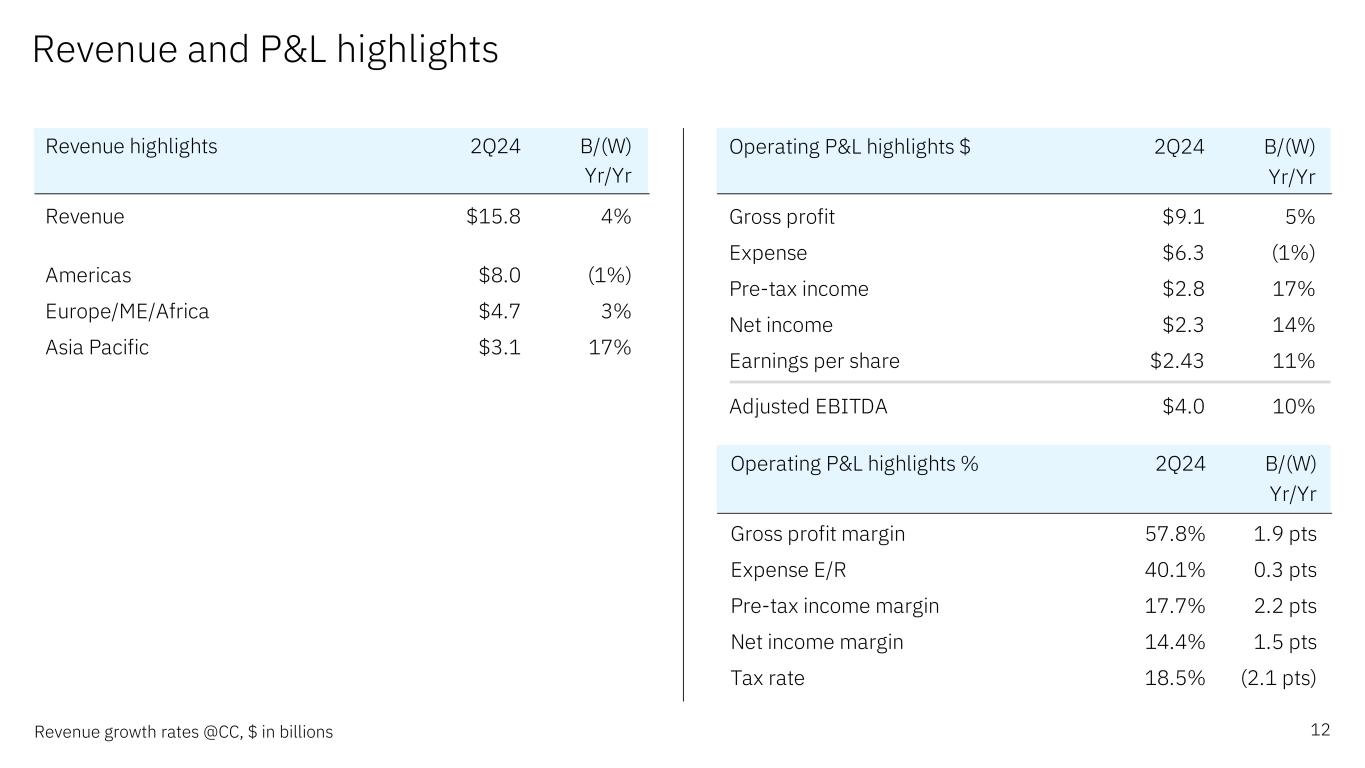

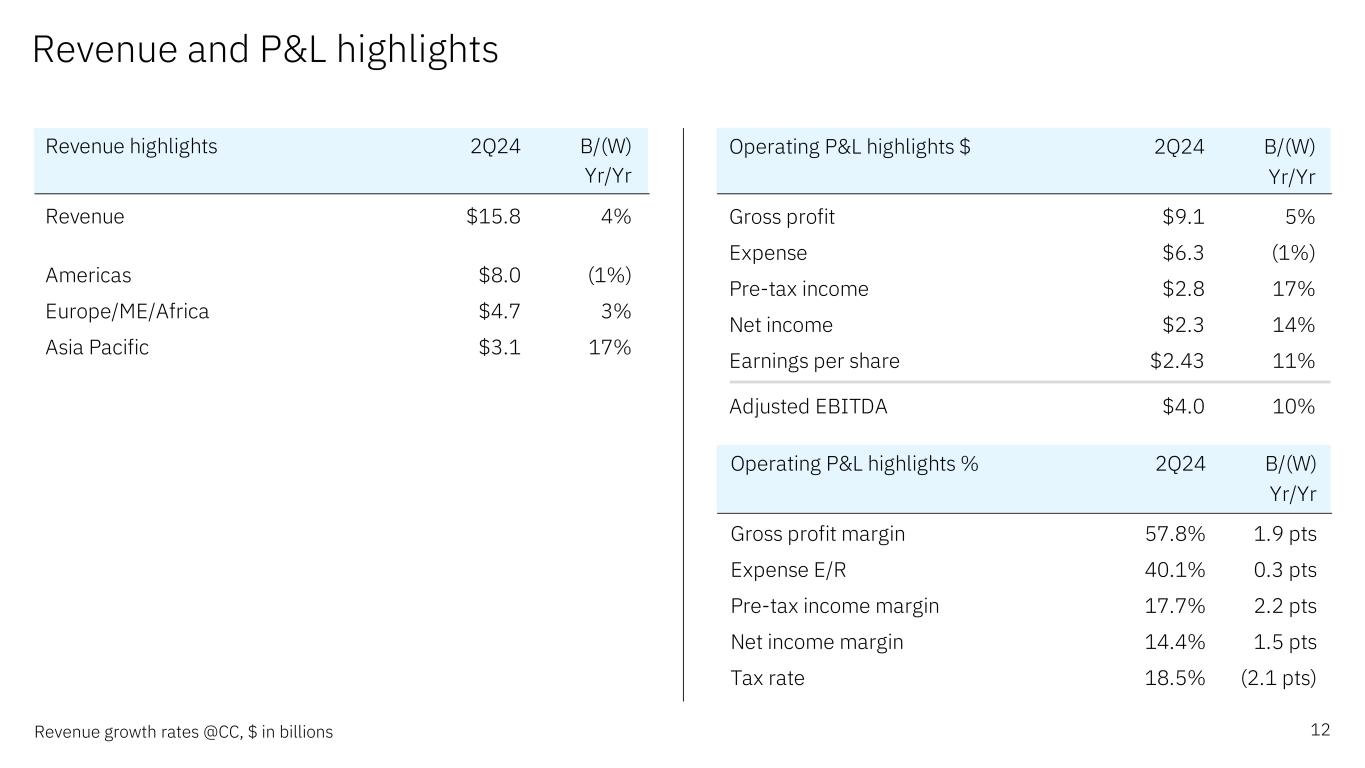

Revenue and P&L highlights 12Revenue growth rates @CC, $ in billions Revenue highlights 2Q24 B/(W) Yr/Yr Revenue $15.8 4% Americas $8.0 (1%) Europe/ME/Africa $4.7 3% Asia Pacific $3.1 17% Operating P&L highlights $ 2Q24 B/(W) Yr/Yr Gross profit $9.1 5% Expense $6.3 (1%) Pre-tax income $2.8 17% Net income $2.3 14% Earnings per share $2.43 11% Adjusted EBITDA $4.0 10% Operating P&L highlights % 2Q24 B/(W) Yr/Yr Gross profit margin 57.8% 1.9 pts Expense E/R 40.1% 0.3 pts Pre-tax income margin 17.7% 2.2 pts Net income margin 14.4% 1.5 pts Tax rate 18.5% (2.1 pts)

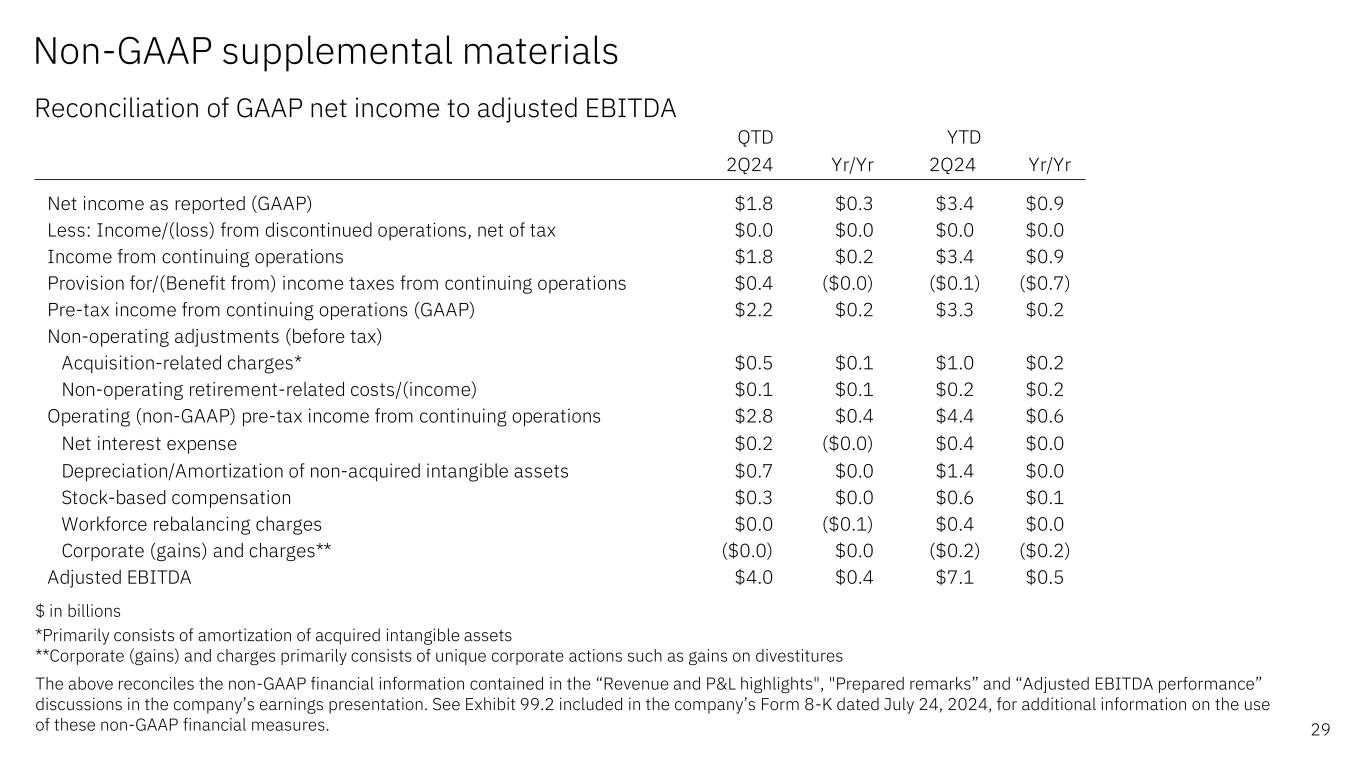

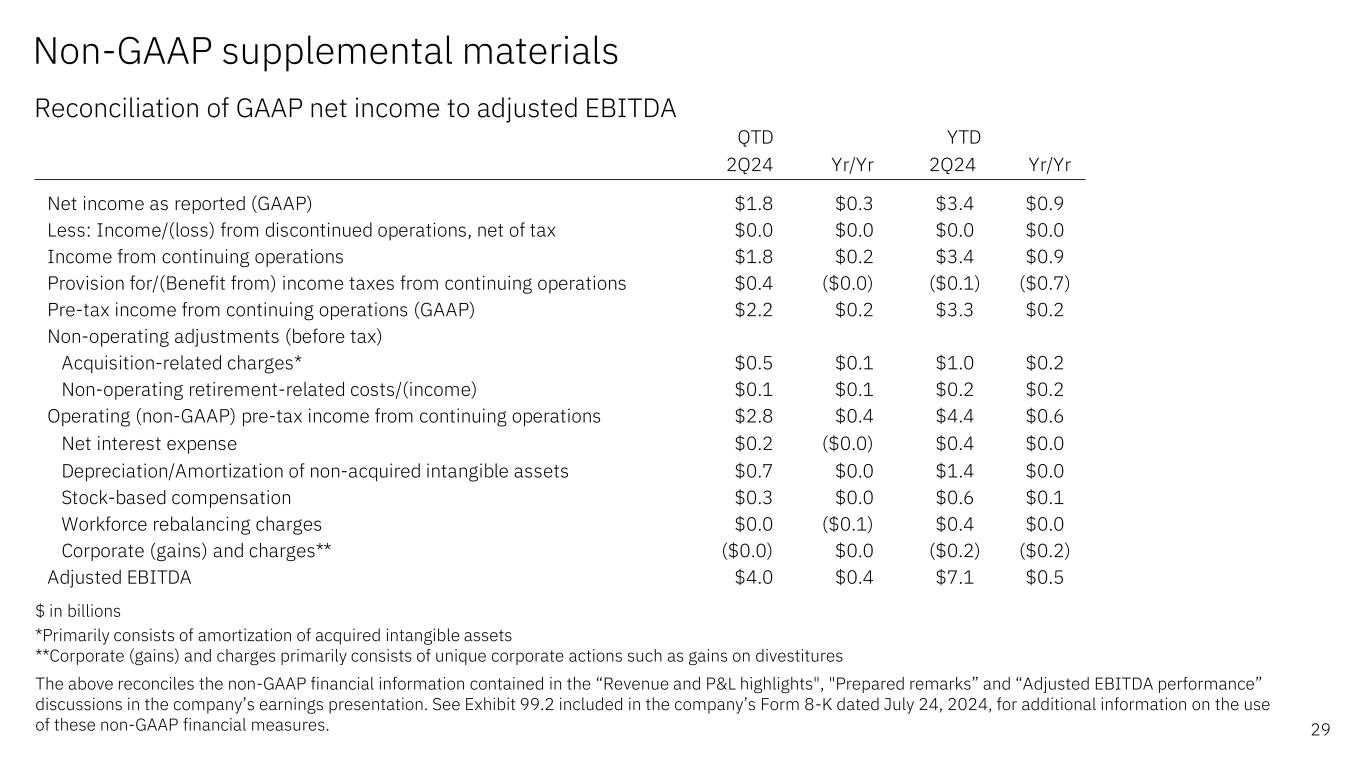

Adjusted EBITDA performance 13 $ in billions *Corporate (gains) and charges primarily consists of unique corporate actions such as gains on divestitures QTD YTD 2Q24 Yr/Yr 2Q24 Yr/Yr Operating (non-GAAP) pre-tax income from continuing operations $2.8 $0.4 $4.4 $0.6 Net interest expense $0.2 ($0.0) $0.4 $0.0 Depreciation/Amortization of non-acquired intangible assets $0.7 $0.0 $1.4 $0.0 Stock-based compensation $0.3 $0.0 $0.6 $0.1 Workforce rebalancing charges $0.0 ($0.1) $0.4 $0.0 Corporate (gains) and charges* ($0.0) $0.0 ($0.2) ($0.2) Adjusted EBITDA $4.0 $0.4 $7.1 $0.5

Cash flow and balance sheet highlights 14 $ in billions *Non-GAAP financial measure; excludes Financing receivables **Non-GAAP financial measure; adjusts for Financing receivables and net capital expenditures Balance sheet Jun 24 Dec 23 Jun 23 Cash & marketable securities $16.0 $13.5 $16.3 Total debt $56.5 $56.5 $57.5 Select debt measures Jun 24 Dec 23 Jun 23 IBM Financing debt $11.1 $11.9 $10.6 Core (non-IBM Financing) debt $45.4 $44.7 $46.9 Cash flow 2Q24 YTD Yr/Yr Net cash from operations* $5.3 $0.9 Free cash flow** $4.5 $1.1 Select uses of cash 2Q24 YTD Yr/Yr Net capital expenditures $0.8 ($0.2) Acquisitions $0.2 ($0.1) Dividends $3.1 $0.1

Currency impact on revenue growth 15 Quarterly averages per US $ 1Q24 Yr/Yr 2Q24 Yr/Yr Spot 3Q24 4Q24 FY24 assumed Euro 0.92 1% 0.93 (1%) 0.92 0% 1% 0% Pound 0.79 4% 0.79 1% 0.77 2% 4% 3% Yen 148 (12%) 156 (14%) 156 (8%) (6%) (10%) Revenue impact, future @assumed Spot (2 pts) ~(1.5 pts) ~(1 pts) (1-2 pts) Prior view ~(2.5 pts) (1.5-2 pts) (1-1.5 pts) (1.5-2 pts) US $B Yr/Yr Revenue as reported $15.8 1.9% Currency impact ($0.3) (2 pts) Revenue @CC 3.8%

Software & Infrastructure segment details 16 Revenue growth rates @CC, $ in billions *Annual recurring revenue for Hybrid Platform & Solutions, growth rate @CC Software segment 2Q24 B/(W) Yr/Yr Revenue $6.7 8% Hybrid Platform & Solutions $4.6 6% Red Hat 8% Automation 16% Data & AI (2%) Security 3% Transaction Processing $2.2 13% Segment profit $2.1 21% Segment profit margin 31.3% 3.6 pts Annual recurring revenue* $14.1 9% Infrastructure segment 2Q24 B/(W) Yr/Yr Revenue $3.6 3% Hybrid Infrastructure $2.4 6% IBM Z 8% Distributed Infrastructure 5% Infrastructure Support $1.3 (3%) Segment profit $0.7 (11%) Segment profit margin 17.9% (2.3 pts)

Consulting segment details 17Revenue & signings growth rates @CC, $ in billions Consulting segment 2Q24 B/(W) Yr/Yr Revenue $5.2 2% Business Transformation $2.4 6% Technology Consulting $0.9 1% Application Operations $1.9 (2%) Gross profit margin 26.3% 0.4 pts Segment profit $0.5 (4%) Segment profit margin 8.9% (0.3 pts) Signings $5.7 (2%) Book-to-bill ratio (TTM) >1.15

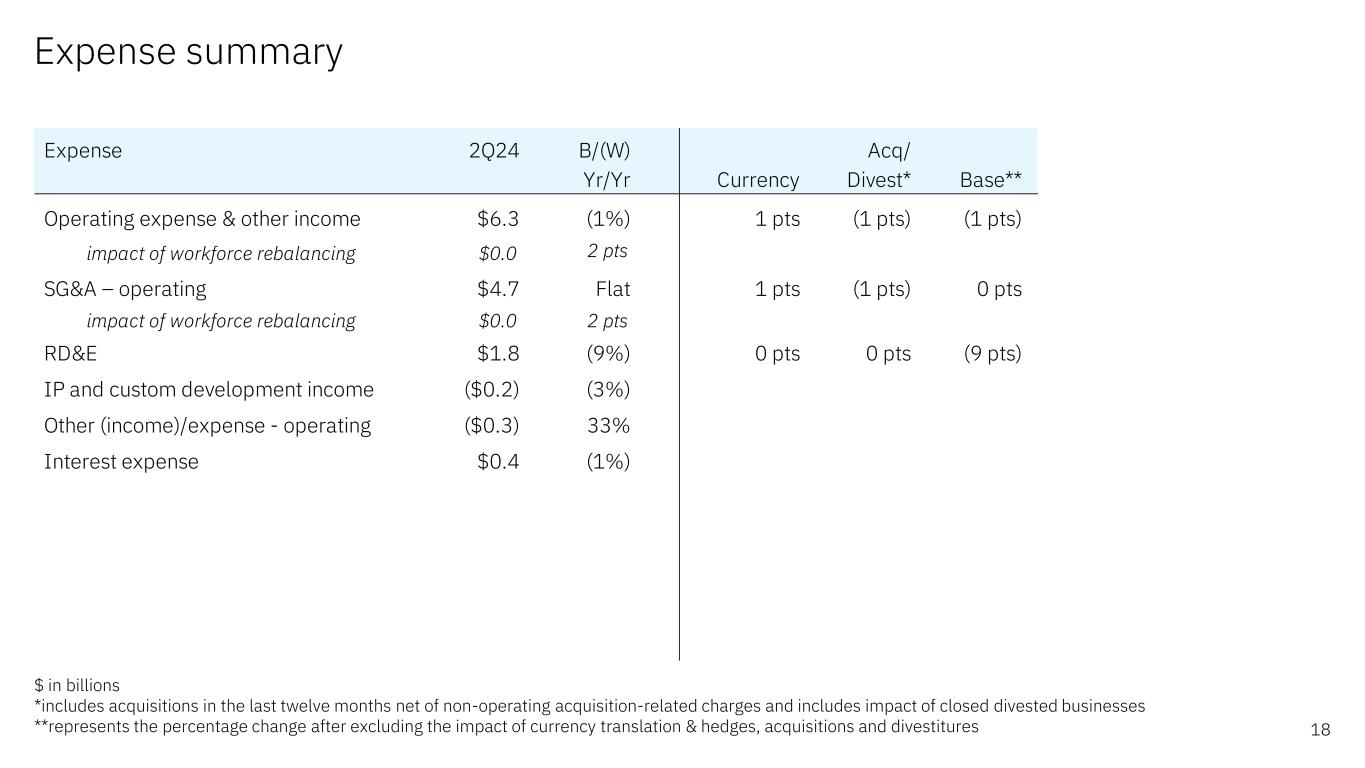

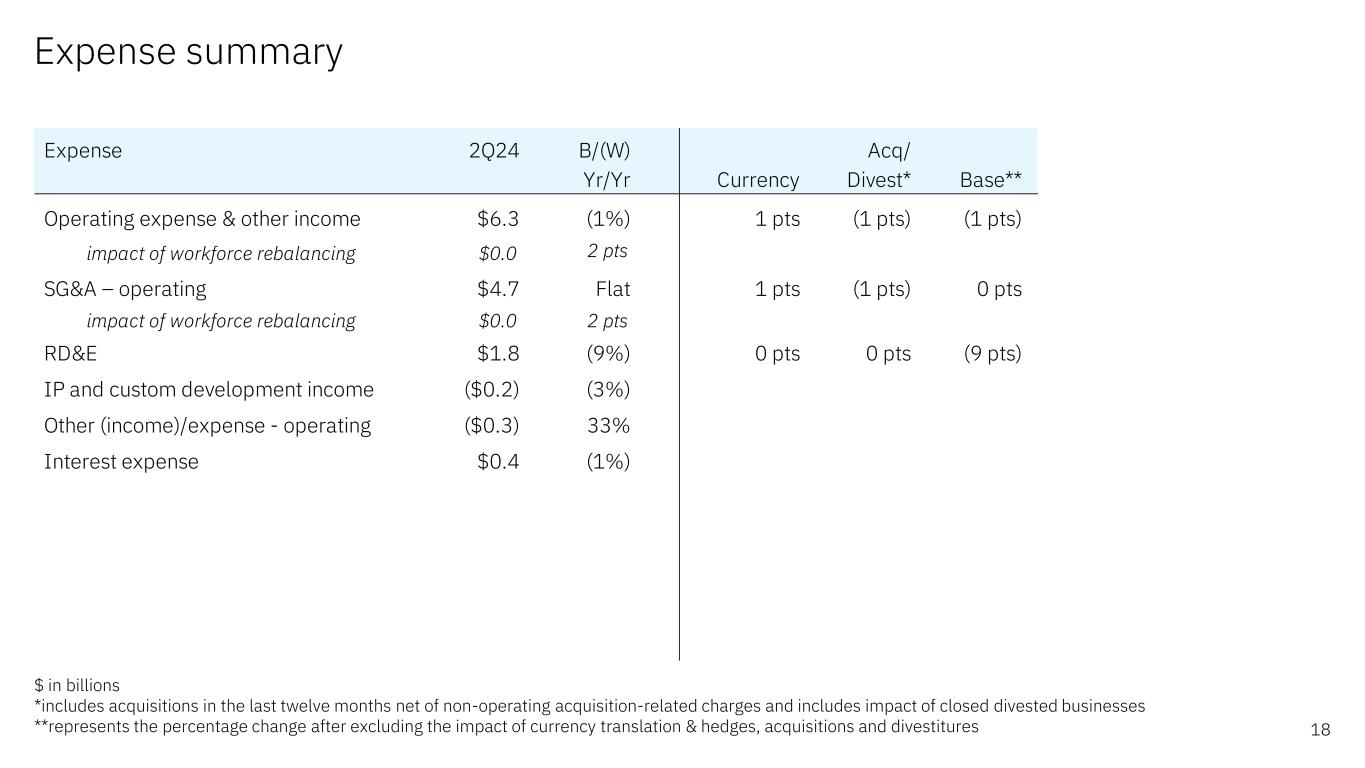

Expense summary 18 $ in billions *includes acquisitions in the last twelve months net of non-operating acquisition-related charges and includes impact of closed divested businesses **represents the percentage change after excluding the impact of currency translation & hedges, acquisitions and divestitures Expense 2Q24 B/(W) Acq/ Yr/Yr Currency Divest* Base** Operating expense & other income $6.3 (1%) 1 pts (1 pts) (1 pts) impact of workforce rebalancing $0.0 2 pts SG&A – operating $4.7 Flat 1 pts (1 pts) 0 pts impact of workforce rebalancing $0.0 2 pts RD&E $1.8 (9%) 0 pts 0 pts (9 pts) IP and custom development income ($0.2) (3%) Other (income)/expense - operating ($0.3) 33% Interest expense $0.4 (1%)

Balance sheet summary 19 $ in billions *includes eliminations of inter-company activity Jun 24 Dec 23 Jun 23 Cash & marketable securities $16.0 $13.5 $16.3 Core (non-IBM Financing) assets* $105.3 $107.9 $103.4 IBM Financing assets $12.5 $13.9 $12.5 Total assets $133.8 $135.2 $132.2 Other liabilities $53.2 $56.1 $52.5 Core (non-IBM Financing) debt* $45.4 $44.7 $46.9 IBM Financing debt $11.1 $11.9 $10.6 Total debt $56.5 $56.5 $57.5 Total liabilities $109.7 $112.6 $109.9 Equity $24.1 $22.6 $22.3

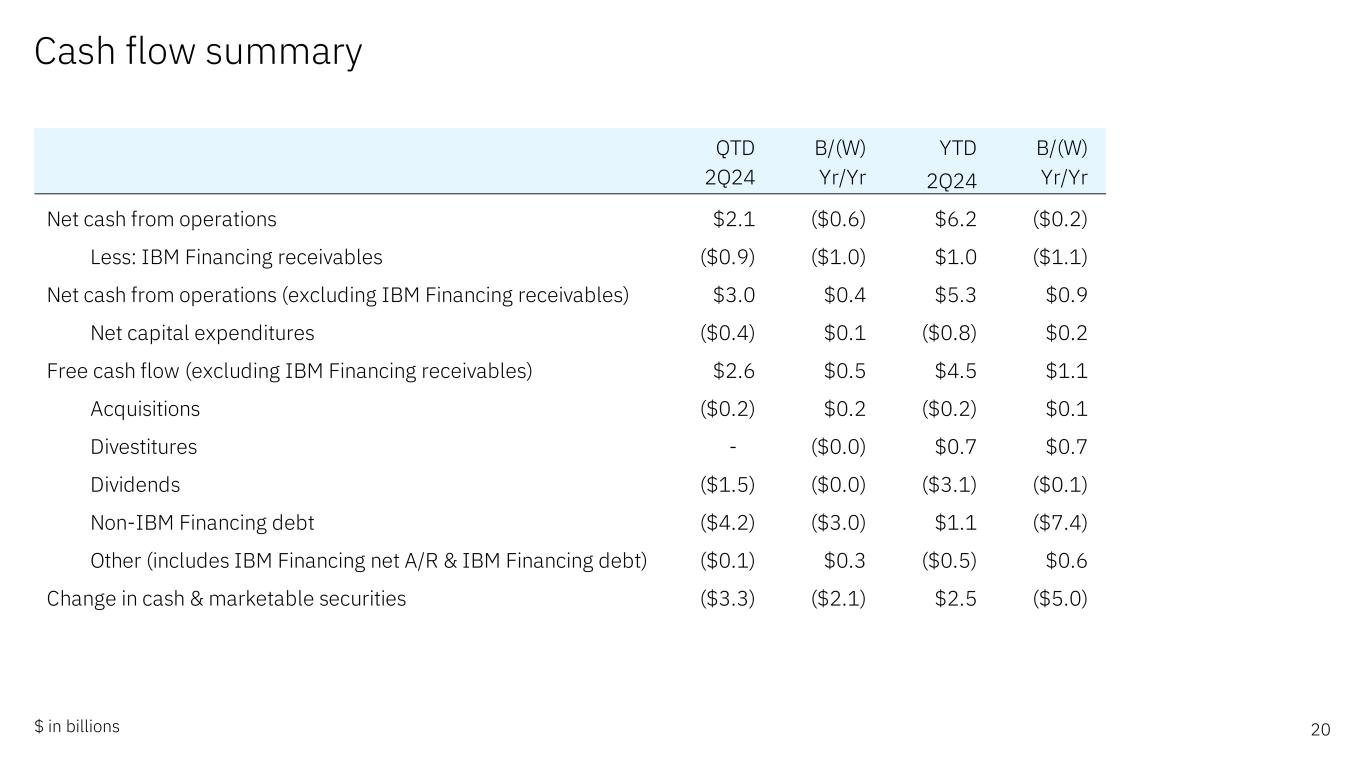

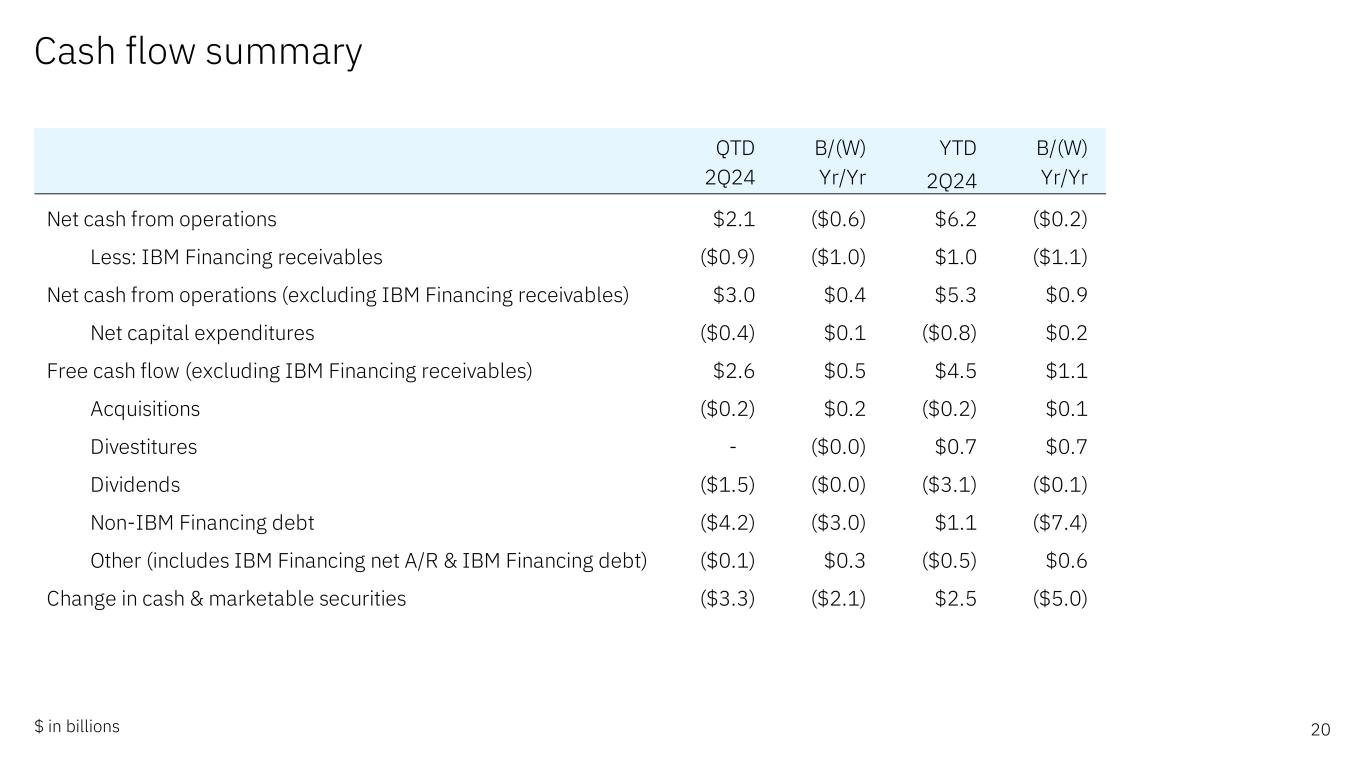

Cash flow summary 20$ in billions QTD B/(W) YTD B/(W) 2Q24 Yr/Yr 2Q24 Yr/Yr Net cash from operations $2.1 ($0.6) $6.2 ($0.2) Less: IBM Financing receivables ($0.9) ($1.0) $1.0 ($1.1) Net cash from operations (excluding IBM Financing receivables) $3.0 $0.4 $5.3 $0.9 Net capital expenditures ($0.4) $0.1 ($0.8) $0.2 Free cash flow (excluding IBM Financing receivables) $2.6 $0.5 $4.5 $1.1 Acquisitions ($0.2) $0.2 ($0.2) $0.1 Divestitures - ($0.0) $0.7 $0.7 Dividends ($1.5) ($0.0) ($3.1) ($0.1) Non-IBM Financing debt ($4.2) ($3.0) $1.1 ($7.4) Other (includes IBM Financing net A/R & IBM Financing debt) ($0.1) $0.3 ($0.5) $0.6 Change in cash & marketable securities ($3.3) ($2.1) $2.5 ($5.0)

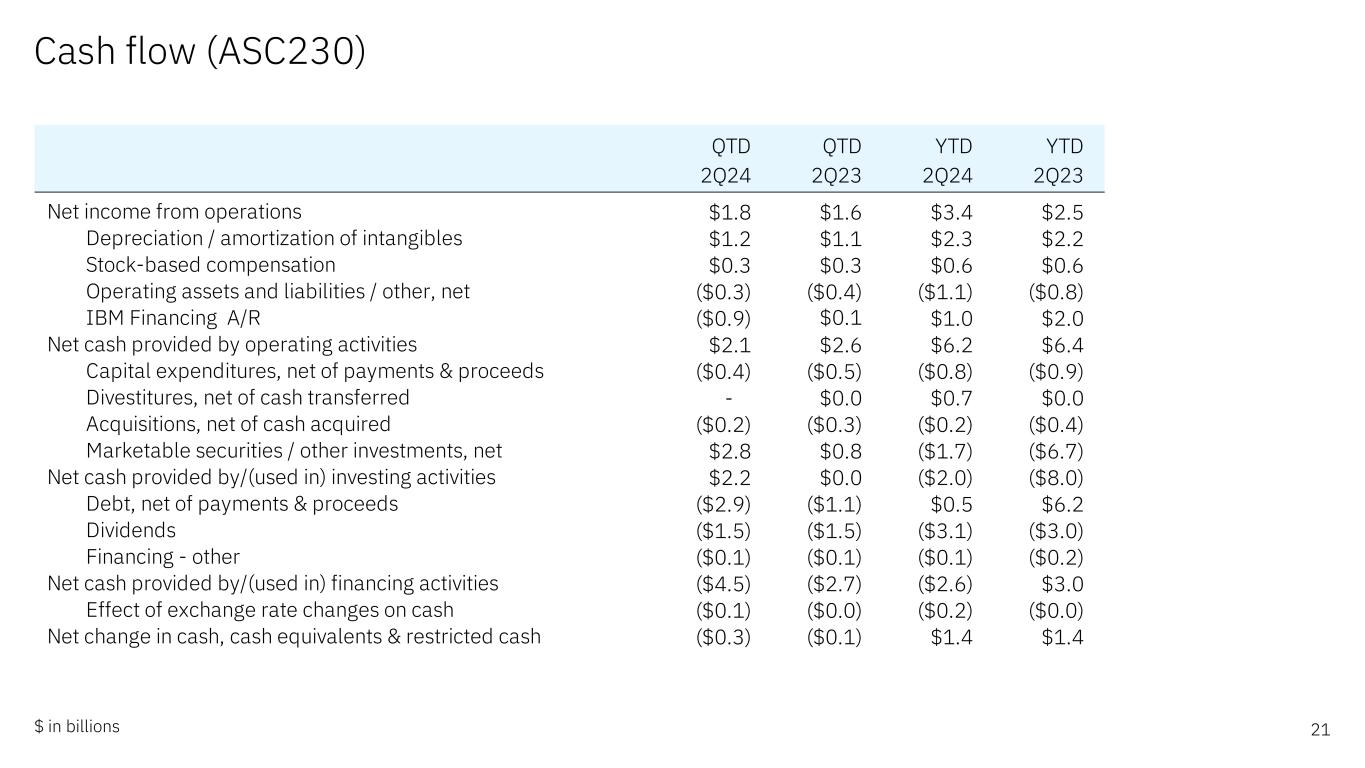

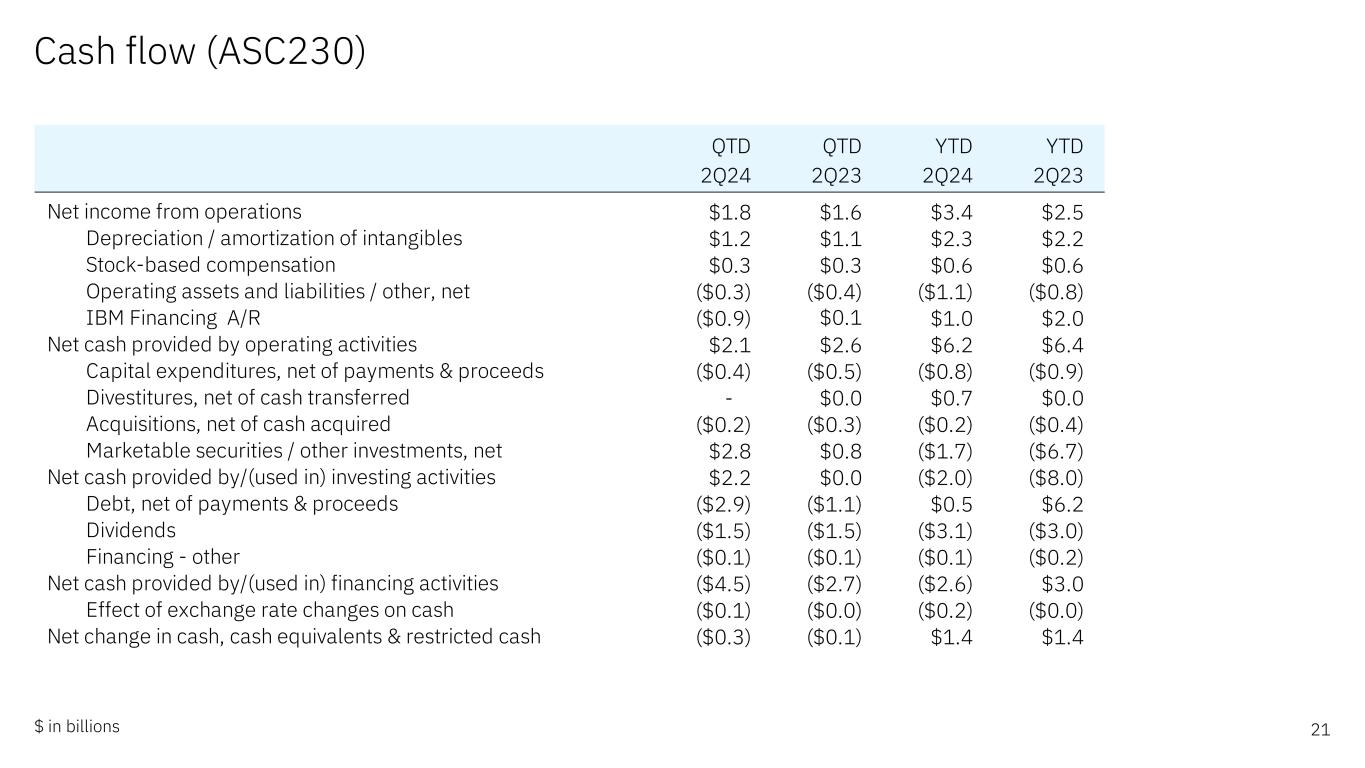

Cash flow (ASC230) 21$ in billions QTD QTD YTD YTD 2Q24 2Q23 2Q24 2Q23 Net income from operations $1.8 $1.6 $3.4 $2.5 Depreciation / amortization of intangibles $1.2 $1.1 $2.3 $2.2 Stock-based compensation $0.3 $0.3 $0.6 $0.6 Operating assets and liabilities / other, net ($0.3) ($0.4) ($1.1) ($0.8) IBM Financing A/R ($0.9) $0.1 $1.0 $2.0 Net cash provided by operating activities $2.1 $2.6 $6.2 $6.4 Capital expenditures, net of payments & proceeds ($0.4) ($0.5) ($0.8) ($0.9) Divestitures, net of cash transferred - $0.0 $0.7 $0.0 Acquisitions, net of cash acquired ($0.2) ($0.3) ($0.2) ($0.4) Marketable securities / other investments, net $2.8 $0.8 ($1.7) ($6.7) Net cash provided by/(used in) investing activities $2.2 $0.0 ($2.0) ($8.0) Debt, net of payments & proceeds ($2.9) ($1.1) $0.5 $6.2 Dividends ($1.5) ($1.5) ($3.1) ($3.0) Financing - other ($0.1) ($0.1) ($0.1) ($0.2) Net cash provided by/(used in) financing activities ($4.5) ($2.7) ($2.6) $3.0 Effect of exchange rate changes on cash ($0.1) ($0.0) ($0.2) ($0.0) Net change in cash, cash equivalents & restricted cash ($0.3) ($0.1) $1.4 $1.4

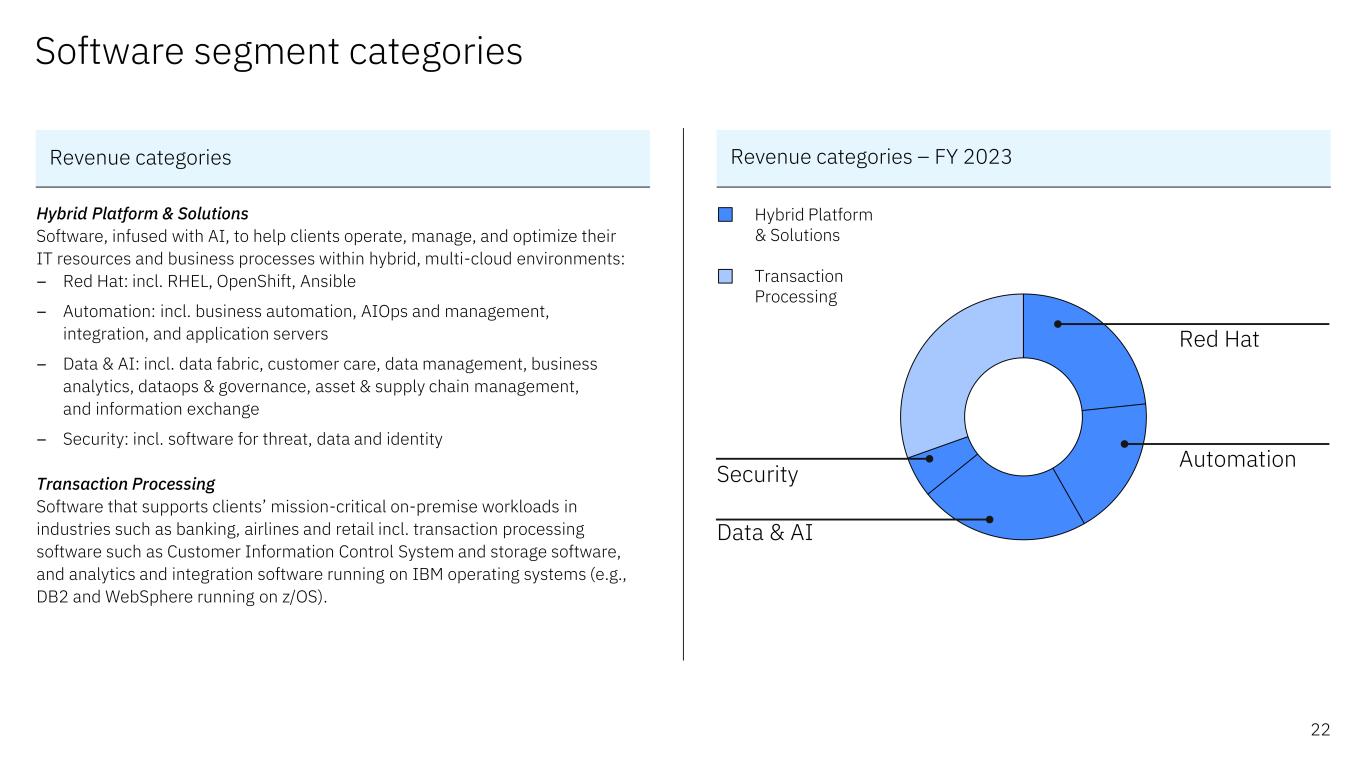

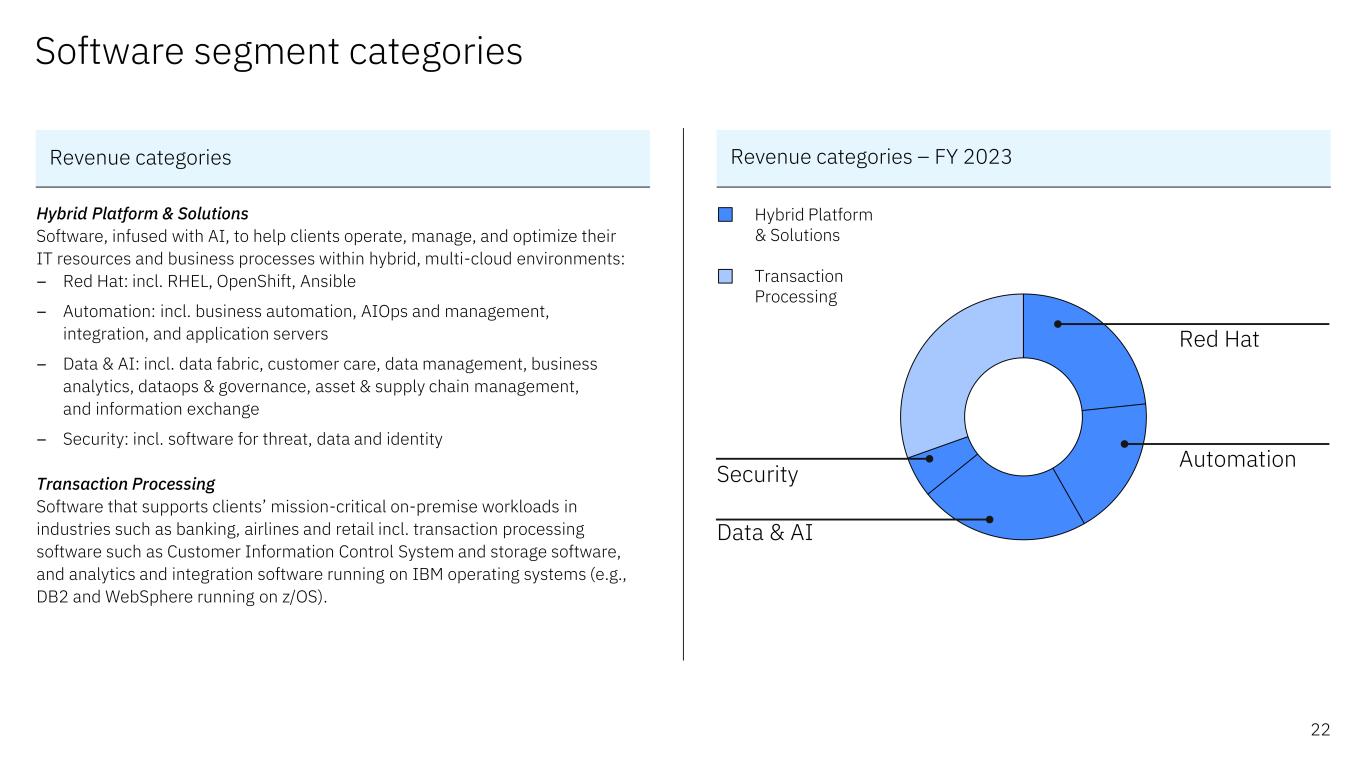

Software segment categories Revenue categories – FY 2023 Hybrid Platform & Solutions Transaction Processing Hybrid Platform & Solutions Software, infused with AI, to help clients operate, manage, and optimize their IT resources and business processes within hybrid, multi-cloud environments: – Red Hat: incl. RHEL, OpenShift, Ansible – Automation: incl. business automation, AIOps and management, integration, and application servers – Data & AI: incl. data fabric, customer care, data management, business analytics, dataops & governance, asset & supply chain management, and information exchange – Security: incl. software for threat, data and identity Transaction Processing Software that supports clients’ mission-critical on-premise workloads in industries such as banking, airlines and retail incl. transaction processing software such as Customer Information Control System and storage software, and analytics and integration software running on IBM operating systems (e.g., DB2 and WebSphere running on z/OS). Revenue categories Red Hat Data & AI Security Automation 22

Business Transformation Technology Consulting Application Operations Consulting segment categories Business Transformation Strategy, process design, system implementation and operations services to improve and transform key business processes. Deploys AI and automation in business processes to exploit the value of data and includes an ecosystem of partners alongside IBM technology, including strategic partnerships with Adobe, Oracle, Salesforce and SAP, among others. Technology Consulting Skills to architect and implement solutions across cloud platforms, including Amazon, Microsoft and IBM, and strategies to transform the enterprise experience and enable innovation, including transformation using AI with watsonx and application modernization for hybrid cloud with Red Hat OpenShift. Application Operations Manages, optimizes, orchestrates and secures custom applications and ISV packages for clients. Provides application management, platform engineering, and security services across hybrid cloud environments. Revenue categories – FY 2023 23 Revenue categories

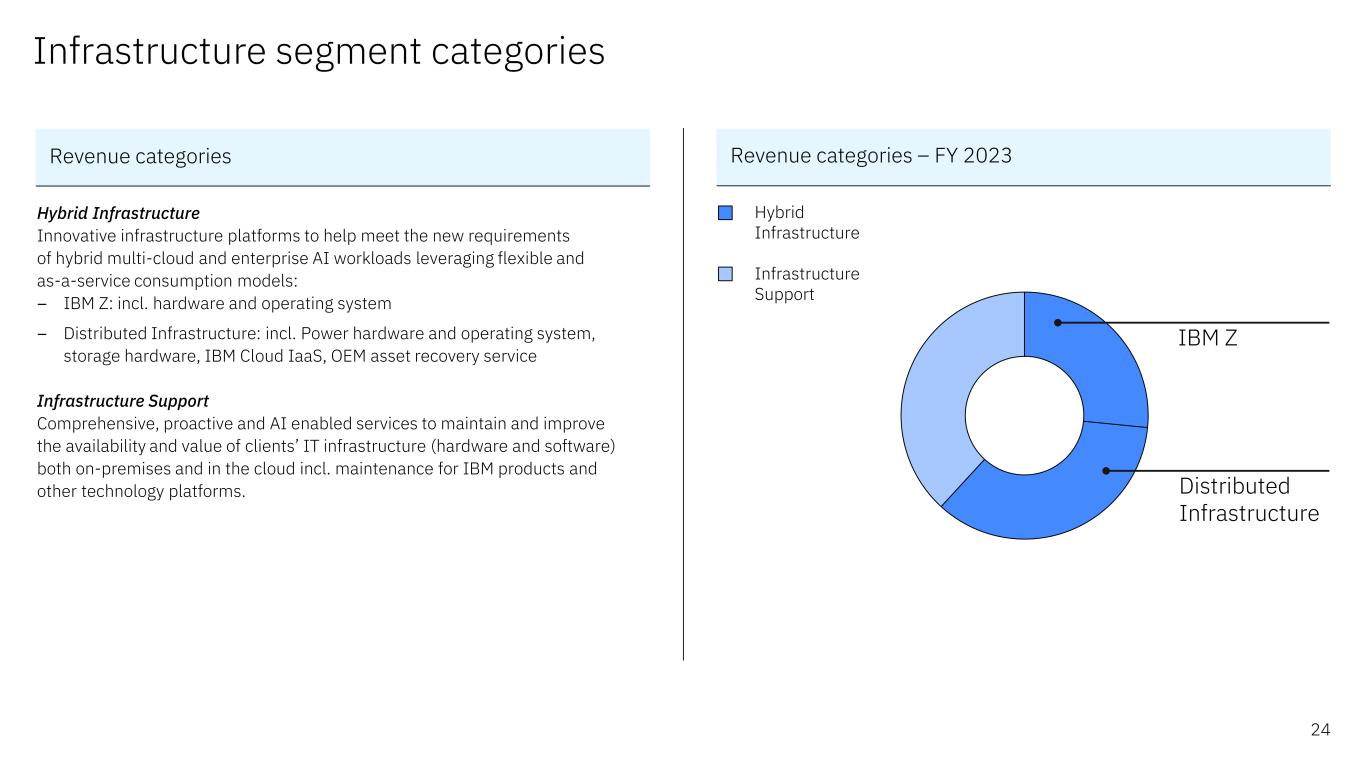

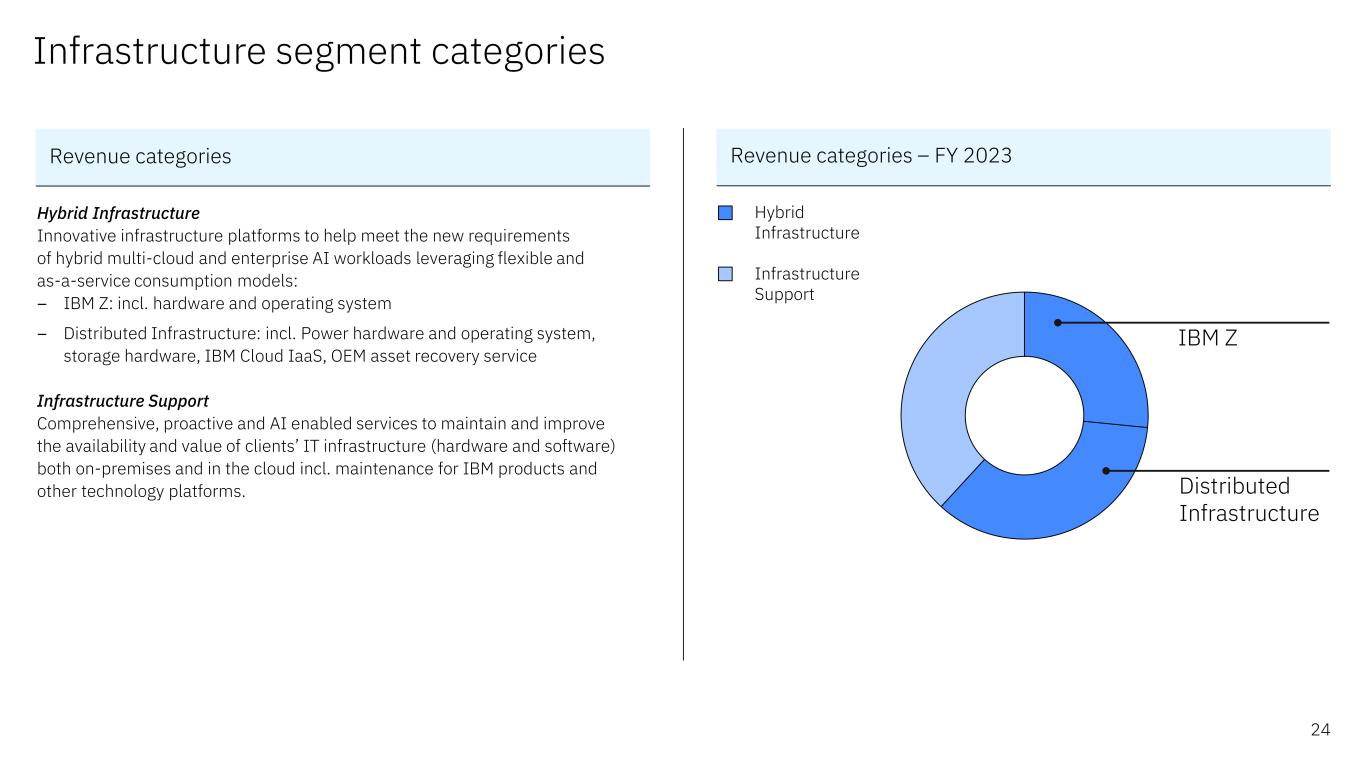

Infrastructure segment categories Hybrid Infrastructure Innovative infrastructure platforms to help meet the new requirements of hybrid multi-cloud and enterprise AI workloads leveraging flexible and as-a-service consumption models: – IBM Z: incl. hardware and operating system – Distributed Infrastructure: incl. Power hardware and operating system, storage hardware, IBM Cloud IaaS, OEM asset recovery service Infrastructure Support Comprehensive, proactive and AI enabled services to maintain and improve the availability and value of clients’ IT infrastructure (hardware and software) both on-premises and in the cloud incl. maintenance for IBM products and other technology platforms. Hybrid Infrastructure Infrastructure Support Revenue categories – FY 2023 24 Revenue categories IBM Z Distributed Infrastructure

Non-GAAP supplemental materials Reconciliation of revenue performance – 2Q 2024 25 The above reconciles the non-GAAP financial information contained in the “Financial highlights”, “Revenue and P&L highlights” and “Prepared remarks” discussions in the company’s earnings presentation. See Exhibit 99.2 included in the company’s Form 8-K dated July 24, 2024, for additional information on the use of these non-GAAP financial measures. GAAP @CC Total revenue 2% 4% Americas (1%) (1%) Europe/ME/Africa 3% 3% Asia Pacific 9% 17% 2Q24 Yr/Yr

GAAP @CC Software 7% 8% Hybrid Platform & Solutions 5% 6% Red Hat 7% 8% Automation 15% 16% Data & AI (3%) (2%) Security 2% 3% Transaction Processing 11% 13% 2Q24 Yr/Yr GAAP @CC Consulting (1%) 2% Business Transformation 3% 6% Technology Consulting (3%) 1% Application Operations (4%) (2%) Infrastructure 1% 3% Hybrid Infrastructure 4% 6% IBM Z 6% 8% Distributed Infrastructure 3% 5% Infrastructure Support (5%) (3%) 2Q24 Yr/Yr Non-GAAP supplemental materials Reconciliation of segment revenue performance – 2Q 2024 26 The above reconciles the non-GAAP financial information contained in the “Software”, “Consulting”, “Infrastructure”, “Software & Infrastructure segment details”, “Consulting segment details” and “Prepared remarks” discussions in the company’s earnings presentation. See Exhibit 99.2 included in the company’s Form 8-K dated July 24, 2024, for additional information on the use of these non-GAAP financial measures.

Non-GAAP supplemental materials Reconciliation of expense summary – 2Q 2024 27 *Represents the percentage change after excluding the impact of currency translation & hedges, acquisitions and divestitures The above reconciles the non-GAAP financial information contained in the “Expense summary” discussion in the company’s earnings presentation. See Exhibit 99.2 included in the company’s Form 8-K dated July 24, 2024, for additional information on the use of these non-GAAP financial measures. Non-GAAP Operating GAAP adjustments (non-GAAP) SG&A Currency 1 pts 0 pts 1 pts Acquisitions/divestitures (1 pts) 0 pts (1 pts) Base* (1 pts) 1 pts 0 pts RD&E Currency 0 pts 0 pts 0 pts Acquisitions/divestitures 0 pts 0 pts 0 pts Base* (9 pts) 0 pts (9 pts) Operating expense & other income Currency 0 pts 0 pts 1 pts Acquisitions/divestitures (1 pts) 0 pts (1 pts) Base* (3 pts) 2 pts (1 pts) 2Q24

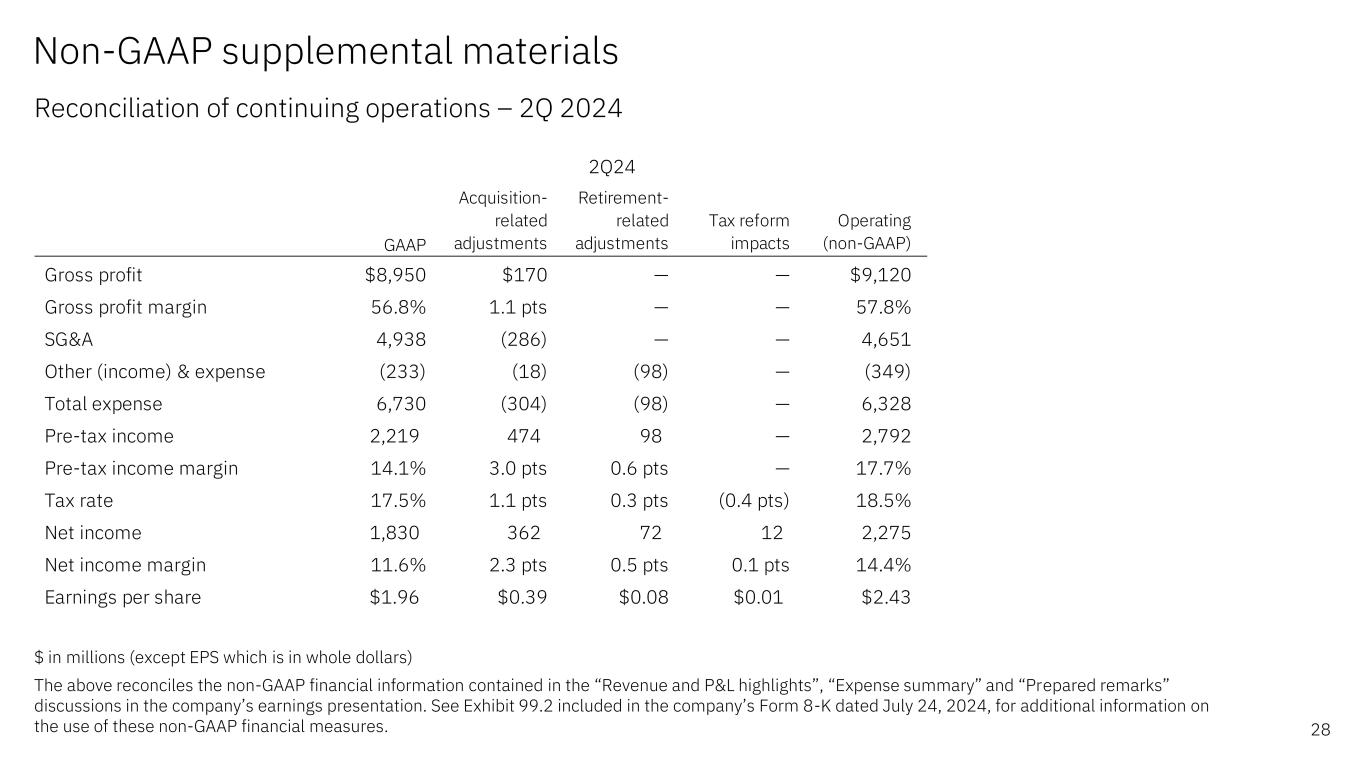

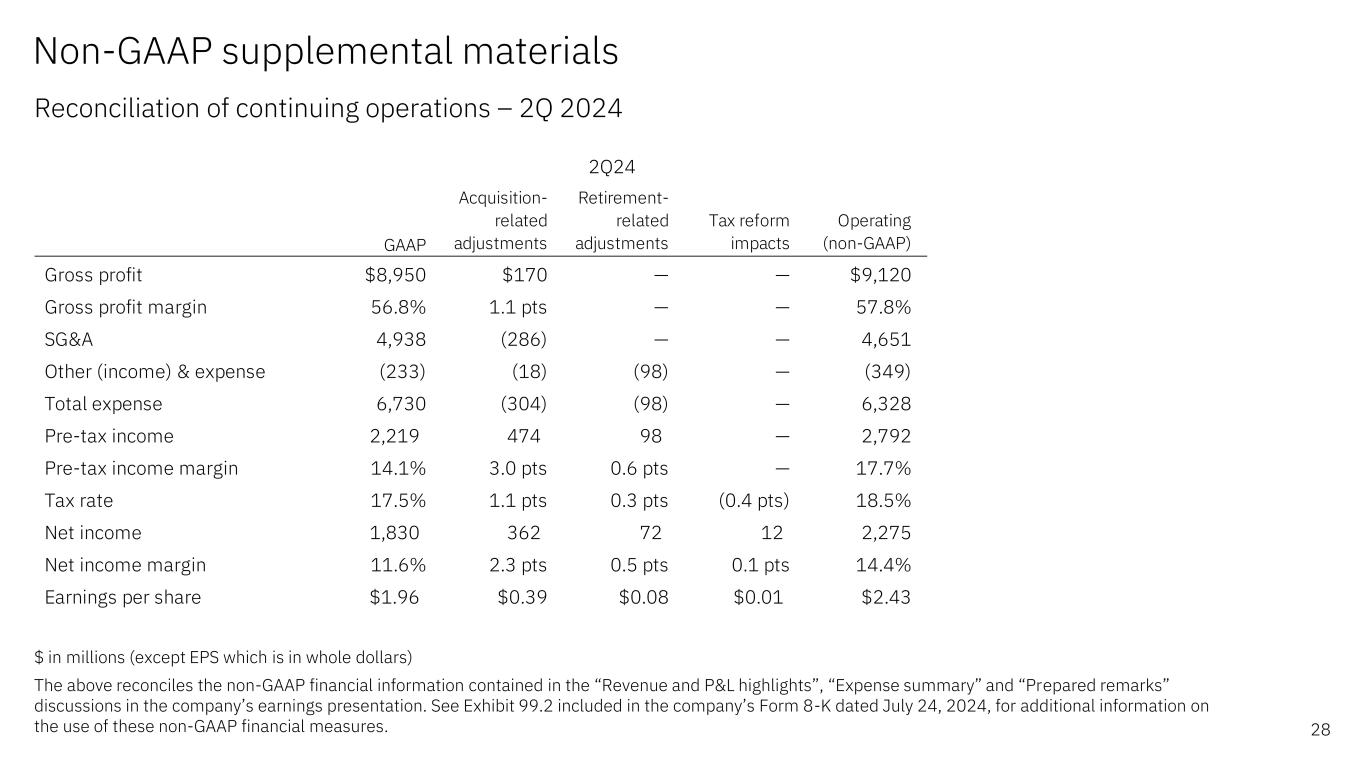

Non-GAAP supplemental materials Reconciliation of continuing operations – 2Q 2024 28 $ in millions (except EPS which is in whole dollars) The above reconciles the non-GAAP financial information contained in the “Revenue and P&L highlights”, “Expense summary” and “Prepared remarks” discussions in the company’s earnings presentation. See Exhibit 99.2 included in the company’s Form 8-K dated July 24, 2024, for additional information on the use of these non-GAAP financial measures. GAAP Acquisition- related adjustments Retirement- related adjustments Tax reform impacts Operating (non-GAAP) Gross profit $8,950 $170 — — $9,120 Gross profit margin 56.8% 1.1 pts — — 57.8% SG&A 4,938 (286) — — 4,651 Other (income) & expense (233) (18) (98) — (349) Total expense 6,730 (304) (98) — 6,328 Pre-tax income 2,219 474 98 — 2,792 Pre-tax income margin 14.1% 3.0 pts 0.6 pts — 17.7% Tax rate 17.5% 1.1 pts 0.3 pts (0.4 pts) 18.5% Net income 1,830 362 72 12 2,275 Net income margin 11.6% 2.3 pts 0.5 pts 0.1 pts 14.4% Earnings per share $1.96 $0.39 $0.08 $0.01 $2.43 2Q24

QTD YTD 2Q24 Yr/Yr 2Q24 Yr/Yr Net income as reported (GAAP) $1.8 $0.3 $3.4 $0.9 Less: Income/(loss) from discontinued operations, net of tax $0.0 $0.0 $0.0 $0.0 Income from continuing operations $1.8 $0.2 $3.4 $0.9 Provision for/(Benefit from) income taxes from continuing operations $0.4 ($0.0) ($0.1) ($0.7) Pre-tax income from continuing operations (GAAP) $2.2 $0.2 $3.3 $0.2 Non-operating adjustments (before tax) Acquisition-related charges* $0.5 $0.1 $1.0 $0.2 Non-operating retirement-related costs/(income) $0.1 $0.1 $0.2 $0.2 Operating (non-GAAP) pre-tax income from continuing operations $2.8 $0.4 $4.4 $0.6 Net interest expense $0.2 ($0.0) $0.4 $0.0 Depreciation/Amortization of non-acquired intangible assets $0.7 $0.0 $1.4 $0.0 Stock-based compensation $0.3 $0.0 $0.6 $0.1 Workforce rebalancing charges $0.0 ($0.1) $0.4 $0.0 Corporate (gains) and charges** ($0.0) $0.0 ($0.2) ($0.2) Adjusted EBITDA $4.0 $0.4 $7.1 $0.5 Non-GAAP supplemental materials Reconciliation of GAAP net income to adjusted EBITDA 29 $ in billions *Primarily consists of amortization of acquired intangible assets **Corporate (gains) and charges primarily consists of unique corporate actions such as gains on divestitures The above reconciles the non-GAAP financial information contained in the “Revenue and P&L highlights", "Prepared remarks” and “Adjusted EBITDA performance” discussions in the company’s earnings presentation. See Exhibit 99.2 included in the company’s Form 8-K dated July 24, 2024, for additional information on the use of these non-GAAP financial measures.

Non-GAAP supplemental materials Reconciliation of net cash from operations to adjusted EBITDA 30 $ in billions *Other assets and liabilities/other, net mainly consists of operating assets and liabilities/other, net in the “Cash flow (ASC230)” discussion, workforce rebalancing charges, non-operating impacts and corporate (gains) and charges The above reconciles the non-GAAP financial information contained in the “Prepared remarks” discussion in the company’s earnings presentation. See Exhibit 99.2 included in the company’s Form 8-K dated July 24, 2024, for additional information on the use of these non-GAAP financial measures. QTD QTD YTD YTD 2Q24 2Q23 2Q24 2Q23 Net cash provided by operating activities $2.1 $2.6 $6.2 $6.4 Add: Net interest expense $0.2 $0.2 $0.4 $0.4 Provision for/(Benefit from) income taxes from continuing operations $0.4 $0.4 ($0.1) $0.5 Less change in: Financing receivables ($0.9) $0.1 $1.0 $2.0 Other assets and liabilities/other, net* ($0.4) ($0.5) ($1.5) ($1.2) Adjusted EBITDA $4.0 $3.7 $7.1 $6.5

Non-GAAP supplemental materials Reconciliation of tax rate and Pre-tax income margin – FY 2024 expectations *Includes estimated discrete tax events for the year, actual events will be recorded as they occur The above reconciles the non-GAAP financial information contained in the “Prepared remarks” discussion in the company’s earnings presentation. See Exhibit 99.2 included in the company’s Form 8-K dated July 24, 2024, for additional information on the use of these non-GAAP financial measures. Tax rate GAAP Operating (Non-GAAP) Full-Year 2024* Mid-to-High Single Digits Mid Teens GAAP Operating (non-GAAP) Pre-tax income margin B/(W) B/(W) Pre-tax income margin Yr/Yr Flat >0.5 pts 31

ibm.com/investor